Abstract

We consider the general problem of a set of agents trading a portfolio of assets in the presence of transient price impact and additional quadratic transaction costs and we study, with analytical and numerical methods, the resulting Nash equilibria. Extending significantly the framework of Schied and Zhang (2019) and Luo and Schied (2020), who considered the single asset case, we prove the existence and uniqueness of the corresponding Nash equilibria for the related mean-variance optimization problem. We then focus our attention on the conditions on the model parameters making the trading profile of the agents at equilibrium, and as a consequence the price trajectory, wildly oscillating and the market unstable. While Schied and Zhang (2019) and Luo and Schied (2020) highlighted the importance of the value of transaction cost in determining the transition between a stable and an unstable phase, we show that also the scaling of market impact with the number of agents J and the number of assets M determines the asymptotic stability (in J and M) of markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Instabilities in financial markets have always attracted the attention of researchers, policy makers and practitioners in the financial industry because of the role that financial crises have on the real economy. Despite this, a clear understanding of the sources of financial instabilities is still missing, in part probably because several origins exist and they are different at different time scales. The recent automation of the trading activity has raised many concerns about market instabilities occurring at short time scales (e.g. intraday), also because of the attention triggered by the Flash Crash of May 6th, 2010 (Kirilenko et al., 2017) and the numerous other similar intraday instabilities observed in more recent years (Johnson et al., 2013; Golub et al., 2012; Calcagnile et al., 2018; Brogaard et al., 2018), such as the Treasury bond flash crash of October 15th, 2014. The role of High Frequency Traders (HFTs), Algo Trading, and market fragmentation in causing these events has been vigorously debated, both theoretically and empirically (Golub et al., 2012; Brogaard et al., 2018).

One of the puzzling characteristics of market instabilities is that a large fraction of them appear to be endogenously generated, i.e. it is often very difficult to find an exogenous event (e.g. a news) which can be considered at the origin of the instability (Cutler et al., 1989; Fair, 2002; Joulin et al., 2008). Liquidity plays a crucial role in explaining these events. Markets are, in fact, far from being perfectly elastic and any order or trade causes prices to move, which in turn leads to a cost (termed slippage) for the investor. The relation between orders and price is called market impact. In order to minimize market impact cost, when executing a large volume it is optimal for the investor to split the order in smaller parts which are executed incrementally over the day or even across multiple days. One of the origins of market impact cost is predatory trading (Brunnermeier & Pedersen, 2005; Carlin et al., 2007): the knowledge that a trader is purchasing progressively a certain amount of assets can be used to make profit by buying at the beginning and selling at the end of the trader’s execution. Part of the core strategy of HFTs is exactly predatory trading. Now, the combined effect on price of the trading of the predator and of the prey can lead to large price oscillations and market instabilities. In any case, it is clear that the price dynamics is the result of the (dynamical) equilibrium between the activity of two or more agents simultaneously trading.

This equilibrium can be studied by modeling the above setting as a market impact game (Carlin et al., 2007; Schöneborn, 2008; Moallemi et al., 2012; Lachapelle et al., 2016; Schied & Zhang, 2019; Strehle, 2017a, b). In a nutshell, in a market impact game, two traders want to trade the same asset in the same time interval. While trading, each agent modifies the price because of market impact, thus when two (or more) traders are simultaneously present, the optimal execution schedule of a trader should take into account the simultaneous presence of the other trader(s). As customary in these situations, the approach is to find the Nash equilibrium, which in general depends on the market impact model.

Market impact games are a perfect modeling setting to study endogenously generated market instabilities. A major step in this direction has been recently madeFootnote 1 by Schied and Zhang (2019). By using the transient impact model of Bouchaud et al. (2004, 2009) plus a quadratic temporary impact cost (which can alternatively be interpreted as a quadratic transaction cost, see below), they have recently considered a simple setting with two identical agents liquidating a single asset and derived the Nash equilibrium. Interestingly, they also derived analytically the conditions on the transaction cost under which the Nash equilibrium displays huge oscillations of the trading volume and, as a consequence, of the price, thus leading to market instabilities.Footnote 2 Specifically, they proved the existence of a sharp transition between stable and unstable markets at a specific value of the transaction cost parameter.

Although the paper of Schied and Zhang highlights a key mechanism leading to market instability, several important aspects are left unanswered. First, market instabilities rarely involve only one asset and, as observed for example during the Flash Crash, a cascade of instabilities affects very rapidly a large set of assets or the entire market (CFTC-SEC, 2010). This is due to the fact that optimal execution strategies often involve a portfolio of assets rather than a single one (see, e.g. Tsoukalas et al. 2019). Commonality of liquidity across assets (Chordia et al., 2000) and cross-impact effects (Alfonsi et al., 2016; Schneider & Lillo, 2019) makes the trading on one asset triggers price changes on other assets. Furthermore, Cespa and Foucault (2014) show that a drop in liquidity in one asset can propagate in another asset, causing a market liquidity crash. Thus, it is natural to ask: is a large market more or less prone to market instabilities? How does the structure of cross-impact and therefore of liquidity commonality affect the market stability? A second class of open questions regards instead the market participants. Do the presence of more agents simultaneously trading one asset tends to stabilize the market? While the solution of Schied and Zhang considers only two traders, it is important to know whether having more agents is beneficial or detrimental to market stability. For example, regulators and exchanges could implement mechanisms to favor or disincentive participation during turbulent periods. Answering this question requires solving the impact game with a generic number of agents and it is discussed in the single asset case in Luo and Schied (2020).

In this paper we extend considerably the setting of Schied and Zhang by answering the above research questions. Specifically, starting from Luo and Schied (2020), we consider (i) the case when agents trade multiple assets simultaneously and cross market impact is present and we provide explicit representations of related Nash equilibria; (ii) after studying how trading conditions may be affected by the cross impact, we derive theoretical results on market stability for the \(J=2\) agents by showing how it is related to cross-impact effects; (iii) we study numerically market stability in the general case and we extend a previous result and conjecture of Luo and Schied (2020) in the multi-asset case.

It is important to notice that in market impact games, market impact is taken as exogenously given. Market microstructure literature has extensively discussed its endogenous nature since the seminal work of Kyle (1985). Theoretical and empirically studies have investigated and provided evidence of how market impact might depend on number of agents and of traded assets, e.g., Bagnoli et al. (2001), Benzaquen et al. (2017), Bucci et al. (2020), Garcia del Molino et al. (2020). Therefore we will consider this dependence and show how the stability of markets in market impact games depends on the way impact scales with the number of agents and the number of assets. We find that, if market impact is independent from the number of agents and assets, larger and more crowded markets are more prone to market instability. However, if, as observed empirically and proposed theoretically, market impact suitably scales with these two quantities, stability can be recovered.

The paper is organized as follows. In Sect. 2 we recall some notation of the market impact games framework and the Luo and Schied (2020) model. We extend the basic model of Luo and Schied (2020) to the multi-asset case in Sect. 3, where we find the corresponding Nash equilibria for different objective functions. We analyse how the cross-impact modifies the trading profile and trading conditions in Sect. 4. Finally, in Sect. 5 we study how the cross-impact matrix affects the market stability and we present how impact must scale with the number of assets to preserve stability. Finally, in Sect. 6 we draw some conclusions.

2 Market impact games

Consider two traders who want to trade simultaneously a certain number of shares, minimizing the trading cost. Since the trading of one agent affects the price, the other agent must take into account the presence of the former in optimizing her execution. This problem is termed market impact game and has received considerable attention in recent years (Carlin et al., 2007; Schöneborn, 2008; Moallemi et al., 2012; Lachapelle et al., 2016; Schied & Zhang, 2019; Strehle, 2017a, b). The seminal paper by Schied and Zhang (2019), considers a market impact game between two identical agents trading the same asset in a given time period.

When none of the two agents trade, the price dynamics is described by the so called unaffected price process \(S_t^0\) which is a right-continuous martingale defined on a given probability space \((\Omega ,(\mathscr {F}_t)_{t\ge 0},\mathscr {F},\mathbb {P})\). A trader wants to unwind a given initial position with inventory X, where a positive (negative) inventory means a short (long) position, during a given trading time grid \( \mathbb {T}=\{t_0,t_1,\ldots ,t_N\},\) where \(0=t_0<t_1<\cdots <t_N=T\) and following an admissible strategy, which is defined as follows:

Definition 2.1

(Admissible Strategy) Given \(\mathbb {T}\) and X, an admissible trading strategy for \(\mathbb {T}\) and \(X\in \mathbb {R}\) is a vector \(\varvec{\zeta }=(\zeta _0,\zeta _1,\ldots ,\zeta _N)\) of random variables such that:

-

\(\zeta _k \in \mathscr {F}_{t_k} \text { and bounded},\ \forall k=0,1,\ldots ,N.\)

-

\(\zeta _0+\zeta _1+\cdots +\zeta _N=X\).

The random variable \(\zeta _k\) represents the order flow at trading time \(t_k\) where positive (negative) flow corresponds to a sell (buy) trade of volume \(|\zeta _k|\). We denote with \(X_1\) and \(X_2\) the initial inventories of the two considered agents playing the game and with \(\Xi =(\xi _{i,k})\in \mathbb {R}^{2 \times (N+1)}\) the matrix of the respective strategies, where \(\varvec{\xi }_{1,\cdot }=\{ \xi _{1,k} \}_{k \in \mathbb {T}}\) and \(\varvec{\xi }_{2,\cdot }=\{ \xi _{2,k} \}_{k \in \mathbb {T}}\) are the strategies of trader 1 and 2, respectively. Traders are subject to fees and transaction costs and their objective is to minimize them by optimizing the execution. As customary in the literature, the costs are modeled by two components. The first one is a temporary impact component modeled by a quadratic term \(\theta \xi _{j,k}^2\), respectively for trader j, which does not affect the price dynamics and depends on the immediate liquidity present in the order book. Notice that, as discussed in Schied and Zhang (2019), this term can also be interpreted as a quadratic transaction fee. Here we do not specify exactly what this term represents, sticking to the mathematical modeling approach of Schied and Zhang.

