Abstract

Remanufacturing can exert positive economic and environmental effects, but factors such as competition and governmental regulations influence its development. In this paper, we investigated the impact of environmental taxes on manufacturers’ production decisions in three cases of a duopoly, in which remanufacturing was not conducted or conducted by one or two of the manufacturers. Based on game theory, the firm’s remanufacturing decision was discussed in cases when only one manufacturer was capable of remanufacturing and both were capable of remanufacturing. Analysis results showed that the benefits from the remanufacturing production cost and competition were the most critical trade-off components. We further analyzed how manufacturers’ decisions affected the environment. The environmental impact was measured by the total emissions, and relevant advice was provided to the regulator. Finally, assessments of numerical examples were performed using assumed values of the parameters to verify our results without loss of generality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, environmental issues such as air and water pollution have been becoming increasingly serious and have attracted considerable public and scientific attention. With the accumulating environmental protection concerns, the view that the emissions should be controlled and reduced has reached a consensus. Governments have implemented a range of policies to curb emissions. More specifically, environmental taxation, which follows the “Polluter-Pays Principle” where the costs of the environmental damage of resource depletion should be borne by polluters or users, has been supported by most OECD and EU countries (Morin and Orsini 2020). For example, carbon taxes have been widely implemented as a typical environmental tax in most of the European countries, such as Denmark, Germany, Italy, Norway, and the UK; they have also been applied in some Asian countries such as Japan (Mortha et al. 2021). Besides carbon taxes, other forms of environmental taxes exist, such as landfill fees for garbage and water pollution taxes (Bian et al. 2018). Most recently, China officially implemented environmental protection tax on four types of emissions: atmospheric pollutants, water pollutants, solid waste, and noise emissions. To comply with these regulations, firms have made an effort to develop sustainable production methods and operations to abate emissions (Yenipazarli 2016).

Remanufacturing, in which recollection, reprocessing, and reselling of already used products as like-new ones are realized, is crucially important to environmental sustainability (Fleischmann et al. 2000; Pazoki et al. 2019). Remanufacturing promotes the reduction of production costs and the emissions released to the environment by decreased energy and raw material consumption. The cost of remanufactured products was estimated to be 50% of the cost of the manufacturing of a new product (Ginsburg 2001). Therefore, a lower negative environmental impact is exerted via product remanufacturing due to reduced emission levels (Li et al. 2018). For example, the cost-saving by the decrease in the emissions resulting from remanufacturing of an inkjet cartridge reached 46% (Yenipazarli 2016). Due to the significant potential in terms of provided economic and environmental benefits, remanufacturing is favored by governments, and corporate remanufacturing has been on enterprises’ agenda and already largely put into operation.

As a matter of fact, considering the required complex production planning and operations for the provision of remanufactured products, firms have been reluctant in making remanufacturing decisions (Atasu et al. 2008; Wang et al. 2021). For instance, while remanufacturing can decrease pollutant emissions, enterprises still should pay environmental taxes (Yenipazarli 2016). On the one hand, by choosing to remanufacture, a manufacturer can reduce its emissions, which would be reflected by a decrease in the environmental tax cost. On the other hand, however, the manufacturer still has to bear the fixed costs for building a collection system, processing operations, and additional cost to remanufacture a product. Hence, the remanufacturing of the product depends on several key factors, such as the emission intensity of remanufacturing, the level of environmental taxes, and the fixed cost incurred. Moreover, manufacturers’ remanufacturing decision becomes much more complicated and difficult to make in the face of competition (Jena et al. 2014). Thus, the manufacturer should further consider the effect of the competitor’s remanufacturing decision and production planning on its operations and financial results (Mitra 2016a, b). Therefore, the appropriate conditions which would contribute to sustaining the profitability of manufacturers under competition and environmental tax payments need to be founded.

The environmental taxes studied in this paper are generic environment-related taxes imposed on industrial emissions such as those of landfill waste and air pollution. We analyzed a duopoly environment where two manufacturers were competing with each other in the presence of environmental tax over the manufacturing and remanufacturing periods. This study addresses the following questions: When should a manufacturer take part in remanufacturing in a duopoly market? How does environmental tax policy affect manufacturers’ remanufacturing decisions? Is there a balanced choice? If one enterprise decides to remanufacture, how would the others react? Is remanufacturing always beneficial to the environment? Under what conditions are environmental taxes effective in reducing emissions? To answer these questions, in this study, we constructed a two-period model to investigate the decisions of the manufacturers in three cases: (1) No-remanufacturing; (2) Remanufacturing by one manufacturer; (3) Remanufacturing by two manufacturers. The number of manufacturers providing remanufactured products in the second period is the main difference between the three cases. By comparing the optimal production and profits obtained under those three cases, we assessed the effect of remanufacturing on duopoly competition under environmental taxes. We investigated the manufacturer’s remanufacturing decision when only one manufacturer was capable of remanufacturing and when both were capable of remanufacturing, and then compared the emission levels under different conditions to provide advice to the government.

The remainder of the paper is organized as follows. Section 2 includes a review of the related literature. Section 3 describes the model and gives the optimal production planning decisions under environmental tax regulation, and Sect. 4 presents comparisons between cases with and without remanufacturing. Also, the optimal conditions for remanufacturing have been analyzed. Section 5 summarizes the main research findings and concludes the paper.

2 Literature review

Two main streams of research in the literature have been related to our work, including those exploring the operation decisions on remanufacturing and the ones addressing the environmental implications of remanufacturing under environmental regulation.

In the former stream of research, the operational decisions and economic implications of remanufacturing are explored. Without considering the competition, Ferrer and Swaminathan (2006) introduced two-period and multi-period models to illustrate the production planning with remanufacturing, where remanufactured products were considered perfect substitutes with new products. Additionally, Geyer et al. (2007) modeled and quantified the economic potential of remanufacturing under constraints such as limited component durability and market demand for remanufactured products. Kaya (2010) explored manufacturers’ optimal incentive and production decisions concerning remanufacturing via a newsvendor model. Furthermore, Mitra (2016a) analyzed the optimal pricing for new and remanufactured products of a monopolist firm in a case of an abundant supply of cores and when core supply was dependent on the acquisition price. Gan et al. (2017) studied the pricing decisions in a closed-loop supply chain, where new and remanufactured products were sold by separate channels. Based on one-way substitution for differentiated products, Liu et al. (2018) proposed a model to evaluate a monopolistic manufacturer’s remanufacturing decision and optimal pricing strategies. Atasu et al. (2008) analyzed the thresholds of OEM competition, green segments, and consumer valuation in remanufacturing, above which manufacturers would provide remanufactured products. In another study, Jena and Sarmah (2014) conducted research on the cooperation and competition issues in a closed-loop supply chain where two manufacturers providing the substitutable products competed to sell new as well as a collection of used products through a common retailer. In a more recent investigation, Mitra (2016b) examined the effect of remanufacturing in the case of two manufacturers in a direct competition that were selling a new product on the primary market, and one of them was selling a remanufactured product on the secondary market. Zhu et al. (2016) constructed a duopoly model to investigate the optimal production and trade-in pricing strategy of firms that were selling a remanufactured product. A number of earlier studies have been conducted on operational decisions associated with remanufacturing in different settings, such as those performed by Debo et al. (2005), Ferguson and Toktay (2006), Wu (2012), and Örsdemir et al. (2014). However, the above studies did not consider the environmental problems and the production decisions faced under environmental regulation.

