Abstract

If one region of the world switches its research effort from dirty to clean technologies, will other regions follow? To investigate this question, this paper builds a North–South model that combines insights from directed technological change and quality-ladder endogenous growth models with business-stealing innovations. While North represents the region with climate ambitions, both regions have researchers choosing between clean and dirty applications, and the resulting technologies are traded. Three main results emerge: (1) In the long run, if the North’s research and development (R&D) sector is sufficiently large, researchers in South will follow the switch from dirty to clean R&D made by researchers in North, motivated by the growing value of clean markets. (2) If the two regions direct research effort toward different sectors and the outputs of the two sectors are gross substitutes, then the long-run growth rates in both regions will be lower than if the global research effort were invested in one sector. (3) If the North’s government induces its researchers to switch to clean R&D through clean technology subsidies, the welfare-maximising choice for South is to ensure that all of its researchers switch too, unless the social discount rate is high. The last result is true even if the South’s R&D sector is large.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The mitigation of the greenhouse effect requires the limiting of greenhouse gas (GHG) emissions by all regions of the world. The assessment in a special report of the Intergovernmental Panel on Climate Change (IPCC) ‘suggests a remaining budget of about 420 GtCO2 for a two-thirds chance of limiting warming to \(1.5\,^\circ \textrm{C}\),’ implying that two decades remain to achieve carbon neutrality (Rogelj et al. 2018).Footnote 1 Such a goal would be difficult if not impossible for a partial coalition of regions to achieve on their own because the stock of GHG in the atmosphere will continue to rise in the long run if the emissions of major regions outside the coalition grow. Laggard regions may be unwilling to introduce mitigation policies such as carbon pricing for various reasons: for example, their governments may believe that the costs of mitigation are too high or that the impact of climate change in their region will be mild, and they simply prefer to free-ride on the contributions of others. The question of how to address non-commitment has been a longstanding focus of research into the global public good problem of GHG mitigation (e.g. Carraro and Siniscalco 1992). In this situation of asymmetric approaches, emission reductions in outsider regions must be crowded in by an ambitious coalition of regions that are determined to mitigate climate change by undertaking unilateral measures. The levers for such crowding in may involve strategic action (Pereau and Tarik 2001), trade sanctions (Nordhaus 2015; Böhringer et al. 2022), induced innovation (Golombek and Hoel 2004), or both (Maria and van der Werf 2008).

This study contributes to the growing literature on innovation-oriented approaches, examining under what conditions a unilateral effort by a single region with climate ambition can trigger a low-carbon transition worldwide. Previous studies have shown that unilateral policy supporting clean innovation may, under some conditions, induce global emission reduction when both regions have innovative capacity and are allowed to trade with the outputs of clean and dirty sectors (van den Bijgaart 2017; Hémous 2016). Our contribution to this literature is twofold.

First, we show that an ambitious region can trigger global redirection of R&D effort from a dirty to a clean sector when regions trade with improvement of technologies (blueprints), instead of trading with the outputs of clean and dirty sectors. By focusing on the trade of blueprints, we highlight the novel narrative on the channels of the impact of unilateral action: when researchers in one region develop green innovation, say, an improved wind turbine, and increase the value of its market, researchers in other regions will work on further innovations of the same technology in order to capture this market.

Second, we explore the optimal response of a government with no climate ambitions after it observes a shift towards clean research in the ambitious region. If researchers in the non-ambitious region lack sufficient private incentive to redirect their R&D effort from dirty to clean technologies, the government in that region will intervene to ensure that the redirection will occur even if that government does not have climate ambitions. It will do this in order to maximise the long-run growth of consumption. Providing that the government is sufficiently patient, this result is independent of the relative size of regions and the initial state of technology.

Our first argument starts with a presumption of quality-ladder technological progress (Grossman and Helpman 1992): by investing effort, a technology firm has the opportunity to improve on and supersede technology developed by a competitor, thus capturing its market. Suppose that one region with strong R&D potential builds up the market of clean technologies: then researchers in other regions will have an incentive to jump on the same technological platform and work on innovations that improve the same technologies, since successful innovations will allow them to capture a valuable market. In our analytical model, we assume that quality ladder technological progress takes place in both the clean and dirty sector.

This pattern of cross-region technological competition has been seen before. One example is competition in the automobile industry. Although the market was pioneered by manufacturers in the United States, Japanese manufacturers partly captured the market through process innovations in the 1960s and 1970s (Cusumano 1988). Kindleberger (1975) describes the case of the advancement of locomotives by German engineers in the mid-19th century. In 1841, all major suppliers of locomotives to the German market were located in Newcastle, Manchester, and Philadelphia. In the 1840s, German manufacturers took a British model, perfected it, and produced a model that outperformed its British rival (Kindleberger 1975). A more recent example is the development of solar PV technology, which in the 50 s, 60 s and 70 s was driven by the innovation effort in US. Since 80 s, it has additionally been fuelled by the development of industry in Japan, since the 2000s by German industry, and more recently by Chinese industry (Nemet 2019). One may expect a similar competition for improvements in the other clean technologies to be induced by appropriately designed policy.

If the switch to clean technologies takes place in one region, private researchers in other regions will evaluate whether the benefits to switching are outweighed by lock-in forces keeping them in dirty markets. Assuming the South’s government is benevolent, it will be strategically motivated to give an additional push to switching, if its discount rate is sufficiently low. Commitment by one region to keep its R&D in the clean sector implies that other regions cannot benefit from inter-regional spillover effects as long as their own R&D remains locked into the dirty sector. Their economic growth rate in such a case is strictly smaller than in the case where all regions work on the same technological platform. Therefore, after one region commits to clean R&D, the optimal response of the other region’s government is to ensure that the switch also occurs in their region.

To formalise our argument, we developed a Directed Technological Change (DTC) model for two regions of the world, ‘North’ and ‘South’. Each region has its own R&D sector with researchers who must choose between developing technologies for either the clean or dirty sectors. By allowing both regions to engage in R&D, we depart from the usual setup of the North–South model, whereby North is a technological leader and South imitates the innovations of the North. For the purpose of this paper, the ‘North’ is the label given to a coalition of countries with ambitious climate goals, while the ‘South’ signifies countries with solely economic objectives. Traditionally, environmental ambition has been considered to go hand in hand with economic maturity and technological advancement, with each reinforcing demand and capacity for the other. However, in recent decades, large, emerging, and less environmentally ambitious economies have experienced rapid growth in the R&D sector (see Dechezlepretre et al. 2011), reflecting a capacity to do much more than just imitate inventions from abroad.

The DTC framework has been widely used to study the role of technological progress in climate change mitigation and resource depletion (see André and Smulders 2014; Aghion et al. 2016; van den Bijgaart 2017; Hémous 2016, Van der Werf and Di Maria 2008 and the survey by Fischer and Heutel 2013). Several studies have applied the framework in a two-region setting. The first closely related work to ours is a study by Acemoglu et al. (2014), who assume that innovations are generated in North and subsequently could be imitated by Southern researchers for their own industries. They demonstrate that a policy supporting green technologies in North can induce imitation of green technologies in South and thus reduce global emissions, provided that there is no international trade. However, if the regions can trade the outputs of the dirty and clean sectors, then South tends to specialise in dirty production, and the imitation of clean technologies thus ceases to be profitable.

In an important departure from Acemoglu et al. (2014), we allow Southern researchers to develop their own innovations, not just imitate, and to trade in their blueprints. This novel approach allows us to demonstrate that (i) emissions reduction by a foreign region can be induced, even if that region is large and has its own strong R&D potential; and (ii) international protection of patents does not prevent R&D policy in one region from redirecting technological change globally. Legally protected clean innovation in North will contribute to clean technological progress in South because researchers in South will build on ideas developed in North.

