Abstract

Social costs for methane and carbon dioxide emissions, from the risk of climate tipping events and deterministic damages, are derived in an analytically tractable model. In the core model: social costs from tipping risks rise with income, just as they do for deterministic damages, and depend on only a few parameters. Consequently, methane’s weight (its social cost relative to carbon dioxide) is constant and independent of temperature projections. But other damage and tipping probability formulations assumed in the literature imply methane’s weight varies over time and with temperature projections. (JEL H23, O44, Q40, Q54, Q56, Q58).

Similar content being viewed by others

Climate change includes the risks of irreversible events, referred to as tipping points. These events can have a material impact on optimal policy. One potential consequence of a risk of tipping is a change in the relative, as well as absolute, social costs of different greenhouse gases because the timing of effects of these gases differ. While carbon dioxide is long-lived, methane decays relatively quickly. Under current Intergovernmental Panel on Climate Change policy, 100-year Global Warming Potentials (GWP100) are used to aggregate methane and carbon dioxide. This paper investigates how tipping risks may affect the social cost of carbon dioxide and the methane weight (its social cost relative to carbon dioxide), compared to the weight determined under GWP100.

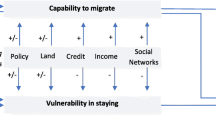

The social costs of greenhouse gases equal the sum of discounted economic losses from deterministic damages and stochastic tipping events, which I assume are linked to atmospheric temperature. As atmospheric carbon dioxide and methane lifetimes differ, one may expect their social costs to vary over time in absolute and relative terms and depend upon temperature projections. However, this is not the case in my benchmark core model building on Golosov et al. (2014): I assume the risk of tipping rises linearly with temperature and will persist long into the future, and a fixed proportional economic impact from a tipping event after some delay.Footnote 1 Social costs consist of two components that rise with income: one from deterministic damages and the other from the risk of tipping. This latter component depends on the discount rate, long-run damages from tipping, the delay in onset and ramp-up of impacts, and how much the tipping probability rises with each degree of warming. So the methane weight is constant, and an increase in deterministic damages can lead to the same social cost (as a ratio of income) as the inclusion of a tipping risk.

While this core model provides a useful benchmark, the underlying assumptions do not cater for our understanding of different potential tipping events; Sect. 3 discusses other assumptions made in the literature. My objective is not to present estimates based on distributions of parameters and the latest knowledge of potential tipping events (Cai & Lontzek 2019; Instead, I derive and discuss analytical equations for the sensitivities and illustrate their effect in Sect. 4 using temperature projections from Representative Concentration Pathways (RCP) scenarios 2.6 and 4.5 that, in my view, bound likely temperature outcomes. The first sensitivity assumes the tipping probability rises quadratically with temperature rather than linearly. Social costs increase for the higher temperature scenario RCP 4.5 relative to RCP2.6. The methane weight is higher than the core model for RCP2.6, as temperature peaks quickly, and lower than core for RCP4.5. Identical social cost-to-income ratios could be obtained using deterministic damages that are quadratic in temperature.

The second sensitivity restricts the number of possible tipping events to one: social costs are lower and an interesting “inevitability” effect emerges, where higher projected temperature outcomes reduce costs, similar to the dead-anyway effect for valuing a statistical life (Pratt & Zeckhauser 1996). Social costs become zero after a tipping event and cannot be replicated using deterministic damages. In the third sensitivity, exponential-linear (in temperature) damages from tipping events introduce a differential welfare impact, proportional to the difference in social costs before and after an event (Lemoine & Traeger 2014). This effect raises social costs and gives more weight to the benefits of reduced temperature in the distant future as the cumulative probability of tipping rises, lowering the methane weight. The fourth sensitivity assumes a tipping risk only exists if temperature rises to new levels (threshold formulation): social costs depend on the timing of peak temperature (the maximum projected temperature level) and the methane weight rises markedly prior to the peak. The fifth sensitivity discusses the increase in social costs when risk aversion is in line with the literature.

1 Previous Literature

Engström and Gars (2016) use a similar model approach to consider different tipping impacts, but do not consider methane and focus on extraction rates and the green paradox, rather than social costs. Nævdal (2006) considers the optimal regulation of methane and carbon dioxide under a threshold tipping risk and finds a temporary boost in the ratio of methane to carbon dioxide stock above the steady state, consistent with an increasing methane weight in a decentralised model. Table 1 in Appendix A lists previous literature that consider tipping points and their approaches – see also Cai (2021) for a recent review.

Under deterministic damages, Marten and Newbold (2012) find that the methane weight rises by up to 50% by 2050, partly due to their climate model, where the marginal forcing of methane decreases slower than carbon with the increasing atmospheric stock. Azar et al. (2023) also find an increasing weight for methane from deterministic damages that are quadratic in temperature if temperatures fall after 2100, and review estimates of the social costs of methane from deterministic damages in the literature.

Another stream of literature investigating different greenhouse gases imposes a maximum temperature and uses a cost-minimisation approach, suggesting a very low weight of methane today, which rises over time.Footnote 2 This paper does not support such a policy, but the threshold formulation induces a similar rise in the methane weight before peak temperature. The framework outlined in this paper can consider other actions with different temporal characteristics, including geoengineering (Bickel & Agrawal 2013; Goes et al. 2011; Heutel et al. 2018) and leakage rates and risks from carbon capture and sequestration (van der Zwaan & Gerlagh 2009).

