Abstract

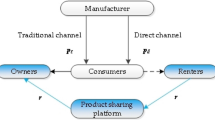

An infinite-period model is established to examine a firm’s long-term trade-in strategy in the presence of a P2P (peer-to-peer) second-hand marketplace. The firm can choose whether to adopt a trade-in strategy and determines the prices of new products with and without trade-ins. In addition to purchasing new products with or without trade-ins, consumers can trade used products on the P2P marketplace. We study a benchmark scenario in which the transaction fee rate of the marketplace is exogenously given and extend it to a scenario where the transaction fee rate is endogenously determined by the marketplace (called the “former scenario” and “latter scenario” for short). The main results are as follows: (1) There is a threshold for the transaction fee rate under which the marketplace exists. In the benchmark scenario, the firm will not adopt the trade-in strategy when product durability and production costs are both high. In the scenario with an endogenous transaction fee rate, the firm can always benefit from adopting the trade-in strategy since the marketplace adjusts the transaction fee rate to make it acceptable to the firm. In addition, the transaction fee rate decreases in product durability and production costs. (2) We compare the former scenario with the latter scenario and find if product durability and production costs are both high, the firm can obtain a higher profit and set a higher discount for trade-in consumers in the latter scenario; otherwise, the firm can obtain a higher profit and set a higher discount in the former scenario.

Similar content being viewed by others

Notes

\(e_1=[1,0,0,0,0]\), \(e_2=[0,1,0,0,0]\), \(e_3=[0,0,1,0,0]\), \(e_4=[0,0,0,1,0]\), \(e_5=[0,0,0,0,1]\).

In this paper, when we discuss the market structure, we refer to the problems of which consumer types exist, whether the firm chooses to adopt the trade-in strategy, and whether there are transactions in the marketplace. These results will facilitate understanding the long-term selling of different durable products.

According to Proposition 6, the range of \(\varphi ^*\) is [0, 1]. Therefore, for any \(\varphi _0\in [0,1]\), \(\varphi ^*\) can be higher or lower than \(\varphi _0\).

In Fig. 5, for ease of expression, trade-in incentive is assumed to be 0 when \(\varphi _0>\varphi _h\).

References

Agrawal, V., Ferguson, M., & Souza, G. (2008). Trade-in rebates for price discrimination and product recovery. IEEE Transactions on Engineering Management, 63(3), 326–339.

Alev, L., Agrawal, V., & Atasu, A. (2020). Extended producer responsibility for durable products. Manufacturing and Service Operations Management, 22(2), 364–382.

Bian, Y., Xie, J., Archibald, T. W., & Sun, Y. (2019). Optimal extended warranty strategy: Offering trade-in service or not. European Journal of Operational Research, 278(1), 240–254.

Cao, K., Wang, J., Dou, G., & Zhang, Q. (2018). Optimal trade-in strategy of retailers with online and offline sales channels. Computers and Industrial Engineering, 123, 148–156.

Cao, K., Bo, Q., & He, Y. (2018). Optimal trade-in and third-party collection authorization strategies under trade-in subsidy policy. Kybernetes, 47(5), 854–872.

Cao, K., Xu, X., Bian, Y., & Sun, Y. (2018). Optimal trade-in strategy of business-to-consumer platform with dual-format retailing model. Omega, 82, 181–192.

Chen, J., & Hsu, Y. (2015). Trade-in strategy for a durable goods firm with recovery cost. Journal of Industrial and Production Engineering, 32(6), 396–407.

Chen, J., & Hsu, Y. (2017). Revenue management for durable goods using trade-ins with certified pre-owned options. International Journal of Production Economics, 186, 55–70.

Chi, X., Fan, Z. P., & Wang, X. (2022). The entry quality threshold setting and commission rate contract selection of a peer-to-peer service sharing platform. Kybernetes. https://doi.org/10.1108/K-02-2022-0248

Choi, T. M., & He, Y. (2019). Peer-to-peer collaborative consumption for fashion products in the sharing economy: Platform operations. Transportation Research Part E: Logistics and Transportation Review, 126, 49–65.

De, P. (2017). Closed-loop supply chain coordination through incentives with asymmetric information. Annals of Operations Research, 253(1), 133–167.

Dong, C., Lei, Y., & Liu, Q. (2022). (Un)conditional collection policies on used products with strategic customers. Production and Operations Management. https://doi.org/10.1111/poms.13826

Fan, X., Guo, X., & Wang, S. (2022). Optimal collection delegation strategies in a retail-/dual-channel supply chain with trade-in programs. European Journal of Operational Research, 303(2), 633–649.

Feng, L., Li, Y., & Fan, C. (2020). Optimization of pricing and quality choice with the coexistence of secondary market and trade-in program. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03588-7

Feng, L., Zheng, X., Govindan, K., & Xue, K. (2019). Does the presence of secondary market platform really hurt the firm? International Journal of Production Economics, 213, 55–68.

Guo, X., Fan, X., & Wang, S. (2022). Trade-in for cash or for new? Optimal pricing decisions under the government subsidy policy. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04664-w

Huang, S., Yang, Y., & Anderson, K. (2001). A theory of finitely durable goods monopoly with used-goods market and transaction costs. Management Science, 47(11), 1515–1532.

Jiang, L. F., Dimitrov, S., & Mantin, B. (2017). P2P marketplaces and retailing in the presence of consumers’ valuation uncertainty. Production and Operations Management, 26(3), 509–524.

Konishi, H., & Sandfort, M. T. (2002). Existence of stationary equilibrium in the markets for new and used durable goods. Journal of Economic Dynamics and Control, 26(6), 1029–1052.

Li, K., & Xiao, L. (2019). Peer-to-peer short-term sharing on the bilateral commission platform. In 2019 16th international conference on service systems and service management (ICSSSM). https://doi.org/10.1109/ICSSSM.2019.8887628

Li, K. J., & Xu, S. H. (2015). The comparison between trade-in and leasing of a product with technology innovations. Omega, 54, 134–146.

Li, Y., Feng, L., Gocindan, K., & Xu, F. (2019). Effects of a secondary market on original equipment manufactures’ pricing, trade-in remanufacturing, and entry decisions. European Journal of Operational Research, 279(3), 751–766.

Ma, Z. J., Zhou, Q., Dai, Y., & Sheu, J. B. (2017). Optimal pricing decisions under the coexistence of “trade old for new’’ and “trade old for remanufactured’’ programs. Transportation Research Part E: Logistics and Transportation Review, 106, 337–352.

Mantin, B., Krishnan, H., & Dhar, T. (2014). The strategic role of third-party marketplaces in retailing. Production and Operations Management Society, 23(11), 1937–1949.

Miao, Z., Fu, K., Xia, Z., & Wang, Y. (2017). Models for closed-loop supply chain with trade-ins. Omega, 66, 308–326.

