Abstract

We investigate quality and pricing decisions for two competing firms in an e-marketplace with online customer reviews. Through developing two-stage game-theoretical models and comparing the equilibriums, we examine the optimal choice among different alternative product strategies: static strategy, adjusting the price, adjusting the quality level, and adjusting both the quality and price dynamically. Our results show that the existence of online customer reviews tends to encourage firms to increase quality and charge low prices in the early stage, and decrease quality and raise prices in the later stage. Moreover, firms should choose the optimal product strategies depending on the impact of customers’ private assessment of product quality from the product information disclosed by firms on the overall perceived product utility and customer uncertainty about the perceived degree of product fit. After our comparisons, the dual-element dynamic strategy is more likely to outperform other strategies financially. Furthermore, we extend our models to examine how the optimal choice of quality and pricing strategies will change if the competing firms have asymmetric initial online customer reviews. From the extended analysis, a dynamic pricing strategy may generate better financial performance than the dynamic quality strategy, which is different from the finding in the basic scenario. Firms should choose the dual-element dynamic strategy, the dynamic quality strategy, the dual-element dynamic strategy coupled with dynamic pricing, and the dynamic pricing strategy in sequence as the impact of customers’ private assessment of product quality on the overall perceived product utility and the weight that the second-stage customers place on their private assessment increase.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Customers’ purchasing behaviors have continued to shift to e-markets over recent years. With the increased popularity of e-commerce platforms such as Amazon and Tmall, there has been a significant growth in online retailing. In China, Tmall broke the sales record with more than 540 billion RMB in transactions at the “Double Eleven shopping festival” in 2021.Footnote 1 The COVID-19 outbreak in 2020, countries have taken many non-pharmaceutical interventions to mitigate its spread, such as widespread lockdown, stay-at-home orders, and closing of educational institutes and non-essential businesses (Gupta et al., 2021). Due to the physical retail stores have had to close or follow strict social distancing rules, the COVID-19 pandemic has accelerated customers’ purchasing behaviors in online markets (Bhatti et al., 2020). For example, in Singapore, the government launched a mobile application that utilizes Bluetooth signals to ensure that the infected individuals (and those who came in contact with them) are self-quarantining themselves. During the self-quarantine and self-isolation, there has been a continuous shift in customer spending in favor of online shopping, such as the rapid popularity of live-streaming e-commerce in China. Therefore, the COVID-19 pandemic has accelerated the shift online as more and more business activities of firms are transitioning to online platforms. Adobe Digital Economy Index reveals that, compared with the pre-COVID-19 era, U.S. e-commerce sales increased by approximately 49% in April 2020 and 60% in May 2020 (Adobe, 2020). Euromonitor expects that even in Russia, where e-commerce is weak, e-commerce sales would grow by more than 40% this year (News, 2020). In China, during the online shopping festival of 2020 Singles Day (over 11 days), the total orders on Tmall.com (the Chinese e-commerce giant) reached 498.2 billion RMB, which nearly doubled the previous year’s 268.4 billion RMB (CNBC, 2020). Although online shopping provides convenience and efficiency, a typical feature of online shopping is that customers increasingly rely on online customer reviews to make informed purchasing decisions, as they cannot physically touch or try products before purchasing them (Chen & Xie, 2008; He et al., 2018; Kuksov & Xie, 2010). Online customer reviews provide an evaluation of a product, in the form of text, images, and even videos, from the perspective of other customers who have bought the product. Such information is a useful supplement to the product information provided by sellers. Thus, given the information asymmetry between customers and sellers, a customer can better judge the true quality of products and whether the products fit his/her needs in the presence of online reviews (Kwark et al., 2014). Therefore, online reviews affect the customers’ purchase choices of the products. A recent survey reports that 88% of customers consult online reviews before making product purchases (DeMers, 2015).

The above reflects that online reviews have a significant impact on customers’ purchasing decisions, and inevitably they will affect the product policy (quality and price) of firms (Jiang & Yang, 2019; Kwark et al., 2014). Intuitively, firms especially new market entrants may be strongly motivated by online customer reviews to provide high-quality products as this can improve online word-of-mouth (WOM) and hence stimulate future demand. A high quality level leads to increased costs, which has an impact on firms’ pricing decisions. To balance the costs and benefits, a firm’s quality strategy is often accompanied by a pricing policy (Zhao & Zhang, 2019). When more online customer reviews are shared and accumulated online, firms may choose to adjust their quality and price according to the market feedback from the reviews (Kocas & Akkan, 2016; Yan & Han, 2021). For example, Huawei upgraded the processor of its tablet line, MatePad 10.4-inch, from Kirin 810 to Kirin 820 in 2020 meanwhile changing selling prices of the versions after the upgrade except for the 6 GB + 64 GB version. Moreover, by intuition, online reviews can be more essential for competitive firms because they can help improve market share, if used properly.

A question that arises naturally from the practice is ‘how do online customer reviews affect firms’ quality and pricing strategies in a competitive e-market environment?’ Many existing studies investigate the quality and pricing decisions (Caulkins et al., 2017; Jiang & Yang, 2019; Kim, 2021; Wang & Li, 2012; Xue et al., 2017). Although several papers have considered the effects of online customer reviews on quality and pricing decisions (e.g., He & Chen, 2018; Jiang & Yang, 2019), no studies so far have analytically compared a dynamic quality and pricing policies taking both online customer reviews and market competition into consideration. That is, there is no mature decision-making scheme to guide firms whether and how to adjust their product strategies according to the online review feedback, especially in a competitive online market (Jiang & Yang, 2019; Yang & Zhang, 2022). By considering the influence of online reviews and market competition on customers’ purchasing behavior, this study attempts to determine the optimal product strategy choice (static/dynamic quality and price decisions) of the competitive firms. In order to achieve the above research objective, we develop two-stage game-theoretical models in which two rival firms selling substitutable products compete on product quality and price. The two firms simultaneously make the quality and price decisions on their products at the beginning of each of the two selling stages. In each stage, new customers enter the market and purchase the product with greater perceived product utility according to their evaluations of product quality and fit dimensions. In the first stage, despite that firms disclose some product information through product description, images, and videos, online customers do not know the true quality and the degree of fit, and depend entirely on their subjective perception of the product utility to decide which one to buy. In the second stage, customers can obtain more product information from online reviews, and they combine what they have gathered from online reviews with their own subjective perception of the product utility to make purchasing decisions. Due to future customers in the second stage can gather more product information from online reviews, each of the two firms may adjust quality and pricing decisions in response to online customer reviews. Starting from the choice behavior of customers, we consider different scenarios in which the product quality and/or selling prices can/cannot be dynamically updated in response to online customer reviews. In different scenarios, we examine different alternative strategies: (i) static strategy, (ii) adjusting the price, (iii) adjusting the quality level, and (iv) adjusting both the quality and price dynamically. In a setting with static competition, the firms do not adjust their product quality and selling prices in the second stage; and in a setting with dynamic competition, they can choose to adjust product quality and/or selling prices in the second stage based on online customer reviews. Following a Nash-game framework, we examine the equilibrium decisions for each model and investigate the corresponding structural properties, and determine the optimal product policy selection by comparing the equilibrium solutions under each strategy. Finally, we extend the above analysis from the case in which the two firms have symmetric initial online customer review profiles to an asymmetric case, and examine its impact on firms’ optimal quality and pricing decisions.