As remanufactured products contribute to curbing emission due to less material and energy consumption, the resulting economic and environmental benefits under environmental regulation have started to attract significant research interest. For example, Liu et al. (2015) formulated optimization models to determine the remanufacturing quantity that maximizes the total profits under mandatory carbon emissions capacity, carbon tax, and cap and trade regulation. In a leader-following Stackelberg game model, Yenipazarli (2016) studied the impact of emission taxes on manufacturers’ production optimization and remanufacturing decisions. The author established approaches to derive triple-win benefits from remanufacturing by instituting emissions taxes. In their research, Wang et al. (2018) investigated the effects of carbon emission tax on the optimal production of new and remanufactured products and explored novel remanufacturing production strategies. Notably, Pazoki and Zaccour (2019) proposed a general functional form for the regulator to improve certain environmental goals, including product recovery and life cycle assessment. Dou et al. (2019) studied the remanufacturing production of a manufacturer under carbon tax regulation, in which different tax prices existed over the manufacturing and remanufacturing periods. Cao et al. (2020) explored the effect of tax and subsidy policies on the production and pricing decisions in a remanufacturing supply chain and examined which policy was optimal. Zhang et al. (2020) investigated the influence of tax, subsidy, and tax-subsidy policies on the remanufacturing production of a profit-maximizing manufacturer. Tran (2021) explored the relationship between green finance, economic growth, energy usage, and carbon emissions. Many studies have also focused on other government policy parameters, such as subsidy (Mitra and Webster 2008; Liu et al. 2017; Sartzetakis et al. 2020), take-back regulation (Atasu and Van 2009; Esenduran et al. 2017), cap-and-trade (Chang et al. 2015; Salamanca et al. 2017; Guo et al. 2021), and reward-penalty mechanism (Wang et al. 2017; Chen et al. 2019). The aforementioned studies have modeled strategies for remanufacturing, providing useful insights into government regulations. However, little research has been conducted on remanufacturing production strategies of manufacturers in direct competition under environmental regulations. In this paper, we report the findings of our investigation on the effects of remanufacturing in a duopoly competition environment under environmental tax regulations.

Drawing on existing research, we formulated a framework to investigate the effect of remanufacturing on duopoly competition and environmental sustainability. The main contribution of this paper lies in its analytical examination of the remanufacturing decisions of manufacturers in a competing environment under environmental taxes. Besides, we analyzed the emissions alongside with the production under different conditions, providing insights that could facilitate the provision of potential environmental benefits from remanufacturing by using environmental taxes by governments.

3 Modelling

We developed a model of a duopoly, in which two manufacturers competed over two periods under environmental taxes. In the first period, manufacturers produced a new product, and the product life cycle is referred to as one period. In the second period, manufacturers had the opportunity to collect used products for remanufacturing and provided both new and remanufactured products. We assumed that one manufacturer could remanufacture only its own cores, but could not remanufacture the other manufacturer’s cores, which was reasonable as manufacturers may utilize different manufacturing and remanufacturing processes. The ratio of the used product that could be collected and used for remanufacturing was measured by the collection rate \(\rho\). The manufacturers jointly made the production decision over the two periods to maximize their profits.

We assumed that no difference existed between the new and remanufactured products. Claims have been reported that remanufactured products are usually perceived to have a lower quality than new products (Atasu et al. 2008; Ullah and Sarkar 2020). However, other researchers consider that remanufactured and new products are perfectly substitutable (Ferrer and Swaminathan 2006; Atasu and Toktay 2013; Jena and Sarmah 2014) and sold at the same price to customers such as disposable cameras and printers. For the simplicity of our model, we assumed that the quality of the new product and the remanufactured product was the same, with no difference in price.

The competition between the two manufacturers is described by the inverse demand function \(p_{i} = a - q_{i} - q_{j}\), where \(p_{i}\) and \(q_{i}\) are the market price and the output of manufacturer \(i \left( { i,j = 1,2,i \ne j} \right)\), respectively. We then used \(q_{i1}\) and \(q_{i2}\) to represent the total output of manufacturer \(i\) in the first and the second periods, correspondingly. Next, if remanufactured products exist in period 2, \(\left( {q_{i2} - q_{ir} } \right)\) and \(q_{ir}\) denote the quantity of new and remanufactured product, respectively. \(R\) represents the remanufacturing case, and \(N\) denotes the absence of a remanufacturing case. The production of both new and remanufactured products leads to undesirable emissions taxed by the government; each emission is charged at a constant tax price \(t\). The total emission is a commonly used metric in the industry. As the production of a remanufactured product generates lower amounts of emissions than new products due to consumption of less material and energy, we designated \(e_{0} \quad {\text{and}}\quad \left( {e_{0} - \beta } \right)\) as the emissions required to manufacture a product using new materials and a used product, respectively. Compared to a new product, a remanufactured product reduces the emission \(\beta\), which is affected by numerous factors such as the product’s physical properties.

The production cost of a new product is denoted by \(c\). Based on previous literature evidence, including the studies performed by Ferguson et al. (2006) and Galbreth and Blackburn (2006), we assumed that the total collection and processing cost of \(q_{r}\) units of remanufactured products as \(kq_{r}^{2}\). Because the unit cost for obtaining and processing returns generally increases with the quantity collected due to additional efforts. We designated the quantities of remanufactured products produced by manufacturer \(i\) as \(q_{ir}\). When the manufacturer decides to remanufacture, it also has to pay the fixed cost to build collection system and the processing facility, designated as \(f\). Moreover, the firm \(i\) has to undertake the environmental tax cost for its emissions over the two periods, calculated by \(tE_{i}\) where \(E_{i} = \left[ {q_{i1} e_{0} + \left( {q_{i2} - q_{ir} } \right)e_{0} + q_{ir} \left( {e_{0} - \beta } \right)} \right]\) with remanufacturing, \(E_{i} = \left[ {(q_{i1} + q_{i2} } \right)e_{0} ]\). Then, \(E\) is the total emissions of the two firms, where \(E = E_{1} + E_{2}\).

To ensure that manufacturers will produce the new product, we assume that the limitation of environmental tax is \(t^{U}\), so that \(t < t^{U} = \frac{{2\left( {a - c} \right)k - 3c}}{{2ke_{0} + 3\beta }}\).

The parameters and an explanation are presented in Table 1.

3.1 No-remanufacturing case

For the case with no-remanufacturing, manufacturers only provide all-new products over the two periods. The profits of the manufacturers, in this case, are formulated as:

To maximize Eq. (1) with backward induction, the optimal production and pricing decisions in the two periods can be given as: \(q_{i1}^{{NN^{*} }} = \frac{{a - c - te_{0} }}{3}\), \(q_{i2}^{{NN^{*} }} = \frac{{a - c - te_{0} }}{3}\), \(p_{i1}^{{NN^{*} }} = \frac{{a + 2c + 2te_{0} }}{3}\), \(p_{i2}^{{NN^{*} }} = \frac{{a + 2c + 2te_{0} }}{3}\). The optimal emission of manufacturer \(i\), the total emission, and the overall profit can be calculated as \(E_{i}^{{NN^{*} }} = \frac{{2\left( {a - c - te_{0} } \right)}}{3}\), \(E^{{NN^{*} }} = \frac{{4\left( {a - c - te_{0} } \right)}}{3}\) and \(\pi_{i}^{{NN^{*} }} = \frac{{2\left( {a - c - te_{0} } \right)^{2} }}{9}\), respectively.

3.2 Remanufacturing by one manufacturer case

Because the two manufacturers have the same power in the market, the case of remanufacturing by manufacturer 1 is asymmetric to the case of remanufacturing by manufacturer 2. Thus, we only consider the case where manufacturer 2 undertakes the remanufacturing activities. The profit-maximizing problem of the manufacturers, in this case, is presented by the formulas:

While the profit of manufacturer 1 originates from selling new products in the two periods, manufacturer 2 also gains from selling remanufactured products in period 2 but bears the cost to remanufacture. Additionally, the constraint \(q_{2r} \le \rho q_{21}\) means that the quantity of the remanufactured product cannot be higher than the used product collected. By maximizing manufacturers’ profits in the two periods, we obtain the optimal production decisions and profits, which are listed in Appendix 1.