Innovation capacity in the Southern region has been incorporated in Hémous (2016) and van den Bijgaart (2017), who make different modeling assumptions about international trade, which influence the rationale for Southern researchers to switch to clean innovation. Specifically, van den Bijgaart (2017) assumes that the two regions trade the outputs of the clean and dirty sectors and Hémous (2016) assumes that they trade the output of the energy-intensive sector, which can use clean or dirty technology. Under these conditions, a tax on dirty goods imported by North (in combination with climate and industrial policies in that region) increases the production of clean (or carbon-neutral) goods in South. The increased demand for clean intermediate goods in North generates demand for local clean innovation in South.

However, these studies did not consider the possibility that North and South could trade clean and dirty technologies.Footnote 2 In Hémous (2016) and van den Bijgaart (2017), although Southern researchers were allowed to innovate, the resulting technologies would not compete directly but rather only indirectly through the intermediate goods trade.

In contrast, we assume that the two regions can trade blueprints, i.e. the improvements of technologies used in the two intermediate sectors, rather than trade the intermediate goods themselves. Blueprints are qualitatively different from intermediate goods because, by nature, they are non-rival. Improvements codified in the blueprints could be traded directly or they could be embedded in the components of solar panels and coal power plant installations (boilers, turbines, and pulverisers), which are traded internationally. The trade of and competition on the markets for electricity-generating technologies can play a significant role in the transition to a low-carbon economy.

By focusing on trade in clean and dirty technologies, rather than trade in intermediate goods, we highlight different reasons why Southern researchers could switch to clean innovation. We argue that Southern researchers redirect their R&D effort towards the clean technological platform because they want to capture the global markets of clean technologies, such as the markets for the components of wind turbines or solar panels.

Furthermore, we show that unilateral action by North can induce global emission reductions under less restrictive conditions than in Hémous (2016) and van den Bijgaart (2017). The North’s action can be effective even if it is not able to introduce trade policy and, perhaps more importantly, even if its economy is smaller than the South’s. When North is small, however, the result requires new conditions: a credible commitment by North to work on clean R&D and sufficient patience on the part of the South’s government (i.e. a sufficiently low discount rate). The Southern government will choose to motivate its researchers to follow the switch to clean R&D, because, otherwise, if Southern researchers continued to work on dirty technological platforms, Southern consumers would never benefit from technological progress made in North. The presence of a patient Southern government is a condition because the private incentives of researchers in South do not include achieving the long-term benefits of coordination with researchers in North.

We elaborate this model next in Sect. 2. Section 3 explores the pull of research allocation in North on choices and technical change in South. Section 4 investigates the consequences for long-run economic growth and emissions in South, depending on their research allocation. Section 5 discusses welfare and presents the optimal research policies for the Southern government. Section 6 discusses implications for the Northern government, and Sect. 7 concludes.

2 The Model

We specify a two-region (North–South) model in which the production of a final good demands the use of intermediate goods, one of which is produced with clean technologies and the other with dirty.

Production of intermediate goods involves labour (which is in fixed supply), sector-specific resources (which are either clean or dirty), and specialised machines (for which the blueprints are developed through research). Research occurs in both regions, but blueprints from a foreign region may not always be adapted for domestic use. The researcher decides whether to allocate research effort to the clean or dirty sector. We assume that the arrival of innovation follows a Poisson process with a constant arrival rate (i.e. the expected number of innovations per unit of research effort and per unit of time). Every innovation materialises in the form of a new blueprint. The researcher holds the property rights to the blueprint forever. However, as we will demonstrate, he or she loses the market when a new innovation arrives. The model is solved in continuous time, i.e. the time periods are not separated.

The primary goal of the model is to understand the incentives that researchers in the Southern region have to switch from dirty to clean technologies if this switch has already taken place in the Northern region. Therefore, in the following set-up we will take the perspective of the Southern region, with its economy viewed as the ‘domestic’ economy and the Northern economy viewed as the ‘foreign’ economy. For simplicity of notation, the macroeconomic variables for the foreign economy will be marked with index f, while those for the home economy will have no index. We will focus the analysis on the case in which all Southern researchers are conducting dirty R&D at the outset.

We will begin by deriving the demand for intermediate goods and for technologies. Then we will show how the profit of technology firms in one sector depends on the revenue of that sector and how the revenue depends on the path of technologies. Finally, we will discuss how the path of technology depends on the allocation of researchers across sectors. We postpone the discussion of consumption dynamics and welfare until Sect. 5 because, while they matter for the central planner’s optimisation, they are not relevant to the decisions of individual researchers.

2.1 Demand for Intermediate Goods and Varieties

2.1.1 Final Good and the Demand for Intermediate Goods

In line with the standard Directed Technological Change model, we assume that the final good is produced using two types of intermediate goods (dirty and clean), which are gross substitutes. Specifically, we assume the Constant Elasticity of Substitution production function,

where \(Y_{ct}\) and \(Y_{dt}\) denote the production of clean and dirty intermediate goods at time t, \(\epsilon >1\) is the elasticity of substitution between the two goods, and \(\Phi\) is the productivity parameter with a symmetric impact on the productivity of clean and dirty technologies.

The final good producer takes the prices as given. We take the price of the final good as the numeraire. The first-order conditions for the producer’s optimum define the demand curves for the clean and dirty intermediate goods:

for \(j=c,d\).

2.1.2 Production of Intermediate Goods

The production of intermediate goods \(j\in \left\{ c,d\right\}\) requires Labour (\(L_{j}\)), natural resources (\(R_{j}\)), and a composite of machines (\(X_{j}\)):

with \(\alpha =\alpha _X+\alpha _R\).

We consider the clean and dirty goods to be using different natural resources (e.g. \(R_c\) might be land required for wind turbines while \(R_d\) is coal), each of which have constant unit costs \(p_{Rc}\) and \(p_{Rd}\), respectively (expressed in terms of the final good), and no scarcity rents.

The technology composite is formed of a continuum of machines: \(\ln X_{j}=\int _{0}^{1}\ln \left( A_{ij}Z_{ij}\right) di\), where \(Z_{ij}\) is a machine of the variety i devoted to sector j, and each machine is characterised by its own productivity parameter \(A_{ij}\).

The machine of variety ij can be produced either by using the most recent domestic blueprint (delivering \(Z_{hij}\)Footnote 3) or by using the most recent foreign blueprint (at quantity \(Z_{mij}\)), provided it can be adapted to the domestic market. The price of machine ij designed by a domestic inventor is \(p_{hij}\) and the price of machine ij designed by a foreign inventor is \(p_{mij}\). Their productivities are given by \(A_{hij}\) and \(A_{mij}\), respectively. Note that, in general, \(A_{mij}\) does not have to be equal to \(A^{f}_{hij}\); that is, foreign firms do not offer machines with the same productivity levels as the machines offered in their countries. If, initially, the state of the technology is different in the two regions, it will remain different after an innovation that improves technologies in both regions. The production and technology paths of the machines are described in the subsection ‘Generation of blueprints and prices of machines’.

The two types of machines are perfect substitutes. The intermediate producer always chooses the machine with the lowest quality-adjusted price. If \(\frac{p_{hij}}{A_{hij}}\le \frac{p_{mij}}{A_{mij}}\), then the producers choose technology provided by the domestic firm (\(Z_{hij}=Z_{ij}\), \(Z_{mij}=0\)). Otherwise, producers choose foreign technologies (\(Z_{mij}=Z_{ij}\), \(Z_{hij}=0\)). Let \(p_{ij}\) be the price of the machine that is chosen by the firm at market ij and let \(A_{ij}\) be its productivity. We assume that the intermediate goods producers take all prices as given. Let \(w_{t}\) denote wages (which must be equal in both sectors as we assume the free flow of labour within a country). The optimisation problem for the representative firm in an intermediate good sector determines the demand for labour, resources, and each machine variety:

2.1.3 Trade

We assume that factors of production are immobile and that no international borrowing or lending take place, which means that net exports must be balanced in every period. There are two types of tradable goods: (1) the final good, which is excludable and rival, and (2) blueprints, which are partly excludable (i.e. the innovator can sell the blueprints giving a right to manufacture a machine) but not rival. Due to the non-rivalry of blueprints, the model is different from a typical Ricardian trade model. Trade takes place because each region generates blueprints that are potentially valuable in the other region. If a firm in one region wants to purchase a blueprint invented in the other region, it can always compensate the inventor by purchasing and exporting some final good. At the regional level, if the region is a net importer of blueprints, it must be a net exporter of the final good.

