Abstract

Over the past two decades, artificial intelligence (AI) has experienced rapid development and is being used in a wide range of sectors and activities, including finance. In the meantime, a growing and heterogeneous strand of literature has explored the use of AI in finance. The aim of this study is to provide a comprehensive overview of the existing research on this topic and to identify which research directions need further investigation. Accordingly, using the tools of bibliometric analysis and content analysis, we examined a large number of articles published between 1992 and March 2021. We find that the literature on this topic has expanded considerably since the beginning of the XXI century, covering a variety of countries and different AI applications in finance, amongst which Predictive/forecasting systems, Classification/detection/early warning systems and Big data Analytics/Data mining /Text mining stand out. Furthermore, we show that the selected articles fall into ten main research streams, in which AI is applied to the stock market, trading models, volatility forecasting, portfolio management, performance, risk and default evaluation, cryptocurrencies, derivatives, credit risk in banks, investor sentiment analysis and foreign exchange management, respectively. Future research should seek to address the partially unanswered research questions and improve our understanding of the impact of recent disruptive technological developments on finance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The first two decades of the twenty-first century have experienced an unprecedented way of technological progress, which has been driven by advances in the development of cutting-edge digital technologies and applications in Artificial Intelligence (AI). Artificial intelligence is a field of computer science that creates intelligent machines capable of performing cognitive tasks, such as reasoning, learning, taking action and speech recognition, which have been traditionally regarded as human tasks (Frankenfield 2021). AI comprises a broad and rapidly growing number of technologies and fields, and is often regarded as a general-purpose technology, namely a technology that becomes pervasive, improves over time and generates complementary innovation (Bresnahan and Trajtenberg 1995). As a result, it is not surprising that there is no consensus on the way AI is defined (Van Roy et al. 2020). An exhaustive definition has been recently proposed by Acemoglu and Restrepo (2020, p.1), who assert that Artificial Intelligence is “(…) the study and development of intelligent (machine) agents, which are machines, software or algorithms that act intelligently by recognising and responding to their environment.” Even though it is often difficult to draw precise boundaries, this promising and rapidly evolving field mainly comprises machine learning, deep learning, NLP (natural language processing) platforms, predictive APIs (application programming interface), image recognition and speech recognition (Martinelli et al. 2021).

The term “Artificial intelligence” was first coined by John McCarthy in 1956 during a conference at Dartmouth College to describe “thinking machines” (Buchanan 2019). However, until 2000, the lack of storage capability and low computing power prevented any progress in the field. Accordingly, governments and investors lost their interest and AI fell short of financial support and funding in 1974–1980 and again in 1987–1993. These periods of funding shortage are also known as “AI wintersFootnote 1”.

However, the most significant development and spread of AI-related technologies is much more recent, and has been prompted by the availability of large unstructured databases, the explosion of computing power, and the rise in venture capital intended to support innovative, technological projects (Ernst et al. 2018). One of the most distinctive The term AI winter first appeared in 1characteristics of AI technologies is that, unlike industrial robots, which need to receive specific instructions, generally provided by a software, before they perform any action, can learn for themselves how to map information about the environment, such as visual and tactile data from a robot’s sensors, into instructions sent to the robot’s actuators (Raj and Seamans 2019). Additionally, as remarked by Ernst et al. (2018), whilst industrial robots mostly perform manual tasks, AI technologies are able to carry out activities that, until some years ago, were still regarded as typically human, i.e. what Ernst and co-authors label as “mental tasks”.

The adoption of AI is likely to have remarkable implications for the subjects adopting them and, more in general, for the economy and the society. In particular, it is expected to contribute to the growth of the global GDP, which, according to a study conducted by Pricewater-house-Coopers (PwC) and published in 2017, is likely to increase by up to 14% by 2030. Moreover, companies adopting AI technologies sometimes report better performance (Van Roy et al. 2020). Concerning the geographic dimension of this field, North America and China are the leading investors and are expected to benefit the most from AI-driven economic returns. Europe and emerging markets in Asia and South America will follow, with moderate profits owing to fewer and later investments (PwC 2017). AI is going to affect labour markets as well. The demand for high-skilled employees is expected to increase, whilst the demand for low-skilled jobs is likely to shrink because of automation; the resulting higher unemployment rate, however, is going to be offset by the new job opportunities offered by AI (Ernst et al. 2018; Acemoglu and Restrepo 2020).

AI solutions have been introduced in every major sector of the economy; a sector that is witnessing a profound transformation led by the ongoing technological revolution is the financial one. Financial institutions, which rely heavily on Big Data and process automation, are indeed in a “unique position to lead the adoption of AI” (PwC 2020), which generates several benefits: for instance, it encourages automation of manufacturing processes which in turn enhances efficiency and productivity. Next, since machines are immune to human errors and psychological factors, it ensures accurate and unbiased predictive analytics and trading strategies. AI also fosters business model innovation and radically changes customer relationships by promoting customised digital finance, which, together with the automation of processes, results in better service efficiency and cost-saving (Cucculelli and Recanatini 2022). Furthermore, AI is likely to have substantial implications for financial conduct and prudential supervisors, and it also has the potential to help supervisors identify potential violations and help regulators better anticipate the impact of changes in regulation (Wall 2018). Additionally, complex AI/machine learning algorithms allow Fintech lenders to make fast (almost instantaneous) credit decisions, with benefits for both the lenders and the consumers (Jagtiani and John 2018). Intelligent devices in Finance are used in a number of areas and activities, including fraud detection, algorithmic trading and high-frequency trading, portfolio management, credit decisions based on credit scoring or credit approval models, bankruptcy prediction, risk management, behavioural analyses through sentiment analysis and regulatory compliance.

In recent years, the adoption of AI technologies in a broad range of financial applications has received increasing attention by scholars; however, the extant literature, which is reviewed in the next section, is quite broad and heterogeneous in terms of research questions, country and industry under scrutiny, level of analysis and method, making it difficult to draw robust conclusions and to understand which research areas require further investigation. In the light of these considerations, we conduct an extensive review of the research on the use of AI in Finance thorough which we aim to provide a comprehensive account of the current state of the art and, importantly, to identify a number of research questions that are still (partly) unanswered. This survey may serve as a useful roadmap for researchers who are not experts of this topic and could find it challenging to navigate the extensive and composite research on this subject. In particular, it may represent a useful starting point for future empirical contributions, as it provides an account of the state of the art and of the issues that deserve further investigation. In doing so, this study complements some previous systematic reviews on the topic, such as the ones recently conducted by Hentzen et al. (2022b) and (Biju et al. 2020), which differ from our work in the following main respects: Hentzen and co-authors’ study focuses on customer-facing financial services, whilst the valuable contribution of Biju et al. poses particular attention to relevant technical aspects and the assessment of the effectiveness and the predictive capability of machine learning, AI and deep learning mechanisms within the financial sphere; in doing so, it covers an important issue which, however, is out of the scope of our work.

From our review, it emerges that, from the beginning of the XXI century, the literature on this topic has significantly expanded, and has covered a broad variety of countries, as well as several AI applications in finance, amongst which Predictive/forecasting systems, Classification /detection/early warning systems and Big data Analytics/Data mining /Text mining stand out. Additionally, we show that the selected articles can be grouped into ten main research streams, in which AI is applied to the stock market, trading models, volatility forecasting, portfolio management, performance, risk & default evaluation, cryptocurrencies, derivatives, credit risks in banks, investor sentiment analysis and foreign exchange management, respectively.

The balance of this paper is organised as follows: Sect. “Methodology” shortly presents the methodology. Sect. “A detailed account of the literature on AI in Finance” illustrates the main results of the bibliometric analysis and the content analysis. Sect. “Issues that deserve further investigation” draws upon the research streams described in the previous section to pinpoint several potential research avenues. Sect. “Conclusions” concludes. Finally, Appendix 1 clarifies some AI-related terms and definitions that appear several times throughout the paper, whilst Appendix 2 provides more information on some of the articles under scrutiny.

Methodology

To conduct a sound review of the literature on the selected topic, we resort to two well-known and extensively used approaches, namely bibliometric analysis and content analysis. Bibliometric analysis is a popular and rigorous method for exploring and analysing large volumes of scientific data which allows us to unpack the evolutionary nuances of a specific field whilst shedding light on the emerging areas in that field (Donthu et al. 2021). In this study, we perform bibliometric analysis using HistCite, a popular software package developed to support researchers in elaborating and visualising the results of literature searches in the Web of Science platform. Specifically, we employ HistCite to recover the annual number of publications, the number of forward citations (which we use to identify the most influential journals and articles) and the network of co-citations, namely, all the citations received and given by journals belonging to a certain field, which help us identify the major research streams described in Sect. “Identification of the major research streams”. After that, to delve into the contents of the most pertinent studies on AI in finance, we resort to traditional content analysis, a research method that provides a systematic and objective means to make valid inferences from verbal, visual, or written data which, in turn, permit to describe and quantify specific phenomena (Downe-Wambolt 1992).

