Abstract

Technological innovations while economically prudent may have harmful consequences to the planet and/or people. This paper empirically investigates the moderating effect of responsible investment on the influence of innovation on firm performance in manufacturing industry. The hypothesized relationships are justified using signalling theory. Relationships are tested using data from six countries in Asia-pacific region, namely Australia, Korea, Taiwan, China, India, and Vietnam. The established measures are drawn from well-established GMRG fifth version survey instrument. The empirical analysis on 297 data points was done using SmartPLS3. The result strongly suggests that the responsible investments have significant positive moderating effect on the innovation, product and process, and firm performance relationships. Managers are, therefore, encouraged to not only consider responsible consequences of technological innovation, but also pay attention to the responsible investment aspects that influence innovation-performance relationship.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The core principle of businesses is to make profits (Friedman, 2007). This philosophy of profit maximization to increase shareholder wealth compels corporations to continuously innovate their product/service offerings and/or processes to remain competitive. However, firms are not always held accountable to society for the adverse effects of innovations on society and the environment (Singh et al., 2020). Consequently, the idea of responsible innovation (RI) is illusory if the associated expenses are motivated by profit maximization (Owen et al., 2020). Nonetheless, RI is now frequently viewed as a strategic tool for gaining credibility and increasing a corporation’s market potential, thereby improving its financial results (De Hoop et al., 2016), thus management and shareholders are realizing the value of responsible innovation.

Responsible innovation (RI) focuses on the socio-ecological needs and challenges and is committed to continuously engaging relevant stakeholders in anticipating the potential problems, mutual learning, and improved decision-making (Wickson & Carew, 2014). The four key dimensions of RI, namely, anticipation, reflexivity, inclusion, and responsiveness (Stilgoe et al., 2013), however, require a fresh approach to unpack them for better theorizing in the context of building an innovation-focused organization that addresses the triple bottom line (i.e., people, profit, and planet) to satisfy all relevant stakeholders.

Aniticipation dimension refers to improvements in foresight and planning aspects such that detrimental aspects of innovation can be foreseen and contained (Stilgoe et al., 2013). Closely associated with this feature is reflexivity, which fouses on creating standards and institutional norms/conducts to reflect on the governance aspects relating to innovation (Stilgoe et al., 2013). And, inclusion refers to being inclusive in the governance and policymaking for RI. These three dimensions are important from strategy and policy perspective, and will shape the responsiveness dimension. It is however the latter that has direct bearing on the stakeholders because of manangerial choices on processes and courses of actions (Stilgoe et al., 2013). It is a link between metagovernance shaped by the other three dimensions and the desired triple bottom line goals.

Responsible investment (RESInvest) is based on “responsiveness,” one of the four dimensions of RI, and deals with allocating resources and capabilities to suitably respond to issues that may arise through the other three dimensions, namely, anticipation, reflexivity, and inclusion (Long & van Waes, 2021). Here, we posit that RESInvest is a manifestation of responsiveness that dedicates resources to strategic areas that enhance a firm’s innovativeness while taking due care of the stakeholders and/or minimizing the adverse impacts of innovations. By adopting this approach, we contend that organizations are mindful of making virtuous and ethical investments, yet contributing to their innovation goals for a superior firm performance (Pandza & Ellwood, 2013). For instance, RESInvest include investments in environment-friendly human resource management (HRM) practices (Singh et al., 2020) and this investment will enhance the innovation impact on firm performance. Hence, as a step in that direction, the first empirical question for testing that we ask in this study is: How does responsible investment influence a firm’s performance? By showcasing this link, future scholarship will be suitably positioned to investigate that “responsible” dimension of investment contributes to the perception of “responsible” innovation. Thereby, the findings of this research is a progressive step towards the call for unpacking and better theorizing of RI (Stilgoe et al., 2013) and drawing linkages with the idea of RESInvest.

RESInvest is gaining significance for innovating organizations as it is deemed valuable to society and the environment, thus revealing the humane side of the firm to the customers and other stakeholders (Atz et al., 2021; Wang et al., 2011; Wu, 2022). However, there is no clear empirical evidence that the presence of RESInvest will influence the association between the innovation in a firm and its performance (Lubberink et al., 2017).

Therefore, we investigate how RESInvest affects innovation practices, specifically product and process innovation, as they are often shown in literature to impact firm performance (Hervas-Oliver et al., 2014; Lee et al., 2019). The expectation that RESInvest will always have a positive impact is somewhat misplaced (Sardana et al., 2020). Furthermore, this interpretation is because of multiple expectations. For instance, Western investors are most likely to have a positive view about RESInvest by manufacturing companies from emerging economies (Shahbaz et al., 2015). However, for a domestic investor, RESInvest, in general, is unlikely to be a deciding factor as investors are profit-seeking, and most domestic customers may not place any monetary value on such investments. Likewise, in mature industries firms struggle to remain profitable, so they may not see much benefit in pursing innovation and/or RESInvest, even in developed market context (D’Este et al., 2012; Madrid-Guijarro et al., 2009). For these reasons top executives have voiced fears that increased RESInvest activities would harm productivity and profitability because such activities involve resource dedication (Aghion et al., 2013). Therefore, to further advance our understanding in this area, we propose another research question as follows: How does responsible investment influence the effect of product and process innovation on the performance of manufacturing organizations?

Innovations, both product and process, are often positively associated with firm performance (Hervas-Oliver et al., 2014; Lee et al., 2019). However, there are possible downsides to these innovations, and this topic warrants further discussion in the scholarly community (Singh et al., 2020). Traditionally, firms strive to fulfill the shareholders’ expectations (i.e., wealth maximization), often ignoring other stakeholders. Although omnipresent, this behavior is even more intense in emerging markets where the regulatory power is relatively weak. Firms can manipulate their stakeholder constituents, such as employees and suppliers, to maximize their economic gains at their costs and/or at the expense of society and environment. RESInvest, in contrast, presupposes that the firms seeking innovation should honor most stakeholders, not just shareholders. Investment in suppliers’ development, workforce training and development, workplace health and safety, and environment-friendly operations reflects this commitment and sends positive signals to the broader community. Using RESInvest, firms can generate goodwill, which in turn increases the returns on innovations. However, this notion lacks clarity in the literature from an empirical perspective, and this study seeks to fill this gap.

Consistent with these expectations, and as indicated in the research question, we empirically investigate the moderating effect of RESInvest activities on innovation and firm performance. We probe the above questions within the manufacturing industry context in key Asia-Pacific countries (such as Australia, Taiwan, Vietnam, India, Vietnam, Korea, and China). The Asia-Pacific region is attracting global attention for manufacturing outsourcing and raw material suppliers. There is labor arbitrage in these countries compared with the Western world. India and China are among the two fastest-growing economies in the world with a strong manufacturing base. Vietnam is also a major contributor to the manufacturing sector in the Asia-Pacific region, with an emphasis on exports. Advanced manufacturing and services are also key to the developed economies of South Korea and Taiwan, contributing more than a quarter to their GDP (The World Bank, 2022). The contribution of manufacturing is a substantive 6% in Australia, which is among the largest 15 GDPs in the world (The World Bank, 2022). The three emerging nations (China, India, and Vietnam) along with three developed nations (Australia, South Korea, and Taiwan) in this study contribute to nearly 69% of the total manufacturing GDP of the Asia-Pacific region.

This study contributes to the literature in two aspects. First, it links the scholarly debate on innovation–performance relationship to a new dimension of RESInvest. Therefore, the investigation of innovation and firm performance in a RESInvest culture is unique and novel from a scholarly perspective. Second, this study presents a combination of the signaling and stakeholder theories to empirically show the moderation effect of RESInvest on the innovation–performance relationship in the context of both developed and emerging countries. Robust empirical results showing innovation and firm performance moderated by RESInvest is a strong signal to diverse stakeholders on the managerial and policy signficance of RI, as discussed later in the ‘Discussion’ section. This study is perhaps one of the early attempts to explore these dimensions and contribute to the increasing body of knowledge on RI.

