Abstract

Corporate accelerators (CAs) have emerged as a key component of entrepreneurship ecosystems, offering startups corporate guidance, industry connections, and resources for accelerated venture creation. Although their proliferation is evident, we still know little about the value they produce for startups across different contexts. This study investigates the organizational setup and program design of 15 CAs in Germany using a unique and hand-collected dataset of 223 alumni startups. Our findings reveal a tradeoff: Specialized and integrated programs positively impact startups’ speed to market and growth, while specialization and rising corporate control may hinder follow-up venture capital financing. This research contributes to our understanding of CAs and the startup acceleration process and provides insights for corporate and accelerator managers and startups alike. Startups can use these findings to identify the most suitable CA for their needs. Program managers and designers gain insights into the strategic orientation and organizational setup that positively impact startup acceleration.

Plain English Summary

While corporate accelerators (CAs) have become a major trend, we still know little about their effectiveness, how they work, and what outcomes they produce for the involved parties. This research examines how CA program designs relate to the performance of accelerated startups after their graduation. Based on an analysis of 223 graduated startups from 15 CAs based in Germany, we observe that their specialization matters, but there is a trade-off. Therefore, while CA programs selecting startups with a strong “strategical fit” to the operations of the sponsoring corporate mother produce high growth rates for the accelerated startups, they have downsides for startups when searching for future investors. Moreover, we find support that organizational integration and linkages are important. The accelerators’ management plays an especially essential role. Therefore, we observe that CAs managed by former entrepreneurs are better at accelerating both the financial and strategic outcomes for graduated startups than programs managed by professionals with strong corporate backgrounds. Our study contributes to the emerging literature on CAs by addressing a gap in the research. By employing a data-driven approach, our findings highlight the need for a nuanced understanding of the value of CAs for startup performance. Consequently, our study provides important insights for corporations in designing their accelerator programs and also assists startup teams in making informed decisions about joining CAs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decade, corporate accelerators (CAs) emerged as a popular, new, and distinct form of innovation intermediary, helping early-stage startups quickly reach successful outcomes (Chan et al., 2020; Cohen et al., 2019; Gutmann et al., 2020; Yu, 2020). The promised advantage of such CAs over non-corporate-led accelerators, such as university or investor-led accelerators, is based on a win–win proposition through complementarities: Both parties lack specific resources that the other partner could complementarily fill (Rigtering & Behrens, 2021). Startups may benefit from “smart financing” and gain valuable inputs from the sponsoring company, including access to industry-specific know-how and networks (Cohen et al., 2019), while the sponsoring corporations get a “window on technologies” (Cohen et al., 2019) and access to new entrepreneurial talents that may help corporates to increase their innovation capacities and rejuvenate their business strategies (Kupp et al., 2017; Moschner et al., 2019).

While the proliferation of CAs is evident, we still know relatively little about the value of these specific accelerator programs, how they work, and which outcomes they produce across different contexts and program designs (Nesner et al., 2020; Hallen et al., 2020; Yu, 2020; Hausberg and Korreck 2017). Previous research has emphasized the importance of program designs, particularly for corporate-led accelerators (Chan et al., 2020; Gregson, 2021). This research has also highlighted conflicting interests, cultural differences, and poor organizational fit as critical factors determining the expected spillovers between parties involved in corporate-led accelerators (Chan et al., 2020; Gregson, 2021). Understanding how to effectively balance these divergent interests and identify critical structural design configurations is essential to optimize the outcomes of CA programs. Such design configurations encompass aspects such as program structure, governance, network partners, mentors, and the integration of CAs into local entrepreneurship ecosystems (Cohen et al., 2019; Gutmann et al., 2020; Brown et al., 2019; Wright and Westhead 2019; Mahmoud-Jouini et al., 2018; Vandeweghe and Fu, 2018).

However, a critical knowledge gap exists regarding the link between these design configurations and their impact on the acceleration process. Most previous studies have reviewed best practices or presented selective descriptive statistics and individual founder success stories (Crișan et al., 2021; Yu et al., 2020), or only controlled for the influence of corporate sponsorship as a “side effect” (Cohen et al., 2019; Hallen et al., 2020; Nogueira, 2022; Yu, 2020). What is needed are empirical studies that establish a link between these CA design configurations and performance while considering the various benefits and costs for all involved parties (Chan et al., 2020; Gregson, 2021; Nogueira, 2022).

This study aims to address this research gap by providing an empirical analysis of the different design configurations of CAs and their influence on the performance of accelerated startups. Our analysis is based on a novel and hand-collected data set of 223 startups that graduated from 15 CAs based in Germany. Using a multilevel approach, we aggregate informants at the startup level, CA level, and corporate sponsor level to explore the relationship between program designs and startup performance outcomes. In order to overcome shortcomings in previous research, our empirical design combines and explores the different perspectives of prior studies, which focused on the level of industry specialization, the different objectives and orientations (financial or strategic orientation), and the social and organizational integration of the sponsoring parent and CA. Our results suggest that startups benefit from participating in highly specialized programs focusing on accelerating a select portfolio of startups operating in industries closely aligned with the parent corporation’s core business. We also find that programs managed by former entrepreneurs accelerate both financial and strategic outcomes for startups. Nevertheless, our results also indicate that startups must consider the potential costs and drawbacks of corporate acceleration. Therefore, while the accelerated startups strategically benefitted from a close and supportive relationship with the parent company, increasing specialization may also create difficulties for startups in attracting venture capital, which may hinder their ability to secure follow-up financing for future growth.

Therefore, our study adds to the emerging literature on CAs in several important ways. First, the empirical design of a multilevel approach allows for opening the “program-performance-link” for each participating company: the CA, the parent company, and the participating startups. Second, this study adds to the “CA performance” controversy, indicating that the debate about the positive or negative impacts of CA programs is far too short-sighted (e.g., Chan et al., 2020; Gutmann et al., 2020; Mahmoud-Jouini et al., 2018). Whether CAs provide advantages for the participating startups or not is contingent and depends on various factors and conditions, including the desired performance outcomes for startups and the design and organization of the CA programs. Therefore, our findings highlight the need for a nuanced understanding of the value of CAs regarding startup performance. While the benefits of industry expertise and business networks are significant, careful consideration must be given to the potential limitations and costs associated with corporate acceleration.

By addressing these factors, both startups and corporations can make informed decisions on their participation in CA programs and optimize the outcomes for all stakeholders involved. Therefore, our study provides key insights for corporations in designing their accelerator programs. Startup teams may benefit from the results by reflecting and analyzing ex-ante the expected benefits and costs of joining a CA program.

This paper is structured as follows: In Section 2, we review the literature on CAs. Based on our discussion, we identify several crucial design elements and further develop our hypotheses in Section 3. We present our methodology in Section 4 before reporting the results of our empirical analysis in Section 5. In Section 6, we discuss our findings and limitations and outline avenues for future research. Finally, we summarize the key results of our study in Section 7.

2 Literature review

Startup accelerators have recently gained significant attraction by entrepreneurship researchers since they provide an opportunity to study the dynamics of early-stage venturing that was previously hard to approach (Cohen et al., 2019; Drori & Wright, 2018). While accelerators have become a global trend, the literature on this new organizational form is still developing and lacks clear core frameworks (Cohen et al., 2019; Crișan et al., 2021; Qin et al., 2019). Initial research could be broadly categorized along two main strands. First, studies discuss the different types and forms of accelerators (Chan et al., 2020) and how they relate or distinguish them from other forms of startup support (e.g., incubators and business angels). Second, other studies focus on the services accelerators perform and the value they create. While there is a common understanding among academics that accelerators positively affect startup performance (Goswami et al., 2018; Wright & Westhead, 2019; Yu, 2020), empirical evidence about their benefits is inconsistent (Chan et al., 2020). Specifically, our understanding of how the various accelerator types work and what outcomes they produce across different designs and organizational contexts remains poor (Nogueira, 2022; Crișan et al., 2021).

