Abstract

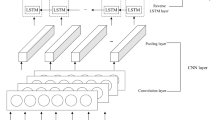

With the economic globalization, it is important to accurately estimate and predict the correlation between global stock markets for the efficient asset allocation around the globe. While practitioners may resort to various GARCH-type models for correlation forecasting, the forecasting accuracy is still not very satisfactory. For the first time, this paper introduces a deep learning method into the research of stock market correlation. A hybrid DCDNN model is developed based on the RDNN (recurrent deep neural network) and DCC-GARCH models. Deep learning is then devised to forecast the prediction error of the DCC-GARCH model in order to improve the prediction accuracy of stock market correlation. An autoencoder is also introduced in the empirical study to extract useful features of the stock index data. Then, the correlations among the stock markets in China, Hong Kong, the United States and Europe are predicted and tested. We show that the accuracy of the DCDNN model is significantly higher than that of the DCC-GARCH model. The results indicate that the introduction of deep learning can help improve the efficacy of existing correlation forecasting methods.

Similar content being viewed by others

Data availability

The data that support the findings of this study are available from the corresponding author upon request.

References

Aladesanmi, O., Casalin, F., & Metcalf, H. (2019). Stock market integration between the UK and the US: Evidence over eight decades. Global Finance Journal, 41, 32–43.

Allard, A.-F., Iania, L., & Smedts, K. (2020). Stock-bond return correlations: Moving away from “one-frequency-fits-all” by extending the DCC-MIDAS approach. International Review of Financial Analysis, 71, 101557. https://doi.org/10.1016/j.irfa.2020.101557

Alp, T., & Demetrescu, M. (2010). Joint forecasts of Dow Jones stocks under general multivariate loss function. Computational Statistics & Data Analysis, 54(11), 2360–2371.

Baek, Y., & Kim, H. Y. (2018). ModAugNet: A new forecasting framework for stock market index value with an overfitting prevention LSTM module and a prediction LSTM module. Expert Systems with Applications, 113, 457–480.

Basher, A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54, 235–247.

Bekaert, G., Hodrick, R. J., & Zhang, X. (2009). International stock return comovements. Journal of Finance, 64(6), 2591–2626.

Bekiros, S. (2014). Nonlinear causality testing with stepwise multivariate filtering: Evidence from stock and currency markets. The North American Journal of Economics and Finance, 29, 336–348.

Bonga-Bonga, L. (2018). Uncovering equity market contagion among BRICS countries: An application of the multivariate GARCH model. The Quarterly Review of Economics and Finance, 67, 36–44.

Celık, S. (2012). The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Economic Modelling, 29(5), 1946–1959.

Chen, Y. H., He, K. J., & Tso, G. K. F. (2017). Forecasting crude oil prices: A deep learning based model. Procedia Computer Science, 122, 300–307.

Chiang, T. C., Lao, L., & Xue, Q. (2016). Comovements between Chinese and global stock markets: Evidence from aggregate and sectoral data. Review of Quantitative Finance and Accounting, 47(4), 1003–1042.

Chong, E., Han, C., & Park, F. C. (2017). Deep learning networks for stock market analysis and prediction: Methodology, data representations, and case studies. Expert Systems with Applications, 83, 187–205.

Daníelsson, J. (2008). Blame the models. Journal of Financial Stability, 4(4), 321–328.

Deng, K. (2018). Another look at large-cap stock return comovement: A semi-markov-switching approach. Computational Economics, 51(2), 227–262.

Efimova, O., & Serletis, A. (2014). Energy markets volatility modelling using GARCH. Energy Economics, 43, 264–273.

Engle, R. F. (2002). Dynamic conditional correlation: A new simple class of multivariate GARCH models. Journal of Business and Economic Statistics, 20(3), 339–350.

Fei, P., Ding, L., & Deng, Y. (2010). Correlation and volatility dynamics in REIT returns: Performance and portfolio considerations. Journal of Portfolio Management, 36(2), 113–125.

Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669.

Gers, F. A., Schmidhuber, J., & Cummins, F. (2000). Learning to forget: Continual prediction with LSTM. Neural Computation, 12(10), 2451–2471.

Güloğlu, B., Kaya, P., & Aydemir, R. (2016). Volatility transmission among Latin American stock markets under structural breaks. Physica a: Statistical Mechanics and Its Applications, 462, 330–340.

Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9(8), 1735–1780.

