Asbstract

We model the value chain of Carbon Capture and Storage (CCS) by focusing on the decisions taken by actors involved in either capture, transport or storage of CO2. Plants emitting CO2 are located apart. If these invest in carbon capture facilities, the captured CO2 is transported to terminals, which again transport the received amount of CO2 to a storage site. Because of network effects, we may have three equilibria: one with no CCS, one with low investments in CCS, and one with high investments in CCS. In a numerical specification of the model, we find that the market for CCS may be in a state of excess inertia, i.e., even if the social cost of carbon is sufficiently high to justify investment from a social point of view, the market actors may not succeed in coordinating their efforts to reach the equilibrium with high investment. The government should then consider offering economic incentives to investments. In addition to the network effect, several other market imperfections exist, such as market power, economics of scale and the environmental externality from CO2 emissions. We identify policy instruments—in addition to a correctly set carbon tax—that will correct for the remaining market imperfections and bring private investments in line with the first-best levels. Without correction, too many terminals are set up and too few plants invest in capture facilities in our reference market structure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

According to IPCC (2014), Carbon Capture and Storage (CCS) should be a key technology to reduce CO2 emissions from power production and industrial sources. The costs of stabilizing CO2 in the atmosphere at 450 ppm by 2100, which is in accordance with the 2 °C target, will increase by 138% if CCS is not used (IPCC 2014, Table SPM.2). CCS is also important for a more ambitious 1.5 °C climate target (IPCC, 2019), and IPCC (2022) states that carbon dioxide removal, including CCS from bioenergy and direct air capture, is necessary to reach both the 1.5 °C and the 2 °C target. Investments in CCS have, however, not been in line with studies simulating the cost-efficient path to the Paris Agreement target, see, for example IEA (2018). Our objective is to study the reason for this gap.

Several reasons have been mentioned in the literature (see Sect. 2 below). One reason is the discrepancy between costs of developing a CCS value chain and the alternative cost of paying a CO2 tax. While cost estimates differ between sources and sectors (Rubin et al. 2015), even the minimum estimate of the aggregate cost of capture, transportation and storage exceeds historic average annual EU ETS prices (Trading Economics 2022). However, since early 2020, the EU ETS price has been increasing, and it may become even higher because the European Climate Law now covers the goals set out in the European Green Deal. As CCS is a long-term investment, the expected future EU ETS prices may be high enough to justify investments in Europe today.

This paper will look at the role of CO2 prices. However, its main contribution is to study the role of imperfections in the markets, such as network effects, market power and economies of scale.

There will be indirect network effects in a CCS value chain: more terminals collecting CO2 from plants will lower the average distance between CO2 emitting plants and terminals, and thus lower the cost of plants to transport captured CO2, and vice versa, more plants investing in capture facilities will increase demand for terminal services. A key challenge is thus to overcome the coordination problem: A plant may not be willing to invest in capture facilities before a reliable solution for storage of captured CO2 exists, for instance that terminals are established that can transport the CO2 to a storage site. Likewise, an actor considering investing in a terminal may not be willing to do so before being confident that there are customers demanding terminal services.

Even if the coordination problem is solved, key characteristics of a potential CCS value chain may undermine investments due to additional market imperfections. First, plants investing in carbon capture facilities will deliver their captured CO2 to the nearest terminal, which may exercise local monopoly power when setting the fee to receive the captured CO2. Second, there is economies of scale in transporting captured CO2 from terminals to a storage site. Third, also the storage actor offering deposit services will be a potential monopolist.

All these factors call for public policy both to coordinate the interests of the actors and to correct the market outcome for other imperfections. The purpose of this paper is to provide a theory-based examination of the market imperfections of a CCS value chain, and use the insights to suggest policy instruments to ensure that once the social cost of carbon (SCC) is sufficiently high to justify CCS investment, the first-best investment levels will materialize along the CCS value chain.

To analyze the CCS value chain, we use the Salop circle model (Salop 1979) as it can handle market power, indirect network effects, and spatial economic activities. In our application of the model, plants are spatially distributed along the circle. Initially, no plant has carbon capture facilities, but through endogenous investments, plants may decide to invest in capture facilities. Furthermore, initially there are no terminals to receive captured CO2 from plants, but terminals may be set up along the circle if such investments are profitable. Terminals transport the received CO2 to a storage site, which is located in the center of the circle. This model set-up is particularly relevant for our numerical case. Geological formations in the North Sea are well explored, and many are found to be compatible with CO2 storage. Moreover, CO2-emitting plants are located close to the coastal line in Belgium, Denmark, Germany, the Netherlands, Norway, Sweden, and the UK, thereby virtually forming a circle around the North Sea.

We calibrate the model to real data and solve it numerically. In the base case, there are three possible equilibria due to the indirect network effects. The equilibrium with the highest CCS market share has higher welfare than the other two equilibria. Without solving the coordination problem, we may end up in the low equilibrium giving excess inertia, see Farrell and Saloner (1986): higher investment in the CCS value chain will improve welfare. The government needs to find instruments to solve the coordination problem. This can be done by providing temporary subsidies to CCS investments. However, since our model is static we cannot analyze the optimal temporary subsidies explicitly.

Assuming that the market has coordinated on the high CCS equilibrium, we can compare the outcome in the base case when no policy instruments are used (except a Pigovian carbon tax) to the first-best social outcome. We find that even if the market succeeds in coordinating on the welfare dominant equilibrium, the share of plants investing in carbon capture facilities is lower than what is socially optimal. The deviation from the first-best outcome reflects non-competitive pricing of terminal services. Moreover, due to the economies of scale combined with free entry, more terminals are set up than what is socially optimal.

We identify instruments to correct for the deviations from a competitive economy, and we also look at two alternative market structures. In the first, we allow the storage provider to operate as a monopoly, and in the second, the storage actor vertically integrates with the terminals and they form a cartel. One conclusion is that the most important policy challenge is to overcome the coordination problem. The welfare gains of regulations to correct for the other market imperfections are limited.

The paper is organized in the following way. Section 2 provides a short literature review and explains our contributions to the literature. In Sect. 3, we present the basic structure of the theory model, while Sects. 4 and 5 give the social optimum and the equilibria for the different market structures. We provide numerical illustrations in Sect. 6, and discuss instruments to solve the coordination problem and to correct for the remaining market failures in Sect. 7. In Sect. 8, we examine scenarios that differ with respect to the welfare gain of investing in CCS, whereas in Sect. 9 we discuss our main results. Finally, Sect. 10 concludes.

2 Contribution to the Literature

Several reasons for the low investments in CCS have been studied in the literature. These include uncertainty about CCS investment costs (Lohwasser and Madlener 2012), shortage of professionals to undertake R&D in CCS as this activity tends to compete with oil and gas development projects (Budins et al. 2018), legal matters (Herzog 2011), public resistance to storage and fear of leakages (van der Zwaan and Gerlagh 2016), and bad model predictions of CCS development because of either underestimation of costs of CCS or overestimation of costs of other mitigation options (Durmaz 2018).

However, a main focus in this paper is network effects. According to Farrell and Klemperer (2007), the consumption of a good has positive network effects if one agent’s purchase of the good i) increases the utility of all others who possess the good, and ii) increases the incentive of other agents to purchase the good. The network effect may be indirect like in our model: If one more plant invests in a capture facility, demand for transportation services to the storage site increases, thereby making investment in terminals more profitable. With more terminals, the average distance between a plant and a terminal decreases, and hence the cost of transporting CO2 from all plants with capture facilities is reduced.

As far as we know, Greaker and Heggedal (2010) was the first paper to use the Salop model to study indirect network effects. They focus on the demand for clean and dirty cars, which will depend on the available refueling network. The first contribution of our paper is to examine indirect network effects in the CCS value chain. Instead of having consumers with heterogeneous tastes, we have plants with heterogeneous costs of investing in a capture facility.

In the original Salop model, firms pay a fixed entry cost to enter a market with a given demand. Firms are spatially differentiated along a circle and can charge a mark-up over marginal costs because consumers located near them can save transport cost by buying from the nearest firm. Firms enter until profit is zero, which in the Salop model leads to excessive entry (Tirole 1988). Our second contribution is to extend the Salop model along two dimensions: we introduce variable demand, i.e., the share of plants investing in capture facilities is endogenous, and we include another source for imperfect competition, namely a monopoly storage actor, which is located in the center of the Salop circle.

