Abstract

The purpose of this paper is to explore whether the implementation of carbon emissions trading policy (CETP) promotes carbon finance, proxied by investment and financing facilitating carbon emissions reduction (IFCER), and reduces carbon emissions. Evidence shows that first, CETP is effective in stimulating IFCER and reducing carbon emissions. Second, the effects of CETP persist over time. Third, the effects of CETP taking effect in pilot regions can spill over to non-pilot regions nearby. Fourth, the effect is more pronounced in eastern and wealthy regions. Finally, R&D and industrial upgrading have a mediating effect linking CETP to IFCER and carbon emissions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Carbon finance, emerging as an important engine for green economic development, is essential in financing renewable and green energy projects to reduce carbon emissions and their negative health impacts, develop climate resilient infrastructure for cities, and ensure environmental sustainability (Labatt and White 2007; Taghizadeh-Hesary and Yoshino 2019). It also refers to financial activities facilitating carbon emissions reduction (CER), such as investment and financing facilitating CER (IFCER) and carbon emissions trading (CET) (Borghesi et al. 2015).Footnote 1 To ensure stable operations of carbon markets, the Kyoto Protocol to the United Nations Framework Convention on Climate Change entered into force on December 11, 1997.Footnote 2 Since then, regional carbon markets have operated and CET has become an ongoing and vital environmental issue in major economies (Kemp and Pontoglio 2011).

Through government policies, CET legalizes emissions and issues emissions permits to firms by making the permits tradable as commodities, which controls carbon dioxide (CO2) emissions to maintain sustainable development (Coase 1960; Dales 1968; Cropper and Oates 1992). Many studies (e.g., Jefferson et al. 2013; Borghesi et al. 2015) also note that carbon emissions trading policy (CETP) can effectively reduce carbon emissions and the associated emissions reduction costs. However, most of the research focuses on the CERP effect on carbon emissions, while little attention has been paid to the effect on carbon finance. Motivated by this possible insufficiency, the purpose of this paper is to study the effect of CETP on carbon finance or, specifically, IFCER in China, in addition to the effect on carbon emissions, measured by carbon emissions intensity (CEI).

Unlike traditional financial activities, carbon finance promotes trading of carbon emissions rights and derivatives that change cost structures of firms with carbon footprints, encouraging them to reduce greenhouse gas emissions (Li and Liu 2011). CETP explicitly helps establish effective carbon trading markets and solve problems associated with carbon emissions allowance reallocation, the measurement of CET, carbon reporting, carbon credit verification, and CER regulations (Peng et al. 2018; Zhou and Li 2019).Footnote 3 CETP is considered a low-cost and sustainable environmental measure that could not only control the quantity of carbon emissions, but also incentivize firms to develop new technologies to further reduce carbon emissions (Requate and Unold 2003).

There are two popular viewpoints on the effects of an environmental measure like CETP considered important for both environmental protection and economic development (Dales 1968). One viewpoint focusing on compliance costs suggests that an environmental measure inevitably raises production costs of firms, which decreases their production efficiency and competitiveness (Brännlund et al. 1995; Levinson 1996). The other viewpoint argues that an environmental measure can stimulate technological innovations due to a compensation effect (Magat 1978; Porter and Van der Linde 1995). Compensation for innovations can even lower production costs under environmental regulations, enhancing both economic growth and environmental protection (Porter and Van der Linde 1995).Footnote 4

In fact, the two schools of thought above do not necessarily contradict to each other. According to the first school of thought, CETP limits the greenhouse gas emissions by firms, inevitably increasing their production costs in the first place. However, if funding is easily accessible and CETP generates extra opportunities, governments and firms may increase IFCER to finance research and development (R&D) and improve green production efficiency (Zhang et al. 2020a; b; Zhang et al. 2021). In addition, regional governments often engage in industrial upgrading. Firms are encouraged to either consume less energy or shift from sectors dominated by high energy-consuming industries to sectors dominated by low energy-consuming and low emissions industries in order to develop their low-carbon economies. The positive feedback, thanks to R&D and industrial upgrading, further benefits firms and the economy, which is in line with the second school of thought. So, can CETP promote carbon finance or IFCER in China? If yes, how CETP operates and what economic mechanisms are at work? We shall study these issues later in this paper.

The reason why we choose the sample in China is that it is not only the largest developing country, but also the largest energy consumer and CO2 emitter in the world. On the one hand, according to the BP Statistical Review of World Energy 2017,Footnote 5 total carbon emissions in China reached 9.12 billion tons in 2016, accounting for 27.3% of global carbon emissions. China plans to reduce carbon emissions by 2–3 billion tons by 2030 (Zhang 2016), dominating total CER of all European countries. Thus, whether China achieves CER will significantly impact global climate change (Wang and Wang 2017; Zhou and Li 2019). In light of the importance of China’s carbon markets, their prosperity plausibly plays an essential role in the success of carbon trading worldwide. Moreover, we use a sample consisting of 30 regions (22 provinces, 4 direct-controlled municipalities, and 4 autonomous regions) in China from 2004 to 2019 that exhibit a great deal of economic diversity. Given the diversity, China’s results may provide insights into CETP and the associated consequences over various stages of economic development. Thus, China offers a perfect and comprehensive platform to study carbon finance.

On the other hand, existing research on CER mainly examines issues in European carbon markets (e.g., Daskalakis 2018; Koch and Mama 2019; Herweg 2020). Although there is limited research on similar issues in China, in reality, abundant attractive investment opportunities and government subsidies for CET prevail in China (Linnenluecke et al. 2016; Liobikienė and Butkus 2017). This study may not only provide practitioners with potentially profitable opportunities, but also help policy makers in other emerging markets identify their possible opportunities and obstacles when implementing the likes of CETP.

Primarily employing the difference-in-difference (DID) model, we assess the effects of CETP on IFCER and CEI in China. Our empirical evidence shows, first, that CETP is significantly and positively (negatively) associated with IFCER (CEI). The effects are robust to numerous tests adopting alternative proxies for major variables, changing the sample interval, using the alternative PSM-DID (propensity-score-matching-difference-in-difference) method, applying randomly selected samples and placebo tests. It definitely suggests that CETP encourages (reduces) IFCER (CEI) in China.

Second, the effects of CETP on IFCER and CEI are persistent for up to six years. Third, CETP can differently impact IFCER across regions. Specifically, CETP significantly promotes IFCER in wealthy regions and eastern regions, but has no significant effect on IFCER in central and western regions. Finally, CETP not only encourages firms to invest more in R&D, but also promotes regional industrial upgrading from a traditional economy to a low-carbon economy, which further reduces emissions and energy consumption. Collectively, CETP can be regarded as an excellent policy instrument promoting IFCER and green economic development.

In view of the applied methodology and results in this paper, it contributes to the literature in the following ways. First, while abundant literature (e.g., Streimikiene and Roos 2009; Gulbrandsen and Stenqvist 2013; Borghesi et al. 2015; Dong et al. 2019; Zhou et al. 2019; Zhu et al. 2020; Zhang et al. 2020a, b; Zhou and Liu 2020) examines the impact of CETP on green economies, relatively little attention is paid to the impact on the associated carbon finance (e.g., Liu and Wei 2016; Yi et al. 2018). This paper studies the impact of CETP on IFCER and CEI by specifically considering the mediating effects of R&D and industrial upgrading, which not only clarifies the economic mechanisms linking CETP to IFCER as well as CEI, but also broadens our understanding about how CETP and IFCER are beneficial.

Second, this paper develops a composite index to quantify IFCER from different dimensions. The novelty of this index arises from the fact that it contains a rich set of measures describing carbon finance, including the depth and efficiency in the use of low-carbon funds, availability of financial services and cost of financial services. The index is expected to integrate the effectiveness of CETP from multiple perspectives.

Finally, while previous studies (e.g., Paolella and Taschini 2008; Caney 2010; Sovacool et al. 2011; Chevallier 2011; Bredin and Muckley 2011; Laing et al. 2014; Reboredo and Ugando 2015; Joltreau and Sommerfeld 2019; Efthymiou and Papatheodorou 2019) mainly analyze policies associated with CER in developed markets, few studies analyze similar issues in emerging markets with less sophisticated financial systems. Hence, as a study of China, the largest emerging market, this paper’s observations on the causality and mediating effects from CETP to IFCER and CEI provide policy makers in other emerging markets with insights into possible economic mechanisms behind the effects as well as the benefits of CETP.

