Abstract

Drawing on dynamic capabilities and the resource-based view, we propose a conceptual model that encompasses big data analytics capabilities (BDAC), digital platform capabilities and network capabilities, supply chain innovation, and firm performance. We use the structural equation modeling to empirically validate this model on the time-lagged data of 221 micro, small, and medium enterprises (MSMEs) in the manufacturing sectors. The empirical results of our data analysis showed that BDAC significantly improved platform and networking capabilities. BDAC also improved supply chain innovation and thus financial performance. Our data indicated that networking capabilities mediated the relationships of both (a) BDAC-supply chain innovation and (b) BDAC-financial performance. Meanwhile, digital platforms mediated only the BDAC-supply chain innovation relationship. The outcomes of sequential mediation confirmed the role of both digital platform and network capabilities and supply chain innovation in the BDAC-firm performance link. Our results provide theoretical implications to operations management and offer practical insights for managers working in manufacturing MSMEs.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, digitalization offers exceptional opportunities for many different organizations, including MSMEs. Nonetheless, most MSMEs, particularly those in less developed economies, lack resources and capabilities that prevent such firms from fully leveraging these technologies. In this environment, big data analytics capabilities (BDAC) are instrumental making innovation by MSMEs more effective by matching customer needs with product and service design (Günther et al., 2017; Johnson et al., 2017), providing new products and services (Zhan et al., 2018), for improving overall firm performance and innovation (Akter et al., 2021b; Mikalef et al., 2019). But, there are many unknowns when it comes to the underlying mechanisms governing the associations among big data analytics, innovation, and performance (Ghasemaghaei & Calic, 2020), particularly for MSMEs in developing economies.

Recently, many researchers have shifted their attention to digital technologies and the role they play in enhancing the performance outcomes according to the resource-based view (RBV) and dynamic capabilities (DC) theories Rana et al., 2021; Sultana et al., 2022a, b; ). Although digital platform capabilities have become an essential part of operations and information technology (IT) research, researchers have recently highlighted the lack of studies that explore the role of different digital capabilities, especially their direct or indirect effects on performance outcomes (Xiao et al., 2020). Researchers have also argued that technologies alone may not enhance firm performance (Yunis et al., 2018) and that organizations require a variety of dynamic competencies (Akter et al., 2021a; Parida et al., 2016a, b; Bertello et al., 2021) to develop and exploit the benefits of such technologies to successfully implement organizational change processes (Salleh et al., 2017), especially in value chains (Wang et al., 2016). Our research aims to address the question of how MSMEs translate their BDAC into innovation and organizational outcomes.

In order to tackle this question, we argue that technological developments pertaining to collecting, analyzing, and interpreting high volumes of facts, figures and data have increased the acceptance of digital platforms and placed them at the core of business models (Belhadia et al., 2020; Wamba et al., 2020). This also means that the successful implementation of digital platform capabilities and technologies involves interactions between different partners across the value chain (Constantinides et al., 2018), thus triggering flexible and dynamic innovation practices (Bresciani et al., 2021). As a result, researchers have highlighted the need for more research on investigating how digital capabilities impact organizational-level outcomes, supported by a deep understanding of network modalities (Helfat & Raubitschek, 2018). We believe that these two kinds of organizational capabilities play a crucial role in such scenarios for a number of reasons.

First, platform capabilities help firms become scalable by consolidating and incorporating general characteristics of the fundamental elements and support change through reconfigurations of various interchangeable modules (Wareham et al., 2014). Second, network capabilities are crucial for MSMEs because these relationship structures produce higher profits in small manufacturing firms (Partanen et al., 2020) due to better use of data-based technologies (Akter et al., 2021b). Stronger networks are related to strong relationships, and thus may be profitable for firms (Walter et al., 2006; Bhatti et al., 2020). Stronger relationships enable firms to gain in-depth knowledge of end users and provide them with solutions based on novel concepts for solving their problems (Messersmith & Wales, 2013).

Consequently, dynamic competencies that lead to efficient platforms and successful networks are critical in value creation, and firms that implement these competencies become part of a wider chain, including other firms, customers, suppliers, etc. (Akter et al., 2021b; Walter et al., 2006). Supply chain managers working for manufacturing MSMEs must design, manage, and alter these capabilities, especially when various stakeholders are involved in their supply chains. Furthermore, implementing digital technologies, including big data and other digital platforms like enterprise resource planning (ERP) systems, requires substantial investment. Although such digital technologies are mostly related to high firm performance (Akter et al., 2019) and innovation, the enormous investments they require do not always produce positive outcomes (Yunis et al., 2018), especially in MSMEs. Accordingly, it is pertinent to study the effects of BDAC, network capabilities, and platform capabilities on innovative supply chains and performance in MSMEs characterized by limited financial and other resources.

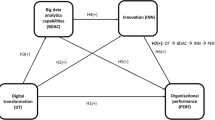

Our research ambitions to theorize and provide empirical evidence of a new theoretical model able to explain underlying mechanisms through which BDAC affects supply chain innovation (SCI) and, ultimately, MSME performance. The double mediation model includes platform and network capabilities by proposing that these dynamic capabilities are critical for achieving better performance through SCI. In fact, our main contributions rely on the theoretical and empirical development of this original double mediation model and suggest that these capabilities are even more important for manufacturing MSMEs for at least two reasons. First, most of the literature is silent on the effect and potential of new technologies on operations for MSMEs (Hoffmann, 2019). More specifically, pragmatic survey-based research is still scarce (Frederico et al., 2019). Second, due to limited resources, MSMEs incessantly look for techniques to be competitive and profitable, and platform and network capabilities may be a vital aspect for refining their BDAC-related outcomes (Lin & Lin, 2016).

2 Literature background

2.1 Underlying theories

According to the RBV theory, the capabilities of an organization to operate and conduct its activities are critical in attaining the competitive advantage (Winter, 2003). The firm’s organizational routines and procedures are further supported by additional dynamic capabilities under shared models of information exchange among stakeholders across the value chain (Helfat & Raubitschek, 2018). In this vein, we explore the interplay between these capabilities through the RBV and DC theories. Previously, researchers have also used these theories to understand the complexities involved in acquiring and transforming digital capabilities (Rana et al., 2021; Sultana et al., 2022b; Wamba et al., 2020). BDAC in the domain of operations and supply chain research are a critical part of decision-making processes due to advanced modeling, optimization, and statistical operations (Hazen et al., 2018; Mishra et al., 2018). An organization’s ability to engage in such operations is referred to as its related capabilities to undertake activities reliably and acceptably (Helfat et al., 2007). Recently, scholars have underlined the significance of BDAC in the supply-chain area (Hazen et al., 2018) since analytics is integral to the Operations Research (OR) (Ren et al., 2017; Choi et al., 2018). As per the definition by Winter (2003), we maintain that a firm’s procedures and practices that lead to enhanced performance outcomes can be considered as critical elements of operational competencies in MSMEs. These operations are further supported by shared modes of information exchange within firms (Nelson & Winter, 1982). Nowadays, digital capabilities are at the forefront of this paradigm shift. Hence, we can argue that digital capabilities enable firms to achieve their overall objective, i.e., to advance positive outcomes (Wilden et al., 2013) by helping companies react to market variations and creating value (Augier & Teece, 2009; Eisenhardt & Martin, 2000) further identified that these core competencies even facilitate the conception and development of supplementary resources and capabilities.

2.2 Big data analytics capabilities

Wamba et al., (2020) define BDAC as “a holistic process that involves the collection, analysis, use, and interpretation of data for various functional divisions to gain actionable insights, create business value, and establish competitive advantage” (p. 2). Firms in different sectors are making substantial investments in developing technological capabilities to expand their systems and processes (Chakravarty et al., 2013) so as to increase their organizational outcomes (Wamba et al., 2020) and remain competitive in dynamic environments (Akter et al., 2021a). Scholars have scrutinized the role of BDAC in large organizations like Google, Amazon, Facebook, and Walmart and found that such organizations achieve higher success rates due to the use of BDAC in their routine processes (Vahn, 2014; Schildt, 2017).