Miao, Z., Mao, H., Fu, K., & Wang, Y. (2018). Remanufacturing with trade-ins under carbon regulations. Computers and Operations Research, 89, 253–268.

Rao, R. S., Narasimhan, O., & John, G. (2009). Understanding the role of trade-ins in durable goods markets: Theory and evidence. Marketing Science, 28(5), 950–967.

Ray, S., Boyaci, T., & Aras, N. (2011). Optimal prices and trade-in rebates for durable, remanufacturable products. Manufacturing and Service Operations Management, 7(3), 208–228.

Rust, J. (1985). Stationary equilibrium in a market for durable assets. Econometrica, 53(4), 783–805.

Ryan, J. K., Sun, D., & Zhao, X. (2012). Competition and coordination in online marketplaces. Production and Operations Management, 21(6), 997–1014.

Vedantam, A., Demirezen, E. M., & Kumar, S. (2021). Trade-in or sell in my P2P marketplace: A game theoretic analysis of profit and environmental impact. Production and Operations Management, 30(11), 3923–3942.

Xiao, Y., & Zhou, S. X. (2020). Trade-in for cash or for upgrade? Dynamic pricing with customer choice. Product and Operations Management, 29(4), 856–881.

Zhu, X., Wang, M., Chen, G., & Chen, X. (2016). The effect of implementing trade-in strategy on duopoly competition. European Journal of Operational Research, 248(3), 856–868.

Acknowledgements

This work has been supported by the NSFC projects nos: 71971047 and 71831003.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appedix A: Proof of Lemma 1

First of all, it is noted that for any \(\theta \), \(R_\theta [N,p,\varphi ]=R_\theta [T,p,\varphi ],v_\theta [N,p,\varphi ]=v_\theta [T,p,\varphi ]\),\(R_\theta [U,p,\varphi ]=R_\theta [H,p,\varphi ]=R_\theta [I,p,\varphi ],v_\theta [U,p,\varphi ]=v_\theta [H,p,\varphi ]=v_\theta [I,p,\varphi ]\).

All \(\theta \) are classified as follows according to the optimal reaction function \(R_\theta [N,p,\varphi ]\).

If \(R_\theta [N,p,\varphi ]=I\), considering \(R_\theta [I,p,\varphi ]\), if \(R_\theta [I,p,\varphi ]=I\), the optimal choice in any Case is I, so it is a II-type consumer; if \(R_\theta [I,p,\varphi ]=U\), then \(R_\theta [U,p,\varphi ]=U\), it is a UU-type consumer; if \(R_\theta [I,p,\varphi ]=N\), it indicates that the optimal action of this type of the consumers from a certain N action to the next N decision is I, and its utility is \((1-\varphi ) p_s+\rho (\theta -p_n)\) in this process. However, if the intermediate action is replaced by N, the utility becomes \((1+\rho )\{\theta -p_n+(1-\varphi ) p_s\}\) which is strictly increased compared with I for any \(\theta \ge p_n\), so \(\theta <p_n\) can be obtained. On the other hand, \(v_\theta [I,p,\varphi ]=(\theta -p_n )+\rho (1-\varphi ) p_s+\rho ^2 (\theta -p_n )+\rho ^3 (1-\varphi ) p_s+ \cdot \cdot \cdot =((\theta -p_n )+\rho (1-\varphi ) p_s)/(1-\rho ^2 )\), but this consumer’s total utility is \((\theta -p_n+(1-\varphi ) p_s)/(1-\rho )\) if choosing action N each period after an action I, under the condition \(\theta <p_n\) and \((\theta -p_n )+\rho (1-\varphi ) p_s>0\) it is strictly greater than the former, which leads to contradiction, so there is no consumer with \(R_\theta [N,p,\varphi ]=I\) and \(R_\theta [I,p,\varphi ]=N\).

If \(R_\theta [N,p,\varphi ]=H\), considering \(R_\theta [H,p,\varphi ]\), if \(R_\theta [H,p,\varphi ]=I\), then \(R_\theta [I,p,\varphi ]=I\), which indicates its type is II; if \(R_\theta [H,p,\varphi ]=O\), then it is a UU-type consumer; if \(R_\theta [H,p,\varphi ]=N\), then it is a NH-type consumer.

If \(R_\theta [N,p,\varphi ]=T\), then \(R_\theta [T,p,\varphi ]=R_\theta [N,p,\varphi ]=T\), it is a TT-type consumer.

If \(R_\theta [N,p,\varphi ]=N\), then it is a NN-type consumer.

\(R_\theta [N,p,\varphi ]\) can never be U, because at this time U is dominated by H.

All possibilities are considered above, so the proof is completed.

Appendix B: Proof of Lemma 2

Suppose \(p_s>\frac{ap_n}{1+a\rho }\). From lemma 1, we know that the buyer of the second-hand market must be a UU-type consumer, if its type is \(\theta \), then \(v_\theta [U,p,\varphi ]=\frac{a\theta -p_s}{1-\rho }\), then the condition \(\theta >\frac{ap_n}{1+a\rho }\) must be satisfied. If this consumer adopts the NH action pattern, the total utility after a certain U action is \(\frac{(\theta -p_n)+\rho a\theta }{1-\rho ^2}\), then \(\frac{a\theta -p_s}{1-\rho } \ge \frac{(\theta -p_n)+\rho a\theta }{1-\rho ^2}\) implies \(\theta <\frac{p_n}{1+a\rho }\), which is contradictory, so \(p_s\le a/(1+a\rho ) p_n\).

Suppose \(p_s<\frac{2ap_n-a+a^2}{(1+2\rho )a-a(1+\rho )\varphi +1}\). Similarly, the seller must be a NN-type consumer, supposing its type as \(\theta \), then \(v_\theta [N,p,\varphi ]=\frac{\theta -p_n+(1-\varphi ) p_s}{1-\rho }\), if this consumer adopts NH strategy, then the total utility after a certain N action is \(\frac{(\theta -p_n)+\rho a\theta }{1-\rho ^2}\), then \(\frac{\theta -p_n+(1-\varphi ) p_s}{1-\rho }\ge \frac{(\theta -p_n)+\rho a\theta }{1-\rho ^2}\). If the consumer adopts the TT strategy, then the total utility after a certain N action is \(\frac{\theta -p_r}{1-\rho }\), then \(\frac{\theta -p_n+(1-\varphi ) p_s}{1-\rho }\ge \frac{\theta -p_r}{1-\rho }\). Considering the supply of used products in the second-hand market, it is known from lemma 1 that it can only come from NN-type consumers and TT-type consumers. Because there are NN-type consumers at the same time, the total utility of TT-type consumers will not be higher than NN-type consumers. Therefore, the two types of consumers must meet the requirements of \(\theta \ge \frac{p_n-(1+\rho )(1-\varphi )p_s}{1-a}\), so the second-hand supply is less than \(1-\frac{p_n-(1+\rho )(1-\varphi )p_s}{1-a}\). Now considering the demand, for NH-type consumers, \(v_\theta [H,p,\varphi ]=\frac{(\theta -p_n)+\rho a\theta }{1-\rho ^2 }\); for UU-type consumers, \(v_\theta [O,p,\varphi ]=\frac{a\theta -p_s}{1-\rho }\). So the demand\(\frac{p_n-(1+\rho )p_s}{1-a}-\frac{p_s}{a}\) can be obtained by comparing. However, when \(p_s<\frac{2ap_n-a+a^2}{(1+2\rho )a-a(1+\rho )\varphi +1}\), \(\frac{p_n-(1+\rho )p_s}{1-a}-\frac{p_s}{a}>1-\frac{p_n-(1+\rho )(1-\varphi )p_s}{1-a}\), it is inconsistent with the liquidation condition. To sum up, \(p_s\ge \frac{2ap_n-a+a^2}{(1+2\rho )a-a(1+\rho )\varphi +1}\).