In the next section, we focus on the theoretical exposition and development of the hypotheses. This section is followed by the research methodology, data analysis, empirical findings, and discussion, and finally, the conclusion includes contributions, shortcomings, and future research directions.

Theoretical background

Responsible investment (RESInvest)

Scholars agree that the elements of RESInvest are inextricably connected and cannot be separated (Sung & Choi, 2014). This also leads to a concern that RESInvest is too general and, thus, needs a specific nomenclature, such as R&D, environmental sustainability, workplace safety, health and hygiene, social sustainability, workforce training and development, and supplier development, to make it actionable. In this study, RESInvest refers to investments in activities that directly impact a firm’s operations and innovation activities, such as suppliers’ development, workforce training and development, workplace health and safety, and environment-friendly operations (Shin et al., 2019; Sung & Choi, 2018; Tang et al., 2018). These are also the primary areas where RESInvest is made, hence the focus of our study.

Substantial theoretical and empirical evidence in the literature shows that investing in innovation-related activities helps businesses develop faster (Farooq et al., 2021). Investments in workforce training and development (WTD) and workplace health and safety (WHS) initiatives build assets and resources that improve the workforce and working conditions (Grossman & Burke-Smalley, 2018). WTD and WHS activities indicate management expectations about human resource development and send a positive signal to the internal and external stakeholders that the firm is concerned about the health, welfare, working conditions, and workforces’ personal growth (Gubbins et al., 2006). Investing in WTD and WHS boosts new knowledge development, new skillset, morale, job satisfaction, productivity, innovation, competence, active learning, sense of attachment, and a long-lasting relationship (Sung & Choi, 2014). The employees perceive that WTD and WHS are relevant and helpful for completing their tasks, which develops optimism and grateful feelings about their employer, which, in turn, leads to a strong bond and attachment toward the job and the firm. Employees work harder for these positive emotions and be more productive (Helm & Mark, 2007). Furthermore, the rich experience, skills, and capabilities will increase workforce adaptability to the evolving conditions and innovative thinking (Sitzmann & Weinhardt, 2019). A motivated workforce proactively engages with diverse stakeholders, including suppliers, thus positively contributing to the joint outcomes. Finally, WTD and WHS promote a sense of social responsibility toward the adoption of environmentally sustainable approaches. Hence, WTD and WHS investments confirm the RESInvest component of the firm and may send positive indications to the stakeholders, thus contributing to firm performance.

Similarly, reducing the environmental impact of operations will help firms achieve the triple bottom line, that is, profit, people, and planet (Gimenez et al., 2012; Singh et al., 2019). Tangible actions by firms to reduce their demand for natural resources and minimize their waste and pollutants directly impact their sustainable operations. These actions increase regulatory compliance and generate goodwill and brand equity (Yao et al., 2019). The firms, located in emerging economies and having a higher level of environmental and sustainable commitments, may acquire outsourcing contracts from international clients, thereby increasing the scale and scope of operations (Chițimiea et al., 2021).

Last but not the least, the investments in supplier development will help the manufacturing firms to focus on core competencies and timely delivery of quality products and services at competitive prices (Krause et al., 1998). Supplier development will lead to increased cooperation and commitment from suppliers thereby meeting the organization’s current and future needs and utlimatley to superior performance and competitive advantage (Dyer & Singh, 1998; Humphreys & Chan, 2004).

In summary, the four dimensions, including suppliers’ development, WTD, WHS, and environment-friendly operations, fall under the purview of RESInvest. Investments in each dimension signal diverse stakeholders (including suppliers, customers, employees, shareholders, and community) that the firm is committed to the triple bottom line. By investing in the four dimensions, a firm further signals that it will create a safe, hygienic, and conducive workplace for employees to be trained and developed to enhance their skillset and capabilities for effective engagement with suppliers to reduce the environmental impact of operations. This will lead to higher firm performance. We further extrapolate our choice of using signaling and stakeholder theories as a useful theoretical lens in this study, both for presenting hypotheses and explaining empirical results.

Signaling theory

Signaling theory addresses the problem of information asymmetry in the markets. The sender must decide whether and how to convey (or signal) information, while the receiver must decide how to interpret the message within the information received (Bergh et al., 2014; Elitzur & Gavious, 2003). Signals are often used to mitigate the information asymmetry on any issue, such as RI. Information asymmetry on RI could be related to ability, intention, or both (Elitzur & Gavious, 2003). Investments in certain dimensions, however, can be an effective tool to signal such responsiveness. The signals that communicate organizational characteristics, desirable or undesirable, are either accidentally conveyed or often noticed and interpreted by the receiver (Myers & Majluf, 1984). For instance, a firm’s investment in suppliers, health and safety, environmentally friendly operations, and workforce training and development convey information about the firm’s operations and/or innovation process and related ethics. A favorable interpretation enhances the goodwill and has a desirable impact on the firm performance. For example, eco-friendly packaging can signal environmentally friendly operations and an estimation for sustainable manufacturing practices.

Stakeholder Theory

Stakeholders are defined as “any group or individual who can affect or is affected by the achievement of the organization’s objectives” (Freeman et al., 2007, pp. 46). The stakeholder theory postulates that firms have explicit and/or implicit contracts with diverse stakeholders such as suppliers, customers, employees, and shareholders and are accountable for respecting all commitments (Freeman, 1984; Jones, 1995). A company’s reputation is built by honoring contracts, both explicit and implicit, which helps decide on the terms of trade it may negotiate with various stakeholders (Cornell & Shapiro, 1987).

A firm’s innovation (product/process) can produce externalities, such as workplace health or pollution, which can affect internal (e.g., employees) and external stakeholders (e.g., customers, suppliers, and regulators). In the context of RI, stakeholders expect investments in environment-friendly operations (e.g., reducing pollution and use of green technology), WTD (e.g., change management and upskilling), health and safety (e.g., working conditions and safety), and supplier development (e.g., knowledge sharing, technology support, and sharing resources). Well-managed expectations can send positive signals to stakeholders, which can positively impact the overall firm performance (Harrison et al., 2010). For instance, suppliers could be important partners in this endeavor, and their development can directly impact supplier sustainability, a signal that indicates RESInvest and provides a distinctive advantage to a firm (Khan et al., 2018).

Responsible Innovation (RI) and responsible investment (RESInvest)

The research on technology and science ethics, risk, and governance dates back several years (Jonas, 1984). So, RI is not a recent concern, but it continues to be an essential subject in research and innovation practice, with varying definitions depending on the time and location (Genus & Stirling, 2018; Stilgoe et al., 2013). RI advocates the idea that while using scientific research and technical innovations, actors should be held accountable for any negative implications on the people, planet, and society (Pandza & Ellwood, 2013). The players involved in technological innovation should act righteously by following all the regulatory and social rules, customs, and standards (Pandza & Ellwood, 2013).

Firms that focus on RI use creative frameworks to connect with their stakeholders (Malhotra et al., 2017), such as developing eco-friendly HRM methods (Singh et al., 2020). Stahl et al. (2017) argued that RI might help an organization succeed by boosting its corporate image, enhancing customer relationships, and improving staff well-being. They suggested that RI can be beneficial in areas such as healthcare, education, and public service. They also proposed three Ps, namely, purpose, process, and product, to structure the RI. The reason(s) for undertaking RI is referred to as the “purpose.” At the same time, “process” refers to all activities involved in achieving RI. Finally, “product” refers to the results of RI. Furthermore, according to Iatridis and Schroeder (2016), RI may be considered an essential part of other current organizational obligations, particularly as a continuation of the organization’s efforts on corporate social responsibility. RI is thus influenced by corporate ethical principles (Singh et al., 2019), knowledge management instruments (Santoro et al., 2019), and purposefully addressing the negative aspects of innovations (Malhotra & Van Alstyne, 2014).

For these reasons, Stilgoe et al. (2013) argued that RI can be employed to help scholars anticipate future effects and consequences of innovations, open up conversations for wider and inclusive dialogue on the subject concerning corporate and institutional responsibility to the society, motivate reflection on the inspirations for and possible implications of such research, and, in turn, use these to stimulate the responsive actions/processes that contribute to RI. For example, Koirala et al. (2018) used the RI framework to design and execute community energy storage (CES), easing the transition to a sustainable, dependable, inclusive, and inexpensive future energy system through coordination and interaction among CES actors and components.