In order to identify the sample of studies on which bibliometric and content analysis were performed, we proceeded as follows. First, we searched for pertinent articles published in English be-tween 1950 and March 2021. Specifically, we scrutinised the “Finance”, “Economics”, “Business Finance” and “Business” sections of the “Web of Science” (WoS) database using the keyword “finance” together with an array of keywords concerning Artificial Intelligence (i.e. “Finance” AND (“Artificial Intelligence” OR “Machine Learning” OR “Deep Learning” OR “Neural Networks*” OR “Natural Language Processing*” OR “Algorithmic Trading*” OR “Artificial Neural Network” OR “Robot*” OR “Automation” OR “Text Mining” OR “Data Mining” OR “Soft Computing” OR “Fuzzy Logic Analysis” OR “Biometrics*” OR “Geotagging” OR “Wearable*” OR “IoT” OR “Internet of Thing*” OR “digitalization” OR “Artificial Neutral Networks” OR “Big Data” OR “Industry 4.0″ OR “Smart products*” OR Cloud Computing” OR “Digital Technologies*”). In doing so, we ended up with 1,218 articles. Next, two researchers independently analysed the title, abstract and content of these papers and kept only those that address the topic under scrutiny in a non-marginal and non-trivial way. This second step reduced the number of eligible papers to 892, which were used to perform the first part of the bibliometric analysis. Finally, we delved into the contents of the previously selected articles and identified 110 contributions which specifically address the adoption and implications in Finance of AI tools focussing on the economic dimension of the topic, and which are employed in the second part of the bibliometric analysis and in the content analysis.

A detailed account of the literature on AI in Finance

In this section, we explore the patterns and trends in the literature on AI in Finance in order to obtain a compact but exhaustive account of the state of the art. Specifically, we identify some relevant bibliographic characteristics using the tools of bibliometric analysis. After that, focussing on a sub-sample of papers, we conduct a preliminary assessment of the selected studies through a content analysis and detect the main AI applications in Finance. Finally, we identify and briefly describe ten major research streams.

Main results of the bibliometric analysis

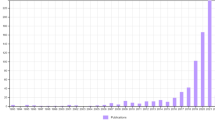

First, using HistCite and considering the sample of 892 studies, we computed, for each year, the number of publications related to the topic “AI in Finance”. The corresponding publication trend is shown in Fig. 1, which plots both the annual absolute number of sampled papers (bar graph in blue) and the ratio between the latter and the annual overall amount of publications (indexed in Scopus) in the finance area (line graph in orange). We also compute relative numbers to see if the trend emerging from the selected studies is not significantly attributable to a “common trend” (i.e. to the fact that, in the meantime, also the total number of publications in the financial area has significantly increased). It can be noted that both graphs exhibit a strong upward trend from 2015 onwards; during the most recent years, the pace of growth and the degree of pervasiveness of AI adoption in the financial sphere have indeed remarkably strengthened, and have become the subject of a rapidly growing number of research articles.

After that, focussing on the more pertinent (110) articles, we checked the journals in which these studies were published. Table 1 presents the top-ten list of journals reported in the Academic Journal Guide-ABS List 2020 and ranked on the basis of the total global citation score (TGCS), which captures the number of times an article is cited by other articles that deal with the same topic and are indexed in the WoS database. For each journal, we also report the total number of studies published in that journal. We can notice that the most influential journals in terms of TGCS are the Journal of Finance (with a TGCS equal to 1283) and the Journal of Banking and Finance (with a TGCS of 1253), whilst the journals containing the highest number of articles on the topic are Quantitative Finance (68 articles) and Intelligent Systems in Accounting, Finance and Management (43).

Finally, Fig. 2 provides a visual representation of the citation-based relationships amongst papers starting from the most-cited papers, which we obtained using the Java application CiteSpace.

Preliminary results of the content analysis

In this paragraph, we shortly illustrate some relevant characteristics of our sub-sample made up of 110 studies, including country and industry coverage, method and underpinning theoretical background. Table 2 comprises the list of countries under scrutiny, and, for each of them, a list of papers that perform their analysis on that country. We can see that our sample exhibits significant geographical heterogeneity, as it covers 74 countries across all continents; however, the most investigated areas are three, that is Europe, the US and China. These results corroborate the fact that the above-mentioned regions are the leaders of the AI-driven financial industry, as suggested by PwC (2017). The United States, in particular, are considered the “early adopters” of AI and are likely to benefit the most from this source of competitive advantage. More lately, emerging countries in Southeast Asia and the Middle East have received growing interest. Finally, a smaller number of papers address underdeveloped regions in Africa and various economies in South America.

The most investigated sectors are reported in Table 3. We can notice that, although it primarily deals with banking and financial services, the extant research has addressed the topic in a vast array of industries. This confirms that the application potential of AI is very broad, and that any industry may benefit from it.

Through our analysis, we also detected the key theories and frameworks applied by researchers in the prior literature. As shown in Table 4, 73 (out of 110) papers explicitly refer to some theoretical framework. Specifically, ten of them (14%) resort to computational learning theory; this theory, which is an extension of statistical learning, provides researchers with a theoretical guide for finding the most suitable learning model for a given problem, and is regarded as one of the most important and most used theories in the field. Specific theories concerning types of neural networks and learning methods are used too, such as the fuzzy set theory, which is mentioned in 8% of the sample, and to a lesser extent, the Naive Bayes theorem, the theory of neural networks, the theory of genetic programming and the TOPSIS analytical framework. Finance theories (e.g. Arbitrage Pricing Theory; Black and Scholes 1973) are jointly employed with portfolio management theories (e.g. modern portfolio theory), and the two of them account together for 21% (15) of the total number of papers. Finally, bankruptcy theories support business failure forecasts, whilst other theoretical underpinnings concern mathematical and probability concepts.

The content analysis also provides information on the main types of companies under scrutiny. Table 5 indicates that 30 articles (out of 110) focus on large companies listed on stock exchanges, whilst only 16 studies cover small and medium enterprises. Similarly, trading and digital platforms are examined in 16 papers that deal with derivatives and cryptocurrencies.

Furthermore, Table 6 summarises the key methods applied in the literature, which are divided by category (note that all the papers employ more than one method). Looking at the table, we see that machine learning and artificial neural networks are the most popular ones (they are employed in 41 and 51 articles, respectively). The majority of the papers resort to different approaches to compare their results with those obtained through autoregressive and regression models or conventional statistics, which are used as the benchmark; therefore, there may be some overlaps. Nevertheless, we notice that support vector machine and random forest are the most widespread machine learning methods. On the other hand, the use of artificial neural networks (ANNs) is highly fragmented. Backpropagation, Recurrent, and Feed-Forward NNs are considered basic neural nets and are commonly employed. Advanced NNs, such as Higher-Order Neural network (HONN) and Long Short-Term Memory Networks (LSTM), are more performing than their standard version but also much more complicated to apply. These methods are usually compared to autoregressive models and regressions, such as ARMA, ARIMA, and GARCH. Finally, we observe that almost all the sampled papers are quantitative, whilst only three of them are qualitative and four of them consist in literature reviews.

A taxonomy of AI applications in Finance

After scrutinising some relevant features of the papers, we make a step forward and outline a taxonomy of AI applications used in Finance and tackled by previous literature. The main uses of AI in Finance and the papers that address each of them are summarised in Table 7.

Many research papers (39 out of 110) employ AI as a predictive instrument for forecasting stock prices, performance and volatility. In 23 papers, AI is employed in classification problems and warning systems to detect credit risk and frauds, as well as to monitor firm or bank performance. The former use of AI permits to classify firms into two categories based on qualitative and quantitative data; for example, we may have distressed or non-distressed, viable–nonviable, bankrupt–non-bankrupt, or financially healthy–not healthy, good–bad, and fraud–not fraud. Warning systems follow a similar principle: after analysing customers’ financial behaviour and classifying potential fraud issues in bank accounts, alert models signal to the bank unusual transactions. Additionally, we see that 14 articles employ text mining and data mining language recognition, i.e. natural language processing, as well as sentiment analysis. This may be the starting point of AI-driven behavioural analysis in Finance. Amongst others, trading models and algorithmic trading are further popular aspects of AI widely analysed in the literature. Moreover, interest in Robo-advisory is growing in the asset investment field. Finally, less studied AI applications concern the modelling capability of algorithms and traditional machine learning and neural networks.

