Abstract

Digital transformation (DT) and Big Data Analytics Capabilities (BDAC) enable SMEs to adapt to rapidly changing markets, innovate, and maintain relevance in the digital age. This research explores the impact of DT on SME performance through the lens of BDAC and innovation, from a multi-methods approach and applying the dynamic capabilities view. It asserts that simply investing in DT doesn't ensure enhanced performance. Analyzing 183 Spanish SMEs from various sectors, the study highlights the need for creating specific conditions that enable DT to positively impact performance. The integration of PLS-SEM and fsQCA methodologies provides a comprehensive analysis of BDAC as pivotal in optimizing SME performance through DT, emphasizing the necessity of strategic alignment with innovation. This nuanced approach, combining the predictive power of PLS-SEM and the configurational insights of fsQCA, demonstrates that investment in DT alone is insufficient without fostering conditions conducive to innovation. Our empirical insights offer actionable guidance for managers utilizing BDA or contemplating technological investments to elevate firm performance which go in the direction of increasing their innovation capabilities. Additionally, these findings equip policymakers with a nuanced understanding, enabling the design of tailored measures promoting DT in SMEs anchored in the nuances of BDAC and innovation capabilities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Organizations are today "data-dependent". They use big data to identify new business opportunities, improve processes and efficiency, better meet customer needs, predict customer behaviour, and reshape business models (Ceipek et al. 2021; Kraus et al. 2022b; Singh and Bala 2024).

According to a recent McKinsey study, although organizations have made significant technology-driven changes over the past two years, they have captured much less of the value than they initially expected. Moreover, top economic performers -multinational companies- do significantly better than their peers. In top-performing organizations, respondents report capturing a median of 50 percent of the full revenue benefits that their recent transformations could have achieved, compared with a median of 31 percent across all respondents—and 40 percent of the maximum cost benefit, compared with 25 percent across all respondents (McKinsey and Company 2022). Digital transformation (hereafeter, DT) offers also Small and Medium-sized Enterprises (SMEs) a useful tool for creating value and enhancing their performance in diverse marketplaces, including both developed and developing nations (Bertello et al. 2021). SMEs, representing over 99% of EU businesses, are the backbone of the economy, necessitating the advancement in digital transformation to sustain their critical role in the market. The transition to digital technologies is essential for their growth, competitiveness, and continued significant contribution to the European economy (Di Bella et al. 2023). Furthermore, it has been analyzed that SMEs with a more advanced use of digital technology report more innovation practices than less digitalized ones, so the industry gives us clues to the importance of innovation in this process (Deloitte and Company 2019).

The most puzzle challenges facing organizations in the DT context today are not only the implementation of the right technology but also the lack of adequate skills and capabilities in the organization (Oberer and Erkollar 2018). Having big data in the organization is not enough to develop a successful big data strategy based on value creation, as the ability to acquire and analyse big data for decision-making is crucial (Verhoef et al. 2016; Dremel et al. 2018). “Big data analytics capabilities” (BDAC) is a concept that has arisen from the analysis of this reality and offers new possibilities to extract value from data management and achieve a competitive advantage. Several studies address this issue and its key importance in the DT process of enterprises (Wamba et al. 2017; Akhtar et al. 2019; Bresciani et al. 2021; Volberda et al. 2021; Shah 2022). Nevertheless, there’s a confusing explanation on the process of BDAC adoption. The role of innovation and its significance in organizational performance that needs to be further investigated (Nambisan et al. 2019; Firk et al. 2022). Some studies highlight the lack of empirical research analysing the impact of BDA in strengthening an organization's innovation capabilities, since innovation has been studied in DT as business model innovation and not as exploration and exploitation capabilities (Wamba et al. 2017; Brand et al. 2021; Zareravasan 2023). Not only technological and digital capabilities should be considered for an increase in organizational performance, but also the capabilities of exploration and exploitation of opportunities (innovation capabilities), might mediate the positive relationship and enhance the effects of DT, and BDAC on organizational performance. Another concern is that most studies about big data analytics and innovation are focused on big enterprises, so there is a gap in SMEs analysis (Maroufkhani et al. 2019; Perdana et al. 2022a, b). Although most companies are proactive in promoting DT, some SMEs still need to identify the strategic value of big data analytics and innovation because it represents a challenge for them (Bertello et al. 2021). According El Telbany et al. (2020) and from the standpoint of the consumer, innovation was viewed as one of the less crucial prerequisites for DT in emerging economies. This could be because innovation is more of an organizational direction set by the organization's executives and strategy makers, who are more constrained by budget and would prefer not to invest in new goods and services or adopt novel business models that would necessitate significant organizational restructuring. Moreover, recent studies only investigated the topic for the IT sector, so it is a real need to address the topic from the heterogeneity of sectors as suggested by Upadhyay and Kumar (2020).

Therefore, we pose three central research questions concerning the role of innovation in the DT process to be effective in increasing performance. First, and with a probabilistic approach: Which is the role of BDAC and innovation in DT process? In this question it is argued whether investment in DT translates into higher performance per se, or whether the creation and promotion of BDAC is necessary to bring about an increase in innovation and therefore, the increase in performance in a more significant way. Secondly, and with a configurational approach: Which combination of conditions lead companies to a high level of performance in the DT process? And, does innovation play a key role for SMEs with these challenges?

Different methods will give different results, so a combinatorial approach of PLS-SEM and fsQCA methodology is proposed in order to solve the complementary research questions (Mas-Tur et al. 2016). The combination of both methodologies allows researchers to make a more robust assessment of the models and hypotheses, as well as the predictive power from a symmetric and asymmetric perspective. The fsQCA allows to strengthen the results of the sequential model analyzed with PLS-SEM by identifying the combinations of antecedents that generate an outcome and better predict and explain real-world business problems (Kumar et al. 2022). The sample is composed of 183 Spanish organizations already committed with the process of DT.

The article presents three significant contributions to the literature on DT and BDAC within SMEs. Firstly, it assesses the role of BDAC and innovation in the DT process, questioning whether investment in DT inherently leads to higher performance or if fostering BDAC is crucial for amplifying innovation and thus performance. Secondly, the research explores which specific conditions and combinations lead to superior performance in DT, emphasizing the essential role of innovation for SMEs facing such challenges. Lastly, through a unique combinatorial approach using PLS-SEM and fsQCA methodologies, the study offers a robust evaluation of models and hypotheses from both symmetric and asymmetric perspectives, highlighting innovation's dual function as both a mediator and an outcome within the dynamic capabilities (DC) framework, crucial for SME resilience and competitive advantage in a digitalized economy (Teece and Pisano 2003; Bibby and Dehe 2018).

Moreover, significant differences according to the size of companies and their sector of activity will be highlighted with practical implications to help managers and policymakers make more efficient DT strategies by focusing on improving innovation capabilities, especially for SMEs that want to quickly reap the full benefits of DT.

2 Theoretical Framework

2.1 Dynamic Capabilities View in the Digital Environment

The role of DC framework in DT and BDAC is pivotal, as these theories provide a framework for understanding how organizations adapt, innovate, and maintain competitive advantage in rapidly changing digital landscapes.

They offer foundational insights into the mechanisms through which organizations navigate and thrive DT, innovation, and the leveraging of BDAC. DC view posits that the ability of a firm to integrate, build, and reconfigure internal and external competences is crucial in rapidly changing environments. This perspective is particularly relevant in the context of DT, where firms must continuously adapt their strategies and operations to leverage technological advancements effectively (Karimi and Walter 2015). On the other hand, the RBV theory emphasizes the strategic value of unique, inimitable resources in gaining and sustaining competitive advantage, underlining the importance of internal capabilities and resources in fostering innovation (Lin and Wu 2014). The integration of BDAC as a dynamic capability further exemplifies the theory’s application, demonstrating how firms can enhance their operational and environmental performance by effectively managing and analyzing large datasets (Sahoo et al. 2023). Together, these theories provide a robust framework for understanding the strategic management of resources and capabilities in the digital era, underscoring the interplay between an organization’s internal strengths and the external digital landscape (Bibby and Dehe 2018; Matarazzo et al. 2021).

