Abstract

We study start-up accelerators, a new type of entrepreneurial support organization characterized by its coaching of regular cohorts of startup founders, that developed rapidly after pioneer accelerator Y-Combinator, founded in 2005, had ‘accelerated’ success stories Dropbox and AirBnB among others. We suggest that accelerators can be analysed as platforms whose function is to relate start-ups and investors within entrepreneurial ecosystems. According to our analysis, leading accelerators play a mediating role in enabling entrepreneurs to attract investors with a higher profile than they would have otherwise. Using propensity score matching, we compare participants to several accelerator programs in North America with similar non-participating start-ups. We measure the prominence of their investors using their centrality in the investor-network. For several top-tier accelerators, we observe that start-ups who participated in their programs attracted higher profile investors than other similar start-ups that were not accelerated. Furthermore, among accelerators, pioneer Y-Combinator appears to benefit from a winner-takes-all effect, which is typical of platform competition: Not only do investors it connects its participant startups to appear to be of a higher profile, but it is also the only accelerator in our sample whose participants gain access to an amount of early-stage funding that is significantly higher than those raised by the control group.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Societies are increasingly entrepreneurial in nature (Audretsch & Thurik, 2000): Entrepreneurial activity is a key driver of economic growth and, accordingly, organizations that support entrepreneurs act as catalyst for economic growth. In this paper we investigate a type of entrepreneurial support organization which goes by the label “accelerator”. We want to find out how accelerator programs influence entrepreneurial ecosystems considering both entrepreneurs and those who invest in their startups. We consider the role of accelerators in fostering network effects, influencing fundraising capacity, and facilitating connections to financial resource providers including lead investors. We also look at differences in performance between dominant accelerators, situated at the top of a platform hierarchy, and less dominant counterparts.

Accelerators are relative newcomers to entrepreneurial ecosystems: Though there are variations, accelerators are private entities that provide strong coaching programs to sequential cohorts of selected start-up founders during short periods of time, in exchange for limited equity in the start-ups they accelerate. Historically, the first organization to claim this label as a descriptor of its activities was Y-Combinator. After early successes with start-ups such as Dropbox and AirBnB, Y-Combinator quickly gained recognition and efforts to replicate its success followed.

As a consequence, accelerators have attracted more and more attention from researchers in economics and management (e.g. Hochberg, 2016; Younger & Fisher, 2020). Several works have notably investigated the role of accelerators as actors within entrepreneurial ecosystems (Moritz et al., 2022; Hernández-Chea et al., 2021). With this paper, we intend to contribute to this stream of research, which Wurth et al. (2022) label the “epistemological” approach, compared to the “ontological” question of how the ecosystem came into being. Specifically, we investigate whether entrepreneurs and founders take advantage of existing ties between accelerators and venture capitalists to develop their own networks. In this way we address the call by Bergman and McMullen (2022)’s to study the interaction between entrepreneurial support organizations and other stakeholders as well as earlier suggestions by Block et al. (2018) to study the interplay between new and established players in entrepreneurial finance and by Clayton et al. (2018) to investigate the function of intermediaries. Theoretically, we lean on network studies and build upon the idea of an action mechanism developed by van Burg et al. (2022) to explain how entrepreneurs benefit from social relationships. To put it in another way, we look for evidence for the existence of a mechanism in which the entrepreneur’s accumulation of resources is mediated by accelerators in a way that is consistent with what David Graham, the founder of Y-Combinator, had stressed as the main goal of his organization: to provide access to the right investors and the right network (Maloux, 2018). Altogether, our investigations suggest that, within entrepreneurial ecosystems, accelerators act as a platform between entrepreneurs and venture capitalists.

In our analysis, we compare accelerated start-ups with similar non-accelerated start-ups, and focus on the prominence of investors they attract, as measured by the position of these investors in the investor network. Analyzing 111 accelerators active between 2005 and 2015 in the USA, which is the environment where the accelerator phenomenon initially appeared and where more data is therefore available, and 668 accelerated startups, we observe that several prominent accelerators did have a positive and statistically significant impact on the centrality of the investors who invested in their accelerated start-ups: Investors attracted by these start-ups tended to occupy a more central position in the investor network than investors attracted by similar non-accelerated start-ups. Furthermore, we observe that Y-Combinator is the only accelerator in our sample that has had a statistically significant and positive impact on the amount of early-stage funds raised by its accelerated startups and that Y-Combinator is also the only accelerator in our sample that had a statistically significant and positive impact on the centrality of the investors in the directed investor network, i.e., in the network that further accounts for leadership roles in investment syndicates. Y-Combinator alumni, compared to the alumni of other accelerators (even the most renowned), were the only ones able to attract prominent investors with a leading role in funding rounds with a higher likelihood than comparable start-ups who did not opt for acceleration.

These results confirm accelerators’ intermediary role as a platform within entrepreneurial ecosystems: By attracting more central investors, accelerators attract higher quality start-ups since entrepreneurs tend to value the reputation signal sent by the investors who invest in their companies, which contributes to attracting other investors. In this context, the dominant role played by Y-Combinator in the accelerator field, as is visible in our study through its impact on early-stage fundraising and directed centrality, definitely corresponds to the standard result of platform competition according to which one winner emerges who “takes all” (Sun & Tse, 2007).

Thus, we highlight the interdependencies that tie actors together within entrepreneurial ecosystems, and contribute to an improved understanding of how the different actors that constitute entrepreneurial ecosystems can develop mutualistic interdependence, as is the case in biological ecosystems (Stam & van de Ven, 2021). However, due to their nature, ecosystems keep changing and the role of actors can change as well. Among other things, the strategic nature of the interdependencies between actors, such as competition among accelerators as they vie to attract the best start-ups and investors, can result in evolution. Therefore we concur with Acs et al. (2017) that in order to understand entrepreneurial ecosystems these dynamics should be taken into account.

In order to address the research question of how accelerator programs influence entrepreneurial ecosystems, the rest of the paper is organized as follows: Sect. 2 reviews what scholars have already analyzed with regard to accelerators and formulates hypotheses with regard to their functioning as actors in entrepreneurial ecosystems, while including reflections on the ontology of entrepreneurial ecosystems and introducing the theoretical framework adopted for the study. Sect. 3 presents our approach, Sect. 4 introduces the results of our analysis, Sect. 5 discusses their implications before Sect. 6 concludes.

2 Literature review

We first review the main issues related to accelerators that have been addressed in the literature. From this, we introduce the entrepreneurial ecosystem perspective as a framework for these observations, and develop our hypotheses.

2.1 Research context

Apart from the appearance of the term investment accelerator in finance (Acemoglu, 1993), the use of the term “accelerator” to denote an organizational form only started in 2005, when Y-Combinator applied this label to itself. As Y-Combinator was the organization behind successful ventures like Dropbox and AirBnB, other organizations rapidly sought to emulate its success in venture creation and therefore soon also adopted a similar label (Younger & Fisher, 2020). Shane and Nicolaou (2018) pose the question why accelerators appeared just after the turn of the century and not earlier. The main factor these authors identify is the cost of bringing software to market, which has shrunk significantly since the nineteen-nineties. Consequently software producing start-ups nowadays need less time and effort move from prototype to market-ready product. A difficulty that remains, and has become more urgent due to the low barriers to entry, is to find clients for the product (Florén et al., 2018, p. 417). Shane and Nicolaou (2018) suggest that accelerators stepped in to address this need in particular.