3.3 Remanufacturing by two manufacturers case

In this case, two manufacturers offer new and remanufactured products in the second period. The profit-maximizing problem of the manufacturers is given by the equation:

Both manufacturers provide new and remanufactured products in the second period. By maximizing manufacturers’ profits in the two periods, we obtain the optimal production decisions and profits listed in Appendix 2.

4 Remanufacturing analysis

4.1 Case in which one manufacturer decides to remanufacture

In this subsection, we consider the condition where only one manufacturer (manufacturer 2) decides to remanufacture, whereas the other manufacturer provides new products in the two periods. We studied the effect of remanufacturing in comparison with the no-remanufacturing case.

Proposition 1

Let \(\overline{t} = \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) , the optimal production decisions of the two manufacturers when manufacturer 2 decides to remanufacture or not hold:

-

(1)

\(q_{i2}^{{NN^{*} }} = q_{i2}^{{NR^{*} }}\), \(p_{i2}^{{NN^{*} }} = p_{i2}^{{NR^{*} }}\);

-

(2)

When \(t \le \overline{t}\), then, \(q_{2r}^{{NR^{*} }} \le \rho q_{21}^{{NR^{*} }}\),\(q_{i1}^{{NN^{*} }} = q_{i1}^{{NR^{*} }}\),\(p_{i1}^{{NN^{*} }} = p_{i1}^{{NR^{*} }}\); When \(t > \overline{t}\), then \(q_{2r}^{{NR^{*} }} = \rho q_{21}^{{NR^{*} }}\), \(q_{21}^{{NN^{*} }} < q_{21}^{{NR^{*} }}\), \(q_{11}^{{NN^{*} }} > q_{11}^{{NR^{*} }}\), \(p_{i1}^{{NN^{*} }} < p_{i1}^{{NR^{*} }}\).

Proposition 1 shows that the total product quantity sold in period 2 is not affected by remanufacturing and that a tax level \(\overline{t}\) exists, above which remanufacturing is constrained by the collected products. The production planning of the manufacturers in period 1 is not affected by the remanufacturing decision for environmental tax price \(t \le \overline{t}\), as the quantity of the new product offered in period 1 is not related to the remanufacturing-related parameters \(k\), \(\rho\), and \(\beta\). However, for the environmental tax price \(t > \overline{t}\), the production of the remanufactured product is constrained by the multiple \(\rho\) of the new product sales in the first period, which also means that remanufacturing is profitable. To increase the supply of remanufactured cores, the manufacturer has the motivation to increase the production of the new product in period 1. Meanwhile, the other manufacturer has to decrease the production of the new product in response to the competition. As a result, the product price in period 1 is higher than that of the no-remanufacturing case.

Based on the optimal responses of manufacturers to environmental taxes, we analyzed the impact of remanufacturing on manufacturers’ profits and emissions. To better understand the impact of remanufacturing, we defined \(\Delta \Pi_{i}^{NR} \left( t \right) = \pi_{i}^{{NR^{*} }} - \pi_{i}^{{NN^{*} }}\) as the optimal incremental profits of manufacturer \(i\) when the remanufactured product is provided by manufacturer 2. Then, manufacturer 2 would decide to remanufacture if \(\Delta \Pi_{2}^{NR} \left( t \right) > 0\). We also defined \(\Delta E_{2}^{NR} \left( t \right) = E_{2}^{{NR^{*} }} - E_{2}^{{NN^{*} }}\) and \(\Delta E^{NR} \left( t \right) = E^{{NR^{*} }} - E^{{NN^{*} }}\) as the increase in manufacturer 2’s emission and total emission from remanufacturing, respectively. While \(\Delta E_{2}^{NR} \left( t \right) > 0\) means manufacturer 2 generates a negative effect on the environment by remanufacturing, \(\Delta E^{NR} \left( t \right) < 0\) indicates that remanufacturing has positive effects on the environment.

Theorem 1

Under environmental taxation \(t \in \left[ {0,t^{U} } \right)\) :

-

(1)

\(\Delta \Pi_{1}^{NR} \left( t \right) = 0\) for \(t \in \left[ {0,\overline{t}} \right]\) , and \(\Delta \Pi_{1}^{NR} \left( t \right)\) is convex in \(t \in \left( {\overline{t},t^{U} } \right)\) with \(\Delta \Pi_{1}^{NR} \left( t \right) \le 0\) for \(t \in \left( {\overline{t},t^{M1} } \right)\) , \(\Delta \Pi_{1}^{NR} \left( t \right) > 0\) otherwise;

-

(2)

\(\Delta \Pi_{2}^{NR} \left( t \right)\) is an increasing convex function of \(t \in \left[ {0,\overline{t}} \right)\) and strictly concave in \(t \in \left( {\overline{t},t^{U} } \right)\) , with a unique maximum at \(t = t^{M2} \in \left( {\overline{t},t^{U} } \right)\) ;

-

(3)

\(\Delta E_{1}^{NR} \left( t \right) = 0\) for \(t \in \left[ {0,\overline{t}} \right]\) , and \(\Delta E_{1}^{NR} \left( t \right)\) is a linear decrease function of \(t \in \left( {\overline{t},t^{U} } \right);\)

-

(4)

\(\Delta E_{2}^{NR} \left( t \right)\) , \(\Delta E^{NR} \left( t \right)\) are piecewise linear convex curve in t with a unique minimum at \(\overline{t}\) , and have only one root on where \(\Delta E_{2}^{NR} \left( {t^{M2} } \right) = 0\) , \(\Delta E^{NR} \left( {t^{M3} } \right) = 0\) , respectively.

With \(t^{M1} = \frac{{2\left( {a - c} \right)\left( {3 + 5k\rho^{2} } \right) - 3c\rho }}{{3\beta \rho + 6e_{0} + 10k\rho^{2} e_{0} }}\), \(t^{M2} = \frac{{e_{0} \left( {a - c} \right)(3 + 4k\rho^{2} )^{2} + 9\left( {1 + k\rho^{2} } \right)\left( {2\beta \rho - e_{0} } \right)\left( {a - c + 2\rho c} \right)}}{{e_{0}^{2} (3 + 4k\rho^{2} )^{2} - 9\left( {1 + k\rho^{2} } \right)(e_{0} - 2\beta \rho )^{2} }}\), \(t^{M3} = \frac{{\left( {a - c} \right)\left( {3\beta + 4k\rho e_{0} } \right) - 6c\left( {e_{0} - \beta \rho } \right)}}{{4k\rho e_{0}^{2} + 3\beta \left( {3e_{0} - 2\beta \rho } \right)}}\), \(t^{M4} = \frac{{\left( {a - c} \right)\left( {3\beta + 2k\rho e_{0} } \right) - 3c\left( {e_{0} - 2\beta \rho } \right)}}{{2k\rho e_{0}^{2} + 6\beta \left( {e_{0} - \beta \rho } \right)}}\), and \(t^{M2} < t^{M3} < t^{M4}\).

Theorem 1 shows that the emissions of the manufacturer associated with remanufacturing will first decrease but then increase. Hence, we obtain \(\Delta E_{2}^{NR} \left( t \right) < 0\) and \(\Delta E^{NR} \left( t \right) < 0\) at \(t = 0\), \(\Delta E_{2}^{NR} \left( t \right) = 0\) and \(\Delta E^{NR} \left( t \right) = 0\) at \(t = t^{M2}\) and \(t = t^{M3}\), respectively. This means the manufacturer’s decision to remanufacture reduces its own emission and total emission for \(t \in \left[ {0,t^{M2} } \right)\) and \(t \in \left[ {0,t^{M3} } \right)\). On the other hand, \(\Delta E_{2}^{NR} \left( t \right) > 0\) and \(\Delta E^{NR} \left( t \right) < 0\) for \(t \in \left( {t^{M2} ,t^{M3} } \right)\), meaning remanufacturing exerts a positive environmental effect even when manufacturer 2’s emissions increase, which can be explained by the decrease in \(q_{11}^{{{\text{NR}}^{*} }}\) due to competition.

