Abstract

Optimal monetary policy models in the linear–quadratic framework produce high variability of interest rates, and are hence inconsistent with the data where typically interest rate smoothing is observed. In this paper we determine optimal monetary polices in a VAR model of the Polish economy with parameter uncertainty. We prove that there exists a structure of the multiplicative uncertainty in the optimal linear–quadratic model that explains the central bank’s behaviour. Thus proving that parameter uncertainty can be the rationale for “timid” movements in the short-interest rate dynamics. Finally, we show that there is trade off between parameter uncertainty and the interest rate smoothing incentive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The fundamental point of the analysis presented in this paper is based on the assumption that policy makers act in an optimal manner. This hypothesis is consistent with a generally accepted principle of economics which states that any economic behaviour can be understood as a problem of constrained optimization (see Tinbergen 1952; Theil 1961). It is believed that this principle should apply to central banks (CBs) (see Friedman 1969; Svensson 1997; Galí 2009) as strictly as to the representative firm or household. However, standard optimal inflation targeting rules obtained in linear–quadratic models are inconsistent with data and produce a too aggressive policy. Moreover, the majority of central bank short-term interest rate paths are smooth and only gradual changes can be observed. This gradualism has been considered as evidence that monetary policy makers follow the interest-rate smoothing incentive and it can be explained using the optimal monetary policy models by adding the interest-rate smoothing term to the CBs objective function (Goodfriend 1987). But this heuristic procedure has not much substantiation in central bank’s targets and raises the question: What are the rational reasons for the gradual movements in the monetary policy instrument?

This paper examines whether gradual movements of optimal interest rates can be explained by incorporating a structure of parameter uncertainty for an optimal central bank with the sole aim of price and output stability. More precisely, we investigate the effects of different forms of uncertainty in the linear framework on the optimal central bank policy. In models with parameter uncertainty we minimize the expected value of central bank’s objective function which is calculated also with respect to the random model’s parameters and as a result we obtain a so called optimal policy with multiplicative uncertainty (or in short robust monetary policy).

The Brainard conservatism principleFootnote 1 not always turns out to be fulfilled in dynamic models. In existing literature this principle is confirmed for a few dynamic models of monetary economy, but still under the assumption that there is no correlation between the risk and the parameter uncertainty. An unambiguous answer to the question of whether the correlated uncertainty about parameters affect optimal monetary policy is not known. We examine the Brainard principle in the presence of correlation between random parameters and exogenous shocks.

This paper proposes a general method based on the dynamic programming principle to derive optimal monetary policy rules with multiplicative uncertainty (see “Appendix 1”). These rules are those that are the best amongst those that yield an acceptable performance in a specified range of models described by parameter uncertainty of the structural model. In this paper we propose a new and simple approach to uncertainty-management with no active learning process, where estimation and control are separated. We apply dynamic programming methods for general linear systems to derive exact solutions. Moreover, we assume that the model parameters follow a serially uncorrelated process with an estimated mean and variance at the beginning of the decision period. This framework helps us to obtain an analytical solution of optimal monetary policy and makes the counter-factual model simulations feasible in reasonable time. Furthermore, we do not need to impose any prior assumptions on the parameters distribution.

In addition to the main contribution, we show empirical application for Poland. As the true model of the economy is unknown, we estimate a VAR model of monetary transmission mechanism in Poland with parameter uncertainty. We do not impose any restriction on random model parameters, hence this approach can to some extent handle model uncertainty. On the basis of the estimated model the optimal paths of macroeconomic variables are found and the analysis of impulse response functions (IRFs) with different stochastic structures of parameters is conducted. Analysing not only these structures of parameter uncertainty but also controlling the level of multiplicative incertitude we compare volatility of macroeconomic variables and IRFs from optimal monetary policy models with the empirical model counterparts to find the uncertainty structure which matches closer the optimal policy to data. We compare the individual influence of two factors: structural uncertainty in macroeconomic dynamics and smoothing term in the central bank objective function on the optimal unrestricted policy rule. We show that the optimal paths of interest rates in the model which has certainty and an interest rate smoothing term in the objective function can be approximated by the optimal interest rates derived from the model without a smoothing term, but with appropriately chosen uncertainty parameters.

The paper is organized as follows: in the next section we briefly review the existing literature on uncertainty in monetary policy. Section 3 introduces the linear model of monetary transmission mechanism with parameter uncertainty. In Sect. 4 we derive the solution to the optimal monetary policy problem with multiplicative uncertainty. Section 5 contains the empirical results where we compare the optimal monetary policy rules with different structures of model uncertainty. In Sect. 6 we conclude our findings.

2 Related Literature on Uncertainty in Monetary Policy

Researchers and central bank practitioners list several sources of uncertainty that can disturb the monetary policy rules (see Poole 1998; Goodhart 1999; Blinder 1999; Greenspan 2004; Onatski and Williams 2003; Woodford 2003a): exogenous shocks which are usually connected with the risk of the model, random economy parameters with unknown distribution i.e. Knightian uncertainty and finally data and model uncertainty. In the view of many policymakers a little stodginess at the central bank is entirely appropriate (see Blinder 1999, and the Kohn comments to Batini and Haldane 1999), since among other things they have little confidence in estimates of the size of the output gap, the equilibrium interest rate and model parameters. As noted by Chow et al. (1975) in general there are no one-sided relationships between the parameter uncertainty and policy rule. Hence quantitative analysis is required.

In many papers the effect of parameter uncertainty on the performance of the optimal Taylor rule is analysed. The authors conclude that in parsimoniously parametrized structural models the parameter uncertainty does not make the optimal Taylor rule attenuated (see Rudebusch 2001; Estrella and Mishkin 1999; Peersman and Smets 1999; Smets 2002 and reference therein). However, Estrella and Mishkin (1999) and Svensson (1999) demonstrate a positive influence of parameter uncertainty at the policy variable in the IS equation on central bank gradual decisions. Other works that also confirm some moderation of optimal policy assume an unrestricted rule and a VAR model with many lags (see Söderström 1999; Salmon and Martin 1999; Sack 2000) or many independently distributed parameters in the restricted VAR model (see Söderström 2002). Sack (2000) gets round the problem of random multipliers and replaces the state variable with its expected value in the previous period, which imply that the central bank cannot respond to contemporaneous shocks in the economy, and assumes that the expected objective function depends both on the squared deviations of expected variables from targets, and on the variance of the targeted variables. This form of uncertainty limits the aggressive movements in the interest rate. Using the Sack approach in Salmon and Martin (1999) the authors confirm the same results for the UK economy. Söderström (2002) considers a simple monetary policy model developed by Svensson (1999). Under the assumption that random parameters are independent of structural shocks and have a diagonal variance–covariance matrix he proves that uncertainty does not necessarily dampen the policy response. Söderström shows that parameter uncertainty at lagged inflation can even increase the optimal response of the interest rate.

Optimal control theory for models with multiplicative uncertainty advise a policy maker how to make optimal decisions from the point of view of minimizing average loss and when the model approximates a correct one. Whereas robust control theory tells us how to make good decisions in the worst case scenario i.e. decision makers minimize worst-case loss (see Hansen and Sargent 2008; Barlevy 2011; Hudgins and Na 2016). Robust policy rules are found assuming that the moments of parameter uncertainty are not available and by using min–max methods where the maximization is taken over the range of parameter values and then we minimize with respect to control variables (cf. Kendrick 2005). In Onatski and Stock (2002), Giannoni (2002) and Giannoni (2007) the authors using the min–max technique show that the robust optimal policy rule is likely to involve an aggressive response of the interest rate to inflation and the output gap shocks than is the case in the absence of uncertainty. A systematic approach based on model error modelling to find robust Taylor-type rules is presented in Onatski and Williams (2003), where Bayesian and minimax techniques are compared. The authors noticed that in the Bayesian case the result strongly depends on prior beliefs of model parameters. With uninformative priors the Bayesian optimal policy rules were attenuated, whereas for stronger prior beliefs and in the min–max case the Bayesian optimal and robust rules were more aggressive than in the absence of uncertainty.