Appendix C: Proof of Proposition 1

We only consider Case I here, and other cases can be obtained similarly.

In Case I, when \(p_n-p_r<(1-\varphi )\frac{ 2ap_n-a+a^2}{(1+2\rho )a-a(1+\rho )\varphi +1}\), if there is a TT-type consumer whose type is \(\theta \), then \(v_\theta [T,p,w]=\frac{\theta -p_r}{1-\rho }\). If the consumer adopts NN strategy after a certain T state, its total utility is \(\frac{\theta -p_n+(1-\varphi ) p_s}{1-\rho }\). Thus \(\frac{\theta -p_r}{1-\rho }\ge \frac{\theta -p_n+(1-\varphi ) p_s}{1-\rho }\), \(p_n-p_r\ge (1-\varphi ) p_s\) is obtained. From lemma 2, we know that \(p_s\ge \frac{ 2ap_n-a+a^2}{(1+2\rho )a-a(1+\rho )\varphi +1}\), which leads to contradiction. Therefore, only NN-type,NU-type,UU-type and II-type consumers may exist in stationary equilibrium.

For all NN-type consumers, \(v_\theta [N,p,\varphi ]=(\theta -p_n+(1-\varphi ) p_s)/(1-\rho )\); for all NH-type consumers, \(v_\theta [N,p,\varphi ]=(\rho (\theta -p_n)+a\theta )/(1-\rho ^2 )\), \(v_\theta [H,p,\varphi ]=((\theta -p_n)+\rho a\theta )/(1-\rho ^2 )\); for all UU-type consumers, \(v_\theta [U,p,\varphi ]=(a\theta -p_s)/(1-\rho )\); for all II-type consumers, \(v_\theta [I,p,\varphi ]=0\). The critical values are obtained by comparing the above formulas.

The \(g^*(\theta ) \) of each type consumers is obtained by (3).

Appendix D: Proof of Lemma 3

First we consider the utility function of the firm in Case IV, the determinant of the Hessian matrix is \(\frac{-(\rho -1)^2}{(a+1)^2}\), thus this matrix is always not negative definite as soon as \(\rho \ne 1\). And it indicates that there is not a interior point of local optimum in Case IV, so we can ignore Case IV because its boundary would be considered in other cases. Since we assume \(\rho =1\) for tractability and conciseness, Case IV is still abandoned because we want to make the result close to the condition when \(\rho \rightarrow 1\).

The four utility functions of the firm in each case are as follows:

Denote the Hessian matrix of \(\pi _{f3}\) as \(H_3\).

Next, by calculating the the determinant of \(H_3\) we can acknowledge \(H_3\) is always strict negative definite if and only if \(\varphi < \frac{a+\sqrt{2-2a^2}-1}{a}\). And when \(\varphi < \frac{a+\sqrt{2-2a^2}-1}{a}\), the optimal point is as follows:

By plugging the above result to \(p_n-p_r = \frac{ (1-\varphi )(2ap_n-a+a^2)}{(1+2\rho )a-a(1+\rho )\varphi +1}\), it is not hard to prove that optimal point always satisfy the limit condition of \(p_n-p_r > \frac{ (1-\varphi )(2ap_n-a+a^2)}{(1+2\rho )a-a(1+\rho )\varphi +1}\) because there is not a root of \((a,c,\varphi )\) in the defined area. Besides, Case I can be regard as a special case of Case III on the hyperplane of \(p_n-p_r = \frac{ (1-\varphi )(2ap_n-a+a^2)}{(1+2\rho )a-a(1+\rho )\varphi +1}\). So, when \(\varphi < \frac{a+\sqrt{2-2a^2}-1}{a}\), Case I is dominated by Case III. Now we define \(\varphi _1=\frac{a+\sqrt{2-2a^2}-1}{a}\).

Then, by solving \(2p_r-p_n=1-a\) we can acknowledge the optimal point satisfy \(2p_r-p_n\le 1-a\) if and only if \(\varphi \le \frac{(1-a)(1+a-c)}{a+ac+a^2}\). Define \(\varphi _2 = \frac{(1-a)(1+a-c)}{a+ac+a^2}\). Remember in Case III if \(2p_r-p_n\ge 1-a\), the HH consumers and UU consumers do not exist and it turn into Case II, so Case II can be regard as a special case of Case III on the hyperplane of \(2p_r-p_n=1-a\). Therefore, when \(\varphi < min{(\varphi _1,\varphi _2)}\), the optimal point in Case III is the firm’s optimal decision.

Define \(\varphi _3=\frac{(3a+c+3)(1-a)}{2a(a+c+1)}\), when \(\varphi \ge \varphi _3\), the optimal point in Case I \(p_n=\frac{(1-\varphi )a+c+1}{2}\) beyond the limit range \(\frac{1-a^2}{1+2a\varphi -a}\). It indicates that Case I is dominated by Case II.

Finally, following inequalities hold since there is not a root of \(c\in (0,1)\) for the equation that makes the two sides of the unequal sign equal, which is not difficult to prove; 1) For all \(\varphi \in (0,1)\), if \(\varphi \le \varphi _2\), then \(\varphi \le \varphi _1\); 2) For all \(\varphi \in (0,1)\), if \(\varphi \ge \varphi _2\), then\(\varphi \ge \varphi _3\). So, when \(\varphi \le \varphi _2\), \(\varphi \le \varphi _1\), and the optimal point in Case III is the firm’s optimal decision. When \(\varphi \ge \varphi _2\), if \(\varphi \le \varphi _1\), then Case I is dominated by Case III and Case III is dominated by Case II; if \(\varphi \ge \varphi _1\), then Case III can be abandoned, also because \(\varphi \le \varphi _1\), Case I is dominated by Case II. Therefore the optimal point in Case II is the firm’s optimal decision as long as \(\varphi \ge \varphi _2\).