2.2 State of the Art of Digital Transformation and BDAC

DT has become a key driver in the strategic development of organizations, increased by the need for agility, innovation, and competitive differentiation. Underpinning this transformation is the deployment of BDAC, which are increasingly recognized as a crucial DC that allows organizations to interpret and act upon vast quantities of data with unprecedented speed and efficiency.

Current literature reveals a dual role of BDAC in the DT process (Kraus et al. 2022a). Firstly, it acts as a driver of innovation, allowing firms to uncover novel insights, streamline processes, and tailor offerings to customer needs (Sahoo et al. 2023). Secondly, BDAC is instrumental in enhancing organizational adaptability and performance. The ability to rapidly process and analyze data enables organizations to anticipate market changes and respond proactively, maintaining competitiveness within dynamic marketplaces (Corte-Real et al. 2017; Wamba et al. 2017).

With the aim of providing an overview of the main constructs of this research, the approach from which we studied them and the main research gaps addressed in the current state of the art literature in the Table 1.

3 Research Models Development

In order to answer the two central research questions, two research models are elaborated that will be tested with PLS-SEM and fsQCA, respectively. The different research hypotheses underpinning the proposed model for probabilistic analysis are explained below.

The investment in DT leads to a greater market share, turnover, and financial performance indicators. However, it should be aligned with faster and efficient processes, plus an organizational structure that accompanies and facilitates the transformation (Mikalef et al. 2019a, b). DT, understood as a sufficient level of digital maturity in the organization, has a significant influence on value creation (Wang et al. 2020), which also implies a positive effect in performance (Dalenogare et al. 2018). In Italian SMEs, DT has led to an improvement of performance and value creation (Matarazzo et al. 2021), and also in Chinese SMEs with key factors being digital technology and digital strategy (Teng et al. 2022). In Do et al. (2022) DT has a positive impact on Vietnamese commercial bank’s performance.

From this literature review, the first hypothesis is derived:

-

H1. DT has a positive and significant effect on performance

DT aims to enhance resources related to technology upgrade and contribute to achieving objectives such as reducing costs, creating new business opportunities, and improving organizational processes. This process implies the enhancement of resources related to technology upgrade which let employees to accomplish breakthrough innovations in organizations (Nicolás-Agustín et al. 2021). To improve the rate of innovation capabilities, organizations can foster behaviours and processes that stimulate innovation and extract the benefits of DT, and thus enhancing the values of an innovation culture (Roblek et al. 2021). However, the relationship between technology and personnel skills in the innovation process is still unclear, as noted by Nambisan et al. (2019). Therefore, we derive the second research hypothesis:

-

H2. DT has a positive and significant effect on innovation

Regarding the impact of DT on the organization, we can also enunciate some more actions such as the increase in the exchange of more fluid information (Nambisan and Zahra 2016), or the increase in efficiency and productivity in operations (Loebbecke and Picot 2015) as well as the increase in value for stakeholders (Choy and Kamoche 2021). The DT plan must explicitly consider HR's involvement in its execution, which indicates several benefits for the company, including speed, increased accessibility and communication, better organizational processes, less paperwork, and more motivation and productivity (Fenech et al. 2019).

Furthermore, a concrete level of digital maturity, which is how DT is understood and measured in this study, is necessary for BDAC to be generated (Pramanik et al. 2019). In other words, if there is no DT, it will not be possible to generate BDAC because the organization will not be prepared to develop a technological infrastructure that supports data, nor data management, nor will employees have the appropriate skills. Therefore, the more homogeneous the development of DT, the greater the impact on the organization's BDAC. We state the following hypothesis:

-

H3. DT has a positive and significant effect on BDAC

Innovation capability was defined by Romijn and Albaladejo (2002) as the set of skills and knowledge at the organizational level that are needed to absorb and master existing technology, products, and processes to improve them and create new ones. We must keep in mind that there are different types of innovation, mainly exploitative and explorative. BDA facilitates new ways of innovating related to experimentation at lower costs, improvisation, and fast failures. It allows cost savings therefore more possibilities of business opportunities which bring competitive advantage (Barlette and Bailette 2022; Shah 2022). Companies that are proactive and focused on promoting BDAC are more likely to increase product and service innovation (Ransbotham and Kiron 2017; Mikalef et al. 2019a, b). Therefore, we hypothesize:

-

H4. BDAC have a positive and significant effect on innovation

BDAC improve agility, which is key to increasing performance in turbulent environments such as the ones we are experiencing today (Ceipek et al. 2021; Barlette and Baillette 2022). In addition, BDAC also improve business value and market performance according to Wamba et al. (2017) and Raguseo and Vitari (2018). BDAC leads to increased competitiveness and performance (Gupta and George 2016) and Su et al. (2021) tests this relationship and contributes with reviews of the literature on each dimension of BDAC in its relationship with performance.

Maroufkhani et al. (2019) conducted a systematic review of the literature on BDAC and performance, where it was found that 14 papers studied financial performance and 27 studied non-financial performance. For the reasons above the next hypothesis is posited:

-

H5. BDAC have a positive and significant effect on performance

According to the studies of Rosenbusch et al. (2011) or Zhang and Hartley (2018) innovation positively affect organizational performance in SMEs, because it is an aggregated effect resulting from positive and negative mediating effects. It is connected to new product performance, process innovation. Moreover, the effect is increased by several factors such as promoting a real innovation orientation, R&D spending, or collaboration with external partners in the case of small companies. Welch et al. (2020) further elaborate on the long-term reinforcing and synergistic effects that the dynamic management of exploitative and explorative capabilities can have on firm performance. Moreover, operational performance is improved through a variety of innovation approaches, including product, process, organizational, and marketing innovation (Kafetzopoulos and Psomas 2016). From this literature review the following hypothesis is posited:

-

H6. Innovation has a positive and significative effect on performance

DT can lead to increased innovation in an organization due to value creation, but certain capabilities that create other innovation capabilities are necessary for this effect to be real and latent (Matarazzo et al. 2021). BDAC, considered as dynamic capabilities, are necessary for this positive effect on innovation to be effective. Certain organizational capabilities are also necessary for the DT process to have a direct effect on increasing organizational performance (Su et al. 2021). BDAC highlight the importance of different resources in different contexts to achieve the common goal of contributing to value-driven decision making based on BDA, leading to increased competitiveness (Shah 2022). Investment in digital skills training by organizations is positively related to performance. For example, having high-performance multidisciplinary teams guarantees a comprehensive understanding of big data issues and leads to more valuable decision-making based on data insights. The implementation of DT in an organization can led to resistance to change and scepticism towards staff who are not trained, motivated, and prepared to be an active part of it (Maroufkhani et al. 2020). Innovation could mediate the relationship between DT and performance (Nambisan et al. 2019), but not all organizations adopting BDA solutions have seen the expected performance improvement. Having BDA capabilities developed in the organization usually imply a strategic innovative orientation (Baiyere et al. 2020). However, a developed ambidextrous innovation capability is needed to notice this effect in its entirety. Therefore, DT is a necessary condition for increased performance, but not sufficient, as innovation plays a key role in this relationship (Maroufkhani et al. 2019). Thus, in the last research hypothesis, we propose a sequential mediation model in which the variables add value to the relationships to achieve the objective of increasing performance.

-

H7. The impact of DT on performance is sequentially mediated by BDAC and innovation

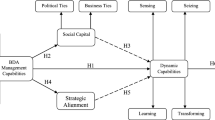

From the hypothesis development, the research model can be (Fig 1) derived.

In order to study the different constructs altogether rather than their relationships and hypotheses separately, we use the fsQCA methodology. To do so, we also include some firm characteristics associated with innovation performance in DT processes such as firm size, turnover, internationalization and firm age.