Theorem 1 also reveals the economic benefit from remanufacturing is related to \(t\). Manufacturer 1 will lose profits for \(t \in \left( {\overline{t},t^{M1} } \right)\), and gain profits for \(t \in \left( {t^{M1} ,t^{U} } \right)\) from the remanufacturing of manufacturer 2. To ensure \(t^{M1} < t^{U}\), it has to satisfy \(\rho < 0.2\) and \(k > \frac{3}{{\rho \left( {1 - 5\rho } \right)}}\). That is to say, manufacturer 1 can gain benefit from remanufacturing when the collection rate is low, and the cost to collect and process is higher for manufacturer 2 under a high level of environmental tax.

For manufacturer 2, as \(\Delta \Pi_{2}^{NR} \left( t \right)\) is increasing for \(t \in \left[ {0,t^{M2} } \right)\) and decreasing for \(t \in \left( {t^{M2} ,t^{U} } \right)\), \(\Delta \Pi_{2}^{NR} \left( t \right)\) it will have at most two roots on \(\left[ {0,t^{U} } \right)\) if \(\Delta \Pi_{2}^{NR} \left( t \right) < 0\) at t = 0. We represent the two roots by \(t_{NR}^{NR} ,t_{RN}^{NR}\) so that \(\Delta \Pi_{2}^{NR} \left( {t_{NR}^{NR} } \right) = \Delta \Pi_{2}^{NR} \left( {t_{RN}^{NR} } \right) = 0\) with \(t_{NR}^{NR} < t_{RN}^{NR}\). Therefore, manufacturer 2 has the motivation to remanufacture for \(t \in \left( {t_{NR}^{NR} ,t_{RN}^{NR} } \right)\) as \(\Delta \Pi_{2}^{NR} \left( t \right) > 0\) if both \(t_{NR}^{NR}\) and \(t_{RN}^{NR}\) exist. The following proposition shows the conditions when remanufacturing is profitable for manufacturer 2.

Proposition 2

Let \(f^{L1} = \frac{{c^{2} }}{4k}\),\(f^{M1} = \frac{{[(3 + 4k\rho )^{2} \left( {1 + k\rho^{2} } \right) - \left( {3 + 4k\rho^{2} )^{2} } \right](a\beta - c\beta + ce_{0} )^{2} }}{{(3 + 4k\rho^{2} )^{2} (3\beta + 2ke_{0} )^{2} }}\),\(f^{U1} = \Delta \Pi_{2}^{NR} \left( {t^{M1} } \right)\), \(0 < f^{L1} < f^{M1} < f^{U1}\), for the remanufacturing decision of firm 2:

(1) \(\Delta \Pi_{2}^{NR} \left( t \right) = 0\) has two roots \(t_{NR}^{NR} ,t_{RN}^{NR}\) on \(\left[ {0,t^{U} } \right)\), such that \(0 < t_{NR}^{NR} < t^{M1} < t_{RN}^{NR} < t^{U}\) if and only if \(f^{M1} \le f < f^{U1}\), in which case it is profitable to provide the remanufactured product for \(t \in \left( {t_{NR}^{NR} ,t_{RN}^{NR} } \right)\)

(2) \(\Delta \Pi_{2}^{NR} \left( t \right) = 0.\) has only one root \(t_{NR}^{NR}\) on \(\left[ {0,t^{U} } \right)\) such that \(0 < t_{NR}^{NR} < t^{M1} < t^{U}\) if and only if \(f^{L1} \le f < f^{M1}\), in which case it is profitable to provide the remanufactured product for \(t \in \left( {t_{NR}^{NR} ,t^{U} } \right)\).

(3) \(\Delta \Pi_{2}^{NR} \left( t \right) = 0\) has no roots on \(t \in \left[ {0,t^{U} } \right)\) if \(0 < f < f^{L1}\), in which case it is profitable to provide the remanufactured product. or if \(f \ge f^{U1}\), in which case it is not profitable to provide the remanufactured product.

Proposition 2 shows the impact of environmental tax \(t\) and fixed cost \(f\) on firm 2’s remanufacturing decision. When the fixed cost is moderate \(f \in \left[ {f^{M1} ,f^{U1} } \right)\), \(\Delta \Pi_{2}^{NR} \left( t \right) = 0\) has two roots, and the remanufacturing decision of firm 2 is not monotonous in response to the increase in \(t\). When \(t < t_{NR}^{NR}\) and \(t > t_{RN}^{NR}\), the revenue brought by remanufacturing is not enough to offset the fixed cost, so manufacturer 2 will not carry out remanufacturing. In the interval \(t \in \left( {t_{NR}^{NR} ,t_{RN}^{NR} } \right)\), the production cost and environmental tax cost saved by remanufacturing make manufacturer 2’s remanufacturing profitable. When the effect of the fixed cost was reduced such as at \(f \in f^{L1} ,f^{M1}\), a higher tax price always makes profitable the remanufacturing of manufacturer 2 because the saved cost compared with that of no-remanufacturing is sufficient to cover the fixed cost. However, a high fixed cost has a dominant impact on manufacturers’ decision-making as it diminishes the feasibility of remanufacturing. This outcome suggests that in addition to environmental tax, subsidies for the fixed cost of remanufacturing could increase the effectiveness of emission reductions by motivating the manufacturer to remanufacture.

To examine the economic and environmental effects of remanufacturing when only one manufacturer decides to remanufacture, a numerical study is conducted. Without loss of generality, the relevant parameters are set as \(a = 500\), \(c = 1\), \(k = 0.5\), \(\rho = 0.15\), \(e_{0} = 500\), \(\beta = 50\). Using these parameter values, we obtain \(t^{M2} = 0.618\), \(t^{M3} = 0.492\), \(t^{M4} = 0.598\), \(\overline{t} = 0.319\), \(t^{U} = 0.763\), \(f^{L1} = 0.5\), \(f^{M1} = 287.77\), \(f^{U1} = 332.736\). By letting \(f = 300 \in \left[ {f^{M1} ,f^{U1} } \right)\), we have \(t_{NR}^{NR} = 0.494\), \(t_{RN}^{NR} = 0.742\).

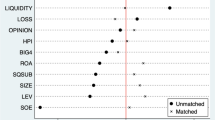

Figure 1 depicts the relationships between \(\Delta \prod \left( t \right)\) and different \(t\) values. As shown, \(\Delta \Pi_{1}^{NR} \left( t \right)\) is always negative for \(t \in \left( {\overline{t},t^{U} } \right)\) because \(t^{M1} > t^{U}\) at this time, which means manufacturer 1 would lose profits when manufacturer 2 conducts the remanufacturing. For \(f = 300\), \(\Delta \Pi_{2}^{NR} \left( t \right) < 0\) for \(0 < t < 0.494\) and \(0.742 < t < 0.763\), where manufacturer 2 would decide not to remanufacture, and \(\Delta \Pi_{2}^{NR} \left( t \right) > 0\) for \(0.494 < t < 0.742\) where the manufacturer would offer a remanufactured product in period 2. Also, as the fixed cost \(f\) decreases, manufacturer 2 would find it is profitable on a larger scale of \(t\). Figure 2 illustrates the association between \({\Delta }E\) and different \(t\) values. We observed that \(\Delta E^{NR} \left( t \right) < 0\) for \(0 \le t < 0.598\) where remanufacturing generates a positive effect on the environment, and \(\Delta E^{NR} \left( t \right) > 0\) for \(0.598 < t < 0.763\) where remanufacturing produces a negative effect on the environment. Combining the effect of remanufacturing with the economic and environmental impact, the manufacturer can achieve a win–win situation under environmental tax regulation for \(t \in \left( {t_{NR}^{NR} ,t^{M4} } \right) = \left( {0.494,0.598} \right)\), in which remanufacturing increases profits while decreasing emissions.

