Abstract

The Porter hypothesis and the pollution haven hypothesis seem to predict opposite reactions by firms facing environmental regulation, as the first invokes the arising of a win–win solution while the second envisages the possibility for firms to flee abroad. We illustrate the possibility of designing policies (taking the form of either emission taxation or environmental standards) able to eliminate firms’ incentives to relocate their plants abroad and create a parallel incentive for them to deliver a win–win solution by investing either in replacement technologies under emission taxation, or in abatement technologies under an environmental standard. This is worked out in a Cournot supergame in which firms may activate the highest level of collusion compatible with their intertemporal preferences.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over more than two decades, the Porter hypothesis (Porter 1991; Porter and van der Linde 1995a, b; Lanoie et al. 2011; Ambec et al. 2013) and the pollution haven hypothesis (Copeland and Taylor 1994, 2004; Fullerton 2006; Levinson and Taylor 2008; Cole et al. 2017) have played a major role in the literature, being consistently investigated both theoretically and empirically. The first hypothesis envisages the possibility for firms to increase their competitiveness and ultimately their profits being spurred rather than hampered by environmental regulation, possibly delivering a win–win solution if its strong version is verified. The second looks instead at the possibility for firms to relocate abroad. In this respect, Copeland and Taylor (2004, p. 9) distinguish between the pollution haven effect, whereby firms react to tight environmental regulation by relocating to more permissive countries, and the proper pollution haven hypothesis, which envisions a shift of polluting firms or industries to countries with weaker environmental policies triggered by reductions of trade costs or barriers.

The two hypotheses seem to tell two opposite stories, since apparently firms might react to tighten environmental policies by either fleeing abroad sticking to brown technologies or investing to clean up their technologies, having the same objective in mind in both, i.e., to find a remedy (from their standpoint) to the pressure exerted by environmental policy and its effects on their profit performance. So, what should we expect firms to do, once any given environmental regulation is adopted?

More importantly, is there any possibility of reconciling them, through the design of an environmental policy which prevents firms from relocating abroad given the existing trade barriers, and then also induces them to vindicate the Porter hypothesis in its strong form? We propose a possible answer to this question, focussing on emission taxation and identifying a range of tax rates which may induce firms not to relocate abroad to a pollution haven and react to regulation with both profitable and socially desirable investments in green technologies. That is, we look at the possibility of reaching equilibria in which pollution havens are not appealing, and firms deliver the win–win solution associated with the strong version of the Porter hypothesis, whereby appropriate policy incentives are conducive to green investments increasing profits as well as welfare.

To perform this task, we adopt a fully deterministic repeated game in which firms are Cournot players and may collude at least partially, the intensity of collusion being determined by time preferences. The model assumes the existence of two countries, one in which firms are initially located, and the other exclusively acting as the pollution haven. The good is purchased only by consumers inhabiting the former, and firms know that relocating to the latter involves a sunk cost to transfer productive capacity abroad, and a shipping cost which increases their perceived total marginal production cost. The government of the home country uses either an emission tax or a per-firm emission standard to reduce emissions and possibly induce firms to adopt a replacement technology which, for simplicity, implies no emissions. This decision may be taken only in the initial period of the supergame. This approach allows us to account for both the pollution haven hypothesis and its effect, due to the interplay between the pressure exerted by environmental policy and the impact of trade costs, which determines firms’ decision about relocation. Then, if indeed firms remain in their country of origin, the profitability of adopting the green technology and the arising of the win–win solution depend on the size of the investment needed to acquire this technology (in absence of uncertainty, we may use acquisition and invention as synonymous).

Our main results can be summarised as follows. If emissions are taxed, we identify a sufficient condition whereby there exists a continuous range of tax rates inducing firms not to relocate abroad to a pollution haven and react to regulation with both profitable and socially desirable investments in green technologies. The upper bound of such range is the unit shipping cost firms would have to bear had they moved to the pollution haven. Moreover, this range may or may not include the socially efficient tax, which falls into the interval for sufficiently high values of the shipping cost. This, however, must be assessed keeping in mind that, once firms decide to remain in the home country, the aim of regulation is to attain the win–win solution, in such a way that in the first period of the supergame firms decide to stay and invest, and the related tax rate becomes inoperative. Additionally, in either case there are infinitely many values of the emission tax, including extremely low ones, conducive to the win–win solution, firms finding the pollution haven unappealing. This contradicts the common view according to which the pressure exerted by environmental regulation should be high for firms to validate the prediction contained in the Porter hypothesis. This happens, for instance, in André et al. (2009) and Lambertini and Tampieri (2012), where vertical product differentiation is used to identify brown and green products with low and high quality levels, respectively, and firms deliver a fully green industry configuration under the stimulus of a sufficiently high lump-sum tax. Their approach, however, means that the green variety is not cost-efficient, and therefore taxation must create a profit wedge that paves the way towards the win–win solution.Footnote 1 Our modelling approach, in which mild emission taxes create a cost efficiency effect with twofold consequences, is close to the Cournot model with asymmetric marginal costs proposed by Constantatos and Herrmann (2011), where indeed the green technology is cost-efficient, as initially envisaged in Porter (1991) and Porter and van der Linde (1995a).

The setting in which each firm faces a symmetric emission standard and react via abatement technologies reveals that the introduction of the standard in the home country makes collusion more stable, deterring thus relocation automatically. In particular, full collusion may be possible at home after the adoption of the standard, while being impossible should firms flee to the pollution haven. The remaining scenario, in which the regulator uses grandfathering to keep a firm at home is in Schmidt and Heitzig (2014), who use an infinite horizon monopoly to identify a sufficient condition (see Proposition 1 in Schmidt and Heitzig (2014, p. 213) consisting in the minimal amount of permits deterring relocation forever,Footnote 2 and is also compatible with investment in abatement technologies. The only relevant difference is that in Schmidt and Heitzig (2014) relocation is costless, but the extension of their main conclusion to the opposite case is straightforward, at least as far the relocation cost is exogenously defined. Nachtigall (2019) modifies the analysis to consider two periods only but allowing for the presence of oligopolistic competition and positive relocation costs. Firms know their relocation costs, while the government of the home country, where consumption takes place, does not. Under these conditions, Nachtigall (2019) characterises the consequences of phasing out free allowances, proving the existence of equilibria in which some firms remain at home and invest in emission abatement while others relocate.

Our model has also some features in common with the literature initiated by Markusen et al. (1993), Barrett (1994) Rauscher (1994) and Simpson and Bradford (1996) and then developed in Ulph and Valentini (2001), Greaker (2003a, b) and Petrakis and Xepapadeas (2003), among others. Although these contributions pivot around the assumption that firms sell only in third markets, they share with ours the possibility for a government to strategically use environmental regulation as an instrument to modify the relative competitiveness of firms on the export market, and also for firms to use the relocation threat instrumentally, to extract a rent. The different nature of our model notwithstanding, our approach does feature the same effects, as the government of the home country may end up competing with that of the foreign one (the pollution haven) to attract firms by modifying the relative level of emission taxes and shipping costs. We show that this mechanism takes the form of a race to the bottom, in which the home government may find itself forced to systematically decrease the emission tax in order to meet the aforementioned sufficient condition, thereby reducing the total marginal cost perceived by firms.

A brief additional remark is in order, about the relationship between technological investments and the intensity of implicit collusion. In this respect, the paper by Damania (1996) is probably the one most closely connected with ours. There, it is shown that emission taxation combined with cartel behaviour may prevent firms from investing in abatement efforts because doing so would jeopardise the profitability of collusion. Here, we prove that (i) the opposite may hold if firms invest in replacement technologies, under both emission taxation and environmental standards, and (ii) if the policy is properly designed, they will also remain in their country of origin, disregarding the possibility of relocating to a pollution haven.

The remainder of the paper is structured as follows. The scenario featuring emission taxation as the relevant environmental policy is illustrated in Sect. 2. Section 3 briefly describes the scenario engendered by the adoption of an environmental standard, with quantity-setting firms. Concluding remarks are in Sect. 4.

2 Emission Taxation

This section is devoted to the implications of emission taxation on firms’ choice between remaining in their home country (and, if so, whether to invest in green technologies) or heading to the pollution haven for good, under the assumption of Cournot competition.