The rest of this paper is organized as follows. Section 2 provides the institutional background and literature review. Section 3 introduces the methodology and the data of this paper. Particularly, we develop a composite index of IFCER to describe the development of carbon finance in 30 regions of China. Section 4 empirically analyzes the impacts of CETP on IFCER and CEI, primarily using the DID method. This section also examines the robustness of the results by adopting alternative specifications and proxies. Numerous conditional tests and the analysis of economic mechanisms behind the effects of CETP are conducted as well. Section 5 concludes this paper and discusses possible policy implications.

2 Institutional background and literature review

2.1 Institutional background of CETP in China

To reduce carbon emissions, China’s National Development and Reform Commission issued “Notice on the Piloting of Carbon Emissions Trading” in October 2011, which approved seven pilot regions for CETP, including Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Fujian. CETP was first implemented in Guangdong on a trial basis in the first half of 2013, and then in other pilot regions between the second half of 2013 and the first half of 2014. CETP mainly covers (1) the establishment and compliance of carbon markets, (2) the inclusion of industries and the allocation of emissions allowances, (3) monitoring, reporting, and verifying the data of carbon emissions, and (4) CET. After more than a year of implementation, CET in the pilot regions gradually improved and steadily operated.

2.2 Literature review

Existing theoretical and empirical studies on CER, CER policies, and carbon finance can be divided into two categories. The first category pays attention to the effectiveness of CER policies and possible economic mechanisms behind its impact. Regarding the effectiveness of CER policies, no consensus has been reached. For example, the extant literature mostly confirms the effectiveness of CER policies (e.g., Wang and Wei 2014; Cheng et al. 2016; Fang et al. 2018; Zhang et al. 2019), while many papers (e.g., Streimikiene and Roos 2009; Gulbrandsen and Stenqvist 2013) do not.

As for the economic mechanisms behind the impact of CER policies on CER, prior studies have explored the roles of technological innovations, industrial upgrading, population density, economic growth, and foreign investment (e.g., Ma and Stern 2008; Su and Ang 2015; Wang and Wang 2017). Among them, technological innovations and industrial upgrading are considered the two most important channels (Cao and Karplus 2014; Yu et al. 2015). On the one hand, technological innovations can reduce energy consumption and the growth of carbon emissions (Zhang et al. 2017a; b). On the other hand, industrial upgrading results in the transformation of high-carbon manufacturing industries, and in turn reduces their carbon emissions (Zhou and Liu 2020). While the existing literature mostly examines the channels through which CER policies impact carbon emissions, this paper pays a great deal of attention to the economic mechanisms behind the effects of CETP on IFCER.

The second category of research is on development of carbon markets, often in three aspects. First, academics make efforts to forecast prices of carbon financial derivatives (e.g., Paolella and Taschini 2008; Chevallier 2011; Bredin and Muckley 2011; Zhao et al. 2018) and to distinguish deterministic factors of the prices (Bredin and Muckley 2011; Yu and Malloy 2014). Second, there exists numerous studies exploring the evolution of global carbon markets as well as their shortcomings, difficulties, and solutions (e.g., Braun 2009; Caney 2010; Sovacool et al. 2011; Hall et al. 2018; Zhou and Li 2019). The third aspect is regarding risk measures associated with carbon trading, including the price risk of derivatives, policy risk, market risk, and technology risk (e.g., Blyth and Buun 2011; Reboredo and Ugando 2015; Wu and Kung 2020).

Given the existing literature, limited studies examine the impact of CET on carbon finance. Moreover, to my knowledge, there is, so far, no satisfactory measure of carbon finance covering all possible dimensions. Motivated by the insufficiency, this paper will first develop a composite measure comprehensively capturing IFCER in China. Then, applying the measure, we analyze the impacts of CETP on IFCER and CEI.

3 Hypotheses, data, and methodology

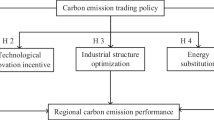

3.1 Hypothesis development

One primary effect of CETP of interest in this paper is on IFCER. Given that the ultimate goal of CETP is CER, which is usually the main purpose of the relevant literature, for comparison, we also employ CEI as an alternative primary variable to measure the direct effects of CETP. In the following, we develop the first hypothesis to test the effects or effectiveness of CETP as follows:

Hypothesis 1

CETP increases IFCER and reduces CEI.

As observed in Fig. 1 and Table 2, possibly because of the spillover effect of CETP, IFCER is higher in some non-pilot regions, such as Hebei, Shandong, Jiangsu, Zhejiang, Jiangxi, Henan, Shaanxi, Shanxi, Anhui, Hunan, Guizhou, and Liaoning. Note that these regions are geographically close to the pilot regions, which arouses our interest in whether IFCER and CEI in the neighborhoods of the pilot regions could be influenced by CETP. If yes, there could exist a spillover effect that explains why those non-pilot regions have higher IFCER.

Hypothesis 2

The effects of CETP in the pilot regions can spill over to the non-pilot regions geographically nearly.

The next issue of interest is the persistence of the effects of CETP. Since CETP requires lots of funding and investments, if the government was not serious, the effect could be temporary. Moreover, given the time-to-build property of (physical) investments, the effects of CETP on IFCER and CEI should be persistent. If the effects increasingly strengthen, the evidence supports that the initial success of CETP could generate more opportunities for IFCER in the subsequent years.

Hypothesis 3

The effects of CETP are persistent.

After examining the effectiveness and persistence of CETP, we next concern the CETP effects across regions by conducting heterogeneity analyses. In Hypothesis 2, we have examined the effects of CETP in non-pilot regions nearly the pilot regions. To dig deeper, of interest are other conditional analyses on essential factors, such as residents’ wealth and geographical locations. Concerning residents’ wealth, carbon emissions are intuitively related to income (GDP per capita). The well-known Environmental Kuznets curve illustrates that there is an inverted U-shaped relationship between them (Cole et al. 1997; Dasgupta et al. 2002; Stern 2004). Zhang et al. (2017a; b) observe that there is also an inverted U-shaped relationship between urbanization and carbon emissions.

Thus, the impact of CETP on IFCER in wealthy regions is expectedly different from that in less-wealthy regions. Due to the fact that wealthy regions usually have more developed local economies, better infrastructures, more available financial instruments, and more active CET, which generates more demand for CER and more opportunities for firms to access IFCER, once CETP is implemented. We expect that CETP has a greater impact on IFCER in wealthy regions than in less wealthy regions.

Hypothesis 4a

The effects of CETP are stronger in wealthy regions.

As for geographical locations, following Huang et al. (2014) and Yang et al. (2020), we divide China into three economic zones—the eastern, central, and western regions with different industrial gradients and various development stages.Footnote 6 Among the economic zones the natural resources, infrastructure, regional development policies vary. The gaps keep widening over time (Wang et al. 2018). For example, as Cheng et al. (2019) argue, the western regions contain mainly resource-intensive and labor-intensive industries. In the short term, they face huge environmental costs and industrial transformation pressure but will receive structural dividends in the long run. The eastern regions contain mainly capital-intensive and technology-intensive industries that are propelled by current incentive policies to optimize industrial structure and develop green economies.

On the one hand, the eastern (coastal) provinces are considered to have an advantage of easy access to marine transportation. Their economies are often more developed and more likely to have mature financial markets with adequate financial instruments and participants than the western and central (inland) provinces. It follows that given CETP as an official guideline toward CER, firms associated with low carbon economy are more willing to locate and operate in eastern regions. The flourishing business further deepens IFCER and accelerates the development of carbon finance. On the other hand, because the central and western regions in China are mostly dominated by heavy industry sectors relying on fossil fuels, their IFCER lags behind those in the eastern regions. Thereby, we expect that CETP has a stronger effect on IFCER in eastern regions than in western and central regions.

Hypothesis 4b

The effects of CETP are stronger in eastern regions.