4.2 The case with two manufacturers deciding to remanufacture

In this subsection, we considered that both duopoly manufacturers decided to offer a remanufactured product in the second period. To study the effect of remanufacturing, we first compared the production decisions when remanufactured products were provided by the two manufacturers with the influence of the no-remanufacturing case decisions, then investigated the remanufacturing decisions of the manufacturers and compared the emissions under different conditions.

Proposition 3

Let \(\overline{t} = \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) then, the optimal production decision of the two manufacturers who both decide to remanufacture or not hold would be:

-

(1)

\(q_{i2}^{{NN^{*} }} = q_{i2}^{{RR^{*} }}\), \(p_{i2}^{{NN^{*} }} = p_{i2}^{{RR^{*} }}\);

-

(2)

When \(t \le \overline{t}\), then \(q_{2r}^{{RR^{*} }} \le \rho q_{21}^{{RR^{*} }}\),\(q_{i1}^{{NN^{*} }} = q_{i1}^{{RR^{*} }}\),\(p_{i1}^{{NN^{*} }} = p_{i1}^{{RR^{*} }}\); When \(t > \overline{t}\), then \(q_{2r}^{{RR^{*} }} = \rho q_{21}^{{NR^{*} }}\), \(q_{i1}^{{NN^{*} }} < q_{i1}^{{RR^{*} }}\),\(p_{i1}^{{NN^{*} }} > p_{i1}^{{RR^{*} }}\).

Proposition 3 reveals that the total quantity sold in period 2 is not affected by remanufacturing as there is no difference between the new and the remanufactured product. Since the same trend was observed in the case with one remanufacturing manufacturer, obviously, a threshold tax price exists below which the production is period 1 is not affected, but above which production planning would change to support the remanufacturing in period 2. For tax price \(t > \overline{t}\), manufacturers find it is overall profitable to increase the supply of new products, which also benefits customers as the product price is lower.

The following proposition characterizes the equilibrium for remanufacturing decision strategies of manufacturer 1 and 2 when both are able to remanufacture.

Proposition 4

When two manufacturers remanufacture, for the remanufacturing decision of the duopoly, we obtain the following Nash equilibrium equations:

-

(1)

For \(t \le \overline{t}\), a pure strategy Nash equilibrium \(\left( {R,R} \right)\) exists if \(f > (c + t\beta )^{2} /4k\); a pure strategy Nash equilibrium \(\left( {N,N} \right)\) is present if \(f < (c + t\beta )^{2} /4k\).Where

$$f^{nr} = \frac{{\left( {1 + k\rho^{2} } \right)[\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }} - \frac{{(a - c - te_{0} )^{2} }}{9},\;\;f^{rr} = \frac{{\left( {1 + k\rho^{2} } \right)(a - c - te_{0} + c\rho + t\beta \rho )^{2} }}{{(3 + 2k\rho^{2} )^{2} }} - \frac{{[\left( {a - c - te_{0} } \right)\left( {1 + 2k\rho^{2} } \right) - \rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }}$$ -

(2)

For \(t > \overline{t}\), there exists a pure strategy Nash equilibrium \(\left( {R,R} \right)\) if \(f < f^{rr}\); and there exists a pure strategy Nash equilibrium \(\left( {N,N} \right)\) if \(f > f^{nr}\); there does not exist any pure strategy Nash equilibrium, and firms 1 and 2 will adopt the same remanufacturing decision with randomness if \(f^{rr} < f < f^{nr}\).Where

$$\begin{aligned} f^{nr} & = \frac{{\left( {1 + k\rho^{2} } \right)[\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }} - \frac{{(a - c - te_{0} )^{2} }}{9},\\ f^{rr} & = \frac{{\left( {1 + k\rho^{2} } \right)(a - c - te_{0} + c\rho + t\beta \rho )^{2} }}{{(3 + 2k\rho^{2} )^{2} }}\\ &\quad - \frac{{[\left( {a - c - te_{0} } \right)\left( {1 + 2k\rho^{2} } \right) - \rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }} \end{aligned}$$

Proposition 4 shows how a firm's remanufacturing decision is related to environmental taxes, fixed costs, and the decision of a competing firm. At a low level of environmental tax, the dominant pure strategy for both manufacturers is to provide remanufactured products when the fixed cost is low and not to remanufacture when the fixed cost is high. Hence, the fixed cost plays a critical role in a firm’s remanufacturing decision-making process. At a high level of environmental tax, however, manufacturers have no dominant strategy for a remanufacturing decision at a medium-level fixed cost. The mechanism behind this process is that remanufacturing can bring profits to the manufacturer when the other manufacturer does not remanufacture, while the two manufacturers will lose their profits when both provide a remanufactured product in period 2, which leads to the nonexistence of the pure strategy equilibrium.

To analyze the effect of remanufacturing on the environment, we compared the emission levels under different conditions.

Proposition 5

Comparing the emission under different circumstances, we have:

(1) When \(t < t^{1}\), then \(E^{NN} > E^{NR} > E^{RR}\);Where

(2) When \(t^{1} < t < t^{2}\), then \(E^{NN} > E^{RR} > E^{NR}\);Where

(3)When \(t^{2} < t < t^{3}\), then \(E^{RR} > E^{NN} > E^{NR}\);Where

(4) When \(t > t^{3}\), then \(E^{RR} > E^{NR} > E^{NN}\).Where

Proposition 5 indicates the negative effect that remanufacturing may have on the environment when the environmental tax rate is too high. Nevertheless, at a relatively low environmental tax rate, the case when both manufacturers undertake remanufacturing will lead to the emission of the lowest quantities of pollution. Therefore, the government can subsidize a fixed rate of the tax value to motivate manufacturers to remanufacture, thus reducing pollutant emissions. When the environment tax rate is in the middle range, only one manufacturer involved in remanufacturing can produce the least emissions. However, when the environmental tax is relatively high, the remanufacturing decision of the manufacturer will result in an increase in the emission level, and thus, the government should not set too high environmental taxes. When the government needs to set a high environmental tax, measures to discourage remanufacturing should also be undertaken.

To confirm and better illustrate our results, we conducted a numerical example. Without loss of generality, the relevant parameters were established as \(a = 500\), \(c = 1\), \(k = 0.5\), \(\rho = 0.20\), \(e_{0} = 500\), \(\beta = 50\). Using these parameter values, we obtained \(\overline{t} = 0.387\), \(t^{1} = 0.616\), \(t^{2} = 0.621\), \(t^{3} = 0.626\), \(t^{U} = 0.763\). Figure 3 depicts the associations between firms’ remanufacturing decisions and different environmental tax and fixed cost rates, while Fig. 4 represents the relationships between the emissions under three cases. \(t < t^{1}\), \(E^{NN} > E^{NR} > E^{RR}\) indicates the effectiveness of remanufacturing to abate emissions, especially when remanufacturing has been undertaken by both manufacturers. Thus, considering the firm’s remanufacturing decision, low fixed-cost tax and subsidy levels are sufficient to generate a positive impact on the environment. However, at \(t > t^{3}\), \({\text{E}}^{RR} > {\text{E}}^{NR} > {\text{E}}^{NN}\), a manufacturer would generate a negative effect on the environment by its decision to remanufacture when the fixed cost is below a certain threshold.

5 Conclusion and policy recommendations

Along with the recognition of the economic and environmental benefits of remanufacturing, many manufacturers have been set on the road to remanufacturing. Furthermore, some companies compete not only in the production and realization of new products but also in remanufactured products, such as printer cartridges, diesel engines, and machine tools. Under environmental tax regulation, we modeled a duopoly including three cases: no-remanufacturing, remanufacturing by one manufacturer, and remanufacturing by two manufacturers, based on manufacturers' decision on providing or not remanufactured products in the second studied period. The remanufacturing decisions of the manufacturers were analyzed, and the economic and environmental effects of remanufacturing were explored.