Consider a two-country world made up by countries I and II lasting forever over discrete time \(t=0,1,2,\ldots \infty ,\) and imagine the scenario in which, at time t = 0, two firms, 1 and 2, are located in country I and supply the market of the same country with a homogenous good adopting a Cournot behaviour. The market demand function in country I is \(p=a-Q\), \(Q=q_{1}+q_{2}\) and firms share the same technology, summarised by the cost function \({\mathcal {C}}_{i}=cq_{i}\), i = 1, 2, with \(c\in \left( 0,a\right) \).

Production pollutes the environment and per-firm emissions are \(e_{i}=q_{i}\), where the emission coefficient is normalised to one through an appropriate choice of units, and we may suppose the government of country I introduces an emission tax \(\theta >0\). As will become evident in the remainder, whether pollution is transboundary or not is immaterial in terms of the results we are about to illustrate.

Moreover, the ensuing exposition relies on symmetric scenarios in which firms either flee to the pollution haven or not, and, if they do not, either invest in a green replacement technology or not. The reasons behind this choice, which may seem to be adopted ad hoc to bypass the full-fledged analysis of strategic interaction between firms as well as policy makers, are spelled out in Sect. 2.4.

2.1 Partial Collusion

Assuming, for the moment, that firms exclusively react to this form of environmental regulation by adjusting output, this implies that the total cost function perceived by firm i becomes \(\widehat{{\mathcal {C}}} _{i}=\left( c+\theta \right) q_{i}\). This holds, of course, if firms remain in their country of origin. If country II has no environmental policy, firms might indeed decide to relocate there, bearing the individual sunk cost \(k>0\) to move their production plants abroad. If they do so, the total cost function of firm i becomes \(\widetilde{{\mathcal {C}}}_{i}=\left( c+\tau \right) q_{i}+k\), where \(\tau >0\) measures the unit transportation cost involved by shipping production from II to I.Footnote 3 It must be true that \( a>\max \left\{ c+\theta ,c+\tau \right\} \) to allow for a positive markup in both cases.

Henceforth, we will use superscripts C, M and N to identify magnitudes pertaining to collusive, monopolistic and non-cooperative (Nash) behaviour. The pivotal element of our argument is firms’ ability to collude, at least partially. Let the discount factor \(\delta \in \left( 0,1\right) \) describe their time preferences. Firms may figure out the possibility of colluding at some \(q^{C}\in \left[ q^{M},q^{N}\right) \), where \(q^{M}=Q^{M}/2=\left( a- {\mathbf {c}}\right) /4\) and \(q^{N}=\left( a-{\mathbf {c}}\right) /3\) are, respectively, 50% of the pure monopoly output and the Cournot–Nash output, and \({\mathbf {c}}=c+\theta \), \({\mathbf {c}}=c\) or \({\mathbf {c}}=c+\tau \) depending on whether (i) firms are in country I and the emission tax has been adopted or not, or (ii) firms have moved to country II. The degree of collusion obviously depends on the design of the punishment used to deter deviations. In what follows, we will illustrate the effects of both grim trigger strategies (as in Friedman 1971) and the optimal stick-and-carrot punishment (as in Abreu 1986). In the remainder, superscripts A and F will stand, respectively, for Abreu and Friedman.

The individual incentive to stick to the collusive path forever is given by

where \(\pi ^{C}=\left( a-2q^{C}-c-\theta \right) q^{C}\) is the per-period individual profit, for any \(t\ge 0\). The optimal deviation taking place along the cheating firm’s best reply function yields

where superscript DC stands for deviation from the collusive path. If this deviation triggers a permanent reversion to the Cournot–Nash equilibrium, the discounted profit flow engendered by the alternative path is

where \(\pi ^{N}=\left( a-c-\theta \right) ^{2}/9\). The condition for the stability of collusion is \(\Pi ^{C}\ge \Pi ^{DC}\), which is satisfied for all

Of course, if \(\delta \rightarrow 0\), firms cannot collude. However, the lower bound of the output interval in (4) decreases monotonically as \(\delta \) increases and, for all \(\delta \in \left[ 9/17,1\right] \), the minimum collusive output coincides with the individual share of the pure monopoly output, i.e., \(q_{F\theta }^{C}=Q_{t}^{M}/2=\left( a-c-\theta \right) /4\) since firms are patient enough to stabilise full collusion forever.

A qualitatively analogous conclusion is delivered by the alternative approach using optimal punishments. By optimal it is meant that this punishment is the most efficient, which in turn means that it must minimise the critical threshold of the discount factor above which collusion is stable forever (Abreu 1986). In particular, the resulting threshold is systematically lower than or at most equal to the one engendered by the perpetual reversion to the one-shot Nash equilibrium of the constituent game after any deviation from the collusive path, as in Friedman (1971). Moreover, the optimal punishment must be as short-lived as possible (that is, it must take place in a single period) in order for players not to be induced to renegotiate the rules of the supergame while the latter is ongoing (which may happen during the reversion to the Nash equilibrium), and must be subgame perfect (or, incentive-compatible), which is by definition true for the Nash equilibrium strategy but not for a candidate as a one-off punishment strategy which, in general, will be harsher than the Nash equilibrium one. All of this implies that the one-off optimal punishment, in this setting output \(q^{P}\), becomes an additional unknown variable, and one needs to design the conditions apt to identify it. What follows, which reflects Abreu (1986, Lemma 17, p. 204), defines the system of inequalities accounting for cartel stability, the subgame perfection of the punishment and the condition ensuring that firms will not quit the supergame should the punishment be adopted after a deviation. To construct the system, we have to define the individual profits generated, respectively, by the symmetric adoption of the optimal punishment, \(\pi ^{P}=\left( a-2q^{P}-c-\theta \right) q^{P}\), and by optimal unilateral deviation from it, \(\pi ^{DP}=\left( a-q^{P}-c-\theta \right) ^{2}/4\). The pair of unknowns \(\left( q^{C},q^{P}\right) \) must satisfy the following three constraints:

Condition (5) is the requirement for collusion stability. The l.h.s. is the net current gain associated with a unilateral deviation from collusion, while the r.h.s. measures the net consequences of this deviation, properly discounted: what appears in parenthesis is the difference between cartel profits (if the deviation does not take place) and the punishment payoff (in the opposite case). If indeed (5) holds, then collusion is stable because deviation is not appealing. Condition (6) determines the incentive to implement the punishment, if necessary. Its definition relies on the same criterion: the l.h.s. measures the current incentive to deviate unilaterally from the punishment, while the r.h.s. is the same as in (5), because the consequences are indeed the same, namely, if the punishment has been implemented then firms may return to the collusive path, otherwise they are called once again to implement the punishment. Condition (7) establishes that the discounted profit flow accruing to each firm from the implementation of the punishment onwards must be non-negative, otherwise firms would quit the supergame (or, shut down production), which would violate the construction of the supergame. The pair \(\left( q^{C},q^{P}\right) \) can be found by solving (5–6) at the margin, and then one must check that (7) is met, at least at the margin. This, for any given value of \(\delta \), holds for all

which jointly imply that the maximum level of collusion is attained at \( q_{A\theta }^{C}=\left( 9-8\delta \right) \left( a-c-\theta \right) /27\) and can be sustained under the threat of a punishment corresponding to \( q_{A\theta }^{C}=\left( 9+8\delta \right) \left( a-c-\theta \right) /27\).Footnote 4 Also here, the most collusive output in (8) collapses onto 50% of the pure monopoly output if firms do not discount the future too much. This happens for all \(\delta \in \left[ 9/32,1\right] \), which, intuitively, is wider than that associated with grim strategies because here firms rely on the most efficient punishment.

Leaving technology unmodified, firms might pay the sunk cost k to abandon country I and transfer their productive plants to country II, where the emission tax is absent. In such a case, they have to bear a unit transportation cost \(\tau \) and may collude up to \(q_{F\tau }^{C}=\left( 9-5\delta \right) \left( a-c-\tau \right) /\left[ 3\left( 9-\delta \right) \right] \) under grim strategies or \(q_{A\tau }^{C}=\left( 9-8\delta \right) \left( a-c-\tau \right) /27\) under optimal punishments to deter deviations. As in the alternative case in which firms remain in their country of origin, both of these outputs become \(Q_{\tau }^{M}/2=\left( a-c-\tau \right) /4\) for \(\delta \ge 9/17\) and \(\delta \ge 9/32\), depending on the specific punishment being used.

