Abstract

With the vigorous development of e-commerce, digital content consumption has prospered in the consumer market. Considering the perishability of digital content products and the negative utility of advertisements on users, the paper develops a dynamic game model for the supply chain with a digital content platform and an upstream advertiser, and obtains the optimal (or equilibrium) resource investing, pricing, and advertising strategies under the centralized and decentralized decision-making cases. The main results show that the marketing strategies of pricing and advertising are constant over the planning horizon, while the operation strategy of resource investing which depends on digital content products’ perishability is decreasing over time. And, the platform may open resource for free to benefit more from advertising. Furthermore, for a certain region with relatively small price sensitivity, a counterintuitive result is obtained that the resource investing level and the profits of both members increase with the price sensitivity under the decentralized case, which is in sharp contrast to the centralized case. Finally, ignoring the product perishability in the decision-making process will cut down the resource investment level and profit, and the profit loss is intensified by a lower price or advertising sensitivity of consumers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, with the rapid development of internet technology and the widespread application of mobile payment, digital revenue has been increasing greatly in the consumer market, driven by the huge growth of internet advertising and digital content consumption. According to the report “Global Entertainment and Media Outlook 2019–2023” from PricewaterhouseCoopers (PwC), the global entertainment and media market value will reach $2.6 trillion by 2023, with a compound annual growth rate of 4.3% (PricewaterhouseCoopers, 2019).

As compared with traditional physical products, digital content products have some special features. First, digital content products are different from traditional physical products in cost structure (Jones & Mendelson, 2011). The fixed costs of digital content products (which can be understood as independent research and development cost, and copyright purchase cost) are high, but the variable costs (such as, production, storage, and transmission) are almost zero. Second, there are no restrictions on the production of digital content products. After investing in resource, digital content platforms can achieve unlimited production and cover the entire market demand. Third, the value of digital content products is perishable, and the consumer valuation of the newer digital content products is higher. For example, the value of the dated version of Microsoft Office software is usually much less than that of the new version (Dou et al., 2017). Empirical evidence also shows that in the video game market, consumer valuation depreciates over time is a common phenomenon (Shiller, 2013). Therefore, it is crucial for digital content platforms to make dynamically resource investing policy from a long-term perspective to maintain their competitiveness.

In addition to the characteristics of digital content products themselves, the profit model of the digital content market is also different from that of the traditional market. As known, product charging revenue is the main income of the traditional market. However, besides the charging revenue, digital content platforms gain a large portion of their income from advertising. From photo sharing to video games, advertising has become an important source of income for many large platforms, such as, Hotmail, Facebook, and MySpace. Some platforms even adopt the strategy of providing free content to attract consumers and advertisers. For example, the Google and Baidu search engines are provided for free to users; the income of such platforms mainly depends on advertising revenue. Moreover, as compared with the traditional advertising, the platform advertising comes in various types, including website sponsorship, built-in search results, product placement, and social networking links. Although platforms can profit from charging advertising fees, they need to take consideration of the user loss due to the negative utility caused by commercial advertisements. In other words, the user size decreases with the volume of commercial advertisements, as consumers generally hate commercial advertisements in experiencing digital content products (Reisinger, 2012). Consequently, platforms should carefully develop advertising strategy and pricing strategy to balance the advertising revenue from advertisers and the charging revenue from users.

As for the game relationship between advertisers and digital content platforms, it is common that advertisers are the dominant party with deciding the advertising expense paid to platforms. Whereas there exist some large platforms who decide the advertising fee themselves, most platforms choose to actively contact advertisers and give up the advertising pricing initiative, rather than waiting for advertising opportunities, so as to avoid advertising revenue loss. The decision-making on advertising payment not only influences the advertising revenue via the direct impacts on the advertising level, but also affects the charging revenue indirectly since the user size is related to the advertising level. The fact that platforms expect a high advertising payment but advertisers prefer to cut down the advertising payment, also makes the game with marketing (advertising and pricing) and operations (resource investing) become more complicated.

Based on the above background, the common theories and models used in the traditional market are no longer fully applicable to the digital content market (Chang & Yuan, 2009). This paper develops a dynamic Stackelberg game model over a finite planning horizon, involving an advertiser who is the leader and a digital content platform who is the follower. The advertiser decides the unit advertising payment to the platform, and the platform dynamically determines the resource price, advertising level, and resource investing level. Specifically, comprehensively considering the features of the digital content market and the negative utility of advertisements on the platform users, this paper studies the operation and marketing decisions of both profit-maximizing firms under a long-term dynamic environment. To examine the efficiency of the digital supply chain, this paper also investigates the centralized case for the sake of comparison. And then, this paper discusses the case without the consideration of the perishability of digital content products in the making-decision process in order to explore the influence of ignoring perishability on firms’ profitability. This work aims at addressing the following questions:

(1) What are the equilibrium advertising payment for the advertiser and the equilibrium resource price, advertising level, and resource investing level for the platform in the game?

(2) How does the ignoring perishability of digital content products affect firms’ operation decisions and profits?

(3) What are the effects of price sensitivity, advertising sensitivity, and unit advertising revenue on the equilibrium decisions and profits?

By solving the dynamic game problem between the advertiser and the platform in basis of the optimal control method, this paper figures out the above questions. The main findings are summarized as follows: (1) The platform opens resource for free if the unit advertising revenue is sufficiently high, or consumers are not very sensitive to advertisements, or consumers are very sensitive to the resource price. (2) Under both the centralized and decentralized cases, taking consideration of the dynamics due to the perishability of digital content products will lead to an optimal (or equilibrium) dynamic operation strategy in resource investing which depends on perishability, but the optimal (or equilibrium) marketing strategies of pricing and advertising are constant over the planning horizon. And in the centralized case, the pricing and advertising policies are independent of the perishability. (3) For a region with relatively small price sensitivity, a counterintuitive result is obtained that the equilibrium resource investing level and profits of both members increase with the price sensitivity, which is in sharp contrast to the centralized case where the optimal resource investing level and profit of the whole supply chain decrease with the price sensitivity. This is because a larger price sensitivity in a certain region can reduce the double marginalization of the supply chain. (4) The equilibrium resource investing level is nonmonotonic with respect to the advertising sensitivity and the unit advertising revenue, which is also different from the centralized case. In addition, it is shown that firms’ neglect of the product perishability will decrease the resource investment level, and lead to the loss of profit which is intensified by lower advertising sensitivity and price sensitivity.

The remainder of this paper is organized as follows. A literature review is provided in Sect. 2. The Stackelberg game model between the advertiser and the digital content platform is developed in Sect. 3. Both analytical and numerical studies are conducted in Sect. 4 to obtain managerial insights. Section 5 summarizes the paper and discusses the future research directions. All proofs are provided in Appendix.

2 Literature review

This paper mainly involves two literature streams: one is the pricing strategy of digital content platforms; the other is the advertising strategy of digital content platforms.