The main results can be summarized as follows. First, when only one manufacturer offers remanufactured products in the second period, more new products would be produced in the first period to supply more remanufactured cores, which is motivated by the profitability of remanufacturing. On the other hand, the other manufacturer would have to reduce its production of new products and may lose profits under a relatively high tax level. The fixed cost plays a key role in manufacturers’ remanufacturing decision-making. As the fixed cost decreases, the interval within which the firm decides to remanufacture expands. Second, when both manufacturers decide to remanufacture, more new products would be manufactured compared with the case of no-remanufacturing if the tax price is above a certain threshold. No dominant strategy concerning a remanufacturing decision would exist if the environmental tax price is relatively high and the fixed cost is medium-level; only the pure strategy Nash equilibrium would be valid under those conditions. Third, under a low tax rate level, manufacturers can reduce their emissions by deciding to remanufacture, and the government can subsidize the fixed cost as support for the activity. Under a high tax rate level, the production of remanufactured products may increase the emissions.

This study shows that the economic and environmental benefits of remanufacturing can be achieved with appropriate measures, which can also facilitate the solution of problems caused by the COVID-19 pandemic. The global environment has been increasingly polluted as a result of the negative impact of COVID-19 spread (Tran 2021). Therefore, based on the results of our study, policymakers must employ a stricter environmental tax policy to curb emissions. Meanwhile, subsidy policies related to manufacturers’ fixed costs for remanufacturing are also required to support remanufacturing when needed. Thus, with proper tax policy set in place, remanufacturing can be feasible towards green recovery in the post-COVID-19 era.

Several research directions exist for the extension of our study in the future. For example, it is worthwhile to examine the multi-period horizon model to obtain insights into long-term environmental protection as an upgrade to the present two-period model assumption. In addition, this research considers that there is no price difference between new and remanufactured products, but valuation differences to remanufactured products have been observed in real-world business. Still another worthy upgrade would be the addition of competing intensity and incorporating uncertainty into the demand function to examine how it would affect manufacturers’ remanufacturing decisions.

References

Atasu A, Sarvary M, Van Wassenhove LN (2008) Remanufacturing as a marketing strategy. Manag Sci 54(10):1731–1746

Atasu A, Toktay LB, Van Wassenhove LN (2013) How collection cost structure drives a manufacturer’s reverse channel choice. Prod Op Manag 22(5):1089–1102

Atasu A, Van Wassenhove LN, Sarvary M (2009) Efficient take-back legislation. Prod Op Manag 18(3):243–258

Bian J, Guo X, Li KW (2018) Decentralization or integration: distribution channel selection under environmental taxation. Transp Res Part E Logist Transp Rev 113:170–193

Cao K, He P, Liu Z (2020) Production and pricing decisions in a dual-channel supply chain under remanufacturing subsidy policy and carbon tax policy. J Op Res Soc 71(8):1199–1215

Chang X, Xia H, Zhu H, Fan T, Zhao H (2015) Production decisions in a hybrid manufacturing–remanufacturing system with carbon cap and trade mechanism. Int J Prod Econ 162:160–173

Chen CK, Akmalul’Ulya M (2019) Analyses of the reward-penalty mechanism in green closed-loop supply chains with product remanufacturing. Int J Prod Econ 210:211–223

Debo LG, Toktay LB, Van Wassenhove LN (2005) Market segmentation and product technology selection for remanufacturable products. Manag Sci 51(8):1193–1205

Dou G, Guo H, Zhang Q, Li X (2019) A two-period carbon tax regulation for manufacturing and remanufacturing production planning. Comput Ind Eng 128:502–513

Enríquez-de-Salamanca Á, Martín-Aranda RM, Diaz-Sierra R (2017) Towards an integrated environmental compensation scheme in Spain: linking biodiversity and carbon offsets. JEAPM 19(02):1750006

Esenduran G, Kemahlıoğlu-Ziya E, Swaminathan JM (2017) Impact of take-back regulation on the remanufacturing industry. Prod Op Manag 26(5):924–944

Ferguson ME, Toktay LB (2006) The effect of competition on recovery strategies. Prod Op Manag 15(3):351–368

Ferrer G, Swaminathan JM (2006) Managing new and remanufactured products. Manag Sci 52(1):15–26

Fleischmann M, Krikke HR, Dekker R, Flapper SDP (2000) A characterization of logistics networks for product recovery. Omega 28(6):653–666

Galbreth MR, Blackburn JD (2006) Optimal acquisition and sorting policies for remanufacturing. Prod Op Manag 15(3):384–392

Gan SS, Pujawan IN, Widodo B (2017) Pricing decision for new and remanufactured products in a closed-loop supply chain with separate sales channel. Int J Prod Econ 190:120–132

Geyer R, Van Wassenhove LN, Atasu A (2007) The economics of remanufacturing under limited component durability and finite product life cycles. Manag Sci 53(1):88–100

Ginsburg J (2001) Manufacturing: once it is not enough, more companies are finding profits in remanufacturing. Business Week, April 16

Guo Q, Su Z, Chiao C (2021) Carbon emissions trading policy, carbon finance, and carbon emissions reduction: evidence from a quasi-natural experiment in China. Econ Change Restruct https://doi.org/10.1007/s10644-021-09353-5

Jena SK, Sarmah SP (2014) Price competition and cooperation in a duopoly closed-loop supply chain. Int J Prod Econ 156:346–360

Kaya O (2010) Incentive and production decisions for remanufacturing operations. Eur J Op Res 201(2):442–453

Li Z, Zheng W, Meng Q, Jin S (2018) The impact of government subsidy and tax policy on the competitive decision-making of remanufacturing supply chains. Int J Sustain Eng 12(1):18–29

Liu B, Holmbom M, Segerstedt A, Chen W (2015) Effects of carbon emission regulations on remanufacturing decisions with limited information of demand distribution. Int J Prod Res 53(2):532–548

Liu Z, Chen J, Diallo C (2018) Optimal production and pricing strategies for a remanufacturing firm. Int J Prod Econ 204:290–315

Liu Z, Tang J, Li BY, Wang Z (2017) A trade-off between remanufacturing and recycling of WEEE and the environmental implication under the Chinese fund policy. J Clean Prod 167:97–109

Mitra S (2016a) Optimal pricing and core acquisition strategy for a hybrid manufacturing/remanufacturing system. Int J Prod Res 54(5):1285–1302

Mitra S (2016b) Models to explore remanufacturing as a competitive strategy under duopoly. Omega 59:215–227

Mitra S, Webster S (2008) Competition in remanufacturing and the effects of government subsidies. Int J Prod Econ 111(2):287–298

Morin JF, Orsini A (2020) Essential concepts of global environmental governance. https://doi.org/10.4324/9780367816681

Mortha A, Taghizadeh-Hesary F, Vo XV (2021) The impact of a carbon tax implementation on non-CO2 gas emissions: the case of Japan. Australas J Environ Manag 28:1–18. https://doi.org/10.1080/14486563.2021.1991498

Örsdemir A, Kemahlıoğlu-Ziya E, Parlaktürk AK (2014) Competitive quality choice and remanufacturing. Prod Op Manag 23(1):48–64

Pazoki M, Zaccour G (2019) A mechanism to promote product recovery and environmental performance. Eur J Op Res 274(2):601–614

Sartzetakis ES (2020) Green bonds as an instrument to finance low carbon transition. Econ Change Restruct. https://doi.org/10.1007/s10644-020-09266-9

Tran QH (2021) The impact of green finance, economic growth and energy usage on CO2 emission in Vietnam–a multivariate time series analysis. Ch Financ Rev Int. https://doi.org/10.1108/CFRI-03-2021-0049

Ullah M, Sarkar B (2020) Recovery-channel selection in a hybrid manufacturing-remanufacturing production model with RFID and product quality. Int J Prod Econ 219:360–374