The size of a firm in terms of number of employees or turnover has always been an indicator of its potential agility and flexibility, closely related to performance. However, the results obtained in some studies are contradictory, as large firms have the most financial resources to increase their performance, for example through investments in DT and BDAC (Diego et al. 2023). On the other hand, SMEs (our focus of study) may show more responsiveness and flexibility in the face of adversity or in decision-making, which is more aligned with corporate DT (Maroufkhani et al. 2020). Therefore, it will be interesting to study it from a configurational perspective. The internationalization of a firm is also related to an increase in its global performance, especially in the context of SMEs, often as a result of digitalization (Bhandari et al. 2023; Wen et al. 2023). The firm age condition has been studied extensively in the literature in different contexts because it refers to the experience accumulated by the firm, but it can also be an indicator of an outdated and out-of-date firm in the context of DT (Almodóvar et al. 2021; Diego et al. 2023). Considering this, we establish the different propositions for the configurational analysis of this study. Moreover, the research model for configurational analysis is developed in Fig 2.

-

P1. Innovation is an influential element in organizational performance

-

P2. BDAC is an influential element in organizational performance

-

P3. DT is an influential element in organizational performance

-

P4. Firm size is an influential element in organizational performance

-

P5. Turnover is an influential element in organizational performance

-

P6. Internationalization is an influential element in organizational performance

-

P7. Firm age is an influential element in organizational performance

4 Methodology

4.1 Data Collection

The study conducted a platform-based questionnaire distributed in July 2022, using a private URL to access the screening questions to ensure that respondents had the necessary organizational and DT skills. Six statements were established to check if the company pre-selected complied with the minimum DT required, such as having cross-cutting digitalization plans and a budget earmarked for DT. The target audience of the study were companies with a turnover equal to or greater than 7 million euros actively engaged in the process of DT in Spain. The respondents answered the questions on a Likert scale of 1–7, and 183 valid responses were obtained.

4.2 Sample Characteristics

SMEs are crucial to the European Union's economy, forming over 99% of all businesses. These enterprises not only embody the entrepreneurial spirit of the EU but also serve as primary job creators, employing millions and fostering innovation. The "Annual Report on European SMEs 2022/2023" projects their performance, underscoring the vital role SMEs play and the challenges they face (Di Bella et al. 2023).

In the Spanish context, according to the INE Q1 2022 survey “ICT in companies”, only 3.77% of companies with less than 10 employees implement big data in their organization, 12,67% of companies with 10 to 49 employees, 23.34% of companies with 50 to 249 employees and 44.20% of companies with more than 250 employees (Instituto Nacional de Estadística 2022a, b). These data also point out the empirical need of elaborating insights and recommendations for SMEs to overcome this challenge, as there’s a need felt by companies to understand, adopt and implement big data analytics within their organizational process. Regarding the respondent’s profile, the sample is gender-distributed in 46% female and 54% male distribution, ranging in age from 18 to 39 a 55% of the respondents, and from 40 to 66 a 45% of the respondents. With respect to their professional management position within the organization, 18.03% were CEOs or general managers, 12.57% were CIOs, and 16.94% were transformation managers. The other managerial positions are mainly marketing managers (8.74%), financial managers (6.01%) and operations managers (4.37%).

The sectors of study are heterogenic. Companies in the information technology sector can be highlighted as the majority in our study (ICT services) (28.42%), as well as financial services (15.3%) and logistics (12.02%). This is followed by non-financial services companies (6.56%), as well as the metal-mechanical sector (4.37%) and the more traditional sectors comprising footwear, textiles, wood, and toys (3.83%) and tourism (3.83%).

In relation to the number of employees, one third of the companies belong to the group of large companies, but 66% are SMEs. This sample was deliberately selected to be able to observe differences with the constructs and hypotheses in companies of different sizes. It is a convenience sample, and therefore it was necessary to include companies that were more advanced in the process of DT and with a greater mastery of BDAC to carry out the study with academic rigor.

4.3 Variable Definition and Measures

Validated and adapted scales according to the results of a previous Delphi study conducted with managers of Spanish SMEs and academic experts were used for this study. All items were rated on a 7-point Likert scale, ranging from 1 (strongly disagree) to 7 (strongly agree). The scales and measures used in the questionnaire employed be found in Appendix 1. Firm size was measured according the recommendations of the European Commission (2003/361/EC), considering a large company the ones with more than 250 employees.

4.4 Data Analysis

A combinatorial approach of PLS-SEM and fsQCA methodologies has been used for data analysis. Partial Least Squares is a composite-based approach to structural equation modelling, which allows testing complex models with latent constructs, including the predictive approach (Hair et al. 2019; Leal-Rodríguez et al. 2023). For some time, it was argued that this technique is suitable for social science research insofar as their assumptions, present fewer restrictions regarding the normality of the variables or the sample size (Hair et al. 2014). However, several authors have commented that a mean-centered symmetric approach leads to an incomplete perspective of the effects of the variables on the outcome (Woodside 2013; Rasoolimanesh et al. 2021). For this reason, there is a call to complement it with the use of asymmetric methodologies that analyze cases as individuals and combinations of variables leading to a specific level of outcome, such as fuzzy-set qualitative comparative analysis (fsQCA).

The use of these two methodologies in tandem overcomes the limitations of both separately and increases the credibility of prescriptions as managerial recommendations (Hair and Sarstedt 2021). As explained in Rasoolimanesh et al. (2021), PLS-SEM is first applied to estimate the measurement and structural model, applying the reliability and validity criteria (Hair et al., 2019). This is followed by the assessment of the model's predictive power. Next, the latent variable scores are extracted from the PLS-SEM analysis, and the fsQCA analysis is started. This, in turn, has five sub-steps: calibrate the continuous latent variables, establish the necessary conditions (those in which the consistency is greater than 0.9 (Ragin 2000), create the truth table where the configurations with a consistency lower than 0.75 are eliminated due to the sample size (Ragin 2006), and finally perform the sufficiency analysis to finally analyze the most consistent solutions.

Some studies in the field that have used the PLS-SEM method in an effective and validated way to explore BDAC are Wamba et al. (2017), Mikalef et al. (2019a, b), Munir et al. (2022), Leal-Rodríguez et al. (2023).

5 Results

5.1 Symmetric Analysis (PLS-SEM)

5.1.1 Measurement Model

First, it is necessary to mention that the constructs involving DT, innovation and performance are modelled in mode A, with a reflective approach. Hence, the evaluation of the measurement model should comprise for such constructs the following steps: Individual item reliability, composite reliability, convergent validity, and discriminant validity with the heterotrait-monotrait ratio (HTMT). The Table 2 reveals that most of the items achieve outer loadings of at least 0.707. Only two items belonging to the DT scale are below 0.707, yet they are very close to this threshold and as the composite reliability is very good it is recommended to keep them in the scale as Hair et al. (2014) indicate. In addition, it is verified at the construct level that the Chronbach Alpha, composite reliability, and Rho A indicators are above 0.7 (Hair et al. 2019), hence indicating that the constructs satisfy the composite reliability requirement. Besides, the average variance extracted (AVE) exceeds 0.5, and therefore the constructs satisfy convergent validity according to the criteria of Fornell and Larcker (1981), indicating that ≥ 50% of the indicator variance should be accounted for. Finally, the model attains discriminant validity by applying the HTMT approach (Henseler et al. 2015).

Secondly, the BDAC construct is modelled in Mode B (formative approach), and therefore the analysis of potential collinearity and the assessment of outers weights must be followed to check its validity and relevance. It should be noted that due to problems of multicollinearity (VIF greater than 0.5) the BDAC dimension related to staff skills has been removed from the model, in accordance with the criteria of Hair et al. (2014). According to Petter et al. (2007), strong multicollinearity across items is indicated by a variance inflation factor (VIF) larger than 3.3. In our situation, the maximum VIF value for indicators was 2.820, which is far less than this important cut-off. Therefore, it can be concluded that the model under study does not have any multicollinearity issues.