Consistent with previous research by Wamba et al., (2017) and Akter et al., (2016), we address BDAC as a dynamic capability of firms. Teece (2014) maintained that dynamic capabilities involve three major components. The first factor, “the sensing capability”, pertains to an organizational competence to ascertain, form, and evaluate technological prospects in their surroundings to capture and capitalize on opportunities. The second factor, “the seizing capability” denotes the capability of a firm to organize the vital resources for value capture. Finally, the third factor is called reconfiguration capability, which combines existing resources with a firm’s potential capabilities (Fainshmidt et al., 2016). These three capabilities thus empower businesses to innovate and allow them to rapidly respond to fluctuations in their markets (Teece, 2014). Likewise, Wilhelm et al., (2015) also proposed that such competencies consist of sensing, learning, and reconfiguring.

2.3 Digital platform and network capabilities

Organizations rely on dynamic capabilities to use and combine various resources and competencies to achieve a competitive advantage and become more profitable. Digital platform competencies mostly pertain to information technology and enable knowledge sharing among different actors across the supply chain. Digital platform capabilities consist of platform integration capabilities for knowledge exchange and reconfiguration capabilities, achieved with the help of design based on modules and standard interfaces in platform and operational systems (Rai & Tang, 2010). Similarly, network capabilities are a firm’s competencies that enhance social capital of its employees as well as other stakeholders (Battistella et al., 2017; Carey et al., 2011). In a similar vein, these competencies have been described as a “…firm’s ability to initiate, develop and utilize internal organizational as well as external inter-organizational relationships” (Zacca et al., 2015, p. 4).

Literature has established the association between network capabilities and resource acquisition, opportunity identification, and quick response to changing customer needs (Acosta et al., 2018). Manufacturing MSMEs may have to rely on external relationships in order to compensate for resource scarcity. Thus, network capacities lead towards higher success rates of entrepreneurial SMEs’ (Parida and Örtqvist, 2015). MSMEs can also improve their performance through better management of internal and external networks. Knowledge sharing, waste reduction, higher innovation rates, and growth opportunities can result from network capabilities (Lin & Lin, 2016).

2.4 Supply chain innovation

SCI encompasses an interconnected set of systems that equip firms to face uncertainty and disturbances across traditional boundaries of the firm by providing unique and state-of-the-art systems to customers (Lee et al., 2011). Businesses operating in data rich contexts have to constantly build up novel products/services based on novel technological advancements to enrich their innovative capabilities (Awan et al., 2021; Gao et al., 2017) outline SCI as “an integrated change from incremental to radical changes in product, process, marketing, technology, resource and/or organization, which are associated with all related parties, covering all related functions in the supply chain and creating value for all stakeholders” (Gao et al., 2017, p. 1544). We maintain that SCI is an integral part of various MSME operations and processes, such as handling procurement, selecting suppliers, fulfilling orders, organizing activities, forecasting demand, and controlling quality. Firms can compete in a dynamic environment and become more competitive through innovation in their supply chains and thus provide novel and unique offers to their customers (Afraz et al., 2021).

2.5 Hypotheses development

When firms process large amounts of data on a daily basis, they require BDAC to make data processing seamless. BDAC also decrease the likelihood of interruptions and ensure the appropriate enhancement of dynamic capabilities (Xiao et al., 2020). Digital infrastructure may be considered a critical resource to support efficient collaboration among various actors across the value chain through software and hardware development and to ensure quick responses to meet consumers’ needs, even when dealing with huge data sets (Frederiksen, 2009). With increased data analytic capabilities, organizations can better process their structured and unstructured data to recognize transactions and distinguish patterns in the data to address market demand (Kumar et al., 2018). BDAC provides opportunities for firms to explore new software and hardware platforms with new capabilities to exploit existing resources and help them prepare for adopting new technologies to satisfy customer needs. In their multiple case studies on BDAC, Lehrer et al., (2018) discovered that firms successfully achieved service innovation by using BDAC to provide a key organizational resource. The researchers found that organizations that leverage analytics to develop digital infrastructure to collect and analyze customer information on advanced digital platforms are more innovative and thus offer customized products and services based on digital platforms (Lehrer et al., 2018). Conversely, when digital analytics capabilities are underdeveloped, companies cannot fully recognize the usefulness of platform capabilities. Thus, the digital infrastructure of such firms does not operate at its highest potential. In their research, Jean & Kim (2020) maintained that platforms could offer novel opportunities for manufacturing MSMEs with resource constraints; BDAC can help enhance these resource capabilities (Mikalef et al., 2019). Thus, we propose the hypothesis that stronger BDAC may lead to stronger digital platform capabilities:

Hypothesis 1

BDAC are positively related to digital platform capabilities in manufacturing MSMEs.

Knowledge and information sharing require firms to create links among various partners to augment their visibility (Gunasekaran et al., 2017). Furthermore, BDAC tend to improve visibility across the value chain to improve FP (Lee et al., 2000; Wamba et al., 2020). BDAC have been positively linked with business processes and agile supply chains (Chen et al., 2014), higher value creation (Rana et al., 2021; Wei & Wang, 2010), and more efficient operations (Sultana et al., 2022a; Caridi et al., 2010).

Similarly, researchers have argued that digital analytical capabilities enable businesses to share and use the information that leverages and reconfigures other relational networks to cater to market demand (Helfat & Raubitschek, 2018; Teece, 2018). These internal and external networks are even more critical in MSMEs, and such digital capabilities must be aligned with a firm’s inclination toward building and using these relational networks (Shu et al., 2018). Traditionally speaking, MSMEs have an underdeveloped digital infrastructure and scarce other resources that may impede the adoption of novel business models (Gupta and Bose, 2019); similarly, manufacturing MSMEs rely heavily on network capabilities to improve their FP (Partanen et al., 2020). Thus, according to the RBV, BDAC can provide novel opportunities for manufacturing MSMEs to build such networks and profit from them. Thus, we propose our next hypothesis as:

Hypothesis 2

BDAC are positively related to network capabilities in manufacturing MSMEs.

As per RBV, BDAC reduce the risk of obsolescence in products, services, and solutions produced by the firms by enhancing innovative capabilities and performance (Mikalef et al., 2019). As such, one can deduce that a firm’s BDAC are significantly tied to innovations in MSME supply chains. Some scholars have also underlined the criticality of BDAC in value chain outcomes, such as the accurate prediction of product maintenance time (Lee et al., 2015) and better forecasting of customer demand and efficient transactions for better inventory and manufacturing management (Lim et al., 2014). Furthermore, while some firms rely on BDAC to design procedures necessary for managing the value chains (Schoenherr & Speier-Pero, 2015), many other organizations exploit these skills to adopt these practices for manufacturing to ensure flexible and efficient production and delivery processes (Almada-Lobo, 2015). Thus, we propose that BDAC are clearly related to SCI in manufacturing MSMEs:

Hypothesis 3

BDAC have a significant positive impact on the SCI of manufacturing MSMEs.

Due to the rapid pace of technological changes and higher competitive pressures, managers need to improve their business model innovations (Cenamor et al., 2019). Digital platform capabilities assist manufacturing organizations in nurturing resources and capabilities based on novel technologies (Xiao et al., 2020). For example, user involvement in R&D for new product and service provision is a means for firms to handle innovation challenges, but this process also involves risks as customer acceptance of such products and services is uncertain (Xiao et al., 2020). However, digital platforms can support firms to overcome such complications by improving the efficacy of exploring new avenues to provide innovative services (Kindström et al., 2013). Thus, the dynamic capabilities of BDAC and digital platforms may initiate innovative behavior among manufacturing firms (Xiao et al., 2020), and so we propose a fourth hypothesis:

Hypothesis 4

Digital platform capabilities mediate the relationship between BDAC and SCI in manufacturing MSMEs.

