Abstract

Inward foreign direct investment (IFDI) carries critical implications for local firms, especially in the context of emerging markets, such as China. Scholars typically suggest that IFDI benefits local firms’ innovation through knowledge spillovers. Our study reveals a downside of such spillovers by articulating the negative influence of IFDI on local firms’ tendencies towards invention patenting (vis-a-vis utility model patenting) within their overall patenting. We further identify two contingency effects to help substantiate the mechanisms underlying the negative effect of IFDI on local firms’ invention patenting tendency. Using panel data on Chinese manufacturing firms during 2000–2010, we find that although industry-level IFDI intensity increases local firms’ total patent applications, it decreases the proportion of invention patents within total applications. This negative effect of IFDI is amplified by industry technology orientation and industry competitive intensity. Our study offers more fine-grained insights into the linkage between IFDI and local innovation by illustrating how local firms balance different types of patents in response to IFDI spillovers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Inward foreign direct investment (IFDI) has important implications for local firms’ strategy and performance (e.g., García et al., 2013; Jin et al., 2019; Lu et al., 2017). Multinational enterprises (MNEs) typically carry superior technology to local firms, especially in emerging markets, such as China (Gao, 2021; Zhang et al., 2010, 2014). The entry of MNEs through IFDI thus enables “the informal transfers of technological know-how,” known as IFDI spillovers (Eapen, 2012, p. 246), which could benefit local firms in the same industries (Caves, 1974; Eden, 2009; Spencer, 2008). Prior studies usually capture the spillover effect by testing the influence of IFDI on local firms’ productivity (Buckley et al., 2007a, 2007b; Liu et al., 2000; Tian, 2007; Wei & Liu, 2006). A burgeoning stream of research further examines how IFDI affects local firms’ technological innovation (hereafter, innovation refers to technological innovation, which is the core focus of our study) (Buckley et al., 2002; Liu & Zou, 2008; Wang & Wu, 2016). Scholars typically suggest that IFDI benefits local innovation through knowledge spillovers (Jiang et al., 2019b), thereby increasing the local firms’ patent applications (e.g., García et al., 2013; Jin et al., 2019; Liu et al., 2010).

Although important and insightful, the extant research mainly focuses on local firms’ total patent applications to capture their overall innovation. Such an approach implicitly assumes homogeneity within the patents, without adequately revealing the potentially different impacts of IFDI on the distinct types of patents. Consequently, the general view on the positive relationship between IFDI and local firms’ patent applications tends to emphasize the benefits of IFDI spillovers for local innovation, yet largely overlooking any potential downside. For example, the new technology brought by IFDI also means imitation opportunities for local firms, which may distract their attention from long-run technological exploration to short-term refinement. This is a critical gap because different types of patents, with different natures (e.g., different levels of novelty), may not equally benefit from IFDI spillovers. Governments in many countries grant multiple types of patents. In particular, China’s State Intellectual Property Office (SIPO) grants two types of patents for technological innovation: (1) invention, referring to the inventions of new products or processes, and (2) utility model, defined as the refinements to existing products or processes for better practice (He et al., 2018).Footnote 1 Scholars commonly recognize that invention patents represent firms’ more novel innovation efforts, while utility model patents are granted for more incremental innovation that hardly reaches the threshold of invention patents (He et al., 2018; Zhou et al., 2017). Thus, it is important to dismantle the homogeneity assumption among patents by exploring how local firms balance different types of patents in response to IFDI.

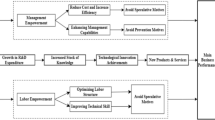

Our study examines how industry-level IFDI shapes local firms’ tendencies towards invention, vis-à-vis utility model, patenting (hereafter, invention patenting tendency), which refer to the proportion of invention patenting within their overall patenting (invention and utility model). Given a certain amount of total patenting, local firms’ invention patenting tendencies reflect how they balance more novel invention patenting versus more incremental utility model patenting. Specifically, IFDI not only presents a source of technology spillovers but also imposes competitive pressures on local firms (Meyer & Sinani, 2009; Spencer, 2008), thereby representing an intriguing form of organizational learning – i.e., learning from foreign competitors. Research typically suggests that IFDI benefits local innovation through two mechanisms: (1) the learning mechanism – greater opportunities for technology transfers that strengthen local firms’ innovation capabilities; and (2) the competition mechanism – intensified foreign competition that motivates local firms to increase innovation to protect or enhance their competitive position (García et al., 2013; Jin et al., 2019; Liu et al., 2010). However, we posit that these two mechanisms shape local firm invention patenting tendency in negative ways. First, the learning from IFDI may shift local firms’ innovation efforts towards incremental refinements based on what they learned from foreign MNEs, but could discourage local firms’ own novel innovation efforts that may lead to inventions of new products and processes. Second, facing competitive pressure intensified by foreign MNEs, local firms may place greater emphasis on utility model patenting they view as more feasible and as fitting better with their competitive position, but reduce invention patenting relying on novel innovation where local firms may perceive themselves as more disadvantaged relative to foreign MNEs.

We further substantiate the learning and competition mechanisms underlying the influence of IFDI on local firm invention patenting tendency by examining the moderating effects of industry technology orientation and industry competitive intensity. While we theorize IFDI influences based on (1) the learning opportunities from IFDI and (2) the competitive pressure intensified by IFDI, these mechanisms are not homogeneous across industries. Higher industry technology orientation usually means greater learning opportunities available for local firms, thereby enhancing the learning mechanism underlying IFDI influences. Moreover, stronger industry competitive intensity among local firms could amplify the competitive pressure imposed by IFDI, which thus strengthens the negative influence of IFDI on invention patenting tendency. Overall, these two moderators capture the heterogeneity within the learning and competition mechanisms, thereby advancing the theory of IFDI’s impact on invention patenting tendency by demonstrating how IFDI’s negative impact happens and differs.

We test the theory in the context of China, one of the largest emerging markets and FDI recipient countries in the world. Typically, Chinese firms are technologically inferior to foreign MNEs operating in local markets and strongly motivated to catch up with foreign rivals (Chang & Xu, 2008; Liu & Zou, 2008; Peng, 2012). Moreover, the Chinese patent system defines invention versus utility model patents based on different levels of novelty in the technological innovation, thus allowing us to explore local firms’ balance of different types of patenting within overall innovation in response to IFDI (He et al., 2018; Zhou et al., 2017). Using panel data on 500 listed manufacturing firms, we find support for our key arguments.

Our study makes several contributions to the literature. First, we advance the literature on IFDI spillovers by revealing how local firms balance different types of patents in response. While prior research focuses on local firms’ overall innovation or total patents to capture the general benefits from IFDI, we challenge the homogeneity assumption within the overall innovation or patenting behaviors by emphasizing the distinction between patent types. Our approach allows us to illuminate how IFDI carries different implications for various types of patents. We provide the fresh insight that IFDI may shift local firms’ innovation efforts from more novel invention to more incremental utility model patenting. This insight enhances the understanding of IFDI impact by revealing a downside of IFDI in reducing local firm invention patenting tendency. Moreover, our study extends the organizational learning research by examining the implications of learning from foreign competitors. While organizational learning theory provides the general premise that learning benefits firm innovation, we caution that, with the accompanied competitive pressure, the learning itself might be relatively unambitious, shifting learners’ efforts from novel inventions towards incremental refinements to better access the learning opportunities and fit their inferior competitive positions to their teachers/rivals.

Our study also offers practical implications for both firm managers and policymakers. First, our novel insights into IFDI’s different influences on distinct types of patents can help local firm managers more comprehensively understand the impacts of the IFDI in the focal industry. Therefore, they can more effectively adapt their innovation tendencies, to better utilize the benefits of IFDI and avoid the potential pitfalls. Furthermore, policymakers, especially those in emerging markets, can also employ our insights to better evaluate the both positive and negative implications of IFDI for local innovation. These, in turn, can inform their policymaking regarding IFDI to achieve the optimal balance of the mixed influences.