The second component is related to permanent impact and affects future price dynamics. Following Schied and Zhang (2019), we consider the celebrated transient impact model of Bouchaud et al. (2004, 2009), which describes the price process \(S_{t}^{\Xi }\) affected by the strategies \(\Xi \) of the two traders, i.e.,

where \(G:\mathbb {R}_{+}\rightarrow \mathbb {R}_+\) is the so called decay kernel, which describes the lagged price impact of a unit buy or sell order over time. Usual assumptions on G are satisfied, i.e., it is convex, nonincreasing, nonconstant so that \(t\mapsto G(|t|)\) is strictly positive definite in the sense of BochnerFootnote 3, see Alfonsi et al. (2012) and Schied and Zhang (2019). Notice that by choosing a constant kernel G, one recovers the celebrated Almgren-Chriss model (Almgren & Chriss, 2001).

The cost faced by each agent is the sum of the two components above. Specifically, let us denote with \(\mathscr {X}(X,\mathbb {T})\) the set of admissible strategies for the initial inventory X on a specified time grid \(\mathbb {T}\), the cost functions are defined as:

Definition 2.2

(Schied & Zhang, 2019) Given \(\mathbb {T}=\{t_0,t_1,\ldots ,t_N\}\), \(X_1\) and \(X_2\). Let \((\varepsilon _i)_{i=0,1,\ldots N}\) be an i.i.d. sequence of Bernoulli \(\left( \frac{1}{2}\right) \)-distributed random variables that are independent of \(\sigma (\bigcup _{t\ge 0}\mathscr {F}_t)\). Then the cost of \(\varvec{\xi }_{1,\cdot }\in \mathscr {X}(X_1,\mathbb {T})\) given \(\varvec{\xi }_{2,\cdot }\in \mathscr {X}(X_2,\mathbb {T})\) is defined as

and the costs of \(\varvec{\xi }_{2,\cdot }\) given \(\varvec{\xi }_{1,\cdot }\) are

Thus the execution priority at time \(t_k\) is given to the agent who wins an independent coin toss game, represented by a Bernoulli variable \(\varepsilon _k\), which is a fair game in the framework of Schied and Zhang (2019). Given the time grid \(\mathbb {T}=\{t_0,t_1,\ldots ,t_N\}\) and the initial values \(X_1,X_2 \in \mathbb {R}\), we define the Nash Equilibrium as a pair \((\varvec{\xi }_{1,\cdot }^*,\varvec{\xi }_{2,\cdot }^*)\) of strategies in \(\mathscr {X}(X_1,\mathbb {T})\times \mathscr {X}(X_2,\mathbb {T})\) such that

One of main results of Schied and Zhang (2019) is the proof, under general assumptions, of the existence and uniqueness of the Nash equilibrium. Moreover, they showed that this equilibrium is deterministically given by a linear combination of two constant vectors, namely

where the fundamental solutions \(\varvec{v}\) and \(\varvec{w}\) are defined as

and \(\varvec{e}=(1,\ldots ,1)^T \in \mathbb {R}^{N+1}\). The kernel matrix \(\Gamma \in \mathbb {R}^{(N+1)\times (N+1)}\) is given by

and for \(\theta \ge 0\) it is \( \Gamma _{\theta }:=\Gamma +2\theta I\), and the matrix \(\widetilde{\Gamma }\) is given by

As shown by Schied and Zhang (2019) all these matrices are positive definite.

An interesting result of Schied and Zhang (2019) concerns the stability of the Nash equilibrium related to the transaction costs parameter \(\theta \) and the decay kernel G. Generically, following Schied and Zhang (2019), we say that a market is unstable if the trading strategies at the Nash equilibrium exhibit spurious oscillations.

Definition 2.3

(Spurious Oscillations) A trading strategy \(\varvec{\xi }\) exhibits spurious oscillations, if there exists a sequence of at least three consecutive trading times, \(t_i,t_{i+1},\ldots ,t_{\tau }\), where \(\tau -i>1\), such that the orders are consecutively composed by buy and sell trades, i.e., there are at least three consecutive trades with opposite direction, \( \xi _{i+k} \cdot \xi _{i+k+1}<0\), for \(k=0,1,\ldots ,\tau -i-1\).

In the optimal execution literature such behavior is termed transaction triggered price manipulation, see Alfonsi et al. (2012). Figure 1 shows the simulation of the price process under the Schied and Zhang model when both investors have an inventory equal to 1 for two values of \(\theta \). The unaffected price process is a simple random walk with zero drift and constant volatility and the trading of the two agents, according to the Nash equilibrium, modifies the price path. For small \(\theta \) (top panel) the affected price process exhibits wild oscillations, while when \(\theta \) is large (bottom panel) the irregular behavior disappears.Footnote 4

Blue lines exhibit the price process when both agents have inventory equals to 1. The top (bottom) panel shows the dynamics when \(\theta =0.01\) (\(\theta =1.5\)). The trading time grid has \(N+1=51\) points, \(G(t)=\exp (-t)\), the volatility of the unaffected price process is fixed to 1 and \(S_0=100\). The vertical grey dotted lines delineates the trading session. The red lines shows the drift dynamics due to trading

Thus, Schied and Zhang (2019) showed, when the trading time grid is equispaced, \(\mathbb {T}_N\), and under general assumptions on G, the existence of a critical value \(\theta ^*=G(0)/4\) such that for \(\theta <\theta ^*\) the equilibrium strategies exhibit oscillations of buy and sell orders for both traders. Hence, the behavior at zero of the kernel function plays a relevant role for the equilibrium stability. Now, we recall the extension of this framework in a multi-agent market (\(J >2\)) of Luo and Schied (2020). Then, we first extend their framework in the multi-asset (\(M>1\)) case, where we show the existence and uniqueness of the related Nash equilibrium. Finally, we generalize the stability result of Schied and Zhang (2019) in the multi-asset case and we show how to appropriately scale with J and M the kernel function in order to prevent huge oscillations in the related equilibria.

2.1 The Luo and Schied multi-agent market impact model

The Luo and Schied (2020) model is an extension of the Schied and Zhang (2019) model where J risk-averse traders want to trade the same asset. The unaffected price process \(S_t^0\) is always assumed to be a right continuous martingale in a suitable filtered probability space \((\Omega ,\mathscr {F},(\mathscr {F}_t)_{t\ge 0},\mathbb {P})\) and it is also required that \(S_{\cdot }^0\) is a square-integrable process. As before, let \(\mathbb {T}=\{t_0,t_1,\ldots ,t_N\}\) be the trading time grid. Consistently with the previous notation, we denote with \(\Xi =(\xi _{j,k})\in \mathbb {R}^{J\times (N+1)}\) the matrix of all strategies, where \(\xi _{j,k}\) is the order flow of agent j at time \(t_k\), so that the affected price process is defined as

where G is the decay kernel. When comparing markets with a variable number of agents, differently from Luo and Schied (2020), we will assume that the function G can depend on J (Bagnoli et al., 2001; Bucci et al., 2020), see below). The generalization of admissible strategy is straightforward, indeed if \(X_{j}\) denotes the inventory of the j-th agent, \(\Xi \) is admissible for \(\varvec{X}\in \mathbb {R}^{J}\) and \(\mathbb {T}\), if \(\varvec{\xi }_{j,\cdot }\) is admissible for \(X_j\) and \(\mathbb {T}\) for each j according to Definition 2.1, i.e., it is adapted to the filtration, bounded and \(\sum _{k=0}^N \xi _{j,k}=X_j\). The set of admissible strategy is denoted as \(\mathscr {X}(\varvec{X},\mathbb {T})\). Then, if we consider all the possible time priorities among the J traders at each time step, i.e. all the possible permutations that determine the time priority for each trading time \(t_k\) assumed to be equiprobable, it is possible to generalize the previous definition of liquidation cost for a trader strategy, see Luo and Schied (2020) for further details. We denote \(\Xi _{-j,\cdot }\) the matrix \(\Xi \) where the j-th row is eliminated.

Definition 2.4

(Luo & Schied, 2020) Given a time grid \(\mathbb {T}\), the execution costs of a strategy \(\varvec{\xi }_{j,\cdot }\) given all other strategies \(\varvec{\xi }_{l,\cdot }\) where \(l\ne j\) is defined as

where \(\theta \ge 0\).

In the framework of Schied and Zhang (2019) we have two risk-neutral agents which want to minimize the expected costs of a strategy, i.e. implementation shortfall orders. Now, following Luo and Schied (2020), we consider the agents’ risk aversion by introducing the mean-variance and expected utility functionals, respectively

where \(\gamma \) is the risk-aversion parameter and \(u_{\gamma }(x)\) is the CARA utility function,

As usual, see e.g. Almgren and Chriss (2001), the minimization of the mean-variance functional is restricted to deterministic admissible strategies, which is denoted as \(\mathscr {X}_{\det }(\varvec{X},\mathbb {T})\). All agents are assumed to have the same risk-aversion \(\gamma \ge 0\), see Luo and Schied (2020) for further details. Moreover, they introduced the corresponding Nash equilibrium for the previously defined functionals.