As noted in Blinder (1999) uncertainty about parameters in optimal monetary policy models is much more difficult to handle. The usual approach to uncertainty-management in the models of monetary transmission mechanism is the application of Bayesian decision-making, where the optimal monetary policy model can be written as the adaptive control problem (Prescott 1972; Zellner 1996; Wieland 2000). In this framework active learning and design techniques are involved and subjective assumption on prior parameters distributions is needed. The Bayesian approach seems to be an adequate framework for uncertainty-management, but since the updating equations are non-linear, the determination of an exact solution usually appears to be impossible. As a result numerical approximation is used to find solutions (Easley and Kiefer 1988; Kiefer and Nyarko 1989; Zellner 1996) which involves high computational costs. Much research on monetary policy states that optimal central banks face a trade off between control and estimation since they are uncertain about the model parameters. Moreover, policy actions may affect the relationships between controls and state variables. Unfortunately the adaptive control approach has not widely attracted the attention of economists or central bank practitioners.Footnote 2 According to Blinder (1999) the explanation of this inadvertence is as follows: “You don’t conduct experiments on a real economy solely to sharpen your econometric estimates”.

3 Model of the Monetary Transmission Mechanism with Uncertainty

We build an empirical monetary policy model for the Polish economy using the vector autoregressive equations with exogenous variables estimated on the quarterly data for the period 2000–2014. Let us recall that in 1998, the Monetary Policy Council (MPC) in Poland announced its decision to adopt an inflation targeting regime. Since 2004 MPC has fixed an inflation target at the level of 2.5% and has used short run interest rate to bring the inflation as close as possible to its target constant level of 2.5%. A practical utility of the optimal and risk-sensitive monetary policy rules in a vector autoregressive framework for the Polish economy were presented in Milo et al. (2013), Bogusz et al. (2015) and Górajski and Ulrichs (2016). In the latter paper authors shows that risk-sensitive monetary policy rules response stronger to shocks than standard optimal rules. As our model uses only one conventional instrument—short term interest rate, we abstract from unconditional forward guidance policy that was applied in 2013 (see Baranowski and Gajewski 2016).

In this paper it is assumed that the economy fluctuation is described by a state vector \(y_t=[x_t,\pi _t,q_t]'\) consisting of output gap, \(x_t={\log }\frac{ GDP _t}{{{\widehat{ GDP }}}_t}\), deviation of inflation from its target, \(\pi _{ t}= CPI _t-{\widehat{ CPI }}_t\), and deviations of real effective exchange rate from its long run trend \(q_t= REER _t-{\widehat{ REER }}_t\).Footnote 3 The only tool used by the policy maker to influence the economy state \(y_t\) is the monetary policy instrument, \(i_t={ WIBOR1M }_t-{\widehat{ WIBOR1M }}_t\), being the deflection of one month interest rate \({ WIBOR1M }_t\) around its trend value \({\widehat{ WIBOR1M }}_t\).Footnote 4 The model is described by the following vector autoregressive specification with present and lagged exogenous prices of oil crude,Footnote 5 \( oil _t\):

where \(t=1,2\ldots ,T,\,{ e}^e_t={{{\mathbf {C}}}}_0 oil _t+{{{\mathbf {C}}}}_1 oil _{t-1}+{\xi }^e_t,\,{\xi }^e_t=[\xi _t^x, \xi _t^\pi ,\xi _t^q]',\,e^i_t={{{\mathbf {F}}}}_0 oil _t+{{{\mathbf {F}}}}_1 oil _{t-1} +\varepsilon ^i_t\) are exogenous shocks such that \(cov({\xi }^e_t,\varepsilon ^i_t|{\mathcal {F}}_{t-1})=0\) Footnote 6 and \({\mathbf {c}}_0, {\mathbf {c}}_1, {{\mathbf {A}}},\,{{\mathbf {B}}},\,{\mathbf {C}}_{0},\,{\mathbf {C}}_{1},\,{\mathbf {D}}_{0},\,{\mathbf {D}}_{1},\,{\mathbf {E}},\,{\mathbf {F}}_{0},\,{\mathbf {F}}_{1}\sim {{\mathcal {F}}}_{0}\) are matrices of parameters obtained from OLS estimation (sample period 2000.q1–2013.q4, see “Appendix 2” for more details).

We call the equation for \(i_t\) in (1) the empirical interest rate rule. It assumes that there is immediate dependence of \(i_t\) on exogenous shocks \(\xi ^e_t\) passed by the term \(D_0y_t\). This partial structure of shock is consistent with models describe in Bernanke and Blinder (1992) and Sack (2000). The results of Söderström (1999) and Sack (2000) are based on the simplest method of identification which is the Choleski decomposition, whereas in Salmon and Martin (1999) authors follow the short run zero restrictions in variance–covariance decomposition, introduced by Sims (1986). We propose a novel shock identification procedure based on optimal policy rule (see “Appendix 3”). The method assumes that the structure of exogenous shocks is estimated using the restriction put on the impulse response function of the optimal interest rate rule.

The multiplicative uncertainty in the model is describe by independent identically distributed random vectors

In Sect. 4 we replace the empirical interest rate rule with robust optimal momentary rules which take into account both: central bank objectives and uncertainty shocks (2).

3.1 Structures of Parameter Uncertainty at State and Control Variables

We consider three stochastic structures of model uncertainty and the benchmark model with certainty i.e. \(\xi ^{{\mathbf {A}}}_{t},\,\xi _t^{{\mathbf {B}}}=0\). (see Table 1). The first structure of uncertainty assumes that parameters at control variable are random. In the second we add the uncertainty to parameters at state variables and assume that they are uncorrelated with each other and with the exogenous shocks. The last stochastic structure of the model allows for correlations between random parameters and exogenous shocks. In all the above considered version of model (1) we assume that shocks in period t have zero conditional mean given that \({\mathcal {F}}_{t-1}\), covariance matrix of exogenous shocks satisfies

for all \(t>0\) and \(m,n\in \{1,2,3\}, m\ne n\). The last condition reflects lack of correlation between uncertainty shocks of different equations.

Moreover, in the model with correlated uncertainty it is assumed that for all \(m, \in =\{1,2,3\}\) we have

where the variance–covariance matrices \(\varSigma _{m,{{\mathbf {A}}}},\,\varSigma _{m,{{\mathbf {A}}}\xi ^e},\,\varSigma _{m,{{\mathbf {B}}}\xi ^e},\,\varSigma _{m,{{\mathbf {A}}}\xi ^e},\,\sigma _{m,{{\mathbf {B}}}}\) are estimated at the beginning of decision period (see “Appendix 2”), and \(un\ge 0\) is the uncertainty parameter. For \(un = 0\) we get the model with certainty. The first structure of shocks assumes uncertainty only in parameters at control variable (\(i_t\)), hence here we assume that \(\varSigma _{m,{\mathbf {A}}\xi ^e}=0,\,\varSigma _{m,{\mathbf {B}}\xi ^e}=0,\,\varSigma _{m,\mathbf {AB}}=0\) and \(\varSigma _{m,{\mathbf {A}}}=0\) for all \(m\in \{1,2,3\}\). In the model with uncorrelated uncertainty we assume that \(\varSigma _{m,{\mathbf {A}}\xi ^e}=0,\,\varSigma _{m,{\mathbf {B}}\xi ^e}=0,\,\varSigma _{m,\mathbf {AB}}=0\) and \(\varSigma _{m,{\mathbf {A}}}\) is diagonal for all \(m\in \{1,2,3\}\).

