Abstract

Most of the existing literature on optimal trade execution in limit order book models assumes that resilience is positive. But negative resilience also has a natural interpretation, as it models self-exciting behaviour of the price impact, where trading activities of the large investor stimulate other market participants to trade in the same direction. In the paper we discuss several new qualitative effects on optimal trade execution that arise when we allow resilience to take negative values. We do this in a framework where both market depth and resilience are stochastic processes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In an illiquid financial market large orders have a substantial adverse effect on the realized prices. It is, therefore, reasonable to divide a large order into smaller ones when an investor faces the task of closing a large position in an illiquid market. The scientific literature on optimal trade execution problems deals with the optimization of such trading schedules. The inputs are time horizon \(T\in (0,\infty )\), size \(x\in {\mathbb {R}}\) (shares of a stock) of the financial position to be closed until time T and model of the price impact.

The literature on optimal trade execution takes price impact as exogenously given. Depending on how the price impact is modeled the majority of current literature can be naturally divided into two groups.

In the first group of models, execution strategies \((X_t)_{t\in [0,T]}\) have absolutely continuous paths \(t\mapsto X_t\), and the price impact at any time t depends only on the derivative \(\dot{X_t}\) at time t. In particular, the price impact at time t is independent of all orders executed at times prior to t and does not influence the impact of the orders executed at times after t. Essentially, what is modeled in this approach is only market depth, and the price impact is purely instantaneous in the sense described above.Footnote 1

In the second group of models, trades induce a transient price impact that decays over time due to resilience effects of the price. In such models, the execution price at time t is influenced in a nontrivial way by orders filled at times prior to t, and the execution at time t in turn influences the execution prices of subsequent orders. Essentially, there are now two quantities to be modeled separately: market depth and resilience. Such models are inspired by a limit order book interpretation. The pioneering work Obizhaeva and Wang (2013) models the price impact via a block-shaped limit order book (which translates into a constant market depth), where the impact decays exponentially at a constant rate. Mathematically, it is this rate that is called resilience.Footnote 2 Our model in this paper falls into this second group.

As explained above, there is a clear qualitative difference between the models in the first and in the second group. Moreover, this translates into qualitative differences in the optimal execution strategies. One of the facets worth mentioning in this respect is that, as opposed to absolutely continuous strategies in the first group of models, optimal strategies in the second group are càdlàg and usually exhibit jumps (in a sense, jumps at certain times allow to better exploit finite resilience).Footnote 3

Most of the existing literature within the second group of models assumes that resilience is positive. The explanation is that the impact of the trade should decay over time. But negative resilience also has a natural interpretation, as it models self-exciting behaviour of the price impact, where trading activities of the large investor stimulate other market participants to trade in the same direction. From this viewpoint, it seems reasonable to expect that there are (particularly unstable) periods in financial markets when the resilience is negative. In this paper we discuss several new qualitative effects in optimal trade execution that can arise when we allow the resilience to take negative values.

In practice, resilience is difficult to estimate from real data (cf. Section 7.3 in Roch (2022)), and we are not aware of any empirical study of whether the resilience can be negative. On the other hand, there recently appeared many papers on trade execution that model self-excitement of price impact in different ways, while, as explained above, negative resilience is an alternative way of modeling this effect. As in Cayé and Muhle-Karbe (2016) and in Fu et al. (2022a), we motivate self-exciting price impact by the following reasons. Imagine, for instance, a large trader performing extensive selling. Firstly, a continued selling pressure makes it more and more difficult to find counterparties. Secondly, such an extensive selling by the large trader may trigger stop-loss strategies by other market participants, where they start selling in anticipation of further decrease in the price. Thirdly, extensive selling may also attract predatory traders that employ front-running strategies. In each case, we obtain an increased price impact for subsequent trades.