Appendix E: Proof of Proposition 3

By derivation and inequality reduction, we obtain:

Appendix F: Proof of Proposition 4

By taking derivative of \(p_{nb}^*-p_{rb}^*\) with respect to \(\varphi _0\),

\(\frac{\partial (p_{nb}^*-p_{rb}^*)}{\partial \varphi _0}=\frac{a(a-1)g(\varphi _0)}{2(- a^2\varphi _0^2 + 2a^2\varphi _0 - 3a^2 - 2a\varphi _0 + 2a + 1)^2}\), where \(g(\varphi _0)=(2a^2+2a^3+a^2c)\varphi _0^2-(2a+4a^2+2a^3+4a^2c)\varphi _0+(4a+c-2ac+a^2c-4a^3)\). The extreme point is \(\frac{2a+4a^2+2a^3+4a^2c}{4a^2+4a^3+2a^2c}>1\), so \(g(\varphi _0)>g(\varphi _h)=\frac{2c(1-a^2)(3a^2+2ac+2a+c^2+2c-1)}{(1+a+c)^2}>0\). So \(\frac{\partial (p_{nb}^*-p_{rb}^*)}{\partial \varphi _0}<0\);

By taking derivative of \(p_{nb}^*-p_{rb}^*\) with respect to a,

\(\frac{\partial (p_{nb}^*-p_{rb}^*)}{\partial a}=\frac{(\varphi _0-2)B}{2(- a^2\varphi _0^2 + 2a^2\varphi _0 - 3a^2 - 2a\varphi _0 + 2a + 1)^2}\).

By taking derivative of B with respect to c, \(\frac{\partial B}{\partial c}=- a^2\varphi _0^2 - a^2 + 2a - 1<0\). So we only need to prove \(B<0\) when \(c=0\). Assume \(c=0\), then \(B=a(\varphi _0-2)h(\varphi _0)\), \(h(\varphi _0)=a^3\varphi _0^2-(2a^3-4a^2+2a)\varphi _0+(1-a)(2+a-3a^2)\). If \(a>1/2\), then \(\varDelta =-4a^2(1-a)^2(2a^2+4a-1)<0\), so \(h(\varphi _0)>0\), else if \(a\le 1/2\), then the extreme point \(\frac{2a^3-4a^2+2a}{2a^3}\ge 1\), so \(h(\varphi _0)>h(1)=2a^3-3a+2>0\). Thus \(h(\varphi _0)>0\), \(B<0\), \(\frac{\partial p_{nb}-p_{rb}}{\partial a}>0\).

By taking derivative of \(p_{nb}^*-p_{rb}^*\) with respect to c,

\(\frac{\partial (p_{nb}^*-p_{rb}^*)}{\partial c}=\frac{(1-a)(2a-a\varphi _0)}{2(- a^2\varphi _0^2 + 2a^2\varphi _0 - 3a^2 - 2a\varphi _0 + 2a + 1)}\ge 0\).

Appendix G: Proof of Proposition 6

First, \(\pi _p\) has three zero points: 0, \(\frac{(1-a)(1+a-c)}{a+ac+a^2}\) and \(\frac{2a+c}{a}\). Denote \(F(\varphi ,a,c)\) as the denominator of \(\frac{\partial \pi _p}{\partial \varphi }\) and \(\varphi _2\) as \(\frac{(1-a)(1+a-c)}{a+ac+a^2}\). The two zero points of the denominator of \(\pi _p\) are \(\frac{a-1\pm \sqrt{2-2a^2}}{a}\). We denote \(\varphi _1\) as the bigger one and it is easy to find the smaller root is negative. When \(\varphi _1\le \varphi _2\), \(3a^2+2c^2+2ac+2a+2c\le 1\). Besides \(\varphi _2\ge 1\) is equivalent to \(a+2a^2+c\le 1\), \(\varphi _1\ge 1\) is equivalent to \(a\le \frac{\sqrt{2}}{2}\). So when \(\varphi _1\le \varphi _2\), \(\varphi _2\ge \varphi _1>1\). Consider the size relationship of \(\varphi _1\), \(\varphi _2\) and 1, there are three potential cases: 1) \(\varphi _1>\varphi _2\). 2) \(\varphi _2\ge \varphi _1>1\). 2) \(\varphi _1\ge \varphi _2>1\). Define them as Case 1, Case 2 and Case 3.

Case 1 If \(\varphi _1>\varphi _2\), \(\pi _p\) is smooth in \((0,\varphi _2)\), then F at least has one zero points for \(\varphi \) in \((0,\varphi _2)\). Noticing that F is a quartic function for \(\varphi \), if F has more than one zero point in \((0,\varphi _2)\), then F must have three zero points. Then \(\frac{\partial ^2 F}{\partial ^2 \varphi }\) has a zero point in \((0,\varphi _2)\). We solved \(\frac{\partial ^2 F}{\partial ^2 \varphi }=0\) and the smaller root is:

where

\(\varphi _r\) must be smaller than \(\varphi _2\). By simplification,

However,

which leads to contradiction.

So F has only one zero points in \((0,\varphi _2)\). Also it is obvious that \(\frac{\partial \pi _p}{\partial \varphi }\) is positive on 0 and negative on \(\varphi _2\). So, \(\pi _p\) is convex in \((0,\varphi _2)\) and \(\varphi ^*\) is existing and unique.

Note that all the roots of \(\frac{\partial ^2 F}{\partial ^2 \varphi }\) is larger than \(\varphi _2\) and its quadratic coefficient is positive, F is concave in \((0,\varphi _2)\), so \(\varphi ^*\le \varphi _2+\varphi ^*\frac{F(\varphi _2)}{F(0)}\), \(\varphi ^*\ge -F(0)/\frac{\partial F(0)}{\partial \varphi }\).