Chou and Shy (1990) is an early contribution analyzing indirect network effects. In their model, the utility derived from a consumer product depends on the supply of a complimentary consumer product. There is no spatial differentiation in the supply of the complimentary product, and hence no reason to use the Salop model as we do. Furthermore, Meunier and Ponssard (2020) examine indirect network effects in the market for alternative fuel cars. They do not use the Salop model but allow the utility of driving a car to depend on the size of the refueling network. They find that both re-fueling stations and alternative fuel cars should be subsidized in the early stages of market development.

In Meunier and Ponssard (2020), there is no excess entry of refueling stations as we have for terminals. Hence, we obtain a somewhat different policy package: subsidies to the CO2 deposit actor, but a tax on entry of CO2 collecting terminals. Note, however, that the entry tax follows from our use of the Salop model. In comparison, Greaker (2021) looks at indirect network effects between electric vehicle owners and fast charging service suppliers. He uses the monopolistic competition model to study the entry of fast-charging stations and find that both the entry of stations and the actual charging of vehicles should be subsidized.

Both the models of Meunier and Ponssard (2020) and Greaker and Heggedal (2010) are, like our model, essentially static. Thus, these models cannot analyze optimal policies in the transition period when the market moves from one equilibrium to another, e.g., from zero CCS to a low market share for CCS (the tipping point, see the discussion in Sect. 6.1) and finally, to a high market share for CCS. In contrast, Greaker and Midttømme (2016) offer a dynamic analysis of network effects. In their model, an old network entails environmental externalities (the dirty network), while a new network does not (the clean network). The two networks evolve over time depending on how the environmental externality is taxed. Greaker and Midtømme (2016) show that imposing a temporarily tax on the dirty network far above the Pigovian rate may be desirable in order to coordinate a transition to the clean network. This suggests that governments should consider intervening in the market for CCS in order to get the CCS technology pass the tipping point.

The empirical CCS literature encompasses two strands; one on CCS cost estimates, see, e.g., ZEP (2011a) and Rubin et al. (2015), and one on the diffusion of CCS technologies. The latter mainly uses electricity market models to study diffusion of CCS in the electricity generation sector in Europe, see, e.g., Golombek et al. (2011), Marañón-Ledesma and Tomasgard (2019), and Aune and Golombek (2021).Footnote 1 We build on the first strand and contribute to the second.

Several papers support that CCS should have a key role in reaching ambitious climate targets, see, e.g.,, Gerlagh and van der Zwaan (2006) on standard cost-efficiency concerns, van der Zwaan and Gerlagh (2009) on the cost efficiency of CCS when geological CO2 leakage is accounted for, and Weitzel et al. (2019) on the role of CCS to cut non-CO2 emissions. However, to the best of our knowledge, our paper is the first to model diffusion of CCS technologies explicitly by taking into account market imperfections like network effects and imperfect competition, although these deviations from a competitive economy clearly exist, and to calibrate such a theory-based model to real world data. This is our third contribution to the literature.

3 The Theory Model

We adjust and extend the standard Salop model to capture key features of the CCS value chain. The consumers in Salop (1979) are replaced by CO2-emitting plants, and the firms in Salop (1979) are replaced by CO2 collecting terminals.

We assume that a fixed number of plants are located evenly around a circle. Initially, all plants emit CO2, and total emissions are equal to \(E.\) Plants emitting CO2 have to pay a tax \(\tau\) per unit of emission, which is set equal to the social cost of carbon, thereby correcting for the negative environmental externality. Alternatively, a plant can install capture facilities and transport the CO2 to a terminal, which is also located on the circumference.

Initially, there are no terminals. We assume, like in the standard Salop model, that once terminals enter, they locate evenly around the circle.Footnote 2 Let n denote the number of terminals and \(S\) the length of the circumference. Hence \(\frac{S}{n}\) is the distance between two neighboring terminals. The maximum distance between a plant and a terminal is then \(\frac{S}{2n},\) whereas the minimum distance is zero. As plants are evenly distributed along the circle, the average distance between a plant and a terminal is \(\frac{S}{4n}.\) Further, let t be the cost of transporting one unit of CO2 to a terminal per unit of distance, where we assume that this price is set in a competitive market. Then the average cost of a plant to transport one unit of CO2 to a terminal is \(\frac{tS}{{4n}}.\)

Let x be cost of investment in capture facilities of a plant, per unit of emission. We assume that this unit cost differs across plants, from \(\underline {x}\) to \(\overline{x}\), reflecting that plants belong to different sectors, for example, aluminum, cement production, waste management, or fossil-fuel based electricity supply. To make the model tractable, we assume that for any segment along the circle the distribution of the investment cost per unit of emission is uniformly distributed.

We now examine which plants will invest in carbon capture facilities. Let \(\hat{x}\) denote the unit cost of investment of a plant which is indifferent between (i) paying the carbon tax \(\tau\) and (ii) investing in carbon capture facilities and then transporting the captured CO2 to the terminal. Hence, plants with a lower unit cost of investment than \(\hat{x}\) will invest in capture facilities.

Then, let q denote the share of plants investing in capture facilities along the circle. Because the distribution of cost of investment per unit of emission is uniformly distributed for any segment, q is given by

Finally, as q measures the share of (all) plants investing in capture facilities, total abatement is \(qE\) and total cost of transport is \(\frac{tS}{{4n}}qE\).

Next, we assume that the distribution of the unit investment cost is independent of the distribution of emissions. Under our assumption of cost of investment being uniformly distributed, we can write the total costs of investment in capture facilities as:

We then move on to the terminals receiving CO2 and transporting it for storage. Each terminal has a fixed entry cost, a, that reflects investment in i) facilities to receive captured CO2 from plants, and ii) a terminal-specific offshore pipeline that transports the received CO2 to the storage site. As this cost is fixed, the cost per unit of CO2 handled will be falling in quantity, and thus we have economies of scale. All terminals will receive the same amount of CO2 from plants, \(\frac{qE}{n}\) (where q and n are endogenous variables).

Terminals charge plants for their delivered amount of CO2, and correspondingly, terminals are charged by the storage actor for the amount of CO2 they deposit. Let \(v\) denote the unit cost of storage. Hence, total cost of the storage actor is \({ }vqE.{ }\)

4 Social Optimum

We start by deriving the social optimum, that is, how many terminals \((n)\) should be set up and the share of plants \((q)\) that should invest in carbon capture facilities from a social point of view. The social cost is the damage from non-abated carbon emissions and the cost of abatement. It consists of five terms: cost of emissions of those plants that are not abating, \(\left( {1 - q} \right)E\tau ,\) cost of those plants that are investing in capture facilities, \(E\int_{{\underline {x} }}^{{\hat{x}}} {\frac{r}{{\overline{x} - \underline {x} }}{\text{d}}r,}\) cost of plants to transport CO2 to terminals, \(\frac{tS}{{4n}}qE,\) cost of entry of terminals, \(an,\) and cost of storage, \(vqE.\) The objective of the planner is to minimize social cost with respect to the share of plants investing in capture facilities (q) and the number of terminals (n) entering the market, i.e., to minimize:

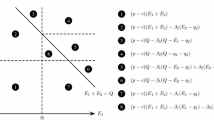

The first-order conditions with respect to q and n are, respectively,

where we have used used (1). Relations (2) and (3) determine the social optimal share of plants investing in CCS, qsoand the social optimal number of terminals, nso where SO denotes the social optimum. According to (2), q is an increasing function in n. Furthermore, relation (3) shows that n is an increasing function in q. From the discussion below on Result 1 and Fig. 1, it will be clear that the set of Eqs. (2) and (3) have two solutions; one with “low” values and one with “high” values of q and n; in our empirical illustration the latter is the first-best social outcome (Sect. 6).