Definition 2.5

(from Luo and Schied 2020) Given the time grid \(\mathbb {T}\) and initial inventories \(\varvec{X} \in \mathbb {R}^J\) for J traders with risk aversion parameter \(\gamma \ne 0\), then:

-

a Nash Equilibrium for mean-variance optimization is a matrix of strategies \(\Xi ^*\in \mathscr {X}_{\det }(\varvec{X},\mathbb {T})\) such that each row \(\varvec{\xi }^*_{j,\cdot }\) minimizes the mean-variance functional \(MV_{\gamma }(\varvec{\xi }_{j,\cdot }|\Xi ^*_{-j,\cdot })\) over \(\varvec{\xi }_{j,\cdot }\in \mathscr {X}_{\det }(X_j,\mathbb {T})\);

-

a Nash Equilibrium for CARA expected utility maximization is a matrix of strategies \(\Xi ^*\in \mathscr {X}(\varvec{X},\mathbb {T})\) such that each row \(\varvec{\xi }_{j,\cdot }^*\) maximizes the CARA expected utility functional \( U_{\gamma }(\varvec{\xi }_{j,\cdot }|\Xi ^*_{-j,\cdot })\) over \(\varvec{\xi }_{j,\cdot }\in \mathscr {X}(X_j,\mathbb {T})\).

In particular, Luo and Schied (2020) showed that when the decay kernel is strictly positive definite and for any \(\mathbb {T}\), parameters \(\theta ,\gamma \ge 0\) and initial inventories \(\varvec{X}\in \mathbb {R}^J\), there exists a unique Nash equilibrium for the mean-variance optimization which is given by

where \({\overline{X}}=\frac{1}{J}\sum _{j=1}^J X_j\) and \(\varvec{v}\), \(\varvec{w}\) are the fundamental solutions defined as

and, if \(\varphi (t):= \hbox {Var}(S_t^0)\), for \(t\ge 0\), the matrix \(\Gamma ^{\gamma ,\theta }\) is defined for \(\theta ,\gamma \ge 0\) as

where \(\Gamma _{\theta }\) is the previously defined kernel matrix. Moreover, if \(S_{t}^0=S_0+\sigma B_t\), for \(t\ge 0\), where \(S_0,\sigma >0\) are constants and \(B_t\) is a standard Brownian motion, i.e., the unaffected price process is a Bachelier model, then (5) is also a Nash equilibrium for CARA expected utility maximization and it is unique if we restrict all trader strategies to be deterministic, see Luo and Schied (2020) for further details.

3 Multi-asset market impact games

We now extend the previous framework allowing the J agents to trade a portfolio of \(M>1\) assets. Indeed, agents often liquidate portfolio positions, which accounts in trading simultaneously many assets. In general, the optimal execution of a portfolio is different from many individual asset optimal executions, because of (i) correlation in asset prices, (ii) commonality in liquidity across assets (Chordia et al., 2000), and (iii) cross-impact effects. In the following we will focus mainly on the third effect, even if disentangling them is a challenging statistical problem and we will discuss its relations with the correlation in asset prices which ensure the existence of Nash equilibrium.

To proceed, we first extend the notion of admissible strategy to the multi-asset case. A strategy for J traders during the trading time interval \(\mathbb {T}\) for M assets is a multidimensional array \(\Xi =(\xi _{i,j,k})\in \mathbb {R}^{M\times J \times (N+1)}\), where \({\xi }_{i,j,k}\) is the strategy for the j-th trader in the i-th asset at time step k. Straightforwardly, given a fixed time grid \(\mathbb {T}\) and initial inventory \(X\in \mathbb {R}^{M\times J}\), where each column j contains the inventories of trader j for the M assets, a strategy \(\Xi \) of random variables is admissible for X if i) for all time step k, \(\Xi _{\cdot ,\cdot ,k}\) is \(\mathscr {F}_{t_k}\)-measurable and bounded and ii) \(\sum _{k=0}^N \varvec{\xi }_{\cdot ,j,k}=\varvec{X}_j \in \mathbb {R}^M\) for each j, where \(\varvec{X}_j\) is the j-th column of X.

The second important point is that the trading of one asset modifies also the price of the other asset(s). This effect is termed cross-impact. While self-impact may be attributed to a mechanical and induced consequence of the order book, the cross-impact may be understood as an effect related to mispricing in correlated assets which are exploited by arbitrageurs betting on a reversion to normality, see Almgren and Chriss (2001) and Schneider and Lillo (2019) for further details. Cross-impact has been empirically studied recently, see e.g. Mastromatteo et al. (2017), Schneider and Lillo (2019) and its role in optimal execution has been highlighted in Tsoukalas et al. (2019).

Mathematically cross-impact is modeled by introducing a function \({\mathcal {Q}}^{(J,M)}: \mathbb {R}_+ \times \mathbb {R}^M \rightarrow \mathbb {R}^M\) describing how the trading of the M assets affect their prices at a certain future time. Note that in general the cross-impact function might depend on the number of assets M and on the number of agents J. Later we will discuss more in detail how this dependence affects market stability. Schneider and Lillo (2019) have discussed necessary conditions for the absence of price manipulation for multi-asset transient impact models. They have shown that the cross-impact function need to be symmetric and linear in order to avoid arbitrage and manipulations. Moreover, following example 3.1 of Alfonsi et al. (2016) and as empirically observed by Mastromatteo et al. (2017), we assume the same temporal dependence of G among the assets. Then, we assume that \({\mathcal {Q}}^{(J,M)}= Q \cdot G(t)\) where Q is linear and symmetric, i.e., \(Q\in \mathbb {R}^{M\times M}\) and \(Q=Q^T\) and \(G:\mathbb {R}_+\rightarrow \mathbb {R}_+\). Clearly the dependence from J and M can be in Q and/or in G(t). We also assume that Q is a nonsingular matrix. Therefore, the price process during order execution is defined as

where we refer to \(Q\in \mathbb {R}^{M\times M}\) as the cross-impact matrix, \(\varvec{S}_t^0\in \mathbb {R}^M\) is the unaffected price process which is assumed to be a right-continuous martingale defined on a suitable filtered probability space and it is a square-integrable process.

If for each asset the time priority among the traders is determined by considering all the possible permutations of agents for each trading time \(t_k\), then, following the same motivation of Schied and Zhang (2019) and Luo and Schied (2020), the Definition 2.4 of liquidation cost is generalized as follows:

Definition 3.1

(Execution Cost) Given a time grid \(\mathbb {T}\) and \(\theta \ge 0\), the execution cost of a strategy \(\Xi _{\cdot ,j,\cdot }\) given all other strategies \(\Xi _{\cdot ,l,\cdot }\) where \(l\ne j\) is defined as

The previous definition is motivated by the following argument. When only agent j trades, the prices are moved from \(\varvec{S}_{t_k}^{\Xi }\) to \(\varvec{S}_{t_k +}^{\Xi }=\varvec{S}_{t_k}^{\Xi } -G(0) Q \varvec{\xi }_{\cdot ,j,k}\). However, the order is executed at the average price and the player incurs in the expenses

Then, suppose that immediately after j the agent l place an order and the prices are moved linearly from \(\varvec{S}_{t_k +}^{\Xi }\) to \(\varvec{S}_{t_k +}^{\Xi } -G(0) Q \varvec{\xi }_{\cdot ,l,k}\), so the cost for l is given by:

The term \(G(0) \langle Q\varvec{\xi }_{\cdot ,j,k}, \varvec{\xi }_{\cdot ,l,k}\rangle \) is the additional cost due to the latency, where on average for each asset half of the times the order of agent j will be executed before the one of agent l, so that the latency costs for agent j at time step k is given by \( \frac{G(0)}{2}\sum _{l\ne j} \langle Q\varvec{\xi }_{\cdot ,l,k},\varvec{\xi }_{\cdot ,j,k}\rangle \), see Luo and Schied (2020) for further details.

The mean-variance and CARA expected utility functionals are straightforwardly generalized using the previous defined execution cost. Indeed,

Therefore, we may define the related Nash equilibria definitions:

Definition 3.2

Given the time grid \(\mathbb {T}\) and initial inventories \(X\in \mathbb {R}^{M\times J}\) for M assets and J traders with risk aversion parameter \(\gamma \ge 0\), then:

-

a Nash Equilibrium for mean-variance optimization is a multidimensional array of strategies \(\Xi ^*\in \mathscr {X}_{\det }(X,\mathbb {T})\) such that \(\Xi _{\cdot ,j,\cdot }^*\) minimizes the mean-variance functional \(MV_{\gamma }(\Xi _{\cdot ,j,\cdot }|\Xi ^*_{\cdot ,-j,\cdot })\) over \(\Xi _{\cdot ,j,\cdot }\in \mathscr {X}_{\det }(\varvec{X}_j,\mathbb {T})\);

-

a Nash Equilibrium for CARA expected utility maximization is a multidimensional array of strategies \(\Xi ^*\in \mathscr {X}(X,\mathbb {T})\) such that each \(\Xi _{\cdot ,j,\cdot }^*\) maximizes the CARA expected utility functional \( U_{\gamma }( \Xi _{\cdot ,j,\cdot }|\Xi ^*_{\cdot ,-j,\cdot })\) over \(\Xi _{\cdot ,j,\cdot }\in \mathscr {X}(\varvec{X}_j,\mathbb {T})\).

We recall that \(\varvec{S}_t^0\) follows a Bachelier model if \(\varvec{S}_{t}^0=\varvec{S}_0+ L\varvec{B}_t\) where \(\varvec{S}_0\) is a fixed vector and \(\varvec{B}_t\) is a multivariate (standard) Brownian motion, where its components are independent with unit variance so that the variance-covariance matrix of \(\varvec{S}_t^0\) is given by \(\Sigma =LL^T\).