Identification of the major research streams

Drawing upon the co-citation analysis mentioned in Sect. "Methodology", we detected ten main research streams: (1) AI and the stock market; (2) AI and Trading Models; (3) AI and Volatility Forecasting; (4) AI and Portfolio Management; (5) AI and Performance, Risk, and Default Valuation; (6) AI and Bitcoin, Cryptocurrencies; (7) AI and Derivatives; (8) AI and Credit Risk in Banks; (9) AI and Investor Sentiments Analysis; (10) AI and Foreign Exchange Management. Some research streams can be further divided into sub-streams as they deal with various aspects of the same main topic. In this section, we provide a compact account for each of the aforementioned research streams. More detailed information on some of the papers fuelling them is provided in Appendix 2.

Stream 01: AI and the stock market

The stream “AI and the Stock Market” comprises two sub-streams, namely algorithmic trading and stock market, and AI and stock price prediction. The first sub-stream deals with the impact of algorithmic trading (AT) on financial markets. In this regard, Herdershott et al. (2011) argue that AT increases market liquidity by reducing spreads, adverse selection, and trade-related price discovery. This results in a lowered cost of equity for listed firms in the medium–long term, especially in emerging markets (Litzenberger et al. 2012). As opposed to human traders, algorithmic trading adjusts faster to information and generates higher profits around news announcements thanks to better market timing ability and rapid executions (Frino et al. 2017). Even though high-frequency trading (a subset of algorithmic trading) has sometimes increased volatility related to news or fundamentals, and transmitted it within and across industries, AT has overall reduced return volatility variance and improved market efficiency (Kelejian and Mukerji 2016; Litzenberger et al. 2012).

The second sub-stream investigates the use of neural networks and traditional methods to forecast stock prices and asset performance. ANNs are preferred to linear models because they capture the non-linear relationships between stock returns and fundamentals and are more sensitive to changes in variables relationships (Kanas 2001; Qi 1999). Dixon et al. (2017) argue that deep neural networks have strong predictive power, with an accuracy rate equal to 68%. Also, Zhang et al. (2021) propose a model, the Long Short-Term Memory Networks (LSTM), that outperforms all classical ANNs in terms of prediction accuracy and rational time cost, especially when various proxies of online investor attention (such as the internet search volume) are considered.

Stream 02: AI and trading models

From the review of the literature represented by this stream, it emerges that neural networks and machine learning algorithms are used to build intelligent automated trading systems. To give some examples, Creamer and Freund (2010) create a machine learning-based model that analyses stock price series and then selects the best-performing assets by suggesting a short or long position. The model is also equipped with a risk management overlayer preventing the transaction when the trading strategy is not profitable. Similarly, Creamer (2012) uses the above-mentioned logic in high-frequency trading futures: the model selects the most profitable and less risky futures by sending a long or short recommendation. To construct an efficient trading model, Trippi and DeSieno (1992) combine several neural networks into a single decision rule system that outperforms the single neural networks; Kercheval and Zhang (2015) use a supervised learning method (i.e. multi-class SVM) that automatically predicts mid-price movements in high-frequency limit order books by classifying them in low-stationary-up; these predictions are embedded in trading strategies and yield positive payoffs with controlled risk.

Stream 03: AI and volatility forecasting

The third stream deals with AI and the forecasting of volatility. The volatility index (VIX) from Chicago Board Options Exchange (CBOE) is a measure of market sentiment and expectations. Forecasting volatility is not a simple task because of its very persistent nature (Fernandes et al. 2014). According to Fernandes and co-authors, the VIX is negatively related to the SandP500 index return and positively related to its volume. The heterogeneous autoregressive (HAR) model yields the best predictive results as opposed to classical neural networks (Fernandes et al. 2014; Vortelinos 2017). Modern neural networks, such as LSTM and NARX (nonlinear autoregressive exogenous network), also qualify as valid alternatives (Bucci 2020). Another promising class of neural networks is the higher-order neural network (HONN) used to forecast the 21-day-ahead realised volatility of FTSE100 futures. Thanks to its ability to capture higher-order correlations within the dataset, HONN shows remarkable performance in terms of statistical accuracy and trading efficiency over multi-layer perceptron (MLP) and the recurrent neural network (RNN) (Sermpinis et al. 2013).

Stream 04: AI and portfolio management

This research stream analyses the use of AI in portfolio selection. As an illustration, Soleymani and Vasighi (2020) consider a clustering approach paired with VaR analysis to improve asset allocation: they group the least risky and more profitable stocks and allocate them in the portfolio. More elaborate asset allocation designs incorporate a bankruptcy detection model and an advanced utility performance system: before adding the stock to the portfolio, the sophisticated neural network estimates the default probability of the company and asset’s contribution to the optimal portfolio (Loukeris and Eleftheriadis 2015). Index-tracking powered by deep learning technology minimises tracking error and generates positive performance (Kim and Kim 2020). The asymmetric copula method for returns dependence estimates further promotes the portfolio optimization process (Zhao et al. 2018). To sum up, all papers show that AI-based prediction models improve the portfolio selection process by accurately forecasting stock returns (Zhao et al. 2018).

Stream 05: AI and performance, risk, default valuation

This research stream comprises three sub-streams, namely AI and Corporate Performance, Risk and Default Valuation; AI and Real Estate Investment Performance, Risk, and Default Valuation; AI and Banks Performance, Risk and Default Valuation.

The first sub-stream examines corporate financial conditions to predict financially distressed companies (Altman et al. 1994). As an illustration, Jones et al. (2017) and Gepp et al. (2010) determine the probability of corporate default. Sabău Popa et al. (2021) predict business performance based on a composite financial index. The findings of the aforementioned papers confirm that AI-powered classifiers are extremely accurate and easy to interpret, hence, superior to classic linear models. A quite interesting paper surveys the relationship between face masculinity traits in CEOs and firm riskiness through image processing (Kamiya et al. 2018). The results reveal that firms lead by masculine-faced CEO have higher risk and leverage ratios and are more frequent acquirers in MandA operations.

The second sub-stream focuses on mortgage and loan default prediction (Feldman and Gross 2005; Episcopos, Pericli, and Hu, 1998). For instance, Chen et al. (2013) evaluate real estate investment returns by forecasting the REIT index; they show that the industrial production index, the lending rate, the dividend yield and the stock index influence real estate investments. All the forecasting techniques adopted (i.e. supervised machine learning and ANNs) outperform linear models in terms of efficiency and precision.

The third sub-stream deals with banks’ performance. In contradiction with past research, a text mining study argues that the most important risk factors in banking are non-financial, i.e. regulation, strategy and management operation. However, the findings from text analysis are limited to what is disclosed in the papers (Wei et al. 2019). A highly performing NN-based study on the Malaysian and Islamic banking sector asserts that negative cost structure, cultural aspects and regulatory barriers (i.e. low competition) lead to inefficient banks compared to the U.S., which, on the contrary, are more resilient, healthier and well regulated (Wanke et al. 2016a, b, c, d; Papadimitriou et al. 2020).

Stream 06: AI and cryptocurrencies

Although algorithms and AI advisors are gaining ground, human traders still dominate the cryptocurrency market (Petukhina et al. 2021). For this reason, substantial arbitrage opportunities are available in the Bitcoin market, especially for USD–CNY and EUR–CNY currency pairs (Pichl and Kaizoji 2017). Concerning daily realised volatility, the HAR model delivers good results. Likewise, the feed-forward neural network effectively approximates the daily logarithmic returns of BTCUSD and the shape of their distribution (Pichl and Kaizoji 2017).

Additionally, the Hierarchical Risk Parity (HRP) approach, an asset allocation method based on machine learning, represents a powerful risk management tool able to manage the high volatility characterising Bitcoin prices, thereby helping cryptocurrency investors (Burggraf 2021).

Stream 07: AI and derivatives

ANNs and machine learning models are accurate predictors in pricing financial derivatives. Jang and Lee (2019) propose a machine learning model that outperforms traditional American option pricing models: the generative Bayesian NN; Culkin and Das (2017) use a feed-forward deep NN to reproduce Black and Scholes’ option pricing formula with a high accuracy rate. Similarly, Chen and Wan (2021) suggest a deep NN for American option and deltas pricing in high dimensions. Funahashi (2020), on the contrary, rejects deep learning for option pricing due to the instability of the prices, and introduces a new hybrid method that combines ANNs and asymptotic expansion (AE). This model does not directly predict the option price but measures instead, the difference between the target (i.e. derivative price) and its approximation. As a result, the ANN becomes faster, more accurate and “lighter” in terms of layers and training data volume. This innovative method mimics a human learning process when one learns about a new object by recognising its differences from a similar and familiar item (Funahashi 2020).