BDAC are useful for firms to explore, attain and reconfigure information from the external environment, and to develop efficient and effective networks of sharing this information (Helfat & Raubitschek, 2018). According to the RBV, BDAC can give manufacturing MSMEs means to better align with their suppliers and customers to acquire and consolidate knowledge from various supply chain partners. Due to technological advancements and constant changes in demand, firms need both internal and external sources (including supplier networks) to remain competitive and innovative (Phelps, 2010; Gao et al., 2015). Manufacturing firms also create lasting associations with their supply chain partners through vertical integration. One such example is the automobile sector, which is heavily dependent upon suppliers and is known for incorporating its suppliers into its product innovation process (Choi & Hong, 2002). Similarly, developing internal networks of information sharing by building social capital has proved to be a critical aspect in enhancing the innovative behavior of both buyers and suppliers (Villena et al., 2011).

When a firm acquires competencies to align internal and external knowledge channels, it enables them to tap into customer needs and offer customized products at a faster pace (Battistella et al., 2017). Efficiently run knowledge and information channels result in increased idea generation and opportunity recognition to promote organizational innovations (Shu et al., 2018). Acquiring a diverse range of information from various sources in an organized way thus accelerates innovation (Wareham et al., 2014). Similarly, we maintain that manufacturing MSMEs can also use BDAC to build their network capabilities, leading to a higher rate of innovation in their supply chains (Zacca et al., 2015). Thus, in line with the above arguments, we conclude that BDAC can improve SCI along with the intervening role of network capabilities of manufacturing MSMEs.

Hypothesis 5

Network capabilities mediate the relationship between BDAC and SCI of manufacturing MSMEs.

BDAC allow firms to identify end-user needs and explore and exploit new business opportunities (Wu, 2010) by remaining flexible and agile to changes in their surroundings (Mikalef & Pateli, 2017). They also help these firms adjust their systems and processes to decrease both waste and expenses (Wilden et al., 2013) and enable companies to innovate cost-effectively by offering new solutions to existing problems (Teece, 2007; Wilden et al., 2013). Finally, such capabilities help generate new strategies and product and service portfolios (Pezeshkan et al., 2016), as well as establish novel means to reconfigure and rearrange the fundamental competencies and align them with their strategies according to the RBV (Teece, 2014). The organizational ability to develop and redesign their competencies to generate and maximize added value from new prospects explains why some firms outperform others (Wamba et al., 2020).

Through digital platform capabilities, organizations can integrate monitoring tools with their daily processes to ensure transparent governing mechanisms based on ethics and trust (Lin & Lin, 2016), resulting in better financial performance. Consistent with previous studies, our research hypothesizes that BDAC enhance the capacity of manufacturing MSMEs to handle and analyze big data. Such firms use this capacity to enhance performance outcomes through technological digital infrastructure capability. Owing to the complexity of digitalization, we thus argue that BDAC may improve the financial performance of manufacturing MSMEs through DPC.

Hypothesis 6

Digital platform capabilities mediate the relationship between BDAC and the FP of manufacturing MSMEs.

Organizations use shared digital architecture to communicate knowledge and information with both internal employees and external partners (Wang and Hu, 2020). Furthermore, firms can use digital capabilities to create common knowledge, such as sharing information regarding organizational processes (Gonzalez & Melo, 2018). Such dynamic capabilities improve communication channels and thus enable the optimization of acquisition and subsequent assimilation and transfer of knowledge (Giotopoulos et al., 2017). Digital capabilities leading to stronger network capabilities entail creating network embeddedness that lessens operational expenditures (Li et al., 2017). Firms therefore benefit from such capabilities to improve the performance outcomes in SMEs (Mangla et al., 2020). These mechanisms are crucial for manufacturing MSMEs because such firms must deal with not only huge data sets corresponding to their daily operations, but also information asymmetries.

To conclude, BDAC may create a feeling of belonging between the various actors of a supply chain and can help build loyalty in them to create a long-term buyer-supplier relationship (Ceccagnoli et al., 2012) as well as other relationships among supply chain partners. Researchers have also argued that SMEs can improve their financial performance due to the signaling ability of the organizational networks (Lin & Lin, 2016). Thus, we conclude from these arguments that BDAC can enable network capabilities to advance the profits of manufacturing SMEs, and thus propose our next hypothesis as:

Hypothesis 7

Network capabilities mediate the relationship between BDAC and the financial performance of manufacturing MSMEs.

Innovation pertains to afirm’s propensity to support adoption, followed by testing, of novel designs, and consequently support for novel product offerings and the latest technology-based systems (Bresciani et al., 2021). Through higher innovative capabilities, a MSME can attain a greater competitive advantage as it increases the performance outcomes of the firms through greater value creation (Deshpande and Farley, 2004). Similarly, Afraz et al., (2021) contended that supply chain innovation may well prove to be a vital antecedent of competitive advantage and accordingly must be an integral part of the strategy-making process of the construction firms.

Some researchers have established a significant connection between innovation and the performance outcomes of manufacturing SMEs (Van Auken et al., 2008). Firms invest in several activities, such as creating better products and services, by increasing the reliability of their operations to improve new product development and enhance their brand image (Li et al., 2006; Braunscheidel & Suresh, 2009) maintained that firms must innovate their supply chains to build an agile and more resilient network of suppliers under environmental conditions like ambiguity and instability as well as to overcome strong competition in the market. Thus, supply chain innovation can significantly improve the financial performance of organizations by making processes efficient (Flint et al., 2008). Consequently, we propose our next baseline hypothesis as follows:

Hypothesis 8

SCI is positively related to manufacturing MSME financial performance.

In line with our previous hypotheses, we propose that both digital platform and network capabilities pooled with innovations in supply chains sequentially mediate the association of BDAC and FP in manufacturing MSMEs. Thus, we propose our last two hypotheses as follows:

Hypothesis 9

Digital platform capabilities and SCI sequentially mediate the relationship between BDAC and manufacturing MSME performance.

Hypothesis 10

Network capabilities and SCI sequentially mediate the relationship between BDAC and manufacturing MSME performance.

The postulated model is shown in Fig. 1, where SCI and firm performance data were collected with a one-month time lag to minimize any possible bias in our study.

3 Methods and measures

3.1 Context and sample

Our research data was collected from a survey of top- and middle-tier managers of MSMEs in Pakistan. This study’s sample frame is the manufacturing firms of Hattar Industrial Estate (HIE), which are registered with the Hattar Industrial Association (HIA). HIE is among the largest industrial parks in the northern province of Khyber Pakhtunkhwa (KPK). HIE was given the status of Special Economic Zone (SEZ) by the government with the aim of attracting more investment and boosting industrialization in the area. The industrial park comprises several sectors, including the textile, chemicals, construction, electrical goods, cooking oil, food and beverages industries. Researchers have previously looked at multiple industries to investigate the supply chain capabilities of manufacturing organizations (Chen et al., 2014) in the area of OR.

We have taken the manufacturing sector as our context as these organizations face multiple challenges of managing a massive volume of data through the utilization of prevailing digital manufacturing technologies in order to pursue stability and efficiency and at the same time, exploiting novel technologies (Andriopoulos & Lewis, 2009). Supply chain innovations are thus a critical means of creating resources and improving firm performance. Kwak et al., (2018) also established that SCI gave South Korean manufacturing firms a greater competitive advantage. Thus, manufacturing firms need to identify and adopt capabilities that enhance supply chain innovations.

We distributed 300 survey questionnaires to the managers of MSMEs based at HIE. We received 221 completed questionnaires from the respondents (our sample size).

3.1.1 Non-response and common method bias

To report the non-response data bias, the responses of the early and late responders were compared by applying a paired t-test in SPSS software. The first 50 and last 50 responses were pulled from the data set to check the non-response bias. The result displays no significant difference between the first 50 early and late 50 respondents, which implies the absence of this particular bias (Clottey & Benton, 2013; Greco et al., 2015). To check the common method bias, the total variance explained was calculated (MacKenzie & Podsakoff, 2012). A total variance explained value of below 50% indicates the absence of this bias (Podsakoff et al., 2012; Vandenberg 2006). Based on this method, in our research the total variance explained value is 17.22%, which is less than 50% and which thus rules out the likelihood of common method bias (Reio, 2010).