Now suppose first that firms are not able to sustain full collusion along the frontier of monopoly profits, and define instantaneous collusive profits as

Before proceeding any further, we may pause to reflect on whether pollution is transboundary or not. If it is, then we may expect the government of country I to apply the emission tax to the inflow of goods, thereby causing a drop in output and profits as the total marginal cost perceived by firms becomes \({\mathbf {c}}=c+\theta +\tau \), which implies that per-period individual profits are \(\pi _{J\theta \tau }^{C}=\left( a-2q_{J\theta \tau }^{C}-c-\theta -\tau \right) q_{J\theta \tau }^{C}\), strictly lower than \( \pi _{J\tau }^{C}\). This suffices to establish that any \(\theta \) preventing firms to move abroad if pollution is not transboundary will also achieve the same result when it is, justifying the assumption stated at the outset of Sect. 2.

Irrespective of the specific punishment being adopted, moving production plants to the pollution haven is not appealing provided

Obviously, for all \(\theta \le \tau \), we have that \(\max \left\{ 0,\left( \pi _{J\tau }^{C}-\pi _{J\theta }^{C}\right) /\left( 1-\delta \right) \right\} =0\), and therefore we may claim the following:

Proposition 1

Suppose \(\delta \in \left( 0,9/32\right) \), so that firms may only sustain partial collusion independently of the punishment scheme. They have no incentive to move to the pollution haven for all

The adoption of an emission tax \(\theta \in \left( 0,\tau \right] \) suffices to ensure that firms will remain in their country of origin for all \(k>0\).

Of course there also exist infinitely many levels of \(\theta \in \left[ \tau ,a-c\right) \) ensuring the same outcome, depending on the level of k. Yet, the above Proposition says that the policy maker has a relatively easy life in fixing the emission tax once the size of sunk costs and shipping costs associated with relocation of productive plants to the pollution haven is known with an acceptable degree of accuracy. We will come back to the size of \(\theta \) in Sect. 2.2.

For all \(\delta \in \left[ 9/32,9/17\right) \), firms locate themselves along the frontier of monopoly profits forever when using optimal punishments, while they still collude only partially when using grim strategies. In the latter case, the above Proposition holds. Under optimal punishments, the no-relocation condition is \(\pi _{\theta }^{M}/\left( 1-\delta \right) \ge \pi _{\tau }^{M}/\left( 1-\delta \right) -k\), and it is satisfied by all \(k\ge \left( \pi _{\tau }^{M}-\pi _{\theta }^{M}\right) /\left( 1-\delta \right) \), which is economically meaningful only if \(\pi _{\tau }^{M}>\pi _{\theta }^{M}\), i.e., for all \(\theta >\tau \), while it is nil for all \(\theta \in \left( 0,\tau \right] \). This reveals an intuitive fact, namely, that the result stated in Proposition 1 extends to full collusion as well (including that sustained by the Nash reversion), as the pivotal element is the relative size of the emission tax and the unit trade cost.

The foregoing analysis indeed shows that the use of an emission tax may easily prevent firms’ relocation to the pollution haven, given the brown nature of their technology. As we are about to illustrate, the policy maker may hope for a lot more, namely, for firms to invest in a green technology and remain in the home country.

2.2 Two Eggs in One Basket

Now the scenario modifies significantly, as we envisage the possibility for each firm to remain in Country I and invest an exogenous amount \(x>0\) in order to acquire (or equivalently invent with perfect certainty) a fully green technology at the very outset of the repeated game. That is, unlike (Damania 1996), we assume this investment takes place at t = 0 and incorporates the total R&D expenditure needed for the technology to become operative and remain so forever, so that x does not modify the expressions of per-period profits, except that firms do not pay the emission tax at all times. Hence, the intervals of collusive outputs obtain by posing \(\theta =0\) either in (4) if the Nash reversion is used, or in (8) under the stick-and-carrot punishment. What follows illustrates the arising of an incentive for firms to invest to clean up their technology once and for all at the initial instant, and stay in country I, under both Nash reversion and optimal punishment.

2.2.1 Grim Trigger Strategies

Assume firms revert to the one-shot Cournot–Nash equilibrium forever if any deviation from the collusive path takes place, and consider the profit flows associated with partially collusive outputs \(q_{F\theta }^{C}\), \(q_{F\tau }^{C}\) and \(q_{Fx}^{C}\):

A quick inspection of (12) and (13) reveals the presence of two different upper bounds to k and x, and, defining these upper bounds as, respectively,

their sequence obviously is \({\overline{x}}_{Fx}^{C}>{\overline{k}}_{F\tau }^{C}\) due to the presence of the transportation cost \(\tau \) in \({\overline{k}} _{F\tau }^{C}\), all else equal. Therefore, firms might find it profitable to invest in the green technology in a range of values of x (even higher than k).

On the basis of (12–13), we see that—provided they remain in country I—firms invest to avoid the burden of emission taxation whenever \(\Pi _{Fx}^{C}>\Pi _{F\theta }^{C}\), that is, for all

Considering that \(\left( a-c\right) ^{2}>\left[ 2\left( a-c\right) -\theta \right] \theta >0\), if \(x\in \left( 0,x_{Fx\theta }^{C}\right) \) then all profit flows are strictly positive, a result which includes the fact that \( x_{Fx\theta }^{C}\in \left( 0,{\overline{x}}_{Fx}^{C}\right) \), and therefore firms invest in the green technology:

Lemma 1

Suppose \(\delta \in \left( 0,9/17\right) \) and firms are in country I. For all \(x\in \left( 0,x_{Fx\theta }^{C}\right) \), they find it profitable to invent the green technology.

Yet, will they remain in country I? This simply boils down to proving that the existence of an incentive to invent or acquire the green technology may be sufficient to ensure also that firms will not move to the pollution haven, if the policy maker is smart enough to design the emission tax appropriately. Firms won’t relocate their productive facilities to country II for all

Now, the difference \(x_{Fx\tau }^{C}-x_{Fx\theta }^{C}\) has the same sign as

and consequently any \(\theta \in \left( 0,\tau \right] \) suffices to ensure that \(x_{Fx\tau }^{C}>x_{Fx\theta }^{C}\). Hence, we may complement the result stated in Lemma 1 by formulating the following:

Proposition 2

Suppose \(\delta \in \left( 0,9/17\right) \) and \(x\in \left( 0,x_{Fx\theta }^{C}\right) \). If so, then adopting \(\theta \in \left( 0,\tau \right] \) is sufficient to induce firms to remain in their country of origin and invest in the green technology.

Now that we have acquired a full view of the game, a few additional remarks on the level of the emission tax are needed to fully appreciate the aim of this policy. To this purpose, two related things are worth stressing. The first is that the government of country I may confine itself to tuning \(\theta \) so as to match the trade cost \(\tau \). Of course (since the expression appearing in (17) is quadratic in \(\theta \)), there is a continuum of tax rates satisfying the necessary and sufficient condition for \(x_{Fx\tau }^{C}>x_{Fx\theta }^{C}\), but \(\theta =\tau \) is a ‘focal’ solution, the only piece of information the regulator needs to obtain being a decently accurate estimate of the unit shipping cost from country II to country I. Put differently, provided going green is profitable for firms, the problem of the policy maker is not that of reducing emissions and obtaining a tax revenue by finding the socially efficient (although not necessarily Pigouvian) tax rate, which might well be a cumbersome task in itself, but rather that of equating the gross profit flows generated in the two cases in which, alternatively, firms remain in the home country and invest in the replacement technology or move their plants to the pollution haven. The second is that, if country I’s government announces the adoption of \(\theta =\tau \) and \(x\in \left( 0,x_{Fx\theta }^{C}\right) \), then firms remain in the home country and invest \(x_{Fx\theta }^{C}\) at t = 0, so that no tax income is ever generated. This unambiguously confirms that what the government of country I must be looking for is not raising a revenue while diminishing emissions, but rather inducing firms to remain and change the nature of their technology once and for all. Yet, as shown in Appendix 1, the efficient tax rate may indeed belong to the interval \(\left( 0,\tau \right] \).

