Abstract

Using granular data from the OECD from 2010 to 2018 that differentiate between adaptation and mitigation measures to address climate change, we employed a double-hurdle model to examine whether countries’ Paris Agreement commitments and governance capacity help attract international climate-change-related financial aid. We found that (1) countries received a short-term aid boost in the year when they submitted the nationally determined contribution, and countries that committed only to action targets rather than emission goals were more likely to receive funds; (2) both the quality of the budget and financial management and the quality of public administration significantly enhanced the likelihood of receiving aid, but only the quality of public administration contributed to attracting funding for adaptations; and (3) multilateral institutions played catalytic roles in fostering bilateral international climate-change aid, particularly by increasing the likelihood of funding.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, we employ a double-hurdle model to examine whether countries’ Paris Agreement commitments, governance capacity, and multilateral institutions’ involvement help attract international climate-change-related financial aid. Our paper contributes to the literature in three ways: by (1) empirically analyzing the drivers of official international climate change finance flows, (2) quantifying the impact of the “big push” of the Paris Agreement, and (3) documenting the roles of public administration, budgetary/financial management, and the catalytic role of multilateral institutions.

First, our analysis adds to the literature examining the potential effects of international environmental commitments on trade, foreign direct investment, and capital market. Previous literature has investigated the impacts of international environment agreements, mostly on trade. Analysis using aggregated data at the county level tends to find nonsignificant impacts from international environment agreements, e.g., Kellenberg and Levinson (2014). Analysis relying on disaggregated data at the industry level or using innovative approaches, such as synthetic control approaches, began documenting significant impacts. For instance, Aichele and Felbermayr (2015) found that countries making binding commitments under the Kyoto Protocol increased their embodied carbon imports from noncommitted countries. Tran (2021) examined the impact of the Kyoto Protocol on the trade of environmental goods and found that the exports of environmental goods by Kyoto countries increased significantly after the Protocol entered into force. Ederington et al. (2022) found that the ratification of an international environmental agreement has negative short-term impacts on exports of the manufacturing industry with medium emission intensity but positive long-term impacts due to shifts to cleaner products.

Several recent studies have started to examine the impact of the Paris Agreement. Tolliver et al. (2020a, 2020b) documented a significant positive impact of commitment to the Paris Agreement on green bond finance. Monasterolo and Angelis (2020) found that the weight of the low-carbon indices within an optimal portfolio tended to increase after the Paris Agreement, indicating that stock market investors started to consider low-carbon assets as an appealing investment opportunity. Focusing on U.S.-listed oil and gas firms, Diaz-Rainey et al. (2021) found that the signing of the Paris Agreement had a large negative impact on the stock returns of companies in the oil and gas sector. Furthermore, the implied volatility increased. Seltzer et al. (2022) documented that climate regulatory risks causally affect bond credit ratings and yield spreads of corporate bonds.

Second, our analysis shares common ground with literatures investigating the role of good governance, which has long been emphasized in the economic development literature (e.g., Acemoglu and Robinson (2012) and Han et al. (2014b)). Recent evidence is mainly from microfronts. Banerjee et al. (2020) showed that better public governance (e.g., just-in-time payment through e-invoicing to workfare programs in India) can reduce leakage in public program payments and overall expenditures. Based on cross-country firm surveys, Bloom et al. (2014, 2016) found that differences in management practices (including governance) account for 30% of the total factor productivity variation between countries. However, as Banerjee et al. (2020) pointed out, empirical studies of governance mainly focus on the aspect of corruption while holding the administrative structure constant, with a few exceptions either examining the roles of functionaries (Burgess et al. 2012) or of bureaucratic discretion (Duflo et al. 2014). While such aspects of public management architecture have been gaining increasing attention in the public administration literature (Pollitt and Bouckaert 2011; Begchin et al. 2018; IMF 2020), related empirical works are still limited, except for Goncalves (2014), who documented that participatory budgeting in Brazilian municipalities during 1990–2004 has channeled a larger fraction of budgets to investments in sanitation and health services and reduced infant mortality rates. Our paper is among the efforts to document empirical evidence on the role of public architecture in international climate change financing.

Third, we contribute to the literature by investigating how commitments undertaken as part of the Paris Agreement shape financial climate aid using a double-hurdle gravity model. The gravity model has been widely used to analyze bilateral flows of trade, FDI, migration, and tourism but has limited application to international climate financial flow, except for Haščič et al. (2015) and Weiler et al. (2018). Haščič et al. (2015) focused on private renewable energy flows; in contrast, our paper focuses on official financial aid, which, as we have discussed above, serves as the most important public financing source for some low-income countries. Weiler et al. (2018) analyzed the role of governance in adaptation financial aid from 2010 to 2015. We advance the understanding by including different aspects of governance, e.g., public administration and budgetary quality, affect differently the likelihood and the volume of receiving aid. In addition, our double-hurdle model outperforms the Heckman Tobit model used in Haščič et al. (2015) and the two-stage Cragg Model used in Weiler et al. (2018). We will discuss the details in Sect. 5.

This way we found that the low-income recipient countries would receive more adaptation and mitigation aid in the year when they submitted their Intended Nationally Determined Commitment (INDC) plan––the official commitment to the Paris Agreement; countries that committed to actions in the submission plan would receive more funds than their peers that committed to emission goals; an improved public administration capacity and sound budgetary and financial management would enhance the probability of receiving aid but had a lesser effect on the volume of funds; multilateral institutions played catalytic roles in fostering bilateral international climate-change aid, particularly by increasing the likelihood of funding.

The remainder of this paper is arranged as follows: Sect. 2 sets out the background, Sect. 3 describes the data, Sect. 4 presents the double-hurdle Tobit gravity model, Sect. 5 discusses the empirical estimation results, Sect. 6 presents several policy simulation scenarios, Sect. 7 describes the robustness check, and Sect. 8 concludes.

2 Background

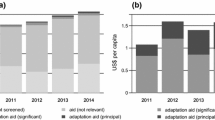

Climate change has gained increasing attention from the social sciences, policy-makers, and capital markets. In capital markets, green bond issuance has grown significantly in recent years, from an average annual issuance of $52 billion in the period from 2008–2018 to a total issuance of $255 billion in 2019 alone (Climate Bonds Initiatives, 2019). The international financial aid also increased substantially: adaptation flows rose from 9.43 billion USD in 2010 to 31.95 billion USD in 2018, while mitigation flows rose from 21.84 billion USD in 2010 to 52.44 billion USD in 2018 (Fig. 1). Policy-makers have been concentrating their campaigns on promoting green economies, green investments, and green recovery. Multilateral institutions have begun promoting carbon tax and green fiscal stimuli as effective fiscal tools in reducing carbon emissions (e.g., Fiscal Monitor October 2020; World Economic Outlook October 2020).

Low-income developing countries are the home of two-thirds of the world population, who are the most vulnerable to climate change risk and represent 90% of future emissions growth. In contrast, these countries only received 20% of funding for green investments (IEA 2021). While the needs for public investment for adaptation in low-income developing countries are large, at approximately 1.1% of GDP per year, the aid from official sources in 2018 was $10 billion, less than half of the investment needed (IMF 2020).

Meanwhile, general international official aid is commonly recognized as a major financing resource of public investments in low-income developing countries (Kraay 2012). Climate-change official aid accounts for a substantial share of domestic investments in some countries. Indeed, as our data show, adaptation aid in Uganda and Mozambique is equivalent to approximately 10% of domestic gross fixed capital formation.Footnote 1 Because of the considerable weight of international climate-change-related official aid in the least developed economies, it is important to examine what factors drive such finance flows.

The international community has started to develop related taxonomy and collect climate-change development finance data. Among these efforts, the OECD has collected activity-level external official climate finance flow dataFootnote 2 for both adaptation and mitigation measures.Footnote 3 Reporting official development assistance (ODA) became mandatory for mitigation in 2006 and for adaptations in 2010. The activity-level data contain information on provider and recipient countries, flow amounts, and sectors.Footnote 4 The granular information of this pioneer dataset opens the possibility of investigating questions such as whether climate-change commitments help in attracting international official finance and whether good public governance or multilateral institutions’ involvement helps.