Crişan et al. (2021) offer a recent, systematic, review of the academic literature on accelerators, complementing the handbook that Wright and Drori (2018) edited on the topic. With respect to accelerators specifically, Crişan et al. (2021) reviewed 98 papers on accelerators and classified them according to the process through which the accelerators studied in the papers were said to deliver benefits to startups. Within their categorization, “access and growth” came out as most common. This category refers to accelerators that focus on providing “access to investors, avenues to reach new markets, and support for product development and launch.” Across the studies surveyed, the authors observed a tendency to confound outputs, “immediate results from the accelerating process”, with outcomes, “non-immediate results related to performance”. In a situation where outputs are more readily measurable, while outcomes are the main interest of policy makers, Crişan et al. (2021) stress the importance of devoting attention to articulating the link between outputs and outcomes.

A substantial amount of research effort has first gone into identifying the features that are essential to the accelerator business model (Drori & Wright, 2018; Cohen et al., 2019) propose the following:

-

An accelerator provides a fixed-term, cohort-based program to start-ups;

-

This offer includes educational components such as mentorship;

-

It also includes participation to the program culminates in a graduation event.

As Crişan et al. (2021) remarked, researchers have also tried to measure the “effects” of accelerator programs. Early investigations typically took the amount of funds raised by the accelerated companies as a key criterion (Hallen et al., 2014; den Besten & Dalle, 2015; Hochberg, 2016; Yu, 2019). Yu (2019) eventually framed the effectiveness of accelerators as their potential ability to resolve uncertainty about start-up quality. Conversely, Hochberg (2016) mostly considered their effect on regional development while, on their part, Mayya and Huang (2019) investigated the effect of the presence of accelerators on investments allotted by corporate venture capitalists to early-stage start-ups in the regions where the accelerators were present.

Casting the net wider, Bergman and McMullen (2022) conducted a systematic review of articles on five types of entrepreneurial support organizations: incubators, science parks, accelerators, maker spaces, and co-working spaces. According to their synthesis, this literature takes a predominantly instrumental view of the activity of entrepreneurial support organizations, mainly overlooking relational aspects. Rather than treating support as “help to become self-sufficient”, they propose to treat it as help to establish ties. They shed light on the similarities and differences among the five types of support organization they focus on, identifying several commonalities: each type of organization emerged a “bit haphazardly”; all create a temporary “holding” environment for entrepreneurs and their ventures, to change for the better; for all, there is “considerable ambiguity” with regards to the benchmark to which the organizations should be held accountable. Across the spectrum, then, Bergman and McMullen (2022) also find that the most popular question that researchers have tried to answer with regard to entrepreneurial support organizations is whether they have an impact, with mixed results. Although there are different organizational forms, no general discernible pattern could suggest that one is superior over another in this respect, independent of their context.

Finally, and closer to our approach, several recent contributions focused on regional studies have taken a perspective more in line with the recent literature on entrepreneurial ecosystems (Mayer et al., 2017). Hernández-Chea et al. (2021), based on a field study in Kenya and Uganda, for instance, point out that organizations like accelerators typically encourage collaboration, while Moritz et al. (2022) stress the importance of coopetition in their study of accelerators in Germany. Others have insisted on the role of accelerators to create an open environment (Del Sarto et al. (2020), in the case of Italy) or a knowledge community (Caccamo and Beckman (2021), for Silicon Valley). Altogether, these studies reinforce the observation of Mian et al. (2016) that fostering accelerators is an important means to achieve innovation and technology-oriented entrepreneurial growth.

2.2 Theoretical foundation

Following Autio et al. (2018), Bliemel et al. (2019), and Hernández-Chea et al. (2021), we suggest that to appreciate the value of accelerators, they should be analyzed according to the role they play within entrepreneurial ecosystems, since actors in an entrepreneurial ecosystem are tied to one another, as members of supply chains, as beneficiaries or benefactors in support relationships, or through knowledge exchange. Beside accelerators, entrepreneurial ecosystems include investors, most notably venture capitalists and business angels, and start-up companies where these investors invest in, plus various other actors such as government agencies or else other entrepreneurial support organizations (Hausberg & Korreck, 2020; Islam et al., 2018; Deffains-Crapsky & Klein, 2016).

Wurth et al. (2022) point out that, among researchers and policy makers, there are two distinct approaches to entrepreneurial ecosystems. The first one treats the ecosystem as “something that can be built” (“ontological”), while the second one focuses on “how it can be known” (“epistemological”). The approach to ecosystems in this paper is part of the latter tradition. That is, we do not focus on the emergence of the ecosystem itself but rather on the emergence of value within the system. Which is not to say that we consider the first approach uninteresting: on the very contrary, we feel that the first approach is inextricably linked to the second one, in the sense that the emergence of value within an ecosystem typically occurs by fostering the emergence of a narrower ecosystem around the actor to whom the value accrues as a sub-system within the wider ecosystem (see Wang (2021) for a more detailed discussion of part-whole relationships within ecosystems).

In this context, the choice of theoretical frameworks within ecosystem research is generally predicated upon the approach toward the ecosystem: at one side, researchers adopt institutional or evolutionary theories, on the other side they adopt economic or network theories depending on the way they treat the ecosystem (Wurth et al., 2022). Here, our treatment of entrepreneurial ecosystems as the conglomeration of entrepreneur’s ecosystems implies that we need to cross the divide: Namely, while the hypotheses that we will develop with regard to the process of the emergence of the entrepreneur’s ecosystem are inspired by elements from institutional theory, we will combine them with elements that adopted from network theory in order to assess the value of an emerging entrepreneur’s ecosystem.

With respect to the latter, a recent review of applications of network theory in studies of entrepreneurship (van Burg et al., 2022) found that, while the literature is complex and diverse, most studies agree that entrepreneurs benefit from their social relationships. In this context, van Burg et al. (2022) propose a taxonomy of five network mechanisms, which they label “accessing”, “acquiring”, “diversifying”, “embedding”, and “associating.” Among these mechanisms, the first, which is about “adding new network ties, which subsequently improves quick and flexible access to knowledge and resources”, and the last, “linking to prominent players which subsequently can increase reputation”, appear specially relevant at the early stage of start-up development upon which the present study is focused. In network terms, the “accessing” mechanism is mainly concerned with the number of ties and their strength, while the “associating” mechanism is rather concerned with the reputation dimension of content and with the centrality of ties. Along similar lines, and regarding early stage development, Kaandorp et al. (2020) study initial networking processes and argue that access is often a prerequisite to any other activities, while Stuart et al. (1999) highlight the value of endorsements and Armanios et al. (2017) specifically discuss the effect of associating with incubators on the reputation of start-ups.

If, then, at the core of early-stage venture founders’ goals is the establishment and development of relationships with other actors in the ecosystem and notably with investors, accelerators can play a role by facilitating introductions of their accelerated start-ups with other stakeholders; namely, these mediated connections would concern better-connected partners compared to direct interactions. In this perspective, start-ups would find it a relevant strategy to focus their initial attention on one well-connected member of the ecosystem: an accelerator with links to other actors and notably to investors. Conversely, investors, on their part, would themselves find it relevant to rely on accelerators in order to provide them with access to startups, provided that these accelerators would have the reputation of screening and selecting appropriate, high profile startups. This two-sided congruence in the strategies of different types of actors, here startups and investors, corresponds to a platform strategy: startups are attracted to an accelerator depending on the investors to which it is itself connected, while investors foster their relationships to an accelerator depending on the startups it attracts. To put it differently, because of the simple and basic importance for startup founders of building relationships within their ecosystem, early-on, accelerators can play the role of platforms, acquiring a mediating role with respect to the access to other actors and notably to investors.