Stream 08: AI and credit risk in banks

The research stream labelled “AI and Credit Risk in Banks”Footnote 2 includes the following sub-streams: AI and Bank Credit Risk; AI and Consumer Credit Risk and Default; AI and Financial Fraud detection/ Early Warning System; AI and Credit Scoring Models.

The first sub-stream addresses bank failure prediction. Machine learning and ANNs significantly outperform statistical approaches, although they lack transparency (Le and Viviani 2018). To overcome this limitation, Durango‐Gutiérrez et al. (2021) combine traditional methods (i.e. logistic regression) with AI (i.e. Multiple layer perceptron -MLP), thus gaining valuable insights on explanatory variables. With the scope of preventing further global financial crises, the banking industry relies on financial decision support systems (FDSSs), which are strongly improved by AI-based models (Abedin et al. 2019).

The second sub-stream compares classic and advanced consumer credit risk models. Supervised learning tools, such as SVM, random forest, and advanced decision trees architectures, are powerful predictors of credit card delinquency: some of them can predict credit events up to 12 months in advance (Lahmiri 2016; Khandani et al. 2010; Butaru et al. 2016). Jagric et al. (2011) propose a learning vector quantization (LVQ) NN that better deals with categorical variables, achieving an excellent classification rate (i.e. default, non-default). Such methods overcome logit-based approaches and result in cost savings ranging from 6% up to 25% of total losses (Khadani et al. 2010).

The third group discusses the role of AI in early warning systems. On a retail level, advanced random forests accurately detect credit card fraud based on customer financial behaviour and spending pattern, and then flag it for investigation (Kumar et al. 2019). Similarly, Coats and Fant (1993) build a NN alert model for distressed firms that outperforms linear techniques. On a macroeconomic level, systemic risk monitoring models enhanced by AI technologies, i.e. k-nearest neighbours and sophisticated NNs, support macroprudential strategies and send alerts in case of global unusual financial activities (Holopainen, and Sarlin 2017; Huang and Guo 2021). However, these methods are still work-in-progress.

The last group studies intelligent credit scoring models, with machine learning systems, Adaboost and random forest delivering the best forecasts for credit rating changes. These models are robust to outliers, missing values and overfitting, and require minimal data intervention (Jones et al. 2015). As an illustration, combining data mining and machine learning, Xu et al. (2019) build a highly sophisticated model that selects the most important predictors and eliminates noisy variables, before performing the task.

Stream 09: AI and investor sentiment analysis

Investor sentiment has become increasingly important in stock prediction. For this purpose, sentiment analysis extracts investor sentiment from social media platforms (e.g. StockTwits, Yahoo-finance, eastmoney.com) through natural language processing and data mining techniques, and classifies it into negative or positive (Yin et al. 2020). The resulting sentiment is regarded either as a risk factor in asset pricing models, an input to forecast asset price direction, or an intraday stock index return (Houlihan and Creamer 2021; Renault 2017). In this respect, Yin et al. (2020) find that investor sentiment has a positive correlation with stock liquidity, especially in slowing markets; additionally, sensitivity to liquidity conditions tends to be higher for firms with larger size and a higher book-to-market ratio, and especially those operating in weakly regulated markets. As for predictions, daily news usually predicts stock returns for few days, whereas weekly news predicts returns for longer period, from one month to one quarter. This generates a return effect on stock prices, as much of the delayed response to news occurs around major events in company life, specifically earnings announcement, thus making investor sentiment a very important variable in assessing the impact of AI in financial markets. (Heston and Sinha 2017).

Stream 10: AI and foreign exchange management

The last stream addresses AI and the management of foreign exchange. Cost-effective trading or hedging activities in this market require accurate exchange rate forecasts (Galeshchuk and Mukherjee 2017). In this regard, the HONN model significantly outperforms traditional neural networks (i.e. multi-layer perceptron, recurrent NNs, Psi sigma-models) in forecasting and trading the EUR/USD currency pair using ECB daily fixing series as input data (Dunis et al. 2010). On the contrary, Galeshchuk and Mukherjee (2017) consider these methods as unable to predict the direction of change in the forex rates and, therefore, ineffective at supporting profitable trading. For this reason, they apply a deep NN (Convolution NNs) to forecast three main exchange rates (i.e. EUR/USD, GBP/USD, and JPY/USD). The model performs remarkably better than time series models (e.g. ARIMA: Autoregressive integrated moving average) and machine learning classifiers. To sum up, from this research stream it emerges that AI-based models, such as NARX and the above-mentioned techniques, achieve better prediction performance than statistical or time series models, as remarked by Amelot et al. (2021).

Issues that deserve further investigation

As shown in Sect. "A detailed account of the literature on AI in Finance", the literature on Artificial Intelligence in Finance is vast and rapidly growing as technological progress advances. There are, however, some aspects of this subject that are unexplored yet or that require further investigation. In this section, we further scrutinise, through content analysis, the papers published between 2015 and 2021 (as we want to focus on the most recent research directions) in order to define a potential research agenda. Hence, for each of the ten research streams presented in Sect. "Identification of the major research streams", we report a number of research questions that were put forward over time and are still at least partly unaddressed. The complete list of research questions is enclosed in Table 8.

AI and the stock market

This research stream focuses on algorithmic trading (AT) and stock price prediction. Future research in the field could analyse more deeply alternative AI-based market predictors (e.g. clustering algorithms and similar learning methods) and draw up a regime clustering algorithm in order to get a clearer view of the potential applications and benefits of clustering methodologies (Law, and Shawe-Taylor 2017). In this regard, Litzenberger et al. (2012) and Booth et al. (2015) recommend broadening the study to market cycles and regulation policies that may affect AI models’ performance in stock prediction and algorithmic trading, respectively.Footnote 3 Furthermore, forecasting models should be evaluated with deeper order book information, which may lead to a higher prediction accuracy of stock prices (Tashiro et al. 2019).

AI and trading models

This research stream builds on the application of AI in trading models. Robo advisors are the evolution of basic trading models: they are easily accessible, cost-effective, profitable for investors and, unlike human traders, immune to behavioural biases. Robo advisory, however, is a recent phenomenon and needs further performance evaluations, especially in periods of financial distress, such as the post-COVID-19 one (Tao et al. 2021), or in the case of the so-called “Black swan” events. Conversely, trading models based on spatial neural networks (an advanced ANN) outperform all statistical techniques in modelling limit order books and suggest an extensive interpretation of the joint distribution of the best bid and best ask. Given the versatility of such a method, forthcoming research should resort to it with the aim of understanding whether neural networks with more order book information (i.e. order flow history) lead to better trading performance (Sirignano 2018).

AI and volatility forecasting

As previously mentioned, volatility forecasting is a challenging task. Although recent studies report solid results in the field (see Sermpinis et al. 2013; Vortelinos 2017), future work could deploy more elaborated recurrent NNs by modifying the activation function of the processing units composing the ANNs, or by adding hidden layers and then evaluate their performance (Bucci 2020). Since univariate time series are commonly used for realised volatility prediction, it would be interesting to also inquire about the performance of multivariate time series.

AI and portfolio management

This research stream examines the use of AI in portfolio selection strategies. Past studies have developed AI models that are capable of replicating the performance of stock indexes (known as index tracking strategy) and constructing efficient portfolios with no human intervention. In this regard, Kim and Kim (2020) suggest focussing on optimising AI algorithms to boost index-tracking performance. Soleymani and Vasighi (2020) recognise the importance of clustering algorithms in portfolio management and propose a clustering approach powered by a membership function, also known as fuzzy clustering, to further improve the selection of less risky and most profitable assets. For this reason, analysis of asset volatility through deep learning should be embedded in portfolio selection models (Chen and Ge 2021).

AI and performance, risk, default valuation

Bankruptcy and performance prediction models rely on binary classifiers that only provide two outcomes, e.g. risky–not risky, default–not default, good–bad performance. These methods may be restrictive as sometimes there is not a clear distinction between the two categories (Jones et al. 2017). Therefore, prospective research might focus on multiple outcome domains and extend the research area to other contexts, such as bond default prediction, corporate mergers, reconstructions, takeovers, and credit rating changes (Jones et al. 2017). Corporate credit ratings and social media data should be included as independent predictors in credit risk forecasts to evaluate their impact on the accuracy of risk-predicting models (Uddin et al. 2020). Moreover, it is worth evaluating the benefits of a combined human–machine approach, where analysts contribute to variables’ selection alongside data mining techniques (Jones et al. 2017). Forthcoming studies should also address black box and over-fitting biases (Sariev and Germano 2020), as well as provide solutions for the manipulation and transformation of missing input data relevant to the model (Jones et al. 2017).