Final goods produced in either country are identical, so their price is identical as long as there is trade. Because we normalised the price of the South’s final good to unity, the price of the North’s final good is also equal to unity. This means that all values for the foreign economy (such as the profit gained from using a blueprint in the foreign region) are expressed in the units of final good.

Given that machines are produced using final goods, which can also be traded, for the solution of the model it is immaterial whether a home firm purchases a foreign blueprint, transfers abroad only the value of the blueprint and produces the machine at home or if the home firm purchases a ready machine and therefore transfers both the value of the blueprint and the cost of production. For clarity of exposition, in our narrative we will assume the former case.

We assume that an innovator can sell blueprints to domestic and foreign monopolists (manufacturers of machines) at different prices, meaning we can consider two separate and independent monopolists’ optimisation problems and use their outcome to determine the price of blueprints for domestic and foreign markets. The reason why the prices for domestic and foreign regions may be different and why arbitrage does not apply is that the inventor has a legal right to control the use of the blueprint and has the power to prevent users in one region from sharing the blueprint with users in the other region.

2.1.4 Labour and Wages

Domestic supply of labour engaged in clean or dirty production is fixed at L. Although it is perfectly substitutable across sectors, it is not mobile internationally. By summing the demand for labour in (3) for the two sectors, we can show that total compensation to labour is a constant fraction of final good output:

We assume that labour supply is constant.

2.1.5 Generation of Blueprints and Prices of Machines

The representation of the technology and innovation market follows that of the quality ladder in Grossman and Helpman (1991). We assume that the technology firms improve on the existing technology for machine of variety ij and sells the blueprints to domestic and, if the innovation is applicable abroad, foreign manufacturers of machines. The technology is characterised by some quality level (A). An innovation results in a new blueprint, which allows a firm to produce a machine with a quality level that is higher than the previous best available technology by a factor \(\left( 1+\gamma \right)\).

If the innovation is not applicable abroad, it will only improve the domestic technology and thus the ratio \(A_{ij}/A^{f}_{ij}\) will increase. If the innovation is applicable abroad, it allows the firm to improve both their domestic and foreign technology by a factor \((1+\gamma )\), while the ratio \(A_{ij}/A^{f}_{ij}\) remains constant. The probability that the innovation is applicable is constant and given by \(\omega\).

In contrast to the original DTC model proposed by Acemoglu et al. (2012), the firms do not lose the property rights of the blueprint after one period. Instead, the firm will lose the market when another firm innovates in the same market. The newcomer captures the entire market for machine of variety ij because her blueprint is characterised by higher productivity. In the context of directed technological change, a similar set-up was considered by Greaker et al. (2018).Footnote 4 This formulation allows us to explicitly take into account that when technological firms decide where to allocate their effort, they consider the value of the market of a particular machine.

An innovation is created by researchers hired by a technology firm. As in the original Grossman-Helpman model, we assume that the arrival of innovations is random and follows the Poisson process: the number of innovations per unit of research effort and per unit of time is distributed according to the Poisson distribution with the arrival rate \(\lambda\).

2.1.6 The Competition Between Technology Firms

Consider a domestic technology firm that has just made an innovation for machine ij. Now the firm, which we label the ‘newcomer’, has to compete with the incumbent firm in the market ij. We assume that this competition takes the Bertrand form. We also assume that the cost of creating machines is \(\psi\) units of final goods. The incumbent cannot reduce its price to below the cost. The newcomer offers a price that is epsilon lower than \(\left( 1+\gamma \right) \psi\) and wins the competition. This implies that in equilibrium, \(p_{hij}=\left( 1+\gamma \right) \psi\). The monopolist does not have an incentive to set a lower price because the demand curve is unit elastic. If the newcomer is a foreign firm generating an adaptable innovation, then exactly the same logic applies and \(p_{mij}=\left( 1+\gamma \right) \psi\). Using (4), this implies that the demand for machines is given by

The instantaneous profit of a newcomer from the domestic market is given by

If the innovation is applicable abroad, which happens with probability \(\omega\), the newcomer also receives the instantaneous profit from the foreign market. The expected value of that profit is given by

Note that since the profit is the same for every variety i, the researchers will be indifferent when choosing to work on any of the varieties within the intermediate sector j. Progress in each variety will therefore be equally likely.Footnote 5

In Sect. 2.2, we detail how competition in the technology sector influences the allocation of researchers and the growth rate.

2.1.7 Equilibrium Revenues of the Dirty and Clean Sectors

Let \(A_{j}\left( t\right)\) stand for the geometric average of technologies in sector j at time t raised to the power \(\frac{\alpha _X}{1-\alpha _X}\) (we introduce this exponent to simplify algebra):

The state of technology, \(A_{j}\), may differ between the regions because not every improvement developed in one country is applicable in the other country.

Thus, using a duality of cost function and production, we can express the price of an intermediate good as follows:

where \(\Omega =\alpha _R^{-\alpha _R}\left( \frac{\alpha _X}{\left( 1+\gamma \right) \psi }\right) ^{-\alpha _X}\left( 1-\alpha \right) ^{-\left( 1-\alpha \right) }\) is a constant. The condition reflects the negative effect of a productivity improvement in sector j on the price of the intermediate good supplied by this sector.

From the labour market equilibrium, wages are \(w=\left( 1-\alpha \right) Y/L\). Combining Eqs. (1), (5) and (9), we find that the revenue in sector j is proportional to

where \(\varphi _X=\left( 1-\alpha _X\right) \left( \epsilon -1\right)\) and \(\varphi =\left( 1-\alpha \right) \left( \epsilon -1\right) .\)Footnote 6

Throughout the paper we assume that the two goods are sufficiently substitutable to ensure that dirty resource use (which is proportional to dirty sector revenue) declines when all research effort is channelled to the clean sector, i.e. \(\varphi >1\). This condition mirrors the condition on the elasticity of substitution in Acemoglu et al.’s (2012) paper. If the condition is not satisfied, then the long-run growth of emissions cannot be prevented, even if global R&D effort is directed towards clean innovation.

Total output can be derived by summing the left- and right-hand sides of (10) over the two sectors and noting that \(P_{c}Y_{c}+P_{d}Y_{d}=Y\). This results in

Using (10) we can also express revenues as

where

is the share of sector j in the total output.

Thus far, we have demonstrated that the profit of a successful innovator is proportional to the total revenue of the sector in which they operate (Eq. 7) and that the revenue is determined by the level of final good output and the distance between the clean and dirty technologies, \({A_{c}}/{A_{d}}\) (Eqs. 12 and 13). If the clean and dirty intermediates are gross substitutes, then an increase in \({A_{c}}/{A_{d}}\) leads to an increase in the share of the clean sector and, if \(Y_{t}\) is kept constant, it leads to an increase in the revenue of the sector and the profit for clean technology owners. Next, we will examine the equilibrium allocation of researchers and demonstrate how the technological growth paths depend on the allocation of researchers across the sectors.

2.2 Technology Paths

We assume that the number of researchers in the two regions is fixed. The population of foreign researchers is normalised to unity (\(\mu ^{f}=1\)). The population of domestic researchers is given by \(\mu\), which also represents the ratio of domestic to foreign researchers. The share of the researcher populations working on the technologies in the clean sector is given by s at home and \(s^{f}\) abroad. In this section, we focus on the determinants of s.

