Abstract

Based on the increasingly popular practice background of corporate mergers and acquisitions (M&A), the feasibility of M&A strategy is studied in the closed-loop supply chain (CLSC) in combination with the different financial strength of competing manufacturers. By constructing a game model in CLSC under three modes of the decentralized decision-making with well-capitalized manufacturers, the decentralized decision-making with a capital-constrained manufacturers and the M&A between competing manufacturers, the paper analyzes the influence of bank loan interest rate and M&A coefficient on the optimal decision and revenue to calculate the conditions that competing manufacturers need to meet to implement the M&A strategy. It finds that: firstly, with the increase of bank loan interest rate, the capital-constrained manufacturers will increase the wholesale price to obtain higher returns, and meanwhile reduce the recycling rate of old products to reduce the capital investment, but the well-capitalized manufacturers will also lower wholesale prices, but they will increase the recycling rate of old products to reduce production costs. Secondly, with the increase in bank interest rates, the revenue of capital-constrained manufacturers decreases, while the well-capitalized manufacturers increase. Thirdly, when competing manufacturers can increase market power or improve core production technology to reduce costs after mergers and acquisitions, they will increase the recycling of old products and reduce the wholesale price of products to gain more market share. Moreover, the better performance of the M&A strategy, the higher the benefits of closed-loop supply chain members will be. Finally, whether manufacturers are capital constrained or not, the M&A strategy are not always beneficial to the manufacturers. And whether the M&A strategy is beneficial or not is related to market demand parameters, recovery cost parameters and merger coefficient. But when these parameters meet certain conditions, the competitive manufacturer’s M&A strategy can benefit all members of the closed-loop supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, M&A activities among companies have become increasingly popular. According to a report by Pricewater-house Coopers, the number of Chinese corporate M&A transactions in 2016 was 11,409 transactions, an increase of 21% over 2015 and 2012 (4116 transactions) nearly three times. The value of M&A transactions in China increased by 313% to $770 billion, almost 4.1 times the record at the end of 2012, with more than 51 deals worth more than $1 billion, more than double the previous record (Lan et al. 2018). Mergers and acquisitions have also begun among some manufacturing companies in the closed-loop supply chain. In order to reduce manufacturing costs and minimize the influence of economic activities on the natural environment, many companies such as Hewlett-Packard, IBM, Kodak and Caterpillar have started to recycle and re-manufacture used products and adopt a closed-loop supply chain operation model. However, due to the low recognition of re-manufactured products by consumers, the lack of market-oriented operation for the recycling of old products, and the immature key technologies of re-manufacturing, manufacturing enterprises that carry out re-manufacturing activities face many challenges. Some re-manufacturing companies hope to break through the predicament through horizontal mergers and acquisitions with competitors. For example, in 2004, the re-manufacturing company Caterpillar completed the merger of three re-manufacturing companies including Wealdstone Engineering Company. In 2006, Caterpillar acquired Progress Rail, the largest railway equipment re-manufacturer in North America, in 2019, ATC Powertrain, an independent re-manufacturer of automotive power-train components in the United States, acquired European ATP Automotive Transmission Remanufacturing Co., Ltd. Some empirical research reports show that many companies have gained positive returns after mergers and acquisitions. For example, the horizontal merger between Baosteel and Wuhan Iron and Steel has been successful and benefited both parties. However, mergers and acquisitions between companies do not always achieve their desired goals, such as Lenovo’s 2014 acquisition of Motorola’s mobility business, which failed to achieve profit growth and lost $469 million. Then, can the merger between re-manufacturing enterprises in the closed-loop supply chain solve the dilemma of the enterprise, and under what circumstances can both parties benefit from the merger, and what impact will it have on the supply chain members?

In addition, there have been many achievements in the research on closed-loop supply chain management, and scholars mostly focus on information flow (how to establish various information mechanisms to realize the coordination of supply chain operations) (Zheng et al. 2017; De Giovanni 2017) and logistics (how to Obtaining a competitive advantage through a low-cost and high-efficiency logistics distribution system) (Kin et al. 2018; Jerbia et al. 2018), it is usually assumed that the capital flow is sufficient. In fact, compared with the forward supply chain, the closed-loop supply chain needs to achieve a closed-loop in both channel design and technology, which requires high initial construction costs. Therefore, manufacturers in the closed-loop supply chain (especially for small and medium-sized enterprises) usually face capital constraints (Wang and Zhang 2017). Considering the positive impact of circular economy on social sustainable development, many countries and regions will take various measures to provide government incentives to encourage more manufacturers to implement closed-loop supply chains. For example, in 2011, China’s National Development and Reform Commission issued a “Notice on Deepening the Pilot Work of Re-manufacturing” points out that the re-manufacturing enterprises included in the national pilot units will be given diversified credit support including credit loans. So when a manufacturer is constrained by capital, which strategy is more beneficial to the closed-loop supply chain and its members, applying for credit loans and seeking capital-sufficient manufacturers for horizontal mergers and acquisitions?

There are two main research literatures related to this paper: (1) corporate mergers and acquisitions, (2) capital-constrained closed-loop supply chain. On the one hand, more scholars have begun to study the vertical and horizontal mergers and acquisitions of enterprises in the supply chain. Jensen and Ruback (1983), Schwert (1996), etc. conducted empirical research on the benefits before and after mergers and acquisitions; Shahrur (2005) shows that horizontal mergers in the supply chain can greatly improve the returns to merged companies and upstream suppliers. Avinadav et al. (2017) showed that when supply chain members have risk-averse characteristics, compared with forward and backward acquisitions, mergers and acquisitions generate higher expected utility and higher product quality for both parties, however, it may be beneficial for consumers bring higher prices; Zhu et al. (2016) studied the impact of upstream and downstream mergers and acquisitions on supply chain members, and the results show that due to market power effects, upstream mergers are more harmful to consumers and society as a whole than downstream mergers; Lan et al. (2018) considered a supply chain with two capital-constrained retailers and suppliers, and discussed different M&A strategies; Yuan et al. (2020) studied the impact of output uncertainty on corporate M&A. However, the above researches are all carried out on the basis of supply chain, and none of them involve relevant researches on mergers and acquisitions in closed-loop supply chains. On the other hand, in recent years, domestic and foreign scholars have published a lot of research literature on capital-constrained supply chains, such as Wu et al. (2019), Li et al. (2018), Huang and Fan (2020), Shen and Shao (2020) to study the production operation and financing strategies under the financial constraints of members of the supply chain. However, there are few studies considering capital constraints in closed-loop supply chains. Wang and Chen (2017) studied the production decisions and financing strategies of capital-constrained remanufacturers. On this basis, Wang et al. (2017a, b) further considered capital under carbon emissions trading. Constrained remanufacturers’ production decisions, while Wang and Zhang (2017) compared capital-constrained remanufacturers’ production strategies under three different recycling modes based on differentiated needs. Liu et al. (2019) based on members’ risk attitudes, study the pricing and recycling decisions of the closed-loop supply chain constrained by the manufacturer’s funds, You et al. (2020), Ding et al. (2018) studied the financing strategy of the closed-loop supply chain under the financial constraints of the recycler.

The main contributions of the paper are as follows: first, different from the above literature, the paper takes the characteristic of manufacturers constrained by funds into consideration and studies the remanufacturer’s optimal decision of seeking manufacturers’ mergers and acquisitions on the closed-loop supply chain Second, the optimal price and recovery decision of the supply chain have been contrastively analyzed under three scenarios: a competitive manufacturer’s decentralized decision-making with sufficient funds, a capital-constrained manufacturer’s decentralized decision-making when applying for bank loans, and a competitive manufacturer’s merger and acquisition. Third, the conditions that the competing manufacturers need to meet for the M&A strategy has been analyzed through the comparison of the optimal decision in different situations and the profits of the members of the supply chain.

2 Problem description and assumptions

2.1 Problem description

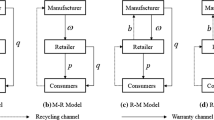

Consider a closed-loop supply chain consisting of two competing manufacturers \(M_{{1}}\) and \(M_{{2}}\) producing substitutable products and a retailer \(R\), where both manufacturers recycle old products to produce re-manufactured products. Two manufacturers can avoid competition and create higher profits through mergers and acquisitions. In order to analyze the advantages and disadvantages of mergers and acquisitions strategies, from the practical situation, this paper considers the two situations of manufacturers’ sufficient funds and financial constraints and the merger strategy. Based on the comparative analysis of optimal decision-making and supply chain profits, a model of sufficient funds of competitive manufacturers \(S\), a model of financial constraints of competitive manufacturers \(B\), and a model of mergers and acquisitions of competitive manufacturers \(M\) are constructed. When the manufacturer’s capital is constrained, it is assumed that the manufacturer borrows from the bank to produce, and the bank’s loan interest rate is \(i_{b}\). To simplify the study, assume that two manufacturers have the same production technology and production costs, that is to say, the cost of producing a new product is \(c_{m}\), and the cost of producing a re-manufactured product is \(c_{r}\).

2.2 Basic assumptions

The definition of related parameters and the differential game model is formulated under the following assumptions:

Assumption 1

Similar to Wang et al. (2017a, b), Wu and Zhou (2017) and other studies assume that the production of re-manufactured products can save costs, that is \(c_{r} < c_{m}\), as \(\Delta = c_{m} - c_{r}\) and the quality and functions of re-manufactured products and new products are exactly the same, there is no difference in price.

Assumption 2

The manufacturer’s recovery rate for used products is \(\tau_{i} \in [0,1],\;i = 1,2\), similar to Raz and Souza (2018) and other studies assuming that the total convex investment cost of recycling used products is \(C_{I} \tau_{i}^{2} /2,\;i = 1,2\). Since the investment scale parameter is relatively cost-saving relative to the re-manufacturing unit, the assumption \(C_{I} \ge {{\alpha \Delta^{{2}} } \mathord{\left/ {\vphantom {{\alpha \Delta^{{2}} } {{4}c_{m} }}} \right. \kern-\nulldelimiterspace} {{4}c_{m} }}\) is true, then the manufacturing \(M_{i}\) average cost of production for a trader is \(c_{i} = \tau_{i} c_{r} + (1 - \tau_{i} )c_{m} ,\;i = 1,2.\)

Assumption 3

The wholesale price of the product produced by the manufacturer \(M_{i}\) to the retailer is \(w_{i} ,\;i = 1,2\), and the retail price of the retailer sold to the consumer is \(p_{i} ,\;i = 1,2\), so the demand functions for two competing products are \(q_{1} = \alpha (1 - \mu ) - \beta p_{1} + \gamma p_{2}\), \(q_{2} = \alpha \mu - \beta p_{2} + \gamma p_{1}\) (Yang et al. 2019; Shang et al. 2016). Among them, \(q_{i} ,\;i = 1,2\) is the product demand of the \(i\) product, \(\alpha > 0\) is the potential market demand, \(\beta > 0\) is the sensitivity coefficient of market demand to price, \(\gamma > 0\) is the competition coefficient of the two products, and \(\mu \in [0,1]\) is the market share of the manufacturer’s \(M_{2}\) product, without loss of general assumptions as \(\mu = 0.5.\)

Assumption 4

The optimal price and recycling decision under different models are denoted \(()_{j}^{k}\), and the profit of the supply chain and its members is denoted \(\pi_{j}^{k} ,\;j \in \{ SC,M_{1} ,M_{2} ,R\} ,\;k \in \{ S,B,M\}\), in which the superscript \(k\) represents different models, and the subscript \(j\) represents different subjects, \(SC,\;M_{1} ,\;M_{2} ,\;R\) representing supply chain, manufacturer \(M_{1}\), manufacturer \(M_{2}\), retailer \(R\) respectively.

3 Model solution and analysis

3.1 Decentralized decision-making scenario with well-funded manufacturers (mode “S”)

In the model \(S\), the funds of the two competing manufacturers are sufficient. The manufacturer and the retailer constitute the Stackelberg game model. The two manufacturers are the leaders of the game, and the retailers are the followers of the game. etc. to make price and recycling decisions at the same time. Therefore, the decision sequence of the model \(S\) is: first, the manufacturer \(M_{{1}}\) and the manufacturer \(M_{{2}}\) each determine the wholesale price and recovery rate, and secondly, based on the decisions of the two manufacturers, the retailer determines the retail price of both products. According to the description of the above problem, the profit functions of manufacturers \(M_{i}\) and retailer are as follows:

According to the principle of profit maximization, the following theorems can be obtained by solving Eqs. (1) and (2) by reverse induction.

Theorem 1

-

(1)

In a closed-loop supply chain, when competing manufacturers are well-funded, two manufacturers have the same wholesale price \(\tau_{1}^{S}\) and \(\tau_{2}^{S}\) recovery rate:

$$\tau_{1}^{S} = \tau_{2}^{S} = \frac{{\Delta \beta (( - \gamma + \beta )c_{m} - 0.5\alpha )}}{{\beta^{2} \Delta^{2} - (\Delta^{2} \gamma + 4C_{I} )\beta + 2\gamma C_{I} }}$$ -

(2)

In a closed-loop supply chain, when competing manufacturers are well-funded, two manufacturers have the same recovery rate \(w_{1}^{S}\) and \(w_{2}^{S}\) :

$$w_{1}^{S} = w_{2}^{S} = \frac{{0.5\Delta^{2} \alpha \beta - 2\beta C_{I} c_{m} - \alpha C_{I} }}{{\beta^{2} \Delta^{2} - (\Delta^{2} \gamma + 4C_{I} )\beta + 2\gamma C_{I} }}$$ -

(3)

The retailer’s retail price for both products \(p_{1}^{S}\) and \(p_{2}^{S}\) is also the same:

$$p_{1}^{S} = p_{2}^{S} = \frac{{(\gamma - \beta )w_{1}^{S} - 0.5\alpha }}{2(\gamma - \beta )}$$

From Theorem 1, when two manufacturers are well-funded, the optimal price and recycling decisions of the supply chain are related to market demand parameters and the total investment in recycling old products. Furthermore, since both manufacturers have the same production costs, market power is balanced, and both manufacturers have the same wholesale prices and recycling decisions, the retailer will also sell both products at the same price. Through the wholesale price, recovery rate and retail price of the two products, the demand for the two products can be further obtained:

where the formula (3) should meet the conditions \(n_{2} = \beta^{2} \Delta^{2} - \Delta^{2} \beta \gamma - 4C_{I} \beta + 2C_{I} \gamma < 0\), \(n_{3} = \Delta \beta (( - \gamma + \beta )c_{m} - 0.5\alpha ) < 0\), \(n_{4} \le 0.\)

So the profit function of a supply chain member is:

3.2 Decentralized decision-making scenario of applying for bank loans with financial constraints of manufacturers (mode “B”)

In the model \(B\), two competing manufacturers have one manufacturer with limited capital. Without loss of generality, it is assumed that the manufacturer \(M_{{2}}\) has limited capital. To simplify the calculation, it is assumed that the initial capital of the manufacturer \(M_{{2}}\) is zero. Due to the government’s credit support for re-manufacturing, usually manufacturing \(M_{{2}}\) can obtain funds for production through bank loans, assuming that the bank’s risk-free loan interest rate is \(i_{b}\). The Stackelberg game model is formed between the manufacturer and the retailer. The two manufacturers are the leaders of the game, and the retailer is the follower of the game. The two manufacturers have equal power to make price and recycling decisions at the same time. Therefore, the decision order of the model \(B\) is consistent with the model \(S\). According to the description of the above problem, the profit functions of the manufacturer \(M_{1}\), the manufacturer \(M_{2}\) and the retailer are as follows:

According to the principle of profit maximization, the following theorems can be obtained by solving Eqs. (6), (7) and (8) by reverse induction.

Theorem 2

-

(1)

In a closed-loop supply chain, when one of the competing manufacturers has limited funds, the optimal wholesale price \(\tau_{1}^{B}\) and recovery rate \(w_{1}^{B}\) for a well-funded manufacturer is:

$$\tau_{1}^{B} = \frac{{(n_{3} \Delta (\beta + \gamma ) + 2C_{I} \gamma \beta c_{m} )\Delta \beta i_{b} + n_{1} n_{3} }}{{\Delta^{2} \beta n_{5} i_{b} + n_{1} n_{2} }},$$$$w_{1}^{B} = \frac{{(\beta (\beta + \gamma )\Delta^{2} (\Delta^{2} \beta 0.5\alpha - 2C_{I} (0.5\alpha + \beta c_{m} )) + 4\beta \gamma c_{m} C_{I}^{2} )i_{b} + n_{1} n_{4} }}{{\Delta^{2} \beta n_{5} i_{b} + n_{1} n_{2} }}$$ -

(2)

Optimal wholesale prices \(\tau_{2}^{B}\) and recovery rates \(w_{2}^{B}\) for manufacturers with limited capital:

$$\tau_{2}^{B} = \frac{{\Delta \beta c_{m} n_{5} i_{b} + n_{1} n_{3} }}{{\Delta^{2} \beta n_{5} i_{b} + n_{1} n_{2} }},\;w_{2}^{B} = \frac{{((0.5\Delta^{2} \alpha - 2C_{I} c_{m} )\beta^{2} (\Delta^{2} (\beta + \gamma ) - 4C_{I} ) - \Delta^{2} \alpha \gamma \beta C_{I} )i_{b} + n_{1} n_{4} }}{{\Delta^{2} \beta n_{5} i_{b} + n_{1} n_{2} }}$$ -

(3)

The retailer’s retail price for both products \(p_{1}^{B}\) and \(p_{2}^{B}\) are as follows:

$$p_{1}^{B} = \frac{{(\gamma - \beta )w_{1}^{B} - 0.5\alpha }}{2(\gamma - \beta )},\;p_{2}^{B} = \frac{{(\gamma - \beta )w_{2}^{B} - 0.5\alpha }}{2(\gamma - \beta )}$$where \(n_{1} = \beta^{2} \Delta^{2} + \Delta^{2} \beta \gamma - 4C_{I} \beta - 2C_{I} \gamma < 0,\) \(n_{2} = \beta^{2} \Delta^{2} - \Delta^{2} \beta \gamma - 4C_{I} \beta + 2C_{I} \gamma < 0,\)

\(n_{3} = \Delta \beta (( - \gamma + \beta )c_{m} - 0.5\alpha ) < 0,\) \(n_{4} = {0}{\text{.5}}\Delta^{2} \alpha \beta - 2\beta C_{I} c_{m} - \alpha C_{I} < 0,\) \(n_{5} = \beta^{3} \Delta^{2} - \Delta^{2} \beta \gamma^{2} - 4C_{I} \beta^{2} + 2C_{I} \gamma^{2} < 0.\)

It can be seen from Theorem 2 that, unlike Theorem 1, since the manufacturer’s \(M_{2}\) funds are limited and can only be produced by applying for bank loans, the optimal price and recovery decision of the supply chain is also related to the bank’s loan interest rate, and because the two manufacturers The capital asymmetry of the two manufacturers is no longer the same at this time, and the specific relationship is shown in Corollary 1 below.

Corollary 1

The optimal price and recycling decisions of competing manufacturers satisfy: \(\tau_{1}^{B} \ge \tau_{2}^{B} ,\) \(w_{1}^{B} \le w_{2}^{B} .\)

Proof

It can be solved by Theorem 2, it can obtained that \(\tau_{1}^{B} - \tau_{2}^{B} > 0,\) \(w_{1}^{B} - w_{2}^{B} < 0.\)

Different from the competing manufacturers in the model \(S\) will set the same price and recycling decisions. From Corollary 1, in the model \(B\), due to the large initial investment cost of recycling old products, in the case of limited funds, manufacturers \(M_{2}\) will reduce the cost of old products. The investment in product recycling thus reduces the recycling rate for the old product, making the recycling rate of the old product less than the recovery rate of the manufacturer \(M_{1}\). In this case, the manufacturer \(M_{2}\) also earns higher profits by increasing the wholesale price so that the wholesale price is greater than the manufacturer’s \(M_{1}\) wholesale price.

Corollary 2

The impact of bank loan interest rates on optimal price and recovery decisions in closed-loop supply chains is as follows:

\(\frac{{\partial \tau_{1}^{B} }}{{\partial i_{b} }} \ge {0,}\;\frac{{\partial \tau_{2}^{B} }}{{\partial i_{b} }} \le {0,}\;\frac{{\partial w_{1}^{B} }}{{\partial i_{b} }} \ge {0},\;\frac{{\partial w_{{2}}^{B} }}{{\partial i_{b} }} \ge {0},\;\frac{{\partial p_{1}^{B} }}{{\partial i_{b} }} \ge {0},\;\frac{{\partial p_{{2}}^{B} }}{{\partial i_{b} }} \ge {0}{\text{.}}\)

Proof

The optimal decision in Theorem 2 can be derived with respect to \(i_{b}\).

It can be seen from Corollary 2 that when the manufacturer \(M_{2}\) has limited funds, as the bank loan interest rate \(i_{b}\) increases, the manufacturer’s \(M_{2}\) financing cost increases. At this time, the cost of recycling old products that require a larger initial capital investment will be greater, so he will lower the recycling rate of old products and gain higher yields by increasing the wholesale price of the product, while the manufacturer \(M_{{1}}\) as a competitor will also increase the wholesale price at this time, resulting in an increase in the retail price of both products. It is worth noting that, contrary to the intuitive feeling, the manufacturer \(M_{{1}}\) will increase the recycling rate of the old product at this time. This is because as the financing cost increases and the product selling price increases, the sales volume of both products will decrease. In order to increase revenue, the manufacturer \(M_{{1}}\) will reduce production costs as much as possible. Since he has sufficient capital, he will increase the recycling rate of old products to reduce average production costs. Thus, as the financing cost of capital-constrained manufacturers increases, competing manufacturers take the same trend of price decisions, but due to different decision motives (financially constrained manufacturers aim to reduce investment, while well-funded manufacturers aim to for maximum profit) will have the opposite trend of recycling decisions.

In addition, the model \(S\) of manufacturer’s capital adequacy is equivalent to the model \(B\) of bank loan interest rate \(i_{b} = 0\), so further from Corollary 2 we can get:

Corollary 3

The optimal price and recovery decisions when the manufacturer has sufficient funds and when the manufacturer has limited funds and apply for a bank loan are compared as follows: \(\tau_{2}^{B} \le \tau_{2}^{S} = \tau_{1}^{S} \le \tau_{1}^{B} ,\) \(w_{1}^{B} \ge w_{1}^{S} ,\) \(w_{2}^{B} \ge w_{2}^{S} ,\) \(p_{1}^{B} \ge p_{1}^{S} ,\) \(p_{2}^{B} \ge p_{2}^{S} .\)

It can be seen from Corollary 3 that, relative to the decentralized decision-making model with sufficient capital, when a competing manufacturer has a financial constraint, the manufacturer will set a higher wholesale price, which will eventually increase the retail price of the product, which is unfavorable to consumers. Through the wholesale price of the two products, the recovery rate and the retail price can further obtain the demand for the two products.

The profit function of retailer \(R\) is

The profit function of manufacturer \(M_{1}\) is

The profit function of manufacturer \(M_{2}\) is

where \(h_{1} = n_{3} \Delta (\beta + \gamma ) + 2C_{I} \beta \gamma c_{m} ,\) \(h_{2} = \beta (\beta + \gamma )\Delta^{2} (\Delta^{2} \beta 0.5\alpha - 2C_{I} (0.5\alpha + \beta c_{m} )) + 4\beta \gamma c_{m} C_{I}^{2} ,\) \(h_{3} = (0.5\Delta^{2} \alpha - 2C_{I} c_{m} )\beta^{2} (\Delta^{2} (\beta + \gamma ) - 4C_{I} ) - \Delta^{2} \alpha \gamma \beta C_{I} .\)

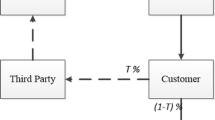

3.3 Competing manufacturer M&A scenario (mode “M”)

Competing manufacturers can avoid competition and increase the benefits of both parties through horizontal mergers and acquisitions. In the model \(M\), when the manufacturers are fully funded, mergers and acquisitions are mainly to avoid product competition and usually reduce production costs and improve core competitiveness. When one manufacturer is financially constrained, M&A also enables well-funded manufacturers to provide adequate capital for capital-constrained manufacturers. In addition, according to the research of Lan et al. (2018), horizontal mergers between enterprises with the same main business will generally lead to lower production costs, and the cost coefficient is represented by \(\eta\) (\(0 \le \eta \le 1\)). Mergers and acquisitions may have positive effects or negative effects. Positive effects will increase the market power of the company and ask for higher wholesale prices. Negative effects will reduce the market power of the company and set low wholesale prices. price, where the effect of mergers and acquisitions is represented by \(\phi (\phi > 0)\). When competing manufacturers merge, the two manufacturers act as a whole. As the leader of the Stackelberg game, they first decide the wholesale price \(w\) and recovery rate \(\tau\) of the product. After the profit is realized, the manufacturer’s \(M_{1}\) profit sharing ratio is \(\xi ,0 \le \xi \le 1\), the manufacturer’s \(M_{2}\) profit sharing ratio for \(1 - \xi\). The retailer sells the product at the price \(p\), then the market demand function for the product is \(q = \alpha - \beta p\). According to the description of the above problem, the profit functions of the manufacturer \(M_{1}\), the manufacturer \(M_{2}\) and the retailer are:

According to the principle of profit maximization, the following theorems can be obtained by solving Eqs. (13), (14) and (15) by reverse induction.

Theorem 3

-

(1)

In a closed-loop supply chain, when competing manufacturers make mergers and acquisitions, the manufacturer’s optimal wholesale price and recovery rate is:

$$\tau^{M} = \frac{{\Delta (\beta \eta c_{m} - \alpha \phi )}}{{\Delta^{2} \beta \eta - 4\phi C_{I} }},\;w^{M} = \frac{{\Delta^{2} \alpha \beta \eta - 2\beta \eta C_{I} c_{m} - 2\alpha \phi C_{I} }}{{(\Delta^{2} \beta \eta - 4\phi C_{I} )\beta }}$$ -

(2)

The retailer’s optimal retail price is

$$p^{M} = \frac{{\beta \eta (\Delta^{2} \alpha - C_{I} c_{m} ) - 3\alpha \phi C_{I} }}{{(\Delta^{2} \beta \eta - 4\phi C_{I} )\beta }}$$

It can be seen from Theorem 3 that, different from Theorems 1 and 2, in the case of mergers and acquisitions by competing manufacturers, the optimal price and recovery decisions are not only affected by the market demand parameters and production cost parameters, but also by the merger coefficient. The impact is as follows:

Corollary 4

The effect of the M&A coefficient \(\phi\) and \(\eta\) on the optimal price and recycling decision of the closed-loop supply chain is as follows:

-

(1)

\(\frac{{\partial \tau^{M} }}{\partial \phi } \ge 0,\) \(\frac{{\partial w^{M} }}{\partial \phi } \le 0,\) \(\frac{{\partial p^{M} }}{\partial \phi } \le 0;\) (2) \(\frac{{\partial \tau^{M} }}{\partial \eta } \le {0,}\) \(\frac{{\partial w^{M} }}{\partial \eta } \ge {0,}\) \(\frac{{\partial p^{M} }}{\partial \eta } \ge {0}{\text{.}}\)

Proof

Take the derivatives of the optimal decision in Theorem 3 with respect to \(\eta ,\phi\) respectively.

Corollary 4 shows that when competing manufacturers conduct mergers and acquisitions, if they can increase market power and have greater bargaining power (\(\phi\) bigger) or can improve core technology and reduce production costs (\(\eta\) smaller), they will increase their interest in the old. Product recycling, reducing the average production cost as much as possible, and reducing the wholesale price of the product to gain more market share is beneficial to consumers. On the contrary, if the merger of two manufacturers is not effective, they can only increase the product by increasing the product. price to increase revenue and reduce investment in old products and reduce recycling rates.

Further comparative analysis of Theorem 3, Theorem 1 and Theorem 2, the following inferences are established.

Corollary 5

The optimal price and recovery decisions when manufacturers are fully funded and manufacturers are M&A are compared as follows:

-

(1)

When \(t_{1} \le 0,\) \(\tau^{M} \le \tau_{1}^{S} = \tau_{2}^{S} ,\) 当 \(t_{1} \ge 0\) 时, \(\tau^{M} \ge \tau_{1}^{S} = \tau_{2}^{S} ;\)

-

(2)

When \(t_{2} \le 0,\) \(w^{M} \le w_{1}^{S} = w_{2}^{S} ,\) \(p^{M} \le p_{1}^{S} = p_{2}^{S} ,\) 当 \(t_{2} \ge 0\) 时, \(w^{M} \ge w_{1}^{S} = w_{2}^{S} ,\) \(p^{M} \ge p_{1}^{S} = p_{2}^{S} .\)

Specially, when \(\phi = \eta\), then \(\tau^{M} \ge \tau_{1}^{S} = \tau_{2}^{S} ,\) \(w^{M} \ge w_{1}^{S} = w_{2}^{S} ,\) \(p^{M} \ge p_{1}^{S} = p_{2}^{S} .\)

Where \(t_{1} = \Delta (\beta \eta c_{m} - \alpha \phi )n_{2} + (4\phi C_{I} - \Delta^{2} \beta \eta )n_{3} ,\) \(t_{2} = (\Delta^{2} \alpha \beta \eta - 2C_{I} (\beta \eta c_{m} + \alpha \phi ))n_{2} + (4\beta \phi C_{I} - \Delta^{2} \beta^{2} \eta )n_{4} .\)

Corollary 5 shows that the relationship between the optimal price and the recovery decision in the two situations of the manufacturer’s sufficient funds and the manufacturer’s merger is related to the production cost parameter, the market demand parameter, the reverse recovery parameter and the merger effect parameter. Under the parameters of reverse recycling and market demand, the price and recycling decision of supply chain members will be deviated according to the effect of mergers and acquisitions by competing manufacturers, and they may be able to obtain more by adopting lower wholesale prices than those with sufficient funds. The strategy of market share may also be more profitable than the strategy of adopting a higher wholesale price with sufficient funds, etc., which can prove the difference between the decentralized decision-making of the manufacturer’s capital constraints and the optimal price and recovery decision in the case of the manufacturer’s merger and acquisition. A similar conclusion is established for the size relationship. It is worth noting that, at that time \(\phi = \eta\), the negative impact of mergers and acquisitions (at this time \(\phi \le 1\)) and the advantages of cost reduction offset each other. At this time, the merger of competing manufacturers is equivalent to the centralized decision-making of two manufacturers to monopolize the market, so it will be more than decentralized. decision to adopt a higher price strategy and increase the recycling of old products. Through the wholesale price, recovery rate and retail price of the two products, the demand for the two products can be further obtained:

The profit function of a supply chain member is:

Comparing the profits of closed-loop supply chain members under different models, the following theorems are established.

Theorem 4

If the funds of the two manufacturers are sufficient, satisfying \(t_{3} > 0,\) the merger of the two competing manufacturers will always bring them higher profits, and if further \(t_{4} > 0\) is established, the retailers can also obtain higher profits at this time.

Where \(t_{3} = C_{I} (\alpha \phi - \beta \eta c_{m} )^{2} n_{2}^{2} \Delta - 2\beta (4\phi C_{I} - \Delta^{2} \beta \eta )n_{3} C_{I} (\Delta n_{3} - 2c_{m} n_{2} + 2n_{4} ),\) \(t_{4} = \Delta n_{2}^{2} (\beta - \gamma )C_{I}^{2} (\alpha \phi - \beta \eta c_{m} )^{2} - n_{3} C_{I} (0.5\alpha n_{2} - (\beta - \gamma )n_{4} )\beta (\Delta^{2} \beta \eta - 4\phi C_{I} )^{2} .\)

Proof

It can be seen from the calculation \(\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - (\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} )\) that at that time \(t_{1} > 0\), there are always two manufacturers whose sum of returns under the circumstance of sufficient capital dispersion is smaller than the sum of the returns under the merger of manufacturers, that is \(\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - \left( {\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} } \right) > 0.\) At this time, in the case of manufacturer mergers and acquisitions, \(\xi = {{(\eta (\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - (\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} )) + \pi_{{M_{1} }}^{S} )} \mathord{\left/ {\vphantom {{(\eta (\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - (\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} )) + \pi_{{M_{1} }}^{S} )} {(\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} )}}} \right. \kern-\nulldelimiterspace} {(\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} )}},\) then the manufacturer’s \(M_{1}\) profit is \(\pi_{{M_{1} }}^{M} = \xi (\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} ) = \eta (\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - (\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} )) + \pi_{{M_{1} }}^{S} ,\) and the manufacturer’s \(M_{2}\) profit is \(\pi_{{M_{1} }}^{M} = (1 - \xi )\left( {\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} } \right) = (1 - \eta )\left( {\pi_{{M_{1} }}^{M} + \pi_{{M_{2} }}^{M} - \left( {\pi_{{M_{1} }}^{S} + \pi_{{M_{2} }}^{S} } \right)} \right) + \pi_{{M_{2} }}^{S} ,\) where \(\eta\) is determined by the market power of both parties, obviously there is \(\pi_{{M_{1} }}^{M} \ge \pi_{{M_{1} }}^{S} ,\;\pi_{{M_{2} }}^{M} \ge \pi_{{M_{2} }}^{S} .\) In addition, seeking \(\pi_{R}^{M} - \pi_{R}^{S} ,\) at that time \(t_{2} > 0,\) \(\pi_{R}^{M} \ge \pi_{R}^{S}\) must have been established.

Similar to the proof of Theorem 4, the following theorems hold when the manufacturer’s capital is constrained.

Theorem 5

If one of the two manufacturers has limited funds, the merger of the two competing manufacturers will always bring them higher profits if \(t_{5} > 0\) is satisfied. If \(t_{6} > 0\) is established, the retailer can also obtain higher profits income.

Where,

Theorem 4 and Theorem 5 respectively give the conditions for the implementation of M&A strategies under the sufficient funds and capital constraints of competing manufacturers. Only when these conditions are met, will the M&A be profitable for competing manufacturers.

4 Numerical analysis

This section compares and analyzes the profits of supply chains and members under different models through numerical simulation. In order to make the results more accurate, two groups of values from Wu (2012) and Jena and Sarmah (2014) were selected for numerical simulation. The value in Wu (2012) is \(C_{I} = 5,\) \(\alpha = 25,\) \(\beta = 8,\) \(\gamma = 3,\) \(c_{m} = 1.5,\) \(c_{r} = 0.85\) and the conditions of Theorem 4 and Theorem 5 can always be satisfied within the reasonable range of values \(i_{b} ,\eta ,\phi\) at this time; the value in Jena and Sarmah (2014) is \(C_{I} = {2}000,\) \(\alpha = {2}00,\) \(\beta = 1,\) \(\gamma = 0.7,\) \(c_{m} = 100,\) \(c_{r} = 50,\) at this time, the conditions of Theorem 4 and Theorem 5 cannot be established. In addition, without loss of generality, the profit distribution ratio in the case of mergers and acquisitions is taken as \(\xi = 0.6\). In addition, for convenience of expression, when the parameter group \(C_{I} = 5\) to \(C_{I}\) be weighed is small, and the parameter group \(C_{I} = {2}000\) to \(C_{I}\) be weighed is large, the numerical simulation results are shown in Figs. 1, 2, 3.

4.1 The impact of changes in bank loan interest rates on the profits of closed-loop supply chain members under different modes

Figure 1 shows the impact of changes in bank loan interest rates \(i_{b}\) on the profits of closed-loop supply chain members under different modes, which are taken \(\phi = \eta = 1\) here. It can be seen from Fig. 1 that in the case of sufficient funds and mergers and acquisitions, the profits of supply chain members have nothing to do with the bank loan interest rate. In the case of bank loans, as the loan interest rate increases, the manufacturer’s \(M_{2}\) financing cost increases and the profit decreases. From Corollary 2, as competitor manufacturers \(M_{1}\) reduce costs by increasing the selling price of their products and increasing the recycling rate of used products, ultimately increasing their profits. Retailer profits also decrease as sales prices for both products increase and sales decrease.

4.2 The impact of changes in merger and acquisition coefficients on the profits of closed-loop supply chain members under different modes

Figure 2 shows the impact of changes in merger and acquisition coefficients \(\phi\) on the profits of closed-loop supply chain members under different modes, which are taken \(i_{b} = 0.05,\;\eta = 1\) here. As can be seen from Fig. 2, in the case of capital adequacy and bank loans, the profits of supply chain members have nothing to do with the M&A coefficient \(\phi\). In the M&A situation, as the M&A coefficient \(\phi\) increases, the competing manufacturers have better M&A effects, and they will take lower prices. Strategies to increase market share will increase recycling to reduce production costs, so manufacturers \(M_{1}\), manufacturers \(M_{2}\) and retailers will increase profits.

4.3 The impact of the change of M&A coefficient on the profits of closed-loop supply chain members under different modes

Figure 3 shows the impact of the change of M&A coefficient \(\eta\) on the profits of closed-loop supply chain members under different modes, which is taken \(i_{b} = 0.05,\;\phi = 1\) here. It can be seen from Fig. 3 that in the case of capital adequacy and bank loans, the profits of supply chain members have nothing to do with the merger coefficient \(\eta\). In the case of mergers and acquisitions, as the merger coefficient \(\eta\) increases, the cost advantage of competing manufacturers after mergers is smaller, so the profits of manufacturers \(M_{1}\), manufacturers \(M_{2}\) and retailers will decrease.

4.4 The comparative analysis of the profits of supply chain members under different modes

In addition, according to Figs. 1, 2, 3, the comparative analysis of the profits of supply chain members under different modes is as follows: (1) Compared with the situation where the manufacturer has sufficient funds, when the manufacturer’s capital is constrained to apply for a bank loan, the manufacturer \(M_{1}\) with sufficient capital will obtain higher returns, and the manufacturers \(M_{2}\) and retailers with capital constraints will obtain lower returns. Therefore, in the closed-loop supply chain where manufacturers compete, even if the market power and core technology level of the two manufacturers are exactly the same, sufficient capital flow Crucially, financial constraints reduce the profitability of both the manufacturer itself and the retailer. (2) No matter whether the manufacturer has financial constraints or not, the M&A of competing manufacturers is not always beneficial to the manufacturer. Whether the M&A strategy is beneficial is mainly related to market demand parameters, reverse supply chain recycling parameters and M&A coefficients. However, if the conditions of Theorem 4 in the case of sufficient capital or Theorem 5 in the case of capital constraints can be satisfied, the mergers and acquisitions of competing manufacturers will not only bring higher profits to the manufacturers, but also increase the profits of the retailers.

5 Conclusions and discussion

5.1 Conclusions

In the context of the increasingly popular practice of corporate mergers and acquisitions, combined with the different financial strengths of competing manufacturers, a closed-loop supply chain game is constructed in three situations: decentralized decision-making with sufficient funds for manufacturers, decentralized decision-making with limited funds for manufacturers, and mergers and acquisitions of competing manufacturers. The model analyzes the influence of bank loan interest rate and M&A coefficient on the optimal pricing decision and expected return, and compares the pricing, recovery decision and participant profit under the three models. The research conclusions are as follows: (1) When two competing manufacturers are evenly matched, that is, when the parameters such as production cost and market share are exactly the same, they will have the same price and recovery decision in the case of sufficient capital, but if one party has limited funds, it will be the same. otherwise. (2) If there is a manufacturer’s capital constraints, with the increase of bank loan interest rates, the capital-constrained manufacturers will increase the wholesale price to obtain higher returns, and at the same time will reduce the recycling of old products and reduce large investment; sufficient funds The manufacturer will also reduce the wholesale price, but since he has sufficient funds he will increase the recycling of old products and reduce the production cost, so as the bank interest rate increases, the profit of the gold-bound manufacturer decreases, and the profit of the well-funded manufacturer increases. (3) If competing manufacturers can increase market power or improve core production technology to reduce production costs after mergers and acquisitions, they will increase the recycling of old products and reduce wholesale prices of products to gain more market share, and after mergers and acquisitions, the better the performance, the higher the benefits of closed-loop supply chain members. (4) No matter whether the manufacturer has financial constraints or not, the merger of competing manufacturers is not always beneficial to the manufacturer. Whether the merger strategy is beneficial is mainly related to market demand parameters, reverse supply chain recovery parameters and merger coefficients. When these parameters are When certain conditions are met, mergers and acquisitions by competing manufacturers can benefit all members of the closed-loop supply chain.

5.2 Discussion

In the increasingly competitive market, manufacturers should fully consider the impact of internal and external factors, and make the optimal feedback strategy according to the changes of competitors’ financial strength, technical level and market demand. At the same time, in M&A activities, manufacturers should also fully consider the impact of supply chain characteristics and M&A coefficient when formulating the optimal wholesale price.

In the future, this paper can carry out extended research from the following two aspects: (1) This paper only considers the horizontal merger strategy between competing manufacturers in the closed-loop supply chain, and there are also cases of vertical mergers and acquisitions between manufacturers and retailers in the forward supply chain. Therefore, the comparative study of horizontal mergers and vertical mergers in closed-loop supply chains can be further discussed; (2) This paper assumes that the parameters of the two manufacturers, such as market share, production cost and recovery cost, are the same except for the capital cost, which can be released in the future. This assumption considers optimal strategies and impacts under different cost structures and market forces.

Availability of data and materials

Not applicable.

References

Avinadav, T., T. Chernonog, and Y. Perlman. 2017. Mergers and acquisitions between risk-averse parties. European Journal of Operational Research 259 (3): 926–934.

De Giovanni, P. 2017. Closed-loop supply chain coordination through incentives with asymmetric information. Annals of Operations Research 253 (1): 133–167.

Ding, S.F., H.M. Su, X.J. Wang, and P.P. Gao. 2018. Financing decision for closed loop supply chain with capital constraints. Computer Integrated Manufacturing Systems 24 (10): 2643–2650.

Huang, S., and Z.P. Fan. 2020. The purchasing and financing strategies of capital-constrained retailer under different channel. Chinese Journal of Management Science 28 (1): 79–88.

Jena, S.K., and S.P. Sarmah. 2014. Price competition and co-operation in a duopoly closed-loop supply chain. International Journal of Production Economics 156: 346–360.

Jensen, M.C., and R.S. Ruback. 1983. The market for corporate control. Journal of Financial Economics 11: 5–50.

Jerbia, R., M. Kchaou Boujelben, M.A. Sehli, et al. 2018. A stochastic closed-loop supply chain network design problem with multiple recovery options. Computers and Industrial Engineering 118 (February): 23–32.

Kin, C., Y. Zhou, and K. Hung. 2018. A dynamic equilibrium model of the oligopolistic closed-loop supply chain network under uncertain and time-dependent demands. Transportation Research Part E 118 (August): 325–354.

Lan, Y., H. Yan, D. Ren, et al. 2018. Merger strategies in a supply chain with asymmetric capital-constrained retailers upon market power dependent trade credit R. Omega 83: 1–20.

Li, B., S.M. An, and D.P. Song. 2018. Selection of financing strategies with a risk-averse supplier in a capital-constrained supply chain. Transportation Research Part E: Logistics and Transportation Review 118 (August): 163–183.

Liu, C.Y., T.H. You, and B.B. Cao. 2019. Pricing and recycling decisions of a closed-loop supply chain considering participators’ risk attitudes and manufacturer capital constraint. Control and Decision 12: 1–10.

Raz, G., and G.C. Souza. 2018. Recycling as a strategic supply source. Production and Operations Management 27 (5): 902–916.

Schwert, G.W. 1996. Markup pricing in mergers and acquisitions. Journal of Financial Economics 41: 153–192.

Shahrur, H. 2005. Industry structure and horizontal takeovers: Analysis of wealth effects on rivals, suppliers, and corporate customers. Journal of Financial Economics 76 (1): 61–98.

Shang, W., A.Y. Ha, and S. Tong. 2016. Information sharing in a supply chain with a common retailer information sharing in a supply chain with a common retailer. Management Science 62 (1): 245–263.

Shen, J.N., and X.F. Shao. 2020. Research on operational strategies for capital-constrained supply chains with yield random. Journal of Industrial Engineering and Engineering Management 34 (1): 210–222.

Wang, Y.J., and W.D. Chen. 2017. Integrated research on production and financing decisions of remanufacturing enterprise considering capital constraint. Journal of Industrial Engineering and Engineering Management 31 (4): 140–146.

Wang, Y.Y., and Y.Y. Zhang. 2017. Remanufacturer’s production strategy with capital constraint and differentiated demand. Journal of Intelligent Manufacturing 28 (4): 869–882.

Wang, W., L. Fan, P. Ma, et al. 2017a. Reward-penalty mechanism in a closed-loop supply chain with sequential manufacturers’ price competition. Journal of Cleaner Production 168: 118–130.

Wang, Y., W. Chen, and B. Liu. 2017b. Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. Journal of Cleaner Production 140: 1118–1128.

Wu, C. 2012. Production economics price and service competition between new and remanufactured products in a two-echelon supply chain. International Journal of Production Economics 140 (1): 496–507.

Wu, X., and Y. Zhou. 2017. The optimal reverse channel choice under supply chain competition. European Journal of Operational Research 259 (1): 63–66.

Wu, D.D., L. Yang, and D.L. Olson. 2019. Green supply chain management under capital constraint. International Journal of Production Economics 215 (August 2018): 3–10.

Yang, H., F. Sun, J. Chen, et al. 2019. Financing decisions in a supply chain with a capital-constrained manufacturer as new entrant. International Journal of Production Economics 216 (April): 321–332.

You T, Liu C, Cao B, Xueyan WU. 2020. Selection strategy of financing mode in manufacturer-led closed-loop supply chain with recycler capital constraint. Chinese Journal of Management 17 (1): 138–147.

Yuan, Z., F.Y. Chen, X. Yan, et al. 2020. Operational implications of yield uncertainty in mergers and acquisitions. International Journal of Production Economics 219: 248–258.

Zheng, B., C. Yang, J. Yang, et al. 2017. Pricing, collecting and contract design in a reverse supply chain with incomplete information. Computers & Industrial Engineering 111: 109–122.

Zhu, J., T. Boyaci, and S. Ray. 2016. Effects of upstream and downstream mergers on supply chain profitability. European Journal of Operational Research 249 (1): 131–143.

Acknowledgements

The authors gratefully acknowledged financial support from the National Natural Science Foundation of China (No. 72172112).

Funding

The National Natural Science Foundation of China (No. 72172112).

Author information

Authors and Affiliations

Contributions

JiW is responsible for the conceptualization, data curation and methodology. YD is responsible for the formal analysis, project administration, resources, software and funding acquisition. JuW is responsible for the Investigation. JiW and YD are responsible for the supervision, validation, visualization, roles/writing—original draft, writing—review and editing. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper. All authors have seen and approved the final version of the manuscript being submitted. They warrant that the article is the authors’ original work, hasn’t received prior publication and isn’t under consideration for publication elsewhere.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wang, J., Deng, Y. & Wang, J. Research on pricing and recycling decision of closed-loop supply chain under the mergers and acquisitions between competing manufacturers. MSE 1, 10 (2022). https://doi.org/10.1007/s44176-022-00009-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s44176-022-00009-w