Pricing strategy has a significantly impact on market demand, and the pricing strategy of digital content platforms has been discussed in many previous studies. For example, Caillaud and Jullien (2003) first put forward two specific charging models of digital content products, i.e. registration fee and transaction fee. And, Rochet and Tirole (2006) define the former as membership or fixed charge and the later as usage or variable charge. As compared with traditional physical products, consumers are more sensitive to digital content products (Goh & Bockstedt, 2013). Analogously, some studies, such as, Boudreau (2012), Casey and Töyli (2012), Keskin and Taskin (2015), and Nan et al. (2016) investigate the pricing strategy of digital content platforms under asymmetric crossover network effects, and show that the platforms can attract more consumers by taking a lower price. Moreover, (Boudreau & Jeppesen, 2015) find that in fact, under the strong asymmetric network effects, digital content platforms can make more profits by providing their resource for free to customers, that is, taking free pricing strategy is more profitable for digital content platforms. Na et al. (2017) consider two pricing strategies of digital content platforms, free value-added strategy and paid-content strategy, and divided digital content platforms into three groups based on the pricing strategies; they find that the platforms who use free value-added strategy obtain the highest profit, followed by the platforms who adopt paid-content strategy, and the worst are the platforms who adopts mixed strategy. Nan et al. (2019) analyze the the optimal pricing strategies for cloud service providers in a competitive setting. Wang and Guo (2021) discuss the optimal subscription strategy for network video platforms: paid strategy, free strategy, and trial strategy; and show how it is affected by social influence. They also suggest that positive social influence expands consumers’ tolerance of advertising when compared to a video with no social influence. Duan et al. (2022) examine the optimal pricing strategy of online platforms by developing a two-sided model considering users’ privacy concerns. They find that the platform can strategically make pricing decisions based on the level of information disclosure to influence user demand and further promote the participation of advertisers, and discuss the conditions under which the online platform has an incentive to provide users with free services. For the establishment of dynamic pricing model, the researchs of Liu et al. (2015) and Sun et al. (2020) provide workable methods and guidance, considering the dynamic pricing and investment strategy for perishable products. Different from these works, this paper examines the dynamic pricing strategy of a digital content platform and identifies the conditions under the platform resource is free and paid in a dynamic game model.

Advertising strategy has received much attention driven by the fact that the advertising revenue shares a large part of income for digital content platforms, and the existing studies focus on the revenue models. For example, Casadesus-Masanell and Zhu (2010) develop four revenue models, i.e., subscription-based model, ad-sponsored model, mixed model, and dual model. They investigate how the revenue model of the potential entrant affects the revenue model of the existing firms, and find that the existing firms prefer to choose singleton model of only subscription-based or ad-sponsored. Pauwels and Weiss (2008) adopt empirical methods and show that for online content providers, it is more profitable to switch from free model to subscription model, even though they may lose the advertising revenue. On the contrary, Chiou and Tucker (2013) adopt empirical methods and find that introducting the subsciption model would significantly reduce the online website traffic, especially the click volume of young consumers. Kumar and Sethi (2009) believe that advertising alone could not support the survival of digital content platform firms. They dynamically establish the revenue model including advertising revenue and subscription fee and obtain the optimal dynamic pricing and advertising level of the digital content platform. Kind et al. (2005) analyze the impact of competition on the revenue of a media platform by establishing mathematical models under different market structures. They demonstrate that under the monopolistic market structure, the platform could choose the model of consumer payment; while under the competitive structure, the platform could make profits by selling advertising space, in which the platform simultaneously charges consumers and advertisers. Godes et al. (2009) establish mathematical models and point out that the greater the competition intensity, the more revenues the media platforms would obtain from consumer payment, and the less revenues they would obtain from advertisers. Chen et al. (2016) studies the effects of different business models on the digital content platform’s revenue and social welfare, and find that when the advertising space is small, the brokerage model is better in profitability for the platform than the advertising model. Lambrecht and Misra (2016) empirically investigate and quantified the tradeoff between resource subscription and advertisements, and show that due to the heterogeneity and the time of consumers’ willingness to pay, adopting a static model may be suboptimal and flexibly adjusting the amount of resource can improve the revenue of the digital content platform. Kaul et al. (2018) construct a integer linear programming model to identify the optimal allocation of advertisements in media over a planning horizon. Kim and Moon (2020) develop a non-linear model and two algorithms to analyze the web advertisement scheduling of online advertisement publishers who maximize advertising effectiveness. Chakraborty et al. (2021) investigate the revenue management problem of Video Sharing Platforms in determining the optimal mix of skippable and non-skippable advertisements, which helps Video Sharing Platforms in determining the incentive they should provide to the advertisers to switch to their preferred advertisement type. This paper focuses on the tradeoff between the advertising revenue and the charging revenue, with the considerations of the perishability of digital content products and the game relationship between a digital content platform and an advertiser.

There also some existing studies focused on the influences of different factors on digital content platforms’ operation and marketing strategies. For example, Lin et al. (2012) consider the online service level, Liu et al. (2012) consider information technology capacity constraints, Chen and Stallaert (2014) consider behavioral factors, and Xiao et al. (2020) consider platform digital empowerment-induced demand. In addition, some scholars investigate the game issues between advertisers and digital content platforms. For example, Sun and Zhu (2013) adopt empirical studies and find that the result consistent with theoretical studies that the digital content platform who has advertising sponsorship would introduce more popular resources. Hao et al. (2017) consider two distinct features of in-app advertising market, and develop a two-sided market model and examine the effects of the two features on the revenue of the media platforms. This work investigates the impacts of price sensitivity, advertising sensitivity, and unit advertising revenue on the optimal decisions and profits of the firms.

To the best of my knowledge, throughout the research developed so far, a few papers provide the dynamic analysis of the digital content market, while most papers usually consider the operation and marketing strategies under a static environment. In addition, those papers in which problems are solved dynamically just consider the pricing strategy or the advertising strategy. This work is different with the existing researches as the consideration of the perishability of digital content products, and accordingly this paper studies the dynamic resource investing strategy of the platform. Moreover, most of the previous analysis of the digital content market focus on the decisions of platform themselves, and few papers consider the decisions of the upstream advertiser. This paper considers the scenario where the advertiser as the leader decides the advertising payment, and the platform as the follower decides the resource price, the advertising level, and the resource investing level in a Stackelberg game framework.

3 Model description

Consider a game model in which an advertiser (she) advertises on a platform (he) who operates digital content products. The platform’s resource level declines over time due to the perishability of digital content products; for example, the newer movies tend to be more valuable to consumers, and after a period of time they will be less attractive. For this reason, the platform continuously invests in the introduction and renewal of resource to guarantee a good profitability. Therefore, the dynamic evolution of the resource level I(t) can be characterized as follows:

where the decision u(t) made by the platform denotes the resource investing level or the increased resource volume at time t; \(\delta >0\) is the depreciation rate of the resource level, and a larger \(\delta \) implies that the resource level is more time-sensitive; and \(I_0\) denotes the initial resource stock. The platform’s resource investing cost is assumed to be \(\frac{s}{2}u^2(t)\), with \(s>0\) reflecting the resource investing efficiency. The quadratic cost form captures the diminishing return of resource investing.

The advertiser advertises on the platform to attract the platform’s users to purchase her products or services, with being allowed an advertising level or intensity l(t) by the platform. The platform’s users need to pay a fee p(t) for using the platform’s resource. As a result, the user size (the consumer demand) of the platform at time t is jointly affected by the resource level I(t), resource price p(t), and advertising level l(t), which is formulated by

where kF(p(t), l(t)) denotes the marginal contribution of the platform resource to the user size, and a larger coefficient k implies that per unit resource can attract more consumers. The term F(p(t), l(t)) reflects the impacts of resource price p(t) and advertising level l(t) on the marginal contribution to the user size. In particular, when there is nothing in the repository (i.e., \(I(t)=0\)), no consumers will use the platform (i.e., \(D(t)=0\)).