Recall that the number of innovations per unit of research effort and per unit of time is distributed according to the Poisson distribution with the Poisson arrival rate, \(\lambda\). This implies that in the clean sector, the expected number of improvements per unit of time delivered by domestic researchers is \(\lambda \mu s\) and the expected number of domestically applicable improvements delivered by the foreign research sector is \(\lambda \omega s^{f}\). Due to the law of large numbers, the expected number of improvements is equal to the fraction of varieties improved. Thus, there are \(\lambda (\mu s+ \omega s^{f})\) varieties that are improved by a factor \(1+\gamma\) at every instance of time. This means that the growth of \(A_{j}\) is given by

In general, the paths of unit productivities for the two sectors, \(A_{c}\) and \(A_{d}\), will differ between the two regions. While the domestic unit productivities follow the processes described in Eq. (14), the unit productivities abroad will follow

2.3 The Value of a Blueprint

As noted in the previous section, innovation is associated with the loss of monopoly profit on the part of the owner of the previous blueprint. On the one hand, the innovator captures the entire value of the market and thus benefits from all previous innovations through an effect known in the endogenous growth literature as the intertemporal spillover effect. On the other hand, the innovator only receives the dividend until the next incremental innovation arrives and captures the full value again through an effect known as the business-stealing effect.

The presence of the two effects was the central feature in the models of Grossman and Helpman (1991) and Aghion and Howitt (1992). Their relative sizes determined whether decentralised innovation effort is higher or lower than is socially optimal. In our model, we are not concerned with the total amount of innovation effort but rather with its distribution across sectors. Here also the role of the two effects is central: as we will see, the possibility of winning the market and benefiting from intertemporal spillovers encourages innovators in South to operate in the same sector as innovators in North. On the other hand, the crowd of researchers concentrated in one sector leads to frequent business stealing and discourages innovation there in the short run.

We will first examine the length of the time period between a blueprint invention and a successive innovation in the same market. For simplicity, we will limit our analysis to an asymptotic steady-state (SS) where s, \(s^{f}\) and the growth rates of productivity in the two sectors are constant. Throughout the analysis we assume that the economy converges toward such an asymptotic SS, i.e. we rule out the possibility of cycles.

Note that since the innovators are indifferent towards working on any variety within sector j, they distribute their effort equally across all varieties. Given that the number of innovations per unit of time and per unit of research effort is distributed Poisson, the distribution of the time interval between two successive innovations in the clean sector is exponential with the parameter \(\lambda \left( \mu s+\omega s^{f}\right)\). Hence, if a firm innovated at time t, the probability that competitors would not devise a successful innovation in the same market by time \(\tau\) is \(e^{-\lambda \left( \mu s+\omega s^{f}\right) \left( \tau -t\right) }\). By the same logic, the probability that a successful domestic firm is present in the foreign market at \(\tau\) is given by \(\omega e^{-\lambda \left( \mu \omega s+s^{f}\right) \left( \tau -t\right) }\). The value of the blueprint in variety i in the clean sector is then given by

where \(\rho\) denotes the discount rate used by a firm.

This can also be expressed as

where

and

The term \(\Gamma\) can be interpreted as the discounted sum of expected profits relative to the current profit. One could also interpret \(\Gamma\) as the expected length of the interval with the monopoly rent adjusted for the growth of the profit and the discount rate.

The growth of profit as a function of growth of technologies can be determined using Eqs. (7), (8) and (10):

where \(Y^{f}\) is the foreign final good output per capita.

Hence, \(\Gamma _c\) can be expressed as

where

In order to ensure that the value of a technology firm is finite, we assume that \(\gamma \alpha _X\left( \epsilon -1\right) <1\). If the condition is satisfied, \(\chi >0\) and the integral in \(\Gamma _c\) is finite.

The growth rate of the economy, g, can be derived from Eq. (11):

Given that in the asymptotic SS the growth rates of the technologies must be constant, the shares of the sector must either be constant, approach unity, or approach zero asymptotically. In either case, as t goes to infinity, g (determined in Eq. (21)) converges to a positive constant; \(\chi \left( s,s^{f},g\right)\) (determined in Eq. (20)) converges to a strictly positive constant; and \(\Gamma _{c}\) (determined in Eq. (19)) approaches its finite and strictly positive limit given by \(1/{\chi \left( s,s^{f},g\right) }\). The same argument applies to \(\Gamma _{c}^{f}\left( s,s^{f}\right)\), \(\Gamma _{d}\left( s,s^{f}\right)\) and \(\Gamma _{d}^{f}\left( s,s^{f}\right)\).

Since \(\Gamma\)’s are constant in the long run, the value of a blueprint in sector j,

grows (or vanishes) together with \(\pi _{j}\) and \(\pi _{jf}\). The growth of profit as a function of growth of technologies is expressed in equtions (17) and (18). The growth of technologies as a function of the allocation of researchers is determined by Eqs. (14) and (15). Combining all these equations enables us to relate the growth of \(v_{c}\) to the allocation of researchers: the larger the number of researchers in the clean sector, the faster the progress of a clean technology, the faster the growth of the revenue of the sector, and the greater the profits and value of the innovation.

Note that the value of the innovation (\(v_c\)) grows in line with the value of the market (\(Y_{c}p_{c}\)). While the value of the market is built by all researchers who worked on a given technology in the past, at any point in time the value of innovation is fully captured by only one researcher: the one who devised the most recent innovation. This intertemporal spillover effect will result in a gravitational force that pulls researchers into one sector. Every researcher will prefer to work for the sector that has accommodated a large number of researchers in the past. We formalise this argument in the next section.

3 Allocation of Research in South Under Laissez Faire

In this section we identify and define the forces that shape allocation for researchers in South, particularly the impact of shifting research from dirty to clean in North. We will first elaborate informally on the insights provided by our model; then we will provide a formal proposition.

We will consider the allocation of researchers from the perspective of South (thus, all variables indexed with f will refer to the value for the North), and we will consider the case in which all Northern researchers work in the clean sector, \(s^{f}=1\). We assume that the Southern government does not intervene and that researchers in South make choices that maximise their individual profit. In Sect. 4 we will relax this assumption and consider the endogenous response of the government.

3.1 Researchers’ Incentives

Since we assume a free entry of technology firms, the zero profit condition will imply that the compensation (or wage) for researchers will be equal to the expected return to research. The return to research in sector j is given by \(\lambda v_{ijt}+\xi _{j}\), where \(\xi _{j}\) denotes the research subsidy for technologies in sector j. The subsidy is financed from a lump-sum tax on consumers in order to avoid any distortionary effect from taxes.

A researcher compares the compensation for research effort in the two sectors and allocates its entire research effort to the dirty sector if \(v_{ict}+\frac{\xi _{c}}{\lambda } \le v_{idt}+\frac{\xi _{d}}{\lambda }\). Note that in this specification, for any parameter values, the government always has the option of incentivising the movement of all researchers to either sector, simply by choosing the appropriate levels of research subsidies in the two sectors.

Suppose now that the government of the foreign country (i.e. the Northern region) increases subsidies for clean research in order to shift researchers to this sector and decrease the equilibrium number of researchers working for the dirty sector. We are interested in the impact of this shift on the allocation of researchers to the South. We distinguish between four types of effects.

First, we observe that an increase of \(s^{f}\) will increase the business-stealing effect in the clean sector and decrease the size of this effect in the dirty sector. In other words, a greater number of researchers working in the clean sector will increase the likelihood of competitors making a successful innovation in this sector and thus the innovator can enjoy its profit for a shorter period. Moreover, fewer competitors in the dirty sector leads to a reduced risk of losing the market in this sector. We marked this effect with curly brackets in (20) above.

Second, note that when a firm has a monopoly in the market of variety i in the clean sector, the unit productivity of other varieties in that sector will grow at the rate \(\gamma \lambda \left( s+s^{f}\right)\). This means that, although some researchers in the clean sector will aim to steal the market i, the remaining researchers will work on improving other varieties. These improvements in turn imply that once the innovator captures the market, the revenue is not constant but rather increases over time. This effect is marked with square brackets in (20).

Third, \(s^{f}\) will influence the value of blueprints in both sectors through its effect on the aggregate growth rate. If the new allocation of research implies a slower growth of the economy, this effect will depress the blueprint values in both the dirty and clean sectors. This effect is captured in the change of the term \(g\left( s,s^{f}\right)\) in Eq. (20).