Having variances and covariances of shocks we define the uncertainty operators \(G_{{\mathbf {A}}}{:}\,M \left( 4 \times 4\right) \rightarrow M(4 \times 4),\,G_{{\mathbf {B}}}{:}\,M \left( 4\times 4\right) \rightarrow {\mathbb {R}},\,G_{\mathbf {AB}}{:}\,M\left( 4\times 4\right) \rightarrow {\mathbb {R}}^{4} ,\,G_{{\mathbf {A}}\xi }{:}\,M\left( 4\times 4\right) \rightarrow {\mathbb {R}}^{4},\,G_{{\mathbf {B}}\xi }{:}\,M\left( 4\times 4\right) \rightarrow {\mathbb {R}}\) by the following formulaeFootnote 7:

for all \({\mathcal {K}}=[k_{nm}]_{4x4}\), where vectors \(e_1,e_2,e_3\) forms the canonical orthonormal basis in \({\mathbb {R}}^3\) and where parameter \(un\in \{0,1,2,3\}\) measures the degree of multiplicative uncertainty in the model.

Table 1 shows the relationship between the stochastic structure of the model and uncertainty operators. Observe that operator \(G_{\mathbf {A}}\) reflects the uncertainty of parameters \({\mathbf {A}}\) at state variable, \(G_{\mathbf {B}}\) contains the randomness of parameters \({\mathbf {B}}\) at control variable, whereas \(G_{\mathbf {AB}}\) measures both variability of all random parameters and correlation between them. Operators \(G_\mathbf {A\xi }, G_\mathbf {B\xi }\) are created from covariances between parameter uncertainty shocks and exogenous shocks. Finally, notice that if there is certainty of model parameters (\(un=0\)), then all uncertainty operators are equal to zero.

4 Optimal Model of Monetary Policy Under Uncertainty

For the optimal central banks we assume the following inter-temporal quadratic loss function which defines the CB objective.

where \(\gamma \) is a discount factor, the weight at deviation of inflation from its target is normalized to one, \(\lambda \) determines the relative weight of the deviations of GDP, \(\nu \) is an interest rate smoothing parameter of L. We consider two types of optimal central bank policies. The first only wants to stabilize both prices and the output gap, thus the bank follows flexible inflation targeting i.e. policy makers assume that \(\lambda >0, \nu =0\) in (7). The second optimal CB follows the flexible objective function with interest rate smoothing incentive, hence policy makers choose the loss function (7) with \(\lambda>0, \nu >0\). Notice that we consider a finite decision horizon T. Therefore, the following control problem is solved by the optimal CBs:

where \(d_t= {\mathbf {c}}_0+{{{\mathbf {C}}}}_0 oil _t+{{{\mathbf {C}}}}_1 oil _{t-1},\,{\mathcal {I}}_T=\{(i_t)_{t=0}^{T-1}{:}\,i_t=i_t(y_0,y_1,\ldots ,y_t), \ t=0,1,\ldots ,T-1\}\) is the set of admissible polices and \( Risk (L)={\mathbb {E}}_{\varepsilon ^e}(L|\xi ^{{\mathbb {A}}},\xi ^{{\mathbb {B}}})\) is a risk function associate with L.Footnote 8 Therefore, in (8) the excepted value is taken with respect to two sources of randomness: exogenous shocks \(\varepsilon ^e=[\varepsilon ^x,\varepsilon ^\pi ,\varepsilon ^q]\) and parameter uncertainty shocks \(\xi ^{{{\mathbf {A}}}},\,\xi ^{{{\mathbf {B}}}}\) and can be rewritten as: \({\mathbb {E}}_{(\xi ^{{\mathbb {A}}}, \xi ^{{\mathbb {B}}})} (Risk(L)|{\mathcal {F}}_0)={\mathbb {E}}( L|{\mathcal {F}}_0)\) Footnote 9 (see DeGroot 2005). Moreover, if \(un>0\), then the solution \(i^*_t\) to (8)–(9) takes into account the perturbations \(\xi ^{{{\mathbf {A}}}}_{t},\,\xi ^{{{\mathbf {B}}}}_{t}\) to the estimated model parameters and in this way \(i^*_t\) constitute robust monetary policy with respect to model uncertainty.

In “Appendix 1” the solution to the general linear–quadratic optimal control problem with multiplicative uncertainty is presented. Here we apply these results in order to derive the formula for optimal and robust monetary policy rules. As the objective function of CB with interest rate smoothing incentive contains lagged control variables we need to use the following state space representation of (9) to derive the optimal monetary policy. Let \({\mathbb {X}}_t=[y_t,i_{t-1}]'\) be a new state variable, then \({\mathbb {X}}_t\) satisfies the equation of the form:

where \(u_t=i_t\) is a control variable, \({\mathbb {A}}=\left[ \begin{array}{cc} {\mathbf {A}}&{}\quad 0 \\ 0&{}\quad 0 \end{array}\right] ,\,\xi ^{{\mathbb {A}}}_t=\left[ \begin{array}{cc} \xi ^{{\mathbf {A}}}_t &{}\quad 0 \\ 0&{}\quad 0 \end{array}\right] ,\,{\mathbb {B}}=\left[ \begin{array}{c} {\mathbf {B}}\\ 1 \end{array}\right] ,\,\xi ^{{\mathbb {B}}}_t=\left[ \begin{array}{c} \xi ^{{\mathbf {B}}}_t \\ 0 \end{array}\right] ,\,{\mathbb {D}}_t=\left[ \begin{array}{c} d_t\\ 0 \end{array}\right] ,\,\xi _{t+1}=\left[ \begin{array}{c} {\mathbf {P}}_{11}\varepsilon _t^e \\ 0 \end{array}\right] \). The expected loss function in the new state space takes the following form:

where \({\mathbb {Q}}_t=\left[ \begin{array}{cc} {\mathbf {Q}}&{}\quad 0 \\ 0&{}\quad \nu \end{array}\right] \) for \(t=0,1,\ldots T-1,\,{\mathbb {Q}}_T=\left[ \begin{array}{cc} {\mathbf {Q}}&{}\quad 0 \\ 0&{}\quad 0 \end{array}\right] ,\,{\mathbf {Q}}=\left[ \begin{array}{ccc} \lambda &{}\quad 0 &{}\quad 0 \\ 0 &{}\quad 1 &{}\quad 0\\ 0 &{}\quad 0&{}\quad 0 \end{array}\right] ,\,{\mathbb {R}}_t=\nu ,\,{\mathbb {F}}=[0,0,0,-\nu ]\). Therefore, the optimal monetary policy with uncertainty is the solution to the problem of minimizing (11) subject to (10).

Applying Theorem 1 from “Appendix 1” to the optimal monetary policy problem (11)–(10) we obtain the formulae for flexible inflation targeting policy with interest rate smoothing incentive ( \(\nu >0\)):

and for the flexible inflation targeting monetary rule (\(\nu =0\)):

where

Here \(({\mathcal {K}}_{t})_{t=0}^T\) is the solution to the Riccati recursion [see “Appendix 1” Eq. (23)], \((p_t)_{t=0}^T\) satisfies (24). The uncertainty operators in (14)–(16) and in (23)–(24) indicate dependence of optimal monetary rule on the stochastic structure of parameter shocks.Footnote 10 Thus the policy does not follow the equivalence principle (see Simon 1956; Theil 1957) and takes into account not only the means but also the variances and covariances of shocks. The last property makes the optimal interest rate to be robust on uncertainty of model parameters. Notice that the optimal central bank with interest rate smoothing incentive implements the policy rule given by (12), which assumes some amount of persistence as it depends on lagged interest rate. Whereas the unrestricted optimal flexible inflation targeting rule (13) does not depend on the lagged \(i_{t-1}\), and therefore the smoothing effect of the optimal interest rate can be explained only by a structure of uncertainty in the model (see Sect. 5).