2.3 Hypothesis development

Since, again, a primary goal for founders of early-stage ventures is to establish and develop relationships with other actors and notably to investors, and since this is precisely where accelerators play a role by introducing the start-ups they accelerate to other actors, we hypothesize that these introductions would result into fruitful relationships with better-connected actors, compared to non-mediated, direct interactions. This “effect” of accelerators would rely on their reputation and the legitimacy that they would confer to the start-up companies they support. Legitimacy can come in many forms: Bloodgood et al. (2016) notably distinguish cognitive legitimacy from pragmatic and normative legitimacy and subdivide the latter two in exchange, influence, dispositional legitimacy, and consequential, procedural, structural, and personal legitimacy, respectively. In general, a start-up is seen as legitimate when it shows it is appropriate for the moment (Suchman, 1995). Cognitive legitimacy can be gained through the ritual of the pitch, which is standard fare in the accelerators’ graduation events, since it allows the entrepreneur to show of the level of preparedness of the start-up to potential investors (Pollack et al., 2012). According to Bitektine (2011), awarding such legitimacy is mostly based on gut feeling and requires little active thought. In contrast, other types of legitimacy rely upon information that needs to be assembled and analyzed. This can be with respect to the the expected return on investment, and more specifically with respect to the products and services it proposes and their fit to the market (Shankar & Clausen, 2020), and the activities of accelerators aimed at helping start-ups attain a level of preparedness that can translate into cognitive legitimacy have been well-documented (Politis et al., 2019; Harrison, 2019; Levinsohn, 2015). Although successful applicants to accelerator programs may have increased their legitimacy already, the mere event of their selection provides them with legitimacy through association or certification (Plummer et al., 2015; Brown et al., 2019). According to this perspective, investors can partly outsource to accelerators the (significant) work of assembly and analysis that allows them to confer pragmatic or normative legitimacy to start-ups. And start-ups, on their part, can focus their initial attention on their accelerator through which the start-up’s legitimacy can be built and diffuse (Bloodgood et al., 2016).

Hypothesis 1

Engagement in accelerator programs engenders a network effect, fostering connections with influential stakeholders within the entrepreneurial ecosystem who possess extensive network ties themselves.

We hypothesize that the desired outcome from participation in an accelerator program would be, for a start-up, the creation of connections that would be “better” than the connections it would already have or would be able to create by itself. However, there are different ways according to which a connection can be considered as “better”, by enabling the start-up to access to more resources, notably knowledge, clients and resources. These benefits might even outweight money, i.e. the amount invested by investors in the startup – which is not a way to diminish its importance (e.g. Smith and Bergman, 2020).

Hypothesis 2

The association between participation in accelerator programs and enhanced quantitative fundraising capacity for participants may not be unequivocal.

In the latter respect, among the actors that provide access to financial resources to start-ups, venture capitalists (VCs) are especially prominent. Venture capitalists actively scout their environment for ventures to invest in. Yet, as Gompers et al. (2019) put it, hardly any entrepreneur “beats the path to the VC’s door without any connection.” Moreover, not all VCs are the same: More prominent, better-connected, VCs let start-ups access more resources through their own connections as well, most notably in later and larger rounds of funding. In this context, the characteristics of VCs that invest in a start-up, and even more so the characteristics of those who take the lead in a funding round, makes a large difference: High-profile investors, especially high-profile lead investors, will be better able to attract others in their syndicates than others (Ko & McKelvie, 2018). In a similar vein, Sørensen (2007) found that companies funded by more experienced VCs are more likely to go public and, once public, stocks held by well-recognized investors demand a lower risk premium (Chung et al., 2018). Moreover, the positive relation between the reputation of a VC investor and the market response and performance of firms after going public is significantly stronger for VCs that were involved in early stages of the firm development (Lee et al., 2011). Finally, Guler and Guillén (2010) point to research indicating that the social status of a VC increases the likelihood that other VCs with a high status join in investment syndicates, that firms supported by such VCs typically perform better, and that entrepreneurs are often prepared to accept worse terms from higher status VCs.

Hypothesis 3

Accelerators’ impact on facilitating connections with financial resource providers, particularly lead investors, is expected to exhibit a stronger positive effect.

This line of reasoning strongly suggests that accelerators, at least the best of them, would act as platform intermediaries between start-ups and VCs, and present the start-ups they support with opportunities to match with higher-profile VCs than they would have encountered without acceleration. Therefore, accelerators would face similar opportunities and constraints as accelerators in the platform economy (Thomas et al., 2014) and, in particular, a very limited number of organizations would eventually tend to dominate each sector due to phenomena known as “winner-takes-all-effects” (cf. Huotari et al., 2017), often associated with “first-mover-advantages” and other dimensions of platform strategies.

Hypothesis 4

The interplay of platform competition dynamics will lead to significant disparities, wherein accelerators occupying the dominant platform position exhibit superior performance compared to their counterparts.

To these main hypotheses, we would like to add subsidiary hypotheses with regards to which start-ups get to participate in accelerator programs. Our main premise being that founders seek to acquire legitimacy for their start-ups (Delmar & Shane, 2004) and that accelerators contribute to confer legitimacy (above), the size of the legitimacy gap between currently awarded legitimacy and potential legitimacy would be a main driver that would bring founders to accelerators, and convince accelerators to adopt their start-ups.

Organizational legitimacy, in the words of Meyer and Scott (1983), “refers to the degree of cultural support for an organization”. In order to distinguish legitimacy from related concepts, such as status and reputation, Deephouse and Suchman (2013) propose to treat legitimacy as an attribute that is dichotomous, non-rival, homogenizing, and political. They explain that organizations can be “more (or less) legitimate” in spite of the dichotomous nature of the concept by virtue of gaining legitimacy with more people and/or increasing the certainty with which these people award the legitimacy. From this perspective, one can interpret the task of bridging the legitimacy gap as an effort to make sure an endeavor is firmly recognized as legitimate by the right audience. An alternative explanation for the phrase “more (or less) legitimate” might be that the many scholars who use this phrase associate legitimacy with status, which is ordinal, or with reputation, which is continuous in nature. In order to build upon the very valuable contributions of these scholars, one could adopt a definition of legitimacy as a favorable social evaluation of any kind. Consequently, the notion of legitimacy gap could be articulated with notions such as reputation gap and status differential.

As succinctly put by Navis and Glynn (2011), the legitimacy of start-ups is based on “who they are” and “what they do”. With respect to the former, Castellano and Khelladi (2017) note that aspects of the founder team affect its legitimacy, such as its size, perhaps, following Erikson (2003), because individuals who join a founding team are more likely to develop entrepreneurial competences. In line with this, Mas-Tur and Simón Moya (2015) found that “Size of the YIC [Young Innovative Company] and the entrepreneur’s sex significantly affect access to subsidies.” More generally, early-stage investors rely heavily on signals of entrepreneur quality (Bernstein et al., 2017).

Subsidiary hypothesis a The size of the founding team positively influences the entrepreneurial quest for legitimacy, indicating a higher propensity to actively seek and obtain social recognition and acceptance.

In addition, the legitimacy gap that would motivate founders to turn to accelerators might also occur when there is an ex-ante mismatch between the actual and perceived entrepreneurial competences of start-up founders. Newbert and Tornikoski (2013), among others, submit that serial entrepreneurs possess a social capital that enhances their legitimacy: they have a “track record”. Hence, since the perception of their competences depends on the availability of a track record, founders with a weaker track record feel the need to establish legitimacy using alternative ways (Rutherford et al., 2009). Likewise, Zhang (2019) find that investors are more confident investing in serial entrepreneurs and suggest that novice entrepreneurs should seek alternative signals to overcome the confidence gap.

Subsidiary hypothesis b In the absence of confounding factors, founders with a proven track record experience a diminished legitimacy gap, suggesting a greater degree of perceived legitimacy attributed to their entrepreneurial endeavors.