Finally, the greater the number of researchers that are working in the clean sector, the faster is the productivity growth of the machines in the clean sector relative to that in the dirty sector. Consequently, the demand for the clean intermediate good grows and so does the size of the market (quantity demanded) for clean machines. Thus, the benefit of capturing one of these markets in the event of a successful innovation also grows. Conversely, fewer researchers in the dirty sector implies slower growth of that sector and fewer benefits from capturing a market in the dirty industry in the long run. This effect is framed in the dependence of technological progress on the number of researchers in each sector (Eqs. (14) and (15)) and the dependence of profits on the state of technology in each sector (Eqs. (17) and (18)). The latter dependence mirrors the path dependency described in Acemoglu et al.’s (2012) paper (see equation (18) in that paper).

Note that, contrary to the first three effects, which change the level of the blueprint’s value (through the changes in the asymptotic SS level of \(\Gamma\)’s ), the last effect changes the growth rate of the blueprint’s value. As a result, this last effect will always dominate the other effects and will determine the relative value of the blueprint in the long run, as t approaches infinity. We will label this effect the long-run pulling effect.

To reverse this result, either factor \(\hat{\Gamma }\) would need to decline at the exponential rate or the growth of productivity would need to reach its limit. An exponential decline in \(\hat{\Gamma }\) would mean that in the long run innovators would enjoy their dividends for an infinitesimally short period of time, which is hard to imagine.Footnote 7

The second possibility is the limit on the growth of productivity. In our model, the exponential growth of productivity under a constant number of researchers is driven by the assumption on spillovers (see Jones 1995). Although this assumption is standard in endogenous growth models (Aghion and Howitt 1992; Grossman and Helpman 1991; Romer 1990), it is theoretically possible that the growth will die out at some point e.g. because researchers will find it increasingly difficult to improve clean technologies (which is known as the fishing-out effect). If there is an upper bound on the productivity (e.g. the floor cost of every potential clean technology) then the argument made above will fail.

The value of blueprints also depends on the obsolescence of technologies that are replaced with innovations. In our setting, we assumed an extreme case of full obsolescence: the moment a new blueprint is available, it immediately replaces the previous blueprint. In reality, such obsolescence is unlikely to be immediate because new technology needs time to diffuse. On the one hand, this means that a successful innovator cannot capture the entire market immediately. On the other hand, it implies a weaker business stealing effect: she or he will retain at least part of the market after another innovator makes subsequent innovations. In either case, the delayed obsolescence will shift the stream of profits in time and therefore it can affect the value of \(\Gamma\)’s.

3.2 Researchers’ Choices

Although the switch of foreign researchers in North to the clean sector will have a positive effect on the value of clean blueprints in the long run in South, this effect may not be sufficiently strong to guarantee the switch of researchers in South. This is because the long-run pulling effect driven by the progress in clean technologies could be offset by the lock-in effect driven by the progress of dirty technologies. The lock-in effect takes place when a substantial portion of researchers in South continue to fuel the progress of dirty technologies (\(s_d=1-s\) is high), which drives up the value of dirty varieties. In the model this would be captured with high \(s_d\), high \(g_d\) and \(g^f_d\) (see Eqs. (14) and (15) and high growth of \(\pi _d\) and \(\pi ^f_d\) (Eqs. (17) and (18)). If the growth of the value of dirty blueprints stays above the growth of the value of clean blueprints, an individual researcher will feel incentivised to stay in the dirty sector. The proposition below sheds light on the conditions under which the switch in North is and is not propagated in South.

Suppose at time \(t=0\) all Southern researchers work in the dirty sector while all Northern researchers work on clean technologies. Let \(A_{d0}\) and \(A_{c0}\) denote the productivity of machines in the dirty and clean sector, respectively, at time \(t=0\). The following proposition clarifies under what conditions the Southern researchers switch to the clean sector.

Proposition 1

Suppose that all researchers in North work on clean technologies. Then the only asymptotic SS is that with all Southern researchers:

-

working in the clean sector if the number of researchers in South is smaller than the number of researchers in North i.e. \(\mu < 1\)

-

working in the clean sector if, initially, \(A_{c}\) is sufficiently high to ensure that \(v_{c}>v_{d}\) for any value of s

-

working in the dirty sector if \(\mu >1\) and \(\omega >\frac{1}{\mu }\) and initially \(A_{d}\) is sufficiently high to ensure that \(v_{c}<v_{d}\) for any value of s

Proof

Proof in the Appendix 1. \(\square\)

The proposition shows that the relative size of the R&D sectors and the initial state of technology in the two sectors are critical for the effectiveness of unilateral climate policy. Parts 1 and 2 of the proposition correspond to propositions 1 and 2 in the work of van den Bijgaart (2017), who obtains similar results for the case when regions trade intermediate goods. Similarly, Parts 1 and 3 here correspond to Parts 1a and 2a of Proposition 7 in Hémous (2016).

The proposition has two important implications for the policy’s effectiveness in supporting the dirty sector in South, which we discuss in Sect. 5. First, when the number of researchers in South is smaller than that of the North, there are no constant (and finite) research subsidies \(\xi _{d}\) and \(\xi _{c}\) that could keep Southern researchers in the dirty sector in the long run. Second, the government in South is always able to incentivise its researchers to switch. Indeed, all that is needed is a temporary subsidy \(\xi _{c}\), which ensures that researchers work in the clean sector, to allow \(A_{c}\) to grow sufficiently large. In the long run, the subsidy can be withdrawn once the lock-in effect works in favour of the clean sector.

3.3 Optimal Reaction of Researchers in South: Summary

We complete this section with a brief summary of results. The business-stealing and the intertemporal spillover effects bring two important forces into the model when Northern researchers switch their attention from the dirty to the clean sector. On the one hand, this switch implies the occurrence of more intensive innovation and business stealing in the clean sector and shorter expected periods in which a successful firm can enjoy its profits. It also implies less research and thus less competition in the dirty sector. On the other hand, having more researchers working in the clean sector increases the value of the market that a potential innovator in the clean sector can capture.

The importance of the latter effect grows over time. A positive number of researchers in the clean sector allows the average value of the market in this sector to grow exponentially. This growth in turn provides increasingly strong incentives for Southern researchers to switch to the clean sector. By contrast, the former effect (of increased competition in the clean sector) leads only to a level decrease in the value of the blueprint in the clean sector. Consequently, it will always be dominated in the long run. The total effect of an increase in the number of Northern researchers in the clean sector will always exert a force that pulls Southern researchers toward the same sector.

This pulling force will not be sufficient, however, to ensure that all Southern researchers make the switch if it is offset by an opposing force deriving from the lock-in effect. The latter effect will dominate when the size of the South’s R&D sector is large and when the initial stock of accumulated knowledge in the dirty sector is large. In such a case, the high initial value of dirty markets encourages the researchers in South to remain in the dirty sector. These researchers will continue to produce growth in the dirty blueprint market, which in turn increases the incentive for other Southern researchers to remain in the dirty sector in the future.

4 The Consequences for Long-Run Growth and Emissions

In this section we will explore the long-run economic growth rate and emissions of the Southern economy when all researchers in both regions work in the clean sector (\(s=s^{f}=1\)) as compared to when the research effort is split, with researchers in North working in the clean sector and researchers in South working in the dirty sector (\(s=0\), \(s^{f}=1\)). We will then use these growth rates to evaluate the welfare of Southern consumers and to discuss the optimal policy choices that can be made by the government in South.