For existing approaches to self-exciting price impact, see Alfonsi and Blanc (2016), Cartea et al. (2018), Cayé and Muhle-Karbe (2016), Fu et al. (2022a) and references therein. We now explain that, mathematically, all these approaches and ours are pairwise substantially different. In Cayé and Muhle-Karbe (2016) the framework is of the Almgren–Chriss type, and self-excitement is produced by the trades of the large trader in a way that the price impact coefficient depends on the trading activity of the large trader. In Alfonsi and Blanc (2016) the orders of the large trader incur price impact like in the Obizhaeva–Wang model (with positive resilience), while the orders of other market participants are modeled by Hawkes processes with self-exciting jump intensities. That is, in contrast to the previously mentioned approach, self-excitement is produced by the trades of other market participants. Cartea et al. (2018) again use Hawkes processes but in a quite different way: they consider an execution model where the large trader places limit orders whose fill rates depend on mutually exciting “influential” market order flows. Fu et al. (2022a) consider liquidation games between several large traders (and the corresponding mean-field limit as well as the single player subcase) with a self-exciting order flow. In a sense, self-excitement in Fu et al. (2022a) is “more endogenous” than in the other mentioned approaches (including ours, where the resilience process is exogenously given), as in Fu et al. (2022a) there appear “child orders” triggered by the large traders’ trading activity, and as the strategies in Fu et al. (2022a) come out as Nash equilibria in the game. In our approach self-excitement is produced by the trades of the large trader at time instances when the resilience is negative in the Obizhaeva-Wang type model where both market depth and resilience are stochastic processes (differently from Cartea et al. (2018) and like in the other mentioned approaches, the large trader trades with market orders).

Despite the differences in the set-up, it is interesting to observe the following qualitative similarity in the strategies that may result from our approach and from the one in Fu et al. (2022a). Below we, in particular, discuss that, in our framework, it is never optimal to overshoot the execution target whenever the resilience is positive, but it can be optimal to overshoot the target if we allow the resilience to take negative values. In other words, in our framework, the possibility to overshoot the target is a qualitative effect of self-excitation via negative resilience. In the same vein, in the single player benchmark model for Fu et al. (2022a) without self-excitation, which goes back to Graewe and Horst (2017), it is not optimal to overshoot the execution target (this is observed in Theorem 2.2 of Horst and Kivman (2021)), whereas the resulting strategies in the model with self-excitation in Fu et al. (2022a) do sometimes overshoot the target (cf. Figure 1 or Figure 2 in Fu et al. (2022a)).

We now briefly describe our framework. The execution strategies are càdlàg semimartingales \((X_t)_{t\in [0-,T]}\) with \(X_{0-}=x\) and \(X_T=0\). As explained above, we need to allow for jumps (i.e., block trades). In particular, a possibility of a block trade at time 0 means that \(X_{0-}\) can be different from \(X_0\). Notice that we do not require X to have monotone paths, which means that we allow for trading in both directions within the execution strategy. We assume that the realized price of the asset is the sum of a martingale unaffected price and a deviation process \((D_t)_{t\in [0-,T]}\) that carries the price impact. The inputs are the price impact process \((\gamma _t)\) driven by (3), which models market depth, and the resilience process \((\rho _t)\). Both enter the dynamics of the deviation process (4). We see from (4) that the sign of \((\rho _t)\) determines whether the deviation process moves back to zero or moves further away from it. The optimal execution problem is given in (6).

This general setting is elaborated in Ackermann et al. (2021a), where the solution to the optimal execution problem is described via a solution to a challenging quadratic BSDE (characteristic BSDE). In Ackermann et al. (2021a) it is shown that the characteristic BSDE has a solution in two specific subsettings of this general framework. In this paper we also complement these results by establishing the existence for the characteristic BSDE in the subsetting, where the resilience process \((\rho _t)\) and the processes \((\mu _t)\) and \((\sigma _t)\) in dynamics (3) for the price impact process \((\gamma _t)\) are independent from the driving Brownian motion \((W_t)\). It turns out that this subsetting is feasible enough to study some new qualitative effects of negative resilience and to explicitly construct pertinent examples.

It is worth noting that the majority of papers on models with finite resilience considers execution strategies of finite variation. In this stream of literature, strategies of infinite variation were first included by Lorenz and Schied (2013), where they allow for a non-martingale dynamics in the unaffected price, and hence the execution strategies need to account for the fluctuations in it. Recently, strategies of infinite variation emerge in related frameworks of Horst and Kivman (2021) and Fu et al. (2022b). In the framework of Ackermann et al. (2021a) we need to include strategies of infinite variation, as they actually come out as optimal trading schedules, e.g., to account for the fluctuations in \((\gamma _t)\) and \((\rho _t)\). This comes with some adjustments in the conventional setting of the optimal execution problem, where the most important one is the term \(d[\gamma ,X]\) in the dynamics (4) of the deviation process \((D_t)_{t\in [0-,T]}\). As the main theme of this paper is to discuss the effects of negative resilience, we withdraw from an extended discussion of the term \(d[\gamma ,X]\) in (4) but rather refer an interested reader to Ackermann et al. (2021a). From this perspective, we mention that Carmona and Webster (2019) provide a strong empirical evidence that trading strategies of large traders are of infinite variation nature.

