Abstract

The research objective is to assess the role of green financing and financial inclusion in developing a cleaner environment for macroeconomic stability in ASEAN economies. The study attempted to estimate the climate mitigation factor associated with a more sanitary environment between 2012 and 2019. Panel data analysis using the augmented Dicky–Fuller test, Phillip–Perron, and fully modified standard most minor square test provides long-term findings in panel data analysis. In addition, the vector error correction technique was also applied to infer study results. The findings indicate that climate change mitigation indicators have a significant impact on the gross domestic product of ASEAN economies. According to the data, a one percent rise in the green finance index results in a 0.321 percent increase in the amount of pollution removed from the environment. According to the research findings, environmental pollution must be decreased, and energy sources must be switched to more creative and ecologically friendly alternatives. Using study findings, several policy recommendations are offered and suggested for stakeholders for implementation. As per our best understanding, effective implementation of study findings and suggestions maximum chances are developing a cleaner environment and boosting macroeconomic stability in the ASEAN context.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The problem of the twenty-first century is climate change and global warming caused by greenhouse gases (Wu et al. 2021). In Paris, 196 nations signed the Paris Agreement on Climate Change, which aims to keep global temperatures from rising more than 2 degrees Celsius each year to avoid the worst consequences of climate change in 2015 (Hoshen et al. 2017). In 2015, about 196 countries signed the Paris Agreement on Climate change on raising the global temperature from rising more than 2 degrees Celsius each year to avoid the worst consequences of climate change (Hoshen et al. 2017). The Paris Agreement and other ecological pollution measures heavily depend on the president's official role (Ng 2018). Environmental initiatives to reduce greenhouse gas emissions are developed and regulated by organizations (Islam et al. 2014); numerous variables include politics, governance, and the social influence on climate change. Although the concept of a cleaner environment is still developing, it is already influencing current policies and activities (Li et al. 2021a, b, c). Climate change mitigation techniques are receiving political support because of the increasing tendency of greenhouse gases (Iqbal et al. 2021a, b). However, climate change's social, geographic, and regional repercussions take on a new dimension to cleaning the environment in highly inhabited areas and projects (Li et al. 2021a, b, c).

As a result of these efforts, there has been a significant improvement in the energy sector (Anh Tu et al. 2021). In ASEAN economies, there are several climates, and environmental changes are predicted. As a result, ecological clean-up is a must for the ASEAN economies region's industrial growth to be as easy as possible. As a result, the ASEAN countries area has to create and execute green finance solutions that are “clean” without causing any damage to the environment and particularly without harming economic development (Iqbal et al. 2021a, b). The ASEAN areas have long been recognized for their relevance in the fight against global warming. New research aims to evaluate the long-term environmental implications of a cleaner environment using green funding methodologies (Ahmad et al. 2021). Environmental degradation and climate change are alarming because of the increasing need for new and practical solutions. The green economy is one of the most successful ways (Iqbal and Bilal 2021a, b). A green economy maximizes societal well-being while minimizing environmental harm (Wu and Zhang 2014). A significant focus of the United Nations Conference on Rio + 20 was on the importance of the green economy to sustainable development (Huang et al. 2021). The most important aspects of the transition to a green economy must be prioritized equally. The green economy's primary effect on government service is examined (Aly et al. 2017). In light of the prior research, it would seem that even a slight shift in public spending might have a significant impact on both public expenditure and economic growth. The exact link between public expenditure and green economic growth has not been thoroughly explored yet (Zhang et al. 2021a, b, c) (Iqbal et al. 2019). An in-depth examination of government spending will help us better understand its relation to green economic growth (Iqbal and Bilal 2021a, b).

Environmental science may reveal nature to develop cleaner environment cooperation (Sun et al. 2022). For example, the 'size impact' describes increased government expenditure boosts business growth. As a result of this mechanism's adverse impact on the environment, green economic growth is declining (Hoshen et al. 2017). There can be no lasting recovery until this long-term funding is made (Jha and Bakhshi 2019). The sustainable rebound forecast for the ASEAN nations will be W- or V-shaped. Since the implementation of COVID-19, the CO2 concentration has decreased, and economic growth has been limited despite global financial troubles and human suffering (Taghizadeh-Hesary and Yoshinio 2020). Members of the ASEAN belt contribute to expanding global markets while fostering standard agreement. The ASEAN proposal also addresses a significant issue: global climate change, which may be handled by close cooperation (Le et al. 2020). Many environmental problems are being researched in emerging nations; however, research is limited in the developed countries of ASEAN states (Iqbal et al. 2021a, b).

Indicators are essential for inefficient development. Environmental monitoring data have been used to have accurate ecological information to identify the sources of degradation. According to the latest Global Environmental Outlook study (UN Environment 2019), research predicts enormous poverty and suffering in the economic direction. From this perspective, it is clear that the current growth is not environmentally sustainable. There are hundreds of environmental indicators that can evaluate the ecological sustainability efficiency in significant environmental and energy challenges.

Our contributions may be found in various ways: (i) this study's excellent findings may considerably add to the literature while clarifying the function of green funding in building cleaner environments in ASEAN nations. (ii) It is unclear exactly how public spending influences market processes. This research shows that fiscal expenditure has a favorable impact on green economic development. (iii) It examines how the ASEAN promotes climate financing and implements climate change mitigation methods. Using the FMOLS and VECM strategy in the ASEAN nations, hydropower may take the role of green funding. Few studies have used the econometric technique to examine the ASEAN nations. For the long-term dynamics of a healthier environment related to financial-economic indicators, this research uses the FOMS and VECM methodologies.