When all researchers focus on the clean sector, the growth of productivity in the clean and dirty sectors can be derived using (14) as \(g_{c}=\frac{\alpha _X}{1-\alpha _X}\gamma \lambda \left( \mu +\omega \right)\) and \(g_{d}=0\), respectively. Inserting it into the expression for final good output growth in (21), we obtain

Notice that in the long run the clean sector will dominate in the economy (i.e. \(\sigma _{ct}\equiv \frac{P_{ct}Y_{ct}}{Y_{t}}=\frac{\left( A_{c,t}^{1-\alpha _X}p_{Rc,t}^{-\alpha _R}\right) ^{\epsilon -1}}{\left( A_{d,t}^{1-\alpha _X}p_{Rd,t}^{-\alpha _R}\right) ^{\epsilon -1}+\left( A_{c,t}^{1-\alpha _X}p_{Rc,t}^{-\alpha _R}\right) ^{\epsilon -1}}\rightarrow 1\)). Therefore, the above expression implies that the long-run growth of the Southern economy is given by \(g=\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\). In the case of a split (\(s=0\), \(s^{f}=1\)), the two sectors will grow at the rates \(g_{c}=\frac{\alpha _X}{1-\alpha _X}\gamma \lambda \omega\) and \(g_{d}=\frac{\alpha _X}{1-\alpha _X}\gamma \lambda \mu\). When this is inserted in the expression for growth, we obtain

In this asymptotic SS, since productivity in the dirty sector grows faster than in the clean sector,Footnote 8 in the long run the dirty sector will dominate the economy, implying that the long-run growth of the Southern economy is given by \(g=\frac{\alpha _X}{1-\alpha }\gamma \lambda \mu\). This growth rate is strictly smaller than in the case of all research effort concentrated in the clean sector.

Proposition 2

The long-run growth of the economy is always larger if researchers from the two regions work in the same sector than if the research effort is split between the two sectors.

Proof

In the text. \(\square\)

Consumption can differ from final-good output due to trade in technologies. It can be shown, however, that when both regions work on clean technologies (\(s=s^{f}=1\)), the growth rate of consumption cannot be smaller than the growth rate of the domestic economy given by \(\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\). If the research effort is split (\(s=0\), \(s^{f}=1\)), consumption cannot grow faster than \(g=\frac{\alpha _X}{1-\alpha }\gamma \lambda \mu\) (see Appendix 2).

The next step is to examine the use of dirty resources along the two possible balanced growth paths. By combining (2) with (10) and (11), we find that the equilibrium level of the use of the dirty resources is given by

When all researchers in the world work in the clean sector, the growth of \(A_{d}\) is equal to zero. On the other hand, \(A_{c}\) exhibits constant growth. The expression inside the square brackets goes to zero asymptotically when the dirty and clean goods are gross substitutes (\(\epsilon >1\) and so \(\varphi _X>0\)). This will translate into a decline of \(R_{d}\) towards zero as long as \(\varphi >1\). In other words, the technological progress in the clean sector will lead to a decline in the use of dirty resources only if the elasticity of substitution between clean and dirty goods is sufficiently high to ensure that \(\varphi =\left( \epsilon -1\right) \left( 1-\alpha \right) >1\).

By contrast, in the asymptotic SS with all Southern researchers working in the dirty sector, productivity in the dirty sector grows faster than productivity in the clean sector. In this scenario, the term within the square brackets approaches unity when the dirty and clean goods are gross substitutes. Consequently, in the long run, the use of dirty resources grows exponentially at the rate \(\frac{1-\alpha _X}{1-\alpha }g_{d}=\frac{\alpha _X}{1-\alpha }\gamma \lambda \mu >0\).

5 Optimal Strategies for the South

Thus far, we have assumed the absence of governmental subsidies in South. Notice that in our specification either government can always choose the pair \(\xi _{c}\) and \(\xi _{d}\), which flips the sign of \(\left( v_{ict}+\xi _{c}\right) -\left( v_{idt}+\xi _{d}\right)\) in any direction. This means that the governments always have the option to induce a switch of research to either sector.

In this section we will demonstrate that if the Southern government is patient, it will have an incentive to introduce subsidies and move the economy to the asymptotic SS with Southern researchers working in the same sector as researchers in North. If the government is impatient, however, its optimal decision depends on the initial distance between technologies as well as the speed at which Southern firms can capture the clean markets.

5.1 Objective of the South’s Government

Let W reflect the objective of the South’s social planner. We assume that it is determined solely by the sum of the discounted flow of consumption

We deliberately assume that the objective does not depend on the quality of the environment in order to highlight the purely economic incentives of the government in South. We also assume no economic damages due to climate change. If the planner in South takes into account the damages, the planner will have additional incentives to encourage innovation in the clean sector. In this paper, we consider the extreme case in which the planner in South does not have these additional incentives.

In each instance of time, consumption is determined by

where \(\left( 1-\alpha \right) Y\) is labour compensation, \(\Pi\) is the aggregated profit domestic firms made on the domestic markets, and \(\Pi ^{f}\) is the aggregated profit domestic firms made on the foreign markets. Domestic consumption differs from domestic final-good output due to exports (necessary to purchase the foreign technologies) and imports (financed by the sale of domestic technologies abroad).

Total output is given by Eq. (11) (restated below for convenience)

We assume that at time \(t=0\), all clean technologies are owned by Northern firms while all dirty technologies are owned by Southern firms.

If at time \(t=0\) all researchers in South switch from dirty to clean R&D (\(s=s^{f}=1\)), then at time \(\tau\),

where \(\phi _{c}\) (\(\phi _c^f\)) is the fraction of clean technologies owned by domestic firms in domestic (foreign) markets (recalling that \(\phi _d=\phi _d^f=1\)). In Sect. 5.4 we show the differential equation governing the evolution of \(\phi _c\) for \(s=1\). The equation predicts that \(\phi _c\) converges to its asymptotic SS value given by \({\mu }/{(\mu +\omega )}\). Similarly, in the asymptotic SS \(\phi _c^f\) converges to \({\omega \mu }/({1+\mu \omega })\).

If all researchers in South remain in the dirty sector, then

The objective of the central planner depends both directly and indirectly on the discount rate, which affects not only the present value of consumption along the path but also the choice of the path of specialisation.

5.2 Optimal Path for a Patient South

When the discount rate is sufficiently low, the planner will always choose the path with faster long-run growth in consumption. Here, we sketch the argument (we provide more formal derivations in Appendix 4).

As argued above in the case of a switch to clean R&D, \(\sigma _{c}\rightarrow 1\) and \(\sigma _{c}^{f}\rightarrow 1\). Hence, we can choose a point of time \(\tau ^{*}\) such that for \(\tau >\tau ^{*}\), \(\sigma _{c}\approx 1\), \(\sigma _{c}^{f}\approx 1\), and consumption grows at a constant rate which is equal to the growth of the domestic economy given by \(g =\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\). Thus, in the long-run, the South’s welfare approaches

where \(C\left( \tau ;1,1\right)\) denotes consumption at time \(\tau\) when \(s=1\) and \(s^{f}=1\), \(g\left( 1,1\right)\) denotes the long-run growth of the domestic economy when \(s=1\) and \(s^{f}=1\) and \(W_{0}\left( 1\right)\) denotes welfare when \(s=1\).

By analogous argument, we can express welfare when Southern researchers stay in the dirty sector (\(s=0\)) as:

where \(C\left( \tau ;0,1\right)\) denotes consumption at time \(\tau\) when \(s=0\) and \(s^{f}=1\), \(g\left( 0,1\right)\) denotes the growth of the domestic economy when \(s=0\) and \(s^{f}=1\) and \(W_{0}\left( 0\right)\) denotes welfare when \(s=0\).

To ensure that all integrals converge, we assume that \(\rho >g\left( 1,1\right) =\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\). For this reason, the terms in \(W_{0}\left( 1\right)\) and \(W_{0}\left( 0\right)\) are finite. However, we can make the term \(\frac{C\left( \tau ^{*};1,1\right) }{\rho -g\left( 1,1\right) }\) in (30) arbitrarily large by choosing a \(\rho\) that is sufficiently low (i.e. sufficiently close to \(\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\)). In turn, the term \(\frac{C\left( \tau ^{*};0,1\right) }{\rho -g\left( 0,1\right) }\) in (31) is bounded from above by \(\frac{C\left( \tau ^{*};0,1\right) }{g\left( 1,1\right) -g\left( 0,1\right) }=\frac{C\left( \tau ^{*};0,1\right) }{\frac{\alpha _X}{1-\alpha }\gamma \lambda \omega }\). This implies that there exists a threshold level, \(\rho ^{*}\left( 0\right)\), such that for every \(\rho <\rho ^{*}\left( 0\right)\), \(W_{0}\left( 1\right) >W_{0}\left( 0\right)\).