In contrast to the rapid growth of climate change financing activities, the most prominent feature of the climate financing literature is its absence. Diaz-Raney et al. (2017) called climate finance an area of “stranded research” when only 12 articles were found on climate finance after they analyzed more than 20,000 articles published in the leading 21 finance journals between 1998 and 2015. Not until 2020 was a special issue in the Review of Financial Studies (Volume 33, Issue 3) devoted to climate finance, with a focus mainly on private financing instead of public financing. We wish our analysis help to add understanding in this regard.

3 Data

In this section, we discuss details on the data sources and definitions of the main explanatory variables. Once the variables are merged, we obtain a panel dataset of 30 provider countriesFootnote 5 and 69 recipient countriesFootnote 6 from 2011 to 2018.

3.1 Financial Aid Data

This data serves as the dependent variable in our analysis. First, we define seven sectors after considering the aid amounts significance and the degrees of freedom: the top six sectors reported in the dataset that received the largest flows and an additional pooled group labeled “Others”. The value shares of the adaptation top six sectors are 23% for agriculture/forest/fishing, 21% for water supply and sanitation, 12% for multisectors, 12% for general environment protection, 6% for transportation and storage, 4% for natural disaster prevention, and the remaining other is 22%. The value shares of the mitigation top six are 34% for energy, 20% for transport and storage, 11% for general environment protection, 6% for agriculture/forest/fishing, 5% for multisectors, 5% for water supply and sanitation, and the remaining other is 19%.

For each country pair in each year, the finance flows are aggregated into seven sectors. For sectors without fund flows, zeros are included. As reporting official development assistance became mandatory for adaptations in 2010 while for mitigation in 2006. Thus, the missing fund flows can be treated as true zeros. The full panel data set includes 115, 920 observations (30 providers, 69 recipients, across 7 sectors, and 8 years). Eventually, 103, 950 observations enter the regression due to unavailability of some right-hand side variables.

3.2 Climate Change Actions

We use the type of goals committed to and year of submission of the INDC to measure the impact of the 2015 Paris Agreement.Footnote 7 To meet the goals set in the Paris Agreement, every country needs to prepare a nationally determined contribution (NDC) every 5 years, which includes detailed targets, measures, and policies that will serve as the basis for national climate action plans. To lead up to the NDC, countries first submitted their plans as an intended NDC (INDC).Footnote 8 In the detailed country-specific INDC, information such as a greenhouse gas (GHG) goal, a non-GHG goal, or no-goal but only actions is included. For example, Ethiopia submitted its INDC with a GHG target in 2017 as “Limit the net GHG emissions in 2030 to 145 Mt CO2e or lower”, Nicaragua submitted its INDC with a non-GHG target in 2018 as “60% of the installed capacity of the electric matrix must come from other types of renewable energy sources by 2030”, and Bahrain submitted its INDC with an actions-only plan with a list of activities, including energy efficiency programs for buildings, petroleum company energy conservation policies, and carbon capture and storage plans. We introduce three dummy variables to represent the type of goals—GHG goals (committing GHG targets or GHG targets plus actions), non-GHG goals (committing to any type with non-GHG targets involved, such as non-GHG targets, non-GHG targets plus GHG targets, and non-GHG targets plus actions), and action-only plans—and year dummies for 2015, 2016, 2017, and 2018.Footnote 9 Because the INDC is a very recent commitment, to the best of our knowledge, we are among the first to examine its impacts.

3.3 Public Administration and Budgetary Management

We use the Country Policy and Institution Assessment (CPIA) datasetFootnote 10 to examine the roles of public administration and the budgetary/financial management of recipient countries in attracting official climate change aid. The World Bank Group publishes the CPIA dataset for the International Development Association (IDA) countries. The CPIA indicators are important tools to assess the capacity of low-income countries. For example, the International Monetary Fund uses CPIA indicators in the debt sustainability analysis framework (IMF 2017). The World Bank allocates aid to IDA countries based on CPIA (Alexander 2010). In this analysis, we use two indicators: the quality of public administrationFootnote 11 and the quality of budgetary and financial management.Footnote 12 The indicators are rated on a scale of 1 (low) to 6 (high). The scores depend on the level of performance of countries in a given year assessed against the criteria,Footnote 13 rather than on changes in performance compared to the previous year.

3.4 Multilateral Institutions’ Participation

Rodrik (1996) posed the question of why there is multilateral lending while countries have bilateral aid programs. He has proposed two advantages of multilateral lending: one is the better capability of internalizing the externality by having more information, and the other is the degree of autonomy that allows multilateral institutes to exercise conditionality. However, Rodrik (1996) did not find empirical evidence on the catalyst role of multilateral institutions for private capital flows. The role of multilateral institutions in providing information on the “quality” of the recipient government was explicitly modeled in the optimal contract design (Azam and Laffont 2003). Based on syndicated loan data, Gurara et al. (2020) found that multilateral institutions are more willing to finance risky projects or borrowers located in countries with high credit and financial risks, where private lenders are reluctant to lend. In our analysis, we examine whether funding from multilateral institutions or philanthropies can help crowd in bilateral funding from donor countries in the context of climate change finance. A dummy variable is introduced, which is equal to one when the recipient country-sector-year received funding from multilateral institutions and zero otherwise.

3.5 Natural Disaster Risk

We use the compound World Risk Index (WRI) in the World Risk Report (WRR)Footnote 14 to measure natural disaster risk. The WRI is the product of the exposure indicator and vulnerability indicator. The exposure indicator measures the exposure of a country’s population to natural hazards such as earthquakes, storms, floods, droughts, and sea level rises (with a weight of 1 for earthquakes, storms, and floods and a weight of 0.5 for droughts and sea level rises). Vulnerability consists of the products of three factors: susceptibility, lack of coping capacities, and lack of adaptive capacities.Footnote 15 The WRI ranges from 0 to 100%, with a higher percentage indicating a higher risk of natural hazards. The WRR has been published annually since 2011. The 2017 WRR reported five-year average (2012–2017) values for each indicator rather than the updated annual value for 2017. Therefore, for 2017, we use the values for 2016 instead.

3.6 Economic Integration Agreement (EIA) and International Investment Agreement (IIA)

We use the NSF-Kellogg Institute DatabaseFootnote 16 on Economic Integration Agreements to represent the economic integration between the provider and the recipient countries. A number between zero and six is assigned to each country pair, with zero indicating no agreement, one for non-reciprocal preferential trade arrangement, two for preferential trade agreement, three for free trade areas, four for custom union, five for common market, and six for economic union. As the data lasts till 2017, we assume 2018 remains as the same as 2017. Higher value means more integration. We use UNCTAD’s International Investment Agreement data to represent the investment agreement.Footnote 17 The dataset covers agreements signed between 1962 and 2020. We assume the agreement exists from the year of enforcement to the last year of our analysis 2018. If there is an agreement, the indicator is equal to one, otherwise zero.Footnote 18

3.7 Fiscal Space

Two commonly used variables related to fiscal space are included: the fiscal balance and the general government’s debt-to-GDP ratio of both provider and recipient countries. The fiscal balance is extracted from the IMF’s fiscal monitor, and the debt-to-GDP ratio is extracted from the IMF’s global debt database. A positive fiscal balance indicates fiscal surplus, and a negative balance means a deficit.

3.8 The Other Explanatory Variables

The bilateral variables of trade-weighted distance, historical colonial relationships, common language, common religion, and WTO memberships of/between provider and recipient countries are from the CEPII dataset on gravity.Footnote 19 The respective GDP (in current USD) and populations of the provider and recipient countries are from the World Bank’s WDI dataset.

Table 1 lists the summary statistics of the data. The minimum size of the deal to be included as nonzero observations is 100 USD. The largest transaction of adaptation is $834 million, and that of mitigation is $2,621 million. As revealed by the smaller median than the mean of the mitigation flows, the mitigation flows had many small transactions combined with occasionally very large deals.

For the nonzero flows, approximately 60% of country-sector–year combinations have Multilateral Development Bank (MDB) financial aid, reflected by the mean value of the MDB dummy (0.61). The public debt to GDP ratios in the provider and recipient countries are not significantly different, with the median and mean of recipient countries’ debt being lower than those of the provider countries (72/79 vs. 84/88). The GDP per capita of the provider countries is significantly higher than the GDP per capita of the recipient countries, consistent with the nature of aid fund flow.