As mentioned, the DT, innovation, and performance variables of this first model are in reflective mode (mode A), so it will be necessary to check the potential discriminant validity through the HTMT criterion, which must be less than 0.9, according to the criteria of Henseler et al. (2015). These authors discovered that traditional methods for assessing discriminant validity in variance-based Structural Equation Modelling, specifically the Fornell-Larcker criterion and the evaluation of cross-loadings, exhibit notably low sensitivity, thereby inadequately detecting issues in discriminant validity. Thus, Henseler et al. (2015) suggest to employ the HTMT (Heterotrait-Monotrait) criteria, a novel approach for discriminant validity assessment in variance-based SEM. The HTMT criteria, which involve comparing heterotrait-heteromethod correlations against monotrait-heteromethod correlations, demonstrate a high sensitivity rate and effectively identify discriminant validity issues. With regard to BDAC, since this construct is modelled in Mode B (formative), there is no need to report its HTMT value. This is shown in Table 3.

5.1.2 Structural Model

In line with Hair et al. (2014), this study uses a bootstrapping technique (5000 random resamples) to produce the standard errors, t-statistics, p-values, and 95% bias corrected confidence intervals which enable the assessment of the statistical support for the direct and indirect relationships proposed in the conceptual model. We see in Table 4 the evaluation of the coefficient of determination, as the R2 or explained variance. According to the criteria of Hair et al. (2014), values below 0.25 are classified as poor and low. In our model we do not have any but, we the BDAC with 0.749 which is considered as substantial effect. In preparadigmatic disciplines and exploratory hypothesis testing, this criterion is used in contrast to Chin's (1998) criterion, which is used in disciplines such as marketing, with more empirically tested scales and models and a more advanced frontier of knowledge.

As seen Table 4, we find empirical support for all the hypotheses except for direct hypotheses 1 (DT ➜ Performance) and 5 (BDAC ➜ performance).

We face a multiple or sequential mediation model in which not all the direct relationships are significant, even if they are positive, because the mediating variables innovation and BDAC are needed for the impact on the organization to be tangible. In other words, DT alone does not have an effective impact on the organization, nor does investment in technology increase organizational performance. Instead, BDAC and innovation in the organization are necessary for DT to be effective and translate into improved organizational performance.

5.1.3 Predictive Analysis

This study evaluates the predictive power of a model by cross-validation with retained data. To this aim, the SmartPLS software version 3.2.9 and the PLS-predict algorithm are used. The Q2 value is used to examine the prediction accuracy of the model, where positive values indicate that the prediction error is lower than PLS-SEM findings using only mean values. According to Hair et al. (2019), if the Q2 values are greater than 0.5, as is the case for BDAC, the predictive power can be said to be highly robust. In the study, the model meets the criteria at both the construct and indicator levels, which confirms the predictive validity of the model (Ringle et al. 2015) (Table 5).

5.2 Asymmetric Analysis (fsQCA)

Fuzzy sets Qualitative Comparative Analysis (fsQCA) is an asymmetric method that combines fuzzy sets and fuzzy logic. Asymmetric models with complexity theory are important for several reasons: First, the correlation coefficient and beta cannot adequately explain the association between two variables (possibly due to the nonlinear association between the independent and dependent variables). This problem can be solved by applying fuzzy sets as this application offers multiple solutions but can lead to the same result, so the business phenomena of DT, BDAC and innovation is explained, aligned to the “strategic management” cluster (Kumar et al. 2022). Although fsQCA was initially aimed at the analysis of small or medium samples, Woodside (2013) points out that there are no limitations to its application to a large sample. This approach is referred to in the literature as causal complexity (Kier and McMullen 2018) that reflected by three properties in fsQCA: conjunction, equifinality, and asymmetry (Ragin 2006; Kier and McMullen 2018).

Therefore, two models were considered:

-

MODEL A: High organizational performance = f(INN,TD,BDAC,INT,SIZE,TURN,AGE)

-

MODEL B: ~ High organizational performance (i.e., low company performance) = ~ f(INN,TD,BDAC,INT,SIZE,TURN,AGE)

The tilde symbol ( ~) in Model B expresses the absence of the outcome. In this particular case, the outcome is high organizational performance. Therefore, the absence of the outcome corresponds to low organizational performance. The different conditions for this study have been explained in the theoretical section. In addition, Appendix I details how each of the conditions has been measured in the questionnaire used to collect the sample.

The initial stage of fsQCA is to choose the cut-offs in the data, which might range from 0 to 1, then calibrate dependent and independent variables into fuzzy sets (Ragin 2008). Determining the thresholds for membership, non-membership, and maximum membership ambiguity is the calibration process. In the language of fsQCA, dichotomous conditions—also referred to as crisp-value conditions—can have a value of 0 or 1. Internationalization and firm size are transformed into a crisp set, as observed in Table 6. The process outlined by Ordanini et al. (2014) is used to convert the 7-point Likert scale that this study utilizes to measure constructs into fuzzy sets, using the direct method for calibrating (Ragin 2008). According to Tho and Trang (2015), full non-membership scores are set at 5, crossover points at 5.5, and full membership thresholds at values greater than 6.3. The choice of opting for a full non-membership of 5 instead of 4.5 is due to the distribution of values, which is based on the bias of respondents to answer (Table 6) affirmatively (strongly agree), as in Backes-Gellner et al. (2016).

According to Huarng and Roig-Tierno (2016) necessity analysis is the percentage of fuzzy set scores in a condition (across all cases) that are less than or equal to the corresponding scores in the result. When a condition's consistency score is higher than 0.9, it is deemed required (Ragin 2000). The consistency and coverage of all conditions, calculated for the outcome's presence and absence are displayed in Table 7. With a consistency level above 0.9 (Schneider and Wagemann 2010), it is outstood that innovation—a crucial component of both our model and the study hypotheses—clearly has to happen in order for the outcome to materialize. This means that, in our sample, high performance always happens when innovation is present, in a context of DT and BDAC building. We thus emphasize its significance and include it into the suggested research paradigm, validating the PLS-SEM analysis's outcome.

We began sufficiency analysis by producing and evaluating the truth table, based on frequency and consistency values (Ragin 2008). Frequency in this case referred to the number of observations for each possible combination and consistency refers to the degree to which cases correspond to the set-theoretic relationships expressed in a solution (Fiss 2011), and a consistency threshold of 0.75 is suggested (Ragin 2006). A higher level of consistency means that the solution is more accurate in explaining the outcome of interest. The output from fsQCA software offers three different solutions: complex, parsimonious, and intermediate (Ragin 2008). In this analysis, a combination of the intermediate and parsimonious solution is used for the presence of the outcome, whilst only the parsimonious solution was considered in the absence of the outcome.

The results could be observed in Table 8 and 9.

In Tables 8 and 9 we observe the resulting configurations, i.e. the paths that can be followed to achieve high performance, or low performance, in each case. From the presence of the outcome, we are going to focus mainly on the 1st configuration, which represents 78% of the cases and which indicates that a high degree of innovation, DT and BDAC lead to high performance. This result represents the model presented in this research and triangulates the results obtained in the probabilistic approach with PLS-SEM.

Configurations 4, 5 and 6 underline the decisive role of innovation for outcome presence. Conditions such as experience or internationalization appear interchangeably in the configurations but do not play a key role in the configurations. For this reason, these conditions have not been theoretically underpinned. However, innovation remains stable, as well as the presence of BDAC as an antecedent, in two of them.

The case of configuration 2 is remarkable because 12% of the cases are represented by young companies, which do not have a high degree of DT or BDAC, but do have innovation capabilities, which lead to high performance. This may be due to the adhocratic or innovation culture that certain companies possess and makes them develop these key capabilities for high performance quickly. Finally, configuration 3 represents 33% of the cases, corresponding to the large companies included in the sample to be able to contrast SMEs with them. The role of innovation is not present in this configuration, but DT and BDAC are needed for high performance.

Contrary to PLS-SEM, fsQCA analysis assumes that there is asymmetry between the variables used. Therefore, we observe configurations leading to the inverse of the outcome (low levels of performance) that are very different from those leading to high levels of performance (Ragin 2008; Ciampi et al. 2021).

In the analysis of the configurations that lead to the inverse of the outcome, we highlight configurations 1 and 2, which represent 43% and 59% of the cases respectively, where the absence of innovation leads small firms to low levels of performance.

Configurations 4, 6 and 7 are also noteworthy, as they support and triangulate the results highlighted in the study. Firms that have acquired technological resources (DT) but have not developed BDAC, cannot extract the full value of these resources and therefore perform poorly compared to those that do develop these capabilities. The remaining control conditions are indifferent (size, internationalization or experience).