Obviously, a higher price p will reduce the marginal contribution of the platform resource to the user size, i.e., \(\frac{\partial F}{\partial p}<0\). Note that advertisements would give rise to a negative utility on the platform users, based on the fact that the users generally dislike the advertisements displayed in using digital content products. For example, consumers would show a sense of disgust if they are interrupted by advertisements when watching movie on an online video platform. Hence, a higher advertising level l will also reduce the marginal contribution, i.e., \(\frac{\partial F}{\partial l}<0\). Furthermore, the marginal effect of the advertising level on the marginal contribution increases with the advertising level, which indicates that the term F(p, l) is a concave and decreasing function with respect to l, i.e., \(\frac{\partial ^2 F}{\partial l^2}<0\). This fact can be shown from the practical observation that the more in-stream advertisements in experiencing digital content products, the lower consumers’ tolerance for the platform. Based on the above considerations and for the sake of analytical discussion, it is assumed that F(p, l) takes the form of \(F(p,l)=a-bp-gl^2\). Therefore, the consumer demand at time t is given by

where \(a>0\) reflects the market potential, and \(b>0\) is the price sensitivity which describes that the consumer demand decreases with price p. The assumption about the linear decreasing demand function with respect to price p is widely used in existing literature (Asdemir et al., 2008; Yuan et al., 2017). The coefficient \(g>0\) denotes the advertising sensitivity, implying that more consumers will stay out of the platform if the advertising level increases. The square of l means that a higher advertising level will lead to a greater degree of consumers’ marginal aversion. The quadratic form widely applied in existing literature characterizes the phenomenon of increasing margin, for which the platform would not make excessive advertisements.

A Stackelberg game arises between the advertiser and the platform, wherein the advertiser is the leader and the platform is the follower. The advertiser advertises her own products or services which are independent with the digital content products on the platform, and obtains revenue H per unit advertisement per platform user. Hence, the advertiser’s advertising revenue per unit time is HD(t)l(t). On the other hand, the advertiser needs to pay advertising expense h to the platform for per unit advertisement per platform user, which is her decision term satisfying the constraint \(h\in [0,H]\). Then the advertiser’s advertising expense paid to the platform per unit time is hD(t)l(t), which describes the transfer payment between the advertiser and the platform. Therefore, the advertiser’s objective functional within a finite planning horizon [0, T], i.e., the total profit \(\pi _a\) with the subscript “a” representing the advertiser, is modeled as

The platform’s revenue per unit time consists of two parts: one is charging revenue p(t)D(t) which comes from the platform users; the other is the advertising revenue hD(t)l(t) from the advertiser. Therefore, the platform’s objective functional over the planning horizon [0, T], i.e., the total profit \(\pi _p\) with the subscript “p” representing the platform, equals to the revenues minus the resource investing cost, and is formulated as

4 Strategy analysis

The paper first considers the centralized case as a benchmark, wherein the advertiser and the platform act as one firm to maximize the overall profit. And then, this paper focuses on the analysis under the decentralized case in which a Stackelberg game arises between the advertiser and the platform.

4.1 The centralized case

In the centralized case, the advertiser and the platform are integrated to one decision-maker. There does not exist the transfer payment between the advertiser and the platform, which is also equivalent to the case where the advertising payment h is given exogenously. Hence, the integrated system’s objective functional over the planning horizon [0, T], i.e., the total profit \(\pi _c\) with the subscript “c” representing the centralized case, is given by

Therefore, the following dynamic optimization problem can be formulated:

which is an optimal control problem with one state variable \(I(\cdot )\) and three control variables \(p(\cdot ), l(\cdot )\), and \(u(\cdot )\).

By solving the optimal control problem (7) based on the maximum principle from (Sethi & Thompson, 2006), the optimal pricing, advertising, and resource investing levels are characterized in the following proposition.

Proposition 1

In the centralized case, the optimal price, advertising level, and resource investing level are respectively given by

where \(\hat{h}=\sqrt{\frac{4ag}{3b^2}}\).

It is interesting to show from Proposition 1 that both the optimal price and advertising level are constant. Specifically, even considering the dynamics of the platform’s resource level due to the perishability of digital content products, the marketing strategies of pricing and advertising are time-invariant, which illustrates that the firm would take static marketing strategies, and only the operation strategy of resource investing is time-varying. These findings can be verified from the practice, for example, many online video platforms in China, such as iQIYI and Youku, have always charged a stable and similar fee per unit time to their users (about 30 yuan RMB per month), and kept inserting advertisements at a stable frequency (including pop-up ads, interstitial ads, etc), while frequently and actively introduced new video resources to attract more users. Furthermore, the pricing and advertising policies are independent of the perishability, while the resource investing level is decreasing over time. It is intuitive that the platform would invest more at the early stage of the planning horizon to attract more consumers, and invest less at the later stage of the planning horizon for saving cost.

In addition, the optimal decisions depend on the unit advertising revenue H. Specifically, when the unit advertising revenue is relatively high (\(H> \hat{h}\)), the platform opens the digital content products free of charge to users (\(p^*_c(t)=0\)). And, the platform does not increase the advertising level unlimitedly no matter how high the unit advertising revenue is. This implies that the optimal advertising level \(\sqrt{\frac{a}{3g}}\) is independent of the unit advertising revenue, and is determined jointly by the market size and the advertising sensitivity. When the unit advertising revenue is relatively low (\(H\le \hat{h}\)), all the time-invariant strategies (pricing and advertising) and the time-varying strategy (resource investing) depend on the unit advertising revenue.

Next, based on the results obtained in Proposition 1, the paper conducts analytical studies for the impacts of the main parameters on the optimal decisions to obtain important managerial implications.

Corollary 1

For the turning point \(H=\hat{h}=\sqrt{\frac{4ag}{3b^2}}\), the results are as follows:

-

(i)

As g increases, \(p^*_c(t)\) is set for free first and then increases, \(l_c^*(t)\) decreases, and \(u^*_c(t)\) decreases.

-

(ii)

As b increases, \(p^*_c(t)\) decreases first and then is set for free, \(l^*_c(t)\) increases first and then keeps constant, and \(u^*_c(t)\) decreases first and then keeps constant.

-

(iii)

As H increases, \(p^*_c(t)\) decreases first and then is set for free, \(l^*_c(t)\) increases first and then keeps constant, and \(u^*_c(t)\) increases.

For Corollary 1(i), the increase of the advertising sensitivity g implies that advertisements exert a larger negative effect on the platform users, causing more consumers to leave the platform market and accordingly a lower profit of the firm. To ensure enough demand for profit, the firm has to reduce the advertising level. Note that the centralized firm’s revenue consists of two parts: advertising revenue HD(t)l(t) and charging revenue p(t)D(t). For a relatively small advertising sensitivity (\(g<\frac{3b^2H^2}{4a}\)), the advertising revenue significantly dominates the charging revenue. Thus, the firm chooses to open the platform for free to attract more consumers. For a relatively large advertising sensitivity (\(g\ge \frac{3b^2H^2}{4a}\)), both the advertising revenue and the charging revenue are important for the firm. In this case, with the advertising sensitivity increasing, the profitability in advertising is reduced, and thus the firm chooses a higher price to obtain a higher charging revenue to make up for the advertising revenue loss. Finally, a larger advertising sensitivity implies that it’s not cost-effective for the firm to spend same expenditures as before in resource investing, as a result of the deterioration of investing environment. In other words, consumers’ incremental dislike about advertisements will reduce the firm’s resource investing willingness.

For Corollary 1(ii), when the price sensitivity b is relatively small (\(b\le \sqrt{\frac{4ag}{3H^2}}\)), both the advertising revenue and the charging revenue are important for the firm’s profitability. The increase of the price sensitivity implies that for the same pricing level, more consumers will leave the platform market. Hence, the firm has to set a lower price to reduce customer defection. However, when the price sensitivity is sufficiently large (\(b>\sqrt{\frac{4ag}{3H^2}}\)), the profitability in charging is greatly reduced, and the charging revenue is significantly dominated by the advertising revenue. Thus, the firm chooses to open the platform for free to attract more consumers. As for the impacts of the price sensitivity on the advertising level and resource investing level, the details are as follows. When the price sensitivity is relatively small, the firm increases the advertising level to improve the advertising revenue for making up for the charging revenue loss due to a lower price, with the price sensitivity increasing. Since an increasing price sensitivity means the deterioration of investing environment, it’s not cost-effective for the firm to spend as much as before in resource investing. When the price sensitivity is sufficiently large, the platform is free to the consumers, and thus the advertising and resource investing levels remain unchanged no matter how the price sensitivity changes.