More generally, let \(W_{0}\left( s\right)\) be the South’s welfare when the share of Southern researchers working in the clean sector in the long run is s. We can follow exactly the same logic as above to show that \(W_{0}\left( 1\right) >W_{0}\left( s\right)\) for \(s<1\). In this case, the term \(\frac{C\left( \tau ^{*};s,1\right) }{\rho -g\left( s,1\right) }\) (corresponding to the second term in (31)) is bounded from above by \(\frac{C\left( \tau ^{*};s,1\right) }{g\left( 1,1\right) -g\left( s,1\right) }\), which is finite unless \(s \rightarrow 1\). Meanwhile, as noted in the paragraph above, we can make the term \(\frac{C\left( \tau ^{*};1,1\right) }{\rho -g\left( 1,1\right) }\) in (30) arbitrarily large by choosing a \(\rho\) that is sufficiently low (i.e. sufficiently close to \(g\left( 1,1\right) \equiv \frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\)). Thus, for every s, there exists a threshold level, \(\rho ^{*}\left( s\right)\), such that for every \(\rho <\rho ^{*}\left( s\right)\), \(W_{0}\left( 1\right) >W_{0}\left( s\right)\).

We summarize the result of this subsection in the following proposition.

Proposition 3

Assume that \(\rho >g\left( 1,1\right) =\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\), so that welfare, W, is always finite. If the planner is sufficiently patient (i.e. \(\rho\) is below the threshold level \(\min _{s}\{\rho ^{*}\left( s\right) \}\)), then the social optimum will always involve switching to clean research in the long run.

Proposition 3 implies that when the South’s government reacts to the switch to clean R&D in North and if it is sufficiently patient, the only possible asymptotic SS is the one with all researchers in the world working in the clean sector. Combined with the discussion of Eq. (23) on the use of dirty resources in Sect. 4, this implies a decline of global emissions towards zero even if a substantial part of the world does not have climate ambition.

Notice also that the proposition implies that the switch to clean R&D in North will be effective under a wide range of parameter values. In van den Bijgaart (2017), Hémous (2016), and Acemoglu et al. (2016), the unilateral switch in North allowed for global decarbonisation either when the South’s government was relatively small or when the R&D policy in North was accompanied by trade policy (e.g. banning/limiting trade in Acemoglu (2016) and Hemous (2016) or introducing taxes that relocate clean production to South in van den Bijgaart (2017)). In our setting, when the South’s government is patient, these conditions are not necessary.

5.3 Sub-game Perfect Nash Equilibrium When South and North are Patient

Finally, in order to endogenise the behaviour of both the Northern and Southern governments, we consider the following game: First, North chooses the subsidy rate for clean and dirty research. This choice is observed by the government in South, which then has to make its own decision. To simplify this game as much as possible, we assume that the payoffs of the North’s government are strictly increasing in the long-run growth of output and strictly decreasing in the growth of the use of dirty resources. We assume that the sole objective of the South’s government is to maximise the long-run growth of output. The South’s government will always set a subsidy that ensures that Southern researchers work in the same sector as Northern researchers. According to the argument in Sect. 4, this will make the long-run growth rate equal to \(\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( \mu +\omega \right)\). Otherwise, i.e. if the government allows its researchers to choose a different sector, the long-run growth of the economy will be \(\frac{\alpha _X}{1-\alpha }\gamma \lambda \max \left( \mu ,\omega \right)\).Footnote 9

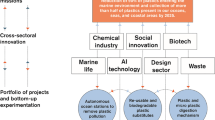

This strategy of the Southern government implies that, no matter which sector North subsidises, the long-run growth in North will always be equal to \(g=\frac{\alpha _X}{1-\alpha }\gamma \lambda \left( 1+\mu \omega \right)\). These payoffs are summarised in Fig. 1.Footnote 10

As a result, if the North’s government is rational and concerned about the environment, then according to this model it will always choose to grant a subsidy to the clean sector.

The proposition below summarises this result:

Proposition 4

Suppose that South and North determine the allocation of their researchers between the clean and dirty sectors (by choosing appropriate research subsidies) and they play a sequential game in which North is the leader and South is the follower. Suppose that the payoff for South is long-run economic growth, while the payoff for North is an increasing function of both long-run economic growth and environmental quality. Accordingly, the unique subgame perfect Nash equilibrium of such a game is defined as follows:

-

The government in South will always choose research subsidies that ensure that Southern researchers work in the same sector as Northern researchers.

-

The government in North will choose research subsidies that ensure that all Northern researchers work for the clean sector.

Proof

In the text. \(\square\)

An important assumption in this game is that North is the first mover. Effectively, this means that the government in North must be fully committed to its initial decision: no matter what the decision of the Southern government may be, North must continue to subsidise the clean R&D.

5.4 Optimal Path for an Impatient South

In this subsection, we illustrate why the impatient central planner might choose to keep research resources in the dirty sector.

5.4.1 Large Technological Distance

When dirty technology is significantly more advanced than clean technology (\(\frac{A_d}{A_c}\) is large) and the dirty sector is relatively large, South may be unwilling to switch: If all researchers move over to work in the clean sector, the growing sector will be very small, due to the lower productivity, while the large sector will be stagnant, due to the lack of researchers and no technological progress in the dirty sector. Thus, the growth rate is small (see Eq. 21). The benefits of switching to clean R&D for consumers in South, as demonstrated in section 5.2, will materialise later, but the impatient central planner will not care about them.

We can formalize this argument using the model. For ease of exposition, we consider the case of symmetric regions (\(\omega =\mu =1\)). Note that the two paths have the same starting point at time \(\tau =0\), \(C_{0}\), whether \(s=1\) or \(s=0\). Consequently, the paths of consumption must be determined by consumption growth rates after the initial point.

Due to high discounting, the central planner will assign small weights to values in the distant future and thus will not be affected by growth rates in the distant horizon. Instead, the planner’s decision will be determined by the growth rates immediately after \(\tau =0\).

With symmetric regions, consumption in South could be expressed (by evaluating the right-hand side of (24)) as

so the growth rate at time \(\tau\) can be determined as a weighted sum of the growth rates of the three terms on the right-hand side. The weights are determined by the contribution of each term to total consumption and they depend on the relative size of the clean and dirty sectors.Footnote 11 Thus, if the size of the clean sector relative to the dirty sector is small, the weights on the first term and the third term are also going to be small.

Now suppose that the technological distance is initially large (\(\frac{A_{c}}{A_{d}}\) is small) and so the relative size of the clean sector \(\frac{p_{c\tau }Y_{c\tau }}{p_{d\tau }Y_{d\tau }}\) will be close to zero at \(\tau =0\). Consider the case in which there are no subsidies in South and therefore no movement from the dirty to the clean sector. Since \(s=0\), the productivities in the two sectors grow at the same rate (recall, we consider the case with \(\mu =\omega =1\)), the share of each sector is constant, and all three terms on the right-hand side grow at the same constant rate given by \(\frac{\alpha _X}{1-\alpha }\gamma \lambda\). Next, consider the choice of subsidies that ensure the movement from the dirty to the clean sector. In this case \(s=1\), and the revenue of the clean sector grows at the rate \(2\frac{\alpha _X}{1-\alpha }\gamma \lambda\) while revenue in the dirty sector remains stagnant.

Consequently, the first term—which captures labour compensation in the clean sector—grows at a high rate; however, its contribution to growth is small because the relative size of the sector will be close to zero at \(\tau =0\). Similarly, the third term may potentially have high growth rates; however, as in the case of the first term, its weight will be close to zero. Meanwhile, the second term, which is proportional to the output of the dirty sector, receives a large weight, but its growth rate will be zero.