In summary, RI is a proactive and collective approach to managing science and innovation to safeguard long-term interests (Stilgoe et al., 2013). Specifically, RI engages appropriate stakeholders to forestall future problems and develop joint learning and superior decision-making to overcome long-term socioecological challenges (Wickson & Carew, 2014). The long-term perspective is crucial as there is a delay among innovations and realizing their negative or positive effects on the socioeconomical dimensions (Owen et al., 2009). Therefore, the management should invest responsibly in innovations that reduce their adverse impacts, resulting in better technological prognostication (Deuten Rip & Jelsma, 1997), risk management techniques (Edelson, 2006), regulations (Rothwell, 1980; Voegtlin & Scherer, 2017), and key stakeholders management (Veronica et al., 2020). This study deals with the RESInvest made in key stakeholders, namely, suppliers (SD), employees (WTS, WTD), and customers (environmentally friendly operations), and is based on responsiveness dimension of ‘responsible innovations’ (RI).

Responsible investment and firm performance

In this study, the RESInvest comprises investments in at least three key stakeholders, namely, suppliers, employees, and customers. These stakeholders are the primary sources/enablers of innovations in terms of value creation, knowledge management, process improvements, capability building, sustainability, goodwill, and green operations (e.g., Sung & Choi, 2014; Kuzma et al., 2020); and firms must focus on these stakeholders.

Suppliers are a vital resource for any enterprise as they provide key materials and services essential for creating the enterprise’s products/services. The supplier base is as important as the enterprise’s own capabilities, directly impacting the quality and cost of the final product/services (Krause et al., 2000). When an enterprise discovers that its suppliers are underperforming, they may undertake supplier development initiatives to improve their skills/capabilities. Supplier development deals with a long-term collaborative effort between the purchasing business and its suppliers to improve their capabilities (quality, cost, delivery, flexibility, and technical) and drive continuous improvements (Watts & Hahn, 1993). Supplier development can lead to broadening of supplier’s capabilities and skills. When a supplier is willing to collaborate for innovation and receives support from the manufacturer, it not only contributes to their broad set of innovation resources, but the associated changes can also align with the manufacturers’ specific requirements, thus creating a win-win situation for both (Nieto & Santamaría, 2007). Furthermore, the supplier, due to the support of manufacturer, might achieve higher innovation capabilities (Carnabuci & Operti, 2013) that will also benefit the manufacturer. So, an investment in supplier development can signal a manufacturer’s higher capabilities to innovate, and also derive more benefits from a stronger association with the supplier.

Investing in supplier development, in terms of selection, evaluation, management, or overall involvement, positively impacts product development, operational efficiency, and financial performance (Srinivasan et al., 2011; Shi & Yu, 2013). Similarly Wagner (2010) suggested that managing good supplier relationships by sharing information helps in improving firm performance. Shi and Yu (2013) stated that supplier integration and close working relationships have financial advantages. Scholars have shown that investing in suppliers improves various financial performance measures, such as return on assets (Hitt et al., 2002), return on investment (Flynn et al., 2010), or the Sharpe ratio (Swink et al., 2010). Supplier development also results in supplier sustainability (Khan et al., 2018), which is much desired by international investors and customers (Wolf, 2014). Therefore, investment in supplier development can signal a strength in the relationship that can advantage manufacturer in many ways (such as more innovation, sustainability, superior firm performance).

Similarly, investing in WTD and WHS results in higher knowledge, skills, competencies, and employee satisfaction (Sung & Choi, 2014). Neely & Hii (1998) suggest that ideas generated by workers in the workplace are the foundation of innovation, so contributing to their skill development is likely to be advantageous. Employers rely on their staff to provide creative and innovative ideas, products, and services (Ahmed, 1998; Sousa, 2011). Hence, with a strong commitment to WTD and WHS, the company sends positive signals to the workforce, which can contribute to higher motivation, cost reduction, and improved work quality. As employees’ commitment levels improve, it positively impacts firm performance (Iles et al., 1990). Simultaneously, for the same reason, job retention levels improve, and workplace accidents/injuries decline (Helm & Mark, 2007). Therefore, investing in workforce training, health, and safety results in organizational resilience, workplace innovation bahavior and, ultimately, in increased competitive advantage and firm performance (Kabir et al., 2018; Sanders et al., 2010).

Similar to investing in workers’ health and safety, the impact of investments in sustainable and environment-friendly operations may have positive implications (Nakamura, 2011). A company’s concern for environmental issues positively influences its social valuation and economic performance (Gimenez et al., 2012), customer and shareholder trust (Nakamura, 2011), a competitive advantage (Chițimiea et al., 2021), and supplier sustainability performance (Khan et al., 2018). The investment in sustainable operations signals manufacturing firm’s concern for environment, end users, and overall society (Kleindorfer et al., 2005). All these can engender goodwill and trust among key stakeholders and society in general, which is a strong source of competitive advantage.

From this discussion, one can conclude that RESInvest in suppliers’ development, workforce training and development, workplace health and safety, and environment-friendly operations will directly impact firm performance by indicating its commitment to affirmative actions, thus generating goodwill among stakeholders. Therefore, we hypothesize as follows:

Hypothesis 1

Responsible investment has a positive influence on firm performance.

Responsible investment and innovation

Studies have provided empirical support to the association between product and process innovationFootnote 1 and various performance measures (e.g., Farooq et al., 2021; Hervas-Oliver et al., 2014). In this study, we argue that RESInvest can moderate this relationship.

Process innovation

A firm’s RESInvest may impact innovations and, thus, firm performance. Process innovation promotes organizational learning, improves product quality, and ultimately enhances firm performance (Piening & Salge, 2015). According to the literature, a RESInvest can act as a source of competitive advantage (e.g., Campbell et al., 2012; Li et al., 2007; Nanath & Pillai, 2017). When a firm has high RESInvest, it may deter competitors because RESInvest is a function of vision, core principles, and culture of the organization, thus making it inimitable. Signaling and stakeholder theories provide a theoretical base for the aforementioned moderating role of RESInvest. In addition, according to the stakeholder theory, a characteristic of the RESInvest is to honor the contracts with key stakeholders, which also contributes to the organizational performance (through loyalty, goodwill, trust, etc.). Firms investing in suppliers, employee training, health and safety, and environmentally friendly operations signal the firms’ socially responsible intent and motives to the market, thus helping achieve superior performance. The RESInvest will engage and empower suppliers and employees to be more creative and try new things thereby encouraging the process innovation.

Supplier networks can be a source of new knowledge and competitive advantage. They not only provide information on new technology, tools, and devices but also facilitate the adoption of new technology (Abd Rahman & Bennett, 2009). Often, the success of process innovation to achieve operational efficiency depends on the inputs from the main suppliers (Wagner & Bode, 2014). Ettlie & Reza (1992) argued that supplier networks can reduce the uncertainties emerging from new manufacturing systems and enhance the ability to capture value. Finally, close working relations with suppliers increase the sense of responsibility among partnering firms and decrease the design complexity and time required to alter the processes, thus influencing process innovation (Cusumano & Nobeoka, 1992). A supplier could also be seen as a cross-industry resource broker that can assist a manufacturing company in gaining access to invaluable resources to improve their process know-how. These firms bring fresh perspectives of improving the processes by sharing critical resources and cross-industry knowledge with the manufacturing firm, thereby impacting their process innovation and contributing to the firm performance (Hargadon, 1998).

Likewise, investments in WTD and WHS can also support the process innovation and enhance its outcome. With positive treatment of workforce, workers will be more contributive and receptive to new ideas being applied, institutionalized, and corporatized. Furthermore, it increases the tendency of risk-taking and experimenting with new ideas (Dewett, 2007) and creativity (Ma et al., 2017). WTD and WHS promote the adoption of new manufacturing techniques, managerial practices, techniques, and tools that are fundamental components of process innovation (Brem et al., 2016), which translate to operational efficiency and firm performance (Helm & Mark, 2007).