2 Literature review

Economic production capabilities and renewable power are essential (Yang et al. 2021a, b). Between 2016 and 2050, a PWC poll estimates that the global economy will grow at a real annual rate of 2.5 percent. Over the next 34 years, the ASEAN economies will grow at a 3.5% annual average rate, compared to the industrialized ASEAN countries' 1.6% (Mohsin et al. 2021a, b, c, d). They were promoting renewable energy assists in modernizing the electricity market while aiding different nations' economic development and environmental aims, as Mohsin et al. (2021a, b, c, d) argue. As seen by the regional variation in the research, the impact has been proven (Iram et al. 2020). Research into the effects of environmental protection strategies on greenhouse gas emissions has been sparse (Zhang et al. 2021a, b, c). Developing Asian countries are featured in this paper, contributing to the existing research on international environmental legislation, renewable and nonrenewable energy sources, and the rise in per capita GDP (Li et al. 2021a, b, c). Green technology and alternative fuels such as solar panels and wind turbines may achieve ecological stability (Xue et al. 2022). Green construction is an environmental, economic facility that reduces ecological impacts throughout life (Mahi et al. 2021).

Reduced waste, fuel efficiency, and greenhouse gas emissions are examples of environmental stability in the home setting (Zakari et al. 2021). The residential environment's sustainable development qualities lower individuals' health impacts (such as high-quality air conditioning) (Anh Tu et al. 2020). There is no significant difference in end-user well-being between a sustainable environment and conventional homes (Chen et al. 2022). Oil production and exploration negatively impact the community, causing food prices to increase, enhancing their living costs (Sun et al. 2021). Environmental criteria have replaced social and economic sustainability in green architecture design, but not as much anymore (Jalo et al. 2021).

Brockway et al. 2021 explored financial, interior, and health benefits. Because of energy efficiency and building costs, some green architects are criticized, including concerns about energy efficiency and the high cost of construction. As seen in the debate above, the connection between energy and development has much attention. Only scientific analysis in Table 1 is (Adom et al. 2021; Brugger et al. 2021). As of 2020 (Chen et al. 2021). But the impact of energy requirements on economic growth in emerging Asian nations is uncertain. These data have no conclusive results. So the energy–growth nexus discussion must conclude (Saunders et al. 2021), (Alemzero et al. 2021a, b), and (Dell'Anaa, 2021). A study on the influence of renewables on economic growth has yet to be issued, which includes both sustainable and entire power. Therefore, it is critical to fill the third strand of writing on growing Economies, which aims to address this gap in the literature.

Many researchers have explored the relationship between money and the environment. According to Feroz et al. (2021), ecological robustness may be achieved by increasing solar energy finance. Environmentalism is the most effective approach to preventing or slowing down environmental damage, according to Fatima et al. (2021). Finance fosters involvement in developing technologies and advances, such as renewable radiation (Han 2021). Previous research has examined the association between green banking and cleaner environmental factors. Still, to our understanding, no studies have examined the relationship between green finance and more immaculate external conditions, investigating all ASEAN countries (Aguilera et al. 2021).

This technique is significant since the link between sustainable banking, and CO2 emissions may be altered by the economic cycle and the volume and kind of climate financing (Ekins and Zenghelis 2021). This technique (green bonds). Climate financing is expected to negatively affect dioxide (CO2) emissions (Ahmed et al. 2021). The amount of CO2 emitted into the atmosphere increases, while the economy expands rapidly and decreases when contracting. Because CO2 is a vibrant and highly phenomenon, the substance of the association between CO2 pollution and green finance might change depending on how the business is doing (Khan et al. 2022). Therefore, positive developments in climate financing may lead to more significant reductions in emissions of CO2 (Grillo et al. 2021).

2.1 Theoretical Background

Research on green finance and clean energy has been lacking, although both topics have long been prominent in sustainable development. According to the Inter-Governmental Panel on Climate Change, global warming will impact over 1.5 degrees Celsius above pre-industrial levels, and an elevated is required to stabilize greenhouse gas emissions, minimize the threat of climate change and poverty, and ensure sustainable development. For the 1.5 °C rise in global temperatures to be avoided, it is clear that a dramatic shift in investment patterns toward green technology initiatives is required (McCollum et al. 2018). According to the UN (UN (United Nations), 2017), $1.5 trillion in green funding is required annually to meet the criteria specified in the Paris Agreement. After the COVID-19 outbreak, it became increasingly critical to identify clean energy sources and green technology funding. To maintain long-term economic development, it is essential to develop new sources of green financing that build on the finance–growth connection. Green finance enables sources of environmental responsibility, funds green innovations, and initiates the production of renewable energy, all of which contribute to sustainable development.

The term “green finance” has a variety of meanings and is frequently referred to as “sustainable finance” or “climate finance.” The supply of financial resources for projects with environmental advantages is known as “green finance.” On the other hand, climate finance is a kind of funding aimed at assisting efforts to combat global warming. All of the concepts in this section revolve around finance options for sustainable development. Green financing is essential to reduce carbon emissions and their adverse effects on human health and the environment. It integrates sustainability considerations into financial decision-making. It is expected that green financing will improve environmental and sustainability concerns by financing climate-neutral, energy, and resource-efficient technologies.