AI and cryptocurrencies

The use of AI in the cryptocurrency market is in its infancy, and so are the policies regulating it. As the digital currency industry has become increasingly important in the financial world, future research should study the impact of regulations and blockchain progress on the performance of AI techniques applied in this field (Petukhina et al., 2021). Cryptocurrencies, and especially Bitcoins, are extensively used in financial portfolios. Hence, new AI approaches should be developed in order to optimise cryptocurrency portfolios (Burggraf 2021).

AI and derivatives

This research stream examines derivative pricing models based on AI. A valuable research area that should be further explored concerns the incorporation of text-based input data, such as tweets, blogs, and comments, for option price prediction (Jang and Lee 2019). Since derivative pricing is an utterly complicated task, Chen and Wan (2021) suggest studying advanced AI designs that minimise computational costs. Funahashi (2020) recognises a typical human learning process (i.e. recognition by differences) and applies it to the model, significantly simplifying the pricing problem. In the light of these considerations, prospective research may also investigate other human learning and reasoning paths that can improve AI reasoning skills.

AI and credit risk in banks

Bank default prediction models often rely solely on accounting information from banks’ financial statements. To enhance default forecast, future work should consider market data as well (Le and Viviani 2018). Credit risk includes bank account fraud and financial systemic risk. Fraud detection based on AI needs further experiments in terms of training speed and classification accuracy (Kumar et al. 2019). Early warning models, on the other hand, should be more sensitive to systemic risk. For this reason, subsequent studies ought to provide a common platform for modelling systemic risk and visualisation techniques enabling interaction with both model parameters and visual interfaces (Holopainen and Sarlin 2017).

AI and investor sentiment analysis

Sentiment analysis builds on text-based data from social networks and news to identify investor sentiment and use it as a predictor of asset prices. Forthcoming research may analyse the effect of investor sentiment on specific sectors (Houlihan and Creamer 2021), as well as the impact of diverse types of news on financial markets (Heston and Sinha 2017). This is important for understanding how markets process information. In this respect, Xu and Zhao (2022) propose a deeper analysis of how social networks’ sentiment affects individual stock returns. They also believe that the activity of financial influencers, such as financial analysts or investment advisors, potentially affects market returns and needs to be considered in financial forecasts or portfolio management.

AI and foreign exchange management

This research stream investigates the application of AI models to the Forex market. Deep networks, in particular, efficiently predict the direction of change in forex rates thanks to their ability to “learn” abstract features (i.e. moving averages) through hidden layers. Future work should study whether these abstract features can be inferred from the model and used as valid input data to simplify the deep network structure (Galeshchuk and Mukherjee 2017). Moreover, the performance of foreign exchange trading models should be assessed in financial distressed times. Further research may also compare the predictive performance of advanced times series models, such as genetic algorithms and hybrid NNs, for forex trading purposes (Amelot et al. 2021).

Conclusions

Despite its recent advent, Artificial Intelligence has revolutionised the entire financial system, thanks to advanced computer science and Big Data Analytics and the increasing outflow of data generated by consumers, investors, business, and governments’ activities. Therefore, it is not surprising that a growing strand of literature has examined the uses, benefits and potential of AI applications in Finance. This paper aims to provide an accurate account of the state of the art, and, in doing so, it would represent a useful guide for readers interested in this topic and, above all, the starting point for future research. To this purpose, we collected a large number of articles published in journals indexed in Web of Science (WoS), and then resorted to both bibliometric analysis and content analysis. In particular, we inspected several features of the papers under study, identified the main AI applications in Finance and highlighted ten major research streams. From this extensive review, it emerges that AI can be regarded as an excellent market predictor and contributes to market stability by minimising information asymmetry and volatility; this results in profitable investing systems and accurate performance evaluations. Additionally, in the risk management area, AI aids with bankruptcy and credit risk prediction in both corporate and financial institutions; fraud detection and early warning models monitor the whole financial system and raise expectations for future artificial market surveillance. This suggests that global financial crises or unexpected financial turmoil will be likely to be anticipated and prevented.

All in all, judging from the rapid widespread of AI applications in the financial sphere and across a large variety of countries, and, more in general, based on the growth rate exhibited by technological progress over time, we expect that the use of AI tools will further expand, both geographically, across sectors and across financial areas. Hence, firms that still struggle with coping with the latest wave of technological change should be aware of that, and try to overcome this burden in order to reap the potential benefits associated with the adoption of AI and remain competitive. In the light of these considerations, policymakers should motivate companies, especially those that have not adopted yet, or have just begun to introduce AI applications, to catch up, for instance by providing funding or training courses aimed to strengthen the complex skills required by employees dealing with these sophisticated systems and languages.

This study presents some limitations. For instance, it tackles a significant range of interrelated topics (in particular, the main financial areas affected by AI which have been the main object of past research), and then presents a concise description for each of them; other studies may decide to focus on only one or a couple of subjects and provide a more in-depth account of the chosen one(s). Also, we are aware that technological change has been progressing at an unprecedented fast and growing pace; even though we considered a significantly long time-frame and a relevant amount of studies have been released in the first two decades of the XXI century, we are aware that further advancements have been made from 2021 (the last year included in the time frame used to the select our sample); for instance, in the last few years, AI experts, policymakers, and also a growing number of scholars have been debating the potential and risks of AI-related devices, such as chatGBT and the broader and more elusive “metaverse” (see for instance Mondal et al. 2023 and Calzada 2023, for an overview). Hence, future contributions may advance our understanding of the implications of these latest developments for finance and other important fields, such as education and health.

Data availability

Full data are available from authors upon request.

Notes

The term AI winter first appeared in 1984 as the topic of a public debate at the annual meeting of the American Association of Artificial Intelligence (AAAI). It referred to hype generated by over promises from developers, unrealistically high expectations from end users, and extensive media promotion.

Since credit risk in the banking industry remarkably differs from credit risk in firms, the two of them are treated separately.

As this issue has not been addressed in the latest papers, we include these two papers although their year of publication lies outside the established range period.

References

Abdou HA, Ellelly NN, Elamer AA, Hussainey K, Yazdifar H (2021) Corporate governance and earnings management Nexus: evidence from the UK and Egypt using neural networks. Int J Financ Econ 26(4):6281–6311. https://doi.org/10.1002/ijfe.2120

Abedin MZ, Guotai C, Moula F, Azad AS, Khan MS (2019) Topological applications of multilayer perceptrons and support vector machines in financial decision support systems. Int J Financ Econ 24(1):474–507. https://doi.org/10.1002/ijfe.1675

Acemoglu D, Restrepo P (2020) The wrong kind of AI? Artificial intelligence and the future of labor demand. Cambr J Reg Econ Soc, Cambr Pol Econ Soc 13(1):25–35

Altman EI, Marco G, Varetto F (1994) Corporate distress diagnosis: comparisons using linear discriminant analysis and neural networks (the Italian experience). J Bank Finance 18(3):505–529. https://doi.org/10.1016/0378-4266(94)90007-8

Amelot LM, Subadar Agathee U, Sunecher Y (2021) Time series modelling, narx neural network and HYBRID kpca–svr approach to forecast the foreign exchange market in Mauritius. Afr J Econ Manag Stud 12(1):18–54. https://doi.org/10.1108/ajems-04-2019-0161

Bekiros SD, Georgoutsos DA (2008) Non-linear dynamics in financial asset returns: The predictive power of the CBOE volatility index. Eur J Fin 14(5):397–408. https://doi.org/10.1080/13518470802042203

Biju AKVN, Thomas AS, Thasneem J (2020) Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—a bibliometric analysis. Qual Quant Online First. https://doi.org/10.1007/s11135-023-01673-0

Black F, Scholes M (1973) The pricing of Options and corporate liabilities. J Pol Econ 81(3):637–654

Booth A, Gerding E, McGroarty F (2015) Performance-weighted ensembles of random forests for predicting price impact. Quant Finance 15(11):1823–1835. https://doi.org/10.1080/14697688.2014.983539

Bresnahan TF, Trajtenberg M (1995) General purpose technologies ‘Engines of growth’? J Econom 65(1):83–108. https://doi.org/10.1016/0304-4076(94)01598-T

Bucci A (2020) Realized volatility forecasting with neural networks. J Financ Econom 3:502–531. https://doi.org/10.1093/jjfinec/nbaa008

Buchanan, B. G. (2019). Artificial intelligence in finance - Alan Turing Institute. https://www.turing.ac.uk/sites/default/files/2019-04/artificial_intelligence_in_finance_-_turing_report_0.pdf.