Finally, in today’s context, investments in environmentally friendly and sustainable operations also shape process innovation as firms are expected to modify their operations and prioritize recycling, reduce carbon emission, and reengineer polluting processes (Lado & Wilson, 1994). Consumers and regulatory pressures drive these initiatives; therefore, firms investing in sustainable operations earn goodwill, reputation, and price premium. This discussion shows that the influence of process innovation on firm performance is higher in manufacturing firms with higher RESInvest than those with lower RESInvest. Therefore, we hypothesize the following:

Hypothesis 2

Responsible investment positively moderates the effect of process innovation on firm performance.

Product innovation

Product innovation has been identified as a key driver of firm success in the management and strategy literature (Andries & Czarnitzki, 2014; Bayus, Erickson, & Jacobson, 2003; Nelson & Winter, 1982). Furthermore, studies have clearly outlined that product innovation enhances firms’ performance through various means, such as differentiating offering from the competitors (Lee et al., 2019), creating entry barriers for competitors (Rousseau et al., 2016), and streamlining and exploring newer markets (Masso & Vahter, 2008). We contend that the RESInvest in supplier development, WTD, WHS, and environment-friendly initiatives affect firms’ product innovation, thus leading to higher performance.

Petersen, Handfield, and Ragatz (2005) argued that including suppliers in discussions improves product creativity by reducing technical uncertainty. Supplier participation in product improvement activities contributes to a lesser time to market, lower development costs, and better quality of the new products (Primo & Amundson, 2002). Granovetter (1973) argued that investment in suppliers gives a diverse range of resources and talents that are advantageous for generating novel ideas. Furthermore, as an outsider, a supplier can boost the innovation-performance relationship of the manufacturing company by providing access to important data (such as early indications on new trends gained by supplying to other companies). Therefore, the right supplier selection would improve asset precision and capability compatibility, resulting in increased product offerings (Song & Benedetto, 2008) and it’s impact on firm performance.

WTD and WHS initiatives complement activities related to supplier engagement. Workforce training can enable knowledge attainment (Sung & Choi, 2014), which, in turn, provides opportunities to modify current knowledge and acquire new (Sung & Choi, 2014), thereby improving the firm offerings. WTD also results in higher learning and drives knowledge management capability that positively influences job effectiveness (Sitzmann & Weinhardt, 2019). Knowledge management capabilities promote internal information flows and encourage employees to take necessary actions for knowledge creation in the future, thereby contributing to new product offerings and/or improving product performance (Caloghirou et al., 2018). WHS increases employee engagement and facilitates a wide range of ideas and perspectives to resolve organizational issues and determine how to improve organizational effectiveness (Grawitch et al., 2006). Evidence suggests that cooperation among various departments significantly improves new product development (McDonough & Griffin, 2000). Furthermore, employee trust and commitment reduce uncertainty, restrict opportunism, and positively impact new product development (Sivadas & Dwyer, 2000).

Investments in sustainable and environmentally friendly activities help firms reduce product-related risks and promote product sustainability (Dyllick & Rost, 2017). Stakeholders across the value chain now expect environmentally friendly products/services, so companies recognize such investments to gain competitive advantage and achieve higher profitability (Gimenez et al., 2012). Furthermore, environment-friendly operations are positively associated with introducing new products, R&D projects, and patent application (Shu et al., 2019). Environmental sustainability leads to quality enhancement (Pil & Rothenberg, 2003), new market opportunities, product price and profit increase (Rao & Holt, 2005), and superior market and financial performance (Klassen & McLaughlin, 1996).

RESInvest prevents competitors from replicating their performance by increasing product creativity and quality (Primo & Amundson, 2002), product offerings (Song & Benedetto, 2008), and raising the costs of knowledge transfer, thereby reducing the risk of imitations (Caloghirou et al., 2018; Gimenez et al., 2012; Sung & Choi, 2014). Firms with a high RESInvest benefit from continual external information flows, which allow them to enhance their innovation practices and remain ahead of competition (Beer, 2015; Liker & Choi, 2004). Hence, organizations with a high RESInvest are more likely to create unique relationships with suppliers, employees, and firm-specific customers, making it difficult for competitors to copy. RESInvest thus help send signals to all the key stakeholders about its ability and intention to develop strong network effects that will further its product innovation and firm performance. Therefore, we posit that the influence of product innovation on firm performance is higher in the manufacturing firms with higher levels of RESInvest than in those with lower levels of RESInvest. The hypothesis is presented as follows:

Hypothesis 3

Responsible investment positively moderates the effect of product innovation on firm performance.

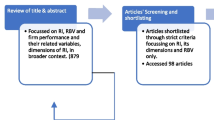

Figure 1 shows the theoretical model proposed in this study.

Research methodology

The context

Asian countries are attracting the academic and practitioners’ attention worldwide because of their emergence as prominent player in the world economy and the growing impact on the global economy (Sardana & Zhu, 2017). Management research in the Asian context adds to the local and global knowledge and, thus, contributes to global “scholarly conversations,” theory development, and empirical testing (Meyer, 2006; Tsui, 2004).

The manufacturing sector is an important sector in Asian countries. Many Asian countries are among the most preferred destinations for outsourcing (Falk & Wolfmayr, 2008), original equipment manufacturing (Wonglimpiyarat, 2018), and raw material supplies (Ruamsook et al., 2009) for the manufacturers in developed countries. Although Asian countries are adept at providing both services and goods, the latter is relatively preferred owing to the recent advancements in the manufacturing sector. Asian manufacturers produce goods of international quality and are less expensive than those produced in other countries (Terziovski, 2010). Unsurprisingly, manufacturing contributes significantly to the GDP, employment, income distribution, poverty reduction, exports, and entrepreneurship in most Asian countries (Tybout, 2000; Jomo, 2003). For example, the manufacturing sector in India employs more than 40 million people (CMIE, 2020). The governments in the Asian countries have realized the importance of the manufacturing sector and are actively promoting it. For example, “Make in India” and “Made in China (MIC) -2025” are two projects promoting the manufacturing sector in India and China, respectively (Zhu et al., 2020).

Although the Asian manufacturing sector has a significant economic value, the environmental and social impact, and the trade-offs cannot be ignored. Wang et al. (2019) suggested that researchers should focus on Asian countries’ responsible consumption and production issues. Although policymakers are promoting environmental initiatives and regulations across Asian manufacturing firms to minimize waste, combat air pollution, and promote renewable energy, the results do not match the expectations (Tseng et al., 2013). Similar to many concepts, the Western replication of sustainability is unsuccessful, and there has been a growing demand for more indigenous, context-specific research in Asian management research to make it more useful (Sardana et al., 2020). This study answers this call for further dialogue in this topical area of RI by investigating the role of RESInvest in innovation and firm performance in the Asian manufacturing sector.

Research data

In this study, a sample of 297 manufacturing organizations from Asia-Pacific countries was used, namely, Australia (25), Korea (77), Taiwan (37), China (30), India (55), and Vietnam (73). The sample was balanced among the three developed countries and the three emerging countries, with a sample representation of 46.80% and 53.20%, respectively. The data were collected from middle to top management executives experienced in manufacturing companies. Using the key informant technique, one survey form is filled by one manufacturing organization (Fugate et al., 2009; Mitchell, 1994). The samples represented manufacturing sectors such as electronics, fabrication and processing, food and kindred products, paper, petroleum, chemical, primary metal, textile, apparel, rubber, transport, and industrial machinery. Based on the literature review, demographic variables such as the experience of respondents, firm size (number of employees), and the types of industries may have a confounding influence on the study results; therefore, we used them as a control (Table 1). The results showed that none of the controls contributes to the model variance. This result confirms that the findings of the study are free of demographic biases.

Measures of validity and reliability

The survey was adapted from the Global Manufacturing Research Group (GMRG). The GMRG is a renowned research group that launched its detailed survey instrument to collect perception data on many constructs related to manufacturing operations. This survey, over past three decades, has been conducted by research scholars from several countries periodically every few years. In this study, the data used the fifth version of the survey, a well-established instrument with reliable and validated measures. The instruments in the survey are now in a very mature stage and stable. Several scholarly publications have used the fifth version of the GMRG survey, such as Sardana et al. (2016) Sardana et al. (2020), which confirms the content validity of the measures.