5 Empirical Results

In this section we consider the simulation on the optimal and robust monetary transmission models (9) with two parametrizations of the objective function and four structures of exogenous shocks (see Table 2). In Scenarios 1, 3, 4, 5 we assume flexible inflation targeting, whereas only in Scenario 2 we add to the central bank objectives an interest rate smoothing incentive term. Scenarios 1 and 2 constitute two benchmark monetary policy models with certainty of model parameters. In the second group of simulations (Scenarios 3, 4 and 5) there is a positive uncertainty about model parameters and at the same time there is no smoothing interest rate term at CB objective function.

We calibrate the relative weight of output gap \(\lambda =0.2\) in objective function based on the estimated DSGE model of the Polish economy (Baranowski et al. 2013) and the quadratic approximation of the wealth function (cf. Galí 2009; Polito and Wickens 2012). Then the smoothing parameter \(\nu =0.55\) is calibrated in such a way that makes the distance between the optimal monetary policy rule with smoothing term at objective function (Scenario 2) and robust monetary policy rule with \(un=3\) and uncorrelated uncertainty (Scenario 4) to be minimal.

We assume that the decision horizon equal to \(T=24\) quarters, which corresponds to the length of the term in office of the Monetary Policy Council in Poland or can be approximately equal to the time of Poland’s entrance to Eurozone. After Poland’s accession to the European monetary union the Polish economy will undergo structural changes and as consequence before this moment we can expect an increase in model uncertainty.

There are several methods to implement optimal policy experiments, which differ in the amount of information used (see Section 4.2 in Polito and Wickens 2012). In this paper in all the experiments we assume that in each period, the policy is re-optimised with decision horizon reduced by one compared to the previous period, i.e. at the beginning we find the policy instrument with finite decision horizon T, in the subsequent quarter we determine the policy with horizon \(T-1\), and after \(T-1\) periods we make the decision about interest rate taking into account that it will affect the economy only in one quarter ahead. This assumption means that after T periods from the initial moment, the economy will undergo structural change (such as Eurozone accession) which leads to among others different policy instruments. We make the unrealistic assumption that the first two moments (mean, variances and covariances) of the VAR parameters and the values of exogenous variable (\( oil _t\)) are known for the whole decision period. Then we reconstruct the VAR paths for both the optimal (\(un=0\)) and robust (\(un>0\)) policy rules by computing the optimal values of the policy instruments and the one-period-ahead forecasts of the state variables using actual and past values of the state vector and current period disturbances \(\xi ^e_t\).

5.1 Optimal and Robust Trajectories Without Interest Rate Smoothing

In this section we solve several versions of the optimal CB problem (8)–(9) under the assumption that policy makers do not follow the interest rate smoothing incentive. Using the results presented in Sect. 4 the optimal and robust policy rule is given by (13).

Figure 1 present the optimal and robust paths of macroeconomic variables for Scenarios 1, 4 (see Table 2) with different levels of uncertainty parameter \(un=0,1,3\).Footnote 11 In Table 3 volatility measures of robust and optimal solutions (Scenarios 1, 3, 4, 5) are compared with each other and with their actual counterparts.

The optimal policy in certainty (Scenario 1) is very oscillating and thus it does not fit recent historical patterns of central bank policies. There are periods where optimal nominal interest rates are strictly below the zero level eg \(-3\)% in 2012q2 and −1% in 2013q2.Footnote 12 Whereas in models with a high level of uncertainty \(un=3\) the interest rates are over zero and the standard deviation of the optimal interest rate decreases with the positive uncertainty parameter and reaches a minimum equal to 1.23 p.p. at \(un=3\) for the model with uncorrelated uncertainty (Scenario 4). Hence by taking into account parameter uncertainty we observe the interest rate smoothing effect, however the actual policy is sightly more gradual, where the standard deviation measure is 0.93 p.p.

Robust momentary policy causes that the optimal inflations \( CPI ^{\mathrm{*}}\) for \(un=1,2,3\), presented on the Fig. 1, wander off slightly from its target level as uncertainty increases. But robust inflation paths are still closer to the inflation target than the empirical path of inflation. The standard deviations of the optimal and robust inflation rate from the target belongs to the interval (0.50p.p., 0.89p.p.) while the average standard deviation of their empirical counterpart is equal to 1.39 p.p.

Moreover, strong fluctuations of optimal interest rate cause relatively large changes of the optimal output gap (see Table 3), but all optimal and robust paths of output gap are less fluctuating than historical trajectories. Under our versions of the model CB’s monetary rule with and without parameter uncertainty brings also grater \( REER ^*\) fluctuations than the actual monetary policy reflected in the empirical series of \( REER \). Furthermore, all optimal and robust trajectories with different levels of uncertainty have the same turning points, while the optimal trajectory of interest rates, inflation and the output gap differ from historical counterparts. The optimal policy rules are better, in terms of implementation of strict inflation targeting than the realized policy in Poland in the period 2008q1–2013q4.

From the above we can conclude that there is a classical trade off between variability of policy instrument and closeness of target variables (inflation, output gap) to their targets. Moreover, for a high level of parameter uncertainty \(un=2,3\) the correlation between parameters distribution increases the volatility of robust interest and exchange rates correspondingly it makes the average distance between inflation and inflation target smaller. Finally, the model with \(un=3\) and uncorrelated uncertainty (Scenario 4) turns out to be the closest to actual data for the Polish economy in period 2008q1–2013q4.

5.2 Uncertainty Versus Interest Rate Smoothing

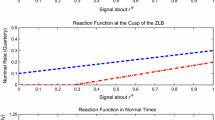

In this section we compare the effect of adding the interest rate smoothing term to the CB objective with the influence of parameter uncertainty on the variability of policy rule. The results shows that there is a trade off between model uncertainty and the interest rate smoothing incentive in CB objective function (see Table 4; Fig. 2). In Table 4 we collect the variability measures from three scenarios. The first two include the models without parameter uncertainty (Scenarios 1 and 2), and only in Scenario 2 we have the interest rate smoothing term in the central bank objective function. We compare them to the data consistent model found in the previous section (i.e. Scenario 4 with \(un=3\)).

It turns out to be possible to calibrate the smoothing parameter \(\nu =0.55\) in such a way that the distance between the optimal monetary policy rule with smoothing term at objective function (Scenario 2) and robust monetary policy rule from Scenario 4 with \(un=3\) is minimal (see Table 4 Footnote 13). Hence this proves that the gradual movements of interest rate commonly observed in much empirical data can be explained by the optimal monetary policy models not only by adding interest rate smoothing term to the CB objective but the same behaviour of interest rate can be obtained from the robust monetary transmission model with an appropriate level of parameter uncertainty.

5.3 Impulse Response Analysis

The next part of the paper includes a comparison of impulse response functions (IRFs) obtained from the VAR model with those from the optimal and robust models.

In the Figs. 3, 4 and 5 for the VAR model we put a grey continuous line for the average IRF paths and their mean \(\pm 2\) standard deviation. Black dashed and doted lines represent IRFs in optimal and robust models with different types or levels of uncertainty. In the first row of each panel of Figs. 3, 4 and 5 we present the effects of exogenous shocks: \(\varepsilon ^{x}, \varepsilon ^{\pi }, \varepsilon ^{q} \) on interest rates, respectively. The second row contains responses of the output gap, inflation and interest rate to monetary policy shock, \(\varepsilon ^{i}\).