Our analysis provides several important insights. First, we find that firms’ optimal quality and pricing strategy in response to online customer reviews in a competitive market is determined by the impact of customers’ private assessment of product quality from the product information disclosed by firms on the overall perceived product utility and customer uncertainty about the perceived degree of product fit, which differs from the finding of Feng et al. (2019) that firms should dynamically adjust their pricing decisions in response to online customer reviews. In contrast, our results lead us to the conclusion that rival firms should choose among a dynamic quality strategy, a dual-element dynamic strategy, and a dynamic pricing coupled with a dual-element dynamic strategy with online customer reviews. Among the three strategies, the dual-element dynamic strategy is more likely to outperform the other two strategies financially. Second, when rival firms have asymmetric initial online customer reviews, in contrast to the basic scenario, a dynamic pricing strategy may outperform a dynamic quality strategy. Unlike the scenario in which asymmetric initial online customer reviews are not considered, rival firms should now choose the dual-element dynamic strategy, the dynamic quality strategy, the dual-element dynamic strategy coupled with dynamic pricing, and the dynamic pricing strategy in sequence as the impact of customers’ private assessment of product quality on the overall perceived product utility and the weight that the second-stage customers place on their private assessment increase. Third, online customer reviews tend to stimulate the rival firms that have no initial online customer reviews to provide high-quality products and charge low prices in the early stage, while reducing the quality level of products and raising prices in the later stage once good online review profiles have been developed. Such a strategy benefits the early customers but not necessarily the later ones in a duopoly market. In contrast, when the asymmetric initial online customer reviews are taken into consideration, the firms choose to increase/reduce product quality and price level over time, depending on their cost efficiency and the difference in the initial online customer reviews. These findings stand in contrast to the claim by Jiang and Yang (2019) that prices in the early stage are often higher than those in later stages in a monopoly market.

The remainder of this paper is organized as follows. Section 2 reviews the relevant literature. Section 3 outlines the model setup, and game-theoretical models with different alternative strategies—static strategy, adjusting the price, adjusting the quality level, and adjusting both the quality and price dynamically—are developed and equilibrium solutions are derived, respectively. Then, different strategies are compared and analyzed to examine the effects of online customer reviews and firm competition on quality and pricing strategies in Sect. 4. In addition, Sect. 5 provides the optimal strategy selection. Furthermore, we extend the analysis to the case in which the two competing firms have asymmetric initial online customer reviews in Sect. 6. Section 7 summarizes the important practical implications of the obtained results to highlight the practical value of our contribution. Finally, the paper is concluded with a discussion of the main findings and future research directions in Sect. 8.

2 Literature review

Our study is closely related to the following two streams of research on (i) product pricing and (ii) product quality considering the effects of online customer reviews.

2.1 Product pricing considering the effects of online customer reviews

With the development of online shopping in recent years, online customer reviews affect increasingly customers’ choice behaviors (Hu et al., 2011, 2012). Meanwhile, online customer reviews have a significant impact on pricing decisions (Chen et al., 2011; Godes, 2017; Mayzlin, 2006). The relevant studies on pricing decisions start by investigating how online customer reviews affect pricing decisions in static settings. Interested readers can refer to the works by Kwark et al., (2014), Godes (2017) and Zhang et al. (2021) for more details.

More relevant to this study, some literatures examine the effects of online customer reviews on dynamic pricing decisions in e-markets. For example, Kuksov and Xie (2010) investigate the optimal product price decisions under a two-period scenario in which an online seller may offer unexpected frills to raise its review ratings, with the finding showing that lowering the price, lowering the price and offering frills, or raising the price and offering frills can all benefit the seller financially. Li (2013) develops a two-period analytical model to examine how online customer reviews can affect product pricing decisions. He finds that in the presence of online customer reviews, sellers always choose to reduce the first-period product selling prices to improve their online reputation. Yu et al. (2016) investigate the effects of customer-generated quality information on dynamic pricing in the presence of strategic customers, and find that firms may reduce the initial selling prices as compared to the case without customer-generated quality information. Liu et al. (2017) develop a two-period duopoly model to investigate how the online customer reviews and sales volume information affect jointly a firm’s price strategy. Their results show that firms can benefit from online customer reviews and sales volume information but not the customers. He and Chen (2018) study the dynamic pricing decisions of electronic products and find that in a market with online customer reviews, the firm selling a higher-quality product may reduce its selling price. Feng et al. (2019) find that firms can benefit from a dynamic pricing strategy in response to online customer reviews. The above studies show that online customer reviews have a significant effect on customer demand and firms’ profits, and that a dynamic pricing strategy can indeed guarantee increased firms’ competitiveness. This work complements the above studies by taking into consideration of product quality as an endogenous decision variable.

2.2 Product quality and pricing in the presence of online customer reviews

Some scholars have investigated quality and pricing decisions jointly in the presence of online customer reviews. Among them, Godes (2017) investigates the effects of online WOM on quality and pricing decisions considering two types of WOM (i.e. informative and persuasive). He develops two analytical models with respect to the two WOMs and derives the optimal quality and pricing strategies. Jiang and Yang (2019) examine how online customer reviews affect the quality and pricing decisions for experience goods during two periods. Their results show that the first-period price is usually higher than the second-period price. Zhao and Zhang (2019) study the optimal quality and pricing decisions for a customer-intensive service system by a dynamic model incorporating a queuing system, taking into consideration of online customer reviews. Zhao et al. (2022) investigate the effects of online reviews on product quality and pricing decisions in a duopoly market that consists of two competing firms. Unlike the aforementioned studies, we consider firm competition and dynamic adjustment of the product policies in investigating the impacts of online customer reviews on product pricing and quality decisions and determine the optimal strategy selection.

Over the years, scholars have continued to explore product pricing and quality decision problems in the presence of online customer reviews. To highlight the distinctions between our research and the related studies, Table 4 summarises the existing key studies according to their focus. Our study complements the existing literature on product pricing and quality with online customer reviews (Feng et al., 2019; He & Chen, 2018; Jiang & Yang, 2019; Kuksov & Xie, 2010; Li, 2013; Liu et al., 2017; Yu et al., 2016; Zhao & Zhang, 2019) by exploring the interactive effects of market competition and online customer reviews on firms’ dynamic pricing and quality decisions in a two-stage setting. As market competition has a significant impact on firms’ pricing and quality decisions (Liu et al., 2016, 2018), it is imperative to examine the interactive influences of competition and online customer reviews on firms’ optimal choice of pricing and quality decisions and their financial performance. Furthermore, it is critical to evaluate the performance of different quality and pricing strategies, as the quality and price decisions in response to online customer reviews can have a significant effect on firms’ performance.

3 Model setup

3.1 Problem description

We study two competing firms \(A\) and \(B\) selling substitutable products \(A\) and \(B\) in an e-market. Each product is considered to have two product attributes: quality and fit (Dellarocas, 2006). Two selling stages are considered, with new customers entering the market sequentially at stage \(n\), \(n=\mathrm{1,2}\). In Stage 1, firms first set product quality and prices respectively, and then customers subjectively evaluate the products’ utility according to the product information disclosed by the two firms that they have received and purchase the product with higher utility. After that, the customers who have made purchases will post online reviews according to their experience with the product. If firms provide high-quality products, customers will write better reviews for them, consequently leading to increased demand in later stages, and not vice versa. Although high-quality products can improve WOM and stimulate future demand, producing them incurs higher costs. Thus, firms need to set an appropriate quality level to balance the cost and benefit. In Stage 2, each of the two firms may need to adjust their product quality and/or pricing policies in response to online customer reviews posted by early customers, as they can obtain more product information from online reviews. This is in line with market practice, as many firms dynamically adjust their quality and pricing strategies according to the market feedback (Kostami & Rajagopalan, 2014; Liu et al., 2020). Subsequently, new customers arrive at the market and decide which products to purchase according to their subjective evaluation of product utility and online customer reviews. We consider different scenarios in which the product quality and/or selling prices can/cannot be dynamically updated in response to online customer reviews. Following a Nash-game framework, we examine the equilibrium decisions for each model and investigate the corresponding structural properties, and determine the optimal product policy selection. Figure 1 illustrates the decision sequence of the game. Before introducing a two-stage game model, key notations for the model are listed in Table 1.

3.2 Customer utility

Following Chen and Xie (2005, 2008), we denote customer utility as perceived product value minus product price. The perceived product value comprises two dimensions: perceived product quality and perceived product fit. Thus, customer utility can be constructed as perceived product quality minus the misfit cost and product price (Kwark et al., 2014).