Burggraf T (2021) Beyond risk parity – a machine learning-based hierarchical risk parity approach on cryptocurrencies. Finance Res Lett 38:101523. https://doi.org/10.1016/j.frl.2020.101523

Butaru F, Chen Q, Clark B, Das S, Lo AW, Siddique A (2016) Risk and risk management in the credit card industry. J Bank Finance 72:218–239. https://doi.org/10.1016/j.jbankfin.2016.07.015

Caglayan M, Pham T, Talavera O, Xiong X (2020) Asset mispricing in peer-to-peer loan secondary markets. J Corp Finan 65:101769. https://doi.org/10.1016/j.jcorpfin.2020.101769

Calomiris CW, Mamaysky H (2019) How news and its context drive risk and returns around the world. J Financ Econ 133(2):299–336. https://doi.org/10.1016/j.jfineco.2018.11.009

Calzada I (2023) Disruptive technologies for e-diasporas: blockchain, DAOs, data cooperatives, metaverse, and ChatGPT. Futures 154:103258. https://doi.org/10.1016/j.futures.2023.103258

Cao Y, Liu X, Zhai J, Hua S (2022) A Two-stage Bayesian network model for corporate bankruptcy prediction. Int J Financ Econ 27(1):455–472. https://doi.org/10.1002/ijfe.2162

Chaboud AP, Chiquoine B, Hjalmarsson E, Vega C (2014) Rise of the machines: Algorithmic trading in the foreign exchange market. J Financ 69(5):2045–2084. https://doi.org/10.1111/jofi.12186

Chen S, Ge L (2021) A learning-based strategy for portfolio selection. Int Rev Econ Financ 71:936–942. https://doi.org/10.1016/j.iref.2020.07.010

Chen Y, Wan JW (2021) Deep neural network framework based on backward stochastic differential equations for pricing and hedging American options in high dimensions. Quant Finance 21(1):45–67. https://doi.org/10.1080/14697688.2020.1788219

Chen J, Chang T, Ho C, Diaz JF (2013) Grey relational analysis and neural Network forecasting of reit returns. Quantitative Finance 14(11):2033–2044. https://doi.org/10.1080/14697688.2013.816765

Coats PK, Fant LF (1993) Recognizing financial distress patterns using a neural network tool. Financ Manage 22(3):142. https://doi.org/10.2307/3665934

Corazza M, De March D, Di Tollo G (2021) Design of adaptive Elman networks for credit risk assessment. Quantitative Finance 21(2):323–340. https://doi.org/10.1080/14697688.2020.1778175

Cortés EA, Martínez MG, Rubio NG (2008) FIAMM return persistence analysis and the determinants of the fees charged. Span J Finance Account Revis Esp De Financ Y Contab 37(137):13–32. https://doi.org/10.1080/02102412.2008.10779637

Creamer G (2012) Model calibration and automated trading agent for euro futures. Quant Finance 12(4):531–545. https://doi.org/10.1080/14697688.2012.664921

Creamer G, Freund Y (2010) Automated trading with boosting and expert weighting. Quant Finance 10(4):401–420. https://doi.org/10.1080/14697680903104113

Cucculelli M, Recanatini M (2022) Distributed Ledger technology systems in securities post-trading services. Evid Eur Global Syst Banks Eur J Finance 28(2):195–218. https://doi.org/10.1080/1351847X.2021.1921002

Culkin R, Das SR (2017) Machine learning in finance: The case of deep learning for option pricing. J Invest Management 15(4):92–100

D’Hondt C, De Winne R, Ghysels E, Raymond S (2020) Artificial intelligence alter egos: Who might benefit from robo-investing? J Empir Financ 59:278–299. https://doi.org/10.1016/j.jempfin.2020.10.002

Deku SY, Kara A, Semeyutin A (2020) The predictive strength of mbs yield spreads during asset bubbles. Rev Quant Financ Acc 56(1):111–142. https://doi.org/10.1007/s11156-020-00888-8

Dixon M, Klabjan D, Bang JH (2017) Classification-based financial markets prediction using deep neural networks. Algorithmic Finance 6(3–4):67–77. https://doi.org/10.3233/af-170176

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133:285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Downe-Wamboldt B (1992) Content analysis: method, applications, and issues. Health Care Women Int 13(3):313–321. https://doi.org/10.1080/07399339209516006

Dubey RK, Chauhan Y, Syamala SR (2017) Evidence of algorithmic trading from Indian equity Market: Interpreting the transaction velocity element of financialization. Res Int Bus Financ 42:31–38. https://doi.org/10.1016/j.ribaf.2017.05.014

Dunis CL, Laws J, Sermpinis G (2010) Modelling and trading the EUR/USD exchange rate at the ECB fixing. Eur J Finance 16(6):541–560. https://doi.org/10.1080/13518470903037771

Dunis CL, Laws J, Karathanasopoulos A (2013) Gp algorithm versus hybrid and mixed neural networks. Eur J Finance 19(3):180–205. https://doi.org/10.1080/1351847x.2012.679740

Durango-Gutiérrez MP, Lara-Rubio J, Navarro-Galera A (2021) Analysis of default risk in microfinance institutions under the Basel Iii framework. Int J Financ Econ. https://doi.org/10.1002/ijfe.2475

Episcopos A, Pericli A, Hu J (1998) Commercial mortgage default: A comparison of logit with radial basis function networks. J Real Estate Finance Econ 17(2):163–178

Ernst, E., Merola, R., and Samaan, D. (2018). The economics of artificial intelligence: Implications for the future of work. ILO Futur Work Res Paper Ser No. 5.

Feldman D, Gross S (2005) Mortgage default: classification trees analysis. J Real Estate Finance Econ 30(4):369–396. https://doi.org/10.1007/s11146-005-7013-7

Fernandes M, Medeiros MC, Scharth M (2014) Modeling and predicting the CBOE market volatility index. J Bank Finance 40:1–10. https://doi.org/10.1016/j.jbankfin.2013.11.004

Frankenfield, J. (2021). How Artificial Intelligence Works. Retrieved June 11, 2021, from https://www.investopedia.com/terms/a/artificial-intelligence-ai.asp

Frino A, Prodromou T, Wang GH, Westerholm PJ, Zheng H (2017) An empirical analysis of algorithmic trading around earnings announcements. Pac Basin Financ J 45:34–51. https://doi.org/10.1016/j.pacfin.2016.05.008

Frino A, Garcia M, Zhou Z (2020) Impact of algorithmic trading on speed of adjustment to new information: Evidence from interest rate derivatives. J Futur Mark 40(5):749–760. https://doi.org/10.1002/fut.22104

Funahashi H (2020) Artificial neural network for option pricing with and without asymptotic correction. Quant Finance 21(4):575–592. https://doi.org/10.1080/14697688.2020.1812702

Galeshchuk S, Mukherjee S (2017) Deep networks for predicting direction of change in foreign exchange rates. Intell Syst Account Finance Manage 24(4):100–110. https://doi.org/10.1002/isaf.1404

Gao M, Liu Y, Wu W (2016) Fat-finger trade and market quality: the first evidence from China. J Futur Mark 36(10):1014–1025. https://doi.org/10.1002/fut.21771

Gepp A, Kumar K, Bhattacharya S (2010) Business failure prediction using decision trees. J Forecast 29(6):536–555. https://doi.org/10.1002/for.1153

Guotai C, Abedin MZ (2017) Modeling credit approval data with neural networks: an experimental investigation and optimization. J Bus Econ Manag 18(2):224–240. https://doi.org/10.3846/16111699.2017.1280844

Hamdi M, Aloui C (2015) Forecasting crude oil price using artificial neural networks: a literature survey. Econ Bull 35(2):1339–1359

Hendershott T, Jones CM, Menkveld AJ (2011) Does algorithmic trading improve liquidity? J Financ 66(1):1–33. https://doi.org/10.1111/j.1540-6261.2010.01624.x

Hentzen JK, Hoffmann A, Dolan R, Pala E (2022a) Artificial intelligence in customer-facing financial services: a systematic literature review and agenda for future research. Int J Bank Market 40(6):1299–1336. https://doi.org/10.1108/IJBM-09-2021-0417

Hentzen JK, Hoffmann AOI, Dolan RM (2022b) Which consumers are more likely to adopt a retirement app and how does it explain mobile technology-enabled retirement engagement? Int J Consum Stud 46:368–390. https://doi.org/10.1111/ijcs.12685