Therefore, and going back to the research propositions stated in the theoretical framework, we can say that for both the presence and absence of the outcome (organizational performance) the firm size condition (measured as number of employees) does not affect the outcome. All propositions are thus fulfilled except proposition 4.

6 Discussion

This research has dissected the complex interplay between DT, BDAC, and innovation, examining their collective impact on SME performance. Grounded in empirical data from Spanish SMEs and bolstered by a multi-methodological approach, the findings resonate with international studies while unveiling nuances distinct to SMEs.

Comparatively, this study echoes the conclusions of Mergel et al. (2019), Wang et al. (2020), Kraus et al. (2021), Do et al. (2022) and Teng et al. (2022) regarding the positive ripple effect of DT on firm performance in various contexts, including China, Vietnam and Italy. However, our results diverge by emphasizing that DT's effect is not inherently sufficient to elevate performance unless it is sequentially mediated by BDAC and innovation capabilities. In addition, Teng et al. (2022) include in their study the variable of digital competences as mediators of this relationship, which we can approximate with our BDAC and their key role in our model.

The sequential mediation framework delineated in this study indicates that BDAC's pivotal role is to catalyze the DT process, thereby engendering innovation and, subsequently, enhancing performance. This phenomenon aligns with insights from Thoeben et al. (2017) and Bresciani et al. (2021). Notably, this pattern stands in stark contrast to evidence from larger entities, where innovation may not be as pivotal due to alternate compensatory resources.

Our configurational analysis, through fsQCA, lends further support by highlighting innovation as a linchpin for high performance, especially in more diminutive firms and young companies. It offers new perspective on the data that the PLS-SEM methodology alone might not reveal due to symmetry assumption (Kumar et al. 2022). This insight reinforces Deloitte and Company 2019revelation on the criticality of innovation in digitally mature SMEs across various national landscapes and also Maroufkhani et al. (2019), Matarazzo et al. (2021) and Yuliantari et al. (2021) which focused on in Balinese SMEs.

However, the study unveils an intriguing dynamic within SMEs that innovation capability can catalyze performance even in the absence of extensive DT or BDAC development, aligning with the work of Volberda et al. (2021) across various European contexts. This underscores a unique strategic pathway for SMEs: that fostering an innovation-centric culture could offer a trajectory to elevated performance, potentially bypassing the extensive resource investments often associated with DTs.

7 Conclusions

7.1 Theoretical Implications

In this research, we propose four main theoretical contributions that offer comprehensive answers to the three research questions presented in the introduction:

Firstly, our study provides a nuanced perspective on the dynamic capabilities’ theory, highlighting the interplay between DT, BDAC, and innovation. We assert that BDAC and innovation serve as essential mediators, facilitating the strategic reconfiguration of resources that enable SMEs to navigate the complexities of DT. This contribution enriches the dynamic capabilities framework, underscoring that it is not the mere presence of digital technologies but their strategic augmentation through BDAC that sparks innovation and ultimately fortifies SME performance.

Secondly, addressing the first question and third on the role of BDAC and innovation, our study establishes that investment in digital technologies per se is not a panacea for improved performance. Rather, it is the strategic enhancement of BDAC that acts as a springboard for innovation, which in turn significantly boosts performance. Our probabilistic analysis demonstrates that BDAC and innovation are not mere byproducts of DT; instead, they are critical mediators that convert technological investments into actionable insights and market opportunities, underscoring their indispensability for effective DT.

We underscore the role of innovation in SMEs as a critical component of dynamic capabilities, seen not just as an outcome but as a fundamental driver of transformation and competitive advantage. Our findings indicate that for SMEs, particularly smaller ones with limited resources, fostering an innovative culture is paramount. Such innovation-driven dynamism is especially crucial for SMEs as they seek to capitalize on DT and BDAC, ensuring that they are not merely consumers of technology but active innovators in their respective markets. Moreover, it also complements the dynamic capabilities framework by emphasizing innovation. This expands the contributions offered in some studies such as Côrte-Real et al. (2017) (which evaluated BDA impact on competitive advantage and performance and considered BDA as a strategic investment in DT processes), and Rialti et al. (2019) that investigated it large European firms, or Zhang et al. (2021) and Wang et al. (2023) who proved this on different samples of Chinese enterprises.

In response to the second question regarding the combination of conditions that lead to high performance, our configurational analysis highlights that a synergetic interplay between various conditions is essential. Among these, innovation capacity emerges as a linchpin. In environments where SMEs confront the challenges of limited resources and rapid market changes, innovation's role is amplified. It is not merely an additional benefit but a central element that enables SMEs to navigate the DT process successfully and achieve enhanced performance levels. Lastly, the importance of a sequential model is revealed in how SMEs transition from digital adoption to performance enhancement. The study contends that the impact of DT on performance is not linear but occurs through a sequential stimulation of BDAC and innovation.

Together, these insights challenge conventional wisdom regarding the DT-performance nexus and advocate for a strategic, nuanced approach to leveraging technology within the dynamic capabilities’ framework. This research not only contributes to academic discourse but also offers practical implications for SMEs operating in the fast-paced digital economy.

7.2 Practical Implications

It is important to emphasise that before conducting this study, many Spanish executives we worked with, were unaware and ignorant of key concepts and processes of DT and data-driven orientation. Many companies simply see DT as a forced change process, often required and influenced by partners, customers, or suppliers, in which they are struggling to survive.

With regards to the descriptive analysis of the results, we can obtain some very interesting insights that are of great interest for managers and policymakers. For example, medium-sized companies with up to 500 employees have an average BDAC level of 5.7 out of 7, while small companies have a lower level of 5.4/7, which shows the barriers to entry in terms of DT of companies with fewer financial resources and less attractive to attract talent with high digital skills, as may be the case of small and micro-enterprises. This is in line with the study of Perdana et al. (2022a, b). In addition, we have also looked at the differences in BDAC levels according to sectors of activity and we highlight the ICT services, financial services, and logistics sector with a higher average BDAC, between 5.9 and 5.6 out of 7. These results are in line with the McKinsey Report (McKinsey and Company 2022). This is not surprising but reaffirms the importance of this sector at regional and national level as a spearhead for the promotion and consolidation of DT.

Non-financial services, tourism, or more traditional sectors such as footwear-textile-wood and toys, have had to reinvent themselves in the wake of the crisis caused by the Covid-19 pandemic. They have a lower BDAC level of approximately 5.5/7. This might be because the financial investment needed for DT can be a barrier of this process, where small companies have fewer resources to do so.

Companies in the lower stage belong to the agri-food, metal-mechanical and non-mechanical processing sectors. These are more traditional sectors where less importance is given to the DT of products and processes and customer orientation but are more oriented towards “business to business” -B2B- (Ribeiro-Navarrete et al. 2021). This demonstrates a challenge at the structural level for some sectors to harness the full value of big data and exploit their investments and efforts in DT due to their inability to make data-driven decisions or train their managers and staff in BDA.

We also conclude with the importance of BDAC and innovation in increasing organizational performance in in SMEs, which currently support the bulk of employment and economic activity. If companies that are not yet part of the active process of DT and invest resources and time in them do not start to foster change, they are destined to fail. This is not a complex, albeit costly task, and requires good planning, analysis of the situation, clear objectives, and good advice to change work processes to be competitive in the market. Therefore, it is a priority to start raising awareness and educating people in digital capabilities and innovation mindset, so that they will be committed to this process and then organizational resources and capabilities will be properly managed. Moreover, we advise top managers to drive and guide this transformation by empowering people who have strong problem-solving skills with regard to big data processes so they exploit its potentialities.