Remark 3.3

The execution cost of Definition 3.1 could be slightly generalizedFootnote 5 by replacing \(\theta <\varvec{\xi }_{\cdot ,j,k},\varvec{\xi }_{\cdot ,j,k}>\) by \(\theta <Q\varvec{\xi }_{\cdot ,j,k},\varvec{\xi }_{\cdot ,j,k}>\). This generalization makes sense financially if the \(\theta \) dependent term is interpreted as a temporary impact component, while it becomes meaningless if it represents a transaction fee term. In the former case, it is also reasonable to assume that the off-diagonal terms are described by the matrix Q, since cross-permanent impact has likely a similar structure to cross-temporary impact. Under these assumptions, we are able to generalize the main results presented in the rest of the paper in the case of the cost defined in Definition 3.1. In Appendix 1 we present the main derivations for this generalization.

3.1 Nash equilibrium for the linear cross impact model

We now prove the existence and uniqueness of the Nash equilibrium in this multi-asset setting. This is achieved by using the spectral decomposition of Q to orthogonalize the assets, which we call “virtual” assets, so that the impact of the orthogonalized strategies on the virtual assets is fully characterized by the self-impact, i.e., the transformed cross impact matrix is diagonal. Thus, the existence and uniqueness of the Nash equilibrium derives immediately by following the same argument as in Schied and Zhang (2019) and Luo and Schied (2020). All the proofs are given in Appendix 1.

Remark 3.4

If we suppose that Q is the identity matrix, then the multi-asset market impact game is a straightforward generalization of the Luo and Schied (2020) model. Indeed, each order of the players for the i-th stock does not affect any other asset.

In general, if we assume that \(\varvec{S}_t^0\) has uncorrelated components, i.e., the variance-covariance matrix \(\Sigma \) is diagonal, then the following result holds.

Lemma 3.5

(Nash Equilibrium for Diagonal Cross-Impact Matrix) If \(\varvec{S}_t^0\) has uncorrelated components, for any strictly positive definite decay kernel G, time grid \(\mathbb {T}\), parameters \(\theta ,\gamma \ge 0\), initial inventory \(X\in \mathbb {R}^{M\times J}\) and diagonal positive cross impact matrix \(D=\hbox {diag}(\lambda _1,\lambda _2,\ldots , \lambda _M)\), there exists a unique Nash Equilibrium \(\Xi ^*\in \mathscr {X}_{\det }(X,\mathbb {T})\) for the mean-variance optimization problem and it is given by

where \({\overline{X}}_{i,\cdot }=\frac{1}{J} \sum _{j=1}^J X_{i,j}\), \(\varvec{v}_i\) and \(\varvec{w}_i\) are the fundamental solutions associated with the decay kernel \(G_i(t)=G(t)\cdot \lambda _i\) and same parameter \(\theta \). Moreover, if \(\varvec{S}^0_t\) follows a Bachelier model, then (8) is also a Nash equilibrium for CARA expected utility maximization.

Remark 3.6

We observe that for risk-neutral agents, i.e., \(\gamma =0\), the assumptions of uncorrelated assets is no more necessary to prove Lemma 3.5. Indeed, the mean-variance functional is restricted only to the expected cost and for linearity \(MV_0(\Xi _{\cdot ,j,\cdot }|\Xi _{\cdot ,-j,\cdot })=\sum _{i=1}^M MV_0(\varvec{\xi }_{i,j,\cdot }|\Xi _{i,-j,\cdot }; G_i)\), where \(MV_0(\varvec{\xi }_{i,j,\cdot }|\Xi _{i,-j,\cdot }; G_i)= \mathbb {E}[C_{\mathbb {T}}(\varvec{\xi }_{i,j,\cdot }|\Xi _{i,-j,\cdot }; G_i)]\) is the expected cost of Definition 2.4 where the decay kernel is multiplied by \(\lambda _i\), and we have the same conclusion of Lemma 3.5 regardless the covariance matrix of \(\varvec{S}_t^0\).

We first introduce some notation and then we state the main results. We say that assets are orthogonal if the corresponding cross-impact matrix is diagonal. Let us consider the spectral decomposition of Q, i.e., \(QV=VD\), where V and D are the orthogonal and diagonal matrices containing the eigenvectors and eigenvalues, respectively. Since we assume that Q is a non singular symmetric matrix, then D is diagonal with all elements different from zero. We define the prices of the virtual assets as \(\varvec{P}_t:= V^T \varvec{S}_t^{\Xi }\) and we observe that

where \(\varvec{P}_t^0:=V^T \varvec{S}_t^0\) and \(\varvec{\xi }_{\cdot ,j,k}^P:=V^T \varvec{\xi }_{\cdot ,j,k}\). This last quantity is the strategy of trader j at time step k in the virtual assets, which is admissible for inventory \(\varvec{X}_j^P=V^T \varvec{X}_j\), i.e, \(\sum _{k=0}^N \varvec{\xi }_{\cdot ,j,k}^P=\sum _{k=0}^N V^T \varvec{\xi }_{\cdot ,j,k}=V^T \varvec{X}_j\). The virtual assets are mutually orthogonal by construction and their corresponding (virtual) decay kernels \(G_i(t)\) are obtained as the product of the original decay kernel G(t) and the corresponding eigenvalues \(\lambda _i\) of the cross impact matrix, i.e., the decay kernel associated with the i-th virtual asset is \(G_i(t):= G(t)\cdot \lambda _i\). Indeed, from Equation (9) the decay kernel G(t) is multiplied by the eigenvalues of the cross impact matrix for each trading time \(t_k\),

Then, as observed in Remark 3.4, the multi-asset market impact game where each asset is orthogonal to others is equivalent to M one-asset market impact games, i.e., Luo and Schied (2020) models. The (virtual) decay kernels \(G_i(t)\) satisfy the assumptions of strictly positive definite kernels as far as \(\lambda _i>0 \ \forall i=1,2,\ldots ,M\), i.e., Q is positive definite (see also Alfonsi et al. 2016). If \(\hbox {Cov}(\varvec{S}_t^0)=\Sigma \), then \(\hbox {Cov}(\varvec{P}_t^0)=V^T \Sigma V\). So, if Q and \(\Sigma \) are simultaneously diagonalizable then \(\hbox {Cov}(\varvec{P}_t^0)\) is diagonal, i.e., the components of \(\varvec{P}_{\cdot }^0\) are uncorrelated and by Lemma 3.5 we obtain the associated Nash equilibria \(\Xi ^{*,P}\), whose components are defined as

where \({\overline{X}}_{i,\cdot }^P=\frac{1}{J}\sum _{j=1}^J X^P_{i,j}\) is the average inventory on the i-th virtual asset among the traders and \(\varvec{v}_i\) and \(\varvec{w}_i\) are the previously defined fundamental solutions of Luo and Schied (2020) for the i-th virtual asset \(P_{\cdot ,i}\). For them, the decay kernel is given by \(G_i(t)=G(t) \cdot \lambda _i\) and the corresponding \(\varphi _i(t)\) is given by \(\hbox {Var}(P_{t,i}^0)\). Since, Q and \(\Sigma \) are both symmetric, so diagonalizable, Q and \(\Sigma \) are simultaneously diagonalizable if and only if Q and \(\Sigma \) commute. Therefore, we consider the following assumption.

Assumption 1

The cross-impact matrix, Q, and the covariance matrix of the unaffected price process \(\varvec{S}_t^0\), \(\Sigma \), commute, i.e., \(Q\Sigma =\Sigma Q.\)

This assumption is frequently made in the literature and approximately valid in real data,Footnote 6 e.g., Mastromatteo et al. (2017) makes this assumption on the correlation matrix. The empirical observation that the matrix Q has a large eigenvalue with a corresponding eigenvector with almost constant components (as the market factor) and a block structure with blocks corresponding to economic sectors (as in the correlation matrix) indicates that the eigenvectors of Q and \(\Sigma \) are the same, i.e. that Q and \(\Sigma \) (approximately) commute. Notice also that Gârleanu and Pedersen (2013) propose a model of optimal portfolio execution where the quadratic transaction cost is characterized by a matrix which is proportional to \(\Sigma \).

We enunciate the following theorem of existence and uniqueness of Nash equilibrium which extends Theorem 2.4 of Luo and Schied (2020).

Theorem 3.7

(Nash Equilibrium for Multi-Asset and Multi-Agent Market Impact Games) For any strictly positive definite decay kernel G, time grid \(\mathbb {T}\), parameter \(\theta ,\gamma \ge 0\), initial inventory \(X\in \mathbb {R}^{M\times J}\) and symmetric positive definite cross impact matrix Q such that Assumption 1 holds, there exists a unique Nash Equilibrium \(\Xi ^*\in \mathscr {X}_{\det }(X,\mathbb {T})\) for the mean-variance optimization problem and it is given by

where V is the matrix of eigenvectors of Q and \(\Xi ^{*,P}\in \mathscr {X}_{\det }(X^P,\mathbb {T})\) is the Nash Equilibrium (10) of the corresponding orthogonalized virtual asset market impact game where \(X^P=V^T X\). Moreover, if \(\varvec{S}^0\) follows a Bachelier model then (11) is also a Nash equilibrium for CARA expected utility maximization.

However, we observe that for risk-neutral agents, i.e., \(\gamma =0\), Assumption 1 is unnecessary. We remark this result in the following Corollary.

Corollary 3.8

If the agents are risk-neutral, i.e., \(\gamma =0\), then for any strictly positive definite decay kernel G, time grid \(\mathbb {T}\), parameter \(\theta \ge 0\), initial inventories \(X\in \mathbb {R}^{M\times J}\) and symmetric positive definite cross impact matrix Q, there exists a unique Nash Equilibrium \(\Xi ^*\in \mathscr {X}_{\det }(X,\mathbb {T})\) for the mean-variance optimization problem and it is given by

where V is the matrix of eigenvectors of Q and \(\Xi ^{*,P}\in \mathscr {X}_{\det }(X^P,\mathbb {T})\) is the Nash Equilibrium associated to the corresponding orthogonalized virtual asset market impact game where \(X^P=V^T X\). Moreover, if \(\varvec{S}^0_t\) follows a Bachelier model then (12) is also a Nash equilibrium over the set \( \mathscr {X}(X,\mathbb {T})\).