For Corollary 1(iii), when the unit advertising revenue H is relatively low (\(H\le \hat{h}\)), both the advertising revenue and the charging revenue contribute to the firm’s profitability. Note that the advertising revenue is directly dependent on consumer demand. As the unit advertising revenue increases, it is obvious that the firm will set a higher advertising level. Furthermore, the firm is motivated to cut the price down and to improve the platform resource investing level for attracting more consumers. However, when the unit advertising revenue is sufficiently high (\(H>\hat{h}\)), the advertising revenue significantly dominates the charging revenue, and thus the firm sets the price to zero. That is, for a high enough advertising revenue, the firm will offer the platform resource for free to users. This explains the phenomenon in practice where some platforms choose to open to the public free of charge to attract subscribers, because the firms earn more from advertising and only need to attract more consumers; for example, YouTube and iQIYI provide a large amount of video resources to consumers for free. Note that in this case, the firm has no space to reduce the price any more for that the platform resource is free for consumers. Thus, in order to enhance consumer demand, the firm no longer raises the advertising level. The rationality behind is that despite increasing advertising level has a positive effect in improving marginal revenue, it also has a negative effect on profitability due to demand loss. These two opposite effects cancel each other out no matter how the unit advertising revenue changes, hence the firm chooses to maintain the constant advertising level independent on the unit advertising revenue. Finally, it is intuitive that the firm is motivated to continuously improve the resource investing level to attract more consumers when the unit advertising revenue becomes higher.

By substituting the optimal decisions \(p^*_c(t)\), \(l^*_c(t)\), \(u^*_c(t)\) presented in Proposition 1 into Eq. (6), the optimal profit of the centralized firm can be obtained as follows:

where \(\varDelta _1=\frac{k(b^2H^2+4ag)^2}{64bg^2\delta se^{\delta T}}\), and \(\varDelta _2=\frac{2kaH\sqrt{3a}}{9\delta s\sqrt{g}e^{\delta T}}\). Some numerical results which show several important parameters’ impacts on the optimal profit under the centralized case, are summarized in Table 1.

Intuitively, an increase in the advertising revenue H will bring more profits for the centralized firm. An increase in the advertising sensitivity g reduces consumer demand, and in turn reduces the profit. An increase in the price sensitivity b reduces consumer demand when the price sensitivity is small, while it has no effect on consumer demand because the platform resource is free when the price sensitivity is large. Therefore, the firm’s profit decreases first and then remains constant as the price sensitivity increases. An increase in the platform resource attraction k implies that more users are drawn to the platform, and thus the profit increases. A higher depreciation rate \(\delta \) implies that the platform resource has greater depreciation, causing more consumers to run off and accordingly profit reduction. An increasing cost coefficient s means a lower investing efficiency, thus reducing the profit. Finally, since a higher initial resource level \(I_0\) means a higher initial demand, the profit is improved.

4.2 The decentralized case

In the decentralized case, a Stackelberg game arises between the advertiser (the leader) and the platform (the follower), denoting the case by the subscript “d”. The dynamic game problem between the upstream advertiser and the downstream platform is described as follows:

First, using backward induction method to solve the dynamic game problem (12). Specifically, for a given advertiser’s advertising payment h, solve the platform’s optimal control problem and obtain the corresponding optimal response functions of pricing, advertising, and resource investing levels as those shown in Eqs. (8)–(10) with the parameter H replaced by h (according to Proposition 1), namely,

The optimal response functions depend on the upstream advertiser’s decision h, that is, the upstream advertiser can control the platform’s response by choosing different advertising payment h. Once the optimal advertising payment \(h^*\) is determined by the advertiser, the optimal strategies for the platform can be obtained by virtue of the optimal response functions in Eqs. (13)–(15). It is can be verified from Eqs. (13)–(15) that despite considering the dynamics of the platform’s resource level due to the perishability of digital content products, the optimal marketing strategies of pricing and advertising will be time-invariant, which implies that the platform would take stable (static) marketing strategies and only take a dynamic operation strategy in resource investing.

By comparing the optimal decisions of the decentralized case to that of the centralized case, the following corollary can be obtained.

Corollary 2

\( p^*_c(t)\le p^*_d(t, h), l^*_c(t)\ge l^*_d(t, h)\), and \(u^*_c(t)\ge u^*_d(t, h)\) hold for any \(t\ge 0\) and \(h\in [0, H]\).

Corollary 2 shows that when a game occurs between the upstream advertiser and the downstream platform, the platform will raise the price and reduce the advertising and resource investing levels, as compared to the centralized case. The double marginalization effect in the supply chain drops a hint that the profit-maximizing advertiser and platform have conflicts to achieve their goals. Obviously, in the decentralized case, the advertiser will set a unit transfer payment h lower than her unit advertising revenue H to gain positive advertising revenue, causing the platform to set a lower advertising level due to advertising margin reduction (i.e., \(H-h<H\)). Meanwhile, the platform increases the price to make up for his advertising revenue loss (i.e., \(hDl<HDl\)). Moreover, owing to the unit revenue reduction, it is not cost-effective for the platform to make resource investing as same as the centralized case to attract more consumers, and thus the resource investing level is reduced in the decentralized case.

Substituting the optimal response functions (13)–(15) into the state equation (1) and the demand function (3), the demand rate can be obtained as

where \(A=\frac{1}{4}b^2h^2+ag\) and \(B=bg^2\delta ^2sI_0\).

By virtue of the response functions (13)–(16), the optimization problem for the advertiser with deciding the optimal unit advertising payment is given as

By solving the optimization problem (17), one can obtain the optimal unit advertising payment h which implicitly depends on the perishability coefficient \(\delta \). Hence, for the decentralized decision-making case, it is concluded that all of the operational and marketing policies depend on the perishability, which is different from the centralized decision-making case. As presented in Eq. (17), the expression of the advertiser’s profit (a high power equation) is too complex to yield the analytical solutions, and thus the paper adopts numerical studies to find some managerial insights. The basic parameters are set as a benchmark: \(a=1, b=0.5, g=0.5, k=0.5, s=0.5, H=3, T=10,\) and \(\delta =0.02\). When analyzing the impacts of a parameter, one keeps the values of other parameters unchanged.

First, Fig. 1a, b depict the advertiser’s optimal (equilibrium) unit advertising payment with respect to the price sensitivity b. Specifically, Fig. 1a presents the advertiser’s profit with the unit advertising payment h under different price sensitivities. As observed, for a given price sensitivity, the advertiser’s profit is a unimodal function with respect to the unit advertising payment, which is driven by two effects. On one hand, the increase of the unit advertising payment decreases the advertiser’s profit directly. On the other hand, a larger unit advertising payment improves the advertiser’s profit indirectly by stimulating the platform to introduce more advertisements. When the unit advertising payment is relatively low, the indirect increasing effect outperforms the direct decreasing effect, where the advertiser’s profit increases with the unit advertising payment, and vice versa. Therefore, for any given price sensitivity b, there exists a unique optimal advertising payment set by the advertiser.