The influence of financial markets on economic development has been extensively studied in the past. The finance–growth nexus focuses on the link between economic growth and the financial sector. The preceding line of study ignored and even exaggerated the role of finance on economic development by recognizing finance as a crucial component as a predictor. On the other hand, many subsequent papers acknowledge the significance of finance and assert that the financial industry may influence long-term growth rates by influencing saving rates, investment decisions, and technological innovation. The financial sector selects technology initiatives with high success possibilities to identify the finest practicable technologies and raise the bar on technological innovation. In addition, the financial services business collects individual savings and makes it easier to make better use of those funds, which improves resource allocation and spurs technical innovation. Based on their study of the effects of banks and stock markets, Beck and Levine (2004) found that the financial sector boosts economic development, indicating that the industry's growth is not dependent on the country's banking or stock market structure. As a result, developing nations have a significant barrier in obtaining the advantages of technology transfers that might help them flourish. The literature has explored the function of finance in the economy across diverse periods and situations, and it is not incorrect to imply that the research has agreed on the long-term influence of finance on growth.

3 Methodology

3.1 Study measures, data, and modeling

The empirical study used data from 2011 to 2019 from https://fred.stlouisfed.org and https://data.worldbank.org. Only China, India, Brazil, and Mexico do so. Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. These nine countries face significant economic and environmental challenges. Growth factors were utilized to estimate research and develop lengthy modeling. CO2 levels in kilotons are used to measure CO2 emissions, GDP in US dollars (constant 2017), demographic percentage, and technical operation grants in US dollars. Standard of living, clean energy usage as a proxy for sustainable banking (kt), inflation, and GDP in USD. The long-term effects of a cleaner environment on economic indicators will be assessed. Green performance index statistics from ASEAN nations are also used to progress toward a greener world. The green performance index scores for ASEAN nations are shown in Table 1. Evidence indicates that ASEAN nations are more concerned with environmental preservation and reducing climate change than ASEAN countries, which is seen in their regard to ecological clean-up efforts. Green funding and the development of a healthier environment in the ASEAN economies are the goals of this study. The objective function Y shows the growth function, and CE represents an environmental function,

where i shows the list of economies; t characterizes the duration; α0 signifies the fixed country effect, and ε shows error term.

3.2 Strategy for econometric estimation

It is necessary to define the integration order of every element so that the root unit panel test can be carried out to achieve this task (Al-mulali et al. 2015). To determine the variables are stationary panel test would be applied. An ADF approach (1979) and a Phillips and Perron (1988) method are utilized to identify unit-roots. The mixed technique is used for estimating the results. This study used the FMOLS approach to show the correlation of data on reducing greenhouse gas emissions and economic growth. This method evaluates the ASEAN areas' pre- and post-climate change economy differently on construct and country’s differences. Panel co-integration and long-run elasticity indicators were used to enhance the FMOLS results. They used the computed residuals to effectively implement long-term study outcomes (Pedroni, 1999).

This research used the OLS technique to evaluate the relationship. Pedroni (2001) suggested that an endogenous parameter must be integrated to use FMOLS.

3.3 Vector error correction modeling (VECM)

It is possible to construct a casualty among variables because of the co-integration of their estimate. They used VECM approaches based on Engle and Granger's two-step procedures (1987). The energy efficiency of the nations examined in this analysis is expected that foreign direct investment (FDI) would have a role in ASEAN nations' economic output (EE). Chinese investments in ASEAN economies have increased significantly, and their assets are heavily weighted toward the oil and transportation sectors. Table 2 shows that nations with energy access have a [39.5646 percent] impact on energy efficiency. The VECM technique shows how components interact over the long term. There may be short-term causation in the VECM, but long-term causality may be demonstrated by the error correction word ECT (1). As a result, the following is how the VECM equation for economic growth (Y) looks

The functions are graphically reported as follows: (Fig. 1).

4 Results and discussion

4.1 Econometric estimation

By 2045, there would be an additional $5.4 trillion in GDP because of the addition of 15.3 million new excellent green employees. The percentage of people in poverty is expected to drop from 9.8 percent in 2018 to 4.2 percent in 2019. Similarly, improved air quality is considered to save the lives of 40,000 people (Brodjonegoro et al. 2019). The Netherlands aimed to increase its energy production by 100% between 2005 and 2015. Economic growth in the Philippines has averaged 6.6 percent during the last six years. Its goal is to have 2.35 GW of wind power installed by 2030. But theoretically, the system can handle as much as 76 GW (GWEC 2019). Vietnam's economy grew at a constant 6% annual rate over the last decade, making it one of the fastest-growing economies globally. Clean energy targets for 2020 and 2050 are 5 percent and 11 percent, respectively (Hezri and Hofmeister 2012). There are 228 MW of wind power built in the country, and the government aims to develop 800 by the end of 2020. (GWEC 2019). These nations have a highly energetic density ratio (Yıldırım et al. 2014), which should motivate them to increase their power generation and decrease their consumption

Table 3 indicates that ADF and PP unit root findings are constant between measurements. As a result, the null hypothesis was confirmed, and it became clear that variables co-integrate in a specific order when they first become stationary. The founder test adds macroeconomic precision to research findings by expanding it. There seems to be a strong correlation between the factors in Table 4. As a result, H1 gets approved.

The growth hypothesis states that using more energy leads to economic growth. Power consumption increases with economic expansion, determined by human capital, natural resources, and new technology. A 22% increase in renewable energy demand would lead to a 1% increase in global economic growth. Carbon emissions of a country's population of one percent rise by 4.55 percent if the GDP rises by one percentage. According to a growing body of research, emissions of carbon dioxide rise as GDP and population increase (Noorpoor and Kudahi 2015; Lin and Raza 2019). Although Singapore, Thailand, and Vietnam all have GDPs of more than $1 trillion, these nations are nevertheless highly populated.

