Abstract

Sponsored search advertising has steadily emerged as one of the most popular advertising tools in online retail. Customers prefer search results that appear on the top to those that appear lower and are willing to pay more for products/brands that appear higher on the search. Sponsored search has a higher conversion efficiency and impacts demand more endogenously through the ranking on the search page than traditional advertising. Online retailers (e-tailers) invest aggressively in bidding to ensure they are ranked high on the search pages. The dynamic nature of sponsored search entails a higher degree of inventory readiness, and e-tailers must dovetail their sponsored search advertising strategy to drive traffic with the level of inventory to avoid consumer disappointments due to stockouts. Extant research has not delved into this critical aspect of sponsored search advertising. We endeavor to solve this business problem for an e-tailer in a dynamic stochastic setting and provide a multi-threshold decision support framework based on different inventory levels. The policy identifies inventory levels: (i) at which a retailer should not place an order, (ii) her desired level of inventory, and (iii) a ceiling up to which no bids are placed. The e-tailer can use our proposed framework to derive an inventory based sponsored search advertising campaign that ensures synchronization between bids and inventory and increases profits. Our results show that customers’ sensitivity to the website’s search rank and variation in reservation price impact the e-tailer's inventory and sponsored search bidding decisions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decade, sponsored search advertising has steadily increased its overall share in the area of digital advertisement spending. Recent reports (Statista, 2022), suggest that sponsored search advertising are expected to reach $279 bn in 2023 in worldwide spending. The inherent popularity of search advertising compared to other modes of online advertising, like banner advertisements or pop-up advertisements lies in the fact that they are less intrusive and are in sync with the user's search queries (Ghose & Yang, 2009). Sponsored search advertising leverages the search engines’ capability to learn the users’ characteristics, thereby facilitating a shift from “mass” advertising to “targeted” advertising (Chen, 2008; Ghose & Yang, 2009; Moe, 2013). This results in the higher Return on Investment (ROI) for sponsored search advertising expenditure compared to traditional offline advertising (Laffey, 2007).

Since customers are using search engines to seek product and brand information, retailers strive to ensure that their brands show up as search results in these product/brand searches. Several researchers, (including Ghose & Yang, 2009) suggest that leads generated by search are directly proportional to the higher ranks of the search results; and they sharply decrease for search results, which appear lower on the page, or in subsequent pages. Hence, advertisers are willing to pay a premium to attain a higher rank in these searches.

While increasing advertising spend on sponsored searches can be highly beneficial to a business, it can also have an unfavorable side effect: inventory stockouts. A firm investing heavily in keywords for sponsored search would generate more traffic on its products’ listings leading to faster sell-outs and potential inventory shortfalls. These stockouts can hurt the firm’s reputation (Jing & Lewis, 2011) and impact their websites’ Click-through-Rates (CTR). For instance, on the eve of Thanksgiving, Christmas, and Black Friday, the intensity of promotion for various products that are offered on sale is remarkable; however, the losses incurred by retailers during these events, in terms of stockouts, and returns amount to roughly $1.75 trillion a year (Krystina, 2015; PR NewsWire, 2012). While for a brick-and-mortar store, running out of stocks results merely in lost sales, it has a far greater impact for an e-tailer. Not only would running out of stock have a negative influence on a product listing, but it might also have a detrimental effect on future sales (Jing & Lewis, 2011; Rao et al., 2011) through adverse reviews from customers. The availability of the product is a key element for Amazon's search ranking algorithm, thereby, stock-out has a negative impact on the shopping search results in Amazon (Amazon Listing service, 2019). Therefore, if there is a stock-out for a particular product, the Amazon search engine would not detect it and the product rank would suffer. These instances highlight the importance of coordination across the promotion and inventory stocking decisions, more so in e-commerce. Sogomonian and Tang (1993) corroborate these findings in their empirical study by emphasizing that the profits were 12% higher when the inventory and promotion decisions were treated as joint, rather than separate problems. Thus, inventory and advertising are complementary forces for the success of any e-commerce business. Proper coordination between the inventory level and the promotion must be maintained for an e-tailer to maximize her profits.

According to our knowledge, the extant models of sponsored search do not investigate the retailer’s inventory replenishment decisions in the context of sponsored search advertising. Operations management and marketing literature have studied the interplay of inventory and marketing decisions (Cheng & Sethi, 1999; Zhang et al., 2008; Feng & Shanthikumar, 2022; Mallidis, Sariannidis, Vlachos, Yakavenka, Aifadopoulou and Zopounidis, 2022; Nguyen & Chen, 2022). However, sponsored search advertising has certain specific characteristics that renders it unique. The number of customers attracted to a website depends on the position of the listing on the results page. Customers have a higher preference for the top-ranked links resulting in greater traffic. In other words, a customer’s willingness to pay, also known as reservation price, is highest for the top listings on the results page. The higher willingness to pay is driven by a customer’s perception of a reliable product based on the top-ranked search results (Ghose & Yang, 2009). Therefore, e-tailers can influence the reservation price of their customers through their sponsored search bids (Ye et al., 2015). So, sponsored search advertising impacts customers’ purchase decisions in more ways as compared to traditional advertising, which has a temporal lag for demand conversions. This makes sponsored search more endogenous and dynamic. And hence, inventory readiness becomes even more critical for e-tailers.

Our study aims to increase the scope of application of sponsored search models by determining optimal bidding and inventory policies for an e-tailer employing sponsored search advertising to promote her products. We develop a multi-period stochastic model and provide a decision support framework based on multiple inventory thresholds that integrates inventory replenishment with sponsored search advertising for product promotion. The multi-threshold policy \(({S}_{1},{S}_{2},\widehat{S})\) provides inventory levels: (i) at which a retailer should not place an order (\({S}_{1}\)) (ii) her desired level of inventory (\({S}_{2})\), and (iii) a ceiling up to which no bids are placed (\(\widehat{S})\). Using this policy, an e-tailer can coordinate her sponsored search bids with inventory decisions to derive an effective inventory-based advertising campaign. Our results show that the inventory level, beyond which a retailer does not place an order and the desired inventory level, both decrease as customers become more sensitive to the rank of the listing. The inventory level, up to which the e-tailer does not bid decreases with an increase in the customers’ mean reservation price. From a managerial point of view, the result implies sponsored search bidding at a lower inventory threshold as the customer’s mean reservation price increases. Sponsored search bidding combined with optimal inventory decisions improves the e-tailer's earnings.

The remainder of the paper is organized as follows; we provide a brief review of the literature in Sect. 2. In Sect. 3, we present the model. Sections 4 and 5 discuss the results and characterize an optimal policy for a finite period problem. In Sect. 6, we perform sensitivity analyses to explore the strategic bidding and reordering options for the e-tailer; we also explore the impact of possible budgetary constraints for promotional activities and draw key managerial insights. Finally, we conclude with an overview of the findings and possible extensions for the model.

2 Literature review

Our paper broadly contributes to the stream of literature that studies the integration of advertising and promotion decisions with inventory management (Kurata & Liu, 2006). Specifically, we contribute to the domain of sponsored search advertising. We first present a brief overview of the extant literature at the interface of advertising policies and inventory replenishment, followed by a brief overview of studies in the sponsored search advertising area.

2.1 Inventory and promotional policies

Balcer (1983) designed an optimal joint inventory and advertising strategy considering a deterministic demand-advertising relationship. Cheng and Sethi (1999) examined the relationship between demand and advertising and derived optimal promotion and order quantity decisions. Zhang et al. (2008) extended this model by using price as a critical variable for enhancing sales. Urban (1992) investigated a finite replenishment inventory model in which demand is a deterministic function of price and advertising expenditure. Sogomonian and Tang (1993) devised a “longest-path” algorithm to suggest optimal timing for promotion, in addition to the production and promotion plans. Avinadav et al. (2013) built on this model by assuming the demand to be both price and time-dependent, and determined the optimal pricing and order quantity decisions along with the optimal replenishment period. Wei & Chen (2011) framed an (s,S,z) policy where the inventory replenishment is carried out using the (s,S) policy and the sales effort (z) is determined based on the inventory level. Shah et al. (2013) designed an algorithm to determine optimal inventory and promotional policies for non-instantaneous deteriorating items. Darmawan et al. (2018) developed a sales and operations plan integrating promotion and production planning decisions. Pereira et al. (2020) presented a comprehensive coverage of literature on articles that integrate sales promotion/advertising decisions with operations planning. In all the aforementioned models of offline advertising with inventory replenishment, an effort has been made to estimate the total advertising budget (Lu, Xu, & Yu, 2018; Sun, 2023). Traditional advertising creates awareness about a product and has a temporal lag between the advertising campaign launch and demand conversions. On the other hand, sponsored search advertising is far more dynamic, and impacts website traffic and demand conversion in a more endogenous manner through the search rank. Our contribution lies in analyzing an online retailer who replenishes inventory while employing sponsored search advertising for her product promotions.