Figure 1b shows that as the price sensitivity b increases, the optimal (equilibrium) unit advertising payment increases first, then decreases, and becomes constant afterwards. When the price sensitivity is relatively small, both the platform’s advertising revenue and charging revenue are important. In this case, the increase of the price sensitivity will decrease the platform’s revenue from charging users due to a reduced demand and a lower price, and thus the advertiser as the leader taking a comparative advantage in the game would provide a higher advertising payment to induce the platform to introduce more advertisements for obtaining a higher advertising revenue. While the price sensitivity is relatively large, the platform’s profitability mostly relies on the advertising revenue. In this case, the advertiser as the leader in the game has incentives to reduce the advertising payment to extract more profits as the price sensitivity increases. Although the advertiser’s action discourages the platform to introduce advertisements, the advertiser’s loss is dominated by the earning from the reduction in the advertising payment, which consequently induces the advertiser to decrease the advertising payment. When the price sensitivity is sufficiently large, the platform’s resource is provided for free, which makes the advertising and resource investing decisions independent of the price sensitivity, and thus the advertiser keeps the unit advertising payment unchanged as the price sensitivity increases.

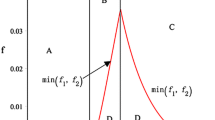

Figure 2 shows the platform’s optimal (equilibrium) decisions with respect to the price sensitivity b. Specifically, Fig. 2a illustrates that when the price sensitivity is relatively small, the price decreases with the price sensitivity. In this case, because both the charging revenue and the advertising revenue are important, the platform has incentives to cut down the resource price to prevent the loss of users as the price sensitivity increases. Meanwhile, as shown in Fig. 2b, the platform rises up the advertising level to make up for the charging revenue loss. When the price sensitivity is large enough, the charging revenue is significantly dominated by the advertising revenue. In order to get a high demand for a considerable advertising revenue, the platform reduce the price to zero, and thus advertising level remain unchanged. Figure 2c, d show that with the price sensitivity increasing, the resource investing level decreases first, then increases slightly, continues to decrease later, and keeps unchanged finally. When the price sensitivity is relatively small, the fact that the increase of the price sensitivity decreases the resource investing efficiency causes the platform to reduce the resource investing level, even though it makes the advertiser increase the unit advertising payment (as shown in Fig. 1b) which promotes the resource investing. As the price sensitivity further increases, however, it is interesting to find that the platform increases the resource investing level, which is driven by a higher advertising payment from the advertiser. This interesting result differs from the centralized decision case where the resource investing level never increases with the price sensitivity. When the price sensitivity increases to a region (i.e., \(0.54<b<0.78\)), the resource investing will not benefit the charging revenue at all because the resource is opened for free. In this case, as the price sensitivity increases, the platform decreases the resource investing level due to the lower advertising payment from the advertiser. When the price sensitivity is sufficiently large (i.e., \(b>0.78\)), since the unit advertising payment remains unchanged, the platform keeps the resource investing level constant. In addition, Fig. 2c shows that for any given price sensitivity, the resource investing level is decreasing over time, which coincides with that in the centralized case and shares the same reasons.

Figure 3 shows the optimal (equilibrium) profits of the two firms with respect to the price sensitivity b. Specifically, Fig. 3a shows that as the price sensitivity increases, the advertiser’s profit increases first and then remains constant (for a relatively large b). Figure 3b shows that the platform’s profit decreases first, then increases slightly, continues to decrease later, and keeps unchanged finally. With the price sensitivity increasing, the platform’s profitability relies more on advertising revenue. Therefore, the advertiser as the leader in the Stackelberg game can strictly benefit from an increasing price sensitivity by inducing the platform to insert more advertisements, until the optimal decisions remain unchanged for a relatively large price sensitivity where her profit keeps unchanged. As for the platform, when the price sensitivity is relatively small, both the charging revenue and advertising revenue are important, and thus his profit decreases first with the price sensitivity. However, it is interesting to show that the platform’s profit correspondingly increases with the price sensitivity further increasing, because the advertiser increases the advertising payment. Recall that in the centralized case, except for the region with sufficiently large price sensitivity where the profit of the centralized system is independent of the price sensitivity, the system’s profit always strictly decreases with the price sensitivity. However, the profits of both members in the decentralized case increase with the price sensitivity in a certain region (for a relatively small b), which is in sharp contrast to the centralized case. In other words, a larger price sensitivity may bring a win-win outcome for both supply chain members. The rationality behind of this counterintuitive result is that a larger price sensitivity in a certain region can induce both members to focus on the profitability from advertising, and to make effective advertising and resource investing decisions, thus reducing the double marginalization in the supply chain. When the price sensitivity continues to increase to a sufficiently large level, the platform’s profit starts to decrease because the advertiser decreases the advertising payment. Finally, the platform’s profit keeps unchanged because the optimal decisions of both members are constant with respect to the price sensitivity.

Next, Figure 4 demonstrates the impacts of the advertising sensitivity g on the advertiser’s optimal (equilibrium) decision. Specifically, Fig. 4a shows that for a given advertising sensitivity, the advertiser’s profit is a unimodal function with respect to the unit advertising payment, which implies that there exists a unique optimal unit advertising payment set by the advertiser. The rationality behind is similar to that for Fig. 1a. Furthermore, Fig. 4b shows that with the advertising sensitivity increasing from a small level to a large level, the optimal unit advertising payment first decreases slightly, then increases significantly, and decreases afterwards. When the advertising sensitivity is relatively small, the platform’s advertising profitability dominates the charging profitability. In this case, the advertiser has no incentive to increase the advertising payment to stimulate the platform’s advertising strategy, since the relatively small advertising sensitivity has made the platform introduce considerable advertisements. Actually, the advertiser as the leader would reduce the advertising payment to extract more profits as the advertising sensitivity increases. While as the advertising sensitivity further increases, the larger negative effect leads to lower resource investing and advertising levels, and thus the advertiser begins to increase the advertising payment to stimulate the platform’s resource investing and advertising strategies. Finally, when the advertising sensitivity is sufficiently large (i.e., \(g>2.2\) as shown in Fig. 4b), the platform’s charging profitability dominates the advertising profitability, and the greater negative effect causes the platform to significantly reduce the resource investing and advertising levels. In this case, the high incentive cost for stimulating the platform’s resource investing and advertising strategies, makes the advertiser lower the advertising payment.

Figure 5 shows the platform’s optimal (equilibrium) decisions with respect to the advertising sensitivity g. Specifically, as the advertising sensitivity increases, the price keeps zero first and then increases, and the advertising level sustainedly declines, while the resource investing level decreases first, then keeps unchanged, and decreases finally. When the advertising sensitivity is relatively small, the advertising profitability outperforms the charging profitability, and thus the platform provides the resource for free to attract more users. When the advertising sensitivity is sufficiently large (i.e., \(g>2.2\) as shown in Fig. 5a), the advertising profitability decreases significantly, and thus the platform begins to increase the price to make up for the advertising revenue loss. As for the advertising decision, the larger advertising sensitivity implies the more the loss of users, and therefore the platform cuts down the advertising level to reduce the user loss, as shown in Fig. 5b. As for the resource investing level, when the advertising sensitivity is small, the resource investing efficiency decreases and the platform reduces the investing level, with the advertising sensitivity increasing. When the advertising sensitivity is intermediate, with it increasing, on the one hand, the advertiser increases the advertising payment (recall the analysis presented for Fig. 4b) which increases the platform’s unit advertising revenue and induces the platform to invest more in resource; on the other hand, an increasing advertising sensitivity leads to a large demand loss which makes the platform decrease the investment in resource. These two effects cancel out each other, and thus the platform keeps the resource investing level unchanged within \(1<g<2.2\), as shown in Fig. 5c, d. This interesting result that the optimal resource investing level is independent of the advertising sensitivity in a certain region is different from the centralized decision case where the optimal resource investing level always decreases with the advertising sensitivity. When the advertising sensitivity is large (i.e., \(g>2.2\)), the advertising revenue decreases (as shown in Fig. 4b), and therefore the platform decreases the resource investing level. In addition, for any given advertising sensitivity, Fig. 5c, d show that, the resource investing level is decreasing over time, which is in line with that of the centralized case.