4 Trading strategies in market impact games

Before studying market stability we investigate how the cross-impact effect and the presence of many competitors may affect trading strategies, in terms of Nash equilibria. To understand the rich phenomenology that can be observed in a market impact game, we introduce three types of traders:

-

the Directional wants to trade one or more assets in the same direction (buy or sell). Notice that a Directional can have zero initial inventory for some assets;

-

the Arbitrageur has a zero inventory to trade in each asset and tries to profit from the market impact payed by the other agents;

-

the Market Neutral has a non zero volume to trade in each asset, but in order to avoid to be exposed to market index fluctuations, the sum of the volume traded in all assets is zero.Footnote 7

We remark that an Arbitrageur is a particular case of a Market Neutral agent in the limit case when the volume to trade in each asset is zero. Clearly in a single-asset market we have only two types of the previous agents, since a Market Neutral strategy requires at least two assets.

4.1 Cross-impact effects and liquidity strategies

To better understand how cross-impact affects optimal liquidation strategies, we consider the case of two risk-neutral agents which can (but not necessarily must) trade M assets. We show below that the presence of multiple assets and of cross-impact can affect the trading strategy of an agent interested in liquidating only one asset. In particular, we find, counterintuitively, that it might be convenient for such an agent to trade (with zero inventory) the other asset(s) in order to reduce transaction costs.

We focus on the two-asset case, \(M=2\), and we analyse the Nash equilibrium when the kernel function has an exponential decay,Footnote 8\(G(t)=e^{-t}\). The first trader is a Directional who wants to liquidate the position in the first asset, i.e., \(X_{1,1}=1\), while the second agent is an Arbitrageur, i.e., \(X_{1,2}=0\). We set an equidistant trading time grid with 26 points and \(\theta =1.5\). The second asset is available for trading, but let us consider as a benchmark case when both agents trade only the first asset. This is a standard Schied and Zhang (2019) game. Figure 2 exhibits the Nash Equilibrium for the two players. We observe that the optimal solution for the Directional is very close to the classical U-shape derived under the Transient Impact Model (TIM)Footnote 9, i.e., our model when only one agent is present. However, the solution is asymmetric and it is more convenient for the Directional to trade more in the last period of trading. This can be motivated by observing that at equilibrium the Arbitrageur places buy order at the end of the trading day, and thus she pushes up the price. Then, the Directional exploits this impact to liquidate more orders at the end of the trading session. We remark that the Arbitrageur earns at equilibrium, since her expected cost is negative (see the caption).

Nash equilibrium \(\varvec{\xi }_{1}^*\) of the Directional and \(\varvec{\xi }_{2}^*\) of the Arbitrageur trading only one asset. The trading time grid is equidistant with 26 points and \(\theta =1.5\). The expected costs are equal to \(\mathbb {E}[C_{\mathbb {T}}(\varvec{\xi }_{1}^*|\varvec{\xi }_{2}^*)]=0.4882\), \(\mathbb {E}[C_{\mathbb {T}}(\varvec{\xi }_{2}^*|\varvec{\xi }_{1}^*)]=-0.0370\)

Now we examine the previous situation when the two traders solve the optimal execution problem taking into account the possibility of trading the other asset. We define the cross impact matrix \(Q=\begin{bmatrix} 1 &{}q \\ q &{} 1 \end{bmatrix}\), where \(q=0.6\). In Fig. 3 we report the optimal solution where the inventory of the agents are set to be \({\varvec{X}}_1= \begin{pmatrix} 1&0 \end{pmatrix}^T\) and \({\varvec{X}}_2= \begin{pmatrix} 0&0 \end{pmatrix}^T\). The Directional wants to liquidate only one asset, but, as clear from the Nash equilibrium, the cross-impact influences the optimal strategies in such a way that it is optimal for him/her to trade also the other asset. In terms of cost, for the Directional trading the two assets is worse off than in the benchmark case (see the values of \(\mathbb {E}[C_{\mathbb {T}}(\Xi _{\cdot ,1,\cdot }^*|\Xi _{\cdot ,2,\cdot }^*)]\) in captions). However, if the Directional trades only asset 1 and Arbitrageur trades both assets, the former has a cost of 0.4935 which is greater than the expected costs associated with Fig. 3. Thus, the Directional must trade the second asset if the Arbitrageur does (or can do it).

For completeness in Table 1 we compare the expected costs of both Directional and Arbitrageur when the two agents may decide to trade i) both assets, i.e., they consider market impact game and cross-impact effect, or ii) one asset, i.e., they only consider the market impact game. It is clear that both agents prefer to trade both assets. Actually, the state where both agents trade two assets is the Nash equilibrium of the game where each agent can choose how many assets to trade.

Optimal strategies for a Directional (\(\Xi _{\cdot ,1,\cdot }^*\)) and an Arbitrageur (\(\Xi _{\cdot ,2,\cdot }^*\)), where their inventories are equal to \((1~ 0)^T\) and \((0~ 0)^T\), respectively. \(Q=\begin{bmatrix} 1 &{} 0.6 \\ 0.6 &{} 1 \end{bmatrix}\), and the trading time grid is an equidistant time grid with 26 points. The expected costs are equal \(\mathbb {E}[C_{\mathbb {T}}(\Xi _{\cdot ,1,\cdot }^*|\Xi _{\cdot ,2,\cdot }^*)]=0.4885\), \(\mathbb {E}[C_{\mathbb {T}}(\Xi _{\cdot ,2,\cdot }^*|\Xi _{\cdot ,1,\cdot }^*)]=-0.0377\) when \(\theta =1.5\)

The solution presented above is generic, but an important role is played by the transaction cost modeled by the temporary impact. When the temporary impact parameter \(\theta \) increases, the benefit of the cross-impact vanishes, and the optimal strategy of the Directional tends to the solution provided by the simple TIM with one asset and no other agent. We find that the difference between these expected costs is negative, i.e. it is always optimal to trade also the second asset, but converges to zero for large \(\theta \), see Fig. 4a. Furthermore, it is worth noting that, if \(S=\sum _k |\xi _{k,2}|\) denotes the total absolute volume traded by the Directional on the second asset, then \(\lim _{\theta \rightarrow 0}S=0\) and \(\lim _{\theta \rightarrow \infty }S=0\) as exhibited from Fig. 4b. This means, that when the cost of trades increases, it is not anymore convenient for both traders to try to exploit the cross impact effect.

a The y axis shows the difference between the expected cost of the Directional when he/she considers the cross-impact effect and the Arbitrageur and the expected cost when he/she places order following the classical one asset TIM model and the x axis the cost parameter \(\theta \). b Cumulative traded volume of the second asset by the Directional when playing against an Arbitrageur as a function of \(\theta \). The inset shows the same curve in semi-log scale. The setting is the same of Fig. 3

4.2 Do arbitrageurs act as market makers at equilibrium?

We now consider the cases when the agents are of different type. In particular, we focus on the role of an Arbitrageur as an intermediary between two Directional traders of opposite sign. When a Directional seller and a Directional buyer trade the same asset(s), are the Arbitrageurs able to profit, acting as a sort of market maker by buying from the former and selling to the latter?

To answer this question, we compute the Nash equilibrium of a market impact game with \(M=2\) assets and \(J=3\) agents, namely a Directional seller with inventory \((1\ 0)^T\), a Directional buyer with inventory \((-1\ 0)^T\), and an Arbitrageur. We assume that agents are risk-neutrals, \(\gamma =0\), and \(Q=\begin{bmatrix}1 &{} 0.6 \\ 0.6 &{} 1\end{bmatrix} \). As panels (a) of Fig. 5 show, the Arbitrageur does not longer trade and the expected costs are 0.1056 and 0 for the two Directional and the Arbitrageur, respectively. This indicates that the two Directional are able to reduce significantly their costs with respect to the previous case, increasing their protection against predatory trading strategies and that the Arbitrageur is unable to act as a market maker. The previous cases are particular examples of the following more general result.

Proposition 4.1

Under the assumptions of Theorem 3.7, the following are equivalent:

-

(a)

The aggregate net order flow is zero for each asset, i.e.,

$$\begin{aligned} {\overline{X}}_{i,\cdot }=\frac{1}{J}\sum _{j=1}^J X_{i,j}=0\quad \forall i=1,2,\ldots ,M; \end{aligned}$$ -

(b)

The optimal solution for an Arbitrageur is equal to zero for all assets.

In other words, when the aggregate net order flow is zero for each asset then there are no arbitrageurs in the market, i.e., the Nash equilibrium for Arbitrageurs is zero, so that the optimal schedule corresponds to place no orders in the market.

Optimal schedule for market impact game with \(M=2\) assets and \(J=3\) risk-neutral agents. a Exhibit the optimal schedule for a Directional seller, buyer (with inventory \((1 \ 0)^T\) and \((-1 \ 0)^T\), respectively), and an Arbitrageur. b Exhibit the optimal schedule for two identical Directional sellers (with inventories \((1 \ 0)^T\), respectively), and an Arbitrageur. Blue and red lines are the Nash equilibrium for the Directional traders. The dark line refers to the equilibrium of the Arbitrageur. The trading time is equidistant with 26 points, where the cross impact is set to \(q=0.6\), \(\gamma =0\) and \(\theta =1.5.\)

As a comparison, we consider two identical Directional sellers (with inventories \((1\ 0)^T\)) and the other parameters are the same as above. Figure 5b, displays the equilibrium solution. The solution of the Directional are identical. While the trading pattern of the Arbitrageur is qualitatively similar to the one of the two agent case (see Fig. 3), the Directional trade significantly less toward the end of the day. This is likely due to the fact that it might be costly to trade for one Directional given the presence of the other. The expected costs of the two Directional is equal to 0.8911 (which is approximately two times of the two players game) and \(-0.0996\) for the Arbitrageur.