Theory and hypotheses

The entry of foreign MNEs—through IFDI—carries critical implications for the domestic firms in local markets (Caves, 1974; Chang & Xu, 2008; Spencer, 2008; Zhang et al., 2010, 2014). IFDI spillovers refer to the potential transfers of technological knowledge from foreign MNEs to the local firms operating in the same industries (Eapen, 2012; Spencer, 2008). This effect is especially salient in emerging market contexts because the superior technology typically carried by foreign MNEs creates greater potential for transfers (Eapen, 2012), and local firms usually have strong motivations to catch up (Chang & Xu, 2008). Thus, this study focuses on the implications of IFDI for local firms in emerging markets, such as China. IFDI spillovers may occur in both product and process domains (Eapen, 2012), through various mechanisms, including the demonstration effect, upstream and downstream linkages, employee turnover, and competitive pressure (Spencer, 2008; Zhang et al., 2010, 2014).

Research conventionally captures the spillover effect by linking IFDI presence with local firms’ productivity. Many studies find evidence for this positive effect (e.g. Buckley et al., 2002, 2007a, b; Caves, 1974; Hejazi & Safarian, 1999; Liu et al., 2000; Tian, 2007; Wei & Liu, 2006), although several others report unsupportive or even opposite findings (e.g., Aitken & Harrison 1999; Feinberg & Majumdar, 2001; De Backer & Sleuwaegen, 2003; Haddad & Harrison, 1993). Research also provides evidence for several learning mechanisms, such as employee turnover (Liu et al., 2010) and linkage mechanisms (Blalock & Simon, 2009; Javorcik, 2004; Santangelo, 2009). Moreover, scholars enrich the IFDI spillover research by examining the impacts of more nuanced characteristics of foreign MNEs (Spencer, 2008), such as nationality diversity (Zhang et al., 2010), entry tenure (Zhang et al., 2014), and competition with local firms (Chang & Xu, 2008).

An important stream of research explores local firms’ innovation to further advance the understanding of IFDI impact (e.g., Buckley et al., 2002; Jiang et al., 2019b; Matusik et al., 2019; Wang & Wu, 2016). In particular, recent research examines how industry-level IFDI shapes local firms’ patenting activities, revealing their greater innovation efforts in the face of the learning opportunities and competitive threats brought by IFDI (García et al., 2013; Jin et al., 2019; Liu et al., 2010). Nevertheless, the prior studies mainly focus on local firms’ total numbers of patent applications that reflect their overall innovation, yet we know less about how local firms balance different types of patenting within their overall patenting activities. Our study addresses this gap by examining local firm invention (vis-à-vis utility model) patenting tendency. While extant research identifies several positive mechanisms of IFDI for local firm overall innovation—as articulated in our literature review in the next section, we posit that these mechanisms could work oppositely for their invention patenting tendency.

IFDI and local innovation

IFDI spillovers represent an intriguing form of organizational learning—learning from foreign competitors, in the sense that the presence of foreign MNEs not only provides learning opportunities for local firms (Eden, 2009; Zhang et al., 2014), but also imposes competitive pressures on them (Meyer & Sinani, 2009; Spencer, 2008). Research suggests that both learning and competition mechanisms benefit local innovation.

Specifically, IFDI provides several opportunities for local firms to learn from foreign MNEs in the same industry. First, local firms can directly observe the activities and products of foreign MNEs in the local markets and thus have greater opportunities to learn from them (Blomström & Kokko, 1998; Guo et al., 2019; Kumaraswamy et al., 2012). This so-called demonstration effect helps local firms update their innovation capabilities and thus facilitates their patenting. Second, local firms can learn from foreign MNEs through upstream and downstream linkages. Foreign MNEs usually establish business linkages with local suppliers and distributors to reduce costs and increase efficiencies (Javorcik, 2004; Santangelo, 2009; Spencer, 2008; Zhang et al., 2010). Such linkages involve the sharing of information about products and processes, thus offering opportunities for suppliers and distributors to gain technological knowledge. MNEs’ advanced technology may first diffuse to the local suppliers and/or distributors and then to local firms that share the same suppliers and/or distributors (Rodríguez-Clare, 1996; Blalock & Simon, 2009; Kumaraswamy et al., 2012). These local firms may enhance their innovation capabilities by learning about foreign MNEs’ more advanced technology, which benefits their patenting. Third, technology transfers also happen through employee turnover. Foreign MNEs in local markets usually invest heavily to train their local employees, while local firms could learn advanced technology from the MNEs by hiring their former employees (Meyer, 2004; Spencer, 2008). In China, for instance, the employee turnover rate is high, especially for professionals, partly because of local firms’ desires to attract talent from MNEs (Leininger, 2007; Zhang et al., 2010). Research shows that employee mobility between foreign MNEs and local firms promotes local firms’ innovation and patenting activities (Fosfuri et al., 2001; Liu et al., 2010).

These opportunities to learn can also be amplified in importance by the need to learn. IFDI intensifies the competitive pressure faced by local firms, who may become more motivated to increase innovation to fight for survival or enhance competitiveness. Although intensified foreign competition erodes local firms’ market shares and resources (Altomonte & Pennings, 2009; Kosova, 2010), scholars emphasize the positive effect of such competitive pressure, especially on local innovation (e.g., Aghion et al., 2009; Veugelers & Van den Houte, 1990). Research shows that local firms are not simply passive receivers of the competitive threats imposed by foreign MNEs, but they must actively respond to protect their market position (Chang & Xu, 2008; Dau et al., 2015; Jin et al., 2019). Specifically, in response to foreign competition, local firms have stronger motivations to upgrade their technology and push their innovation (Blomström & Kokko, 1998), usually by learning from foreign firms (Zhang et al., 2014). Indeed, technological innovation is not only a key domain in which local firms benefit from IFDI spillovers (Eapen, 2012; Liu et al., 2010; Spencer, 2008), but also a critical strategy to catch up with foreign MNEs (Chang & Xu, 2008; Jin et al., 2019). In sum, the extant literature suggests that IFDI not only presents learning opportunities that foster local firms’ patenting but also intensifies competitive pressure that motivates them to enhance patenting.

IFDI and local firm invention patenting tendency

Our study moves beyond the current thinking by exploring the heterogeneity within local firms’ patenting (i.e., invention versus utility model). In doing so, we go deeper into local firms’ innovation choices in the face of IFDI to theorize more nuanced strategy implications of learning from foreign competitors. Given the challenges that foreign competitors do not teach local firms intendedly but impose competitive threats on local firms, we argue that local firms tend to emphasize the type of patenting that better harmonizes the learning opportunities and their competitive advantages. In particular, local firms, as the learners, are likely to place greater emphasis on the type of patenting, (1) in which it is comparatively easier for them to access learning opportunities, and (2) which better aligns with their competitive advantages over the foreign MNEs, the teachers/competitors (or, at least, where they are relatively less inferior). Accordingly, while extant research emphasizes the positive implications of both learning and competition mechanisms for local innovation in general, we caution a potential downside of learning from foreign competitors whereby local firms’ efforts may shift from more novel inventions to more incremental refinements, thereby reducing their tendencies towards invention (vis-à-vis utility model) patenting within overall innovation.