Electricity pollution harms the atmosphere by 2%. As the number of people who have access to energy fluctuates, energy efficiency reduces by roughly 8 percent. While only 4% to 6% of ASEAN members substantially impact their nations' GDP, FDI has a sizeable average impact on the group's total direct investment (QPI).

4.2 Split analysis

According to our findings, Europe's natural capital is negatively impacted by environmental deterioration. The European Union has a score of 47, which is below the index threshold of 50 points. A score of 100 represents full compliance with the environmental criteria of all 21 indicators chosen to indicate significant ecological functions related to natural capital. Even in Finland, the highest-scoring nation, the difference between present and unsustainable circumstances is 40 points. Environmental integrity is the worst-hit area, with a wide disparity in effectiveness across ecological tasks.

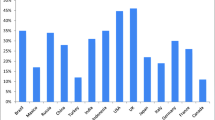

Figure 2 shows the sustainable energy rating. The per capita education spending factors are 0.057 and 0.126. (PCEDU). In contrast, per population research and development (PCRD) costs were 0.022 and 0.073. The low-GDP-per-capita nations depicted here may reasonably estimate structure and technological impacts. The public spending coefficient for countries with low GDP per capita is 0.215. At a 1% significance level, this statistic is of interest. However, the coefficient is measured at 0.049 for nations with high income per capita. At a 5% level, this number is substantial.

Nations, mainly terrestrial ecologies, perform poorly when reducing CO2 emissions and chemical contamination of ecosystems. Diversification and natural health are also low on the life support component. Material supply looks superior to waste elimination. The selling price of abiotic and biotic resources is only a guess. Economies tend to rank well when it comes to drinking water quality and indoor air pollution. Outdoor air pollution is an exception, maybe because the Global Health Organization's guideline values are more tolerant than the policy priorities established. For World Heritage sites, performance is entirely inconsistent with many nations not possessing any environmental sites inside their territory when considering the amenity function. Governments often have good ratings regarding bathing sites and access to green areas.

Table 5 shows that global warming may significantly impact traditional market processes. The demographic has also contributed considerably to the significant increase in power demand. The ASEAN nations provided responsiveness of 99.37% (Table 5) to another input variable projected in the simulation, indicating the range of economic data estimates associated with climate change mitigation. Since carbon dioxide emission data from the same country exhibit a high degree of homogeneity across time, it may be concluded that variability within nations accounts for over 99% of CO2 emissions over time.

4.3 Long-run and robustness estimation

Table 6 demonstrates the increasing dynamic discovered. According to the findings, reducing CO2 emissions benefits overall ASEAN industrial prosperity. Renewable energy has made a big difference in this regard. On the other hand, green funding plays a vital role in promoting alternative energy sources. The correlation between factors was deemed substantial by all ASEAN member nations. Wind and solar power play an essential part in green finance approaches for ecosystem cleansing and greening, as shown below. Such data confirmed the financial development and economic growth, showing one-way causation between environmental cleaning and economic development in the ASEAN area. As a result, local economic development and climate change mitigation are intrinsically and extrinsically linked to renewable power solutions (Omri 2014). The findings must be evaluated with caution. Firstly, the index assesses whether nations meet science-based environmental standards across various ecological and resource concerns. It is theoretically possible to get a normalized score of 75 in two countries where one-quarter of the population is subjected to air pollution marginally above environmental limits. At the same time, the other quarter is exposed to levels many times higher. As a result, the index's measures are territorial rather than consumption-based. SESI's primary purpose is to generate better. Therefore, it concentrates on natural capital that the government can easily manage. Usage measurements, on the other hand, may add to the conclusions.

So the panel's findings are still conceptually and geographically relevant. The models' results have a confidence level of 1 percent for the lowest percentile and 99 percent for the highest percentile for residual errors. Floods endanger 48% of global property, over 50% of international people, and 46% of the worldwide property. Most of the world's population lives in underdeveloped nations. The nominal GDP of the world's 1.5 billion inhabitants was expected to be about $6.5 trillion in 2018. Their GDP is equivalent to China's, even though their population is more than China's. Economic growth was increased by one factor, resulting in a rise of one-tenth percent, or 0.11 percent, above the current rate. Because our findings are consistent with past research on ASEAN regional efforts in various scenarios, we emphasize the relevance of a cleaner environment in economic growth via climate financing on regional scales such as ASEAN. Using the FMOLS method, there were able to include the growth function's impacts on the environment, as shown in Table 7. Using these facts, it is clear that CO2 levels may rise and fall with the growth of ASEAN economies.

Environmental protection should be linked to the housing study community's focus on older people's homes. First, the idea of environment gerontology suggests that the home environment strongly influences older people's well-being because of the interaction between the house and personal competence. Older persons who live in homes with sustainable development elements have a superior standard of living since these features may meet their sustainability demands. Senior citizens also play a significant role in sustainable development, which cannot be overstated. Elderly ecological donating involves facilitating their own physical and mental well-being and psychological health, thanks to the actions and contact with the natural world they participated.

4.4 Environmental sustainability and Green performance

The ASEAN economies' figures varied slightly, but ASEAN countries are more prepared to address climate change. Brazil has the lowest score of ASEAN economies, ranging from 46 to 54%. Mexico has a score of over 75% in green performance. China is setting a new standard in green performance, scoring above 93 percent. Just 60% of Indonesians are environmentally conscious, which is alarming and calls for quick action to ensure a sustainable future and civilization. Among ASEAN nations, only France is less economical to do green, scoring below 60%. ASEAN has one nation (e.g., France), while ASEAN has two countries.

