Abstract

The study considers the closed-loop supply chain (CLSC) decision using federated learning platform (FL platform), establishes a CLSC game model including one manufacturer, one retailer and one third party, analyzes the influence of FL platform on optimal decisions and revenues of CLSC system from the perspectives of information reliability, information security and investment cost, and establishes a cost-sharing and revenue-sharing contract (CSRS contract) to coordinate CLSC system. Results show that, the greater consumers' recognition of the remanufactured product, the higher its price and revenue; using FL platform can guarantee the degree of consumer information security, which in turn has a constructive effect on the CLSC; when the FL platform is not adopted, the manufacturer will raise more revenue by misrepresenting the manufacturing and remanufacturing costs; the FL platform would provide some incentive for manufacturers to disclose true cost information and improve the CLSC revenue; an increase in investment costs would lead to a reduction in revenue, so CLSC members would need to make investment decisions based on revenue comparisons before and after using the platform; finally, within the feasibility of the contract parameters, the CSRS contract both maximizes optimal revenue of CLSC system and improves revenue per member.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The idea of sustainability has led manufacturers to rethink and reorient their production strategies, CLSC have received much attention from both industry and academia (Ramakrishnan & Chakraborty, 2020). On the one hand, various major manufacturers, e.g. Apple, Hewlett-Packard, Toyota, etc., have integrated recovery and remanufacturing activities into their existing production processes to gain additional economic benefits (Li et al., 2019; Wei et al., 2020a). In another aspect, many experts focus on the research of CLSC to provide decision basis for CLSC members and solve current problems. For example, Zheng et al. (2017) analyzed CLSC decision and coordination considering dual-channel sales. Although the application and research of CLSC are getting mature, some apparent problems have not received enough attention as well as effective solutions.

One of the first issues worth noting is that some of the information is only in the hands of individual supply chain members, while others must complete the decision-making according to the finite information provided by the party in control of the information. According to Porter's competitive strategy theory, supply chain members have competitive relationships with upstream and downstream members, and in order to gain advantages in negotiations, enterprises tend to retain private information. Therefore, individual member enterprise usually faces the risk of low information reliability in the circumstance of information asymmetry, i.e., the collection cost information of recycler and retailer (Li et al., 2014; Zhang et al., 2014). Though enterprises may be able to benefit from short-term concealment or deception, the partnership will be terminated, while the discounted value of the benefits from maintaining a long-term partnership will be much greater than the short-term benefits. Precisely because the cooperation and competition among supply chain enterprises is multi-stage and long-term, the issue of improving information reliability becomes even more important. To this end, many scholars have systematically studied the issue of improving information asymmetry and information reliability from the angle of coordinated operation and other perspectives (Ali et al., 2021; Liu et al., 2019). Nevertheless, current research focuses on solving information problems through management instruments, which need to be constantly adjusted based on time and situation, and the decision-making conditions in different fields and situations may vary greatly. Therefore, conventional information incentive strategies must be adjusted to enhance the efficiency of CLSC systems (Shen et al., 2021).

Another noteworthy issue is that in no industry are businesses immune to the electronic transmission of consumer information and its potentially disastrous results (Park et al., 2022). For example, analysts estimate that eBay suffered a loss of revenue of approximately $200 million from a data breach in 2014 (Durowoju et al., 2022). Especially in the age of big data, information security is facing a new normal (Sindhuja, 2021). As a complex network, there is a risk of information leakage within the supply chain (Zhang et al., 2012). Efficient information security management could guarantee the stability of the supply chain (Sindhuja, 2021). However, little research has been reported on how to reduce the risk of information leakage and improve information security in CLSC.

The current solutions on these two problems are not mature enough, firstly, solutions have shortcomings, especially in terms of generalizability, and secondly, the solutions cannot take into account both problems. The development of artificial intelligence technology has created the possibility for the solution of this problem, especially federated learning which was explicitly put forward by Google in 2016 (Alferaidi et al., 2022). Federated learning enables federated modeling without data sharing, thus achieving a balance between privacy-preserving and data sharing analysis (Alferaidi et al., 2022). Its properties form a natural fit with the two problems we expect to solve, something that artificial intelligence technologies such as blockchain and IoT cannot do. On the one hand, participants of the FL platform can collectively set up a global information sharing model without violating laws and regulations on privacy data, thus solving the problem of data island (Chen et al., 2020; Yang et al., 2019). Therefore, when federated learning is applied to CLSC, it can promote information sharing among CLSC members to a certain extent, avoid the space of cost misrepresentation created by information asymmetry, and improve information reliability. On the other hand, federated learning can enhance data privacy protection of users and improve information security, which is achieved by transferring content between servers and local devices mainly for model parameters or other information, not original user data, so that the original data would not leave the locality (Zhu et al., 2021; Alferaidi et al., 2022).

Based on aforementioned analysis, if companies would like to ameliorate information environment and make more rational decisions, they must thoroughly embrace and energetically pursue the application of FL platform. However, the adoption of FL platform may trigger distortions in revenues of related subjects. CLSC members must consider the question of how much value its application adds compared to the investment, so this paper explores investment decision conditions of federated learning (Fazlollahtabar & Kazemitash, 2021). In addition, this paper finds that there is efficiency loss in the CLSC through analysing the revenue model after investment. To circumvent this situation, this paper adopts a CSRS contract to inspire CLSC participants to apply FL platform and realize coordination.

The outstanding contribution of this paper is to expand the practical value of federated learning through analysis, confirm the role of federated learning in improving information reliability and security in CLSC, and promote the implementation of FL platform in CLSC; clarify the importance of factors such as information reliability and security for CLSC; provide a cost range for federated learning implementation in CLSC; and make significant contribution to revenue optimization of CLSC members through contract coordination.

The remainder of the article is arranged as follows. Section 2 systematically reviews papers closely correlated with the paper. Section 3 explains underlying assumptions of the article and the shape of demand functions. Section 4 counts and elaborates the optimal decision and revenue under every model, then discusses investment decisions and CSRS contract to enable CLSC coordination. Section 5 validates the research results through numerical simulations. Section 6 sums up the paper and indicates subsequent research paths.

2 Literature review

2.1 Closed-loop supply chain

Since the CLSC was proposed, its research has received extensive attention from academics both at home and abroad, and people have studied it in terms of the development lineage, operation mode and coordinated operation of the CLSC, which has established a rich theoretical foundation for the paper. In order to promote the systematization of CLSC research, some scholars have systematically sorted out the main results and recent advances achieved by CLSC research. For instance, Govindan et al. (2015) screened and analyzed 382 literature, pointed out the future research directions and development opportunities of reverse logistics and CLSC; Diallo et al. (2017) retrospected a number of literature on the quality and reliability of products in CLSC; Ropi et al. (2021) conducted a comprehensive retrospect of remanufacturing models for CLSC and analyzed uncertainty trends, identifying the localization and subsequent research requirement for decision support approaches in CLSC.

In terms of specific operations, many studies have provided theoretical guidance for firms to make CLSC model choices. Savaskan et al. (2004) pointed out the significance of remanufacturing second-hand products, then addressed the issue of reverse channel structure selection through the Stackelberg model; Esmaeili et al. (2016) researched the behavior of enterprises carrying out recovery policies in a two-level CLSC and indicated the optimum strategy for each model to make pricing decisions; regarding the choice of sales model, He et al. (2019) have explored how the manufacturer of dual-channel CLSC choose the best solution for the sales channel of new and remanufactured products under government subsidies; Lv et al. (2022) studied decisions and recovery route selection of the CLSC under certain policies.

On this basis, some academics have been exposed to in-depth studies on the coordinated operation of CLSC. Van-Der-Rhee et al. (2010) put forward a novel multi-level supply chain revenue-sharing contract mechanism between entities, demonstrated its advantages over the traditional revenue-sharing contract mechanism of neighboring entities; Choi et al. (2013) investigated effective models of different CLSC under diverse channel leaders, and coordinated forward and reverse logistics using tariff contracts and CSRS contracts; Tang et al. (2020) conducted a study of a CLSC for remanufacturing in a competing market and designed a progressive transfer price scheme between manufacturer and retailer to realize identical rate of return with that in centralized coordination; Zhou and Gu (2022) studied the pricing strategy of CLSC under a practical e-commerce model using game theory, and proposed a collaborative construction method for CLSC to guide them to reduce costs and improve their competitive advantage; Zhao et al. (2022) structured a CLSC considering corporate social responsibility and used a pricing coordination mechanism to markedly promote and secure the profitability of CLSC, so as to complete decision-making close to or at the optimal level; Li et al. (2023) studied blockchain application decisions and the incentive contract in CLSC under information asymmetry.