First, the learning from IFDI benefits local firms’ invention patenting less than utility model patenting. Specifically, the helpful knowledge for invention patenting, such as how to invent new products or processes and how to explore new technology, is usually tacit rather than codified, thus harder to acquire without deep embeddedness within an organization (Lin et al., 2009; Yang et al., 2011). This kind of knowledge is less likely to be informally transferred from foreign MNEs to local firms. Such knowledge transfers are especially rare because foreign MNEs usually come to emerging markets for cheaper labor and production, but less often for conducting advanced technological development. This fact further limits local firms’ opportunities for learning from IFDI about inventing new products. Overall, the benefits of learning from IFDI could be limited for promoting local firms’ invention patenting. Instead, foreign MNEs bring more advanced technology and products to local markets, which may raise the threshold of inventing new products and processes and thus make local firms’ invention patenting more challenging. On the other hand, through IFDI spillovers, local firms obtain greater opportunities to learn about foreign MNEs’ existing technology and products, which are more observable and transferable than the tacit know-how about inventions (Spencer, 2008; Zhang et al., 2010, 2014). Such learning could benefit local firms’ utility model patenting based on incremental refinements to existing technology or products. For example, local firms may utilize the technology learned from foreign MNEs to update their products for better practice or improve cost-efficiency in their manufacturing process. They may also improve the shape or functions of the existing products learned from foreign MNEs to fit local practice and local consumer preference. Compared with inventions that usually take longer time to absorb the relevant knowledge and generate returns, utility model patenting based on incremental refinements represents an easier and quicker way to benefit from the technology transfers (Hennart, 2009, 2012). Attracted by the readily accessible learning opportunities, local firms may devote greater resources and efforts to more incremental innovation that results in utility model patenting. In contrast, inventions of new products or processes, which benefit less from learning opportunities but are more challenging and time-consuming (Jansen et al., 2006), may become less attractive to local firms. Overall, they shift efforts from invention to utility model patenting.

Furthermore, the competitive pressure intensified by IFDI may also push local firms to place greater emphasis on incremental refinements of existing technology or products relative to inventions of new technology or products. While local firms are motivated to increase overall innovation and patenting as a response to foreign competition, they need to balance the two types of patenting in terms of which better fits their competitive position against foreign MNEs. Although scholars suggest that inventions foster more novel innovation and thus constitute a potential way to deal with competitive pressure by fostering differentiation (Voss et al., 2008), we posit that invention patenting is less suitable for local firms to compete against foreign rivals, while utility model patenting based on incremental refinements fits better with local firms’ competitive position. Specifically, local emerging market firms are usually inferior to foreign MNEs in advanced technology (Eapen, 2012; Liu et al., 2010; Zhang et al., 2010, 2014). That is, compared with their foreign competitors, local firms’ technological capabilities are farther away from the technology frontier that represents the most advanced technology in their industries (Aghion et al., 2009). Thus, foreign MNEs own the first mover advantages in exploring new technology beyond the current frontier (Luo & Peng, 1998), such as inventing new products or processes. Local firms, in contrast, have an unfavorable competitive position in such novel inventions, whereby it could be especially challenging and costly for them to compete against foreign MNEs. On the other hand, local firms’ advantages over foreign MNEs usually rest in their greater local knowledge, such as a better understanding of local market demands and consumer preferences. This is because foreign MNEs suffer from a liability of foreignness caused by their “unfamiliarity with and lack of roots in a local environment” (Zaheer, 1995, p. 343). Accordingly, utility model patenting, such as local adaptation by refining MNEs’ existing products and processes for better local practice, may help local firms more effectively utilize their advantages to establish a favorable competitive position relative to the foreign MNEs. Additionally, local firms’ balance of two types of patents is also subject to their resource availability. Foreign competition erodes local firms’ market shares and profit margins (Altomonte & Pennings, 2009; Kosova, 2010), which constrains their resources and capabilities to initiate the more resource-consuming novel inventions. Utility model patenting may be comparatively more achievable in such circumstances (Jansen et al., 2006). Likewise, novel inventions are long-run-oriented, with a longer period to create returns (Dewar & Dutton, 1986; Marvel & Lumpkin, 2007). In contrast, incremental refinements in utility model patents are more likely to generate quick returns, thus presenting greater flexibility in response to the competitive or survival threats imposed by IFDI.

In sum, utility model patenting better fits the learning opportunities derived from IFDI spillovers and local firms’ competitive positions against foreign firms than invention patenting. Accordingly, in the face of higher IFDI in the focal industry, we predict that local firms tend to place relatively less emphasis on invention (vis-à-vis utility model) patenting.

Hypothesis 1

(H1). IFDI is negatively related to local firm invention patenting tendency.

We above theorize the influence of IFDI on local firm invention patenting tendency based on both learning and competition mechanisms. However, neither mechanism is homogeneous. The learning from IFDI is contingent on industry technology orientation that shapes the opportunities for learning advanced technology, while the competition pressure imposed by IFDI depends on industry competitive intensity among local firms. Accordingly, we examine the moderating roles of industry technology orientation and industry competitive intensity in the linkage between IFDI and invention patenting tendency, to help substantiate and demonstrate the underlying mechanisms of learning and competition, respectively.

The moderating effect of industry technology orientation

As learning opportunities present a mechanism underlying the negative effect of IFDI on invention patenting tendency, we posit that this effect is more salient in more technologically oriented industries. Specifically, local firms’ learning from foreign MNEs may happen to a greater extent in those industries in which technological capability is more important for local firms. Indeed, these local firms generally have stronger sensitivity to technology transfers and greater absorptive capacity to utilize the existing products and processes that they learn from foreign MNEs (Cohen & Levinthal, 1990; Siegel & Hambrick, 2005). Accordingly, in more technologically oriented industries, the learning opportunities from IFDI are more likely to be utilized by local firms.

As noted above, local firms’ learning from foreign MNEs benefits their invention patenting less than utility model patenting. Even though there are greater learning opportunities in more technologically oriented industries, local firms can hardly obtain the tacit knowledge about how to invent new products and technology through the informal and unintended channels provided by IFDI (Lin et al., 2009; Yang et al., 2011). Moreover, although local firms usually have stronger innovation capabilities in industries with higher technology orientation, the threshold of inventing new products or processes in such industries may be raised substantively by the greater technology and products brought by foreign MNEs. The higher threshold thus imposes tougher challenges for local firms’ invention patenting. In contrast, the learning opportunities in more technologically oriented industries further amplify the benefits of IFDI for local firms’ utility model patenting. This is because local firms in these industries are more sensitive to the technology and products brought by foreign MNEs and relatively more capable of utilizing the learning opportunities from the foreign MNEs (Filatotchev et al., 2009; Siegel & Hambrick, 2005), which facilitate the local firms’ utility model patenting based on incremental refinements to such technology and products. Overall, we predict that the effect of IFDI on local firm invention patenting tendency is reinforced by industry technology orientation.

Hypothesis 2

(H2). The negative relationship between IFDI and local firm invention patenting tendency is strengthened by industry technology orientation.

The moderating effect of industry competitive intensity

As competitive pressure presents a mechanism underlying the negative effect of IFDI on local firm invention patenting tendency, we posit that this effect is enhanced by the industry competitive intensity among local firms. Industry competitive intensity refers to the magnitude of the effect a firm has on its competitors’ survival in the same industry (Barnett, 1997). In the industries with higher competitive intensity, firms usually have lower market shares and profit margins, thus facing greater risks of being crowded out of their market segments by their competitors (Barnett, 1997; Basu, Phelps, & Kotha, 2011). These firms are thus more sensitive to the competitive pressure imposed by their potential rivals (Dess & Beard, 1984; Su et al., 2015). Therefore, the entry of foreign MNEs—through IFDI—may impose more salient competitive or even survival threats for the local firms in more competitive industries. In less competitive industries, conversely, local firms usually enjoy greater market shares and higher profit margins, which help buffer the competitive threats they perceive from foreign MNEs. Overall, the competition mechanism derived from IFDI may have stronger influence on local firms in more competitive industries.

As articulated above, although invention patenting fosters differentiation and thus helps deal with the foreign competition derived from IFDI, utility model patenting could be more achievable, flexible, and appropriate to local firms’ competitive position than invention patenting. In more competitive industries, because of their lower market shares or profit margins and higher perceived threats, local firms’ resources may be more severely limited by foreign competition and they more urgently need feasible solutions to fight for survival. In such circumstances, the higher availability and flexibility of utility model (vis-à-vis invention) patenting, as the response to IFDI, is further heightened. Moreover, these local firms, with stronger sensitivity to the competitive threats imposed by IFDI of foreign MNEs (Barnett, 1997; Dess & Beard, 1984), may place even greater emphasis on utility model patenting, whereby they are more likely to establish a favorable competitive position against foreign competitors or IFDI (Hennart, 2009, 2012), relative to novel inventions in which they are technologically inferior to foreign MNEs (Aghion et al., 2009). Overall, we predict that the effect of IFDI on local firm invention patenting tendency is more prominent in more competitive industries.