2 Core Model and Social Costs

The core model uses five key assumptions that lead to analytical tractability: (i) logarithmic utility; (ii) full one-period depreciation of capital; (iii) an exponential-linear deterministic impact of historical emissions on output;(iv) Cobb–Douglas production; and (v) a risk of tipping events linear in temperature with fixed proportional impacts. Golosov et al. (2014) use assumptions (i) to (iv) and find a constant optimal tax-to-income ratio for carbon dioxide, independent of economic growth and climate outcomes. This result occurs because the assumptions imply a constant savings rate, so consumption is proportional to output, and damages are exponential-linear, so emissions lead to a linear reduction in log output and thus welfare. Barrage (2014) and Rezai and van der Ploeg (2015) find the results are reasonably robust to variation in these assumptions. Golosov et al. (2014) satisfy (iii) by assuming that atmospheric carbon concentration is a linear function of historical emissions and an exponential impact of carbon concentration on output. Instead, I assume that temperature is a linear function of historical emissions, which can replicate more complex climate-economy models well, and an exponential-linear impact of temperature on output. This latter assumption leads to an approximately linear relationship between global damages and temperature for the level of damages considered, consistent with Burke et al. (2015).Footnote 3

A global representative household maximises the following in discrete time, for consumption \({C}_{t}\) and discount factor \(\beta\):

Atmospheric temperature above pre-industrial is a linear function of historical non-interacting carbon dioxide and methane emissions \({E}_{c,t}\) and \({E}_{m,t}\) in units of GtCO2e:

Figure 1 shows temperature responses to pulse emissions under GWP100, \({\psi }_{g,t}\).Footnote 4 These impulse functions are central to this paper and highlight the sharp temperature responses to methane relative to the carbon dioxide pulse. Further details are in Appendix C.

Deterministic damages are exponential-linear in temperature with parameter \(\upgamma >0,\) and the function \({f}_{t}\) represents stochastic damages from tipping. For capital \({K}_{t}\) and a function \(F\) of emissions and a vector of other inputs \({{\varvec{X}}}_{t}\), such as labour, output \({Y}_{t}\) is given by:

The emission variables \({E}_{g,t}\), \(g\in \left\{c,m\right\}\), correspond to emission-intensive activities, in units of carbon dioxide equivalent, which could themselves be functions of other factors and emissions without affecting the results. However, to simplify the treatment of uncertainty, I ensure that temperature outcomes (hence emissions) are independent of whether tipping events have occurred, so emissions-intensive activities cannot be functions of capital or final output. Thus, while a tipping event will have a lasting effect on output and capital stocks, it does not affect emissions.Footnote 5 Capital depreciates completely after one period, so the feasibility constraint in the final goods sector is

Tipping occurs in each period with probability \({p}_{t}\). An event variable \({I}_{t}\) is zero if tipping does not occur in period \(t\), and \(\delta\) if tipping occurs. Multiple tipping events are possible, but no more than one event in a period, and the tipping probability is independent of whether events have already occurred, making things easier in a discrete-time framework.Footnote 6 Following a tipping event, there is a delay of \(d\) periods until the onset of impacts and awareness that an event has been triggered. Impacts then ramp up linearly over \(r\) periods so that the full impact occurs after \(d+r\) periods. The function \({f}_{t}\) is a function of temperature, previous tipping events, the safe temperature below which there is no risk of tipping \({T}_{min}\), and parameter \(\mu\) as follows:

2.1 Social Costs

The social cost-to-income ratio consists of a constant component due to deterministic damages \({\widehat{D}}_{g}\), and a variable component due to the stochastic risk of tipping \({\widehat{S}}_{g,t}\).

Lemma 1: Given (1) to (4), the social cost-to-income ratio for emission g is

The proof is in Appendix A. As described by Golosov et al. (2014), a tax equal to the social costs combined with lump-sum rebates implements the social optimum in a competitive equilibrium where production factors are freely allocated across sectors.Footnote 7 The weight of methane is \({\widehat{\Lambda }}_{m,t}/{\widehat{\Lambda }}_{c,t}.\) The following proposition assumes that the risk of tipping follows (5) and is always present, which seems reasonable as temperatures will likely remain elevated above pre-industrial levels for centuries.

Proposition 1: Given (1) to (5) and assuming \({T}_{t}\ge {T}_{min}\) for all t, then the social cost-to-income ratio from a tipping risk is given by:

The proof is in Appendix A. The parameter \(\Omega\) accounts for the delay in the onset of impact and the time to ramp up to full impact \(\delta\). The effect of tipping risks on the social cost-to-income ratio is equivalent to boosting the deterministic damages parameter \(\gamma\) by \(\frac{\Omega \delta \mu }{1-\beta }\). Both components \({\widehat{D}}_{g}\) and \({\widehat{S}}_{g}\) are constant by construction: while deterministic damages combine (exponential) linear damages with a fixed (100%) probability, climate tipping combines fixed proportional damages with a probability of tipping linear in temperature and independent of previous tipping events.