Figure 6 shows the two firms’ optimal profits with respect to the advertising sensitivity. Specifically, as the advertising sensitivity increases, the profitability of the advertiser weakens and thus her profit decreases. The intuition is the same as that of the advertising level. With the advertising sensitivity increasing, the platform’s profit is decreasing in the region with relatively small or large advertising sensitivity, and is independent of those intermediate advertising sensitivities where a higher advertising revenue and a smaller demand cancel out each other in profitability and the resource investing level keeps unchanged.

Finally, Fig. 7 illustrates the impacts of the unit advertising revenue H on the advertiser’s optimal (equilibrium) decision. Specifically, Fig. 7a shows that for a given advertising revenue, the advertiser’s profit is unimodal with respect to the advertising payment, and thus there exists a unique optimal advertising payment set by the advertiser. Figure 7b shows that with the advertising revenue increasing, the advertising payment increases first, then keeps unchanged, and increases finally. When the advertising revenue is low, the advertiser increases the advertising payment to induce the platform to increase investments, as the advertising revenue increases. When the advertising revenue is intermediate, the advertiser keeps the advertising payment unchanged. In this region, the price is set to zero by the platform. Although a higher advertising payment induces the platform to made more resource investments, it also incurs a higher cost for the advertiser. These two factors cancel out each other and yield a constant advertising payment. When the advertising revenue is sufficiently high, the revenue increase is significantly exceeds the increase in the advertising payment, and thus the advertiser increases the advertising payment.

Figure 8 shows the platform’s optimal (equilibrium) decisions with respect to the unit advertising revenue H. When the unit advertising revenue is low, the advertiser increases the advertising payment, and thus the platform increases the advertising level, as the unit advertising revenue increases. However, the user demand decreases as the advertising level increases, and hence the platform decreases the price and increases the resource investing level. When the unit advertising revenue is intermediate, the platform’s decisions are unchanged because the advertiser keeps the advertising payment unchanged in a certain region of the unit advertising revenue. When the unit advertising revenue is high, the advertiser increases the advertising payment; while the platform keeps the advertising level unchanged due to a zero price and just increases the resource investing level. Additionally, Fig. 8c shows that for any given unit advertising revenue, the resource investing level decreases over time. Figure 9 shows the optimal (equilibrium) profits of the two firms with the unit advertising revenue varying. It is intuitive that a higher unit advertising revenue will bring the advertiser a higher profit. Since the impact of the unit advertising revenue on the platform’s profit depends on the advertiser’s advertising payment, the platform’s profit increases first, then keeps unchanged, and increases finally.

4.3 Discussion on the value of consideration of perishability

Note that in the centralized case, the pricing and advertising policies are independent of the perishability, and only the investment policy depends on the perishability. Notwithstanding, for the decentralized case, all of the operational and marketing policies depend on the perishability, so it can be expected that the value of considering perishability would be intensified compared to the centralized case. Therefore, for simplification, the following takes the centralized case as an example to discuss the scenario where the firm ignores the perishability of digital content products when making decisions. By comparing the firm’s profits earned in the two cases with and without consideration of the perishability, the paper can show the influence of the firm’s neglect of perishability on its profitability.

When the firm ignores the perishability of digital content products, the corresponding optimal price and advertising level keep the same as (8) and (9) under the centralized case, but the resource investing level changes to

which is smaller than (10). That is, ignoring the perishability will cut down the resource investing. By substituting the above optimal decisions into Eq. (6), the corresponding optimal profit of the centralized firm is obtained as

where \(\varDelta '_1=\frac{k(b^2H^2+4ag)^2}{64bg^2s}\), and \(\varDelta '_2=\frac{2kaH\sqrt{3a}}{9s\sqrt{g}}\).

Owing to the complex expression of the firm’s profits in Eqs. (11) and (19), numerical study are conducted to identify the influence of ignoring perishability on the firm’s profitability, with setting the basic parameters: \(a=1\), \(b=0.5\), \(g=0.5\), \(s=0.5\), \(T=10\), \(H=0.7\), and \(\delta =0.1\). It should be mentioned that the paper only focuses on the general case \(H<\hat{h}\) with \(p>0\), and the results obtained are robust for the case \(H>\hat{h}\) where the product is free (\(p=0\)). As shown in Figs. 10 and 11, the firm obtains more profits in the case with considering the product perishability than that with ignoring the product perishability. Furthermore, it is observed that the difference between the profits with and without consideration of perishability is monotonically decreasing with the price sensitivity or the advertising sensitivity. This illustrates that a lower price or advertising sensitivity of consumers will intensify the profit loss caused by ignoring the product perishability. In summary, the digital content platform should attach importance to the consideration of the product perishability when making operation decisions.

5 Conclusions

Digital content platforms have two salient features: one is the perishability of digital content products; the other is the negative utility on the platform users caused by the advertisements displayed on the platform. Based on the two features, this paper develops a dynamic game model for the supply chain with a digital content platform and an upstream advertiser, and investigates the operation and marketing strategies of the supply chain members. By using optimal control method, the paper solves the corresponding Stackelberg game in a dynamic environment over a finite planning horizon where the advertiser as the leader decides the advertising payment, and the platform as the follower dynamically decides the resource price, advertising level, and resource investing level. The main contribution of the paper is the analysis for the operational issues of the related firms in the digital content market by developing a dynamic model.

In order to fully analyze the model, the paper first considers the centralized case where the advertiser and the platform are integrated to one decision-maker, then solves the Stackelberg game under the decentralized case, and compares the two cases. By conducting analytical and numerical studies, the paper presents the optimal (or equilibrium) strategies and the impacts of the price sensitivity, the advertising sensitivity, and the unit advertising revenue on the optimal (or equilibrium) decisions and profits of the supply chain members. The main findings are presented as follows. First, under both the centralized and decentralized cases, despite considering the dynamics of the platform resource level due to the perishability of digital content products, the marketing strategies of pricing and advertising are static, and only the operation strategy of resource investing is dynamic. Second, for a region with relatively small price sensitivity, it is interesting to show that a increasing price sensitivity may make the platform increase the resource investing level, which is in contrast to the centralized case where the optimal resource investing level decreases with the price sensitivity. Furthermore, in this case, a counterintuitive result is obtained that the equilibrium profits of both members in the decentralized case increase with the price sensitivity, which is also different from the centralized case where the whole system’s profit decreases with the price sensitivity. The rationality behind is that a larger price sensitivity in a certain region can reduce the double marginalization in the supply chain. Third, the equilibrium resource investing level also exhibits nonmonotonicity with respect to the advertising sensitivity and the unit advertising revenue, which is in contrast to the centralized case. Fourth, the platform may open resource for free when the unit advertising revenue is sufficiently high, or the consumers are not very sensitive to advertisements, or consumers are very sensitive to the resource price. Finally, it is shown that ignoring the product perishability when making decision will lead to lower resource investment and profit, and the loss is intensified by a lower price or advertising sensitivity of consumers.

There are a few limitations in this paper. For instance, it is assumed that the advertiser is the leader in the Stackelberg game, however, in some cases of the real world, the digital content platform is the leader. Hence, future study may consider different game sequences. In addition, in this paper, the firms make decisions under symmetric information. However, the platform may keep the market demand as private information. Under asymmetric information, how will the firms’ strategies change needs further study in the future research. Besides, future research may also consider the uncertainties of the perishability of digital content products which is common in practice, and this extension would resort to the stochastic dynamic game method.