We used SmartPLS3 to develop our integrated structural equation model. As recommended by Hair et al. (2014), the Partial Least Sqaure-Structural Equation Modeling (PLS-SEM) was used because of the formative nature of the constructs and the exploratory nature of this study’s hypothesized structural relations. The PLS-SEM follows a nonparametric approach, which is free of the data normality assumptions. The PLS-SEM is also appropriate for sample sizes that are too small for Covariance bases SEM (CB-SEM) but sufficiently large to ensure generalizability of the research findings. The PLS algorithm was used to test the measurement model (Table 2) and the model fit analysis was performed. The model was found to fit with indices (χ^2 = 350.97, NFI = 0.827, SRMR = 0.177) consistent with the threshold (Hair et al., 2014).

The average variance extracted (AVE), composite reliability (CR), and reliability coefficient alpha of the constructs product innovation (0.797, 0.940, 0.915), RESInvest (0.556, 0.833, 0.735), and firm performance (0.714, 0.882, 0.799) were consistent with the threshold (> 0.49, > 0.7, > 0.7) suggested by Hair et al. (2014). This confirmed the convergent validity of the constructs. The square root of the AVE of each construct was above the bi-variate correlations with other constructs, and this confirmed the discriminant validity (Table 3). The measures were free of multi-collinearity because the variance inflation factor (VIF) for all items were less or close to 3 (threshold < 5). The loadings of all items of each construct were between 0.7 and 0.9. We captured the process innovation as the percentage of major process changes in the last financial year.

Common method bias

The common method bias is not unusual in the research, with the same individual responding to the predictor and predicted variables. In this study, the dependent variable data were collected from the books of accounts of the manufacturing firms. The overall firm performance was captured using three parameters, namely, % change in total sales of goods and services, % change in profitability, and % change in the market share in the last fiscal year (Table 4). The % changes ranged from “reduced more than 25%” to “increased more than 25%.” We coded these responses on a scale of 1 to 7. This is a standard practice in the data preparation of the GMRG surveys. The details of GMRG surveys have been discussed earlier in the scale measures section. We developed a scale for measuring the overall firm performance as a ready reference (Table 4).

The description of the data collection method for the dependent variable shows that the study is free of common method bias. The dependent variable data are not perception data but the real % change in the firm’s performance over a year. The independent data were the perception data from the key informants and top executives of the manufacturing organizations.

To follow the standard statistical practices, we also applied the remedies suggested by Podsakoff et al., (2003) to ensure that the study is free of undesired biases. The % variance explained by the single forced factor in the dimension reduction method was 39.48%, significantly lesser than the threshold of 50%. The questionnaire instrument was divided into three documents. The document “cover page” contained the questions on demographics. The document “core module” included the scale of RESInvest. While the document “innovation module” had questions related to product and process innovation. This division helped break the monotony of the responders. We used the fifth version of the GMRG survey, which has been refined and improved over two decades by hundreds of reputed scholars across the globe (Sardana et al., 2016). The survey questions were simple, straightforward, and precise, which did not cause any significant difficulty to the respondents while answering the questions. Based on our statistical and process remedies, we conclude that the research is free of biases.

Empirical analysis

The path model of SmartPLS3 was used to test the hypotheses. As the path and measurement model was a single integrated SEM model, the model fit indices were the same and presented in the earlier section. A bias-corrected bootstrap method with 500 iterations was used to determine the results of the path model (Table 5). The RESInvest (β = 0.256, T = 4.327, p < 0.001) showed a positive association with the firm performance; therefore, the hypothesis H1 found support (Fig. 2).

The moderating effect of the RESInvest on the effect of process innovation (β = 0.145, T = 2.506, p < 0.05) and that of product innovation (β = 0.086, T = 1.993, p < 0.05) on firm performance were positive and significant; therefore, hypotheses H2 and H3 are supported. The support of H2 and H3 indicates that the firms having higher RESInvest showed a higher positive association between the process innovation and firm performance and product innovation and firm performance, respectively (Fig. 3A and B).

Post-hoc analysis

We analyzed our model at different levels of the moderator RESInvest. For this, we extracted the moderation plots from SmartPLS version 3 (e.g., Arayankalam et al., 2021). The plots shows the influence of innovation on performance at multiple levels. The influence of process and product innovation on firm performance is plotted at three levels of responsible investment namely mean RESInvest, minus one sigma and plus one sigma above the mean. Figure 4 shows that as RESInvest increases, the effect of process innovation and product innovation on firm performance increases. The influence of product and process innovation on firm performance is steeper at higher levels of RESInvests vis-à-vis the lower levels. This pattern is consistent in both the graphs. Graphical analysis ensures the statistical robustness of our hypothesized results.

Discussion

RESInvest is essential to showcase to the stakeholders that the firm has invested responsibly to undertake the innovation. This is an important dimension that complements the idea of RI per se (Kuzma & Roberts, 2018). RI may directly contribute to the benefit of the planet, people, and profits (Scherer & Voegtlin, 2020; Voegtlin & Scherer, 2017), but if the actions leading to it are not perceived to be responsible by the stakeholders, then its benefits are probably adversely affected (Lubberink et al., 2017). The empirical research advances this thought and provides insights on the moderating effect of RESInvest between innovation, product and process, and firm performance. We observed that the moderating influence of RESInvest on the effect of process innovation on performance (β = 0.145*) was higher than that of product innovation (β = 0.086*). This shows that the effect of process innovation on performance is significantly higher than that of product innovation in manufacturing organizations with higher RESInvest. The rate of change in the firm performance (path coefficient) with that of the change in RESInvest for process innovation is higher than that of product innovation.

As part of the RESInvest, we consider those aspects that directly contribute to the operations and thus influence the innovation dimension. In this study, the aspects considered for RESInvest are supplier development, WHS, WDT, and environment-friendly operations. It is interesting to report that RESInvest directly and significantly influenced firm performance positively in manufacturing firms in the Asia-Pacific region. This is a fascinating outcome as manufacturing firms in several Asian countries have often been criticized for their apathy for the environment and having poor working conditions, even disregarding employee development and training (Soundararajan et al., 2017). This finding will signal and motivate other manufacturing firms in the region that RESInvest contributes to the firm performance.

This study also confirms that innovation, whether product or process, positively impacts firm performance when RESInvest is considered. Firms that care for the environment, well-being, safety, and workforce development by investing in these areas will enhance the desired impact of their innovation on performance. This could be due to the direct positive effects, such as employee motivation, commitment, innovative capability, and knowledge (Abd Rahman & Bennett, 2009; Caloghirou et al., 2018; Iles et al., 1990; Song & Benedetto, 2008; Sung & Choi, 2014), as discussed earlier. An indirect effect would be the development of an overall perception among stakeholders that the innovation by the firm contributes to the performance and is conducted responsibly. This is a significant value added to the firm’s perception among stakeholders.

Theoretical implications

The consideration of RESInvest as a moderator of innovation and firm performance is novel from the scholarly perspective. It brings a more holistic consideration to the discussion of RI. Following the approach of this study, scholars are motivated to broaden their perspective on RI, and empirically unpack its four constituents and their influence, direct and/or indirect, on firm performance. In this paper, we attempted to do the same with ‘responsiveness’ dimension of RI (Stilgoe et al., 2013). Responsiveness dimension within RI must also include affirmative actions that can influence innovation within the firm. These affirmative actions demand investments that are responsibly motivated. And, by bringing those affirmative actions into the purview of “responsible” investments (RESInvest), we sought to draw its influence on association between innovation and firm performance. These responsible invesments could be in worker’s development, health and safety, supplier development and environmental sustainability. This study, through the use of RESInvest in empirical analysis, creates adjacency between the stakeholder theory and the idea of responsible innovation, thereby enriching both of them. This is our first theoretical contribution and results in this paper showcasing the increased impact of innovation on performance due to RESInvest.