Hypothesis 3

(H3). The negative relationship between IFDI and local firm invention patenting tendency is strengthened by industry competitive intensity.

Methods

Data and sample

We test our hypotheses in the Chinese context for two reasons. First, China is one of the largest FDI recipient countries in the world, and foreign MNEs constitute a significant portion of the Chinese market. As such, IFDI could substantively affect the strategies and performance of Chinese firms (Chang & Xu, 2008; Tian, 2007). Second, China is an emerging market—local firms are technologically inferior to the MNEs that are usually from advanced countries (Liu et al., 2010; Zhang et al., 2010, 2014). Thus, IFDI presents both opportunities for technology transfers and competitive pressure for local Chinese firms. Overall, China provides an appropriate research setting to investigate IFDI’s impact on local innovation.

We collect data mainly from three sources. The patent information of Chinese listed companies comes from the Chinese Patent Database. This database matches the patent information provided by China’s State Intellectual Property Office (SIPO) with Chinese companies listed on the Shanghai and Shenzhen Exchanges (He et al., 2018) and has been widely used to investigate Chinese firms’ innovation (e.g., Zhou et al., 2017). We obtain the industry-level IFDI data, again based on the three-digit industry code, from Chinese Statistical Yearbooks published by Chinese National Bureau of Statistics, following prior research (Xia et al., 2014). The financial data of Chinese listed firms comes from China Stock Market and Accounting Research (CSMAR), a professional and widely used database for Chinese listed firms (e.g., Xia et al., 2014; Zhang & Qu, 2016; Zhou et al., 2017).

Based on the Chinese Patent Database, our sample includes Chinese listed companies, whose information is publicly available and more reliable. We focus on firms in the manufacturing industries (i.e., three-digit industry code based on China Securities Regulatory Commission: C13–C43) to ensure that their innovation activities are generally comparable, in line with the prior research on IFDI spillovers (e.g., Tian 2007; Zhang et al., 2010, 2014). Indeed, the technological innovation of manufacturing firms is hardly comparable with those in nonmanufacturing industries, such as agricultural, banking, service, construction, and mining industries. To address the right truncation bias that is common in patent data (Phelps, 2010), we use the patent data in 2000–2010. This time window is also appropriate to test our theory, during which foreign firms played a significant role in the Chinese market and typically had more advanced technologies than local firms to foster spillovers (Xia et al., 2014; Zhang et al., 2014). We identify 651 firms (6,203 firm-year observations) with complete information, which constitutes the full sample to examine local firm overall patenting (i.e., the total number of patent applications). Further, to examine local firm invention patenting tendency (i.e., the ratio of invention patent applications to total patent applications), we limit our analysis to a sample of firm-year observations with non-zero total patent applications (N = 2,528, for 500 firms). Following prior research, we employ the Heckman two-stage approach to address the potential sample selection bias (Certo et al., 2016; Zhang & Qu, 2016). In our final sample, there are no subsidiaries of foreign MNEs, and we control for the effect of foreign equity ownership. Alternatively, to rule out the possibility of knowledge spillovers through the ownership channel, we conduct robustness checks in the samples of firms (1) without foreign ownership (N = 2,280), (2) with foreign ownership less than 10% (N = 2,358), and (3) less than 20% (N = 2,445). The independent and control variables are lagged by one year to alleviate reverse causality. Alternatively, we lag these variables by two and three years, respectively, to capture the longer-run effects of IFDI on local innovation (Zhang et al., 2014).

Dependent variables

Our core dependent variable is local firm invention patenting tendency, while we also examine their overall patenting to link our study with prior findings. Following prior research (e.g., García et al., 2013; Jiang et al., 2019a; Liu et al., 2010; Zhou et al., 2019), we use local firms’ patent applications to indicate their patenting. Based on the patent law of China, the SIPO grants two kinds of patents for technological innovation: (1) invention, defined as any new technical solution relating to a product, a process, or improvement thereof; and (2) utility model, defined as any new technical solution relating to the shape, the structure, or their combination, of a product, which is fit for practical use (He et al., 2018; Zhou et al., 2017). We sum the numbers of invention and utility model patent applications to measure local firms’ overall patenting.

Furthermore, we measure invention patenting tendency by the proportion (percentage) of invention patent applications within the total applications of both invention and utility model patents. That is, within a certain level of overall patenting, a higher proportion of invention patents indicates greater emphasis on the relatively novel innovation. The approach of using proportion to proxy tendency is consistent with prior studies in similar contexts (e.g., Lin et al., 2009; Yang et al., 2011). In our full sample, we identify totally 16,502 applications for invention patents and 28,349 for utility model patents. These numbers are consistent with the notion that invention patents involve more novel innovation and thus are less common than utility model patents based on more incremental innovation.

Additionally, we use the applications for invention and utility model patents as two separate dependent variables to provide supplementary evidence.

Independent variable

We measure the independent variable, IFDI, by the IFDI intensity at the industry level. Consistent with prior research, we capture IFDI intensity by the investment or activities of foreign companies within a certain industry in a given year (e.g., Chang & Xu 2008; Zhang et al., 2010, 2014), based on the three-digit industry categorization (Xia et al., 2014). Specifically, based on the data from Chinese Statistical Yearbooks, we first calculate the ratios of assets, firm number, sales, and revenues of foreign firms to the corresponding total values of each industry, and then construct an IFDI intensity index as the average of these four ratios (Xia et al., 2014). Alternatively, we use each single ratio as the measure of IFDI for robustness checks.

Moderators

We hypothesize the moderating effects of industry technology orientation and industry competitive intensity, while controlling for their main effects on invention patenting tendency. First, we measure industry technology orientation by the industry-level R&D intensity (Siegel & Hambrick, 2005), calculated as the ratio of total R&D expenditure to total sales within each industry, following prior studies (Li et al., 2007; Xia et al., 2014). The data come from Chinese Statistical Yearbooks on Science and Technology. Second, we measure industry competitive intensity (among local firms) by the reversely coded Herfindahl index. Consistent with prior research, Herfindahl index (HHI) is calculated as the sum of squared market shares of local firms in a certain industry (Zhou et al., 2017). A higher HHI indicates lower competitive intensity. Thus, we reversely code HHI (i.e., 1- HHI) to indicate industry competitive intensity.

Control variables

We control several factors with potential influence on local innovation. First, to control for the ownership effects, we include both state ownership and foreign ownership, measured by the ratios of equity shares owned by state and foreign entities, respectively. State ownership is to control for the potential effects of the government support on firm innovation (Zhang et al., 2014; Zhou et al., 2017). Foreign ownership is included to control the possible technology transfers through the ownership channel (Xia et al., 2014). Second, we control firm size (logged total assets), age, and profitability (the returns on assets, ROA), given their general effects on firms’ innovation capability and emphasis on innovation novelty (Greve, 2007; Lim & McCann, 2014). Third, we control for organizational slacks, which affect not only firms’ technological investment (Lim & McCann, 2014), but also their tendencies towards novel innovation (Voss et al., 2008). Thus, we add a slack index, calculated as the sum of the normalized current ratio (current assets/current liabilities) and working capital-to-sales ratio (Chen & Miller, 2007; Lim & McCann, 2014). Likewise, we control the financial leverage (debt-to-equity ratio), which also indicates the potential slack (Iyer & Miller, 2008). Besides, the fixed ratio (fixed assets/total assets) is included to control for firms’ flexibility to switch their efforts between different types of patenting (O’Brien & David, 2014). Also, we control for firms’ growth opportunity, indicated by the market-to-book ratio (O’Brien & David, 2014).