Naturally, the weight of methane will be constant and equals \({\Gamma }_{m}/{\Gamma }_{c}\). When the discount rate is high, the weight of methane is high due to the rapid temperature effect of a methane pulse relative to carbon dioxide (Fig. 1). A discount rate of around 1% implies a methane weight of 1, corresponding to current policy using GWP100.

3 Sensitivities

This section discusses the effect of the following model changes on social costs: a quadratic tipping probability, limiting the risk of tipping to a single event, exponential-linear damages where the post-tipping impact increases with temperature, a threshold tipping risk formulation, and greater risk aversion. As deterministic damages are unchanged, discussions of social costs relate solely to tipping risks.

3.1 Tipping Probability Quadratic in Temperature

If the tipping probability rises quadratically with temperature, \(p\left({T}_{t}\right)={\mu }_{Q}{{\widetilde{T}}_{t}}^{2}\), then social costs \({\widehat{S}}_{Q,g,t}\) become

Social costs now depend on temperature projections and no longer grow with income, and the methane weight will vary. Note the absence of an expectation operator, as a tipping event does not impact temperature outcomes. Consider temperature stabilisation at \({T}^{*}\), so that \(\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{g,i}{\widetilde{T}}_{i}={\widetilde{T}}^{*}{\Gamma }_{g}\) and social costs become:

3.2 One Tipping Event Only

While a few other papers consider the possibility of multiple tipping events, most studies consider the effect of a single event. In this case, the expectation at time t of the derivative of the tipping probability at time \(t+i\), \({p}_{one,t+i}\), is reduced by the chance that tipping will have occurred between \(t-d+1\) and \(t+i-1\) as follows:

Thus, social costs are lower in this framework. While this result is intuitive, consider the effect of temperature projections. As the risk of tipping before period \(t+i\) increases with temperature, higher temperature projections reduce social costs today, which I call an “inevitability” effect. This effect would create positive feedback from lower emission taxes to higher temperature projections in a model with endogenous temperature.

3.3 Exponential-Linear Damages

A tipping event could lead to a change in the climate response rather than fixed damages, such as reduced absorption of carbon into the oceans discussed by Lenton et al. (2008) and considered by Lemoine and Traeger (2014).Footnote 8 Increased sensitivity to temperature can act as a proxy for a change in the climate response: an exponential-linear damages (ED) case examines the implications of both the probability of tipping and impacts increasing with temperature, so (5) becomes \({f}_{ED,t}={T}_{t}\sum_{i=-\infty }^{{\text{t}}}{R}_{t-i+1}{I}_{i-d}\). Social costs are a function of expected temperature levels and, assuming the impacts of tipping have not occurred at time \(t\), (6) becomes

The first bracketed term in (11) relates to the differential welfare impact (Lemoine & Traeger 2014) and is proportional to the difference in social costs before and after tipping impacts. The second bracketed term relates to the marginal hazard effect, as exists in the core model and previous sensitivities, and captures the benefits of a marginal reduction in the tipping risk. Social costs now increase by \(\frac{{\delta }_{ED}}{1-\beta }{\Gamma }_{g}\) after the full impact of a tipping event as the marginal damages from temperature increase. Consider temperature stabilisation at \({\widetilde{T}}^{*}>0\), so that \({\mathbb{E}}_{t}{I}_{ED,t-d+k}=\mu {\widetilde{T}}^{*}{\delta }_{ED}\). Then, social costs become

A delay in the onset of tipping impact, or a gradual ramp-up of impacts, decreases the marginal hazard effect due to discounting: core social costs \({\widehat{S}}_{g}\) for carbon dioxide and methane reduce equally. The differential welfare impact has an opposing force: a delay in awareness increases social costs (\(\sum_{j=1}^{i+d}{R}_{j}\) rises with \(d\)), assuming no awareness of a tipping event to date. Further, the component \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{g,i}\sum_{j=1}^{{\text{i}}+{\text{d}}}{R}_{j}}{{\Gamma }_{g}}\) lowers the methane weight in two key ways. First, there is a greater weight on future temperature impacts because the cumulative chance that tipping occurs increases with time.Footnote 9 Second, a gradual ramp-up of impacts amplifies this effect by reducing the extent of short-run temperature effects. In contrast, a delay in the onset of impacts partially offsets these effects.Footnote 10

3.4 Threshold Tipping Formulation

A threshold formulation is akin to a phase transition in physics, such as a transition from liquid to gas at a particular temperature (and pressure). The literature often suggests tipping events could occur above a temperature threshold or within a range: the collapse of Atlantic thermohaline circulation “probably requires more than 4 °C warming”; the disappearance of the Greenland ice sheet “may occur at 0.8 °C – 3.2 °C (with best estimate 1.6 °C)”; and collapse of the West Antarctic ice sheet “may be triggered at > 4 °C warming” (Lenton 2013). Assuming tipping risks are proportional to the extent that the current temperature exceeds the previous maximum, the tipping probability from (5) becomes