Figure 3 presents IRFs in Scenarios 1 and 4. Notice that the impulse response functions in the VAR model and models with robust and optimal monetary rules are economically plausible, but the latter exhibit different shape patterns than those of the VAR model. All the responses of optimal and robust \( WIBOR1M ^*\) to price (\(\varepsilon ^\pi \)), demand (\(\varepsilon ^x\)) and exchange rate (\(\varepsilon ^q\)) shocks have a maximum level at the beginning and are significantly stronger than hump-shaped patterns of \( WIBOR1M \) reactions from the VAR model. Moreover, we can observe an interest rate smoothing effect via uncertainty. For the models with certainty or with small values of the parameter uncertainty (\(un=0,1\)) we observe very aggressive reactions of optimal monetary rules to the exogenous shocks, but as un goes up these responses become up to 3 times lower, simultaneously the time of the return of the robust interest rate to equilibrium is longer. Furthermore, a stabilizing effect after monetary policy shock on the output gap and on CPI is present in models with optimal and robust momentary policy. Hence, in particular the costs of monetary policy tightening in terms of output losses are also significantly lower than in VAR model. Moreover, the responses of \( REER ^*, WIBOR1M ^*\) to monetary shock \(\varepsilon ^i_t\) in the optimal policy model are very aggressive, but the robust polices attenuate them and make the return of all variables to steady state after interest rate shock longer.

IRFs in models with uncertainty \(un=3\) (Scenario 3—black solid lines, Scenario 4—black doted lines, Scenario 5—black dashed lines) to one-standard-deviation shocks to demand (\(\varepsilon ^x\)), prices (\(\varepsilon ^\pi \)), exchange rates (\(\varepsilon ^q\)) and monetary policy (\(\varepsilon ^i\))

IRFs in models with \(un=0, 3\) and \(\nu =0, 0.55\) (Scenario 1—black solid lines, Scenario 2—black dashed lines, Scenario 4—black doted lines) to one-standard-deviation shocks to demand (\(\varepsilon ^x\)), prices (\(\varepsilon ^\pi \)), exchange rates (\(\varepsilon ^q\)) and monetary policy (\(\varepsilon ^i\))

In Fig. 4 we compare the IRFs of models with different structures of uncertainty. Adding correlation between random parameters and exogenous shocks has an effect in the opposite direction by increasing the maximal reaction of policy instrument to demand (\(\varepsilon _t^x\)) and price (\(\varepsilon _t^\pi \)) shocks and shortens their time of return to equilibrium. We can also observe that the correlation structure of parameters decreases slightly the time at which inflation, output gap and interest rate is at steady state after the interest rate shock.

Finally, Fig. 5 presents IRFs of the model from Scenario 2—with a positive interest rate smoothing parameter \(\nu =0.55\), and compares it with the reaction from the optimal policy model (Scenario 1) and the data consistent robust monetary policy model (Scenario 4). We can observe the considerable similarity between the IRFs in Scenarios 2 and 4 (black dashed and black doted lines). Scenario 2 gives slightly less oscillating reactions of \( WIBOR1M ^*\), and the maximum response of inflation is somewhat stronger.

Next we calculate the feedback VAR horizons and the optimal horizons (see Table 5) defined as the time at which inflation should be on target (90% of maximal response vanishes) in the future after one standard deviation shock in the VAR model and optimal and robust models, respectively [cf. Batini and Nelson (2001)]. From Table 5 we conclude that all optimal horizons are shorter than the feedback VAR horizons, especially for shock from target (\(\varepsilon ^\pi \)) and instrument (\(\varepsilon ^i\)) variables the difference is striking. Moreover, in Scenarios 3, 4, 5 (i.e. in models without interest rate smoothing incentive) for the monetary policy impulse \(\varepsilon ^i\) the model uncertainty makes the return of optimal inflation longer by as much as 6 quarters in Scenarios 4. At the same time the increase in parameter un does not change significantly the time of return of inflation after the demand shock \(\varepsilon ^x\). Finally, comparing the times of inflation return to equilibrium we are able to match closely the model with interest rate smoothing incentive (Scenario 2) with the model with uncorrelated uncertainty structure (Scenario 4 with \(un=3\)). The last observation is another confirmation of the trade off between interest rate smoothing and model uncertainty.

6 Conclusions

This paper proposes a general method based on the dynamic programming principle to derive optimal monetary policy rules with multiplicative uncertainty. These rules are robust with respect to parameter uncertainty of the structural model thus they yield a data consistent paths of short run interest rate.

For Polish quarterly data in the period 2008–2014 we find optimal and robust monetary policy rules. We notice that standard optimal rules with parameter certainty are inconsistent with data, they produce a very aggressive policy. However, the volatility of the robust interest rate decreases with positive parameter uncertainty. With a high level of uncertainty the optimal policy model matches closer actual data and generates significantly smoother and less oscillating impulse responses of interest rate and exchange rate. Therefore, our findings confirm the Brainard conservatism principle.

A high level of model uncertainty is also responsible for interest rate smoothing behaviour commonly presented in empirical data. We confirm that there is a trade off between parameter uncertainty and the interest rate smoothing incentive. However, the correlation between parameters uncertainty has the opposite effect and leads to an increase in magnitude of interest rate response to shocks and at the same time, it shortens the time of return to equilibrium.

Finally, the stabilizing effect of parameter uncertainty on IRFs of state variables to monetary policy shock is confirmed. All optimal horizons are shorter than the feedback VAR horizons, especially for price \(\varepsilon ^\pi _t\) and monetary policy \(\varepsilon ^i_t\ \) shocks.

Notes

Kendrick (1981) presents several applications of adaptive control in economics.

Here \( CPI _t\) stands for inflation, measured using consumer price index, annual percentage changes and \( CPI ^{ target }_t\) is the National Bank of Poland target inflation, \( GDP _t\) is seasonally adjusted real GDP and \({\widehat{ GDP }}_t\ \) represents potential GDP and is obtained by Hodrick–Prescott filter; \( REER _t\) is real effective exchange rate in Poland, 2010q1 \(=\) 100, seasonally adjusted and \({\widehat{ REER }}_t\) is Hodrick–Prescott trend of real effective exchange rate.

\({\widehat{ WIBOR }1M}_t\) is estimated long-term trend of interest rate in period t (seasonally adjusted, Hodrick–Prescott filter).

\( oil _t\) is oil Brent price in period t per barrel in the Polish zloty at constant prices of 2010. Oil prices are included into the model to capture the inflation expectations which usually helps to solve “the price puzzle” (see Sims 1992).

\({{\mathcal {F}}}_{t}=\sigma (i_{-1},y_0,( oil _s)_{s=0}^t,(\xi ^e_s)_{s=1}^t,(\varepsilon ^i_s)_{s=1}^t, (\xi ^{{\mathbf {A}}}_{s})_{s=1}^t, (\xi ^{{\mathbf {B}}}_s)_{s=1}^t)\) is \(\sigma \)-algebra of events observed up to the period t. The condition \( cov ({\xi }^e_t,\varepsilon ^i_t|{\mathcal {F}}_{t-1})=0\) means that the monetary policy shock \(\varepsilon ^i_t\) does not have instantaneous impact on macroeconomic variables \(y_t\) which is consistent with the observation that nominal and real rigidities prevent economic agents from making instantaneous adjustments.

\(M\left( m\times n\right) \) stand for the linear space of \(m\times n\) matrices.

For vector (X, Y) of random variables we use the notation \({\mathbb {E}}_{(X,Y)}F(X,Y)\) to express the expected value of F(X, Y) with respect the joint probability distribution. Moreover, by the law of total probability we get \({\mathbb {E}}_{(X,Y)}F(X,Y)={\mathbb {E}}_X({\mathbb {E}}_{Y}(F(X,Y)|X))\).