We, finally, embed our paper into a broader set of related literature on optimal trade execution in models with finite resilience. After the pioneering paper Obizhaeva and Wang (2013) subsequent work either extends the framework in different directions or suggests alternative frameworks with similar features.Footnote 4 Alfonsi et al. (2008) study constrained portfolio liquidation in a model of the type as in Obizhaeva and Wang (2013). There is a subgroup of models which include more general limit order book shapes, see Alfonsi et al. (2010), Alfonsi and Schied (2010), Predoiu et al. (2011). Models in another subgroup extend the exponential decay of the price impact to general decay kernels, see Alfonsi et al. (2012), Gatheral et al. (2012). Finite player games with deterministic model parameters and transient impact were studied by Luo and Schied (2019), Schied et al. (2017), Schied and Zhang (2019) and Strehle (2017). Models with transient multiplicative price impact have recently been analyzed in Becherer et al. (2018a, 2018b), whereas Becherer et al. (2019) contains a stability result for the involved cost functionals. Superreplication and optimal investment in a block-shaped limit order book model with exponential resilience is discussed in Bank and Dolinsky (2019, 2020) and in Bank and Voß (2019). The present paper falls into the subgroup that studies time-dependent (possibly stochastic) market depth and resilience, see Ackermann et al. (2021a, 2021b), Alfonsi and Acevedo (2014), Bank and Fruth (2014), Fruth et al. (2014), and Fruth et al. (2019). To point out the difference from our present paper, we notice that all mentioned papers except Ackermann et al. (2021a, 2021b) consider only positive resilience, the framework in Ackermann et al. (2021b) is in discrete time, while Ackermann et al. (2021a) does not study the question of what kind of new effects can arise when the (time-dependent) resilience process is allowed to take negative values.

The paper is organized as follows. Section 2 contains a precise description of our setting and formulates the problem of optimal trade execution in this setting. Section 3 describes the solution to this optimal trade execution problem based on the results from Ackermann et al. (2021a). The key ingredient here is Sect. 3.1 that establishes existence of a solution to the characteristic BSDE in our setting. In Sect. 4 we present two general results about the possibility for optimal execution strategies in such models to overjump zero or to exhibit premature closure. Loosely speaking, a necessary condition for overjumping zero or premature closure is to have negative resilience at least for some time, while a sufficient condition for that is to have negative resilience for some time close to the time horizon T. See Sect. 4 for the precise formulations and more detailed discussions. Via case studies in Sect. 5 we address several questions that arise in discussions in Sect. 4. For instance, one of the examples shows that the “close to \(T\,\)”-requirement in the sufficient condition mentioned above is essential. It is worth mentioning that Sect. 5 contains both examples with deterministic optimal strategies and examples with stochastic ones and, in the latter examples, the strategies are of infinite variation. In one of other examples we see that, with resilience that can take negative values, it is possible that the optimal execution strategy closes the position at a certain point in time and reopens it immediately. Finally, the paper is concluded with a more tricky example, where the position is kept closed during a time interval, after which it is reopened again.

2 Problem formulation

Let us introduce the stochastic order book model in which we analyze the effects of negative resilience. In Remark 2.2 below we explain in which sense the model is a special case of the model considered in Ackermann et al. (2021a) and in which sense not. Remark 2.1 provides information on where to find more detailed motivations and derivations of the order book model.

We fix a terminal time \(T>0\) and consider trading in the time interval [0, T]. Let \((\Omega , {\mathcal {F}}_T, ({\mathcal {F}}_t)_{t \in [0,T]}, P)\) be a filtered probability space that satisfies the usual conditions and supports a Brownian motion \(W=(W_t)_{t\in [0,T]}\). Furthermore, we assume that \(({\mathcal {F}}_t)_{t \in [0,T]}\) has the structure \({\mathcal {F}}_t=\bigcap _{\varepsilon >0}({\mathcal {F}}^W_{t+\varepsilon }\vee {\mathcal {F}}^\perp _{t+\varepsilon })\), \(t \in [0,T)\), \({\mathcal {F}}_T={\mathcal {F}}^W_T\vee {\mathcal {F}}^\perp _T\), where \(({\mathcal {F}}^W_t)_{t \in [0,T]}\) denotes the filtration generated by W, and \(({\mathcal {F}}^\perp _t)_{t \in [0,T]}\) is a right-continuous complete filtration such that \({\mathcal {F}}_T^W\) and \({\mathcal {F}}^\perp _T\) are independent. Throughout the paper, \(E_t[\cdot ]\) denotes the conditional expectation \(E[\cdot | {\mathcal {F}}_t]\) for \(t \in [0,T]\), and \(\mu _L\) denotes the Lebesgue measure on [0, T].