2.2 Sponsored search advertising

In today’s competitive e-commerce environment, retailers employ sponsored search advertising by placing bids on relevant keywords to ensure visibility for their customers (Barbosa, Saura, Zekan and Ribeiro-Soriano, 2023; Erdmann et al., 2022). Dinner et al. (2014) evaluated the interplay of cross-channel effects of traditional, online display advertisements and paid search advertising. Goldfarb and Tucker (2011) explored substitution patterns across advertising platforms using real-time data and observed that the relationship between online and offline media is mediated by the marketers’ need to target their communications. Im et al. (2019) developed a model to predict the user’s purchase intent using the keywords the users search for and an analysis of their browsing sessions (click-throughs). Leveraging the consumer search behavior, Scholz et al. (2019) developed a model that automatically generates keywords. B. Chen, Li, Wang, & Li (2022) evaluated the effect of nine channels of online advertising and how each of the channels is impacting the customer’s potential purchase intention. Consumer triggered advertising, such as search advertising was found to have a positive impact compared to firm initiated communications. Yang and Ghose (2010) analyzed the interdependence between organic listings and paid search listings and demonstrated a positive correlation between the two listings. Several other factors affecting the click rate have been discussed in the literature (Ghose & Yang, 2009; Johansson, 1979; Little, 1979; Villas-Boas, 1993). Yang, Lu, & Lu (2014) analyzed the impact of competition from incumbent players as well as future entrants on the click rate for a keyword, and value per click. A recent work by Dayanik and Sezer (2023) explore the multiple-keyword bidding strategy for an e-tailer. Extant literature suggests that RoI for advertising expenditure demonstrates an S-Curve behavior. Initially, advertising levels have extremely low returns, then grow significantly with increasing marginal returns, then saturate, with returns diminishing as advertising continues to grow. All these models assume a Poisson arrival process (Johansson, 1979; Little, 1979; Villas-Boas, 1993; Ye et al., 2015) for the customer. Using real-time data, Ghose and Yang (2009) developed logit models for calculating click rate probability as a function of the keyword length, brand, retailer, rank, etc. to analyze the impact of these variables on click rates. Later, Ghose et al. (2014) incorporated the effect of customer rating as a factor in determining the click rate. The model was built on a dataset consisting of about 40 attributes encompassing the website attributes, user attributes, and the search engine’s attributes Abhishek and Hosanagar (2013) considered the impact of advertising spends in terms of bids for keywords, and the impact of focal brand’s position on the search results, on resultant clicks, to derive the relationship between the bid and position, and position and clicks. All other variables being constant, the retailers with the highest bids are placed at the top, i.e. the position that is most likely to be clicked by the user (Varian, 2007). Chan and Park (2015) studied the effect of position on click rate at different stages of user activity—impression, click, or terminal click (conversion). The most recent work of Ye et al. (2015) suggests that a customer’s reservation price could be considered as a de-facto function of the advertiser’s bid, since the customer’s likeliness of conversion is dependent on the rank (in search results- which, in turn depends on the advertiser’s bid) of the website. Tunuguntla et al. (2019) developed a model to determine the optimal bid and price where the customer’s reservation price is a function of inventory on hand. Dayanik and Parlar (2013) developed a model to suggest a dynamic optimal bidding policy for each period under a budget constraint. However, there was no scope for inventory replenishment provided to the retailer in any of the aforementioned sponsored search advertising models.

Anecdotal evidence advocates active coordination between inventory and promotion decisions, preventing stock-out situations and improving overall profitability. We analyze this added complexity in our study and endeavor to fill the research gap by providing the e-retailer with an opportunity to replenish inventory, while employing sponsored search advertising. Next, we present our model that integrates consumer search and purchase behavior with an online retailer’s bidding (Cost-per-Click scheme) under sponsored search advertising and inventory replenishment.

3 Model description

We develop a multi-period stochastic dynamic programming model in which at the start of each time-period, the retailer observes the inventory level and decides on the sponsored search bidding amount (\(b\)) and the inventory order quantity (\(q)\). The orders are delivered at the beginning of the next time-period. We consider the selling price of the product to be exogenous to the model that is determined by external market dynamics. Demand generation using sponsored search advertising involves three steps: (i) creating awareness about the product (generating an impression) (b) attracting customers to the site (obtaining a click), and (iii) purchase taking place (conversion). Table 1 provides the notations used in the model.

Next, in Sects. 3.1, 3.2, 3.3, and 3.4 we explain the mechanism of impressions, click rate, the factors affecting conversion probability, and the online retailer’s profit maximization problem.

3.1 Impressions

Each time an advertisement is displayed on the page, irrespective of whether it has been clicked or not by the consumer, it is considered an impression. Every sponsored search bid maps onto a certain number of impressions (Google AdWords). Under Google’s Cost-per-Click (CPC) scheme, the retailer can estimate the number of impressions the bid is likely to generate using its bid simulator (Google Adwords, 2020b). The primary step to generate demand through sponsored search advertisements is ensuring impressions, which is driven by the rank of the advertisement on the search page. Generally, the ranks are assigned based on the Quality Score (QS) (which depends on relevance, metadata, etc.) (Google Adwords, 2020a) and the bid placed by the advertiser. The information about Quality Score for individual websites can be found in their AdWords account statistics. However, a Quality score gets accumulated over time and can be effective only through long-term efforts undertaken by a retailer such as landing page quality, brand building, and the quality of the product offerings. In our model, while we do not explicitly model the effects of organic results, we consider the “Quality Score”, which results in organic results. The study by Agarwal et al. (2015) suggest that organic results (and competition) substitute sponsored search in click performance, and critically complement conversion performance. We realize and appreciate that quality score for a given e-tailer requires long-term effort and cannot be updated in the short term. Therefore, in the shorter horizon, bid is the only lever that the retailer can use to influence the ranking of the sponsored search. Through a higher bid, the retailer can achieve a better rank leading to a higher number of impressions.

3.2 Click rate

An increase in the number of impressions in turn can possibly lead to an increase in the attendant number of clicks. A customer’s decision to click on a link is influenced by the rank at which it is being listed, as a higher-ranked link is intuitively considered more reliable (Ye et al., 2015). The clicks are assumed to follow a Poisson distribution, where the click rate function \(\uplambda \left(b\right)\) is strictly positive, increasing, and twice differentiable in the retailer’s bid \(b\) (Tunuguntla et al., 2019; Ye et al., 2015).

Our analysis considers the click rate with respect to bid as an S-shaped curve, which is well established in the extant literature (Ghose & Yang, 2009; Johansson, 1979; Little, 1979; Tan & Mookerjee, 2005; Villas-Boas, 1993). We have used an S-shaped curve defined by the maximum click rate \(({\lambda }_{\infty })\) that can be attained at bid \(b=\infty \), minimum click rate \(({\lambda }_{0})\) in the absence of any bid \(b=0\), sharpness (\(\alpha ),\) and steepness factors \((\beta )\), to represent the click rate as a function of bid (Ye et al., 2015). While making her bidding decision, the retailer can estimate the functional relationship between the click-rate and the bids based on Eq. (1).

3.3 Conversion

Once a customer clicks on the link and visits the website, a conversion/purchase happens based on his/her reservation price. If the customer’s reservation price exceeds the posted price, a conversion takes place. As stated earlier, customers are more likely to click and purchase from the top-ranked links (Ye et al., 2015). Hence, we model the reservation price of the customer group as a random variable that follows a probability distribution that is influenced by the retailer’s bid amount. Intuitively, therefore, websites with better rankings, which are displayed at the top of the page, have a higher probability of conversion than the websites displayed at the bottom of the page. This suggests that mean reservation price of the customers increases as the bid amount increases. Similarly, we assume that the range of reservation prices of customers also widens as the bid amount increases, implying the standard deviation of the reservation price increases as the bid increases. This is explained by the two groups of customers who are attracted by the higher ranking of the listing. The first group is the high-valuation customers who are less price-sensitive and are attracted by the high rank of the listing. The second group of customers comprises “window-shoppers” with much lower reservation prices who click on the links that appear at the top without much intent of purchasing the product, or maybe simply gathering product information. The interplay of this customer mix who click on the top-ranked listings lead to a higher standard deviation of the reservation price with increasing bid amounts. \(\mu (b)\) and \(\sigma (b)\) represent the mean and standard deviation of the reservation price of the customers. As explained, \(\mu \left(b\right)\) increases as the bid \(b\) increases. Similarly, the standard deviation \(\sigma \left(b\right)\) of \(\vartheta (b)\) is strictly increasing in \(b\). We assume the coefficient of variation of \(\vartheta (b)\) is decreasing in \(b\) implying the mean increases at a faster rate compared to the standard deviation. In other words, the downward shift that window shoppers inflict on the reservation price of the customer mix is outweighed by the upward shift caused by high-value customers leading to a reduction in the coefficient of variation of the customer reservation price. Ghose and Yang (Ghose & Yang, 2009) empirically support this assumption. We formulate the reservation price distribution in Eq. (2):

Let \(\vartheta \left(b\right)\) denote a customer’s reservation price for a given bid \(b\), \(\vartheta (b)\) is given by

Here, \(R\) is the customer’s reservation price when the retailer bids zero and we assume that\(R=\left(\underline{y},\overline{y}\right)\sim (0,\infty )\). The minimum reservation price that any customer would have for a given product (at zero bid), is denoted by\(\underline{y}\), and the maximum that any customer would pay is captured by \(\overline{y}\). In other words, the distribution of reservation price of customers when there is no impact of bid is given by\(R\).