The final hypothesis explores possible economic mechanisms behind the effects of CETP. For example, it is possible that there could be indirect effects between CETP and IFCER, first from CETP to a mediating variable, and second from the mediating variable to IFCER.

Following MacKinnon et al. (2000) and Zhou and Liu (2020), this paper proposes two mediating variables—R&D (lnR&D) and the proportion of tertiary industries (lnIndu3)—to investigate the economic mechanisms linking CETP to IFCER. The hypothesis is constructed as follows:

Hypothesis 5

There exist mediating effects linking CETP to IFCER and CEI.

3.2 Description of the employed variables and data

3.2.1 Developing a composite index of IFCER

Following De Souza Cunha et al. (2021), Mohsin et al. (2020), Chen et al. (2020), we construct a composite IFCER index on an annual basis to measure carbon finance. As shown in Table 1, the IFCER index, similar to the one proposed by Liu et al. (2018), is based on four dimensions, including market depth, efficiency of the use of CER funds, availability of financial services, and cost of financial services.Footnote 7 First, measured by the total issuances of stocks, funds, and bonds (direct financing) associated with low carbon economy to the total number of emissions control firms in a given region (Chen et al. 2020), the market depth reflects the involvement of the region in IFCER. The more actively a region involves, the deeper the carbon markets in the region (Linnenluecke et al. 2016; Koch and Mama 2019; Mohsin et al. 2020). The annual data are obtained from the WIND database, the Oriental Wealth Network, and the Green Financial Bond Database of the China Financial Information Network.

The second dimension—efficiency of the use of CER funds—is measured by the ratio of CER in a region to the sum of issued stocks, bonds and funds associated with low carbon economy. CER is derived following the IPCC (Intergovernmental Panel on Climate Change) accounting methodology.Footnote 8 The efficiency of the use of CER funds captures the strength of CER after a region receives CER funds. The larger the ratio, the higher the efficiency of the use of CER funds (Liao and Shi 2018). The data on an annual basis are available from China Energy Statistical Yearbook and China Environmental Statistical Yearbook.

As for the third dimension of IFCER, following Mohsin et al. (2020), the availability of financial services is computed as the ratio of the total number of financial institutions to the total number of emissions control firms in a region or the availability of indirect financing. The higher the ratio in a region, the more the IFCER services are available to firms. The associated data are collected from the China Regional Financial Operation Report released by the People's Bank of China.

The fourth dimension is the cost of financial services measured by the weighted-average RMB lending rates in a region at the end of the year. The higher the interest rate in a region, the higher cost the financial services in the region (Boissinot et al. 2016; Mohsin et al. 2019). The data come from the China Regional Financial Operation Report.

Since CETP took effect in most pilot regions between the second half of 2013 and the first half of 2014, year 2014 is regarded as the breakpoint of the implement of CETP. That is, years 2004–2013 are classified as the years before the implementation of CETP, while 2014–2019 are the years after the implementation of CETP. First, each of the six indicators under the four dimensions is standardized as follows:

where i, j, and t are the index regions, indicators, and years, respectively, j = 1, 2, …, 6, i = 1, 2, …, 30, t = 2004, …, 2013. \(x_{jit}\) denotes the value of indicator j in region i over year t, \(X_{jit}^{ + }\) \(\left( {X_{jit}^{ - } } \right)\) denotes indicator j with a positive (negative) effect, \(M_{jt}\) and \(m_{jt}\) denote the maximum and minimum of indicator j across regions over year t. Then, we assign \(X_{jit}^{ + }\) \(\left( {X_{jit}^{ - } } \right)\) to \(X_{jit}\), for \(j = 1, 2, \ldots , {\text{and}}\; 5\; \left( {j = 6} \right)\).

Second, the coefficient of variation is used to calculate the weights of the indicators in Table 1. Specifically, the six indicators are weighted in the following scheme:

where \(\omega_{jt}\) is the weight of indicator j in year t, \(\overline{X}_{jt}\) and \(\sigma_{jt}\) are, respectively, the mean and the standard deviation of indicator j over regions \(\left( {X_{jit} , i = 1,2, \ldots ,30} \right)\), and \(V_{jt}\) represents the coefficient of variation of the indicator.

Thirdly, the composite index of the six indicators measuring IFCER in region i is calculated as:

The index lies between 0 and 1. A higher \({\text{IFCER}}_{it}\) implies a more active carbon finance.

3.2.2 IFCER across regions

According to the results of the IFCER index reported in Table 2, first, the maximum value of IFCER is 0.683 in Guangdong, the minimum value is 0.015 in Hainan, and the average value of IFCER from 2004 to 2019 is 0.211. Second, IFCER is increasing over time, implying that IFCER in China is gradually improving. Thirdly, IFCER of the seven pilot regions is generally higher than that of the non-pilot regions, especially after the implementation of CETP, supporting that the CETP effect are prominent.

Based on the means of IFCER in regions reported in Fig. 1 and Table 2, China can be divided roughly into three echelons of low-carbon development. The first echelon is represented by seven pilot regions as well as coastal regions such as Jiangsu and Zhejiang. The average IFCER in Guangdong after the implementation of CETP reaches 0.569, ranks first in China, possibly because Guangdong is overall a relatively developed region and has very active carbon markets. Beijing, Shanghai, Fujian, Zhejiang and Jiangsu closely follow Guangdong in terms of IFCER.

Beijing, the capital city of China, is known as the political and cultural center, while Shanghai and Fujian are major coastal economic regions. There exist abundant projects and funding associated with low carbon economy, which facilitates and accelerates the development of carbon finance. Regions such as Zhejiang and Jiangsu have well-developed financial markets and can attract plentiful capital inflows. IFCERs of inland regions such as Chongqing and Hubei are lower than those of the coastal pilot regions, probably due to their geographical locations. In fact, CET in those inland regions is still at an early stage, although their IFCER have been improving.

The second echelon includes provinces Shaanxi, Liaoning, Jiangxi, Hunan, and so on whose IFCER values range between 0.15 and 0.3. These non-pilot regions are located near some pilot regions and are possibly affected by the spillover effect from the pilot regions. It follows that the spillover raises CET and IFCER in these non-pilot regions. The third echelon is represented by Qinghai, Gansu, Ningxia, and so on whose average IFCER values are low and below 0.15. Their low IFCER probably results from their low levels of economic prosperity, geographical locations, or others, which we shall pay attention to later.

3.2.3 Other variables and data sources

There are additional data sources of control variables that may affect IFCER and CEI in the corresponding regressions. They include GDP per capita (PGDP), the proportion of secondary industries (Indu2), the proportion of tertiary industries (Indu3), foreign direct investment (FDI), energy consumption intensity (ECI), and environmental support (ES). Except ECI and ES collected from the China Energy Statistical Yearbook and the China Environment Yearbook, other variables are available from the China Statistical Yearbook. All variables are obtained on an annual basis.

3.3 The baseline model

The sample used in this paper consists of 22 provinces and 4 direct-controlled municipalities, and 4 autonomous regions in China from 2004 to 2019,Footnote 9 all of which are partitioned into seven pilot and 23 non-pilot regions. The pilot regions are applied as the treatment group where CETP takes effect, while other non-pilot regions are the control group where CETP is not implemented. One primary variable of interest in this paper is IFCER. Since the ultimate goal of CETP is to achieve CER, for comparison, we also employ CEI as an alternative primary variable to measure the direct effect of CETP.

To verify the impacts of CETP on IFCER and CEI, we apply a DID model to our analysis. This paper forms a quasi-natural experiment for comparative analysis by dividing provinces, direct-controlled municipalities, and autonomous regions in China into the pilot regions and the non-pilot regions, based on the implementation of CETP. The CETP effects on IFCER and CEI as are tested as follows:

where i and t are the index regions and years, respectively. \({\text{lnIFCER}}_{it}\) and \({\text{lnCEI}}_{it}\), respectively, denote the logarithms of IFCER and CEI. \({\text{Treatment}}_{i}\) is a dummy variable taking a value of one if CETP takes effect in region i or the region is a pilot region, and zero otherwise. \({\text{Time}}_{t}\) is a dummy variable taking a value of one when CETP takes effect in year t, and zero otherwise. Hence, \(\left( {{\text{Treatment}}_{i} \times {\text{Time}}_{t} } \right)\) is considered a region-time interaction dummy variable associated with the implementation of CETP. If CETP significantly improves IFCER in the pilot regions, then the coefficient should be significantly positive.