Our approach to uncertainty management assumes that parameter probability distributions are unknown. But a decision-maker form some subjective probability distribution. Hence to some extent the vectors of shocks \((\xi ^{{\mathbf {A}}},\xi ^{{\mathbf {A}}})\) can be interpreted as form of the Knightian uncertainty (see Cagliarini and Heath 2000). We assume that this subjective probability coincide with the distribution of the parameter estimates, therefore the policy-maker uses these estimates to construct robust policy which minimizes the expected loss with respect to both risk of the model and multiplicative uncertainty.

Notice that in (10) the uncertainty shocks affect only first coordinate of \({\mathbb {X}}_t\) thus the uncertainty operators are given by (6) i.e. \(G_{{\mathbb {A}}}=G_{{\mathbf {A}}},\,G_{{\mathbb {B}}}=G_{{\mathbf {B}}},\,G_{\mathbb {AB}}=G_{\mathbf {AB}},\,G_{\mathbb {A}}{_\xi }=G_{{\mathbf {A}}\xi ^e},\,G_{\mathbb {B}}{{_\xi }}=G_{{\mathbf {B}}\xi ^e}\).

The floor to nominal interest rates is given by the costs of holding currency (see Yates 2004), hence negative close to zero values of interest rates are consistent with a theory. By taking a positive weight, \(\nu \), on the interest rate smoothing term in Eq. (7) we can eliminate the negative nominal interest rates eg. see Fig. 2 for \(\nu =0.55\).

Our simulations confirm that this result seems to be robust with respect to the values of \(\lambda \in (0,5)\).

We can use any estimation method of the model eg the Bayesian technique and then use the posterior variances and covariance of model parameters to construct the uncertainty operators.

For any \(k,n\in \{1,2,3,\ldots \}\) such that \(n>k\) let us denote by \(Proj_k\) the canonical projection from \({\mathbb {R}}^n\) to \({\mathbb {R}}^k\) or from M(n, n) to M(k, k) defined by taking the first k or \(k\times k\) coordinates from its argument.

For a matrix \(\left[ \begin{array}{cc} a &{}\quad b \\ c&{}\quad d \end{array}\right] \) we use a simplified notation: \(\left[ \begin{array}{cc} a &{}\quad b \\ c&{}\quad d \end{array}\right] =[a,b;c,d]\).

References

Baranowski, P., & Gajewski, P. (2016). Credible enough? Forward guidance and perceived National Bank of Polands policy rule. Applied Economics Letters, 23(2), 89–92.

Baranowski, P., Górajski, M., Malaczewski, M., & Szafrański, G. (2016). Inflation in Poland under state dependent pricing. Journal of Economics, 64(10), 937–957.

Barlevy, G. (2011). Robustness and macroeconomic policy. Annual Review of Economics, 3(1), 1–24.

Batini, N. & Haldane, A. (1999). Forward-looking rules for monetary policy. In Monetary policy rules (pp. 157–202). University of Chicago Press.

Batini, N., & Nelson, E. (2001). Optimal horizons for inflation targeting. Journal of Economic Dynamics and Control, 25(6), 891–910.

Bernanke, B. S., & Blinder, A. S. (1992). The federal funds rate and the channels of monetary transmission. The American Economic Review, 82(4), 901–921.

Blinder, A. S. (1999). Central banking in theory and practice. Cambridge: MIT Press.

Bogusz, D., Górajski, M., & Ulrichs, M. (2015). Strict vs flexible inflation targeting in the optimal monetary policy model for Poland. Statistical Review, 62(4), 379–396.

Brainard, W. C. (1967). Uncertainty and the effectiveness of policy. The American Economic Review, 57(2), 411–425.

Cagliarini, A. & Heath, A. (2000). Monetary policy-making in the presence of Knightian uncertainty. Sydney: Reserve Bank of Australia.

Chow, G. C., et al. (1975). Analysis and control of dynamic economic systems. New York: Wiley.

DeGroot, M. H. (2005). Optimal statistical decisions. New York: Wiley.

Easley, D., & Kiefer, N. M. (1988). Controlling a stochastic process with unknown parameters. Econometrica: Journal of the Econometric Society, 56(5), 1045–1064.

Estrella, A. & Mishkin, F. S. (1999). Rethinking the role of NAIRU in monetary policy: Implications of model formulation and uncertainty. In Monetary Policy Rules (pp. 405–436). University of Chicago Press.

Friedman, M. (1969). The optimum quantity of money and other essays. Chicago, IL: Aldine Press.

Galí, J. (2009). Monetary policy, inflation, and the business cycle: An introduction to the New Keynesian framework. Princeton, NJ: Princeton University Press.

Giannoni, M. P. (2002). Does model uncertainty justify caution? Robust optimal monetary policy in a forward-looking model. Macroeconomic Dynamics, 6(1), 111–144.

Giannoni, M. P. (2007). Robust optimal monetary policy in a forward-looking model with parameter and shock uncertainty. Journal of Applied Econometrics, 22(1), 179–213.

Goodfriend, M. (1987). Interest rate smoothing and price level trend-stationarity. Journal of Monetary Economics, 19(3), 335–348.

Goodhart, C. (1999). Central bankers and uncertainty. In: Proceedings-British Academy (Vol. 101, pp. 229–272). Oxford University Press Inc.

Górajski, M., & Ulrichs, M. (2016). Optimal risk-sensitive monetary policy for the Polish economy. Bank i Kredyt, 1, 1–31.

Greenspan, A. (2004). Risk and uncertainty in monetary policy. American Economic Review, 94(2), 33–40.

Hansen, L. P., & Sargent, T. J. (2008). Robustness. Princeton, NJ: Princeton University Press.

Hudgins, D., & Na, J. (2016). Entering \(H^{\infty }\)-optimal control robustness into a macroeconomic. Computational Economics, 47(2), 121–155.

Judge, G. G., Hill, R., Griffiths, W., Lutkepohl, H. & Lee, T. C. (1988). Introduction to the theory and practice of econometrics. New York: Wiley.

Kendrick, D. A. (1981). Stochastic control for economic models. New York: McGraw-Hill.

Kendrick, D. A. (2005). Stochastic control for economic models: Past, present and the paths ahead. Journal of Economic Dynamics and Control, 29(1), 3–30.

Kiefer, N. M., & Nyarko, Y. (1989). Optimal control of an unknown linear process with learning. International Economic Review, 30(3), 571–586.

Milo, W., Bogusz, D., Górajski, M., & Ulrichs, M. (2013). Notes on some optimal monetary policy rules: The case of Poland. Acta Universitatis Lodziensis Folia Oeconomica, Financial Markets and Macroprudential Policy, 295, 59–77.

Onatski, A., & Stock, J. H. (2002). Robust monetary policy under model uncertainty in a small model of the US economy. Macroeconomic Dynamics, 6(1), 85–110.

Onatski, A., & Williams, N. (2003). Modeling model uncertainty. Journal of the European Economic Association, 1(5), 1087–1122.

Peersman, G., & Smets, F. (1999). The Taylor rule: A useful monetary policy benchmark for the Euro area? International Finance, 2(1), 85–116.

Polito, V., & Wickens, M. (2012). Optimal monetary policy using an unrestricted VAR. Journal of Applied Econometrics, 27(4), 525–553.

Poole, W. (1998). A policymaker confronts uncertainty. Federal Reserve Bank of St. Louis Review, 80(5), 3–8.

Prescott, E. C. (1972). The multi-period control problem under uncertainty. Econometrica: Journal of the Econometric Society, 40(6), 1043–1058.