The dummy variables for INDC targets revealed that GHG target commitments accounted for the majority of the countries that submitted the INDC (62%), followed by countries that made any targets with non-GHGs involved (21%), and countries that only committed to action plans (17%). Regarding the distribution of years in which countries submitted INDCs, 2016 was the year most countries made the commitment (55%), followed by 2017 (28%), 2018 (14%), and 2015 (4%). On CPIA capacities, the highest scores of the quality of public administration in the sample are 4 and 4.5 for the quality of budgetary and financial management, respectively.

4 Methodology

We assume that the climate-related finance flows between the provider and recipient countries follow the gravity relationship. That is, finance flows are the result of unobserved forces between the provider and recipient countries. When the forces are strong enough, there are finance flows. As an analogy to Newton’s law of gravity in physics, the force is stronger either when the masses of two planets (GDPs of countries) are larger or the distance between two planets (distance between two countries) is shorter. The reason we do not observe aid flow from the recipient countries to provider countries is that the force from the recipient countries is not strong enough to induce flow, e.g., the GDP of recipient countries is not high enough.

Our analysis incorporates the cases of no fund flow between paired countries, that is, zero finance flows. The trade literature traditionally estimated the gravity model by only using data on positive trade flows. A growing body of research has started to recognize that using only the positive trade flow might induce biased estimates. Several approaches were recommended to incorporate zero observations. Helpman et al. (2008) developed a two-stage procedure consisting of both the selection of trade partners and trade-flow equations to incorporate the zero trade flows; Santos Silva and Tenreyro (2006) proposed estimating the gravity models in multiplicative form by using the Poisson pseudomaximum-likelihood (PPML) to address the heteroskedasticity and deal with zero flows; however, Martin and Pham (2020) argued that PPML does not yield the least-biased estimates when the zero trade flows are economically determinedFootnote 20 and with higher frequency. The closest precedent to our paper was that of Haščič et al. (2015), who analyzed the role of public policies on private renewable energy flows from 2000 to 2011. Haščič et al. (2015) used the Heckman-Tobit (HT) to incorporate zero-flow observations. Our double-hurdle model is more accommodating than HT because HT implies the aid participation decision (selection) dominates the finance volume decision. That is, when a donor country decided to aid (selection is equal to one), a positive volume would be observed. In contrast, the double-hurdle framework we use allows the corner solution of zero finance flow as the utility-maximizing decision of country pairs. That is, the model allows aid participation with zero-flows. The zero flows in such cases would not necessarily mean no aid participation. As mentioned in the introduction, Weiler et al. (2018) used a two-stage Cragg Model to analyze the impact of governance on adaptation financing aid. In their model estimates the two stages separately while we estimate the selection and the funding volume jointly. Madden (2008) has provided an extensive discussion on comparing sample selection models and two-part models.

In our modeling framework, the gravity forces work in two channels: one is the gravity or attractions of recipient countries for provider countries to aid, and the other channel is the forces between the recipient and provider countries to determine how large the fund flows would be. The selection of recipient countries and the following fund volume are allowed to move jointly. The double-hurdle framework allows the corner solution of zero finance flow, which means provider countries choose to aid recipient countries (selection is equal to 1), but zero funding is provided due to either limited budget or other reasons. That is, zero fund flows do not mean that a country chose not to aid.

Our double-hurdle Tobit model is set out as follows:

where \({y}_{1}^{*}\) is the latent variable for the selection of the aid recipient country and \({y}_{2}^{*}\) is the latent variable for the finance flows. \({X}_{1}\) and \({X}_{2}\) are the column vectors of explanatory variables, \({B}_{1}\) and \({B}_{2}\) represent the column vectors of the coefficients of explanatory variables, and \(\in_{1}\) and \(\in_{2}\) are normal random disturbances. Equation (1) models whether the unobservable latent gravity of \({y}_{1}^{*}\) is larger than a threshold (\({\overline{y} }_{1}\)) for the fund to flow. The observation can be represented by a binary variable of \({I}_{1}\), that is, \({I}_{1}=1,\) when \({y}_{1}^{*}\ge {\overline{y} }_{1}\); otherwise, \({I}_{1}=0\). For convenience of estimation, we assume \({\overline{y} }_{1}\) is equal to 0. We call Eq. (1) hurdle 1.

Equation (2) models the gravity of \({y}_{2}^{*}\) in terms of the volume of the fund flow. To accommodate the nature of the volume of fund flow—positive flow when gravity is high enough and zero otherwise—a Tobit model is used. That is, \({{y}_{2}=y}_{2}^{*}\), when \({y}_{2}^{*}\ge 0\); otherwise,\({y}_{2}=0\). We call Eq. (2) hurdle 2. Combining Eqs. (1) and (2), \({y}_{2}={y}_{2}^{*}{I}_{1}.\) In the gravity model, \({y}_{2}\) is the natural logarithm transformed fund flows when \(I_{1} = 1\).Footnote 21 The conditional probability mass for \(y_{2}\) can be expressed as \(P\left( {y_{2} = 0} \right)\) for and the conditional density function as \(f_{ + } \left( {y_{2} } \right)\) for \(y_{2} > 0\), which leads to. \(y_{2} = 0\)\(\in_{2} \sim N\left( {0,\sigma^{2} } \right)\)

Assume the error terms follow the normal distribution as \(\in_{1} \sim N\left( {0,1} \right)\) and \(\in_{2} \sim N\left( {0,\sigma^{2} } \right)\). The probability mass \(P\left( {y_{2} = 0} \right)\) can be expressed as \(1 - P\left( {y_{2} > 0} \right)\), where \(P\left( {y_{2} > 0} \right)\) is a joint probability of \(y_{1}^{*} \ge 0\) and \(y_{2}^{*} \ge 0,\) that is,

where \({\Phi }\left( \cdot \right)\) denotes the distribution function of a standard bivariate normal distribution with the correlation coefficient between \(\in_{1}\) and \(\frac{{ \in_{2} }}{\sigma }\) as \(\rho_{12}\). If there are no correlations between \(\in_{1}\) and \(\frac{{ \in_{2} }}{\sigma }\), then \(\rho_{12} = 0\), and Eq. (4) can be written as \(1 - {\Phi }\left( {X_{1} B_{1} } \right) {\Phi }\left( {\frac{{X_{2} B_{2} }}{\sigma }} \right).\)

The density function \(f_{ + } \left( {y_{2} } \right)\) is conditional based on \(y_{1}^{*} \ge 0\) and \(y_{2}^{*} \ge 0\) as.

The log-likelihood function for the entire sample N is.

where \(\ln L_{i} = \left\{ {\begin{array}{*{20}c} {\ln P\left( {y_{2}^{i} = 0} \right),\; if\; y_{2}^{i} = 0} \\ {\ln f_{ + } \left( {y_{2}^{i} } \right),\; if \;y_{2}^{i} > 0} \\ \end{array} } \right.\).

We use the maximum likelihood method to estimate the parameters of interest by searching values that can maximize the log-likelihood function in Eq. (6). One advantage of our approach is that it allows the correlation coefficient \(\rho_{12}\) (correlations between the choices of the aid recipient country and the financing volumes) to be nonzero.