The final theoretical contribution of the study is the application of signaling theory in the growing area of research on responsible innovation. RESInvest supporting affirmative actions benefitting diverse stakeholders has the ability to signal to the market, institutions, and stakeholders that the firm is competitively positioned. A robust and positive reinforcement on innovation and performance link moderated by RESInvest further boosts the message of firm’s competence. And, as RESInvest significantly contributes to the responsiveness dimension of innovation, it signals that the innovations are responsible innovations. In addition, it can also act as an insurance-like protection for the relationship-based intangible assets of a company (Godfrey, 2005) or as a risk-mitigation strategy (Ioannou & Serafeim, 2015). Therefore, this paper contributes to the idea that firms can use RESInvest as signal to improve the perception of RI, an aspect that scholars can investigate in future studies.

Managerial implications

The attention to RI is topical (Stilgoe et al., 2013). While scholars have focused on the impact of innovation on firms’ financial performance, little attention has been paid on how to nurture responsiveness characteristics in innovation being pursued. Managerial focus has been on the the impact of innovation on the planet and people (Singh et al., 2020). This paper provides a complementary perspective to this by unpacking responsiveness in RI as managerial decision making and actions. We suggest that managers can make responsible investments that will support innovation and performance linakges. For the purposes of this study, responsible investments are linked to supplier development, workforce training and development, workforce health and safety, and environmental concerns.

Innovation and performance has concerned all types of organizations (government, for-profit, not-for-profit) and that the linkages can be improved by making investments responsibly in the mentioned areas is likely to be of significant managerial interest. The finding that RESInvest significantly enhances the impact of innovation, product and process, on firm performance is of value to the senior leadership team. The senior management team is likely to organize their entities likewise and if they recognize the value of RESInvest, they are more likely to make such investments (Singh et al., 2020). The study demonstrates that RESInvest comprising of supplier development, workforce training and development, workforce health and safety, and environmental concerns positively enhances innovation and firm performance association. It therefore gives multiple advantagies to a firm, such as higher performance, fulfilling triple bottom line goals, and a general perception of being responsible. Hence, the sudy unambiguously conveys strategic importance of RESInvest to the leadership team. The leadership team in a business, thus, can make actionable choices in these directions and this will have implication on the organization.

While several Asia-Pacific countries are strong players in the global value chain of manufacturing and their economies dependent on this sector, so the results of this research has significant implications for them. This is particularly important as awareness and concern for ‘sustainability’ practices rise globally, but business practices in several Asia-Pacific countries are perceived to be lagging in this front. The findings that RESInvest is an important contributor to firm performance in the manufacturing context of Asia-Pacific is reassuring to managers to pay attention to responsible innovation that further sustaninability practices. At the same time, the empirical data provides policymakers in the Asia-Pacific region with an affirmative answer to their perusal of domestic regulatory measures and international accords that seek to raise bars against labor norms, health and safety, environment, and sustainability practices.

Limitations and directions of future research

This empirical investigation, notwithstanding the aforementioned contributions, also has some shortcomings and limitations. The sample of manufacturing companies represents several countries, which helps in generalization; however, deeper and more interesting specific country and/or sub-industry insights can be developed by replicating the study and increasing the number of firms representing a country or a sub-industry. The findings of this study are limited to only manufacturing firms, while there is a broader part of economies shared by service firms. Although this is a limitation for the current study, it is an opportunity for future research. This study is focused on the Asia-Pacific region, which limits generalization; a larger and diverse sample could help further generalization and more nuanced findings on contextual dimensions (e.g., developed countries versus emerging countries). Scholars can focus on other activities, such as community involvement, within the scope that can be deemed responsible and contribute to innovation. Furthermore, a few variables may be triggered first before affecting the firm performance, such as goodwill or supplier loyalty. Future research may also consider these mediating/moderating variables for increasing the prediction power of the model. Likewise, future works can investigate if RESInvest improves the perception of RI. Finally, understanding the organizational and contextual antecedents to RESInvest (such as the number of independent directors, foreign partnerships, or export orientation) can also be very useful in developing an aggregate picture.

Notes

Product innovation is a new or substantially enhanced product or services, such as substantial changes in technical requirements, subassemblies, product software, convenience, or other functionality, whereas process innovation is the introduction of a new or substantially enhanced manufacturing or delivery method, including major improvements in techniques, tools, and/or software (OECD, 2005).

References

Abd Rahman, A., & Bennett, D. (2009). Advanced manufacturing technology adoption in developing countries: The role of buyer-supplier relationships. Journal of Manufacturing Technology Management, 20(8), 1099–1118.

Aghion, P., Van Reenen, J., & Zingales, L. (2013). Innovation and institutional ownership. American Economic Review, 103(1), 277–304.

Ahmed, P. K. (1998). Culture and climate for innovation. European Journal of Innovation Management, 1(1), 3043.

Andries, P., & Czarnitzki, D. (2014). Small firm innovation performance and employee involvement. Small business economics, 43(1), 21–38.

Arayankalam, J., Khan, A., & Krishnan, S. (2021). How to deal with corruption? Examining the roles of e-government maturity, government administrative effectiveness, and virtual social networks diffusion. International Journal of Information Management, 58, 102203.

Atz, U., Van Holt, T., Douglas, E., & Whelan, T. (2021). The return on sustainability investment (ROSI): Monetizing financial benefits of sustainability actions in companies. Sustainable consumption and production, volume II (pp. 303–354). Cham: Palgrave Macmillan.

Bayus, B. L., Erickson, G., & Jacobson, R. (2003). The financial rewards of new product introductions in the personal computer industry. Management Science, 49(2), 197–210.

Beer, M. (2015). You can’t engage employees by copying how other companies do it.Harvard Business Review. https://hbr.org/2015/11/you-cant-engage-employees-by-copying-how-other-companies-do-it.

Bergh, D. D., Connelly, B. L., Ketchen Jr, D. J., & Shannon, L. M. (2014). Signalling theory and equilibrium in strategic management research: An assessment and a research agenda. Journal of Management Studies, 51(8), 1334–1360.

Brem, A., Nylund, P. A., & Schuster, G. (2016). Innovation and de facto standardization: The influence of dominant design on innovative performance, radical innovation, and process innovation. Technovation, 50, 79–88.

Carnabuci, G., & Operti, E. (2013). Where do firms’ recombinant capabilities come from? Intraorganizational networks, knowledge, and firms’ ability to innovate through technological recombination. Strategic management journal, 34(13), 1591–1613.

Caloghirou, Y., Giotopoulos, I., Korra, E., & Tsakanikas, A. (2018). How do employee training and knowledge stocks affect product innovation? Economics of Innovation and New Technology, 27(4), 343–360.

Campbell, B. A., Coff, R., & Kryscynski, D. (2012). Rethinking sustained competitive advantage from human capital. Academy of Management Review, 37(3), 376–395.

Chițimiea, A., Minciu, M., Manta, A. M., Ciocoiu, C. N., & Veith, C. (2021). The drivers of Green Investment: A bibliometric and systematic review. Sustainability, 13(6), 3507.

CIME (2020). Accessed on 18 may 2021 https://ceda.ashoka.edu.in/ceda-cmie-bulletin-manufacturing-employment-halves-in-5-years/

Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance.Financial management,5–14.

Cusumano, M. A., & Nobeoka, K. (1992). Strategy, structure and performance in product development: Observations from the auto industry. Research Policy, 21(3), 265–293.

De Hoop, E., Pols, A., & Romijn, H. (2016). Limits to responsible innovation. Journal of Responsible Innovation, 3(2), 110–134.

D’Este, P., Iammarino, S., Savona, M., & von Tunzelmann, N. (2012). What hampers innovation? Revealed barriers versus deterring barriers. Research policy, 41(2), 482–488.

Deuten, J. J., Rip, A., & Jelsma, J. (1997). Societal embedding and product creation management. Technology Analysis & Strategic Management, 9(2), 131–148.

Dewett, T. (2007). Linking intrinsic motivation, risk taking, and employee creativity in an R&D environment. R&D Management, 37(3), 197–208.

Dyer, J. H., & Singh, H. 1998. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Academy of management review, 23(4), 660–679.