Rudebusch, G. D. (2001). Is the fed too timid? Monetary policy in an uncertain world. Review of Economics and Statistics, 83(2), 203–217.

Sack, B. (2000). Does the fed act gradually? A VAR analysis. Journal of Monetary Economics, 46(1), 229–256.

Salmon, C. & Martin, B. (1999). Should uncertain monetary policy-makers do less? Bank of England Working Papers No. 99 (pp. 1–53).

Simon, H. A. (1956). Dynamic programming under uncertainty with a quadratic criterion function. Econometrica, Journal of the Econometric Society, 24(1), 74–81.

Sims, C. A. (1986). Are forecasting models usable for policy analysis? Federal Reserve Bank of Minneapolis Quarterly Review, 10(1), 2–16.

Sims, C. A. (1992). Interpreting the macroeconomic time series facts: The effects of monetary policy. European Economic Review, 36(5), 975–1000.

Smets, F. (2002). Output gap uncertainty: Does it matter for the Taylor rule? Empirical Economics, 27(1), 113–129.

Söderström, U. (1999). Should central banks be more aggressive? Technical report. Sveriges Riksbank Working Paper Series.

Söderström, U. (2002). Monetary policy with uncertain parameters. The Scandinavian Journal of Economics, 104(1), 125–145.

Svensson, L. E. (1997). Inflation forecast targeting: Implementing and monitoring inflation targets. European Economic Review, 41(6), 1111–1146.

Svensson, L. E. (1999). Inflation targeting: Some extensions. The Scandinavian Journal of Economics, 101(3), 337–361.

Theil, H. (1957). A note on certainty equivalence in dynamic planning. Econometrica: Journal of the Econometric Society, 25(2), 346–349.

Theil, H. (1961). Economic forecast and policy, vol. XV of Contributions to Economic Analysis, Amsterdam: North Holland Pub. Co.

Tinbergen, J. (1952). On the theory of economic policy. Amsterdam: North Holland Pub. Co.

Whittle, P. (1996). Optimal control: Basics and beyond. New York: Wiley.

Wieland, V. (2000). Monetary policy, parameter uncertainty and optimal learning. Journal of Monetary Economics, 46(1), 199–228.

Woodford, M. (2003a). Interest and prices: Foundations of a theory of monetary policy. Princeton, NJ: Princeton University.

Woodford, M. (2003b). Optimal interest-rate smoothing. The Review of Economic Studies, 70(4), 861–886.

Yates, T. (2004). Monetary policy and the zero bound to interest rates: A review1. Journal of Economic Surveys, 18(3), 427–481.

Zabczyk, J. (1996). Chance and decision. Stochastic Control in Discrete Time. Quaderni, Scuola Normale Superiore, Pisa

Zellner, A. (1996). An introduction to Bayesian inference in econometrics. New York: Wiley.

Acknowledgements

The author gratefully acknowledges the financial support from the funding programme for young researchers at the Faculty of Economics and Sociology, University of Łódź. The author would like to thank the anonymous reviewers, Paweł’ Baranowski, Zbigniew Kuchta, Dominika Machowska, Grzegorz Szafrański Magdalena Ulrichs and Szymon Wójcik for their helpful and constructive comments that greatly contributed to improving the final version of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author gratefully acknowledges the financial support from the funding programme for young researchers at the Faculty of Economics and Sociology, University of Łódź.

Appendices

Appendix 1

\((\Omega ,{\mathcal {F}},{\mathbb {P}} ,({\mathcal {F}}_t)_{t=0,1,\ldots })\) be a probability space with filtration.

Lemma 1

Let Z, z and U, u be random vectors of dimensions \(n\times 1\) and \(m\times 1\), respectively, moreover, let \({\mathbb {Z}}=[Z'_1,\ldots ,Z'_k]'_{k\times n},\,{\mathbb {U}}=[{U}'_1,\ldots ,{U}'_k]'_{k\times m}\) and \({\mathbb {A}}=[a_{ij}]_{m\times k},\,{\mathbb {B}}=[b_{ij}]_{m\times n}\) be random matrices such that \(z,u,{\mathbb {A}},{\mathbb {B}}\) are \({\mathcal {F}}_t\)-measurable for some \(t\ge 1\). Then, we have:

where \(\varSigma _{t,ZU}={\mathbb {E}}((Z-{\mathbb {E}}Z)(U-{\mathbb {E}}U)'|{\mathcal {F}}_t)=[\sigma _{t,ij}]_{n\times m}\) and \(\varSigma _{t,{Z}_i{U}_j}={\mathbb {E}}(({Z}_i-{\mathbb {E}}{Z}_i)({U}_j-{\mathbb {E}}{U}_j)'|{\mathcal {F}}_t)\) for \(i=1,2,\ldots k,\,j=1,2,\ldots m\) and \(e_1,\ldots ,e_m\) is standard basis in \({\mathbb {R}}^m\).

Proof

By straightforward calculation we get

Using (17) we can prove (18) and (19). Indeed, for (18) we have:

and for (19) we obtain:

Let \({\mathbb {X}}_t{:}\,\varOmega \rightarrow {\mathbb {R}}^N,\,t=0,1,\ldots T\) be a sequence of random variable. Assume that

where \({\mathbb {A}}\in {\mathbb {R}}^{N\times N}, {\mathbb {B}}\in {\mathbb {R}}^{c\times N},\,{\mathbb {D}}_t\in {\mathbb {R}}^N\) are known matrices, \(u_t\) is a control process, \(\xi _t, \xi ^{\mathbb {A}}_t=[\xi ^{{\mathbb {A}}'}_{1,t+1}, \ldots , \xi ^{{\mathbb {A}}'}_{N,t+1}]'_{N\times N}, \xi ^{\mathbb {B}}_t=[\xi ^{{\mathbb {B}}'}_{1,t+1}, \ldots , \xi ^{{\mathbb {B}}'}_{N,t+1}]'_{N\times N},\,t=1,2,\ldots \) are sequences of random variables with conditional means and covariances defined by (H1) and (H2) below. For instance \(\xi ^{{\mathbb {A}}}_{j,t+1}\) is a random row vector representing parameter uncertainty of \({\mathbb {A}}\) in the j-equation of the system (20). Let \({\mathcal {F}}_0=\sigma (X_0,{\mathbb {D}}_1,\ldots ,{\mathbb {D}}_{T})\) be initial \(\sigma \)-algebra of events and for all \(t=1,2.\ldots ,T\) we define \({\mathcal {F}}_t=\sigma ({\mathcal {F}}_0, \xi _1,\ldots ,\xi _t,\xi ^{\mathbb {A}}_1,\ldots ,\xi ^{\mathbb {A}}_t,\xi ^{\mathbb {B}}_1,\ldots ,\xi ^{\mathbb {B}}_t)\) We assume that the following hypothesis holds. For all \(t=1,2,\ldots , T-1\) and all \(i,j=1,2,\ldots ,N\) we have:

In (H1)–(H2) it is assumed that at initial time 0 the policymakers knows the conditional means, variances and covariances between model parameters and exogenous shocks.

where \(\gamma>0,\,{\mathbb {Q}}_1,\ldots ,{\mathbb {Q}}_{T}\ge 0,\,{\mathbb {R}}_1,\ldots ,{\mathbb {R}}_{T-1}>0\) and \({\mathbb {F}}_1, {\mathbb {F}}_2,\ldots {\mathbb {F}}_{T-1}\in {\mathbb {R}}^{N\times c}\).

The problem of minimizing (21) subject to (20) over the set of admissible controls \({\mathcal {U}}_{T}\),

is called a linear–quadratic problem with multiplicative uncertainty. Notice that for \((u_t)_{t=0}^{T-1}\) we have \({\mathbb {X}}_t\sim {\mathcal {F}}_t\) for all t and hence \(u_t\sim {\mathcal {F}}_t\).