3.2 Construct measures

The scales in the research are adopted from earlier research. We focused on three specific dynamic capabilities as antecedents of innovation and performance in MSMEs, namely: (a) BDAC, (b) digital platform capabilities, and (c) network capabilities. For the operationalization of BDAC, we followed the research by Akter et al., (2016), Wamba et al., (2017), Wamba et al. (2019), and Wilden et al., (2013). According to Wilden et al., (2013), and in accordance with Teece (2007) theory, the construct of dynamic capabilities is a multidimensional concept with three distinctive dimensions, namely “sensing, seizing, and reconfiguring”.

For digital platform capabilities, we drew from data related to the integration and reconfiguration of digital platforms of MSMEs. Consistent with the scale used by Cenamor et al., (2019), the digital platform capability construct is measured by a two-dimensional scale consisting of four items each.

Regarding network capabilities, we based our scale on research by Parida et al., (2016a, b; Walter et al., (2006); Cenamor et al., (2019), who maintain that an MSME’s network capabilities encompass the firm’s capability to “develop and utilize inter-organizational relationships to gain access to various resources held by other actors” (Walter et al., 2006, p. 542). The scale for this category is based on four dimensions: “internal communication, coordination, relationship skills, and partner knowledge”. Each dimension is measured with three items.

SCI has been adopted by the six-item measure developed by Kwak et al., (2018). It has been utilized by Afraz et al., (2021) in their study. Finally, the operationalization of the last variable, firm performance, was taken from Li et al., (2015) and used by Saglam et al., (2020), fits our context of analysis. A five-point scale has been used to measure these items. It ranged from one as “strongly disagree” to five as “strongly agree.”

4 Data analysis and results

We tested our proposed hypotheses with structural equation modeling (SEM) in AMOS. Several scholars previously used this method to test hypotheses of different models (Akter et al., 2011; Aslam et al., 2018; Ferraris et al., 2019; Gawankar et al., 2020). SEM, as a second-generation method, has the advantage of simultaneous modeling of causal relationships among different types of variables. More specifically, the covariance-based SEM, or CB-SEM, test pertains to the model fitness with the data; its purpose is to reduce the differences between the sample covariance and the model covariance matrices from observed variables. Here, we assess the measurement model through confirmatory factor analysis (CFA) to establish both the reliability and validity of the constructs. We then determine the causal relationship among variables, i.e., the structural model (Zainudin, 2014). The fitness of measurement is suitable because it is inclusive of the sample size proportion variance and covariance matrices. It also highlights the traditional criterion to check all the latent constructs and confirm that the items are valid (Awang et al., 2015).

4.1 Demographics and statistics

The results of demographics in Table 1 show that most of our respondents fall into the 26–35-year-old age bracket, with a frequency of 121 (54.8%). With regard to gender, most of our respondents are male (79.6%). The majority of the participants have low experience, while the qualification data shows that 79.18% have a bachelor’s degree or an advanced level degree, meaning the participants are highly educated.

The mean and standard deviations of the constructs along with their correlation values are given in Table 2.

4.2 Confirmatory factor analysis

4.2.1 Model fit

To test model fit, we use indices such as the “chi-square” (CMIN) and “goodness of fit” (GFI). Here, the “comparative fit index” (CFI) indicates model fit, whereas the adjusted goodness of fit (AGFI) is a parsimonious measure of model fit (Keramati et al., 2010). Furthermore, other measures of fit such as chi-square divided by degree of freedom (CMIN/DF), Tucker-Lewis index (TLI), AGFI, and GFI, were found to be 1.75, 0.931, 0.809, 0.845, respectively. Finally, the “root mean square error of approximation” (RMSEA) and CFI values of the model are 0.059 and 0.94, respectively (shown in Table 3). The analysis also revealed a p-value of 0.000 for our model. All of these values are within the recommended levels.

These results clearly confirm the model fit (CMIN/DF = 1.75 and p-value ≤ 0.05) of our proposed model, as advised by Hair et al., (2010)d Hair et al., (2015).

4.2.2 Reliability and convergent validity

Appendix A shows the standardized estimates of all the constructs of the model. Cua et al., (2001) have suggested that items having higher factor loadings (i.e., greater than 0.5) can be retained in the model. Accordingly, we retained any items with factor loadings above 0.5. Next, the average variance extracted (AVE) value is calculated using the following formula:

where λ refers to the “standardized factor loadings” and n is the number of items. A general rule for AVE is that values of 0.5 or higher show satisfactory convergent validity (Fornell & Larcker, 1981). Our data shows that all the AVE is higher than 0.5 for all the constructs. Construct reliability (CR) values are calculated using the following formula:

The general rule regarding CR estimation is that a CR value of 0.7 or higher means the data is reliable; values between 0.6 and 0.7 are also accepted (Netemeyer et al., 2003). Our CR results show that all values are higher than 0.7. The acceptable value for Cronbach’s alpha (α) is ≥ 0.7 (Nunnally, 1978; Christensen et al., 2015); our results indicate that our data is reliable.

4.2.3 Nomological and discriminant validity

The SIC value is the square root of the inter-item correlation (IC). As suggested by Fornell & Larcker (1981), the SIC should be less than the AVE of the variable to accept the discriminant validity. Our results show AVE values that are greater than the SIC values. As such, we can maintain that all the constructs are valid. Nomological validity is calculated to measure the relationship numerically. For that purpose, the correlation coefficient should be significant (Fornell & Larcker, 1981). in the values shown in Table 4 indicate that all values are significant and thus there is nomological validity between the variables.

4.3 Hypothesis testing

In order to test the direct and indirect effects, the SEM technique was used in AMOS. The mediating effects were calculated with the Hayes process by using the number of bootstrap samples of 2000 with confidence intervals of 95%. The results for this study are stated in the Table 5 below. Results show that values for the standardized coefficient of BDAC with digital platform capabilities (DPC), network capabilities (NC), and SCI are significant and no existence of zero between the upper and lower confidence intervals.

The p-value is also significant, which shows that BDAC are significantly related to DPC, NC and SCI. Thus, these hypotheses are accepted. The mediating effect of NC between BDAC and FP, as well as the mediating effect of NC in BDAC and SCI, depict the significant relationship, thus the proposed hypotheses are accepted. The intervening effect of DPC between BDAC-SCI link is also confirmed as there is a significant relationship with p-values of less than 0.05. However, the mediating role of DPC between BDAC and FP is insignificant, as zero exists among the upper and lower class intervals and the p-value exceeds the threshold (i.e., 0.05); accordingly, this proposed hypothesis is rejected. The results in the table further specify that SCI is directly and strongly related to FP. Results of the serial mediation of DPC and SCI among BDAC and FP demonstrates the significant relationship, so the hypothesis for this serial mediation is accepted. Finally, the result of the serial mediation of NC and SCI among BDAC and FP also demonstrates the significant relationship; the hypothesis for this serial mediation is thus accepted.

5 Discussion

The speedy advancements of digital technologies have stimulated openings for innovation, and data can be leveraged to design and deliver new solutions for the customers (Raptis et al., 2019). However, defining and developing the roles of digital platform and networking capabilities in supply chains has not been not fully established (De Reuver et al., 2018). Therefore, the internal mechanisms of how BDAC influence manufacturing MSMEs must be explored to generate valuable information regarding the performance outcomes of these MSMEs. Thus, we sought to understand how big BDAC play a role in MSME operations and how these capabilities in operations management might lead to better organizational performance.

Specifically, using the RBV and DC theories as they apply to firms, we proposed that BDAC would lead to increased dynamic capabilities, namely digital platform capabilities and network capabilities. Consistent with Teece (2007; 2014), we operationalized BDAC with sensing, seizing, and reconfiguring capabilities. Furthermore, we contended that when firms have better BDAC, they have greater SCI and thus become more profitable.

The SEM results confirmed our initial hypotheses that BDAC significantly increase platform and networking capabilities. The findings also confirmed that BDAC is crucial in improving supply chain innovation for manufacturing MSMEs. The results also supported the hypotheses that networking capabilities mediated between both BDAC-supply chain innovation and BDAC-manufacturing MSMEs performance. Although our findings confirmed the intervening mechanisms of DPC in the BDAC-SCI link, digital platforms did not mediate between the BDAC-performance link of manufacturing MSMEs. However, when the sequential mediation of digital platform capabilities and supply chain innovation were considered, the mediation path was found to be significant. This signifies that the impact of BDAC on MSME outcomes is substantial when firms acquire digital platform capabilities for innovation. Similarly, network capabilities are also significant for BDAC-manufacturing MSME performance through supply chain innovation.