Heston SL, Sinha NR (2017) News vs sentiment: predicting stock returns from news stories. Financial Anal J 73(3):67–83. https://doi.org/10.2469/faj.v73.n3.3

Holopainen M, Sarlin P (2017) Toward robust early-warning models: a horse race, ensembles and model uncertainty. Quant Finance 17(12):1933–1963. https://doi.org/10.1080/14697688.2017.1357972

Houlihan P, Creamer GG (2021) Leveraging social media to predict continuation and reversal in asset prices. Comput Econ 57(2):433–453. https://doi.org/10.1007/s10614-019-09932-9

Huang X, Guo F (2021) A kernel fuzzy twin SVM model for early warning systems of extreme financial risks. Int J Financ Econ 26(1):1459–1468. https://doi.org/10.1002/ijfe.1858

Huang Y, Kuan C (2021) Economic prediction with the fomc minutes: an application of text mining. Int Rev Econ Financ 71:751–761. https://doi.org/10.1016/j.iref.2020.09.020

IBM Cloud Education. (2020). What are Neural Networks? Retrieved May 10, 2021, from https://www.ibm.com/cloud/learn/neural-networks

Jagric T, Jagric V, Kracun D (2011) Does non-linearity matter in retail credit risk modeling? Czech J Econ Finance Faculty Soc Sci 61(4):384–402

Jagtiani J, Kose J (2018) Fintech: the impact on consumers and regulatory responses. J Econ Bus 100:1–6. https://doi.org/10.1016/j.jeconbus.2018.11.002

Jain A, Jain C, Khanapure RB (2021) Do algorithmic traders improve liquidity when information asymmetry is high? Q J Financ 11(01):1–32. https://doi.org/10.1142/s2010139220500159

Jang H, Lee J (2019) Generative Bayesian neural network model for risk-neutral pricing of American index options. Quant Finance 19(4):587–603. https://doi.org/10.1080/14697688.2018.1490807

Jiang Y, Jones S (2018) Corporate distress prediction in China: a machine learning approach. Account Finance 58(4):1063–1109. https://doi.org/10.1111/acfi.12432

Jones S, Wang T (2019) Predicting private company failure: a multi-class analysis. J Int Finan Markets Inst Money 61:161–188. https://doi.org/10.1016/j.intfin.2019.03.004

Jones S, Johnstone D, Wilson R (2015) An empirical evaluation of the performance of binary classifiers in the prediction of credit ratings changes. J Bank Finance 56:72–85. https://doi.org/10.1016/j.jbankfin.2015.02.006

Jones S, Johnstone D, Wilson R (2017) Predicting corporate bankruptcy: an evaluation of alternative statistical frameworks. J Bus Financ Acc 44(1–2):3–34. https://doi.org/10.1111/jbfa.12218

Kamiya S, Kim YH, Park S (2018) The face of risk: Ceo facial masculinity and firm risk. Eur Financ Manag 25(2):239–270. https://doi.org/10.1111/eufm.12175

Kanas A (2001) Neural network linear forecasts for stock returns. Int J Financ Econ 6(3):245–254. https://doi.org/10.1002/ijfe.156

Kelejian HH, Mukerji P (2016) Does high frequency algorithmic trading matter for non-at investors? Res Int Bus Financ 37:78–92. https://doi.org/10.1016/j.ribaf.2015.10.014

Kercheval AN, Zhang Y (2015) Modelling high-frequency limit order book dynamics with support vector machines. Quant Finance 15(8):1315–1329. https://doi.org/10.1080/14697688.2015.1032546

Khandani AE, Kim AJ, Lo AW (2010) Consumer credit-risk models via machine-learning algorithms. J Bank Finance 34(11):2767–2787. https://doi.org/10.1016/j.jbankfin.2010.06.001

Kim S, Kim D (2014) Investor sentiment from internet message postings and the predictability of stock returns. J Econ Behav Organ 107:708–729. https://doi.org/10.1016/j.jebo.2014.04.015

Kim S, Kim S (2020) Index tracking through deep latent representation learning. Quant Finance 20(4):639–652. https://doi.org/10.1080/14697688.2019.1683599

Kumar G, Muckley CB, Pham L, Ryan D (2019) Can alert models for fraud protect the elderly clients of a financial institution? Eur J Finance 25(17):1683–1707. https://doi.org/10.1080/1351847x.2018.1552603

Lahmiri S (2016) Features selection, data mining and financial risk classification: a comparative study. Intell Syst Account Finance Managed 23(4):265–275. https://doi.org/10.1002/isaf.1395

Lahmiri S, Bekiros S (2019) Can machine learning approaches predict corporate bankruptcy? evidence from a qualitative experimental design. Quant Finance 19(9):1569–1577. https://doi.org/10.1080/14697688.2019.1588468

Law T, Shawe-Taylor J (2017) Practical Bayesian support vector regression for financial time series prediction and market condition change detection. Quant Finance 17(9):1403–1416. https://doi.org/10.1080/14697688.2016.1267868

Le HH, Viviani J (2018) Predicting bank failure: An improvement by implementing a machine-learning approach to classical financial ratios. Res Int Bus Financ 44:16–25. https://doi.org/10.1016/j.ribaf.2017.07.104

Li J, Li G, Zhu X, Yao Y (2020) Identifying the influential factors of commodity futures prices through a new text mining approach. Quant Finance 20(12):1967–1981. https://doi.org/10.1080/14697688.2020.1814008

Litzenberger R, Castura J, Gorelick R (2012) The impacts of automation and high frequency trading on market quality. Annu Rev Financ Econ 4(1):59–98. https://doi.org/10.1146/annurev-financial-110311-101744

Loukeris N, Eleftheriadis I (2015) Further higher moments in portfolio Selection and a priori detection of bankruptcy, under multi-layer perceptron neural Networks, HYBRID Neuro-genetic MLPs, and the voted perceptron. Int J Financ Econ 20(4):341–361. https://doi.org/10.1002/ijfe.1521

Lu J, Ohta H (2003) A data and digital-contracts driven method for pricing complex derivatives. Quant Finance 3(3):212–219. https://doi.org/10.1088/1469-7688/3/3/307

Lu Y, Shen C, Wei Y (2013) Revisiting early warning signals of corporate credit default using linguistic analysis. Pac Basin Financ J 24:1–21. https://doi.org/10.1016/j.pacfin.2013.02.002

Martinelli A, Mina A, Moggi M (2021) The enabling technologies of industry 4.0: examining the seeds of the fourth industrial revolution. Ind Corp Chang 2021:1–28. https://doi.org/10.1093/icc/dtaa060

Mondal S, Das S, Vrana VG (2023) How to bell the cat? a theoretical review of generative artificial intelligence towards digital disruption in all walks of life. Technologies 11(2):44. https://doi.org/10.3390/technologies11020044

Moshiri S, Cameron N (2000) Neural network versus econometric models in forecasting inflation. J Forecast 19(3):201–217. https://doi.org/10.1002/(sici)1099-131x(200004)19:33.0.co;2-4

Mselmi N, Lahiani A, Hamza T (2017) Financial distress prediction: the case of French small and medium-sized firms. Int Rev Financ Anal 50:67–80. https://doi.org/10.1016/j.irfa.2017.02.004

Nag AK, Mitra A (2002) Forecasting daily foreign exchange rates using genetically optimized neural networks. J Forecast 21(7):501–511. https://doi.org/10.1002/for.838

Papadimitriou T, Goga P, Agrapetidou A (2020) The resilience of the US banking system. Int J Finance Econ. https://doi.org/10.1002/ijfe.2300

Parot A, Michell K, Kristjanpoller WD (2019) Using artificial neural networks to forecast exchange rate, including Var-vecm residual analysis and prediction linear combination. Intell Syst Account Finance Manage 26(1):3–15. https://doi.org/10.1002/isaf.1440

Petukhina AA, Reule RC, Härdle WK (2020) Rise of the machines? intraday high-frequency trading patterns of cryptocurrencies. Eur J Finance 27(1–2):8–30. https://doi.org/10.1080/1351847x.2020.1789684

Petukhina A, Trimborn S, Härdle WK, Elendner H (2021) Investing with cryptocurrencies – evaluating their potential for portfolio allocation strategies. Quant Finance 21(11):1825–1853. https://doi.org/10.1080/14697688.2021.1880023

Pichl L, Kaizoji T (2017) Volatility analysis of bitcoin price time series. Quant Finance Econ 1(4):474–485. https://doi.org/10.3934/qfe.2017.4.474

Pompe PP, Bilderbeek J (2005) The prediction of bankruptcy of small- and medium-sized industrial firms. J Bus Ventur 20(6):847–868. https://doi.org/10.1016/j.jbusvent.2004.07.003

PricewaterhouseCoopers-PwC (2017). PwC‘s global Artificial Intelligence Study: Sizing the prize. Retrieved May 10, 2021, from https://www.PwC.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html.