There is a discontinuity in the temperature-derivative of the tipping probability if temperature stabilises. If we assume increasing temperatures so \({\widetilde{T}}_{T,t}>0\) for all t, then the tipping social cost-to-income component is constant and equal to \({\upbeta }^{d}\delta {\mu }_{T}{\Gamma }_{g}\) (note the absence of the denominator compared with (7), which will become clear). But the occurrence of peak temperature should be considered in this case. Consider the weak assumption that until period \(\uptau\), \({\widetilde{T}}_{T,t}>0\) for \(t<\uptau\), and from then on \({\widetilde{T}}_{T,t}=0\) for \(t\ge\uptau\), so once temperature peaks, it never rises back above that peak. Then

The proof is in Appendix A. Consider no impact delay or ramp-up for clarity. A marginal increase in temperature \({T}_{t}\) increases the chance of tipping in period \(t\) by \({\mu }_{T}d{T}_{t}\) if \(t\le \tau\). In the core model, there is no effect on the tipping probability in future periods, so \(\frac{\partial {\mathbb{E}}_{{\text{t}}}{f}_{t+j}}{\partial {T}_{t}}=\mu \delta\) for all \(j\ge 0,\) and the infinite sum leads to the denominator \(1-\beta\). However, for the threshold formulation, if \(t<\tau ,\) the chance of tipping in period \(t+1\) is reduced by \({\mu }_{T}d{T}_{t}\) so \(\frac{\partial {\mathbb{E}}_{{\text{t}}}{f}_{t+j}}{\partial {T}_{t}}=0\) for \(j\ge 1\) and there is no \(1-\beta\) denominator, while if \(t=\tau ,\) then \(\frac{\partial {\mathbb{E}}_{{\text{t}}}{f}_{t+j}}{\partial {T}_{t}}={\mu }_{T}\delta\) for \(j\ge 0\).

Interestingly, initial social costs are lower if peak temperature occurs further into the future. There is no tipping risk (hence no social cost) once temperature stabilises or falls in the long run.Footnote 11 In contrast, tipping will (eventually) occur in the core model for any temperature stabilisation with a non-zero tipping probability. Ultimately, the best representation will depend on the nature of the specific tipping event, and may be a combination of both core and threshold (or other) formulations.Footnote 12

3.5 Risk Aversion

A logarithmic power utility is commonly used and implies an intertemporal elasticity of substitution of unity. However, some papers disentangle time preferences and risk aversion as described by Epstein and Zin (1990), including Bretschger and Vinogradova (2018), Cai and Lontzek (2019), Olijslagers and van Wijnbergen (2024) and Traeger (2018). This approach allows compliance with risk aversion estimates in the literature without leading to excessively high risk-free discount rates. An increase in risk aversion over that implied by a logarithmic utility is achieved by adding an expectation term as shown in the Bellman equation, omitting time subscripts and with parameter \(\alpha\):

Given the simplifying assumptions detailed in Appendix A, further risk aversion increases the tipping component of the social cost-to-income ratio for carbon dioxide according to the following approximation:

For parameters used in the next section \(\delta =0.1\), \(d=5,\) \(\beta ={0.985}^{10}=0.86\) so \({\mathrm{\varphi }}_{f}=10\), \(\kappa =\frac{1}{3}\) and \(d=5\) and \(r=5\), so \(\Omega =0.33\). Traeger (2018) show that values of \(\mathrm{\alpha }\in \left[-1.2,-0.7\right]\) are consistent with relative risk aversion values between 10 and 6 in the literature.Footnote 13 The uplift approximation in (16) relies on a small \(\Phi\), between 0.27 and 0.46 given the parameters, so it is rough. The range of risk aversion uplift to match the literature is between 13% and 23%, broadly consistent with Cai and Lontzek (2019) for similar parameter values.

4 An Illustration Using Temperature Projections

Consider the RCP2.6 and 4.5 temperature projections detailed in Stocker et al. (2013)Footnote 14: I extrapolate to 2300 and then assume temperature stabilises (Panel A in Fig. 2). Assume that emissions lead to these temperature outcomes in each case, but allow marginal changes so that social costs are well defined by (6). For expositional clarity, deterministic damages are infinitesimal, so carbon dioxide social costs relate to a tipping risk only, and methane weights are well-defined even if the tipping risk is zero.

Social costs and cost-to-income ratios of carbon dioxide, and the methane weight, from a tipping risk. CO2 Carbon dioxide. Methane weight of 1 is consistent with GWP100. Quadratic= Tipping probability quadratic in temperature. One only= A tipping event can only occur once. Exp damages= Damages from tipping are exponential-linear. Deterministic damages are infinitesimal for clarity. One only and Exp damages projections assume tipping does not occur ex-post. $ values in Panel D indicate social costs in 2020

Global output is $85 trillion in 2020 and grows by 2 per cent annually. Fixed damages from a tipping event are 10% of output, and the annual discount rate is 1.5%, as used in the DICE 2016R2 model. Following Lontzek et al. (2015), the tipping probability parameter is \(\mu =0.025\) and \({T}_{min}\) is set to 1 °C. A linear rise in temperature to 2 °C in 2100 leads to an expectation of 0.13 tipping events triggered by 2100.Footnote 15 The quadratic tipping probability and threshold sensitivities are calibrated to match this tipping expectation by 2100, so \({\mu }_{Q}=0.035\) and \({\mu }_{T}=0.16\). In the exponential-linear damages case, 2 degrees of warming post-tipping leads to 10% damages, so \({\updelta }_{{\text{ED}}}=\updelta /2\). The delay from a tipping event to the onset of impact is 5 decades, followed by another 5 decades ramping up to full impact.