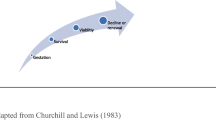

Accelerators historically developed out of business incubators (Ceaușu et al., 2017). While some researchers recognize accelerators as a special form of incubators, others define them as a very distinct organizational form of innovation intermediary (Yu, 2020; Hallen et al., 2020; Hathaway, 2016). Accelerators invite and select promising new startups and entrepreneurial teams to work side-by-side during a short-term boot camp program of about 2–3 months (Cohen et al., 2019; Fehder & Hochberg, 2014). The selected startups are organized into cohorts called “batches.” Every startup in a batch receives the same amount of funding, which is meant to cover only the basic expenses for experimentation for the program’s duration (Cohen et al., 2019). During the program, startups receive training, professional coaching, and access to mentors and network partners that help accelerate their ventures (Drori & Wright, 2018). The accelerator program regularly ends with a “demo day” event, where startups pitch their business ideas to potential investors (Moschner et al., 2019).

Today, the accelerator landscape has become vast, and accelerators come in different organizational forms and types and vary, among others, based on the program’s duration, scope, size, and composition of batches (e.g., Cohen et al., 2019; Kanbach & Stubner, 2016). Existing programs are either wholly or partly sponsored by governments, run by investors or venture capitalists, or sponsored by universities or non-government organizations. Most prominently, CAs are acceleration programs run by established corporations and constitute most accelerator programs worldwide (e.g., Cohen et al., 2019; Gust, 2016; Hallen et al., 2020).

While the proliferation of CAs is evident, their value is controversial. Kohler (2016) underlined that given their distinct business models, CAs work differently from other forms of accelerators and, thus, might not always create advantages for accelerated startups. The core business model of CAs is based on matching complementary resources (Nesner et al., 2020; Urbaniec & Żur, 2021). Both parties (the sponsoring corporation and the accelerated startup) lack specific resources, and the other can fill these gaps. Corporations often struggle with risky innovation projects and strategic renewal while lacking resources for experimentation and research and development (R&D). In contrast, young entrepreneurial firms suffer from the “liability of newness,” the lack of business and industry experience, and, of course, their most pressing need, access to venture funding (Radcliffe & Lehot, 2018). By engaging in accelerator programs, corporations gain access to startups, screen young talents, and learn about upcoming innovations (Gutmann et al., 2020; Urbaniec & Żur, 2021), while startups benefit from “smart” financing and gain access to corporate resources, networks, and new inputs to scale their business. Therefore, CAs act as innovation intermediaries creating a win–win for the involved parties (Hallen et al., 2020; Kupp et al., 2017).

However, while the impact of a “few” startups on the performance of a multi-billion-dollar corporation is questionable and even more difficult to demonstrate empirically (Steiber & Alänge, 2021; Urbaniec & Żur, 2021; Cohen et al., 2019), the advantages for startups participating in these programs are possible, but consistent empirical evidence remains missing. Initial studies that controlled for some sort of corporate sponsorship report mixed findings. Yu (2020) found that accelerated startups need more time and are less likely to achieve key milestones than their non-accelerated peers. Cohen et al. (2019) reported that investor-led accelerators outperformed CAs in increasing the market valuation of accelerated startups. Nogueira (2022) found that corporate accelerated startups close earlier and higher deals within the first year but have smaller exit sums. Cohen and Hochberg (2014), Dempwolf et al. (2014), and Hochberg (2016) raised general concerns about the impact of CAs. Therefore, given the short training timeframe, typically lasting only a couple of weeks, the effect of acceleration on startups’ future growth prospective is questionable.

Other articles stress that whether startups benefit from corporate acceleration is highly contextual and depends on various settings and organizational factors, such as the offered services and program design (Pauwels et al., 2016), the sponsoring corporation’s commitment, the program’s objective, the selection of accelerated startups, the mentors’ quality, the partner network (Fehder & Hochberg, 2014), and the embeddedness of the program in the startup ecosystem (Drori & Wright, 2018; Madaleno et al., 2022; Stayton & Mangematin, 2019). Vandeweghe and Fu (2018) and Canovas-Saiz et al. (2020) noted significant performance differences and that the design program decision should also be based on the desired outcomes, namely, whether startups primarily seek strategic or financial acceleration. Similarly, Hallen et al. (2020) outlined that while some accelerator designs effectively increase startups’ market validation, they may not automatically be promotive for speeding up business and product development. Moreover, research also warns of the detrimental effects of corporate mentorship since CAs may pose risks for accelerated startups. Conflicting interests, different objectives, hidden strategic agendas, the misuse of power, resource dependency and organizational relatedness, and the interference of the corporate parent sponsor limit entrepreneurial opportunities (Kurpjuweit & Wagner, 2020; Shankar & Shepherd, 2019). Startups may risk being drowned in the corporate world (Weiblen & Chesbrough, 2015), losing their necessary freedom to experiment and create innovative business models and products (Hutter et al., 2021).

To weigh the costs against the benefits of corporate acceleration, researchers emphasize the general importance of the organizational design and governance of these programs. A prominent strand in the innovation management literature has stressed the challenges that frequently occur when coordination and innovation activities among such “unequal partners,” like young creative startups, cooperate and large, rigid firms do not (Kohler, 2016; Richter et al., 2018; Rigtering & Behrens, 2021). The main challenge is identifying and designing organizational set-ups that best match and coordinate complementary resources while balancing the different interests. From the literature on incubators and corporate innovation labs, we have learned that there are trade-offs regarding the organizational design of such innovation units, which must be carefully balanced. Whether these innovation units are tight or loosely coupled with the parent company is of significant interest, and both may help increase but also stifle innovation outcomes (Gonthier & Chirita, 2019; Kruft & Kock, 2019).

Moreover, the strategic fit between the selected innovation and venture projects and the given corporate resource matters for exploiting the synergies and leveraging the costs versus the benefits of corporate sponsorship (Shankar & Shepherd, 2019). Previous findings in this research area suggest that while innovation units must be, at least to a certain extent, independent from the operations of the corporate sponsor to guarantee creativity and novel idea generation, tight organizational coupling and a close strategic fit between the selected innovation projects and existing corporate products help in leveraging existing resources and the successful diffusion of innovation projects (Mahmoud-Jouini et al., 2018; Shankar & Shepherd, 2019). It is very likely that these trade-offs also apply to CAs as a very distinct form of corporate innovation units Richter et al. (2018).

Nevertheless, the academic debate about the design of corporate-led accelerators here has just begun. Empirical research is limited and is based on best practices, single case studies, or expert interviews (e.g., Gonzalez-Uribe & Leatherbee, 2018; Gutmann et al., 2020). Our understanding of how corporate acceleration works and should be best organized remains scant. Amid the debate on the cost and benefits of CAs, two questions have yet not been sufficiently answered. The first is whether specialized or more generic programs are better for corporate acceleration (Gregson, 2021; Colombo et al., 2018). The second is about the integration of these programs and how the relationship between the CA program, its management, and the sponsoring corporation influences the work and outcomes of the acceleration process (Gregson, 2021; Mahmoud-Jouini et al., 2018; Moschner et al., 2019). Initial findings here suggest that there are distinct effects that must be actively managed and ultimately depend on the design context and the desired outcomes for startups when applying for CA programs (Gonzalez-Uribe & Leatherbee, 2018; Motoyama & Knowlton, 2017).