These observations bring us to the last step. Note that behind Proposition 2 there lies the possibility of validating the Porter hypothesis in its strong form as well. To check it, we just need to define the welfare flows engendered by firms in the two different perspectives in which they remain in country I and either (i) invest to obtain the replacement technology, or (ii) keep paying the emission tax. In case (i), welfare is the sum of firms’ net discounted profit flows plus the discounted flow of consumer surplus, \(CS_{Fx}^{C}=\left( 2q_{Fx}^{C}\right) ^{2}/\left[ 2\left( 1-\delta \right) \right] \), hence \(SW_{Fx}^{C}=2\Pi _{Fx}^{C}+CS_{Fx}^{C}\); in the second case, the welfare flow is instead

where \(CS_{F\theta }^{C}=\left( 2q_{F\theta }^{C}\right) ^{2}/\left[ 2\left( 1-\delta \right) \right] \) is consumer surplus, \(T_{F\theta }^{C}=2\theta q_{F\theta }^{C}/\left( 1-\delta \right) \) is the tax income, and \({\mathcal {D}}_{F\theta }^{C}=v\left( 2q_{F\theta }^{C}\right) ^{2}/\left( 1-\delta \right) \) is the environmental damage, with parameter \(v>0\) scaling the marginal environmental damage. If \(v>1/2\), the environmental damage more than offsets consumer surplus, and conversely.

We may now proceed to discover that \(SW_{Fx}^{C}>SW_{F\theta }^{C}\) provided that \(x\in \left( 0,x_{FSW}^{C}\right) \), where

which is positive and higher than \(x_{Fx\theta }^{C}\) for all \(\delta \in \left( 0,9/17\right) \); moreover, \(\max \left\{ x_{FSW}^{C},{\overline{x}} _{Fx}^{C}\right\}>x_{Fx\tau }^{C}>x_{Fx\theta }^{C}\) over the same range. This result delivers the following message, ancillary to Proposition 2:

Corollary 1

Provided \(x\in \left( 0,x_{Fx\theta }^{C}\right) \), by setting \(\theta =\tau \) the regulator surely attains the sequence \(x_{Fx\theta }^{C}<x_{Fx\tau }^{C}<\max \left\{ x_{FSW}^{C},{\overline{x}}_{Fx}^{C}\right\} \), and therefore, by making the pollution haven unattractive, it also paves the way towards a validation of the Porter Hypothesis in its strong form, for all \(\delta \in \left( 0,9/17\right) \).

Once again, the level of the tax is instrumental to the twofold purpose of environmental regulation in this model. This can be reformulated by saying that the appropriate policy is that which becomes immediately outdated. The novel features of the present analysis are (i) the arising of a continuum of emission tax rates achieving the goals of making pollution havens unappealing and vindicating the strong version of the Porter hypothesis, and (ii) the fact that this continuum does admit infinitely many soft tax rates, among which possibly also the socially efficient one (see Appendix 1).

Before proceeding to optimal punishments, we may note that (irrespective of the structure of the punishment and the intensity of collusion) resorting to some form of R&D cooperation (a cartel or an RJV) or information sharing abating the per-firm innovation cost would imply higher incentives for firms to remain in their country of origin and invest in green technologies, all else equal. Accordingly, a government might accompany environmental regulation with R&D subsidies or softer taxation if firms do activate R&D cartels or RJVs. This is a straightforward corollary of a strand of literature that has highlighted the presence of a positive relationship between R&D cooperation and collusion stability (Martin 1995; Lambertini et al. 1998, 2002; Cabral 2000; Miyagiwa 2009; Levy 2012).

2.2.2 Optimal Punishment

Now take the optimal punishment case, again under partial collusion; here, \( \delta \in \left( 0,9/32\right) \). The corresponding collusive profit flows are, respectively,

if firms remain in the home country and invest in the green technology. Otherwise, the net individual profit flow is

while relocating to country II each firm obtains

The discussion follows the same lines as under infinite Nash reversion, and therefore we may reconstruct it quickly. To begin with, suppose firms remain in country I. We have \(\Pi _{Ax}^{C}>\Pi _{A\theta }^{C}\) for all

Once again, if \(x\in \left( 0,x_{Axt}^{C}\right) \), then all profit flows are strictly positive and firms have an incentive to invest to clean up their technology. This replicates Lemma 1 for the optimal punishment case.

Next, there arises the question whether firms will stay in their home country or not. This requires \(\Pi _{Ax}^{C}>\Pi _{A\tau }^{C}\), which is met for all

Moreover, the difference \(x_{Ax\tau }^{C}-x_{Ax\theta }^{C}\) has the sign of

where \(2\left( a-c\right) -\tau -\theta >0\) surely, so that the sign of \( x_{Ax\tau }^{C}-x_{Axt}^{C}\) depends on the size of \(\theta \). In particular, a sufficient condition for \(x_{Ax\tau }^{C}>x_{Ax\theta }^{C}\) is \(\theta =\tau \). These findings lead to the replication of Proposition 2.

Referring to the relevant discounted welfare flows \(SW_{Ax}^{C}=2\Pi _{Ax}^{C}+CS_{Ax}^{C}\) and \(SW_{A\theta }^{C}=2\Pi _{A\theta }^{C}+CS_{A\theta }^{C}+T_{A\theta }^{C}-{\mathcal {D}}_{A\theta }^{C}\), one can easily verify that the equivalent of Corollary 1 applies under the most efficient punishment scheme as well, since \(x_{Ax\theta }^{C}<x_{Ax\tau }^{C}<\max \left\{ x_{ASW}^{C},{\overline{x}}_{Ax}^{C}\right\} \). Hence, provided \(x\in \left( 0,x_{Ax\theta }^{C}\right) \), the win–win solution can be attained by adopting an emission tax rate \(\theta =\tau \), with a view to inducing firm to remain at home and replace their technology, rather than collecting the corresponding tax income.

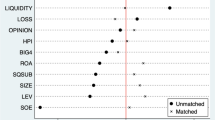

The picture of what happens under partial collusion—irrespective of the specific punishment being used to stabilise it—is in Fig. 1, in which the critical levels of the green R&D investment are drawn as a function of the discount factor \(\delta \). The upper bound of the latter, \({\overline{\delta }}\), is either 9/32 or 9/17 depending on the punishment. The area identified by the star, below \(x_{Ax\theta }^{C}\) and to the left of \({\overline{\delta }}\), is that in which (i) firms do not move to the pollution haven, and (ii) the win–win solution obtains. It is also worth stressing once again that the picture in Fig. 1 surely applies at \(\theta =\tau \), which suffices for \(x_{Ax\tau }^{C}>x_{Ax\theta }^{C}\). Should this not be the case, then the starred region hosting the win–win solution would be identified by any \(x\in \left( 0,\min \left\{ x_{Jx\theta }^{C},x_{Jx\tau }^{C}\right\} \right) \), J = A, F. Should x be at least as large as \(\min \left\{ x_{Jx\theta }^{C},x_{Jx\tau }^{C}\right\} \), the government could subsidise green innovation using public money.

The special case in which \(\delta =0\) and firms do not collude at all as they do not attach any relevance whatsoever to future profits is quickly dealt with. In this scenario,

with firms staying in country I and adopting the green technology for all \( x\in \left( 0,\left. x_{x\theta }^{C}\right| _{\delta =0}\right) \). The latter exercise, although elementary in itself, offers the possibility of highlighting that \(x_{Fx\theta }^{C}\) and \(x_{Ax\theta }^{C}\) are both monotonically increasing in \(\delta \) and therefore some degree of collusion facilitates the attainment of the win–win solution in situations where the strict adherence to a fully noncooperative behaviour might induce firms to quit the home country and move to the pollution haven.

2.3 Full Collusion

If \(\delta \in \left[ {\overline{\delta }},1\right] \), firms can collude along the frontier of monopoly profits independently of where they are and what they do. Their profit flows simplify as follows:

and the overall pattern of collusive profits for \(\delta \in \left[ 0,1 \right] \) looks as in Fig. 2. For any given regime identified by \(j=\theta ,\tau ,x\), the partially collusive per-period individual profits depart from the noncooperative Nash equilibrium profits at \(\delta =0\) and increase faster if the optimal punishment is adopted, reaching 50% of full monopoly profits at \(\delta =9/32\), while the same level is attained at \(\delta =9/17\) under grim trigger strategies.