In addition, to see which specific actions managers should focus on to improve the organizational situation, we have analysed the underlying values of each construct that have the highest factor loadings analysed with PLS-SEM methodology. Looking at the organization’s BDAC, managers should focus on continuously examining innovative opportunities, and using generic software modules to develop new systems. In addition, it is also interesting to encourage interdepartmental cooperation and collaboration between business analysts and line staff so that decisions are made based on the knowledge and experience of all employees on different topics. Furthermore, the growing accessibility and affordability of big data tools and technologies is another important factor propelling the expansion of the SME market through the use of big data. With data processing and storage prices falling, SMEs can now access and benefit from advanced analytics capabilities that were previously exclusive to giant corporations. Furthermore, the development of software-as-a-service (SaaS) and cloud computing models has made it simpler for them implement big data solutions without having to make a sizable upfront investment.

In relation to the recommendations for policymakers, we would like to highlight the importance of specific programs focused on the particularities and needs of SMEs, which despite not having great investment possibilities in high technologies, can obtain great benefits from DT and impact on their performance if certain capabilities are developed. Therefore, it is essential that governments focus on promoting the innovation capabilities and BDAC of SMEs through aid programs and subsidies for the acquisition and implementation of technology, consulting and advisory services for the implementation of BDAC, as well as courses. training in digital and innovation skills and values.

7.3 Limitations and Future Lines of Research

Regarding the limitations of the study, it must be highlighted that the survey used for this research relies on self-reported data. Although it is a common approach, some managers might be biased in responding about their organization's capabilities or performance depending on their recent experience or situational knowledge. To this end, we have tried to ask some pre-screening questions to see if the respondent was the right person, but in some cases, this may not be sufficient to eliminate this bias. Therefore, we recognise this limitation and as a future step we propose a sampling with multiple respondents to improve the internal validity of the results. Another limitation is that in this study it is not possible to consider the passage of time or how long it has taken for organizations to become the way they are. This would require a longitudinal study, which we are planning for next year, to support further the links provided and as it was recommended in Wamba et al. (2020).

Within the future lines of research, we consider that big data has great potential not only to transform business but to be a significant factor in ensuring competitive advantage for businesses. For this reason, organizations need a proper comprehensive understanding of the antecedents of BDAC in the organizations and how could they develop these capabilities in a fast and efficient way to be supportive in this matter. In addition, and due to the results of the study in which innovation is declared as key to achieve high performance in contexts of DT, it would be very interesting to study the organizational culture and innovation-oriented values that can make a company develop these capabilities and therefore be able to increase its performance.

Data Availability

My manuscript has no associate data.

References

Akhtar P, Chen H, Ali M, Ali T (2019) Investigating the role of big data analytics capabilities in promoting firm performance: an empirical study of Chinese and Pakistani firms. Inf Syst Front 21:681–697

Almodóvar P, Nguyen QTK, Verbeke A (2021) An integrative approach to international inbound sources of firm-level innovation. J World Bus 53:1–12

Backes-Gellner U, Kluike M, Pull K, Schneider MR, Teuber S (2016) Human resource management andradical innovation: a fuzzy-set QCA of US multinationals in Germany, Switzerland, and the UK. Journal of Business Economics 86:751–772

Baiyere AS, Salmela H, Tapanainen T (2020) Digital transformation and the new logics of business process management. Eur J Inf Syst 29:238–259

Barlette Y, Bailette D (2022) Big data analytics for competitive advantage: conceptual framework and research agenda. J Bus Res 144:554–567

Berman S (2012) Digital transformation: opportunities to create new business models. Strategy Leadersh 40:16–24

Bertello A, Ferraris A, Bresciani S, De Bernardi P (2021) Big data analytics (BDA) and degree of internationalization: the interplay between governance of BDA infrastructure and BDA capabilities. J Manag Gov 25:1035–1055

Bhandari KR, Zámborský P, Ranta M, Salo J (2023) Digitalization, internationalization, and firm performance: a resource-orchestration perspective on new OLI advantages. Int Bus Rev 32:102135

Bibby L, Dehe B (2018) Building big data analytics capabilities for the future: a dynamic capabilities approach. J Bus Res 86:197–210

Brand M, Tiberius V, Bican PM, Brem A (2021) Agility as an innovation driver: towards an agile front end of innovation framework. Rev Manag Sci 15:157–187

Bresciani S, Ciampi F, Meli F, Ferraris A (2021) Using big data for co-innovation processes: Mapping the field of data-driven innovation, proposing theoretical developments and providing a research agenda. Int J Inf Manag 60:102347

Ceipek R, Hautz J, Petruzzelli AM, De Massis A, Matzler K (2021) A motivation and ability perspective on engagement in emerging digital technologies: the case of internet of things solutions. Long Range Plan 54:101991

Chang KH, Chen YR, Huang HF (2015) Information technology and partnership dynamic capabilities in international subcontracting relationships. Int Bus Rev 24:276–286

Chen H, Tian X (2022) Resource orchestration for digital transformation: A systematic review and future research agenda. J Bus Res 135:647–658

Chin WW (1998) Commentary: Issues and opinion on structural equation modeling. MIS Q vii-xvi

Choy KL, Kamoche K (2021) Digital transformation and value creation: a stakeholder perspective. Technol Forecast Soc Change 164:120478

Ciampi F, Demi S, Magrini A, Marzi G, Papa A (2021) Exploring the impact of big data analytics capabilities on business model innovation: the mediating role of entrepreneurial orientation. J Bus Res 123:1–13

Côrte-Real N, Oliveira T, Ruivo P (2017) Assessing business value of big data analytics in European firms. J Bus Res 70:379–390

Costa Melo I, Alves Junior PN, Queiroz GA, Yushimito W, Pereira J (2023) Do We Consider Sustainability When We Measure Small and Medium Enterprises’ (SMEs’) Performance Passing through Digital Transformation? Sustainability 15:4917

Dalenogare LS, Kapper M, Tortorella GL (2018) Digital transformation in the industry 4.0 context: a review. Int J Prod Econ 195:318–330

de Diego RE, Almodóvar P, del Valle ID (2023) What drives strategic agility? Evidence from a fuzzy-set qualitative comparative analysis (FsQCA). Int Entrep Manage J 19:599–627

Deloitte & Company (2019) The performance of Small and Medium Sized Businesses in a digital world. https://www2.deloitte.com/content/dam/Deloitte/es/Documents/Consultoria/The-performance-of-SMBs-in-digital-world.pdf

Di Bella L, Katsinis A, Laguera Gonzalez J, Odenthal L, Hell M, Lozar B (2023) Annual Report on European SMEs 2022/2023. Publ Off Eur Union Luxemb. https://doi.org/10.2760/028705,JRC134336

Do TD, Pham HAT, Thalassinos EI, Le HA (2022) The impact of digital transformation on performance: Evidence from Vietnamese commercial banks. J Risk Financial Manag 15:21

Dremel C, Overhage S, Schlauderer S, Wulf J (2018) Towards a capability model for big data analytics. Proceedings der 13. Int Tagung Wirtschaftsinformatik (WI 2017), St. Gallen, S. 1141–1155

El-Telbany O, Abdelghaffar H, Amin H (2020) Exploring the digital transformation gap: evidence from organizations in emerging economies.

Feliciano-Cestero MM, Ameen N, Kotabe M, Paul J, Signoret M (2023) Is digital transformation threatened? A systematic literature review of the factors influencing firms’ digital transformation and internationalization. J Bus Res 157:113546

Fenech T, Deakins D, Tamasy C (2019) The impact of digital transformation on human resource management. J Bus Res 98:375–386

Firk S, Gehrke Y, Hanelt A, Wolff M (2022) Top management team characteristics and digital innovation: Exploring digital knowledge and TMT interfaces. Long Range Plan 55:102166

Fiss PC (2011) Building better causal theories: A fuzzy set approach to typologies in organization research. Acad Manage J 54:393–420

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18:39–50

Gupta JND, George B (2016) Toward an improved measurement of data and analytics capabilities. J Bus Res 69:517–527

Hair JF, Hult GTM, Ringle CM, Sarstedt M (2014) A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications

Hair JF, Risher JJ, Sarstedt M, Ringle CM (2019) When to use and how to report the results of PLS-SEM. Eur Bus Rev 29:2–24

Hair JF, Sarstedt M (2021) Explanation plus prediction—The logical focus of project management research. Project Manage J 52:319–322