We also control several regional-level factors. First, local firms’ colocation density of IFDI may affect foreign-local technological spillovers and competitive intensity (Zhang et al., 2014). We control this effect by the IFDI density index at the province level, which is developed by the National Economic Research Institute (NERI) (Fan et al., 2011). Also, the patenting of emerging market firms could be affected by the regional institutional environments, especially the intellectual property right (IPR) institutions. Thus, we control this factor by adding the IPR institution index at the province level, also developed by the NERI. Both IFDI and IPR indexes are important components of NERI’s marketization index, which has been widely employed in the management literature (e.g., Li & Qian 2013). We also include the provincial GDP growth rate to control growth opportunities at the regional level. Finally, we include year, industry, and province dummies to control for the unobservable effects at these levels.

In additional analyses, we control the lagged dependent variable (i.e., past invention patenting tendency) to mitigate the potential auto-correlation issue, and the results remain unchanged. Moreover, firm-level R&D intensity may influence firm patent applications (Zhou et al., 2017). Unfortunately, Chinese listed firms started disclosing their R&D information only from 2007 and thus the sample with firm-level R&D is substantively smaller. We control for firm-level R&D intensity (the ratio of R&D expenses to total sales) in a robustness check based on a subsample in 2007–2009.

Data analysis

As noted above, we measure local firm overall patenting by using the count variable of patent applications. Its distribution in the full sample (Mean: 7.17; S.D. = 34.09) indicates over-dispersion, which violates an assumption of the Poisson model. Hence, we use the negative binomial (NB) model. Further, given a large proportion of the dependent variable is zero (3,675 out of 6,203; Vuong test: p = 0.005), we use the zero-inflated negative binomial (ZINB) model and report the robust standard errors (Greene, 2012; Xia et al., 2014). We use the same approach in examining invention and utility model patent applications as two separate dependent variables.

Moreover, local firm invention patenting tendency is measured as a percentage with lower and upper bounds (i.e., 0% and 100%). Hence, we use the panel Tobit model that is more appropriate for censored data (e.g., Benner & Ranganathan 2012; Chen, 2008) and set 0% and 100% as lower and upper bounds. Furthermore, we cannot observe invention patenting tendency if the total application number of two types of patents is zero in a given year. Thus, to test our hypotheses about invention patenting tendency, the analyses limit to the final sample of firm-year observations with non-zero total applications (N = 2,528 for 500 firms).

The construction of our final sample may result in the self-selection bias, as local firms’ decisions on whether to apply for patents may not be exogenous but could be influenced by the IFDI level in their industries. To address this issue, we employ the Heckman two-stage approach, following the prior research (e.g., Zhang & Qu 2016; Zhu & Chen, 2015). Based on recent recommendations (Certo et al., 2016), we first check if the sample-induced endogeneity exists. In the first stage, we use a dummy variable of patent applications (equals 1 if the number is non-zero and 0 otherwise) as the dependent variable and run a panel Logit regression in the full sample (see the results in Model 1, Table 3). We include all the control variables listed above, plus the design application number as the exclusion restriction. Chinese SIPO defines design as any new design relating to the shape, pattern, color, or their combination, of a product that creates an aesthetic feeling and is fit for industrial application (He et al., 2018). That is, design represents an aesthetic-related intellectual property, distinct from the technology-related intellectual property represented by invention and utility model patents. Design applications reflect firms’ emphasis on intellectual properties and may affect firms’ decisions on whether to apply for technology-related patents (i.e., the dummy variable of patent applications, namely the dependent variable in the first stage), which is empirically verified (b = 0.066, p = 0.000). But there is no clear reason to suggest that design applications affect firms’ balance between the two types of technology-related patents (i.e., invention patenting tendency, namely the dependent variable in the second stage), which is also empirically verified (p = 0.901). Moreover, we include IFDI intensity in the first-stage model, as Certo and colleagues (2016) particularly emphasize the role of x (the independent variable in the second stage, or IFDI intensity in the context of this study), demonstrating that “x must be a significant predictor of an observation’s being included in the final sample for sample selection bias to occur. If x is not significant in the first stage, though, sample selection will not emerge—regardless of a correlation between error terms e and u” (2016, p. 2649). We find that the effect of IFDI intensity on the local patenting dummy is not significant (b = 0.750, p = 0.148), suggesting that the sample-induced endogeneity is not a serious issue. Therefore, we report the panel Tobit results without the Heckman approach in the main analysis, while the panel Tobit results with the Heckman approach (i.e., with the inverse Mill’s ratio from the first-stage regression) are presented as a robustness check.

Results

We present descriptive statistics and correlations of all variables in Table 1. Table 2 A shows the results of the main analysis. Model 1 includes control variables. In Model 2, we add IFDI intensity to test H1. In Models 3–4, we further add the interactions of IFDI intensity with industry technology orientation and industry competitive intensity, respectively, to test H2 and H3. Model 5 is the full model, in which the variance inflation factors (VIFs) of all variables are less than 7.57—below the acceptable threshold, suggesting that multicollinearity is not a serious issue. In addition, Table 2B shows the results of ZINB regressions in the full sample. Model 6 tests how IFDI influences local firms’ overall patenting. Models 7–8 examine invention and utility model patents as the dependent variables, respectively, to provide evidence for IFDI’s separate influences on these two types of local firm patenting.

Although without formal hypothesis, we first test whether IFDI is positively related to local firms’ overall patenting, as suggested by the prior literature. This relationship is supported, as the coefficient of IFDI is positive and significant in Model 6 (b = 1.097, SE = 0.223, p = 0.000, CI95%=[0.659, 1.534]). To interpret the effect size in this count model, we calculate the marginal effect of IFDI on local patenting, using the prchange program in STATA (Li & Tang, 2010; Long & Freese, 2006). The result indicates that one standard deviation increase of IFDI raises the total patent applications by approximately 2.139, with other variables set at the means (Long & Freese, 2006). This suggests that the economic significance of IFDI’s effect on local firm overall patenting is considerable, given that its effect size is moderately high among all variables (6th out of 15).

H1 suggests that IFDI is negatively related to local firm invention patenting tendency. The coefficient of IFDI is negative and significant in Model 2 (b=-38.227, SE = 16.677, p = 0.022, CI95%=[-70.914, -5.540]), consistent with the results in Models 3–5. These results support H1, suggesting that higher IFDI presence at the industry level may reduce invention patenting tendencies of local firms.

We also separately examine the invention and utility model patents to provide supplementary evidence for H1. The effect of IFDI on invention patent applications is positive but non-significant in Model 7 (b = 0.454, SE = 0.608, p = 0.456, CI95%=[-0.738, 1.646]), while the effect of IFDI on utility model patent applications is positive and significant in Model 8 (b = 1.467, SE = 0.275, p = 0.000, CI95%=[0.928, 2.005]). For these effect sizes, our results indicate that one standard deviation increase of IFDI raises the applications of invention patents by about 0.783 and raises the applications of utility model patents by about 1.356. These findings are consistent with our predictions that although IFDI promotes local firms’ overall patenting, IFDI shifts their efforts towards more incremental utility model patenting within the overall patenting.

H2 states that industry technology orientation strengthens the relationship between IFDI and local firm invention patenting tendency. The coefficient of the interaction term between IFDI and industry technology orientation is negative and significant in Model 3 (b=-47.815, SE = 14.221, p = 0.001, CI95%=[-75.686, -19.942), strengthening the negative relationship between IFDI and invention patenting tendency. Thus, H2 is supported, which is consistent with the result in Model 5 (b=-46.207, SE = 16.084, p = 0.004, CI95%=[-77.731, -14.683]). To illustrate this effect size, we plot Fig. 1 (based on Model 3). Figure 1 demonstrates how the marginal effect of IFDI on invention patenting tendency (y-axis) changes with industry technology orientation (x-axis). The small dots represent all observations in the final sample, while the two outer lines plot the 95% confidence ranges (same for figures hereafter). Figure 1 shows that the marginal effect of IFDI on invention patenting tendency is negative and significant for all the observations (supporting H1), which becomes increasingly strong (i.e., more negative) with the increase of industry technology orientation, hence in line with H2.