Clearly, the case of full collusion being a special case of the partially collusive scenario, on the basis of the expressions appearing in (27) it is easily ascertained that a sufficient condition for \(\Pi _{\theta }^{M}>\Pi _{\tau }^{M}\) consists in setting \(\theta \in \left( 0,\tau \right] \), and \(\Pi _{x}^{M}>\Pi _{\theta }^{M}\) for all \( x<x_{x\theta }^{M}\equiv \theta \left[ 2\left( a-c\right) -\theta \right] / \left[ 8\left( 1-\delta \right) \right] \), and it is worth noting that \( x_{x\theta }^{M}\) is monotonically increasing in the discount factor, with \( \lim _{\delta \rightarrow 1}x_{x\theta }^{M}=\infty \). Moreover, \(\Pi _{x}^{M}>0\) for any \(x\in \left( 0,x_{x\theta }^{M}\right] \). This is due to the fact that \(\Pi _{x}^{M}>0\Leftrightarrow x<{\overline{x}}_{x}^{M}\equiv \left( a-c\right) ^{2}/\left[ 8\left( 1-\delta \right) \right] \), with \( {\overline{x}}_{x}^{M}>x_{x\theta }^{M}\). These findings jointly imply that, if firms are extremely patient, they will surely respond to the aforementioned ‘sufficient’ tax policy by (i) remaining in the home country and (ii) investing any finite amount \(x_{x\theta }^{M}\) to endow themselves with the green technology.

As far as social preferences are concerned, \(SW_{x}^{M}>SW_{\theta }^{M}\) for anyFootnote 5

Moreover, \(x_{x\theta }^{M}<\min \left\{ x_{SW}^{M},{\overline{x}} _{x}^{M}\right\} \) for all \(\delta \in \left[ 9/32,1\right] \). Consequently, we may claim

Proposition 3

Suppose \(\theta \in \left( 0,\tau \right] \). If firms can sustain full collusion independently of the specific punishment, any \(x\in \left( 0,x_{x\theta }^{M}\right) \) yields the win–win solution, with firms remaining in the home country and adopting the green technology.

There remains to examine in some more detail the range \(\delta \in \left[ 9/32,1\right) \). Here, firms reach the frontier of industry profits only by adopting the most efficient punishment, while remaining short of it using grim trigger strategies. Therefore, they disregard the possibility of transferring their plants to the pollution haven and go for the green technology independently of the nature of the punishment only if \(x\in \left( 0,x_{Fx\theta }^{C}\right) \). Hence, on the basis of Propositions 2 and 3, we have

Corollary 2

Suppose \(\theta \in \left( 0,\tau \right] \) and \(\delta \in \left[ 9/32,1\right) \). In this region, the win–win solution arises irrespective of the punishment adopted to sustain any degree of collusion iff \(x\in \left( 0,x_{Fx\theta }^{C}\right) \).

2.4 On Strategic Interaction Between Firms or Governments

What we have seen thus far only considers cases in which firms’ choices are fully symmetric, which in itself may appear unjustified, as firms can individually decide whether to stay in country I or not, and, if either firm remains at home, it may or may not invest in the green technology. Likewise, governments may strategically use their instruments: for instance, the government of country II might subsidise production or shipping costs to attract firms, triggering an analogous reaction by country I’s government, which could then modify the emission tax or introduce a tariff on imports.

A complete description of strategic interplay between firms requires the analysis of two \(2\times 2\) reduced-form games. The first describes the choice between leaving country I to reach the pollution haven, the second concerns the decision about whether to adopt the green technology or not, provided both firms have decided not to relocate to country II. Both must be investigated for generic levels of collusion alternatively sustained by Nash or optimal punishments.

The first game amounts to analysing an asymmetric cartel formed by firms bearing different total marginal costs, respectively determined by the technological marginal cost and either \(\theta \) or \(\tau \). As we know from the literature on asymmetric cartels, from Harrington (1991) to Miklós-Thal (2011), the asymmetry of marginal cost is an issue, as in line of principle production should be concentrated in the firm with the lowest marginal cost, with an ex post side payment to the other(s). This has two implications: the first is that the most efficient firm might not honor such a commitment, and the second is that the side payment might reveal the existence of a collusive mechanism to antitrust authorities, in particular if, as in the present model, it should cross the border between the two countries.

There is an alternative scenario in which side payments are ruled out and production quotas are supposed to be calculated according to a bargaining solution, the most commonly invoked being the Nash one. Yet, thus far, the maximisation of the related Nash product hasn’t been analytically solved, as the related first order condition features the unknown (the sharing rule) at the fifth power, as illustrated in Appendix 2, where the problem is defined for the setting with a firm in country I and the other in country II.

The remaining case in which both are in country I, but a firm adopts the green technology while the other doesn’t and keep paying the emission tax suffers from the analogous drawback, as the efficient production quotas solving the Nash bargaining problem cannot be identified analytically. However, both cases feature a relevant exception, in which the policy maker of country I adopts the prescription outlined in Propositions 1–2 at the margin, setting \(\theta =\tau \). If so, firms’ marginal costs are identical and the asymmetric setting becomes observationally equivalent to a symmetric supergame in which the only relevant feature is the size of fixed costs, either k or x, validating all of the above claims. Yet, the \(2\times 2\) games illustrating firms’ strategic decisions under fully noncooperative behaviour are also laid out in Appendix 3, with the characterisation of the conditions under which both remain in country I and adopt the green replacement technology.

The essential elements of the second game, concerning strategic interaction between governments, can be grasped through an informal discussion. The issue is that, say, each policy maker may manipulate total marginal cost, either \({\mathbf {c}}=c+\theta \) or \({\mathbf {c}}=c+\tau ,\) to convince firms to stay in country I or leave it. Now, suppose \(\theta =\tau \), in such a way that Proposition 1 holds and the government of country I keeps firms at home for all \(k\ge 0\). The obvious reply by its counterpart is to subsidise shipping and/or production costs to increase \(\pi _{J\tau }^{C}\) enough for \(0\le k<\pi _{J\tau }^{C}-\pi _{J\theta }^{C}\) to hold. Define this level of total marginal cost as \({\mathbf {c}}^{\prime }=c+\tau ^{\prime }<c+\tau .\) Of course, the policy maker in country I may reset the emission tax at \(\theta ^{\prime }=\tau ^{\prime }\). This necessarily triggers an undercutting process whereby countries engage themselves in a fiscal competition which takes the form of a race to the bottom until \(\theta =\tau =0\), with the pressure exerted by environmental regulation and shipping becoming progressively milder. Once the tax and the unit shipping cost have disappeared, the residual choice for both governments is to subsidise production, with \(\theta <0\) and a unit subsidy \(\eta \in \left( 0,c\right] \) offered to firms in I and II, respectively. This implies that the sufficient condition \(\theta =\tau \) continues to hold in the race to the bottom as well, and reinforces the result outlined above.

3 Emission Standard

Now we turn our attention to the alternative case in which country I’s regulator adopts an emission standard s imposed to both firms. To this purpose, we shall use once again the initial Cournot setup with constant and identical marginal production costs for both firms, plus the usual quadratic cost associated with the need of complying with the standard. In this case, if firms remain at home, they must adhere to the standard. Hence, the question is not whether they will invest in green R&D if they remain at home, but rather whether they will remain in their country of origin.

The design of the emission standard closely replicates what appears in Ulph (1996) and Montero (2002a, b), among others.Footnote 6 The objective of the regulator consists in limiting industry-wide emissions at \(S=s_{1}+s_{2}\) and the symmetry of the model allows us to set \(s_{i}=s\), which is the per-firm emission standard. As we are about to see, the exact level of the standard has no impact on cartel stability. The standard imposes the same quadratic cost on both firms, in such a way that the profit function of firm i when located in country I is \(\pi _{i}=\left( a-q_{i}-q_{j}-c\right) q_{i}-b\left( q_{i}-s\right) ^{2}\). Here, b is a positive parameter measuring the efficiency level of the abatement technology. For the sake of brevity, we shall confine ourselves to the opposite cases of full collusion under optimal punishments or Nash behaviour. To save upon notation in the remainder of the section, we define \({\mathsf {a}}\equiv a-c\).