5 Market Outcomes

In this section, we examine how the share of plants investing in capture facilities and the number of terminals are determined under three alternative market structures. Each case is analyzed as a multi-stage game within our static model. In the base case, referred to as regulated storage, the government sets the price of deposit services. This regulation can be rationalized as a way to correct for the potential exertion of market power by the single deposit supplier. In another case, the single deposit supplier has merged with the terminal actors to form a cartel. This case mimics the basic structure of the Northern Lights project in the North Sea, which covers the first CCS terminal and commercial deposit; see Sect. 9 for more details. Finally, we have included a case, which takes an intermediate position—monopoly storage. Here, there is no collusion between terminals and the deposit supplier, and the price for deposit services is not regulated by the government.

5.1 Regulated Storage

In this game, the storage actor is regulated and must charge a price for storage services, \(z,\) that is equal to its unit cost \(v.\) In contrast, each terminal sets the price that maximizes its profit.

In stage one of the game, plants decide whether to invest in capture facilities. Furthermore, potential terminal actors decide whether to set up terminals. In stage two of the game, terminals decide how much to charge plants for delivering their CO2, and each plant with capture facilities decides to which terminal it will deliver its CO2. Plants without capture facilities pay the carbon tax.

Since plants do not know the actual location of the terminals when they invest, and terminals do not know how many plants there will be with capture facilities when they enter, we look for a perfect Bayesian equilibrium (PBE). Each plant’s belief about the transportation cost of CO2 is based on the average distance to a terminal, i.e., \(\frac{tS}{{4n}}\), and each terminal believes that a share of plants, given by (1), will invest in capture facilities; these are beliefs that are consistent with a PBE. We can then solve the game by backward induction.

5.1.1 Regulated storage—stage two

We first derive the demand for CO2-deliveries to terminals. A plant that has invested in capture facilities (in stage one) chooses which terminal to transport its captured CO2. Denote the two terminals located closest to a plant by \(\alpha\) and \(\beta ,\) and let \(p_{\alpha }\) and \(p_{\beta }\) be the prices per unit of received CO2 charged by the two terminals, respectively. If a plant transports its CO2 to terminal \(\alpha ,\) its cost of transport per unit of CO2 will be \(td\) where d is the distance to terminal \(\alpha .\) In addition, the plant has to pay \(p_{\alpha }\) for each unit of CO2 delivered to terminal \(\alpha .\) The distance d that makes a plant indifferent between transporting its CO2 to terminal \(\alpha\) or terminal \(\beta\) is defined from Eq. (4),

where \(S/n - d\) is the distance between the plant and terminal \(\beta ,\) and \(p_{\beta }\) is the price charged by terminal \(\beta .\) Solving (4) with respect to d, we find

Hence, plants with a lower distance to terminal \(\alpha\) than the one in (5) will transport its CO2 to terminal \(\alpha .\)

Above, we defined q as the share of plants investing in capture facilities (in any segment along the circle). Therefore, a terminal receives CO2 from a share q of all plants located less than d from its location; this is the case on both sides of its location. Furthermore, because \(qE/S\) is the average amount of CO2 transported per unit of distance, the total amount of CO2 received by a terminal is found by using (5):

We then look at the equilibrium CO2-delivery prices. In stage two of the game, costs of investment are sunk and hence terminal \(\alpha\) will choose the price \(p_{\alpha }\) such that the profit \(\left( {p_{\alpha } - z} \right)D\left( {p_{\alpha } ,p_{\beta } } \right)\) is maximized, where \(z = v\) is the unit cost of the terminal, that is, the price the terminal has to pay to the storage actor for each unit of CO2 it deposits. All terminals solve the same type of problem, and in a symmetric equilibrium the common price will be

In the regulated storage case, the term \(\frac{tS}{n}\) represents the mark-up of a terminal, reflecting that terminals execute market power.

5.1.2 Regulated storage—stage one

Each plant decides whether to invest in capture facilities or pay the carbon tax \(\tau .\) If the plant invests, it faces three cost components: the known cost of investment (x), the expected cost of transport \(\left( {tS/4n} \right)\) and the expected price paid to the terminal (p). A plant being indifferent between these two choices has a unit cost of investment equal to \(\hat{x},\) where \(\hat{x}\) is the solution of

The left hand side of (8) shows the marginal cost of a plant that is not abating, i.e., the carbon tax, whereas the right hand side shows the marginal abatement cost of the marginal plant. Using (1), (7) and (8) we find the equilibrium share of plants that chooses to abate:

Relation (9) is the optimal response of plants considering to invest in capture facilities, that is, for a given number of terminals, \(n,\) it shows the share of plants that will invest in capture facilities. Like in the social optimum, more terminals increase the share of plants investing in capture facilities.

By comparing the optimal response of plants in the social optimum and in the current case of regulated storage, we see that the term \(- \frac{tS}{{4n}}\) in (2) has been replaced by \(- \frac{5tS}{{4n}}\) in (9). The difference \(\left( { - \frac{tS}{n}} \right)\) reflects execution of market power by terminals (under regulated storage), see (7), which tends to lower the share of plants investing in capture facilities.

The profit of a terminal is the difference between revenues and costs in the two stages of the game. First, in stage one of the game there is a cost of establishing a terminal, a. Second, profit from stage two in the game is \(\left( {p_{\alpha } - z} \right)D\left( {p_{\alpha } ,p_{\beta } } \right)\). As \(p_{\alpha } = p_{\beta } = z + tS/n,\) see (7), the net revenue from stage two is given by \(tqES/n^{2} ,\) where we have used (6). In line with the original Salop model, we assume free entry so that in equilibrium, profit will be zero:

Thus

Relation (10) is the optimal response of terminals, i.e., for a given share of plants that has invested in capture facilities, \(q,\) it shows the number of terminals that will be set up. As seen from (10), a higher share of plants investing will, cet. par., increase the number of terminals that enters the market. Note that (10) looks similar to (3), which shows the optimal response of terminals from a social point of view. The only difference is that the denominator in (3) is four times higher than the denominator in (10). Hence, an increase in the share q has a higher effect on terminal entry under regulated storage than what is socially optimal.

Finally, we simply assume that the rational, forward-looking storage actor knows that the total amount of received CO2 will be \(qE,\) and thus, its capacity cannot be lower than this magnitude.

Relations (9) and (10) determine the share of plants investing in capture facilities, \(q^{v} ,\) and the number of terminals, \(n^{v} ,\) where \(v\) denotes the current case of a regulated price of storage services. Because of the non-linearity of these relations, there may be more than one internal solution to this system of equations:

Result 1 The solution to (9) and (10) may not be unique. There may be two internal solutions with a positive share of plants investing in capture facilities and a positive number of terminals. Denote these two solutions (\(q_{l}^{v} ,n_{l}^{v} )\) and (\(q_{h}^{v} ,n_{h}^{v} )\). We have \(q_{l}^{v} < q_{h}^{v}\) and \(n_{l}^{v} < n_{h}^{v}\).

Proof

Relation (9) and (10) can be combined to yield the following cubic equation:

where Y \(= \sqrt q\).

For some parameter values, the cubic equation has two real roots yielding the two solutions (\(q_{l}^{v} ,n_{l}^{v} )\) and (\(q_{h}^{v} ,n_{h}^{v} )\), see also Fig. 1 below and Greaker and Heggedal (2010) for a more detailed proof of a similar result.

We will return to a discussion of the two internal solutions in Sect. 6. There we will argue that the equilibrium with the lowest number of terminals and share of plants investing in capture facilities will be unstable, whereas the other equilibrium is stable.

Below, we give a short presentation of the two other market structures, namely monopoly storage and cartel. We refer to Appendix A for a detailed presentation of these two cases.

5.2 A Monopoly Storage Actor

Let the storage actor be free to set a storage fee \(z\) that maximizes its profits. This game evolves over three stages. In stage zero, the rational, forward-looking storage actor commits to a storage fee z. Investment in carbon capture facilities by plants and the number of terminals to be build are determined in stage one, whereas the price p that plants have to pay for delivering CO2 is determined by each terminal in stage two.

Because stage one and two are identical to the case of regulated storage, Eqs. (9) and (10) above also apply in the case of monopoly (m) storage, except that now the price of storage services, \(z = z^{m} > \nu ,\) is the one that maximizes the profit of the monopoly storage actor, see (14) in Section A.1 in the Appendix A.

