Abstract

There has been a recent increase in efforts to develop broader models to assess the impact of climate change and climate change policies, both in terms of impact measures (beyond GDP) and in terms of modelling complexity (beyond DICE/RICE models). Climate policies aimed at reducing CO2 emissions can have impacts in multiple sectors of the economy, and can change consumption levels over time. We show how the sustainability indicator Genuine Savings can be endogenised within a general equilibrium model and used as a criterion for judging the impacts of such policies in terms of future well-being. Differences in Genuine Savings rates between CO2 emission reduction scenarios are discussed. We show how a broader, Genuine Savings-based assessment of climate change can result in a re-evaluation of the consequences and costs of inaction in terms of various climate change-related policies; and how multiple environmental and well-being outcomes can be analysed within a unified modelling framework.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Traditionally, policy makers interested in assessing the consequences of climate change and policy options which respond to the challenges of climate change have relied on models producing forecasts under a range of future scenarios (Nordhaus 2010). The indicator of choice for economic impacts in these models is GDP.

Efforts to expand the framework offered by the Nordhaus DICE/RICE models have taken two directions. Some authors have tried to improve the modelling of the biophysics and the economics that underline the model, especially towards the treatment of climate change uncertainties and adaptation (Lontzek et al. 2016; Cai et al. 2015; De Bruin et al. 2009; Oritz et al. 2011). Other contributions aim at going «beyond GDP» and offer a broader view of climate impacts (Pezzey and Burke 2014; Collins et al. 2017). Among such broader measures, the variation of “comprehensive wealth” in a given country (Stiglitz et al. 2009) is gaining prominence. Inclusive Wealth is understood in this context to include all types of capital stocks from which a country derives benefit flows generating well-being. Such stocks include but are not limited to natural capital, produced capital, human capital, and social capital.

As discussed in Hanley et al. (2015), a theoretical elaboration of this perspective on wealth was summarized by Dasgupta (2009), based on a number of contributions (Arrow et al. 2012; Dasgupta 2001; Pezzey 2004; Weitzman 1997). Various authors (Fleurbaey 2015) have demonstrated how the rate of change of comprehensive wealth is an indicator of the sustainability of the development path adopted by the considered economy. This rate of change in wealth has been termed “Genuine Savings” (GS). Whilst GS and changes in comprehensive wealth are now reported as country-level indicators of sustainable development (e.g. Greasley et al. 2014), there has been limited use of such indices in the evaluation of climate change policies. To our knowledge, the only exceptions are Stiglitz et al. (2009) and Pezzey and Burke (2014).

Our aim in this paper is to further the literature on climate change assessment using (a) GS as a comprehensive measure of impacts and (b) a detailed production structure for the resource use and environmental impacts of the world economy. To this end, we use an integrated assessment model (IAM) based on the RICE model, combining an optimizing central planner with a series of resource balance models and a life cycle perspective on environmental impacts, based on previously-published work (Tokimatsu et al. 2011, 2012, 2013, 2014). The use of three resource balance models and one simplified climate model allows us to map resource use to an extended production function via 10 sectors representing the economy. Then, inventories reflecting this resource use by the 10 sectors are used as inputs in a lifecycle impact assessment (LCIA) model to generate environmental impacts related to 4 “policy goals” concerning human health, biodiversity preservation, resource use and ecosystem functioning preservation. Lifecycle impact assessment (LCIA) can be described as a framework to capture a wide range of environmental impacts related to the consumption of goods and services «from cradle to grave». Impacts are included at all geographical levels over the whole lifecycle.

Our modelling endogenously computes GS under a range of future scenarios based on differences in climate policy, biodiversity preservation, resource conservation and ecosystems management. We are therefore able to (a) compute “current value” GS based on simulated comprehensive investment flows at given future points in time t under a range of future scenarios and (b) offer an assessment of the evolution of GS in the coming decades based on the long run consequences of climate change, demographics and energy and resource needs. Such a model can be used in a policy appraisal context. Policy options could be evaluated in terms of their effects on long-run development prospects via their impact on GS, as both theoretical and empirical work has shown how GS is a forward-looking indicator of changes in future consumption (Greasley et al. 2014; Hanley et al. 2015).

Our results are presented with respect to a business-as-usual scenario where the environmental consequences of production do not generate costs for producers. We then internalise those costs as an additional cost on production, before testing various policy-induced constraints on CO2 emissions, biodiversity reduction, resource use patterns and population dynamics.

For the policy options considered in this paper, we find GS as estimated by our model to be declining over time. In some scenarios, GS turns negative between 2050 and 2100, showing unsustainability in development. Unsurprisingly, the lower the expected productivity growth, and the faster the expected population growth, the quicker GS turns negative. Under most scenarios, implementing more stringent climate policies will have a positive impact on GS, as the environmental cost weighing on production is alleviated. However, the most stringent policies can also place such a high burden on production that they have a negative impact on GS, as gross and net savings fall faster than the environmental cost.

In Sect. 2 we review the literature on climate policy economic impact modelling, and discuss the theoretical underpinnings for GS in this context. In Sect. 3 we present our modelling framework and explain how we derive GS from our detailed natural resources allocation and environmental impact minimization mechanism. In Sect. 4 we present our scenarios and calibration and in Sect. 5 our results and sensitivity analysis. In Sect. 6 we discuss academic and policy consequences and future steps to popularize GS as an indicator of choice for sustainability assessment in a climate change context. Full details on model structure and functioning can be found in a set of appendices at the end of the paper.

2 Literature

2.1 Climate Policy Analysis Using Economic Modelling

There is a long tradition of modellingFootnote 1 for policy related environmental and sustainability issues, possibly reducible to two families of models. The analysis of far-reaching phenomena such as global warming rests on so-called integrated assessment models (IAMs). These models offer quantitative assessments and “compartmentalisedFootnote 2” impacts of global warming. IAM still in widespread use include the Edmonds–Reilly model (now known as the global change assessment model; GCAM) (Calvin et al. 2013), AIM (Asia–Pacific integrated assessment model) (Akashi et al. 2013), IMAGE (integrated model to assess the global environment) (Stehfest et al. 2014), ReMIND (regional model of investments and development) (Luderer et al. 2018) and MESSAGE (model for energy supply strategy alternatives and their general environmental impact) (Riahi et al. 2011). These models analyzed the demand and supply balances of energy, food, and biomass resources, and the trajectory of greenhouse gases (GHGs). However, they can fail to model the feedback on economic growth of global warming impacts and sometimes do not offer any monetary valuation of damage.

The second family regroups representative models developed to analyse the economic impacts of global warming. These are the dynamic integration of climate and economy (DICE) (Nordhaus and Yang 1996; Nordhaus 2013), regional DICE (RICE) (Nordhaus and Boyer 2000), and FUND (climate framework for uncertainty, negotiation and distribution) (Waldhoff et al. 2014) models. Model for evaluating the regional and global effects of GHG reduction policies (MERGE) (Manne and Richels 1992) was a first attempt to offer a hybrid approach between the two families, succeeded by world induced technical change hybrid (WITCH) (Emmerling et al. 2016).

These different approaches have each their limits:

-

Models that offer a detailed analysis of demand and supply (energy, CO2 emissions, etc.) have weak frameworks for the economic assessment of global warming impacts on a sectoral basis.

-

Models analysing the economic impacts of global warming are weak in treating resource supply and use.

-

Amongst models of economic impacts, a trade-off exists between models offering compartmentalised impacts and models offering efficient paths and cost–benefit analysis.

Common across many of these models is a damage function that estimates a social cost of carbon (SCC, Tol 2005). As stressed in Pindyck (2013) and Pezzey and Burke (2014), the use of the SCC often raises more questions than it answers because of the uncertainty associated with the function’s parameters. Notably, a highly aggregated damage function fails to accurately represent the complex interactions existing amongst environmental goals such as climate regulation, biodiversity preservation and ecosystem maintenance.

While we keep the general principle of assessing the economic consequences of a more or less stringent “carbon emissions budget”, we strive to include a more realistic, if still stylized, description of environmental interactions with the economy, as in the IAM literature. We propose an original IAM combining modelling approaches to obtain breakdowns of resource balances and an economic assessment of environmental impacts. Our model combines sub-models for resource balances (energy, and minerals), a simplified model for land use (food and biomass), and a simplified climate model based on RICE 2010 (Nordhaus 2010), with an environmental LCIA model based on LIME3 (Itsubo et al. 2014, 2015). CO2 emissions in the model are generated through resource extraction and use in our disaggregated economy, food consumption and patterns of land use change. These sub-models include production and energy technologies of varying carbon intensity. They interact in a cost minimization program to determine global resource extraction and energy availability at the lowest cost under the constraint of the carbon budget in some of our scenarios (see Sect. 4.2).

We believe this approach to be an improvement over the use of a conventional aggregate damage function, as we are able to assess the interactions between the sub models and to distinguish between the direct and indirect effects of variations in CO2 emissions regulation. Our results build on previous publications by Tokimatsu et al. (2011, 2012, 2013). We extend these previous efforts with a wide range of climate related scenarios, updated datasets and enhanced modelling framework, especially related to productivity assessment and GS computation. The key contribution of the paper is to show how GS can be estimated within an integrated, economic model of climate change, and then used to evaluate climate policy options.

2.2 Genuine Savings

“Sustainable development” can be interpreted as a pattern of societal development along which intergenerational human well-being does not decline. The economy supporting that sustainable development can be described as a system designed to manage the economy’s set of assets from which well-being is derived. In time t, managers of the system have to determine the level of consumption, the use of assets and the resources used to maintain those assets in a functioning state.

The mapping of these decisions over time is referred to by Dasgupta (2009) as an «economic program». The set of technological and institutional mechanisms that generates a state of the system at any point in time is the “resource allocation mechanism” (RAM). Sustainable development is therefore an economic program that will lead to non-declining intergenerational well-being based on the allocation by the RAM. This vision holds even if the RAM is not optimal. In other words, the allocation of resources does not need to result from a comprehensive system of competitive markets, whilst utility-yielding resources not traded in any market should also be included in well-being measures. Such an economic program can only be pursued and the RAM characterised if a correct set of shadow prices (SP) can be identified. SP are defined as the rates of substitutions of one capital stock for another consistent with the maximisation of intertemporal welfare: for each asset, the shadow price shows what decrease in discounted future well-being would result from a reduction in the stock of each asset.

Genuine Savings (GS) is the year-on-year change in the total wealth (total assets) of an economy. This total wealth is to be understood as a “comprehensive wealth”; that is the economic value of all the stocks and assets available in a given economy, including those without market values. GS was established as an indicator of sustainability by successive theoretical contributions from Dasgupta and Heal (1974), Solow (1974), Stiglitz (1974) and Hartwick (1977) to the more recent contribution by Weitzman (1997), Pezzey (2004) and Dasgupta (2009). A detailed presentation of both theory and empirical use of GS can be found in Hanley et al. (2015).

Empirical evidence shows that, over the long run, GS is a predictor of changes in future well-being (Greasley et al. 2014; Hamilton and Clemens 1999; Hanley et al. 2015). It thus has two advantages as an indicator for use in climate policy: (a) GS measures changes in the values of all of the assets which are important to determining future well-being in a country, including natural capital stocks (it is a comprehensive indicator); (b) it can show how current choices over climate policy impact on future well-being, in a theoretically consistent manner (it is a forward-looking indicator).

Our aim is thus to examine the use GS as the indicator of choice in a climate change forecasting and scenario building model. Climate change has a broadly based impact on numerous environmental assets. To design efficient climate change mitigation and adaptation strategies, it is important to base assessment on a measure of sustainability that encompasses all relevant assets. Our modelling strategy is able to trace GS rate variations to specific impacts of climate change. We can estimate shadow prices and capital stocks at every period, and thus obtain a series of values for GS over the next century.Footnote 3

3 The Model

We model the world economy as composed of n = 10 regions, indexed by j. The time frame of the model is based on 10 year intervals, indexed by t. Each region has a total population Nj,t, of which a fixed proportion Lj,t is employed for production. In each region, the exogenous population is used in conjunction with the endogenous level of output in period t (Yj,t) to determine resource use.

3.1 Resource Balance, Climate and LCIA Models

Natural resources used in the model are divided in three main categories:

-

Minerals: including aluminium, copper, lead, zinc and scrap metals,

-

Energy sources: including coal, oil, gas, biomass, solar, hydro, nuclear and wind power.

-

Land use: cropland, grassland, forestry, urban land and other types of land.

These resources are mobilised in the three resource balance sub-models to generate energy supply (electricity, heat, fuel), natural capital based products (cereals, meat, paper and Lumbering board), and produced capital based items (steel, machine and tools, concrete). See the diagram in Appendix 1 (Supplementary material) for a graphic representation of the interactions between these three models.

Inventories from the resource balance models will determine gross output Fj,t. For computation purposes, resource use is embodied in four assets, entering the production function as factors ELj,t, NEj,t, Mj,t and LRj,t:

where Aj,t is the exogenously given total factor productivity term, Kj,t is physical capital, Hj,t is human capital, ELj,t is electricity, NEj,t is non-electric energy, Mj,t denotes non-fuel mineral resources, and LRj,t denotes land resources. Dynamics for Aj,t, Kj,t and Hj,t are obtained straight from the amended RICE model and are presented below.

Figure 1 represents the construction of our model. The three resource balance sub-models embody the technology used to turn resources into assets, generating gross output Fj,t. Population and net output are used every period to set global demand.

Production function factors associated with the supply of resources comes at a cost of extraction and transformation. For simplicity, each model generates one final total cost: FCj,t which is the production cost of fuel, NFCj,t the cost of non-fuel resources and LCj,t the cost of land resources. Formally:

With TCj,t the total cost. Resource supply through the production function is determined through cost minimization using dynamic linear programming. An exhaustive presentation of the cost formulation is available in Appendix 1 (Supplementary material). The total cost formulation is the second output of our resource balance models in Fig. 1. It should be noted that TCj,t includes direct resource use and production costs, but also an abatement cost corresponding to the selection of cleaner technologies as the global carbon externality increases.

Our modelling strategy for abatement differs from the usual RICE framework in this respect. The social planner will pick levels of consumption and output/resource use and the associated technological mix, but does not explicitly target an optimal, aggregate cost of abatement.

Then, the resource balance models generate inventories in the sense of the life cycle impact assessment (LCIA) literature. Inventories represent the flows that are identified in life cycle analysis as having an environmental impact. Inventories are used as inputs in so-called dose–response functionsFootnote 4 that convert inventories values into environmental impacts expressed in a common physical unit.

A particular type of such relationship generate series for global mean temperature rise (GTR) and sea level rise (SLR) from greenhouse gases (GHG) emissions. The simplified climate model used to this end is taken straight from the RICE 2010 model, a full description of which can be found in Nordhaus (2010). These impacts are then regrouped in so-called «endpoints» that represent societal goals associated with sustainability [Table 1; Appendix 4 (Supplementary material)]. Endpoints are a tangible translation of physical flows (inventories) into social values (Pizzol et al. 2015). We consider four endpoints: human health, resources production, net photosynthetic primary production (NPP, which can be assimilated to proper ecosystem functioning) and biodiversity.

The main policy instrument in our framework is the carbon budget, a global cap on emissions that may or may not be imposed at various levels of stringency. Table 1 shows how four different scenarios regarding GHG, ranging from business as usual) (BAU), full costing (FC) and doubling the CO2 concentration (2xCO2) to 2DC (targeting 2 °C temperature rise) and CO2R (a regular path for carbon emission reduction) are associated will alter endpoint values. Scenarios describing biodiversity losses reduction (BIOLR), resource demand reduction (RDR) and population growth reduction (PopR) which translate into changing endpoints are also included. All scenarios are presented in greater detail in Sect. 4.2.

The total value of the societal impact of resource use can therefore be computed as an environmental cost of production (ENVj,t), computed as:

This environmental cost, is best understood as a flow/impact/value relationship. Invj,t (flow) are inventory releases. DRj,t (impact) is a function to express the dose–response “function” (or cause-effect chain) (Itsubo et al. 2014; Tang et al. 2014, 2015a, b, 2016; Yamaguchi et al. 2016) that relate damages at the four endpoints to their causes, expressed as \( Inv_{j,t} \).Footnote 5 As a result, we (loosely) define the endpoints EPj,t as EPj,t = DRj,tInvj,t.

MWTPj,t is effectively the shadow price or social cost associated with these aggregated environmental impact. The procedure used to define MWTPj,t in the model and under different scenarios is discussed in Appendix 4 (Supplementary material). We use marginal willingness to pay (MWTP) instead of estimating a damage function as the estimation of an aggregated function is ill-suited to our disaggregated modelling structure. Representing environmental change and the associated damage through endpoints allows us to value the relative importance of different consequences of climate change. See Itsubo et al. (2015), Tokimatsu et al. (2016a, b), Murakami et al. (2017) and Kolstad et al. (2014) for more details.

We consider these MWTP-based values as the equivalent of an iceberg cost imposed on production: the more resources are used in production, the higher the indirect damage on the environment. As shown in Fig. 1, this cost can be assimilated to the various regulatory costs imposed on producers to prevent or compensate for environmental damage. We impose this cost on total output as it effectively constrains the production set of the social planner:

Net output Yj,t is therefore the sum of gross output minus direct production cost TCj,t and minus the indirect environmental damage cost ENVj,t. Based on this estimated value, the cost of environmental degradation associated with the endpoints is imposed on the social planner over time.

It should be noted that abatement in the model works as a composition effect against the increase of ENVj,t. As population and output grow over time, GHG emissions increase (scale effect). Then, abatement leads to an incentive to alter land use and energy system, creating a downward pressure on ENVj,t (composition and technique effect). Hence, standard results features of workhorse climate models are replicated under our framework. The four Eqs. 3.1, 3.2, 3.3 and 3.4 summarize our production structure. This structure is then passed on to the modified RICE model for utility maximisation.

3.2 The Modified RICE Model

Decisions regarding investment and consumption are taken in the utility maximising part of the model, based on the cost of resource use presented in Sect. 3.1, population growth, technology, produced and human capital dynamics of accumulation. Formulated as such, this is an economic problem we solve using a modified Ramsey–Cass–Koopmans model (Ramsey 1928) adapted from the RICE framework. The social planner invests in assets to preserve the total stock value and maximise consumption over time in value terms.

As in the original RICE model, it is possible to trade off consumption today to “invest” in lower emissions now against avoided climate change in the future. Our model pictures a representative agent in each of the world regions. In each region j, the representative agent acting as the social planner maximises aggregate welfare which is a function of individual utility (Eq. 3.5):

where \( U\left( {c_{j,t} } \right) \) is the per capita utility of consumption in region j at time t. The parameter η is the elasticity of the marginal utility of consumption.Footnote 6 Total Regional Utility U(Cj,t), is obtained by multiplying individual utility by Nj,t,Footnote 7 the exogenously given population number for region j in time t. We then sum regional total utility for all future time periods over the time horizon T to obtain intertemporal well-being Vj,t:

where DF is the discount factor, defined as \( DF_{t} = \left( {{\raise0.7ex\hbox{$1$} \!\mathord{\left/ {\vphantom {1 {1 + \rho }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${1 + \rho }$}}} \right)^{t} \) with ρ the pure rate of time preference, reflecting the consideration of future generations by the current ones. Each region is assumed to produce a single commodity, which can be used for either “generalized” consumption or investment as economic variables. This generalized consumption includes not only traditional market purchases of goods and services but also non-market ones like enjoyment of the environment. Finally, regional-level intertemporal well-being Vt is maximised at the aggregate level via the function Wt:

WtFootnote 8 is the objective function weighted sum of social welfare, Vj,t for region j by Negishi weights, Negj,t.Footnote 9 The use of Negishi weights means that the marginal utility of consumption is equal in each region and each period.

Gross output is determined by the nested production function in Eq. 3.1. While resource based factors are derived from the resource balance models, produced capital Kj,t and Human capital Hj,t are computed using standard equations of motion.

We assume that all transfers of production factors across regions happen through investment and divestment: there is no lump sum transfers of capital, capital is effectively immobile. Physical capital accumulation and depreciation happens only through the usual equation of motion:

where δ is the annual rate of capital depreciation. Human capital Hj,t is accumulated first through an increase in the labour force Lj,t, which is tied to the exogenous population growth:

where κj is the region-specific share on total population. Human capital also increases as individual training and education increases. The value of the human capital stock of region j at time t is determined by average education years (Sj,t) using a transformation function \( \phi \left( . \right) \) total human capital is therefore:

Following Arrow et al. (2012), the variable Aj,t in Eq. 3.1 represents not only total factor productivity, but more generally, an index of all the institution-related changes in the economy that positively impact the resource allocation mechanism. We keep a formulation for this index similar to the one in DICE (2013):

The growth rate τj,t for every period is determined through subsequent runs of the model: see Appendix 2 (Supplementary material). Produced, human capital and natural resource inputs then enter the production function (Eq. 3.1). Net output is allocated between generalized consumption Cj,t and investment in physical capital \( I_{j,t} \), so as to maximise aggregate (world level) well-being Wt, under the following budget constraint:

There is interregional trade, with Mj,t the imports and Xj,t the exports and trade is not balanced between regions. It is nonetheless balanced globally:

Thus, the accumulated trade surplus/deficit of each region is not necessarily zero in any period, the final period included.Footnote 10

The structure of the model is summarised in Fig. 2. The blue box represent the resource balance and climate models, generating production function factors, costs and inventories. The yellow box represents the transformation of inventories into endpoints then environmental cost ENVj,t. The red box represents the modified RICE model while the green box is our exogenously determined population scenarios.

3.3 The Genuine Savings Indicator

We defined Genuine Savings (GS) as the rate of change of capital stocks, valued at appropriate shadow prices. GS can be computed in two ways as detailed in Hanley et al. (2015) and Arrow et al. (2012). Our modelling strategy generates implicit shadow prices (through intergenerational well-being maximisation) for some assets like produced capital and human capital, and explicit shadow prices for natural resources.

When explicitly computed, shadow prices are defined in line with theory as the rate of change in global well-being when the relevant stock varies, over the change in well-being when consumption varies. Hence, shadow prices are estimated as the relative price, in value or utility terms, of changes in capital in terms of increased or forgone consumption.

Applied to the valuation of our environmental impact EXTj,t, the shadow price MWTPj,t becomes:

We compute regional shadow prices for our endpoints EPj,t tied to environmental impact and for all regional resource use derived from our resource balance model. We denote by qj,t these resource use and SPj,t their associated shadow prices. We therefore have two sets of shadow prices MWTPj,t and SPj,t for the direct flows from resource use and indirect flows from environmental impact. We then define GS as:

The above GS equation is calculated post-model computation: GS components are derived from various sections of the model using relevant stocks and shadow prices. The first term (Ij,t − δKj,t − ∑ 41 MWTPj,t * EPj,t) is estimated using the produced capital equation of motion (Eq. 3.8) and the value for ENVj,t. We consider ENVj,t as a joint product of produced capital formation and subtract its value accordingly.

We then use resource extraction and fuel minerals, as computed in the resource balance model, as our quantity vector for natural capitalFootnote 11qj,t. These quantities are then multiplied by the relevant shadow prices SPj,t. Our measure of natural capital to be included in GS differs from the factors included in the production function (3.1) as heat and secondary energy inputs such as electricity are excluded.

The second term (Imj,t + Iej,t) is based on the assumption that consumption as computed using Eq. 3.12 also includes medical and education expenses. Therefore, we compute investment in health Imj,t and investment in education Iej,t exogenously and separately from the values taken by Ij,t. \( Im_{j,t} \) is estimated using a power function, where aj, bj and aj are parameters calibrated using World Bank data. Total investment value is then determined by regional levels of per capita net output \( \frac{{Y_{j,t} }}{{N_{j,t} }} \) and total population Nj,t.

Iej,t is estimated using a linear function where dj, ej and fj are parameters calibrated using World Bank data. Total investment value is then determined by regional levels of per capita net output and total population.

Our GS estimates are computed based on a 10-years step. To adjust for population growth and technological progress (both exogenous in our model) we then subtract from the year on year growth rate both rates of change:

With nj,t the population growth rateFootnote 12 and τj,t the growth rate associated with Hicks-neutral technological and institutional change. Wj,t is total wealth in t [see Appendix 4 (Supplementary material)]. GSntj,t is the notation for this final, fully adjusted GS rate. See Appendix 3 (Supplementary material) for further discussion on GS in our setting.

4 Calibration and Scenarios

GS will be our indicator to assess sustainability through several scenarios of emission reduction and various changes in the key parameters of the model: the rate of population growth and the rate of total factor productivity growth.

4.1 Calibration

Production function factors have initial levels, some of which (EL, NE) are come from drivers of demand (GDP, population, from the Shared Socio-Economic Pathways (SSP)-2). The sectoral demands exogenously derived from the drivers are given to the three cost models. Via minimization process, variables such as resource extractions and land use are determined, which are transferred to the production function.

Then the three models are formulated as minimizing TC + ENV to obtain starting levels of those variables. Then, finally, we redefine the model including all equations to solve the maximization again consistent with macro parameters (C, I, u, …), TC, and ENV. Then a new GDP level is obtained, and we re-calculate the new level of demands to restart this iteration, until results stabilized.

The discrete time step of our model is 10 years. There are 10 regions: North America, West Europe, Japan, Oceania, China, East-South Asia (including Association of Southeast Asian Nations (ASEAN) member countries, plus India), the Middle East and North Africa, Sub-Saharan Africa, Latin America, and the former Soviet Union and East Europe. Our population is assumed to be composed of representative agents, its size being estimated based on UN projections from the SSP-2 scenario (Samir and Lutz 2017). Population data (Nj,t) and the reference level (\( \bar{Y}_{j,t} \)) of the GDP scenario are taken from the SSP database (version 0.9.3) (IIASA 2015), in which IIASA-WiC Population and OECD GDP are applied.

Regarding the labour population (Lj,t), we compute the labour population rate at each time period for each area, based on a medium-scenario population projection by the United Nations (UN 2003, 2011). We subsequently multiply these figures by the population data (Nj,t). Calibration data for C, I, Y, M, X, in 2010 and δ (set from 7 to 18% per annum) for the respective regions, are obtained from the World Development Indicators (WDI) (World Bank 2015) and the Global Trade Analysis Projects (GTAP) data base (Purdue University 2015). The setting of the initial K value is obtained from the RICE 2010 model (Nordhaus 2010).

We use a nested CES production function inspired by Berndt and Wood (1975), Manne and Richels (1992) in a departure from the usual specification in either RICE-99 or -2010 (Nordhaus and Boyer 2000; Nordhaus 2010). MWTP0 is derived from the discrete choice experiments used in environmental valuation, whose data is obtained from both face-to-face and Internet surveys in G20 and Asian countries. Details of the survey and analysis can be found in Itsubo et al. (2015), Murakami et al. (2017) and Tokimatsu et al. (2016b).

The utility discount rate, ρ, is assumed to be 1.5% per annum, in the lower end of the range in the literature (0.1–5%) (Portney and Weyant 1999; Stern 2006; Dasgupta 2008; Nordhaus 2007). The elasticity of the marginal utility of consumption η is set at 1.5 from DICE 2013 (Nordhaus 2013). Regarding the importance of parameter settings in the production function (Maeda and Nagaya 2013), we reviewed the parameters ε and λ in the literature (Berndt and Field 1981; Nemoto 1984; Manne and Richels 1992; Markandya and Pedroso-Galinato 2007). Capital depreciation is set as 0.07–0.18 depending on regions. Since the one-time period of our model is assumed to be 10 years, we use the tenth power of the annual rate in the equation. The income elasticity of substitution over time σ is set as 0.5 as default from Pearce (2003).

TFP is calibrated from data sources to fit the scenarios (level of production). The form of function ϕ is increasing, but diminishing in rate (ϕ′ = dϕ/dS > 0, ϕ′′ = d2ϕ/dS2 < 0), where ϕ equals 0 when S is 0. Here ϕ′ denotes marginal income increase by additional education attainment, corresponding to the coefficient (rate of return); ϕ′ was determined using data from various studies (Psacharopoulos 1994; Hall and Jones 1999; Psacharopoulos and Patrinos 2004; Lutz et al. 2007; Barro and Lee 2010; World Bank 2015).

We do not follow DICE 2013 for our initial values for the TFP level (Aj,0) and growth rate (τj,t). We calibrate τj,t based on the future baseline scenario (SSP-2) to obtain feasible solutions for computation. In some sections we applied historical data from Klenow (2005). See Appendix 2 (Supplementary material) for more details.

4.2 Scenarios

We propose scenarios to asses various climate change situations in our framework. The setting generated by the model as described so far is the “Full Costing” scenario (FC). Under this scenario, the production side pays the full costs to production of environmental impacts, as presented in Eq. 3.4. Emissions are not exogenously constrained by a carbon budget, so that the global level of emissions in every period is the sole product of utility maximisation constrained by the total direct cost TCj,t and the environmental cost ENVj,t. Under this scenario, the world can expect a global mean temperature rise (GTR) in 2100 of 3.1 °C as emissions are turn into global warming.

A better description of the current situation would be a setting where although environmental impacts are valued, they are not effectively supported by anyone. We define this scenario as the «Business As Usual» (BAU) scenario. Under BAU the cost Eq. 3.4 becomes:

When computing GS under the BAU scenario, we keep the formula in Eq. (3.4′), valuing ENVj,t using net output Yj,t and the income elasticity of benefit transfer σ instead, as presented in Appendix 4 (Supplementary material). The BAU scenario combines the absence of a global policy to tackle climate change (no carbon budget) with a lack of internalisation of carbon costs on the production structure. In line with the climate change assessment literature, the BAU scenario is presented as a comparison point where unlimited climate change is allowed to happen. To maintain a fair basis for comparison, ENVj,t is subtracted from output levels (and Genuine Savings) post simulations.

We then design two scenariosFootnote 13 where cumulative emissions are capped, unlike the FC scenario where only cost pressures limit emissions. First, the 2DC scenario is based on a total of cumulative emissions up to 2100 that is consistent with the 2 °C target. This effectively imposes cumulative emissions of zero over the time horizon. This is made possible in the model by allowing positive emissions over the first several decades, then balanced-out by negative emissions in the latter half of the century (Tokimatsu et al. 2017).

At the other end of the spectrum, the «CO2 double scenario» (2xCO2) is obtained by adding cumulative emissions from 2010 to 2150 as in the WRE-550 scenario (Wigley et al. 1996), resulting in an atmospheric concentration of CO2 of 550 ppm. This is equal to doubling the atmospheric CO2 concentration compared to pre-industrial levels, or about 2.9 °C GTR. The various emission caps are imposed through the simplified climate model derived from RICE 2010 (Nordhaus 2010).

Carbon budgets impact GS values in two ways. First, a more stringent cap will limit fossil fuels extraction, trigging costly substitution away from non-renewable energies in the production function. Second, varying levels of atmospheric CO2 concentration will lead to changing global mean temperature and sea levels, impacting in turn the environmental impact cost ENVj,t. The rather small observed reduction in GTR between the 2xCO2 and FC scenario shows a generous carbon budget which imposes only marginal constraints on the global economy and therefore leads to a very limited switch to carbon abating technologies.

Imposing a global cumulative emissions cap is not the only policy instrument for climate change mitigation and adaptation. Because of the broad-based nature of climate change impacts, indirect and/or second best policies can also lead to significant reductions in CO2 atmospheric concentration. Such policies include actions for biodiversity preservation (an environmental goal in itself, with climatic consequences), actions to limit resource extraction and actions for alleviating population-related environmental pressures. To test such policies, we offer four scenarios with constraints on the long run evolution of impact variables associated with carbon emission reduction (CO2R), biodiversity losses reduction (BIOLR), resources demand reduction (RDR), population growth reduction (PopR).

We use the first scenario, CO2R, to scale the others. We impose a further reduction of 0.3% per period in CO2 emissions compared to the baseline reduction in the FC case. This leads to a cumulative extra reduction of 20% in emissions, that sets this scenario on a 2.6° GTR. Such a reduction is imposed the same way and propagates through the same mechanisms as in the 2DC and 2xCO2 scenarios.

For the biodiversity related BIOLR scenario, we impose a reduction of 0.3% per period on the total value of the impact on Biodiversity,Footnote 14 as estimated through the environmental impact cost ENVj,t. This leads to an end of period situation where the value of the impact on biodiversity is reduced by 15%. This biodiversity constraint mostly limits the scale of land use change in the model, but also reduces possible CO2 emissions and resource use leading to a 2.7 GTR in 2100. On the one hand, such a reduction imposes a scale-back on production and net output, as the world economy cannot deplete biodiversity to expand the production set. On the other hand, as the biodiversity-linked environmental impact declines, net output Yj,t increases. There is therefore a potential trade-off for the world economy, transitioning through this scenario from a high gross output/high biodiversity impact, to a low gross output/low biodiversity impact, with undetermined consequences on net output Yj,t.

The population related scenario PopR imposes a reduction of 0.3% per period compared to the FC baseline on population growth. As a result, population growth deviates from the central SSP-2 scenario, ranging closer from the SSP-1 scenarios. As population first increases at a lower rate, then decreases after peaking around 2060, environmental pressures are reduced accordingly, leading the world to a 2.5 GTR in 2100.

The final RDR scenario limits by the same 0.3% per period compared to the BAU baseline the amount of resources that can be extracted in the resource balance models. Intuitively, it reduces gross output through production factors ELj,t (electricity) NEj,t (non-electric energy) and Mj,t (mineral resources use). It also reduces the direct cost of production TCj,t and the indirect environmental cost ENVj,t, leading to a 2.0 GTR in 2100.

5 Results

Based on the detailed structure of our modelling, we present the contribution of GS components in Eq. 3.15 to its final value as a percentage of net output Yj,t (Fig. 3). The largest factor determining global GS is produced capital depreciation. This is in line with country level detailed GS estimates (Greasley et al. 2014; Lindmark and Acar 2013) and recent studies on the role of manufacturing in development (Haraguchi et al. 2017) which show the persistent role of manufacturing as the backbone of economic activity. Proper maintenance of produced capital ought to be a key part of sustainability. It should be noted that produced capital depreciation amounts to 7–19% of GDP per year depending on the region, according to WDI figures (2010).

The second biggest contributing factor weighing down on GS is LU&LUC (land use and land use change). The third largest impact is global warming, acid rain, local air pollution. It is followed by depletion of non-fuel mineral resources, and energy resources in energy resource-rich regions. The relatively small contribution of human and health capital can be explained by their relatively low shadow prices. Stocks for both assets increase over time, but this relative abundance exerts downwards pressures on the shadow price and overall investment.

In the remainder of the section we present GS estimates based on Eq. 3.18, adjusted for population growth nj,t and overall institutional and productivity change τj,t.

5.1 Scenario Results

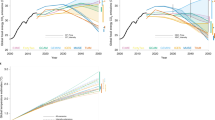

5.1.1 Direct, CO2-Focussed Climate Policy Scenarios

With the drivers of GS estimates in mind, we turn to our four climate policy scenarios, BAU, FC, 2DC and 2xCO2. In the BAU scenario, no additional action is undertaken to reduce the externalities associated with natural resources consumption. We find GS to be decreasing continuously from a starting point of 1.3% change in 2030 to − 0.3% for 2090 (Table 2). This confirms the unsustainability of our current practices. The FC scenario, where full costing is applied, brings the world back in the sustainable zone over the whole period (Fig. 4).

We compare our scenarios based on two metrics. We first use GS rates in years 2030, 2060 and 2090 as an indicator of overall sustainability. We then provide the cumulative, undiscounted value for It to represent the current value cost in produced capital investment for each time interval associated with the scenario. A policy option is therefore characterised by (a) its sustainability as estimated using GS, (b) its climate consequences in terms of GTR in 2100 and (c) its global investment budget represented by the cumulative sum of Its.

Figure 4 shows the FC scenario, 2xCO2 scenario where the tolerated maximum for emissions is increased and 2DC scenario where it is almost zero. Differences between FC and 2xCO2 scenarios are limited at any point with a long run advantage for 2xCO2 (1.8, 1.2 and 0.7% against 1.7, 1.5 and 0.9% respectively). In terms of total investment, performance is also marginally better in scenario 2xCO2 (see Table 2).

The 2DC scenario leads to a rapid decline in GS compared to FC (1.8, 1.2 and 0.7% against 0.9, − 1.5 and − 2.0% respectively). Cumulative investment is also consistently smaller at all time. Although GS is declining over time in all scenarios, the scale of the observed decline is uneven.

On the one hand, the limited increase in allowed CO2 emissions in the 2xCO2 scenario has a positive impact on GS. On the other hand, both the very stringent reduction in emissions in the 2DC scenarios and the absence of control in the BAU scenario lead to a steep decline in GS, suggesting that the world cannot accommodate either.

5.1.2 Indirect Climate Policy Scenarios

We turn to our indirect climate policy scenarios to put CO2 emission reduction policies in perspective. The CO2R (reduction in CO2 emissions similar to the 2xCO2 scenario), RDR (reduction in resources demand), PopR (reduction in the population growth rate) and BIOLR (reduction in biodiversity damage value) scenarios impact on GS are shown in Fig. 4, along the FC scenarios.

We observe differences between the scenarios, although the PopR and BIOLR scenarios outperform the FC scenario over the time horizon. Both lead to GS levels of 0.9% in 2090 against 0.7% for FC, while both also lead to lower cumulative investment. Interestingly the CO2R policy scenario is dominated by all the other options over most of the time horizon (0.3% and the highest cumulative investment value). This is linked to the way emissions reduction are imposed. Emissions cuts are imposed every period in the CO2R case without discretion, when the 2xCO2 scenarios gave the world economy more latitude to optimally-time emission reductions.

This confirms the trade-off between the stringency of CO2 reduction emission policy and GS. Cutting emissions too hard and too fast leads to a significant decline in GS, whilst inaction also leads to lower GS values than minimum and stringent control. These scenarios offer tentative evidence that some indirect policies can have equal, if not greater impact on climate change than policies targeting emissions directly. Encompassing policy options such as population reduction (population influences many variables at a time) and biodiversity reduction (acting on land use, emissions and resource extraction) make a difference for the better.

Table 2 summarises our results. Unsustainability is defined as negative GS at any point in time (Arrow et al. 2012). In this light, most of our scenarios depict a sustainable global economy, with the notable exceptions of the BAU and 2DC scenarios. It is significant that these two genuinely unsustainable paths exhibit the highest (lowest) level on investment and the least (most) stringent level of emissions control respectively. The other scenarios are still in sustainable territory, but depict a worrying downward trend in Genuine Savings that should alarm policy makers.

The scenarios presented here can be summarised by their outcomes in terms of GS and GTR (Fig. 5). We first observe that most scenarios lead to a sustainable outcome in 2030, 2060 and 2090 as GS values are positive. Nonetheless the succession of fitted curves linking scenarios for a given year show a decline in GS over time as all GS values in later periods are lower than in early period. At every period, policies leading to a 2100 GTR of 2.6–2.9 °C will lead to the highest possible GS values. It can also be observed that scenarios with rather similar outcomes in terms of GS have vastly different results in terms of GTR in 2100.

We believe Fig. 5 is a clear illustration of our policy contribution. GS is a potent indicator of global sustainability and it can be used to assess various climate related policy based on their consequences on well-being, including a wide variety of environmental impact. While maximising GS can be set as an objective, the way this is achieved matter. Contextualising the GS outcome with scenarios and indicators such as GTR shed precious light on the possible structural economic change needed to tackle climate change.

5.2 Sensitivity Analysis

We begin our sensitivity analysis by testing exogenous changes in the TFP growth rate. It is common to see climate change policy (and more generally the struggle for sustainable development) as a race between the population growth rate nj,t and the TFP growth rate τj,t. As a result, we tested our assumptions on these parameters with computations where nj,t increases by 0.1% per period then decreases by 0.1%, and τj,t increases by 1% per period then τj,t decreases by 1%.

Figure 6 shows the high sensitivity of GSnt to changes in τ. A cumulative reduction of 1% per year of τ leads to a rapid and catastrophic decline in GSnt. We believe this sensitivity is linked to substitutability issues in the model. Confronted with a fixed technological mix and dwindling and increasingly costly resources, the social planner arbitrages in favour of consumption, while inclusive investment is eroded through ever increasing resource consumption and environmental impact.

Population levels in our model are exogenous. Population starts from around seven billion in 2010, increases up to roughly 9.5 billion in 2070, and decreases to some 9 billion in our baseline setting called on the SSP-2 scenario. In this scenario we add (subtract) 0.1% per year to this trend, resulting in a 2100 population of 10 (8) Billion people.Footnote 15

As was the case with τ, we witness in Fig. 6 a regular decline in GS under pressure from an increasingly large pool of consumers. An interesting feature regarding population is the lack of symmetry between population growth and reduction. A lower population growth rate alleviates the burden on resources in the medium run, but substitutability issues weigh on GS so that the 2100 situation is similar to the baseline scenario.

We also performed sensitivity analyses on the values for the pure rate of social time preference ρ and elasticity of marginal utility η, the Income elasticity of benefits σ and the truncation of year T for computing wealth. These analyses are discussed in Appendix 5 (Supplementary material).

6 Discussion

6.1 The Decline in Genuine Savings

As was discussed in the original Dasgupta–Heal–Solow–Stiglitz model, maintaining consumption over time requires substitution away from resource-intensive growth. We show here that when substitutability is constrained by a production function based on current technology and the most pressing environmental externalities are internalised, the level of optimal investment fails to prevent a fall in GS. Maintaining consumption and utility on the one hand, and production and a diversified pool of assets on the other hand, appear to be incompatible goals.

There is striking unanimity in our results over the long run decline in sustainability. In this sense, we extend the modelling of carbon intensity presented in the Stiglitz et al. (2009) report, showing that even under rather conservative assumptions regarding global warming, the world is heading towards unsustainability. GS remains positive in most scenarios, but only by a small margin. Behind this trend lies an increasing appetite for natural resources, fuelled by an increasing global population and less than sufficient productivity gains.

6.2 Climate Policy Options

The climate change and sustainability scenarios show that no single policy option manages to reverse the declining sustainability identified in GS. Part of this comes from the interlocking of environmental, economic and social issues. But it is also a consequence of the magnitude of the changes needed.

When caps on CO2 emissions or concentration are used as policy instruments, a trade-off appears. Cost-based policies (resting on the full costing of climate impacts) such as the FC scenario and quantitative but lax policies such as the 2xCO2 scenario yield declining but, positive GS. Strict quantitative policies such as the 2DC and CO2R scenarios significantly reduce GS and even lead the world economy close to collapse. A trade-off thus appears in our model, associated with the stringency of climate policy. Cutting emissions too quickly and too fast leads to free-falling GS, while inaction as in the BAU scenario leads to lower GS. There is therefore a sustainable path to be found in between, based on an optimal pricing of environmental impacts.

We highlight another way out of the dilemma. Our results show that indirect climate policies associated with biodiversity preservation or resource extraction caps fare well, even better, than emission caps. As a result, action should be undertaken simultaneously on several aspects of environmental capital. The cost of inaction appears to be high: failure in one field of climate policy will have a strong and increasing impact on GS, as compensation in other fields will get more and more costly.

Finally and perhaps unsurprisingly, the most powerful single lever available to shore up sustainability is a reduction in population growth rates. This result can be regarded as a direct consequence of population growth being (a) exogenous and (b) the main driving force for economic activity in our framework. These assumptions are nonetheless based on well-established stylised facts, and it would therefore not be surprising if, all else failing, population related measures enter the spectrum of climate change policy.

6.3 Policy Implications

A well-established literature has shown that GS are useful as an indicator of sustainability. We show here that GS is also capable of providing policy guidance in the field of climate policy. Valuation of the components of GS under different climate scenarios shows that the largest negative impact on GS are to be expected from maintenance costs of existing produced capital, and from land use and land use change and global warming and associated impacts, in descending order. This observation sets a clear policy agenda for the century. Policy priority should be put on the replacement of existing produced capital to meet more stringent standards of durability, energy efficiency and environmental impact. This process would also yield significant productivity gains, a useful alleviation of environmental constraints. The second key policy goal is to control more global land use more efficiently, to prevent undesirable land use change especially.

We are also able to compare the various policy scenarios based on cumulative investment in produced capital. As levels of GS are associated with various amounts of investment in produced capital, we observe that better GS performance tends to be associated with lower levels of cumulative investment. We believe this shows the possibility of over-investing in produced capital (so-called “wasteful investment”). Beyond a certain scenario-specific point, investment can be detrimental because of environmental consequences.

Measures which focus solely on CO2 emissions do not rank highly. This might seem puzzling and suggest an insufficient shadow price of carbon being used. Unlike Pezzey and Burke (2014) we do not factor in the possibility of catastrophic climate change. This scenario would nonetheless be consistent with our 2DC scenario, as one can imagine that emergency measures to cut down emissions would then be implemented. Under the current production organisation and barring a catastrophic event, issues related to produced capital depreciation and land use are more pressing than CO2 emissions for long-run wellbeing, according to the model here presented.

7 Conclusion

In this article we extend the workhorse DICE/RICE model into an integrated assessment model (IAM) with models for resource balance and a life cycle impact assessment (LCIA) model. We use the resource balance models to obtain a detailed, disaggregated production structure and a more realistic pattern of resource use. The LCIA model allows us to compute a dis-aggregated total cost for the environmental impacts of production, a cost that is typically either neglected or reduced to the cost of rising CO2 concentrations in other papers. We use Genuine Savings (GS) as our main indicator to assess sustainability implications of climate policy scenarios, and draw comparisons between direct and indirect climate policy scenarios. Our innovative IAM gives a more detailed picture of the changes linked to these scenarios and allows us to illustrate important trade-offs for policy design against climate change.

We contribute to the literature first via this original modelling setting. We are able to reproduce the declining sustainability already encapsulated in other forecasting exercises, but we can derive new inferences on the reasons behind this increasing un-sustainability. A first obvious reason lies with the increasing direct and environmental cost of resource use and extraction. We find that land use change it likely to play a large role for future sustainability, even larger than climate change as a whole. This finding cannot be attributed to a low price of carbon as we do not rely on an estimate for the social cost of carbon.

Our results also stress how structural change and institutional and technical change will be critical to maintain sustainability over the century. Productivity might be «almost everything» in the long run (in the words of Paul Krugman) but our model suggests that levels way above the current performance of mature economies are needed to stall the decline of GS over the coming century. We also identify a negative feedback on produced capital: as the environment deteriorates, more resources need to be diverted to maintain consumption. This in turn increases the pressure on natural resources as the existing stock of produced capital is worn down. Another key message of our setting is therefore that proper maintenance and improvement of existing capital is critical, as post-1945 infrastructure, designs and facilities will all be gradually decommissioned (especially in the energy sector).

Only a combination of policies addressing resource use, population, technical progress and the multiple aspects of human-induced environmental change (biodiversity, environmental impacts on human health, etc.) can support sustainability over the long run. However, given the inertia in complex systems such as the world economy, radical actions (such as a very strict zero emission policy) might lead to economic collapse. Change needs to be steady and strictly enforced, but incremental and encompassing. Finally, we show how GS can be used as a robust sustainability indicator, once amended and computed in an integrated modelling set-up.

More work is, as is customary, needed to increase the usefulness of IAM and address some of the remaining weaknesses of GS. As suggested by Solow (2012), more work is needed on the production side of sustainability and GS, after years of focus on their welfare significance. Efforts should also be directed towards easing the integration of life cycle analysis with economic tools to propose truly economic-ecological models. We attempted to broaden the number of assets and impacts integrated in our estimates for GS. The price for this is to rely on estimates for shadow prices that might lack theoretical robustness. Progress in the assessment of ecosystem services, and the linkage between changes in the condition of natural capital stocks and future well-being would go some way to address this concern (Fenichel and Abbott 2014).

Notes

For a comprehensive review, see Bosello (2016).

We understand those compartmentalised impacts as differentiated impacts in terms of sustainable development goals (human health, biodiversity, crop production, flood protection, etc.) as opposed to aggregated “environmental impact”.

A contribution that is quite close to our aim is offered by Pezzey and Burke (2014). They amend GS for the physical processes associated with global warming, and include carbon prices which offer a more realistic estimation of the costs associated with uncontrolled climate change, relative to a target of no more than 2 degrees of warming. Nonetheless, they rely on the DICE aggregated damage function, and are therefore unable to offer scenario assessments as detailed as those presented here.

For an illustration on dose response functions see “Appendix 4”.

As an example, global warming impacts on human health are expressed through the relative increase in pandemic diseases prevalence due to the global mean temperature rise \( (GTR(t)) \) (Tang et al. 2015a).

It also represents the curvature of the utility function, or the rate of inequity aversion, measuring the extent to which a region is willing to reduce the welfare of high consumption generation and to improve that of low consumption generation.

The given population number, \( N_{j,t} \), is taken from the SSP-2 scenario in order to coherently analyze climate change mitigation. The number is the middle of range among the 5 SSP scenario families (Samir and Lutz 2017), somewhat higher than UN’s (2003) mid projection, but still close to the central level compared with high- and low- projections.

t ≥ 0, with time steps of 10 years from 2010 to 2150. We use steps of 10 years to give enough time for the changes to happen in real life, following the World Bank view on Wealth accounting.

The Negishi technique is referenced from Nordhaus and Yang (1996).

As trade is not constrained to be balanced at any time, exogenous constraints reflecting the feasible evolution of consumption and investment are imposed every period for every region j. In “Appendix 2”, we show that while trade is not balanced by assumption, the end period position of each region is very closed to be balanced.

10 resources are considered: copper, lead, zinc, bauxite, iron ore, limestone, coal, oil, gas, uranium.

See “Appendix 4” for more details on the adjustment for population growth.

All subsequent scenarios are based on the FC scenario: the ENV cost is imposed on the production function.

The state of biodiversity preservation is represented in our model as an index expressed in EINES units, where lower values indicates a greater distance to extinction for a bundle of endangered species. The lower the index value, the higher the shadow price, so that increasing effort for biodiversity preservation gets costlier over time.

Population changes greatly influence several components of our model: education expenditure (Ie), medical expense (Im), average education years (S), rate of return of educational attainment (φ′), Growth rate g of per capita consumption (c).

References

Akashi O, Hanaoka T, Masui T, Kainuma M (2013) Having global GHG emissions by 2050 without depending on nuclear and CCS. Clim Change 123(3–4):611–622. https://doi.org/10.1007/s10584-013-0942-x

Arrow KJ, Dasgupta P, Goulder LH, Mumford KJ, Oleson K (2012) Sustainability and the measurement of wealth. Environ Dev Econ 17(03):317–353

Barro RJ, Lee J-W (2010) A new data set of educational attainment in the world, 1950–2010. NBER working paper no. 15902

Berndt E, Field B (eds) (1981) Modelling and measuring natural resource substitution. MIT Press, Cambridge

Berndt E, Wood D (1975) Technology, prices, and the derived demand for energy. Rev Econ Stat 57:259–268

Bosello F (2016) The role of economic modelling for climate change mitigation and adaptation strategies. In: Markandya A, Galarraga I, de Murieta ES (eds) Routledge handbook of the economics of climate change adaptation. Routledge International Handbooks, London

Buchholz W, Schumacher J (2010) Discounting and welfare analysis over time: choosing the η. Eur J Polit Econ 26:372–385

Cai Y, Judd KL, Lenton TM, Lontzek TS, Narita D (2015) Environmental tipping points significantly affect the cost-benefit assessment of climate policies. Proc Natl Acad Sci USA 112(15):4606–4611

Calvin K, Wise M, Clarke L, Edmonds J, Kyle P, Luckow P, Thomson A (2013) Implications of simultaneously mitigating and adapting to climate change: initial experiments using GCAM. Clim Change 117:545–560

Collins RD, Selin NE, Weck OL, Clark WC (2017) Using inclusive wealth for policy evaluation: application to electricity infrastructure planning in oil-exporting countries. Ecol Econ 133:23–34

Dasgupta P (2001) Human well-being and the natural environment. Oxford University Press

Dasgupta P (2008) Discounting climate change. J Risk Uncertain 37:141–169

Dasgupta P (2009) The welfare economic theory of green national accounts. Environ Resour Econ 42(1):3–38

Dasgupta P, Heal GM (1974) The optimal depletion of exhaustible resources. Rev Econ Stud 42:3–28

de Bruin KC, Dellink RB, Tol RSJ (2009) AD-DICE: an implementation of adaptation in the DICE model. Clim Change 95:63–81

Emmerling J, Drouet L, Reis LA, Bevione M, Berger L, Bosetti V, Carrara S, Cian ED, D’Aertrycke GDM, Longden T, Malpede M, Marangoni G, Sferra F., Tavoni M, Witajewski-Baltvilks J, Havlik P (2016) The WITCH 2016 model—documentation and implementation of the shared socioeconomic pathways, NOTA DI LAVORO 42.2016. https://www.feem.it/m/publications_pages/2016719114334NDL2016-042.pdf. Accessed 10 July 2018

Fenichel E, Abbott J (2014) Natural capital: from metaphor to measurement. J Assoc Environ Resour Econ 1:1–27

Ferreira S, Hamilton K, Vincent JR (2008) Comprehensive wealth and future consumption: accounting for population growth. World Bank Econ Rev 22(2):233–248

Fleurbaey M (2015) On sustainability and social welfare. J Environ Econ Manag 71:34–53

Greasley D, Hanley N, Kunnas J, McLaughlin E, Oxley L, Warde P (2014) Testing Genuine Savings as a forward-looking indicator of future well-being over the (very) long-run. J Environ Econ Manag 67:171–188

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others? Q J Econ 2:83–116

Hamilton K, Clemens M (1999) Genuine Savings rates in developing countries. World Bank Econ Rev 13(2):333–356

Hanley N, Dupuy L, Mclaughlin E (2015) Genuine Savings and sustainability. J Econ Surv 29(4):779–806

Haraguchi N, Cheng CFC, Smeets E (2017) The importance of manufacturing in economic development: has this changed? World Dev 93(C):293–315

Hartwick JM (1977) Intergenerational equity and the investing of rents from exhaustible resources. Am Econ Rev 67(5):972–974

IIASA (2015) SSP database. Accessed 17 Jan 2016

Itsubo N, Murakami K, Kuriyama K, Yoshida K, Tokimatsu K (2015) Development of weighting factors for G20 countries—explore the difference in environmental awareness between developed and emerging countries. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-015-0881-z

Itsubo N, Tang L, Motoshita M, Ii R, Matsuda K, Yamaguchi K (2014) Global and regional normalization—estimation and validation of normalization values using endpoint approach. Int J Life Cycle Assess

Johnston RJ, Rolfe J, Rosenberger R, Brouwer R (eds) (2015) Benefit transfer of environmental and resource values: a guide for researchers and practitioners (the economics of non-market goods and resources). Springer, Berlin

Klenow PJ (2005) ‘Externalities and growth’. Handbook of economic growth 1, Part A. Elsevier, Amsterdam, pp 817–861

Kolstad C, Urama K, Broome J, Bruvoll A, Cariño Olvera M, Fullerton D, Gollier C, Hanemann WM, Hassan R, Jotzo F, Khan MR, Meyer L, Mundaca L (2014) Social, economic and ethical concepts and methods. In: Edenhofer O, Pichs-Madruga R, Sokona Y, Farahani E, Kadner S, Seyboth K, Adler A, Baum I, Brunner S, Eickemeier P, Kriemann B, Savolainen J, Schlömer S, von Stechow C, Zwickel T, Minx JC (eds) Climate change 2014: mitigation of climate change: Contribution of working group III to the fifth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, United Kingdom and New York, NY

Lindmark M, Acar S (2013) Sustainability in the making? A historical estimate of Swedish sustainable and unsustainable development 1850–2000. Ecol Econ 86:176–187. https://doi.org/10.1016/j.ecolecon.2012.06.021

Lontzek TS, Narita D, Wilms O (2016) Stochastic integrated assessment of ecosystem tipping risk. Environ Resour Econ 65:573–598

Luderer G, Leimbach M, Bauer N, Kriegler E, Baumstark L, Bertram C, Giannousakis A, Hilaire J, Klein D, Levesque A, Mouratiadou L, Pehl M, Pietzcker R, Piontek F, Roming N, Schultes A, Schwanitz VJ, Strefler J (2018) Description of the REMIND model (Version 1.6). https://www.pik-potsdam.de/research/sustainable-solutions/models/remind/remind16_description_2015_11_30_final. Accessed 10th July 2018

Lutz W, Goujon A, Samir KC, Sanderson W (2007) Reconstruction of populations by age, sex and level of educational attainment for 120 countries for 1970–2000. Vienna Yearb Popul Res 5:193–235