3.1 Full Collusion

The argument largely replicates that outlined in the previous version of the model, and consequently we may omit some of the mathematical details. If firms remain in country I and collude along the frontier of industry profits, each of them produces the equilibrium output \(q_{s}^{C}=\left( {\mathsf {a}}+2bs\right) /\left[ 2\left( 2+b\right) \right] \) and receives profits \(\pi _{s}^{C}=\left[ {\mathsf {a}}\left( {\mathsf {a}}+4bs\right) -8bs^{2} \right] /\left[ 4\left( 2+b\right) \right] \). The optimal unilateral deviation from the cartel is \(q_{s}^{DC}=\left( {\mathsf {a}}+2bs\right) \left( 3+2b\right) /\left[ 4\left( 1+b\right) \left( 2+b\right) \right] \). As far as the one-off punishment phase is concerned, the symmetric punishment profits are \(\pi _{s}^{P}=\left( {\mathsf {a}}-2q^{P}\right) q^{P}-b\left( q^{P}-s\right) ^{2}\), and the deviation from the optimal penal code \( q_{s}^{DP}=\left( {\mathsf {a}}+2bs-q^{P}\right) /\left[ 2\left( 1+b\right) \right] \) delivers profits \(\pi _{s}^{DP}=\left( {\mathsf {a}} -q^{DP}-q^{P}\right) q^{DP}-b\left( q^{DP}-s\right) ^{2}\) to the defecting firm. The set of conditions coincides with the triple of inequalities in (5–7). In particular, solving (5–6), we obtain the critical threshold of the discount factor above which full collusion is sustainable at home, and the minimum output level qualifying as the optimal punishment:

Then, it is easily checked that constraint (7) is loose. Now we may notice that, while intuitively \(q_{s}^{P}\) increases monotonically in s, the critical discount factor \(\delta _{s}^{*}\), although not explicitly featuring the emission standard, is nonetheless affected by the steepness of the cost associated with the presence of the standard, namely, parameter b. In particular, \(\partial \delta _{s}^{*}/\partial b<0,\) with \(\delta _{s}^{*}\le 9/32\) for all \(b\ge 0\) and \( \lim _{b\rightarrow \infty }\delta _{s}^{*}=1/4\). This implies

Lemma 2

The stability of full collusion, although independent of the level of the standard, is enhanced by its introduction, and the resulting threshold level of the discount factor is monotonically decreasing in the steepness of the abatement cost.

Also note that the stabilising effect associated with the introduction of the standard is explicitly illustrated by \(\partial q_{s}^{P}/\partial s>0\). The above Lemma has a straightforward consequence on firms’ location decisions, for the following reason. Should they relocate plants abroad to avoid abiding by the standard, their total cost function would become \( {\widetilde{C}}_{i}=\left( c+\tau \right) q_{i}+k\). However, this fact would immediately entail that the critical discount factor for full collusion to be stable would be 9/32. Accordingly, we may formulate

Proposition 4

If \(\delta \in \left( \delta _{s}^{*},9/32\right) \), firms can collude on the frontier of industry profits only by remaining in country I.

That is, if ex ante the policy maker’s educated guess is that firms are not activating a perfect cartel in absence of the standard, then by adopting it she/he may expect firms not to move out to the pollution haven as a reaction to this form of regulation. All of the above, of course, applies exclusively to the case of full collusion, and one may wonder whether it might hold in general, or not. In this respect, instead of illustrating the detailed analysis of partial collusion, one may just take a look at the baseline situation in which firms play the one-shot Nash equilibrium.

3.2 The Noncooperative Case

Profits are \(\pi _{s}^{N}=\left[ {\mathsf {a}}\left( {\mathsf {a}}+4bs\right) \left( 1+b\right) -b\left( 9+8b\right) s^{2}\right] /\left( 3+2b\right) ^{2}\) if firms remain in country I, and \(\pi _{\tau }^{N}=\left( {\mathsf {a}}-\tau \right) ^{2}/9-k\) if instead they relocate plants to the pollution haven. Disregarding k for the moment and solving \(\pi _{s}^{N}-\left. \pi _{\tau }^{N}\right| _{k=0}=0\) w.r.t. s, one finds that since \(\pi _{s}^{N}-\pi _{\tau }^{N}\) is quadratic and concave in s, \(\pi _{s}^{N}>\left. \pi _{\tau }^{N}\right| _{k=0}\) for all \(s\in \left( 0, {\widehat{s}}\right) \).Footnote 7 Therefore, in the same interval, it is necessarily true that \(\pi _{s}^{N}>\pi _{\tau }^{N}\) for all \(k>0\). This amounts to saying that there are infinitely many levels of the standard at which firms have no incentive to go abroad. Moreover, the domestic social welfare function \(SW_{I}^{N}=2\pi _{s}^{N}+CS_{s}^{N}- {\mathcal {D}}^{N}\), in which \({\mathcal {D}}^{N}=4s^{2}\) is the environmental damage, is maximised at \(s^{*}=2{\mathsf {a}}b/\left[ 3\left( 3+4b\right) \right] \in \left( 0,{\widehat{s}}\right) \), which implies our final result:

Proposition 5

Suppose firms do not collude at all, irrespective of where they are based. If the regulator optimally sets the emission standard, this prevents firms from relocating to the pollution haven.

In other words, if firms play the one-shot Nash equilibrium forever, the straightforward maximisation of domestic welfare by country I’s authority has the pleasant consequence of eliminating altogether the risk of seeing firms flee to the pollution haven. Quite obviously, Propositions 4–5 entail that analogous results apply in case of partial collusion, at any level between the one-shot Nash equilibrium and the perfect cartel.

4 Concluding Remarks

The foregoing analysis illustrates that the apparent dissonance between the Porter hypothesis and the pollution haven hypothesis/effect, in terms of their streamlined implications concerning the reaction of firms’ to environmental regulation, can be eliminated through an appropriate design of the policy itself. This may indeed serve the twofold purpose of (i) eliminating the firms’ incentive to quit their country of origin and (ii) triggering a win–win solution. This has been shown to apply under any level of partial collusion in presence of emission taxation, and sketched at an intuitive level in presence of an environmental standard. From a qualitative point of view, an interesting aspect of the above results is that there exists a continuum of policy levels delivering the desired outcome. This, more explicitly, amounts to saying that the volume of information the public authority needs to acquire is not too demanding.

Finally, we would like to add a few words concerning the lack of empirical evidence sustaining the twofold subject of this theoretical paper. This does not come as a surprise, since the two hypotheses haven’t been jointly studied in the same model so far, but the present framework may signal the possibility of taking further steps in this direction, both on the theoretical and on the empirical side.

Notes

Analogous considerations hold for the Cournot model with asymmetric marginal costs in Lambertini (2017, pp. 243–245), in which the green technology involves a higher marginal cost than the brown one, and a sunk investment.

Since the model is deterministic, the unit shipping cost \(\tau \) is invariant. Were it not, because of any stochastic elements affecting the repeated game, then also \(\theta \) would necessarily vary over time in order to reproduce the results we are about to derive.

Then, it can be easily checked that the discounted continuation payoff is strictly positive, that is, (7) is loose in correspondence of the pair \(\left( q_{A\theta }^{C},q_{A\theta }^{P}\right) \).

Some tedious but elementary algebra is necessary to ascertain that \( x_{SW}^{M}>0\) for all \(\delta \in \left[ 9/32,1\right] \) and \(\theta \in \left( 0,a-c\right] \).

The expression of \({\widehat{s}}\) is omitted for brevity.

For the sake of brevity, I am not citing several other contributions to this debate, which is very clearly summarised in Requate (2007).

The second order condition for welfare maximisation is always satisfied, as

$$\begin{aligned} \frac{\partial ^{2}SW_{F\theta }^{C}}{\partial \theta ^{2}}=-\frac{4\left( 1+2v\right) \left( 9-5\delta \right) ^{2}}{9\left( 9-\delta \right) ^{2}\left( 1-\delta \right) }<0 \end{aligned}$$As in the former case, also here the second order condition for welfare maximisation is always satisfied.