References

Asdemir, K., Yurtseven, Ö., & Yahya, M. A. (2008). An economic model of click fraud in publisher networks. International Journal of Electronic Commerce, 13(2), 61–90.

Boudreau, K. J. (2012). Let a thousand flowers bloom? An early look at large numbers of software app developers and patterns of innovation. Organization Science, 23(5), 1409–1427.

Boudreau, K. J., & Jeppesen, L. B. (2015). Unpaid crowd complementors: The platform network effect mirage. Strategic Management Journal, 36(12), 1761–1777.

Caillaud, B., & Jullien, B. (2003). Chicken and egg: Competition among intermediation service providers. The RAND Journal of Economics, 34(2), 309–328.

Casadesus-Masanell, R., & Zhu, F. (2010). Strategies to fight ad-sponsored rivals. Management Science, 56(9), 1484–1499.

Casey, T. R., & Töyli, J. (2012). Dynamics of two-sided platform success and failure: An analysis of public wireless local area access. Technovation, 32(12), 703–716.

Chakraborty, S., Basu, S., Ray, S., & Sharma, M. (2021). Advertisement revenue management: Determining the optimal mix of skippable and non-skippable ads for online video sharing platforms. European Journal of Operational Research, 292(1), 213–229.

Chang, W. L., & Yuan, S. T. (2009). A Markov-based collaborative pricing system for information goods bundling. Expert Systems with Applications, 36(2), 1660–1674.

Chen, J., Fan, M., & Li, M. (2016). Advertising versus brokerage model for online trading platforms. Management Information Systems Quarterly, 40(3), 575–596.

Chen, J., & Stallaert, J. (2014). An economic analysis of online advertising using behavioral targeting. MIS Quarterly, 38(2), 429–450.

Chiou, L., & Tucker, C. (2013). Paywalls and the demand for news. Information Economics and Policy, 25(2), 61–69.

Dou, Y., Hu, Y. J., & Wu, D. J. (2017). Selling or leasing? Pricing information goods with depreciation of consumer valuation. Information Systems Research, 28(3), 585–602.

Duan, Y., Liu, P., & Feng, Y. (2022). Pricing strategies of two-sided platforms considering privacy concerns. Journal of Retailing and Consumer Services, 64, 102781.

Godes, D., Ofek, E., & Sarvary, M. (2009). Content vs. advertising: The impact of competition on media firm strategy. Marketing Science, 28(1), 20–35.

Goh, K. H., & Bockstedt, J. C. (2013). The framing effects of multipart pricing on consumer purchasing behavior of customized information good bundles. Information Systems Research, 24(2), 334–351.

Hao, L., Guo, H., & Easley, R. F. (2017). A mobile platform’s in-app advertising contract under agency pricing for app sales. Production and Operations Management, 26(2), 189–202.

Jones, R., & Mendelson, H. (2011). Information goods vs. industrial goods: Cost structure and competition. Management Science, 57(1), 164–176.

Kaul, A., Aggarwal, S., Krishnamoorthy, M., & Jha, P. C. (2018). Multi-period media planning for multi-products incorporating segment specific and mass media. Annals of Operations Research, 269(1), 317–359.

Keskin, T., & Taskin, N. (2015). Strategic pricing of horizontally differentiated services with switching costs: A pricing model for cloud computing. International Journal of Electronic Commerce, 19(3), 34–53.

Kim, G., & Moon, I. (2020). Online banner advertisement scheduling for advertising effectiveness. Computers and Industrial Engineering, 140, 106226.

Kind, H. J., Nilssen, T., & Sørgard, L. (2005). Financing of media firms: Does competition matter? Institute for Research in Economics and Business Administration.

Kumar, S., & Sethi, S. P. (2009). Dynamic pricing and advertising for web content providers. European Journal of Operational Research, 197(3), 924–944.

Lambrecht, A., & Misra, K. (2016). Fee or free: When should firms charge for online content? Management Science, 63(4), 1150–1165.

Lin, M., Ke, X., & Whinston, A. B. (2012). Vertical differentiation and a comparison of online advertising models. Journal of Management Information Systems, 29(1), 195–236.

Liu, D., Kumar, S., & Mookerjee, V. S. (2012). Advertising strategies in electronic retailing: A differential games approach. Information Systems Research, 23, 903–917.

Liu, G., Zhang, J., & Tang, W. (2015). Joint dynamic pricing and investment strategy for perishable foods with price-quality dependent demand. Annals of Operations Research, 226(1), 397–416.

Na, H. S., Hwang, J., Hong, J. Y., & Lee, D. (2017). Efficiency comparison of digital content providers with different pricing strategies. Telematics and Informatics, 34(2), 657–663.

Nan, G., Shi, F., Dou, R., & Li, M. (2016). Duopoly pricing of software products under free strategy: Limited-feature vs. seeding. Computers and Industrial Engineering, 100, 13–23.

Nan, G., Zhang, Z., & Li, M. (2019). Optimal pricing for cloud service providers in a competitive setting. International Journal of Production Research, 57(20), 6278–6291.

Pauwels, K., & Weiss, A. (2008). Moving from free to fee: How marketing can stimulate gains and stem losses for an online content provider. Journal of Marketing, 72(3), 14–31.

PricewaterhouseCoopers. (2019). Global Entertainment and Media Outlook 2019–2023. PricewaterhouseCoopers.

Reisinger, M. (2012). Platform competition for advertisers and users in media markets. International Journal of Industrial Organization, 30(2), 243–252.

Rochet, J. C., & Tirole, J. (2006). Two-sided markets: A progress report. The RAND Journal of Economics, 37(3), 645–667.

Sethi, S. P., & Thompson, G. L. (2006). Optimal control theory: Applications to management science and economics. Berlin: Springer.

Shiller, B. R. (2013). Digital distribution and the prohibition of resale markets for information goods. Quantitative Marketing and Economics, 11(4), 403–435.

Sun, M., & Zhu, F. (2013). Ad revenue and content commercialization: Evidence from blogs. Management Science, 59(10), 2314–2331.

Sun, X., Tang, W., Chen, J., & Zhang, J. (2020). Optimal investment strategy of a free-floating sharing platform. Transportation Research Part E: Logistics and Transportation Review, 138, 101958.

Wang, W., & Guo, Q. (2021). Subscription strategy choices of network video platforms in the presence of social influence. Electronic Commerce Research, 1–28. https://doi.org/10.1007/s10660-021-09504-w

Xiao, D., Kuang, X., & Chen, K. (2020). E-commerce supply chain decisions under platform digital empowerment-induced demand. Computers and Industrial Engineering, 150, 106876.

Yuan, Z., Xu, H., Gong, Y., Chu, C., & Zhang, J. (2017). Designing public storage warehouses with high demand for revenue maximisation. International Journal of Production Research, 55(13), 3686–3700.

Acknowledgements

The author is grateful to the editor, anonymous reviewers, and Professor Guowei Zhu for their efforts and valuable suggestions that improved this paper. This work was supported by the Humanities and Social Sciences Youth Foundation of Ministry of Education of China (Grant number: 21XJC630011), and the National Natural Science Foundation of China (Grant number: 72201217).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

By employing the optimal control theory (Sethi & Thompson, 2006), the Hamiltonian function of the centralized case is given as follows:

where \(\lambda _c\) is the adjoint variable for the state variable I.