In the first stage a customer cannot obtain the full product information and they subjectively perceive the product quality level and the degree of product fit based on the product information disclosed by the firms. With respect to the quality dimension, customers are often uncertain about the quality level before product purchases in e-markets (Kuksov & Xie, 2010). Like Hu et al. (2015), we use \(\delta \) to represent customer evaluations of product utility from quality dimension, which is assumed to follow a two-point distribution, i.e., \(\delta =\left\{\begin{array}{cc}{\delta }_{H}& \mathrm{with probability} \alpha \\ {\delta }_{L}& \mathrm{with probability} 1-\alpha \end{array}\right.\). Here, \(\delta \) shows customers’ perceived uncertain product utility from unit quality level of products (Hu et al., 2015). Hence, customers’ expected utility from product quality is \({[\delta }_{H}\alpha +{\delta }_{L}(1-\alpha )]{Q}_{1,i}^{jj}\). For the fit dimension, we employ a horizontal product differentiation model (Hotelling, 1929) to measure the misfit cost. In the Hotelling model, products \(A\) and \(B\) are located at 0 and 1, respectively, in the interval [0, 1], and customers are distributed uniformly along the interval. Thus, the distance between products’ and customers’ locations on the interval can be used to measure the degree of misfit and the misfit cost equals to the degree of misfit times the unit misfit cost \(t\). Similar to the quality dimension, customers may also be uncertain about the degree of misfit; thus we assume that customers’ perception of their location is at \(y\) with probability \({\beta }_{C}\), \(y\in [\mathrm{0,1}]\) when they receive the product information disclosed by the firms (Lewis & Sappington, 1994). Ultimately, using Bayesian updating (Kwark et al., 2014), we obtain the misfit costs entailed by products \(A\) and \(B\) for customers as \(\left[{\beta }_{C}y+(1-{\beta }_{C})/2\right]t\) and \(\left[1-{\beta }_{C}y-(1-{\beta }_{C})/2\right]t\), respectively. In summary, we develop the utility function for customers in Stage 1 as follows.

Regarding Stage 2, customers can receive more product information through online reviews posted by customers who purchased products in Stage 1. That is, in the second stage a customer can assess the product utility according to two sources of information: common assessment as revealed by online customer reviews and the customer’s private assessment from product information disclosed by the firms. Hence, customers in the later stage can evaluate product utility from online customer reviews in addition to their subjective evaluations of product utility. Online customer reviews can provide product information regarding both the quality and fit dimensions (Kwark et al., 2014). For the quality dimension, quality information can be updated because product quality may be adjusted according to online reviews. Similar to that in the first stage, customers’ private assessment of product utility from quality dimension is \({[\delta }_{H}\alpha +{\delta }_{L}(1-\alpha )]{Q}_{2,i}^{jj}\). Meanwhile, we model customers’ common assessment of product utility from online customer reviews regarding quality dimension as \(\theta {x}_{1,i}^{jj}\), where \({x}_{1,i}^{jj}\) is the average evaluation of quality attributes about product \(i\) by the customers who purchased the product in Stage 1. Different from customers’ private assessment from quality dimension that different customers have different perception \(\delta \), all customers have the same perception \(\theta \) on quality level from online customer reviews. Thus, a customer’s total expected utility in Stage 2 in terms of the quality dimension becomes \(r{[\alpha \delta }_{H}+\left(1-\alpha \right){\delta }_{L}]{Q}_{2,i}^{jj}+(1-r)\theta {x}_{1,i}^{jj}\) (Kwark et al., 2014). For the fit dimension, after browsing online customer reviews, customers can be more certain about whether the product is a good ‘fit’ (Archak et al., 2011; Kwark et al., 2014). We employ \({\beta }_{R}\) to measure the probability that customers perceive a misfit degree \(y\) from online reviews, \({\beta }_{R}>{\beta }_{C}\) (Kwark et al., 2014). Therefore, the customer utility function in Stage 2 is constructed as Eq. (2).

When customers are more certain that a product is a good ‘fit’ after browsing online customer reviews, the misfit cost becomes smaller. However, if they are more certain that a product is a ‘misfit’, the misfit cost becomes larger. As analysed above, the quality level of products in Stage 1 influences the online reviews posted by customers in Stage 1, which further affects the customer utility in Stage 2, as shown in Eq. (2). Because one of our focuses is on product quality decision in response to online customer reviews, it is imperative to quantify the relationship between quality level of products and online customer reviews regarding the quality dimension. We develop a linear function to measure the improved online customer reviews regarding the quality dimension by increasing the product quality level, i.e. \({x}_{1,i}^{jj}=\xi {Q}_{1,i}^{jj}\). Thus, the customer utility functions in Stage 2 can be transformed as:

Combining Eqs. (1) and (3), customers in Stage 1 subjectively evaluate the product utility according to the product information disclosed by the two firms. Different from this, customers in Stage 2 evaluate product utility from online reviews posted by customers in Stage 1 in addition to their subjective evaluations of product utility. Given the difference across the two stages, customers in Stage 2 have a nonzero \(1-r\) and a nonzero \(\theta \) which show the extent to value online review information on quality dimension. Regarding product fit, after browsing online customer reviews, customers can be more certain about whether a product is a good ‘fit’. Therefore, customers in Stage 2 have a lower uncertainty about the perceived degree of product fit, i.e. \({\beta }_{R}>{\beta }_{C}\).

3.3 Two-stage game-theoretical model

In practice, firms periodically adjust product policies with updated market feedback. Therefore, when customer reviews are shared and accumulated online, firms may choose to adjust their decisions on quality and price in response to the online WOM. In this paper, we consider that each firm has four alternative product strategies including static strategy (S), adjusting the price (P), adjusting the quality level (Q), and adjusting both the quality and price dynamically (D). Under different strategies, customers perceive the product utility differently, we construct customer utility functions under different strategies as shown in Sect. 3.2. According to the utility functions, demand functions can be derived, all proofs are provided in Appendix A. Subsequently, from the obtained customer demands, profit functions of the two firms can both be constructed. Table 2 summarises the customer demand and profit functions under different strategies.

Although higher quality level will improve online customer reviews and further attract more future demand, firms will incur extra costs by increasing the quality level of their products. From profit functions in Table 2, a quadratic cost function of the product quality is adopted as \(k{({Q}_{n, i}^{jj})}^{2}\), where \(k\) represents the firms’ cost efficiency, and a low value of \(k\) indicates that the firm is more cost-efficient (Jiang & Yang, 2019). As our focus is to investigate the effects of online customer reviews and market competition on quality and pricing decisions and the associated financial performance, we suppose the two firms have a same cost efficiency. Moreover, although customers pay attention to both product fit and quality (Chen & Xie, 2005), product quality is often regarded as one of the most important factors influencing customers’ purchasing decisions (Jiang & Yang, 2019). Thus, firms’ decisions on the product fit dimension are not involved in this study.

By deriving the game-theoretical models, firms’ profit functions for each model can be strictly concave functions with respect to their decision variables. We then derive the equilibrium solutions for the different models. From the equilibrium solutions, we find that the rival firms are consistent in their product pricing strategies. However, regarding product quality, the rival firms do not show consistency in their deicisons. That is, there exist equilibrium solutions under strategy SQ and strategy PD, respectively, as shown in Table 4. All proofs of the equilibrium solutions are presented in Appendix A.

4 The effects of online reviews and firm competition on quality and pricing strategies

To examine whether the rival firms need to adjust dynamically their quality and pricing strategies in response to online customer reviews and the effects of the different product strategies on firms’ pricing and quality decisions and their financial performance, we first compare the equilibriums of Model PP and Model SS to derive Proposition 1.

Proposition 1.

Compared to the static strategy, a dynamic pricing strategy in response to online customer reviews will:

-

(1)

Reduce product prices in the early stage and raise prices in the later stage; that is, \({p}_{1}^{PP*}<{p}^{SS*}\) and \({p}^{SS*}<{p}_{2}^{PP*}\) ;

-

(2)

Increase or reduce the quality level of products depending on the relationship between customers’ private assessment of product quality from the product information disclosed by firms and the common assessment of product quality as revealed by online reviews; that is, \({Q}^{SS*}<{Q}^{PP*}\) , if \(\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]<\theta \xi \) ; otherwise, \({Q}^{PP*}<{Q}^{SS*}\) ;

-

(3)

Increase or reduce firms’ profits depending on the cost efficiency and the relationship between customers’ private assessment of product quality from the product information disclosed by firms and the common assessment of product quality as revealed by online reviews; that is, \({\pi }^{PP*}<{\pi }^{SS*}\), if \(\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]<\theta \xi \) and \(k<\phi \);Footnote 2otherwise, \({\pi }^{SS*}<{\pi }^{PP*}\).