Now the implicit function \(\varphi ^*(a,c)\) exists. First, for any a, \(\varphi ^*(a,0)\ge \varphi ^*(a,1)\) by the above estimates. Then assume there exists \(c_1\) and \(\frac{\partial \varphi ^*(c_1)}{\partial c}=0\). Because

\(\frac{\partial \varphi ^*(c_1)}{\partial c}=-\frac{\partial F(a,c_1,\varphi ^*(c_1))}{\partial c}/\frac{\partial F(a,c_1,\varphi ^*(c_1))}{\partial \varphi }\), \(\frac{\partial F(a,c_1,\varphi ^*(c_1))}{\partial c}=0\). Also we know \(F(a,c_1,\varphi ^*(c_1))=0\), so \(c_1\) is a fold root for quadratic function \(F(a,c,\varphi ^*(c_1))\). By \(\varDelta =0\), \((a^2\varphi ^2+2a^2\varphi +3a^2-2a\varphi -2a-1)(a^2\varphi ^2-2a^2\varphi +3a^2+2a\varphi -2a-1)^3=0\). The four roots of \(\varphi \) are \(\frac{a-1\pm \sqrt{2-2a^2}}{a}, \frac{1-a\pm \sqrt{2-2a^2}}{a}\). However, in this case \(\varphi _2<\frac{a-1+\sqrt{2-2a^2}}{a}<\frac{1-a+\sqrt{2-2a^2}}{a}\) and \(0>\frac{1-a-\sqrt{2-2a^2}}{a}>\frac{a-1-\sqrt{2-2a^2}}{a}\), so \(\varphi ^*(c_1)\) can not be any one of them which leads to contradiction. So \(\frac{\partial \varphi ^*}{\partial c}<0\) in \((0,\varphi _2)\).

Also the implicit function \(\varphi ^*(a,c)\) (Here \(\varphi ^*(a,c)\) is used as the the implicit function induced by \(F(a,c,\varphi )=0\)) for a exists, for any c, \(\lim _{a\rightarrow 0}\varphi ^*(a,c)\rightarrow +\infty \) by the above estimates and \(\varphi ^*(1,c)=0\) because \(\varphi _h=0\). So \(\frac{\partial \varphi ^*}{\partial a}<0\) in \(0+\) and \(1-\). Assume there exists \(a_1\) which satisfies \(\frac{\partial \varphi ^*(a_1)}{\partial a}=0\), then \(a_1\) is a multiple root for 5-order function \(F(a,c,\varphi ^*(a_1))\). Also, there exists \(a_2\) which satisfies \(\varphi ^*(a_1,c)=\varphi ^*(a_2,c)\), so \(a_2\) is a root for 5-order function \(F(a,c,\varphi ^*(a_1))\).

Now consider \(F(a,c,\varphi ^*(a_1))\). \(F(0,c,\varphi ^*(a_1))=c-c^2>0\), but \(F\rightarrow -\infty \) when \(a\rightarrow -\infty \), so F has at least one negative real root. We find F have 5 real roots and denote them as \(a_1,a_1,a_2,a_3,a_4\), also by coefficients of F, \(a_3a_1a_1a_2a_4=\frac{c^2-c}{\varphi ^4-15\varphi ^2+10\varphi +6}<0\), so we can assume \(a_3<0\) and \(a_4>0\).

Consider the root of F as a function of \(\varphi \) between the three roots of \(\pi _p\). When \(a\rightarrow 0\), these roots are all negative for all roots are not positive. But when \(a\rightarrow -1-c\), \(\varphi _2\rightarrow +\infty \), so there exist root which is bigger than \(2-\frac{c}{1+c}\), it is bigger than 1 and thus bigger than \(\varphi ^*(a_1)\). According to continuity there exists \(a_0\in (-1-c,0)\) which satisfy \(\varphi ^*(a_0)=\varphi ^*(a_1)\), so \(a_0\) is a root for 5-order function \(F(a,c,\varphi ^*(a_1))\), so \(a_0=a_3\).

Then \(a_4>\frac{a_3a_1a_1a_2a_4}{-1-c}\), \(a_4<(a_3+a_2+a_1+a_1+a_4)+1+c\), so \(\frac{a_3a_1a_1a_2a_4}{-1-c}<(a_3+a_2+a_1+a_1+a_4)+1+c\). By substituting the coefficients of F we can simplify it to \(c^3+6c\varphi ^3-9c\varphi ^2-12c\varphi +8c+4\varphi ^3-12\varphi ^2+6\varphi +10<0\). However \(c^3+6c\varphi ^3-9c\varphi ^2-12c\varphi +8c+4\varphi ^3-12\varphi ^2+6\varphi +10>c^3+6c\varphi ^3-9c\varphi ^2-12c\varphi +8c+2>c^3-12c\varphi +5c+8>0\) which leads to contradiction. So \(\frac{\partial \varphi ^*}{\partial a}<0\) in \((0,\varphi _2)\).

Case 2: If \(\varphi _2\ge \varphi _1>1\) and \(\varphi _2>\frac{2a+c}{a}\). It is obvious that \(\frac{\partial \pi _p}{\partial \varphi }\) is positive on 0 and 1 and we will show that F retain positive in (0, 1). At this time when \(\varphi _1>\frac{2a+c}{a}\), then \(\frac{\partial \pi _p}{\partial \varphi }\) is negative on \(\frac{2a+c}{a}\), so there is a root for F in \((1,\frac{2a+c}{a})\). By Case I F can not have three or more roots in \((0,\varphi _2)\), so F retain positive in (0, 1). When \(\varphi _1<\frac{2a+c}{a}\), then there is a root for F in \((\frac{2a+c}{a},\varphi _2)\), F retain positive in (0, 1) for the same reason. so in this case \(\varphi ^*=1\).

Case 3: If \(\varphi _2\ge \varphi _1>1\) and \(\varphi _2<\frac{2a+c}{a}\). It is obvious that \(\frac{\partial \pi _p}{\partial \varphi }\) is positive on 0 and 1 and we will also show that F retain positive in (0, 1). Assume F has two roots in (0, 1), then F has four real roots: two of them are in (0, 1), one of them is in \((\varphi _2,\frac{2a+c}{a})\) and the last one is in \((\frac{2a+c}{a},+\infty )\). Denote \(z_1,z_2,z_3,z_4\) as the four roots. Then \(z_4\ge (z_1+z_2+z_3+z_4)-3-\frac{2a+c}{a}\), by using coefficient of F, \(z_4\ge \frac{ac+c^2+c+4-4a^2}{a+c+1}\). Besides, \(\varphi _2\frac{ac+c^2+c+4-4a^2}{a+c+1}< z_3z_4<z_1z_2+z_1z_3+z_1z_4+z_2z_3+z_2z_4+z_3z_4\) which can be simplified as

However, as \(3a^2+2c^2+2ac+2a+2c\le 1\),

which leads to contradiction. So, F retains positive in (0, 1) and \(\varphi ^*=1\).

Appendix H: Proof of Proposition 7

It is obvious that \(\pi ^*_{p1}\le \pi ^*_{p2}\). When \(\varphi <\varphi _h\), \(\frac{\partial \pi _f}{\partial \varphi }= \frac{a(a - 1)(a\varphi - c - 2a)(c - ac + a\varphi + a^2\varphi + a^2 + ac\varphi - 1)}{2(- a^2\varphi ^2 + 2a^2\varphi - 3a^2 - 2*a\varphi + 2a + 1)^2}<0\). So when \(\varphi _0<\varphi ^*\), \(\pi ^*_{f1}>\pi ^*_{f2}\). Otherwise, \(\pi ^*_{f1}\le \pi ^*_{f2}\).