References

Abreu DJ (1986) Extremal equilibria of oligopolistic supergames. J Econ Theory 39:191–225

Ambec S, Cohen M, Elgie S, Lanoie P (2013) The Porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Policy 7:2–22

André FJ, González P, Porteiro N (2009) Strategic quality competition and the Porter hypothesis. J Environ Econ Manag 57:182–94

Barnett A (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70:1037–41

Barrett S (1994) Strategic environmental policy and international trade. J Public Econ 54:325–38

Buchanan JM (1969) External diseconomies, corrective taxes, and market structure. Am Econ Rev 59:174–77

Cabral L (2000) R&D cooperation and product market competition. Int J Ind Organ 18:1033–47

Cole MA, Elliott RJR, Zhang L (2017) Foreign direct investment and the environment. Annu Rev Environ Resour 42:465–87

Constantatos C, Herrmann M (2011) Market inertia and the introduction of green products: can strategic effects justify the Porter hypothesis? Environ Resour Econ 50:267–84

Copeland BR, Taylor MS (1994) North–South trade and the environment. Q J Econ 109:755–87

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42:7–71

Damania D (1996) Pollution taxes and pollution abatement in an oligopoly supergame. J Environ Econ Manag 30:323–36

Friedman JW (1971) A non-cooperative equilibrium for supergames. Rev Econ Stud 28:1–12

Fullerton D (ed) (2006) The economics of pollution havens. Edward Elgar, Cheltenham

Greaker M (2003a) Strategic environmental policy: eco-dumping or a Green strategy? J Environ Econ Manag 45:692–707

Greaker M (2003b) Strategic environmental policy when the governments are threatened by relocation. Resour Energy Econ 25:141–54

Harrington JE Jr (1991) The determination of price and output quotas in a heterogeneous cartel. Int Econ Rev 32:767–92

Katsoulacos Y, Xepapadeas A (1995) Environmental policy under oligopoly with endogenous market structure. Scand J Econ 97:411–20

Lambertini L (2013) Oligopoly, the environment and natural resources. Routledge, London

Lambertini L (2017) Green innovation and market power. Annu Rev Resour Econ 9:231–52

Lambertini L, Tampieri A (2012) Vertical differentiation in a cournot industry: the Porter hypothesis and beyond. Resour Energy Econ 34:374–80

Lambertini L, Poddar S, Sasaki D (1998) Standardization and the stability of collusion. Econ Lett 58:303–10

Lambertini L, Poddar S, Sasaki D (2002) Research joint ventures, product differentiation and price collusion. Int J Ind Organ 20:829–54

Lanoie P, Laurent-Lucchetti J, Johnstone N, Ambec S (2011) Environmental policy, innovation and performance: new insights on the Porter hypothesis. J Econ Manag Strategy 20:803–42

Levin D (1985) Taxation within Cournot oligopoly. J Public Econ 27:281–90

Levinson A, Taylor MS (2008) Unmasking the pollution Haven effect. Int Econ Rev 49:223–54

Levy N (2012) Technology sharing and tacit collusion. Int J Ind Organ 30:204–16

Markusen JR, Morey ER, Olewiler ND (1993) Environmental policy when market structure and plant location are endogenous. J Environ Econ Manag 24:69–86

Martin R, Muûls M, de Preux LB, Wagner UJ (2014) Industry compensation under relocation risk: a firm-level analysis of the EU emissions trading scheme. Am Econ Rev 104:2482–2508

Martin S (1995) R&D joint ventures and tacit product market collusion. Eur J Polit Econ 11:733–41

Miklós-Thal J (2011) Optimal collusion under cost asymmetry. Econ Theor 46:99–125

Miyagiwa K (2009) Collusion and research joint ventures. J Ind Econ 57:768–84

Montero J-P (2002a) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Montero J-P (2002b) Market structure and environmental innovation. J Appl Econ 5:293–325

Nachtigall D (2019) Dynamic climate policy under firm relocation: the implications of phasing out free allowances. Environ Resour Econ 74:473–503

Petrakis E, Xepapadeas A (2003) Location decisions of a polluting firm and the time consistency of environmental policy. Resour Energy Econ 25:197–214

Porter ME (1991) America’s Green strategy. Sci Am 264:168

Porter ME, van der Linde C (1995a) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Porter ME, van der Linde C (1995b) Green and competitive: ending the stalemate. Harvard Business Review (September–October), 120–134

Rauscher M (1994) On ecological dumping. Oxf Econ Pap 46:822–40

Requate T (2005) Dynamics incentives by environmental policy instruments—a survey. Ecol Econ 54:175–95

Requate T (2007) Environmental policy under imperfect competition. In: Tietenberg T, Folmer H (eds) The international yearbook of environmental and resource economics 2006/2007, A survey of current issues. Edward Elgar, Cheltenham, pp 120–207

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology—will the true ranking please stand up? Eur Econ Rev 47:125–46

Schmidt RC, Heitzig J (2014) Carbon leakage: grandfathering as an incentive device to avert firm relocation. J Environ Econ Manag 67:209–223

Simpson RD (1995) Optimal pollution taxation in a Cournot Duopoly. Environ Resour Econ 6:359–69

Simpson RD, Bradford R (1996) Taxing variable costs: environmental regulation as industrial policy. J Environ Econ Manag 30:282–300

Ulph A (1996) Environmental policy and international trade when governments and producers act strategically. J Environ Econ Manag 30:265–81

Ulph A, Valentini L (2001) Is environmental dumping greater when plants are footloose? Scand J Econ 103:673–88

Acknowledgments

We would like to thank two anonymous referees, Vincenzo Denicolò, Charles Mason, Santiago Rubio, Tasos Xepapadeas, Aart de Zeeuw and the audience at the 3rd International Workshop on the Economics of Climate Change and Sustainability (Bologna, May 3-4, 2019), the workshop on Protection of Property Rights and Competition: India and Italy (Bologna, July 23, 2019) and 46th EARIE Conference (PFU Barcelona, August 30 - September 1, 2019) for helpful comments and discussion. The usual disclaimer applies.

Funding

Open Access funding provided by Alma Mater Studiorum - Università di Bologna.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 Appendix 1

Here we show that there exists an admissible parameter range wherein the key result stated in Proposition 2 may hold, irrespective of the specific nature of the deterrence used to stabilise implicit collusion, if the regulator adopts the welfare-maximising tax rate. In this respect, it is worth recalling that in imperfectly competitive markets, the emission tax maximising welfare, in general, will not be Pigouvian. That is, it won’t be equal to the marginal environmental damage, as we know from Buchanan (1969) and Barnett (1980) for the monopoly case and Levin (1985), Katsoulacos and Xepapadeas (1995), Simpson (1995) and then many others in the oligopoly case. When market power matters and market demand is not infinitely elastic, the second-best tax will be lower than the marginal damage (in particular in a symmetric Cournot duopoly), except in presence of asymmetric productive technologies (Simpson 1995) or under free entry (Katsoulacos and Xepapadeas 1995), in which cases it will exceed the marginal damage.Footnote 8

Under grim trigger strategies, the FOC taken on (18) w.r.t. \(\theta \) is nil at

which is positive for all \(v>\left( 9+7\delta \right) /\left[ 4\left( 9-5\delta \right) \right] \). If \(\delta =0\) (which holds either in the one-shot game or in the equivalent case in which firms are totally impatient), then \(\left. \theta _{F}^{*}\right| _{\delta =0}=\left( a-c\right) \left( 4v-1\right) /\left[ 2\left( 1+2v\right) \right] \). This tells that, in the static benchmark game, if the damage is at least 50% of consumer surplus then it is optimal to tax emissions; otherwise, the optimal policy consists in subsidising production.Footnote 9

Of course, \(\theta _{F}^{*}\) is admissible if and only if it doesn’t drive to zero individual and industry output, that is, it must be lower lower than \(a-c\). This is equivalent to requiring

which is always true since

Hence, \(\theta _{F}^{*}\) satisfies Proposition 2 provided that \(\theta _{F}^{*}<\tau <a-c\). The second part of this necessary and sufficient condition must be met, once again, to ensure positive outputs should firms relocate to the pollution haven. As for the first part,

in which \(\left( a-c\right) \left[ 9+7\delta -4v\left( 9-5\delta \right) \right] <0\) when \(\theta _{F}^{*}>0,\) and conversely. Hence, the second-best tax rate \(\theta _{F}^{*}>0\) indeed lies below the unit transportation cost \(\tau \) and satisfies the claim in Proposition 2 iff

with the critical threshold on the r.h.s. being lower than \(a-c\) for all \( \delta \in \left( 0,1\right) \) and \(v>0\), as we know from (32).