5.3 Vertical integration—cartel

Now, we examine that case where the terminals and the single storage actor merge to form a profit-maximization cartel. When maximizing profits, the cartel considers how the price charged on plants affects their decision to invest in capture facilities.

In Section A.2 in the Appendix A, we show that the equilibrium in this game is the solution of two equations, namely (3) above and

Because both the social planner and the profit-maximizing cartel chooses, for any share of plants investing in carbon capture facilities, the number of terminals that minimizes total costs of terminals, (3) characterizes both the social optimum and the market with vertical integration. In contrast, the social planner chooses, for any number of terminals, the share of plants investing in capture facilities that minimizes total costs of plants, whereas the cartel neglects that the mark-up it imposes on plants distorts their investment decisions. Therefore, the response curve of plants differ between the social optimum, see (2), and the case of a cartel, see (11).

Table 1 summarizes the three market outcomes and the first-best social outcome. For each case, we have specified the set of equations that determines the share of plants investing in capture facilities and the number of terminals that will be set up.

6 Empirical Illustrations

In this section, we offer empirical illustrations of the three market outcomes and the first-best social outcome. We assume the Salop circle covers six countries (Norway, Denmark, Germany, Belgium, the Netherlands and the UK), and that the center of the circle is in the North Sea, where there are suitable underwater geological formations for CO2 storage. Table 2 shows the benchmark parameter values; these are ballpark estimates based on data from the geographical area and the general literature that ensure internal solutions of the four outcomes discussed above. We refer to Appendix B for a documentation of the data sources.

6.1 The Four Outcomes

Figure 1 shows the four outcomes. For each case, there are two equations that give relationships between the share of plants investing in carbon capture, \(q,\) and the number of terminals, \(n,\) see Table 1. Note that for each of the three alternative market structures (regulated storage, monopoly storage and cartel), there are two points where the relevant curves cross. These are two equilibria, each with positive numbers of terminals and shares of plants investing in carbon capture facilities, see Result 1 above.

For each market structure, the two relations determining the equilibria are optimal response curves. Using these relations and the standard condition of stability, see, for example, Greaker and Heggedal (2010), it is straightforward to show that (for each market structure) the equilibrium with the lowest values of \(q\) and \(n\) is unstable, i.e., a tipping point, whereas the equilibrium with the highest values of \(q\) and \(n\) is stable.

To derive the equilibria in Fig. 1, we assumed internal solutions in Sect. 5. There is, however, also a corner solution for each of the three market structures. This is a trivial equilibrium with no investment neither in capture facilities nor in terminals: If no plant invests in capture facilities, there will be no demand for terminal services and thus no terminals will be built. Similarly, if no terminals are set up, plants will not be able to handle their captured CO2, and thus there will be no investment in capture facilities.Footnote 3

In the discussion below, for each market structure we focus on the internal, stable equilibrium. This equilibrium has lower social cost than the corresponding unstable equilibrium and the trivial equilibrium.

The first-best social optimum is found where the curves representing relations (2) and (3) intersect. Here, 46 percent of the plants invest in CCS and there are 5.94 terminals, see Table 3.Footnote 4 Needless to say, the social cost is lowest in the social optimum, see Table 3. It is also about 10% lower than the social cost with no CCS. If the Pigovian tax \(\tau\) increases, the response curve of plants, (2), shifts outwards, whereas the response curve of terminals, (3), is not affected. Therefore, a higher tax \(\tau\) will for sure increase the optimal (first-best) share of plants investing in capture facilities and the optimal (first-best) number of terminals.

In the case of a regulated storage actor (Case 1), the equilibrium is found where the curve illustrating relation (9) (with the price of storage services, \(z,\) being equal to the cost of storage, \(v)\) intersects with the curve representing restriction (10). With a monopoly storage actor (Case 2), the actor sets the price for deposit services that maximizes profits. Like in Case 1, the equilibrium is found where the curves illustrating relations (9) and (10) intersect, but now the price of storage in relation (9) exceeds the cost of storage \((z > v).\) Therefore, the curve illustrating relation (9) in the monopoly storage case is located above the curve illustrating relation (9) in the regulated storage case, see Fig. 1.

As seen from Table 3, both under regulated storage and monopoly storage the number of terminals (11.11 and 8.14) is greater than in the first-best social optimum (5.94). The reason for this is that neither the storage actor nor the individual terminal owners internalize the economies of scale effect in transport of CO2. On the other hand, a lower share of plants invests in carbon capture facilities under regulated storage (40%) and monopoly storage (21%) than in the social optimum (46%), which reflects market power of terminals (in Case 1 and Case 2), and also market power of storage supply in Case 2.

If a cartel owns all terminals and the storage site (Case 3), the equilibrium is found where the curves illustrating relations (3) and (11) intersect. Here, 22 percent of the plants invest in carbon capture facilities and the number of terminals is 4.13. Hence, there is a lower share of plants investing in carbon capture facilities and also fewer terminals than in the social optimum (22% vs. 46%, and 4.13 vs. 5.94). The two outcomes differ because of the exploitation of market power by the cartel in determining the price p that plants face when delivering CO2 to terminals. The mark-up element of this price, \(tS/n,\) see (7), discourages plants to invest in carbon capture facilities, and potential terminal actors respond by setting up fewer terminals, see (3).

We summarize our findings in the following result:

Result 2 In all three market outcomes, the share of plants investing in carbon capture is lower than in the social optimum leading to higher social cost than in the first best. Of the three market outcomes “monopoly storage” has highest social cost followed by “the cartel”, while “regulated storage” comes closest to the first best.

Also note that with regulated storage and monopoly storage, the equilibrium number of terminals is greater than in the first-best social outcome, whereas the ranking is opposite for a cartel. On the one hand, many terminals lowers the transport distance of captured CO2 between plants and terminals. On the other hand, many terminals implies less utilization of economics of scale. In the first-best social outcome, the balance between these two conflicting considerations is optimal, while in the market outcomes in which terminals enter independently, the so-called business stealing effect leads to excess entry, see Tirole (1988). As already mentioned in the literature review section, not all models with indirect network externalities do necessary lead to excess entry in the supply of the complimentary product (here: handling captured CO2 and transporting it to a storage site).

6.2 The Importance of the Carbon Tax

In Sect. 6.1 we presented numerical values for the four outcomes, using the benchmark parameter values. In particular, we imposed a carbon tax of 90 euro2016/tCO2 and assumed that also the social cost of carbon (SCC) is 90 euro2016/tCO2. Whereas 90 euro2016/tCO2 is in line with international studies on the emission price needed to reach the two-degree target of the Paris agreement, see Appendix B, the CO2 price in the EU ETS market has almost always been lower than 90 euro/tCO2; see Trading Economics (2022). While a government can impose an additional tax on top of the EU ETS price to reach a total price of 90 euro/tCO2, no European country has to date implemented such a policy directed at emission-intensive plants in the electricity sector or in the manufacturing industries. Below, we therefore consider the more interesting case where the SCC is lower than 90 euro/tCO2 and (as above) the carbon tax \(\tau\) is set equal to the SCC.

From (2) (social optimum), (9) (regulated storage and monopoly storage), and (11) (cartel) we see that a lower carbon tax \(\left( \tau \right)\) tends to lower the share of plants investing in capture facilities. This will, cet. par., lower the number of terminals, see (3) (social optimum and cartel) and (10) (regulated storage and monopoly storage).

By varying the SCC, and thus changing the carbon tax accordingly, we find that as long as the carbon tax is at least 69 euro/tCO2, all three market outcomes have internal solutions (when no additional instrument is used). With a somewhat lower carbon tax than 69 euro/tCO2, there is no internal solution for regulated storage and storage monopoly (when no additional instrument is used), whereas there is CCS investment under a cartel. However, once the carbon tax is below 60 euro/tCO2 there is no CCS investment in any of the market cases if no additional policy instrument is introduced. Still, as long as the carbon tax exceeds 56 euro/tCO2, it is optimal from a social point of view to invest in CCS.