Appendix I: Proof of Proposition 8

According to Proposition 4, When \(c+a+2a^2\ge 1\), \(\frac{\partial (p^*_{n}-p^*_{r})}{\partial \varphi }<0\). So \(i_1>i_2\) if \(\varphi _0<\varphi ^*\); \(i_1\le i_2\) if \(\varphi ^*\le \varphi _0\le \varphi _h\).

Appendix J: Results When \(\rho \) is not too small

This section shows the results when \(\rho \) is not too small. All the results in the text part are examined when \(\rho \) is not too small and the main qualitative results still hold. Except for Proposition 6 and a part of Proposition 4 which are hard to prove and examined by numerical study, all the propositions and lemmas of \(\rho =1\) in the text part are rediscussed here and they have the same numbers after “J." (for example, Lemma 3 and Proposition 3 correspond to Lemma J.3 and Proposition J.3). All the observations of \(\rho =1\) in the text part are also reobserved here and they have the same numbers after “J." (for example, Observation 1 corresponds to Observation J.1).

We list the results of the scenario when the transaction fee rate is exogenously given (Subsection J.1), the results of the scenario when the transaction fee rate is endogenously determined by the marketplace (Subsection J.2) and the comparison between the two scenarios (Subsection J.3).

The definitions of a “not too small" \(\rho \) is shown later in the first two subsections.

1.1 J.1 Scenario with an exogenously given transaction fee rate

In this subsection we assume that the transaction fee rate of the marketplace is exogenously given and denote it as \(\varphi _0\). We will focus on the market structure and the trade-in incentive. For a given \(\varphi _0\), define \(\rho _0(a,\varphi _0) = \max (\rho _1(\varphi _0),\rho _2(a),\rho _3(a,\varphi _0))\), where

Figure 4 shows \(\rho _0\) with respect to a and \(\varphi _0\).

The results of this subsection is proved when \(\rho \ge \rho _0\). As explained in the text part, \(\rho \ge 0.95\) holds in general. Therefore as shown in Table 5, this sufficient condition can be satisfied in reality at most times.

Define \((p_n^*,p_r^*)=\arg \max _{p_n,p_r}{\pi _f}\) as the firm’s optimal pricing decision (\(\pi _f\) is defined in Eq.(8)). Define

\((p_{n2},p_{r2})\) is the optimal point in \(S_{II}\) (\(S_i\) are defined in Subsubsection 3.3.1). \((p_{n3},p_{r3})\) is the optimal point in \(S_{III}\).

Lemma J.3

For a given \(\varphi _0\), when \(\rho \ge \rho _0\), \((p_n^*,p_r^*)\) can be expressed as follows:

Proof

First, by the proof of Lemma 3, the Hessian matrix of \(\pi _{f4}\) is not negative definite. Thus there is not a optimal point inside of region \(S_{IV}\). we can ignore this case since it must be dominated by one of the other three cases.

The utility function of the firm in other three cases are:

In Case I and Case II, the utility functions are concave. The optimal points are:

Substituting them into the conditions of region \(S_{I}\) (\((1-a) (1+a \rho )/(1+a \rho \varphi _0+a \varphi _0-a)-p_{n}>0\)) and \(S_2\) (\(p_{n}-(1-a) (1+a \rho )/(1+a \rho \varphi _0+a \varphi _0-a)>0\)), respectively, we can obtain \((1-a) (1+a \rho )/(1+a \rho \varphi _0+a \varphi _0-a)-p_{n1}>0\) if and only if \(\varphi _0<\varphi _1\), \(p_{n2}-(1-a) (1+a \rho )/(1+a \rho \varphi _0+a \varphi _0-a)>0\) if and only if \(\varphi _0>\varphi _2\). \(\varphi _1\) and \(\varphi _2\) are expressed as follows:

Define

By simplification, \(\varphi _1-\varphi _2>0\) is equivalent to \(x_1<x_2\). As \(x_1^2-x_2^2=-8 a^2 (1+\rho )^2 (1-a)^2 (1+a \rho ) (1+a \rho -c)<0\), so \(\varphi _1>\varphi _2\). When \(\varphi _0>\varphi _1\), Case I is dominated by Case II.

Denote the Hessian matrix of \(\pi _{f3}\) as \(H_3\).

Define

\(H_3\) is negative definite if and only if its determinant \(\left| H_3\right| >0 \), which is equivalent to \(a_3 \varphi _0^2+b_3 \varphi _0+c_3>0\). It is not difficult to note that \(a_3<0,c_3>0\), so when \(\varphi _0>0\), \(a_3 \varphi _0^2+b_3 \varphi _0+c_3>0\) if and only if \(\varphi _0\) is smaller than the larger root of the quadratic equation \(a_3 \varphi _0^2+b_3 \varphi _0+c_3=0\). Denote this root as \(\varphi _3\),

Therefore, when \(\varphi _0<\varphi _3\), \(H_3\) is negative definite. The optimal point \((p_{n3},p_{r3})\) is the optimal solution in Case III.

Consider the conditions for Case III:

By solving the equations that makes the two sides of the unequal sign equal, when \(\rho \ge \rho _1(\varphi _0)\), \(\frac{a(1-a)(1-\varphi _0)}{(2\rho +\varphi _0-\varphi _0 \rho -1)a+1}>1-a\). When \(\rho \ge \rho _3(a,\varphi _0)\), \(\frac{(1+2\rho )a-(1+\rho )a \varphi _0+1}{(2\rho +\varphi _0-\varphi _0 \rho -1)a+1}<1+\rho \). Thus, if \(p_{n3},p_{r3}\) satisfy Eq. (13a), they also satisfy Eq. (13b). Substitute \(p_{n3},p_{r3}\) into Eq. (13a), we can obtain \(p_{n3}-(1+\rho )p_{r3}+1-a>0\) if and only if \(\varphi _0<\varphi _4\), where

Now compare \(\varphi _3\) and \(\varphi _4\). Define

By simplification, \(\varphi _3-\varphi _4>0\) is equivalent to \(x_3<x_4\). Note that \(x_3,x_4\) is linear in c, we only need to prove \(x_3<x_4\) when \(c=0\) and \(c=1\). When \(c=0\), \(x_3<0,x_4>0\). When \(c=1\),

When \(\rho \ge \rho _2(a)\), the quadratic function \(-13a^2\rho ^2+68a^2\rho + 9a^2 -62a\rho ^2 + 14a -9\rho - 7\) is negative. So, \(\varphi _3>\varphi _4\). By the similar method, we can also obtain \(\varphi _4>\varphi _1\).