Let \(G(.)\) and \(g(.)\) denote the cumulative distribution function (cdf) and probability density function (pdf) of \(R\). We assume that \(G(.)\) has an increasing failure rate (IFR); i.e., \(g(.)/\overline{G}(.)\) is increasing. Let \(p\) denote the posted price of the product.

Then the cdf of \(\vartheta (b)\),

In the context of our model, we define the conversion rate in a given time-period as the probability that a customer who clicked the retailer’s sponsored search link purchases the product. It follows from the definition that the conversion rate is essentially the probability of reservation price \(\vartheta (b)\) exceeding the posted price, i.e.

We make the following technical assumptions to ensure the smoothness of the profit function.

(a) \(G(.)\) has a continuous first-order derivative.

(b) \(\upmu (b)\) and \(\sigma (b)\) have continuous first-order derivatives.

These assumptions are satisfied by many general probability distribution functions such as Gamma distribution, Beta distribution, Weibull distribution, etc.

To capture the aggregate demand in a given time-period, we use a probability matrix \(L\left(i,j\right)\) similar to the one used by Ghose and Yang (2009), comprising the number of clicks and converts conditional on those clicks. Given \(N\) number of impressions, the probability of getting \(i\) clicks and \(j\) converts are calculated using Eq. (5):

This is obtained by taking the product of two Binomial distributions- \(i\) clicks out of \(N\) impressions, \(j\) conversions out of \(i\) clicks, with probabilities of successes being the click rate probability (\(\lambda \left(b\right))\) and the conversion probability (\(\overline{F }(p|b))\) respectively.

3.4 The profit maximization problem

We develop a finite-horizon stochastic dynamic programming model from the e-retailer’s profit maximization objective.

The retailer starts with \(I\) units of inventory over a \(T\) period horizon. The objective of the retailer is to integrate his bidding decision \(b\) with the inventory ordering decision \(q\) so that the inventory level reaches a particular desired quantity. We assume the inventory orders have a lead time of one-time unit, i.e., the order is delivered at the start of the next time-period. The equation for the probability of conversion is calculated as follows:

The profit maximization equation is given by:

where, \(d\) = \(\mathrm{min}(I,j)\)

\(\pi \left(0,I\right)\) =\(I*s\) for \(I>0\)

The retailer chooses the optimal bid and order quantity at the start of each time-period, such that the expected profit is maximized. The terminal condition indicates the salvage value of the product at the last time-period.

Next, we present the theoretical results of the stochastic dynamic programming model, and in Sect. 5, we use the theoretical results to derive a multi-threshold policy based on different inventory levels that provide essential decision rules for inventory-based sponsored search bidding.

4 Theoretical results

Analytically, we attempt to show the behavior of the optimal bid and order quantity as the inventory on hand changes.

We use the monotone likelihood ratio property (Ferguson, 1967) to analyze the results. Let \({Z}^{+}\) be the set of non-negative integers and \(X\) be a discrete random variable with probability mass function \(f\left(x,\delta \right), x\in {Z}^{+},\) which involves a parameter \(\delta ,\) let \(\overline{F }\left(x,\delta \right)={P}_{\delta }\left(X\ge x\right)=\sum_{k=x}^{\infty }f(k,\delta ).\) Assume that for any \(x\in {Z}^{+} and every \delta , f\left(x,\delta \right)=0, i.e. f\left(k,\delta \right)=0\) for every \(k\left(\ge x\right)\in {Z}^{+}, i.e. \overline{F }\left(x,\delta \right)=0.\) Let \(g(.)\) be a non-decreasing function over \({Z}^{+}\) such that \({E}_{\delta }\left\{g\left(x\right)\right\}= \sum_{x=0}^{\infty }g\left(x\right)f(x,\delta )\) exists finitely for every \(\delta .\) In the application considered later, the effective range of \(X\) is finite and hence the existence of \({E}_{\delta }\{g(x)\}\) is always guaranteed.

Lemma 1

The distribution of X has a monotone likelihood ratio in the sense that.

for every \({x}_{1},{x}_{2}\in {Z}^{+}, {x}_{1}<{x}_{2}, and every {\delta }_{1}, {\delta }_{2}, {\delta }_{1}<{\delta }_{2}.\) Then,

-

(a)

For every \(x\in {Z}^{+}, \overline{F }\left(x,\delta \right)\) is non-decreasing in \(\delta .\)

-

(b)

\({E}_{\delta }\left\{g\left(x\right)\right\}\) is non-decreasing in \(\delta \).

Proof: See Appendix B

Lemma 2

If \(X\) follows the binomial distribution with parameters \(n\) and \(\phi \), then for every non-decreasing function \(g(.)\) over \({Z}^{+}\). \(E\{g(x)\}\) is non-decreasing in \(n\) as well as \(\phi .\)

Proof: See Appendix B

Using the above lemmas, we show that the expected demand is non-decreasing in inventory on-hand and bid.

Proposition 1:

Let \(0<{\phi }_{1},{\phi }_{2}<1\), and \(N\) and \(I\) be positive integers such that \(N>I\). Then,

\(L=\sum_{i=0}^{N}\sum_{j=0}^{i}\mathrm{min}\left(I,j\right)\left(\genfrac{}{}{0pt}{}{N}{i}\right){\phi }_{1}^{i}{\left(1-{\phi }_{1}\right)}^{N-i}\left(\genfrac{}{}{0pt}{}{i}{j}\right){\phi }_{2}^{j}{\left(1-{\phi }_{2}\right)}^{i-j}\) is non-decreasing in \(I,N,\) and \({\phi }_{1}.\)

Proof: See Appendix B

\(N\) Represents the number of impressions, i.e. the number of customers exposed to the advertisement. This increases the sample set of potential customers. The number of impressions is directly dependent on the bid amount. The higher the bid, the higher is the number of impressions, click rate probability \({\phi }_{1}\), and probability of conversion \({\phi }_{2}\). From the above proposition, it can be inferred that the expected demand is non-decreasing in inventory-on-hand and bid.

Proposition 2

For the retailer to continue maximizing his profits even at higher levels of inventory, optimal order quantity must be non-increasing with inventory for a given bid.

Proof: See Appendix B

A given bid generates a specified level of demand. Based on the inventory-on-hand, the order will be placed by considering the demand generated through the bid. In other words, there exists a desired level of inventory to be maintained at each time- period. If the current inventory on hand is sufficient for fulfilling the demand in the subsequent period as well, the retailer would not place any order. In other words, there exists a level of inventory, beyond which no order is placed.

Proposition 3

For the retailer to continue maximizing his profits even at higher levels of inventory, the optimal bid must be non-decreasing with inventory for a fixed order quantity.

Proof: See Appendix B

As the inventory on hand increases, the retailer uses the bid lever to generate sufficient demand. The objective of the retailer should be to minimize the inventory carried over to the subsequent period. As a result, with rising inventory on hand, the bid should be raised accordingly.

5 Multi-threshold policy & decision support framework

We represent the analytical results in the form of a multi-threshold policy. The policy is a modification of the existing base stock policy, wherein decisions are linked to multiple thresholds of inventory levels. The multi-threshold policy can be used as a decision support tool to coordinate sponsored search advertising with inventory replenishment.

5.1 \(({{\varvec{S}}}_{1},{{\varvec{S}}}_{2},\widehat{{\varvec{S}}})\)Policy

\(({S}_{1},{S}_{2},\widehat{S})\) Represent the inventory levels based on which sponsored search bidding and ordering decisions can be taken in each time-period. These inventory threshold levels provide critical decision support in terms of ordering and bidding decisions. Whenever the inventory level exceeds \({S}_{1},\) no order is to be placed. \({S}_{2}\) is the desired inventory level to be attained in the subsequent time-period based on which an order is to be placed \(\widehat{S}\) is used to determine the sponsored search bidding decisions. If the inventory is below this threshold, then it is optimal for the retailer not to place any bid (See Table 2Footnote 1). Proposition 2 proves the existence of \({S}_{1}, {S}_{2}\) and Proposition 3 proves the existence of \(\widehat{S}\) (Refer to proof in appendix). Next, we explain the \(({S}_{1},{S}_{2},\widehat{S})\) policy by a numerical example.