The study has underlined the importance of environmental assets in world financial growth. According to estimates, economic integration increases by 45 percent when exports increase by 7 percent, thus according to estimates. The ASEAN nations may utilize this study to increase their energy production while strengthening their financial sectors. Advanced economies received 237 billion dollars in donations from the six MDBs between 2011 and 2018. Since 2013. According to the research of Park et al. (2019), it is estimated that the MDBs promised $165 billion in 2018. In (Yuan and Gallagher 2018), it was emphasized that MDBs' $110 billion yearly gaps needed to be filled, emphasizing sustainable financing in Latin America and the Caribbean. An additional $7 billion in green funding and $4.4 billion from MDBs will be available in 2015, as per a newly released government study. Researchers observed that MDBs preferred nations with more progressive civil rights legislation and socialist governments.

4.5 Discussion

As well as examining how tackling climate change affects GDP, this study also looked at how carbon policies and personnel management affect GDP (Kihombo et al. 2022), as well as how much carbon capture is used, and how ecologically responsible technology advancement is needed (Yang et al. 2021a, b). Several variables led us to choose a group of ASEAN countries to study (Schusler et al. 2021). Minimal levels of CO2 are dependent on the efforts of these seven major economies, which account for approximately half of global GDP (De Matteis et al. 2021). ASEAN emissions were higher in absolute terms in 2010 (Bibi et al. 2021). In a study published in 2020 by Khan and Hou (2021), of the ASEAN countries, Canada produces the most greenhouse gas emissions and consumes the most power per person.

Canada's climate change policy will be assessed as ordinary due to its continuous fossil fuel subsidies. In addition, whereas the USA has low efficiency, the UK, Indonesia, and Germany all have outstanding greenhouse gas emissions and oil use outcomes. The research is intriguing because it examines the quasi traits of regional states, such as ASEAN. The world's most powerful nations may utilize the findings of this study to help them devise policies for a more peaceful world (Zhao, Saydaliev, and Iqbal 2022). According to the long-term calculations assumptions, the study constructions development in the ASEAN regions. Results like these support the authors of the study's theory that a cleaner environment (such as climate change mitigation) is associated with better income progress. Climate financing techniques will assist in enhancing the environmental, economic, and social well-being of the ASEAN area.

In contrast to the weak sustainable construction, which presupposes the loss of disposition can be fully reimbursed, the constrained replacement capacity between alternative capital types and environmental resource functional areas and the idea that some elements of natural capital provide irreplaceable functions are much closer to the actual physiological fact that guides the ecological mechanism and the engrained source of social. Measurements that indicate a low achievement might be deceiving, resulting in bad decisions. As a proof of concept, this initial edition of SESI can give regulation knowledge by helping nations traverse the environmental sustainability agenda beyond particular concerns and giving scores that can be used to compare, analyze, and compare amongst countries. SESI gives a snapshot of a company's specific efficiency against sustainability impacts to show if a natural town's ability to supply ecological functions has been impaired in this setting.

As a result, the following hypotheses have been approved, and our research results are expected to be sustainable for a lengthy period. The * denotes statistical significance at the 5% level. Tables 3 and 4, based on the VECM technique, illustrate the quantitative results of the research with know a great, suggesting long-term unidirectional causation between healthier environments and Climate financing potential, in agreement with Taghizadeh-Hesary and Yoshino (2020). By Halicioglu (2009) and Omri (2013), our findings support their findings (2014). Its results, on the other hand, are similar to those of earlier studies (such as Liu et al. 2020; Anser et al. 2020; Lou et al. 2019), confirming the unidirectional findings of the current research and failing to connect the strong future of any ASEAN nations area studied recently. As a result, the present study provides legislators with essential recommendations that address a theoretical, empirical, and practical vacuum.

5 Conclusion and policy implications

This study suggests that from 2011 to 2019, the ASEAN nations should examine alternative options to altering environmental financing and environmental circumstances. There are now two types of countries: developed and growing (i.e., treated group and control group). Pre-matching international statistics have been employed to deal with the time-variation that may weaken reasoning to deal with this issue (as suggested by Abadie 2017). To reduce the time intervals between courses, you may use this method. The ASEAN nations have the quickest industries in the twenty-first millennium. Hydroelectricity, solar photovoltaics, and windmills are only some of China's many renewable energy resources. A long moment has elapsed since China began engaging in sustainable power to reach 15% of its total energy supply from renewable sources by 2020. In 2018, it was 14.3%, with a 33% share of overall spending on renewable (IRENA 2020; Meidan 2020). To be competitive and effective today, other nations need to rethink their sustainability practices within the SDGs paradigm. This study underlined the significance of ASEAN nations creating legislation willing to tackle systematic risks. A framework for managing environmental issues in ASEAN nations is provided (see Fig. 2). According to the studies ' methodology, there was no association between the ASEAN nations' environmental funding and climate risk profiles. Moreover, estimations of the minimal effect show that oil imports are unlikely to disturb the ASEAN nations' energy efficiency and environmental sustainability.