Therefore, when \(\varphi _0<\varphi _4\), Case I and Case II are dominated by Case III because they can be regarded as a special case of Case III on the hyperplane of \(p_n-(1+\rho )p_r+1-a=0,p_n-\frac{(1+2\rho )a-(1+\rho )a \varphi _0+1}{(2\rho +\varphi _0-\varphi _0 \rho -1)a+1}p_r+\frac{a(1-a)(1-\varphi _0)}{(2\rho +\varphi _0-\varphi _0 \rho -1)a+1}=0\). Since \(\varphi _3>\varphi _4\), the optimal point \((p_{n3},p_{r3})\) in Case III is the optimal solution of Eq. (9). When \(\varphi _0>\varphi _4\), Case III must be dominated since the optimal solution in Case III is on the boundary. Since \(\varphi _4>\varphi _1\), Case I is dominated by Case II, the optimal point \((p_{n2},+\inf )\) in Case II is the optimal solution of Equation (9). \(\square \)

Proposition J.2 is directly derived from Lemma J.3.

Proposition J.2

When \(\varphi _0\le \varphi _h\), the condition of Case III is satisfied under which trade-in consumers exist and new products are purchased by both TT-type and NU-type consumers; otherwise, the condition of Case II is satisfied under which trade-in consumers do not exist and new products are purchased by NU-type consumers only.

Similar to Proposition 2, Proposition J.2 indicates that the firm adopts trade-in strategy and sell the recycled products on the P2P marketplace as long as the transaction fee rate does not exceed \(\varphi _h\). Thus, \(\varphi _h\) is the firm’s maximum acceptable transaction fee rate for trade-in strategy. The threshold \(\varphi _h\) is analyzed in Proposition J.3.

Proposition J.3

\(\frac{\partial \varphi _h}{\partial a}<0,\frac{\partial \varphi _h}{\partial c}<0\).

Proof

By simplification, \(\frac{\partial \varphi _h}{\partial a}<0\) is equivalent to \(2 a^2 c \rho ^2 + 6 a^2 c \rho - a^2 \rho ^3 + 5 a^2 \rho ^2 - 6 a c \rho ^2 - 2 a c \rho - 2 a \rho ^2 + 10 a \rho - 3 c^2 \rho - c^2 - 4 c \rho + 4 c - \rho + 5>0\).

By simplification, \(\frac{\partial \varphi _h}{\partial c}<0\) is equivalent to \((1-a) (3+\rho ) (1+a \rho )/(a (1+\rho ) (1+a \rho +c)^2)>0\), which is obvious. \(\square \)

Similar to Proposition 3, Proposition J.3 shows that the maximum acceptable transaction fee rate decreases in durability and production costs.

Define

It is not difficult to note that \(\frac{g(a,c,\rho )}{\partial c}>0\), \(\frac{g(a,c,\rho )}{\partial a}>0\).

The following proposition examines how the transaction fee rate and production costs effect on trade-in incentives.

Proposition J.4

(1) When \(\varphi _0\le \varphi _h\) and \(a<-(\rho - 1)/(3 \rho - 2 \varphi _0 - 2 \varphi _0 \rho + 2 \rho ^2 + 3)\), \(\frac{\partial (p^*_{n}-p^*_{r})}{\partial c}<0\); otherwise, \(\frac{\partial (p^*_{n}-p^*_{r})}{\partial c}\ge 0\).

(2) When \(\varphi _0\le \varphi _h\), \( \rho + a + ap + 2 a \rho ^2 >1\) and \(g(a,c,\rho )>0\), \(\frac{\partial (p^*_{n}-p^*_{r})}{\partial \varphi _0}<0\).

Proof

By simplification, \(\frac{\partial (p^*_{n}-p^*_{r})}{\partial c}<0\) is equivalent to \(3 a + \rho - 2 a \varphi _0 + 3 a \rho + 2 a \rho ^2 - 2 a \varphi _0 \rho - 1<0\) which is linear about a. By taking derivative of \(p^*_n-p^*_r\) with respect to \(\varphi _0\),

where

By taking derivative of f with respect to \(\varphi _0\),

By taking derivative of \(\frac{\partial f}{\partial \varphi _0}\) with respect to c,

When \(c=0\),

Therefore \(\frac{\partial f}{\partial \varphi _0}<0\). When \(\varphi _0=\varphi _h\),

So when \(\varphi _0<\varphi _h\), \(f>0\), \(\frac{\partial (p^*_n-p^*_r)}{\partial \varphi _0}<0\). \(\square \)

Note that the case of \(a\le \frac{1-\rho }{3 \rho - 2 \varphi - 2 \varphi \rho + 2 \rho ^2 + 3}\) can be ignored since it actually requires a very low a (according to previous approximation, in this case \(a<0.01\)). Thus, similar to Proposition 4, Proposition J.4 shows that when trade-in consumers exist, the trade-in incentive increases in production costs. When trade-in consumers exist and both durability and production costs are not too low (\( \rho + a + ap + 2 a \rho ^2 >1\) and \(g(a,c,\rho )>0\)), the trade-in incentive decreases in the transaction fee rate. Besides, it is hard for us to examine how durability effect on trade-in incentives. The numerical result shows that when \(\varphi _0\le \varphi _h\), the trade-in incentive increases in durability a (Fig. 5)Footnote 4.

Figure 5 show that when trade-in consumers exist, the trade-in incentive increases in durability and production costs. The result of Proposition 4 is now examined by Proposition J.4 and Fig. 5.

1.2 J.2 Scenario with an endogenous transaction fee rate

In this scenario, we consider the transaction fee rate \(\varphi \) as a decision variable of the P2P marketplace. We discuss the optimal transaction fee rate of the P2P marketplace, and analyze the trade-in incentive and the marketplace’s profit through a numerical study. In order to define the P2P marketplace’s transaction fee rate in stationary equilibrium \(\varphi ^*\), we first assume \(\varphi ^*\) satisfies \(\rho \ge \rho _0(a,\varphi ^*)\). Then we obtain a numerical approximation of \(\varphi ^*\) under this assumption and show that \(\rho \ge \rho _0(a,\varphi ^*)\) holds in most of the parameter area.

We first prove that the maximum acceptable transaction fee rate for the firm \(\varphi _h\) is always positive.

Lemma J.4

\(\varphi _h\ge 0\).

Proof

\(\varphi _h=\frac{x}{2 a (\rho + 1) (c + a \rho + 1)}\), where

By taking derivative of x with respect to c, \(\frac{\partial x}{\partial c}=3a - 3\rho + 3a\rho - 2a\rho ^2 - 1<1.5a- 3\rho - 0.5a\rho ^2 - 1<0\). When \(c=1\), \(x=- 2a^2\rho ^3 + a^2\rho ^2 - 3a^2\rho - 5a\rho ^2 + 9a\rho - 4\rho + 4\ge - 2a^2\rho ^3 + a^2\rho ^2 - 3a^2\rho - 5a\rho ^2 + 9a\rho \ge 0\). Therefore \(x\ge 0\). \(\square \)

Similar to Proposition 5, when the P2P marketplace determines the transaction fee rate, the transaction fee rate will always be less than the maximum acceptable transaction fee rate for the firm since it is always greater than 0.

Proposition J.5

When \(\rho \ge \rho _0(a,\varphi ^*)\), the condition of Case III is always satisfied in stationary equilibrium under which trade-in consumers exist and new products are purchased by both TT-type and NU-type consumers.

Define

According to Proposition J.4 and Eq. (5), the optimization problem of the P2P marketplace can be expressed as follows:

Denote \(\varphi ^*(a,c,\rho )\) as the optimal solution of (5). The numerical result shows that there exists a unique \(\varphi ^*(a,c,\rho )\) (Fig. 6).

Then, denote \(\rho ^{'}_0(a,c,\rho )=\rho _0(a,c,\varphi ^*(a,c,\rho ))\). As shown in Fig. 7, the area of “o" indicates \(\rho \ge \rho ^{'}_0(a,c,\rho )\) and the area of “x" indicates \(\rho < \rho ^{'}_0(a,c,\rho )\). We find the assumption \(\rho \ge \rho ^{'}_0(a,c,\rho )\) can cover most of the parameter area. Thus the results in this subsection do not lose much generality.

In addition, the numerical result shows that the optimal transaction fee rate \(\varphi ^*(a,c,\rho )\) decreases in durability a and production costs c when \(\rho \ge \rho ^{'}_0(a,c,\rho )\) (Fig. 8).

In summary, when \(\rho \ge \rho ^{'}_0(a,c,\rho )\), according to the numerical results there exists a unique \(\varphi ^*(a,c,\rho )\) and \(\varphi ^*(a,c,\rho )\) decreases in both durability a and production costs. The major results of Proposition 6 are examined. Now, we use numerical study to analyze the trade-in incentive and the P2P marketplace’s profit. We first find the trade-in incentive increases in both durability and production costs when \(\rho \ge \rho ^{'}_0(a,c,\rho )\), which is similar to that in Subsection 1 (Fig. 9).

In the following, we investigate the profit of the P2P marketplace since it is now a decision-maker.

Observation J.1

(1) \(\pi _p^*\) first increases and then decreases in a. (2) \(\pi _p^*\) decreases in c.

According to Fig. 10, when \(\rho \ge \rho ^{'}_0(a,c,\rho )\), the profit of the P2P marketplace first increases and then decreases in durability, while it always decreases in production costs. The result is similar to Observation 1.

1.3 J.3 Comparison between the two scenarios

Denote the scenario in Subsection J.1 as Scenario J.1, and the scenario in Subsection J.2 as Scenario J.2. We have found that trade-in strategy is always adopted in Scenario J.2, while trade-in strategy is not adopted in Scenario J.1 when product durability and production cost are high. This subsection further compares these two scenarios from the perspectives of the proportion of trade-in consumers which is denoted as \(\beta \), the marketplace and the firm’s profits, and the trade-in incentive.

Observation J.2

In Scenario J.2, \(\beta >0.3\) always holds. \(\beta \) approaches 1 when both a and c approach 0.

According to Fig. 11, similar to Observation 2, when durability and production costs are both low, most of the consumers will purchase new product with trade-ins, while when durability and production costs are both high, there is still a proportion of trade-in consumers.

Denote \(\pi ^*_{p1},\pi ^*_{f1}\) as the marketplace and the firm’s profits in Scenario J.1 and \(\pi ^*_{p2},\pi ^*_{f2}\) as the marketplace and the firm’s profits in Scenario J.2 respectively. Denote \(i_1,i_2\) as the trade-in incentive in Scenario J.1 and Scenario J.2, respectively. The following two propositions compare the profits and the trade-in incentives in the two scenarios.

Proposition J.7

1) \(\pi ^*_{p1}\le \pi ^*_{p2}\).

2) When \(\varphi _0<\varphi ^*\), \(\pi ^*_{f1}>\pi ^*_{f2}\). When \(\varphi ^*\le \varphi _0\le \varphi _h\), \(\pi ^*_{f1}\le \pi ^*_{f2}\).

Proof

When \(\varphi <\varphi _h\), it is obvious that \(\pi ^*_{p1}\le \pi ^*_{p2}\).

By taking derivative of \(\pi _f\) with respect to \(\varphi \),

When \(\varphi <\varphi _h\), \(4 \rho + 4 a \varphi - 9 a \rho + 5 a \rho ^2 + 3 a^2 \rho - a^2 \rho ^2 + 2 a^2 \rho ^3 + 2 a^2 \varphi \rho ^2 + 4 a \varphi \rho + 2 a^2 \varphi \rho - 4<0\). Note that

So \(\frac{\partial \pi _f}{\partial \varphi }<0\). When \(\varphi _0<\varphi ^*\), \(\pi ^*_{f1}>\pi ^*_{f2}\). Otherwise, \(\pi ^*_{f1}\le \pi ^*_{f2}\). \(\square \)

Similar to Proposition 7, Proposition J.7 shows that: 1) The marketplace ’s profit in Scenario J.2 is always higher. 2) When trade-in strategy is adopted (\(\varphi _0\le \varphi _h\)), which scenario the firm can obtain a higher profit in depends on which scenario features a lower transaction fee rate.

Proposition J.8

When \( \rho + a + ap + 2 a \rho ^2 >1\) and \(g(a,c,\varphi )>0\), \(i_1>i_2\) if \(\varphi _0<\varphi ^*\); \(i_1\le i_2\) if \(\varphi ^*\le \varphi _0\le \varphi _h\).

Proof

According to Proposition J.4, When \(\varphi <\varphi _h\), \( \rho + a + ap + 2 a \rho ^2 >1\) and \(g(a,c,\varphi )>0\), \(\frac{\partial p^*_{n}-p^*_{r}}{\partial \varphi }<0\). So \(i_1>i_2\) if \(\varphi _0<\varphi ^*\); \(i_1\le i_2\) if \(\varphi ^*\le \varphi _0\le \varphi _h\). \(\square \)

Similar to Proposition 8, Proposition J.8 indicates that when trade-in strategy is adopted and both durability and production costs are not too low, the scenario in which the trade-in incentive is higher depends on which scenario features a lower transaction fee rate.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, X., Xie, J. & Li, T. Trade-in strategy for durable products in the presence of a peer-to-peer second-hand marketplace. Ann Oper Res 326, 223–260 (2023). https://doi.org/10.1007/s10479-023-05333-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-023-05333-2