\({\text{Control}}_{it}\) denotes the set of control variables that may affect IFCER, including PGDP, Indu2, FDI, ECI, and ES. \(\gamma_{i}\) and \(r_{t}\) represent the region fixed effects, while \(\delta_{t}\) and \(p_{t}\) denote the time fixed effects. Please see “Appendix 3” of this paper for the derivations of all variables.

4 Empirical results

4.1 Descriptive statistics and parallel trend tests

4.1.1 Descriptive statistics

Table 3 reports the descriptive statistics of the main variables in this paper. For example, the mean of IFCER is 0.211 and the mean of \(\left( {{\text{TreatmentTime}}} \right)\) is 0.102, implying 10.2% of region-year observations in which CETP takes effect. Among the control variables, the mean value of PGDP is 10.341 with a standard deviation of 0.688. The mean of Indu2 is 0.431, while that of Indu3 is 0.396, indicating that secondary industries are proportionally larger than tertiary industries in most regions of China.

4.1.2 Parallel trend test

Before proceeding to the estimation of our baseline regressions with DID, it is necessary to test whether the hypothesis of parallel trend is satisfied for the treatment (pilot) and control (non-pilot) groups. The parallel trend test is shown in Fig. 2 providing visual chronological changes in IFCER in the pilot and the non-pilot regions, particularly surrounding the implementation of CETP. Before that (2004–2013), IFCER in the treatment and control groups both exhibited a rising trend. Afterwards (2014–2019), the rising trend maintains and accelerates particularly after 2017. In addition, Fig. 2 shows that after the implementation of CETP, IFCER of the treatment group increases on average more than those of the control group, preliminarily supporting that CETP has a positive impact on IFCER. Both the treatment and control groups satisfy the parallel trend, an important assumption to apply the DID model.

4.2 Analyses of empirical results

4.2.1 Results of the baseline models

To test Hypothesis 1, Table 4 reports the effects of CETP on IFCER and CEI under the baseline models, Eqs. (4) and (5). As shown in the table, the dependent variable for the models under columns (1) and (2) is lnIFCER, and the two regression models reflect the impact of (the implementation of) CETP on IFCER in regions without and with control variables. The results of the baseline models with lnCEI as the dependent variable are reported under columns (3) and (4) without and with control variables, respectively.

As a result, the coefficients of lnIFCER on (\({\text{TreatmentTime}}\)) under columns (1) and (2) are significantly positive at least at the 10% level, indicating that CETP has a positive effect on improving IFCER in each region. Specifically, the coefficient of lnIFCER on \(\left( {{\text{TreatmentTime}}} \right)\) under columns (1) and (2) is, respectively, 8.8% (2.3%) at least at the 10% level of significance. In other words, the implementation of CETP raises lnIFCER by 8.8% (2.3%) without (with) the control variables. By contrast, the coefficients of lnCEI on \(\left( {{\text{TreatmentTime}}} \right)\) under columns (3) and (4) are significantly negative, respectively, -20.8% and -18.0%. It implies that the implementation of CETP reduces lnCEI by 20.8% (18.0%) without (with) the control variables. The evidence firmly supports Hypothesis 1 and the effective roles of CETP in increasing IFCER and reducing carbon emissions.

Among the control variables, first, FDI promotes IFCER. FDI can bring advanced management and green technologies to low-carbon firms, which enables them to effectively use IFCER and promotes IFCER. Second, Indu2 has a negative impact on IFCER. A larger share of secondary sector implies a lower capacity to accommodate industries and firms promoting CER, leading to a negative impact on IFCER. Third, ECI has a positive effect on IFCER. Given the China’s ultimate goal of CER, a higher energy consumption of a region implies higher necessity of CER in the region, attracting more capital flows into IFCER. Fourth, the positive (negative) effect of ES on IFCER and CEI indicates that ES by regional government can be regarded as its attitude toward CER. Plausibly, more ES attracts IFCER and reduces carbon emissions.

4.2.2 The spillover effects of CETP nearly the pilot regions

Going a step further, this subsection examines Hypothesis 2 by conducting tests to distinguish the existence of the spillover effects of CETP in the non-pilot regions nearby the pilot regions. To do so, we assess the effects of CETP only in the non-pilot regions and slightly modify Eqs. (4) and (5) by replacing \(\left( {{\text{TreatmentTime}}} \right)\) with \(\left( {{\text{NeighborTime}}} \right)\). \({\text{Neighbor}}_{i}\) is a dummy variable and takes a value of one, if region i is Hebei, Shandong, Jiangsu, Zhejiang, Jiangxi, Henan, Shaanxi, Shanxi, Anhui, Hunan, Guizhou, and Liaoning that are geographically close to the pilot regions, and zero otherwise. If the coefficients of lnIFCER and lnCEI on \(\left( {{\text{NeighborTime}}} \right)\) in the non-pilot regions are significantly different from zero, then the spillover effect exists. Moreover, we can distinguish the strength of the spillover effects by comparing the coefficient magnitudes between \(\left( {{\text{TreatmentTime}}} \right)\) and \(\left( {{\text{NeighborTime}}} \right)\). Table 5 reports the results.

As a result, the coefficient of lnIFCER on \(\left( {{\text{TreatmentTime}}} \right)\) for the pilot regions under column (1) and that on \(\left( {{\text{NeighborTime}}} \right)\) for the non-pilot regions under column (2) is, respectively, 0.064 and 0.004 and significant at the 1% level. Moreover, the coefficient on \(\left( {{\text{TreatmentTime}}} \right)\) is larger than that on \(\left( {{\text{NeighborTime}}} \right)\) in magnitude. Similarly, under columns (3) and (4), the coefficients of lnCEI on \(\left( {{\text{TreatmentTime}}} \right)\) and \(\left( {{\text{NeighborTime}}} \right)\) are, respectively, -0.111 and -0.033 and significant at least at the 10% level, and the coefficient magnitude on \(\left( {{\text{TreatmentTime}}} \right)\) is larger than that on \(\left( {{\text{NeighborTime}}} \right)\). This indicates that CETP improves IFCER and reduces CEI mainly in the pilot regions. Interestingly, the existence of the spillover effect affects (in the same directions but to a lesser extent) IFCER and CEI in the regions nearby the pilot regions, which confirms Hypothesis 2.

4.2.3 Persistence of the CETP effects

In this subsection, we shift our attention to Hypothesis 3 and examine the persistence of the CETP effects on IFCER and CEI. To accommodate the impacts of CETP over up to the sixth year after the implementation of CETP, we slightly revise Eqs. (4) and (5) as follows:

where \({\text{Treatment}}_{i} \times {\text{Time}}_{t}^{k}\) is the region-time interaction dummy variable of CETP in year k after the implementation of CETP. Since year 2013 is recognized as the implementation time of CETP in the pilot regions, k = n if T = 2013 + n, n = 1, 2, 3, 4, 5, and 6. Using the DID model, this paper estimates Eqs. (6) and (7) and shows the results in Table 6.

The dependent variable under columns (1) and (2) is lnIFCER, while that under columns (3) and (4) is lnCEI. The models under columns (1) and (3) do not include control variables, while the models under columns (2) and (4) do. As a result, the coefficients of lnIFCER on (Treatment × time) from one to six years after the implementation of CETP are all significantly positive, regardless of the inclusion of control variables, implying that CETP has a persistent positive impact on IFCER for up to six years after the implementation of CETP. Moreover, the coefficients on lnIFCER (Treatment × timek, k = 1, …, 6) under column (2) are increasing with k. They are, respectively, 0.020, 0.015, 0.024, 0.048, 0.056, and 0.091, for k = 1, …, 6, supporting that the effect of CETP on IFCER strengthens over time.

The absence of control variables under column (3) makes the regression results confusing. The coefficients on (Treatment × timek, k = 1, …, 6) are mostly insignificant. However, once including the control variables under column (4), the coefficients all turn to be significantly negative for one to six years after the implementation of CETP. For example, CEI is reduced by 12.2% in the first year after the implementation of CETP at the 5% level of significance, by 14.6% in the second year at the 1% level of significance, and by 21.6% in the sixth year at the 1% level of significance. The evidence on lnIFCER and lnCEI verifies the persistence of the CETP effects and confirms Hypothesis 3.