5.1 Theoretical implications

According to Teece (2018), firms capture value through dynamic capabilities by creating innovative ecosystems and business models. Our study proposed a theoretical model grounded in the RBV to explain how dynamic capabilities underpin not only innovation in supply chains but also improve the performance of manufacturing MSMEs. Our study is significant for the following reasons.

First, previously academics has provided proof of the constructive impact of BDAC on innovation and organizational outcomes (Mikalef et al., 2019). However, few researchers have attempted to explore the inner mechanisms of this link. According to the RBV of firms, dissimilar competencies may result in diverse performance outcomes (Teece, 2010). The DC view focuses on the necessity of a clear emphasis on such capabilities not just for surviving but for growing in an uncertain and unstable global marketplace (Schilke et al., 2018).

Researchers have previously pointed out the dangers of poor strategic capability-building, specifically in acquiring and using technological advancements and digital platforms, and they have warned of the serious repercussions of such actions, which might critically impede a firm’s success (Xiao et al., 2020). Thus, our paper details the underlying mechanisms to best utilize these dynamic capabilities in the manufacturing sector. Some researchers have found that such capabilities help businesses leverage external information and technological resources for achieving competitive advantage (Cenamor et al., 2019). Such capabilities also facilitate knowledge sharing among supply chain partners. We argue that MSMEs can create such capabilities and use them to share knowledge with their partners, and in so doing improve their innovation and performance.

Second, the effect of BDAC on SCI, mediated by digital platform and network capabilities, has not been previously addressed in depth, especially for MSMEs—only a handful of studies have empirically tested these relationships to date (Mikalef et al., 2019; Xiao et al., 2020). Although some researchers have explored innovation as a phenomenon with regard to digital technologies, the exact relationship of digital platform and network competencies in the BDAC-supply chain innovation remains unmapped (Xiao et al., 2020). As such, our research aims to address these gaps by proposing and testing the effect of BDAC, DPC, and NC on the SCI and performance of manufacturing MSMEs.

Third, we also advance the theoretical underpinnings of the complexities involved in the innovation performance of MSMEs, especially in the resource-constrained environment of developing countries. Manufacturing MSMEs are plagued by resource scarcity; not being able to leverage big data to create innovation due to poor digital platform and network capabilities can be disastrous for them. Hence, we offer a holistic framework for such firms that can support them to improve not only the innovations across their supply chains but also their performance.

5.2 Practical implications

Today, the manufacturing sector is facing the dual challenges of keeping up with rapidly changing technological advancements and the need for superior performance; big data analytics and digital transformation may provide a solution (Schoenherr & Speier-Pero, 2015). Furthermore, operations researchers and practitioners are always involved in the problem-solving and decision-making processes, and analytical tools, mathematical models, and simulations may help them in their jobs (Mortenson et al., 2015). It is therefore necessary for operational managers and decision-makers to fully comprehend the complex process of developing and using the dynamic capabilities model.

Our study claims that the dynamic capabilities of big data analytics, digital platforms and networks all help to improve the performance of manufacturing MSMEs by improving innovation performance. Operations and supply chain managers of such firms can focus on enhancing these capabilities in order to improve their day-to-day operations as we found evidence that BDAC leads to higher innovation and firm performance through the interplay of both digital platform and network capabilities. Top management must direct their energy toward strategy development and implementation to build such capabilities in these MSMEs.

These dynamic capabilities can also overcome some of the obstacles that MSMEs face due to financial and other resource constraints. According to Helfat & Raubitschek (2018), managers continuously engage and evolve in their ecosystems with products, knowledge, and capabilities all linked together. Operations and supply chain managers at MSMEs must realize that as their digital ecosystems evolve over time, they must acquire and improve these critical complementary capabilities to prepare themselves for future challenges in the industry 4.0 era.

5.3 Limitations and future work

Although ours is one of very few studies that have taken a holistic view of the intervening effects of dynamic capabilities in manufacturing MSMEs, it is not without some limitations. We will describe these limitations here to offer future avenues of research. First, we collected our data from one geographical location. Future studies can replicate this study and test it in other regions with different cultural values and infrastructure support, which can have an impact on the relationships explored in this study. Studies could also be directed to extend our model with reference to the potentialities of big data for internationalization (Bertello et al., 2021) to explore the role of biases that may affect this process (Akter et al., 2021a). Second, although our study was time-lagged to minimize any bias resulting from the common method we used, future studies could also take into account multiple respondents’ views on the constructs. Finally, although we propose BDAC as an antecedent of digital platform and network capabilities, we cannot rule out the reverse causality of the model; future studies could explore reverse causality to fully understand this complex relationship.

References

Acosta, A. S., Crespo, Á. H., & Agudo, J. C. (2018). Effect of market orientation, network capability and entrepreneurial orientation on international performance of small and medium enterprises (SMEs). International Business Review, 27(6), 1128–1140

Afraz, M. F., Bhatti, S. H., Ferraris, A., & Couturier, J. (2021). The impact of supply chain innovation on competitive advantage in the construction industry: Evidence from a moderated multi-mediation model. Technological Forecasting and Social Change, 162, 120370

Akter, S., Bandara, R., Hani, U., Wamba, S. F., Foropon, C., & Papadopoulos, T. (2019). Analytics-based decision-making for service systems: A qualitative study and agenda for future research. International Journal of Information Management, 48, 85–95

Akter, S., D’Ambra, J., & Ray, P. (2011). Trustworthiness in mHealth information services: an assessment of a hierarchical model with mediating and moderating effects using partial least squares (PLS). Journal of the American Society for Information Science and Technology, 62(1), 100–116

Akter, S., McCarthy, G., Sajib, S., Michael, K., Dwivedi, Y. K., D’Ambra, J., & Shen, K. N. (2021a). Algorithmic bias in data-driven innovation in the age of AI. International Journal of Information Management, 60, 102387

Akter, S., Wamba, S. F., Gunasekaran, A., Dubey, R., & Childe, S. J. (2016). How to improve firm performance using big data analytics capability and business strategy alignment? International Journal of Production Economics, 182, 113–131

Akter, S., Wamba, S. F., Mariani, M., & Hani, U. (2021b). How to build an AI climate-driven service analytics capability for innovation and performance in industrial markets? Industrial Marketing Management, 97, 258–273

Almada-Lobo, F. (2015). The Industry 4.0 revolution and the future of manufacturing execution systems (MES). Journal of innovation management, 3(4), 16–21

Andriopoulos, C., & Lewis, M. W. (2009). Exploitation-exploration tensions and organizational ambidexterity: Managing paradoxes of innovation. Organization science, 20(4), 696–717

Aslam, H., Blome, C., Roscoe, S., & Azhar, T. M. (2018). Dynamic supply chain capabilities: How market sensing, supply chain agility and adaptability affect supply chain ambidexterity. International Journal of Operations & Production Management, 38(12), 2266–2285

Augier, M., & Teece, D. J. (2009). Dynamic capabilities and the role of managers in business strategy and economic performance. Organization science, 20(2), 410–421

Awang, Z., Afthanorhan, A., & Asri, M. A. M. (2015). Parametric and non parametric approach in structural equation modeling (SEM): The application of bootstrapping. Modern Applied Science, 9(9), 58–67

Battistella, C., De Toni, A. F., De Zan, G., & Pessot, E. (2017). Cultivating business model agility through focused capabilities: A multiple case study. Journal of Business Research, 73, 65–82

Belhadia, A., Kamble, S. S., Jabbourc, C. J. C., Ndubisi, N. O., & Venkatesh, M. (2020). Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries.Technological Forecasting and Social Change,120447

Bertello, A., Ferraris, A., Bresciani, S., & De Bernardi, P. (2021). Big data analytics (BDA) and degree of internationalization: the interplay between governance of BDA infrastructure and BDA capabilities.Journal of Management and Governance,1–21