Finally, and with respect to the “what they do”, how a start-up proposition is received will also depend on the context: Indeed, the survival chances of ventures are severely impacted by the quality of the regional entrepreneurial ecosystem in which they operate (Vedula & Kim, 2019). Regional differences make that in some places the prima facie legitimacy of entrepreneurial endeavours is higher than in other places (Díez-Martín et al., 2016). Besides, opinion leaders confer legitimacy to the pursuit of certain activities to the detriment of others (Kennedy, 2008), and some propositions may resonate more than others because they are similar to propositions by others for which legitimacy already has been established (Younger & Fisher, 2020) or for which there appears to be a better “product-market fit” (Shankar & Clausen, 2020). Sectors matter too because venture capitalist prefer investing in areas where any uncertainty about the viability of the offering and about market demand can be resolved quickly (Lerner & Nanda, 2020).

Subsidiary hypothesis c The magnitude of the legitimacy gap is contingent upon contextual factors, including temporal, spatial, and proposed activity considerations, indicating that the level of social recognition and acceptance varies based on the specific entrepreneurial context.

As is clear from the above, the notion of legitimacy, including with respect to its cognitive and institutional dimensions, contributes to understanding how an entrepreneur is able to nurture an ecosystem of clients, suppliers and investors around its venture. In this paper, our focus is on the transfer of legitimacy from accelerators, which can be said to be part of an established organizational field, to startups, which are nascent organizations operating on a different field within the same overarching ecosystem. As a consequence, we mostly consider the legitimacy of accelerators as a given element, for the present study, and analyze how accelerators can help with respect to its transfer, in the context of an entrepreneurial ecosystem.

3 Method

In this paper we assume that accelerators form an “organizational field” (DiMaggio & Powell, 1983). That is, we assume that they carry out similar activities and respond to similar pressures (reputational, regulatory, or otherwise) from the environment. Given that the accelerators were first created in the United States, and because of our specific interest in the interaction between accelerators and venture capital, which is also prominent in the US (Nicholas, 2019; Grilli et al., 2019), we focus on and limit ourselves to this country.

3.1 Data sample

We retrieved information from CrunchBase, a public database of start-up companies widely used for scientific studies (Dalle et al., 2017). Our raw dataset, which was retrieved in August 2016 through the application programming interface provided by Crunchbase (API version 3), is composed of all start-ups with headquarters in the United States for which information on their founders was available, and consisted in approximately 45,000 start-ups and 140,000 records of funding rounds associated with an identifier of the organization that received the funding, the amount and date of funding, the type of funding (venture capital, seed, IPO) and the investors involved. For each organization, CrunchBase includes information on its founders, the founding date, the location of its headquarters, and the sector or market in which it is active. We then cleaned up this dataset by excluding start-ups for which information was incomplete, or for which funding data were inconsistent (notably when the sum of funds listed per funding round did not match the total amount of funds indicated in the database). We also excluded companies founded after 2014. We further restricted our study to start-ups that had raised more than $150,000. The reason for this restriction is that accelerators themselves can invest up to $150,000 in start-ups enrolled in their programs, with the consequence that an endogeneity bias would result if we were not to exclude them. Applying this restriction, we exclude start-ups that did not manage to attract at least one investor other than their accelerator. Finally, to ensure consistency, we also excluded the start-ups for which Crunchbase indicated an “exit”, that is, an end of its activity due to bankruptcy or takeover. Our final sample was composed of 6000 start-ups, with a participation in an accelerator program for 688 among them that were identified on the basis of information compiled by the web site SeedDB, an independently curated inventory of accelerators and their beneficiaries commonly used in the academic literature on accelerators (see e.g. Cohen and Hochberg, 2014; Regmi et al., 2015; Porat, 2014, among others), including a Crunchbase identifier to allow for direct matching, and whose accuracy we manually reconfirmed.

3.2 Variables and procedure

We consider the characteristics of the start-ups that make them selected (or not) to take part in accelerator programs as independent variables, while the characteristics of the investments they receive are identified as dependent variables.

3.2.1 Dependent variables

The “accessing” network mechanism outlined previously stresses the material dimension of content whereas the “associating” network mechanism addresses the reputational dimension of content and the positioning of the related person or entity in the network. As both network mechanisms are likely to be active at early stage venture development, hypotheses have been formulated both with respect to the material dimension of content (hypothesis 2) as well as with respect to position of the investor the entrepreneur connects with as structural aspects (hypothesis 1 and 3). Correspondingly, the dependent variables address both the material dimension (funds raised) as well as with a structural feature (centrality) of the relationships established with the help of accelerators.

Table 1 lists the dependent variables under study. We identify measures of investor notoriety and measures of investments received since the objective of the investigations presented here is to determine whether accelerator programs make a difference for the start-ups that benefit from them with respect to the investors and investments they attract. In order to control for the influence of confounding factors, we limit our attention to investments in the early stage funding rounds, also known as “Seed” and “Series-A” funding rounds, which occur early in the life of a start-up, i.e., shortly after graduating from the program, as opposed to later-stage rounds for which the influence of factors unrelated to accelerators is likely to be prominent.

Investor prominence

A central interest of network analysis is to understand the factors that affect the transmission of signals in the network: In the case of epidemics it allows us to track and control the spread of disease; in the case of investor networks, as we mobilize them this paper, it contributes to identify the most influential nodes Sharkey (2017) by measuring their centrality. Among available measures of centrality, we opt here for Katz centrality which, unlike degree centrality, but like eigenvector centrality and PageRank, does not just rely on the number of neighbors to a given node in the network but also accounts for the importance (or centrality) of these neighbors. Landherr et al. (2010) provide an in-depth comparison of common centrality measures and argue that among them Katz-centrality is the only one that is both monotonic with respect to the distance between nodes and with respect to the number of shortest paths between nodes, as well as being stable with regards to the ordering of nodes. In addition, in the context of our study, another useful characteristic of Katz centrality is that it can be applied to both directed and undirected networks (Sharkey, 2017).

We compute two centrality indices for each start-up, by averaging the centrality of all investors who participated in its Seed and Series A funding rounds for non-directed Katz and for directed Katz, respectively. As is standard in the literature on venture networks since (Hochberg et al., 2007), when two investors co-invest in a funding round, a bidirectional link can be created between them so as to globally create a bidirectional, non-directed network of investors. On the basis of this network we compute the variable kmn, a centrality index for each investor in this network, measured here according to Katz centrality, which we take as proxy for investor prominence and denote here as non-directed Katz. Thanks to the presence of detailed information on funding rounds in Crunchbase, we are also able to generate an unidirectional network by taking into account the leadership role that investors take in funding rounds, which is a further indication of their prominence: Specifically, when an investor is identified as leading a funding round, it is linked to the other participants in this round with a directed connection from the leader to the followers. Variable kmd then measures the Katz centrality of investors within this directed network, denoted as directed Katz.

Investments

With respect to the amount of investment granted to start-ups in their early stage funding rounds, we assign the sum of the Seed and Series A funds as the value of the variable fsa, used here after logarithmic transformation since the values of this variable are not normally distributed. We typically do not consider the rounds separately as they can often be confused or conflated in primary data.

While it is the case that most of the capital available for investment is held by a small number of large venture capital firms, it is relatively rare for these firms to invest in the early stages (Lerner & Nanda, 2020). Sovereign wealth funds, hedge funds, mutual funds and other public market investors have started to invest in firms prior to their initial public offering but their importance remains limited at the earlier stages of startup development, just after participation (or not) in accelerator programs, since they typically select among firms that are already backed by venture capital firms. Conversely, a very large number of smaller venture capital firms have appeared over the past decades that have turned their attention to less mature entrepreneurial projects, resulting in a highly competitive market for early-stage funding, at least in the USA.

3.2.2 Independent variables

Table 2 lists the independent variables under study. In addition to the founding date of the start-up, we consider indicators of the experience of the founding team, of the location of the start-up, and of its area of activity. Informed notably by hypothesis a–c, these variables typically are used to model the propensity of start-ups to join accelerator programs. Dummy variable a serves as dependent variable in the propensity model.