The above research literature on CLSC provides ideas that can be drawn on for the construction of the model in this paper, but it is not difficult to find that much of the current research has focused on the coordination of CLSC and reverse channels. Most of them has ignored differences between products in actual sales, so very little research has been done on dual retail channels for products and the coordination in this situation. In addition, the influence of improved information reliability and security on contract choice has yet to be studied. Therefore, research on improving information reliability and security and achieving CLSC coordination is still supposed to be further enriched.

2.2 Impact and treatment of information asymmetry

Most of above-mentioned literature about CLSC are on the basis of information symmetry, while in reality, the leading company often monopolizes a great amount of important information, and it will be laborious for other enterprises to gain accurate information and data from them, thus they cannot make reasonable pricing decisions. At present, information asymmetry has become the bottleneck of CLSC management, which is not conducive to the coordinated advancement of all participants of the CLSC, nor does it contribute to the continued development of companies, society and all of humanity. Therefore, many scholars have begun to follow with interest the function of information asymmetry on supply chains. Cakanyildirim et al. (2012) pointed out that information asymmetry can have an adverse impact on CLSC, with the retailer suffering significant losses when external markets overestimate or underestimate suppliers' production costs; Wei et al. (2015) took game theory to probe optimal decisions of CLSC under information symmetry and asymmetry, finding that information asymmetry of manufacturers in manufacturing and remanufacturing costs possibly raises retail prices, and the private information of retailers on recycling quantity and recycling market size possibly elevates wholesale prices; Yan et al. (2016) pointed out that the manufacturer will exploit information advantages to improve cost information, and that the behavior can damage the revenue of remaining participants and the whole system; Wang et al. (2022a) investigated how information asymmetry influences CLSC performance, and demonstrated that it is not always profitable when the manufacturer holds private information about fairness.

Numerous literatures have shown that information asymmetry usually affects CLSC decisions, thus some studies have proposed different types of contracts to weaken information asymmetry in supply chains. Mukhopadhyay et al. (2008) researched dual-channel coordination contracts when the manufacturer only retains partial information about retailer's value-added cost; Wang et al. (2017) used information screening contracts to assist the manufacturer in obtaining product recycling information and explored the effect of reward and punishment mechanisms on CLSC members' equilibrium decisions and profitability, noting that reward and punishment mechanisms can lessen the adverse impacts of information asymmetry and increase product recycling rates and supply chain members' revenues; Rathnasiri et al. (2022) put forward a dynamic cost-sharing contract to address problems of information asymmetry and inefficient costs in supply chains; Qin et al. (2022) explored the equilibrium situation of electronic CLSC under information symmetry and asymmetry, and proposed a CSRS contract to optimize recovery decisions to enable electronic CLSC coordination.

Based on the above literature, it can be found that most of the current studies focus on motivating supply chain enterprises to share information through diverse contracts. Nevertheless, this approach is not universally applicable and does not address the problem of reduced information reliability caused by cost information asymmetry in CLSC management, i.e., information reliability is not considered as a major portion of factors affecting the decision-making of CLSC members.

2.3 The development and application of federated learning

Federated learning is a new distributed learning technique whose core idea is to achieve a state of equilibrium between data sharing computation and data privacy protection by interchanging model parameters or intermediate results for distributed model training without interchanging local individual or sample data (Lo et al., 2021).

In business operations, diverse companies or even diverse departments of a company can have information asymmetry, and various data usually exist in the form of isolated islands. Federated learning can help various members of the platform to share information through its distributed learning. In addition, people usually consider their own raw data being uploaded to deep learning servers as insecure, federated learning protects user privacy by exchanging only model parameters, and becomes one of the most influential AI techniques to address corporate information disclosure and user information protection. The properties of federated learning are reflected in some literature. Wang et al. (2013) explored the problem of "usable invisibility" of data and proposed the concept of federated modeling with privacy protection using multiple data sources without the need to share the original individual data; Wei et al. (2020b) proposed algorithms for reducing the gradients computed from two different datasets so that a gradient parameters from diverse subscribers will not be retrospected to its proprietors, thus well protecting user privacy; Dai and Meng (2022) showed that online federated learning and online migratory learning are cooperation modes to address a number of issues such as data islands.

In terms of specific application, Yoo et al. (2022) detailed ways of applying federated learning techniques to the medical field and summarized the key problems in medical federated learning and their solutions; Alferaidi et al. (2022) pointed out that federated learning is widely concerned as an emerging technology for solving data islands, and it’s gradually starting to be used in finance, healthcare, smart cities, and other fields; Li et al. (2022) indirectly realized the target of demand information sharing by means of federated learning and effectively mitigated the bullwhip effect in demand forecasting for entire supply chain system; Zhang and Guo (2022) constructed an decision model for cross-border e-commerce on account of federated learning, then proposed a corresponding synergistic promotion strategy; Wang et al. (2022b) proposed a new retail supply chain merchandise demand forecasting framework on account of vertical federated learning, which addresses the data security and privacy issues faced by new retail; Zheng et al. (2023) pointed out that federated learning not only has obvious advantages in data privacy protection, but also can help supply chain members effectively predict risks.

Throughout the above-mentioned literature, although the available research on CLSC, information asymmetry, federated learning and other related fields has been abundant, the following deficiencies still exist: (1) Although the FL platform is emerging rapidly as an emerging technology, few studies have considered the use of FL platform in CLSC. (2) The number of studies on CLSC from the perspective of information reliability and security is relatively small, and the investment decision and coordination problems after adopting FL platform are even less discussed. (3) From the game theory perspective, there are fewer studies on the investment decision conditions and contractual incentive mechanisms of CLSC considering changes in market demand, environmental friendliness, information reliability and information security. Based on these, the study explores in detail investment decision and coordination problems of CLSC parties after adopting the FL platform, and develops a CSRS contract to incentivize CLSC actors and assist them in gaining more revenue.

3 Methodology

3.1 Underlying assumptions

It is assumed that the manufacturer has take in the remanufacturing procedure of recovered products into its initial manufacturing system, as a consequence, it is able to use raw materials with unit manufacturing cost \(c_{n}\) to produce new products and recycled materials with unit remanufacturing cost \(c_{r}\) to produce remanufactured products immediately. It needs to mention that the new product has a price differentiation with the remanufactured product.

The study assumes that information asymmetry exists in the CLSC, which primarily includes two areas of information: only the manufacturer has the actual manufacturing cost information \(c_{n}\) and actual remanufacturing cost information \(c_{r}\) completely, i.e., \(c_{n}\) and \(c_{r}\) are private information of the manufacturer, which creates conditions for the manufacturer to publish manufacturing cost information \(c_{nf}\) and remanufacturing cost information \(c_{rf}\) respectively under information asymmetry. Since wholesale and retail prices are jointly owned by two or more supply chain members, this study concludes that prices cannot be private information of any one party. Assuming that each participant in the CLSC aims to maximize their own revenues, the manufacturer will use its information advantage to plunder more revenue, which is specifically manifested in this study as \(c_{n} < c_{nf}\) and \(c_{r} < c_{rf}\).

After using the FL platform, the supply chain changes significantly in three ways. First, we assume that when the FL platform is not adopted, neither party can achieve effective management of information, i.e., the amount of information is in the state of overload. As the amount of information increases, information reliability is in a decreasing state, specifically, manufacturing cost information reliability \(H(i) = \frac{m}{i}\),\((m > 0)\) and remanufacturing cost information reliability \(I(j) = \frac{n}{j}\), \((n > 0)\). And after using the platform, CLSC members can better obtain timely and accurate cost information from each other, thus improving information reliability and weakening the degree of misrepresentation of cost information of each party up to a point. As mentioned by Pernagallo and Torrisi (2020), the incorporation of computer processing technology can make the most of information and enhance the efficiency of information processing. However, there is also a limit to the processing power of techniques, which implies that non-human technology won't be able to process more information either at some point with the growth of information. Therefore, this paper adopts \(A(i) = - ai^{2} + bi,i \in [\frac{{b - \sqrt {b^{2} - 4a} }}{2a},\frac{{b + \sqrt {b^{2} - 4a} }}{2a}],(a > 0,b = \sqrt {\frac{{4ac_{nf} }}{{c_{n} }}} > 0)\) to represent the efficiency of the FL platform in managing information between the manufacturer and retailer, and \(i\) to represent the amount of information between them. All at once, the reliability of the production information content increases when information management efficiency improves, that is to say, the manufacturing cost information published by the manufacturer gradually approaches the true value, resulting in a reduction in the degree of manufacturing cost misrepresentation, which is in an inverse variation relationship, so \(A(i)^{ - 1}\) is taken as the manufacturer's misrepresentation factor for unit manufacturing cost information, which represents the effect of FL platform on the manufacturer's misrepresentation factor for unit manufacturing cost information. When \(i = \frac{b}{2a}\), \(A(i)^{ - 1}\) takes the minimum value \(\frac{{c_{n} }}{{c_{nf} }}\) signifying that the supply chain can achieve manufacturing cost information symmetry with the adoption of the FL platform; the degree of misrepresentation of manufacturing cost information by the FL platform is enhanced when the value of \(\left| {i - \frac{b}{2a}} \right|\) becomes larger; when \(i = \frac{{b \pm \sqrt {b^{2} - 4a} }}{2a}\), the FL platform cannot handle the manufacturing cost information asymmetry problem. Similarly, \(B(j) = - kj^{2} + zj,j \in [\frac{{z - \sqrt {z^{2} - 4k} }}{2k},\frac{{z + \sqrt {z^{2} - 4k} }}{2k}],(k > 0,z = \sqrt {\frac{{4kc_{rf} }}{{c_{r} }}} > 0)\) is used to represent the efficiency of the FL platform in managing the information between manufacturer and third party, \(j\) represents the amount of information between them, so \(B(j)^{ - 1}\) is taken as the manufacturer's misrepresentation factor for unit remanufacturing cost information to represent the effect of FL platform on the manufacturer's misrepresentation factor for unit remanufacturing cost information. \(i\) and \(j\) will not take endpoint values at the same time, otherwise the FL platform will be completely unable to deal with information asymmetry and improve information reliability problems, and there is no need for CLSC members to invest in using the platform. Second, consumers' personal information will be better protected. In general, the information security factors in the supply chain will affect consumer behavior, and the improvement of information security level will help to improve consumers' willingness to purchase and promote the success of the transaction. In the article, we suppose that when the degree of consumer information security \(\lambda\) increases, consumer utility increases accordingly. Third, supply chain members need certain capital investment to use FL platform, and the unit investment costs of manufacturer, retailer and third party will be recorded as \(c_{ml}\), \(c_{rl}\), \(c_{tl}\) in this paper in turn.

3.2 Model description

The study builds a two-level dual-channel CLSC system including one manufacturer, one retailer and one third party, where the decision sequence of the Stackelberg game will be followed among the member firms. Among them, the manufacturer occupies the dominant position, whose main task is to be answerable to the manufacturing of new products, as well as the recycling and remanufacturing of second-hand products. The manufacturer sells new products to the retailer at a wholesale price of \(w_{n}\) and remanufactured products to the third party at a wholesale price of \(w_{r}\). The retailer and third party take actions qua followers responsible for selling two products and determine unit retail prices of \(p_{n}\) and \(p_{r}\) for two products individually, in view of the cost and price information provisioned by the manufacturer. In the study, the manufacturer's decision variables are the wholesale prices of two products, the retailer's decision variable is the retail price of new products, and the third party's decision variable is the retail price of remanufactured products.

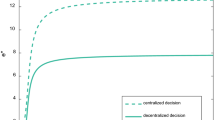

Referring to reference to the literature of Liu et al. (2020) and Wan et al. (2022), so as to clearly determine the changes that occur in the CLSC using the FL platform, to explore the range of costs suitable for making investments, and to improve the efficiency of the CLSC, model \(f\) is constructed in this paper. As shown in Fig. 1, \(f = \{ ND,NC,FD,FC\}\). \(ND\) denotes a traditional CLSC (T-CLSC), namely, a decentralized decision-making game model without using FL platform; \(NC\) denotes centralized decision-making game model for a T-CLSC; \(FD\) denotes a federated learning CLSC (FL-CLSC), namely, decentralized decision-making game model with investment in using FL platform; and \(FC\) denotes a centralized decision-making game model with investment in using FL platform by CLSC members. So as to obtain the investment conditions of FL platform and achieve FL-CLSC coordination, we solves the optimal decision of the above models respectively, and obtains the investment conditions of FL platform with incentive effect by comparing revenues in models \(ND\) and \(FD\). By comparing revenues in models \(FD\) and \(FC\), we determine that whether model \(FD\) realizes the optimal revenue. If it doesn't happen, the optimal revenue is achieved by using the CSRS contract.

The demand function is established based on the following four aspects: (1) The paper holds the hypothesis that consumers' willingness to pay for the new product is \(v\), \(v \in \left[ {0,1} \right]\). \(\alpha\) indicates consumers' recognition of the remanufactured product, \(\alpha \in [0,1]\). (2) Assuming that the manufacturer takes certain measures to make the new (remanufactured) product possess the environmental friendliness \(e_{n} (e_{r} )\) and meet \(e_{n} < e_{r}\) (Xie et al., 2022). The consumers' willingness to pay for the unit environmental quality of the product is \(\xi\), \(\xi\) obeys a uniform distribution of \(\left[ {0,d} \right]\), whose probability density function is \(f\left( \xi \right)\) and distribution function is \(F\left( \xi \right)\). (3) Information misrepresentation factor reflects the effect of FL platform on improving information reliability, which mainly involves misrepresentation factor for unit manufacturing cost information and misrepresentation factor for unit remanufacturing cost information in the product distribution process, both of which have a negative impact on consumers' willingness to pay. In addition, this paper uses \(\omega\) to describe the sensitivity coefficient of consumers to information misrepresentation factor, which is ultimately reflected in the utility function. (4) Adopting FL platform not only helps supply chain members to better exchange information and improve information reliability, but also can effectively safeguard users' private data security. In the article, we suppose that there is no discrepancy in consumers' concern for personal information security before and after using the FL platform, which is recorded as \(\beta\). Thus, the degree of consumer information security is used to reveal this difference, and if CLSC members do not adopt the FL platform, the degree of consumer personal information security \(\lambda\) is lower than after using, i.e., \(\lambda_{ND} = \lambda_{NC} < \lambda_{FD} = \lambda_{FC}\).

On the basis of utility function theory, consumers would like to pay for products when their practical value is more valuable than their perceived value. Consumers' perceived value is influenced by their willingness to pay, retail price, environmental friendliness, information reliability and security, and the relevance among them can be expressed as shown below:

Under the condition of \(U > 0\), consumers would like to pay for the product. Consequently, the market demand functions for two products could be derived as below:

In the T-CLSC, the cost information obtained by retailer and third party is less reliable, thus the corresponding market demand function is:

In summary, Table 1 summarises the central parameters of this paper.

4 Discussion

4.1 Model ND

In the model ND, T-CLSC members don't adopt the FL platform. The manufacturer as the dominant firm produces new and remanufactured products and first gives their wholesale price, while retailer and third party set retail prices for two products separately, then supply and sell the products. Additionally, if the T-CLSC system doesn't adopt the FL platform, the reduced information reliability among T-CLSC members gives the manufacturer a larger room for cost misrepresentation, i.e., the manufacturer publishes cost information beyond the actual cost to the outside world, thus making itself a higher revenue.

The manufacturer's decision objective function is:

Let the game model of each participant in the T-CLSC be \(\Gamma\). Then \(\Gamma\) is:

Based on formulas (5) and (8), \(\frac{{\partial^{2} \pi_{r}^{ND} }}{{\partial^{2} p_{n} }} = - \frac{{2e_{r} }}{{de_{n} (e_{r} - e_{n} )}} < 0\) is obtained according to the backward induction, so there exists a great value of \(\pi_{r}^{ND}\). Therefore, the retailer obtains the maximum revenue when \(p_{n}\) satisfies \(\frac{{\partial \pi_{r}^{ND} }}{{\partial p_{n} }} = 0\). The response function of \(p_{n}\) can be acquired as shown below:

Based on formulas (6) and (8), \(\frac{{\partial^{2} \pi_{t}^{ND} }}{{\partial^{2} p_{r} }} = - \frac{2}{{d(e_{r} - e_{n} )}} < 0\) is obtained according to the backward induction, so there exists a great value of \(\pi_{t}^{ND}\). Hence, the third party gains the maximum revenue when \(p_{r}\) reaches \(\frac{{\partial \pi_{t}^{ND} }}{{\partial p_{r} }} = 0\). The response function of \(p_{r}\) can be obtained as follows:

Combining formula (9) with formula (10) yields:

Substituting formulas (11) and (12) into formula (7), we get \(\pi_{m}^{ND} = (w_{n} - c_{nf} ) \times \frac{{e_{r} e_{n} \left[ {w_{r} - \alpha v + \omega H(i) + \omega I(j) + w_{n} - v - 2\beta \lambda_{ND} + de_{r} - de_{n} } \right]}}{{de_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}}\)\(+ (w_{n} - c_{nf} ) \times \frac{{2e_{r}^{2} \left[ {v - w_{n} + \beta \lambda_{ND} - \omega H(i)} \right]}}{{de_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}} - (w_{r} - c_{rf} ) \times \frac{{e_{n} \left[ {\alpha v - w_{r} + \beta \lambda_{ND} - \omega I(j)} \right]}}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}\)\(+ (w_{r} - c_{rf} ) \times \frac{{e_{r} \left[ {w_{n} - v + \omega H(i) - 2\omega I(j) - 2w_{r} + 2\alpha v + 2de_{r} - 2de_{n} + \beta \lambda_{ND} } \right]}}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}\). The Hessian matrix for solving \(\pi_{m}^{ND} (w_{n} ,w_{r} )\) is: \(H = \left[ {\begin{array}{*{20}c} { - \frac{{2e_{r} (2e_{r} - e_{n} )}}{{de_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}}} & {\frac{{2e_{r} }}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} \\ {\frac{{2e_{r} }}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} & { - \frac{{2(2e_{r} - e_{n} )}}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} \\ \end{array} } \right]\). Since the determinant of the Hessian matrix \(\det (H) = \frac{{4e_{r} }}{{d^{2} e_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}} > 0\), it is a concave function of \(\pi_{m}^{ND} (w_{n} ,w_{r} )\) with respect to the variable \(w_{n} ,w_{r}\). Therefore, the first-order conditions for the manufacturer to obtain maximum revenue are \(\frac{{\partial \pi_{m}^{ND} }}{{\partial w_{n} }} = 0\) and \(\frac{{\partial \pi_{m}^{ND} }}{{\partial w_{r} }} = 0\). Denoting \(Y_{1} = v + \beta \lambda_{ND/NC} - \omega H(i) - c_{nf}\), \(Z_{1} = \alpha v + \beta \lambda_{ND/NC} - \omega I(j) - c_{rf}\), the joint equation yields optimal wholesale prices of two products as shown below:

Substituting formulas (13) and (14) into formulas (11) and (12), the optimal retail prices of two products could be obtained successively as follows:

Further, by substituting formulas (15) and (16) into formulas (5) and (6), we are able to obtain the market demands for two products, which are arranged in the following order:

Accordingly, the optimal revenues of T-CLSC members are:

According to formulas (13), (14), (15), (16), (19), (20) and (21), Proposition 1–3 can be obtained.

Proposition 1

In decentralized decision-making without FL platform, as consumers' recognition of the remanufactured product improves, the optimal wholesale price of new product is unaffected, optimal prices of remanufactured product and revenues of manufacturer and third party enhance, but retail price of new product and revenue of retailer reduce.

Proof

See “Online Appendix A1”.

In the light of Proposition 1, in model ND, there is no interaction between the optimal wholesale price of new product and consumers' recognition of the remanufactured product. The optimal prices of the remanufactured product and optimal revenues of manufacturer and third party are positively correlated with consumers' recognition of the remanufactured product, while retail price of new product and revenue of retailer are negatively related to consumers' recognition of the remanufactured product.

Proposition 2

Under the condition of decentralized decision-making without the FL platform, the optimal wholesale and retail prices of two products and optimal revenues of T-CLSC members increase when the degree of consumer information security increases, and vice versa.

Proof

See “Online Appendix A2”.

In the light of Proposition 2, in model ND, optimal prices of two products and revenues of all T-CLSC members are positively correlated with the degree of consumer information security.

Proposition 3

In the absence of FL platform, the enhanced manufacturing information reliability decreases the optimal price of new product and revenues of manufacturer and retailer while enhances optimal retail price of remanufactured product and revenue of third party, where the optimal wholesale price of remanufactured product makes no allowance for information reliability; the enhanced remanufacturing information reliability decreases optimal price of remanufactured product and revenues of manufacturer and third party while increases the optimal retail price of new product and optimal revenue of retailer, where wholesale price of new product is not affected.

Proof

See “Online Appendix A3”.

In the light of Proposition 3, in model ND, the cost information reliability of a product is negatively correlated with its optimal prices and revenue from the production and sale of the product, and positively correlated with the optimal retail price and sales revenue of another product, without affecting the optimal wholesale price of another product.

4.2 Model NC

In supply chain management, decentralized decision-making usually reduces supply chain performance. Therefore, a centralized decision-making game model is developed in this article. In the model NC, all T-CLSC participants establish management decisions with the ultimate target of maximizing whole revenue of the T-CLSC system. At this moment, the whole revenue function of T-CLSC is:

Based on formulas (5), (6) and (22), the value of solving the Hessian matrix \(\pi^{NC} (p_{n} ,p_{r} )\) is: \(H = \left[ {\begin{array}{*{20}c} { - \frac{{2e_{r} }}{{de_{n} (e_{r} - e_{n} )}}} & {\frac{2}{{d(e_{r} - e_{n} )}}} \\ {\frac{2}{{d(e_{r} - e_{n} )}}} & { - \frac{2}{{d(e_{r} - e_{n} )}}} \\ \end{array} } \right]\). Since the determinant of the Hessian matrix \(\det (H) = \frac{{4e_{r} }}{{d^{2} e_{n} (e_{r} - e_{n} )}} > 0\), \(\pi^{NC} (p_{n} ,p_{r} )\) is a concave function regarding variables \(p_{n} ,p_{r}\). When \(\frac{{\partial \pi^{NC} }}{{\partial p_{n} }} = 0\), \(\frac{{\partial \pi^{NC} }}{{\partial p_{r} }} = 0\), the T-CLSC is capable of acquiring its maximum revenue. Based on the above conditional simultaneous equation, the optimal retail prices of both products are obtained as shown below:

Further, substituting formulas (23) and (24) into formulas (5) and (6), the market demands for two products could be obtained in the following order:

Accordingly, the overall optimal revenue of the T-CLSC system is:

According to formulas (23), (24) and (27), Propositions 4, 5 and 6 could be picked up.

Proposition 4

In the centralized decision-making without FL platform, as consumers' recognition of the remanufactured product improves, the optimal retail price of new product will not be influenced, and the optimal retail price of remanufactured product and optimal revenue of whole T-CLSC will enhance.

Proof

See “Online Appendix A4”.

In the light of Proposition 4, in model NC, there is no interaction between optimal retail price of new product and consumers' recognition of the remanufactured product. The optimal retail price of remanufactured product and optimal revenue of whole T-CLSC is positively correlated with consumers' recognition of remanufactured product.

Proposition 5

In the centralized decision-making without FL platform, the optimal retail prices and revenue of whole T-CLSC increase when the degree of consumer information security increases, and vice versa.

Proof

See “Online Appendix A5”.

In the light of Proposition 5, in model NC, the optimal retail prices of both products and revenue of T-CLSC are positively related to the degree of consumer information security.

Proposition 6

In the absence of FL platform, the enhanced manufacturing cost information reliability reduces the optimal retail price of new product and entire T-CLSC revenue, besides that, the optimal retail price of remanufactured product is unaffected; the enhanced remanufacturing cost information reliability reduces optimal retail price of remanufactured product and overall T-CLSC revenue while the optimal retail price of new product is invulnerable to affect.

Proof

See “Online Appendix A6”.

In the light of Proposition 6, in model NC, the cost information reliability of a product is negatively correlated with its optimal retail price and optimal revenue of the whole T-CLSC, but it will not influence the optimal retail price of another product.

4.3 Model FD

In the model FD, the FL-CLSC members choose to use the FL platform. The dominant manufacturer produces and sets the wholesale price of both products first. Then the retailer and third party, as followers, set the retail price of both products according to the cost information and wholesale prices, and are responsible for the supply and sale of products. In addition, if the CLSC system uses the FL platform, the information reliability among FL-CLSC members is enhanced and the information misrepresentation is weakened to some extent, i.e., the cost information announced by the manufacturer to the public will be constantly close to the actual cost information.

The manufacturer's decision objective function is:

Let the game model of FL-CLSC members be \(\Gamma\). Then \(\Gamma\) is:

Based on formulas (3) and (29), \(\frac{{\partial^{2} \pi_{r}^{FD} }}{{\partial^{2} p_{n} }} = - \frac{{2e_{r} }}{{de_{n} (e_{r} - e_{n} )}} < 0\) is obtained according to the backward induction, so there exists a great value of \(\pi_{r}^{FD}\). Therefore, the retailer obtains the maximum revenue when \(p_{n}\) satisfies \(\frac{{\partial \pi_{r}^{FD} }}{{\partial p_{n} }} = 0\). The response function of \(p_{n}\) could be gained as below:

Based on formulas (4) and (29), \(\frac{{\partial^{2} \pi_{t}^{FD} }}{{\partial^{2} p_{r} }} = - \frac{2}{{d(e_{r} - e_{n} )}} < 0\) is obtained according to the backward induction, so there exists a great value of \(\pi_{t}^{FD}\). Therefore, \(p_{r}\) satisfies \(\frac{{\partial \pi_{t}^{FD} }}{{\partial p_{r} }} = 0\) when the third party obtains the maximum revenue. The response function of \(p_{r}\) could be gained as below:

Combining the above two formulas yields:

Substituting formulas (32) and (33) into formula (28), we get

The Hessian matrix for solving \(\pi_{m}^{FD} (w_{n} ,w_{r} )\) is: \(H = \left[ {\begin{array}{*{20}c} { - \frac{{2e_{r} (2e_{r} - e_{n} )}}{{de_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}}} & {\frac{{2e_{r} }}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} \\ {\frac{{2e_{r} }}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} & { - \frac{{2(2e_{r} - e_{n} )}}{{d(e_{r} - e_{n} )(4e_{r} - e_{n} )}}} \\ \end{array} } \right]\). Since the determinant of Hessian matrix \(\det (H) = \frac{{4e_{r} }}{{d^{2} e_{n} (e_{r} - e_{n} )(4e_{r} - e_{n} )}} > 0\), \(\pi_{m}^{FD} (w_{n} ,w_{r} )\) is a concave function regarding variables \(w_{n} ,w_{r}\). Therefore, the first-order approaches for the manufacturer to obtain maximum revenue are \(\frac{{\partial \pi_{m}^{FD} }}{{\partial w_{n} }} = 0\) and \(\frac{{\partial \pi_{m}^{FD} }}{{\partial w_{r} }} = 0\). Denoting \(Y_{2} = v + \beta \lambda_{FD/FC} - \omega A(i)^{ - 1} - A(i)^{ - 1} c_{nf} - c_{ml} - c_{rl}\), \(Z_{2} = \alpha v + \beta \lambda_{FD/FC} - \omega B(j)^{ - 1} - B(j)^{ - 1} c_{rf} - c_{ml} -\) \(c_{tl}\), and the joint equation yields the optimal wholesale prices in order:

Substituting formulas (34) and (35) into formulas (32) and (33), the optimal retail prices of both products are obtained as below:

Ulteriorly, bringing formulas (36) and (37) into formulas (3) and (4), the market demands for two products could be picked up in the following order:

Correspondingly, the optimal revenues for the FL-CLSC members are as below:

According to formulas (34), (35), (36), (37), (40), (41) and (42), several propositions have been drawn.

Proposition 7

In decentralized decision-making using the FL platform, as consumers' recognition of the remanufactured product, the optimal wholesale price of new product is invulnerable to affect by it, the optimal prices of remanufactured product and optimal revenues of manufacturer and third party would enhance, and retailer's optimal retail price and revenue would reduce.

Proof

See “Online Appendix A7”.

In the light of Proposition 7, in model FD, there is no interaction between the optimal wholesale price of new product and consumers' recognition of the remanufactured product. The optimal prices of remanufactured product and optimal revenues of manufacturer and third party are positively correlated with consumers' recognition of the remanufactured product, while retail price of new product and revenue of the retailer are negatively related to consumers' recognition of the remanufactured product.

Proposition 8

In decentralized decision-making using the FL platform, the optimal prices and revenues of FL-CLSC members increase as the degree of consumer information security of consumers enhances and vice versa.

Proof

See “Online Appendix A8”.

In the light of from Proposition 8, in model FD, the optimal prices of two products and revenues of all FL-CLSC members are positively related to the degree of consumer information security.

Proposition 9

Increased information reliability enhances manufacturer's optimal revenue. When \(i < \frac{b}{2a}\), the misrepresentation factor for unit manufacturing cost information decreases, i.e., information reliability improves, the optimal wholesale price of remanufactured product is unaffected, the optimal price of new product improves or decreases monotonically, and retail price of remanufactured product and revenue of the third party reduce while revenue of retailer increases; when \(i \ge \frac{b}{2a}\), the CLSC changes in the opposite direction. When \(j < \frac{z}{2k}\), the manufacturer's misrepresentation factor for unit remanufacturing cost information decreases, i.e., information reliability increases, the optimal wholesale price of new product is unaffected, optimal prices of remanufactured product improve or reduce monotonically, and retail price of the new product and revenue of retailer reduce while the optimal revenue of third party increases; when \(j \ge \frac{z}{2k}\), the supply chain changes in the opposite direction.

Proof

See “Online Appendix A9”.

In the light of Proposition 9, within a certain range, the cost information reliability of a product is negatively correlated with the optimal revenue of production and sales of the product, and positively correlated with the optimal retail price and sales revenue of another product, without affecting the optimal wholesale price of another product. Besides, changes in other decisions mainly depend on the values of parameters such as \(\omega\) and \(c_{nf}\).

Proposition 10

An increase in FL investment costs on either side of the FL-CLSC enhances optimal retail prices, decreases the optimal revenue of the manufacturer. In particular, an increase in unit investment cost for the manufacturer adopting FL platform increases the optimal wholesale prices of two products, decreases optimal revenues of retailer and third party; when the unit investment cost for the retailer adopting FL platform increases, the optimal wholesale price of remanufactured product is unaffected, optimal wholesale price of new product and optimal revenue of the retailer decrease while revenue of third party increases; when the unit investment cost for the third party adopting FL platform increases, the optimal wholesale price of new product is not influenced, the optimal wholesale price of remanufactured product and revenue of third party reduce, and the optimal revenue of retailer enhances.

Proof

See “Online Appendix A10”.

In the light of Proposition 10, in model FD, the unit FL investment cost for the manufacturer is positively related to optimal prices of two products, and negatively correlated with revenues of all FL-CLSC members. The unit FL investment cost for the retailer is positively correlated with optimal retail prices of two products and revenue of third party, but negatively correlated with the optimal wholesale price of new product and optimal revenue of manufacturer and retailer while wholesale price of the remanufacturerd product is not affected. The unit FL investment cost for the third party is positively correlated with optimal retail prices of two products and revenue of retailer, but negatively correlated with wholesale price of remanufacturerd product and revenue of manufacturer and third party while wholesale price of new product is unaffected.

4.4 Model FC

In the model FC, for obtaining more revenue, the target of FL-CLSC parties is to maximize the whole FL-CLSC revenue. At this moment, the entire revenue function of the FL-CLSC is as below:

Based on formulas (3), (4) and (43), the Hessian matrix for solving \(\pi^{FC} (p_{n} ,p_{r} )\) is: \(H = \left[ {\begin{array}{*{20}c} { - \frac{{2e_{r} }}{{de_{n} (e_{r} - e_{n} )}}} & {\frac{2}{{d(e_{r} - e_{n} )}}} \\ {\frac{2}{{d(e_{r} - e_{n} )}}} & { - \frac{2}{{d(e_{r} - e_{n} )}}} \\ \end{array} } \right]\), since the determinant of the Hessian matrix \(\det (H) = \frac{{4e_{r} }}{{d^{2} e_{n} (e_{r} - e_{n} )}} > 0\), \(\pi^{FC} (p_{n} ,p_{r} )\) is a concave function regarding variables \(p_{n} ,p_{r}\). The supply chain can obtain its maximum revenue when \(\frac{{\partial \pi^{FC} }}{{\partial p_{n} }} = 0\) and \(\frac{{\partial \pi^{FC} }}{{\partial p_{r} }} = 0\). The optimal retail prices of two products could be obtained from the joint equation in view of above conditions in the following order:

Ulteriorly, bringing formulas (44) and (45) into formulas (3) and (4), the market demands for two products could be obtained as follows, respectively:

Accordingly, the overall optimal revenue of the FL-CLSC system is:

According to formulas (44), (45) and (48), several propositions have been drawn.

Proposition 11

In the centralized decision-making using FL platform, as consumers' recognition of the remanufactured product heightens, the optimal retail price of new product is unaffected, and the optimal retail price of remanufactured product and optimal revenue of whole FL-CLSC improve.

Proof

See “Online Appendix A11”.

In the light of Proposition 11, in model FC, there is no interaction between optimal retail price of new product and consumers' recognition of the remanufactured product. The optimal retail price of remanufactured product and optimal revenue of whole FL-CLSC is positively related to consumers' recognition of the remanufactured product.

Proposition 12

In the centralized decision-making using FL platform, the optimal retail prices of both products and revenue of whole FL-CLSC increase when the degree of consumer information security increases, and vice versa.

Proof

See “Online Appendix A12”.

In the light of Proposition 12, in model FC, the optimal retail prices of both products and revenue of FL-CLSC will be positively related to the degree of consumer information security.

Proposition 13

Enhanced information reliability increases the optimal revenue of the entire FL-CLSC. When \(i < \frac{b}{2a}\), the manufacturer's misrepresentation factor for unit manufacturing cost information decreases, i.e., information reliability improves, the optimal retail price of remanufactured product is not affected, and retail price of new product improves or reduces monotonically; when \(i \ge \frac{b}{2a}\), the supply chain changes in the opposite direction. When \(j < \frac{z}{2k}\), the manufacturer's misrepresentation factor for unit remanufacturing cost information decreases, i.e., information reliability improves, the optimal retail price of new product is not affected, and retail price of remanufactured product improves or reduces monotonically; when \(j \ge \frac{z}{2k}\), the supply chain changes in the opposite direction.

Proof

See “Online Appendix A13”.

In the light of Proposition 13, in a certain range, the cost information reliability of a product is negatively correlated with the optimal revenue of the whole FL-CLSC, without affecting the optimal retail price of another product. Additionally, changes in optimal retail price of this product is mainly decided by the values of parameters such as \(\omega\) and \(c_{nf}\).

Proposition 14

An increase in the FL investment cost of FL-CLSC parties will reduce the entire optimal revenue of the FL-CLSC. In particular, an enhancement in unit investment cost for the manufacturer adopting FL platform increases optimal retail prices of both products; an increase of unit investment cost for the retailer adopting FL platform leaves the optimal retail price of remanufactured product unaffected while increases retail price of the new product; besides, an increase in unit investment cost for the third party adopting FL platform leaves the optimal retail price of new product unaffected while increases retail price of remanufactured product.

Proof

See “Online Appendix A14”.

In the light of Proposition 14, in model FC, the unit FL investment cost for the manufacturer has a positive correlation with optimal retail prices of two products, while it is negatively correlated with optimal revenue of the whole FL-CLSC. The unit FL investment cost for retailer is positively correlated with the optimal retail price of new product, but negatively correlated with revenue of whole FL-CLSC while retail price of remanufacturerd product is unaffected. The unit FL investment cost for third party is positively correlated with the optimal retail price of remanufacturerd product, but negatively correlated with revenue of whole FL-CLSC while retail price of new product is not affected.

4.5 Investment decision

In the FD model, FL-CLSC members use the FL platform to improve information reliability and security, which helps to improve the trust relationship between each business member and between businesses and consumers, and build a lasting and good cooperation relationship. The retailer and third party can accomplish decision-making in view of more accurate cost information, i.e., the use of the FL platform can help retailer and third party organize product sales efforts more rationally. At this time, the products made by the manufacturer can respond well to the market demand. From model ND and model FD, it is known that using FL platform makes the revenues of manufacturer, retailer and third party change. Generally speaking, FL investment cost should satisfy the revenues of supply chain members after using FL platform is higher than the revenue before using FL platform, i.e. \(\pi_{m}^{FD * } > \pi_{m}^{ND * }\), \(\pi_{r}^{FD * } > \pi_{r}^{ND * }\), \(\pi_{t}^{FD * } > \pi_{t}^{ND * }\). Based on the above conditions, Proposition 15 can be obtained.

According to formulas (19), (20), (21), (40), (41) and (42), Proposition 15 is obtained.

Proposition 15

The use of FL platform is feasible for FL-CLSC members when \(c_{ml}\), \(c_{rl}\) and \(c_{tl}\) satisfy both condition \(\psi_{1}\), condition \(\psi_{2}\) and condition \(\psi_{3}\).

Proof

See “Online Appendix A15”.

In the light of Proposition 15, it is profitable to invest in FL platform for CLSC participants only when the cost of FL investment satisfies that the revenues of CLSC parties after adopting FL platform is higher than the revenues before using FL platform, i.e., CLSC members has the incentive to invest and use FL platform. By comparing decentralized decision-making model of FL-CLSC with decentralized decision-making model of T-CLSC, it could be drawn that terms \(\psi_{1}\), \(\psi_{2}\) and \(\psi_{3}\) of investment decision are satisfied, and the CLSC members could determine if they are supposed to make investment decision by the aforementioned conditions.

4.6 FL-CLSC coordination

On the basis of formulas (36), (37), (40), (41), (42), (44), (45) and (48), it is known that

when

the condition is noted as \(\psi_{4}\).

From the model FD and model FC, it could be drawn that the use of the FL platform causes changes in the retail prices and revenues of CLSC members with diverse operation models. Under the condition of \(\psi_{4}\), the centralized decision-making is often superior to decentralized decision-making in product pricing and increasing the whole revenue of CLSC system. The main causation for this phenomenon is that the FL-CLSC members still give prominence to the original traditional concept of maximizing their own revenues under the decentralized decision-making model, while ignoring the economic benefits of FL-CLSC system as a whole, and there is an efficiency loss. Consequently, the paper adopts the CSRS contract to coordinate FL-CLSC so as to maximize the revenue of the whole system, which leads to Proposition 16.

Proposition 16

Under the CSRS contract, the retail prices of both products are equal to optimal retail prices of model FC, i.e., \(p_{n}^{LC * } = p_{n}^{FC * }\), \(p_{r}^{LC * } = p_{r}^{FC * }\), respectively. The CSRS contract enables coordination of FL-CLSC members' investment in using the FL platform when the revenue-sharing coefficient \(\eta_{1} ,\eta_{2}\) and the cost-sharing coefficient \(\gamma_{1} ,\gamma_{2}\) satisfy specific conditions simultaneously.

Proof

See “Online Appendix A16”.

In an effort to guarantee that the revenues of entire FL-CLSC members of are improved after coordination using the CSRS contract, \(\pi_{m}^{LC * } > \pi_{m}^{FD * }\), \(\pi_{r}^{LC * } > \pi_{r}^{FD * }\), \(\pi_{t}^{LC * } > \pi_{t}^{FD * }\) needs to be satisfied so that the corresponding range of values of \(\eta_{1} ,\eta_{2} ,\gamma_{1} ,\gamma_{2}\) can be obtained.

5 Simulation and numerical analysis

In an effort to validate the accuracy and effectiveness of the aforementioned theoretical analysis, this part uses Mathematica software to simulate the CLSC model. On the basis of satisfying the hypothetical conditions, we make \(A(i) = 0.2\); \(B(j) = 0.4\); \(H(i) = 0.005\); \(I(j) = 0.97\); \(d = 2.4\); \(e_{r} = 0.88\); \(e_{n} = 0.48\); \(v = 0.7\); \(\alpha = 0.85\); \(\lambda_{ND} = \lambda_{NC} = 0.53\); \(\lambda_{FD} = \lambda_{FC} = 0.93\); \(c_{nf} = 0.8\); \(c_{rf} = 0.3\); \(\beta = 3\); \(\omega = 0.55\); \(c_{ml} = 0.4\); \(c_{rl} = 0.2\); \(c_{tl} = 0.3\), the specific simulation results when we use diverse parameters as independent variables are revealed in Figs. 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14 and 15.

According to formulas (13), (14), (15), (16), (19), (20) and (21), Fig. 2a–c are acquired, respectively. Figure 2 penetrates the variation tendency of optimal decision and revenue in the model ND when consumers' recognition of the remanufactured product changes. Just like we can see in Fig. 2, the optimal price of remanufactured product, revenues of manufacturer and third party all enhance with the enhancement in consumers' recognition of the remanufactured product. Among these dependent variables, the retail price of the remanufactured product could be the most responsive to changes. Thus, an enhancement to consumers' recognition of the remanufactured product profits both manufacturer who produces remanufactured products and third party who sells remanufactured products. Conversely, when more consumers turn their attention to cheaper remanufactured products, retail sales of new products would be forced to a lower price, and retailer's optimal revenue decreases. Figure 2 shows no difference with Proposition 1 above.

According to formulas (13), (14), (15), (16), (19), (20) and (21), we can obtain Fig. 3a–c separately. Figure 3 reveals the trend of optimal decision and revenue in the model ND when the degree of consumer information security changes. According to Fig. 3, the optimal prices of both products and revenue of every T-CLSC member increase with the improvement of the degree of consumer information security, which displays that consumers would like to pay a higher price for protecting their information and each company can gain more revenue. Therefore, the T-CLSC members should make improving consumer information security to be one of the focus points in terms of T-CLSC management. Figure 3 is consistent with Proposition 2 above.

According to formulas (13), (14), (15), (16), (19), (20), and (21), respectively, Fig. 4a–f are acquired. Figure 4 proclaims the trends of optimal decisions and revenues in the model ND when information reliability changes. As shown in Fig. 4a–c, the optimal prices of new product and revenues of manufacturer and retailer reduce as manufacturing cost information reliability increases. Therefore, manufacturing cost information reliability is usually low in the T-CLSC, on the one hand, the manufacturer will falsely process and transmit the information for obtaining more revenue; on the other hand, the retailer, as the beneficiary of misrepresentation, it is likely to assist the manufacturer in this process. As shown in Fig. 4d–f, when remanufacturing cost information reliability increases, the optimal price of remanufactured product and revenues of manufacturer and third party all decrease. Similarly, the manufacturer still misrepresents remanufacturing cost information, so the third party may assist the manufacturer in falsifying cost information to gain more revenue. Figure 4 remains consistent with Proposition 3 above.

According to formulas (23), (24) and (27), we can obtain Fig. 5a, b, respectively. Figure 5 reveals the variation tendency of the optimal decision and revenue in the model NC when consumers' recognition of the remanufactured product changes. As we can see in Fig. 5, the optimal retail price of remanufactured product and revenue of T-CLSC system change in the same direction as the consumers' recognition of the remanufactured product, and the optimal retail price of new product is not affected during this process. Therefore, T-CLSC system should take active measures to heighten the acceptance and recognition of the remanufactured product by consumers in centralized decision-making. Figure 5 shows no difference with Proposition 4 above.

According to formulas (23), (24) and (27), Fig. 6a, b are obtained, respectively. Figure 6 reveals the variation tendency of optimal decision and revenue in the model NC when the degree of consumer information security changes. As shown in Fig. 6, the optimal retail prices and revenue of T-CLSC system change equally along with the degree of consumer information security. Therefore, the improvement of consumer information security will have a favorable impact on the T-CLSC. Figure 6 shows no difference with Proposition 5 above.

According to formulas (23), (24) and (27), respectively, Fig. 7a–d are acquired. Figure 7 indicates the variation tendency of optimal decision and revenue in the model NC when the information reliability changes. As shown in Fig. 7a, b, the optimal retail price of new product and revenue of T-CLSC both decrease as manufacturing cost information reliability increases. As we can see in Fig. 7c, d, when remanufacturing cost information reliability enhances, the optimal retail price of remanufactured product and revenue of T-CLSC both decrease. Therefore, in the centralized decision-making of T-CLSC, information reliability is usually low, i.e., the members tend to raise more revenue by misrepresenting the production cost information and the remanufacturing cost information. Figure 7 is consistent with Proposition 6 above.

According to formulas (34), (35), (36), (37), (40), (41) and (42), Fig. 8a–c could be acquired, respectively, and Fig. 8 declares the variation tendency of optimal decisions and revenues in the model FD the consumers' recognition of remanufactured product changes. On the basis of Fig. 8, optimal prices of the remanufactured product and revenues of manufacturer and third party all change equally along with the consumers' recognition of the remanufactured product, with the retail price of remanufactured product being the most responsive to changes in this parameter. Therefore, increasing consumers' recognition of remanufactured product will improve revenues of manufacturer and third party, but the optimal revenue of the retailer will decrease. Figure 8 remains consistent with Proposition 7 above.

According to formulas (34), (35), (36), (37), (40), (41) and (42), Fig. 9a–c are obtained. Figure 9 proclaims the variation tendency of optimal decision and revenue in the model FD when the degree of consumer information security changes. As we can see in Fig. 9, the optimal prices of both products and revenue of each FL-CLSC member change in the same direction as the degree of consumer information security, which is consistent with the findings in the model ND. Therefore, the effect of the degree of consumer information security on the CLSC did not change after using FL platform. Figure 9 remains consistent with Proposition 8 above.

According to formulas (34), (35), (36), (37), (40), (41) and (42), respectively, Fig. 10a–f are obtained, and Fig. 10 proclaims the variation tendency of optimal decisions and revenues in the model FD when the information misrepresentation factor changes. As shown in Fig. 10a–c, the optimal wholesale price of new product, retail price of remanufactured product and revenue of third party change equally as manufacturer's misrepresentation factor for unit manufacturing cost information, while the optimal retail price of new product and revenues of manufacturer and retailer change in the opposite direction. When \(i < \frac{b}{2a}\), the manufacturer's misrepresentation factor for unit manufacturing cost information decreases, the reliability increases, and the optimal revenues of manufacturer and retailer increases; the optimal revenue of third party decreases, mainly because the optimal retail price of remanufactured product reduces, while the revenue margin of third party per unit of product decreases. As shown in Fig. 10d–f, the optimal retail price of the new product and revenue of retailer change equally as the manufacturer's misrepresentation factor for unit remanufacturing cost information, while optimal prices of the remanufactured product, revenues of manufacturer and third party change oppositely. When \(j < \frac{z}{2k}\), the manufacturer's misrepresentation factor for unit remanufacturing cost information decreases, the reliability increases, and the optimal revenues of manufacturer and third party enhances; the optimal revenue of retailer reduces, mainly because the optimal retail price of new product decreases, thus the revenue of retailer per unit of product decreases. The adoption of FL platform can promote information sharing among FL-CLSC members, mainly because the manufacturer, as the dominant player and information controller, will increase its optimal revenue with the increase of information reliability, i.e., misrepresentation of cost information will lead to its own revenue loss, so it will take the initiative to provide the true information it has. Figure 10 is consistent with Proposition 9 above.

Figure 11a–i are obtained according to formulas (34), (35), (36), (37), (40), (41), and (42), respectively. From Fig. 11a–c, we find that in the decentralized decision-making using federated learning, the optimal prices hike up with the improvement in unit investment cost for the manufacturer, and the revenue of each FL-CLSC member decreases, which may be caused by the impact of the reduction in demand that exceeds the improvement in price. From Fig. 11d–f, it is apparent that in the decentralized decision-making using federated learning, the optimal retail prices and revenue of the third party improve with the increasing investment cost for the retailer, and the optimal wholesale price of the new product and revenues of the manufacturer and retailer reduce. As to the third party, the increasing investment cost for the retailer raises the optimal retail price of remanufactured product, thus the third party can profit from it. For both the manufacturer and retailer, the effect of the rising optimal retail price of new product is weaker than the impact of reduced market demand. As Fig. 11g–i show, in the decentralized decision-making using federated learning, the optimal retail price of new product and optimal revenue of retailer hike up with the improving investment cost for the third party, and the optimal wholesale price of remanufactured product and revenues of manufacturer and third party reduce. For the retailer, the increasing investment cost for the third party raises the optimal retail price of the new product, thus the retailer can revenue from it. For both the manufacturer and third party, an enhancement in optimal retail price of the remanufactured product is weaker than lower market demand. Figure 11 is consistent with Proposition 10 above.

According to formulas (44), (45) and (48), Fig. 12a, b could be acquired, respectively. Figure 12 displays the variation tendency of the optimal decision and revenue in model FC when the consumers' recognition of the remanufactured product changes. Just like we can see in Fig. 12, the optimal retail price of remanufactured product and optimal revenue of the FL-CLSC system change in the same direction as the consumers' recognition of the remanufactured product, and the new product is not affected. Therefore, in the centralized decision-making, the FL-CLSC system should also focus on improving consumers' recognition of the remanufactured product. Accordingly, Fig. 12 is consistent with Proposition 11 above.

According to formulas (44), (45) and (48), Fig. 13a–b are obtained, respectively. Figure 13 reveals the trend of optimal decision and revenue in the model FC when the degree of consumer information security changes. As shown in Fig. 13, the optimal retail prices and revenue of FL-CLSC system change in the same direction as the degree of consumer information security. Combined with the above analysis, it is found that it is profitable for all participants in the CLSC system to improve consumer information security, regardless of whether the FL platform is adopted or whether decentralized or centralized decision-making is made. Figure 13 is consistent with Proposition 12 above.

According to formulas (44), (45) and (48), respectively, Fig. 14a–d are obtained, and Fig. 14 reveals the trend of optimal decision and revenue in the model FC when the information misrepresentation factor changes. As shown in Fig. 14a, b, the optimal retail price of new product varies equally as the misrepresentation factor for unit manufacturing cost information, while the remanufactured product is impervious, and the optimal revenue of FL-CLSC system varies inversely with it. When \(i < \frac{b}{2a}\), the manufacturer's misrepresentation factor for unit manufacturing cost information decreases, the reliability enhances, the optimal sales price of new product reduces, while the optimal revenue of FL-CLSC system improves, mainly because the impact of the reduced optimal retail price of new product is weaker than the impact of rising market demand. As we can see in Fig. 14c, d, the optimal retail price of remanufactured product and revenue of FL-CLSC system vary inversely with the manufacturer's misrepresentation factor for unit remanufacturing cost information. Besides, the optimal retail price of new product is impervious to it. When \(j < \frac{z}{2k}\), the manufacturer's misrepresentation factor for unit remanufacturing cost information reduces, the reliability enhances, and the optimal retail price of the remanufactured product and revenue of FL-CLSC system increase, mainly because the influence of the increase in optimal retail price of remanufactured product is weaker than the influence of reduction in market demand. The adoption of FL platform can promote information sharing in the FL-CLSC system, mainly because the optimal revenue of the FL-CLSC system will improve with the increase of information reliability. Figure 14 shows no difference with Proposition 13 above.

Figure 15a–f can be obtained according to formulas (44), (45) and (48), respectively. From Fig. 15a, b, it is obvious that in the centralized decision-making using federated learning, the optimal retail prices increase with the increase in the unit investment cost for the manufacturer while the optimal revenue of FL-CLSC system decreases, which may be caused by the fact that the impact of the reduction in demand exceeds the impact of the improvement in price. From Fig. 15c, d, it is obvious that in the centralized decision-making using federated learning, the optimal retail price of the new product increases with increasing investment cost for retailer, while the remanufactured product is no interaction with it, and the optimal revenue of FL-CLSC system decreases, which may be caused by the fact that the impact of the enhancement of the optimal retail price of new product is weaker than the impact of the decrease of market demand. As can be seen from Fig. 15e, f, under the condition of centralized decision-making using federated learning, the optimal retail price of remanufactured product increases accompanied by increased unit investment cost for third party, while the new product changes no allowance for it, and the optimal revenue of FL-CLSC system decreases, which may be based on the reality that the improvement of the optimal retail price of remanufactured product is weaker than reduced market demand. Figure 15 is consistent with Proposition 14 above.

6 Conclusions

The study probes a CLSC system including one manufacturer, one retailer, and one third party. Taking the manufacturer as the dominant firm, we construct four models, ND, NC, FD, and FC, calculate and analyze the effects of the application of FL platform on decisions and revenues of CLSC under decentralized and centralized decision-making game models, give investment decision conditions and contractual incentives for the CLSC members to use the FL platform, and verify and analyze optimal outcome of the models with the help of numerical simulations. This article shows that (1) Consumers' recognition of the remanufactured product varies in line with revenues of the manufacturer, third party and system, while in the opposite direction to the optimal revenue of the retailer. (2) Adopting the FL platform can enhance the protection of consumer information security, which is conducive to improving the optimal revenues of each CLSC member and the CLSC as a whole. (3) When FL platform is not adopted, the manufacturing cost information reliability varies inversely with optimal revenues of manufacturer, retailer and T-CLSC system; the remanufacturing cost information reliability changes inversely with optimal revenues of manufacturer, third party, and T-CLSC system, i.e., misrepresenting cost information can benefit the CLSC members who produce or sell the product. (4) The adoption of FL platform can improve the information processing efficiency to a certain extent. At this time, manufacturing cost information reliability changes positively with the optimal revenues of manufacturer, retailer and FL-CLSC system; remanufacturing cost information reliability varies positively with the optimal revenues of manufacturer, third party, FL-CLSC system. However, when the amount of information exceeds the processing power of federated learning, the speed of information processing slows down, energy consumption increases, and efficiency decreases. (5) Adopting FL platform requires CLSC members to invest capital, and the investment cost of each member tends to vary inversely with its revenue and that of the overall system. (6) Only when the FL investment costs satisfy certain conditions, the employment of FL platform is conducive for FL-CLSC members to obtain revenues not less than T-CLSC, i.e., it is feasible for CLSC members to invest FL platform. (7) The cost-sharing and revenue-sharing coefficients must satisfy certain conditions in order to improve the revenues of FL-CLSC members after coordination, i.e., the CSRS contract is able to attain system coordination under these conditions.

After studying decisions and coordination of T-CLSC and FL-CLSC, the following management insights are drawn: (1) The higher consumers' recognition of remanufactured product, the more favorable production and sales of remanufactured product. The manufacturer and third party can actively take measures such as brand construction and product assurance to improve public recognition of remanufactured products, thus gaining more revenues while taking corporate social responsibility. (2) The degree of consumer information security has a favorable influence on the CLSC, and it is important for CLSC members to take this as an important base for promoting supply chain development, and this paper has verified the positive role of federated learning in this regard. Besides, the government needs to establish a sound network regulation mechanism based on the existing government network regulation work so that government regulation can be more standardized and efficient. Indirectly, the government can also support the development and application of artificial intelligence technologies, such as federated learning, to create the technological cornerstone of information protection for enterprises. (3) Information asymmetry may interfere with decision-making of CLSC members, even restrict the healthy and sustainable advancement of CLSC. The application of federated learning may be one of the effective ways to deal with the problem, which can improve the revenue of CLSC members to a certain extent, motivate CLSC members to share true cost information, improve information reliability and trust relationship between each other, and promote long-term cooperation among all parties. (4) If the CLSC members have a desire to improve information reliability and security through federated learning and ameliorate the whole situation of the CLSC. They should clarify the cost of their own investment in using FL platform, so as to make the right investment decision. If investment costs are higher than additional revenues, CLSC members have no incentive to invest. At this time, the government can encourage CLSC members to adopt FL platform by providing subsidies in the early stage of implementation. (5) If supply chain members only pursue to maximize their own revenues, they might damage the revenues of other CLSC members, or even trigger malicious concealment among members and force the supply chain to be interrupted. The CSRS contract is able to act as an internal motivation mechanism of CLSC to encourage system members to invest in using FL platform, achieve overall FL-CLSC coordination and maximize revenues of FL-CLSC members, and to help FL-CLSC members establish strategic partnerships to maintain the smooth operation of the system.