Dyllick, T., & Rost, Z. (2017). Towards true product sustainability. Journal of Cleaner Production, 162, 346–360.

Edelson, D. C. (2006). Balancing innovation and risk.Educational design research,100–106.

Elitzur, R., & Gavious, A. (2003). Contracting, signaling, and moral hazard: A model of entrepreneurs,‘angels,’and venture capitalists. Journal of Business Venturing, 18(6), 709–725.

Ettlie, J. E., & Reza, E. M. (1992). Organizational integration and process innovation. Academy of Management Journal, 35(4), 795–827.

Falk, M., & Wolfmayr, Y. (2008). Services and materials outsourcing to low-wage countries and employment: Empirical evidence from EU countries. Structural Change and Economic Dynamics, 19(1), 38–52.

Farooq, R., Vij, S., & Kaur, J. (2021). Innovation orientation and its relationship with business performance: Moderating role of firm size. Measuring Business Excellence. https://doi.org/10.1108/MBE-08-2020-0117.

Flynn, B. B., Huo, B., & Zhao, X. (2010). The impact of supply chain integration on performance: A contingency and configuration approach. Journal of Operations Management, 28(1), 58–71.

Fugate, B. S., Stank, T. P., & Mentzer, J. T. (2009). Linking improved knowledge management to operational and organizational performance. Journal of Operations Management, 27(3), 247–264.

Freeman, R. E. (1984). “Strategic Management: A Stakeholder Approach”, Advances in Strategic Management. Boston, MA: Pitman 1984.

Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., & De Colle, S. (2007). Stakeholder theory: The state of the art. New York: Cambridge University Press.

Friedman, M. (2007). The social responsibility of business is to increase its profits. Corporate ethics and corporate governance (pp. 173–178). Berlin, Heidelberg: Springer.

Genus, A., & Stirling, A. (2018). Collingridge and the dilemma of control: Towards responsible and accountable innovation. Research Policy, 47(1), 61–69.

Gimenez, C., Sierra, V., & Rodon, J. (2012). Sustainable operations: Their impact on the triple bottom line. International Journal of Production Economics, 140(1), 149–159.

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4): 777–798. https://doi.org/10.5465/amr. 2005.18378878

Granovetter, M. S. (1973). The strength of weak ties. American Journal of Sociology, 78(13), 1360–1380.

Grawitch, M. J., Gottschalk, M., & Munz, D. C. (2006). The path to a healthy workplace: A critical review linking healthy workplace practices, employee wellbeing, and organizational improvements. Consulting Psychology Journal: Practice and Research, 58(3), 129.

Grossman, R., & Burke-Smalley, L. A. (2018). Context-dependent accountability strategies to improve the transfer of training: A proposed theoretical model and research propositions. Human Resource Management Review, 28(2), 234–247.

Gubbins, C., Garavan, T. N., Hogan, C., & Woodlock, M. (2006). Enhancing the Role of the HRD Function: The Case of a Health Services Organisation.Irish Journal of Management, 27(1).

Hair, J. F. Jr., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European business review, 26(2), 106–121.

Hargadon, A. B. (1998). Firms as knowledge brokers: Lessons in pursuing continuous innovation. California Management Review, 40(3), 209–227.

Harrison, J. S., Bosse, D. A., & Phillips, R. A. (2010). Managing for stakeholders, stakeholder utility functions, and competitive advantage. Strategic management journal, 31(1), 58–74.

Helm, R., & Mark, A. (2007). Implications from cue utilization theory and signalling theory for firm reputation and the marketing of new products. International Journal of Product Development, 4(3–4), 396–411.

Hervas-Oliver, J. L., Sempere-Ripoll, F., & Boronat-Moll, C. (2014). Process innovation strategy in SMEs, organizational innovation and performance: A misleading debate? Small Business Economics, 43(4), 873–886.

Hitt, L. M., Wu, D. J., & Zhou, X. (2002). Investment in enterprise resource planning: Business impact and productivity measures. Journal of Management Information Systems, 19(1), 71–98.

Humphreys, P. K., Li, W. L., & Chan, L. Y. (2004). The impact of supplier development on buyer–supplier performance. Omega, 32(2), 131–143.

Iatridis, K., & Schroeder, D. (2016).Responsible research and innovation in industry.

Iles, P., Mabey, C., & Robertson, I. (1990). HRM practices and employee commitment: Possibilities, pitfalls and paradoxes. British Journal of Management, 1(3), 147–157.

Ioannou, I., & Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strategic Management Journal, 36(7), 1053–1081.

Jomo, K. S. (2003). Manufacturing competitiveness in Asia. UK: Taylor & Francis.

Jonas, H. (1984). The imperative of responsibility. In search of an ethics for the technological age. Chicago: Chicago University Press.

Jones, T. M. (1995). Instrumental stakeholder theory: A synthesis of ethics and economics. Academy of management review, 20(2), 404–437.

Kabir, Q. S., Watson, K., & Somaratna, T. (2018). Workplace safety events and firm performance. Journal of Manufacturing Technology Management, 29(1), 104–120.

Khan, S. A., Kusi-Sarpong, S., Arhin, F. K., & Kusi-Sarpong, H. (2018). Supplier sustainability performance evaluation and selection: A framework and methodology. Journal of Cleaner Production, 205, 964–979.

Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management science, 42(8), 1199–1214.

Kleindorfer, P. R., Singhal, K., & Van Wassenhove, L. N. (2005). Sustainable operations management. Production and operations management, 14(4), 482–492.

Koirala, B. P., van Oost, E., & van der Windt, H. (2018). Community energy storage: A responsible innovation towards a sustainable energy system? Applied energy, 231, 570–585.

Krause, D. R., Handfield, R. B., & Scannell, T. V. (1998). An empirical investigation of supplier development: Reactive and strategic processes. Journal of operations management, 17(1), 39–58.

Krause, D. R., Scannell, T. V., & Calantone, R. J. (2000). A structural analysis of the effectiveness of buying firms’ strategies to improve supplier performance. Decision sciences, 31(1), 33–55.

Kuzma, E., Padilha, L. S., Sehnem, S., Julkovski, D. J., & Roman, D. J. (2020). The relationship between innovation and sustainability: A meta-analytic study. Journal of Cleaner Production, 259, 120745.

Kuzma, J., & Roberts, P. (2018). Cataloguing the barriers facing RRI in innovation pathways: A response to the dilemma of societal alignment. Journal of Responsible Innovation, 5(3), 338–346.

Lado, A. A., & Wilson, M. C. (1994). Human resource systems and sustained competitive advantage: A competency-based perspective. Academy of management review, 19(4), 699–727.

Lee, R., Lee, J. H., & Garrett, T. C. (2019). Synergy effects of innovation on firm performance. Journal of Business Research, 99, 507–515.

Li, W., Humphreys, P. K., Yeung, A. C., & Cheng, T. E. (2007). The impact of specific supplier development efforts on buyer competitive advantage: An empirical model. International Journal of Production Economics, 106(1), 230–247.

Liker, J. K., & Choi, T. Y. (2004). Building deep supplier relationships. Harvard business review, 82(12), 104–113.

Long, T. B., & van Waes, A. (2021). When bike sharing business models go bad: Incorporating responsibility into business model innovation. Journal of Cleaner Production, 297, 126679.

Lubberink, R., Blok, V., Van Ophem, J., & Omta, O. (2017). Lessons for responsible innovation in the business context: A systematic literature review of responsible, social and sustainable innovation practices. Sustainability, 9(5), 721.

Ma, Z., Long, L., Zhang, Y., Zhang, J., & Lam, C. K. (2017). Why do high-performance human resource practices matter for team creativity? The mediating role of collective efficacy and knowledge sharing. Asia Pacific Journal of Management, 34(3), 565–586.

Madrid-Guijarro, A., Garcia, D., & Van Auken, H. (2009). Barriers to innovation among spanish manufacturing SMEs. Journal of small business management, 47(4), 465–488.

Malhotra, A., & Van Alstyne, M. (2014). The dark side of the sharing economy… and how to lighten it. Communications of the ACM, 57(11), 24–27.