5.2 A numerical example: \(({{\varvec{S}}}_{1},{{\varvec{S}}}_{2},\widehat{{\varvec{S}}})\) policy

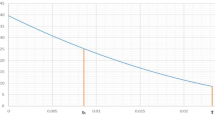

We fix the price at \(p=100\) and vary the bid between 0 and 100 in discrete steps of 10 for a product with cost \(c=40\) and holding cost \(h=5\) per time-period. For a click rate curve with values of \((\alpha ,\beta ,{\lambda }_{0}, {\lambda }_{\infty })\) = (0.1, 4, 0.3, 1) and constants \(({\gamma }_{\mu }, {\gamma }_{\sigma },{k}_{1},{k}_{2},K,\theta )\) having values (0.5, 0.3, 1, 0.2, 8, 0.1), the model yielded the following graph (Fig. 1). The bids have been discretized for simplicity. The policy holds for continuous bids as well. The more continuous the bid, the more drastic is the change in optimal bid with inventory. The value of the x-intercept, the point where the order quantity line cuts the x-axis, indicates the value of \({S}_{1}\), beyond which the order quantity becomes zero. The value of the y-intercept, the point where the order quantity line first meets the y-axis, indicates the value of \({S}_{2}\), the desired level of inventory to be maintained in each time-period. The value of the x-intercept, the largest coordinate where the bid line cuts the x-axis, indicates the value of \(\widehat{S}\), the level of inventory up to which the retailer does not bid.

From Fig. 1, we get the values \({S}_{1}=110, {S}_{2}=60, and \widehat{S}=5\). Using the \(({S}_{1},{S}_{2},\widehat{S})\) policy, we recommend the following decision support criteria at different levels of inventory on hand using Table 3. If the inventory on hand is less than 5 units, then it is optimal not to bid for a sponsored search. If the inventory on hand is less than 110, then the order quantity will be such that the inventory level is pushed up to 60 units at the start of the next time-period. If the inventory on hand is greater than 110, then the retailer should not place any order. The \(({\mathrm{S}}_{1},{\mathrm{S}}_{2},\widehat{\mathrm{S}})\) policy provides a convenient decision support mechanism based on a multi-threshold base stock method.

Elaborating further, it can be observed that the optimal bids are non-decreasing with the inventory on hand, and the optimal order quantity is non-increasing with the inventory on hand for a given bid. As stated in Proposition 2, a constant bid generates a constant demand every period. However, as the inventory on hand increases, the retailer must adjust his order quantity such that he can fulfill the demand for both the current and subsequent periods, which is reflected in the order quantity decreasing with the inventory on hand at a constant bid. Similarly, according to Proposition 3, at constant order quantity, the retailer is only left with the bid lever to generate sufficient demand. Hence, the optimal bid is increasing with inventory on hand at constant order quantity.

Next, we study changing demand dynamics influenced by sponsored search bidding and how that impacts the multi-threshold inventory policy.

5.3 Stochastic dominance

We use the concept of stochastic dominance (Karlin, 1962) to model the demand behaviour in the sponsored search bidding-inventory decision problem. A stochastic dominance relationship is defined as follows: Let \({\tau }_{1}\) and \({\tau }_{2}\) be two random variables with probability densities \({w}_{1}\) and \({w}_{2}\), and cumulative distributions \({W}_{1}\) and \({W}_{2}\) respectively. \({\tau }_{2}\) dominates \({\tau }_{1}\), if

The above condition implies that \({\tau }_{2}\) dominates \({\tau }_{1}\) when demands based on \({w}_{1}\) have a larger probability of taking smaller values than those based on the density \({w}_{2}\). Further, if \({\tau }_{2}\) dominates \({\tau }_{1}\), then \(E\mathcal{L}({ \tau }_{1})\le E\mathcal{L}({ \tau }_{2})\) for any nondecreasing real valued function \(\mathcal{L} (\mathrm{Bulinskaya}, 2004)\).

In our model, \(L\left(i,j\right)\) denotes the probability matrix of clicks and converts. In Proposition 1 we have proved that \(L\left(i,j\right)\) is non-decreasing in \(I,N,\) and \({\phi }_{1}.\) The stochastic ordering between demand states denoted by \(L\left(i,j\right)\) along with the results of Proposition 1 implies that demand in a higher demand state is more likely to be higher than that in a lower demand state. Further, sponsored search bidding would more likely lead to a demand state with a stochastically higher demand and if current demand state is higher, the next period is more likely to be in a demand state with a stochastically higher demand.

The value function (6) consists of two components: the revenue and cost incurred in the current period and the profit in the future time periods. A myopic solution can be obtained by ignoring the future profits and converting the problem to a newsboy-type model (Cheng & Sethi, 1999). The desired inventory level of the myopic newsboy-model is given by \(\overline{S }\) = \({\Omega }^{-1}\left(\frac{p-bi-c}{p+h-s}\right)\), where \(\Omega \) denotes the distribution function of the demand based on customer’s reservation price and the probability of clicks and converts. If demand states follow stochastic dominance as defined earlier, then for\({d}^{\prime}>d\),\({, \overline{S} }_{t,{d}^{\prime}}\ge { \overline{S} }_{t,d}\).

We now analyze how stochastic dominance in demand states impact the desired inventory level of the multi-threshold inventory policy. We denote the desired inventory level \({S}_{2}\) of the multi-threshold policy at time \(t\) and demand state \(d\), by \({S}_{2(t,d)}\)

Proposition 4:

For demand states \({d}^{\prime}>d\) and \(\forall t\),

-

\({S}_{2(t,{d}^{\prime})}\ge {S}_{2(t,d)}\)

-

\({S}_{2(t+1,d)}\ge {S}_{2(t,d)}\)

Proof: See Appendix B

The above proposition states that the desired inventory level \({S}_{2}\) increases at a higher demand state where realized demand in the higher demand state cannot be stochastically lower than that in the lower demand state. Also, the desired inventory level is non-decreasing with \(t.\) In our model, the distribution of reservation price of customers has an increasing failure rate (IFR). \(L\left(i,j\right)\) is a product of two Binomial distributions. Binomial distribution follows the properties of increasing generalised failure rate (IGFR) and the product of two IGFR random variables also follows IGFR properties (Lariviere, 2006). Hence, \(L\left(i,j\right)\) has an IGFR. The demand is modelled based on customer’s reservation price and the probability matrix given by clicks and converts, \(L\left(i,j\right)\), Therefore, the demand also follows IGFR since all IFR random variables are IGFR (Banciu & Mirchandani, 2013). Hence, the demand in our model satisfies the stochastic ordering property mentioned above (Karl-Walter Gaede, 1991).

The above results provide critical insights with regard to the desired inventory level of the multi-threshold policy in the sponsored search-inventory decision problem under changing demand dynamics.

In the next section, we illustrate the factors that impact \({S}_{1},{S}_{2},\) and \(\widehat{S}\) and derive critical managerial insights through extensive numerical analyses.

6 Managerial insights

We model the click rate function as an S-shaped curve as given in Eq. (1). The S-shaped curve is defined by two parameters- namely, the steepness \((\alpha )\) and the sharpness \((\beta )\) as given in the equation below. We model the click rate as a Poisson arrival process, a function of the retailer’s bid.

Conversion takes place only when the customer’s reservation price exceeds the posted price. A customer’s willingness to pay is contingent on the rank of the listing. Referring to Eq. (2), reservation price is modelled as a function of bid. Bid can act as a proxy for the rank (Ye et al., 2015). The functional forms for the mean reservation price \((\mu \left(b\right))\) and standard deviation \((\sigma (b))\) are given below.

where \({\gamma }_{\mu }, {\gamma }_{\sigma }, {k}_{1},{k}_{2}\) are constants.

These constants are used to quantify the impact of rank (bid) on a customer’s reservation price. The constants \(\alpha \) and \(\beta \) determine the sensitivity of customers to click on a link based on the rank of the listing.

6.1 Sensitivity analysis- impact of rank of listing

To understand the impact of rank of the listings on the multi-threshold policy, we analyze various market conditions by simulating different values of the constants \({\gamma }_{\mu }, {\gamma }_{\sigma },{k}_{1},{k}_{2}, \alpha ,\) and \(\beta \). The parameter values used in our sensitivity analysis study are summarized in Table 4. We fix the price at \(p=100,\) and vary the bids discretely in steps of \(10\) between \(0 and 100\).

We consider three scenarios- (i) customers are extremely sensitive to the rank of the listing, i.e. the customers click and convert only for the topmost listings, \((i=1)\) (ii) customers are moderately sensitive to the rank of the listing, \((i=2)\) (iii) customers are marginally sensitive to the rank of the listing, \((i=3)\). Three different click rate curves that have been used to represent the scenarios are given in Figs. 2a, 3a, and 4a. We analyze the impact of the sensitivity of customers to the rank of the sponsored search listings on\({S}_{1}, {S}_{2}, and \widehat{S}\). Let \({S}_{1i},{S}_{2i},\widehat{{S}_{i}}\) denote the values of \({S}_{1}, {S}_{2}, and \widehat{S}\) in the \({i}^{th}\) scenario. The constants \({\gamma }_{\mu }, {\gamma }_{\sigma ,}{k}_{1},{k}_{2}\) determine the impact of the bid on the customers’ mean reservation price \((\mu \left(b\right))\) and standard deviation \((\sigma \left(b\right))\), which in turn affects the probability of conversion. The constants are selected such that the bid acts as a proxy for the rank of the listing.

The click-rate curves represent the sensitivity of customers to the position of listing on the results page. Now, based on these click rate curves, the \(({S}_{1},{S}_{2},\widehat{S})\) policy provides inventory thresholds that can be used as an important decision support tool.