Founder Experience

Crunchbase provides a list of founders associated with each start-up. Variable fdr simply measures the number of distinct founders listed. Variable cfr is computed as the ratio between the number of founders and the number of companies previously founded by these founders, and is used as a proxy for the experience of the founding team. In addition, variable cfb is computed as the number of companies among those that have previously been founded by the founding team that have managed to raise private funds, and is used as a more informed proxy for the experience of the founding team, not only with respect to founding start-ups but also to raising funds.

Location

Dummy variables ca, ny, ma, and tx indicate whether the start-ups were located in the main regions where entrepreneurial ecosystems are located in the United States. The value of these variables is determined by the location of the headquarters as specified in Crunchbase.

Activity

Crunchbase also uses tags to qualify the activities of companies, which we adopt as a proxy for their sector of activity. These tags do not follow a predefined nomenclature (such as NACE) but instead are relatively unstructured. In an effort to reduce the dimensionality of these data, we applied Latent Dirichlet Allocation (LDA) (Phan et al., 2008; Grün & Hornik, 2011) to identify clusters of tags. LDA is a text mining technique widely used in various disciplines to categorize large quantities of text into topics (cf. Jelodar et al., 2019). Amongst others, it has been used in systematic reviews (Mo et al., 2015). As is often the case for clustering techniques, no clear-cut rules exist for the number of clusters or topics into which the algorithm should split the data. Here, we instructed LDA to split the data into between 2 and 10 topics and then assessed the discriminatory power of each outcome on the basis of the heuristics proposed by Nikita (2020). Since the best outcome was achieved by splitting the tags into four topic areas, we selected this number for our variables. Specifically, the variables f1-4 indicate the strength of affiliation of the observed company with activity-groupings (topics) 1 to 4. Table 2 specifies the grouping of tags into the four topics generated by LDA. To construct variables f1-4, we count how many tags within a grouping are associated with the focal company and then normalize these counts following standard practice.

3.2.3 Accelerator differentiation

There were 111 accelerators in total in whose programs one or more of the start-ups in our sample have participated. For each accelerator, we compute the total amount of funds raised by start-ups associated with the accelerator and use this information to order the accelerators and place them in four different groups. We adopt the procedure of Simón-Moya et al. (2014) to qualify the differences and similarities among these groups. Specifically, for each variable defined in section 3.2.1 and 3.2.2, we first test for homogeneity of variances across groups (homoscedasticity) with Levene’s test. In case the test does not reject the hypothesis that variances are equal, we apply ANOVA and use the F-test to test for differences among the groups. If Levene’s null-hypothesis is rejected, we resort to the Browne-Forsythe statistic. Finally, we apply post-hoc tests to determine which groups are different: We use the Tukey test for homoscedastic variables with a statistically significant inter-group difference and we use the Games-Howell tests on heteroscedastic variables with a statistically significant inter-group difference. Beyond statistical significance we also look at the effect size of the differences between groups. Effect size concerns the magnitude of the difference between groups Sullivan and Feinn (2012). For two independent groups, effect size can be measured by dividing the difference of the group means by the standard deviation of either group. A commonly used indicator of effect size, Cohen’s d, which we employ as well, refers to the effect size as negligible for standardized differences in means that are smaller than 0.2, small in case they are bigger than 0.2 and smaller than 0.5, moderate from 0.5 to 0.8, and large for anything higher.

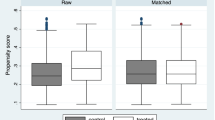

3.2.4 Matching procedure

In order to investigate the differences between start-ups who participated in accelerator programs and those who did not, we use propensity score matching (PSM) (Sekhon, 2011). PSM is a method used by various studies in the field of entrepreneurship research (Vries & Block, 2011; Lin et al., 2013; Stephan, 2014) and which has recently been used in research on accelerators (Assenova, 2019). It is based on identifying a control group of individuals (here, start-ups), that are similar to other individuals (start-ups) who have been treated (here, accelerated), but who have not. PSM first estimates a model of the likelihood that a start-up has of being accelerated. For each start-up that has been accelerated, the procedure then identifies start-ups with the same likelihood of having been accelerated, but that have in fact not been accelerated. Contrary to the method adopted by Gonzalez-Uribe and Leatherbee (2018), who compare accelerated start-ups with start-ups who applied to accelerators but were turned down, propensity score matching allows to create a control group with the same distribution of initial qualities as the treatment group.

In our case, after checking for interdependence between the variables using correlation tests, we estimate the propensity of a start-up to attend an accelerator program using a logit model where participation in an accelerator program is the dependent variable, and the start-up characteristics listed in Table 2 are the independent variables. We compute variance inflation factors to check for multicollinearity among variables and the Hosmer-Lemeshow test to estimate the quality of the model. On the basis of the estimated model, we then match each accelerated start-up in the sample with a non-accelerated start-up picked from the pool of 5398 non-accelerated companies in our sample. Replacements, i.e., the matching of two different accelerated start-ups with the same control company, were not allowed. A bias can potentially result from this approach since the matching may depend on the order in which it is implemented. Nevertheless, since we use a large pool of observations to select from, together with a random shuffling of the order of observations in the database, the severity of this effect is limited. Match-balance results are incorporated in the results presented in the next section.

The results we report concern the average treatment effect on the treated (referred to as ATT or ATET in the literature). ATT is calculated as the average difference in outcomes between treated start-ups and their match from the control group. In addition we carried out what some would consider a “double robustness check”, which is to estimate the effect as the coefficient associated with the treatment dummy within a regression estimate of the outcomes on the baseline covariates (Stuart, 2010; Zhao et al., 2021). These additional results are not presented below, but are available upon request.

Table 3 givens an indication of the distribution of the variables in our sample. Considering the similarity between the mean and median values, it appears that the distribution of values for many variables is fairly regular. The variable fsa forms a clear exception to this pattern and in this case the logistic transformation effectively addresses the issue.

Note that start-up that participate in accelerator programs have typically been created fairly recently. This reflects the growth in accelerator activity over the period of observation from 2005 till 2015. Besides, while it is common to see at least two co-founders, it is rare to see sequential entrepreneurs. Furthermore, the four regions for which we specify dummy variables account for over half of the locations where start-ups are based with 35 percent in California alone. This last observation is not surprising since these four states are among the;ost populous in the USA and cover areas such as Silicon Valley and Route 128, which are traditionally associated with entrepreneurship activity.

Finally, note the diversity of activities that start-ups focus on.

With respect to investor interest after acceleration, which is measured by the independent variables, one can note the large range of values and high standard deviations, which point to a large variation in the benefits start-ups get from participating in accelerator programs.

4 Results

4.1 Differences among accelerators

Figure 1 plots the distribution of funds raised by start-ups associated with accelerators for the 111 accelerators in our sample, with colors corresponding to 4 different groups (see previous section). The y-axis indicates the total amount of funds (in billion USD) for each accelerator and the labels of the x-axis provide the names of the accelerators concerned. Accelerators are ordered according to the total of funds associated with them and split into four adjacent groups, as described in the previous section. Funds are extremely unevenly distributed among accelerators, with the start-ups associated with one single accelerator, Y-Combinator, having attracted more than half of the funds. A second group of accelerators is made up by three regional members of the Techstars network, AngelPad and 500start-ups, with funds per accelerator ranging from 300 to 500 million dollars. A third group is associated with total funds raised between 70 and 200 million and a fourth group with less than 50 million of funds raised by its start-ups. The number of start-ups associated with each group of accelerators is indicated in the first row of Table 4.

Table 4 presents a selection of results from the statistical tests detailed in the previous section, including ANOVA tests on each variable listed in Tables 1 and 2, and subsequent pairwise tests for differences in the means of that variable among the groups. We qualify the importance of the difference on the basis of Cohen’s d, the most commonly used indicator of effect size (Fritz et al., 2012). For the sake of brevity Table 4 only provides results for the variables for which a significant difference was found with respect to pairwise comparisons of adjacent groups. Full results are available from the authors.