Panel B shows the social costs for carbon dioxide for the core model and the quadratic, one-only and exponential-linear damages sensitivities for the RCP2.6 projection. Panel C shows the same results as Panel B as a ratio of income \(Y\), highlighting how social costs deviate from income growth in the sensitivities. Consistent with Proposition 1, social costs rise with income in the core formulation and are independent of temperature outcomes; thus, core results are identical in Panels C and D. The weight of methane in core is greater than one (Panels E and F): the initial methane social cost is $26 per tonne CO2e compared with $22 for carbon dioxide.Footnote 16 There are 0.11 and 0.20 expected tipping events triggered by 2100 under RCP2.6 and RCP4.5, respectively.

A quadratic tipping probability means higher temperatures lead to greater marginal tipping risks and higher social costs. Under RCP2.6, the social cost for carbon dioxide begins higher than core but rises slower than income due to falling temperatures, while it is higher than core and rises faster than income under the increasing temperatures in RCP4.5. The methane weight is higher under RCP2.6 as temperatures fall in the future, while the weight starts lower and rises under RCP4.5. In both cases, the methane weight matches the core weight as the temperature stabilises. At this point for RCP4.5, for example, social costs are \(2{\widetilde{T}}^{*}{\mu }_{Q}/\mu \approx 5.6\) times the core model from (9).

If only one tipping event is possible, social costs are lower than core: initially by 7% and 13% for carbon dioxide for RCP2.6 and RCP4.5 respectively, and when temperature stabilises, by 2% and 41% respectively. The reduction in the methane social cost is smaller than for carbon dioxide, as the cumulative risk of tipping grows into the future, so the methane weight is higher than core.

If damages from tipping are exponential-linear in temperature, the profile of social costs for carbon dioxide is similar to the quadratic sensitivity. Consider the endpoint under RCP4.5. From (12), the marginal hazard effect is \(\frac{{\delta }_{ED}}{\delta }{T}^{*}\approx 1.5\) times the core social cost. The differential welfare impact is \(\frac{{\delta }_{ED}}{\delta }{\widetilde{T}}^{*}\frac{(1-\beta )}{\Omega }\left(\frac{\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{c,i}\sum_{j=1}^{i+d}{R}_{j}}{{\Gamma }_{c}}\right)\approx \frac{1}{2}2\frac{0.14}{0.33}\left(7.5\right)=3.2\) times core, making the social cost about 4.7 times core. As \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{g,i}\sum_{j=1}^{i+d}{R}_{j}}{{\Gamma }_{g}}\) is 7.5 for carbon dioxide and only 3.6 for methane, the methane weight is markedly lower and less than current policy.

In the threshold formulation, the initial social cost of carbon dioxide is 9% higher than core for RCP2.6 and 10% lower than core for RCP4.5 (Fig. 3). As a tipping risk only exists if temperature rises, this social cost ratio increases slightly and then drops to zero following peak temperature, and the methane weight is more than triple the current policy just before the peak. As social costs depend on the timing, rather than level, of peak temperature, the dynamics are identical between projections but shifted in time. The sharp changes in costs would become smooth with uncertainty of temperature outcomes, or with the effect of climate policy in an endogenous model where temperature may stabilise for an extended period.Footnote 17 If the threshold formulation were combined with exponential-linear damages, the social cost would drop gradually beyond peak temperature due to the delay in awareness that an event has occurred.

5 Conclusion

This paper examines the social costs of methane and carbon dioxide under climate tipping risks. Several formulations are considered as the nature and consequences of such risks differ between tipping events and are uncertain. The core model has restrictive assumptions that allow an easy calculation of social costs given a few parameters. A couple of temperature projections illustrate the results.

As in all work in this field, this paper has many limitations. While the risks of tipping in a stochastic framework are considered, the model and associated parameters are assumed to be known a priori. The restrictive assumptions in the economic framework do not allow precautionary capital formation considered in other papers such as van der Ploeg and de Zeeuw (2018). There is no discussion of the effect of climate policy on growth and emissions. The assumption that temperature is a linear function of previous actions can replicate the more complex climate-economy models well, but tipping impacts on climate feedback, such as a lower carbon dioxide decomposition rate, require a more complex framework.

Notes

A collapse of major ice sheets leading to severe sea-level rise is an example of a shock that would have long-term and direct economic impacts.

For damages up to around 10% of output, an exponential function is approximately linear. Burke, Hsiang, & Miguel 2015 find non-linear local responses to temperature but approximately linear losses at a global level.

The GWP of a gas is the time-integrated radiative forcing from a pulse emission, relative to an equal mass of carbon dioxide, and thus resulting weights depend on the choice of time horizon. For example, methane has a 100-year GWP of 28 and a 20-year GWP of 84 (IPCC 2014). The 100-year GWP was adopted by the United Nations Framework Convention on Climate Change and its Kyoto Protocol and is now used widely as the default metric. The clearest recommendation for 100 years is that a significant fraction of carbon dioxide is removed from the atmosphere over this time scale (Fuglestvedt et al. 2003), and this period also roughly corresponds to the anticipated maximum change in temperature (WMO 1992).