4.3 Robustness tests

Up to now, we have applied baseline regressions to verify Hypotheses 1, 2, and 3. Before proceeding any further, this subsection ensures the reliability of our previous results by conducting five robustness tests.

4.3.1 An alternative measure of ES

The first robustness test is to apply an alternative measure of ES as a control variable in the baseline models—Eqs. (4) and (5)—originally using the investment in environmental pollution control to measure the regional ES, similar in essence to mostly prior studies. This issue is important because, through moderate interventions, e.g., public spending on human resources, R&D, or others, governments can prompt a sustainable green economy and lower risks, leading to reductions in obstacles and higher returns on firms’ investments (Taghizadeh-Hesary et al. 2021; Zhang et al. 2021). Now, following Ji et al. (2021), we attempt to make a revision and employ the amount of industrial pollution treatment completed to measure ES. Then, we re-estimate the baseline models and report the results in Table 7.

The results show that the coefficient of lnIFCER is significantly positive, while that of lnCEI is significantly negative. Although there are differences in the estimated values of the CETP effects, they are consistent with the results of the baseline model, supporting the robustness of the positive effect of CETP on IFCER and the negative effect on CEI.

4.3.2 An alternative sample period

Since 2018, the National Development and Reform Commission of the People's Republic of China has successively issued a series of policies (e.g., Development and Reform Environmental Resources [2019] No. 689, Development and Reform Price Regulation [2018] No. 943, etc.). Similar to CETP, those policies are mainly to promote green development. They mostly make efforts to reform regional environmental resources and encourage regions to build a market-oriented green system. To ensure that the observed impacts are not driven by other green development policies, this paper changes the sample period to years 2004–2017 to measure the effects of CETP on IFCER and CEI. Table 8 shows the results. Basically, CETP still has a significantly positive (negative) impact on IFCER (CEI). In fact, we also employ other possible sample periods, and the conclusions are qualitatively the same, which supports the robustness of the effects of CETP.

4.3.3 A random sampling method

To make sure that the CETP effects may be confounded by outliers or other unobservable effects, in this subsection and the following subsection, procedures of random sampling methods are used to re-select subsamples of regions to form a new treatment group and control group. First, we repeat the random resampling of pilot and non-pilot regions for regressions for 500 times. Each time, we randomly re-select 4 out of the 7 original pilot regions and 12 out of the 23 original non-pilot regions. Then, the re-selected 16 pilot and non-pilot regions are employed as the sample of the regressions under the baseline models, Eqs. (4) and (5). This procedure generates 500 parameter estimates. The standard deviations of this sample of 500 parameter estimates are used to generate the standard errors of the parameter estimates. Table 9 reports the means of t-statistics of the selected coefficients, using the corresponding 500 parameter estimates.

If CETP still has significantly positive effects on CEI and IFCER, our previous results are considered robust. As expected, the evidence shows that CETP is significantly positive (negatively) associated with lnIFCER (lnCEI) at least at the 10% level, regardless of the inclusion of the control variables. The observed consistency with Table 4 confirms the robustness of our results.

4.3.4 Placebo tests

In this subsection, this paper conducts the placebo tests by randomly designating the pilot and not-pilot regions. Different from the formations of the treatment and control groups in the previous subsection, pilot regions in this subsection are not necessarily included in the treatment group. Instead, the treatment group consists of seven regions that are completely randomly selected from the 30 regions, and other 23 regions constitute the control group. The random sampling is repeated 500 times, each of which is separately followed by regressions of Eqs. (4) and (5) with the randomly selected treatment and control groups. Figure 3 plots the probability density functions of the estimated coefficients of lnIFCER and lnCEI on \(\left( {{\text{TreatmentTime}}} \right)\) in the left and right halves, respectively. The evidence shows both sets of estimated coefficients concentrate around zero. It follows that the random sampling will not generate meaningful results and the CETP effects estimated previously are unlikely to be driven by other unobservable factors.

The probability density functions of the estimated coefficients. This figure plots the probability density functions of the estimated coefficients of lnIFCER and lnCEI on \(\left( {{\text{TreatmentTime}}} \right)\) in the left and right halves, respectively. First, the treatment group consists of seven regions randomly selected from the 30 regions, and other 23 regions constitute the control group. Second, the random sampling is repeated 500 times, each of which is followed separately by regressions as follows. \({\text{lnIFCER}}_{it} = \beta_{0} + \beta_{1} {\text{Treatment}}_{i} \times {\text{Time}}_{t} + \sum \alpha_{i} {\text{Control}}_{it} + \gamma_{i} + \delta_{t} + \varepsilon_{it} ,\) where \(i\) and \(t\) index regions and years, respectively. \({\text{lnIFCER}}_{it}\) and \({\text{lnCEI}}_{it}\), respectively, denote the logarithms of IFCER and CEI. \({\text{Treatment}}_{i}\) is a dummy variable taking a value of one if CETP takes effect in region i or the region is a pilot region, and zero otherwise.\({\text{Time}}_{t}\) is a dummy variable taking a value of one when CETP takes effect in year t, and zero otherwise. \({\text{Treatment}}_{i} \times {\text{Time}}_{t}\) is a region-time interaction dummy variable of the implementation of CETP. \({\text{Control}}_{it}\) denotes control variables that include GDP per capita (PGDP), the proportion of secondary industry value added (Indu2), foreign direct investment (FDI), energy consumption intensity (ECI), and environmental support (ES). For the detailed derivations of all variables, please see “Appendix 3” of this paper. \(\gamma_{i}\) and \(r_{t}\) represent the region fixed effects, while \(\delta_{t}\) and \(p_{t}\) denote the time fixed effects

4.3.5 The PSM-DID method

CETP was first implemented in Guangdong on a trial basis in the first half of 2013 and then implemented in other pilot regions between the second half of 2013 and the first half of 2014. Based on these disparities, we employ DID to estimate the effects associated with the implementation of CETP. However, although known to lessen most of the problems associated with endogeneity, DID does not prevent possible sample selection biases. For example, the selection of pilot regions may not be completely random. Given the large disparities in environmental support and economic development across regions, the PSM method, proposed by Rosenbaum and Rubin (1983), is powerful to predict the similarity of probabilities to balance the distribution of the observed covariates between the treatment and control groups. To reduce possible endogeneity due to the non-random sample selection or match the pilot and non-pilot regions with similar probability of implementing CETP, we apply the PSM-DID method proposed by Heckman et al. (1997) as a robustness test.

A balance test applying all control variables is applied to check whether there is a significant difference in the selected variables between the pilot and the matched non-pilot regions with and without PSM. If there is no significant difference, then PSM is appropriate. As reported in Table 10, the standard deviations of all variables reduce after applying PSM, and the covariates between the pilot and non-pilot regions are insignificantly different, meeting the parallel hypothesis required by DID. Thus, with PSM, the distributions of the selected variables between the pilot and the matched non-pilot regions are relatively balanced.

First, a PSM approach is used to match the pilot and non-pilot regions, so that there is no significant difference between the pilot and the matched non-pilot regions. Second, a DID model is used to estimate the impacts of CETP on IFCER and CEI. The estimation results using PSM-DID are documented in Table 11. As a result, the CETP effects are rather clear, employing PSM-DID. The coefficients, signs, and significance levels of the CETP effects in the regressions with lnIFCER and lnCEI as the dependent variables are generally consistent with the previous results, as documented in Table 4, supporting their robustness.

4.4 Heterogeneity analyses

In this subsection, we turn our attention to Hypotheses 4a and 4b by testing whether and how the effects of CETP on IFCER vary across regions, based on GDP per capita and geographical locations.Footnote 10 An exploration of this heterogeneity issue can provide insight into how the effects of CETP work and help design subsequent policies more precise and effective for sustainable development.