5 Instabilities in market impact games

We now turn to our attention to the study of market stability. Since the seminal work of Schied and Zhang (2019) we know that, when two risk-neutral agents trade one asset, stability is fully determined by the value \(\theta \) of the transaction cost, see Theorem 2.7 of Schied and Zhang (2019). Here we extend their results for the multi-asset case and we derive a general result which involves the spectrum of the cross-impact matrix. However, the proof of Schied and Zhang (2019) cannotFootnote 10 be extended to the multi-agent case with J risk-averse agents, even though in the one asset case, as highlighted by Luo and Schied (2020). Therefore, we study market stability by using numerical analyses for the general setting of multi-agent and multi-asset case from which we deduce a new conjecture which is in line with the analyses carried out by Luo and Schied (2020). We conclude by presenting some advice to policy regulators which want to prevent market instability.

To clarify better our results, we introduce two definitions of market stability in a market with M assets and J traders:

Definition 5.1

(Strong Stability) The market is strongly (uniformly) stable if \(\forall \) \(\theta \ge 0\) the Nash equilibrium \(\varvec{\xi }_{i,j,\cdot }^*\in \mathscr {X}(X_{i,j},\mathbb {T})\) does not exhibit spurious oscillations \( \forall \ X_{i,j} \in \mathbb {R}\) initial inventory, for all assets \(i=1,2,\ldots ,M\) and agents \(j=1,2,\ldots ,J\).

Definition 5.2

(Weak Stability) The market is weakly stable if there exists an interval \( I \subset \mathbb {R}_+\) such that \(\forall \) \(\theta \in I\) the Nash equilibrium \(\varvec{\xi }_{i,j,\cdot }^*\in \mathscr {X}(X_{i,j},\mathbb {T})\) does not exhibit spurious oscillations \( \forall \ X_{i,j}\in \mathbb {R}\) initial inventory, for all assets \(i=1,2,\ldots ,M\) and agents \(j=1,2,\ldots ,J\)

We recall that a spurious oscillations is a sequence of trading times such that the orders are consecutively composed by buy and sell trades, see Sect. 2. Therefore, Schied and Zhang (2019) showed that for \(M=1\) and \(J=2\) the market is not strongly but only weakly stable where I, the stability region, is equal to \([\theta ^*,+\infty )\) where \(\theta ^*=G(0)/4.\)

5.1 Scaling of impact with J and M

Up to now we have not discussed how the function \({\mathcal Q}^{(J,M)}\), and therefore its components Q and G(t), depend on the number of agents J and the number of assets M. While this is not important for finding the Nash equilibrium, we will show below that the behavior of \({{\mathcal {Q}}}^{(J,M)}\) is critical to study the stability properties of markets. In this subsection we review what the theoretical and empirical literature tells us about this dependence.

Concerning the dependence of impact on J, Bagnoli et al. (2001) generalizes the Kyle (1985) model to the case when \(J\ge 1\) symmetrically informed agents are simultaneously present, and shows that the Kyle’s lambda, i.e. the proportionality factor between price impact and aggregated order flow, scales as \(J^{-1/\alpha }\), where \(\alpha \) is the exponent of the stable law describing the price and uninformed order flow distribution. Moreover if the second moment of both variables is finite, Bagnoli et al. (2001) shows that the Kyle’s lambda scales as \(1/\sqrt{J}\) (see also Lambert et al. 2018 for the non symmetrical case when distributions are Gaussian). In our impact model, this property can be modeled by assuming that the decay kernel depends on J as \(G(t):=J^{-\beta } \cdot {\bar{G}}(t)\) where \({\bar{G}}(t)\) is the J independent part of the decay kernel and \(\beta \ge 0\). The case \(\beta =0\) corresponds to the additive case, while for \(\beta =1\) the total instantaneous impact does not depend on the number of agents J. On the empirical side, there are some recent evidences suggesting that the impact strength depends on the number of agents simultaneously trading. Figure 3 of Bucci et al. (2020) indicates that market impact of a metaorderFootnote 11 decreases with the number of metaorders simultaneously present.

Concerning the dependence of impact from M, the recent work of Garcia del Molino et al. (2020) proposes a multi-asset version of the Kyle model. In particular, they prove the existence and uniqueness of the linear equilibrium and show in Proposition 3.4 that the cross-impact matrix Q (\(\Lambda \) in their notation) satisfies \(\frac{1}{4} \Sigma _0=Q \Omega Q\) where \(\Sigma _0\) and \(\Omega \) are the covariance matrices of the fundamental price and of the bids of the noise trader, respectively. If we assume that these matrices have a one factor structure and can be decomposed as \(\Sigma _{0}=s_d I+s_n \varvec{e}\varvec{e}^T\) and \(\Omega =\omega _d I+ \omega _n \varvec{e}\varvec{e}^T\), where \(s_d,s_n,\omega _d,\omega _n\in \mathbb {R}\) and \(\varvec{e}\) is the vector with all components equal to one, then necessarilyFootnote 12\(Q=q_d I+q_n \varvec{e}\varvec{e}^T\), where \(q_d,q_n \in \mathbb {R}\). However, since \(\frac{1}{4} \Sigma _0=Q \Omega Q\), \(q_d=\sqrt{\frac{s_d}{4\omega _d}}\) which is independent from M [this was also empirically observed by Benzaquen et al. 2017] and more interestingly, \(\lim _{M\rightarrow \infty }q_n=\lim _{M\rightarrow \infty } \left( -q_d\pm \sqrt{ \frac{s_d}{4\omega _n}}\right) \frac{1}{M}=0\).Footnote 13 Thus, in the model the off-diagonal terms of Q scale as 1/M and asymptotically, when M becomes large, the cross-impact terms would vanish and Q would converge towards a diagonal matrix. The decay of cross-impact coefficients with the number of considered assets M has been empirically observed in Benzaquen et al. (2017).

In conclusion, theoretical and empirical studies have shown that market impact is generally dependent on the number of assets and on the number of agents. While we have some indication of the scaling properties in some specific cases, the general form of this dependence is still an open issue. In the following we will show that if market impact does not properly scale with J and M, markets become more unstable when more assets and/or more agents are present.

5.2 Market stability and cross impact structure

In this Section we consider \(J=2\) risk-neutral agents which trade \(M>1\) assets. We study whether the increase of the number of assets and the structure of cross impact matrix help avoiding oscillations and market instability at equilibrium according to the previous definitions. To this end, we consider different structures of the cross-impact matrix Q describing the complexity of the market for what concerns commonality in liquidity.

We first show that instabilities are generically observed also in the multi-asset case and that actually more assets generally make the market less stable if the elements of the cross-impact matrix do not depend on M. For simplicity let us consider \(M=2\) assets and a game between a Directional and an Arbitrageur (similar results hold for different combinations of agents). We choose \(G(t)=e^{-t}\), the cross impact matrix equal to \(Q=\begin{bmatrix} 1 &{} 0.9\\ 0.9 &{}1 \end{bmatrix}\), and we consider \(\theta =0.3\); remember that for the one asset case the market is stable for this value of \(\theta \). Figure 6 shows that for this value of \(\theta \) the strategies are oscillating and therefore the market is not strongly stable. More surprisingly, the fact that oscillations are observed for \(\theta =0.3\) indicates that the transition between the two stability regimes depends on also on the number of assets and that more assets require larger values of \(\theta \) to ensure stability. In the following we prove that this is the case and we determine the threshold value. Figure 6 shows also the case \(\theta =0\). Notably, in this case the oscillations in the second asset disappear. This is due to the fact that, since \(\Gamma _{0}^1\), (\(\Gamma _0^2\)), the \(\Gamma \) matrix associated with the first (second) virtual asset is equal to \((1+q) \Gamma \), (\((1-q) \Gamma \)), the combination of “fundamental" solutions \(\varvec{v}\) and \(\varvec{w}\) are the same for the two virtual assets. Thus, at equilibrium the two solutions for the second asset are exactly zero.

Nash Equilibrium for a Directional and an Arbitrageur, where their inventories are equal to \((1~ 0)^T\) and \((0~ 0)^T\) respectively. The blue lines are the optimal solution when \(\theta =0\) and the red lines when \(\theta =0.3\). The trading time has 51 points and \(Q=\begin{bmatrix} 1 &{} 0.9\\ 0.9 &{}1 \end{bmatrix}\)

We have shown in a simple setting that having more than one available asset does not help improving the strong stability of the market and increases the threshold value between stable and unstable markets. Now, we show that when the number of assets tends to infinity and G does not depend on M, the market becomes unstable. To this end we introduce the definition of asymptotic stability.

Definition 5.3

(Asymptotic weak stability) The market is asymptotically weakly stable if it is weakly stable when \(M\rightarrow \infty .\)

Given this definition, we prove the following:

Theorem 5.4

(Instability in Multi-Asset Market Impact Games) Suppose that G is a continuous, positive definite, strictly positive, log-convex decay kernel and that the time grid is equidistant. Let \(({\lambda _i})_{i=1,..,M}\) be the eigenvalues of the cross-impact matrix Q. If \(\theta <\theta ^*\) the market is unstable, where

Moreover, if the largest eigenvalue of the cross-impact matrix diverges for \(M\rightarrow \infty \), i.e., \(\lim _{M\rightarrow +\infty }\lambda _{max}=+\infty \), then the market is not asymptotically weakly stable. The theorem tells that the instability of the market is related to the spectral decomposition of the cross-impact matrix, i.e. to the liquidity factors.