Awan, U., Bhatti, S. H., Shamim, S., Khan, Z., Akhtar, P., & Balta, M. E. (2021). The Role of Big Data Analytics in Manufacturing Agility and Performance: Moderation–Mediation Analysis of Organizational Creativity and of the Involvement of Customers as Data Analysts.British Journal of Management

Bhatti, S. H., Vorobyev, D., Zakariya, R., & Christofi, M. (2020). Social capital, knowledge sharing, work meaningfulness and creativity: evidence from the Pakistani pharmaceutical industry.Journal of Intellectual Capital, Vol. ahead-of-print

Braunscheidel, M. J., & Suresh, N. C. (2009). The organizational antecedents of a firm’s supply chain agility for risk mitigation and response. Journal of operations Management, 27(2), 119–140

Bresciani, S., Ciampi, F., Meli, F., & Ferraris, A. (2021). Using big data for co-innovation processes: Mapping the field of data-driven innovation, proposing theoretical developments and providing a research agenda.International Journal of Information Management,102347

Carey, S., Lawson, B., & Krause, D. R. (2011). Social capital configuration, legal bonds and performance in buyer–supplier relationships. Journal of operations management, 29(4), 277–288

Caridi, M., Crippa, L., Perego, A., Sianesi, A., & Tumino, A. (2010). Do virtuality and complexity affect supply chain visibility? International Journal of Production Economics, 127(2), 372–383

Ceccagnoli, M., Forman, C., Huang, P., & Wu, D. J. (2012). Cocreation of value in a platform ecosystem! The case of enterprise software. MIS Quarterly, 36(1), 263–290

Cenamor, J., Parida, V., & Wincent, J. (2019). How entrepreneurial SMEs compete through digital platforms: The roles of digital platform capability, network capability and ambidexterity. Journal of Business Research, 100, 196–206

Chakravarty, A., Grewal, R., & Sambamurthy, V. (2013). Information technology competencies, organizational agility, and firm performance: Enabling and facilitating roles. Information Systems Research, 24(4), 976–997

Chen, Y., Wang, Y., Nevo, S., Jin, J., Wang, L., & Chow, W. S. (2014). IT capability and organizational performance: the roles of business process agility and environmental factors. European Journal of Information Systems, 23(3), 326–342

Choi, T. M., Wallace, S. W., & Wang, Y. (2018). Big data analytics in operations management. Production and Operations Management, 27(10), 1868–1883

Choi, T. Y., & Hong, Y. (2002). Unveiling the structure of supply networks: case studies in Honda, Acura, and DaimlerChrysler. Journal of Operations Management, 20(5), 469–493

Christensen, S. M., Mikkelsen, N. D., Frieden, M., Hansen, H. F., Koch, T., Pedersen, D. S., & Westergaard, M. (2015). U.S. Patent No. 9,045,518. Washington, DC:U.S. Patent and Trademark Office

Clottey, T., & Benton, W. C. Jr. (2013). Guidelines for improving the power values of statistical tests for nonresponse bias assessment in OM research. Decision Sciences, 44(4), 797–812

Constantinides, P., Henfridsson, O., & Parker, G. G. (2018). Introduction—Platforms and infrastructures in the digital age. Information Systems Research, 29(2), 3–6

Cua, K. O., McKone, K. E., & Schroeder, R. G. (2001). Relationships between implementation of TQM, JIT, and TPM and manufacturing performance. Journal of Operations Management, 19(6), 675–694

De Reuver, M., Sørensen, C., & Basole, R. C. (2018). The digital platform: A research agenda. Journal of Information Technology, 33(2), 124–135

Deshpandé, R., & Farley, J. U. (2004). Organizational culture, market orientation, innovativeness, and firm performance: an international research odyssey. International Journal of Research in Marketing, 21(1), 3–22

Eisenhardt, K., & Martin, J. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10/11), 1105–1121

Fainshmidt, S., Pezeshkan, A., Lance Frazier, M., Nair, A., & Markowski, E. (2016). Dynamic capabilities and organizational performance: a meta-analytic evaluation and extension. Journal of Management Studies, 53(8), 1348–1380

Ferraris, A., Devalle, A., Ciampi, F., & Couturier, J. (2019). Are global R&D partnerships enough to increase a company’s innovation performance? The role of search and integrative capacities. Technological Forecasting and Social Change, 149, 119750

Flint, D. J., Larsson, E., & Gammelgaard, B. (2008). Exploring processes for customer value insights, supply chain learning and innovation: an international study. Journal of Business Logistics, 29(1), 257–281

Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39–50

Frederico, G. F., Garza-Reyes, J. A., Anosike, A., & Kumar, V. (2019). Supply Chain 4.0: concepts, maturity and research agenda. Supply Chain Management: An International Journal, 25(2), 262–282

Frederiksen, A. (2009). Competing on analytics: The new science of winning

Gao, D., Xu, Z., Ruan, Y. Z., & Lu, H. (2017). From a systematic literature review to integrated definition for sustainable supply chain innovation (SSCI). Journal of Cleaner Production, 142, 1518–1538

Gao, G. Y., Xie, E., & Zhou, K. Z. (2015). How does technological diversity in supplier network drive buyer innovation? Relational process and contingencies. Journal of Operations Management, 36, 165–177

Gawankar, S. A., Gunasekaran, A., & Kamble, S. (2020). A study on investments in the big data-driven supply chain, performance measures and organisational performance in Indian retail 4.0 context. International Journal of Production Research, 58(5), 1574–1593

Ghasemaghaei, M., & Calic, G. (2020). Assessing the impact of big data on firm innovation performance: Big data is not always better data. Journal of Business Research, 108, 147–162

Giotopoulos, I., Kontolaimou, A., Korra, E., & Tsakanikas, A. (2017). What drives ICT adoption by SMEs? Evidence from a large-scale survey in Greece. Journal of Business Research, 81, 60–69

Gonzalez, R. V. D., & de Melo, T. M. (2018). The effects of organization context on knowledge exploration and exploitation. Journal of Business Research, 90, 215–225

Greco, L. M., O’Boyle, E. H., & Walter, S. L. (2015). Absence of malice: A meta-analysis of nonresponse bias in counterproductive work behavior research. Journal of Applied Psychology, 100(1), 75–97

Gunasekaran, A., Papadopoulos, T., Dubey, R., Wamba, S. F., Childe, S. J., Hazen, B., & Akter, S. (2017). Big data and predictive analytics for supply chain and organizational performance. Journal of Business Research, 70, 308–317

Günther, W. A., Mehrizi, M. H. R., Huysman, M., & Feldberg, F. (2017). Debating big data: A literature review on realizing value from big data. The Journal of Strategic Information Systems, 26(3), 191–209

Gupta, G., & Bose, I. (2019). Strategic learning for digital market pioneering: Examining the transformation of Wishberry’s crowdfunding model. Technological Forecasting and Social Change, 146, 865–876

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. D. (2010). Multivariate Data Analysis (7th ed.). Upper Saddle River, New Jersey: Prentice Hall

Hair, N. L., Hanson, J. L., Wolfe, B. L., & Pollak, S. D. (2015). Association of child poverty, brain development, and academic achievement. JAMA pediatrics, 169(9), 822–829

Hazen, B. T., Skipper, J. B., Boone, C. A., & Hill, R. R. (2018). Back in business: Operations research in support of big data analytics for operations and supply chain management. Annals of Operations Research, 270(1–2), 201–211

Helfat, C. E., & Raubitschek, R. S. (2018). Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems. Research Policy, 47(8), 1391–1399

Helfat, C. E., Finkelstein, S., Mitchell, M., Peteraf, M. A., Singh, H., Teece, D. J., & Winter, S. G. (2007). Dynamic Capabilities: Understanding Strategic Change in Organizations. Malden, Mass: Blackwell Publishing

Hoffmann, M. (2019). Smart Agents for the Industry 4.0: Enabling Machine Learning in Industrial Production. Springer Nature

Jean, R., & Kim, D. (2020). Internet and SMEs’ internationalization: The role of platform and website. Journal of International Management, 26(1), 100690