6.1.1 Effect on \({{\varvec{S}}}_{1}\)

\({S}_{1}\) Represents the level of inventory on hand beyond which no order is placed. It is observed that \({S}_{11}<{S}_{12}<{S}_{13}\). In the scenario \(i=1,\) customers are likely to visit the link only at the top positions. This implies the retailer always has to bid extremely high to generate demand. The quantity to be ordered is directly a function of demand generated. The cost of demand generation is highest in the first scenario, making it quite expensive to generate a higher level of demand. The level of inventory beyond which no order is placed, \({S}_{11}\), hence has the least value. Similarly, in scenario \(i=3\), the customers are marginally sensitive to the position of the listing, i.e. they are likely to visit the website even with a relatively lower rank of the listing. This provides the retailer with an opportunity to generate higher demand at a lower cost. Hence, the quantum of demand generated is higher leading to a higher threshold value for \(i=3\), i.e.,\({S}_{13}>{S}_{11}\). The scenario \(i=2\) is an intermediate case that is self-explanatory.

6.1.2 Effect on \({{\varvec{S}}}_{2}\)

\({S}_{2}\) Represents the desired level of inventory to be maintained each period. It is observed that \({S}_{21}<{S}_{22}<{S}_{23}\). The difficulty of generating a greater quantum of demand increases with the sensitivity of the customers to the rank of the listings (\(i=\mathrm{1,2},3)\). In other words, the retailer has to bid/invest higher in \(i=1\) than \(i=3\), to generate a higher level of demand at a given cost. Hence, the demand generated decreases with the sensitivity of customers to the rank of the listings. It is, therefore, optimal for the retailer to maintain lower inventory levels as the sensitivity of the customers to the rank of the listings increases.

6.1.3 Effect on \(\widehat{{\varvec{S}}}\)

The value of \(\widehat{S}\), the inventory level up to which the retailer does not bid in sponsored search advertising, depends on the magnitude of the retailers’ cost-per-click. The behavior of \(\widehat{S}\) with respect to the customers’ sensitivity to the rank of the listing follows the ordering: \({\widehat{S}}_{1}>{\widehat{S}}_{2}>{\widehat{S}}_{3}\). As the likelihood of conversion increases, the retailer has a higher incentive to generate more traffic. When the customers are less sensitive to the rank of the listing, the retailer is likely to achieve higher sales at a lower rank. This encourages the retailer to bid even at low levels of inventory. When the customers are highly sensitive to the rank of the listing, a purchase is likely to happen only at high bids. Therefore, the retailer does not bid at low levels of inventory when the customers are highly sensitive to the rank of the listing.

6.2 Effect of mean reservation price

Next, we evaluate the impact of varying the mean of the distribution of the customers’ reservation price on the multi-threshold policy by keeping the variance of the distribution constant. A click rate curve with parameters \(\alpha =0.1 and \beta =5\) is considered, to account for customers being moderately sensitive to the rankings. The bids are varied discretely in steps of \(10\) between \(0\) and \(100\). We simulate both low and high customer reservation prices and analyze the impact on the \(({S}_{1},{S}_{2},\widehat{S})\) policy.

The parameters with their numerical values are shown in Table 5.

The graphs showing the bid, order quantity, and profit in both the scenarios are provided in Figs. 5 and 6. The retailer is expected to earn higher profits when the mean reservation price of the customers is high. We find that \({S}_{1}\) increases as the mean reservation price increases. As the customer’s willingness to pay increases, the retailer is more likely to sell a higher number of units leading to a higher threshold value for \({S}_{1}\).

As a consequence, the retailer would order a larger quantity of items, which explains the higher value of \({S}_{2}\) in case of a higher mean reservation price. Our results show that with a higher customer mean reservation price, the value of \(\widehat{S}\) decreases, implying that the retailer should start bidding at a lower inventory threshold as the customer’s mean reservation price increases. As the likelihood of purchase by a customer increases with a higher mean reservation price, the retailer’s incentive to bid and attract more traffic to his website increases resulting in a lowering of the \(\widehat{S}\) threshold. With an increase in the mean reservation price of the customer base, the retailer should bid higher and use sponsored search advertising in conjunction with higher order quantities to boost profit.

6.3 Impact of budget constraint on sponsored search and reordering decisions

The above sections demonstrate the retailer’s optimal strategies and optimal policy when there are no constraints on promotion budgets. In this section, we show how the promotion strategy changes in the presence of a budget constraint.

We simulated three scenarios of low (budget = 3000), medium (budget = 4000) and high (budget = 6000) budgets. The parameter values used for these simulations are same as in Sect. 5.2. For the budgeted cases, only an additional constraint of budget has been added with all other parameters remaining the same. The graphs indicating the policy decisions at each inventory level are presented in Fig. 7a-d.

The baseline case without any inventory constraint is also presented here to enable ease of comparison to reader on optimal policy with and without budget constraint. A comparison across all scenarios shows that the trend remains similar in all cases where bid is non-decreasing with inventory and the optimal order quantity is non-increasing with the inventory on hand for a given bid. However, the difference is in the thresholds of optimal policy obtained in each of these scenarios. All parameters \({S}_{1},{S}_{2},and \widehat{S}\) are non-decreasing as the budget increases.

The firm invests more aggressively on bids and the firm assumes a far more proactive role in terms of inventory replenishment in order to avoid a possible stockouts in case of baseline scenario. In other words, the lower the budget available for promotion through sponsored search, the more conservative would be the approach towards bid related investment. This also explains why firms with lower promotional budgets do not maintain an unusually large inventory, or order as frequently, (or as high) as in cases when higher promotional budgets are available.

7 Conclusion

We have modelled a problem at the interface of marketing and operations in which an online retailer coordinates its promotion through sponsored search advertising and complements that with the inventory decisions. We endeavor to fill a critical research gap by integrating sponsored search bidding with inventory policies. We derive a multi-threshold decision rule, wherein the promotion and ordering decisions are determined based on different threshold levels of the inventory on hand. This policy provides a decision support framework for managers optimizing both sponsored search bidding and inventory ordering decisions. We find that the optimal bid increases as the inventory on hand increases. Consequently, the order quantity within a particular bid value decreases as the level of inventory increases. When higher bids positively influence the demand generated, it is optimal to stock more inventory as described in the policy. The sensitivity of customers to the ranking of advertisements impacts the thresholds of the \(({\mathrm{S}}_{1},{\mathrm{S}}_{2},\widehat{\mathrm{S}})\) policy. The inventory level beyond which a retailer does not place an order and the desired level of inventory both decrease as customers become more sensitive to the rank of the listing. With customers becoming more sensitive to the rank of the listing, clicks and converts occur only at the higher ranks. This increases the cost of clicks and converts leading to higher costs for generating demand. Therefore, an increase in sensitivity to the ranking of the listing implies a higher cost of generating traffic. On the other hand, when the customers are less sensitive to the rank of the listing, the retailer is likely to get higher sales at a lower cost. This encourages the retailer to bid even at low levels of inventory.

Next, we ran the model for different levels of customers’ mean reservation prices. We find that the inventory level beyond which a retailer does not place an order and the desired level of inventory both increase with the increase in customers’ mean reservation price. Our results also show that the inventory level up to which the retailer does not bid decreases with an increase in the customers’ mean reservation price. These imply that the retailer should consider bidding at a lower inventory threshold as the customer’s mean reservation price increases. The above insight is useful for the retailer as it provides critical recommendations in terms of the bidding pattern. To ensure the generation of sufficient clicks, it is more profitable for a retailer to bid higher when the customer base has a high mean reservation price. In this scenario, the retailer uses a higher bid to generate a higher rank in the listing, leading to a higher number of converts. Hence, sponsored search bidding complemented with optimal inventory decisions leads to higher profits for the retailer as customers’ mean reservation price increase.

In this model, the bidding and replenishment decisions have the same periodicities. The model can further be enhanced by considering different periodicities for the bidding and replenishment decisions. In future studies, incorporating the supply-side considerations, e.g., capacity and associated resource constraints for the retailer could make for interesting research problems.

Notes

A graphical representation of Table 2 using a flowchart has been appended in Appendix A.

References

Abhishek, V., & Hosanagar, K. (2013). Optimal bidding in multi-item multislot sponsored search auctions. Operations Research., 61(4), 855–873.

Agarwal, A., Hosanagar, K., & Smith, M. D. (2015). Do organic results help or hurt sponsored search performance? Information Systems Research, 26(4), 695–713.

Amazon Listing service. (2019). Various consequences of running out amazon store order & inventory? Retrieved March 22, 2022, from https://www.amazonlistingservice.com/blog/amazon-store-order-inventory/

Avinadav, T., Herbon, A., & Spiegel, U. (2013). Optimal inventory policy for a perishable item with demand function sensitive to price and time. International Journal of Production Economics, 144(2), 497–506. https://doi.org/10.1016/j.ijpe.2013.03.022

Balcer, Y. (1983). Optimal advertising and inventory control of perishable goods. Naval Research Logistics Quarterly, 30(4), 609–625. https://doi.org/10.1002/nav.3800300406

Banciu, M., & Mirchandani, P. (2013). New results concerning probability distributions with increasing generalized failure rates. Operations Research, 61(4), 925–931.