4.4.1 GDP per capita

To verify Hypothesis 4a, a conditional test on GDP per capita is conducted to examine whether the impact of CETP on IFCER in wealthy regions is different from that in less-wealthy regions. First, based on the average of GDP per capita across regions from 2004 to 2019, 11 regions above the average are categorized as the wealthy regions, while the other 19 regions below the average are categorized as the less-wealthy regions. Second, using these two subsamples, we run the baseline regression, Eq. (4), and report the results under columns (1) and (2) of Table 12. As a result, the coefficients of IFCER on \(\left( {{\text{TreatmentTime}}} \right)\) in wealthy and less wealthy regions are both significantly positive, but the regression coefficient of IFCER in less wealthy regions is smaller than that in wealthy regions. It implies that the effects of CETP are stronger in wealthy regions and lends support to Hypothesis 4a.

4.4.2 Geographical locations

Now, we attempt to test Hypothesis 4b by analyzing a conditional test on geographical locations to examine whether the impact of CETP on IFCER varies across geographical locations. First, all regions are divided into three groups, eastern, central and western regions, based on the geographical locations. Second, employing these three subsamples, we estimate the baseline regression, Eq. (4), and report the results of location heterogeneity under columns (3), (4), and (5) of Table 12, respectively. Evidence shows that the coefficient on (Treatment × time) in eastern regions is significantly positive, while those in central and western regions are insignificantly negative. The results clearly confirm our belief and Hypothesis 4b that the impact of the implementation of CETP on IFCER in eastern regions is stronger than those in central and western regions.

4.5 Economic mechanisms behind the effects of CETP

The previous empirical analyses in this paper have confirmed that CETP can improve IFCER. In this subsection, we are interested in how CETP increases IFCER or the validity of Hypothesis 5 that there exist possible economic mechanisms behind the effects of CETP on IFCER. We propose R&D and Indu3 as two possible mediating variables. Then, we propose models, similar to Wen et al. (2018), to test whether CETP raises IFCER through the two mediating variables as follows:

where \({\text{Mech}}_{it}\) is the selected mediating variable, \({\text{lnR}}\& {\text{D}}\) or \({\text{lnIndu}}3\). First, in Eq. (8), we mainly check whether the coefficient of lnIFCER on \(\left( {{\text{Treatment}} \times {\text{time}}} \right)\) (\(\hat{\alpha }_{1}\)) is significantly positive. If yes, CETP significantly improves IFCER. Second, Eq. (9) is designed to examine whether CETP stimulates the mediating variable or the coefficient of Mech on \(\left( {{\text{Treatment}} \times {\text{time}}} \right)\) (\(\hat{\alpha }_{2}\)) is significantly different from zero. Third, Eq. (10) is to test the existence of the mediating effect, indicated by \(\hat{\alpha }_{4}\), with controls for the implementation of CETP. If \(\hat{\alpha }_{2}\) and \(\hat{\alpha }_{4}\).are both significantly different from zero, there exists a mediating (indirect) effect, first from CETP to Mech, and then from Mech to IFCER. The effect can be quantified as \(\left( {\hat{\alpha }_{2} \times \hat{\alpha }_{4} } \right)\). Similarly, if \(\hat{\alpha }_{3}\) is significantly different from zero, there is a direct effect of CETP on IFCER. Table 13 reports the results.

Concerning the mediating effect of R&D, Columns (1), (2), and (3) show the estimated results of Eqs. (8), (9), and (10), respectively. First, under column (1), the regression coefficient on (Treatment × time) (\(\hat{\alpha }_{1}\)) is 0.023 and significant at the 10% level, indicating that CETP increases IFCER. Second, \(\hat{\alpha }_{2}\) under column (2) (0.155) is significant at the 5% level, indicating that CETP increases R&D. Third, the coefficients on \(\left( {{\text{Treatment}} \times {\text{time}}} \right)\) (\(\hat{\alpha }_{3} = 0.027\)) and on \(\left( {{\text{ln}}R\& D} \right)\) (\(\hat{\alpha }_{4} = 0.024\)) under column (3) are both significant at the 1% level positive. This follows that the mediating effect of R&D exists and the indirect effect \(\left( {\hat{\alpha }_{2} \times \hat{\alpha }_{4} } \right)\) shares the same sign (direction) with the direct effect \(\left( {\hat{\alpha }_{3} } \right)\), suggesting that CETP can further improve IFCER through R&D. The observed scenario is that first CETP attracts firms to invest in R&D; second. R&D can encourage technological innovations and improve energy efficiency, which generates more investment opportunities and further stimulates IFCER.

As for the mediating effect of tertiary industries, the results are shown under columns (4), (5), and (6). The coefficients under column (4) are identical to those under column (1), while the coefficient of \({\text{lnIndu}}3\) on (Treatment × time) (\(\hat{\alpha }_{2}\)) under column (5) is significantly positive at the 1% level, indicating that the implementation of CETP results in industrial upgrading from secondary industries to tertiary industries, mainly covering service and financial firms. Under column (6), the coefficients on \(\left( {{\text{Treatment}} \times {\text{time}}} \right)\) (\(\hat{\alpha }_{3}\)) and \({\text{lnIndu}}3\) (\(\hat{\alpha }_{4}\)) are also significantly positive both at the 5% level, supporting the existence of the mediation effect. Given the positive sign of both the direct and indirect effects, it is possible CETP can first trigger industrial upgrading, and then the expanding tertiary industries induce demands for further CER and IFCER. According to the evidence associated with R&D and tertiary industries, Hypothesis 5 is confirmed.

5 Conclusion and policy implications

Developing a composite index to quantify IFCER, this paper employs data from 2004 to 2019 and the DID method to examine the impacts of CETP on IFCER and CEI. The evidence shows that, first, CETP increases IFCER and reduces CEI. Second, the effects of CETP in the pilot regions can spill over to the non-pilot regions nearby. Third, the effects of CETP are persistent for up to six years. Fourth, the effects of CETP are robust to a variety of tests applying alternative proxies for major variables, changing the sample interval, using the alternative PSM-DID method, applying randomly selected samples and placebo tests. Fifth, additional conditional tests show that the effects of CETP are stronger in wealthy regions and in eastern regions.

Finally, the economic mechanisms behind the effects of CETP are observed. R&D and the proportion of tertiary industries play vital roles in linking CETP to IFCER and CEI. For example, CETP encourages firms to invest in R&D that in turn promote more technological innovations and improve energy efficiency, which generates more investment opportunities and further stimulates IFCER.

Based on the observed empirical findings, this paper has four policy implications as follows. First, in light of the existence of the spillover effect, as long as policy makers make efforts to develop the likes of CETP to reduce carbon emissions, the benefits should be more than expected. Second, the authority should be aware of possible mechanisms behind the effect of CETP on IFCER to accelerate the development and benefit from it. For example, the government may motivate firms to carry out R&D in low-carbon technologies by appropriately issuing additional free carbon emissions allowances to those firms with green outputs. Third, thanks to our conditional analyzes in Sect. 5.4, it is necessary to fully recognize relevant characteristics among regions and utilize their strength and roles in CER and CET to build effective carbon trading markets. Finally, many countries may recently experience difficulties in their economies (probably due to the COVID-19 pandemic), but it is worth keeping carrying out CER policies, similar to CETP, to not only clean air, but also encourage industrial upgrading and possibly accelerate green recovery, given the observed benefits in China.

Notes

All abbreviations are recorded in “Appendix 1” of this paper.

The Kyoto Protocol is an international environmental treaty with the goal of stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system. Industrialized countries and economies were committed to limiting and reducing greenhouse gases emissions in accordance with agreed individual targets.

According to the “Report on the Seventh Five-Year-Plan” published in 1986, China was divided into three regions: the eastern, central and western regions. In 1997, the National People's Congress decided to establish Chongqing as a municipality directly under the central government and to include it in the western regions. As a consequence, the eastern regions include Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan; the central regions include Shanxi, Nei Mongol, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, Guangxi; the western regions include Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.

“Appendix 1” presents a theoretical analysis to explore possible dimensions of IFCER.

According to the IPCC accounting method, total carbon emissions = Σ energy consumption CO2 emissions intensity. Please see Ji et al. (2021) for the calculation details.

Hong Kong, Macau, Taiwan, and Tibet are excluded.

For simplicity, from now on, we only discuss the effect of CETP on IFCER. The untabulated results on CEI (available upon request) are consistent with our previous conclusions.