An alternative assumption is that tipping impacts directly lowers utility rather than production, as discussed in Gerlagh and Liski (2018).

Multiple potential tipping points mean that the expected number of tipping events increases without bound as temperature rises, and there is no updating the probability function if a tipping event occurs.

Golosov et al. (2014) also show the optimal tax formula applies when exhaustible resource stocks apply.

van der Ploeg (2014) also discusses sensitivity to the functional form of damages.

Assuming no delay or ramp-up for clarity, the component \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{g,i}\sum_{j=1}^{i+d}{R}_{j}}{{\Gamma }_{g}}\) simplifies to \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}i{\psi }_{g,i}}{{\Gamma }_{g}}\). As the temperature effect of methane is relatively short-lived, \(\frac{{\psi }_{m,i}}{{\psi }_{c,i}}>\frac{{\psi }_{m,j}}{{\psi }_{c,j}} {\text{for}} 0<i<j,\) then \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}i{\psi }_{c,i}}{{\Gamma }_{c}}>\frac{\sum_{i=0}^{\infty }{\beta }^{i}i{\psi }_{m,i}}{{\Gamma }_{m}}\).

Omitting a ramp-up, the component \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}{\psi }_{g,i}\sum_{j=1}^{i+d}{R}_{j}}{{\Gamma }_{g}}\) reduces to \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}i{\psi }_{g,i}}{{\Gamma }_{g}}+d\), so the presence of \(d\) mitigates the contribution of \(\frac{\sum_{i=0}^{\infty }{\beta }^{i}i{\psi }_{g,i}}{{\Gamma }_{g}}\).

A declining optimal carbon price-to-income ratio has been found in other studies: as a consequence of uncertainty in Cai and Lontzek (2019) and Daniel, Litterman, and Wagner (2019) and of directing technical change to clean energy in Acemoglu, Aghion, Bursztyn, and Hemous (2012). Such a decline has implications for temperature and emissions outcomes and potentially on public perceptions of a carbon price. A lower tax after peak temperature has passed may help people appreciate the objective of the tax, and its temporary nature may alleviate public resistance.

Crépin and Nævdal (2020) discuss an approach that would account for delays between temperature and the tipping probability called inertia risk not considered in this paper.

The standard risk aversion coefficient defined in the Epstein-Zin setting is \(1-\frac{\alpha }{1-\beta }\).

I consider these projections as likely bounds to the future temperature path.

The probability of at least one tipping event by 2100 is 12.5%.

For comparison, Nordhaus (2017) finds a social cost of carbon of $44 (converting $31 in 2015 using 2010 $US) per tonne of carbon dioxide using the DICE-2016R2 model. Note I only consider social costs due to tipping risks.

As found in simulations in an earlier draft.

References

Aaheim A, Fuglestvedt JS, Godal O (2006) Costs savings of a flexible multi-gas climate policy. Energy J 27:485–501

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166. https://doi.org/10.1257/aer.102.1.131

Azar C, Martín JG, Johansson DJ, Sterner T (2023) The social cost of methane. Clim Change 176(6):71

Barrage L (2014) Sensitivity analysis for Golosov, Hassler, Krusell, and Tsyvinski (2014): Optimal taxes on fossil fuel in general equilibrium. Econometrica supplemental material

Bickel JE, Agrawal S (2013) Reexamining the economics of aerosol geoengineering. Clim Change 119(3–4):993–1006

Bretschger L, Vinogradova A (2018) Escaping Damocles’ sword: endogenous climate shocks in a growing economy. CER-ETH–Center of Economic Research at ETH Zurich, Working Paper, 18, p 291

Burke M, Hsiang SM, Miguel E (2015) Global non-linear effect of temperature on economic production. Nature 527(7577):235–239. https://doi.org/10.1038/nature15725

Cai Y (2021) The role of uncertainty in controlling climate change. In: Oxford research encyclopedia of economics and finance

Cai Y, Lontzek TS (2019) The social cost of carbon with economic and climate risks. J Polit Econ 127(6):2684–2734

Cai Y, Judd KL, Lenton TM, Lontzek TS, Narita D (2015) Environmental tipping points significantly affect the cost− benefit assessment of climate policies. Proc Natl Acad Sci 112(15):4606–4611

Cai Y, Lenton TM, Lontzek TS (2016) Risk of multiple interacting tipping points should encourage rapid CO2 emission reduction. Nat Clim Chang 6(5):520–525

Clarke HR, Reed WJ (1994) Consumption/pollution tradeoffs in an environment vulnerable to pollution-related catastrophic collapse. J Econ Dyn Control 18(5):991–1010

Crépin AS, Nævdal E (2020) Inertia risk: Improving economic models of catastrophes. Scand J Econ 122(4):1259–1285

Cropper ML (1976) Regulating activities with catastrophic environmental effects. J Environ Econ Manag 3(1):1–15

Daniel KD, Litterman RB, Wagner G (2019) Declining CO(2) price paths. Proc Natl Acad Sci U S A 116(42):20886–20891. https://doi.org/10.1073/pnas.1817444116