Hu, Y., Ni, J., & Wen, L. (2020). A hybrid deep learning approach by integrating LSTM-ANN networks with GARCH model for copper price volatility prediction. Physica A-Statistical Mechanics and its Applications, 557, 124907. https://doi.org/10.1016/j.physa.2020.124907

Huang, W. (2007). Financial integration and the price of world covariance risk: large vs. small-cap stocks. Journal of International Money and Finance, 26(8), 1311–1337.

Kim, H. Y., & Won, C. H. (2018). Forecasting the volatility of stock price index: A hybrid model integrating LSTM with multiple GARCH-type models. Expert Systems with Applications, 103, 25–37.

Kleć, M., & Koržinek, D. (2014). Unsupervised feature pre-training of the scattering wavelet transform for musical genre recognition. Procedia Technology, 18, 133–139.

Krauss, C., Do, X. A., & Huck, N. (2017). Deep neural networks, gradient-boosted trees, random forests: Statistical arbitrage on the S&P 500. European Journal of Operational Research, 259(2), 689–702.

Lago, J., Ridder, F. D., & Schutter, B. D. (2018). Forecasting spot electricity prices: Deep learning approaches and empirical comparison of traditional algorithms. Applied Energy, 221, 386–405.

Lee, H.-T. (2010). Regime switching correlation hedging. Journal of Banking & Finance, 34(11), 2728–2741.

Nair, V., Hinton, G.E. (2010). Rectified linear units improve restricted boltzmann machines. In Proceedings of the twenty seventh international conference on machine learning (ICML-10), pp. 807–814.

Öztek, M. F., & Öcal, N. (2016). The effects of domestic and international news and volatility on integration of Chinese stock markets with international stock markets. Empirical Economics, 50(2), 317–360.

Panda, A. K., & Nanda, S. (2017). Short-term and long-term Interconnectedness of stock returns in Western Europe and the global market. Financial Innovation, 3(1), 2199–4730.

Sezer, O. B., Gudelek, M. U., & Ozbayoglu, A. M. (2020). Financial time series forecasting with deep learning : A systematic literature review: 2005–2019. Applied Soft Computing. https://doi.org/10.1016/j.asoc.2020.106181

Shiferaw, Y. A. (2019). Time-varying correlation between agricultural commodity and energy price dynamics with Bayesian multivariate DCC-GARCH models. Physica A-Statistical Mechanics and Its Applications, 526, 120807. https://doi.org/10.1016/j.physa.2019.04.043

Turban, E., Sharda, R., & Delen, D. (2011). Decision support and business intelligence systems (9th ed.). Pearson Prentice Hall.

Turgutlu, E., & Ucer, B. (2010). Is global diversification rational? Evidence from emerging equity markets through mixed copula approach. Applied Economics, 42(5), 647–658.

Wang, K.-M. (2013). Did Vietnam stock market avoid the “contagion risk” from China and the US? The contagion effect test with dynamic correlation coefficients. Quality & Quantity, 47(4), 2143–2161.

You, L., & Daigler, R. T. (2010). Is international diversification really beneficial? Journal of Banking & Finance, 34(1), 163–173.

Zhang, X., Zhu, Y. M., & Yang, L. S. (2018). Multifractal detrended cross-correlations between Chinese stock market and three stock markets in The Belt and Road Initiative. Physica A: Statistical Mechanics and Its Applications, 503, 105–115.

Zhao, Y., Li, J. P., & Yu, L. (2017). A deep learning ensemble approach for crude oil price forecasting. Energy Economics, 66, 9–16.

Acknowledgments

We would like to thank the Editor and the anonymous referees for their insightful comments and suggestions for the revision of this paper. Any remaining errors are our responsibility. This research was supported by National Natural Science Foundation of China (No. 71601159), National Social Science Fund of China (No. 19ZDA074) and Fundamental Research Funds for the Central Universities (No. JBK2107035).

Author information

Authors and Affiliations

Contributions

Jian Ni & Yue Xu Contributions Conceptualization, Methodology, Resources, Supervision, Writing—review & editing: Jian Ni; Data curation, Formal Analysis, Writing – original draft, Software, Validation, Visualization: Yue Xu.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Correspondence to Yue Xu.

Rights and permissions

About this article

Cite this article

Ni, J., Xu, Y. Forecasting the Dynamic Correlation of Stock Indices Based on Deep Learning Method. Comput Econ 61, 35–55 (2023). https://doi.org/10.1007/s10614-021-10198-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-021-10198-3