According to the first-order condition, one has

It can be verified that Hamiltonian function (A.1) is concave with respect to p, l, and u. Thus, the optimal control is unique. The adjoint variable requires to satisfy the following adjoint equation:

Note that the initial condition \(I(0)=I_0\) and the terminal condition \(\lambda _c(T)=0\). In consideration of the constraints that all of the control variables should be non-negative, one solves the above Eqs. (A.2)–(A.5) simultaneously and obtain the results in Proposition 1. \(\square \)

Proof of Corollary 1

First consider the optimal advertising level. When \(b\le \sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial l^*_c(t)}{\partial b}=\frac{H}{2g}>0\). When \(b>\sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial l^*_c(t)}{\partial b}=0\). Therefore, \(l^*_c(t)\) increases first and then keeps unchanged as b increases. When \(g\ge \frac{3H^2b^2}{4a}\), \(\frac{\partial l^*_c(t)}{\partial g}<0\). When \(g<\frac{3H^2b^2}{4a}\), \(\frac{\partial l^*_c(t)}{\partial g}<0\). And the expression of \(l^*_c(t)\) is continuous in g. Therefore, \(l^*_c(t)\) decreases with g. When \(H\le \sqrt{\frac{4ag}{3b^2}}:=\hat{h}\), \(\frac{\partial l^*_c(t)}{\partial H}>0\). When \(H>\sqrt{\frac{4ag}{3b^2}}\), \(\frac{\partial l^*_c(t)}{\partial H}=0\). Therefore, \(l^*_c(t)\) increases first and then keeps unchanged as H increases.

Next consider the optimal price. Note that the expression of \(p^*_c(t)\) is continuous in system parameters. When \(b\le \sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial p^*_c(t)}{\partial b}<0\). When \(b>\sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial p^*_c(t)}{\partial b}=0\). Therefore, \(p^*_c(t)\) decreases first and then keeps unchanged as b increases. When \(g\ge \frac{3H^2b^2}{4a}\), \(\frac{\partial p^*_c(t)}{\partial g}>0\). When \(g<\frac{3H^2b^2}{4a}\), \(\frac{\partial p^*_c(t)}{\partial g}=0\). Therefore, \(u^*_c(t)\) keeps unchanged first and then increases as g increases. When \(H\le \sqrt{\frac{4ag}{3b^2}}\), \(\frac{\partial p^*_c(t)}{\partial H}<0\). When \(H>\sqrt{\frac{4ag}{3b^2}}\), \(\frac{\partial p^*_c(t)}{\partial H}=0\). Therefore, \(p^*_c(t)\) increases first and then keeps unchanged as H increases.

Finally consider the optimal resource investing level. The expression of \(u^*_c(t)\) is continuous in system parameters. When \(b\le \sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial u^*_c(t)}{\partial b}=\frac{(H^2b^2+4ag)k(e^{\delta T}-e^{\delta t})(3H^2b^2-4ag)}{64g^2e^{\delta T}\delta sb^2}<0\). When \(b>\sqrt{\frac{4ag}{3H^2}}\), \(\frac{\partial u^*_c(t)}{\partial b}=0\). Therefore, \(u^*_c(t)\) decreases first and then keeps unchanged as b increases. When \(g\ge \frac{3H^2b^2}{4a}\), \(\frac{\partial u^*_c(t)}{\partial g}<0\). When \(g<\frac{3H^2b^2}{4a}\), \(\frac{\partial u^*_c(t)}{\partial g}<0\). Therefore, \(u^*_c(t)\) decreases with g. When \(H\le \sqrt{\frac{4ag}{3b^2}}\), \(\frac{\partial u^*_c(t)}{\partial H}>0\). When \(H>\sqrt{\frac{4ag}{3b^2}}\), \(\frac{\partial u^*_c(t)}{\partial H}>0\). Therefore, \(u^*_c(t)\) increases with H. \(\square \)

Proof of Corollary 2

First consider the price. As \(h^*\le H\), one divides the parameters into three cases. When \(\hat{h}\le h^*\le H\), \(p^*_c(t)=p^*_d(t)=0\). When \(h^*\le H\le \hat{h}\), \(p^*_c(t)=\frac{4ag-3b^2H^2}{8bg}\), \(p^*_d(t)=\frac{4ag-3b^2(h^*)^2}{8bg}\), and thus \(p^*_c(t)\le p^*_d(t)\). When \(h^*\le \hat{h}\le H\), \(p^*_c(t)=0\), \(p^*_d(t)=\frac{4ag-3b^2(h^*)^2}{8bg}\), and thus \(p^*_c(t)\le p^*_d(t)\). In conclusion, it can be obtained that \(p^*_c(t)\le p^*_d(t)\).

Next consider the advertising level. Similarly, three cases are discussed. When \(\hat{h}\le h^*\le H\), \(l^*_c(t)=l^*_d(t)=\sqrt{\frac{a}{3g}}\). When \(h^*\le H\le \hat{h}\), \(l^*_c(t)=\frac{bH}{2g}\), \(l^*_d(t)=\frac{bh^*}{2g}\), and thus \(l^*_c(t)\ge l^*_d(t)\). When \(h^*\le \hat{h}\le H\), \(l^*_c(t)=\sqrt{\frac{a}{3g}}\), \(l^*_d(t)=\frac{bh^*}{2g}\le \frac{b\hat{h}}{2g}=l^*_c(t)\). In conclusion, it can be obtained that \(l^*_c(t)\ge l^*_d(t)\).

Finally consider the resource investing level. Similarly, three cases are discussed. When \(\hat{h}\le h^*\le H\), \(u^*_c(t)=\frac{2kaH\sqrt{3a}(e^{\delta T}-e^{\delta t})}{9\delta s\sqrt{g}e^{\delta T}}\), \(u^*_d(t)=\frac{2kah^*\sqrt{3a}(e^{\delta T}-e^{\delta t})}{9\delta s\sqrt{g}e^{\delta T}}\), and thus \(u^*_c(t)\ge u^*_d(t)\). When \(h^*\le H\le \hat{h}\), \(u^*_c(t)=\frac{k(b^2H^2+4ag)^2(e^{\delta T}-e^{\delta t})}{64bg^2\delta se^{\delta T}}\), \(u^*_d(t)=\frac{k(b^2(h^*)^2+4ag)^2(e^{\delta T}-e^{\delta t})}{64bg^2\delta se^{\delta T}}\), and thus \(u^*_c(t)\ge u^*_d(t)\). When \(h^*\le \hat{h}\le H\), \(u^*_c(t)=\frac{2kaH\sqrt{3a}(e^{\delta T}-e^{\delta t})}{9\delta s\sqrt{g}e^{\delta T}}\ge \frac{2ka\hat{h}\sqrt{3a}(e^{\delta T}-e^{\delta t})}{9\delta s\sqrt{g}e^{\delta T}}=\frac{4ka^2(e^{\delta T}-e^{\delta t})}{9b\delta se^{\delta T}}\), \(u^*_d(t)=\frac{k(b^2(h^*)^2+4ag)^2(e^{\delta T}-e^{\delta t})}{64bg^2\delta se^{\delta T}}\le \frac{k(b^2(\hat{h})^2+4ag)^2(e^{\delta T}-e^{\delta t})}{64bg^2\delta se^{\delta T}}=\frac{4ka^2(e^{\delta T}-e^{\delta t})}{9b\delta se^{\delta T}}\), and thus \(u^*_c(t)\ge u^*_d(t)\). In conclusion, it can be obtained that \(u^*_c(t)\ge u^*_d(t)\). \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sun, X. Strategy analysis for a digital content platform considering perishability. Ann Oper Res 320, 415–439 (2023). https://doi.org/10.1007/s10479-022-04967-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04967-y