Diaz D, Keller K (2016) A potential disintegration of the West Antarctic Ice Sheet: implications for economic analyses of climate policy. Am Econ Rev 106(5):607–611

Dietz S, Venmans F (2019) Cumulative carbon emissions and economic policy: in search of general principles. J Environ Econ Manag 96:108–129

Dietz S, van der Ploeg F, Rezai A, Venmans F (2021) Are economists getting climate dynamics right and does it matter? J Assoc Environ Resour Econ 8(5):895–921

Engström G, Gars J (2016) Climatic tipping points and optimal fossil-fuel use. Environ Resource Econ 65(3):541–571

Epstein LG, Zin SE (1990) ‘First-order’risk aversion and the equity premium puzzle. J Monet Econ 26(3):387–407

Fuglestvedt JS, Berntsen TK, Godal O, Sausen R, Shine KP, Skodvin T (2003) Metrics of climate change: assessing radiative forcing and emission indices. Clim Change 58(3):267–331

Gerlagh R, Liski M (2018) Carbon prices for the next hundred years. Econ J 128(609):728–757

Goes M, Tuana N, Keller K (2011) The economics (or lack thereof) of aerosol geoengineering. Clim Change 109(3–4):719–744

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82(1):41–88

Heutel G, Moreno-Cruz J, Shayegh S (2018) Solar geoengineering, uncertainty, and the price of carbon. J Environ Econ Manag 87:24–41

IPCC (2014) Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change

Johansson DJ, Persson UM, Azar C (2006) The cost of using global warming potentials: analysing the trade off between CO 2, CH 4 and N 2 O. Clim Change 77(3–4):291–309

Keller K, Bolker BM, Bradford DF (2004) Uncertain climate thresholds and optimal economic growth. J Environ Econ Manag 48(1):723–741

Lemoine D, Traeger C (2014) Watch your step: optimal policy in a tipping climate. Am Econ J Econ Pol 6(1):137–166

Lemoine D, Traeger CP (2016) Economics of tipping the climate dominoes. Nat Clim Chang 6(5):514

Lenton TM (2013) Environmental tipping points. Annu Rev Environ Resour 38:1–29

Lenton TM, Held H, Kriegler E, Hall JW, Lucht W, Rahmstorf S, Schellnhuber HJ (2008) Tipping elements in the Earth’s climate system. Proc Natl Acad Sci 105(6):1786–1793

Lontzek TS, Cai Y, Judd KL, Lenton TM (2015) Stochastic integrated assessment of climate tipping points indicates the need for strict climate policy. Nat Clim Chang 5(5):441

Manne AS, Richels RG (2001) An alternative approach to establishing trade-offs among greenhouse gases. Nature 410(6829):675

Marten AL, Newbold SC (2012) Estimating the social cost of non-CO2 GHG emissions: Methane and nitrous oxide. Energy Policy 51:957–972

Matthews HD, Gillett NP, Stott PA, Zickfeld K (2009) The proportionality of global warming to cumulative carbon emissions. Nature 459(7248):829–832

Michaelis P (1992) Global warming: efficient policies in the case of multiple pollutants. Environ Resource Econ 2(1):61–77

Nævdal E (2006) Dynamic optimisation in the presence of threshold effects when the location of the threshold is uncertain–with an application to a possible disintegration of the Western Antarctic Ice Sheet. J Econ Dyn Control 30(7):1131–1158

Nordhaus WD (2017) Revisiting the social cost of carbon. Proc Natl Acad Sci 114(7):1518–1523

Nordhaus W (2019) Economics of the disintegration of the Greenland ice sheet. Proc Natl Acad Sci 116(25):12261–12269

O’Neill BC (2003) Economics, natural science, and the costs of global warming potentials. Clim Change 58(3):251–260

Olijslagers S, van Wijnbergen S (2024) Discounting the future: on climate change, ambiguity aversion and Epstein–Zin preferences. Environ Resour Econ, 1–48.

Polasky S, De Zeeuw A, Wagener F (2011) Optimal management with potential regime shifts. J Environ Econ Manag 62(2):229–240

Pratt JW, Zeckhauser RJ (1996) Willingness to pay and the distribution of risk and wealth. J Polit Econ 104(4):747–763

Rezai A, van der Ploeg F (2015) Robustness of a simple rule for the social cost of carbon. Econ Lett 132:48–55

Shine KP, Fuglestvedt JS, Hailemariam K, Stuber N (2005) Alternatives to the global warming potential for comparing climate impacts of emissions of greenhouse gases. Clim Change 68(3):281–302

Stocker TF, Qin D, Plattner G-K, Tignor M, Allen SK, Boschung J et al (2013) Climate change 2013: the physical science basis. Contribution of working group I to the fifth assessment report of the intergovernmental panel on climate change, p 1535

Taconet N, Guivarch C, Pottier A (2021) Social cost of carbon under stochastic tipping points: when does risk play a role? Environ Resource Econ 78:709–737

Traeger CP (2018) Ace–analytic climate economy (with temperature and uncertainty)