The finance of green technologies requires green money to meet sustainable development objectives. It is envisaged that the present financial markets would allocate the savings to initiatives using cutting-edge green technology that will assist in slowing the rate of environmental damage. Despite the rapid deterioration of the environment and the various attempts, it can be observed that the pool of funding is still matched with projects that are ecologically damaging and worsen present situations. Even though green financing is essential for the progress of green technology, investments in these technologies still do not attract enough investors. Many governments lack the enormous financial requirements, necessitating the involvement of the private sector, given the massive investment requirements of green businesses. However, private sector investment in green technology is very restricted due to the significant costs and risks involved with early investments in green technologies, making the rate of return significantly very tiny. Since green investments are so hazardous, the banking industry is unwilling to offer to fund green technology, creating the need for new types of finance. More substantial financial system involvement has also been a possible solution to the funding restrictions encountered by clean energy and green technology initiatives. Experts are needed to pay more attention to the growing significance of environmental sustainability in our aging population. Despite this, a comprehensive examination of the currently available information is still missing. In addition to hindering stakeholders' awareness of the intricate linkages between aging, environmental sustainability, and the residential environment, this deficiency results in hurdles to future research. Therefore, this study intends to fill this vacuum in the knowledge by conducting a literature review on the environmental sustainability of older individuals' living environments.

Researchers in this sector are looking to fill gaps in the literature, identify research subjects, and offer new avenues for future investigation under consideration. “What are the research subjects in the researched field?”; “What is the research progress of each topic?”; “What are the research gaps in the examined field?”; and “What research directions paths may be recommended to address the research gaps?”. Qualitative content analysis was used to accomplish this goal and answer these study questions. Results from this study will aid stakeholders in their knowledge of the environmental sustainability of older persons' home environments and open the door to further research in this area in the future.

As a limitation, the study faced the availability of data and time as a significant limitation. They the suggest following topics to investigate and extend the debate in literature;

-

Role of green finance in sustainable environmental technologies

-

Unlock private investment in a cleaner environment

-

Public support to track the performance of a cleaner environment in post-COVID world

-

Green financial stability to achieve a cleaner environment under the environmental protection vision

-

Financial inclusion and climate change mitigation in ASEAN economies in post-COVID-world

References

Abadie MO (2017) Modeling of particle transport in indoor environments: 25 years of research at ULR. In: Advances in building physics research-conference in the honor of Francis Allard, June 2017

Adom PK, Agradi M, Vezzulli A (2021) Energy efficiency-economic growth nexus: what is the role of income inequality? J Clean Prod 310:127382

Aguilera RV, Aragón-Correa JA, Marano V, Tashman PA (2021) The corporate governance of environmental sustainability: a review and proposal for more integrated research. J Manag 47(6):1468–1497

Ahmad B, Iqbal S, Hai M, Latif S (2021) The interplay of personal values, relational mobile usage and organizational citizenship behavior. Int Technol Smart Educ

Ahmed Z, Nathaniel SP, Shahbaz M (2021) The criticality of information and communication technology and human capital in environmental sustainability: evidence from Latin American and Caribbean countries. J Clean Prod 286:125529

Alemzero DA, Sun H, Mohsin M, Iqbal N, Nadeem M, Vo XV (2021a) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res 28(2):2158–2171

Alemzero DA, Iqbal N, Iqbal S, Mohsin M, Chukwuma NJ, Shah BA (2021b) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res 28(5):5359–5371

Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat Hazards 79(1):621–644

Aly A, Jensen SS, Pedersen AB (2017) Solar power potential of Tanzania: identifying CSP and PV hot spots through a GIS multicriteria decision making analysis. Renew Energy 113:159–175https://doi.org/10.1016/j.renene.2017.05.077

Anh Tu C, Chien F, Hussein MA, Ramli MM Y, Psi MMMSS, Iqbal S, Bilal AR (2021) Estimating role of Climate financing on energy security, economic and environmental integration of BRI member countries. Singapore Econ Rev

Anh Tu C, Sarker T, Rasoulinezhad E (2020) Factors influencing the green bond market expansion: evidence from a multi-dimensional analysis. J Risk Financ Manag 13(6):126

Anser MK, Yousaf Z, Zaman K, Nassani AA, Alotaibi SM, Jambari H, Khan A, Kabbani A (2020) Determination of resource curse hypothesis in mediation of financial development and clean energy sources: go-for-green resource policies. Resour Policy 66:101640

Beck T, Levine R (2004) Stock markets, banks, and growth: panel evidence. J Bank Financ 28(3):423–442

Bibi A, Zhang X, Umar M (2021) The imperativeness of biomass energy consumption to the environmental sustainability of the USA revisited. Environ Ecol Stat 28(4):821–841

Brockway PE, Sorrell S, Semieniuk G, Heun MK, Court V (2021) Energy efficiency and economy-wide rebound effects: a review of the evidence and its implications. Renew Sustain Energy Rev 141:110781

Brodjonegoro BP et al (2019) Person in charge LCDI commissioners authors and editors system dynamics modelling team supporting modelling team analysis (IIASA): supporting team

Brugger H, Eichhammer W, Mikova N, Dönitz E (2021) Energy efficiency vision 2050: how will new societal trends influence future energy demand in the European countries? Energy Policy 152:112216

Chen M, Sinha A, Kexiang H, Shah MI (2021) Impact of technological innovation on energy efficiency in industry 4.0 era: moderation of shadow economy in sustainable development. Technol Forecast Soc Change 164:120521https://doi.org/10.1016/j.techfore.2020.120521

Chen W, Deng J, Niu L (2022) Identification of core risk factors and risk diffusion effect of urban underground engineering in China: a social network analysis. Saf Sci 147:105591

De Matteis F, Preite D, Striani F, Borgonovi E (2021) Cities’ role in environmental sustainability policy: the Italian experience. Cities 111:102991

Dell’Anna F (2021) Green jobs and energy efficiency as strategies for economic growth and the reduction of environmental impacts. Energy Policy 149:112031