We summarize these findings in the following result:

Result 3 If the social cost of carbon is above 56 euro/tCO2, it is socially optimal to invest in CCS. Suppose no additional policy instruments other than a carbon tax are used, and that the carbon tax faced by plants is set equal to the social cost of carbon. Then there will be no investment in CCS in market Cases 1 and 2 if the social cost of carbon is below 69 euro/tCO2. Similarly, there will be no investment in CCS in market Case 3 if the social cost of carbon is below 60 euro/tCO2.

Result 3 suggests that CCS could be locked out from the market if the social cost of carbon is too low to sustain socially profitable CCS investments; the threshold value is 56 euro/tCO2, which was the EU ETS price in the summer of 2021, see Trading Economics (2022). With a carbon tax between 57 and 68 euro/tCO2 and no additional instruments, there will be (i) no CCS investment under regulated storage and monopoly storage even though such investments are socially optimal, and (ii) positive CCS investment under a cartel, but the level of investment will differ from the first-best outcome. Finally, with a carbon tax exceeding 68 euro/tCO2 there will be positive CCS investment under all three market structures even if no additional policy instrument is imposed, but investments in capture facilities and terminals will differ from the first-best social values.

7 How to Achieve the First-Best Outcome?

Below, we first we examine how the government can design instruments to overcome the coordination problem following from the indirect network effect. Next, we discuss instruments the government can use in order to fully correct for exertion of market power, economies of scale, and the indirect network externality.

7.1 How to Overcome the Coordination Problem?

Because there exist three equilibria for each market structure, the government may need to help the actors to coordinate such that the stable equilibrium with high levels of investment materializes. However, with a cartel there is hardly a coordination problem: the cartel can simply build the number of terminals that corresponds to its profit maximizing outcome. Plants will then respond by choosing investment in capture facilities that is in line with this number of terminals.

For the other two market structures, i.e., regulated storage and monopoly storage, there may be a dynamic process with government involvement leading to the realization of the outcome with a high CCS market share.

We now illustrate the basic idea. Denote the number of terminals in the unstable equilibrium by \(n_{\min }^{j} ,\)\(j = {\kern 1pt} \,\nu ,m.\) Hence, the objective of the government is to ensure that initially, slightly more than \(n_{\min }^{j}\) terminals will be committed to be set up. To obtain such a commitment, the government can tender precisely this number of terminals. Once the tendered terminals are built, the dynamics of the market, combined with the government using policy instruments to correct for market imperfections (see the discussion in Sect. 7.2), will ensure that the first-best outcome is reached.

7.2 Correction for Additional Market Imperfections

In this subsection we show how the remaining imperfections—market power, economies of scale, and the indirect network externality—can be internalized through policy instruments so that the market outcome coincides with the social optimum. We concentrate on the base case, regulated storage, and refer to A.3 in the Appendix A for the other market outcomes.

With regulated storage, we need one instrument to correct for the non-competitive price of terminals to handle captured CO2. We also need one instrument to internalize the net effect of economies of scale and the indirect network externality.

From (7) we see that a lower cost of storage, z, will, cet. par., lower the price, \(p\), plants have to pay to deliver CO2 at terminals. Hence, one way to correct for the non-competitive price of delivering CO2 to terminals is to offer a subsidy for storage services, \(s_{v} ,\) which will lower the regulated price of storage to \(v - s_{v} .\) This is confirmed from (9): A lower cost of storage will, cet. par., increase the share of plants investing in capture facilities.

To internalize the net of effect of economies of scale and the effect of the network externality, the obvious instrument is to impose an entry tax on terminals; a tax will discourage entry of terminals, thereby avoiding excessive entry. We find the optimal entry tax under regulated storage, \(t_{a}^{\nu } ,\) by combining the first-order conditions for terminals in the social optimum, (3), and under regulated storage, (10). This gives

Hence, the optimal entry tax is fixed.Footnote 5 Furthermore, by combining the first-order conditions (2) and (9), we find that under regulated storage the optimal storage subsidy, \(s_{\nu }^{\nu } ,\) is given by:

The storage subsidy is increasing in the transportation cost parameter t and in the first-best distance between terminals, \(\frac{S}{{n^{SO} }};\) from (7) we know that the price charged by a terminal, p, is increasing in the mark-up, \(tS/n.\) Because the first-best number of terminals, \(n^{SO} ,\) is increasing in the Pigovian tax, see Sect. 6, the optimal storage subsidy (under regulated storage) is decreasing in the Pigovian tax.

In order to find the numerical values of the optimal instruments under regulated storage, we construct a system with two equations, (9) and (10), where we impose that \(q^{\nu } = q^{SO}\) and \(n^{\nu } = n^{SO}\). Further, we replace the regulated price \(\nu\) by \(\nu - s_{\nu }^{\nu }\) and the entry cost a by \(a + t_{a}^{\nu } .\) We then solve this system with respect to \(s_{\nu }^{\nu }\) and \(t_{a.}^{\nu }\).

The values of the optimal instruments are shown in Table 4. This Table includes the optimal instruments for monopoly storage and cartel; see A.3 in the Appendix A for a discussion on how these policy instruments are calculated. Under regulated storage, the government offers a subsidy for storage of 14.37 euro/tCO2, whereas the tax on entry of terminals should be 165.3 million euro. The solution is illustrated in Fig. 2. Here we have shown the market equilibrium under regulated storage without any instruments (Case 1), the first-best social outcome, and also the market equilibrium under regulated storage with optimal instruments. As seen from Fig. 2, the curves representing (9) and (10) both shift downwards with optimal instruments, and they intersect at the social optimum.

Note that with the optimal tax on entry, \(t_{a}^{\nu } = 3a,\) the response curve of terminals under regulated storage coincides with the response curve of the social planner, (3). This follows from the response curve of terminals, (10), when a is replaced by \(a + = 4a.\) Note also that even with the entry tax and the storage subsidy, we still have multiple equilibria. This suggests that we might still need a temporary intervention from the government in order to kick start investments.

The optimal instruments in Table 4 are calculated under the assumption that both the SCC and the carbon tax are 90 euro/tCO2. In Fig. 3, we take a closer look at how this common value impacts the magnitude of the instruments needed to ensure that the social outcome is achieved. In the figure, the SCC varies from 57 to 90 euro/tCO2; according to Result 3, for this interval it is socially optimal to invest in CCS.Footnote 6

As seen from panel a, both the socially optimal number of terminals and the share of plants investing in capture facilities increase in the SCC, which is in line with the discussion in Sect. 6. Under regulated storage (Case 1), the storage subsidy (in panel b) is lower the higher is the SCC, which is in line with the discussion in the current section. However, the relationship is opposite under a cartel (Case 3), which is in line with the discussion in Section A.3 in the Appendix A.

From A.3 we also know that under monopoly storage (Case 2), the impact on the storage subsidy of a higher SCC is indeterminate. However, with our calibration the subsidy is increasing in the SCC, see panel b in Fig. 3. Finally, Panel c shows that the entry tax (to be imposed under regulated storage and monopoly storage) is independent of the SCC; this is in line with the discussion in the current section (on regulated storage, see (12)) and in Section A.3 (on monopoly storage).

8 Scenarios

In this section, we examine how the market outcomes depend on some of the exogenous parameter values. In the spirit of Meunier and Ponssard (2020), we combine different assumptions on costs and market size to study alternative scenarios to our reference case. For a discussion on how a low carbon price, cost parameters and the market size of CCS each impacts the market outcomes and the optimal instruments to reach the first-best outcome, we refer to Appendix C.

In their study of electric vehicles, Meunier and Ponssard (2020) define three scenarios, which they call "Take-off", "Powering up" and "Cruising". The scenarios illustrate different stages of market development, which are represented by different values of the exogenous parameters. While electric vehicles are consumer goods with a potentially very large market, carbon capture is a specialized technology which may to some extent be acquired be power plants and other emission-intensive industries. As alternatives to our reference case, we hence define one pessimistic scenario with high costs and low potential demand for CCS, and one optimistic scenario with low costs and high potential demand for CCS. Both scenarios are designed so that some adoption of CCS is socially optimal.