We analyze some realistic cross-impact matrices and their implications for the stability of the Nash equilibrium. Specifically, we consider the one-factor and block matrices.

5.2.1 One factor matrix

We say that Q is a one factor matrix if \(Q=(1-q)I+q\cdot \varvec{e}\varvec{e}^T\), where \(\varvec{e}=(1,\ldots ,1)^T \in \mathbb {R}^M\) and \(q\in (0,1)\) to guarantee the positive definiteness Q. As we have seen in Sect. 5.1, q can be a function of M. Then it holds:

Corollary 5.5

Under the assumptions of Theorem 5.4, if the cross-impact matrix is a one factor matrix, then the market is not asymptotically weakly stable if \(\lim _{M\rightarrow \infty } qM\) diverges.

This implies that when M increases and q is independent from M, the transactions cost \(\theta \) must raise in order to prevent market instability, since \(\theta ^*=G(0)\lambda _{max}/4\sim G(0)qM/4\), because \(\lambda _{max}=1+q(M-1)\). On the contrary, when, as in the multi-assset Kyle model of Garcia del Molino et al. (2020), it is \(q=O\left( \frac{1}{M}\right) \), the market is asymptotically stable. Thus the market stability conditions critically depends on the scaling of market impact with M.

Figure 7 exhibits the equilibrium for a Directional and an Arbitrageur, when \(\theta =1.5\), \(q=0.2\) and \(M=2000\). The inventory of the Directional is 1 for the first 1000 assets and zero for the others. The solutions clearly show spurious oscillations of buy and sell orders. Notice that in the one asset case this value of \(\theta \) gives a stable market.

Nash equilibrium when \(\theta =1.5\) between a Directional with inventory \((1,\ldots ,1,0,\ldots ,0)^T\in \mathbb {R}^M\) and an Arbitrageur with inventory \((0,\ldots ,0)^T\in \mathbb {R}^M\), where \(M=2,000\). The cross impact matrix is a one factor matrix with \(q=0.2\). The blue lines exhibits the volume traded for any of the first 1, 000 assets, while the red ones are those for any of the last 1, 000 assets. The equidistant time grid has 26 points

We observe that the eigenvector corresponding to \(\lambda _{max}\) is given by \(\varvec{e}\), which represents an equally weighted portfolio. As a consequence, if we consider a Market Neutral agent against an Arbitrageur the solution becomes stable \(\forall \ \theta > (1-q)/4\), since both traders have zero inventory on the first virtual asset. Thus, oscillations might disappear when the inventory of the agents in the first virtual asset is zero.

A generalization of the above model considers Q as a rank-one modification matrix, i.e. \(Q= D+ \varvec{\beta } \varvec{\beta }^T\), where \(D=\hbox {diag}(1- \beta _1^2,\ldots , 1- \beta _M^2)\) and \(\varvec{\beta }\in \mathbb {R}^M\) is a fixed vector. In this way the cross impact is not the same across all pairs of stocks. We find again that the market is not asymptotically stable if the \(\beta \)s do not suitably scale with M, i.e. instability occurs when \(\lim _{M\rightarrow \infty } \langle \beta ^2_i\rangle M\) diverges, where \(\langle ...\rangle \) is the average value over the M values.

5.2.2 Block matrix

We now assume that the cross impact matrix has a block structure in such a way that cross impact between two stocks in the same block i is \(q_i\), while when the two stocks are in different blocks the cross impact is q, which we assume to be \(0\le q<q_i \ \forall i\). This is consistent with the empirical evidence in Mastromatteo et al. (2017), where blocks are in good correspondence with economic sectors.

Let us denote with \(M_i\) the number of stocks in block i, (\(i=1,\ldots K\)), and let \(Q_i=(1-q_i)I+q_i\cdot \varvec{e}_i \varvec{e}_i^T \in {{\mathbb {R}}}^{M_i}\times {{\mathbb {R}}}^{M_i}\) with \(q_i\in (0,1)\) and \(\varvec{e}_i=(1,\ldots ,1)^T \in \mathbb {R}^{M_i}\), where K is the number of blocks. We define the cross impact matrix as:

In a similar way of Sect. 5.2.1\(q_i\) might depend on the number of stocks in the i-th cluster, \(M_i\). We prove an analogue result as for the one factor matrix case:

Corollary 5.6

Under the assumptions of Theorem 5.4, if Q is a block matrix, where each block is a one factor matrix, if (i) \(\lim _{M_i\rightarrow +\infty } M_i (q_i -q) \rightarrow +\infty \) for all \(i=1,2,\ldots ,K\) and (ii) \(\lim _{M\rightarrow + \infty }\frac{M}{K}\rightarrow +\infty \), then the market is not asymptotically weakly stable.

Nash equilibrium when \(\theta =1.5\) with inventories for the Market Neutral \(X_0=(1,\ldots ,1,-1,\ldots ,-1)^T\in \mathbb {R}^M\) and for the Arbitrageur \(Y_0=(0,\ldots ,0)^T\in \mathbb {R}^M\), where \(M=2000\). The cross impact matrix is a block matrix with \(K=10\). The figure exhibits the equilibria related to one (the first) asset for each block. The trading time grid is an equidistant time grid with 26 points. Each block has a cross-impact \(q_i\) equal to \(0.1, 0.2, \ldots , 0.9\) for \(i=1,2,\ldots ,9\) and 0.95 for the last one

When \((q_i-q)\) is independent from \(M_i\), for all i, and the average number of stocks of a cluster tends to infinity when M goes to infinity, the transaction costs level parameter must raise in order to prevent instability. As an example, we consider \(K=10\) equally sized blocks from an universe of \(M=2,000\) assets and set \(q=0.05\) where each block has a fixed cross-impact \(q_i\). With this kind of cross impact matrix, we have K large eigenvalues whose eigenvectors correspond to virtual assets displaying oscillations. The optimal trading strategies for stocks belonging to the same block are the same. Thus in Fig. 8 we show the Nash equilibrium for the first asset in each of the 10 blocks when the two agents are a Market Neutral and an Arbitrageur. The oscillations are evident, as expected, in all traded assets.

We now study how the critical value \(\theta ^*\) varies when the number of assets increases for different structures of the cross impact matrix and therefore of the liquidity factors. Comparing different matrix structures is not straightforward since the critical value depends on the values of the matrix elements. To this end we consider the set of symmetric cross impact matrices of M assets having one on the diagonal and fixed sum of the off diagonal elements. More precisely let \(h\in \mathbb {R}\), then we introduce for each M the set

One important element of this set is the cross impact matrix \(Q_{1fac}\in {{\mathbb {R}}}^{M\times M}\) of a one factor model (see above) with off-diagonal elements equal to \(2h/M(M-1)\). In Appendix 1 we prove the following:

Theorem 5.7

For a fixed \(h\in \mathbb {R}\), let us consider the related one-factor matrix \(Q_{1fac}\in {\mathcal {A}}_h^M\), then

i.e. among all the matrices with one in the diagonal and constant sum of the off-diagonal terms, the one-factor matrix (i.e. where all the off-diagonal elements are equal) is one of the matrices with the smallest largest eigenvalue.

Moreover, we prove in the last part of Appendix 1 that the previous is not a strict inequality, by showing that both a diagonal block matrix, with identical blocks, and the one-factor matrix have the same maximum eigenvalue. This theorem implies that among all the cross impact matrices belonging to \({\mathcal {A}}_h^M\), the one factor case is among the most stable cross-impact matrices. For example, it is direct to construct an example of a block diagonal cross impact matrix with non-zero off block elements (i.e. similar to what observed empirically) and to prove that its critical \(\theta ^*\) is larger than the critical value for the one factor matrix having the same value h of total cross-impact.

5.3 Market stability in multi-agent and multi-asset market impact games

We now study how the stability of the market depends on the number of agents, J, the number of assets, M, the risk-aversion parameter \(\gamma \), and the number of trading periods N. Specifically, we compute numerically the critical value of \(\theta \) after which the market is not stable. However, we first observe that to study the stability it is sufficient to analyse the fundamental solutions of each virtual assets.

5.3.1 Characterization of the fundamental solutions

If all agents have the same inventory, i.e., \(\varvec{X}_{\cdot ,j}=\varvec{Z}\ \forall j\) where \(\varvec{Z} \in {\mathbb R}^M\) is a fixed inventory vector, then also the virtual inventories are all equal, since \(\varvec{X}^P_{\cdot ,j}=V^T \varvec{Z} \equiv \varvec{Z}^P \ \forall j\). Then, \({\overline{X}}_{i,\cdot }^P=\frac{1}{J}\sum _{j=1}^J X_{i,j}^P=Z_i^P\) and by Eq. (10) the solution for all agent j in virtual asset i is given by \(\Xi _{i,j}^{*,P}=Z_{i,j}^P \varvec{v}_i.\) So, let \(V=\begin{bmatrix} \varvec{\nu }_1 | \varvec{\nu }_2|\cdots |\varvec{\nu }_M \end{bmatrix}\) the matrix of eigenvectors of Q, which we may assume to be normalized, \(\varvec{\nu }_i^T \varvec{\nu }_i=1\), if \(\varvec{X}_{\cdot ,j}=\varvec{\nu }_m \ \forall j\) then the optimal schedule on the virtual assets is given

since \(\varvec{X}_{\cdot ,j}^P=V^T \varvec{X}_{\cdot ,j}\) has 1 in the m-th position and zero otherwise, so \( \Xi _{\cdot ,j}^{*}=V\cdot \Xi _{\cdot ,j}^{*,P}=\varvec{\nu }_{m} \otimes \varvec{v}_m, \ \forall j, \) which means that the strategies for all traders is fully characterized by the fundamental solution \(\varvec{v}_m\).