H3 predicts that industry competitive intensity strengthens the relationship between IFDI and local firm invention patenting tendency. However, this hypothesis is weakly supported, as the coefficient of the interaction term between IFDI and industry competitive intensity is negative and marginally significant in Model 4 (b=-256.504, SE = 145.867, p = 0.079, CI95%=[-542.397, 29.389]), but not significant in the full model (b=-35.135, SE = 164.438, p = 0.831, CI95%=[-357.427, 287.157]). Again, to illustrate the effect size of industry competitive intensity, we plot Fig. 2 (based on Model 4) to show how the marginal effect of IFDI on invention patenting tendency (y-axis) changes with industry competitive intensity (x-axis). Figure 2 illustrates that the marginal effect of IFDI on invention patenting tendency is negative and significant for all the observations (supporting H1), which becomes increasingly strong (i.e., more negative) with the increase of industry competitive intensity, consistent with H3.

Endogeneity tests

Heckman two-stage approach for sample selection bias. As articulated above, we use the Heckman two-stage approach to address the potential self-selection bias (see results in Table 3). Model 1 shows the results in the first stage, while Models 2–5 hierarchically present the panel Tobit results at the second stage, which are essentially the same as the main analysis above.

ITCV test for omitted variables. While we above show the negative relationship between IFDI and local firm invention patenting tendency, we also acknowledge that IFDI may not be fully exogenous but may be influenced by certain unobservable factors that also affect local firm invention patenting tendency. To examine the potential bias caused by omitted variables, we calculate the impact threshold of a confounding variable (ITCV) for the independent variable, IFDI intensity, following prior research (Gamache & McNamara, 2019; Lee et al., 2020). The ITCV helps assess how strongly the potential omitted variable has to be correlated with the independent and dependent variables to invalidate the inference. We find that to nullify the effect of IFDI on local firm invention patenting tendency, an omitted variable would have to be correlated with both IFDI and local firm invention patenting tendency with a minimal coefficient of 0.0469. This is unlikely because, among all the control variables, none has a higher correlation than this impact threshold with both IFDI and local firm invention patenting tendency (the highest correlation of the control variable is 0.0171, based on industry technology orientation). Overall, ITCV tests suggest that omitted variables are not a serious issue.

Reverse causality. To explore an alternative explanation that foreign MNEs are attracted to the industries where local firms have lower invention patenting tendencies, we ran an additional analysis using local firm invention patenting tendency as the independent variable to explain industry-level IFDI intensity as the dependent variable. To reflect the time sequence of cause and effect, we lagged local firm invention patenting tendency and control variables (the same as those in the main analysis) by one, two, and three years, respectively. We used the fixed-effects model to address firm-level omitted variables. The results show that the effects of local firm invention patenting tendency on industry-level IFDI intensity are not significant in any of the models. We also used the panel Tobit model as an alternative estimation method and obtained consistent results. All the results are available upon request. Overall, these findings help address the alternative explanation that foreign MNEs are attracted to the industries where local firms have lower invention patenting tendencies.

Robustness checks

We check the robustness of our findings to alternative samples, measures, lag effects, and control variables. First, we run the analyses in alternative samples of firms (1) without any foreign ownership, (2) with foreign ownership less than 10%, and (3) with foreign ownership less than 20%. The results, presented in Appendices A1, A2, and A3, remain largely unchanged, suggesting that our findings are not sensitive to foreign ownership.

Second, we respectively employ each of four single ratios to measure the IFDI intensity (i.e., the ratio of foreign firms’ assets, number, sales, and revenues within the industry). The results are highly consistent with the main analyses, suggesting that our findings are robust to alternative measures of IFDI. All the results are available upon request.

Third, we recognize that it usually takes longer time to develop invention patents than utility model patents. In China, for example, the general time to develop an invention patent is between two and three years, while three to six months for utility model patents (He et al., 2018). Accordingly, to account for the potentially different time lags of IFDI’s impact on these two types of patents, we lag independent and control variables by two and three years, respectively. The results are presented in Appendices B1 and B2, in which the negative relationship between IFDI and invention patenting tendency still holds. That is, even though we allow for longer time for local firms to develop inventions, they still decrease invention patenting tendency in response to IFDI, suggesting that the negative relationship in H1 is not because of the longer development time of invention patents.

Finally, we further add firm-level R&D intensity as a control variable, which limits our sample to the time window of 2007–2009 (N = 893, for 394 firms). The results, presented in Appendix C, are generally robust, although the moderating effects are weaker. These results suggest that our finding on the negative relationship between IFDI and invention patenting tendency is not sensitive to firm-level R&D intensity.

Discussion

Our study seeks to illuminate the influence of IFDI on local firms’ balance of different types of patents (i.e., invention versus utility model). Extending the organizational learning theory in the context of IFDI spillovers, we theorize the strategy implications of learning from foreign competitors, thereby revealing the negative influence of IFDI on local firm invention (vis-à-vis utility model) patenting tendency. We find that while IFDI is positively related to local firm total patent applications, it is negatively related to the proportion of invention patents. Additionally, we show that the negative effect of IFDI on local firm invention patenting tendency is strengthened by industry technology orientation and industry competitive intensity.

Theoretical contributions

Our study contributes to the literature on IFDI spillovers by advancing more fine-grained implications of IFDI for local innovation. Scholars typically view IFDI spillovers as local firms’ learning from foreign MNEs in domestic markets (e.g., Zhang et al., 2010, 2014). Compared with the commonly examined local productivity, local innovation more closely captures such a learning effect, because innovation represents a more immediate and relevant outcome in the technology domain. Thus, recent research has recognized the importance of examining local innovation in evaluating the impact of IFDI (e.g., García et al., 2013; Jin et al., 2019; Liu et al., 2010). Our study goes a step further to shed light on the heterogeneity within local innovation in terms of different types of patenting (invention versus utility model) with different levels of innovation novelty. Indeed, innovation is not simply a matter of how much but, more essentially, a question of how novel (Dewar & Dutton, 1986; Marvel & Lumpkin, 2007). In doing so, our study offers more nuanced insights and evidence for IFDI’s impact on local firms’ balance of different types of patenting within overall innovation. Furthermore, while IFDI spillovers are generally viewed as positive environmental changes for local innovation—consistent with our findings, we demonstrate a downside of IFDI in the sense that it reduces local firm invention patenting tendency, which reflects their emphasis on the more novel type of patents within their overall patenting efforts. Our findings of the moderating effects of industry technology orientation and industry competitive intensity further enhance our theory by demonstrating that both learning and competition could be mechanisms underlying the negative influences of IFDI on local firm invention patenting tendency. Overall, our study extends the prior research on IFDI and local innovation by exploring the heterogeneity within local innovation and by revealing a downside of IFDI in reducing local firms’ tendencies towards the more novel innovation for invention patenting within their overall innovation.

Furthermore, our study also enriches the research on firms’ competitive response to IFDI. Emphasizing the strategic role of local firms, prior research has explored their strategic or competitive responses to IFDI or MNE investment (Dau et al., 2015). This line of research challenges the conventional research on IFDI spillovers that assumes local firms to be passive receivers, by investigating how local firms actively compete against their foreign rivals (Chang & Xu, 2008; Meyer, 2004). Our study carries key implications for this research, given that patenting (or innovation) constitutes an important firm strategy for enhancing competitiveness. Specifically, in addition to local firms’ overall innovation response to IFDI (e.g., García et al., 2013; Jin et al., 2019; Liu et al., 2010), our study further examines how they adapt tendencies between two types of patenting with different levels of innovation novelty. In doing so, our findings reveal local firms’ more nuanced strategic choices of innovation in the face of IFDI—i.e., they tend to place greater emphasis on the more incremental utility model (vis-à-vis invention) patenting. In sum, our findings imply that to compete against more advanced foreign MNEs, local firms are more likely to rely on strategies (utility model patenting or incremental innovation in our context) that are more achievable and suitable for their competitive position.