In our model, as shown in Eq. (4), the probability of observing zero financial flow is a joint event that both \(y_{1}^{*}\) and \(y_{2}^{*}\) are lower than the threshold value of zero. In contrast, Heckman Tobit, as illustrated in Heckman (1976), handles the zero flow only through the selection, only requiring \(y_{1}^{*}\) lower than the threshold.Footnote 22

Next, we introduce more variables into the specifications as follows:

where \({Y}_{ijkt}^{1*}\) and \({Y}_{ijkt}^{2*}\) are the latent gravity of sector \(k\) in recipient country \(j\) from provider country \(i\) at time \(t\) for the adaptation/mitigation finance flow. The observable counterpart of \({Y}_{ijkt}^{1*}\) is \({Y}_{ijkt}^{1}\), which is equal to one when there is a positive flow from country \(i\) to sector \(k\) in country \(j\) at time \(t.\) That is, country \(i\) chooses to aid sector \(k\) in country \(j\) at time \(t\). Similarly, the observable counterpart of \({Y}_{ijkt}^{2*}\) is \({Y}_{ijkt}^{2}\), where \({Y}_{ijkt}^{2}\) is the positive fund flow observed in the data. I \({NDC}_{jt}\) represents variables on the nationally determined contributions, including what type of goals are set, such as GHG emission goals, non-GHG goals, actions only, and the years in which country \(j\) submitted the plan. \({CPIA}_{jt}\) indicates the quality of public administration and the quality of budgetary and financial management of recipient country \(j\) at time \(t.\) \({FS}_{it}\) and \({FS}_{jt}\) are fiscal spaces indicated by the general government debt-to-GDP ratio and fiscal balance of provider country \(i\) and recipient country \(j\) at time\(t\). \({Risk}_{jt}\) represents the world risk indices of recipient country \(j\) to natural disasters. \({X}_{ijt}\) indicates the common control variables in the gravity model, including trade-weighted distance between country \(i\) and country\(j\), dummy variables to indicate whether country \(i\) and country \(j\) share a common language, common religions, an historical colonial relationship, trade agreements, respective GDP per capita and population at time \(t\). The parameters \(\alpha_{i} , \theta_{j} ,\gamma_{k} , {\text{and}} \delta_{t}\) are dummy variables representing the fixed effects of provider country, recipient country, sector, and time. \(\varepsilon_{ijkt}\) indicates the error terms. Only the fixed effects of provider countries enter Eq. (7) as the variables of interest, such as \(INDC_{jt} , CPIA_{jt} , {\text{and}} Risk_{jt}\), which are all recipient county specific. The fixed effects of recipient countries, if included, are designed to capture any unobserved recipient country specific features. When we have the variables of interest all recipient country specific, due to limited variations along \(j\), we choose to include our first priority–the observed variables instead of the recipient country fixed effect.

A common concern in the literature on the impact of environmental agreements on trade is endogeneity. That is, the timing of a country entering into the agreements might be the result of shocks in trade or an unobserved force driving both the trade flow and decision to enter into the agreement. To address the endogeneity, previous literature recommended including time-varying country-fixed effects in the panel data regression, e.g., Aichele and Felbermayr (2015), Ederington et al. (2022). Such endogeneity is of less concern in our analysis. First, as the aid has very specific project to finance,Footnote 23 the actions financed by the aid is either part of committed actions or helping to achieve the goal set in the commitment. That is, the aid will be used directly on the climate efforts, which helps lessening the concern that the commitment is to attract the aid rather than making the climate efforts. Second, another concern is whether more financing aid induces commitments. As one policy goal of the variable on the left-hand side—official climate-related finance aid—is to encourage and finance recipient countries’ climate change actions to achieve the goal of the Paris Agreement, the coefficient estimates related to the INDC in our analysis are to assess whether the donor countries honor the design of climate-related finance aid. Additionally, as we will discuss in the following sections, the INDC enhances the likelihood of receiving funding but not boosting volumes also help to address the endogeneity concern. We will discuss the details in the following section.

5 Empirical Results

The double-hurdle gravity model was estimated for adaptation and mitigation flow, as shown in Table 2. We ran the model under the assumption with and without correlations between two hurdles. For both types of finance flow, the estimates of correlation between two hurdles \(\rho_{12}\) were positive and significant, and the log-likelihood values at the maximum were similar. Thus, we chose the specification with correlations Column (2) for adaptation and Column (4) for mitigation as our baseline framework. The robustness checks in Sect. 7 are based on the specification with correlations.

Interestingly, both the higher quality of public administration (0.127 for adaptation and 0.213 for mitigation) and higher quality of budgetary and financial management (0.04 for adaptation) were significantly instrumental in the transmission of financial aid (hurdle 1: selection), but only the public administration (0.033 for adaptation and 0.039 for mitigation) brought in a larger volume of funding (hurdle 2). The quality of budgetary and financial management no longer had a significant effect. That is, even though both qualities measure capacity, the organizational structure (where civilian central government staff are structured to design and implement government policy and deliver services effectively) attracts more funds to recipient countries, while operational capacity (a comprehensive and credible budget aligned with policy priorities, effective financial management systems, and timely and accurate accounting and fiscal reporting) enhances the probability of aid arriving but not the volume of the funding. Such different impacts of the same capacity on selection (hurdle 1) and volume (hurdle 2) help to partially address the endogeneity concern. That is, to address that the positive coefficients are not a reflection of the impact of international climate change aid on the state capacity’s development, the “ineffectiveness” of the quality of budgetary and financial management in explaining the fund volume helps. Additionally, in hurdle 1, the quality of public administration has a much higher impact on mitigation than on adaptation (0.213 vs. 0.127) while having a higher impact compared to the quality of budgetary and financial management for adaptation (0.127 vs. 0.048).

Regarding climate change actions, compared to the GHG goal (the benchmark),Footnote 24 the commitment type of action-only targets has a significant and positive impact on incurring both adaptation (0.29) and mitigation aid (0.295), while the non-GHG target has a smaller but still significant positive impact (0.043 for adaptation and 0.089 for mitigation). That is, compared to countries with emission reduction goals, recipient countries that committed to actions-only targets are more favorable by donors. One possible explanation is that the provider countries regard the action-only commitment more tangible than the emission targets; thus, they place a greater value on actions. Provider countries perceive the least benefit from GHG goal commitments, so they place less value on GHG targets. For the timing of the INDC commitment, as shown by the estimates of INDC dummies, countries are more likely to experience a short-term boost in the year when they submitted their commitment, except for 2015 for adaptationFootnote 25 and except for 2017 for mitigation. The short-term boosts of the 2018 commitment were much stronger than those of the other years, which might reflect that climate change campaign actions were by then gaining more attention in attracting official aid.

The catalytic role of multilateral institutions occurs through enhancing both the likelihood that other bilateral providers will provide funds (0.395 for adaptation and 0.396 for mitigation) and the volumes of funds (0.043 for adaptation and 0.06 for mitigation).Footnote 26

Natural disaster risk, measured by WRI, plays a significant role in determining the occurrence of climate change financial aid (hurdle 1) for both adaptation and mitigation (1.513 for adaptation and 1.307 for mitigation) but only affects the amount of mitigation funding received (0.47 in hurdle 2).

The commonly used gravity model control variables in both selection (hurdle 1) and volume (hurdle 2) are geographic distance, a dummy for colonial history, common language, common religion, whether both countries are WTO members or have investment agreements, and the economic integration degrees. The coefficient of geographic distance is significantly negative in both hurdles (− 0.4 for adaptation and − 0.347 for mitigation for hurdle 1; − 0.085 for adaptation and -0.091 for mitigation for hurdle 2), the sign of which is consistent with gravity model theory. For selection (hurdle 1), colonial history, common language, and common religion have similar impacts for both adaptation and mitigation fund flows. Membership in the WTO has a negative impact on both adaptation and mitigation (− 0.109 for adaptation; − 0.076 for mitigation). For volume (hurdle 2), colonial history, common language and common religions all have significant and similar impacts on mitigation fund flows, whereas only colonial history and common language have significant impacts on adaptation. But membership in the WTO has a positive impact on the volumes of adaptation. The negative impact of WTO membership might indicate that climate change official aid (our dependent variable) serves as complementary financing to trade-based commercial financing and is more needed when trade-based financing is insufficient. Once provider countries decide to provide aid, the volume of funding would be positively associated with the WTO membership.

The EIA differentiates the degree of integrations, such as free trade area, common market, and economic union etc. and measures the integration beyond the WTO membership. Furthermore, the investment agreements emphasize one additional specific area–investment. Thus, it is not surprising to find that, in contrast to the WTO membership, both the EIA and investment agreements work positively and significantly to funding selection with investment agreement positively affecting the funding volume for both adaptation and mitigation. It is interesting to observe all three factors–membership of WTO, EIA, and investment agreement––all have impacts but work differently.

Provider countries with higher GDP are more likely to provide and tend to provide more funds for both adaptation and mitigation. Recipient countries with higher GDP are more likely to receive and tend to receive more funds for mitigation but not adaptation, which might reflect the fact that countries with larger economies are more likely to emit greater amounts of GHGs and that mitigation activities in these countries will be more impactful.