Johnson, J. S., Friend, S. B., & Lee, H. S. (2017). Big data facilitation, utilization, and monetization: Exploring the 3Vs in a new product development process. Journal of Product Innovation Management, 34(5), 640–658

Keramati, A., Mehrabi, H., & Mojir, N. (2010). A process-oriented perspective on customer relationship management and organizational performance: An empirical investigation. Industrial Marketing Management, 39(7), 1170–1185

Kindström, D., Kowalkowski, C., & Sandberg, E. (2013). Enabling service innovation: A dynamic capabilities approach. Journal of Business Research, 66(8), 1063–1073

Kumar, N., Qiu, L., & Kumar, S. (2018). Exit, voice, and response on digital platforms: An empirical investigation of online management response strategies. Information Systems Research, 29(4), 849–870

Kwak, D. W., Seo, Y. J., & Mason, R. (2018). Investigating the relationship between supply chain innovation, risk management capabilities and competitive advantage in global supply chains. International Journal of Operations & Production Management, 38(1), 2–21

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management science, 46(5), 626–643

Lee, O. K., Sambamurthy, V., Lim, K. H., & Wei, K. K. (2015). How does IT ambidexterity impact organizational agility? Information Systems Research, 26(2), 398–417

Lee, S. M., Lee, D., & Schniederjans, M. J. (2011). Supply chain innovation and organizational performance in the healthcare industry. International Journal of Operations & Production Management, 31(11), 1193–1214

Lehrer, C., Wieneke, A., Vom Brocke, J., Jung, R., & Seidel, S. (2018). How big data analytics enables service innovation: materiality, affordance, and the individualization of service. Journal of Management Information Systems, 35(2), 424–460

Li, G., Fan, H., Lee, P. K., & Cheng, T. C. E. (2015). Joint supply chain risk management: an agency and collaboration perspective. International Journal of Production Economics, 164, 83–94

Li, M., Zheng, X., & Zhuang, G. (2017). Information technology-enabled interactions, mutual monitoring, and supplier-buyer cooperation: A network perspective. Journal of Business Research, 78, 268–276

Li, S., Ragu-Nathan, B., Ragu-Nathan, T. S., & Rao, S. S. (2006). The impact of supply chain management practices on competitive advantage and organizational performance. Omega, 34(2), 107–124

Lim, L. L., Alpan, G., & Penz, B. (2014). Reconciling sales and operations management with distant suppliers in the automotive industry: A simulation approach. International Journal of Production Economics, 151, 20–36

Lin, F. J., & Lin, Y. H. (2016). The effect of network relationship on the performance of SMEs. Journal of Business Research, 69(5), 1780–1784

MacKenzie, S. B., & Podsakoff, P. M. (2012). Common method bias in marketing: Causes, mechanisms, and procedural remedies. Journal of retailing, 88(4), 542–555

Mangla, S. K., Raut, R., Narwane, V. S., & Zhang, Z. J. (2020). Mediating effect of big data analytics on project performance of small and medium enterprises.Journal of Enterprise Information Management

Messersmith, J. G., & Wales, W. J. (2013). Entrepreneurial orientation and performance in young firms: The role of human resource management. International Small Business Journal, 31(2), 115–136

Mikalef, P., & Pateli, A. (2017). Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. Journal of Business Research, 70, 1–16

Mikalef, P., Boura, M., Lekakos, G., & Krogstie, J. (2019). Big data analytics capabilities and innovation: the mediating role of dynamic capabilities and moderating effect of the environment. British Journal of Management, 30(2), 272–298

Mishra, D., Gunasekaran, A., Papadopoulos, T., & Childe, S. J. (2018). Big Data and supply chain management: a review and bibliometric analysis. Annals of Operations Research, 270(1), 313–336

Mortenson, M. J., Doherty, N. F., & Robinson, S. (2015). Operational research from Taylorism to Terabytes: A research agenda for the analytics age. European Journal of Operational Research, 241(3), 583–595

Nelson, R. R., & Winter, S. G. (1982). The Schumpeterian tradeoff revisited. The American Economic Review, 72(1), 114–132

Netemeyer, R. G., Bearden, W. O., & Sharma, S. (2003). Scaling Procedures: Issues and Applications. Thousand Oaks: Sage Publications

Nunnally, J. C. (1978). Psychometric Theory 2nd ed

Parida, V., & Örtqvist, D. (2015). Interactive effects of network capability, ICT capability, and financial slack on Technology-Based small firm innovation performance. Journal of Small Business Management, 53(1), 278–298

Parida, V., Oghazi, P., & Cedergren, S. (2016a). A study of how ICT capabilities can influence dynamic capabilities. Journal of Enterprise Information Management, 29(2), 179–201

Parida, V., Patel, P. C., Wincent, J., & Kohtamäki, M. (2016b). Network partner diversity, network capability, and sales growth in small firms. Journal of Business Research, 69(6), 2113–2117

Partanen, J., Kohtamäki, M., Patel, P. C., & Parida, V. (2020). Supply chain ambidexterity and manufacturing SME performance: The moderating roles of network capability and strategic information flow. International Journal of Production Economics, 221, 107470

Pezeshkan, A., Fainshmidt, S., Nair, A., Frazier, M. L., & Markowski, E. (2016). An empirical assessment of the dynamic capabilities–performance relationship. Journal of Business Research, 69(8), 2950–2956

Phelps, C. C. (2010). A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Academy of Management Journal, 53(4), 890–913

Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2012). Sources of method bias in social science research and recommendations on how to control it. Annual review of psychology, 63(1), 539–569

Rana, N. P., Chatterjee, S., Dwivedi, Y. K., & Akter, S. (2021). Understanding dark side of artificial intelligence (AI) integrated business analytics: assessing firm’s operational inefficiency and competitiveness.European Journal of Information Systems, 1–24

Rai, A., & Tang, X. (2010). Leveraging IT capabilities and competitive process capabilities for the management of interorganizational relationship portfolios. Information systems research, 21(3), 516–542

Raptis, T. P., Passarella, A., & Conti, M. (2019). Data management in industry 4.0: State of the art and open challenges. Ieee Access : Practical Innovations, Open Solutions, 7, 97052–97093

Reio, T. G. Jr. (2010). The threat of common method variance bias to theory building. Human Resource Development Review, 9(4), 405–411

Ren, J. S., Wamba, S. F., Akter, S., Dubey, R., & Childe, S. J. (2017). Modelling quality dynamics, business value and firm performance in a big data analytics environment. International Journal of Production Research, 55(17), 5011–5026

Saglam, Y. C., Çankaya, S. Y., & Sezen, B. (2020). Proactive risk mitigation strategies and supply chain risk management performance: an empirical analysis for manufacturing firms in Turkey.Journal of Manufacturing Technology Management

Schildt, H. (2017). Big data and organizational design–the brave new world of algorithmic management and computer augmented transparency. Innovation, 19(1), 23–30

Schilke, O., Hu, S., & Helfat, C. E. (2018). Quo vadis, dynamic capabilities? A content-analytic review of the current state of knowledge and recommendations for future research. Academy of Management Annals, 12(1), 390439

Schoenherr, T., & Speier-Pero, C. (2015). Data science, predictive analytics, and big data in supply chain management: Current state and future potential. Journal of Business Logistics, 36(1), 120–132

Shu, R., Ren, S., & Zheng, Y. (2018). Building networks into discovery: The link between entrepreneur network capability and entrepreneurial opportunity discovery. Journal of Business Research, 85, 197–208

Sultana, S., Akter, S., & Kyriazis, E. (2022a). How data-driven innovation capability is shaping the future of market agility and competitive performance? Technological Forecasting and Social Change, 174, 121260

Sultana, S., Akter, S., & Kyriazis, E. (2022b). Theorising Data-Driven Innovation Capabilities to Survive and Thrive in the Digital Economy.Journal of Strategic Marketing,1–27

Teece, D. (2007). Explicating Dynamic Capabilities: The Nature and Microfoundations of (Sustainable) Enterprise Performance. Strategic Management Journal, 28, 1319–1350

Teece, D. J. (2010). Business models, business strategy and innovation. Long Range Planning, 43(2–3), 172–194