If \({\overline{X}}_{i,\cdot }=0, \ \forall i\) then \({\overline{X}}_{i,\cdot }^P=0\) and by Eq. (10) the solution for each agent j is given by \(\Xi ^{*,P}_{i,j}=X_{i,j}^P \varvec{w}_i, \ i=1,2,\ldots ,M.\). Thus, as for the previous case, if the inventory of the j-th trader \(\varvec{X}_{\cdot ,j}=\varvec{\nu }_m\) (and if \({\overline{X}}_{i,\cdot }=0\) for all i), then his/her optimal schedule on the virtual assets is given by

so that \( \Xi _{\cdot ,j}^{*}=V\cdot \Xi _{\cdot ,j}^{*,P}=\varvec{\nu }_{m} \otimes \varvec{w}_m, \).

We summarize the previous results as follows:

-

(a)

If all agents have the same inventories, i.e. \(\varvec{X}_{\cdot ,j}=\varvec{\nu }_m\ \forall j\), then the Nash equilibrium for j is proportional to \(\varvec{v}_m\), i.e, \(\Xi _{\cdot ,j}^{*}=\varvec{\nu }_{m} \otimes \varvec{v}_m.\)

-

(b)

If \({\overline{X}}_{i,\cdot }=0, \ \forall i\) and \(\varvec{X}_{\cdot ,j}=\varvec{\nu }_m\), then the Nash equilibrium for j is proportional to \(\varvec{w}_m\), i.e, \(\Xi _{\cdot ,j}^{*}=\varvec{\nu }_{m} \otimes \varvec{w}_m.\)

We observe that, respectively, if \(\varvec{v}_m\), or \(\varvec{w}_m\), exhibits spurious oscillations also \(\Xi _{\cdot ,j}^{*}\) is affected by these oscillations, respectively. We recall that market is unstable if a particular initial inventories leads to optimal trading strategies with spurious oscillations. So we can restrict the stability analysis on the fundamental solutions among all assets.

5.3.2 Numerical analysis of stability

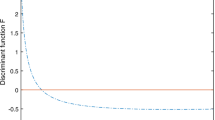

In this section we study how J, M, \(\gamma \), and N affect the market stability in the multi-agent and multi-asset case. In particular, we compute numerically \(\theta ^*\) such that when \(\theta <\theta ^*\) the market is unstable. As observed in Sect. 5.3.1 it is sufficient to examine the oscillations of the fundamental solutions on the virtual assets.

We consider the following setting:

-

The time grid is equidistant \(\mathbb {T}_N=\{\frac{kT}{N}|k=0,1,\ldots ,N\}\), where \(T=1\) and \(N\in \mathbb {N}\);

-

The decay kernel is exponential, \(G(t)=e^{-t}\);

-

The cross-impact matrix is a one factor matrix, \(Q=(1-q)I_M+q \varvec{e} \varvec{e}^T\), where \(q=1/2\);

-

\(\varvec{S}_t^0\) follows a Bachelier model where the covariance matrix is equal to Q.

Luo and Schied (2020) conjectures that in the one-asset case \(\theta ^*\) satisfies

therefore, given the results of Sect. 5, our conjecture is that

where \(\lambda _{max}\) is the maximum eigenvalue of Q. We recall that in the above setting, \(\lambda _{max}=1+\frac{M-1}{2}\) and \(G(0)=1\). Moreover we are assuming that G and Q do not depend explicitly on J and M. Thus, in the first analysis we set \(N=300\), \(\gamma =10\) and we compute \(\theta ^*\) as a function of M and J. Figure 9 exhibits the corresponding level curves. It is worth noticing that the relation between J and M is very close to that of Eq. 14. Indeed, the average relative discrepancy on \(\theta ^*\) is of the order of \(10^{-3}\).

Level curves of \(\theta ^*\) in function of M and J for fixed \(N=300\) and \(\gamma =10\). The bottom left corner, corresponding to \(M=1\) and \(J=2\), is the case of Schied and Zhang (2019)

Finally, we examine how \(\theta ^*\) depends on N and \(\gamma \) for fixed M and J, which are \(M=J=11\), see Fig. 10 which illustrates the related surface.Footnote 14

Overall, the numerical results suggests that for fixed M and J the relation (14) holds when N is not too small, since for the chosen parameter Eq. (14) predicts \(\theta ^*=15\).

5.3.3 Scaling and market stability: comparative statics for J and M

The conjecture in Eq. 14 indicates that, if market impact does not suitably scale with the number of assets and of agents, market turns out to be unstable for large J and M, unless the transaction costs parameter \(\theta \) increases appropriately.

From Eq. 14 it is clear that a sufficient condition for asymptotic stability, i.e. that there exists a finite value of \(\theta ^*\) above which the market is stable in a market with many agents and many assets, is that the two following limits are finite:

-

\(\lim _{M\rightarrow \infty } \lambda _{max}\)

-

\(\lim _{J \rightarrow \infty } JG(0)\)

The first limit is finite, for example, in a multiasset Kyle model as in Garcia del Molino et al. (2020) with a one factor structure for fundamental price and net order flow of noise traders (see Sect. 5.1). For the second limit, we have empirical and theoretical evidences that the kernel scales with J as \(G(t)=J^{-\beta }{\bar{G}}(t)\). Clearly we would need \(\beta \ge 1\) to have asymptotic stability in J. Multi agent Kyle models with finite variance of the fundamental price suggest \(\beta =1/2\) (see Bagnoli et al. (2001) and Sect. 5.1), while the empirical evidence is more ambiguous, due to the difficulty to identify empirically the trading activity of different agents. Thus it is still an open issue if this type of setting can provide asymptotically stable markets in the limit of large J.

Schied and Zhang (2019) have highlighted the importance of transaction cost \(\theta \) in determining whether the Nash equilibrium of a market impact game is stable or unstable. They prove the existence of a threshold value of \(\theta \) below which the market is unstable. By extending the framework to many agents and assets, we have shown the importance of the scaling properties of market impact, which in these games is exogenous, in determining market stability. If the largest eigenvalue of the cross impact matrix diverges with M or if the kernel goes to zero slower than \(J^{-1}\) the market will be unstable for large values of M or J, respectively.

6 Conclusions

In this paper we investigated the general problem of Nash equilibria in market impact games with an arbitrary number of assets and of agents. Specifically, we extended the results of Schied and Zhang (2019) and Luo and Schied (2020) in several directions. We first considered a multi-asset market where we introduced the cross-impact effect among assets. We solved the Nash equilibrium, we analysed the optimal solution provided by the equilibrium, and we studied the impact of transaction costs on liquidation strategies. We found that in the presence of cross impact it might be convenient to trade auxiliary assets in order to minimize market impact cost of a position a trader wants to liquidate. Thus the optimal execution problem should be handled intrinsically as a multi-asset problem.

We then used market impact games to investigate several potential determinants of market instabilities driven by finite liquidity and simultaneous trade execution of many agents. In addition to the existence of a transition between a stable and an unstable phase when the transaction cost is smaller than a given threshold (Schied & Zhang, 2019), we find that markets become asymptotically in J and M unstable when the impact does not scale suitably with these variables. On one side, these results set limits to the parameters of models that do not lead to instability and on the other, contributes to the theoretical and empirical literature on market impact in multi agent and multi-asset settings.

From the policy perspective, the conjecture above indicates that the critical transaction cost level \(\theta \) below which instabilities are present grows with the impact coefficient G(0) (or its scaled version), the number of traders J, and the largest eigenvalue \(\lambda _{max}\) of the cross impact matrix. Thus, to ensure stability, the transaction cost parameter \(\theta \) should be set taking into account the above variables, and be increased or decreased when they significantly change.Footnote 15

Clearly, an increase of the transaction costs might discourage trading activity, therefore decreasing overall market participation and possibly price discovery. For example, in the one period multi-agent Kyle model of Bagnoli et al. (2001) the mean square deviation of the market price from the fundamental value goes to zero with the number of agents as \((J+1)^{-1}\). Thus regulators should fix transaction costs by balancing the contrasting objectives of increasing traders participation/price discovery and stabilizing markets.

Notes

The function \(t\mapsto G(|t|)\) is strictly positive definite in the sense of Bochner, if for all \(n\in \mathbb {N}\), \(t_1,t_2,\ldots ,t_n \in \mathbb {R}\) and \(x_1,x_2,\ldots ,x_n \in \mathbb {R}\), \(\sum _{i,j = 1}^n x_i x_j G(|t_i-t_j|)\ge 0\), where the equality it is satisfied if and only if \(x_1=x_2=\cdots =x_n=0.\) Alfonsi et al. (2012) (Proposition 2) show that it is satisfied as G is convex, nonincreasing and nonconstant. This condition prevents the existence of price manipulation strategies in the sense of Huberman and Stanzl (2004), see Alfonsi et al. (2012) and Schied and Zhang (2019) for further details.

Moreover, we observe that the presence of spurious oscillations in the price dynamics may affect the consistency of the spot volatility estimation. Indeed, these oscillations act as a market microstructure noise, even if this noise is caused by the oscillations of a deterministic trend, while usually it is characterized by some additive noise term. In particular, we find that when \(\theta \) is close to zero the noise is amplified by spurious oscillations, while for sufficiently large \(\theta \) these oscillations do not compromise the consistency of the spot volatility.

We thank an anonymous Referee for this suggestion.