The result regarding the effect of a dynamic pricing strategy on product prices is reasonable, as low prices in the early stage help firms improve their online profile and therefore penetrate the market faster. However, firms gradually raise their product prices over time to enhance their profitability. This pricing strategy is adopted by many firms in practice and is consistent with the findings in Kostami and Rajagopalan (2014) and Chen and Jiang (2021). The effect of a dynamic pricing strategy on the quality level depends on the impact of quality improvement on customers’ perceived product utility through online reviews. More specifically, if online customer reviews can significantly increase customers’ perceived utility relative to their private assessment of product quality from the product information disclosed by firms, firms will be incentivized to invest more in improving the quality level of products to raise the online customer reviews and stimulate more demand accordingly. This may explain why customers are more willing to shop on e-commerce platforms with online review functions, because customer reviews can motivate firms to provide high-quality products (Jiang & Yang, 2019; Sun & Xu, 2018). Although increased demand can benefit the firms, higher quality level will incur extra costs. In this case, if firms’ cost parameter is less than a threshold level, the relatively low cost parameter (high cost efficiency) will encourage the firms to further improve their quality level, and thus the cost of quality improvement can outweigh the benefit gained from the increased demand. Ultimately, the dynamic pricing strategy has a negative impact on firms’ profits. In contrast, if online customer reviews have little impact on customer evaluations of product quality, firms will reduce the quality level of their products. Although reduced quality level results in worse online WOM and decreased future demand, it saves the production costs which provide the leeway for firms to increase their profit margin. In this case, the dynamic pricing strategy can produce a better financial performance relative to the static policy, which is similar to that in the existing studies such as He and Chen (2018) and Feng et al. (2019).

In the current e-markets in practice, many online firms frequently alter selling prices of their products due to the flexibility and low cost of price changes in e-markets. Moreover, many existing studies find that dynamic pricing can positively affect firms’ profits in e-markets with online customer reviews, such as He and Chen (2018) and Feng et al. (2019). Different from the industrial practice and the findings of the existing studies, Proposition 1 shows that a dynamic pricing strategy can not necessarily guarantee increased firms’ financial performance in a competitive e-market with online customer reviews. The results of Proposition 1 highlight the importance of market competition in firms’ operational decisions and provide important strategic guidance regarding price decisions for practitioners engaging in e-commerce retailing businesses.

Now, we examine the effects of a dynamic quality strategy on firms’ quality and pricing decisions and their financial performance. After comparing the equilibrium solutions of Models QQ and SS, we obtain the following proposition.

Proposition 2.

Compared to the static strategy, a dynamic quality strategy in response to online customer reviews will:

-

(1)

Reduce the product quality level in the product selling stages, that is, \({Q}_{1}^{QQ*}<{Q}^{SS*}\) and \({Q}_{2}^{QQ*}<{Q}^{SS*}\) ;

-

(2)

Has no impact on the product prices, that is, \({p}^{QQ*}={p}^{SS*}\) ;

-

(3)

Increase firms’ profits, i.e., \({\pi }^{SS*}<{\pi }^{QQ*}\) .

Customers in the later stages, in general, know the product quality level more accurately, as early customers have shared product information through online reviews (Guan et al., 2020; Yu et al., 2016). Thus, with the static strategy, firms tend to provide higher quality levels in order to stimulate future demand and improve profitability. When firms can dynamically adjust the quality level of their products with updated market information from online customer reviews, they are more likely to provide a lower quality level as compared to the static quality, because they have an opportunity to adjust the quality level after observing online customer reviews. As a result, with the dynamic quality strategy, the quality levels of both firms’ products in the two selling stages are lower than those in the static strategy, as shown in part (1) of Proposition 2.

Furthermore, a lower quality level will have a negative impact on customer demand. Therefore, both firms have a motivation to reduce product prices because of the cost savings from a decrease in the quality level. However, in a competitive market, if a firm reduces its product price, the competitor will be forced to lower its price, which intensifies the price competition. Therefore, neither firm will want to break the price equilibrium by changing product prices, as shown in part (2) of Proposition 2. Obviously, the dynamic quality strategy in response to online customer reviews harms customer utility because, with this strategy, customers buy products of a lower quality at the same prices.

It is evident from Proposition 2 that from the firms’ profit perspective, a dynamic quality strategy is always beneficial compared to the static strategy, which is consistent with the findings in Zhao and Zhang (2019). This is because on the one hand, the same prices guarantee firms’ profit margin, and on the other hand, reduced quality level helps firms save production costs. Combining Proposition 1, a dynamic quality strategy is an effective product policy in response to online customer reviews but not a dynamic pricing strategy in a competitive e-market; this is against one’s expectation. This implies that it is always critically important for firms to look at different ways to dynamically alter their product quality in a competitive e-market with online customer reviews, although quality changes tend to expend higher costs and are more difficult than price changes in firms’ business operations. Also, this explains why many firms invest significantly in product development (Krishnan & Ulrich, 2001).

As Proposition 2 shows, a dynamic quality strategy adopted by the two rival firms has a positive impact on firms’ profits. A question that arises naturally from this is whether a dynamic quality strategy adopted by only one firm can be beneficial. To answer this, we compare the equilibrium solutions of Models SQ and SS to derive Proposition 3.

Proposition 3.

Compared to the static strategy, if firm \(B\) adopts a dynamic quality strategy in response to online customer reviews:

-

(1)

Firm \(A\) will raise its product price; however, firm \(B\) itself will reduce the product selling price; that is, \({p}^{SS*}<{p}_{A}^{SQ*}\) and \({p}_{B}^{SQ*}<{p}^{SS*}\) ;

-

(2)

The product quality level of firm \(A\) is increased, i.e., \({Q}^{SS*}<{Q}_{A}^{SQ*}\) ; the product quality level of firm \(B\) is reduced, i.e., \({Q}_{1,B}^{SQ*}<{Q}^{SS*}\) and \({Q}_{2,B}^{SQ*}<{Q}^{SS*}\) ;

-

(3)

Increase profits of firm \(A\) , i.e., \({\pi }^{SS*}<{\pi }_{A}^{SQ*}\) ; increase or reduce profits of firm \(B\) depending on the cost parameter and its corresponding threshold level; that is, \({\pi }^{SS*}<{\pi }_{B}^{SQ*}\) , if \(\frac{2{\tau }^{2}\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-\varphi }-\left({\tau }^{2}+\varphi \right)\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-{\tau }^{2}}}{12{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)\left[\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-\varphi }-\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-{\tau }^{2}}\right]}<k\) ; otherwise, \({\pi }_{B}^{SQ*}<{\pi }^{SS*}\) .

Interestingly, different from the result of Proposition 2 that a dynamic quality strategy is always beneficial to firms’ profits, Proposition 3 shows that when only one firm adjusts dynamically the quality level, it might hurt the firm financially. When a firm adjusts dynamically the quality level, it will choose to reduce the quality level of its product compared to the static strategy, as the firm has an opportunity to adjust the product quality after observing online customer reviews. In this case, a lower quality level negatively affects customer demand and online customer reviews, which forces the firm to reduce its product price in order to sustain demand, as shown in part (1) of Proposition 3. Obviously, the decreased demand and reduced product price have a negative impact on the firm’s financial performance, except in the case that the firm’s cost parameter exceeds a threshold level [see part (3) of Proposition 3]. Although the decreased customer demand and reduced product price result in decreased sales revenue, the lower quality level produces the cost savings. On the other hand, if the cost parameter is relatively low, that is, the cost efficiency is high, the competing firm \(A\) will be encouraged to further increase its quality level, resulting firm \(B\) to reduce the product price dramatically in response. Therefore, only when the cost parameter exceeds a threshold level, adjusting dynamically the quality level can guarantee increased profits of firm \(B\). In practice, many firms invest significantly in product development (Krishnan & Ulrich, 2001) to constantly pursue product innovation and look at different ways to minimise the cost parameter of producing their products at every opportunity. However, Proposition 3 finds that adjusting dynamically the quality level by a relative more cost-efficient firm might hurt financially the firm in a competitive e-market.