Additionally, our study extends the organizational learning theory by examining the strategy implications of learning from foreign competitors—an intriguing form of organizational learning as accompanied by the competitive forces imposed by teachers. Organizational learning theory has greatly enhanced our understanding that firms’ practices and performance benefit from their learning from their own experiences and/or other organizations (Fiol & Lyles, 1985; Huber 1991). But what remains underexplored is the strategic role of the learners in the learning process, such as how they strategically utilize the learning opportunities based on their competitive position. The learning from foreign competitors is especially challenging for the learners due to the non-intentional role of the teachers and the accompanied competitive threats from the teachers. Indeed, the unstructured, informal nature of the learning opportunities from IFDI creates greater difficulty for local firms seeking to access the less codified tacit knowledge spillovers. Furthermore, the competitive pressure imposed by the teachers makes it inadequate for the learners to simply become “better selves” but the learners need to strategically integrate the learning with their competitive position to compete against the teachers/rivals. Such challenges highlight the importance of local firms’ strategic response.

We theorize the strategy implications of learning from foreign competitors in the context of how local firms balance different types of patenting in the face of IFDI. Our theory illustrates that local firms are more likely to place strategic emphasis on the type of patenting that benefits more from the learning opportunities and better fits with their competitive advantages relative to their foreign rivals/teachers. While organizational learning research generally suggests the positive impact of IFDI on local innovation, our theory reveals the negative implications of IFDI for local firm invention patenting tendency. Our study thus cautions a downside of learning from foreign competitors in discouraging firms’ novel innovation in inventing new products and processes while encouraging their utility model patenting based on incremental refinements.

Practical implications

From a practical perspective, this study offers important implications for both firm decision makers and public policymakers. For firm decision makers, especially those in local firms in emerging markets, our study illustrates that IFDI may not equally benefit their different types of innovation or patenting activities but may even hinder certain types. Such insights can help firm leaders make more effective responses to IFDI. Specifically, they can utilize the learning opportunities from IFDI to enhance their innovation capabilities and outcomes. In the meanwhile, however, they should be aware of the potential pitfalls derived from such learning opportunities. For example, the learning benefits may discourage their own inventions. A key implication is that firm decision makers cannot simply assume the benefits of learning from foreign firms but need to mindfully consider any potential downsides of such learning. Moreover, our study also implies that decision makers of local firms in emerging markets need to make appropriate strategic responses to the competitive pressure from foreign MNEs. A critical challenge for the local firms is that the competitive pressure may draw their attention to some shorter-term responses that are more feasible and flexible and distract them from longer-run initiatives that could be more fundamental for their future competitiveness. This insight can stimulate local firm decision makers to view foreign competition as not only a short-term survival issue but also a long-run development issue, thereby making an optional balance between them.

For public policymakers, especially those from emerging markets, our study illuminates that the entry of foreign MNEs, through IFDI, has both positive and negative implications for local innovation. In particular, the learning from IFDI shifts local firms’ innovation efforts from novel inventions to incremental utility model patenting. Such knowledge can help the policymakers more comprehensively assess their policies about IFDI so that they can adjust the policies based on which types of local innovation they intend to encourage. If policymakers intend to promote local firms’ substantial innovation for new products and technology (rather than incremental refinements), they should not simply encourage IFDI by assuming the natural benefits of the learning from IFDI spillovers. Instead, they need to impose more specific requirements for the entry of foreign MNEs to create better opportunities for knowledge transfers in terms of developing new products and technology. For example, governments can offer favorable conditions to attract IFDI but require foreign firms to establish collaborative R&D institutions with local firms. Additionally, the entry of foreign MNEs can threaten local firms’ market positions or even survival. Consequently, local firms would have to emphasize short-term responses, with the risk of overlooking long-run development. In this regard, local policymakers can play a role in helping mitigate local firms’ survival threats and encourage their long-run investment in competing against foreign rivals. For example, in the industries with a higher IFDI intensity, the governments can provide local firms with special subsidies or loans in supporting their long-term explorative investment to become industry pioneers or leaders.

Limitations and future research

First, our study explores the heterogeneity within local innovation by examining two types of patenting with different levels of innovation novelty. Nevertheless, due to data limitations, we did not capture the heterogeneity within each type of patent in terms of quality or novelty. Furthermore, patents are not a perfect proxy for firm innovation capabilities, and they are not the only way to protect firm innovation. For example, firms can also use secrecy for innovation protection. Due to data limitations, we were not able to examine secrecy in this study. In this regard, future research may collect more nuanced data on patents and secrets to provide better evidence for IFDI and local innovation.

Second, we theorize the influence of IFDI on local firm invention patenting tendency based on two mechanisms—learning and competition. Nevertheless, we were not able to directly measure these two mechanisms but relied on two moderating effects to help demonstrate their functioning. Moreover, due to the data limitation on firm-level R&D, we theorize and test the moderating role of industry-level technology orientation. Future research might collect nuanced data to measure these two mechanisms more directly and thus separately evaluate each of them.

Third, we do not gauge the performance effects of the strategic choices of focusing on utility model rather than invention patents. Returning to the managerial implications, it may be the case that making the leap to novel inventions is a wiser strategic choice that produces better performance. Indeed, from an IB perspective, one further research angle worth pursuing is the connection between these patenting or innovation tendencies and any subsequent (or even concomitant) internationalization success of such firms (Boso et al., 2016).

Finally, while China, as an important emerging market, is one of the most common settings for studying IFDI impacts (e.g., Chang & Xu 2008; Zhang et al., 2010, 2014), theory-testing in a single country may give rise to the concern about generalizability of our findings. Thus, we encourage future research to examine IFDI’s effects on local innovation in various research settings, including the more complex setting of developed-to-developed economy IFDI.

Notes

China’s SIPO also grants another type of patents, design patents, which relate to the aesthetic feelings created by any products (He et al., 2018). Accordingly, design patents are not directly relevant to technological innovation, the core focus of our study. Therefore, we focus on invention patents and utility model patents in our theoretical development and empirical measures. In the “data analysis” section, we will use design patents as the exclusion restriction in the Heckman two-stage analysis.

References

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. Review of Economics and Statistics, 91, 20–32

Aitken, B. J., & Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89, 605–618

Altomonte, C., & Pennings, E. (2009). Domestic plant productivity and incremental spillovers from foreign direct investment. Journal of International Business Studies, 40, 1131–1148

Barnett, W. P. (1997). The dynamics of competitive intensity. Administrative Science Quarterly, 42, 128–160

Basu, S., Phelps, C., & Kotha, S. (2011). Towards understanding who makes corporate venture capital investments and why. Journal of Business Venturing, 26, 153–171

Benner, M. J., & Ranganathan, R. A. (2012). Offsetting illegitimacy? How pressures from securities analysts influence incumbents in the face of new technologies. Academy of Management Journal, 55, 213–233

Blalock, G., & Simon, D. H. (2009). Do all firms benefit equally from downstream FDI? The moderating effect of local suppliers’ capabilities on productivity gains. Journal of International Business Studies, 40, 1095–1112

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys, 12, 247–277

Boso, N., Story, V. M., Cadogan, J. W., Annan, J., Kadić-Maglajlić, S., & Micevski, M. (2016). Enhancing the sales benefits of radical product innovativeness in internationalizing small and medium-sized enterprises. Journal of Business Research, 69(11), 5040–5045

Buckley, P. J., Clegg, J., & Wang, C. (2002). The Impact of inward FDI on the performance of Chinese manufacturing firms. Journal of International Business Studies, 33, 637–655

Buckley, P. J., Clegg, J., & Wang, C. (2007a). Is the relationship between inward FDI and spillover effects linear? An empirical examination of the case of China. Journal of International Business Studies, 38, 447–459

Buckley, P. J., Wang, C., & Clegg, J. (2007b). The impact of foreign ownership, local ownership and industry characteristics on spillover benefits from foreign direct investment in China. International Business Review, 2, 142–158

Caves, R. E. (1974). Multinational firms, competition, and productivity in host-country markets. Economica, 41, 176–193

Certo, S. T., Busenbark, J. R., Woo, H. S., & Semadeni, M. (2016). Sample selection bias and Heckman models in strategic management research. Strategic Management Journal, 37, 2639–2657