Teece, D. J. (2014). The foundations of enterprise performance: Dynamic and ordinary capabilities in an (economic) theory of firms. Academy of Management Perspectives, 28(4), 328–352

Teece, D. J. (2018). Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Research Policy, 47(8), 1367–1387

Vahn, G. Y. (2014). Business analytics in the age of Big Data. Business Strategy Review, 25(3), 8–9

Van Auken, H., Madrid-Guijarro, A., & Garcia-Perez-de-Lema, D. (2008). Innovation and performance in Spanish manufacturing SMEs. International Journal of Entrepreneurship and Innovation Management, 8(1), 36–56

Vandenberg, R. J. (2006). Introduction: statistical and methodological myths and urban legends: where, pray tell, did they get this idea? Organizational Research Methods, 9(2), 194–201

Villena, V. H., Revilla, E., & Choi, T. Y. (2011). The dark side of buyer–supplier relationships: A social capital perspective. Journal of Operations management, 29(6), 561–576

Walter, A., Auer, M., & Ritter, T. (2006). The impact of network capabilities and entrepreneurial orientation on university spin-off performance. Journal of Business Venturing, 21(4), 541–567

Wamba, S. F., Dubey, R., Gunasekaran, A., & Akter, S. (2020). The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. International Journal of Production Economics, 222, 107498

Wamba, S. F., Gunasekaran, A., Akter, S., Ren, S. J., Dubey, R., & Childe, S. J. (2017). Big data analytics and firm performance: Effects of dynamic capabilities. Journal of Business Research, 70, 356–365

Wang, C., & Hu, Q. (2020). Knowledge sharing in supply chain networks: Effects of collaborative innovation activities and capability on innovation performance. Technovation, 94, 102010

Wang, G., Gunasekaran, A., Ngai, E. W., & Papadopoulos, T. (2016). Big data analytics in logistics and supply chain management: Certain investigations for research and applications. International Journal of Production Economics, 176, 98–110

Wareham, J., Fox, P. B., & Cano Giner, J. L. (2014). Technology ecosystem governance. Organization science, 25(4), 1195–1215

Wei, H. L., & Wang, E. T. (2010). The strategic value of supply chain visibility: increasing the ability to reconfigure. European Journal of Information Systems, 19(2), 238–249

Wilden, R., Gudergan, S. P., Nielsen, B. B., & Lings, I. (2013). Dynamic capabilities and performance: strategy, structure and environment. Long Range Planning, 46(1–2), 72–96

Wilhelm, H., Schlömer, M., & Maurer, I. (2015). How dynamic capabilities affect the effectiveness and efficiency of operating routines under high and low levels of environmental dynamism. British Journal of Management, 26(2), 327–345

Winter, S. G. (2003). Understanding dynamic capabilities. Strategic management journal, 24(10), 991–995

Wu, L. Y. (2010). Applicability of the resource-based and dynamic-capability views under environmental volatility. Journal of Business Research, 63(1), 27–31

Xiao, X., Tian, Q., & Mao, H. (2020). How the Interaction of Big Data Analytics Capabilities and Digital Platform Capabilities Affects Service Innovation: A Dynamic Capabilities View. Ieee Access : Practical Innovations, Open Solutions, 8, 18778–18796

Yunis, M., Tarhini, A., & Kassar, A. (2018). The role of ICT and innovation in enhancing organizational performance: The catalysing effect of corporate entrepreneurship. Journal of Business Research, 88, 344–356

Zacca, R., Dayan, M., & Ahrens, T. (2015). Impact of network capability on small business performance. Management Decision, 53(1), 2–23

Zainudin, A. (2014). A Handbook on SEM. MPWS Publisher. Bangi Malaysia (pp.61–64)

Zhan, Y., Tan, K. H., Li, Y., & Tse, Y. K. (2018). Unlocking the power of big data in new product development. Annals of Operations Research, 270(1–2), 577–595

Funding

Open access funding provided by Università degli Studi di Torino within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

Convergent validity and reliability.

Sr. No | Items | Factor Loading (λ) |

|---|---|---|

Big data analytics capabilities (AVE = 0.733, CR = 0.943, α = 0.943) | ||

1 | “Our organization tracks changes in internal and external business environments” | 0.828 |

2 | “Our organization continuously processes and interprets information” | 0.864 |

3 | “Our organization exploits the available opportunities to enhance organizational competitiveness” | 0.115 |

4 | “Our organization uses advanced supporting technologies” | 0.877 |

5 | “Our organization uses advanced analytical techniques” | 0.895 |

6 | “Our organization combines and integrates information from many data sources for use in decision-making” | 0.116 |

7 | “Our organization routinely applies data visualization techniques to assist users or decision-makers to explore new market opportunities in highly volatile and complex environments” | 0.852 |

8 | “Our organization uses dashboards that provide information that help to carry out root cause analysis and continuous improvement to minimize risk” | 0.462 |

9 | “Our organization deploys dashboard applications/information to our managers’ communication devices (e.g., smartphones, computers)” | 0.818 |

10 | “Our organization renews its business strategy based on the information derived via advanced techniques to sustain competitive advantage” | 0.432 |

Digital platform capability (AVE = 0.563, CR = 0.865, α = 0.873) | ||

1 | “Our platform easily accesses data from our partners’ IT systems” | 0.799 |

2 | “Our platform provides seamless connection between our partners’ IT systems and our IT systems (e.g., forecasting, production, manufacturing, shipment)” | 0.76 |

3 | “Our platform has the capability to exchange real-time information with our partners” | 0.391 |

4 | “Our platform easily aggregates relevant information from our partners’ databases (e.g., operating information, business customer performance, cost information)” | 0.425 |

5 | “Our platform is easily adapted to include new partners” | 0.741 |

6 | “Our platform can be easily extended to accommodate new IT applications or functions” | 0.73 |

7 | “Our platform can be easily extended to accommodate new IT applications or functions” | 0.294 |

8 | “Our platform consists of modular software components, most of which can be reused in other business applications” | 0.718 |

Network capability (AVE = 0.543, CR = 0.904, α = 0.908) | ||

1 | “In our company we have regular meetings for every project” | 0.655 |

2 | “In our company employees develop informal contacts among themselves” | 0.732 |

3 | “In our company managers and employees often give feedback to each other” | 0.412 |

4 | “In our company we analyze what we would like and desire to achieve with which partner” | 0.728 |

5 | “In our company we develop relations with each partner based on what they can contribute” | 0.331 |

6 | “In our company we discuss regularly with our partners how we can support each other” | 0.712 |

7 | “In our company we have the ability to build good personal relationships with our business partners” | 0.797 |

8 | “In our company we can deal flexibly with our partners” | 0.801 |

9 | “In our company we almost always solve problems constructively with our partners” | 0.382 |

10 | “In our company we know our partners’ markets” | 0.706 |

11 | “In our company we know our partners’ products/procedures/services” | 0.751 |

12 | “In our company we know our partners’ strengths and weaknesses” | 0.402 |

Supply chain innovation (AVE = 0.613, CR = 0.863, α = 0.86) | ||

1 | “We pursue a cutting-edge system that can integrate information” | 0.728 |

2 | “We pursue technology for real-time tracking” | 0.808 |

3 | “We pursue innovative vehicles, packages or other physical assets” | 0.825 |

4 | “We pursue continuous innovation in core global supply chain processes” | 0.767 |

5 | “We pursue agile and responsive processes against changes” | 0.47 |

6 | “We pursue creative methods and/or services” | 0.355 |

Firm performance (AVE = 0.517, CR = 0.841, α = 0.847) | ||

1 | “We have a better return on investment than our competitors” | 0.653 |

2 | “We have a better return on sales than our competitors” | 0.738 |

3 | “We have better growth in sales than our competitors” | 0.805 |

4 | “We have better growth in profit than our competitors” | 0.789 |

5 | “We have better growth in market share than our competitors” | 0.585 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bhatti, S.H., Ahmed, A., Ferraris, A. et al. Big data analytics capabilities and MSME innovation and performance: A double mediation model of digital platform and network capabilities. Ann Oper Res (2022). https://doi.org/10.1007/s10479-022-05002-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-022-05002-w