Barbosa, B., Saura, J. R., Zekan, S. B., & Ribeiro-Soriano, D. (2023). Defining content marketing and its influence on online user behavior: A data-driven prescriptive analytics method. Annals of Operations Research. https://doi.org/10.1007/s10479-023-05261-1

Bulinskaya, E. V. (2004). Stochastic orders and inventory problems. International Journal of Production Economics, 88(2), 125–135.

Chan, T. Y., & Park, Y.-H. (2015). Consumer search activities and the value of ad positions in sponsored search advertising. Marketing Science, 34(4), 606–623. https://doi.org/10.1287/mksc.2015.0903

Chen, L. (2008). Combining keyword search advertisement and site–targeted advertisement in search engine advertising. Journal of Service Science and Management, 1(3), 233–243. https://doi.org/10.4236/jssm.2008.13025

Chen, B., Li, L., Wang, Q., & Li, S. (2022). Promote or inhibit? Research on the transition of consumer potential purchase intention. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04777-2

Cheng, F., & Sethi, S. P. (1999). A periodic review inventory model with demand influenced by promotion decisions. Management Science, 45(11), 1510–1523. https://doi.org/10.1287/mnsc.45.11.1510

Darmawan, A., Wong, H., & Thorstenson, A. (2018). Integration of promotion and production decisions in sales and operations planning. International Journal of Production Research, 56(12), 4186–4206. https://doi.org/10.1080/00207543.2018.1431418

Dayanik, S., & Parlar, M. (2013). Dynamic bidding strategies in search-based advertising. Annals of Operations Research, 211(1), 103–136. https://doi.org/10.1007/s10479-013-1427-z

Dayanik, S., & Sezer, S. O. (2023). Optimal dynamic multi-keyword bidding policy of an advertiser in search-based advertising. Mathematical Methods of Operations Research, 97(1), 25–56.

Dinner, I. M., Van Heerde, H. J., & Neslin, S. A. (2014). Driving online and offline sales: The cross-channel effects of traditional, online display, and paid search advertising. Journal of Marketing Research, 51(5), 527–545. https://doi.org/10.1509/jmr.11.0466

Erdmann, A., Arilla, R., & Ponzoa, J. M. (2022). Search engine optimization: The long-term strategy of keyword choice. Journal of Business Research, 144, 650–662.

Feng, Q., & Shanthikumar, J. G. (2022). Applications of stochastic orders and stochastic functions in inventory and pricing problems. Production and Operations Management, 31(4), 1433–1453.

Ferguson, T. S. (1967). Mathematical statistics: A decision theoretic approach. Academic Press Inc.

Gaede, K. W. (1991). Stochastic orderings in reliability. Lecture notes-monograph series (pp. 123–140). JSTOR.

Ghose, A., Ipeirotis, P. G., & Li, B. (2014). Examining the impact of ranking on consumer behavior and search engine revenue. Management Science, 60(7), 1632–1654. https://doi.org/10.1287/mnsc.2013.1828

Ghose, A., & Yang, S. (2009). An empirical analysis of search engine advertising: Sponsored search in electronic markets. Management Science, 55(10), 1605–1622. https://doi.org/10.1287/mnsc.1090.1054

Goldfarb, A., & Tucker, C. (2011). Search engine advertising: Channel substitution when pricing ads to context. Management Science, 57(3), 458–470. https://doi.org/10.1287/mnsc.1100.1287

Google Adwords. (2020a). About quality score–Google Ads help. Retrieved November 9, 2020, from https://support.google.com/google-ads/answer/7050591?hl=en

Google Adwords. (2020b). Estimate your results with bid, budget and target simulators–Google Ads help. Retrieved March 5, 2020, from https://support.google.com/google-ads/answer/2470105?hl=en

Im, I., Dunn, B. K., Lee, D. I., Galletta, D. F., & Jeong, S. O. (2019). Predicting the intent of sponsored search users: An exploratory user session-level analysis. Decision Support Systems, 121, 25–36. https://doi.org/10.1016/j.dss.2019.04.001

Jing, X., & Lewis, M. (2011). Stockouts in online retailing. Journal of Marketing Research. https://doi.org/10.1509/jmkr.48.2.342

Johansson, J. K. (1979). Advertising and the S-curve: A new approach. Journal of Marketing Research, 16(3), 346–354.

Karlin, S., & Carr, C. R. (1962). Prices and optimal inventory policies. Chapter 10 in studies in applied probability and management science. Stanford University Press.

Krystina, G. (2015). Retailers are losing $1.75 trillion over this. Retrieved January 29, 2017, from http://www.cnbc.com/2015/11/30/retailers-are-losing-nearly-2-trillion-over-this.html

Kurata, H., & Liu, J. J. (2006). Optimal promotion planning-depth and frequency-for a two-stage supply chain under Markov switching demand. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2006.01.009

Laffey, D. (2007). Paid search: The innovation that changed the web. Business Horizons, 50(3), 211–218. https://doi.org/10.1016/j.bushor.2006.09.003

Lariviere, M. A. (2006). A note on probability distributions with increasing generalized failure rates. Operations Research, 54(3), 602–604.

Little, J. D. C. (1979). Feature article—aggregate advertising models: The state of the art. Operations Research, 27(4), 629–667. https://doi.org/10.1287/opre.27.4.629

Lu, Y., Xu, M., & Yu, Y. (2018). Coordinating pricing, ordering and advertising for perishable products over an infinite horizon. Journal of Systems Science and Systems Engineering. https://doi.org/10.1007/s11518-017-5357-1

Mallidis, I., Sariannidis, N., Vlachos, D., Yakavenka, V., Aifadopoulou, G., & Zopounidis, K. (2022). Optimal inventory control policies for avoiding food waste. Operational Research, 22, 1–17.

Moe, W. W. (2013). Advanced database marketing: Innovative methodologies and applications for managing customer relationships. Gower Publishing, Ltd. Retrieved from https://books.google.com/books?hl=en&lr=&id=U-rJDPt0X4IC&pgis=1

Nguyen, D. H., & Chen, H. (2022). An effective approach for optimization of a perishable inventory system with uncertainty in both demand and supply. International Transactions in Operational Research, 29(4), 2682–2704.

PR NewsWire. (2012). UK Retailers’ Christmas gamble fails as stock-outs could cost 1.87bn pounds sterling in lost opportunities this Christmas–The street. Retrieved January 29, 2017, from https://www.thestreet.com/story/11790107/1/uk-retailers-christmas-gamble-fails-as-stock-outs-could-cost-187bn-pounds-sterling-in-lost-opportunities-this-christmas.html

Pereira, D. F., Oliveira, J. F., & Carravilla, M. A. (2020). Tactical sales and operations planning: A holistic framework and a literature review of decision-making models. International Journal of Production Economics, 228, 107695. https://doi.org/10.1016/J.IJPE.2020.107695

Rao, S., Griffis, S. E., & Goldsby, T. J. (2011). Failure to deliver? Linking online order fulfillment glitches with future purchase behavior. Journal of Operations Management, 29(7–8), 692–703.

Scholz, M., Brenner, C., & Hinz, O. (2019). AKEGIS: Automatic keyword generation for sponsored search advertising in online retailing. Decision Support Systems, 119, 96–106. https://doi.org/10.1016/j.dss.2019.02.001

Shah, N. H., Soni, H. N., & Patel, K. A. (2013). Optimizing inventory and marketing policy for non-instantaneous deteriorating items with generalized type deterioration and holding cost rates. Omega, 41(2), 421–430. https://doi.org/10.1016/j.omega.2012.03.002

Sogomonian, A. G., & Tang, C. S. (1993). A modeling framework for coordinating promotion and production decisions within a firm. Management Science, 39(2), 191–203. https://doi.org/10.1287/mnsc.39.2.191

Statista. (2022). Search advertising: Market data & analysis. Retrieved September 18, 2023, from https://www.statista.com/study/38338/digital-advertising-report-search-advertising/

Sun, X. (2023). Strategy analysis for a digital content platform considering perishability. Annals of Operations Research, 320(1), 415–439.