In contrast, the dynamic quality strategy of firm \(B\) has a positive impact on the profit of the competing firm \(A\) who adopts a static strategy. It leads to a higher product price for firm \(A\), owing to the improved online word-of-mouth recommendations following the increase of quality level, which in turn has a positive impact on its profitability. This is logical and consistent with the findings of Kwark et al. (2014) that better word-of-mouth can help firms increase profits.

Proposition 4.

When firm \(B\) adjusts dynamically its product quality in response to online customer reviews, if the competitor, i.e., firm \(A\) also adopts a dynamic quality strategy:

-

(1)

Firm \(A\) will reduce its product price, i.e., \({p}^{QQ*}<{p}_{A}^{SQ*}\) ; however, firm \(B\) will raise the product price, i.e., \({p}_{B}^{SQ*}<{p}^{QQ*}\) ;

-

(2)

The product quality level of firm \(A\) is reduced, i.e., \({Q}_{1}^{QQ*}<{Q}_{A}^{SQ*}\) and \({Q}_{2}^{QQ*}<{Q}_{A}^{SQ*}\) ; however, the product quality level of firm \(B\) is increased, i.e., \({Q}_{1,B}^{SQ*}<{Q}_{1}^{QQ*}\) and \({Q}_{2,B}^{SQ*}<{Q}_{2}^{QQ*}\) ;

-

(3)

Increase profits of firm \(B\) , i.e., \({\pi }_{B}^{SQ*}<{\pi }^{QQ*}\) ; increase or reduce profits of firm \(A\) depending on the cost parameter and its corresponding threshold level; that is, \({\pi }^{QQ*}<{\pi }_{A}^{SQ*}\) , if \(k<\frac{\left({\tau }^{2}+\varphi \right)\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-\varphi }-2\varphi \sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-{\tau }^{2}}}{12{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)\left[\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-\varphi }-\sqrt{8k{\beta }_{C}{\beta }_{R}t\left({\beta }_{C}+{\beta }_{R}\right)-{\tau }^{2}}\right]}\) ; otherwise, \({\pi }_{A}^{SQ*}<{\pi }^{QQ*}\) .

It is clear from Proposition 4 that when a firm adopts a dynamic quality strategy in response to online customer reviews, if the competitor also does that, the effects of the competitor’s dynamic quality strategy on the two firms’ quality and pricing decisions are similar to those in Proposition 3. In the interests of brevity, this is not repeated here. Moreover, consistent with Proposition 3, whether a firm can gain more financial benefits from its own dynamic quality strategy depends on its cost parameter and the corresponding threshold level. Specifically, a firm’s dynamic quality strategy will have a positive impact on its profits when the cost parameter exceeds a threshold level. From Propositions 3 and Proposition 4, the threshold level of the firm \(B\)’s cost parameter exceeds that of the firm \(A\)’s cost parameter. Therefore, combining Propositions 3 and 4, it is better for a firm to adopt a dynamic quality strategy, when the competitor dynamically adjusts the product quality. And in this case, a dynamic quality strategy of the two firms can help the rival firms gain more financial benefits (see Proposition 2). This finding shows that a dynamic quality strategy is indeed an effective product policy in response to online customer reviews in a competitive e-market, which has not been revealed in the existing studies, such as Godes (2017) and Jiang and Yang (2019), but is consistent with the industrial practice that firms constantly conduct product innovation to launch new product lines (Joshi et al., 2016).

Here, we investigate the impacts of a dynamic quality strategy on firms’ quality and pricing decisions and profitability, considering the presence of dynamic pricing. By comparing the equilibriums of Models DD and PP, we derive the following proposition.

Proposition 5.

In the case of a dynamic pricing strategy, if firms also dynamically adjust their product quality:

-

(1)

The dynamic quality strategy has no impact on the product prices, that is, \({p}_{1}^{DD*}={p}_{1}^{PP*}\) and \({p}_{2}^{DD*}={p}_{2}^{PP*}\) ;

-

(2)

The firms decrease their product quality in the selling stages; that is, \({Q}_{1}^{DD*}<{Q}^{PP*}\) and \({Q}_{2}^{DD*}<{Q}^{PP*}\) ;

-

(3)

Firms’ profits increase, that is, \({\pi }^{PP*}<{\pi }^{DD*}\) .

Compared to dynamic pricing, when the rival firms dynamically adjust both their price and quality decisions, the two firms choose to reduce their respective product quality. Intuitively, both firms have the margin to reduce product prices because of the cost savings from a decrease in the product quality level. However, in a competitive market, if a firm reduces its product price, the competitor will be forced to lower its price, which intensifies the price competition. Therefore, neither firm will want to break the price equilibrium by changing product prices. Obviously, the dynamic quality strategy negatively affects customer utility because they then buy lower quality products at the same prices. From the firms’ profit perspective, a dynamic quality strategy is always beneficial, if it is coupled with dynamic pricing. This finding is consistent with the result of Proposition 2 and the findings in Zhao and Zhang (2019).

In the following, we examine how the price and quality decisions change over time under different quality and pricing strategies and derive Corollary 1.

Corollary 1.

Comparing the equilibrium price and quality in different selling stages under different quality and pricing strategies, we find:

-

(1)

The presence of online customer reviews encourages firms to reduce prices in the early stage while raising prices in the later stage, i.e., \({p}_{1}^{PP*}<{p}_{2}^{PP*}\) and \({p}_{1}^{DD*}<{p}_{2}^{DD*}\) ;

-

(2)

The presence of online customer reviews encourages firms to decrease product quality over time, i.e., \({Q}_{2}^{QQ*}<{Q}_{1}^{QQ*}\) and \({Q}_{2}^{DD*}<{Q}_{1}^{DD*}\) .

It is clear from Corollary 1 that firms tend to reduce prices in the early stage while increasing prices in the later stage, which is similar to the result in Proposition 1. Considering the dynamic quality strategy, firms should provide high-quality products in the early stage but reduce product quality level in the later stage. This finding is consistent with industrial practice and is similar to that of Kostami and Rajagopalan (2014), as online reviews become more influential in customers’ purchasing decisions in practice (Chen & Xie, 2008), many firms tend to provide high-quality products in the early stage to accumulate good WOM and build a customer base while reducing the quality level of their products over time to maximize profits. Obviously, in this case, the reduced quality level and raised product prices in the later stage will harm customer utility because customers in the later stage buy products of a lower quality level at a higher price. Moreover, online review recommendations are often seen as persuasive WOM in practice (Godes, 2017). The findings of Corollary 1 show that after observing online reviews, firms tend to reduce the quality level of their products, which extend the existing studies demonstrating that in the presence of a persuasive WOM, firms tend to provide a higher quality level (Godes, 2017).

After the above series of comparisions, we find that it is better for a firm to adopt a dynamic quality strategy, when its competitor does that. And a dynamic quality strategy of the rival firms is always financially beneficial for the two firms in response to online customer reviews but not necessarily a dynamic pricing strategy. Moreover, a dual-element dynamic strategy (the simultaneous adoption of dynamic quality and dynamic pricing) always performs better than a dynamic pricing strategy.

5 Optimal choice among alternative quality and pricing strategies

5.1 Comparisons among alternative quality and pricing strategies

From the systematic analyses in Sect. 4, strategies QQ, DD and PD (see Table 4) are likely to be optimal to achieve maximized financial performance for the rival firms. Therefore, the two firms should choose among the three strategies. To evaluate the optimal selection of the alternative quality and pricing strategies, we compare the equilibrium profits of the three strategies.

