Abstract

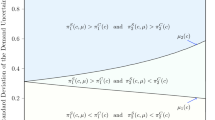

Cost asymmetry is generally thought to hinder collusion because a more efficient firm has both more to gain from deviations and less to fear from retaliation than less efficient firms. Our paper reexamines this conventional wisdom and characterizes optimal collusion without any prior restriction on the class of strategies. We stress that firms can credibly agree on retaliation schemes that maximally punish even the most efficient firm. This implies that whenever collusion is sustainable under cost symmetry, some collusion is also sustainable under cost asymmetry; efficient collusion, however, remains more difficult to sustain when costs are asymmetric. Finally, we show that in the presence of side payments cost asymmetry facilitates collusion.

Similar content being viewed by others

References

Abreu D.: Extremal equilibria of oligopolistic supergames. J Econ Theory 39, 191–225 (1986)

Abreu D.: Towards a theory of discounted repeated games. Econometrica 56, 383–396 (1988)

Athey S., Bagwell K.: Optimal collusion with private information. Rand J Econ 32(3), 428–465 (2001)

Athey S., Bagwell K.: Collusion with persistent cost shocks. Econometrica 76(3), 493–540 (2008)

Bae H.: A price-setting supergame between two heterogeneous firms. Eur Econ Rev 31, 1159–1171 (1987)

Bain J.S.: Output quotas in imperfect cartels. Q J Econ 62, 617–622 (1948)

Bernheim B.D., Whinston M.D.: Multimarket contact and collusive behavior. Rand J Econ 21(1), 1–26 (1990)

Blume A.: Bertrand without fudge. Econ Lett 78, 167–168 (2003)

Compte O., Jenny F., Rey P.: Capacity constraints, mergers and collusion. Eur Econ Rev 46, 1–29 (2002)

Cramton P.C., Palfrey T.R.: Cartel enforcement with uncertainty about costs. Int Econ Rev 31, 17–47 (1990)

Davidson C., Deneckere R.: Excess capacity and collusion. Int Econ Rev 31(3), 521–541 (1990)

Dechenaux, E., Kovenock, D.: Endogenous rationing, price dispersion, and collusion in capacity constrained supergames. Krannert Graduate School of Management, Purdue University, working paper no. 1164 (2003)

Deneckere, R.J., Kovenock, D.: Capacity-constrained price competition when unit costs differ. CMSEMS discussion paper No. 861, Northwestern University (1989)

Deneckere R.J., Kovenock D.: Bertrand–Edgeworth duopoly with unit cost asymmetry. Econ Theory 8, 1–25 (1996)

European Commission.: Commission Fines Five Companies in Citric Acid Cartel. Press Release, December 5, 2001

European Commission.: Commission Fines Five Companies in Sodium Gluconate Cartel. Press Release, March 19, 2002

Friedman J.W.: A noncooperative equilibrium for supergames. Rev. Econ stud 38(1), 1–12 (1971)

Hammond, S.D.: Caught in the Act: Inside an International Cartel. Presented at OECD, Department of Justice Speech, Paris, France, 18 Oct 2005. http://www.usdoj.gov/atr/public/speeches/212266.pdf. Accessed 28 Sept 2009

Harrington J.E. Jr: The determination of price and output quotas in a heterogeneous cartel. Int Econ Rev 32(4), 767–792 (1991)

Hoernig S.H.: Bertrand games and sharing rules. Econ Theory 31, 573–585 (2007)

Ivaldi, M., Rey, P., Seabright, P., Tirole, J.: The economics of tacit collusion. IDEI Working Paper n. 186, Report for DG Competition, European Commission (2003)

Jehiel P.: Product differentiation and price collusion. Int J Ind Organ 10, 633–641 (1992)

Kihlstrom R., Vives X.: Collusion by asymmetrically informed firms. J Econ Manage Strategy 1, 371–396 (1992)

Lambson V.E.: Optimal penal codes in price-setting supergames with capacity constraints. Rev Econ Stud 54, 385–397 (1987)

Lambson V.E.: Some results on optimal penal codes in asymmetric Bertrand supergames. J Econ Theory 62, 444–468 (1994)

Lambson V.E.: Optimal penal codes in nearly symmetric Bertrand supergames with capacity constraints. J Math Econ 24(1), 1–22 (1995)

Mailath G.J., Samuelson L.S.: Repeated Games and Reputations: Long-Run Relationship. Oxford University Press, Oxford (2006)

McAffee R.P., McMillan J.: Bidding rings. Am Econ Rev 82(3), 579–599 (1992)

Miklós-Thal, J.: Optimal collusion under cost asymmetry. Working paper (2008)

Pesendorfer M.: A study of collusion in first-price auctions. Rev Econ Stud 67(3), 281–411 (2000)

Roberts K.: Cartel behaviour and adverse selection. J Ind Econ 33, 401–413 (1985)

Rothschild R.: Cartel stability when costs are heterogeneous. Int J Ind Organ 17, 717–734 (1999)

Scherer F.M.: Industrial Market Structure and Economic Performance. Houghton Mifflin Company, Boston (1980)

Schmalensee R.: Competitive advantage and collusive equilibria. Int J Ind Organ 5, 351–368 (1987)

Tirole J.: The Theory of Industrial Organization. MIT Press, Cambridge (1988)

Vasconcelos H.: Tacit collusion, cost asymmetries, and mergers. Rand J Econ 36(1), 39–62 (2005)

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is based on chapter 2 of my doctoral dissertation at the University of Toulouse 1, written under the guidance of Patrick Rey. I thank co-editor Dan Kovenock, two anonymous referees, Mohamed Belhaj, Bruno Jullien, Ulrich Kamecke, Joe Harrington, and participants of the 2004 WZB/CEPR “Collusion and Cartels” conference, the Econometric Society World Congress 2005, and the European Winter Meeting of the Econometric Society 2005 for feedback and helpful comments.

Rights and permissions

About this article

Cite this article

Miklós-Thal, J. Optimal collusion under cost asymmetry. Econ Theory 46, 99–125 (2011). https://doi.org/10.1007/s00199-009-0502-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-009-0502-9