Tan, Y., & Mookerjee, V. S. (2005). Allocating spending between advertising and information technology in electronic retailing. Management Science, 51(8), 1236–1249. https://doi.org/10.1287/mnsc.1050.0424

Tunuguntla, V., Basu, P., Rakshit, K., & Ghosh, D. (2019). Sponsored search advertising and dynamic pricing for perishable products under inventory-linked customer willingness to pay. European Journal of Operational Research, 276(1), 119–132. https://doi.org/10.1016/j.ejor.2018.12.026

Urban, T. L. (1992). Deterministic inventory models incorporating marketing decisions. Computers & Industrial Engineering, 22(1), 85–93. https://doi.org/10.1016/0360-8352(92)90035-I

Varian, H. R. (2007). Position auctions. International Journal of Industrial Organization, 25(6), 1163–1178. https://doi.org/10.1016/j.ijindorg.2006.10.002

Villas-Boas, J. M. (1993). Predicting advertising pulsing policies in an oligopoly: A model and empirical test. Marketing Science, 12(1), 88–102. https://doi.org/10.1287/mksc.12.1.88

Wei, Y., & Chen (Frank), Y. (2011). Joint determination of inventory replenishment and sales effort with uncertain market responses. International Journal of Production Economics, 134(2), 368–374. https://doi.org/10.1016/j.ijpe.2009.11.011

Yang, S., & Ghose, A. (2010). Analyzing the relationship between organic and sponsored search advertising: Positive, negative, or zero interdependence? Marketing Science, 29(4), 602–623. https://doi.org/10.1287/mksc.1090.0552

Yang, S., Lu, S., & Lu, X. (2014). Modeling competition and its impact on paid-search advertising. Marketing Science, 33(1), 134–153. https://doi.org/10.1287/mksc.2013.0812

Ye, S., Aydin, G., & Hu, S. (2015). Sponsored search marketing: Dynamic pricing and advertising for an online retailer. Management Science, 61(6), 1255–1274. https://doi.org/10.1287/mnsc.2014.1915

Zhang, J.-L., Chen, J., & Lee, C.-Y. (2008). Joint optimization on pricing, promotion and inventory control with stochastic demand. International Journal of Production Economics, 116(2), 190–198. https://doi.org/10.1016/j.ijpe.2008.09.008

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Author A (Vaishnavi Tunuguntla) declares that she has no conflict of interest. Author B (Preetam Basu) declares that he has no conflict of interest. Author C (Krishanu Rakshit) declares that he has no conflict of interest. Author D (Thanos Papadopoulos) declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Flowchart depicting the multi-threshold Inventory (S 1 ,S 2 ,Ŝ) decision rules for bidding and ordering

Appendix B: Analytical proof for the multi-threshold policy

Analytically, we attempt to show the behavior of the optimal bid and order quantity as the inventory on hand changes.

We use the monotone likelihood ratio property to analyze the results. We slightly modify the existing proof of monotone likelihood Ratio Property taking into account the subtleties of our model.

Let \({Z}^{+}\) be the set of non-negative integers, and \(X\) be a discrete random variable with probability mass function \(f\left(x,\delta \right), x\in {Z}^{+}\) write.

\(F\left(x,\delta \right)={P}_{\delta }\left(X\ge x\right)=\sum_{K=x}^{\infty }f(K,\delta )\). Assume that for any \(x\in {Z}^{+}\) \(, f\left(x,\delta \right)=0 \Rightarrow f\left(K,\delta \right)=0\) for every \(K\left(\ge x\right)\in {Z}^{+},\) i.e., \(\overline{F }\left(x,\delta \right)=0\)…equation (a1).

Let \(g(.)\) be a non-decreasing function over \({Z}^{+}\) such that.

\({E}_{\delta }\left\{g\left(X\right)\right\}=\sum_{x=0}^{\infty }g\left(x\right)f(x,\delta )\) … equation (a2).

exists finitely for every \(\delta .\) In the application considered later, the effective range of \(X\) is finite and hence the existence of \({E}_{\delta }\{g(X)\}\) is always guaranteed.

Lemma 1

The distribution of X has monotone likelihood ratio in the sense that

for every \({x}_{1},{x}_{2}\in {Z}^{+}, {x}_{1}<{x}_{2},\) and every \({\delta }_{1}, {\delta }_{2}, {\delta }_{1}<{\delta }_{2}.\) Then,

-

(c)

For every \(x\in {Z}^{+}, \overline{F }\left(x,\delta \right)\) is non-decreasing in \(\delta .\)

-

(d)

\({E}_{\delta }\left\{g\left(x\right)\right\}\) is non-decreasing in \(\delta \).

Proof

This result is essentially known (Ferguson, 1967).

However, for the sake of completeness, taking care of the subtleties of present setup, a proof is being shown below.

-

(a)

Take any fixed \(x\in {Z}^{+}, and {\delta }_{1}, {\delta }_{2}, {\delta }_{1}<{\delta }_{2}.\) Then by equation (a2) \(,\) for every \({x}_{1}\left(\in {Z}^{+}\right)<x, f\left(x,{\delta }_{2}\right)f\left({x}_{1},{\delta }_{1}\right)\ge f(x,{\delta }_{1})f({x}_{1},{\delta }_{2})\) and summing this over all such\({x}_{1}\),

\(f\left(x,{\delta }_{2}\right)\left\{1-\overline{F }\left(x,{\delta }_{1}\right)\right\}\ge f(x,{\delta }_{1})\{1-\overline{F }(x,{\delta }_{2})\)…equation (a3).

Similarly, for every \({x}_{2}\left(\in {Z}^{+}\right)\ge x,\) \(f\left({x}_{2},{\delta }_{2}\right)f\left(x,{\delta }_{1}\right)\ge f\left({x}_{2},{\delta }_{1}\right)f\left(x,{\delta }_{2}\right)\) and summing this over all such \({x}_{2},\)

\(\overline{F }\left(x,{\delta }_{2}\right)f\left(x,{\delta }_{1}\right)\ge \overline{F }\left(x,{\delta }_{1}\right)f(x,{\delta }_{2})\)…equation (a4).

If \(f\left(x,{\delta }_{1}\right)=0,\) then by equation (a1), \(\overline{F }\left(x,{\delta }_{1}\right)=0\le \overline{F }\left(x,{\delta }_{2}\right).\) On the other hand, if \(f\left(x,{\delta }_{1}\right)>0, then \overline{F }\left(x,{\delta }_{1}\right)>0.\) In this case, if \(\overline{F }\left(x,{\delta }_{1}\right)=1,\) then by equation (a3), \(\overline{F }\left(x,{\delta }_{2}\right)=1,\) i.e. \(\overline{F }\left(x,{\delta }_{1}\right)=\overline{F }\left(x,{\delta }_{2}\right).\) Finally, if \(f\left(x,{\delta }_{1}\right)>0 and \overline{F }\left(x,{\delta }_{1}\right)<1,\) then by equation (a3) and equation (a4),

\(\frac{\overline{F }(x,{\delta }_{2})}{\overline{F }(x,{\delta }_{1})}\ge \frac{f(x,{\delta }_{2})}{f(x,{\delta }_{1})}\ge \frac{1-\overline{F }(x,{\delta }_{2})}{1-\overline{F }(x,{\delta }_{1})}\) which yields \(\overline{F }\left(x,{\delta }_{1}\right)\le \overline{F }\left(x,{\delta }_{2}\right).\) This proves (a).

-

(b)

(b) Write \(h\left(0\right)=g\left(0\right),\) and \(h\left(x\right)=g\left(x\right)-g\left(x-1\right), x=\mathrm{1,2},..\) so that.

\(g\left(M\right)=\sum_{x=0}^{\infty }g\left(M\right)f\left(x,\delta \right)=\sum_{M=0}^{\infty }\sum_{x=0}^{M}h\left(x\right)f\left(M,\delta \right)=\sum_{x=0}^{\infty }\sum_{M=x}^{\infty }h\left(x\right)f\left(M,\delta \right)=\sum_{x=0}^{\infty }h\left(x\right)\overline{F }(M,\delta )\) and (b) follows from (a), noting that (i) \(\overline{F }\left(0,\delta \right)=1\) and (ii) \(h\left(x\right)\ge 0\left(x=\mathrm{1,2},\dots \right)\) as \(g(.)\) is non-decreasing over \({Z}^{+}\). Note that the change in order of summation in the above is justified because \({E}_{\delta }\{g(X)\}\) exists finitely for every \(\delta .\)

Lemma 2

If \(X\) follows the binomial distribution with parameters \(n\) and \(\phi \), then for every non-decreasing function \(g(.)\) over \({Z}^{+}\). \(E\{g(x)\}\) is non-decreasing in \(n\) as well as \(\phi .\)

Proof

The probability mass function of \(X\) is given by \(f\left(x,n,\phi \right)= \left\{\begin{array}{l}\left(\genfrac{}{}{0pt}{}{n}{x}\right){\phi }^{x}{\left(1-\phi \right)}^{n-x}, if x=\mathrm{0,1},2,\dots n\\ 0 ,otherwise\end{array}\right.\)

Where \({\prime}{n}^{\prime}\) is a positive integer and \(0<\phi <1\). Clearly, condition (1) is met with \(\delta \) interpreted as either \(n or \phi .\) As shown in (i) and (ii) below, (2) is also met with \(\delta \) interpreted as either \(n or \phi \). Hence, the result follows from Lemma 1.