After controlling the GDP, populations work opposite direction with the GDP. Countries with larger population are less likely to provide or receive climate finance aid (hurdle 1). After deciding to aid, provider countries with larger population tend to fund more while recipient countries with larger population tend to receive less for mitigation. The results are interesting. When the GDP works as the enhancing factor of gravity, as embedded in the gravity model, the size of population serves as gravity-reducing factor, except for provider country for mitigation fund volume. The findings are consistent with the purpose of mitigation activity: mitigation is conducted to reduce the emissions sources or enhance the sinks of GHGs, which affect the populations in provider countries, which have direct impact on the population in provider countries.

For the fiscal space variables, the provider countries’ debts to GDP are significant for both adaptation and mitigation (− 0.081 for adaptation and − 0.248 for mitigation): the higher the debts in provider countries, the fewer funds are provided. For adaptation, provider countries tend to give less funding when they have a higher fiscal balance. The higher fiscal balance of provider countries might indicate that they are on a contractionary fiscal path and, therefore, less likely to spend.

In terms of sectors, compared to the benchmark group (the pooled sectors other than the top six sectors), transportation and agriculture received more funds for adaptation, whereas the benchmark sector received more funds for mitigation.

The provider country fixed effects are included in hurdle 1, and the year fixed effects, the provider country fixed effects, and the recipient country fixed effects are included in hurdle 2. For the goodness of fit, McFadden’s \(\rho\) is estimated.Footnote 27 As shown by McFadden’s \(\rho\), the specification fits the adaptation flow (0.63) better than the mitigation flow (0.70).

6 Policy Simulation

To interpret the coefficient estimates of our baseline model to fund volume, we simulate several scenarios in this section. We use adaptation only for this purpose.

6.1 Financing Impact of the INDC Commitment

As presented in Table 2, the INDC commitment enters hurdle 1 only. The INDC commitment does not affect the funding volume (hurdle 2). Thus, the impact of these commitment would affect the likelihood of receiving aid. At aggregated level, the impact can be expressed as the number of transactions. Using the 2018 as the example, assume those countries that submitted the commitment in 2018 do not submit. With the other variables unchanged, the number of adaptations fundings would decrease to 1084 from 1316, a 18% decrease. Assume the countries that submitted action-only type of commitment submit GHG target, the number of adaptation fundings would decrease to 1061, a 19% decline.

6.2 Financing Increases by Improving the Quality of Governance to Frontiers

As baseline results show in Table 2, the roles of the quality of budgetary and financial management and the quality of public administration are different: both positively and significantly affect the selection of adaptation, while only the quality of public administration affects selection of mitigation and both adaptation and mitigation volume.

In this section, we simulate how much the recipient countries would receive had every country improved the governance quality to their peer frontiers: a score of 4.5 for the quality of budgetary and financial management and a score of 4 for the quality of public administration. With the other factors unchanged, the total adaptation in 2018 would have increased from 4696 million USD to 5130 million USD (a growth of 9.2.%) with the improvement in the quality of budgetary and financial management of each recipient country to 4.5 and to 6273 million USD (a growth of 33.6%) with the improvement in the quality of the public administration to 4. Figure 2 shows the boxplot of fund boosted due to governance improvements. Countries are grouped by their current quality of budget or public administration scores (horizontal axis). As shown in Fig. 2, countries with lower initial governance capacity benefit more by improving to the governance capacity frontier: the median of the group with the lowest score is much higher than the medians of other groups. Improving the quality of public administration brings more benefit than that ofbudgetary and financial management: the medians of right panel are higher than those of the left panel.

6.3 Financing Loss in the Absence of Multilateral Institute Involvement

In this section, we simulate the impact of the catalytic role of multilateral institutions in the international climate-change finance flow. Assuming there had been no involvement of multilateral institutions, the overall adaptation fund from 2010 to 2018 would have dropped 1613 million USD (a 5.3% decline from 30,591 million USD to 28,978 million USD). The 5.3% decline in fund volume might look small. However, we must keep in mind that 5.3% is the impact of multilateral institutes after controlling for all the other driving factors, such as distance, GDP, population, natural disaster risks, quality of governance, climate-change actions, etc. Thus, the simulation provides a numerical illustration of the catalytic role played by the multilateral institutions in leading the aid flows to the recipient countries.

6.4 Implication of the COVID-19-driven Rising Public Debt on the Financing Landscape

Country authorities have provided unprecedented support to lifelines to fight the COVID-19 pandemic and have incurred a considerable increase in public debt. The IMF has estimated that global public debt has increased by 14% of GDP due to the pandemic (Fiscal Monitor April 2021).

In this section, we simulate the impact of the rising public debt of provider countries on the landscape of official climate change flow for both adaptation and mitigation. Assume the climate finance aid would respond to the public debt in post-Covid episodes in the same way as it did during the pre-Covid periods, for which our data covered. Assuming the public debt in the provider countries increased by 14% of GDP in 2018, we assess how much of the fund flows would decline. The adaptation fund flow would decrease from 4696 million USD to 4079 million USD–a 617 million decrease (13%). Compared to the impact of governance capacity and the role of multilateral institutions, the rising debt of provider countries would be affected at a similar magnitude.

7 Robustness Check

Several issues might bias our estimates. We proceed to check the robustness of our findings in this section.

7.1 Multicollinearity between Qualities of Governance

One concern is the asymmetric impact of the quality of public administration and the quality of budgetary management on the volume of funds (hurdle 2): the effectiveness of the quality of public administration and the ineffectiveness of the quality of budgetary and financial management obtained in the baseline model (Table 2) are potentially driven by the multicollinearity between the two indicators. The correlation between the two indicators is indeed high: 0.62 (Figure A1).Footnote 28 To rule out the possibility that the results are driven by the multicollinearity between the two indicators, we run the regression by including only one of the two indicators each time for hurdle 2. As shown in Table 3, without including the quality of public administration, the coefficients of the quality of budgetary and financial management remain nonsignificant for both adaptation and mitigation, which provides strong evidence to support our findings in the baseline model on the ineffectiveness of quality of budgetary and financial management to induce a higher volume of funds. In contrast, when excluding the quality of budgetary management from hurdle 2, the coefficients of the quality of public administration are still positive (0.023 for adaptation and 0.013 for mitigation). Their significance is sustained. The results show that our findings on the asymmetric impacts of the quality of public administration and the quality of budgetary management on enhancing the likelihood of receiving funds and the volume of funds are robust.

7.2 Enhancement or Shifting of Funding

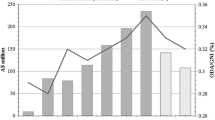

Another concern is whether the increasing official climate change finance flows and the effectiveness of the driving factors documented in the baseline results are due to funding shifted to climate change purposes from the other development purposes instead of a net enhancement. We collected the OECD’s Development Finance Data, which describe official aid targeting the general economic development and welfare of developing countries.Footnote 29 To ensure that these data are comparable to the climate-change finance flow data, we only include the Development Finance Data sourced from OECD Development Assistance Committee (DAC) countries.Footnote 30 Figure 3 shows three time series: the official development aid flow from Development Finance Data, which is labelled as I. Total Aid Flow in Fig. 3 (yellow line),Footnote 31 the adaptation and mitigation flow from climate-change finance flow data, which is labelled as II. Adapt. & Miti. Flow (red line), and the official development aid flow excluding adaptation and mitigation,Footnote 32 which is labelled as III. Flow excluding Adapt. & Miti. (Green line).

Because the adaptation and mitigation flow data (II) are not an exact subset of the official development aid flow dataset (I), the official development aid excluding adaptation and mitigation (III) is an approximation of the development aid fund net of climate change, which might be subject to downward bias.Footnote 33 In Fig. 3, the official development aid flow and climate change (adaptation and mitigation flows) share a similar increasing trend. Their correlation coefficient is 0.81 and significant at 1%. The correlation between adaptation and mitigation (II) and the official development aid flow excluding adaptation and mitigation (III) is weaker, at 0.57, and significant at 1%.

However, the common trend becomes weaker between the official development aid flow (I) and adaptation and mitigation flow (II) for the second half of the period (2010–2018): a nonsignificant correlation coefficient of 0.38. The correlation coefficient between adaptation and mitigation (II) and the official development aid flow excluding adaptation and mitigation (III) become negative at 0.67 (significant at 5%). That is, from 2011, climate change became more important in the development finance landscape. The donor countries allocated more funds to climate change purposes while sustaining or increasing the overall development aid to a lesser degree.

Thus, the discussion above still does not fully address the concern about whether the increased climate-change aid flow was the result of fund shifting or a net increase in funding. To directly examine the impact of official development aid on climate finance, we run the baseline regression by including total official development aid (I) and official development aid excluding climate change (III) as additional control variables. As shown in Table 4, all coefficients are positive. The coefficients of official development aid are significant for both adaptation and mitigation. The coefficient of official development aid excluding climate change is significant for mitigation. Therefore, the increased climate-change finance flows are not from fund shifting. Instead, climate change aid flows are in tandem with other official forms of development aid.

7.3 Alternative Modeling Approaches

In this section, we do robustness checks by introducing provider-recipient country pair fixed effects, provider-year, and recipient-year fixed effects to the baseline model, using other modeling approaches, merging adaptation and mitigation flows, and adding the debt-to-service ratio as an additional indicator for fiscal space.

First, we revise the specification in the baseline model in several aspects: in the volume hurdle (hurdle 2), replace the provider, recipient, and time fixed effects with provider-recipient, provider-year, and recipient-year fixed effects, interact the sector dummies with the quality of public administration and quality of budgetary and financial management, and introduce the Pairs Agreement commitment types and commitment years. The results are presented in column (1) and (2) in Table 5. An alternative specification is to keep the hurdle 2 unchanged as in the baseline model but replace the provider fixed effects with provider-year fixed effects in hurdle 1. The results are presented in column (3) and (4) in Table 5.Footnote 34

The inclusion of provider-year and recipient-year fixed effect in the volume hurdle helps as the decision to provide aid is, most likely, a multilateral as opposed to a bilateral one. This argument runs much along the lines of that made for the trade multilateral resistance terms in Anderson and Wincoop (2003) and Baier and Bergstrand (2009). The provider’s decision to aid depends not only on the characteristics of the country that ultimately receives aid but on the characteristics of all potential recipients. A similar case can be made for the potential recipient, which may adjust commitments and even governance quality based on the universe of potential providers. In column (3) and (4), replacing the provider fixed effects with the provider-year fixed effects in hurdle 1 would help to control for any time-variant characteristics of the provider country, e.g., fiscal space variables.

As column (1) and (2) in Table 5 shown, the coefficient estimates of hurdle 1 do not change compared to the baseline model in Table 2. The governance qualities do vary across different sectors: the quality of public administration enhances aid volume in environmental protection sector and the quality of budgetary and financial management enhance the fund in transport, agriculture, and other sectors for adaptation and in water, energy, and other sectors for mitigation. The Pairs Agreement commitment types and committed years (INDCActOnly, INDCnonGHG, INDC15/16/17/18) do not affect the aid volume. The estimates of other variables remain consistent with the baseline model.

The estimates shown in column (3) and (4) remain consistent with the baseline model, except for in hurdle 2, the coefficient of the quality of budgetary and financial management for mitigation (0.019) turns to be significant with the magnitude remaining the same as in the baseline.

Second, we use two commonly used approaches to re-estimate our model, including Gamma pseudo maximum likelihood (Gamma-PML) and Poisson pseudo maximum likelihood (Poisson-PML). Both Gamma-PML and Poisson-PML can incorporate zero flows (Head and Mayer 2015). Because Gamma-PML minimizes the difference between the ratio of observations to the fitted value, whereas Poisson-PML minimizes the difference between observations and the fitted values, they avoid having logarithmic transformation of zeros as in log-normal OLS. We present the results in Table 6. However, we should bear in mind that the results cannot be directly compared to the baseline results in Tables 2 and 5, as Table 6 incorporates zeros and positive fund volume together into the modeling framework in one single regression, which is closer to hurdle 2 without considering hurdle 1. We use the same specification as in hurdle 2 of Table 5, including the interacting items of sectors and governance qualities, the Pairs Agreement commitments, provider-recipient country fixed effects, provider-year, recipient-year fixed effects.

As revealed by the root mean squared deviation (RMSD), the smaller the RMSD is, the better the goodness of fit across specifications. Gamma-PML works substantially better than Poisson-GML for both adaptation and mitigation. Another striking result is that the coefficients of distance varied significantly across the two approaches. As advised by Head and Mayer (2015, on pages 174 and 177), Gamma-PML gives an efficient estimate when the deviation is proportional to the mean, and the divergence of coefficients of distance between Poisson- and Gamma-PML may signal model misspecification. Compared to the coefficient of distance in hurdle 2 in Table 5 (− 0.039 for adaptation and − 0.019 for mitigation), Gamma-PML yields similar estimates: -0.011 for adaptation and − 0.013 for mitigation, which are far different from those of Poisson-PML (− 0.494 for adaptation and − 0.435 for mitigation).

Focusing on the results of superior Gamma-PML, indeed the coefficient estimates of variables that also enter hurdles 2 of Table 5 (column 1 and 2) generally yield similar signs and significance. For example, The Pairs Agreement commitment types and committed years (INDCActOnly, INDCnonGHG, INDC15/16/17/18) do not affect the aid volume. The quality of budgetary and financial management enhances the fund in transport for adaptation and in water, energy, and other sectors for mitigation. Higher provider debt-to-GDP would reduce aid fund for both adaptation and mitigation whereas higher recipient debt-to-GDP would reduce aid in mitigation. The results of Gamma-PML provide strong support for our double-hurdle model. Furthermore, as the double-hurdle model incorporates the selection hurdle too, it models richer information.

Third, we merge adaptation and mitigation flows to rerun the baseline model. Considering the stark difference between the nature of adaptation and mitigation activities, such a merger only serves as an econometric check of the robustness. Sector grouping is different from those of adaptation and mitigation in the baseline case: the largest sector after merging is energy, followed by transport, environmental protection, agriculture, water, and multiple sectors. All the other sectors are pooled and serve as the benchmark sector. As shown in Table 7, the results after merging adaptation and mitigation are similar to those at baseline. The quality of public administration and quality of budgetary management are positive and significant in enhancing the likelihood of fund flows and funding volume. The action-only INDC is significantly positive, while the INDC non-GHG target is less in attracting funds. Except for 2015, the INDCs made in 2016 to 2018 boosted the funds in those years. Multilateral institutions not only enhanced the likelihood of receiving funds but also brought in a larger volume. The similar results of merging adaptation and mitigation to our baseline results show the robustness of the baseline estimates.

Fourth, in addition to the general government’s debt-to-GDP, another commonly used indicator is debt-service cost, which measures the short-term flow needed to service the debt rather than the medium-term stock level of debt. In our analysis, the fiscal balance incorporates debt interest payments and reflects short-term flow needs. When we include the debt-service cost to GDP ratio of the recipient countriesFootnote 35 as an additional variable, the coefficients are insignificant. Therefore, we do not present the results in the paper.

8 Conclusion

In this paper, we employed a double-hurdle gravity model to examine whether countries’ Paris Agreement commitments, governance capacity, and multilateral institutions’ involvement help attract international official climate-change financial aid by using OECD activity level data for both adaptation and mitigation activities. We use countries’ INDCs to measure commitment to the Paris Agreement. We find that in the submission year of the INDC, countries received a short-term aid boost. Compared to the emission goals, the action-only target worked significantly better in terms of enhancing the likelihood of receiving funds for both adaptation and mitigation, reflecting that the provider countries value the action plan more than the emission goals committed.

Regarding the role of governance capacity, two different indicators were used: the quality of public administration and the quality of budgetary and financial management. The simultaneous inclusion of both indicators into the two hurdles (the selection and the volume) and their different roles in the hurdles help to address the endogeneity concern; the positive impacts of governance capacity were not driven by international climate change fund aid. In contrast, governance capacity induces fund flows because different aspects of capacity have different effects: both the quality of the budget and financial management and the quality of public administration significantly enhance the likelihood of receiving adaptation aid, but only the quality of public administration contributes to attracting fund volume in both adaptations and mitigation.

Another interesting finding is the significant multilateral institutions’ catalytic roles in international climate change aid finance. If there were no multilateral institutions’ involvement in official adaptation funding, the total amount of bilateral aid from 2010 to 2018 would drop by 1613 million USD, equivalent to a 5.3% decline. The potential negative impact associated with the rising public debt due to the COVID-19 pandemic is large: using adaptation as an example, an annual decline of 617 million USD—an approximately 13% decrease annually. One caveat of the simulations is the static and partial equilibrium assumptions implied with the other factors unchanged. Nevertheless, the simulations are helpful in measuring the impacts of the different factors in a tangible way.

Climate change issues become increasingly urgent with a large tail risk. Financing is the key factor enabling countries to take mitigation and adaptation actions. Our analysis, dedicated to international official finance flows, recommends actions—active participation in international climate change agreements, building governance capacities, and active involvement of multilateral institutions—that beneficiary countries and the international community should take to attract more funds to adapt and mitigate climate change impacts.

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Code Availability

The code that supports the findings of this study are available from the corresponding author on reasonable request.

Notes

The annual average adaptation inflows to Uganda/Mozambique were 638.5 million/363.8 million USD in 2018, while their gross fixed capital formations in 2018 were $7,918 million (https://data.worldbank.org/indicator/NE.GDI.FTOT.CD?locations=UG)/$3,019 million USD (https://data.worldbank.org/indicator/NE.GDI.FTOT.CD?locations=MZ).

The data have included detailed descriptions on the purpose of each project. For instance, one project in Armenia in 2018 sought to improve the resilience of the highly exposed Artik city of Armenia to hydrometeorological threats that are increasing in frequency and intensity as a result of climate change. The project will reduce the quantity of debris flowing into a reservoir located in Artik city and the pollution of agricultural lands (300 hectares of arable land 190 hectares of pastures, 15 hectares of hay meadows, 640 ha of artificial forests, 80 ha of water reservoir and other natural landscapes) in the project impact area by increasing their resilience and adaptation to climate change. Therefore, we lable the dataset as activity-level data.

The data are available for the Development Assistance Committee countries (24 member countries) starting from 2000; however, the regular collections only started in 2008 for mitigation flow and from 2010 for adaptation flow. The climate-related development finance data are only sourced from public providers, including bilateral, multilateral, and philanthropic entities. https://www.oecd.org/dac/financing-sustainable-development/development-finance-topics/climate-change.htm

Mitigation and adaptation are two major climate change strategies: mitigation involves actions to reduce the emission sources or enhance the sinks of greenhouse gases, whereas adaptations are adjustments in natural or human systems in response to actual or expected climatic stimuli or their effects that moderate harm or exploit beneficial opportunities (IPCC 2001).

ARE, AUS, AUT, BEL, CAN, CHE, CZE, DEU, DNK, ESP, FIN, FRA, GBR, GRC, IRL, ISL, ITA, JPN, KOR, LTU, LUX, LVA, NLD, NOR, NZL, POL, PRT, SVN, SWE, and USA.

AFG, AGO, ARM, BDI, BEN, BFA, BGD, BIH, BTN, CAF, CIV, CMR, COG, COM, CPV, DJI, ERI, ETH, GEO, GHA, GIN, GMB, GNB, GRD, GUY, HND, HTI, IND, KEN, KGZ, KHM, KIR, LAO, LBR, LKA, LSO, MDA, MDG, MLI, MMR, MNG, MOZ, MRT, MWI, NER, NGA, NIC, NPL, PAK, PNG, RWA, SDN, SEN, SLB, SLE, STP, TCD, TGO, TJK, TON, TZA, UGA, UZB, VNM, VUT, WSM, YEM, ZMB, and ZWE.

The Paris Agreement established a goal to limit average global temperature rise to well below 2 °C and to pursue efforts to limit it to 1.5 °C.

A country’s INDC is converted to an NDC when it formally joins the Paris Agreement by submitting an instrument of ratification, acceptance, approval, or accession unless a country decides otherwise.

Quality of public administration assesses the extent to which civilian central government staff is structured to design and implement government policy and deliver services effectively.

Quality of budgetary and financial management assesses the extent to which there is a comprehensive and credible budget linked to policy priorities, effective financial management systems, and timely and accurate accounting and fiscal reporting, including timely and audited public accounts.

The criteria for the quality of public administration covers the core administration defined as the civilian central government (and subnational governments, to the extent that their size or policy responsibilities are substantial), excluding health and education personnel and police, include (1) managing its own operations, (2) ensuring quality in policy implementation and regulatory management, and (3) coordinating the large public sector human resources management regime outside the core administration (deconcentrated and arms-length bodies and subsidiary governments). The criteria for quality of budgetary and financial management include (1) a comprehensive and credible budget, linked to policy priorities; (2) effective financial management systems to ensure that the budget is implemented as intended in a controlled and predictable way; and (3) timely and accurate accounting and fiscal reporting, including timely auditing of public accounts and effective arrangements for follow up.

The Institute for Environment and Human Security at the United Nations University in Bonn and Bündnis Entwicklung Hilft jointly developed the World Risk Index in 2011.

The susceptibility is the likelihood of suffering harm in extreme natural events, which depends on the structural characteristics and framework of a society. Coping consists of a society’s ability to minimize negative impacts, while adaptive capacities are more forward-looking measures and strategies to address the negative impact in the future.

https://sites.nd.edu/jeffreybergstrand/ database-on-economic-integration-agreements/

The majority of the agreement is biliteral. When an agreement is signed between one country and a regional association, the country is treated to having agreements with each one of the associations.

Martin and Pham (2020) call the Eaton-Tamura model and Heckman model which they used in their analysis for the data generating process economically determined as these models have solid economic foundation. In contrast, as the data generating process used in Santos Silva and Tenreyro (2006) has no particular economic motivation, the data generating process is regarded as not economically determined.

The multiplicative relationship of mass and distance in the original gravity model can be transformed to an additive relationship by natural logarithm transform.

Indeed, we did carry out a robustness check by using the Heckman Tobit to model the adaptation and mitigation finance flow. The results are presented in Table 8 in the Appendix. The likelihoods at maximum are − 40,056 and − 30,592, respectively, which are much lower (less powerful in explaining the climate-finance flows) than the baseline results we report in Table 2. The general results are consistent with our baseline results. But, in the selection part, the coefficient estimates for INDC commitments, CPIA budget, and EIA are insignificant due to the model’s limitation in handling the corner solution.

E.g., in 2018, one project in Armenia is to improve resilience of highly exposed Artik city to hydro-meteorological threats that are increasing in frequency and intensity as a result of climate change by reducing the quantity of debris flowing to reservoir located down the Artik city and the pollution of agricultural lands in the project impact area.

The reason to use GHG as the benchmark is that quantitative reduction limitations or reduction commitments (i.e., GHG targets) were the traditional type of objectives embedded in earlier climate change agreements (e.g., the Kyoto Protocol) whereas action-only and non-GHG types of commitments were a prominent feature of the Paris Agreement.

The commitments in year 2015 were made near the end of the year because the Paris Agreement was ratified in the same year, which allowed limited time for the provider countries to act.

We run a robustness check by replacing the MDB dummy with the MDB funding volume. The MDB funding amount induces both significant and higher likelihood and volume of mitigation aid but does not induce higher amount of adaptation aid. The detailed results are available upon request.

\({1-loglikelihood}_{max}/{loglikelihood}_{ref}\), where the \({loglikelihood}_{ref}\) assumes all parameters as zero.

The unconditional pairwise correlation is presented in Figure A1 in the appendix, in which the adaptation and mitigation flows are redefined as dummy variables (equal to one if there are fund flows, zero otherwise) to show correlations between the fund flows and all the factors.

Including ODA (official development aid) and OOA (other official aid).

The official development aid flow minus mitigation and adaptation funds.

For instance, in 2015 and 2016, Japan provided more climate finance funding than development funding; that is, its official aid excluding adaptation and mitigation were negative values.