With regard to the characteristics of start-ups selected, and while no general pattern is visible, accelerators seem to differentiate amongst themselves with regards to the geographical location of the start-ups and with respect to the activities carried out by the start-ups participating in their programs.

With regard to investors, the mean non-directed Katz centrality (kmn), used as a proxy for investor prominence, decreases clearly step by step from group 1 to group 4, with a larger step between groups 2 and 3. Directed Katz centrality (kmd), which focuses on the prominence of lead investors, also decrases from group 1 to group 4, with the main step occurring between groups 1 and 2 in this case. Funding (log(fsa)) also declines from group 1 to group 4, with the most important decline occurring between group 3 and 4. These results provide support to and confirm Hypothesis 4.

4.2 Differences between accelerated and non-accelerated start-ups

Propensity model and balance

For each start-up in our sample, as described in the previous section, we select a counterpart among the other start-ups in our database using propensity score matching. We estimate a logistic model of the propensity to participate in an accelerator program given start-up characteristics as defined by the independent variables listed in Table 2. We checked for the absence of multicollinearity and interdependence between variables, including by computing the variance inflation factors for the variables in the model after estimating it, and found them to be sufficiently low to dismiss concerns. In order to assess the quality of the model, we subjected it to the Hosmer-Lemeshow Goodness of Fit (GOF) Test and found the fit to be statistically significant at the 1% level with a resolution of 50 bins, which is reassuring with respect to the appropriateness of the model.

This model and its results corroborate the subsidiary hypotheses developed in Sect. 2.3: considering the propensity to enroll in an accelerator programs as a proxy for the existence of a legitimacy gap, we observe that the track record (cfr; cfb) has a negative effect on this propensity (Hypothesis a) and we further observe a positive effect of the size of the founding team (fdr: Hypothesis b) and significant effects for time, location, and activity (Hypothesis c).

We identify a match for 665 out of 668 accelerated start-ups in our sample, the 3 start-ups for which we could not find a match being identified as outliers as they exhibit extreme values for one or more of their characteristics. We further observe a good balance between the “treated” set of 665 accelerated start-ups in our sample and the “control” set of 665 non-accelerated counterparts, with no significant differences with regards to the independent variables except for founding date, with a low difference of 3 months. Table 5 reports on the differences between accelerated and non-accelerated start-ups, as well as the differences with regard to start-ups associated with particular groups of accelerators and their non-accelerated counterparts.

Consequences on investors and investments

With regard to the outcome variables, participation in accelerator programs is associated with attracting investors of higher prominence, as measured by non-directed Katz centrality, for the first two groups of accelerators, with a further marked difference between the first and second group. Conversely, start-ups accelerated by accelerators in group 4 tend to raise lower funds than their counterparts. These results provide support for Hypothesis 4, for Hypothesis 2, and for Hypothesis 1 yet only for accelerators associated with groups 1 and 2.

Y-Combinator

Start-ups of the first group, accelerated by Y-Combinator, are associated with a higher directed-Katz, and raise a larger amount of funding. However, the previous results (Table 5) show a difference in terms of how accelerated and control start-ups were located for this particular group, in addition to the difference in terms of founding dates. We therefore apply propensity score matching a second time to Y-Combinator exclusively. Table 6 presents additional results for a dual propensity score matching limited to group 1 start-ups where Californian start-ups were matched with Californian start-ups, and non-Californian start-ups were matched with non-Californian start-ups, i.e., considering group 1 start-ups as belonging to 2 sub-groups depending on their location. Previous results with respect to the prominence of attracted investors hold strongly for group 1 start-ups, and a significant difference is also visible with respect to the amount of funding raised. Conversely, there is no significant difference among the distributions of directed Katz values: That is, Californian start-ups, whether accelerated by Y-Combinator or not, attract leading Silicon Valley investors that tend to assume a leadership role in their deals, whereas start-ups outside California do not. These results offer a strong support to Hypothesis 1 for Y-Combinator and reject Hypothesis 3, or at least do not provide support for Hypothesis 3 due to a broader “Silicon Valley” effect.

5 Discussion

In an article for the Annals, and with respect to the crucial selection of startups by investors, Zhong et al. (2018) propose a recommendation system aimed at selecting start-ups at later stages of their development. The study reported here is complementary to their effort in that it highlights the role of accelerators in the selection of start-ups at an earlier stage.

The results of our analysis also support the view that participation in accelerator programs facilitates start-up integration within an entrepreneurial ecosystem. At the same time, they clarify the fact that some of the accelerators are better intermediaries than others. Taken together, this confirms that accelerators could be seen as platforms and that, among them, dominant platforms would emerge that attract the entrepreneurs with the best ventures and the investors with the best connections.

Relation to similar studies

As mentioned above, our analysis of accelerators as platforms is consistent with the view of accelerators as a “key structural element” in entrepreneurial ecosystems (Autio et al., 2018).It is also in line with the approach advocated for financial markets (Sørensen, 2007). Our findings with regard to the special position of Y-Combinator concur both with what is known in the platform literature as the “winner-takes-all” or Matthew-effect (Sun & Tse, 2007) and with observations on the field (Younger & Fisher, 2020). It helps solve the “accelerator-conundrum” by explaining why accelerators, taken globally, might not have an effect on accelerated start-ups fundraising, or might even have a negative effect Yu (2019): only a few prominent accelerator-platforms can have a significant effect on fundraisingand more generally, as we originally emphasized here, on the quality of the attracted investors. We are not the first to apply propensity score matching techniques in this context: while Yu (2019) relied on hand-coding, other scholars have adopted propensity scores as more easily replicable matching method (Kher et al., 2020; González-Uribe & Reyes, 2021). Yet, to our knowledge, we are the first to measure the prominence of investors in accelerated start-ups on the basis of social network centrality measures. Goswami et al. (2018) also study accelerators as intermediaries with regard to accelerators in Bangalore, but also limit themselves to interviews and document analysis. Our results for the US, by quantifying the ability of accelerators to connect, indeed refer to one of the four areas of accelerator expertise identified in their study. We would also like to emphasize that our identification of accelerators as providers of legitimacy is not unrelated to Wright and Drori (2018)’s early observations. Bliemel et al. (2019) also saw accelerators as providers of “start-up infrastructure”, which is also related to cognitive legitimacy (Caccamo & Beckman, 2021). However, our study suggests that accelerators can provide other types of legitimacy as well, which is relevant for stakeholders who typically adopt a more complex way of judging an organization’s legitimacy (Bitektine, 2011).

Alternative explanations

With regards to the conundrum described above, Qin et al. (2019) conjectured that part of the reason might be heterogeneity among start-ups. They pointed to differences among the strategies adopted by entrepreneurs to get most out of their participation in an accelerator program. Through the propensity score matching method adopted in this paper, we are able to control for at least part of this heterogeneity. The fact that we are still not able to find an effect of acceleration on the amount of funds raised suggests that the importance of heterogeneity among start-ups as explanation for the lack of direct monetary benefits is probably not appropriate.

We interpret the high values of investor centrality for some start-ups as the result of selection by more central investors. Yet, it may also be the case that these start-ups accede to denser networks with a higher investor centrality on average. Bliemel et al. (2016) posit that investors in such networks are likely to rely on normative processes to judge legitimacy of start-ups while investors in sparse networks with lower centrality rely more on pragmatic processes. This difference should be visible in the start-up selection process that is carried out by accelerators as they confer pragmatic and normative legitimacy through this process. The only difference we find among selected start-ups is in terms of the activities they propose to carry out. Ex post, one can try to associate the activities of focus 2 and 4 (see above), which score high among accelerators associated with low centrality values, dispositional, and hence, pragmatic legitimacy and investigate to what extent they express activities to are similar to those already proposed in the ecosystem. In contrast, the activities of focus 3 would be markers of consequential, or perhaps structural, in any case normative legitimacy. To the extent that labels like “apps” and “payments” are specific about outcomes than the sectoral markers present in focus 2 and 4, this might indeed be the case. From the perspective of start-ups, however, whether our interpretation or the alternative interpretation presented here is correct does not make an important difference. Under both interpretations accelerators are a useful intermediary if they allow start-ups to connect to investors of high centrality.