Ekins P, Zenghelis D (2021) The costs and benefits of environmental sustainability. Sustain Sci 16(3):949–965

Fatima N, Li Y, Ahmad M, Jabeen G, Li X (2021) Factors influencing renewable energy generation development: a way to environmental sustainability. Environ Sci Pollut Res 28(37):51714–51732

Feroz AK, Zo H, Chiravuri A (2021) Digital transformation and environmental sustainability: a review and research agenda. Sustainability 13(3):1530

Grillo R, Fraceto LF, Amorim MJ, Scott-Fordsmand JJ, Schoonjans R, Chaudhry Q (2021) Ecotoxicological and regulatory aspects of environmental sustainability of nanopesticides. J Hazard Mater 404:124148

GWEC G (2019) Global wind energy outlook. Brussels. ISSN 2525-3409

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164

Han H (2021) Consumer behavior and environmental sustainability in tourism and hospitality: a review of theories, concepts, and latest research. J Sustain Tour 29(7):1021–1042

Hezri AA, Hofmeister W (2012) Energy policy and the transition to a green economy: an introduction. Towards a green economy: in search of sustainable energy policies for the future. Institute of Strategic and International Studies

Hoshen MS, Hasan MN, Hossain S, Al Mamun MA, Mannan A, Al Mamun A (2017) Climate financing: an emerging form of sustainable development in Bangladesh. IOSR J Bus Manag 19(12):24–30

Huang J, Wang X, Liu H, Iqbal S (2021) Financial consideration of energy and environmental nexus with energy poverty: promoting financial development in G7 economies. Front Energy Res 666

Iqbal S, Bilal AR (2021) Investment performance: emotional beasts are dragging into the darkness of the castle. Global Bus Rev. https://doi.org/10.1177/09721509211044309

Iqbal S, Bilal AR, Nurunnabi M, Iqbal W, Alfakhri Y, Iqbal N (2021a) It is time to control the worst: testing COVID-19 outbreak, energy consumption and CO2 emission. Environ Sci Pollut Res 28(15):19008–19020

Iqbal S, Taghizadeh-Hesary F, Mohsin M, Iqbal W (2021b) Assessing the role of the green finance index in environmental pollution reduction. Estudios De Economía Aplicada 39(3):12

Iqbal S, Bilal AR (2021a) Energy financing in COVID-19: how public supports can benefit?. China Finance Rev Interl

Iqbal W, Yumei H, Abbas Q, Hafeez M, Mohsin M, Fatima A et al (2019) Assessment of wind energy potential for the production of renewable hydrogen in Sindh Province of Pakistan. Processes 7(4):196

Iram R, Zhang J, Erdogan S, Abbas Q, Mohsin M (2020) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res 27(4):3858–3870

IRENA (2020) Renewable energy and jobs: annual review 2020

Islam MA, Yousuf S, Hossain KF, Islam MR (2014) Climate financing in Bangladesh: challenges and opportunities–a descriptive approach. Inter J Green Econ 8(1):74–91

Jalo N, Johansson I, Kanchiralla FM, Thollander P (2021) Do energy efficiency networks help reduce barriers to energy efficiency? a case study of a regional Swedish policy program for industrial SMEs. Renew Sustain Energy Rev 151:111579

Jha B, Bakhshi P (2019) Green finance: fostering sustainable development in India. Int J Recent Technol Eng 8:3798–3801

Khan I, Hou F (2021) The impact of socio-economic and environmental sustainability on CO2 emissions: a novel framework for thirty IEA countries. Soc Indic Res 155(3):1045–1076

Khan SAR, Ponce P, Yu Z, Golpîra H, Mathew M (2022) Environmental technology and wastewater treatment: strategies to achieve environmental sustainability. Chemosphere 286:131532

Kihombo S, Vaseer AI, Ahmed Z, Chen S, Kirikkaleli D, Adebayo TS (2022) Is there a tradeoff between financial globalization, economic growth, and environmental sustainability? an advanced panel analysis. Environ Sci Pollut Res 29(3):3983–3993

Le TH, Nguyen CP, Park D (2020) Financing renewable energy development: insights from 55 countries. Energy Res Soc Sci 68

Li W, Chien F, Hsu CC, Zhang Y, Nawaz MA, Iqbal S, Mohsin M (2021a) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy 72:102063

Li W, Chien F, Ngo QT, Nguyen TD, Iqbal S, Bilal AR (2021c) Vertical financial disparity, energy prices and emission reduction: empirical insights from Pakistan. J Environ Manag 294:112946

Li W, Chien F, Kamran HW, Aldeehani TM, Sadiq M, Nguyen VC, Taghizadeh-Hesary F (2021b) The nexus between COVID-19 fear and stock market volatility. Econ Res-Ekonomska istraživanja 1–22

Lin B, Raza MY (2019) Analysis of energy related CO2 emissions in Pakistan. J Clean Prod 219:981–993

Liu Y, Li Q, Yang L, Mu K, Zhang M, Liu J (2020) Urban heat island effects of various urban morphologies under regional climate conditions. Sci Total Environ 743:140589

Lou J, Holbrook NJ, O’Kane TJ (2019) South Pacific decadal climate variability and potential predictability. J Clim 32(18):6051–6069

Mahi M, Ismail I, Phoong SW, Isa CR (2021) Mapping trends and knowledge structure of energy efficiency research: what we know and where we are going. Environ Sci Pollut Res 28(27):35327–35345