This study aims to provide a first framework for evaluating the impact of CAs and how their design influences the success of accelerated startups. Responding to the recent calls for more nuanced empirical research, we investigate the effect of programs’ specialization and the organizational integration of CAs on the growth of startups and their ability to raise follow-up venture capital investments after graduating from the program. In the next section, we develop our main hypotheses.

3 CA design and performance

3.1 The role of specialization

Colombo et al. stressed the need to analyze “[…] the choice between a generalist and a specialized programs with a focus on specific technologies or industries” (2018, p. 195). Wright and Westhead (2019) detected considerable heterogeneity in whether and to what degree a particular program is specialized or generic in the sense that it allows for startups from various technological or industrial backgrounds.

Accelerator managers have a few key design choices related to the specialization of CA programs (Pauwels et al., 2016). Specifically, selecting the startups themselves is of significant interest (Cohen et al., 2019). Therefore, two crucial dimensions must be considered. The first relates to the resource or strategic fit between the selected startup and sponsoring corporation (Shankar & Shepherd, 2019). The second relates to the fit among the selected startups within each batch (Cohen et al., 2019). In both dimensions, the central question is whether having a heterogenous batch of startups with diverse backgrounds or specialized batches focused on groups of startups with similar technological backgrounds and industry affiliations is better for achieving the best outcomes.

Currently, little is known about the costs and benefits of specialized vs. more generic programs and how it affects the outcomes of the corporate acceleration process. There are likely trade-offs to balance, and each dimension creates different outcomes for accelerated startups. The main reason for founders choosing a corporate-led program over other accelerator types is the advantages that are supposed to come with having an experienced corporate supporter (Nesner et al., 2020; Urbaniec & Żur, 2021): industry-related expertise, access to business networks, the chance to use production facilities, testing laboratories, and help to develop and commercialize their ideas faster (Canovas-Saiz et al. 2020; Stayton & Mangematin, 2019; Harrison & Fitza, 2014;). To exploit those synergies, a certain relatedness between the strategic resources of the accelerated startups and the parent corporation is essential to effectively leverage and transfer complimentary resources (e.g., Richter et al., 2018).

However, strong strategical relatedness also poses several risks for the selected startups. Losing entrepreneurial freedom and increasing resource dependency might harm creative entrepreneurship (Weiblen & Chesbrough, 2015). An exhaustive thread in the broader innovation literature has stressed the importance of diversity and heterogeneous skill sets in innovation alliances (e.g., Hottenrott & Lopes-Bento, 2016; Van Beers & Zand, 2014). Diverse skills, experiences, and resources are needed to increase creativity and knowledge spill-over among partners (e.g., Lee et al., 2019; Nathan & Lee, 2013; Audretsch et al., 2018). Belderbos et al. (2018) found that diverse knowledge stocks between startups and their corporate partner positively affect the accelerated startups’ growth and market evaluation. Losing intellectual property is also considered a potential downside. Through their investments, corporations endorse the technological viability and strategic importance of the startup’s idea (Harrison & Fitza, 2014). Therefore, since they are significantly smaller than corporations, startups run into the risk that their technology will be taken (Weiblen & Chesbrough, 2015). Park and Bae (2018) described this as “swimming with the sharks.” Dushnitsky and Shaver (2009) provided evidence that startups avoid corporate investments when operating in the same industry, especially if their intellectual property protection is low.

A strong and strategic fit and close collaboration between the sponsoring corporation and its portfolio of startups may result in potential lock-in effects. Yu (2020) found that accelerated startups raised smaller venture capital tickets and struggled with follow-up investments. Since it is difficult to assess the extent to which the success of startups could be traced back to the support of their corporate sponsors, venture capitalists tend to underestimate the value of accelerated startups. However, Canovas-Saiz et al. (2020) reported that startups that graduated from corporate-led accelerators raised larger ticket prices and received earlier and much faster external funding. They argued that getting accepted into a CA program is a positive quality signal to investors.

We agree with previous studies (Richter et al., 2018; Yu, 2020) that there may be a potential trade-off. While a strong industry-focus is one main motivation for startups joining CAs, rising specificity and strategic interference of the parent company may even threaten startups’ future performance. Moreover, we believe whether and to what degree startups benefit from program specialization is a question of attended benefits. If startups seek strategic development, such as access to R&D, business networks, and training, a close fit between selected startups and the sponsoring corporation in their related industry and technological base is advantageous. However, it is disadvantageous for financial outcomes, such as startups’ market valuation and opportunities, to raise venture capital. Increasing partner-specificity and resource dependency might keep away future investors. Therefore, we hypothesize:

-

H1a: A strong industry fit between the parent company and the selected startups is positively associated with the strategic performance of accelerated startups.

-

H1b: A strong industry fit between the parent company and the selected startups is negatively associated with the financial performance of accelerated startups.

The batch structure used to assist startups is one of the most fundamental design innovations introduced by accelerators (Cohen et al., 2019; Pauwels et al., 2016). By grouping startups in batches, they benefit from coordinated programs and should co-learn from each other via co-creation and knowledge spillovers. Batch size, plurality, and industry diversity among the portfolio of startups are seen as critical. Hallen et al. (2020) noted that while small programs are of limited appeal to startups, larger portfolios decrease the attention available for each startup. Moreover, the knowledge transfer among the startups must be proactively managed. Larger batches drive anonymization and competition for resources among the selected startups, which may harm spillovers and the entire acceleration process (Hallen et al., 2020). Belderbos et al. (2018) also found that portfolio size negatively affected the technological performance of accelerated startups. Moreover, Lee et al. (2015) reported an inverted U-shape between portfolio size and knowledge transfer from startups to corporations. Regarding the batch’s composition, there also appears to be a trade-off argument. While a homogeneous portfolio of startups in terms of industry relatedness and development stage allows leveraging existing networks and sharing expertise and knowledge (Cohen et al., 2019), a certain diversity and heterogeneity in knowledge and skills are needed to increase creativity and inter-organizational learning among the batches’ participants.

We agree with previous studies that the batch’s structure and composition are essential for co-creation and learning among accelerated startups. While a minimum diversity is always essential for creative experimentation, we believe that it is disadvantageous for the corporate-led acceleration process. Startups benefit from co-creation and shared experience with startups operating in closely related technological and industry fields. A relatively homogenous batch fosters each startup’s speed of development, increasing market growth and opportunities to raise high market valuations. We hypothesize:

-

H2a: Homogenous batches with a strong industry focus positively affect the strategic performance of accelerated startups.

-

H2b: Homogenous batches with a strong industry focus positively affect the financial performance of accelerated startups.

3.2 The role of integration

When establishing CAs, “different organizational configurations, such as the governance and organizational integration of the program” (Kanbach & Stubner, 2016, p. 1762) must be considered. Like the question of specialization, it is considered that there may be trade-offs. While strong organizational ties and knits between the program and its sponsoring parent company guarantee easy access to corporate resources and support, organizational independence and high levels of managerial autonomy are necessary to design a program where startups feel encouraged to experiment and engage in entrepreneurial innovations (Colombo & Murtinu, 2017; Dushnitsky & Shapira, 2010; Mahmoud-Jouini et al., 2018). Two aspects here have been intensively discussed. First is the topic of the professional background and previous work experience of the programs’ lead managers (Hallen et al., 2020). Second is where the accelerator program should be located, off- or on-site (i.e., close to or far from the corporate parent), to increase the spillover effect (Cohen et al., 2019).

In their study of 287 US-based accelerators, Cohen et al. (2019) reported that 65% of seed accelerator managing directors had corporate experience, 54% had some form of entrepreneurial experience, and 34% had worked for investment corporations. The work experience that accelerator managers bring considerably influences the type and portfolio of services provided to accelerated startups. For example, accelerator managers with entrepreneurial experience often rely more on the support of external advisors than investor-led programs. Managers with corporate experience tend to build on partner networks and choose smaller batch sizes (Canovas-Saiz et al., 2020; Cohen et al., 2019). Moreover, former entrepreneurs highly value co-learning and spillovers among the selected startups. In contrast, programs led by former investors and corporate employers rely on expert training and specialists.

Since CAs act as innovation intermediaries balancing and matching corporate resources and startups’ needs, program managers that speak “both languages,” the language of the corporate parent and that of the startups, may be advantageous for the success of corporate acceleration (Cohen et al., 2019). Program managers bring industry-specific knowledge and contacts to the program. Industry and branch expertise, and the personal network of the CA manager, promise startups access to suitable project partners and increase the program’s reputation among investors and the entrepreneurship community (Hallen et al., 2020). Moreover, if they have previously worked for the sponsoring company or at least have direct, personal connections with employees of the corporate sponsor guarantee easy and barrier-free access to departments and complementary resources. The managers here serve as an important bridge between the corporate sponsor and the accelerated startups, finding and matching the right mentors and experienced personnel and providing access to knowledge and internal resources (e.g., Nesner et al., 2020).

Additionally, CA leads with prior experience in the corporation, or a competitor has profound knowledge about the internal processes and can easily navigate corporate and industry politics (Cohen et al., 2019). Trust, less corporate control, and higher program budgets could be potential positive outcomes for startup acceleration. Conversely, accelerator managers with their own founding experience provide hands-on advice and access to the external, broader entrepreneurship ecosystem other than corporate interests and existing networks (Cohen et al., 2019; Hallen et al., 2020). That knowledge may help startups to increase their market potential and business development and drive the reputation of the CA program across the startup community.

How the professional background shapes the corporate acceleration process is not yet fully understood. No clear patterns emerge from the few existing empirical studies. Cohen et al. (2019) reported that accelerators sponsored by corporations are more likely to engage with managers with corporate experience than entrepreneurs. They also reported that those programs managed by former corporate employees had smaller budgets than accelerators run by former investors and entrepreneurs. Moreover, their study found that startups that graduated from an accelerator managed by former entrepreneurs are much faster at raising money after the program. In contrast, alumni startups of accelerators managed by former corporate employees raise higher post-program market validations (Cohen et al., 2019).

We believe that having program managers with a professional background as an entrepreneur and industry experience is crucial. Especially in the specific context of CAs, both prior experiences are needed: Managers must moderate and balance interests and resources between portfolio startups and the corporate sponsor. Prior industry experience promises easy access to internal resources, industry networks, and partners, but this also poses several risks for startups’ future development. For example, the corporate sponsor might support only the startups in the program that are valuable for the corporation’s given portfolio and future strategies. Therefore, we suggest that CA programs managed by former founders are more likely to increase startups’ post-program performance. Consequently, we hypothesize:

-

H3a: CA programs managed by former entrepreneurs positively affect the strategic performance of accelerated startups.

-

H3b: CA programs managed by former entrepreneurs positively affect the financial performance of accelerated startups.

The location is also a crucial design choice when considering a program’s level of organizational integration. A vast body of research in entrepreneurship and innovation literature stresses the specific role of geography and spatial proximity in stimulating knowledge spillovers and entrepreneurship development. Industrial clusters, dense local talent networks, research institutes, technology-based firms, and cultural amenities that attract a creative class of human capital are important antecedents for entrepreneurship (e.g., Audretsch et al., 2021; Mellander & Florida, 2021).

For CA managers, where to locate the program is central since it involves several important aspects that might not be easy to balance. On the one hand, the accelerator must be located in an attractive and vibrant place close to the local startup scene. Co-location enables spillovers and interactions with multiple actors in the local startup environment (e.g., investors, mentors, and startups) and increases the program’s reputation (Drori & Wright, 2018). On the other hand, on-site locations and the spatial proximity of the CA program and its sponsoring corporation are important since it helps leverage existing resources, increase the exchange of ideas and knowledge, and integrate the startups’ innovation. Nevertheless, tight and close linkages also increase the risk of a high degree of dependency, strong relatedness of a CA’s startups, and interference of the corporate sponsor in developing startups, their ideas, and their business models. Increasing corporate interference and dependence may frighten future investors. Where to best locate a CA remains unanswered. While there appears to be a tendency toward locating seed accelerators in startup hubs (Drori & Wright, 2018; Canovas-Saiz et al., 2020), there is an inconclusive picture for CAs. Cohen et al. (2019) outlined that corporate-led programs are often started close to corporate headquarters, suggesting that given the strategic aim of most CAs, using their accelerators as a “window on technology,” they prefer proximity to maximize knowledge spillovers and inter-organizational learning. Nevertheless, we also believe that there is a matter of the desired outcomes: When startups seek complementary resources and strategic aims, nearby CA programs best increase synergism. However, programs near the corporate sponsor negatively affect maximizing financial outcomes. Therefore, we hypothesize:

-

H4a: CA programs near the sponsoring corporation positively affect the strategic performance of accelerated startups.

-

H4b: CA programs near the sponsoring corporation positively affect the financial performance of accelerated startups.

4 Empirical analysis

4.1 Data collection

Our study explores whether differences in CAs’ designs lead to variance in startups’ performance outcomes. A key focus of our within- and cross-analyses was to identify and measure core differences across CAs’ design choices. Previous research has stressed the importance of geography and the institutional context for explaining entrepreneurship growth (e.g., Wright & Westhead, 2019; Rice & Noyes, 2021; Wurth et al., 2022). Therefore, much of the variability in the success of startups across countries stems from the institutional context and the quality of the entrepreneurship ecosystems (Stam & Welter, 2020), including a broad range of both “soft” factors, such as local cultures (Audretsch et al., 2021; Mellander & Florida, 2021), and “hard-driven” factors, such as infrastructure, taxes, business regulations, local industries, and vital markets for venture capital (Cherubini Alves et al., 2021; Audretsch & Belitski, 2021).

We decided to limit our data research solely to CA programs based in Germany to avoid potential biases due to institutional and country effects. In addition, Germany has a thriving startup ecosystem and plays a leading role in developing the European CA landscape. Therefore, since large corporates and hidden champions traditionally drive Germany’s innovation capacity, and these firms often face difficulties in radical innovation and strategic renewal, seeking close partnerships with startups, such as through incubators and accelerator programs, is a promising avenue for them (Kupp et al., 2017; Mitze & Strotebeck, 2019; Rank, 2014). Moreover, the availability of data on accelerators, particularly those run by corporates, is relatively limited, posing a challenge for previous research. This unique advantage allowed us to directly engage with the participating firms without country boundaries, enabling us to bridge any potential data gaps if data is missing. Therefore, focusing on Germany and its CA landscape was a strategically sound decision for our research setting. Conscious of the potential limitations of our Germany-focused research approach, we acknowledge the unique characteristics and dynamics of Germany’s CA landscape. In the discussion, we will critically evaluate these implications to ensure a comprehensive assessment of the generalizability of our findings within an international context.

We screened the Pitchbook data platform to identify the relevant corporate-led accelerator programs. PitchBook collects data on ventures, startups, investors, mergers and acquisitions, funds, advisors, startup coaches, founders, and people across the entrepreneurship community and is one of the most established databases for both entrepreneurship and venture capital researchers (PitchBook, 2021; Yimfor & Garfinkel, 2023). We found that between 2001 and 2019, 223 startups had been actively enrolled in 15 accelerator programs affiliated with a corporation or industrial firm. Table 1 provides an overview of the CA programs included in our dataset.

We collected data on each startup and the enrolled CA program. Therefore, we aggregated information on three levels (startup, CA, and corporate sponsor) and obtained information from various sources, including websites, social media profiles (e.g., LinkedIn and Facebook), and corporate annual reports. Table 2 summarizes the used variables, their measurements, and their corresponding data sources.

4.2 Dependent variables

We measured the success of the acceleration process at the startup level as the performance of each accelerated startup one year after graduating from the program. Capturing the impact of accelerator programs has been challenging in previous studies (Hallen et al., 2020). Data availability and the lack of longitudinal information make evaluating the impact of accelerator programs difficult. Besides missing data, the performance measurement is itself complex. Accelerator programs support startups in the very early seed stage of their venture development. Often, nothing more than a basic idea exists at this stage of development. Therefore, focusing on well-established key performance indicators (KPIs) such as employee growth, revenues, sales, accounts, or market validation may not be applicable for startups when they attain and graduate from accelerator programs (Gonzalez-Uribe & Leatherbee, 2018). Consequently, prior studies have chosen creative ways to measure the effect of accelerators (for an overview of previously deployed measures, see Canovas-Saiz et al. (2020)). Notably, the acceleration process is understood to be complex and produces distinct outcomes that should be considered when evaluating the benefits of accelerators (Hallen et al., 2020), including the more common financial-oriented KPIs, such as the venture capital amount, market evaluation, and firm value, and the more strategically-driven KPIs, such as speed to market or total sales (e.g., Crișan et al., 2021; Yu, 2020).

Responding to these calls, we decided to capture the impact of the CA program by relying on two distinct measures of startup performance. The first outcome measure is strategic and aims to reflect the market development speed of accelerated startups using social network metrics. Previous research has established the reliability of web-based measures, such as web traffic and social media attention on platforms like LinkedIn, Facebook, and Twitter, as suitable proxies for assessing the social capital of startups during the seed stages of venture development. These measures are positively associated with increased market reach and customer traction for accelerated startups (Vismara, 2016; Crișan et al., 2021; Gonzalez-Uribe & Leatherbee, 2018; Hallen et al., 2020). Therefore, consistent with the recommendations of Hallen et al. (2020), we tracked the number of links and redirections from external websites to each startup’s webpage provided by the Pitchbook database.

The second outcome measure is financial and is the total venture funding raised by each accelerated startup. The amount of external funding startups manage to raise is an external quality signal, reflecting how promising venture investors find the potential of startups (Colombo et al., 2022; Regmi et al., 2015). It is the most used KPI in accelerator literature (Crișan et al., 2021).

4.3 Independent variables

To collect information on the design features of each CA program, we synthesized data from several sources, including the program’s website and career platforms. The costs and benefits of specialized vs. generic programs (i.e., whether programs select only startups targeting a single industry or specific technologies) are of significant interest in our study. Therefore, we relied on two distinct measures to capture the effect of accelerators’ specialization on startup performance. First, we constructed a dummy variable to express the “industry fit” between each startup in the batch and the sponsoring corporations. We coded “1” when the startup and corporation are active in the same industry and “0” when not.

The second variable represents batch diversity, hence the “portfolio fit” (i.e., the industry fit among the selected startups within the batch), that is, whether we have a diverse, heterogenous batch or whether selected startups are more homogenous in targeting specific industries. Therefore, we constructed a Herfindahl–Hirschman index based on standard industrial classification (SIC) coding and inverted the values to measure the industry specialization among startups (1 = total homogeneity; 0 = total heterogeneity).

We argued above that balancing the organizational integration level matters in the success of CAs. That is, whether tightly or loosely bounded programs perform better. Coupling here refers to the strength of the organizational ties between the CA unit and its corporate parent, that is, whether the unit is relatively autonomous and organizationally detached from the operations and decisions of the corporate sponsor or whether we observe a high degree of organizational integration and relatedness. Therefore, we constructed two distinct variables to measure the level of integration. The first variable aimed to capture organizational relatedness from the professional background of the accelerator’s management team. We used occupational data from LinkedIn and counted the years of entrepreneurial experience as a ratio of the years working in industry. Hallen et al. (2020) reported that the career background that accelerator managers bring highly influences the features and outcomes of programs. In the specific case of CAs, we argued that the balance between previous entrepreneurial and industry experiences is important for the corporate acceleration process. However, prior work experience in the corporate world provides programs access to industry-related networks, expertise, and internal corporate resources. In addition, managers with an entrepreneurial background (i.e., “speak the same language”) know the problems of startups, let them feel more supported, and may provide target-oriented support. Moreover, programs run by managers with a founder background foster entrepreneurial experimentation and freedom for each startup and therefore protect startups from drowning in the corporate world (Weiblen & Chesbrough, 2015).

The second variable measured the degree of organizational integration by considering the geographical distance between the corporate headquarters and the accelerator unit. Previous research found that whether corporate innovation units are “onsite or offsite” is an important governance category, reflecting the degree of organizational freedom and determining the capacity of innovation spillovers and how easily startups can access corporate resources and benefit from shared expertise. To measure the relevance of spatial distance, we created a logarithm of the kilometer distance between the corporate headquarters and the office spaces of the CA unit.

Additionally, we explored other characteristics of CA programs and their impact on startup acceleration. Of course, size matters. Exclusive batches with a few selected startups promise each startup high levels of attention and an adequate supply of resources, increasing the quality of training and mentorship. However, batches that are too small limit diversity and potential spillovers (Cohen et al., 2019). We proxy the influence of CA’s size via two variables: the number of accelerated startups in the batch and employees per accelerated startup.

An extensive network of corporate partners, external consultants, experts, and specialists can drive the acceleration process (Hallen et al., 2020; Yu, 2020). We investigated the role of external partner networks on the success of corporate acceleration by counting the number of corporate partners listed on the program’s website.

Providing high-quality support for startups is costly. Unfortunately, all information about each corporate acceleration program’s funding and sponsoring structure was unavailable. Therefore, we used the annual revenue of the parent corporation as a broad “control” for the accelerator’s financial backing. The reputation of an accelerator program is also a crucial prerequisite for its overall performance (Cohen et al., 2019). The image of a CA directly and indirectly affects its startups’ acceleration (Sørensen, 2007). Better performing CAs gain a better reputation in the market. Since highly recognized programs are more attractive to applying startups, they have a larger pool of applicants, which helps them select the best candidates. Moreover, selecting the best of the best attracts the best partners and investors and increases the opportunity for spillovers and equity deals. We controlled for the popularity of CA programs by counting their number of followers on the prominent social media platforms LinkedIn, Twitter, and Facebook. A similar proxy has been used previously (e.g., Gonzalez-Uribe & Leatherbee, 2018).

We considered several control variables at the startup level. First, we controlled for the startups’ team size and age, which are both proxies of its maturity and stage of venture development. Previous studies found that the speed of venture development is often associated with the applied business model and market channels (e.g., Cohen et al., 2019). Business-to-consumer (B2C) markets often rely on network effects, initially requiring exhaustive marketing efforts and a critical mass of customers. Startups in business-to-business (B2B) markets regularly have revenues in the very early stages of development and often need just one key business partner to speed up market entry. Therefore, we constructed a control dummy variable to differentiate whether the startups target B2B or B2C markets. We additionally controlled for whether startups had already received funding from venture investors before attending the CA.

4.4 Descriptive statistics

Table 3 presents the descriptive statistics. Table 4 reports the correlations for our dataset.

On average, the selected startups in our dataset raised US$3.7 million, describing the money they had received from all investors to date. As expected, this variable was strongly right-skewed (standard deviation = US$10.8 million). Since many early-stage startups only raised several hundred thousand dollars, this number was shaped by recent, very successful startups in our dataset, such as Sphere Medical and the mobile bank N26. The largest sum of US$70 million had been raised by Innoviz Technologies.

Regarding the strategic outcome measure, the average startup in our sample reported about 123 referring domains. On average, only around 20% of the accelerated startups were active in the same industry as the sponsoring corporate parent. Driven by the digitization trend, the CAs in our sample appeared to invest heavily in information and communications technology-driven startups independent from the industry of their sponsoring parent corporation. The batch diversity was reported as a Herfindahl–Hirschman index (1 = total homogeneity; 0 = total heterogeneity). None of our observed CAs specialized in a single industry sector.

The average batch size was 53 selected startups. However, the large standard deviation suggests large differences in the selection strategy and sizing of batches among the CAs in our dataset. The smallest program focused on a batch of three startups, and the largest program included 75 startups in its portfolio. On average, the distance between the accelerators and their corresponding corporate headquarters was 230 km. Several accelerators were active in the same city as their corporate parent, while others were located further away, with startup hubs like Berlin and Munich being very prominent locations.

Our descriptive statistics intuitively confirmed previous findings. For example, the explorative study by Hallen et al. (2020) revealed that CAs tend to be led by managers with prior industry and corporate work experience rather than entrepreneurial experience. In our dataset, on average, the accelerators’ management team had three times more industry expertise than years working as a founder.

Regarding attendance rate and startup support, almost every included program in our dataset supplied at least one employee for each accelerated startup. Considering that there are also external specialists, coaches, and mentors for supervision and training, this number is interestingly high and suggests that startup acceleration needs intensive mentoring and costs significant overhead. Additionally, CAs often had more corporate partners than their sponsoring parent corporation. In our dataset, the average CA had 0.2 corporate partners for each startup being managed.

CAs have been a relatively recent phenomenon. The average age of the included programs was five years (in 2019), with the Siemens Technology Accelerator being the oldest program, founded in 2001. We measured the reputation and recognition of programs as the sum of all social media followers on LinkedIn, Twitter, and Facebook. However, several programs had not operated on those social media platforms at the time of data collection. The financial backing of the program, as a measure of the revenue of the parent corporation, ranged from €3 billion to €160 billion. While some medium-sized German companies are pioneers and led or co-sponsored programs (e.g., Vogel), operating accelerator programs seems primarily a practice among blue chip companies. Most parent companies were stock exchange-listed, global players and renowned brands from the automotive, health, and media industries.

Size and age are important KPIs for startups since they demonstrate survival and future growth capacities. On average, the observed startups employed 14 people; the smallest only had two employees, and the largest had 200. As expected, the startups were, on average, 4–5 years old, with some being founded shortly before this data was collected. We included a dummy variable to control for whether a startup was active in the B2B or B2C markets; 70% were active in the B2B market. Finally, the average startup had 4–5 investors, although they showed a relatively large range of 1–24 investors.

All correlations were weak to moderate and were not suspicious of collinearity. Several relationships provide novel and interesting insights into the design of CAs in Germany. For example, the significant and positive relationship between startup and CA ages suggests that established accelerators tend to select startups in their later stages of early venture development. This finding partly supports previous observations, such as by Gutmann et al. (2019, 2020), who reported that the German market for corporate venture and acceleration activity differs from mature markets, such as the USA, where accelerators are primary very early seed-stage intermediaries.

Moreover, the negative correlation between the managers’ prior industry experience and the spatial distance between an accelerator and its corporate parent is also quite interesting. Corporate-led accelerators managed by staff with prior industry experience tend not to be located near the sponsoring parent company’s headquarters, while programs managed by former entrepreneurs are. This difference may indicate that accelerator industry-experienced managers can rely on tight internal networks and corporate trust and do not have to be located nearby to access corporate resources. Like Cohen et al. (2019), we also observed that accelerators led by managers with a strong entrepreneurial background tended to choose diverse startups from various sectors, while managers with a corporate background selected homogenous startup batches. Regarding the batch sizes, we observed a clear direction toward the “smaller is better” thought process among CAs. As suggested, the weak positive association between strategic and financial performance (r ~ 0.3) demonstrates that both measures are distinct but not entirely independent outcomes from the acceleration process.

4.5 Modeling strategy

We applied a multilevel, nested analysis exploring information on (i) the accelerator level, (ii) the accelerated startup level, and (iii) the sponsoring parent corporation level. A key advantage of our nested research model was that it helps to clarify the differences among CA designs and to associate them with variances in startup outcomes. Nested models have also been previously used in research on accelerators (e.g., Chan et al., 2020; Cohen et al., 2019). We tested the effect of accelerator core design choices on the post-program strategic (Model 1) and financial (Model 2) performance of accelerated startups.

The strategic outcome measure was a count variable, with all observations > 0 and highly left-skewed. The financial performance (venture capital raised) was a continuous dependent variable with all observations > 0 and a high probability for small numbers (left-skewed). Given the skewness and distribution of the two dependent variables, linear model estimators may not be applicable, and we should consider alternative estimators, such as the Poisson estimator or negative binominal regression modeling. We conducted least square robustness checks, such as with the M-, MM-, and S-estimators, and further ran ordinary least-square and Poisson regression models to compare the goodness-of-fit. As expected, Poisson regression modeling found the best-fitting estimator for both Model 1 and Model 2.

Our data dataset contained several missing values. We found complete data for only 132 of our 233 startups. Data for missing observations were calculated through within-model congenial chained multiple imputations using variable-specific regression methods. This approach has been proven appropriate and has been used in previous studies within the broader management literature (e.g., Murray, 2018). We cross-checked the robustness using dummies to control, at least to some extent, whether the results substantially differ. We also controlled for outliers and multicollinearity. The results were robust and inconspicuous. The mean variance inflation factors were in an acceptable range (2.5–4.4).

5 Results

Table 5 presents the results of our regression analysis.

We argued that the degree of the program’s specialization and integration matter for the success of the startup acceleration process. Therefore, we used two distinct design variables to measure the effect of a CA’s degree of specialization. First is the industry fit: whether the startup and the sponsoring corporate parent share the same industry. Second, we constructed a Herfindahl–Hirschman index based on industry SIC codes to measure batch diversity (i.e., the industry fit between the accelerated startups within each batch).

We found opposite effects on startup performance for the individual fit between the corporate parent and each accelerated startup. For the strategic outcome measure represented in Model 1, we found a positive and statistically significant relationship between a strong industrial fit and startups’ market growth, measured by their web referencing (ß = 0.626, p < 0.01). Therefore, we confirm H1a. For the financial performance measure represented in Model 2, we found a negative and statistically significant relationship (ß = − 0.676, p < 0.01). Therefore, we also confirm H1b. Consequently, a strong industry fit between the corporate parent and the startups appears to decrease their chances of raising high-volume venture capital tickets after graduating from the accelerator program. These findings reflect some of our arguments developed above where specialized programs may help to exploit the benefits of complementary resources and industry-specific expertise, accelerating startups’ speed to market and product development, but may frighten future non-corporate investors because the accelerated startups’ products, business models, and/or services may be too aligned with the interests, needs, or industry specifics of the corporate parent company.

Regarding accelerators’ batch diversity, we argued that a strong industrial fit among the selected startups in each batch promotes knowledge spillovers and co-creation between them, which might, for example, speed up their market and product development and drive their value among investors. Our findings partially support this argumentation. The negative and statistically significant coefficient for batch diversity in Model 1 (ß = − 1.301, p < 0.01) indicates that startups benefit strategically from homogeneous startup batches (i.e., CAs that select startups targeting closely related industries). Therefore, we confirm H2a. However, we find no evidence for H2b. Model 2 does not support a significant relationship between the coefficient for batch diversity and our financial performance measure (ß = − 1.013, p > 0.1). Therefore, we find no effect of batch diversity on startups’ ability to raise venture capital.

With H3a and H3b, we posited that the accelerator’s level of integration is crucial for CAs’ success. Therefore, we relied on two proxies. First, the program managers’ entrepreneurial experience. Second, the spatial distance between the parent corporation and the CA. Our findings show that accelerated startups in programs managed by experienced entrepreneurs had higher strategic and financial performance than those in CAs led by managers with a strong corporate background, as indicated by the positive and statistically significant coefficients in Model 1 (ß = 0.731, p < 0.01) and Model 2 (ß = 1.785, p < 0.1). Therefore, we have confirmed H3a and H3b: startups graduating from CAs managed by former entrepreneurs benefit from larger venture capital ticket sizes and increased market traction.

For the spatial distance measure, we found a marginally negative but statistically significant effect on our two startup performance measures (Model 1 ß = − 0.000, p < 0.01; Model 2 ß = − 0.001, p < 0.01). This negative relationship suggests that accelerator programs located near the corporate parent may be more beneficial for the acceleration process. However, since both regression coefficients are very small and close to zero, the suggested location effect should be interpreted cautiously. From a technical standpoint, however, we still need to confirm H4a and H4b.

We found a negative and statistically significant relationship between batch size and both startup performance measures, indicating that startups benefit from small and exclusive programs, which may reflect effective supervision and intense mentoring (Model 1 ß = − 0.014, p < 0.01; Model 2 ß = − 0.036, p < 0.01).

Our findings on the number of CA employees managing the batch of startups support a similar conclusion. We found a negative and statistically significant relationship between staff number and our measure for the strategic performance of accelerated startups (Model 1: ß = − 0.088, p < 0.01). Therefore, fewer staff may increase the quality of relationships between mentors and startups, resulting in individual and customized training and coaching, which may help startups develop suitable strategies to grow and gain market access. Nevertheless, we found no statistically significant relationship between CA staff size and startup financial performance (Model 2: ß = 0.013, p < 0.01).

Furthermore, we found a negative and statistically significant relationship between the number of corporate partners and both performance measures (Model 1 ß = − 0.917, p < 0.01; Model 2 ß = − 3.425, p < 0.01). A large body of research literature indicates the costs and benefits of large partner networks in innovation alliances. These findings may also be applied to CAs: It may be more a matter of quality than quantity. Specialization, experience working together, less coordination and communication, established close personal relationships, intensive training, and mentorship may contribute more to the acceleration and the program’s quality than having a large set-up of changing specialists and experts (Parker, 2008). Therefore, the early involvement of a few experienced and highly committed key partners could be crucial in helping young entrepreneurial firms (Bjørgum and Sørheim, 2015). Moreover, having many partners on their side increases the managerial overhead in coordinating exchanges and partnerships. Consequently, partners may feel less responsible for coaching the startup, a moral hazard phenomenon known from free-riding in large-sized teams (Albanese & Van Fleet, 1985; Manso, 2011).

We additionally controlled for the program’s age as a noisy proxy for both the experience and reputation of the accelerator program in the startup scene. We found no significant effects in both models. For the role of the program’s reputation, we found only small, negligible effects (Model 1 ß = 0.000, p < 0.01; Model 2 ß = 0.000, p < 0.01). Therefore, our results indicate that having many followers on social media does not contribute to the startup acceleration process. Finally, we used a broad control for the financial backing through the parent corporation without finding a sizable robust impact on the two performance measures of the acceleration process.

At the startup level, we controlled for the startup’s size (number of employees) and age as a proxy for past and future success. These describe both the startups’ resources and past experiences. As expected, the beta coefficients were positive and statistically significant for both models, demonstrating that larger (Model 1 ß = 0.011, p < 0.01; Model 2 ß = 0.022, p < 0.01) and more established (Model 1 ß = 0.161, p < 0.001; Model 2 ß = 0.081, p < 0.01) startups are more successful in raising capital and gaining market access. The dummy variable of whether the startup was active in B2B markets was explicitly used due to its impact on our strategic performance variable. We found that being in the B2B market impeded a startup’s ability to gain market access (Model 1: ß = − 0.547, p < 0.01). Moreover, the number of active investors was a positive indicator of future strategic growth and follow-up investments (Model 1 ß = 0.039, p < 0.01; Model 2 ß = 0.102, p < 0.01).

6 Discussion

The recent popularity of CAs calls for research to evaluate their value. While much of the current accelerator literature is solely focused on the general effect of seed accelerators, little is known about the work and design of those accelerator programs run and sponsored by established corporations. It is evident that those programs work differently. However, investigations are needed to understand whether the outcomes they produce are affected by their design and how they are organizationally linked and related to their sponsoring corporate sponsor.

The much more established literature on incubators already demonstrates potential trade-offs, and incubator managers must identify those design elements that best balance mutual interests and complementary resources (e.g., Gonthier & Chirita, 2019; Kruft & Kock, 2019). Here, the trade-off between tightly vs. loosely coupled incubators is especially of significant interest for incubation success. However, our findings suggest that the management of corporate-led accelerators faces a similar challenge. While they must design programs that provide startups with sufficient freedom and space for entrepreneurial experimentation, they must identify organizational linkages and leverage existing corporate resources with accelerated startups to increase business and product development (e.g., Lee et al., 2018).

Our results strongly support that specialization in industry focus is one of the main strategic advantages of CAs (Colombo et al., 2018). We found that small, exclusively selected batches of accelerated startups from similar industries performed better. Moreover, the industrial fit between the corporate sponsor and the startups was also a KPI. Our findings suggest that startups joining programs that tightly align with the industry and strategic aims of the corporate sponsor have greater market traction. Industry expertise and specialized, industry-specific training promote fast market access and growth. Access to networks and complementary knowledge speed up product and business development. Besides the advantages of corporate mentorship, entrepreneurs often name potential spillovers due to collaboration and co-working with other startups as important reasons for applying to an accelerator program (Cohen & Hochberg, 2014). Our results suggest that accelerated startups benefit from their peers and being in relatively homogenous batches. Startups with similar industry and technological backgrounds can easily share experiences and knowledge and may support each other more effectively in finding appropriate solutions. Moreover, homogenous batches imply higher competition between the startups (Cohen et al., 2019), which may also contribute to their increased performance. Yu (2020) reported that startups participating in an accelerator program often fail to reach milestones. Therefore, promoting competition among the selected startups may foster the corporate acceleration process.

Nevertheless, our results also partially support previous findings that are less optimistic about the performance of accelerator programs (Ceaușu et al., 2017; Yu, 2020). In our study, considering the specific case of CAs, we found that a strong industrial fit between each startup and the parent corporation negatively affected the financial performance of accelerated startups. Our findings indicate that startups graduating from a program strongly oriented towards the corporate parent reported smaller follow-up venture capital funding. These findings contrast with previous studies. The literature here repeatedly argues that joining accelerators improves startups’ funding chances by providing a strong “positive” signal to investors, lowering search costs for investors, and reducing information asymmetries (e.g., Venâncio & Jorge, 2022). Therefore, accelerated startups close earlier and achieve higher venture capital tickets (e.g., Hallen et al., 2020; Yu, 2020).

However, our results suggest this does not necessarily hold for the specific case of corporate-led accelerators. We found that the closer the fit between the selected startups and sponsoring corporate parents, the lower the venture capital ticket sizes for the accelerated startups. There may be several explanations for this effect. While startups benefit from relationship-specific investments by the CA, such investments are prone to hold-up problems. Partner specificity and startups being increasingly dependent on the resources and expertise of their parent company might scare off potential investors and lead to under-investment. Venture capitalists and financiers may avoid investments in startups that run through corporate acceleration because of the tacit knowledge and misappropriated risks that come with resource dependency and complementary goods. Similarly, Cohen et al. (2019) found that accelerators sponsored by investors recruit larger venture capital funding for their accelerated startups than university, government, and corporate programs.

Another possible explanation is grounded in the strategic posture of the CA program. Shankar and Shepherd (2019) outlined that corporates may run accelerators for two distinct reasons with different outcomes. First, they use their accelerators as a source to nurture corporate innovation. Here, the strategic fit between the corporation’s given portfolio and the startup’s innovation is essential. The primary goal is to detect and absorb suitable new products and business innovations that complement existing operations and product portfolios and not to promote venture survival or future chances of accelerated startups. The second strategic posture is venture emergence (Shankar & Shepherd, 2019). Here, CAs are interested in nurturing entrepreneurship ecosystems and equity investments. While most corporates use their accelerators as a window toward emerging technology options, accelerator designs may follow elements that primarily aim to speed up the development of complementary products rather than bringing out radical innovations. This posture might explain the negative relationship between highly specialized programs and venture capital raised by accelerated startups.

In addition, the level of organizational integration is of major importance for the success of acceleration. Integration here refers to the strength of connections through which the CA is organizationally linked to the parent company. We expected that there is also a trade-off. While loosely coupled CAs guarantee relative autonomy, protect minority corporate influence, and foster experimentation (all necessary for young entrepreneurial firms to grow), tight organizational links between the accelerator and its corporate parent promote knowledge transfer and the leverage of existing organizational resources. Startups easily gain access to corporate resources and find experienced mentors and industry experts. It is a significant challenge for accelerator managers to identify and design organizational arrangements that guarantee maximum accessibility to corporate networks and resources while minimizing the threat of corporate influence. We proxied the level of organizational integration using two measures: the managers’ previous work experience and the spatial distance between the accelerator office and corporate headquarters.

Our findings confirm that distance matters. CAs close to the parent company have better outcomes for accelerated startups. These results partially support previous findings in accelerator literature (Cohen et al., 2019; Canovas-Saiz et al. 2020) and in the much broader literature on innovation systems outlining the general importance of space and spatial proximity for knowledge spillovers and entrepreneurship (e.g., Audretsch and Feldmann, 1996). Spatial proximity intensifies collaborations and informal exchanges between the accelerator, accelerated startups, and the parent company (Hallen et al., 2020).

Moreover, our results corroborate the particular role accelerator management plays in the success of accelerator programs (Cohen et al., 2019; Hallen et al., 2020). Previous studies outlined that the management team’s background and work experience influences the nature and success of accelerator programs via multiple channels. For example, it influences the network and mentors they can bring to support their startups. Moreover, the managers’ background may even tie closely to the initial sponsor and supporter of the program. In the specific case of CAs, we argued that whether managers had previously worked in the corporate world was a KPI. While corporate and internal ties are essential to provide startups with the promised corporate resources, experience as a founder increases their ability to advise startups and opens access to the startup community, including venture capitalists and coaches. We used the entrepreneurial experience as a fraction of the management team’s overall corporate working years as an additional proxy to measure organizational integration. We found that CAs run by managers with strong entrepreneurial backgrounds performed better. Startups had higher growth rates and raised more venture capital funding than corporate programs with less entrepreneurially experienced managers. Therefore, our findings complement previous studies such as Hallen et al. (2020), Cohen et al. (2019), and Yu (2020) that did not find robust relationships between the accelerator managers’ type of previous work experience and the success of accelerated startups, although they noticed its importance.

7 Limitations and future research

Our study on CA programs and their design had several limitations. These limitations also highlight potential avenues for future research and provide insights for further understanding and improving the effectiveness of CA programs.

Like every empirical study, this study suffered from limited data access and availability. Since the phenomenon of corporate acceleration is relatively new, the availability of historical data and the opportunity to perform longitudinal analyses are limited. Due to their newness and small size, startups hardly have any disclosure requirements. Therefore, few financial documents, such as balance sheets, are available for early-stage startups, which are the focus of CA programs. Another important avenue for future research involves conducting longitudinal analyses to examine the long-term effects of CA programs on startup performance. Our study focused primarily on the post-program graduation performance of accelerated startups. However, understanding the trajectory of startups over an extended period can provide valuable insights into the long-term benefits of participating in such programs. Longitudinal research can show whether the observed performance gains are sustainable or temporary. Additionally, it would be valuable to investigate the external investors’ role and investment strategies in post-accelerator funding rounds. Specifically, understanding whether certain types of investors attribute different values to participating in a CA program and if they have distinct preferences regarding program graduates would be insightful. This research direction will contribute to a more comprehensive understanding of the long-term impact of program design and the external funding dynamics in entrepreneurial finance and the startup lifecycle.

Moreover, like most similar data, our data suffer from selection bias and challenges in differentiating between selection and treatment effects. One significant limitation of our dataset was the lack of access to information and data about the applicant pool. We do not have insights into why certain startups were selected or rejected from a program. This limitation poses challenges in fully understanding the selection effects and their potential influence on the observed performance outcomes. Future research could overcome this limitation by obtaining access to detailed applicant data, such as application materials, pitch decks, and selection criteria, to comprehensively analyze the impact of selection on program outcomes. Future research should overcome and mitigate the limitations of our dataset. Cross-country data or meta-analytical approaches would lead to higher generalizability of findings. Therefore, further research should enhance quantitative datasets through surveys to better understand the underlying mechanisms through which program design influences startup performance. Qualitative interviews with selected startups, program coaches, and partners may capture rich insights into the quality of mentorship, networking opportunities, and the program curriculum’s influence. Researchers should interview CA leads about organizational ties to the parent company, such as reporting lines and duties, financial budget information, incentive systems for key personnel, and an approximation of the CAs’ standing and priority among further corporate venturing, innovation, and research activities.