In the pessimistic scenario, all cost parameters increase by 10% relative to the benchmark. Emissions eligible for CCS are reduced by 86.5% compared to the reference case, reflecting that only an amount corresponding to 25% of manufacturing emissions is eligible for CCS (There is no emission from electricity supply). On the other hand, in the optimistic scenario all cost parameters are 10 percent lower than the benchmark values. Emissions eligible for CCS are increased by 26.5% compared to the reference case; this assumption reflects that 100% of emissions from power plants and 50% of manufacturing emissions are eligible for CCS.

Table 5 shows the results of this exercise. In the reference case, the social cost if CCS is not used at all will be 3.3% higher than in the first-best social outcome. One reason for the low difference is that in our reference scenario, a large part of emissions—almost 70%—is not eligible for CCS. When counting only emissions that are eligible for CCS, the difference in social cost between using and not using CCS is about 10%. Furthermore, given that CCS takes off, i.e., that the “high” level of investment materializes, the social cost is between 0.3% (regulated storage) and 1.3% (monopoly storage) higher than in the first-best social outcome. This is clearly lower than the partial gain from reaching the equilibrium with high level of investment (compared to no CCS).

In the pessimistic scenario, the social cost in the case of no use of CCS is only 0.1% higher than in the first-best social outcome. Therefore, it does not matter much whether CCS takes off or not in the pessimistic scenario. Furthermore, in the pessimistic scenario there is positive CCS investment in the cartel case only. To obtain a CCS value chain in the two other market cases, policy instruments are required to trigger investment; see the discussion in Sect. 7.2.

In the optimistic scenario, the social cost derived from no use of CCS is 7% higher than in the socially efficient outcome. Moreover, the additional social cost in the three market outcomes, measured relative to social cost in the first-best outcome, is in the order of 2%. Hence, what matters is mainly to overcome the coordination problem; this will reduce the additional social cost from 7% (no CCS) to around 2%. To avoid the last 2%, the government has to use additional instruments to correct for various market imperfections, see the discussion in Sect. 7.2.

To construct Table 5, we have assumed that the carbon tax is equal to the SCC, which is 90 euro/tCO2. Suppose, however, that the government sets a lower carbon tax than the SCC, say, 70 euro/tCO2. This will lower the incentives to invest in CCS. For example, with a cartel in the optimistic scenario the share of plants investing in CCS drops from 0.27 to 0.16, whereas the number of terminals drops from 5.46 to 4.19. If the cartel succeeds in reaching the equilibrium with high level of investment (when the imposed carbon tax is 70 euro/tCO2), social costs are 3.8% higher than in the social optimum. The corresponding number in Table 5 is 2.0%. Hence, the partial effect of imposing a too low carbon tax under a cartel (in the optimistic scenario) is an increase in social cost of 1.8%. The corresponding number in the reference case is somewhat lower; 1.1%.

To sum up the discussion, in the reference case and the optimistic case what matters the most is to reach the equilibrium with high investment. The importance of using a Pigovian carbon tax as well as additional instruments to correct for other market imperfections may be of the same order of magnitude, although the ranking will of course depend on the exact deviation between the SCC and the carbon tax.

9 Discussion

Clearly, our model is a simplification of the complex matter of building a CCS value chain. We assume that terminal owners invest in terminals simultaneously with plant investing in capture facilities. Thus, all investments take place in one stage of the game. In reality, we may have sequential decisions with some terminals moving first and plants near these terminals being more prone to invest in carbon capture facilities.

We still believe that our model captures essential features of the main obstacles to establishing a CCS value chain. All the market imperfections present in our model are, as far as we can understand, also present in reality; economies of scale, market power, network effects and not to forget, correct pricing of carbon emissions.

In our study, the social cost of carbon should be at least 57 euro/tCO2 to justify CCS investment. One interesting result from the robustness tests is that a cartel, consisting of all terminals and the storage site, is the only market structure that supports CCS investments for a carbon tax between 60 and 68 euro/tCO2. Furthermore, the carbon tax needs to be at least 69 euro/tCO2 to make CCS investment profitable in the two other market configurations. Hence, for values of the carbon tax between 57 and 69 euro/tCO2 the market may be in a so-called state of excess inertia.

Moreover, we find that even with carbon taxes above 69 euro/tCO2, the market for CCS does not necessarily take off. Since there are multiple equilibria, and reasoning based on our model suggests that investments need to reach a tipping point in order for the market to take off, the market could be in a state of excess inertia also for carbon taxes above 69 euro/tCO2. There is then a potential role for the government to ensure that investments reach this tipping point. This can be done by issuing a tender for one or more storage sites and a tender for a minimum number of CO2 delivery terminals. Using a tender in the form of an auction should ensure that the government does not pay too much for this minimum infrastructure.

The Northern Lights project (Northern Lights 2021) is one step in this direction, although a tender was to our knowledge not used. The project will cover a terminal in the western part of Norway and a pipe from the terminal to a storage site in the North Sea. The facilities will be owned and operated by a consortium consisting of Equinor, Shell and Total. According to the Norwegian Government, which will provide significant financial support to the project, Northern Lights should prove that CCS is technically feasible (OED 2020). Furthermore, the project should internalize learning- and scale effects, and trigger a boost in CCS activities in Northern Europe.

Another clean technology that is characterized by network effects is electric cars being dependent on a charging network. Taalbi and Nielsen (2021) find that a lack of network was a serious disadvantage for the electric car vis-a-vis the gasoline car back in the early 1900. Moreover, they conjecture that the electric car could have won the race already then if a better energy infrastructure had been in place. Currently, more and more governments seem to acknowledge that network effects could hamper the introduction of the electric car. They hence provide temporary support both to buyers of electric cars and to the establishing of a network in line with our finding that there may exist a tipping point below which the market may not develop even if the electric car improves welfare.

10 Concluding Remarks

While CCS has been announced as an important technology to reach the 1.5 °C and 2 °C climate targets in the long run (IPCC 2014; 2019), the current capacity of CCS is still tiny (IEA 2020). In this paper, we have studied whether imperfections in the different parts of a CCS value chain, especially in transportation and storage, may block CCS investments.

To do this, we have used a Salop type of model (Salop 1979) where plants are located around a circle. These plants have the options either to pay a tax per unit of their CO2 emissions (equal to the social cost of carbon) or to invest in carbon capture facilities. If they invest in carbon capture, they need to transport the captured CO2 to a terminal, which is also located on the circle. The terminal transports the CO2 to a storage site located in the center of the circle.

In the model, there are four types of imperfections in the CCS value chain. First, terminals are local monopolies and therefore charge a markup on their fee to receive CO2, which will lower investment in carbon capture facilities. Second, there is an indirect network effect: if one plant invests in carbon capture facilities, investments in terminals will be more profitable, which again will make investment in carbon capture facilities more attractive for other plants because the average transport distance to a terminal has decreased. Third, there is economies of scale in transport that can give excess entry of terminals, as the cost per unit handled by the terminal increases in the number of terminals. Finally, the storage actor may have market power.

We study three market structures, besides the social optimum; a regulated storage actor, a monopoly storage actor and a cartel that controls terminals and storage. All market outcomes differ from the social optimum even if the plants pay the socially optimal carbon tax. However, we also find that both the cartel and the social planner internalize economies of scale and the network externality.

We then provide numerical simulations based on a storage site in the North Sea. We assume that the carbon tax is set equal to the social cost of carbon (90 euro/tCO2), thereby fully correcting for the negative externality of emissions of CO2. The results show that all market outcomes provide a lower share of plants investing in carbon capture facilities than the socially optimal share. In particular, the cases of monopoly storage and cartel give a significantly lower share of plants investing in capture facilities than under regulated storage. Under regulated storage and a monopoly storage, the number of terminals is higher than the socially optimal number because of economies of scale (combined with free entry), while the ranking is opposite under a cartel. Even if the cartel internalizes the economies of scale and the network effect, the amount of stored CO2 will be much lower than what is socially optimal because of the high fee faced by plants investing in capture facilities; this lowers the need for terminal services.