Wang W, Zhang Y, Li Y, Zhao X, Cheng M (2017) Closed-loop supply chains under reward-penalty mechanism: retailer collection and asymmetric information. J Clean Prod 142:3938–3955

Wang X, Zhu Y, Sun H, Jia F (2018) Production decisions of new and remanufactured products: implications for low carbon emission economy. J Clean Prod 171:1225–1243

Wang Z, Wang Y, Liu Z, Cheng J, Chen X (2021) Strategic management of product recovery and its environmental impact. Int J Prod Res 59(20):6104–6124

Wu CH (2012) Product design and pricing strategies with remanufacturing. Eur J Op Res 222(2):204–215

Yenipazarli A (2016) Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur J Op Res 249(1):117–130

Zhang Y, Hong Z, Chen Z, Glock CH (2020) Tax or subsidy. Design and selection of regulatory policies for remanufacturing. Eur J Op Res 287(3):885–900

Zhu X, Wang M, Chen G, Chen X (2016) The effect of implementing trade-in strategy on duopoly competition. Eur J Op Res 248(3):856–868

Funding

The work has been supported by the National Natural Science Foundation of China (NSFC) under Grant No. 71790615.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest regarding the publication of this article.

Data Availability

All data are included in the article and its appendix.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Optimal solutions for remanufacturing by one manufacturer.

\(NR\) | \(t \le \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) | \(t > \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) |

|---|---|---|

\(q_{i2}^{{NR^{*} }}\) | \(\frac{{a - c - te_{0} }}{3}\) | \(\frac{{a - c - te_{0} }}{3}\) |

\(p_{i2}^{{NR^{*} }}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) |

\(q_{11}^{{NR^{*} }}\) | \(\frac{{a - c - te_{0} }}{3}\) | \(\frac{{\left( {a - c - te_{0} } \right)\left( {1 + 2k\rho^{2} } \right) - \rho \left( {c + t\beta } \right)}}{{3 + 4k\rho^{2} }}\) |

\(q_{21}^{{NR^{*} }}\) | \(\frac{{a - c - te_{0} }}{3}\) | \(\frac{{\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)}}{{3 + 4k\rho^{2} }}\) |

\(q_{2r}^{{NR^{*} }}\) | \(\frac{c + t\beta }{{2k}}\) | \(\frac{{\rho \left[ {\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)} \right]}}{{3 + 4k\rho^{2} }}\) |

\(p_{i1}^{{NR^{*} }}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) | \(\frac{{a\left( {1 + 2k\rho^{2} } \right) + 2\left( {1 + k\rho^{2} } \right)\left( {c + te_{0} } \right) - \left( {c + t\beta } \right)\rho }}{{3 + 4k\rho^{2} }}\) |

\(\pi_{1}^{{NR^{*} }}\) | \(\frac{{2(a - c - te_{0} )^{2} }}{9}\) | \(\frac{{(a - c - te_{0} )^{2} }}{9} + \frac{{[\left( {a - c - te_{0} } \right)\left( {1 + 2k\rho^{2} } \right) - \rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }}\) |

\(\pi_{2}^{{NR^{*} }}\) | \(\frac{{2(a - c - te_{0} )^{2} }}{9} + \frac{{(c + t\beta )^{2} }}{4k} - f\) | \(\frac{{(a - c - te_{0} )^{2} }}{9} + \frac{{\left( {1 + k\rho^{2} } \right)[\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)]^{2} }}{{(3 + 4k\rho^{2} )^{2} }} - f\) |

\(E_{1}^{{NR^{*} }}\) | \(\frac{{2e_{0} \left( {a - c - te_{0} } \right)}}{3}\) | \(\frac{{e_{0} \left[ {2\left( {3 + 5k\rho^{2} } \right)\left( {a - c - te_{0} } \right) 3\rho \left( {c + t\beta } \right)} \right]}}{{3\left( {3 + 4k\rho^{2} } \right)}}\) |

\(E_{2}^{{NR^{*} }}\) | \(\frac{{2e_{0} \left( {a - c - te_{0} } \right)}}{3} - \frac{{\beta \left( {c + t\beta } \right)}}{2k}\) | \(\frac{{e_{0} \left( {a - c - te_{0} } \right)}}{3} + \frac{{\left( {e_{0} - \rho \beta } \right)\left[ {\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)} \right]}}{{3 + 4k\rho^{2} }}\) |

\(E^{{NR^{*} }}\) | \(\frac{{4e_{0} \left( {a - c - te_{0} } \right)}}{3} - \frac{{\beta \left( {c + t\beta } \right)}}{2k}\) | \(\frac{{\left( {a - c - te_{0} } \right)\left[ {2e_{0} \left( {6 + 7k\rho^{2} } \right) - 3\rho \beta } \right] + 3\rho \left( {c + \beta t} \right)\left( {e_{0} - 2\beta \rho } \right)}}{{3\left( {3 + 4k\rho^{2} } \right)}}\) |

Appendix 2

Optimal solutions for remanufacturing by two manufacturers.

\(RR\) | \(t \le \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) | \(t > \frac{{2k\rho \left( {a - c} \right) - 3c}}{{3\beta + 2k\rho e_{0} }}\) |

\(q_{{{\text{i2}}}}^{{RR^{*} }}\) | \(\frac{{a - c - te_{0} }}{3}\) | \(\frac{{a - c - te_{0} }}{3}\) |

\(p_{{{\text{i2}}}}^{{RR^{*} }}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) |

\(q_{i1}^{{RR^{*} }}\) | \(\frac{{a - c - te_{0} }}{3}\) | \(\frac{{a - c - te_{0} + \rho \left( {c + t\beta } \right)}}{{3 + 2k\rho^{2} }}\) |

\(q_{{{\text{ir}}}}^{{RR^{*} }}\) | \(\frac{c + t\beta }{{2k}}\) | \(\frac{{\rho \left[ {a - c - te_{0} + \rho \left( {c + t\beta } \right)} \right]}}{{3 + 2k\rho^{2} }}\) |

\(p_{{{\text{i2}}}}^{{RR^{*} }}\) | \(\frac{{a + 2c + 2te_{0} }}{3}\) | \(\frac{{\left( {1 + 2k\rho^{2} } \right)a + 2\left( {c + te_{0} } \right) - 2\rho \left( {c + t\beta } \right)}}{{3 + 2k\rho^{2} }}\) |

\(\pi_{i}^{{RR^{*} }}\) | \(\frac{{2(a - c - te_{0} )^{2} }}{9} + \frac{{(c + t\beta )^{2} }}{4k} - f\) | \(\frac{{(a - c - te_{0} )^{2} }}{9} + \frac{{\left( {1 + k\rho^{2} } \right)(a - c - te_{0} + c\rho + t\beta \rho )^{2} }}{{(3 + 2k\rho^{2} )^{2} }} - f\) |

\(E_{i}^{{RR^{*} }}\) | \(\frac{{2e_{0} \left( {a - c - te_{0} } \right)}}{3} - \frac{{\beta \left( {c + t\beta } \right)}}{2k}\) | \(\frac{{e_{0} \left( {a - c - te_{0} } \right)}}{3} + \frac{{\left( {e_{0} - \rho \beta } \right)\left( {a - c - te_{0} + c\rho + t\beta \rho } \right)}}{{3 + 2k\rho^{2} }}\) |

\(E^{{RR^{*} }}\) | \(\frac{{4e_{0} \left( {a - c - te_{0} } \right)}}{3} - \frac{{\beta \left( {c + t\beta } \right)}}{k}\) | \(\frac{{2e_{0} \left( {a - c - te_{0} } \right)}}{3} + \frac{{2\left( {e_{0} - \rho \beta } \right)\left( {a - c - te_{0} + c\rho + t\beta \rho } \right)}}{{3 + 2k\rho^{2} }}\) |

