Abstract

This analysis explores robust designs for an applied macroeconomic discrete-time LQ tracking model with perfect state measurements. We develop a procedure that reframes the tracking problem as a regulator problem that is then used to simulate the deterministic, stochastic LQG, H-infinity, multiple-parameter minimax, and mixed stochastic/H-infinity control, for quarterly fiscal policy. We compare the results of the five different design structures within a closed-economy accelerator model using data for the United States for the period 1947–2012. When the consumption and investment tracking errors are more heavily emphasized, the H-infinity design renders the most aggressive fiscal policy, followed by the multiple-parameter minimax, mixed, LQG, and deterministic versions. When the control tracking errors are heavily weighted, the resulting fiscal policy is initially more aggressive under the multi-parameter specification than under the H-infinity and mixed designs. The results from both weighting schemes show that fiscal policy remains more aggressive under the robust designs than the deterministic model. The simulations show that the multi-parameter minimax and mixed designs provide a balancing compromise between the stochastic and robust methods when the worst-case concerns can be primarily limited to a subset of the state-space.

Similar content being viewed by others

References

Amman, H.M. (1996). Numerical methods for linear-quadratic models. In H. Amman, D. Kendrick, and J. Rust (Eds.), Handbook of computational economics (Vol. 1, Ch. 13, pp. 295–332). Amsterdam: Elsevier.

Barlevy, G. (2011). Robustness and macroeconomic policy. Annual Review of Economics, Federal Reserve Bank of Chicago, 3, 1–24.

Basar, T. (1992). On the application of differential game theory in robust controller design for economic systems. In G. Feichtinger (Ed.), Dynamic economic models and optimal control (pp. 269–278). North-Holland: Amsterdam.

Basar, T., & Bernhard, P. (1991). \(H^{\infty }\) - optimal control and related minimax design problems. Boston: Birkhauser.

Basar, T. & Olsder, G. (1999). Dynamic noncooperative game theory (2nd ed.). Philadelphia: SIAM.

Bernhard, P. (2002). Survey of linear quadratic robust control. Macroeconomic Dynamics, 6, 19–39.

Brainard, W. (1967). Uncertainty and the effectiveness of policy. American Economic Review, 57, 411–425.

Carvalho, V. (2005). Robust-optimal fiscal policy. Available at SSRN: http://ssrn.com/abstract=997142 or doi:10.2139/ssrn.997142.

Chow, G. (1967). Multiplier accelerator, and liquidity preference in the determination of national income in the United States. Review of Economics and Statistics, 49, 1–15.

Chow, G. (1975). Analysis and control of dynamic economic systems. New York: John Wiley and Sons.

Dennis, R., Leitemo, K., & Soderstrom, U. (2009). Methods for robust control. Journal of Economic Dynamics and Control, 33(8), 1004–1616.

Diebold, F. (2005). On robust monetary policy with structural uncertainty. In J. Faust, A. Orphanees, & D. Reifschneider (Eds.), Models and monetary policy: research in the tradition of Dale Henderson, Richard Porter, and Teter Tinsley (pp. 82–86). Washington, DC: Board of Governors of the Federal Reserve System.

Green, M., & Limebeer, D. (2012). Linear robust control. New York: Dover Books.

Hansen, L. & Sargent, T. (2008). Robustness. Princeton: Princeton University Press.

Hansen, L., & Sargent, T. (2007). Recursive robust estimation and control without commitment. Journal of Economic Theory, 136, 1–27.

Hansen, L., Sargent, T., & Tallarini, T. (1999). Robust permanent income and pricing. Review of Economic Studies, 66(4), 873–907.

Karantounieas, A. (2013). Managing pessimistic expectations and fiscal policy. Theoretical Economics, 8, 193–231.

Kendrick, D. (1981). Stochastic control for econometric models. New York: McGraw Hill.

Kendrick, D. (2005). Stochastic control for economic models: Past, present and the paths ahead. Journal of Economic Dynamics and Control, 29, 3–30.

Kendrick, D., & Amman, H. M. (2006). A classification system for economic stochastic control models. Computational Economics, 27, 453–482.

Kendrick, D. & Amman, H.M. (2010). A Taylor Rule for fiscal policy? Paper presented at 16th international conference on computing in economics and finance of the Society for Computational Economic in London in July of 2010, Available as Tjalling C. Koopmans research Institute, Discussion Paper Seres nr: 11–17, Utrecht School of Economics, Utrecht University. http://www.uu.nl/SiteCollectionDocuments/REBO/REBO_USE/REBO_USE_OZZ/11-17.pdf

Kendrick, D., & Shoukry, G. (2013). Quarterly fiscal policy experiments with a multiplier accelerator model. Computational Economics, 42, 1–25.

Leeper, E., Walker, T., Yang, S. (2010). Government investment and fiscal stimulus, IMF Working Paper No WP/10/229.

Lucas, R., & Stokey, N. (1983). Optimal fiscal and monetary policy in an economy without capital. Journal of Monetary Economics, 12, 55–93.

Onatski, A., & Stock, J. (2002). Robust monetary policy under model uncertainty in a small model of the US economy. Macroeconomic Dynamics, 6, 85–110.

Rustem, B. & Howe, M. (2002). Algorithms for worst-case design applications to risk management. Princeton: Princeton University Press.

Sage, A. & C. White (1977). Optimum systems control (2nd ed.). Engelwood Cliffs: Prentice Hall.

Svec, J. (2012). Optimal fiscal policy with robust control. Journal of Economic Dynamics and Control, 36, 349–368.

Taylor, J. (1993). Macroeconomic policy in a world economy. New York: NY, Norton.

Tornell, A. (2000). Robust-H-infinity forecasting and asset pricing anomalies. NBER Working Paper No. 7753.

Williams, N. (2008). Robust control. In Steven N. Durlauf & Lawrence E. BlumeNew Palgrave dictionary of economics (2nd ed.). Palgrave Macmillan

Zakovic, S., Wieland, V., & Rustem, B. (2007). Stochastic optimization and worst-case analysis in monetary policy design. Computational Economics, 30, 329–347.

Acknowledgments

The authors are grateful to David Kendrick, Alex Ufier, and three anonymous referees for comments on earlier drafts of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

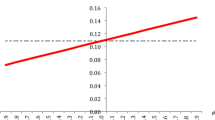

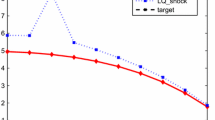

Tables 1, 2, 3 present the data graphed in Figs. 1, 2, 3, respectively, so that all of the data points can be compared with more detailed resolution. These data are in billions of constant dollars, so that a 1-point difference between data points represents $1 billion annualized. Consumption and investment are fixed at their initial values in period 1. Government purchases is fixed in period 0, and the first optimal policy action for government spending occurs in period 1. Deviations from targeted changes in government spending are penalized.

Tables 4, 5, 6 present the data graphed in Figs. 6, 7, 8, 9, respectively. The trajectories for government purchases under the H\(^{\infty }\)-control and 2-parameter minimax designs appear close in Fig. 6, but the differences are easily seen in Table 4.

Tables 7, 8, 9 show the data graphed in Figs. 11, 12, 13, respectively, where the deviations from targeted changes in government spending are not penalized.

Rights and permissions

About this article

Cite this article

Hudgins, D., Na, J. Entering H\(^{\infty }\)-Optimal Control Robustness into a Macroeconomic LQ-Tracking Model. Comput Econ 47, 121–155 (2016). https://doi.org/10.1007/s10614-014-9472-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-014-9472-5