Malhotra, A., Majchrzak, A., & Niemiec, R. M. (2017). Using public crowds for open strategy formulation: Mitigating the risks of knowledge gaps. Long Range Planning, 50(3), 397–410.

Masso, J., & Vahter, P. (2008). Technological innovation and productivity in late-transition Estonia: Econometric evidence from innovation surveys. The European Journal of Development Research, 20(2), 240–261.

McDonough, E. F., & Griffin, A. (2000). Creating systemic capability for consistent high performance new product development. New Product Development and Production Networks (pp. 441–458). Berlin, Heidelberg: Springer.

Meyer, K. E. (2006). Asian management research needs more self-confidence. Asia Pacific journal of management, 23(2), 119–137.

Mitchell, V. W. (1994). Using industrial key informants: Some guidelines. Market Research Society Journal, 36(2), 1–5.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Nakamura, E. (2011). Does environmental investment really contribute to firm performance? An empirical analysis using japanese firms. Eurasian Business Review, 1(2), 91–111.

Nanath, K., & Pillai, R. R. (2017). The influence of green is practices on competitive advantage: Mediation role of green innovation performance. Information Systems Management, 34(1), 3–19.

Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Cambridge, MA: Harvard University Press.

Neely, A., & Hii, J. (1998). Innovation and business performance: a literature review. The Judge Institute of Management Studies, University of Cambridge, 0–65.

Nieto, M. J., & Santamaría, L. (2007). The importance of diverse collaborative networks for the novelty of product innovation. Technovation, 27(6–7), 367–377.

Owen, R., Baxter, D., Maynard, T., & Depledge, M. (2009). Beyond regulation: Risk pricing and responsible innovation. Environmental Science & Technology, 43(14), 6902–6906.

Owen, R., Macnaghten, P., & Stilgoe, J. (2020). Responsible research and innovation: From science in society to science for society, with society. Emerging Technologies: Ethics, Law and Governance (pp. 117–126). Routledge.

Pandza, K., & Ellwood, P. (2013). Strategic and ethical foundations for responsible innovation. Research Policy, 42(5), 1112–1125.

Petersen, K. J., Handfield, R. B., & Ragatz, G. L. (2005). Supplier integration into new product development: Coordinating product, process and supply chain design. Journal of operations management, 23(3–4), 371–388.

Piening, E. P., & Salge, T. O. (2015). Understanding the antecedents, contingencies, and performance implications of process innovation: A dynamic capabilities perspective. Journal of Product Innovation Management, 32(1), 80–97.

Pil, F. K., & Rothenberg, S. (2003). Environmental performance as a driver of superior quality. Production and Operations Management, 12(3), 404–415.

Podsakoff, P. M., MacKenzie, S. B., Jeong-Yeon, L., & Podsakoff, N. P. 2003.“Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies.”Journal of Applied Psychology88:879–903.

Primo, M. A., & Amundson, S. D. (2002). An exploratory study of the effects of supplier relationships on new product development outcomes. Journal of Operations management, 20(1), 33–52.

Rao, P., & Holt, D. (2005). Do green supply chains lead to competitiveness and economic performance? International journal of operations & production management, 25(9), 898–916.

Rousseau, M. B., Mathias, B. D., Madden, L. T., & Crook, T. R. (2016). Innovation, firm performance, and appropriation: A meta-analysis. International Journal of Innovation Management, 20(03), 1650033.

Rothwell, R. (1980). The impact of regulation on innovation: Some US data. Technological Forecasting and Social Change, 17(1), 7–34.

Ruamsook, K., Russell, D. M., & Thomchick, E. A. (2009). Sourcing from low-cost countries. The International Journal of Logistics Management, 20(1), 79–96.

Sanders, K., Moorkamp, M., Torka, N., Groeneveld, S., & Groenevled, C. (2010). How to Support Innovative Behaviour? The Role of LMX and Satisfaction with HR Practices, Technology and Investment, 1: 59–68.

Santoro, G., Thrassou, A., Bresciani, S., & Del Giudice, M. (2019). Do knowledge management and dynamic capabilities affect ambidextrous entrepreneurial intensity and firms’ performance?. IEEE Transactions on Engineering Management, 68(2): 378–386.

Sardana, D., & Zhu, Y. (2017). Conducting business in China and India: A comparative and contextual analysis. UK: Palgrave Macmillan.

Sardana, D., Gupta, N., Kumar, V., & Terziovski, M. (2020). CSR ‘sustainability’practices and firm performance in an emerging economy. Journal of Cleaner Production, 258, 120766.

Sardana, D., Terziovski, M., & Gupta, N. (2016). The impact of strategic alignment and responsiveness to market on manufacturing firm’s performance. International Journal of Production Economics, 177, 131–138.

Scherer, A. G., & Voegtlin, C. (2020). Corporate governance for responsible innovation: Approaches to corporate governance and their implications for sustainable development. Academy of Management Perspectives, 34(2), 182–208.

Shahbaz, M., Nasreen, S., Abbas, F., & Anis, O. (2015). Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Economics, 51, 275–287.

Shi, M., & Yu, W. (2013). Supply chain management and financial performance: Literature review and future directions. International Journal of Operations & Production Management, 33(10), 1283–1317.

Shin, N., Park, S. H., & Park, S. (2019). Partnership-based supply chain collaboration: Impact on commitment, innovation, and firm performance. Sustainability, 11(2), 449.

Shu, C., Zhao, M., Liu, J., & Lindsay, W. (2019). Why firms go green and how green impacts financial and innovation performance differently: An awareness-motivation-capability perspective. Asia Pacific Journal of Management, 37(3), 795–821.

Singh, S. K., Chen, J., Del Giudice, M., & El-Kassar, A. N. (2019). Environmental ethics, environmental performance, and competitive advantage: Role of environmental training. Technological Forecasting and Social Change, 146, 203–211.

Singh, S. K., Del Giudice, M., Chierici, R., & Graziano, D. (2020). Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technological Forecasting and Social Change, 150, 119762.

Sitzmann, T., & Weinhardt, J. M. (2019). Approaching evaluation from a multilevel perspective: A comprehensive analysis of the indicators of training effectiveness. Human Resource Management Review, 29(2), 253–269.

Sivadas, E., & Dwyer, F. R. (2000). An examination of organizational factors influencing new product success in internal and alliance-based processes. Journal of marketing, 64(1), 31–49.

Song, M., & Di Benedetto, C. A. (2008). Supplier’s involvement and success of radical new product development in new ventures. Journal of operations management, 26(1), 1–22.

Sousa, C. M., & Coelho, F. (2011).European Journal of Marketing, 45(7/8):1029–1050.

Srinivasan, M., Mukherjee, D., & Gaur, A. S. (2011). Buyer–supplier partnership quality and supply chain performance: Moderating role of risks, and environmental uncertainty. European Management Journal, 29(4), 260–271.

Stahl, B. C., Obach, M., Yaghmaei, E., Ikonen, V., Chatfield, K., & Brem, A. (2017). The responsible research and innovation (RRI) maturity model: Linking theory and practice. Sustainability, 9(6), 1036.

Stilgoe, J., Owen, R., & Macnaghten, P. (2013). Developing a framework for responsible innovation. Research Policy, 42(9), 1568–1580.

Sung, S. Y., & Choi, J. N. (2014). Do organizations spend wisely on employees? Effects of training and development investments on learning and innovation in organizations. Journal of organizational behavior, 35(3), 393–412.

Sung, S. Y., & Choi, J. N. (2018). Effects of training and development on employee outcomes and firm innovative performance: Moderating roles of voluntary participation and evaluation. Human resource management, 57(6), 1339–1353.

Swink, M. L., Golecha, R., & Richardson, T. (2010). Does supply chain excellence really pay off?Supply Chain Management Review, 14(2).

Tang, M., Walsh, G., Lerner, D., Fitza, M. A., & Li, Q. (2018). Green innovation, managerial concern and firm performance: An empirical study. Business Strategy and the Environment, 27(1), 39–51.

Terziovski, M. (2010). Innovation practice and its performance implications in small and medium enterprises (SMEs) in the manufacturing sector: A resource-based view. Strategic Management Journal, 31(8), 892–902.