An analogous exercise can be carried out for the supergame in which firms rely on optimal punishments to stabilise collusion. Here, the welfare-maximising policy is identified byFootnote 10

which is positive for all \(v>\left( 9+16\delta \right) /\left[ 4\left( 9-8\delta \right) \right] \). To begin with, observe that

everywhere, the reason being that optimal punishments allow firms to intensify collusion (thereby producing and polluting less, all else equal), and therefore the welfare-maximising tax is lower than under grim trigger strategies. As a consequence, the adoption of efficient punishments expand the interval to which \(\tau \) must belong in order for the equivalent of Proposition 2 to apply, as the condition becomes \(\tau \in \left( \theta _{A}^{*},a-c\right) \), with the lower bound strictly lower than it would be under grim trigger strategies.

This fact, in itself, would suffice to conclude that optimal punishments make the regulator’s task easier. Yet, to complete the picture, we may proceed as above to find that \(a-c>\theta _{A}^{*}\) always, since

and

which requires

and this threshold is always lower than \(a-c\).

1.2 Appendix 2

Total cartel output is \(Q^{C}\), so that we may write country I’s demand function as \(p=a-Q^{C}\). Then, we may confine ourselves to examine the asymmetric supergame in which firm 1 has remained in the home country while firm 2 has moved to the pollution haven. Since firms bear asymmetric total marginal costs, we define production quotas as \(q_{1}^{C}=\sigma _{1}Q^{C}\) and \(q_{2}^{C}=\sigma _{2}Q^{C}=\left( 1-\sigma _{1}\right) Q^{C}\) since \(\sigma _{2}=\left( 1-\sigma _{1}\right) \). The associated per-period collusive profit functions are

whose sum must be maximised w.r.t. total cartel output, to find \(Q^{C}=\left[ a-c-\sigma _{1}\theta -\left( 1-\sigma _{1}\right) \tau \right] /2\). Hence, the expressions of individual collusive profits simplify as follows:

The Nash equilibrium profits are

and the optimal sharing rule \(\sigma _{1}^{NBS}\) determined by the Nash Bargaining solution requires solving a FOC which contains a quintic polynomial in \(\sigma _{1}\), as it must maximise the Nash product \(V=\left( \pi _{1}^{C}-\pi _{1}^{N}\right) \left( \pi _{2}^{C}-\pi _{2}^{N}\right) \). This is due to the fact that \(\pi _{i}^{C}-\pi _{i}^{N}\), i = 1, 2 is cubic in \(\sigma _{1}\), and therefore V features \(\sigma _{1}^{6}\). In the special case in which \(\theta =\tau \),

which implies that V is strictly concave in \(\sigma _{1}\) and delivers \( \sigma _{1}^{NBS}=1/2\). In this circumstance, all possible supergames are symmetric in terms of the gross discounted profits accruing to firms, the only difference lying in the possible presence of fixed costs. Consequently, this particular policy, if adopted by the government of country I, largely simplifies the problem also for firms and ensures that they will remain in their country of origin irrespective of the nature of punishments, and will switch from brown to green for all \(x\in \left( 0,x_{Jx\theta }^{C}\right) \), J = A, F.

1.3 Appendix 3

Here we briefly expose the \(2\times 2\) reduced form games proving that, if firms do not collude at all, there exists a continuum of emission taxes validating the equivalent of Propositions 2 and 3 and Corollary 2. To begin with, Matrix 1 illustrates the choice about relocation. Strategies I and II refers to the choice of the home country vs the pollution haven.

2 | |||

|---|---|---|---|

I | II | ||

1 | I | \(\dfrac{\left( a-c-\theta \right) ^{2}}{ 9\left( 1-\delta \right) }\,;\,\dfrac{\left( a-c-\theta \right) ^{2}}{ 9\left( 1-\delta \right) }\) | \(\dfrac{\left( a-c-2\theta +\tau \right) ^{2}}{9\left( 1-\delta \right) }\,;\,\dfrac{\left( a-c+\theta -2\tau \right) ^{2}}{9\left( 1-\delta \right) }-k\) |

II | \(\dfrac{\left( a-c+\theta -2\tau \right) ^{2}}{ 9\left( 1-\delta \right) }-k\,;\,\dfrac{\left( a-c-2\theta +\tau \right) ^{2} }{9\left( 1-\delta \right) }\) | \(\dfrac{\left( a-c-\tau \right) ^{2}}{9\left( 1-\delta \right) }-k\,;\,\dfrac{\left( a-c-\tau \right) ^{2}}{9\left( 1-\delta \right) }-k\) | |

Matrix 1 | |||

Given the symmetry of the matrix, we may take firm 1’s standpoint to see that, along the first column,

surely positive for all \(\theta \in \left( 0,\tau \right] \). Along the second column it is easily verified that the same expression obtains. Then, we see that the same conclusion holds along the main diagonal,

since any \(\theta \in \left( 0,\tau \right] \) suffices to ensure the positivity of the above expression. Hence, if firms always play the one-shot Nash equilibrium, an emission tax at most equal to the unit shipping cost ensures that (I, I) is the unique Nash equilibrium in pure strategies, as well as that it is also Pareto efficient for firms.

Now we turn to Matrix 2, in which the relevant strategies (whether to invest or keep paying the emission tax) are x and \(\theta \).

2 | |||

|---|---|---|---|

x | \(\theta \) | ||

1 | x | \(\dfrac{\left( a-c\right) ^{2}}{9\left( 1-\delta \right) }-x\,;\,\dfrac{\left( a-c-\theta \right) ^{2}}{9\left( 1-\delta \right) }-x\) | \(\dfrac{\left( a-c+\theta \right) ^{2}}{9\left( 1-\delta \right) }-x\,;\,\dfrac{\left( a-c-2\theta \right) ^{2}}{9\left( 1-\delta \right) }\) |

\(\theta \) | \(\dfrac{\left( a-c-2\theta \right) ^{2}}{ 9\left( 1-\delta \right) }\,;\,\dfrac{\left( a-c+\theta \right) ^{2}}{ 9\left( 1-\delta \right) }-x\) | \(\dfrac{\left( a-c-\theta \right) ^{2}}{9\left( 1-\delta \right) }\,;\,\dfrac{\left( a-c-\theta \right) ^{2}}{9\left( 1-\delta \right) }\) | |

Matrix 2 | |||

Strategy x is strictly dominant for all \(x<4\left( a-c-\theta \right) / \left[ 9\left( 1-\delta \right) \right] \), and therefore this condition ensures that (x, x) will be the only equilibrium at the intersection of dominant strategies provided that firms have not relocated to the pollution haven. It also delivers the win–win solution for all \(x<\min \left\{ 4\left( a-c-\theta \right) /\left[ 9\left( 1-\delta \right) \right] ,\theta \left[ 2\left( a-c\right) -\theta \right] /\left[ 9\left( 1-\delta \right) \right] \right\} \), with

obviously compatible with the requirement \(\theta \in \left( 0,\tau \right] \). As a last remark, note that \(\theta \left[ 2\left( a-c\right) -\theta \right] /\left[ 9\left( 1-\delta \right) \right] \) simplifies to \(\theta \left[ 2\left( a-c\right) -\theta \right] /9\) if \(\delta =0\), in correspondence of which firms are compelled to play noncooperatively forever, as already noted in the main text.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ranocchia, C., Lambertini, L. Porter Hypothesis vs Pollution Haven Hypothesis: Can There Be Environmental Policies Getting Two Eggs in One Basket?. Environ Resource Econ 78, 177–199 (2021). https://doi.org/10.1007/s10640-020-00533-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-020-00533-x