Specifications in Table 5 and Table 6 may be subjected to the caveat that the coefficient estimates of variables with recipient-time variations, such as the quality of public administration, become meaningless when the provider-recipient fixed effects, provider-year fixed effects, or recipient-year fixed effects are included according to Head and Mayer (2015) (see Sect. 3.7). Thus, Table 5 and Table 6 only serve for robustness check purposes.

The data on provider countries debt-service cost are more limited. Thus, including debt-service cost to GDP ratio of provider countries would substantially reduce the number of observations.

References

Acemoglu D, Robinson JA (2012) Why Nations Fail: The Origins of Power, Prosperity, and Poverty. Crown Business, New York

Aichele R, Felbermayr GJ (2015) Kyoto and carbon leakage: an empirical analysis of the carbon content of bilateral trade. Rev Econ Stat 97(1):104–115

Alexander, N., 2010. “The Country Policy and Institutional Assessment (CPIA) and Allocation of IDA Resources: Suggestions for Improvements to Benefit African Countries.” Heinrich Boell Foundation Report.

Anderson JE, Wincoop EV (2003) Gravity with gravitas: A solution to the border puzzle. Am Econ Rev 93(1):170–192

Azam JP, Laffont JJ (2003) Contracting for aid. J Dev Econ 70:25–58

Baier SL, Bergstrand JH (2009) Bonus vetus OLS: a simple method for approximating international trade-cost effects using the gravity equation. J Int Econ 77(1):77–85

Banerjee A, Duflo E, Imbert C, Mathew S, Pande R (2020) E-governance, accountability, and leakage in public programs: experimental evidence from a financial management reform in India. Am Econ J Appl Econ 12(4):39–72

Begchin NA, Bogacheva OV, Smorodinov OV (2018) Spending reviews as an instrument for public finance management in oecd countries: theoretical aspect. Financ J 3:49–63

Bloom N, Lemos R, Sadun R, Scur D, Van Reenen J (2014) Jeea-Fbbva lecture 2013: the new empirical economics of management. J Eur Econ Assoc 12:835–876. https://doi.org/10.1111/jeea.12094

Bloom N, Sadun R, Reenen JV, (2016) “Management as a Technology?,” In: NBER Working Papers 22327, National Bureau of Economic Research, Inc.

Burgess R, Hansen M, Olken BA, Potapov P, Sieber S (2012) the political economy of deforestation in the tropics. Q J Econ 127(4):1707–1754

Diaz-Rainey I, Robertson B, Wilson C (2017) Stranded research? Leading finance journals are silent on climate change. Clim Change 143:243–260. https://doi.org/10.1007/s10584-017-1985-1

Diaz-Rainey I, Gehricke SA, Roberts H, Zhang R (2021) Trump vs. Paris: the impact of climate policy on US listed oil and gas firm returns and volatility. Int Rev Financ Anal 76:101746

Duflo E, Greenstone M, Pande R, Ryan N (2014a). “The Value of Regulatory Discretion: Estimates from Environmental Inspections in India. “NBER Working Papers 20590, National Bureau of Economic Research, Inc.

Ederington J, Paraschiv M, Zanardi M (2022) The short and long-run effects of international environmental agreements on trade. J Int Econ 139:103685

Goncalves S (2014) The effects of participatory budgeting on municipal expenditures and infant mortality in Brazil. World Dev 53:94–110

Gurara D, Presbitero A, Sarmiento M (2020) Borrowing costs and the role of multilateral development banks: evidence from cross-border syndicated bank lending. J Int Money Financ 100:102090

Han X, Khan H, Zhuang J (2014b) “Do Governance Indicators Explain Development Performance? A Cross-Country Analysis”, Economics Working Paper Series, No 417, Asian Development Bank.

Haščič I et al (2015) Public interventions and private climate finance flows: empirical evidence from renewable energy financing. OECD Environment. https://doi.org/10.1787/5js6b1r9lfd4-en

Head K, Mayer T (2015) “Gravity equations: workhorse, toolkit, and cookbook,” handbook of international economics. In: Gopinath G, Helpman E, Rogoff K (eds) Handbook of international economics, edition 1, volume 4, chapter 0. Elsevier, pp 131–195

Heckman J (1976) The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models. Ann Econ Soc Meas 5:475–492

Helpman E, Melitz M, Rubinstein Y (2008) Estimating trade flows: trading partners and trading volumes. Quart J Econ 2:441–487

IEA. 2021. “Net Zero by 2050”. IEA, Paris https://www.iea.org/reports/net-zero-by-2050

IMF. 2020. Fiscal Monitor Oct 2020: Policies for the Recovery. https://www.imf.org/en/Publications/FM/Issues/2020/10/27/Fiscal-Monitor-October-2020-Policies-for-the-Recovery-49642.

IPCC. 2001. “Climate Change 2001: Synthesis Report.” Cambridge University Press.

Kellenberg D, Levinson A (2014) Waste Of effort? International environmental agreements. J Assoc Environ Resour Econ Univ Chic Press 1(1):135–169

Kraay A (2012) How large is the government spending multiplier? Evidence from world bank lending. The Q J Econ Oxford Univ Press 127(2):829–887

Madden D (2008) Sample selection versus two-part models revisited: the case of female smoking and drinking. J Health Econ 27(2):300–307

Martin W, Pham CS (2020) Estimating the gravity model when zero trade flows are frequent and economically determined. Appl Econ 52(26):2766–2779

Monasterolo I, Angelis LD (2020) Blind to Carbon Risk? An Analysis of Stock Market Reaction to The Paris Agreement. Ecol Econ 170:106571

Pollitt, C. and G. Bouckaert (2011). “Public Management Reform: A Comparative Analysis - New Public Management, Governance, and the Neo-Weberian State (3rd ed.) “Oxford: Oxford University Press.

Rodrik D (1996). “Why is there multilateral lending?” In Annual world bank conference on development economics 1995. World Bank, Washington, D.C., pp. 167– 193.

Santos Silva J, Tenreyro S (2006) The Log of gravity. Rev Econ Stat 88:641–658

Seltzer L, L Starks, Zhu Q (2022) “Climate Regulatory Risk and Corporate Bonds”, NBER Working Paper No. 29994.

The International Monetary Fund, 2017, Guidance Note on the Bank-Fund Debt Sustainability Framework for Low-Income Countries.

The International Monetary Fund. 2020. “Well Spent: How Strong Infrastructure Governance Can End Waste in Public Investment.” USA: International Monetary Fund. https://doi.org/10.5089/9781513511818.071

Tolliver C, Keeley AR, Managi S (2020a) Policy targets behind green bonds for renewable energy: do climate commitments matter? Technol Forecast Soc Chang 157:120051

Tolliver C, Keeley AR, Managi S (2020b) Drivers of green bond market growth: the importance of nationally determined contributions to the Paris agreement and implications for sustainability. J Clean Prod 244:118643

Tran TM (2021) International environmental agreement and trade in environmental goods: the case of kyoto protocol. Environ Resource Econ 83:341–379

Weiler F, Klöck C, Dornan M (2018) Vulnerability, good governance, or donor interests? The allocation of aid for climate change adaptation. World Dev 104:65–77

Zeileis A (2006) Object-oriented computation of sandwich estimators. J Stat Softw 16(9):1–16

Zeileis A, Köll S, Graham N (2020) Various versatile variances: an object-oriented implementation of clustered covariances in R. J Stat Softw 95(1):1–36

Acknowledgements

The authors would like to thank constructive comments from Catherine Pattillo, Raphael Espinoza, Paulo Medas, Jean-Marc Fournier, Hamid Davoodi, William Gbohoui, and participants in the Fiscal Policy division seminar. The authors are responsible for all errors and the views of the authors do not represent IMF views or IMF policy. The views expressed herein should be attributed to the authors and not to the IMF, its Executive Board, or its management.

Funding

This paper has not been submitted elsewhere in identical or similar form, nor will it be during the first three months after its submission to the Publisher. The authors did not receive support from any organization for the submitted work. The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Contributions

These authors contributed equally to this work. XH contributed equally to this work with YC. Roles: data curation, formal analysis, methodology, software, writing–original draft, writing–review & editing. YC contributed equally to this work with XH. Roles: conceptualization, formal analysis, methodology, supervision, writing–original draft, writing–review & editing.

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions