Abstract

This paper examines the environmental knowledge externalities of FDI within and across cities in an emerging economy context. It argues that the extent of these environmental externalities is contingent upon local industrial agglomeration. Using a panel dataset of 280 Chinese prefectural cities from 2003 to 2012, we employ a spatial economic approach. Although limited to evidence from soot and \(\hbox {SO}_{2}\) pollutants, our results suggest that FDI brings overall positive environmental knowledge externalities to a region, and also spillovers to nearby regions. Specialised cities may lock into a particular technological path, attenuating the absorption and diffusion of a variety of FDI environmental knowledge. Conversely, diversified cities promote cross-fertilisation of environmental knowledge and mitigate local pollution intensity at the aggregated city level. This study adds to the literature by highlighting the importance of considering both the spatiality of FDI and industrial structure in understanding FDI environmental knowledge spillovers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The role of inward foreign direct investment (thereafter FDI) has long been debated and has attracted substantial attention from both academics and policymakers. Considerable research efforts have already been devoted to examining whether the presence of FDI catalyses productivity and technological spillovers that lead to growth in host countries’ industries or regions (Crespo and Fontoura 2007; Driffield and Love 2007). Yet, critics see an exponential trend of environmental degradation as a ‘hidden aspect’ of FDI-led growth in host countries in the face of rising global environmental concerns (Pazienza 2014).

To date, the majority of existing studies have focused on exploring the environmental impact of FDI on economic growth, the determinants of FDI-led pollution, and the stringency of the environmental regulations in host countries to support or repudiate the existence of FDI environmental benefits (Copeland and Taylor 2004; Dean et al. 2009; Dijkstra et al. 2011; He 2006). The empirical evidence on the role of FDI on recipient countries’ environmental performance however remains ambiguous and inconclusive (Erdogan 2014; Pazienza 2014). Moreover, both dynamic and spatial dependence is vital to understanding the environmental knowledge externalities of FDI (hereafter ‘FDI-EKE’), but they have seldom been considered. Few studies also consider the conditions under which FDI environmental spillovers might appear, especially in the context of developing countries.

To this end, this paper intends to examine the FDI environmental knowledge externalities within and across cities and how their extent is contingent upon local industrial agglomeration in an emerging economy. The contributions of this paper are twofold. First, we contribute to the inconclusive debate on the existence of FDI environmental spillovers by systematically considering both its spatial dependence and dynamic effect. These effects have often been neglected in previous research. However, the economic geography literature has long acknowledged the existence of effects from neighbouring regions rather than those limited to within an area. These effects can be spatially correlated and cause autocorrelation across geographic regions (LeSage and Pace 2010). It is also necessary to consider the dynamic dimension of both pollution intensity and FDI in a region as their current levels may be related to past ones (Driffield 2006; Perkins and Neumayer 2008). We are among the first attempts to take into account both of these dynamic and spatial perspectives in order to shed light on the inconclusive FDI-EKE, and to respond to the recent call for a more extensive use of spatial models in studying environmental issues (Kyriakopoulou and Xepapadeas 2013).

Second, our study further makes an important attempt to reconcile the conflicting debates surrounding the existence of FDI environmental externalities by suggesting that they are contingent upon regional characteristics, such as industrial agglomeration. Although relatively limited in number, several previous studies have suggested there is a link between local industrial agglomeration and environmental performance (Cole et al. 2013; Costantini et al. 2013; Picazo-Tadeo and García-Reche 2007; Verhoef and Nijkamp 2008). We extend this line of enquiry by linking two strands of literature on the environmental impact of FDI and industrial agglomeration. We also, to the best of our knowledge, have made the first attempt to investigate more specifically how different types of industrial agglomeration, namely, specialisation and diversity, unlock the environmental externalities that FDI may bring to the hosting regions. Clearly, an understanding of such an underlying mechanism that can potentially diffuse FDI-EKE is important for policymakers to promote FDI and coordinate local industrial activities in order to benefit from FDI environmental knowledge spillovers.

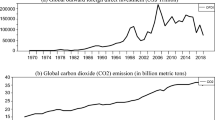

We study the aforementioned relationships in the emerging market context of China. Over the last three decades, China has witnessed remarkable economic growth, rapid industrialisation and urbanisation (Ning 2009; Wang et al. 2010). As of 2014, China was also the world’s largest FDI recipient in 2014, overtaking the US for the first time since 2003, and its regional industrial structure has undergone enormous development (Ning 2009) (see also section 4.4 and Fig. 2). China’s economic success comes at an enormous environmental cost, however, and the impact is felt both regionally and globally: 16 of the world’s 25 most polluted cities are located in China (Cole et al. 2011; Zheng et al. 2010). This unique setting provides an opportunity to study the intensified relationship between FDI and pollution within and across regions, as well as the effect of the rapidly developed regional industrial structure. An understanding of the underlying mechanisms of regional characteristics can clearly aid governments in designing policy that facilitates regions’ abilities to benefit from FDI environmental spillovers and to better meet environmental challenges during economic development. We have contrasted a unique city-level dataset from 280 Chinese cities from 2003 to 2012. To the best of our knowledge, this research uses the longest time period and more pollutant measures at the city level and thus extends earlier empirical studies on China, e.g. those of Cole et al. (2011) and Wang and Chen (2014).

The remainder of this paper is organised as follows. We first present a literature review on FDI externalities, industrial agglomeration, and regional environmental performance. Next, we outline our research methodology, data and variable measurements, and analysis. Finally, our findings, policy implications, and research limitations are discussed.

2 Literature Review and Hypotheses Development

2.1 FDI and Environmental Spillovers

The proposition of the existence of FDI-EKEs is broadly similar to the knowledge transfer mechanisms identified in the general FDI spillovers literature. When knowledge cannot be appropriated fully by the organisation that created it, it spills over to other nearby organisations that interact with it. Knowledge processed by an economic agent thus becomes a function of the knowledge generation of another (Beaudry and Schiffauerova 2009; Feldman and Audretsch 1999; Krugman 1991). Direct FDI-EKEs are expected to occur through technology transfer and licensing or ‘vertical or horizontal linkage’, where multinationals’ subsidiaries integrate local firms into their value chain as customers or suppliers. Local firms thus learn to comply with the environmental standards and practices that are self-imposed by multinational enterprises (MNEs) or their stakeholders (Perkins 2003; Zhu et al. 2012). Indirect FDI-EKE, conversely, may take place via labour mobility as skilled workers shift employment from MNE subsidiaries to domestic firms, thereby facilitating the local adoption of environment efficient technologies (Cole et al. 2008). These externalities may also occur through ‘demonstration effects’, whereby local firms imitate or adopt technologies and operating practices successfully used by MNEs, thereby intentionally or unintentionally improving environmental aspects of their technology efficiency. Local firms could also be driven by heightened competition as a result of MNEs’ entry to upgrade technologies, leading to the improvement of environmental efficiencies (Albornoz et al. 2009; Huber 2008; Perkins and Neumayer 2009).

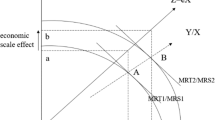

For those scholars who suggest a positive FDI-EKE effect following the ‘pollution halo hypothesis’, they contend that multinationals may be less pollution intensive than their domestic counterparts because they use more advanced and cleaner technologies, environmental management systems and practices. The presence of FDI may eventually yield substantial environmental benefits to the recipient developing countries due to the embedded environmental knowledge in technology transfer and spillovers (Albornoz et al. 2009; Zarsky 1999). Moreover, multinationals undertaking FDI are theorised as possessing an asset that gives them superior competitive advantages over domestic firms, including advanced technologies, patents, trade secrets, brand and managerial practices (Blomström and Kokko 1998; Crespo and Fontoura 2007; Meyer and Sinani 2009). They are more likely to bring new technologies to the host countries because of their need to exploit this ownership-based advantage to outperform local rivals (Dunning and Lundan 2008). Technology advancement means that potentially more environmentally friendly and less energy- and pollution-intensive technologies are applied in production (Perkins and Neumayer 2008). The technique effect and growth (scale effect) and industrial composition (structural effect) have been perceived to be the central determinants of emissions intensity (Grossman and Krueger 1995).

For those scholars who argue the negative FDI-EKE, they follow the ‘pollution haven hypothesis’ and suggest that increasing globalisation fuels multinationals’ relocation of pollution-intensive production to countries with less stringent environmental and social standards to circumvent environmental regulation-induced production costs in their home countries. Host country governments will ‘race to the bottom’ by intentionally lowering their environmental standards in the hopes of attracting more FDI and trade for growth, which will eventually lead to greater environmental degradation (Javorcik and Wei 2004; Tole and Koop 2010). Moreover, the presence of FDI can have a ‘crowding-out effect’, as MNEs with advanced business acumen can outcompete domestic firms. These companies can offer superior products and services and higher pay, thereby drawing customers, investors, suppliers and skilled employees away from domestic firms (García et al. 2013; Tian 2006). Domestic firms may suffer from reduced profitability, leaving them with little to invest in modern equipment and operating practices. The companies may instead rely on cheaper, outdated and more polluting technologies to achieve cost minimisation. Moreover, given the weak environmental regulatory and institutional development in the host developing countries, MNEs can choose to transfer outdated and polluting technologies to avoid the cost of environmental regulation compliance in their home countries. The presence of FDI could therefore be detrimental to the local environment as the ‘pollution haven hypothesis’ postulates (Javorcik and Wei 2009; Wang and Chen 2014).

The empirical literature is also divided, offering ambiguous and inconclusive results on FDI environmental spillovers. For example, Eskeland and Harrison (2003) examine the developed nation FDI patterns in Côte d’Ivoire, Morocco, Mexico, and Venezuela, and find that foreign firms are less polluting than their peers in developing countries. Similarly, Javorcik and Wei (2004) demonstrate that there is no evidence to support the pollution haven hypothesis that foreign firms will relocate to Eastern European countries with weak environmental regulations. In the same vein, Cole et al. (2008) show that foreign ownership and foreign training of a domestic workforce have positive environmental implications based on a sample of Ghanaian firms. Albornoz et al. (2009) find that both foreign-owned and domestic firms with linkages with foreign companies are more likely to implement environmental management systems in Argentina, thus supporting positive FDI environmental spillovers. Bao et al. (2011) also show that FDI has reduced overall pollution emissions in Chinese provinces, while Lan et al. (2012) show that positive FDI environmental spillovers depend on the level of human capital.

In contrast, several scholars find negative or insignificant environmental externalities to support a haven effect. For example, Andonova (2003) finds that the presence of FDI does not necessarily lead to a higher rate of clean technology adoption in the central and eastern European context. Perkins and Neumayer (2008) show that FDI does not have a significant influence on domestic emission efficiency across over 90 developing countries. Similar to the work of Zarsky (1999) and He (2006) finds empirically that a scale effect of industrial output contributed by FDI in Chinese provinces would increase the level of the pollution generated and have only a marginal impact on industrial emissions, although MNEs were found to be generally more environmentally efficient. Similarly, Wang and Chen (2014) use a panel of Chinese city-level data and demonstrate that FDI in general generates negative environmental externalities.

Several possible explanations for these mixed empirical results could be diverse estimation methods (e.g. panel vs cross-sectional data), different time periods or models of specifications, or divergent contexts (regional vs firm, developed vs developing nations or across countries) (Blomström and Kokko 1998; Crespo and Fontoura 2007; Görg and Greenaway 2004; Meyer 2004; Meyer and Sinani 2009). However, the fundamental issue is that both spatial and dynamic effects are often not considered when studying general FDI spillovers, nor are FDI-EKE and pollution levels in a region. These studies generally fall into two categories. First, one common assumption is that the robustness checks of internal variables, specification testing or the use of dummy variables are sufficient for estimations with regional dimensions. As Autant-Bernard and LeSage (2011) and LeSage and Pace (2010) note, regional data are very unlikely to be spatially independent. This approach could become biased because spatial autocorrelation may affect the vectors of externalities estimated when agglomeration and interregional interactions are considered (Driffield 2006). Similarly, mixed results could be due to the omission of the dynamic dimension of the externalities. Current factor levels can be related to their previous levels. These include FDI volume, accumulated experience and knowledge through learning-by-doing, improvement in environmental technologies and technology in general, the diffusion of environmental policy innovation, and pollution and production levels (Cole et al. 2006; Driffield 2006; Hong and Sun 2011). Autocorrelation across time and endogeneity issues can become serious issues in estimating the direction of externalities (see also 3.2).

Moreover, although the theoretical debate and empirical evidence on FDI-EKE is far from conclusive, there are numerous reasons to believe that the presence of FDI outweighs its possible negative haven environmental effects and brings overall positive externalities to emerging markets. This finding is observed primarily because the pollution abatement cost is often negligible compared to the total costs of production relocation from developed to emerging economies (Hoffmann et al. 2005; Meyer 2004; Zarsky 1999). Second, developing countries or regions with less stringent environmental regulations can also be politically and socially unstable. MNEs may well avoid relocating to these countries to protect their corporate image and minimise the risks of operational disruption and environmental incidents which may significantly outweigh the savings gained from lax environmental regulations (Tole and Koop 2010). Third, MNEs are likely to use the same standards and practices, including environmental ones, in production across all their markets. These companies pursue this course regardless of whether they are in domestic or foreign markets or required by the host countries or stakeholders to achieve scale economies and managerial simplicity, thereby reducing the risk of environmental and production incidents (Angel et al. 2007; Meyer 2004; Perkins and Neumayer 2009). Fourth, the ‘crowding-out effect’ may also be simply a short-term dynamic adjustment in response to foreign competition. In the longer term, MNEs are more likely to improve, rather than reduce, overall domestic environmental efficiency (Perkins and Neumayer 2009). Finally, unlike developed countries where home-grown innovation capabilities are robust, FDI is often the primary source of capital investment and newer technology in developing countries (Poelhekke and Van Der Ploeg 2009; Wang et al. 2016) and is thus more likely to be the source of technology transfer of environmental innovations to improve host countries’ environmental efficiency (Perkins 2003).

Based on both the theoretical and methodological discussion above, we first take a fresh look at the inconclusive FDI environmental externality debate both within and across regions, as well as taking into account the dynamic effect in an emerging market context.

2.2 Regional Dimension of FDI Environmental Knowledge Externalities and Industrial Agglomeration

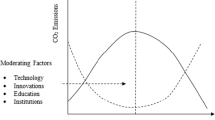

Another fundamental issue that may lead to these mixed results on FDI environmental spillovers as discussed above, is that the presence of FDI in a region or foreign ownership of a firm per se is often assumed to be the critical factor in developing countries. Whether FDI has a positive or negative spillover effect, however, depends on both endogenous and exogenous factors and not entirely on the amount of FDI inflows (Crespo and Fontoura 2007). This dependence also applies to FDI-EKE (Wang and Chen 2014). FDI spillovers can be conditioned by a range of factors, such as local absorptive capability, effective linkages between foreign and domestic firms in the local value chain, a sufficient stock and mobility of local human capital, the level of foreign tangible assets, as well as pace and regularity of the entry process (Crespo and Fontoura 2007; Lan et al. 2012; Meyer and Sinani 2009; Wang and Chen 2014).

Although the literature specifically addressing the determinants of FDI environmental spillovers is sparse, several attempts have been made to highlight the importance of local capabilities. For example, based on a sample of Ghanaian firms, Cole et al. (2008) argue that foreign ownership increases firms’ access to environmentally efficient technologies. The use of such technologies, however, depends on the international experience or foreign training of local managers. Similar findings have been published by Albornoz et al. (2009), who show that firms with a greater proportion of skilled employees are more receptive to FDI environmental spillovers in Argentina. Using cross-country evidence, Hoffmann et al. (2005) show that spillovers are dependent on the host country’s level of development. Wang and Chen (2014) note the importance of host country institutions in reducing FDI-led \(\hbox {SO}_{2}\) emissions in China.

Despite the small body of literature delineating the contingencies for FDI-EKE, the regional dimension of FDI remains insufficiently studied. Most studies have yet to consider the extent to which FDI externalities could differ across regions when different degrees of proximity and agglomeration are considered. This may be a further cause of contradictory results in previous works. To our knowledge, the role of industrial agglomeration as an important locus has yet to be fully understood. As argued by many scholars, knowledge spillovers including environmental knowledge are often geographically bound, and regions could thus differ substantially in the volume of knowledge creation (Beaudry and Schiffauerova 2009; Feldman and Audretsch 1999; Krugman 1991). This is due to the tacit and contextual nature of knowledge which requires interpersonal contacts for knowledge sharing and technological learning. Economic agents’ potential to absorb new knowledge or technologies therefore depends on distance. Firms and industries agglomerate to achieve spatial proximity and benefit from localised non-pecuniary knowledge spillovers (Feldman and Audretsch 1999; Krugman 1991).

Several recent pioneering studies have considered including certain regional aspects of environmental performance and spillovers, although they do not directly focus on FDI, its antecedents or the emerging market context. For example, Cole et al. (2013) find a spatial correlation of carbon emissions by Japanese firms, thus indirectly indicating the possible cause of regional industry agglomeration. Based on numerical simulation, Kyriakopoulou and Xepapadeas (2013) conclude that spatially differentiated environmental policies and industrial pollution act as centrifugal forces to industry agglomeration which results from the regional natural cost advantages and knowledge spillovers. Costantini et al. (2013) find that industrial specialisation, technological and pollution intraregional spillovers are highly relevant in explaining regional environmental performance in Italy. As discussed earlier, FDI may bring new technologies to a region with potential environmental knowledge, and the contingency views have shown some possible factors. We therefore have good reason to believe that possible FDI-EKE will be contingent upon different types of industrial structures, namely, specialisation and diversity.

We elaborate upon the depiction of Glaeser et al. (1992) who formulated the Marshall–Arrow–Romer (MAR) specialisation externalities and claimed that the concentration of an industry in a region can encourage frequent interactions among firms in the same or related fields, thus leading to intra-industrial knowledge spillovers. This is because specialisation can lower transmission costs as the scale of the same industrial activities increases and engenders the efficient sharing of specialised infrastructure, facilities, and industrial inputs, thereby easing knowledge flows and fostering local collective learning (Beaudry and Schiffauerova 2009; Ó Huallacháin and Lee 2011) .

There are, however, some reasons to expect that specialisation may hinder knowledge transfer, especially in regard to environmental spillovers. First, specialisation may result in an improvement in a narrow range of technological activities. As the spillovers originate from economic agents in similar technological fields, they may only spur incremental innovation that primarily aims to increase productivity, rather than the creation of novel knowledge that leads to radical innovation and fundamentally addresses production-related environmental issues. Moreover, narrow specialisation may hamper interorganisational interactions and reduce the opportunity for learning or knowledge recombining from different technological fields (Beaudry and Schiffauerova 2009; Ó Huallacháin and Lee 2011). Hence, specialisation may constrain the diffusion of FDI-EKE between domestic firms within and across regions.

Secondly, specialised regions may be more vulnerable to ‘locking in’ to a particular technological path to diffuse environmental knowledge. This effect makes these regions less flexible and means that it can be more difficult to adjust to exogenous changes, such as technological changes (Drucker 2015; Ó Huallacháin and Lee 2011). It may reduce the chances of the local absorptive capacity being compatible with technologies, such as potential environmental knowledge in our case, brought by FDI to a region (Buerger and Cantner 2011). Moreover, as opposed to innovation which has mainly productivity implications, environment-related innovation often involves adopting, updating, or replacing production equipment and practices. This type of innovation may require firms to develop new knowledge based on a variety of knowledge sources in order to move away from the existing technology areas and practices.

Third, even if specialisation may improve a region’s potential receptivity to new technologies from FDI, most domestic firms may be geared toward improving short-term productivity and may be less likely to have any or specific aims to improve environmental performance or efficiencies (Costantini et al. 2013). This effect may be more pronounced in the case of developing countries where economic or efficiency gains are emphasised over environmental ones by both firms and policymakers. Firms may also disincentivise devoting long-term commitments and costly investments to a less immediate financial return. Given that environmental regulations are weakly enforced, FDI pouring into these specialised regions may lead to an even higher level of pollution intensity both within and across regions.

In opposition to MAR, Jacob’s diversity externalities postulate that the local variety of industries promotes intra-industry spillovers for knowledge creation in a geographic region (Jacobs 1969). Jacobean scholars argue that the sources of knowledge creation and spillovers are external to the industry within which a firm operates (Beaudry and Schiffauerova 2009). There are two main reasons for these scholars to contend that Jacobean externalities are more beneficial than the MAR ones in terms of diffusing FDI-EKE.

First, the agglomeration of different industries in close proximity enables firms to draw upon a variety of local knowledge sources, thereby providing a breeding ground for new environmental ideas. This agglomeration is particularly favourable to radical innovation and the emergence of new technology fields. Firms can explore, imitate, share, and recombine complementary knowledge from various disciplines across industries (Harrison et al. 1996; Quatraro 2010). Industrial diversity therefore promotes the search and experimentation in innovation which lead to greater knowledge spillovers in a region (Beaudry and Schiffauerova 2009). This should also be very helpful for domestic firms seeking to test new technologies with the environmental potential brought in by FDI or to recombine them with their existing knowledge to innovate environmentally efficient products or services that better suit local conditions.

Second, industrial diversity promotes the cross-fertilisation of ideas that is especially helpful for firms to incorporate environmental solutions or inventions developed in their production from one industry to another (Combes 2000; Neffke et al. 2011). The initial cost of investment in environmental knowledge creation or problem-solving is lowered by spreading it across a variety of activities across industries (Buerger and Cantner 2011). Thus, unlike specialisation, which may promote knowledge spillovers and production efficiency, industrial diversity could improve the overall environmental technological advancement of a region (Ó Huallacháin and Lee 2011). It should also facilitate the diffusion of FDI environmental technologies across different industries and mitigate overall pollution intensity at the aggregate city level.

3 Methods

3.1 Data

The empirical context of this study is China, the world’s largest FDI destination and emerging market. We construct a panel of 280 prefecture cities (hereafter ‘cities’) spread across the entire country from 2003 to 2012. Within each city, 19 industries, as based on the classifications of the National Bureau of Statistics of China (NBS), are used to calculate the industrial agglomeration variables. In total, we identify 2127 city year observations for our spatial panel analyses, excluding missing values. Our sample includes cities from 23 provinces, 4 municipalities (‘super cities’: Beijing, Shanghai, Tianjin, and Chongqing), and 4 autonomous regions. Cities from Tibet are excluded due to a lack of data, and Hong Kong and Macau are excluded because they are subject to different administrative systems. The sample period is determined by the availability of our dependent variables—industrial emission measures. All data are compiled from various issues of the Urban Statistical Yearbook and the China Statistical Yearbook for Regional Economy.

3.2 Estimation Methodology

To analyse the impact of industrial agglomeration and the spatial externalities of FDI on the intensity and spatiality of pollution, there is a need for dynamic specification. Pollution intensity can be proxied by its past level. It is important to capture the effect of learning by doing and technology adoption from FDI, or other changes in the scale of operations that may have a cumulative effect on emissions. A lagged dependent variable is therefore included. Furthermore, as discussed in the literature review, spatial dependence must be considered when studying interregional externalities (LeSage and Pace 2010). Pollution from one location can be affected by neighbouring localities and lead to spatial autocorrelation across space and time, rendering ordinary least squares (OLS) estimators invalid.

Previous studies such as that of Cole et al. (2013) have already found the level of regional pollution is jointly and significantly determined by that of neighbouring regions. Similarly, the flow of FDI to one region may be affected by others nearby (Ning et al. 2016). We thus include the spatial lags of the dependent variables and FDI. Our estimation model is presented formally below:

where i denotes the city and t the year. X represents f control variables (see 3.3.3). FDI is the flow of foreign direct investment. SPE refers to industrial specialisation and DIV denotes the industrial diversity of region i. We also include the interaction terms between FDI, DIV and SPE. \(\beta \) and \(\phi \) are the corresponding estimated parameters of the explanatory and control variables and \(\mu _{i,t} \) is the disturbance term. \(Pollution_{i,t-1} \) is our time-lagged dependent variable \(\upgamma \) is its estimated coefficient. \(\sum \nolimits _{j=1}^n {W_{ij}}\) denotes i, jth element of the row standardised spatial weight matrix of \(n\times n\) dimension that depends on the geographic distance. n corresponds to the number of cities. The geographic distance is inverse squared to reflect a gravity relationship among cities. \(\sum \nolimits _{j=1}^n {W_{ij,t}} \ln Pollution_{i,t} \) is the spatially lagged dependent variable and \(\sum \nolimits _{j=1}^n {W_{ij,t} } \ln FDI_{i,t}\) is our key spatially lagged explanatory variable; we use them to proxy the weighted average of these two characteristics of neighbouring cities. \(\lambda \) and \(\varphi \) are the corresponding estimated coefficients. All variables are in natural logarithm.

A standard approach to estimating a spatial economic model is to employ a maximum likelihood method (Elhorst 2014; LeSage and Pace 2010); however, this approach is not designed to handle the potential endogeneity of both serially and spatially lagged regressors. For example, reverse causation may well generate estimation problems in studies of regional pollution performance. FDI may lead to reduced or increased pollution intensity, but less polluted or dirtier regions are also more likely to attract or deter FDI. Moreover, the explanatory variables may have an impact upon pollution intensity, which may also have an impact upon some (or all) of the explanatory variables. These endogeneity issues may arise in such circumstances. OLS estimation will tend to overestimate the effects of the explanatory variables. The conventional fixed effect transformation is also insufficient to control for spatial autocorrelation and becomes correlated with the lagged dependent variables in our dynamic model.

We therefore employ the system generalised method of moments (SGMM) estimation method with robust standard errors. SGMM is regarded as an appropriate method for dealing with unobserved heterogeneity and endogeneity, as well as situations in which the explanatory variables are not strictly exogenous. Furthermore, SGMM is also suitable for short panel datasets, as it allows the use of first differences of the equation above to eliminate fixed effects, as well as the use of instruments of further lags and lagged levels of explanatory variables and the endogenous dependent variable, including both those of time and spatial lags. This method also helps to more fully exploit the available moment conditions in a finite sample (Blundell and Bond 1998). We use the first differences of the second and third lags and lagged levels of dependent and explanatory variables as instruments and Hansen’s J test to check their overall validity. The Arellano–Bond (AR) test is also employed to detect the existence of the first or second order serial correlation. Finally, the two-step covariance matrix is implemented for finite sample correction, as suggested by Windmeijer (2005).

3.3 Variables

3.3.1 Dependent Variable

Pollution intensity the dependent variables for our estimations are the log of a city’s total amount of industrial pollution emission over its geographic area as a proxy for pollution intensity in a given city area to reflect the spread of pollution. We employ three pollution indicators: sulphur dioxide emissions (\(\hbox {SO}_{2})\), waste water (WATER) and soot and dust (SOOT) in tons per square kilometre of the cities. \(\hbox {SO}_{2}\) comes mainly from mining and smelting activities with the use of hard coal, brown coal and petroleum. Waste water refers to industrial waste water that is produced mainly through industrial processing of petroleum and coke, smelting and processing raw metals, chemicals, and paper. By contrast, soot and dust (SOOT) originate from a relatively large variety of industries. We use these polluters as our environmental indicators because they can better reflect the environmental impact of rapid industrialisation and urbanisation that has taken place in China over the last 20 years (Cole et al. 2011; De Groot et al. 2004; He et al. 2014). The official data are also available for a reasonably long period at the city level to allow the use of panel analysis and to control for unobserved heterogeneity across regions.

3.3.2 Explanatory Variables

FDI we employ the annual flow of inward FDI scaled by total population in a city to proxy the density and presence of inward FDI and to reduce the heterogeneity of territorial units. The FDI inflow is the actual utilised amount of capital in millions of Yuan. This is based on the theoretical justification that new technology is often embedded in the new capital investment flows into a location (Bajo-Rubio et al. 2010; Cheung and Lin 2004; Driffield and Love 2007).

Industrial Specialisation (SPE) To measure the Marshall externalities originating from intra-industry specialisation in a city, we adopt the Krugman specialisation index (Krugman 1991). This index is defined as follows:

where \(E_{ij}\) is employment in industry j in city i, and n and m are the total number of industries (max. = 19) and cities (max. = 280), respectively. The higher the value of city i’s \({ SPE}_{i}\) is the more it deviates from the average of the entire country and the more it is considered to be specialised.

Industrial Diversity (DIV) To measure the impact of the urban diversity of industries (Jacobs externalities), we follow the work of Marrocu et al. (2013) and construct a diversity variable (DIV) as follows:

where k is the total number of industries. We employ the Hirschman-Herfindahl concentration index on employment, but exclude industry j which is considered when the diversity of the city and industry j is calculated (\(j^{{\prime }}\ne j)\). This indicator avoids linking the diversity of an industry with its own specialisation. The index is then inverted to allow us to interpret a higher DIV value as a greater degree of industry diversity in a city. Again, we descale this index by the city’s diversity relative to that of the entire country.

3.3.3 Control Variables

We control for several factors that may affect a city’s pollution intensity. Similar to the environmental Kuznets curve function (Grossman and Krueger 1994), we first control for the scale effect which arises through the growth potential and size of a city; it is proxied by the GDP growth rate. \({ Scale}^{2}\) captures the non-linear form between GDP growth and pollution. Technique refers to the effect of changes on the techniques of production or technological progress on pollution that comes from domestic technological sources (Cole 2000). It can also proxy the technological absorptive capability of a city for FDI. We use the share of the number of science and technology employees over the total employment of a city in a similar fashion to Jones’s (1995) proxy of research and development (R&D) which used the number of scientists and engineering employees. We also seek to control for the effects resulting directly from industrial output on the spread of pollution in a city, rather than for a simple structural effect caused by a shift in the composition of the local economy. The structural changes are found to play a relatively minor and debatable role in affecting pollution emissions (Perkins and Neumayer 2009; Stern 2004). We therefore use the total industrial output (output) measured in 10,000 RMB and scaled by city area to proxy the changes in the intensity of industrial activities.

Next, we control for urban features that may have an impact on pollution. We first include local environmental stringency (stringency) as it can increase pollution abatement costs and potentially reduce regional pollution. We capture this effect by using the total number of state environmental staff over the population, following the work of Dean et al. (2009), as it reflects the resources government devotes to managing pollution. The transportation density (transport) is measured by the number of travel journeys over the population. We use it to control for the degree of interactions as a result of the available transportation infrastructure in the city (He and Wang 2012). We also include cities’ total trade (import and export) to control for their openness (Copeland and Taylor 2004; Dean et al. 2009). We expect that cities with higher environmental stringency, better interconnectedness, and stronger technological capabilities have low yields of pollution intensity (De Groot et al. 2004; Zhang and Fu 2008).

4 Empirical Results

4.1 Descriptive Analysis

In Figs. 1 and 2, we first map out the spatial distribution of our key variables using geographical information systems (GIS). The maps offer a visual representation of our expected results across cities in 2004 and 2012. Figure 1 illustrates two snapshots of the spatial distribution of three pollutants, SOOT, \(\hbox {SO}_{2}\) and WATER. \(\hbox {SO}_{2}\) was heavily concentrated in cities in Hubei, Hunan, Shandong and Liaoning provinces, as well as the Hebei area in 2004. The 2012 map highlights a concentration trend such that the \(\hbox {SO}_{2}\) intensity had become even more pronounced in these areas. The map of soot and dust in 2004 shows a more concentrated pattern in Shanxi, Sichuan, Zhejiang, and South East China. While these pollutants remain more heavily concentrated in Shangxi, the disparity of SOOT intensity between regions has been reduced and is dispersed more across the entire country. The distribution of waste water is different from the above two pollutants: waste water is clustered around principal watercourses such as the Changjiang, Huanghe, and Zhujiang delta areas.

Figure 2 shows the uneven geographical distribution of per capita FDI inflows, which were largely concentrated in cities in coastal regions, such as Tianjin, Jiangsu, Zhejiang, Fujian and Guangdong in 2004. While these regions maintain a large share of FDI, there is also an increase in the density of FDI intensities in their surrounding cities. Certain areas in central and western regions have also increased their FDI inflows, e.g. cities in Hunan, Jiangxi, and Henan. The distributions of FDI and pollution intensity also seem to be clustered, indicating possible spatial autocorrelation among cities.

Figure 2 also illustrates the spatial distribution of relative specialisation and diversity in 2004 and 2012. When comparing the two snapshots, it is noticeable that cities in the inland and central and northeast regions have become increasingly specialised, while the distribution in the coastal regions is more scattered. The degree of diversity in the coastal and central regions also shows an increasing trend, but the overall pattern across cities is very scattered in different provinces. When comparing all maps, diversified areas in most regions have relatively low pollution intensity; the opposite is true for specialised regions. However, it is difficult to visualise an explicit relationship between all pollutants and FDI—either positive or negative—prior to controlling for their dynamic and spatial effects, as well as for the total regional industrial output. These preliminary results highlight the importance of considering these effects and warrant further exploration of the visual patterns through our spatial econometric analysis.

4.2 Spatial Regression Analysis

We present the summary statistics and correlation matrix of the variables in Table 1. The correlation coefficients between the dependent and independent variables are relatively high and indicate a good selection of variables. We have further checked for potential multicollinearity by both inspecting the value of the correlation coefficients among independent variables and computing the variance inflation factors (VIF). All values are within an acceptable range with a mean VIF value of 1.63. The correlations between SPE, DIV and three pollutants are negative. We must interpret these pairwise correlations with caution because they only present the contemporaneous effect and do not account for the moderating effects and spatial dependence we include in our econometric analysis. Unlike our spatial regression analysis, the correlations here cannot inform the directionality and temporal relationships between the variables.

The regression results are reported in Tables 2, 3 and 4. We first inspect the consistency of the SGMM estimators, which requires valid instruments and the absence of a second-order serial correlation (Blundel and Bond 1998). We use the lagged first differences of the dependent and explanatory variables from year 2 to 3 as instruments, and also employ the Hansen test for overidentifying restrictions and the overall validity of the instruments in the estimation process. In all tables, the insignificant values of the Hansen J-statistics across all our models support the view that the instrumental variables are uncorrelated to residuals. Moreover, the Arellano–Bond (AR) tests in all models indicate that the first-order AR(1) and not the second-order AR(2) error terms are serially corrected. This finding further supports the use of GMM for our estimation in our models.

Tables 2, 3 and 4 also report the results of our SGMM estimations individually with three different pollution indicators as dependent variables. For each set of estimations, we first include our control variables and the main explanatory variable, FDI. This is followed by including the interaction terms with specialisation and diversity in the following models. For models (1)–(5) in all three tables, Pollution \(_{i, t-1}\) is positively significant at the 1% or below level. This indicates the importance of considering the past emission levels of all three pollutants, as it positively influences the current level and therefore shows the persistence of pollutions. The spatial lags, \(\mathbf{W}ln({ Pollution}_{it} )\), are statistically significant throughout models (1)–(5) for SOOT and \(\hbox {SO}_{2}\). Ceteris paribus, these results indicate the presence of spatially dependent pollution among neighbouring cities in China. For each 10% increase in the average level of pollution emission intensity in neighbouring cities, SOOT emission intensity increases approximately 4%, while \({ SO}_{2}\) declines approximately 5%. We do not, however, find any significant spatial dependence of WATER, although it shows the expected positive signs throughout the relevant models.

It is worth noting that the opposite signs between the spatial lags of \(\hbox {SO}_{2}\) and SOOT and the insignificant sign of waste water may be related to the emission nature of these pollutants. As discussed in the variables section, soot and dust are generated during the process of industrial production from a large variety of sources, e.g. coal burning, metal smelting and processing, and cement and concrete production. They are therefore difficult to abate across sectors. Given that the aforementioned interlinkages between cities such as the cross-regional industrial value chains, an increase in demand in the upstream or downstream sectors of the value chains in one city can raise the supply in neighbouring cities and vice versa (Liu et al. 2009). As a result, rising production and associated emissions of an industry in a city can drive up the production and associated emission levels of related upstream or downstream industries in its neighbouring areas in the regional industrial supply chain. By contrast, \(\hbox {SO}_{2}\) is generated mainly from only a few sources, such as burning sulphur-intensive fuels and mining activities. The technologies to reduce \(\hbox {SO}_{2 }\) emissions are relatively easier to implement by adopting ‘end-of-pipe’ techniques to retain the sulphur content or by switching to lower sulphur fuels (De Groot et al. 2004; Zhang and Fu 2008). For example, this can be achieved by closing down mines or power stations or shutting down small-scale glass, cement and oil-refining factories in certain areas in China (Cole et al. 2008). The negative relationship between a city’s sulphur emission levels and its neighbours’ could be observed as the concentration process of this pollutant from the city to neighbouring locations and as being driven by its increasing scale in those areas. This is also visually confirmed by our map in Fig. 1. The impact of waste water emission among regions, however, does not exhibit spatial dependence. This might be because the interregional effects were constrained by the heterogeneous levels of local water treatment infrastructures, drainage systems, and the quality of water from the complex hydrological systems clustered on large watercourses (Hatt et al. 2004). It is therefore unable to generate a cross-city interregional effect in the country as a whole. This is also visually depicted in Fig. 1.

For our key explanatory variable, we expect FDI to reduce pollution intensity. As expected and shown in Tables 2 and 3, the effects of FDI are most pronounced in reducing SOOT (\(\upbeta \) in the range of −0.296 to −0.364) and \(\hbox {SO}_{2}\) emissions (\(\upbeta \) in the range of −0.111 to −0.149), and show negative and statistical significance throughout models (1)–(5). For waste water in Table 4, FDI has the expected signs across models, but is consistently statistically insignificant. These results support that when \(\hbox {SO}_{2}\) and SOOT are used as pollutants, FDI demonstrates interregional knowledge spillovers, thus reducing a city’s emissions levels. In terms of FDI’s interregional spillover effects, W*FDI is negatively and significantly associated with \(\hbox {SO}_{2 }\) and SOOT at the 1% significance level. Ceteris paribus, our results suggest that for each 10% increase in FDI intensity in neighbouring cities, there is approximately a 7% decrease in SOOT emission intensity and a 5% decrease in \(\hbox {SO}_{2}\) intensity. Moreover, the coefficients of W*FDI are much greater than those of FDI. These results suggest the spatial dependence of environmental FDI and indicate that cities benefit from FDI flows received in neighbouring regions in reducing the emission intensity of these two pollutants. Again, we do not find such an effect for WATER. When \(\hbox {SO}_{2}\) and SOOT are used as the pollutants, FDI brings overall greener technologies to a location and has both inter- and intraregional environmental spillover effects.

Regarding industrial agglomeration, our results reveal that the primary effect of SPE is positively and significantly related to the pollution intensity of SOOT, (\(\upbeta \) = 1.191 and 1.646, \(P<0.05\) and 0.01, respectively) and \(\hbox {SO}_{2}\), (\(\upbeta = 0.948\) and 0.883, \(P<0.01\) and 0.05, respectively) in models 2 and 3 and Tables 3 and 4. These suggest that industrial specialisation increases a city’s pollution level. The interaction term SPE*IFDI is positive and significant (\(\upbeta = 0.214\) and 0.162, \(P<0.05\) and 0.01 in model 2 of both tables), showing the positive moderating effect of specialisation on the relationship between FDI and the two pollutants. The spatial interaction term of W*IFDI*SPE in model 3 in both tables is positive and significant (\(\upbeta = 0.297\) and 0.146, \(P<0.01\) and 0.1). This finding indicates that the intra-regional FDI-EKE is similarly positively moderated by a city’s industrial specialisation and that its strength was reduced for SOOT and \(\hbox {SO}_{2}\).

By contrast, we find that the main effect of industrial diversity (DIV) is negatively related to all three pollutants. It is only statistically significant, however, when SOOT is used as the dependent variable (\(\upbeta = -1.731\), P < 0.1). This also applies to W*IFDI*DIV, which is only negative and significant for SOOT (\(\upbeta = -1.772\), P < 0.05) and implies an enhancing effect for W*FDI when SOOT is used as the pollutant indicator, although the other two indicators have the expected signs. These results also reflect the nature of these pollutants because \(\hbox {SO}_{2}\) originates from several industrial sources and is therefore less amenable to effects from FDI spillovers, which benefit from the cross-fertilisation of environmental techniques from a variety of industries. Taken together, cities with a greater level of specialisation foster higher aggregate emissions of both \(\hbox {SO}_{2}\) and SOOT. Higher diversity can facilitate the diffusion of FDI environmental knowledge and bring down the aggregate level of emissions of SOOT.

For our control variables, scale is significantly and positively related to all three pollutants, as is scale across all models in Tables 3 and 4. This result suggests the linear rather than non-linear effect of scale in our models. Technique is negatively correlated with all three pollutants, but is only significant throughout all models in Table 3 and only partially in Table 4 for \(\hbox {SO}_{2}\). Industrial output is positive and significant at the 1% level throughout all models for \(\hbox {SO}_{2}\) and SOOT. For these two pollutants, the results of our control variables indicate that cities with a larger scale, higher industrial activities, and a lower level of technological capability, are more likely to have a higher emissions’ intensity. Moreover, our results concerning the other control variables of stringency, trade and transportation are insignificant. This might be because environmental stringency requires far more management resources than the current level (He et al. 2014), transportation is not a main source of industrial pollution in China (He et al. 2002), and it might reflect the international efforts to tackle trade-related emissions (Grossman and Krueger 1991). Taken together, these results still indicate that pollution reduction relies heavily on technological improvement and innovation; FDI has been an important source. Again, we find our models are poorly suited to estimate the effects on WATER.

We further conducted several robustness tests to check the extent to which our results are affected by alternative specifications. First, we used alternative spatial weight matrices, which include the row normalised binary contiguity matrix and K-nearest neighbour weight matrix with 3 and 5 neighbours as did LeSage and Pace (2010). Our main results remain materially unchanged. Second, we adopted various benchmark thresholds within 10% of the total employment of a city when calculating industrial agglomeration (Ning et al. 2016). Our results remain duly unaffected. We also included road mileage in the cities to proxy a city’s connectedness and exclude transportation and trade from our models. Our main results remain robust and largely unaffected. Our results are not robust when all control variables are removed from the models which is most likely a result of omission effects. When we further include an additional control variable, a ratio of mining and manufacturing over primary sector employment, our estimation for soot and dust remains duly unchanged. Our models on the two pollution measures are however sensitive to the additional control variable and indicate first order serial autocorrections which render these models invalid. Research limitations are discussed in the conclusion.

5 Discussion and Conclusions

Although there is a large and growing body of literature that is devoted to studying FDI productivity and knowledge spillovers, the environmental impact of the investment also deserves attention because it affects the sustainability of economic growth. This paper investigates the spatiality of both FDI and pollution intensity, as well as their interaction with local industrial structures. We also consider the spatial dependence and dynamic effect of pollution intensity and FDI and use the SGMM method to address endogenous regressors. Based on the analysis of a panel of 280 Chinese cities for the period from 2003 to 2012, we made what is, to the best of our knowledge, the first attempt to explain the intra- and interregional mechanisms that moderate FDI environmental knowledge externalities. We thus provide a contingency view and new empirical evidence to reconcile the conflicting FDI environmental spillover effects following the halo and haven hypotheses. We also visualise the distributions of our key explanatory variables, FDI, pollution intensity and industrial structures.

Our empirical results indicate the existence of environmental externalities from FDI within and across regions. Ceteris paribus, FDI brings environmental knowledge and has positive spillovers in the city of investment, leading to reduced pollution intensity. Cities also benefit more from FDI received in neighbouring regions than in their own city when it comes to improving their environmental performance, thus indicating an interregional flow of environmental knowledge. Our results are broadly in support of the pollution halo thesis at the aggregated regional level. This is in line with the wider findings of the literature on positive FDI knowledge and technology spillovers (e.g. Crespo and Fontoura 2007; Meyer and Sinani 2009), as well as those of studies more specifically related to environmental externalities (e.g. Albornoz et al. 2009; Bao et al. 2011; Cole et al. 2008; Huber 2008; Perkins and Neumayer 2008). Of the three pollutants, however, only industrial air emissions, \(\hbox {SO}_{2}\) and SOOT have shown consistent results and demonstrate both spatial and time dimension dependence. This result is consistent with previous work that has examined these two dimensions separately using air emissions as pollution measurements (e.g. Cole et al. 2013; Perkins and Neumayer 2008). Our research highlights that the characteristics of pollutants, such as their geographically dispersive nature, the varieties of sources and prevention techniques, should be carefully considered as they may contribute to the inconclusiveness of FDI-EKE.

While corroborating the positive FDI-EKE supported by the halo thesis, our results are also not at odds with negative FDI-EKE as seen in the pollution haven hypothesis. Rather, we suggest that one should view FDI-EKE from both the contingency and spatial perspectives. We thus attempt to reconcile the inconclusive debate by suggesting that FDI-EKE is dependent on certain regional characteristics to unlock ‘silver linings’. As knowledge transfer and learning takes place through firm interactions, we consider industrial agglomeration as the important regional dimension that causes variation in a region’s absorptive capability to gain from the environmental knowledge brought by FDI.

Our results indicate that pollution intensity increases with regional industrial specialisation, which, in turn, attenuates FDI-EKE within cities. The same relationships hold for interregional effects. An increase in a city’s specialisation limits the extent of FDI-EKE from its neighbours. Specialised cities may be locked into a particular industrial file or technology path, leading to an inability to absorb and diffuse a variety of greener technologies brought by FDI, and resulting in inflexibility in adjusting to external technological changes. Moreover, specialisation may only improve productivity in a narrow range of industries, and it is possible that it cannot positively impact local environmental performance. This is because domestic firms, especially in developing countries, such as China, may focus primarily on the former and see little need to improve the latter.

By contrast, pollution intensity decreases with industrial diversity which further promotes FDI environmental spillovers in the region of investment. In terms of interregional effects, diversity enables cities to disseminate FDI-borne environmental knowledge to neighbours. As a result, it mitigates pollution intensity as a whole at the aggregated city level. Our results thus echo the Jacobean view that the cross-fertilisation of industrial knowledge plays a key role in technological spillovers (Beaudry and Schiffauerova 2009; Buerger and Cantner 2011; Combes 2000); however, we do not expect that it exerts any influence across all pollution measures because in the context of a developing country, diversity may lead to a weak regional knowledge base, thereby reducing the absorptive capability for advanced knowledge from FDI (Wang et al. 2016). Nevertheless, our results indicate that industrial diversity may lead to a reduction in pollutants, such as soot, that come from a large variety of polluting sources. In short, this paper further extends earlier studies that examine the relationship between pollution and industrial agglomeration. We contribute to existing theories by linking the two strands of literature on the environmental impact of FDI and industrial agglomeration, and conceptualise a moderating effect of the latter to reconcile the inconclusive FDI-EKE debate.

In policy terms, our empirical analysis yields several important points for consideration in improving regional environmental performance. First, technology, including environmental know-how, is often embedded in FDI flowing to recipient countries. FDI thus presents a great potential for knowledge spillovers, including environmental knowledge externalities, to both the city of investment and its neighbours. Policies continuously attract and promote FDI to a greater extent, especially in the emerging market context where local technological capabilities are weak. Second, our results have demonstrated the spatial dependence of FDI-EKE. Cities also benefit more from inter- than intraregional FDI-EKE. To maximise the benefit from spillovers, the policy focus needs to be on the interconnectedness of industries within a location and of cities in nearby regions to encourage greater sharing and spread of environmental knowledge from FDI. Third, the inconclusive FDI-EKE studies primarily focus on the effects of FDI within a location. Less attention has been paid to the underlying regional mechanisms. This has created confusion and a dilemma for regional authorities looking to promote FDI. Based on our analysis, we reveal that regional characteristics play a vital role in absorbing and disseminating knowledge embedded in FDI. Specialised cities may be more geared towards absorbing FDI productivity spillovers, and therefore, more environmentally oriented policies are needed to maximise FDI-EKE. Specialisation also often comes with inflexibility to external technological changes. Furthermore, policy must focus on improving the technology, managerial and operational practices and standards that may lead to raising environmental efficiency in the region. Diversified cities can foster a breeding ground for domestic firms to experiment with environmental ideas through interaction with foreign firms. This facilitates the spread of environmental knowledge within and across cities, although its influence is weak and not effective across all pollutants. Policy should thus be steered towards improving regional technological bases to enhance FDI-EKE.

This paper is not without limitations and future research can further explore these issues and extend the literature. First, our results are based on a single-country study. The empirical context is China which has received a huge amount of FDI and has experienced rapid urbanisation and industrialisation in a very short period of time. Our results therefore might be particularly pronounced compared to other countries. The replication of this research in a cross-country context would be a very promising step to generalising the contingency view and the effect of FDI-EKE proposed here. Future research could also explore other regional dimensions to extend this line of enquiry. Second, our research is limited by the availability of sectorially disaggregated data in the empirical context we chose. Sectorial distribution of FDI may reveal the types of FDI and the linkages it builds with local industries which can create increased environmental spillovers. We are also limited by our data to use alternative measures such as local R&D expenditures to measure technological improvement, and longitudinal legal or levy changes to measure stringency. Moreover, we have adopted the employment-based agglomeration measures, which have been commonly used in the previous literature and are applicable to different geographic levels (O’Donoghue and Gleave 2004). Although they indicate the intensity of industrial agglomeration activities, they do not reflect the effect of local sectoral composition which future research can further investigate. Third, we are also limited by the availability of firm-level data that could help elucidate a firm’s motivations and interactions with foreign subsidiaries which may affect industrial emission behaviours within and across regions. Last but not least, a more complicated framework is needed to understand more detailed FDI-EKE diffusion mechanisms, such as the threshold, ownership and motivations of FDI, technological gaps between foreign and domestic firms or levels of industrialisation that can potentially facilitate more FDI-EKE. Although we are limited by our data in achieving these, our research, based on a regional-level analysis, provides a contingency view of industrial agglomeration on FDI environmental spillovers. We thus inform the inconclusive debate and provide practical ways forward for regions to benefit from such spillovers and meet environmental challenges.

References

Albornoz F, Cole MA, Elliott RJ, Ercolani MG (2009) In search of environmental spillovers. World Econ 32:136–163

Andonova LB (2003) Openness and the environment in Central and Eastern Europe: can trade and foreign investment stimulate better environmental management in enterprises? J Environ Dev 12:177–204

Angel DP, Hamilton T, Huber MT (2007) Global environmental standards for industry. Annu Rev Environ Resour 32:295

Audretsch DB, Feldman MP (2004) Knowledge spillovers and the geography of innovation. Handb Reg Urban Econ 4:2713–2739

Autant-Bernard C, LeSage JP (2011) Quantifying knowledge spillovers using spatial econometric models. J Reg Sci 51:471–496

Bajo-Rubio O, Díaz-Mora C, Díaz-Roldán C (2010) Foreign direct investment and regional growth: an analysis of the Spanish case. Reg Stud 44:373–382

Bao Q, Chen Y, Song L (2011) Foreign direct investment and environmental pollution in China: a simultaneous equations estimation. Environ Dev Econ 16:71–92

Beaudry C, Schiffauerova A (2009) Who’s right, Marshall or Jacobs? The localization versus urbanization debate. Res Policy 38:318–337

Blomström M, Kokko A (1998) Multinational corporations and spillovers. J Econ Surv 12:247–277

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Buerger M, Cantner U (2011) The regional dimension of sectoral innovativeness: an empirical investigation of two specialized suppliers and two science-based industries. Pap Reg Sci 90:373–393

Cheung K-Y, Lin P (2004) Spillover effects of FDI on innovation in China: evidence from the provincial data. China Econ Rev 15:25–44

Cole MA (2000) Air pollution and ‘dirty’industries: how and why does the composition of manufacturing output change with economic development? Environ Resour Econ 17:109–123

Cole MA, Elliott RJ, Fredriksson PG (2006) Endogenous pollution havens: does FDI influence environmental regulations? Scand J Econ 108:157–178

Cole MA, Elliott RJ, Strobl E (2008) The environmental performance of firms: the role of foreign ownership, training, and experience. Ecol Econ 65:538–546

Cole MA, Elliott RJ, Zhang J (2011) Growth, foreign direct investment, and the environment: evidence from Chinese cities. J Reg Sci 51:121–138

Cole MA, Elliott RJ, Okubo T, Zhou Y (2013) The carbon dioxide emissions of firms: a spatial analysis. J Environ Econ Manag 65:290–309

Combes P-P (2000) Economic structure and local growth: France, 1984–1993. J Urban Econ 47:329–355

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(1):7–71

Costantini V, Mazzanti M, Montini A (2013) Environmental performance, innovation and spillovers. Evidence from a regional NAMEA. Ecol Econ 89:101–114

Crespo N, Fontoura MP (2007) Determinant factors of FDI spillovers—what do we really know? World Dev 35:410–425

De Groot HL, Withagen CA, Minliang Z (2004) Dynamics of China’s regional development and pollution: an investigation into the environmental Kuznets curve. Environ Dev Econ 9:507–537

Dean JM, Lovely ME, Wang H (2009) Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ 90:1–13

Dijkstra BR, Mathew AJ, Mukherjee A (2011) Environmental regulation: an incentive for foreign direct investment. Rev Int Econ 19:568–578

Driffield N (2006) On the search for spillovers from foreign direct investment (FDI) with spatial dependency. Reg Stud 40:107–119

Driffield N, Love JH (2007) Linking FDI motivation and host economy productivity effects: conceptual and empirical analysis. J Int Bus Stud 38:460–473

Drucker J (2015) An evaluation of competitive industrial structure and regional manufacturing employment change. Reg Stud 49(9):1481–1496

Dunning JH, Lundan SM (2008) Multinational enterprises and the global economy. Edward Elgar Publishing, Cheltenham

Elhorst JP (2014) Spatial panel data models. In: Spatial econometrics. Springer, pp 37–93

Erdogan AM (2014) Foreign direct investment and environmental regulations: a survey. J Econ Surv 28(5):943–955

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Feldman MP, Audretsch DB (1999) Innovation in cities: science-based diversity, specialization and localized competition. Eur Econ Rev 43:409–429

García F, Jin B, Salomon R (2013) Does inward foreign direct investment improve the innovative performance of local firms? Res Policy 42:231–244

Glaeser EL, Kallal HD, Scheinkman JA, Shleifer A (1992) Growth in cities. J Polit Econ 100:1126

Görg H, Greenaway D (2004) Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Res Obs 19:171–197

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement (Vol. Working Paper 3914). National Bureau of Economic Research, Cambridge, MA

Grossman GM, Krueger AB (1994) Economic growth and the environment. In: National Bureau of Economic Research Working Paper No. 4634

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110:353–377

Harrison B, Kelley MR, Gant J (1996) Innovative firm behavior and local milieu: exploring the intersection of agglomeration, firm effects, and technological change. Econ Geogr 72:233–258

Hatt BE, Fletcher TD, Walsh CJ, Taylor SL (2004) The influence of urban density and drainage infrastructure on the concentrations and loads of pollutants in small streams. Environ Manag 34:112–124

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60:228–245

He J, Wang H (2012) Economic structure, development policy and environmental quality: an empirical analysis of environmental Kuznets curves with Chinese municipal data. Ecol Econ 76:49–59

He C, Huang Z, Ye X (2014) Spatial heterogeneity of economic development and industrial pollution in urban China. Stoch Environ Res Risk Assess 28:767–781

He K, Huo H, Zhang Q (2002) Urban air pollution in China: current status, characteristics, and progress. Annu Rev Energy Environ 27:397–431

Hoffmann R, Lee CG, Ramasamy B, Yeung M (2005) FDI and pollution: a granger causality test using panel data. J Int Dev 17:311–317

Hong E, Sun L (2011) Foreign direct investment and total factor productivity in China: a spatial dynamic panel analysis. Oxf Bull Econ Stat 73:771–791

Huber J (2008) Pioneer countries and the global diffusion of environmental innovations: theses from the viewpoint of ecological modernisation theory. Glob Environ Change 18:360–367

Jacobs J (1969) The economies of cities. Random House, New York

Javorcik BS, Wei S-J (2004) Pollution havens and foreign direct investment: dirty secret or popular myth? Contrib Econ Anal Policy 3(2):1–32

Javorcik BS, Wei S-J (2009) Corruption and cross-border investment in emerging markets: firm-level evidence. J Int Money Finance 28:605–624

Jones CI (1995) R & D-based models of economic growth. J Polit Econ 103:759–784

Krugman PR (1991) Geography and trade. MIT Press, Cambridge

Kyriakopoulou E, Xepapadeas A (2013) Environmental policy, first nature advantage and the emergence of economic clusters. Reg Sci Urban Econ 43:101–116

Lan J, Kakinaka M, Huang X (2012) Foreign direct investment, human capital and environmental pollution in China. Environ Resour Econ 51:255–275

LeSage JP, Pace RK (2010) Spatial econometric models. In: Handbook of applied spatial analysis. Springer, pp 355–376

Liu X, Wang C, Wei Y (2009) Do local manufacturing firms benefit from transactional linkages with multinational enterprises in China? J Int Bus Stud 40:1113–1130

Marrocu E, Paci R, Usai S (2013) Productivity growth in the old and new Europe: the role of agglomeration externalities. J Reg Sci 53:418–442

Meyer KE (2004) Perspectives on multinational enterprises in emerging economies. J Int Bus Stud 35:259–276

Meyer KE, Sinani E (2009) When and where does foreign direct investment generate positive spilloverst? A meta-analysis. J Int Bus Stud 40:1075–1094

Neffke F, Henning M, Boschma R, Lundquist K-J, Olander L-O (2011) The dynamics of agglomeration externalities along the life cycle of industries. Reg Stud 45:49–65

Ning L (2009) China’s rise in the world ICT industry: industrial strategies and the catch-up development model. Routledge, Abingdon-on-Thames

Ning L, Wang F, Li J (2016) Urban innovation, regional externalities of foreign direct investment and industrial agglomeration: evidence from Chinese cities. Res Policy 45:830–843

Ó Huallachá B, Lee D-S (2011) Technological specialization and variety in urban invention. Reg Stud 45:67–88

O’Donoghue D, Gleave B (2004) A note on methods for measuring industrial agglomeration. Reg Stud 38:419–427

Pazienza P (2014) The relationship between FDI and the natural environment. Springer, New York

Perkins R (2003) Environmental leapfrogging in developing countries: a critical assessment and reconstruction. Nat Resour Forum 27(3):177–188

Perkins R, Neumayer E (2008) Fostering environment-efficiency through transnational linkages? Trajectories of CO2 and SO2, 1980–2000. Environ Plan A 40:2970–2989

Perkins R, Neumayer E (2009) Transnational linkages and the spillover of environment-efficiency into developing countries. Glob Environ Change 19:375–383

Picazo-Tadeo AJ, García-Reche A (2007) What makes environmental performance differ between firms? Empirical evidence from the Spanish tile industry. Environ Plan A 39:2232

Poelhekke S, Van Der Ploeg F (2009) Foreign direct investment and urban concentrations: unbundling spatial lags. J Reg Sci 49:749–775

Quatraro F (2010) Knowledge coherence, variety and economic growth: manufacturing evidence from Italian regions. Res Policy 39:1289–1302

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32:1419–1439

Tian X (2006) Accounting for sources of FDI technology spillovers: evidence from China. J Int Bus Stud 38:147–159

Tole L, Koop G (2010) Do environmental regulations affect the location decisions of multinational gold mining firms? J Econ Geogr 11(1):151–177

Verhoef E, Nijkamp P (2008) Urban environmental externalities, agglomeration forces, and the technological ‘deus ex machina’. Environ Plan A 40:928

Wang D, Chen W (2014) Foreign direct investment, institutional development, and environmental externalities: evidence from China. J Environ Manag 135:81–90

Wang CC, Lin GC, Li G (2010) Industrial clustering and technological innovation in China: new evidence from the ICT industry in Shenzhen. Environ Plan A 42:1987

Wang Y, Ning L, Li J, Prevezer M (2016) Foreign direct investment spillovers and the geography of innovation in chinese regions: the role of regional industrial specialization and diversity. Reg Stud 50(5):806–822

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126:25–51

Zarsky L (1999) Havens, halos and spaghetti: untangling the evidence about foreign direct investment and the environment. Foreign Direct Invest Environ 13:47–74

Zhang J, Fu X (2008) FDI and environmental regulations in China. J Asia Pac Econ 13:332–353

Zheng S, Wang R, Glaeser EL, Kahn ME (2010) The greenness of China: household carbon dioxide emissions and urban development. J Econ Geogr 11(5):761–792

Zhu Q, Cordeiro J, Sarkis J (2012) International and domestic pressures and responses of Chinese firms to greening. Ecol Econ 83:144–153

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ning, L., Wang, F. Does FDI Bring Environmental Knowledge Spillovers to Developing Countries? The Role of the Local Industrial Structure. Environ Resource Econ 71, 381–405 (2018). https://doi.org/10.1007/s10640-017-0159-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0159-y