Appendix 3

Proof of Theorem 1

By comparing the results presented in Appendix 1 and the no-remanufacturing case ones, we obtain \(\Delta \Pi_{1}^{NR} \left( t \right) = 0\) for \(t \le \overline{t}\) and \(\Delta \Pi_{1}^{NR} \left( t \right) = - \frac{{\left( {a - c - te_{0} } \right)^{2} }}{9} + \frac{{\left( { - a + c + c\rho + t\beta \rho - 2ak\rho^{2} + 2ck\rho^{2} + te_{0} + 2kt\rho^{2} e_{0} } \right)^{2} }}{{\left( {3 + 4k\rho^{2} } \right)^{2} }}\) for \(t > \overline{t}\). At the boundary \(t = \overline{t}\), \(\Delta \Pi_{1}^{NR} \left( t \right)_{{\left\{ {t \le \overline{t}} \right\}}} = \Delta \Pi_{1}^{NR} \left( t \right)_{{\{ t > \overline{t}\} }}\) and so \(\Delta \Pi_{1}^{NR} \left( t \right)\) is a continuous function of \(t\). For \(t > \overline{t}\), \(\frac{{\partial \Delta \Pi_{1}^{NR} \left( t \right)}}{\partial t} = \frac{2}{9}e_{0} \left( {a - c - te_{0} } \right) + \frac{{2\left( {\beta \rho + e_{0} + 2k\rho^{2} e_{0} } \right)\left[ {\left( {c + t\beta } \right)\rho - 3\left( {1 + 2k\rho^{2} } \right)\left( {a\beta - c\beta + ce_{0} } \right)} \right]}}{{\left( {3 + 4k\rho^{2} } \right)^{2} }}\). \(\frac{{\partial^{2} \Delta \Pi_{2}^{NR} \left( t \right)}}{{\partial t^{2} }} = \frac{{2\rho \left( {3\beta + 2k\rho e_{0} } \right)\left( {3\beta \rho + 6e_{0} + 10k\rho^{2} e_{0} } \right)}}{{9\left( {3 + 4k\rho^{2} } \right)^{2} }} > 0\). Thus, \(\Delta \Pi_{1}^{NR} \left( t \right)\) is a convex function of \(t\) for \(t > \overline{t}\). Note that at \(t = 0\), \(\Delta \Pi_{1}^{NR} \left( t \right) = 0\). This means that \(\Delta \Pi_{1}^{NR} \left( t \right) < 0\) for \(t \in \left( {\overline{t},t^{M1} } \right)\) and \(\Delta \Pi_{1}^{NR} \left( t \right) > 0\) for \(t \in \left( {t^{M1} ,t^{U} } \right)\) with \(t^{M1} = \frac{{2\left( {a - c} \right)\left( {3 + 5k\rho^{2} } \right) - 3c\rho }}{{3\beta \rho + 6e_{0} + 10k\rho^{2} e_{0} }}\) such that \(\Delta \Pi_{1}^{NR} \left( {t^{M1} } \right) = 0\). To satisfy \(t^{M1} < t^{U}\), it also requires \(\rho < 0.2\) and \(k > \frac{3}{{\rho \left( {1 - 5\rho } \right)}}\).

By comparing the result in Appendix 1 and the no-remanufacturing case, we have \(\Delta \Pi_{2}^{NR} \left( t \right) = \frac{{\left( {c + \beta t} \right)^{2} }}{4k} - f\) for \(t \le \overline{t}\) and \(\Delta \Pi_{2}^{NR} \left( t \right) = - \frac{{\left( {a - c - te_{0} } \right)^{2} }}{9} + \frac{{\left( {1 + k\rho^{2} } \right)\left[ {\left( {a - c - te_{0} } \right) + 2\rho \left( {c + t\beta } \right)} \right]^{2} }}{{\left( {3 + 4k\rho^{2} } \right)^{2} }} - f\) for \(t > \overline{t}\). At the boundary \(t = \overline{t}\), \(\Delta \Pi_{2}^{NR} \left( t \right)_{{\left\{ {t \le \overline{t}} \right\}}} = \Delta \Pi_{2}^{NR} \left( t \right)_{{\{ t > \overline{t}\} }}\) and so.

\(\Delta \Pi_{2}^{NR} \left( t \right)\) is a continuous function of \(t\). For \(t \le \overline{t}\), \(\frac{{\partial \Delta \Pi_{2}^{NR} \left( t \right)}}{\partial t} = \frac{{\beta \left( {c + t\beta } \right)}}{2k} > 0\). Besides, \(\frac{{\partial^{2} \Delta \Pi_{2}^{NR} \left( t \right)}}{{\partial t^{2} }} = \frac{{\beta^{2} }}{2k} > 0\). So, \(\Delta \Pi_{2}^{NR} \left( t \right)\) is an increasing convex function of \(t\) for \(t \le \overline{t}\). For \(t > \overline{t}\), \(\frac{{\partial \Delta \Pi_{2}^{NR} \left( t \right)}}{\partial t} = \frac{2}{9}e_{0} \left( {a - c - te_{0} } \right) + \frac{{2\left( {1 + k\rho^{2} } \right)\left( {2\beta \rho - e_{0} } \right)\left( {a - c + 2c\rho + 2t\beta \rho - te_{0} } \right)}}{{\left( {3 + 4k\rho^{2} } \right)^{2} }}\). \(\frac{{\partial^{2} \Delta \Pi_{2}^{NR} \left( t \right)}}{{\partial t^{2} }} = - \frac{{2\rho e_{0}^{2} \left( {3 + 4k\rho^{2} } \right)^{2} - 18\rho \left( {1 + k\rho^{2} } \right)\left[ {e_{0} - 2\beta \rho } \right]^{2} }}{{9\left( {3 + 4k\rho^{2} } \right)^{2} }} < 0\). Note that at \(t = 0\), the derivative is \(\frac{\beta c}{{2k}} > 0\). At \(t = \overline{t}\), the derivative is \(\frac{{2\rho \left( {a\beta - c\beta + ce_{0} } \right)\left( {6\beta + 6k\beta \rho^{2} + k\rho e_{0} } \right)}}{{3\left( {3 + 4k\rho^{2} } \right)\left( {3\beta + 2k\rho e_{0} } \right)}}\). This means that \(\Delta \Pi_{2}^{NR} \left( t \right)\) is increasing for \(t \in \left[ {0,t^{M2} } \right)\) and is decreasing for \(t \in \left( {t^{M2} ,t^{U} } \right)\) with the optimum is reached at \(t^{M2} = \frac{{e_{0} \left( {a - c} \right)\left( {3 + 4k\rho^{2} } \right)^{2} + 9\left( {1 + k\rho^{2} } \right)\left( {2\beta \rho - e_{0} } \right)\left[ {\left( {a - c} \right) + 2\rho c} \right]}}{{e_{0}^{2} \left( {3 + 4k\rho^{2} } \right)^{2} - 9\left( {1 + k\rho^{2} } \right)\left[ {e_{0} - 2\beta \rho } \right]^{2} }}\). Regarding the behavior of \({\Delta E}_{1}^{NR} \left( t \right)\), \({\Delta E}_{2}^{NR} \left( t \right)\), \({\Delta E}^{NR} \left( {\text{t}} \right)\) with respect to \(t\), because \({\Delta E}_{1}^{NR} \left( t \right)\), \({\Delta E}_{2}^{NR} \left( t \right)\), \({\Delta E}^{NR} \left( {\text{t}} \right)\) is a linear function of tax price \(t\), the proof is straightforward and omitted.

Rights and permissions

About this article

Cite this article

Qiu, Y., Jin, Y. Impact of environmental taxes on remanufacturing decisions of a duopoly. Econ Change Restruct 55, 2479–2498 (2022). https://doi.org/10.1007/s10644-022-09394-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09394-4