From Table 4, the equilibrium profits of strategy PD are complex, to depict which one can be the optimal strategy choice, a numerical analysis by Monte Carlo simulation is conducted for evaluating firms’ profits, and the basic parameter scopes are set as follows: \(t=(\mathrm{0,100})\), \({\beta }_{R}=(\mathrm{0.5,1})\), \({\beta }_{C}=(\mathrm{0,0.5})\), \(r=(0, 1)\), \(k=(\mathrm{0,100})\), \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}=(\mathrm{1,100})\) and \(\theta \xi =(\mathrm{0,100})\). Within the basic parameter scopes, we have conducted five groups of simulation experiments for each parameter. In each group of experiments, we randomly alter the value of one parameter and evaluate its impact on each firm’s profit and the equilibrium decisions from Monte Carlo simulation of 10,000 times. Note that for each group of experiments, five rounds of simulation experiments are carried out. The simulated Monte Carlo results show that the equilibrium decisions and the optimal policy selection have good robustness. And for each group of experiments, it is not possible to clearly present the simulated results of 10,000 times with useful managerial insights, and thus we selected 200 samples randomly for ease of presentation. Take parameter \({\beta }_{R}\) as an example, the selected 200 samples randomly for each group of experiments from the simulated Monte Carlo results of 10,000 times are shown in Fig. 2, to demonstrate the comparisons of the three strategies. From Fig. 2, we find that with different values of parameter \({\beta }_{R}\), each of the three strategies QQ, DD and PD could be optimal strategy choice for the rival firms. Moreover, we examine the effects of other several key parameters on the optimal stragegy choice. Similarly, the simulation analysis shows that the three strategies QQ, DD and PD all could be optimal strategy choice for the rival firms under different parameter scopes. Note that the Monte Carlo simulation results of other parameters are provided in online supplementary materials which can be accessed here: http://tiny.cc/z91zuz. Therefore, it can be concluded that each of the three strategies QQ, DD and PD could be optimal strategy choice in a competitive market with online customer reviews depending on different parameter scopes.

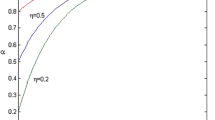

Further, with respect to each group of the simulation experiments, by counting the Monte Carlo results of 10,000 times, we calculate the proportion that each of the three strategies becomes the optimal strategy selection under different parameter values. In Fig. 3, we display how changes in the values of parameter \({\beta }_{R}\) (reflecting the value of online customer reviews on the misfit attribute in the second stage) affect the proportions of the three optimal strategies QQ, DD and PD. We find that with increase of parameter \({\beta }_{R}\), the proportion of strategy QQ that becomes optimal strategy choice reduces; whereas the proportions of strategies DD and PD which become the optimal strategy choices increase, respectively. The statistical results of the effects that other key parameters have on the proportions are also provided in online supplementary materials which can be accessed here: http://tiny.cc/z91zuz. Specifically, for the parameter \({\beta }_{C}\) reflecting the value of product information disclosed by the firms on the degree of misfit, in contrast to parameter \({\beta }_{R}\), the simulation analysis shows that an increase in the parameter \({\beta }_{C}\) results in an increase in the proportion of strategy QQ that becomes an optimal strategy; whereas the proportions of strategies DD and PD which become the optimal strategy choices decrease, respectively. Besides, we calculate the influence of the unit misfit cost \(t\) on the proportions of the three optimal strategies QQ, DD and PD being optimal. Similar to the effect of \({\beta }_{C}\), the statistical results show that as the unit misfit cost \(t\) increases, the proportion of strategy QQ that becomes optimal increases; however the proportions of strategies DD and PD which become the optimal strategies decrease, respectively. Regarding parameter \(r\) corresponding to the weight that customers paying attention to their private assessment of product utility from the product information disclosed by firms, its effect on the proportions of optimal strategies is also consistent with the parameter \({\beta }_{C}\). For cost parameter which can reflect the cost efficiency \(k\), the numerical analysis illustrates that an increase in the cost parameter will result in the decrease in the proportions of strategies QQ and PD being optimal strategies respectively but an increase in the proportion of strategy DD to be optimal. For customers’ private assessment of the product utility about quality level from the product information disclosed by firms \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\), its increase will lead to the increase in the proportions of strategies QQ and DD being optimal strategies respectively but the decrease in the proportion of strategy PD to be optimal. Finally, with respect to the common assessment of the product utility from quality dimension as revealed by online reviews \(\theta \xi \), as it increases the proportions of strategies QQ and PD which become the optimal strategy choices increase, respectively; however, the proportion of strategy DD being optimal will decreases.

Figures 2 and 3 depict whether the three alternative product strategies will be optimal strategy choice and the probability that any strategy becomes optimal. In the following, we determine under what conditions these three strategies are optimal, respectively, in order to provide decision guidance for the optimal strategy selection. From the above analysis, when each of the three strategies is optimal depending on the related model parameters. We thus examine the corresponding parameter distributions in the optimal implementation of each strategy using Monte Carlo simulation, to determine when the strategies are optimal, respectively. For example, in Fig. 3a, there is a 32.8% probability that the strategy QQ will be optimal strategy choice. We wonder in what value spaces are the model parameters distributed in the 32.8% probability. The basic parameter scopes used are the same to those in Figs. 2 and 3. For simplicity, we employ boxplot to depict the distributions of model parameters corresponding to each strategy selection here, as shown in Fig. 4. In the boxplots, we normalize all model parameters. From Fig. 4, we find that although the equilibrium profits depend on many model parameters under each strategy, the optimal strategy selection is not necessarily sensitive to all the related parameters. For example, we can see from Fig. 4 that some parameters such as the cost parameter \(k\) and the unit misfit cost \(t\) are in general uniformly distributed in their definition domains. This implies that distributions of these parameters have little impacts on the optimal strategy selection.

Figure 4 shows that for all the three strategies QQ, DD and PD, \(r\), \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\) and \({\beta }_{R}\) are always the most sensitive three parameters when each one is optimal because of their relatively more concentrated distributions compared to other parameters. Therefore, the firms should choose among the three strategies depending on \(r\) (the weight that customers place on their private assessment of product utility from quality dimension), \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\) (the expected utility perceived by customers subjectively from the unit quality level) and \({\beta }_{R}\) (customer uncertainty about the perceived degree of product fit). More specifically, small values of \(r\) and \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\) but a large value of \({\beta }_{R}\) will help the rival firms increase financial benefits from strategy QQ than other strategies. This is because on the one hand, the value of \(\theta \xi \) is relatively high as shown in Fig. 4a. In this case, if \(r\) and \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\) are both small, then the quality adjustment on customers’ perceived product utility through online customer reviews can significantly change their perceived utility relative to their subjective evaluations of product quality, as shown in Eq. (3). This provides the leeway for the rival firms to alter the quality level to increase their profit margins. On the other hand, there is low customer uncertainty about the perceived product fit (corresponding to a high value of \({\beta }_{R}\)). It implies when customers are more certain about which product is a better ‘fit’, this intensifies the market competition. In this case, neither firm wants to change their respective product prices. However, with a increase in the value of \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\), the strategy DD is more likely to outperform other strategies financially to become an optimal strategy selection, as shown in Fig. 4b. Because in this case, the quality adjustment on customers’ perceived product utility through online reviews can not significantly change customers’ perceived utility relative to their subjective evaluations of product quality. This provides the leeway for the rival firms to alter the product prices to increase their profit margins. Due to the low customer uncertainty about the perceived product fit, a dynamic pricing strategy alone might negatively affect a firm’s profit, resulting that neither firm chooses only to dynamically adjust prices. Thus, a dual-element dynamic strategy (strategy DD) could be more beneficial. Otherwise, strategy PD is more likely to become an optimal strategy selection, as shown in Fig. 4c. Because in this case, a matching strategy may neutralise the quality and price differentiation between the firms and, consequently, the intensified market competition will decrease their profits.

From the above simulation results, we find that which of the three strategies QQ, DD and PD the rival firms should choose depends mainly on the parameter distributions of \(r\), \(\alpha {\delta }_{H}+(1-\alpha ){\delta }_{L}\) and \({\beta }_{R}\). In practice, it is difficult for firms to accurately estimate all the market factors, because the market factors are diverse and changeable. However, from our numerical anslyses, it is critically important for firms to concentrate their resources to evaluate the important market factors which have significant impacts on the operational decisions rather than analysing all market factors.

5.2 The effects of the variance of online reviews

In practice, customers have different perception and experience of a product, thus resulting in differentiated product reviews, i.e. variance of online customer reviews. Other existing studies show that variance of online customer reviews has significant impacts on firms’ operational decisions (e.g., Kostyra et al., 2016), therefore we examine its influence on the quality, price and profits in this subsection. Following existing studies (e.g., Zhao & Zhang, 2019), we consider that the variance of online reviews affects customer utility by changing customers’ willingness to pay. The customer utility functions considering the effects of the variance of online customer reviews are developed as follows.