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Marketing Sci 43:115–135

Huarng KH, Roig-Tierno N (2016) Qualitative comparative analysis, crisp and fuzzy sets in knowledge and innovation. J Bus Res 69:5181–5186

Instituto Nacional de Estadística (2022a) Empresas con menos de 10 empleados: Las TIC en las empresas (primer trimestre de 2022)– Análisis de Big Data. https://www.ine.es/jaxi/Datos.htm?tpx=53924

Instituto Nacional de Estadística (2022b) Empresas con 10 o más empleados: Las TIC en las empresas (primer trimestre de 2022) por agrupación de actividad económica (excepto CNAE 56, 64–66 y 95.1) y tamaño de la empresa. Análisis de Big Data. https://www.ine.es/jaxi/Datos.htm?tpx=53911

Jansen J (2005) Ambidextrous organizations: a multiple-level study of absorptive capacity, exploratory and exploitative innovation and performance (No. 55)

Kafetzopoulos D, Psomas E (2016) The relationship between innovation and firm performance: an empirical analysis. Int J Produc Perform Manag 65:39–58

Karimi J, Walter Z (2015) The role of dynamic capabilities in responding to digital disruption: A factor-based study of the newspaper industry. J Management Inf Syst 32:39–81

Kier AS, McMullen JS (2018) Entrepreneurial imaginativeness in new venture ideation. Acad Manage J 61:2265–2295

Kim KJ, Lim CH, Lee DH, Lee J, Hong YS, Park K (2012) A concept generation support system for product-service development. Service Science 4(4):349–364

Kraus S, Breier M, Lim WM, Dabić M, Kumar S, Kanbach D, Ferreira JJ (2022a) Literature reviews as independent studies: guidelines for academic practice. Rev Manage Sci 16:2577–2595

Kraus S, Durst S, Ferreira JJ, Veiga P, Kailer N, Weinmann A (2022b) Digital transformation in business and management research: An overview of the current status quo. Int J Inf Manage 63:102466

Kraus S, Jones P, Kailer N, Weinmann A, Chaparro-Banegas N, Roig-Tierno N (2021) Digital transformation: An overview of the current state of the art of research. SAGE Open 11:21582440211047576

Kumar S, Sahoo S, Lim WMK, S, Bamel, U, (2022) Fuzzy-set qualitative comparative analysis (fsQCA) in business and management research: A contemporary overview. Technol Forecast Soc Change 178:121599

Leal-Rodríguez AL, Sanchís-Pedregosa C, Moreno-Moreno AM, Leal-Millán AG (2023) Digitalization beyond technology: Proposing an explanatory and predictive model for digital culture in organizations. J Innov Knowl 8:100409

Lin Y, Wu LY (2014) Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J Bus Res 67:407–413

Loebbecke C, Picot A (2015) Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J Strategic Inf Syst 24:149–157

Maroufkhani P, Wagner R, Wan Ismail WK, Baroto MB, Nourani M (2019) Big data analytics and firm performance: A systematic review. Information 10:226

Maroufkhani P, Tseng ML, Iranmanesh M, Ismail WKW, Khalid H (2020) Big data analytics adoption: Determinants and performances among small to medium-sized enterprises. Int J Inf Manag 54:102190

Mas-Tur A, Roig-Tierno N, Soriano DR (2016) Barriers to women entrepreneurship. PLS vs. QCA: do different methods yield different results?. In Proceedings of International Academic Conferences (No. 3305622). Int Inst Soc Econ Sci

Matarazzo MP, Penco L, Profumo G, Quaglia R (2021) Digital transformation and customer value creation in Made in Italy SMEs: a dynamic capabilities perspective. J Bus Res 123:642–656

McKinsey & Company (2022) Three New Mandates for Capturing a Digital Transformation's Full Value. https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/three-new-mandates-for-capturing-a-digital-transformations-full-value

Mergel I, Edelmann N, Haug N (2019) Defining digital transformation: results from expert interviews. Government Inf Q 36:101385

Mikalef P, Boura M, Lekakos G (2017) Exploring the characteristics and the sources of big data projects: an empirical study. J Bus Res 70:320–327

Mikalef P, Boura M, Lekakos G (2019a) Exploring the impact of big data analytics on innovation. Information & Management 56:103–120

Mikalef P, Giannakos M, Pappas IO (2018) Big data analytics capabilities: a systematic literature review and research agenda. IseB 16:547–578

Mikalef P, Pappas IO, Krogstie J, Giannakos MN (2019b) Digital transformation: review, development and future directions. J Bus Res 100:360–371

Munir R, Siddiqi J, Hussain M, Saif-Ur-Rehman M (2022) Big data analytics and social media marketing: an empirical investigation of small and medium enterprises. J Bus Res 141:98–109

Nakata C, Zhu Z, Kraimer ML (2008) The complex contribution of information technology capability to business performance. Journal of Managerial Issues 485–506

Nambisan S, Lyytinen K, Majchrzak A, Song M (2019) Digital innovation management: reinventing innovation management research in a digital world. MIS Q 43:1101–1121

Nambisan S, Zahra SA (2016) Digital entrepreneurship: toward a digital technology perspective of entrepreneurship. Entrep Theory Pract 41:1029–1055

Nicolás-Agustín JL, García-Peñalvo FJ, Zangrando V (2021) Does digital transformation enhance innovation capacity in organizations? Lit Rev Sustainability 13:2009

Oberer B, Erkollar A (2018) Leadership 4.0: Digital leaders in the age of industry 4.0. Int J Organiz Leadersh. Retrieved from: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3337644 Consulted: 15/03/2022

Ordanini A, Parasuraman A, Rubera G (2014) When the recipe is more important than the ingredients: a qualitative comparative analysis (QCA) of service innovation configurations. J Serv Res 17:134–149

Perdana A, Lee HH, Arisandi D, Koh S (2022a) Accelerating data analytics adoption in small and mid-size enterprises: a singapore context. Technol Soc 69:101966

Perdana A, Lee HH, Koh S, Arisandi D (2022b) Data analytics in small and mid-size enterprises: enablers and inhibitors for business value and firm performance. Int J Account Inf Syst 44:100547

Petter S, Straub D, Rai A (2007) Specifying formative constructs in information systems research. MIS Q 31:623–656

Pramanik S, Guha D, Chatterjee S (2019) Digital transformation and its impact on big data analytics capability: an exploratory study. J Bus Res 98:417–428

Ragin CC (2000) Fuzzy-set social science. Univ Chicago Press

Ragin CC (2006) Set relations in social research: evaluating their consistency and coverage. Polit Anal 14:291–310

Ragin CC (2008) Measurement versus calibration: a set‐theoretic approach

Raguseo E, Vitari C (2018) Big data analytics capabilities and performance: a systematic literature review and research agenda. in proceedings of the 51st Hawaii Int Conf Syst Sci

Ransbotham S, Kiron D (2017) The benefits and challenges of the digital business transformation. MIT Sloan Manage Rev 58:1–12

Rasoolimanesh SM, Ringle CM, Sarstedt M, Olya H (2021) The combined use of symmetric and asymmetric approaches: partial least squares-structural equation modeling and fuzzy-set qualitative comparative analysis. Int J Contemp Hosp Manag 33:1571–1592

Rialti R, Zollo L, Ferraris A, Alon I (2019) Big data analytics capabilities and performance: evidence from a moderated multi-mediation model. Technol Forecast Soc Change 149:119781

Ribeiro-Navarrete S, Botella-Carrubi D, Palacios-Marqués D, Orero-Blat M (2021) The effect of digitalization on business performance: an applied study of KIBS. J Bus Res 126:319–326

Ringle CM, Wende S, Will A (2015) SmartPLS 3. Boenningstedt: SmartPLS GmbH

Roblek V, Meško M, Pušavec F, Likar B (2021) The role and meaning of the digital transformation as a disruptive innovation on small and medium manufacturing enterprises. Front Psychol 12:592528

Romijn H, Albaladejo M (2002) Determinants of innovation capability in small electronics and software firms in southeast England. Res Policy 31:1053–1067