Among scholars who have investigated accelerators, the perspective adopted by Hochberg (2016), who link accelerators with the dynamism of regional entrepreneurial ecosystems, is most like ours. In line with this perspective, Mayya and Huang (2019) show that corporate venture capitalists significantly increase their investments in early-stage start-ups in regions where seed accelerators are present. Indeed, we also found higher levels of funds raised for start-ups in certain regions, accelerated or not. The presence of accelerators, dominant or not, or indeed of incubation structures more in general is not included among the criteria used to rank entrepreneurial ecosystems by Sitaridis and Kitsios (2020). Still, it matters.

In contrast, we do not feel that the resource-based view would be specially helpful to explain our results. This perspective was proposed by Uhm et al. (2018) to interpret difference and similarities between start-ups in the US and Korea. Of course, the accelerator’s ability to connect to investors can be seen as a resource it provides to start-ups, but it tends to overlook the importance of this ability as a resource for potential investors. The crucial point here is that our study illustrates that resources are not passive entities that are waiting to be selected, but rather dynamic elements that need to be managed and developed (Zahra, 2021). Entrepreneurial ecosystem are all about the creation and transformation of resources (Spigel & Harrison, 2018) and actions undertaken in view of gaining legitimacy are crucial in this context. This is typically why Qin et al. (2019) looked at resource acquisition rather than selection. Nevertheless, we feel that even the focus on resource acquisition by start-ups has some limitations in the context of accelerators since the resources acquired during the short duration of an accelerator program are limited: However, these resources can be amplified through the legitimacy gained by participating.

Limitations

Our study does not look into the motivations of founders or investors to turn to accelerators. Our data typically do not allow us to corroborate or invalidate the idea proposed by Yu (2019) that the role of accelerators is to reduce the start-up founders’ uncertainty with respect to the quality of their projects. We do, however, look at the experience of founders and the notoriety of investors, which both could be construed as motivating factors. Besides the study only covers start-ups participating on accelerator programs in the US in the first ten years of the existence of accelerators as institutional form. Undoubtedly lengthening the period and broadening the geographic scope would yield a large and more diverse sample to analyze, potentially also less coherent. Finally, there might be room for improvement in choice of methods, in particular with regards to the implementation of propensity score matching where machine learning alternatives to logistic regression have been proposed (Westreich et al., 2010), although such improvements would probably not fundamentally alter the results presented here.

Implications

We see the theoretical contributions of our work as threefold: First, we articulate the notion of accelerator outcomes, and the discussions around it, with the research on entrepreneurial ecosystems, in ways that suggest that this articulation is not at all anecdotal, all the more so as, second, we integrate elements from the platform ecosystem literature with the entrepreneurial ecosystem literature (cf. Acs et al., 2017); and, third, we try to create connections between two hitherto separate streams within this body of literature, by bridging notions from network theory with notions from legitimacy theory.

Lerner (2010) lists three different audiences that could benefit from a better understanding of how entrepreneurship phenomena unfold: entrepreneurs and generally startup founders, policy makers, and venture capitalists. By shedding additional light on the relations between entrepreneurs, accelerators and investors, we hope that our investigations might contribute to clarify the role that accelerators play for startup founders, and the supplementary role that a few accelerators in a given ecosystem might play in this respect, and thus orienting the strategic choices of startup founders: when choosing an accelerator, the outcome of not choosing the leading one or leading ones might appear considerably more consequential to them as soon as they consider accelerators as platforms. To put it differently, our results tell startup founders that in addition to acquiring knowledge from accelerators, they should do also take into account the social capital they can acquire when choosing among accelerators. In addition, our study could help policy makers who seek to deepen their understanding of how entrepreneurial ecosystem are structured: namely, policies aimed at supporting a large number of entrepreneurial support organization might face difficulties that would stem from the consequences of the existence of platform competition. As soon as startup founders anticipate this outcome, they would certainly self-select according, which would result in non-top-tier accelerators failing to attract high profile startups, thus with potential negative consequences with respect to how public money can be used if too widely distributed. Finally, our results might also contribute to orient the choices of venture capitalists notably with respect to the so-called “sourcing” of the startups they might invest in, by encouraging them to look, first and foremost, at the startups accelerated by the leading accelerators, or conversely, to look for under-valued opportunities in the portfolio of other, less prominent accelerators.

Suggestions for further research

Krishnan (2013) argues that operations management scholars should seriously consider themes related to entrepreneurship as avenues for future research due to the centrality of this activity in contemporary societies. Judging by the frequency with which the term “entrepreneurship” is mentioned in operations research journals, this call finds a growing resonance. Broadly speaking, there are two ways in which operations research can contribute to the study of entrepreneurship. The first is through the application of familiar methods of techniques to this novel terrain, be it neural networks (Jain & Nag, 1998), data envelopment analysis (Sorkhi & Paradi, 2020), multi-criteria decision making (Sitaridis & Kitsios, 2020), or something else altogether; the second is to adapt its theoretical models and leverage their rigor to explain entrepreneurial processes (Phan & Chambers, 2013). In the context of research on accelerators, in terms of methods the above-mentioned incorporation of machine learning in propensity score matching would be an obvious avenue. In terms of theory, it would be of particular interest to see to what extent research on crowdfunding (Mahbub et al., 2022; Li and Cao, 2021, for instance) could be brought to bear to studies of the accelerator-mediated interactions between start-ups and investors.

6 Conclusion

This paper studies the effect of accelerators on the early stage of start-up development. The effect found turned out to be dependent on the identity and reputation of the accelerator supporting the start-up. In particular, we found that alumni of well-known accelerators can attract investors with a position that is more central to the entrepreneurial system than the position associated with investors in similar companies that did not participate in accelerator programs.

The results of our propensity-matched study comparing accelerated and non-accelerated start-ups suggest a renewed understanding of the accelerator phenomenon: Namely, accelerators appear as a competitive platform market with a very limited number of winners. Such an analysis could of course contribute to modify the perceptions and the decisions of start-up founders and entrepreneurs about which accelerator to select. Furthermore, the fact that most accelerators do not have a statistical impact on the amount of funds raised by accelerated start-ups, nor often on the prominence of investors they are able to connect their startups to, could also be of relevance for policymakers, when assessing their options with respect to the development of their ecosystems: Notwithstanding the positive effects identified by Hochberg (2016) and others, their strategies could be different whether there would already exist, or not, a leading ’accelerator-platform’ within their ecosystem.

Supplementary information. Detailed results are available on request.

References

Acemoglu, D. (1993). Learning about others’ actions and the investment accelerator. The Economic Journal, 103(417), 318–328. https://doi.org/10.2307/2234770

Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10. https://doi.org/10.1007/s11187-017-9864-8

Armanios, D. E., Eesley, C. E., Li, J., & Eisenhardt, K. M. (2017). How entrepreneurs leverage institutional intermediaries in emerging economies to acquire public resources. Strategic Management Journal, 38(7), 1373–1390. https://doi.org/10.1002/smj.2575

Assenova, V. (2019). Institutional change and early-stage startup selection: Evidence from applicants to venture accelerators. SSRN Scholarly Paper ID 3448893, Social Science Research Network, Rochester, NY.

Audretsch, D. B., & Thurik, A. R. (2000). Capitalism and democracy in the 21st century: From the managed to the entrepreneurial economy*. Journal of Evolutionary Economics, 10(1), 17–34. https://doi.org/10.1007/s001910050003

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95. https://doi.org/10.1002/sej.1266

Bergman, B. J., & McMullen, J. S. (2022). Helping entrepreneurs help themselves: A review and relational research agenda on entrepreneurial support organizations. Entrepreneurship Theory and Practice, 46(3), 688–728. https://doi.org/10.1177/10422587211028736

Bernstein, S., Korteweg, A., & Laws, K. (2017). Attracting early-stage investors: Evidence from a randomized field experiment. The Journal of Finance, 72(2), 509–538. https://doi.org/10.1111/jofi.12470

Bitektine, A. (2011). Toward a theory of social judgments of organizations: The case of legitimacy, reputation, and status. Academy of Management Review, 36(1), 151–179. https://doi.org/10.5465/amr.2009.0382

Bliemel, M., Flores, R., De Klerk, S., & Miles, M. P. (2019). Accelerators as start-up infrastructure for entrepreneurial clusters. Entrepreneurship & Regional Development, 31(1–2), 133–149. https://doi.org/10.1080/08985626.2018.1537152

Bliemel, M. J., Flores, R. G., de Klerk, S., Miles, M. P. P., Costa, B., & Monteiro, P. (2016). The role and performance of accelerators in the Australian startup ecosystem. SSRN Scholarly Paper ID 2826317, Social Science Research Network, Rochester, NY.

Block, J. H., Colombo, M. G., Cumming, D. J., & Vismara, S. (2018). New players in entrepreneurial finance and why they are there. Small Business Economics, 50(2), 239–250. https://doi.org/10.1007/s11187-016-9826-6

Bloodgood, J. M., Hornsby, J. S., Rutherford, M., & McFarland, R. G. (2016). The role of network density and betweenness centrality in diffusing new venture legitimacy: An epidemiological approach. International Entrepreneurship and Management Journal, 2(13), 525–552. https://doi.org/10.1007/s11365-016-0412-9

Brown, R., Mawson, S., Lee, N., & Peterson, L. (2019). Start-up factories, transnational entrepreneurs and entrepreneurial ecosystems: Unpacking the lure of start-up accelerator programmes. European Planning Studies, 27(5), 885–904. https://doi.org/10.1080/09654313.2019.1588858

Caccamo, M., & Beckman, S. (2021). Leveraging accelerator spaces to foster knowledge communities. Technovation, 113, 102421. https://doi.org/10.1016/j.technovation.2021.102421

Castellano, S., & Khelladi, I. (2017). Legitimacy: The missing link in investigating the dynamics of entrepreneurial teams in successful champagne houses. International Journal of Entrepreneurship and Small Business, 32(1–2), 160–180. https://doi.org/10.1504/IJESB.2017.085992

Chung, S. L., Liu, W., Liu, W. R., & Tseng, K. (2018). Investor network: Implications for information diffusion and asset prices. Pacific-Basin Finance Journal, 48, 186–209. https://doi.org/10.1016/j.pacfin.2018.02.004

Clayton, P., Feldman, M., & Lowe, N. (2018). Behind the scenes: Intermediary organizations that facilitate science commercialization through entrepreneurship. Academy of Management Perspectives, 32(1), 104–124. https://doi.org/10.5465/amp.2016.0133

Cohen, S., Fehder, D. C., Hochberg, Y. V., & Murray, F. (2019). The design of startup accelerators. Research Policy, 48(7), 1781–1797. https://doi.org/10.1016/j.respol.2019.04.003

Cohen, S., & Hochberg, Y. V. (2014). Accelerating startups: The seed accelerator phenomenon. SSRN Scholarly Paper ID 2418000, Social Science Research Network, Rochester, NY.

Crişan, E. L., Salanţă, I. I., Beleiu, I. N., Bordean, O. N., & Bunduchi, R. (2021). A systematic literature review on accelerators. The Journal of Technology Transfer, 46, 62–89. https://doi.org/10.1007/s10961-019-09754-9

Dalle, J. M., den Besten, M., & Menon, C. (2017). OECD: Using crunchbase for economic and managerial research. Technical report.

Deephouse, D. L., & Suchman, M. (2013). Legitimacy in organizational institutionalism. The SAGE Handbook of Organizational Institutionalism, 49–77. SAGE.

Deffains-Crapsky, C., & Klein, P. G. (2016). Business angels, social networks, and radical innovation. In D. Bögenhold, J. Bonnet, M. Dejardin, & D. Garcia Pérez de Lema (Eds.), Contemporary entrepreneurship: Multidisciplinary perspectives on innovation and growth (pp. 275–290). Springer. https://doi.org/10.1007/978-3-319-28134-6_18

Del Sarto, N., Isabelle, D. A., & Di Minin, A. (2020). The role of accelerators in firm survival: An fsQCA analysis of Italian startups. Technovation, 90–91, 102102. https://doi.org/10.1016/j.technovation.2019.102102

Delmar, F., & Shane, S. (2004). Legitimating first: Organizing activities and the survival of new ventures. Journal of Business Venturing, 19(3), 385–410. https://doi.org/10.1016/S0883-9026(03)00037-5

den Besten, M., & Dalle, J. M. (2015). A comparative analysis of funds raised by startups that benefitted from US accelerators. In Interdisciplinary European conference on entrepreneurship research, Montpellier, France.

Díez-Martín, F., Blanco-González, A., & Prado-Román, C. (2016). Explaining nation-wide differences in entrepreneurial activity: A legitimacy perspective. International Entrepreneurship and Management Journal, 12(4), 1079–1102. https://doi.org/10.1007/s11365-015-0381-4

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160. https://doi.org/10.2307/2095101

Drori, I., & Wright, M. (2018). Accelerators: Characteristics, trends and the new entrepreneurial ecosystem. In M. Wright (Ed.), Accelerators: Successful venture creation and growth (pp. 1–20). Edward Elgar Publishing.

Erikson, T. (2003). Towards a taxonomy of entrepreneurial learning experiences among potential entrepreneurs. Journal of Small Business and Enterprise Development, 10(1), 106–112. https://doi.org/10.1108/14626000310461240

Florén, H., Frishammar, J., Parida, V., & Wincent, J. (2018). Critical success factors in early new product development: A review and a conceptual model. International Entrepreneurship and Management Journal, 14(2), 411–427. https://doi.org/10.1007/s11365-017-0458-3

Fritz, C. O., Morris, P. E., & Richler, J. J. (2012). Effect size estimates: Current use, calculations, and interpretation. Journal of Experimental Psychology: General, 141(1), 2–18. https://doi.org/10.1037/a0024338

Gompers, P. A., Gornall, W., Kaplan, S. N., & Strebulaev, I. A. (2019). How do venture capitalists make decisions? Journal of Financial Economics, 135(1), 169–190. https://doi.org/10.1016/j.jfineco.2019.06.011

Gonzalez-Uribe, J., & Leatherbee, M. (2018). The effects of business accelerators on venture performance: Evidence from start-up Chile. The Review of Financial Studies, 31(4), 1566–1603. https://doi.org/10.1093/rfs/hhx103

González-Uribe, J., & Reyes, S. (2021). Identifying and boosting “Gazelles’’: Evidence from business accelerators. Journal of Financial Economics, 139(1), 260–287. https://doi.org/10.1016/j.jfineco.2020.07.012

Goswami, K., Mitchell, J. R., & Bhagavatula, S. (2018). Accelerator expertise: Understanding the intermediary role of accelerators in the development of the Bangalore entrepreneurial ecosystem. Strategic Entrepreneurship Journal, 12(1), 117–150. https://doi.org/10.1002/sej.1281