Theorem 1

Let \(G_\mathbb {A}, G_\mathbb {B}, G_{\mathbb {A}\xi }, G_{\mathbb {B}\xi }, G_{\mathbb {AB}}\) be the uncertainty operators defined by (30)–(34). If the sequence of matrices \({\mathcal {R}}_t,t=0,1,\ldots ,T-1\) defined below by (27) is positive definite, then the value function for the linear–quadratic problem with multiplicative uncertainty is of the form:

where

Moreover, the solution to the linear–quadratic problem with multiplicative uncertainty is given by

where

and \(({\mathbb {X}}^*_t)_{t=0,1,\ldots ,T}\) is the optimal state sequence:

for \(t=0,1,\ldots ,T-1\).

Proof

We use the dynamic programming principle (see Whittle 1996; Zabczyk 1996). Let \(V_T,V_{T-1},\ldots ,V_0\) be a sequence of value function defined by:

for all \(x\in {\mathbb {R}}^N, t=0,1,\ldots ,T-1\), where \(F_{t+1}(x,u)={\mathbb {D}}_{t+1}+({\mathbb {A}}+\xi ^{{\mathbb {A}}}_{t+1})x+({\mathbb {B}}+\xi ^{{\mathbb {B}}}_{t+1})u+\xi _{t+1}\). Notice that (22) is satisfied for T with \({\mathcal {K}}_T={\mathbb {Q}}_T, p_T=0, v_T=0\). We assume that (22) holds for \(t+1<T\) and we calculate \(V_t\). Observe that

where

By (H1) the second term in the above equation vanishes. Using (H2) and Lemma 1 the last term can be decomposed as follows

where the uncertainty operators \(G_{{\mathbb {A}}}{:}\,{\mathbb {R}}^N\rightarrow {\mathbb {R}}^{N\times N}, G_{{\mathbb {B}}}{:}\,{\mathbb {R}}^N\rightarrow {\mathbb {R}}^{c\times c}, G_{{\mathbb {A}}\xi }{:}\,{\mathbb {R}}^N\rightarrow {\mathbb {R}}^{N}, G_{{\mathbb {B}}\xi }{:}\,{\mathbb {R}}^N\rightarrow {\mathbb {R}}^{c}, G_{\mathbb {AB}}{:}\,{\mathbb {R}}^N\rightarrow {\mathbb {R}}^{N\times c}\) are defined by

for all \(K\in {\mathbb {R}}^{N\times N},\,x,y\in {\mathbb {R}}^{N}\) and \(u,w\in {\mathbb {R}}^{c}\). Applying the definitions of uncertainty operators in (29) and then substituting (29) in (28), we obtain:

After the rearrangement we have

where

and where \({\mathcal {R}}_t\) is given by (27). Hence solving the above optimization problem we obtain the optimal control \(u^*_t=G_tx+g_t\) with

Finally, the optimal value of \(V_{t}(x)\) takes the form

where

After rearrangement we obtain (22).

Appendix 2

We assume in Sect. 3.1 that the model parameters at interest rate and state variable are assumed to be random variables. In order to conduct the experiments with optimal and robust policy we estimate the first two moments of model parameters by means of the ordinary least square (OLS) method.Footnote 14 Let us recall that for VAR models OLS estimators of the following parameters are consistent and asymptomatically normal and uncorrelated with model exogenous shocks. But in the finite samples they are biased in mean, and their variances and covariance are correlated with exogenous shocks (cf. Judge et al. 1988). OLS estimators of \({\mathbf {A}}=[{\mathbf {A}}_1,{\mathbf {A}}_2,{\mathbf {A}}_3]', {\mathbf {B}}=[{\mathbf {B}}_1,{\mathbf {B}}_2,{\mathbf {B}}_3]', \varSigma , \Sigma _{m,{\mathbf {A}}}, \sigma ^2_{m,{\mathbf {B}}}, \varSigma _{m,\mathbf {AB}}, \varSigma _{m,{\mathbf {A}}\xi ^e}, \varSigma _{m,{\mathbf {B}}\xi ^e}\) are given byFootnote 15

for \(m=1,2,3\) (m is number of the equation) and where \({\mathbb {X}}=[{\mathbb {Y}}_{-1}, {\mathbf {i}},{\mathbf {1}},\mathbf {oil},\mathbf {oil}_{-1}]_{7\times N}, {\mathbb {Y}}=[y_1';y_2';\ldots ;y_N']'=[{\mathbb {Y}}_1,{\mathbb {Y}}_2,{\mathbb {Y}}_3]_{3\times N},\,{\mathbb {Y}}_{-1}=[y_0';y_1';\ldots ;y_{N-1}']' ,\,{\mathbf {i}}=[i_0,i_1,\ldots ,i_{N-1}]',\,{\mathbf {1}}=[1,1,\ldots ,1]',\,\mathbf {oil}=[ oil _1, oil _2,\ldots , oil _{N}]',\,\mathbf {oil}_{-1}=[ oil _0, oil _1,\ldots , oil _{N-1}]'\) are the matrices consist of samples of state and control variables and \(\hat{\xi ^e}=[\hat{\xi ^e_1};\ldots ;\hat{\xi ^e_T}]'=\) are the residuals i.e. \(\hat{\xi ^e_t}=y_t-{\hat{y}}_t, {\hat{y}}_t={\mathbb {X}}[\hat{{\mathbf {A}}}, \hat{{\mathbf {B}}}, {\hat{\mathbf {{{c}}}}}_0,{\hat{\mathbf {C}}}_0,\hat{\mathbf {{C}}}_1]\) for \(t=1,2,\ldots ,N\).Footnote 16

Appendix 3

In the Sect. 3 we have imposed the following partial structure of exogenous shocks:

where \(\varepsilon ^x_t,\varepsilon ^\pi _t,\varepsilon ^q_t,\varepsilon ^i_t\) are fundamental shocks in the economy called demand, price, exchange rate and interest rate shocks, respectively. Notice that \({{{\mathbf {P}}}}_{11}, {{{\mathbf {P}}}}_{ 21}, {{{\mathbf {P}}}}_{22}\) satisfy \({{{\mathbf {P}}}}^{-1}_{22}{{{\mathbf {P}}}}_{21}{{{\mathbf {P}}}}^{-1}_{11}={{\mathbf {I}}}-{{\mathbf {D}}}_0,\,\varvec{\Sigma }_\xi ={{{\mathbf {P}}}}_{11}{{{\mathbf {P}}}}'_{11}\) and \(\sigma ={{{\mathbf {P}}}}^2_{22}\). In the optimal monetary model we replace the empirical policy rule from (1) by its optimal counterpart [see (12)] and make the shock identification procedure complete by imposing all three possible zero restrictions on elements of matrix \({{{\mathbf {P}}}}_{ 11}\) and analysing the signs of the impulse response functions (IRFs) of optimal interest rates in the model with certainty. We choose the matrix \({{{\mathbf {P}}}}_{ 11}\) which gives contractionary response of the optimal interest rate to demand, \(\varepsilon ^x_t\), and price, \(\varepsilon ^\pi _t\), shocks and expansionary response to the exchange rate shock (appreciation of the Polish zloty), \(\varepsilon ^q_t\). This identification procedure give the following estimates:

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Górajski, M. Robust Monetary Policy in a Model of the Polish Economy: Is the Uncertainty Responsible for the Interest Rate Smoothing Effect?. Comput Econ 52, 313–340 (2018). https://doi.org/10.1007/s10614-017-9678-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9678-4

Keywords

- Optimal monetary policy

- Parameter uncertainty

- The Brainard conservatism principle

- Interest rate smoothing

- SVAR model