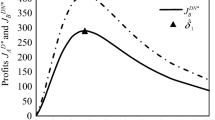

where \(\eta =\left\{\begin{array}{cc}{[{\eta }_{0}+{\omega }_{1}Var-{\omega }_{2}(x-{x}_{0})]}^{+}& x>{x}_{0}\\ {[{\eta }_{0}-{\omega }_{1}Var-{\omega }_{2}(x-{x}_{0})]}^{+}& x<{x}_{0}\end{array}\right.\) indicates customer price sensitivity. \({\eta }_{0}\) is the initial price sensitivity before observing online customer reviews. \({\omega }_{1}\) is the marginal effect of the variance of online customer reviews on price sensitivity. \({\omega }_{2}\) is the marginal effect of the accumulated aggregated online customer reviews on price sensitivity. \(x\) indicates the accumulated aggregated online customer reviews and \({x}_{0}\) indicates the accumulated aggregated reviews meeting customer expectation. Here we take the case of \(x>{x}_{0}\) as an example to demonstrate the effects of the variance of online customer reviews, as shown in Figs. 5, 6 and 7. We only examine the effects of the variance of online customer reviews under strategies QQ and DD, because these two strategies are more likely to outperform other strategies, as shown in Fig. 3. The related parameters are set as follows: \({\eta }_{0}=0.3\), \({w}_{1}=0.05\), \({\omega }_{2}=0.1\), \({x}_{0}=3\), \(\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}=1\), \(\theta =2\), \(\xi =1\), \(k=5\), \({\beta }_{C}=0.3\), \({\beta }_{R}=0.4\), \(t=5\) and \(r=0.3\).

In practice, the real reviews often deviate from customer expectation. A high accumulated aggregated reviews indicate that previous customers are satisfied with the product, thus resulting in a premium price. That is, new customers might be willing to pay a higher price for a product with high WOM (Kwark et al., 2014). In this case, if there is a large variance of online customer reviews, new customers may be reluctant to pay a high price for the product. That is, the price sensitivity increases. This is because, a large variance of online customer reviews indicates that while the aggregated reviews are high, there are still a lot of people who have had a bad product experience. Therefore, the firms are forced by a large variance to reduce the product prices and decrease their quality level to increase profit margins, as shown in Figs. 5 and 6. Obviously, the decreased quality level and lowered product prices have a negative influence on firms’ profits, as shown in Fig. 7. Moreover, it is evident from Fig. 7 that the dual-element dynamic strategy has a larger advantage than a dynamic quality strategy as the variance of online customer reviews increases.

6 An extended analysis of asymmetric initial online customer reviews

6.1 The extension model and product strategy analysis

The previous analysis is based on the assumption that there are no initial online customer reviews for either firm’s products. In practice, firms may already have online customer reviews, and their review profiles may vary (e.g., Kwark et al., 2014), thus affecting their decisions on quality and pricing strategies. Therefore, we extend our analysis by relaxing the above assumption to consider the case in which the competing firms have different initial online customer reviews. Unlike in the original game, in the first product selling stage of the new model, customer utility is affected by the level of the initial online customer reviews. We use \({R}_{i}\) to show the initial level of firms’ online customer reviews, and without loss of generality, we assume that \({R}_{d}={R}_{A}-{R}_{B}>0\). Specifically, the customer utility functions in the first stage are developed as follows.

Similar to our previous analysis, we consider that each of the competing firms with high and low initial online customer reviews can adopt four alternative strategies: the static strategy (S), adjusting the price (P), adjusting the quality level (Q), and adjusting both the quality and price dynamically (D). The model development, equilibriums and proofs of this extended analysis are all provided in Appendix B. By deriving the equilibrium solutions, only six strategies are likely to achieve equilibriums to achieve maximized financial performance for the rival firms, including strategies SS, PP, QQ, DD, SQ and DP, which is consistent with the results of our previous analysis. Therefore, to examine the effects of different product strategies, we compare the obtained equilibriums of the six strategies to determine the optimal choice of quality and pricing strategies.

We first explore the effects of a dynamic quality strategy adopted by one firm on the price, quality and profits, whether or not its competitor adopts a dynamic quality strategy, by comparing the dynamic quality strategy SQ to the static decision SS and the dynamic quality strategy QQ, respectively. The comparison results are consistent with those in the previous analysis in which the asymmetric initial online customer reviews are not considered. Specifically, a dynamic quality strategy of a firm will encourage its competitor to increase the quality level and raise the product price which always guarantees increased profits. In contrast, for the firm who adopts a dynamic quality strategy, it will choose to reduce the quality level and product price, and it can benefit financially from the adopted dynamic quality strategy only when the cost efficiency belows a threshold level. Moreover, it is better for a firm to adopt a dynamic quality strategy, when its competitor does that, and consequently, strategy SQ is not an equilibrium strategy for the two rival firms. Therefore, we compare the effects on the price, quality and profits between the dynamic quality strategy adopted simultaneously by the rival firms and the static strategy in the following, and derive Proposition 6.

Proposition 6.

-

(1)

The firm with better initial online customer reviews will reduce the product quality in the product selling stages, that is, \({Q}_{1,A}^{h,QQ*}<{Q}_{A}^{h,SS*}\) , \({Q}_{2,A}^{h,QQ*}<{Q}_{A}^{h,SS*}\) ; in contrast, whether the firm with worse initial online customer reviews raises or reduces the product quality depends on the difference in the initial online customer reviews between the two rival firms, i.e., \({Q}_{B}^{l,SS*}<{Q}_{1,B}^{l,QQ*}\) , if \({R}_{do}^{1}<{R}_{d}\) Footnote 3 ; otherwise, \({Q}_{1,B}^{l,QQ*}<{Q}_{B}^{l,SS*}\) ; \({Q}_{B}^{l,SS*}<{Q}_{2,B}^{l,QQ*}\) , if \({R}_{do}^{2}<{R}_{d}\) Footnote 4 ; otherwise, \({Q}_{2,B}^{l,QQ*}<{Q}_{B}^{l,SS*}\) ;

-

(2)

The firm with better initial online customer reviews will reduce its product price, while the firm with worse initial online customer reviews raises its product price; that is, \({p}_{A}^{h,QQ*}<{p}_{A}^{h, SS*}\) and \({p}_{B}^{l,SS*}<{p}_{B}^{l,QQ*}\) ;

-

(3)

The dynamic quality strategy adopted by the two firms will always increase the profit of the firm with worse initial online customer reviews, i.e., \({\pi }_{B}^{l,SS*}<{\pi }_{B}^{l,QQ*}\). However, it might hurt the profit of a firm with better initial online customer reviews; that is, \({\pi }_{A}^{h,QQ*}<{\pi }_{A}^{h,SS*}\), if \({R}_{do}^{3}<{R}_{d}\).Footnote 5

Proposition 6 shows that when the two rival firms dynamically adjust product quality, the firm with better initial online customer reviews (firm \(A\)) always chooses to reduce its product quality level as compared to the static decision scenario. The positive WOM enables firm \(A\) to capture the majority of the market share. With the dynamic quality strategy, firm \(A\), on the one hand, tends to reduce the quality level to increase its profit margin, and on the other hand, reduce the product price to maintain market share. However, the dynamic quality strategy can have a negative/positive impact on the profit of firm \(A\), as illustrated in part (3) of Proposition 6. Interestingly, when firm \(A\)’s advantage in the initial online customer reviews exceeds a threshold level, firm \(A\)’s profits will be reduced under the dynamic quality strategy as compared to the static strategy. This is because a large advantage in the initial online customer reviews of firm \(A\) will lead firm \(B\) to improve its quality level, to compete with firm \(A\), as shown in part (1) of Proposition 6. Thus, firm \(A\)’s profits will decrease. This finding is different from that in the previous analysis showing that a dynamic quality strategy of the two firms is always beneficial, as shown in Proposition 2. It highlights the importance of the difference in WOM between the competing firms in choosing the quality and pricing strategies.