Tsur Y, Zemel A (1998) Pollution control in an uncertain environment. J Econ Dyn Control 22(6):967–975

van der Ploeg F (2014) Abrupt positive feedback and the social cost of carbon. Eur Econ Rev 67:28–41

van der Ploeg F, de Zeeuw A (2016) Non-cooperative and cooperative responses to climate catastrophes in the global economy: a north–south perspective. Environ Resource Econ 65(3):519–540

van der Ploeg F, de Zeeuw A (2018) Climate tipping and economic growth: precautionary capital and the price of carbon. J Eur Econ Assoc 16(5):1577–1617

van der Ploeg F, de Zeeuw A (2019) Pricing carbon and adjusting capital to fend off climate catastrophes. Environ Resource Econ 72(1):29–50

van der Zwaan B, Gerlagh R (2009) Economics of geological CO 2 storage and leakage. Clim Change 93(3):285–309

WMO (1992) Scientific Assessment of Ozone Depletion: 1991, Global Ozone Research and Monitoring Project–Report No. 37. World Meteorological Organization Geneva, Switzerland

Acknowledgements

Helpful comments from Warwick McKibbin, David Stern, Frank Jotzo, Jack Pezzey, Reyer Gerlagh, Cameron Eren, Nicholas Rivers, Chris Wokker, Larry Liu, Martin Quaas, anonymous referees and audiences at the Australian National University, London School of Economics, Hamburg University, Institute for International Economic Studies and AERE, EAERE and EEA conferences and MEEW workshop.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest statement

The author declares that he has no relevant or material financial interests that relate to the research described in this paper.

Research Involving Human Participants and/or Animals

NA.

Informed Consent

NA.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Proof and derivations

1.1 Proof of Lemma 1 (6)

The social cost of carbon equals the optimal carbon tax and is derived using a Lagrangian method. The social planner chooses \({C}_{t}\), \({K}_{t}\), \({E}_{m,t}\), \({E}_{c,t}\) and \({{\varvec{X}}}_{t}\) to maximise (1) subject to production and temperature constraints. Constraints on emissions technologies, which do not use capital or the final good as inputs, and other factors are omitted.

First-order conditions for \({C}_{t}\), \({K}_{t+1}\) and \({T}_{t}\) are

A constant savings rate is implied by the conditions for \({C}_{t}\) and \({K}_{t}\), as \(\frac{1}{{C}_{t}}=\beta \kappa {\mathbb{E}}_{t}\left(\frac{1}{{C}_{t+1}}\frac{{Y}_{t+1}}{{K}_{t+1}}\right)\) leads to \(\frac{{Y}_{t}-{C}_{t}}{{C}_{t}}=\beta \kappa {\mathbb{E}}_{t}\left(\frac{{Y}_{t+1}}{{C}_{t+1}}\right)\) which implies \({C}_{t}={\left(1-\beta \kappa \right)Y}_{t}\). The multiplier for temperature reflects marginal deterministic damages and the expected damages from tipping risks. The social cost of gas \(g\) in units of the final good \({\Lambda }_{g,t}\) equals the sum of the future effects on temperature \({\psi }_{g,i}\) multiplied by the temperature multiplier:

1.2 Proof of Proposition 1 (7)

From (6),

1.3 Derivation of (14)

which leads to (14) as.

1.4 Derivation of (16)

For simplicity, assume a constant temperature effect for carbon \({\psi }_{c,j}={\psi }_{c} j\ge 1\), as outlined in Matthews et al. (2009) and recently adopted by Dietz and Venmans (2019). Assume the impact of a tipping event in the next period is \(\Omega \delta /\beta\), to reflect delay in impact onset and ramp-up time used in Sect. 4. Omitting deterministic damages, time subscripts and signifying time \(t+1\) variables using prime, the value function is

Using a trial solution, we have:

The first-order condition for capital leads to \({K}^\prime=\frac{\beta {\mathrm{\varphi }}_{K}}{1+\beta {\mathrm{\varphi }}_{K}}Y\), and substitution into (22) leads to

Equating terms for \({\text{log}}K,\) f, and the first-order conditions for T and E:

The shadow price of carbon energy \({\mathrm{\varphi }}_{E}\) consists of the benefits for production and the negative externality from temperature increase. The latter term is the social cost of carbon dioxide expressed in consumption units, \({S}_{EZ,c}/C\), so:

Appendix B: Previous literature

Appendix C: Climate model

The climate model in this paper follows Shine et al. (2005), giving a rapid temperature response to carbon dioxide emissions as recently advocated by Dietz et al. (2021). The GWP100 of methane is determined by summing radiative forcings annually up to 100 years. For carbon dioxide, temperature responses at time \(t\) after an emissions pulse (in discrete time) are

where \(H\) is the heat capacity of the system, \(\lambda\) is a climate sensitivity parameter, \({a}_{i}\) are coefficients which sum to 1, \({\alpha }_{i}\) reflect gas lifetimes in years, \(\zeta\) is by definition the constant \(\lambda H\) in years, and \({B}_{c}\) is the radiative forcing due to a 1 Gt change in carbon dioxide. For methane, the equations are simpler:

Parameter values are shown in Table 2.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wiskich, A. Social Costs of Methane and Carbon Dioxide in a Tipping Climate. Environ Resource Econ (2024). https://doi.org/10.1007/s10640-024-00864-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s10640-024-00864-z