Rosenbusch N, Brinckmann J, Bausch A (2011) Is innovation always beneficial? a meta-analysis of the relationship between innovation and performance in SMEs. J Bus Ventur 26:441–457

Sahoo S, Upadhyay A, Kumar A (2023) Circular economy practices and environmental performance: analysing the role of big data analytics capability and responsible research and innovation. Bus Strateg Environ 32:6029–6046

Schneider CQ, Wagemann C (2010) Standards of good practice in qualitative comparative analysis (QCA) and fuzzy-sets. Comparat Sociol 9:397–418

Shah TR (2022) Can big data analytics help organizations achieve sustainable competitive advantage? Dev Enq Technol Soc 68:101801

Sheikh SA, Goje SK (2021) The impact of digital transformation on organizational performance: a literature review. J Organiz Change Manage 34:404–427

Singh S, Bala N (2024) Industry 4.0: Its evolution and future prospects. In Industry 4.0. CRC Press

Skare M, de Obesso MDL, Ribeiro-Navarrete S (2023) Digital transformation and European small and medium enterprises (SMEs): a comparative study using digital economy and society index data. Int J Inf Manage 68:102594

Su CH, Nguyen TH, Li M, Cheng CC (2021) Big data analytics capabilities and firm performance: a systematic review and research agenda. J Bus Res 131:57–70

Teece D, Pisano G (2003) The dynamic capabilities of firms. Springer, Berlin Heidelberg

Teece DJ (2007) Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strateg Manage J 28:1319–1350

Teng X, Wu Z, Yang F (2022) Research on the relationship between digital transformation and performance of SMEs. Sustainability 14:6012

Tho ND, Trang NTM (2015) Can knowledge be transferred from business schools to business organizations through in-service training students? SEM and fsQCA findings. J Bus Res 68:1332–1340

Thoeben KV, Vos J, Waller MA (2017) Beyond digital transformation: why culture, talent, and organizational design matter. Deloitte Review 20:96–109

Upadhyay P, Kumar A (2020) The intermediating role of organizational culture and internal analytical knowledge between the capability of big data analytics and a firm’s performance. Int J Inf Manage 52:102100

Verhoef PC, Bijmolt TH (2019) Digital transformation: a review and synthesis. J Brand Manage 26:1–14

Verhoef PC, Kooge E, Walk N (2016) Creating value with big data analytics: making smarter marketing decisions. Routledge

Volberda HW, Khanagha S, Baden-Fuller CM, Mihalache OR, Birkinshaw J (2021) Strategizing in a digital world: overcoming cognitive barriers, reconfiguring routines and introducing new organizational forms. Long Range Plann 54:102110

Wamba SF, Akter S, Edwards A, Chopin G, Gnanzou D (2017) How big data can make big impact: findings from a systematic review and a longitudinal case study. Int J Prod Econ 183:230–246

Wamba SF, Dubey R, Gunasekaran A, Akter S (2020) The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. Int J Prod Econ 222:107–498

Wang S, Zhang R, Yang Y, Chen J, Yang S (2023) Has enterprise digital transformation facilitated the carbon performance in Industry 4.0 era? evidence from Chinese industrial enterprises. Comput Ind Eng 184:109576

Wang Y, Wang Y, Yang Y, Shi Y (2020) How does digital transformation affect organizational performance? the roles of information technology investment intensity and innovation capability. Inf Manage 57:103166

Welch H, Brodie S, Jacox MG, Bograd SJ, Hazen EL (2020) Decision-support tools for dynamic management. Conserv Biol 34:589–599

Wen K, Alessa N, Marah K, Kyeremeh K, Ansah ES, Tawiah V (2023) The impact of corporate governance and international orientation on firm performance in smes: evidence from a developing country. Sustainability 15:5576

Woodside AG (2013) Moving beyond multiple regression analysis to algorithms: calling for adoption of a paradigm shift from symmetric to asymmetric thinking in data analysis and crafting theory. J Bus Res 66:463–472

Yang Y, Shamim S, Herath DB, Secchi D, Homberg F (2023) The evolution of HRM practices: big data, data analytics, and new forms of work. Rev Managerial Sci 1–6

Yuliantari NPY, Pramuki NMWA (2021) The role of digital transformation and digital innovation to SMEs performance in Bali-Indonesia. International Journal of Science and Management Studies 4(6):9–16

Zareravasan A (2023) Boosting innovation performance through big data analytics: an empirical investigation on the role of firm agility. J Inform Sci 49:1293–1308

Zhang J, Long J, von Schaewen AME (2021) How does digital transformation improve organizational resilience?—findings from PLS-SEM and fsQCA. Sustainability 13:11487

Zhang Q, Hartley K (2018) The effect of innovation on SME performance: a measurement approach. J Small Bus Manage 56:142–157

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. The data collection of this study was funded by “Cátedra de Empresa y Humanismo” of University of Valencia, and the authors want to acknowledge Prof. Tomás Gonzalez Cruz for his help and support along the development of this research.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Maria Orero-Blat, Antonio Leal Rodríguez, Daniel Palacios Marqués and Alberto Ferraris and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors have no competing interests to declare that are relevant to the content of this article.

Data transparency

All data and materials as well as software application or custom code support their published claims and comply with field standards.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1: Questionnaire

Appendix 1: Questionnaire

1.1 Digital Transformation (Nicolás-Agustín et al. 2021)

Rate 1 to 7 the following aspects according to your perception within your company, 1 being 'strongly disagree', 2 'disagree', 3 'somewhat disagree', 4 'indifferent', 5 'more agree than disagree', 6 'agree' and 7 'strongly agree' for the current situation of your organization.

-

1.

A flexible organizational structure that allows us to deal with the changes brought about by digital transformation

-

2.

Digitization of products and services offered to customers.

-

3.

Digital communication channels with our employees, such as corporate portals, WhatsApp groups, digital newsletters and corporate social networks.

-

4.

Digital communication channels with our suppliers: digital orders, centralized purchasing, EDI, etc.

-

5.

Digital order forms (include B2b or b2c).

-

6.

Use of digital applications for internal financial statements or Blockchain.

-

7.

Extracting information from big data analysis for decision making 8.

-

8.

Use of digital surveys to measure customer satisfaction.

-

9.

Use of metrics to measure the effectiveness and efficiency of digital channels: CRM, web visits, digital channel visits, social media interactions, etc.

-

10.

Use of dashboards to analyze the company's results.

1.2 Big Data Analytical Capabilities (Adapted from Kim et al. 2012)

Rate 1 to 7 the following aspects according to your perception within your company, 1 being 'strongly disagree', 2 'disagree', 3 'somewhat disagree', 4 'indifferent', 5 'more agree than disagree', 6 'agree' and 7 'strongly agree' for the current situation of your organization.

About organization's technology infrastructure

-

1.

If we have multiple offices or employees work outside the central office (telecommuting, branch offices and mobile devices), all of them are connected to the central office to share analytical information.

-

2.

There are no identifiable communication bottlenecks within our organization for sharing analytical information.

-

3.

Software applications can be used simultaneously on multiple analytics platforms.

-

4.

Information is shared seamlessly across our organization, regardless of location.

-

5.

Generic software modules are widely used in the development of new systems.

-

6.

We continually examine innovative opportunities for the strategic use of business analytics.

About BDA management capacity:

-

1.

We perform business analysis planning processes systematically.

-

2.

We frequently adjust business analysis plans to better adapt to changing conditions in the environment.

-

3.

When we make business analysis investment decisions, we estimate the effect they will have on the productivity of employees' work.

-

4.

When we make business analytics investment decisions, we project how much these options will help end users make faster decisions at a lower cost.

-

5.

In our organization, business analysts and line staff meet regularly to discuss important issues and coordinate efforts.

-

6.

In our organization, information is shared between business analysts and line staff so that those making decisions or performing work have access to all available information.

-

7.

In our organization, the responsibility for analytical development is clear.

-

8.

We constantly monitor the performance of the analytical function.

-

9.

Our company is better than the competition at connecting parties, providing analytical methods, or incorporating detailed information into a business process.

About the big data skills of your organization's staff:

-

1.

Our analysis staff is very capable in programming skills.

-

2.