McCollum DL, Zhou W, Bertram C, De Boer HS, Bosetti V, Busch S et al (2018) Energy investment needs for fulfilling the Paris Agreement and achieving the Sustainable Development Goals. Nat Energy 3(7):589–599

Meidan M (2020) China: climate leader and villain. In: Hafner M, Tagliapietra S (eds) The geopolitics of the global energy transition. Springer, Cham, pp 75–91

Mohsin M, Hanif I, Taghizadeh-Hesary F, Abbas Q, Iqbal W (2021a) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy 149:112052

Mohsin M, Iqbal N, Taghizadeh-Hesary F, Iram R (2021) Poverty reduction for inclusive sustainable growth in developing Asia. In: Taghizadeh-Hesary F, Panthamit N, Yoshino N (eds) Poverty reduction for inclusive sustainable growth in developing Asia. Springer, Singapore, pp 165–182. https://doi.org/10.1007/978-981-16-1107-0_8

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo XV (2021c) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett 43:101520

Mohsin M, Ullah H, Iqbal N, Iqbal W, Taghizadeh-Hesary F (2021d) How external debt led to economic growth in South Asia: a policy perspective analysis from quantile regression. Econ Anal Policy 72:423–437

Ng AW (2018) From sustainability accounting to a climate financing system: Institutional legitimacy and market heterogeneity in a global financial centre. J Clean Prod 195:585–592

Noorpoor AR, Kudahi SN (2015) CO2 emissions from Iran's power sector and analysis of the influencing factors using the stochastic impacts by regression on population, affluence and technology (STIRPAT) model. Carbon Manag 6(3–4):101–116

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40:657–664

Omri A (2014) An international literature survey on energy-economic growth nexus: evidence from country-specific studies. Renew Sustain Energy Rev 38:951–959

Park JO, Tanner LB, Wei MH, Khana DB, Jacobson TB, Zhang Z et al (2019) Near-equilibrium glycolysis supports metabolic homeostasis and energy yield. Nature Chem Biol 15(10):1001–1008

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2001) Fully modified OLS for heterogeneous cointegrated panels. In: Nonstationary panels, panel cointegration, and dynamic panels. Emerald Group Publishing Limited

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Saunders HD, Roy J, Azevedo IM, Chakravarty D, Dasgupta de la Rue du Can S, Wei, T (2021) Energy efficiency: what has research delivered in the last 40 years? Annu Rev Environ Resour 46:135–165

Schusler TM, Espedido CB, Rivera BK, Hernández M, Howerton AM, Sepp K, Chaudhary VB (2021) Students of colour views on racial equity in environmental sustainability. Nat Sustain 4(11):975–982

Sun H, Edziah BK, Kporsu AK, Sarkodie SA, Taghizadeh-Hesary F (2021) Energy efficiency: the role of technological innovation and knowledge spillover. Technol Forecast Soc Chang 167:120659

Sun L, Fang S, Iqbal S, Bilal AR (2022) Financial stability role on climate risks, and climate change mitigation: implications for green economic recovery. Enviro Sci Pollut Res 1–12

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies 13(4):788

Wu H, Zhang Y (2014) Reversing DNA methylation: mechanisms, genomics, and biological functions. Cell 156(1–2):45–68

Wu X, Sadiq M, Chien F, Ngo QT, Nguyen AT (2021) Testing role of Climate financing on climate change mitigation: evidences from G7 and E7 countries. Environ Sci Pollut Res 28(47):66736–66750

Xue Y, Mohsin M, Taghizadeh-Hesary F, Iqbal N (2022) Environmental performance assessment of energy-consuming sectors through novel data envelopment analysis. Front Energy Res 9:713546

Yang B, Jahanger A, Usman M, Khan MA (2021a) The dynamic linkage between globalization, financial development, energy utilization, and environmental sustainability in GCC countries. Environ Sci Pollut Res 28(13):16568–16588

Yang Z, Abbas Q, Hanif I, Alharthi M, Taghizadeh-Hesary F, Aziz B, Mohsin M (2021b) Short-and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy 165:43–51

Yıldırım E, Sukruoglu D, Aslan A (2014) Energy consumption and economic growth in the next 11 countries: the bootstrapped autoregressive metric causality approach. Energy Econ 44:14–21

Yuan F, Gallagher KP (2018) Greening development lending in the Americas: trends and determinants. Ecol Econ 154:189–200

Zakari A, Adedoyin FF, Taghizadeh-Hesary F, Pazouki A (2021) Environmental treaties’ impact on the environment in resource-rich and non-resource-rich countries. Environ Sci Pollut Res 28(25):33108–33119

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021a) Public spending and green economic growth in BRI region: the mediating role of green finance. Energy Policy 153:112256

Zhang J, Patwary AK, Sun H, Raza M, Taghizadeh-Hesary F, Iram R (2021b) Measuring energy and environmental efficiency interactions towards CO2 emissions reduction without slowing economic growth in central and western Europe. J Environ Manage 279:111704

Zhang L, Huang F, Lu L, Ni X, Iqbal S (2021c) Energy financing for energy retrofit in COVID-19: recommendations for green bond financing. Environ Sci Pollut Res 1–12

Zhao L, Saydaliev HB, Iqbal S (2022) Energy financing, COVID-19 repercussions and Climate change: implications for emerging economies. Climate Change Econ 2240003

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Saydaliev, H.B., Chin, L. Role of green financing and financial inclusion to develop the cleaner environment for macroeconomic stability: Inter-temporal analysis of ASEAN economies. Econ Change Restruct 56, 3839–3859 (2023). https://doi.org/10.1007/s10644-022-09419-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09419-y