To reach the first-best social outcome, the government first has to design instruments that solve the coordination problem: for all market structures considered, there are three equilibria—one stable equilibrium without any investment, one unstable equilibrium with “low” investment, and one stable equilibrium with “high” investment. The government could initially subsidize terminals to ensure that the latter equilibrium is reached, which is the socially preferable one. Once the coordination challenge is solved, the government should implement policy instruments that correct for all remaining deviations from a competitive economy. However, our simulations show that once the coordination problem is solved, the most important task is to set an optimal carbon tax. The welfare gains of correcting other deviations are limited.

Our modelling framework could be extended in several ways. We have not included economies of scale in transportation of captured CO2 from plants to terminals. In this case, it will be optimal for plants to cooperate on the transportation to terminals. This will reinforce the network effect, which again will impact the optimal number of terminals.

Furthermore, we have not considered other abatement options than CCS. Both in electricity supply and manufacturing, other options exist (IPCC 2022). Introducing this will shrink the CCS market, and we found in our robustness tests that this will lower the socially optimal number of terminals and also the share of plants investing in carbon capture facilities.

Finally, we have assumed that there is only one storage site. In the future, there may be competition between storage suppliers as also Denmark, the Netherlands, and the UK are considering investing in storage facilities (see, e.g., Greensand 2021; Port of Rotterdam 2021; SCCS, 2021). With more than one storage supplier, the price of storage will be lower than in the case of monopoly storage. This will tend to increase demand for storage services and trigger more investment in all parts in the CCS value chain.

Notes

In our model, this assumption can be justified by the fact that an actor needs a concession from the government to build a terminal. We assume that the government will impose equally spaced apart terminals as this location pattern is a necessary condition to minimize social cost.

From the discussion of the stability of the internal equilibria, it follows that the trivial equilibrium with no investment is stable.

As the number of terminals is a continuous variable, the outcome is not an integer. In the literature, it is common to associate the integer closest to this continuous variable as the value that will materialize.

The fixed entry tax reflects our assumption of a fixed cost of entry of terminals. As an alternative assumption, suppose we let the unit cost of a terminal of receiving and handling CO2 be represented by a hyperbola,\(a/(qE/n) + b.\) Here, the parameter \(a\) is the fixed cost of a terminal of handling the received CO2, like in the model, whereas the parameter \(b\) is the unit cost of pipe transport if the transported quantity is “very large”. The cost of all terminals of receiving the total amount of CO2, i.e., \(qE,\) is \(({\raise0.7ex\hbox{$a$} \!\mathord{\left/ {\vphantom {a {(qE/n)}}}\right.\kern-0pt} \!\lower0.7ex\hbox{${(qE/n)}$}}{\kern 1pt} \, + \,\;b)qE = an + bqE.\) Then the optimal tax on terminals is \(t = 3a - bqE/n^{SO} < 3a.\) In the special case of \(b = 0,\) we obtain \(t = 3a.\)

Solid curves in Panels b and c reflect that the market outcome, without any additional instruments, is characterized by positive CCS investments (internal solution). In contrast, dashed curves in Panels b and c reflect that the market outcome, without any additional instruments, is characterized by no CCS investments (corner solution).

After plants have invested in capture facilities, the cartel has an incentive to increase the price p so that plants are (almost) indifferent between using the capture facilities or not. Rational, forward-looking plants will realize this ex ante. To avoid this problem, we assume that the cartel can credibly commit to its price p, for example, through written contracts with plants prior to its investment in capture facilities.

In our model, the average volume of transported CO2 from plants to a terminal \((qE/4n)\) is 3.4 MtCO2 in the social optimum and varies between 1.4 and 2.4 MtCO2 in the market outcomes (with benchmark parameter values).

Kjärstad et al. (2016) offers a number of estimates for offshore pipeline costs. These are in the range of 6.6 to 37.4 euro/tCO2 per 250 km, with an average significantly above 10.8.

References

Atkins and Oslo Economics (2016) Kvalitetssikring (KS1) av KVU om demonstrasjon av fullskala fangst, transport og lagring av CO2, Report for the Norwegian ministry of petroleum and energy and the Norwegian ministry of finance. Report number D014a

Atkins and Oslo Economics (2018) Kvalitetssikring (KS2) av demonstrasjon av fullskala fangst, transport og lagring av CO2 Rapport fase 1 og 2, Report for the Norwegian ministry of petroleum and energy and the Norwegian ministry of finance

Aune FR, Golombek R (2021) Are carbon prices redundant in the 2030 EU climate and energy policy package? Energy J 42(3):233–277

Barker DJ, Turner SA, Napier-Moore PA, Clark M, Davison JE (2009) CO2 caputre in the cement industry. Energy Procedia 1:87–94

Budins S, Krevor S, Mac Dowell N, Brandon N, Hawkes A (2018) An assessment of CCS costs, barriers and potential. Energ Strat Rev 22:61–81

Chou C, Shy O (1990) Network effects without network externalities. Int J Ind Organ 8:259–270

Durmaz T (2018) The economics of CCS: Why have CCS technologies not had an international breakthrough? Renew Sustain Energy Rev 95:328–340

Trading Economics (2022) Data retrieved Sep 12022 from https://tradingeconomics.com/commodity/carbon

Farrell J, Klemperer P (2007) Coordination and lock-in: competition with switching costs and network effects. In: Armstrong M, Porter R (eds) Handbook of industrial organization. Elsevier, Amsterdam, pp 1967–2072

Farrell J, Saloner G (1986) Installed base and compatibility: innovation, product preannouncements, and predation. Am Econ Rev 76:940–955

Gerlagh R, van der Zwaan B (2006) Options and instruments for a deep cut in CO2 emissions: carbon dioxide capture or renewables, taxes or subsidies? Energy J 27(3):25–48

Golombek R, Greaker M, Kittelsen SAC, Røgeberg O, Aune FR (2011) Carbon capture and storage in the European power market. Energy J 32(3):209–237

Greaker M (2021) Optimal regulatory policies for charging of electric vehicles. Trans Res Part D. https://doi.org/10.1016/j.trd.2021.102922

Greaker M, Midttømme K (2016) Optimal environmental policy with network effects: will pigovian taxation lead to excess inertia? J Public Econ 143:27–38

Greaker M, Heggedal TR (2010) Lock-in and the transition to hydrogen cars: should governments intervene?, BE J Econ Anal Policy, 10(1)

Greensand (2021) Data retrieved 23 March from https://www.maerskdrilling.com/news-and-media/press-releases/project-greensand-north-sea-reservoir-and-infrastructure-certified-for-co2-storage

Herzog HJ (2011) Scaling up carbon dioxide capture and storage: from megatons to gigatons. Energy Economics 33:597–604

IEA (2008) World energy outlook. International Energy Agency, Paris

IEA (2018) World energy outlook 2018. IEA/OECD, France Paris

IEA (2020) Tracking Power 2020. IEA/OECD, Paris, France. Data retrieved 7 June 2020 from https://www.iea.org/reports/tracking-power-2020/ccus-in-power

IPCC (2005) IPCC special report on carbon dioxide capture and storage. In: Metz B, Davidson O, de Coninck HC, Loos M, Meyer LA (eds) Prepared by working group III of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, p 442

IPCC (2014) Climate change 2014: mitigation of climate change, working group III contribution to the fifth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, UK New York, NY, USA

IPCC (2019) Global warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty In: V Masson-Delmotte, P Zhai, HO Pörtner, D Roberts, J Skea, PR Shukla, A Pirani, W Moufouma-Okia, C Péan, R Pidcock, S Connors, JBR Matthews, Y Chen, X Zhou, MI Gomis, E Lonnoy, T Maycock, M Tignor, T Waterfield (eds.)