As input processes we require three \(({\mathcal {F}}^\perp _t)_{t\in [0,T]}\)-progressively measurable processes \(\rho =(\rho _t)_{t\in [0,T]}\), \(\mu =(\mu _t)_{t\in [0,T]}\), and \(\sigma =(\sigma _t)_{t\in [0,T]}\) such that there exist deterministic \(\overline{c}, \overline{\varepsilon }\in (0,\infty )\) such that

Here and in what follows, we write \(\rho _.\), \(\mu _.\), etc., to emphasize the presence of the time variable, i.e., we do so to indicate that we speak about the process as a whole. Assumption (1) is a structural condition on the input processes which, roughly speaking, ensures that the minimization problem under consideration (see (6) below) is convex. To see this, we refer to the alternative representation of the cost function provided in (Theorem 3.1 Ackermann et al. (2021a)). Note that the process \(2\rho + \mu -\sigma ^2\) also shows up in the denominator of the driver of the characteristic BSDE (7). Assumption (2) is a boundedness condition that we need in order to ensure existence of a solution of BSDE (7). Please note that Assumption (1) in combination with Assumption (2) also implies boundedness of \(\sigma \).

The two processes \(\mu \) and \(\sigma \) are used to model price impact. More precisely, we define the price impact process \(\gamma =(\gamma _t)_{t\in [0,T]}\) to be the solution of

where \(\gamma _0\) is a positive \({\mathcal {F}}_0\)-measurable random variable. Consequently, \(\gamma \) is the positive continuous \(({\mathcal {F}}_t)_{t\in [0,T]}\)-adapted process

Given an open position \(x\in {\mathbb {R}}\) to be liquidated, an execution strategy is a càdlàg semimartingale \(X=(X_t)_{t\in [0-,T]}\) such that \(X_{0-}=x\) and \(X_T=0\). For any \(t \in [0,T]\), the quantity \(X_{t-}\) describes the remaining position to be closed during [t, T]. As in Ackermann et al. (2021a) we follow the convention that a positive position \(X_{t-}>0\) means the trader has to sell an amount of \(|X_{t-}|\) shares, whereas \(X_{t-}<0\) requires to buy an amount of \(|X_{t-}|\) shares. Note that we do not require an execution strategy X to have monotone paths and hence we allow for selling and buying within the same strategy. Moreover, the paths of execution strategies can exhibit jumps and thus so-called block trades are possible.

We assume that trading according to an execution strategy X affects the asset price. To model this influence we associate to every execution strategy X a deviation process \(D=(D_t)_{t \in [0-,T]}\) with initial deviation \(d \in {\mathbb {R}}\). We assume that the actual price of the asset is the sum of an unaffected price and the price deviation D. The unaffected price is assumed to be a martingale satisfying suitable integrability assumptions. This ensures that the optimal trade execution problem we are about to set up (see (6) below) does not depend on the unaffected price process and that we only need to focus on the deviation D (see (Remark 2.2 Ackermann et al. (2021a)) for more detail). The deviation is modeled as follows. Given \(x,d \in {\mathbb {R}}\) and an execution strategy \(X=(X_t)_{t\in [0-,T]}\), the deviation process \(D=(D_t)_{t\in [0-,T]}\) associated to X is defined by

i.e.,

When ignoring the effects of X on D at time \(t\in [0,T]\) we see from (4) that the sign of \(\rho _t\) determines whether the deviation tends back to 0 or further moves away from it. In the case \(\rho > 0\), which is typically assumed in the literature, the deviation is always reverting to 0 and the speed of reversion is determined by the magnitude of \(\rho \). The input process \(\rho \) thus models how fast the order book recovers from past trades and is therefore called the resilience process. We allow \(\rho \) to also take negative values and thereby enable the incorporation of signaling effects, where, e.g., a series of buy trades might indicate the arrival of further buy trades and therefore lead to a further growth of the deviation process.