(i) For \({x}_{1},{x}_{2}\in {Z}^{+}, {x}_{1}<{x}_{2},\) positive integers \({n}_{1}, {n}_{2},{n}_{1}<{n}_{2},\) and any fixed \(\phi \left(o<\phi <1\right),\) let

If \(x>{n}_{1},\) then \({x}_{2}>{n}_{1}\) and \(A=0,\) while if \({x}_{2}>{n}_{1},\) then \(A=f\left({x}_{2},{n}_{2},\phi \right)f\left({x}_{1},{n}_{1},\phi \right)\ge 0.\) If neither \({x}_{1}\) nor \({x}_{2}\) exceeds \({n}_{1},\) then after a little simplification,

\(\frac{f\left({x}_{2},{n}_{2},\phi \right)f({x}_{1},{n}_{1},\phi )}{f\left({x}_{2},{n}_{1},\phi \right)f({x}_{1},{n}_{2},\phi )}=\frac{\left({n}_{2}-{x}_{1}\right)!\left({n}_{1}-{x}_{2}\right)!}{\left({n}_{2}-{x}_{2}\right)!\left({n}_{1}-{x}_{1}\right)!}=\frac{\left({n}_{2}-{x}_{2}+1\right)\dots ({n}_{2}-{x}_{1})}{\left({n}_{1}-{x}_{2}+1\right)\dots ({n}_{1}-{x}_{1})}>1\), i.e., \(A>0\)

(ii) For \({x}_{1},{x}_{2}\in {Z}^{+}, {x}_{1},{x}_{2}, 0<{\phi }_{1},{\phi }_{2}<1,\) and any fixed positive integer \(n\), let \(B=f\left({x}_{2},n,{\phi }_{2}\right)f\left({x}_{1},n,{\phi }_{1}\right)f({x}_{1},n,{\phi }_{2})\). If \({x}_{1}>n or {x}_{2}>n,\) then \(B=0.\) Else, if neither \({x}_{1}\) nor \({x}_{2}\) exceeds \(n\), then \(\frac{f\left({x}_{2},n,{\phi }_{2}\right)f({x}_{1},n,{\phi }_{1})}{f\left({x}_{2},n,{\phi }_{1}\right)f({x}_{1},n,{\phi }_{2})}={\left[\frac{{\phi }_{2}\left(1-{\phi }_{1}\right)}{{\phi }_{1}\left(1-{\phi }_{2}\right)}\right]}^{{x}_{2}-{x}_{1}}>1,\) i.e.\(B>0\).

Proposition 1

Let \(0<{\phi }_{1},{\phi }_{2}<1\), and \(N\) and \(I\) be positive integers such that \(N>I\). Then,

\(L=\sum_{i=0}^{N}\sum_{j=0}^{i}\mathrm{min}\left(I,j\right)\left(\genfrac{}{}{0pt}{}{N}{i}\right){\phi }_{1}^{i}{\left(1-{\phi }_{1}\right)}^{N-i}\left(\genfrac{}{}{0pt}{}{i}{j}\right){\phi }_{2}^{j}{\left(1-{\phi }_{2}\right)}^{i-j}\) is non-decreasing in \(I,N,\) and \({\phi }_{1}.\)

Proof

Trivially, \(L\) is non-decreasing in \(I\), as \(\mathrm{min}\left({I}_{1},j\right)\le \mathrm{min}({I}_{2},j)\) for \({I}_{1}<{I}_{2}.\) Next, observe that \(L=\sum_{i=0}^{N}g\left(i\right)\left(\genfrac{}{}{0pt}{}{N}{i}\right){\phi }_{1}^{i}{\left(1-{\phi }_{1}\right)}^{N-i},\)… Equation (a5).

where \(g\left(i\right)= \sum_{j=0}^{i}\mathrm{min}\left(I,j\right)\left(\genfrac{}{}{0pt}{}{i}{j}\right){\phi }_{2}^{j}{\left(1-{\phi }_{2}\right)}^{i-j}\)

For any fixed positive \(i\), we can interpret \(g(i)\) as the expectation of \(H\left(Y\right)=\mathrm{min}\left(I,Y\right),\) where \(Y\) has the binomial distribution with parameters \(i\) and \({\phi }_{2}.\) Since \(H\left(.\right)\) is non-decreasing, by Lemma 2, \(g\left(i\right)\) is non-decreasing over positive integers \(i\). Moreover, \(g\left(i\right)\ge 0\) for every positive integer \(i,\) while, trivially, \(g\left(0\right)=0.\) Hence, \(g(.)\) is non-decreasing over \({Z}^{+}.\) Now, by equation (a5), \(L\) can be interpreted as the expectation of \(g(X)\), where \(X\) has the binomial distribution with parameters \(N\) and \({\phi }_{1}.\) Because \(g\left(.\right)\) is non-decreasing over \({Z}^{+}\), it is immediate from Lemma 2 that \(L\) is non-decreasing in \(N\) as well as \({\phi }_{1}\).

Consider the equations.

\(L\left(i,j\right)=\frac{N!}{j!\left(N-j\right)!\left(i-j\right)!}*{\left({\phi }_{1}{\phi }_{2}\right)}^{j}*{\left[{\phi }_{1}\left(1-{\phi }_{2}\right)\right]}^{i-j}{\left[1-{\phi }_{1}\right]}^{N-i}\) …equation (a6).

Where \({\phi }_{1}= \lambda \left(b\right)=\) click probability and \({\phi }_{2}=\overline{F}\left(p|b\right)=\) conversion probability.

\( \pi \left( {t,I} \right) = {\text{max}}\sum\limits_{{b,q,0}} \left[ {\sum\limits_{{i = 0}}^{N} {\sum\limits_{{j = 0}}^{i} L } \left( {i,j} \right)*\left\{ {\left( {p*d} \right) - \left( {b*i} \right) - h*\left( {I - d} \right) - \left( {c*q} \right)} \right.} \right.\quad \left. {\left. { + \pi \left( {t - 1,I - d + q} \right)} \right\}\mathop \sum \limits_{{i = 0}}^{N} } \right] \) Equation (a7).

Where \(d=\mathrm{min}(I,j)\) and \(\pi \left(0,I\right)=s*I\)

Proposition 2

In order for the retailer to continue maximizing his profits even at higher inventories, optimal order quantity must be non-increasing with inventory for a given bid.

Proof

We prove the above proposition by induction. We assume that \(p>c>s.\) Given that the bid is constant, it can be implied that \({L}_{1}={L}_{2}={L}_{3}=\dots ={L}_{n}\)

Let \({I}^{\prime}=I+\Delta I\).

From equation (a7), we get, \(\pi \left(0,I\right)=s*I\)

This shows that at constant bids, optimal order quantity decreases with inventory.

Proposition 3

In order for the retailer to continue maximizing his profits even at higher inventories, the optimal bid must be non-decreasing with inventory for a fixed order quantity.

Proof:

We prove the above proposition by induction. We assume the retailers order the same quantity each period, then from Proposition 1, the quantity \(L\left(i,j\right)*d\) changes with \(N,{\phi }_{1}, and I.\) Bid affects \(N and {\phi }_{1}.\) (Also, note that \(p\gg b\)).

Therefore, \(b and I\) affect \(L\left(i,j\right)*d.\)

Let \({I}^{\prime}=I+\Delta I\).

From this, it can be said that the optimal bid should be non-decreasing with inventory when the retailer orders same quantity every period.

Proposition 4

For demand states \(d^{\prime} > d\) and \(\forall t\),

-

(iii)

\(S_{{2\left( {t,d^{\prime}} \right)}} \ge S_{{2\left( {t,d} \right)}} \)

-

(iv)

\(S_{{2\left( {t + 1,d} \right)}} \ge S_{{2\left( {t,d} \right)}} \)

Proof

(i) We prove the above proposition by induction. At \(t=1\), the profit maximization problem reduces to the myopic newsboy problem and hence for \(d^{\prime} > d\),\(S_{{2\left( {1,d^{\prime}} \right)}} = { }\overline{S}_{{1,d^{\prime}}} \ge { }\overline{S}_{1,d} = S_{{2\left( {1,d} \right)}}\).

From Proposition 1, we know that \(L\left( {i,j} \right){ }\) is non-decreasing in \(I,N,{ }\) and \(\phi_{1}\). Therefore at \(t = 2, \) for demand state \(d^{\prime}\) that is stochastically larger than the demand state \(d\), \({ }\overline{S}_{{2,d^{\prime}}} \ge { }\overline{S}_{2,d}\).

Hence, \(S_{{2\left( {2,d^{\prime}} \right)}} \ge S_{{2\left( {2,d} \right)}}\).

Repeating the above step for \(t = 3, 4, \ldots , N\), we complete the proof of (i).

-

(v)

Since \(L\left( {i,j} \right){ }\) is non-decreasing in \(N{ }\) and \(\phi_{1}\), \({ }\overline{S}_{t + 1,d} \ge { }\overline{S}_{t,d}\). Therefore, \(S_{{2\left( {t + 1,d} \right)}}\) = \({ }\overline{S}_{t + 1,d} \ge { }\overline{S}_{t,d} = S_{{2\left( {t,d} \right)}}\).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Tunuguntla, V., Basu, P., Rakshit, K. et al. Sponsored search advertising and inventory replenishment: a decision support framework for an online retailer. Ann Oper Res (2024). https://doi.org/10.1007/s10479-023-05643-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05643-5