Maeda A, Nagaya M (2013) Intra- and intergenerational equities in energy-climate policy modeling. J Econ Policy Stud 70(2):40–43

Manne AS, Richels RG (1992) Buying greenhouse insurance: the economic costs of carbon dioxide emission limits. MIT Press, Cambridge

Markandya A, Pedroso-Galinato S (2007) How substitutable is natural capital? Environ Resour Econ 37:297–312

Murakami K, Itsubo N, Kuriyama K, Yoshida K, Tokimatsu K (2017) Development of weighting factors for G20 countries—part 2: estimation of willingness to pay and annual global damage cost. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-017-1372-1

Nemoto J (1984) On substitution possibilities between energy and non-energy inputs—a nested CES production function analysis. Econ Stud Q 35:139–158

Nordhaus WD (2007) A review of the Stern review on the economics of climate change. J Econ Lit 45:686–702

Nordhaus WD (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven

Nordhaus WD (2010) Economic aspects of global warming in a post-Copenhagen environment. Proc Natl Acad Sci USA 107(26):11721–11726

Nordhaus WD (2013) The climate casino: risk, uncertainty, and economics for a warming world. Yale University Press, New Haven

Nordhaus WD, Boyer J (2000) Warming the world: economic models of global Warming. MIT Press, Cambridge

Nordhaus WD, Yang Z (1996) A regional dynamic general equilibrium model of alternative climate-change strategies. Am Econ Rev 86:741–765

Oritz RA, Golub A, Lugovoy O, Markandya A, Wang J (2011) DICER: a tool for analyzing climate policies. Energy Econ 33:S41–S49

Pearce DW (2003) Conceptual framework for analyzing the distributive impacts of environmental policies. Paper prepared for the OECD environment directorate workshop on the distribution of benefits and costs of environmental policies, March 2003, Paris, France

Pezzey JCV (2004) One-sided sustainability tests with amenities, and changes in technology, trade and population. J Environ Econ Manag 48:613–631

Pezzey JCV, Burke PJ (2014) Towards a more inclusive and precautionary indicator of global sustainability. Ecol Econ 106:141–154

Pindyck Robert S (2013) Climate change policy: what do the models tell us? J Econ Lit 51(3):860–872

Pizzol M, Weidema B, Brandao M, Osset P (2015) Monetary valuation in life cycle assessment: a review. J Clean Prod 86:170–179

Portney PR, Weyant JP (eds) (1999) Discounting and intergenerational equity. RFF Press, Washington

Psacharopoulos G (1994) Return to investment in education: a global update. World Dev 22:1325–1343

Psacharopoulos G, Patrinos HA (2004) Returns to investment in education: a further update. Educ Econ 12:111–134

Purdue University (2015) GTAP data base purdue: global trade analysis project data base. Accessed 17 Jan 2016

Ramsey FP (1928) A mathematical theory of saving. Econ J 38:543–559

Riahi K, Rao S, Krey V, Cho C, Chirkov V, Fischer G, Kindermann G, Nakicenovic N, Rafaj P (2011) RCP 8.5—A scenario of comparatively high greenhouse gas emissions. Clim Change 109:33–57

Samir KC, Lutz W (2017) The human core of the shared socioeconomic pathways: population scenarios by age, sex and level of education for all countries to 2100. Glob Environ Change 42:181–192

Solow RM (1974) Intergenerational equity and exhaustible resources. Rev Econ Stud 42:29–45

Solow R (2012) A few comments on “sustainability and the measurement of wealth”. Environ Dev Econ 17(3):354–355

Stehfest E, van Vuuren D, Kram T, Bouwman L, Alkemade R, Bakkenes M, Biemans H, Bouwman A, den Elzen M, Janse J, Lucas P, van Minnen J, Müller M, Prins A (2014) Integrated assessment of global environmental change with IMAGE 3.0. model description and policy applications. PBL Netherlands Environmental Assessment Agency, The Hague

Stern N (2006) Stern review: the economics of climate change. Cambridge University Press, Cambridge

Stiglitz JE (1974) Growth with exhaustible natural resources. Rev Econ Stud 42:123–152

Stiglitz JE, Sen A, Fitoussi J-P (2009) Rapport de la Commission sur la mesure des performances et du progrès social

Tang L, Nagashima T, Hasegawa K, Ohara T, Sudo K, Itsubo N (2014) Development of human health damage factors for PM2.5 based on a global chemical transport model. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-014-0837-8

Tang L, Ii R, Tokimatsu K, Itsubo N (2015a) Development of human health damage factors related to CO2 emissions by considering future socioeconomic scenarios. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-015-0965-9

Tang L, Nagashima T, Hasegawa K, Ohara T, Sudo K, Itsubo N (2015b) Development of human health damage factors for tropospheric ozone considering transboundary transport on a global scale. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-015-1001-9

Tang L, Higa M, Tanaka N, Itsubo N (2016) Assessment of global warming impact on biodiversity using the extinction risk index in LCIA: a case study of Japanese plant species. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-017-1319-6

Tokimatsu K, Yamaguchi R, Sato M, Yasuoka R, Nishio M, Ueta K (2011) Measuring future dynamics of Genuine Saving with changes of population and technology: application of an integrated assessment model. Environ Dev Sustain 13(4):703–725

Tokimatsu K, Yamaguchi R, Sato M, Yasuoka R, Nishio M, Ueta K (2012) Measuring sustainable development for the future with climate change mitigation; a case study of applying an integrated assessment model under IPCC SRES scenarios. Environ Dev Sustain 14(6):915–938

Tokimatsu K, Yasuoka R, Nishio M, Ueta K (2013) Sustainability and the measurement of future paths in Genuine Savings: case studies. Int J Sustain Dev World Ecol 20(6):520–531

Tokimatsu K, Yasuoka R, Nishio M, Ueta K (2014) A study on forecasting paths of Genuine Savings and wealth without and with carbon dioxide constraints: development of shadow price functions. Environ Dev Sustain 16(3):723–745

Tokimatsu K, Konishi S, Ishihara K, Tezuka T, Yasuoka R, Nishio M (2016a) Role of innovative technologies under the global zero emissions scenarios. Appl Energy 162(15):1483–1493

Tokimatsu K, Aicha M, Yoshida K, Nishio M, Endo E, Sakagami M, Murakami K, Itsubo N (2016b) Measuring marginal willingness to pay using conjoint analysis and developing benefit transfer functions in various Asian cities. Int J Sustain Dev World Ecol. https://doi.org/10.1080/13504509.2016.1168326

Tokimatsu K, Yasuoka R, Nishio M (2017) Global zero emissions scenarios: the role of biomass energy with carbon capture and storage by forested land use. Appl Energy 185:1899–1906

Tol RSJ (2005) The marginal damage costs of carbon dioxide emissions: an assessment of the uncertainties. Energy Policy 33(16):2064–2074

Tol RSJ (2009) The economic effects of climate change. J Econ Perspect 23(2):29–51

UN (2003) (United Nations, Department of Economic and Social Affairs, Population Division). World population to 2300. http://www.un.org/esa/population/publications/longrange2/WorldPop2300final.pdf. Accessed 13 May 2016

UN 2011 UNDESA Population Division (United Nations, Department of Economic and Social Affairs, Population Division) (2011) World population prospects: the 2010 revision, highlights and advance tables, ESA/P/WP.220. Accessed 17 Jan 2016

Waldhoff S, Anthoff D, Rose S, Tol RSJ (2014) The marginal damage costs of different greenhouse gases: an application of FUND. Econ: Open-Assess E-J, 8(2014–31):1–33

Weitzman ML (1997) Sustainability and technical progress. Scand J Econ 99(1):1–13

Wigley TML, Richels R, Edmonds J (1996) Economics and environmental choices in the stabilization of atmospheric CO2 concentrations. Nature 379:240–243

World Bank (1997) Expanding the measure of wealth: indicators of environmentally sustainable development. Environmentally sustainable development studies and monographs series, no. 17. World Bank, Washington, DC

World Bank (2011) The changing wealth of nations: measuring sustainable development in the new millennium

World Bank (2015) World development indicators. http://data.worldbank.org/indicator. Accessed 17 Jan 2016

Yamaguchi K, Ii R, Itsubo N (2016) Ecosystem damage assessment of land transformation using species loss. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-016-1072-2

Acknowledgements