Chang, S. J., & Xu, D. (2008). Spillovers and competition among foreign and local firms in China. Strategic Management Journal, 29, 495–518

Chen, W. R. (2008). Determinants of firms’ backward- and forward-looking R&D search behavior. Organization Science, 19, 609–622

Chen, W. R., & Miller, K. D. (2007). Situational and institutional determinants of firms’ R&D search intensity. Strategic Management Journal, 28, 369–381

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152

Dau, L. A., Ayyagari, M., & Spencer, J. (2015). Strategic responses to FDI in emerging markets: are core members more responsive than peripheral members of business groups. Academy of Management Journal, 58, 1869–1894

De Backer, K., & Sleuwaegen, L. (2003). Does foreign direct investment crowd out domestic entrepreneurship. Review of Industrial Organization, 22, 67–84

Dess, G., & Beard, D. W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 29, 52–73

Dewar, R. D., & Dutton, J. E. (1986). The adoption of radical and incremental innovations: An empirical analysis. Management Science, 32, 1422–1433

Eapen, A. (2012). Social structure and technology spillovers from foreign to domestic firms. Journal of International Business Studies, 43, 244–263

Eden, L. (2009). Letter from the editor-in-chief: FDI spillovers and linkages. Journal of International Business Studies, 40, 1065–1069

Fan, G., Wang, X., & Zhu, H. (2011). National Economic Research Institute Index of Marketization of China’s Provinces. Beijing: Economic Science Press

Feinberg, S. E., & Majumdar, S. K. (2001). Technology spillovers from foreign direct investment in the Indian pharmaceutical industry. Journal of International Business Studies, 32, 421–437

Filatotchev, I., Liu, X., Buck, T., & Wright, M. (2009). The export orientation and export performance of high-technology SMEs in emerging markets: The effects of knowledge transfer by returnee entrepreneurs. Journal of International Business Studies, 40, 1005–1021

Fiol, C. M., & Lyles, M. A. (1985). Organizational learning. Academy of Management Review, 10, 803–813

Fosfuri, A., Motta, M., & Rønde, T. (2001). Foreign direct investment and spillovers through workers’ mobility. Journal of International Economics, 53(1), 205–222

Gao, R. (2021). Inward FDI spillovers and emerging multinationals’ outward FDI in two directions. Asia Pacific Journal of Management. https://doi.org/10.1007/s10490-021-09788-4

García, F., Jin, B., & Salomon, R. (2013). Does inward foreign direct investment improve the innovative performance of local firms? Research Policy, 42(1), 231–244

Guo, L., Zhang, M. Y., Dodgson, M., Gann, D., & Cai, H. (2019). Seizing windows of opportunity by using technology-building and market-seeking strategies in tandem: Huawei’s sustained catch-up in the global market. Asia Pacific Journal of Management, 36(3), 849–879

Greene, W. (2012). Econometric Analysis. Harlow, UK: Pearson Education Limited

Greve, H. R. (2007). Exploration and exploitation in product innovation. Industrial and Corporate Change, 16, 945–975

Haddad, M., & Harrison, A. (1993). Are there positive spillovers from direct foreign investment? Evidence from panel data for Morocco. Journal of Development Economics, 42, 51–74

He, Z. L., Tong, T. W., Zhang, Y., & He, W. (2018). Constructing a Chinese patent database of listed firms in China: Descriptions, lessons, and insights. Journal of Economics and Management Strategy, 27, 579–606

Hejazi, W., & Safarian, A. E. (1999). Trade, foreign direct investment, and R&D spillovers. Journal of International Business Studies, 30, 491–511

Hennart, J. F. (2012). Emerging market multinationals and the theory of the multinational enterprise. Global Strategy Journal, 2, 168–187

Hennart, J. F. (2009). Down with MNE-centric theories! Market entry and expansion as the bundling of MNE and local assets. Journal of International Business Studies, 40, 1432–1454

Huber, G. P. (1991). Organizational learning: The contributing processes and the literatures. Organization Science, 2, 88–115

Iyer, D. N., & Miller, K. D. (2008). Performance feedback, slack, and the timing of acquisitions. Academy of Management Journal, 51, 808–822

Jansen, J. J., Van Den Bosch, F. A., & Volberda, H. W. (2006). Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Management Science, 52, 1661–1674

Javorcik, B. S. (2004). Does foreign direct investment increase the productivity of domestic firms? Is search of spillovers through backward linkages. American Economic Review, 94, 605–627

Jiang, F., Wang, G., & Jiang, X. (2019a). Entrepreneurial orientation and organizational knowledge creation: A configurational approach. Asia Pacific Journal of Management, 36(4), 1193–1219

Jiang, M. S., Jiao, J., Lin, Z., & Xia, J. (2019b). Learning through observation or through acquisition? Innovation performance as an outcome of internal and external knowledge combination. Asia Pacific Journal of Management, 38, 35–63

Jin, B., García, F., & Salomon, R. (2019). Inward foreign direct investment and local firm innovation: The moderating role of technological capabilities. Journal of International Business Studies, 50(5), 847–855

Kosova, R. (2010). Do foreign firms crowd out domestic firms? Evidence from the Czech Republic. Review of Economics and Statistics, 92, 861–881

Kumaraswamy, A., Mudambi, R., Saranga, H., & Tripathy, A. (2012). Catch-up strategies in the Indian auto components industry: Domestic firms’ responses to market liberalization. Journal of International Business Studies, 43, 368–395

Leininger, J. (2007). Recent compensation and benefit trends in China. China Business Review, 34, 28–31

Li, J., & Qian, C. (2013). Principal-principal conflicts under weak institutions: A study of corporate takeovers in China. Strategic Management Journal, 34, 498–508

Li, J., & Tang, Y. (2010). CEO hubris and firm risk taking in china: the moderating role of managerial discretion. Academy of Management Journal, 53, 45–68

Li, J., Yang, J., & Yue, D. (2007). Identity, community and audience: how wholly owned foreign subsidiaries gain legitimacy in China. Academy of Management Journal, 50, 175–190

Lim, E., & McCann, B. T. (2014). Performance feedback and firm risk taking: The moderating effects of CEO and outside director stock options. Organization Science, 25, 262–282

Lin, Z. J., Peng, M. W., Yang, H., & Sun, S. L. (2009). How do networks and learning drive M&As? An institutional comparison between China and the United States. Strategic Management Journal, 30, 1113–1132

Liu, X., Lu, J., Filatotchev, I., Buck, T., & Wright, M. (2010). Returnee entrepreneurs, knowledge spillovers and innovation in high-tech firms in emerging economies. Journal of International Business Studies, 41, 1183–1197

Liu, X., Siler, P., Wang, C., & Wei, Y. (2000). Productivity spillovers from foreign direct investment: evidence from UK industry level panel data. Journal of International Business Studies, 31, 407–425

Liu, X., & Zou, H. (2008). The impact of greenfield FDI and mergers and acquisitions on innovation in Chinese high-tech industries. Journal of World Business, 43(3), 352–364

Long, J. S., & Freese, J. (2006). Regression Models for Categorical Dependent Variables using STATA. College Station, TX: STATA Press

Lu, J., Ma, X., Taksa, L., & Wang, Y. (2017). From LLL to IOL: Moving dragon multinationals research forward. Asia Pacific Journal of Management, 34(4), 757–768

Luo, Y., & Peng, M. W. (1998). First mover advantages in investing in transitional economies. Thunderbird International Business Review, 40, 141–163

Marvel, M. R., & Lumpkin, G. T. (2007). Technology entrepreneurs’ human capital and its effects on innovation radicalness. Entrepreneurship Theory and Practice, 31, 807–828

Matusik, S. F., Heeley, M. B., & Amorós, J. E. (2019). Home court advantage? Knowledge-based FDI and spillovers in emerging economies. Global Strategy Journal, 9(3), 405–422

Meyer, K. E. (2004). Perspectives on multinational enterprises in emerging economies. Journal of International Business Studies, 35, 259–276