Altogether, if the initial distance between technologies is sufficiently large, the growth rate of the economy at time \(\tau =0\) can be arbitrarily small (to show this formally, we also need to demonstrate that the growth is bounded, which we demonstrate in Appendix 3). In combination with the high discount rate, this implies that the South’s government will favour the status-quo by allowing the growth of the dirty sector rather than introducing subsidies that could incentivize the switch from dirty to clean R&D.

5.4.2 Cumbersome Catch-Up

In this section we investigate how the speed at which Southern technology firms capture the Northern markets (i.e. the speed of change in \(\phi _c\)) affects the decisions of a central planner in South. In section 5.2, we demonstrated that this speed is irrelevant to a patient central planner in South because consumer welfare depends primarily on long-run growth. However, speed may be a pivotal factor in the central planner’s decision-making if she or he is impatient.

Consider again the case of symmetric regions described in the previous subsection. As before the consumption can be expressed using Eq. (32) and the optimal choice of an impatient central planner will be determined by the growth rates immediately after \(\tau = 0\).

The growth of consumption can be evaluated using Eqs. (10), (14), (21) and (32). Suppose that initially Southern technology firms are absent from the clean market. In this case the growth rate for \(s=1\) (i.e. if the central planner moves all researchers to the clean sector) will be

and the growth rate for \(s=0\) (i.e. if the central planner keeps all researchers in the dirty sector) will be

In Appendix 5 we show that there exists a value of initial technological distance \(\frac{A_{c}}{A_{d}}\) for which the value of the expression in the square bracket in (33) is exactly equal to the value in (34). In the vicinity of this technological distance, the central planner decision will depend on the second term in (33), which depends on \(\left( \frac{d\phi _{c}}{d\tau }\right)\), i.e. the speed at which Southern technology firms capture the Northern markets.

The speed can be linked to the parameters of the model. The number of blueprints lost by South at each instance of time will be \(2\lambda \phi _c\), while the number of blueprints developed by researchers in South will be \(\lambda\), and so the path of \(\phi _c\) is determined by \(\frac{d\phi _c}{d\tau }=-2\lambda \phi _c+\lambda\). If initially Southern technology firms are absent from the clean market, then the speed of gaining blueprints will be given by \(\frac{d\phi _c}{d\tau }=\lambda\). If that speed is very high, the central planner will take into account the additional benefit of investing in clean R&D in terms of capturing the foreign market and will thus decide to switch to clean technologies.Footnote 12

5.5 Optimal Reaction of Government in South: Summary

To summarise the results on the optimal policy of the South, we have shown that the patient government will always set a policy that pushes the researchers in South toward the clean sector. The patient government should ensure that its consumers benefit from the ideas developed in North. If in the steady-state researchers in South and North work on two different and substitutable technological platforms, in the long run ideas developed in North will have no value for consumers in South because production there is based on the dirty technology platform. If instead the Southern and Northern researchers work on the same platform, then they will build on each other’s ideas. Given the commitment of North to clean R&D, the South’s government should not allow technology firms to remain focused on dirty technologies if its objective is ultimately to maximise the long-run growth of consumption.

If the Southern government is impatient, redirecting Southern researchers to the clean sector is not always optimal. Such a move involves high opportunity costs in the short run: redirecting R&D effort away from the dirty technology platform implies that in the first years the largest economic sector is stagnant. Whether or not future growth outweighs the short-run cost depends on factors such as the discount rate, the speed at which Southern firms can capture clean markets, and the distance between clean and dirty technologies. In addition, the relative size of the R&D sector in North may play a substantial role too. If the North’s R&D sector is much smaller than that of the South, then its potential contribution to long-run growth will be small, and, accordingly, the benefits of working on one technology platform will be small. On the other hand, if the size of the R&D sector in North is comparable to that of the South, the benefit of faster long-run growth could be substantial.

The argument above shows that the long-run decarbonisation of the global economy depends on the R&D potential of the coalition of countries committed to support clean R&D. If the coalition has a majority or near-majority in the global R&D potential, other countries will switch to clean R&D too and emissions will fall in the long run. If the coalition is too small, however, the other countries will continue to work on dirty technologies if they are impatient.

6 Policy Options and Tradeoffs for North

In the previous section we discussed the welfare-maximising choices of research subsidies by South and briefly examined the optimal R&D policies by North in the Sub-game Perfect Nash Equilibrium. In this section we take the perspective of North and provide an informal discussion of its policy options. We go beyond simple policy instruments discussed in our model and explore the implications of our results for the potential accompanying policies such as sharing knowledge, strengthening the research capacity of the other region, and protecting legal rights to the blueprints.

The policy in North should encourage competition between researchers in North and South over the clean technology markets. Preventing Southern researchers from standing on the shoulders of technological giants in North would push them back to the dirty sector. At best, if the Southern R&D sector is smaller than the sector in North, the distance between dirty and clean technologies would decrease more slowly compared to a scenario in which everyone works on the clean technology platform. At worst, if the South’s R&D sector is larger than the North’s, preventing Southern researchers from using Northern knowledge would result in faster technological progress in dirty technologies relative to clean technologies. Note that in this case, the Southern government has no incentive to subsidise clean research regardless of how patient it is.

Indeed, North could increase the likelihood of Southern researchers joining the clean technology platform by adopting measures that improve the capacity of researchers in South to adapt and improve clean technologies developed in North. Concrete examples of this include training for engineers in South, financing common clean R&D projects, and perhaps technology transfer and licensing. This policy reduces the profits of technology firms in the short run (see the static market capturing effect described in section 3.1) but increases consumer welfare in the long run.

However, increasing the capacity of South to improve clean blueprints must not eliminate the legal protection of blueprints developed in North. Legal protection ensures that successful innovators in North receive a stream of monopoly rents. If there is no such stream, the market returns to innovations in North are zero.Footnote 13 Indeed, the presence of temporary monopoly rents is essential for long-run technological progress (see the discussion on monopolistic competition among innovators in Romer (1989) and more recently Acemoglu (2008)).

7 Conclusions

Building on the framework of Acemoglu et al. (2012) and Grossman and Helpman (1991), we have presented a North–South model in which both regions can innovate in clean or in dirty technologies and which allows the regions to trade in technology goods (i.e. machines that embody the innovations). A successful innovation in South allows the innovator to capture the domestic market and, if the innovation is applicable externally (which is the case with exogenous probability), to capture the market in the Northern region as well. A successful innovator will then receive a stream of profits until this market is ‘stolen’ by a subsequent innovation, which may come either from South or the North.

We show that an incentive to steal the markets for clean technology can lead researchers in South to shift their research effort towards these technologies and abandon their work on dirty technologies. A sufficient condition for this to occur is that the Northern R&D sector is larger than South R&D sector - i.e. if the Northern coalition is sufficiently wide.

We examined the macroeconomic effects of the two possible asymptotic steady states: one in which all researchers are working in the clean sector and one in which researchers are split, with all Southern researchers working in the dirty sector and all Northern researchers working in the clean sector. Ironically, while at the micro level the concentration of all researchers in the clean sector produces the strongest possible business stealing, at the macro level, such concentration produces the fastest possible economic growth. The entire global research effort is focused on building growth in the clean sector, which in the long run determines the final output growth in both regions. In the alternative asymptotic SS, the global research effort is split between two sectors producing substitutable goods. Due to this substitutability, the size of the clean sector in South shrinks to zero in the long run, while the aggregate economy in South will not benefit from any innovations developed in North.

Finally, we endogenised the behaviour of the governments in the two regions. When the Southern government cares only about long-run growth, its optimal strategy will always be to set research subsidies that ensure the Southern researchers will be working in the same sector as the Northern researchers. If the Northern government values both long-run growth and the quality of the environment, the only possible subgame perfect equilibrium in this setup is the one in which subsidies are used to ensure that both regions work only on the growth of the clean sector. Importantly, this result rests on the assumption that both governments place less emphasis on the economic costs of the policy during the transition period. It also rests on the assumption that the Northern region can commit to its strategy of supporting clean technologies and will not alter its strategy under any circumstances.