The elasticity of technological innovation illustrates the degree of response of CER to changes in financing for technological innovations.

References

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Berman E, Bui LT (2001) Environmental regulation and productivity: evidence from oil refineries. Rev Econ Stat 83(3):498–510

Blyth W, Bunn D (2011) Coevolution of policy, market and technical price risks in the EU ETS. Energy Policy 39(8):4578–4593

Boissinot J, Huber D, Lame G (2016) Finance and climate: The transition to a low-carbon and climate-resilient economy from a financial sector perspective. OECD J Financ Market Trends 2015(1):7–23

Borghesi S, Cainelli G, Mazzanti M (2015) Linking emission trading to environmental innovation: evidence from the Italian manufacturing industry. Res Policy 44(3):669–683

Brännlund R, Färe R, Grosskopf S (1995) Environmental regulation and profitability: an application to Swedish pulp and paper mills. Environ Resource Econ 6(1):23–36

Braun M (2009) The evolution of emissions trading in the European Union-The role of policy networks, knowledge and policy entrepreneurs. Acc Organ Soc 34(3–4):469–487

Bredin D, Muckley C (2011) An emerging equilibrium in the EU emissions trading scheme. Energy Econ 33(2):353–362

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manag 45(2):278–293

Caney S (2010) Markets, morality and climate change: What, if anything, is wrong with emissions trading? New Polit Econ 15(2):197–224

Cao J, Karplus VJ (2014) Firm-level determinants of energy and carbon intensity in China. Energy Policy 75:167–178

Chen ZY, Xu L, Qian CX (2020) Measuring the development level of carbon finance in China and its dynamic evolution. J Quant Econ Technol 37(08):62–82 (in Chinese)

Cheng B, Dai H, Wang P, Xie Y, Chen L, Zhao D, Masui T (2016) Impacts of low-carbon power policy on carbon mitigation in Guangdong Province, China. Energy Policy 88:515–527

Cheng J, Yi J, Dai S, Xiong Y (2019) Can low-carbon city construction facilitate green growth? Evidence from China’s pilot low-carbon city initiative. J Clean Prod 231:1158–1170

Chevallier J (2011) A model of carbon price interactions with macroeconomic and energy dynamics. Energy Econ 33(6):1295–1312

Coase RH (1960) The problem of social cost. In: Classic papers in natural resource economics. Palgrave Macmillan, London, pp 87–137

Cole MA, Rayner AJ, Bates JM (1997) The environmental Kuznets curve: an empirical analysis. Environ Dev Econ 2:401–416

Cropper ML, Oates WE (1992) Environmental economics: a survey. J Econ Lit 30(2):675–740

Dales JH (1968) Pollution, property & prices; an essay in policy-making and economics. https://agris.fao.org/agris-search/search.do?recordID=US201300589613

Dasgupta S, Laplante B, Wang H, Wheeler D (2002) Confronting the environmental Kuznets curve. J Econ Persp 16:147–168

Daskalakis G (2018) Temporal restrictions on emissions trading and the implications for the carbon futures market: Lessons from the EU emissions trading scheme. Energy Policy 115:88–91

De Souza Cunha FAF, Meira E, Orsato RJ, Klotzle MC, Lucena AF (2021) Do low-carbon investments in emerging economies pay off? Evidence from the Brazilian stock market. Int Rev Financ Anal 74:101700

Dong F, Dai Y, Zhang S, Zhang X, Long R (2019) Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci Total Environ 653:565–577

Efthymiou M, Papatheodorou A (2019) EU Emissions Trading scheme in aviation: policy analysis and suggestions. J Clean Prod 237:117734

Fang G, Tian L, Liu M, Fu M, Sun M (2018) How to optimize the development of carbon trading in China-Enlightenment from evolution rules of the EU carbon price. Appl Energy 211:1039–1049

Gulbrandsen LH, Stenqvist C (2013) The limited effect of EU emissions trading on corporate climate strategies: Comparison of a Swedish and a Norwegian pulp and paper company. Energy Policy 56:516–525

Hall S, Roelich KE, Davis ME, Holstenkamp L (2018) Finance and justice in low-carbon energy transitions. Appl Energy 222:772–780

Heckman JJ, Ichimura H, Todd PE (1997) Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. Rev Econ Stud 64:605–654

Herweg F (2020) Overlapping efforts in the EU Emissions Trading System. Econ Lett 193:109323

Huang J, Yang X, Cheng G, Wang S (2014) A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J Clean Prod 67:228–238

Jefferson GH, Tanaka S, Yin W (2013) Environmental regulation and industrial performance: evidence from unexpected externalities in China. Working paper, Available at SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2216220

Ji XL, Yang Z (2021) Does carbon emissions trading “accelerate” the reduction of carbon emissions and intensity? Bus Res 4(2):46–55 (in Chinese)

Joltreau E, Sommerfeld K (2019) Why does emissions trading under the EU Emissions Trading System (ETS) not affect firms’ competitiveness? Empirical findings from the literature. Clim Policy 19(4):453–471

Kemp R, Pontoglio S (2011) The innovation effects of environmental policy instruments: a typical case of the blind men and the elephant? Ecol Econ 72:28–36

Koch N, Mama HB (2019) Does the EU Emissions Trading System induce investment leakage? Evidence from German multinational firms. Energy Econ 81:479–492

Labatt S, White RR (2007) Carbon finance: the financial implications of climate change. Wiley, Hoboken

Laing T, Sato M, Grubb M, Comberti C (2014) The effects and side-effects of the EU emissions trading scheme. Wiley Interdiscip Rev Clim Change 5(4):509–519

Levinson A (1996) Environmental regulations and manufacturers’ location choices: evidence from the Census of Manufactures. J Public Econ 62(1–2):5–29

Li KF, Liu CZ (2011) Construction of carbon finance system and promotion of environmental finance innovation in China. Energy Procedia 5:1065–1072

Li B, Zhou J, Tian YH (2014) Carbon emissions and industrial structure change in the perspective of global externalities. Resour Sci 36(12):2483–2490 (in Chinese)

Liao X, Shi X (2018) Public appeal, environmental regulation and green investment: evidence from China. Energy Policy 119:554–562

Linnenluecke MK, Smith T, McKnight B (2016) Environmental finance: a research agenda for interdisciplinary finance research. Econ Model 59:124–130

Liobikienė G, Butkus M (2017) The European Union possibilities to achieve targets of Europe 2020 and Paris agreement climate policy. Renew Energy 106:298–309

Liu YW, Ding LP, Li Y, Hu ZY (2018) The measure of financial inclusion in China and its economic growth effect. China Soft Sci 2018(3):36–46 (in Chinese)

Liu Y, Wei T (2016) Linking the emissions trading schemes of Europe and China-Combining climate and energy policy instruments. Mitig Adapt Strat Glob Change 21(2):135–151

Ma C, Stern DI (2008) China’s changing energy intensity trend: a decomposition analysis. Energy Econ 30(3):1037–1053

MacKinnon DP, Krull JL, Lockwood CM (2000) Equivalence of the mediation, confounding and suppression effect. Prevent Sci 1:173–181

Magat WA (1978) Pollution control and technological advance: a dynamic model of the firm. J Environ Econ Manag 5(1):1–25

Mohsin M, Rasheed AK, Sun H, Zhang J, Iram R, Iqbal N, Abbas Q (2019) Developing low carbon economies: an aggregated composite index based on carbon emissions. Sustain Energy Technol Assess 35:365–374

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo XV (2020) Developing low carbon finance index: evidence from developed and developing economies. Finance Res Lett, forthcoming

Paolella MS, Taschini L (2008) An econometric analysis of emission allowance prices. J Bank Finance 32(10):2022–2032

Pargal S, Wheeler D (1996) Informal regulation of industrial pollution in developing countries: evidence from Indonesia. J Polit Econ 104(6):1314–1327

Peng J, Yu BY, Liao H, Wei YM (2018) Marginal abatement costs of CO2 emissions in the thermal power sector: a regional empirical analysis from China. J Clean Prod 171:163–174

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Persp 9(4):97–118

Reboredo JC, Ugando M (2015) Downside risks in EU carbon and fossil fuel markets. Math Comput Simul 111:17–35