PricewaterhouseCoopers- PwC (2018). The macroeconomic impact of artificial intelligence. Retrieved May 17, 2021, from https://www.PwC.co.uk/economic-services/assets/macroeconomic-impact-of-ai-technical-report-feb-18.pdf.

PricewaterhouseCoopers- PwC (2020). How mature is AI adoption in financial services? Retrieved May 15, 2021, from https://www.PwC.de/de/future-of-finance/how-mature-is-ai-adoption-in-financial-services.pdf.

Qi M (1999) Nonlinear predictability of stock returns using financial and economic variables. J Bus Econ Stat 17(4):419. https://doi.org/10.2307/1392399

Qi M, Maddala GS (1999) Economic factors and the stock market: a new perspective. J Forecast 18(3):151–166. https://doi.org/10.1002/(sici)1099-131x(199905)18:33.0.co;2-v

Raj M, Seamans R (2019) Primer on artificial intelligence and robotics. J Organ Des 8(1):1–14. https://doi.org/10.1186/s41469-019-0050-0

Rasekhschaffe KC, Jones RC (2019) Machine learning for stock selection. Financ Anal J 75(3):70–88. https://doi.org/10.1080/0015198x.2019.1596678

Reber B (2014) Estimating the risk–return profile of new venture investments using a risk-neutral framework and ‘thick’ models. Eur J Finance 20(4):341–360. https://doi.org/10.1080/1351847x.2012.708471

Reboredo JC, Matías JM, Garcia-Rubio R (2012) Nonlinearity in forecasting of high-frequency stock returns. Comput Econ 40(3):245–264. https://doi.org/10.1007/s10614-011-9288-5

Renault T (2017) Intraday online investor sentiment and return patterns in the U.S. stock market. J Bank Finance 84:25–40. https://doi.org/10.1016/j.jbankfin.2017.07.002

Rodrigues BD, Stevenson MJ (2013) Takeover prediction using forecast combinations. Int J Forecast 29(4):628–641. https://doi.org/10.1016/j.ijforecast.2013.01.008

Van Roy V, Vertesy D, Damioli G (2020). AI and robotics innovation. In K. F., Zimmermann (ed.), Handbook of Labor, Human Resources and Population Economics (pp. 1–35) Springer Nature

Sabău Popa DC, Popa DN, Bogdan V, Simut R (2021) Composite financial performance index prediction – a neural networks approach. J Bus Econ Manag 22(2):277–296. https://doi.org/10.3846/jbem.2021.14000

Sariev E, Germano G (2020) Bayesian regularized artificial neural networks for the estimation of the probability of default. Quant Finance 20(2):311–328. https://doi.org/10.1080/14697688.2019.1633014

Scholtus M, Van Dijk D, Frijns B (2014) Speed, algorithmic trading, and market quality around macroeconomic news announcements. J Bank Finance 38:89–105. https://doi.org/10.1016/j.jbankfin.2013.09.016

Sermpinis G, Laws J, Dunis CL (2013) Modelling and trading the realised volatility of the ftse100 futures with higher order neural networks. Eur J Finance 19(3):165–179. https://doi.org/10.1080/1351847x.2011.606990

Sirignano JA (2018) Deep learning for limit order books. Quant Finance 19(4):549–570. https://doi.org/10.1080/14697688.2018.1546053

Soleymani F, Vasighi M (2020) Efficient portfolio construction by means OF CVaR and K -means++ CLUSTERING analysis: evidence from the NYSE. Int J Financ Econ. https://doi.org/10.1002/ijfe.2344

Sun T, Vasarhelyi MA (2018) Predicting credit card delinquencies: an application of deep neural networks. Intell Syst Account Finance Manage 25(4):174–189. https://doi.org/10.1002/isaf.1437

Szczepański, M. (2019). Economic impacts of artificial intelligence. Retrieved May 10, 2021, fromhttps://www.europarl.europa.eu/RegData/etudes/BRIE/2019/637967/EPRS_BRI(2019)637967_EN.pdf

Tao R, Su C, Xiao Y, Dai K, Khalid F (2021) Robo advisors, algorithmic trading and investment management: Wonders of fourth industrial revolution in financial markets. Technol Forecast Soc Chang 163:120421. https://doi.org/10.1016/j.techfore.2020.120421

Tashiro D, Matsushima H, Izumi K, Sakaji H (2019) Encoding of high-frequency order information and prediction of short-term stock price by deep learning. Quant Finance 19(9):1499–1506. https://doi.org/10.1080/14697688.2019.1622314

Trinkle BS, Baldwin AA (2016) Research opportunities for neural networks: the case for credit. Intell Syst Account Finance Manage 23(3):240–254. https://doi.org/10.1002/isaf.1394

Trippi RR, DeSieno D (1992) Trading equity index futures with a neural network. J Portf Manage 19(1):27–33. https://doi.org/10.3905/jpm.1992.409432

Uddin MS, Chi G, Al Janabi MA, Habib T (2020) Leveraging random forest in micro-enterprises credit risk modelling for accuracy and interpretability. Int J Financ Econ. https://doi.org/10.1002/ijfe.2346

Varetto F (1998) Genetic algorithms applications in the analysis of insolvency risk. J Bank Finance 22(10–11):1421–1439. https://doi.org/10.1016/s0378-4266(98)00059-4

Vortelinos DI (2017) Forecasting realized Volatility: HAR against principal components combining, neural networks and GARCH. Res Int Bus Financ 39:824–839. https://doi.org/10.1016/j.ribaf.2015.01.004

Wall LD (2018) Some financial regulatory implications of artificial intelligence. J Econ Bus 100:55–63. https://doi.org/10.1016/j.jeconbus.2018.05.003

Wanke P, Azad MA, Barros C (2016a) Predicting efficiency in Malaysian islamic banks: a two-stage TOPSIS and neural networks approach. Res Int Bus Financ 36:485–498. https://doi.org/10.1016/j.ribaf.2015.10.002

Wanke P, Azad MA, Barros CP, Hassan MK (2016c) Predicting efficiency in Islamic banks: an integrated multicriteria decision Making (MCDM) Approach. J Int Finan Markets Inst Money 45:126–141. https://doi.org/10.1016/j.intfin.2016.07.004

Wei L, Li G, Zhu X, Li J (2019) Discovering bank risk factors from financial statements based on a new semi-supervised text mining algorithm. Account Finance 59(3):1519–1552. https://doi.org/10.1111/acfi.12453

Xu Y, Zhao J (2022) Can sentiments on macroeconomic news explain stock returns? evidence from social network data. Int J Financ Econ 27(2):2073–2088. https://doi.org/10.1002/ijfe.2260

Xu D, Zhang X, Feng H (2019) Generalized fuzzy soft sets theory-based novel hybrid ensemble credit scoring model. Int J Financ Econ 24(2):903–921. https://doi.org/10.1002/ijfe.1698

Yang Z, Platt MB, Platt HD (1999) Probabilistic neural networks in bankruptcy prediction. J Bus Res 44(2):67–74. https://doi.org/10.1016/s0148-2963(97)00242-7

Yin H, Wu X, Kong SX (2020) Daily investor sentiment, order flow imbalance and stock liquidity: Evidence from the Chinese stock market. Int J Financ Econ. https://doi.org/10.1002/ijfe.2402

Zhang Y, Chu G, Shen D (2021) The role of investor attention in predicting stock prices: the long short-term memory networks perspective. Financ Res Lett 38:101484. https://doi.org/10.1016/j.frl.2020.101484

Zhao Y, Stasinakis C, Sermpinis G, Shi Y (2018) Neural network copula portfolio optimization for exchange traded funds. Quant Finance 18(5):761–775. https://doi.org/10.1080/14697688.2017.1414505

Zheng X, Zhu M, Li Q, Chen C, Tan Y (2019) Finbrain: When finance meets ai 2.0. Front Inform Technol Electr Eng 20(7):914–924. https://doi.org/10.1631/fitee.1700822

Funding

Open access funding provided by Università Politecnica delle Marche within the CRUI-CARE Agreement. This study has not received specific funding. We are granted with research funds by our institution which would allow us to cover the publication costs.

Author information

Authors and Affiliations

Contributions

Conceptualization: MC and SB. Methodology: SB. Investigation: MC, XG, SB. Writing: Marco Cucculelli, Xhoana Goga, Salman Bahoo and JM. Writing – Review and Editing: JM. Supervision: MC. Project Administration: MC.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions