Abstract

We propose a model for exploring the feasibility and effectiveness of a green transition from dirty to clean technologies. It relies on an evolutionary framework for the technology selection that accounts for the environmental domain dynamics, in terms of pollution evolution. A regulator charges an environmental tax to the producers, and the agents can choose between the less profitable clean technology and the more profitable dirty one, which, however, is taxed to a greater extent with respect to the clean one. The environmental tax depends endogenously on the level of pollution, which rises because of the producers’ emissions. The pollution stock also naturally decays, and can be abated by involving the resources collected from the taxation. We analytically study the resulting two-dimensional model from both statically and dynamically, to understand under what conditions the green transition can take place and results in an improvement for the environmental quality. We show that excessive over-taxation of the dirty technology may be not beneficial, as steady state pollution level can increase above a certain taxation threshold and multiple steady states can emerge. Moreover, dynamics can result in persistent endogenous oscillations that systematically lead to a significant increase in pollution levels. Finally, we discuss the economic rationale for the results also in the light of possible policy suggestions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Worldwide pollution and anthropogenic climate changes are two of the most dramatic and challenging issues of the beginning of the twenty-first century (Pörtner et al., 2022). Despite a number of already undertaken actions, as, for instance, the 2015 Paris Agreement in which 194 nations committed themselves to keep the increase in temperature below \(1.5\,{^{\circ }}\)C, this problem still seems very far to be consistently managed. A measure of the importance of this effort is evident in the yearly hosted United Nations (UN) Climate Change Conference of the Parties (COP); the aim of these meetings is “... to accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change”.Footnote 1 The ‘EU fit 55 package’ (Ovaere & Proost, 2022) is a further agreement aiming at reducing emissions in Europe by at least 55% before 2030 and achieving climate neutrality by 2050.

Global warming is becoming worse and worse on a yearly basis. Some authors (see, as an example, (Armstrong et al., 2022)) claim that the world is reaching a threshold temperature above which changes aiming at reverting the actual trend will be highly likely irreversible. As of 2022, it has been measured that the quantity of carbon dioxide (one of the main component of greenhouse gas and the one with the largest radiative forcing (Masson-Delmotte et al., 2021)) yearly emitted into the atmosphere has reached the enormous quantity of 50 gigatonnes.Footnote 2

If, on one hand, substantial improvements have been successfully achieved in terms of lead pollution (a remarkable example is the one regarding lead in gasoline that has been eliminated worldwide, being Algeria in 2021 the last country to comply with (Hannah & Max, 2022)), on the other plastic waste released into the oceans is still an open issue.

However, if we observe the scenarios realized in terms of pollution evolution through the years, we can ascertain substantial differences from country to country, with either increasing, decreasing or persistently oscillating pollutant levels (also comparing neighboring country, or with similar development levels, as reported e.g. in Menuet et al. (2020)), making the issue of planning effective strategies both compelling and complex. The relevant point to raise in order to tackle this worrisome outlook is how to enforce a “green transition” toward less polluting best practices. Fiscal policies are relevant, here (see chapter 5 in Adam et al. (2010)).

The theoretical economic literature regarding issues related to environmental quality and climate changes is vast, encompasses many research strands and is virtually impossible to summarize. We limit ourselves to mentioning the portion of contributions that studies the interaction between the environmental quality and economic growth (for surveys on earlier contributions we refer to Brock and Scott Taylor (2005); Xepapadeas (2005); Levin and Xepapadeas (2021)). In this regard, we make reference to seminal contribution by John and Pecchenino (1994), in which the conflict between economic growth and environmental sustainability is studied by taking into account an OLG economy. Here, the agent preferences depend both on consumption choices and on a dynamically evolving index of environmental quality. The same model has then been studied from the dynamical point of view by Zhang (1999), who showed that cyclical and chaotic trajectories are possible. Through years, the modelling approach in John and Pecchenino (1994) has been reconsidered and enriched; to provide just some examples, we recall the contributions by Seegmuller and Verchère (2004), in which the occurrence of endogenous fluctuations is again investigated, and Fodha and Seegmuller (2013), where the authors examine the effectiveness of policies to improve the quality of the environment through government debt. The main focus of this research stream is on macroeconomic issues. The interplay between economics and environment has been investigated from a micro perspective by Matsumoto and Szidarovszky (2020), and Matsumoto et al. (2022), Matsumoto et al. (2023), considering oligopolistic market structures.

The previous discussion should have made clear that the most appropriate setting to analyze technological transition problem is the dynamical one. It seems natural to introduce an evolutionary framework for studying the feasibility of the green transition toward sustainable technologies. Still, this modelling step has been taken in just a handful of contributions.

To the best of our knowledge, we can mention (Zhang et al., 2019) and (Zhang & Li, 2018), in which emissions abatement and public pollution governance are analyzed by applying evolutionary game theory, and the contribution by Zeppini (2015). In Zhang and Li (2018), Zhang and Li examine the conditions for stable cooperation between various local governments. They take into account the effects of the spread of the pollutant, and the government can adopt compensatory or punitive mechanisms. They show that the more heterogeneous the local governments are (e.g., in terms of preferences, production costs or investment choices), the more cooperative they are. In Zhang et al. (2019), the authors study the evolutionary selection between adopting a green technology or purchasing carbon credits. The effect of intervention, or not, by the government is considered. In particular, the government can attempt to act within the framework of environmental carbon trading to curb the practice of carbon credits. The resulting model consists of a two dimensional continuous dynamical system and strategic choices evolve under replicator dynamics. The environmental domain is not explicitly modelled. In Zeppini (2015), Zeppini studies the transition from dirty to clean technologies by considering a discrete choice model, in which the adoption of a technology is the consequence of an evolutionary selection. The selection mechanism is driven by the respective profitability of each production process, by positive externalities due to social interactions, by technological progress and by a pollution tax charged on dirty producers. Such levy is gauged by a regulator with the goal of promoting the transition toward clean technology. In Zeppini (2015), the aim of taxation policies is simply to reduce the profitability of dirty producers and force them to opt for less polluting methods. The main results of this contribution are related to the existence of multiple coexisting steady states, due to the “lock-in” effects generated by the imitative process, and unstable dynamics characterized by period-2 cycles triggered by the tax level. However, in Zeppini (2015), the environmental domain is not part of the model and, consequently, it is not possible to assess how the green transition affects (and is affected by) the environmental quality.

In the present contribution, starting from an evolutionary setting close to that proposed in Zeppini (2015), we want to investigate the role of the environmental domain on the effective possibility of achieving a transition toward sustainable technologies by adopting environmental taxation. Differently from Zeppini (2015), we neglect the influence of network externalities on the adoption of a particular technology,Footnote 3 shifting our focus on the interaction between the discrete choice model and the dynamics characterizing the environmental sphere. As in Zeppini (2015), agents can choose to adopt a clean or a dirty technology, in which the latter one is inherently more profitable. Differently from Zeppini (2015), we assume that the regulator can levy taxes on both kinds of producers, charging more the dirty ones. Moreover, in Zeppini (2015) tax is levied regardless of the actual environmental quality, being taxation proportional to the share of dirty producers only. Conversely, in the present contribution the regulator can implement an ambient (or environmental) taxFootnote 4 that charges the adopted technologies, so that agents are taxed consistently to the ambient level of the pollutant.

The dynamics related to the environmental domain are modelled by introducing a variable that corresponds to the pollutant level. The stock of pollutant increases due to the emissions of both clean and dirty producers, while it decreases thanks to natural decay and absorption achieved by employing the resources collected through taxation.Footnote 5 The main research questions we seek to tackle concern the feasibility through an environmental taxation policy of a green transition that leads to sustainable levels of environmental quality. In particular:

-

1.

Under what conditions an environmental taxation is able to trigger the green transition toward clean technology?

-

2.

To what extent is the green transition always able to improve the environmental quality?

We stress that the modelling approaches adopted in Zhang et al. (2019) and Zeppini (2015) do not allow addressing the two previous questions, due to the lack of an explicit description of the environmental domain. We analyze the previous two issues from both the static and dynamical point of view, and we show how, from both perspectives, managing the previous issues can be a complicated task. From the static point of view, the initially beneficial effect of charging more heavily the dirty producers allows starting a migration toward clean technologies that reduces the pollutant levels, but this can turn into a reversed situation if the taxation levels becomes too unbalanced. Moreover, scenarios characterized by high efficiency in abatement can result in multiple coexisting steady states. In this case, scenarios characterized by a larger share of producers adopting cleaner technologies not necessarily correspond to those characterized by an improved environmental quality. In addition to this, both the taxation level and the effectiveness of abatement can have a destabilizing effect on dynamics. They can be the source of endogenous quasi-periodic oscillating trajectories resembling those observed in real contexts (see e.g. (Menuet et al., 2020)), highlighting how the dynamical analysis can depict a substantially different scenario from that static. In particular, when pollution trajectories exhibit strongly oscillating behaviors, they possibly reach from time-to-time peaks that are much more significant than the average level. To stress this, we show how the proposed modelling approach paves the way for some initial, early-stage discussion in view of policy implications.

The structure of this contribution is as follows: in Sect. 2 we introduce the model, in Sect. 3 we analyze its steady states and their properties. In Sect. 4 we illustrate the possible dynamical behaviors while in Sect. 5 we discuss the results also in view of some green policy management insights. Section 6 concludes and provides some possible future developments of the research. Supplementary material is available and includes the proofs of Propositions.

2 The model

We consider a productive environment in which an infinite number of manufacturers, assumed to amount to a unit mass, can choose between two technologies, a ‘clean’ one or a ’dirty’ one. The share of firms that, at each discrete time t, exploits the first (latter) technology is denoted with \(x_{c, t}\) (\(x_{d, t} = 1 - x_{c, t}\)).

Firms operate in a competitive market and face production costs that differ with respect to fixed costs. Polluting technologies are cheaper than those clean (e.g. these latter need for skilled workers as dealing with a more innovative technology, and clean technology has in general high maintenance costs, see e.g. (Acemoglu et al., 2016)) and they are therefore more profitable than environmentally friendly ones. Regulators that want to establish an effective environmental policy must then act so that dirty manufacturing becomes less rewarding, hinting agents that exploit it to shift toward cleaner, more sustainable technologies. A common policy is to apply an environmental tax,Footnote 6 i.e. by introducing a “price for a permit to pollute” (see e.g. (Menuet et al., 2020)), which makes it possible to adjust taxation to pollution levels. A greater amount of taxes should be paid by all the producers when the pollution levels are large, while this burden can be reduced if the pollution is low. This translates into the model the effect of an increasingly strong public intervention when the quality of the environment deteriorates. If \(p_t\) is a measure of the pollution stock observed in the environment at time t, the resulting environmental tax (see (Menuet et al., 2020)) can be modelled by \(\tau _i p_t\), with \(\tau _d > \tau _c \ge 0\), encompassing the taxation level charged to a representative agent adopting the \(i -\)th technology, and it is proportional to \(p_t\). Further, each \(\tau _i\) represents the levy charged for a unitary amount of pollution stock.

In line with Zeppini (2015), the green transition process can be modelled through an evolutionary selection mechanism. The agents can choose between the clean or the dirty technology. Share adheres to one of the two technologies depending on the related fitness measure \(\tilde{u}_{i, t} = u_{i, t} + \eta _{i, t}, i = c, d,\) which describes the performance of technology i. The fitness measures have a publicly available component \(u_{i, t}\), which corresponds to the profitsFootnote 7\(\lambda _i - \tau _i p_t\) realized by each kind of producer. Profits positively depend on the intrinsic profitability \(\lambda _i\) of the chosen technology (i.e. the component of profits strictly related the production process, net of the regulator intervention) and negatively depend on the taxation level \(\tau _i\) charging the adoption of a particular technology.Footnote 8 In addition to this, the fitness measures are affected by a noise (e.g. due to non-observable traits or by errors in the profit estimation). If this stochastic component \(\eta _{i, t}\) is assumed to be represented by independent and identically distributed (across the agents and each technology) random variables that are drawn from a double exponential distribution, we have that, as the population of agents diverges, the probability to select a particular technology is described by the binomial logit discrete choice model

In the previous equation, parameter \(\beta \ge 0\) measures the intensity of choice or evolutionary pressure of the selection mechanism. It implicitly encompasses the degree of rationality of the agents in adopting a particular technology, so that the larger \(\beta \) is, the more the profitability gap \(\Delta u_t\) affects the choices of the agents.Footnote 9 We note that \(\beta \) inversely depends on the variance of \(\eta _{i, t}\) (for more details about the logit mechanism, we refer the interested reader to Brock and Hommes (1997); Galanis et al. (2022) and to the reference therein).

From \(u_{c, t} = \lambda _c - \tau _c p_t\) and \(u_{d, t} = \lambda _d - \tau _d p_t\), setting \(\lambda _0 = \lambda _d - \lambda _c\) and \(\Delta u_t = u_{d, t} - u_{c, t}\), the time evolution of the share of clean producers \(x_t\) can be described by

from which indeed \(x_{d, t + 1} = 1 - x_{c, t + 1}\).

The sign of term \(\Delta u_t\) denotes which technology performs better and depends on the distance between the intrinsic profits of the two technologies and on the gap between taxes levied on agents exploiting either the dirty or the clean productive facilities. Even if we are interested in studying what happens when \(\tau _d > \tau _c\), in what follows we allow for \(\tau _c = \tau _d\), which will be used as a benchmark, limit situation.

In line with the existing literature (John & Pecchenino, 1994; Seegmuller & Verchère, 2004; Fodha & Seegmuller, 2013), a simple way of modelling dynamics for the environmental sphere is

The pollution level at the next time period is influenced by three factors. The first one is the natural pollution decay, encompassed in term \(- \alpha p_t\), where \(\alpha \in (0; 1)\) represents the rate at which pollution naturally decreases. Moreover, firms are assumed to have a constant pollution intensity of emissions; such quantities only differ with respect to the adopted technology. During the production process, that takes place throughout the time interval \([t,t+1),\) the clean and the dirty technology respectively pollute at a constant rate \(\varepsilon _c\ge 0 \) and \(\varepsilon _d>\varepsilon _c,\) so they emit pollution stocks respectively corresponding to \(\varepsilon _c x_t\) and \(\varepsilon _d (1 - x_t).\) We stress that \(\varepsilon _i\) is actually the average stock of pollution emitted by a single producer adopting technology i. Finally, the last term in the right hand side of (2) displays how the aggregate amount of taxes collected in t levying the clean (respectively, dirty) technology \(\tau _c p_t x_t\) (respectively, \(\tau _p p_t (1 - x_t)\)) is used and affects pollution abatement, with parameter \(\theta \ge 0\) that gauges the effectiveness of resources adopted in pollution reduction policies.Footnote 10 We remark this last term endogenously depends both on the actual pollution level and on the share of manufacturers resorting to each of the technologies. The case \(\theta = 0\) represents the limit situation in which either it is impossible to reduce the pollution or no measure to abate the pollution is taken.

We assume that the “virgin”, unpolluted state in which there is no contamination in the environment is set at \(p = 0\) and hence \(p_t\) can not become negative. As a consequence of this, if the stock of abated and naturally absorbed pollution were potentially larger than the amount of pollution present at time \(t + 1\) (due to \(p_t\) and to new emissions), the resulting pollution level would correspond to that of the virgin scenario, with \(p_{t + 1}\) = 0, which explains the \(\max \{ \}\) function on the right hand side of (2).

Introducing function \(M: (0, 1) \times [0, + \infty ) \rightarrow (0, 1) \times [0, + \infty ), (x, p) \mapsto M (x, p)\) defined by

we obtain the two-dimensional dynamical system that describes the coevolution of shares of technology adoption and the environmental sphere.

3 Static analysis

In this section, we focus on the study of steady states of model (3) and on their properties. To better explain this and to understand the economic rationale of their occurrence, we subdivide the analysis into different steps. We start focusing on two simplified benchmark problems, consisting of the two uncoupled models related to the environmental domain and to the evolutionary mechanism.

3.1 Static analysis of uncoupled models

If we assume constant values for \(x^{*} \in (0, 1)\), model (3) reduces to the one dimensional, linear recurrence equation defined through function \(\rho : [0, + \infty ) \rightarrow [0, + \infty ), p \mapsto \rho (p)\) by

for which we have the following result.

Proposition 1

Model (4) has a unique, strictly positive steady state

which is decreasing with respect to both \(\tau _d\) and \(\theta \), and for which we have

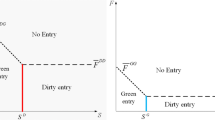

The environmental dynamics with a constant, exogenous technology distribution always have a unique steady state. Its comparative statics with respect to taxation and technology efficiency are predictable as, ceteris paribus, an increase of either \(\tau _d\) or \(\theta \) raises the amount of abatable pollution (through an increase of collected resources or an improved effectiveness), and this contributes to a reduced steady state pollution stock. What is more counterintuitive is that, as the share of clean producers increases, the value of \(p^{*}\) does not necessarily decrease. Making the former condition in (5) more explicit, though, we can identify three possible scenarios on the behavior of the share of clean firms (see Fig. 1):

-

(a)

a decrease of steady state pollution if \(\frac{\tau _d}{\varepsilon _d} - \frac{\tau _c}{\varepsilon _c} < \frac{\alpha }{\theta } \left( \frac{1}{\varepsilon _c} - \frac{1}{\varepsilon _d} \right) \) (blue line);

-

(b)

steady state pollution does not change if \(\frac{\tau _d}{\varepsilon _d} - \frac{\tau _c}{\varepsilon _c} = \frac{\alpha }{\theta } \left( \frac{1}{\varepsilon _c} - \frac{1}{\varepsilon _d} \right) \) (red line);

-

(c)

an increase of steady state pollution if \(\frac{\tau _d}{\varepsilon _d} - \frac{\tau _c}{\varepsilon _c} > \frac{\alpha }{\theta } \left( \frac{1}{\varepsilon _c} - \frac{1}{\varepsilon _d} \right) \) (black line);

It is worth noting that each ratio \(\tau _i / \varepsilon _i\) in the left hand side of (5) represents the tax for each unit of pollutant emitted by each technology \(i = c, d,\) and correspond to the ratio between the positive (by supporting abatement through taxation) and negative (by polluting) effects on the environment of the presence of each technology. The left hand side in (5) then represents the (positive or negative) gap between the relative intensity of taxation of dirty and clean producers. To understand the occurrence of scenarios (b) and (c), let us assume that we are at a steady state, so that the amount of pollutant emitted and that naturally decays and is abated balance out. In the following comments we make reference to Fig. 1. When a fraction of dirty producers is replaced by clean producers, two concurrent phenomena take place. The amount of emitted pollutant decreases, but collected resources from the taxation of a unit of pollutant reduce as well. If the marginal reduction in emissions is greater than the marginal reduction in removal, the steady state pollution will decrease, since disadvantage coming from the reduced potential capability to abate pollution is more than compensated for the reduced stock of pollution released. However, the opposite effect on \(p^{*}\) is obtained if the marginal reduction in emissions is not significant with respect to the marginal loss in abatement capability due to the decrease in collected resources from the reduced share of dirty producers. This occurs if the difference in emissions between the clean and the dirty producers is small relative to the taxes charged upon them. The effect of this (exogenous) transition is to replace dirty and heavily charged producers with not-so-clean and, proportionally, under-taxed producers and the final effect is a deterioration of the environmental scenario. This counterintuitive result resides in the fact that the clean producers still generate some pollution (\(\varepsilon _c = 1\)). In the numerical example reported in Fig. 1, the dirty emission rate is 50% more then the clean one. The realized shift to a less polluting, but still not sufficiently clean, technology does not carry the expected result. We can summarize the previous result as follows.

Outcome 1

An increase of the share of the clean producers can lead to an increase of the steady state pollution level if the taxation of dirty producers is, proportionally to their respective emissions, larger than the taxation of the clean ones.

The previous outcome stresses that the environmental domain, which was not explicitly modelled in Zeppini (2015), can play a relevant role that cannot be neglected in order to fully understand green transition processes. Conversely, if we assume a constant value for \(p^{*}\), Eq. (1) is actually a static process, with a constant distribution of shares \(x^{*} = \frac{1}{1 + e^{\beta (\lambda _0 - p^{*} (\tau _d - \tau _c))}}\). It is immediate to see that \(x^{*}\) increases both with respect to \(p^{*}\) and \(\tau _d\), as they both foster a green transition by penalizing the profitability of the dirty technology and driving agents to adopt the clean one.

3.2 Static analysis of coupled model

We start characterizing conditions under which \(\textbf{s}^{*} = (x^{*}, p^{*})\) are steady states of (3), and their possible number. In what follows, we assume that solutions to equations and steady states are counted with their multiplicities. To this end, let us introduce functions \(f_1:(0,1)\rightarrow [0,+\infty ),\,x\mapsto f_1(x)\) and \(f_2:[0,+\infty )\rightarrow (0,1),\,p\mapsto f_2(p).\)

Proposition 2

Model (3) always has either a unique or three steady states. At any steady state \(\textbf{s}^{*} = (x^{*}, p^{*})\) we have

A necessary condition for the occurrence of multiple steady states is

The explicit analytical expression of steady states of (3) is not available. The share component \(x^{*}\) is implicitly defined by the latter identity in (6) and determines the steady state value of pollution level through the former expression in (6). Proposition 2 shows that, even if for the two uncoupled dynamical mechanisms a unique steady state is possible, when they are coupled, a multiplicity of steady states can occur. We stress that coexistent steady states occurred in Zeppini (2015) as well, but in that case it was necessary to take into account an additional element in the model, represented by a (suitably large intensity of) positive externality of agent’s decisions due to social interaction. Proposition 2 shows that, in an evolutionary framework, the simple mechanisms characterizing the environmental domain can be the source of steady state multiplicity. This is possible only if condition (7) holds true; otherwise, a unique steady state exists. It is relevant to underline that condition under which \(p^{*}\) negatively depends on the share of clean producers (scenario (c) after Proposition 1) is the same necessary condition that can induce multiplicity of steady states. What drives both behaviors are not the absolute values of pollution and taxation; rather, this depends on their relative values, which enter in the thresholds defining concurrent scenarios. We stress that such a phenomenon is completely ascribed to interaction between the evolutionary mechanisms and the environmental domain, and it is driven by elements that are related to the regulator choices (encompassed in the taxation levels \(\tau _d\) and \(\tau _c\)), to the agent choices (the adopted technology, depending on the intensity of choice \(\beta \) and the intrinsic profitability gap \(\lambda _0\)) and to the environmental domain (\(\varepsilon _c,\varepsilon _d,\alpha \) and \(\theta \)).

To deepen the economic rationale of this phenomenon, we need to investigate some additional features of model (3). At the present point, we can just remark that multiple steady states are possible only if the increase of clean producers brings about the growth of the steady state pollution levels (Outcome 1). Moreover, the greater the effectiveness of abatement technology is, the more likely scenario (c) occurs because, ceteris paribus, this magnifies the marginal loss in the pollution abatement as the number of clean producers increases.

We remark that the right hand side in (7) is always positive. If both taxation levels were equally proportional to the rates of emissions, i.e. the relative intensity of taxation gap were null, just a unique steady state would be possible. The same occur if such a gap is negative, while a relative over-taxation of the polluting technology paves the way for the occurrence of multiple steady states.

In the next propositions we study how the uniqueness/multiplicity scenarios of steady states evolve on varying the parameter settings on their possible range of values. If we always have a unique steady state, we identify it by \(\textbf{s}^{*} = (x^{*}, p^{*})\). Conversely, when scenarios characterized by a unique or three steady states alternate, we identify steady states by \(\textbf{s}_i^{*} = (x_i^{*}, p_i^{*})\), with \(i \in \{1, 2, 3\}\). In this case, the index related to steady states is such that, if \(i < j\), we have \(x_i^{*} < x_j^{*}\), namely steady states are ordered with respect to the share of clean agentsFootnote 11. As otherwise specified, in all the simulations reported in this section we set \(\beta =25, \lambda _0=1, \alpha =0.5, \varepsilon _c=1, \varepsilon _d=1.5\), and \(\tau _c=1.\)

The first set of results concerns the behavior of steady states with respect to \(\tau _d\). We start considering two limit cases, corresponding to \(\theta = 0\) (i.e. the is no pollution abatement) and to \(\varepsilon _c = \tau _c = 0\) (i.e. clean producers do not pollute at all, and hence they are not levied any tax).

Proposition 3

Let \(\theta = 0.\) A unique steady state \(\textbf{s}^{*}=(x^{*},p^{*})\) exists for \(\tau _d \in (\tau _c, + \infty )\). As \(\tau _d\) increases, we have that \(x^{*}\) increases and approaches 1 as \(\tau _d \rightarrow + \infty \), while \(p^{*}\) decreases.

Increasing taxation of dirty producers promotes a gradual green transition. Since \(\theta = 0\), the shares of dirty and clean producers just affect the stock of emissions, and hence the steady state pollution goes on decreasing as \(\tau _d\) becomes larger and larger thanks to the transition from dirty to clean producers. We stress that even if in this case the very majority of the agents can adopt the green technology (\(x^{*} \rightarrow 1\) as \(\tau _d \rightarrow + \infty \)) with a persistent decrease of pollution levels, \(p^{*}\) can be large if the clean producers are significantly polluting, since no abatement policy is implemented.

Proposition 4

Let \(\varepsilon _c = \tau _c = 0\) and \(\theta > 0\). A unique steady state \(\textbf{s}^{*}=(x^{*},p^{*})\) exists for \(\tau _d \in (\tau _c, + \infty )\). As \(\tau _d\) increases, we have that \(x^{*}\) increases and approaches some \(\bar{x}^{*} < 1\) as \(\tau _d \rightarrow + \infty \), while \(p^{*}\) decreases.

If clean producers do not pollute at all and they are not taxed, a unique steady state is possible. However, differently from Proposition 4, in this setting a complete green transition does not occur, and an environmental taxation is able to drive only a fraction of producers toward the clean technology. The reason is that, as the green transition starts, since an increasingly share of the producers does not pollute, the steady state pollution level decreases, and this occurs faster than the increase of taxation. At some point, the penalization through \(\tau _d\) of the dirty technology is balanced out by the decrease in \(p^{*},\) and hence the green transition stops.

Now we consider the case of \(\varepsilon _c > 0,\) distinguishing three different scenarios depending on \(\theta .\)

Proposition 5

Let \(\varepsilon _c > 0.\) There is \(\theta _a > 0\) such that if \(\theta \in (0, \theta _a]\), a unique steady state \(\textbf{s}^{*}=(x^{*},p^{*})\) exists for \(\tau _d \in (\tau _c, + \infty )\). As \(\tau _d\) increases, we have that \(x^{*}\) increases and there exists \(\tilde{\tau }_d > \tau _c\) such that \(p^{*}\) decreases on \((\tau _c, \tilde{\tau }_d)\) and increases on \((\tilde{\tau }_d, + \infty )\).

The results of Proposition 5 are graphically depicted in the top row in Fig. 2. Figure 2a shows that the share of clean producers is strictly increasing and converges to 1. Here, the presence of the dirty technology becomes negligible for a sufficiently large value of \(\tau _d,\) and we can say that the green transition essentially takes place. However, Fig. 2b illustrates that the steady state pollution level, for increasing values of \(\tau _d\), correspondingly decreases only up to threshold \(\tilde{\tau }_d\). This phenomenon is a direct consequence of the mechanisms that leads to Outcome 1. If \(\tau _d\) is small, we know from (7) that increasing the share of clean producers leads to a decrease of the pollution level. In this case, as \(\tau _d\) increases, the emitted pollution decreases thanks to the green transition, and the pollution abatement still becomes more consistent, as the transition is initially slow (leftmost part of the curve in Fig. 2a), and hence the small decrease of resources collected by the taxation of (the decreasing share of) dirty producers is more than offset by the increase of the taxation level. However, if we further increase \(\tau _d\), the green transition accelerates, as the utility of the dirty technology starts to be penalized by the environmental tax. Moreover, we come to a point at which increasing the share of clean producers leads to an increase of the pollution level, due to the reduction in the abatement. This initially slows down the decrease in the pollution level, and when the reduction in abatement is stronger than the decrease in the emission, the steady state pollution starts increasing (middle parts of the curve in Fig. 2b). From this level on, \(p^{*}\) increases reaching a steady pattern. We eventually come to a situation in which most producers adopt the clean technology. In this case, the marginal effect of an increase of \(\tau _d\) is small (right parts of the curves in Fig. 2a, b). A qualitative comparison between these two graphs pinpoints that, for sufficiently large values of \(\tau _d,\) switching from a more polluting to a less (but not substantially so) polluting technologies might lead to an unwanted outcome when dealing with taxation policies. We summarize the previous discussions as follows.

Outcome 2

An increase of the taxation of dirty producers with a consequent growth of the share of green producers not necessarily leads to a decrease for the steady state pollution levels.

Top row: steady state \(\textbf{s}^{*}\) on increasing \(\tau _d\) when \(\theta =1\) lies in the range considered in Proposition 5. Middle and bottom rows: steady states \(\textbf{s}^{*}_i,i=1,2,3\) on increasing \(\tau _d\) when \(\theta =1.5\) and \(\theta =3\) are in the range considered in Propositions 6 and 7, respectively. Steady state shares of clean producers and pollution levels are reported the first and second columns. The third column shows functions \(p^{*}=f_1(x^{*})\) (purple line) and \(p^{*}=f_2^{-1}(x^{*})\) (green line) defined through (6), and asterisks represent steady states

We note that in Zeppini (2015) it would not be possible to have evidence of Outcome 2, and not just because environmental dynamics are not explicitly considered. In fact, in Zeppini (2015) it is assumed that the clean producers do not pollute at all (and therefore do not face an environmental tax). Following Proposition 4, in this context, Outcome 2 does not realize, which suggests that the simplifying hypothesis of having certain non-polluting technologies could be misleading and hide relevant phenomena. We stress that Proposition 5 also shows that if the effectiveness of pollution abatement measures is small, we always have a unique steady state. To give an insight on this, we make reference to Fig. 2c. The green curve describes the effect of a change of the share of clean producers on the steady state pollution level. The purple curve represents the steady state stock of pollution for which a given share of clean producers is selected by the evolutionary mechanism.Footnote 12 Indeed, \(\textbf{s}= (x, p)\) is a steady state if the two curves intersect. As \(\tau _d\) increases, the utility of the dirty technology decreases, as the environmental tax \(\tau _d p_t\) that each dirty producer is charged increases. Even when the environmental situation improves (i.e. \(p_t\) decreases) thanks to the larger amount of resources collected for the pollution abatement and to the increased presence of clean producers, the small effectiveness is not sufficient to allow for a decrease in the pollution level at least proportional to the increase of \(\tau _d\), and hence more producers adopt the clean technology. For small \(\theta ,\) this is the unique possible scenario, which is not the case when effectiveness increases, as shown in the next results.

Proposition 6

Let \(\varepsilon _c > 0\). There exist \(\theta _b> \theta _a > 0\) and \(\tau _{d, 2}> \tau _{d, 1}> 0\) such that if \(\theta \in (\theta _a, \theta _b)\), a unique steady state \(\textbf{s}_1^{*}\) exists for \(\tau _d < \tau _{d, 1}\), three steady states \(\textbf{s}_1^{*}, \textbf{s}_2^{*}\) and \(\textbf{s}_3^{*}\) exist for \(\tau _d \in (\tau _{d, 1}, \tau _{d, 2})\), and a unique steady state \(\textbf{s}_3^{*}\) exists for \(\tau _d > \tau _{d, 2}\). When three steady states coexist, we have \(x_1^{*}< x_2^{*} < x_3^{*}\) and \(p_1^{*}< p_2^{*} < p_3^{*}.\) As \(\tau _d\) increases, \(x_1^{*}\) and \(x_3^{*}\) increase; there exists \( \tilde{\tau }_d\in (\tau _c, \tau _{d, 1}]\) such that \(p^{*}_1\) decreases on \((\tau _c, \tilde{\tau }_d)\) and increases on \((\tilde{\tau }_d, \tau _{d, 1})\), while \(p^{*}_3\) increases on \((\tau _{d, 1}, + \infty )\).

We stress that coexistent steady states occurred in Zeppini (2015), Zhang et al. (2019) as well. In Zhang et al. (2019), coexistence is with corner equilibria, and this is induced by the replicator dynamics. Moreover, differently from what we will show in Sect. 4, in Zhang et al. (2019), depending on the parameter configuration, just one attractor can be stable at once, and no path dependency phenomena arise. In Zeppini (2015), coexistence occurred only if an additional element in the model is taken into account, represented by a (suitably large intensity of) positive externality of agent’s decisions due to social interaction. The behavior described in Proposition 6 is graphically depicted in the middle row in Fig. 2. Results abiding in this and the following Propositions should be taken into account carefully as, now, more than a steady state coexist. In Fig. 2d, e colors identify different steady states. Looking at the blue lines, the share of clean manufacturers increases and the pollution level decreases, which is what a green transition policy strives to obtain, while an increase in \(p^{*}\) characterizes the red linesFootnote 13. The fulfillment of the reduction in pollution will then depend on the initial status of the system, involving dynamical effects of path dependency.

For intermediate values of \(\theta \), three steady states can exist, but only for moderate values of \(\tau _d\) (see also Fig. 2f). To explain this, let us assume that the environmental situation is initially characterized by a suitably small pollution level. As \(\tau _d\) increases, we have that, as taxation of dirty producers increases, the effectiveness of abatement is large enough to considerably lower the pollution level. The joint effect is such that the taxation level \(\tau _d p_t\) remains small enough to allow dirty technology to be profitable, and steady state \(\textbf{s}_1^{*},\) which is characterized by a population dominated by dirty producers and a low level of pollution, is still possible. Note that if the environmental situation is such that the pollution level is initially more consistent, this scenario can not occur, as the environmental tax charging dirty producers is heavy, and in this case we have a green transition toward the clean technology. However, since this is just a “less dirty” technology that pollutes as well and is under-levied, this leads to few resources collected for pollution abatement, a worse environmental situation, and a not as desired outcome of the green transition. Steady state \(\textbf{s}_3^{*}\) is characterized by a population dominated by clean producers and a larger level of pollution than that at \(\textbf{s}_1^{*}\). However, the abatement technology is not sufficiently efficient to keep on decreasing the pollution level as the number of dirty producers increases and the collected resources decrease. On top of this, if \(\tau _d\) is very large, the former scenario is not self-sustaining and steady state \(\textbf{s}_1^{*}\) disappears, leading to the existence of the unique steady state \(\textbf{s}^{*}_3\). Note that, from the previous discussion, we can also perceive why \(\textbf{s}_2^{*}\) does not play an active role as a steady state, as, in some sense, it just discriminates between the occurrence of the two scenarios. Finally, we consider the case of large values of \(\theta \).

Proposition 7

Let \(\varepsilon _c > 0\). There are \(\theta _b > 0\) and \(\tau _{d, 1}>0\) such that, if \(\theta \in [\theta _b, + \infty ),\) a unique steady state \(\textbf{s}_1^{*}\) exists for \(\tau _d < \tau _{d, 1}\) and three steady states \(\textbf{s}_1^{*}, \textbf{s}_2^{*}\) and \(\textbf{s}_3^{*}\) exist for \(\tau _d > \tau _{d, 1}\), with \(x_1^{*}< x_2^{*} < x_3^{*}\) and \(p_1^{*}< p_2^{*} < p_3^{*}\). As \(\tau _d\) increases, we have that \(x_1^{*}\) and \(x_3^{*}\) increase; there exists \(\tilde{\tau }_d\in (\tau _c,+\infty ]\) such that \(p^{*}_1\) decreases on \((\tau _c, \tilde{\tau }_d)\) and increases on \((\tilde{\tau }_d, +\infty )\), while \(p^{*}_3\) increases on \((\tau _{d, 1}, + \infty )\).

The results of Proposition 7 are graphically depicted in the bottom row in Fig. 2. We note that Proposition 7 allows for a decreasing behavior of \(p_1^{*}\) for any \(\tau _d>\tau _c\) (this occurs when \(\tilde{\tau }_d=+\infty \)). In all the numerical simulations we performed, we always observed this latter scenario, but in any case the change for \(p_1^{*}\) for suitably large values of \(\tau _d\) is negligible.

In Fig. 2g and h, as \(\tau _d\) increases, we have a reduction in the pollution related to \(\textbf{s}_1^{*}\) (blue color); this is achieved with very small changes in the share of clean producers. This fact can be explained with the capability of the resources collected by means of taxation to positively impact on pollution reduction. The resulting scenario is very similar to that of Proposition 6, with the unique difference that, in the present case, the existence of multiple steady states is persistent. The reason is that the strong capability to abate the pollution is able to constantly reduce the pollution level and this consequently keeps the taxation \(\tau _d p_t\) for the dirty technology moderate, so that each dirty producer is moderately levied, and the green transition may not take place. We summarize the previous discussions as follows.

Outcome 3

For suitably large effectiveness of pollution abatement, multiple coexisting steady states are possible, characterized by either a large share of dirty producers and a low pollution level or by a small share of clean producers and a high pollution level.

Once more, the previous outcome is made possible by considering polluting clean producers and by studying the interaction between the environmental side and the evolutionary selection of technologies. Outcome 3 is missed resting upon a modelling approach as in Zeppini (2015). We stress that for both \(\theta \in (\theta _a, \theta _b)\) and \(\theta \in (\theta _b, + \infty )\), the realization of one of the coexisting scenarios is allowed by the kind of initial environmental situation, but studying this requires dynamical investigations, so we will return on it in Sect. 4.

Finally, we remark that, with respect to \(\alpha , \theta , \varepsilon _c\) and \(\varepsilon _d,\) the components of steady states \(\textbf{s}^{*},\textbf{s}_1^{*}\) and \(\textbf{s}^{*}_3\) behave as expected, with shares of clean producers and pollution levels decreasing as \(\alpha \) and \(\theta \) increase and increasing as \(\varepsilon _c\) or \(\varepsilon _d\) increase. In particular, comparing the panels reported in different rows in Fig. 2, the maximum possible steady state levels of \(p^{*}\) significantly decrease when the effectiveness of abatement improves. However, as it will become evident from the analysis in Sect. 4, increasing \(\theta \) can have substantial effects on the steady state stability, so its role can be entirely understood only from the dynamical perspective. Finally, decreasing the taxation level of the clean technology \(\tau _c\) has a “symmetric” effect with respect to that obtained by increasing \(\tau _d\). Its rationale can be then understood along the lines of the comments related to Proposition 1. For the analytical details about these results we refer the interested reader to Cavalli et al. (2023).

4 Dynamical analysis

In this section we study the dynamical properties of model (3), providing both analytical characterization of the stability regions and numerical investigation of out-of-equilibrium dynamics. The goal is not to provide a systematic characterization of any possible dynamical behaviors occurring in model (3), but to pay specific attention to those dynamics from which we can infer additional economic insights with respect to the static perspective. In the proposed simulations,Footnote 14 we set \(\lambda _0 = 1, \beta = 25\), and \(\varepsilon _d = 1.5\) and we focus on two scenarios, a former one in which clean producers do not pollute at all (in this case we set \(\varepsilon _c = \tau _c = 0\)) and a latter one in which the clean technology pollutes (setting \(\varepsilon _c = 0.5\) and \(\tau _c = 1.2\)). We note that differently from the parameter configuration used for the static simulations, in this section we consider reduced emissions and increased taxation for the clean producers. The setting considered in Sect. 3 allowed us to place emphasis on the scenarios characterized by coexisting steady states (see also condition (7)). As it will become evident from the following analytical results and related comments, the more the clean technology is charged proportionally to its emissions, the more likely non convergent dynamics occur. As we will discuss in Sect. 5, both the static and dynamical results alone provide relevant insights on the economic phenomena occurring, so the two distinct parameter settings for static and dynamical simulations allow discussing in an organic way the picture of the possible outcomes of model (3).

To better understand the role of share and pollution dynamics on the stability of the steady states, we discuss the possible dynamical evolution of \(p_t\) and \(x_t\) starting from two benchmark situations.

4.1 The role of pollution equation

To study the dynamical effects related to the environmental side, we focus on Eq. (4), in which \(p^{*}\) is locally asymptotically stable provided that \(| \rho ' (p^{*}) | < 1\). A simple direct check shows that, since \(x^{*} \in (0, 1)\), we have that \(\rho ' (p^{*}) < 1\) is always true, while inequality \(\rho ' (p^{*}) > - 1\), to hold, requires condition

It is straightforward to see that \(\bar{x} \le 0\) if and only if \(\alpha + \tau _d \theta - 2 \le 0,\) in which case \(p^{*}\) is stable independently of \(x^{*}\). Conversely, \(p^{*}\) is stable only for suitably large values of the share of clean producers. We note that fulfillment of the stability condition is negatively affected by term \(\alpha + \theta \tau _d (1 - x^{*}) + \theta \tau _c x^{*},\) which represents the stock of pollution that is removed from the environment if \(p_t = 1\). This means that, with no evolutionary mechanism on shares, the natural decay, the effectiveness of technology for the abatement, and the taxation levels of each kind of producers have, in addition to the share of dirty producers, a destabilizing effect.

The explanation of this is related to the direct proportionality between the resources collected through taxation and the pollution level. As a result, the abated pollution stock is directly proportional to the level of pollution. As \(\theta ,\alpha ,\tau _c\) or \(\tau _d\) progressively increase, we pass from a scenario in which their aggregated effects are small and the pollution level monotonically decreases until it reaches the steady state level \(p^{*},\) to situations in which \(p_t\) falls below \(p^{*}.\) The consequence of this is that the collected taxes reduce, and this results in fewer interventions to improve the quality of the environment, so pollution increases. This leads to an oscillating behavior, with endogenous fluctuations that can dampen or, for large values of \(\theta , \alpha , \tau _c\) or \(\tau _d\), self-sustain and become persistent. We can summarize this as follows.

Outcome 4

If the joint effect of the taxation level of clean producers, the share of dirty producers and their taxation level, the effectiveness of abatement technology and the natural decay is so significant to allow removing a large amount of pollutant, this can give rise to self-sustained and persistent oscillating behavior leading pollution level to not converge toward a constant level.

4.2 The role of evolutionary selection of shares

If we consider an exogenous, constant in time pollution level \(p^{*}\), the share distribution would result stationary, and, consequently, the uncoupled share equation can not be the source of endogenous non convergent dynamics. However, the coupling between shares and pollution dynamics can give rise to “second order”, indirect effects as a consequence of which persistent oscillations can arise even if the two uncoupled dynamics were stable. To show this, we consider the simplified model obtained by setting \(\alpha = 1\) and \(\theta = 0\). This allows focusing on the role of the evolutionary selection mechanism alone, excluding the emergence of dynamical behaviors arising from Outcome 4 and related to the environmental sphere. The pollution equation reduces to \(p_{t + 1} = \varepsilon _c x_t + \varepsilon _d (1 - x_t)\), and hence the pollution stock at time \(t + 1\) does not (directly) depend on the pollution level at time t. The resulting model can be rewritten as the one-dimensional second order difference equation defined through function \(\sigma : (0, 1) \rightarrow (0, 1), x \mapsto \sigma (x)\) by

For equation (9), we have the following Proposition.Footnote 15

Proposition 8

The unique steady state \(x^{*} \)of (9) is locally asymptotically stable provided that

When (10) is violated, a Neimark-Sacker bifurcation can occur.

Equation (9) describes how a change in the shares has a delayed effect on the share evolution itself. In fact, the distribution of adopted technologies at time t uniquely determines the pollution level at time \(t + 1\), which in turns determines the share of clean producers at time \(t + 2\). Assume that for example, the pollution level is high due to presence of many dirty producers. As a consequence of this, the regulator increases the levy on producers and the clean technology is adopted by an increased number of agents and the environmental quality will improve. The reduced pollution level will induce the regulator to reduce the tax burden, with a consequent increase in the profitability of the dirty technology and of the share of agents adopting it. If the agents suitably take into account the difference in the profitability measures of the two strategies (i.e. \(\beta \) is not too small), such fluctuations can become persistent, and this eventuality occurs when the profitability gap increases, consequently of differences in the taxation levels. However, if \(\tau _d\) is further increased, the reduction in the rebound of the fitness measure of the dirty producers obtained when the pollution decreases is smaller, since the adoption of dirty technology is heavily charged. This leads to oscillations in shares around larger values of \(x_t\), but with smaller amplitudes. Above a certain level of \(\tau _d\), these oscillations dampen and we again have convergence, which is now toward a population almost completely composed by clean producers. This then identifies a second possible source of instabilities, which is essentially due to the evolutionary selection of shares. We remark it as follows.

Outcome 5

The evolutionary selection mechanism can give rise to persistent overreaction phenomena, due to a second order effect of the change in the shares on the share evolution themselves, even when mediated by potentially stable pollution dynamics alone. In particular, these phenomena occur for intermediate taxation levels of the dirty technology.

We stress that in Zeppini (2015) such a second order effect could not take place, since the production of new pollution stock is assumed to be concurrent to the change of technology adoption by the agents. Since the production processes require time to take place, it is realistic to assume that the pollution emission occurs throughout the whole time interval \([t, t + 1).\) This contributes to the delayed effect of a share change on the shares themselves and gives rise to quasi-periodic dynamics, which is missing in Zeppini (2015).

4.3 Dynamics of interaction between evolutionary mechanism and environmental sphere

We now turn our attention to the analytical study of stability for model (3). We start from the case of a non-polluting clean technology in which, as shown in Proposition 4, we have a unique steady state \(\textbf{s}^{*}\) for any taxation level of the dirty technology.

Proposition 9

Let \(\varepsilon _c = \tau _c = 0\). The unique steady state \(\textbf{s}^{*} = (x^{*}, p^{*})\) of (3) is locally asymptotically stable provided that

When the former (respectively, latter) condition in (11) becomes an equality, instability can only occur through a flip (respectively Neimark-Sacker) bifurcation. In particular, \(\textbf{s}^{*}\) is locally asymptotically stable for \(\tau _d = \tau _c = 0\) and it is unstable for \(\tau _d > \bar{\tau }_d,\) for some suitable \(\bar{\tau }_d > 0\).

According to (11), \(\textbf{s}^{*}\) is stable for suitably small values of \(\tau _d\). In fact, if \(\tau _d = 0\), since no taxes are collected, there is no pollution abatement but natural decay only, and the pollution level monotonically increases/decreases toward the steady state level. Moreover, we note that the first terms in the former condition in (11) correspond to the left-hand side in (8), while the last fraction is positive. This means that, in case \(\varepsilon _c = \tau _c = 0\), the introduction of the evolutionary selection of shares has the potential effect of hindering the instabilities arising from the dynamics of the pollution, as large levels of pollution drive the agents to adopt the clean technology, and this progressively reduces the pollution level and softens the endogenous large oscillations in \(p_t\) explained by Outcome 4. However, along the lines of Outcome 5, the evolutionary selection of shares can be itself a source of instabilities, and this explains the latter, new stability requirement in (11).

For the following explanations, we refer to the simulations reported in Fig. 3. In Fig. 3b we report a two dimensional bifurcation diagramFootnote 16 with respect to variables \(\tau _d\) and \(\theta \). Note that Proposition 9 shows that \(\textbf{s}^{*}\) is stable on a right neighborhood of \(\tau _d = 0\) and unstable on a neighborhood of \(\tau _d = + \infty \), but for intermediate values of \(\tau _d\) we may have in principle several transitions from stability to instability and vice-versa. Since similar scenarios are more evident in the case of \(\varepsilon _c > 0\), we discuss that situation after Proposition 12. We start focusing on the case of small and intermediate values of the effectiveness parameter \(\theta \), corresponding to the lower and middle parts of Fig. 3a. In this case, as \(\tau _d\) increases, the steady state becomes unstable by means of a Neimark-Sacker bifurcation (see also the bifurcation diagram reported in Fig. 3b). The quasi-periodic nature of dynamics is related to the delay due to the second order effect of share changes on themselves described in Outcome 5. Conversely, if \(\theta \) is suitably large (upper part in Fig. 3a), for small values of \(\tau _d\) the oscillations can arise directly from the pollution dynamics, which would be unstable even in the case of constant shares, and are transmitted to the share evolution mechanism. In this case, oscillations inherit the cyclical nature induced by those characterizing the pollution levels, and a flip bifurcation occurs.

Looking at Fig. 3a, we note that, as \(\theta \) initially increases, the taxation level \(\tau _d\) that triggers instability increases as well. This can be explained recalling that, as \(\theta \) increases, \(p^{*}\) declines, so dynamics take place around a reduced level of pollution, and the overall taxation \(\tau _d p_t\) of dirty producers consequently decreases. For this reason, the fitness measure of dirty producers prevails only in the case of larger taxation levels with respect to those for small \(\theta \), and we observe strong changes in their shares only for larger values of \(\tau _d\). Conversely, above a certain threshold of \(\theta \), instability occurs for increasingly small taxation levels. This is due to the change in the source of instability, which is now occurring in the environmental sphere (Outcome 4). In particular, it is easy to show that even if \(p^{*}\) decreases with respect to \(\theta \), \(\theta p^{*}\) increases with respect to \(\theta \). This is reasonable since, as the pollution stock decreases, the environmental situation improves, and it is simpler to abate pollution level rather than in a polluted environment. As a consequence of this, the amount of pollution \(\theta \tau _i p_t\) that can be abated thanks to the taxation of a single producer increases with \(\theta \) and, in line to the discussion related to Outcome 4, the steady state becomes unstable for reduced values of \(\tau _d\).

Simulations related to the case of non polluting clean technology, obtained setting \(\varepsilon _c= \tau _c = 0\) (Proposition 9). a Two-dimensional bifurcation diagram on varying \(\tau _d\) and \(\theta .\) b, c Bifurcation diagram on varying \(\tau _d\) and times series for a particular value of \(\tau _d\). The share of clean producers and the pollution level are respectively represented using black (left scale) and red (right scale) colors

Now we turn our attention on the case of polluting clean technology. Firstly, we focus on the role of the limit values for the taxation of the dirty technology, namely when both dirty and clean technologies are charged the same extent \((\tau _c = \tau _d)\) and when \(\tau _d \rightarrow + \infty \).

Proposition 10

Let \(\textbf{s}^{*} = (x^{*}, p^{*})\) be a steady state of (3) for \(\varepsilon _c > 0\). If \(\tau _c = \tau _d\), \(\textbf{s}^{*} \) is locally asymptotically stable provided that \(\tau _c \theta + \alpha < 2\). There is \(\bar{\tau }_d > 0\) such that, if \(x^{*} \rightarrow 1\) as \(\tau _d \rightarrow + \infty ,\) we have that \(\textbf{s}^{*} \) is locally asymptotically stable for \(\tau _d>\bar{\tau }_d\) provided that \(\tau _c \theta + \alpha < 2\). If \(x^{*}\) does not approach 1 as \(\tau _d \rightarrow + \infty ,\) we have that \(\textbf{s}^{*}\) is unstable for \(\tau _d > \bar{\tau }_d.\)

The main difference with the case of \(\varepsilon _c = 0\) is that, when \(\varepsilon _c > 0\) and if \(\alpha + \tau _c \theta < 2,\) we have that dynamics recover converge to the steady state if the taxation of the dirty technology is suitably large.Footnote 17 In discussing the previous proposition, we refer to the two-dimensional bifurcation diagram reported in Fig. 4a, in particular to the left boundary, which corresponds to the case of \(\tau _c = \tau _d\). We start from the situation in which the effectiveness of pollution abatement is small (\(\theta < \theta _a\) in Proposition 5, bottom part of Fig. 4a), and hence there exists a unique steady state for any \(\tau _d \in [\tau _c, + \infty )\) and a scenario in which the vast majority of producers adopts the clean technology could in principle take place, since \(x^{*} \rightarrow 1\) as \(\tau _d \rightarrow + \infty \).

We note that condition \(\tau _c \theta + \alpha < 2\) is exactly the stability condition for \(p^{*}\) in the pollution equation with exogenous shares since, if \(\tau _c = \tau _d\) or if \(\tau _d = + \infty \) (in which case \(x^{*} = 1\)), the left-hand side in (8) simplifies to \(2 - \alpha - \theta \tau _c > 0\). This means that instabilities arise from the environmental side, and can be explained accordingly to Outcome 4. In this scenario, \(\textbf{s}^{*}\) is either simultaneously stable at \(\tau _c = \tau _d\) and \(\tau _d = + \infty \) or simultaneously unstable at \(\tau _c = \tau _d\) and \(\tau _d = + \infty \).

In the limit case of \(\tau _d = \tau _c\), the shares of clean and dirty producers do not depend on the pollution level, and their distribution depends only on the intrinsic profitability difference \(\lambda _0\) and on the intensity of choice \(\beta \). In this case, since the taxation level is the same for both technologies, dirty producers do not benefit from adopting a clean technology, so most producers immediately decide to switch to the dirty technology (in the limit \(\beta \rightarrow + \infty \) we would have dirty producers only). If \(\tau _d\) is slightly larger than \(\tau _c\), the transient or persistent oscillations in the pollution levels induce fluctuations in the distribution of clean producers, as the fitness measure of the clean technology is slightly more favored (resp. hindered) when the pollution level is large (resp. small). These oscillations can dampen or be persistent, depending on the underlying dynamics of the pollution equation and according to the discussion related to Outcome 4. Let us now consider the case \(\tau _d \rightarrow + \infty \). In the presence of a whatever small level of pollution, all the producers would adopt a clean technology (i.e. \(x^{*} = 1\)). Also, in this case no oscillation arises from the share dynamics, and dynamics are either stable or not depending on those arising from the environmental sphere.

If the efficiency of pollution abatement is intermediate (\(\theta _a< \theta < \theta _b\) in Proposition 6), we have that, for mild values of \(\tau _d\), three steady states coexist but, at the extreme values of the range of variation of \(\tau _d\), we still have a unique steady state. Within this range, dynamics can be explained similarly to the case with \(\theta < \theta _a\). We simply note that, in this case, the maximum taxation level for the clean technology that guarantees convergent dynamics is smaller than in the previous case. The reason is that \(\alpha + \tau _c \theta \), for the same value of \(\tau _c\), is larger and larger as \(\theta \) increases and, thanks to the improved efficiency in pollution abatement, significant variations in the pollution levels occur for reduced taxation level.

If the efficiency of pollution abatement is large (\(\theta > \theta _b\) in Proposition 7, middle and top parts of Fig. 4a), we have that, for suitably large values of \(\tau _d,\) three steady states always coexist. The above discussion indeed still applies for \(\tau _d \rightarrow + \infty \) at \(\textbf{s}_3^{*}\), as in this case we have a population composed of almost all clean producers. Conversely, at \(\textbf{s}_1^{*}\), this does not occur, we have that a significant share of dirty producers is still present in the market and this, according to the dynamics discussed with Outcome 4, has a destabilizing effect. We remark that, for suitably large values of \(\tau _d\), \(\textbf{s}^{*}_1\) is unstable and can coexist with a stable steady state \(\textbf{s}^{*}_3\).

Now we consider the limit case \(\theta = 0\).

Proposition 11

Let \(\theta = 0\) and \(\varepsilon _c > 0.\) The unique steady state \(\textbf{s}^{*} = (x^{*}, p^{*})\) of (3) is locally asymptotically stable provided that

In particular, condition (12) is fulfilled for \(\tau _d = \tau _c\) and \(\tau _d > \bar{\tau }_d,\) for some suitable \(\bar{\tau }_d > 0\).

When condition (12) is violated, instability can occur only through a Neimark-Sacker bifurcation.

Simulations related to the case of polluting clean technology, obtained setting \(\varepsilon _c=0.5\) and \( \tau _c = 1.2\) (Proposition 11 and 12). a Two-dimensional bifurcation diagram on varying \(\tau _d\) and \(\theta .\) Inside the black boundary region, multiple steady states coexist. b, c Bifurcation diagrams on varying \(\tau _d.\) The share of clean producers and pollution are respectively represented using black (left scale) and red (right scale) colors

A bifurcation diagram related to the previous Proposition is reported in Fig. 4b. As already noted, when \(\theta = 0\) the pollution dynamics with exogenous shares converge toward the steady state. Recalling the discussion following Proposition 10, we understand why, for the limit values of \(\tau _d\), we have that \(\textbf{s}^{*}\) is stable. Conversely, when \(\tau _d \in (\tau _c, + \infty )\), the unique source of instability is related to the second order effect arising from the interdependence between pollution and share dynamics (Outcome 5). When \(\tau _d\) is small, we have convergent dynamics, while for intermediate values of \(\tau _d\) the interaction between pollution and share dynamics can give rise to a Neimark-Sacker bifurcation with consequent quasi-periodic dynamics. The explanation of these two scenarios is basically the same of that provided for the case of \(\varepsilon _c = 0.\)

The main difference between cases \(\varepsilon _c = 0\) and \(\varepsilon _c > 0\) is that, in this latter one, as \(\tau _d\) increases, the share of the clean producers can become as close to 1 as we want. This means that, as \(\tau _d\) increases, the share of the clean producers can become as close as we want to 1. This progressively reduces the profitability advantage of the dirty technology, which in turns firstly reduces the extent of oscillatory phenomena and hence leads to their disappearance, stabilizing dynamics. A scenario in which, on increasing a parameter, a stable steady state becomes unstable and finally regains stability is often called bubble in the bifurcation diagram. Stability conditions in the general case are reported in the following proposition. We emphasize that it has been demonstrated that the continuous model in Zhang et al. (2019) can explain the occurrence of periodic oscillations in the dynamics of the shares of the agents adopting the clean technology. However, it is not possible to understand the impact of this situation on the environment. Based on the results of Sect. 3, we point out that it cannot be assumed that a higher proportion of green producers can ensure a better quality of the environment.

Proposition 12

A steady state \(\textbf{s}^{*} = (x^{*}, p^{*})\) is locally asymptotically stable provided that

When the second (respectively, third) condition in (13) is violated, instability can only occur through a flip (respectively, Neimark-Sacker) bifurcation. In particular, when three steady states exist, \(\textbf{s}^{*}_2\) is always unstable.

We start noting that, when the first condition in (13) is the only one that becomes an equality, we have the emergence/disappearance, through a saddle-node bifurcation, of a couple of new steady states, in line with the static analysis carried on in Sect. 3. When three steady states coexist, we have that \(\textbf{s}^{*}_2\) is always unstable, as the first condition in (13) is violated. We already discussed Outcome 5 and the rationale for the occurrence of quasi-periodic dynamics in the current model, differently from Zeppini (2015). We can highlight two additional differences: the possible return to stability as \(\tau _d\) increases and the occurrence of complex dynamics. Concerning the former one, in Zeppini (2015) instability is possible only under large self reinforced effects of decision externalities. However, as \(\tau _d\) grows, the disutility for dirty producers due to taxation reduces when their share is very small, and this more than compensates the disutility due to reduced positive externalities. The result is that the share of dirty producers rises sharply, and this leads to a persistent period-two cycle. Conversely, in the current model, increased taxation can have a positive effect on the level of pollution, which stabilizes the dynamics of agent selection. Finally, in the corresponding model in Zeppini (2015), the lack of interaction between the environmental and the evolutionary selection mechanism, which is the source of possibly chaotic dynamics in the present model, explains the simple non convergent dynamics that can arise.

Even if the theoretical level of the investigation and the simple model we consider do not allow us to provide a quantitative comparison of the results with the empirical ones, the whole picture of complexity that emerges can start providing some insights on the elements that have to be taken into account for suitable policy interventions.

For the comments about Proposition 12, we make reference to the two dimensional bifurcation diagram reported in Fig. 4a, in which we stress that the left and lower boundaries have been already studied in the previous Propositions. We stress that the black boundary denotes the region inside which we have multiple steady states.

If we look at horizontal sections of the lower part of Fig. 4a, we can see that, as \(\tau _d\) increases, we have a Neimark-Sacker bubble (see the bifurcation diagram in Fig. 4b).

Two-dimensional bifurcation diagrams on varying \(\varepsilon _d\) and \(\tau _d.\) a Non polluting clean technology (\(\varepsilon _c= \tau _c = 0\)); b polluting clean technology (\(\varepsilon _c=0.5, \tau _c = 1.2\)). Inside the black boundary region, multiple steady states coexist. In both cases, we set \(\theta =0.5\)

As already explained in the case where \(\theta = 0\), the Neimark-Sacker bubble occurs due to an overreaction phenomenon in the evolutionary selection mechanism, which lessens and disappears as the profitability of the dirty technology decreases. However, we also remarked how, for \(\theta > 0\) and suitably large \(\tau _d\), the dynamics of pollution can become unstable. Depending on the parameter setting, we can have that, in addition to the Neimark-Sacker bubble, a flip bubble emerges due to the oscillations induced by the dynamics of the pollution, as we can infer from the central horizontal part of the two dimensional bifurcation diagram reported in Fig. 4a. Note that, as \(\tau _d\) increases, the share of clean producers increases as well and this, recalling (8) and the subsequent comments, has a stabilizing effect on the environmental dynamics, and so differently from the pollution equation with fixed exogenous shares, we observe a return to stability. However, an increase of \(\tau _d\) can trigger the second order effect on the share dynamics (Outcome 5) that gives rise to a Neimark-Sacker bubble. If \(\theta \) is further increased, the two bubbles merge, with the effect that, as \(\tau _d\) increases, stability is lost through a period doubling and recovered through a Neimark-Sacker bifurcation (see Fig. 4c). We summarize the previous discussions as follows.

Outcome 6

Intermediate taxation levels for the dirty technology can be the source of endogenous oscillating or complex dynamical behaviors in the trajectories of the pollution levels.

Outcome 7

Stable steady states can become unstable as the efficiency in pollution abatement increases.

We note that it is out of the scope of this contribution to discuss the previous results from a quantitative point of view. Indeed, simple model (3) can be furhet refined to provide quantitatively comparable results with those real. For example, looking at Figs. 3b, c, and 4b, c, large changes in the shares may occur from time to time, and this can be unrealistic depending on the kind of technology under investigation and on the time scale. In Section B of the supplementary material the interested reader can find a simple modification of the share updating process that provides less abrupt fluctuations of the shares. The previous dynamical discussion and that related to the policy insights in Sect. 5 still hold true for the modified model as well.

The last set of simulations is related to what happens when the rate of emissions of dirty producers change, increasing from the minimum level \(\varepsilon _c\). Looking at Fig. 5, when dirty producers have low emission rates, a reduced taxation \(\tau _d\) can effectively stabilize dynamics (in this case, increasing \(\tau _d\) would introduce instability phenomena related to over-taxation, as previously discussed). When \(\varepsilon _d\) grows, increasing values for \(\tau _d\) allows for a complete stabilization only if \(\varepsilon _c>0,\) while, conversely, this just leads to a qualitative stabilization. The reported simulations suggest that, from the dynamical point of view, scenarios with reduced pollution emissions are more advisable than those with large abatement efficiency, since a suitable taxation policy can recover steady state stability.

Before concluding this section, referring to Fig. 6 we cast a quick glance on basins of attractions when multiple steady states coexist. This is achieved with the same parameter configuration used for Fig. 4a except for \(\alpha =0.2.\)

Basins of attraction related to steady state \(\textbf{s}_3\) (black asterisk, blue region) and the period-2 cycle (red asterisk, yellow region) arisen from the instability of \(\textbf{s}_1.\) We set \(\theta =1\) and \(\alpha =0.2,\) while the remaining parameters are those used for the simulation reported in Fig. 4a

We numerically checked through intensive simulations that when \(\textbf{s}_1\) and \(\textbf{s}_3\) coexist, \(\textbf{s}_1\) is unstable, and we actually observe coexistence between \(\textbf{s}_3\) and a period-2 cycle attractor. As we can see, the basin related to \(\textbf{s}_3\) lies around it, and \(\textbf{s}_3\) is more likely reached if the initial share of clean producers is suitably large, as otherwise convergence toward it realizes only starting from particular initial pollution levels. Moreover, for given initial conditions, increasing \(\tau _d\) can alter the final outcome. For example, an initial configuration that, for small values of \(\tau _d,\) gives rise in the long run to a period-2 cycle, can converge to \(\textbf{s}^{*}_3\) for intermediate taxation levels, while it can again evolve toward periodic dynamics when \(\tau _d\) is large.

5 Discussion and insights on policy issues

In this section, we want to carry an explanation of the relevance of the static and dynamical properties of the model, in order to examine the findings in light of environmental policy insights. The static analysis suggests that policymakers should increase the taxation of the dirty technology wisely. Diversifying the taxation of technologies by placing more burden on the dirty producers has an initial positive effect, both on the promotion of technological change and on improving the quality of the environment. However, there exist scenarios for which such an action will backfire, with either a despicable increase in pollution levels (Outcome 2) or failures in obtaining transition toward the clean one (Outcome 3). Moreover, green transitioning does not necessarily imply an ameliorated environmental quality if the clean technology has some polluting capability (Outcome 3). Another caveat is that, even in the limit case of a perfectly clean technology, transition might not involve the majority of producers. At least, differently from the case above, in this scenario pollution decreases. Likewise, improved abatement technology may give way to a number of unintended consequences. Similarly to what discussed before, the green transition might dampen and a ‘lock-in’ situation ensues, where multiple steady states give rise to a less than expected reduction in pollution. Moreover, recalling Fig. 6, on varying \(\tau _d\) no attractor becomes “more robust” in terms of basins of attraction. The sensitivity of these with respect to \(\tau _d\) makes it difficult for the regulator to adjust \(\tau _d\) in order to promote convergence toward a desirable steady state.

On top of this, the interaction between the two variables in the proposed model might drive pollution to values that are hard to forecast by means of the static analysis only, which turns out to be misleading in elaborating effective policies. In some parameter settings, endogenous oscillations in pollution dynamics could lead \(p_t\) significantly above its steady state values. The shares of technology adoption could end up in similar behaviors, with oscillation in the shares of manufacturers that comply with the clean/dirty technologies.