IPCC (2022) Climate change 2022: mitigation of climate change. contribution of working group III to the sixth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, UK and New York, NY, USA

Kjärstad J, Skagestad R, Eldrup NH, Johnssona F (2016) Ship transport—a low cost and low risk CO2 transport option in the Nordic countries. Int J Greenhouse Gas Control 54:168–184

Leeson D, Mac Dowell N, Shah N, Petit C, Fennell PS (2017) A techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int J Greenhouse Gas Control 61:71–84

Northern Lights (2021) Data retrieved 23 Mar from https://northernlightsccs.com/en/about

Lohwasser R, Madlener R (2012) Economics of CCS for coal plants: Impact of investment costs and efficiency on market diffusion in Europe. Energy Economics 34:850–863

Marañón-Ledesma H, Tomasgard A (2019) Analyzing demand response in a dynamic capacity expansion model for the European power market. Energies 12:2976

Meunier G, Ponssard J-P (2020) Optimal policy and network effects for the deployment of zero emission vehicles. Eur Econ Rev 126:29

OED (2020) Langskip–fangst og lagring av CO2, Meld.St. 33 (2019–2020). The Norwegian Ministry of Petroleum and Energy

Port of Rotterdam (2021) Data retrieved 23 Mar from https://www.portofrotterdam.com/en/news-and-press-releases/102-million-euros-in-funding-on-the-horizon-for-porthos-project

Rubin ES, Davison JE, Herzog HJ (2015) The cost of CO2 capture and storage. Int J Greenhouse Gas Control 40:378–400

Salop SC (1979) Monopolistic competition with outside goods. Bell J Econ 10(1):141–156

SCSS (2021) Data retrieved 23 Mar from https://www.sccs.org.uk/images/expertise/briefings/SE-CO2-Hub.pdf

Taalbi J, Nielsen H (2021) The role of energy infrastructure in shaping early adoption of electric and gasoline cars. Nature Energy. https://doi.org/10.1038/s41560-021-00898-3

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge, MA

United Nations Climate Change (2020) Greenhouse gas inventory data-detailed data by party. Retrieved June 1, 2020 from https://di.unfccc.int/detailed_data_by_party

USDOE (2014) FE/NETL CO2 transport cost model: Description and user’s Manual, Report No. DOE/NETL-2014/1660. US Dept of Energy, National Energy Technology Laboratory, Pittsburgh, PA.

van der Zwaan B, Gerlagh R (2009) Economics of geological CO2 storage and leakage. Clim Change 93:285–309

van der Zwaan B, Gerlagh R (2016) Offshore CCS and ocean acidification: a global long-term probabilistic cost-benefit analysis of climatic change mitigation. Clim Change 137:157–170

Weitzel M, Saveyn B, Vandyck T (2019) Including bottom-up emission abatement technologies in a large-scale global model for policy assessment. Energy Econ 83:254–263

ZEP (2011a) The costs of CO2 transport: post-demonstration CCS in the EU, Eur Technol Platform Zero Emission Fossil Fuel Power Plants. Brussels

ZEP (2011b) The costs of CO2 storage: post-demonstration CCS in the EU, Eur Technol Platform Zero Emission Fossil Fuel Power Plants. Brussels

Funding

Open access funding provided by OsloMet - Oslo Metropolitan University. This paper is funded by CREE—Oslo Centre for Research on Environmentally friendly Energy, PLATON—PLATform for Open and Nationally accessible climate policy knowledge, and Device—Developing value chains for CO2 storage and blue hydrogen in Europe, all supported financially by the Research Council of Norway. Earlier versions of the paper have been presented at a CREE workshop, PLATON workshops, 26th Annual Conference of EAERE in 2021, an IAEE webinar, and at the University of Bergen. Comments from Michael Hoel and two anonymous referees are highly appreciated.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Alternative market structures

In this Appendix, we study two other market cases, namely monopoly storage and cartel.

1.1 A.1 Monopoly Storage

Here, we study the case in which the storage actor is free to set a storage fee \(z\) that maximizes its profits. Note that once plants have invested in capture facilities, the monopoly storage actor has an incentive to increase the storage fee z so that plants are (almost) indifferent between using the capture facilities or not. Rational, forward-looking plants will realize this ex ante. To avoid this problem, we assume that the monopoly storage actor can credibly commit to its fee z, for example, through written contracts with plants prior to their investment in capture facilities.

This game evolves over three stages. In stage zero, the rational, forward-looking storage actor commits to a storage fee z. Investment in carbon capture facilities by plants and the number of terminals to be build are determined in stage one, whereas the price p that plants have to pay for delivering CO2 is determined by each terminal in stage two.

Because stage one and two are identical to the case of regulated storage, Eqs. (9) and (10) also apply in this case, except that \(z = \nu\) has been replaced by the endogenous storage fee \(z = z^{m}\) where m refers to the current case of a monopoly storage actor. The profit of the storage actor is \((z-v)qE.\) Hence, the Lagrangian of the optimization problem is

From the derived first-order conditions and using (10), we find an expression for the profit-maximizing price of storage:

Relations (9) (with \(z = z^{m} ),\) (10) and (14) determine the triple \(({z}^{m},{q}^{m},{n}^{m})\) where \({z}^{m}>v\) (for \(z=v,\) profit of the storage actor is zero). As will be clear from the discussion related to Fig. 1, also this case has more than one equilibrium.

1.2 A.2 Vertical Integration—Cartel

Under regulated storage and monopoly storage, there was per assumption no coordination between the \(n\) terminals, nor any coordination between the terminals and the storage actor. We now examine the corner case in which there is full coordination between these \(n+1\) actors, that is, we assume they merge and form a cartel that maximizes total profits. The game evolves as follows. In stage one, the cartel determines the number of terminals to be set up and the price p that all plants have to pay when delivering CO2 at a terminal. In stage two, plants invest in capture facilities and decide to which terminal they will transport their captured CO2.Footnote 7

The cartel receives \(qE\) units of CO2 from the plants and thus obtains the income \(pqE.\) The cartel has, however, two types of costs: cost of entry, \(an,\) and cost of building storage capacity, \(vqE.\)

When maximizing profits, the cartel takes into account how its price p affects the decision of plants of whether to invest in capture facilities, see (8). Combining this relation with (15), i.e., the definition of the share q, we obtain

Relation (15) shows how a change in the price p impacts the share q (for a given number of terminals).

The cartel \(\left( c \right)\) maximizes its profits

with respect to p and n. The first-order condition with respect to p implies

Combing (3) with the first-order condition with respect to n that follows from maximizing (2), we obtain (3), which is part of the system that characterizes the social optimum. Inserting (3) into (1), we obtain

Relations (3) and (4) determine the share \({q}^{c}\) and the number of terminals \({n}^{c}\) under a cartel, i.e., vertical integration. We then find the price \({p}^{c}\) from (3). Note that the difference between the optimal response of plants in the social optimum, see (2), and the optimal response of plants under a cartel, see (4), is that the denominator is twice as high in the latter case than in the social optimum. Hence, an increase in the number of terminals triggers a lower increase in plants investing in capture facilities under a cartel than in the social optimum. This reflects the market power of the cartel; it charges the plants a high price \(p.\)

1.3 A.3 Correcting the Market Imperfections to Achieve the Social Optimum

1.3.1 Monopoly storage

To correct the market outcome under monopoly storage (Case 2), we can use the same type of instruments as we used in the case of regulated storage. The optimal instruments—a storage subsidy \(s_{\nu }^{m}\) and an entry tax \(t_{a}^{m}\)— are found by solving the system (9) and (10) with \(q^{m} = q^{SO}\) and \(n^{m} = n^{SO} ,\) and where \(z\) in (9) is replaced by \(z^{m}\) from (14), \(\nu\) in (9) is replaced by \(\nu - s_{v}^{m}\), and \(a\) in (10) is replaced by \(a + t_{a}^{m} .\) Because (10) characterizes both regulated storage and monopoly storage, the optimal entry tax is also in the case of monopoly storage given by (12).

Furthermore, combining (2), (9) and (14) we find that the optimal storage subsidy under monopoly storage is increasing in the first-best share of plants investing in capture facilities \((q^{SO} )\), but decreasing in the first-best number of terminals \((n^{SO} )\):

As a higher Pigovian tax leads to a higher \({q}^{SO}\) and also a higher \({n}^{SO}\), see Sect. 6, the impact of a higher Pigovian tax on the optimal storage subsidy under monopoly storage is ambiguous.

Table 4 in the main text shows that the storage subsidy should be much higher under monopoly storage (52.80) than under regulated storage (14.37). Under monopoly storage, the price for storage services is high, which pushes up the price faced by plants for terminal services. It is then necessary with a high storage subsidy to provide sufficient incentives for plants to invest in carbon capture facilities.

1.3.2 Cartel