For the firm with worse initial online customer reviews (firm \(B\)), whether it raises or reduces the quality level depends on the difference in the initial online customer reviews between the two rival firms. A large difference in the initial online customer reviews will result in firm \(B\) improving its product quality. Further, the increased product quality level can improve online customer reviews and stimulate future demand. Consequently, firm \(B\) will raise the product price to increase profit. In contrast, a small difference in the initial online customer reviews will lead firm \(B\) to reduce its product quality level but not to the same extent as firm \(A\). As a result, firm \(B\) can still raise its product price while maintaining market competitiveness. In this case, while firm \(B\) enjoys increased profits, firm \(A\) can also benefit from the dynamic quality strategy as it can capture the majority of the market share with better initial online customer reviews.

It is evident from Proposition 6 that a dynamic quality strategy is always beneficial to the firm with worse initial online customer reviews but not necessarily the firm with better initial online customer reviews as compared to the static strategy. When the difference in the initial online customer reviews between the two rival firms is less than a threshold level, both firms can benefit more financially from a dynamic quality strategy compared to a static strategy, and consequently a dynamic quality strategy is an equilibrium strategy but not the static strategy. However, if the difference in the initial online customer reviews between the two rival firms exceeds a threshold level, the firm with worse initial online customer reviews prefers still a dynamic quality strategy but the firm with better initial online customer reviews prefers a static strategy, as a result, neither the dynamic quality strategy nor the static strategy is an equilibrium strategy. From the above, consistent with the analyses in the previous sections showing that a static strategy can not be an equilibrium strategy, consequently the following analysis concentrates on the dynamic strategies with a consideration of different initial online customer reviews between the two firms. First, we compare the quality and pricing decisions under the dynamic strategies and derive Proposition 7.

Proposition 7.

Firm \(A\) with better initial online customer reviews will provide a higher quality level and charge a higher price than firm \(B\) with worse initial online customer reviews, i.e. \({Q}_{n,B}^{l,jj*}<{Q}_{n,A}^{h,jj*}\) , \({p}_{n,B}^{l,jj*}<{p}_{n,A}^{h,jj*}\) .

Despite the fact that firm \(A\) will reduce the quality level and product price under a dynamic quality strategy (see Proposition 6), its product quality level and price are still higher than those of the firm with worse initial online customer reviews across all the dynamic strategies. This result is not surprising as, in practice, firms with better online customer reviews tend to charge a higher price, which is also supported by the existing studies (e.g., Kwark et al., 2014).

Now, we look at the effects of different initial online customer reviews on quality and price decisions under different dynamic strategies over the two selling stages and derive the following proposition.

Proposition 8.

-

(1)

When firms dynamically adjust their product prices, \({p}_{1,A}^{h,PP*}<{p}_{2,A}^{h,PP*}\) , \({p}_{2,B}^{l,PP*}<{p}_{1,B}^{l,PP*}\) , if \(k<\frac{\left\{r\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]+(1-r)\theta \xi \right\}\left\{2r\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]+\left(1-r\right)\theta \xi \right\}}{6{\beta }_{R}t}\) ; otherwise, \({p}_{2,A}^{h,PP*}<{p}_{1,A}^{h,PP*}\) , \({p}_{1,B}^{l,PP*}<{p}_{2,B}^{l,PP*}\) ; \({p}_{1,A}^{h,DD*}<{p}_{2,A}^{h,DD*}\) , \({p}_{2,B}^{l,DD*}<{p}_{1,B}^{l,DD*}\) , if \(k<\frac{{r}^{2}{\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]}^{2}+{\left[(1-r)\theta \xi \right]}^{2}+r\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right](1-r)\theta \xi }{6{\beta }_{R}t}\) ; otherwise, \({p}_{2,A}^{h,DD*}<{p}_{1,A}^{h,DD*}\) , \({p}_{1,B}^{l,DD*}<{p}_{2,B}^{l,DD*}\) ;

-

(2)

When firms dynamically adjust their product quality, the presence of online customer reviews encourages both firms to reduce product quality over time, i.e., \({Q}_{2,A}^{h,QQ*}<{Q}_{1,A}^{h,QQ*}\) and \({Q}_{2,B}^{l,QQ*}<{Q}_{1,B}^{l,QQ*}\) ;

-

(3)

When firms dynamically adjust their product quality and prices, if firms’ cost parameter is less than a threshold level, \(k<\frac{{r}^{2}{\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]}^{2}+r\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right](1-r)\theta \xi }{6{\beta }_{R}t}\) , firm \(B\) will reduce its product quality over time, i.e., \({Q}_{2,B}^{l,DD*}<{Q}_{1,B}^{l,DD*}\) ; for firm \(A\) , only if there is a relatively small difference in the initial online customer reviews between the two firms, i.e., \({R}_{d}<{R}_{do}^{4}\) Footnote 6 , it will choose to reduce product quality, i.e., \({Q}_{2,A}^{h,DD*}<{Q}_{1,A}^{h,DD*}\) . However, if firms’ cost parameter exceeds a threshold level, \(\frac{{r}^{2}{\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right]}^{2}+r\left[\alpha {\delta }_{H}+\left(1-\alpha \right){\delta }_{L}\right](1-r)\theta \xi }{6{\beta }_{R}t}<k\) , only when there is a relatively small difference in the initial online customer reviews, i.e., \({R}_{d}<{R}_{do}^{5}\) Footnote 7 , firm \(B\) will choose to reduce product quality, i.e., \({Q}_{2,B}^{l,DD*}<{Q}_{1,B}^{l,DD*}\) ; for firm \(A\) , it will always reduce its product quality over time, i.e., \({Q}_{2,A}^{h,DD*}<{Q}_{1,A}^{h,DD*}\) .

Part (1) of Proposition 8 shows that under the dynamic pricing strategy, when firms’ cost parameter is less than a threshold level, the presence of online customer reviews encourages firm \(A\) to raise selling prices over time, while firm \(B\) will reduce its product price over time. However, when firms’ cost parameter exceeds a threshold level, firm \(A\) will reduce its product price and, in contrast, firm \(B\) will raise its selling price over time. A low cost parameter (corresponding to a high cost efficiency) would prevent firm \(B\) from improving its product quality level. Instead, firm \(B\) will cut its price over time to enhance its competitiveness. Therefore, firm \(A\) can raise its product price to take advantage of better WOM. In contrast, a high cost parameter would incentivize firm \(B\) to provide a higher quality level and raise product price over time, and firm \(A\) has to reduce the product price in response. These results are different from those in the previous scenario (see Corollary 1), which shows that the presence of online customer reviews encourages both firms to reduce prices in the early stage and increase prices in the later stage.

Part (2) of Proposition 8 shows that under the dynamic quality strategy, the presence of online customer reviews provides firms with an incentive to reduce product quality over time if the competing firms have different WOM profiles. This finding is consistent with the results when the asymmetric initial online customer reviews are not considered, and is in line with industry practice and supported by the existing literature (Kostami & Rajagopalan, 2014). As part (3) of Proposition 8 shows, under the dynamic quality and price strategy, whether the presence of online customer reviews leads to an increase or decrease in the quality level over time depends on firms’ cost efficiency, the difference in the initial online customer reviews and their corresponding threshold levels.

The above analyses show that the difference in WOM between competing firms has a significant impact on the price, quality and firms’ financial performance. In practice, many firms choose to match their competitors’ decisions on quality and price. However, our results show that matching competitor’s decisions might be unwise and it is critically important for firms to determine their operational decisions considering the different WOM (Kwark et al., 2014).

6.2 Optimal choice among alternative product strategies in the extended analysis

In Sect. 6.1, we derive that strategies PP, QQ, DD and DP are likely to be optimal to achieve maximized financial performance for the rival firms. Therefore, the two firms should choose among the four dynamic strategies. In this section, we evaluate firms’ equilibrium profits under the four dynamic decision scenarios to determine the optimal strategy selection. Owing to the complexity of profit functions for the four dynamic strategies, numerical simulation is employed for the evaluation. Similar to the previous analysis, we use Monte Carlo simulation to randomly sample 10,000 times in the definition domain of model parameters. The basic parameter scopes for the Monte Carlo simulation are set as follows: \(\xi =\left(\mathrm{0,100}\right)\), \(\theta =(\mathrm{0,100})\), \({R}_{d}=(\mathrm{0,5})\) and \({\beta }_{R}=(\mathrm{0,1})\), other parameter scopes used in the extended analysis are the same to the previous scenario.