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: Will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Rosenbaum P, Rubin D (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70:41–55

Sovacool BK, Mukherjee I, Drupady IM, D’Agostino AL (2011) Evaluating energy security performance from 1990 to 2010 for eighteen countries. Energy 36(10):5846–5853

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Develop 32:1419–1439

Streimikiene D, Roos I (2009) GHG emission trading implications on energy sector in Baltic States. Renew Sustain Energy Rev 13(4):854–862

Su B, Ang BW (2015) Multiplicative decomposition of aggregate carbon intensity change using input–output analysis. Appl Energy 154:13–20

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103

Taghizadeh-Hesary F, Yoshino N, Rasoulinezhad E, Rimaud C (2021) Power purchase agreements with incremental tariffs in local currency: an innovative green finance tool. Glob Finance J 50:100666

Wang C, Wang F (2017) China can lead on climate change. Science 357(6353):764–764

Wang K, Wei YM (2014) China’s regional industrial energy efficiency and carbon emissions abatement costs. Appl Energy 130:617–631

Wang N, Lee JCK, Zhang J, Chen H, Li H (2018) Evaluation of Urban circular economy development: an empirical research of 40 cities in China. J Clean Prod 180:876–887

Wanlley & Whitehead (1994) The contribution of environmental regulations to slowdown in productivity growth. J Environ Manag 8:381–390

Wu T, Kung CC (2020) Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technol Forecasting Social Change 152:119884

Yang L, Ma C, Yang Y, Zhang E, Lv H (2020) Estimating the regional eco-efficiency in China based on bootstrapping by-production technologies. J Clean Prod 243:118550

Yi L, Li CP, Yang L, Liu J (2018) The development of carbon finance in China’s seven major carbon trading pilots: a comparative study on the development of seven major carbon trading pilot projects in China. China Popul-Resources Environ 28(2):134–140 (in Chinese)

Yu J, Mallory ML (2014) Exchange rate effect on carbon credit price via energy markets. J Int Money Financ 47:145–161

Yu S, Zhang J, Zheng S, Sun H (2015) Provincial carbon intensity abatement potential estimation in China: a PSO–GA-optimized multi-factor environmental learning curve method. Energy Policy 77:46–55

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang N, Yu K, Chen Z (2017a) How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107:678–687

Zhang W, Li J, Li G, Guo S (2020a) Emission reduction effect and carbon mark-et efficiency of carbon emissions trading policy in China. Energy 196:117117

Zhang W, Zhang N, Yu Y (2019) Carbon mitigation effects and potential cost savings from carbon emissions trading in China’s regional industry. Technol Forecast Soc Chang 141:1–11

Zhang YJ, Peng YL, Ma CQ, Shen B (2017b) Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100:18–28

Zhang Y, Li S, Luo T, Gao J (2020b) The effect of emission trading policy on carbon emission reduction: evidence from an integrated study of pilot regions in China. J Clean Prod 265:121843

Zhang Z (2016) Making the transition to a low-carbon economy: the key challenges for China. Asia Pacific Policy Stud 3(2):187–202

Zhao X, Han M, Ding L, Calin AC (2018) Forecasting carbon dioxide emission-ns based on a hybrid of mixed data sampling regression model and back propagation neural network in the USA. Environ Sci Pollut Res 25(3):2899–2910

Zhou B, Zhang C, Song H, Wang Q (2019) How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci Total Environ 676:514–523

Zhou D, Liu YC (2020) Impacts and mechanisms of China’s carbon trading pilot policies on urban carbon emission performance. China Environ Sci 40(1):453–464 (in Chinese)

Zhou K, Li Y (2019) Carbon finance and carbon market in China: progress and challenges. J Clean Prod 214:536–549

Zhu B, Zhang M, Huang L, Wang P, Su B, Wei YM (2020) Exploring the effect of carbon trading mechanism on China’s green development efficiency: a novel integrated approach. Energy Econ 85:104601

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: A summary of all abbreviations

Table

14 documents all abbreviations employed in this paper.

Appendix 2: Possible dimensions of IFCER

Following Chen et al. (2020), this section presents a theoretical analysis of possible influencing factors of IFCER. Suppose there are a representative firm and a financial institution in the economy. Assume that carbon emissions are generated by the firm and have a negative externality effect on the whole economic system, which will reduce the returns of the firm.

Before the implementation of CETP, no one provides financing to the firm for CER projects. The revenue function of the firm is:

where \(\pi\) represents the revenue of the firm, \(q\) denotes the quantity of output of the firm and \(P\) is the output price. If there is no CET, since the government requires that CEI of the firm cannot exceed the specified quota, otherwise it will pay a penalty of \(qT\), where \(T\) is the cost parameter associated with the penalty before the implementation of CETP.

After the implementation of CETP, IFCER is available for the firm. The return of the firm is as follows:

where \(v_{c}\) denotes the total amount of financing with which the firm carries out technological innovation in order to achieve CER. μ is the elasticity of technological innovation,Footnote 11\(0 < \mu < 1\), \(v_{c}^{\mu }\) is the degree of CER by the firm through technological innovation. \(t\) denotes the cost parameter of CET after the implementation of CETP, \((t < T)\). \(\left( {1 - v_{c}^{\mu } } \right)qt\) is considered the transaction cost of CET, including transaction fees and others. \(r_{c}\) is the interest rate at which financial institutions finance CER projects.

To determine the optimal financing size \(\left( {v_{c}^{*} } \right)\) for the firm, we take the first derivative of \(\pi\) with respect to \(\left( {v_{c} } \right)\) in Eq. (12) and let it equal zero as follows:

Then, substituting \(v_{c}^{*}\) in Eqs. (12) yields the following:

Equation (14) describes the returns of the firm at the optimal financing size. To emphasize the difference between after and before the implementation of CETP, we take the difference between Eqs. (14) and (11) and derive the following:

It can be seen that \({\Delta }\pi \ge 0\), which indicates that the revenue of the firm should increase after the implementation of CETP. There are two reasons. First, the transaction cost of the market decreases after the implementation of CETP, as indicted by the cost saving \(\left( {T - t} \right)q\), given a fixed q. The cost saving reflects the benefit of the implementation CETP on CET.

The second term of the right-hand side in Eq. (15) can be regarded as the effect of financing CER projects on the revenue of the firm. Assuming a fixed \(q\), the second term of the right-hand side \(\left[ {\frac{{\left( {\mu qt} \right)^{{1/\left( {1 - \mu } \right)}} \left( {1/\mu + 1} \right)}}{{\left( {1 + r_{c} } \right)^{{\mu /\left( {1 - \mu } \right)}} }}} \right]\) shows that given the existence of \(v_{c}^{*}\) or the sufficiency of funds, the benefit of the implementation of the firm depends on the technological innovation elasticity \(\mu\) and the interest rate \(r_{c}\). In the following, we attempt to explain why we propose the four dimensions in Sect. 3.2.1 to describe IFCER.

Explicitly, CER projects reducing CEI can be either financed through indirect financing (the first dimension of IFCER) or direct financing (the third dimension of IFCER), reflected by \(v_{c}\). The larger the amount of financing for CER, the higher the level of carbon finance. With regard to the second dimension, the higher the elasticity of technological innovation \(\left( \mu \right)\), the more efficient the use of funds, the more carbon dioxide emissions are reduced. Finally, as for the fourth dimension, the higher the cost of financial services, the lower income of the firm, the lower the level of carbon finance. Collectively, IFCER can be evaluated by the amount of direct and indirect financing for CER, the efficiency of the use of funds, and the cost of financial services.

Appendix 3: A summary of all variable definitions

Table

15 records all definitions and derivations of variables employed in this paper.

Rights and permissions

About this article

Cite this article

Guo, Q., Su, Z. & Chiao, C. Carbon emissions trading policy, carbon finance, and carbon emissions reduction: evidence from a quasi-natural experiment in China. Econ Change Restruct 55, 1445–1480 (2022). https://doi.org/10.1007/s10644-021-09353-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09353-5

Keywords

- Carbon emissions trading policy

- Investment and financing facilitating carbon emissions reduction

- Carbon emissions reduction

- Carbon finance