For \(x,d \in {\mathbb {R}}\), we let \({\mathcal {A}}_0(x,d)\) be the set of all execution strategies X (i.e., càdlàg semimartingales \(X=(X_t)_{t\in [0-,T]}\) with \(X_{0-}=x\) and \(X_T=0\)) such that all three conditions

are satisfied.

Given \(x,d \in {\mathbb {R}}\) and \(X \in {\mathcal {A}}_0(x,d)\), we then consider the expected costs

The optimal trade execution problem considered here consists in minimizing the expected costs over \(X \in {\mathcal {A}}_0(x,d)\). An optimal strategy is an execution strategy \(X^* \in {\mathcal {A}}_0(x,d)\) such that

We point out that possible jumps of the integrators at time 0 contribute to the integrals \(\int _{[0,t]} \ldots dX_s\), \(\int _{[0,t]} \ldots d[X]_s\), and \(\int _{[0,t]} \ldots d[\gamma ,X]_s\) in the definition of the deviation (4) and the expected costs (5).

Remark 2.1

We refer to the introduction of Ackermann et al. (2021a) as well as Sections 4, 5 and Appendix A therein for a discussion of the specific form of the deviation dynamics (4) and the expected costs (5). In short, they come from a block-shaped symmetric limit order book model, and, e.g., the term \(d[\gamma ,X]\) in (4) appears because execution strategies are not necessarily of finite variation. We also mention Carmona and Webster (2019) for empirical evidence that, in related settings, trading strategies are of infinite variation nature.

Remark 2.2

Let us briefly explain in which sense the setting outlined above is a special case of the model considered in Ackermann et al. (2021a). In Ackermann et al. (2021a) we consider a general continuous local martingale M instead of the Brownian motion W to drive the price impact process \(\gamma \) in (3). Moreover, in Ackermann et al. (2021a) we do not require that the three input processes \(\rho \), \(\mu \), and \(\sigma \) are independent of the martingale M.

In (Section 7 Ackermann et al. (2021a)) we establish existence of a solution to a characteristic BSDE (see (3.2) & (3.3) Ackermann et al. (2021a)) for the trade execution problem in two subsettings: The first one assumes that \(\sigma \equiv 0\), whereas the second one assumes that the underlying filtration is continuous (in the sense that every martingale is continuous). In the present paper we complement these results by establishing in Theorem 3.1 below existence of a solution to the BSDE in the subsetting outlined above. This is included in neither of the two subsettings considered in Ackermann et al. (2021a).

3 Solution of the trade execution problem

In this section we provide a probabilistic solution of the optimal trade execution problem (6). To this end, we establish in Sect. 3.1 an existence result for a characteristic BSDE associated to problem (6). Subsequently, in Sect. 3.2, we combine this result with the main results in Ackermann et al. (2021a) to obtain a representation of the optimal strategy for (6).

3.1 Characteristic BSDE

A representation of the minimal expected costs, a characterization for the existence of an optimal strategy as well as a formula for the optimal strategy in the general framework considered in Ackermann et al. (2021a) are provided as a main result in (Theorem 3.4 Ackermann et al. (2021a)). This result is based on the existence of a solution of a certain BSDE ((3.2) & (3.3) Ackermann et al. (2021a)).

In the setting of the present paper, where \(\rho ,\mu ,\sigma \) are independent of the Brownian motion W, we consider the BSDE

By a solution of (7) we mean a pair \((Y,M^\perp )\) such that

-

(7) is satisfied P-a.s.,

-

Y is an \(({\mathcal {F}}_t)_{t\in [0,T]}\)-adapted, càdlàg, [0, 1/2]-valued process, and

-

\(M^\perp \) is a càdlàg \(({\mathcal {F}}_t)_{t\in [0,T]}\)-martingale with \(M_0^\perp =0\), \(E([M^\perp ]_T)<\infty \), and \([M^\perp ,W]=0\).

We show in Theorem 3.1 the existence of a solution \((Y,M^\perp )\) of (7).Footnote 5 Any such solution \((Y,M^\perp )\) of (7) provides a solution \((Y,0,M^\perp )\) of the BSDE ((3.2) & (3.3) Ackermann et al. (2021a)) (in the sense that ((3.4) Ackermann et al. (2021a)) is satisfied). In particular, we can invoke in Section 3.2 below the main results from (Section 3 Ackermann et al. (2021a)).

Theorem 3.1

Under (1) and (2) there exists a solution \((Y,M^\perp )\) of (7).

Proof

Let \(L:{\mathbb {R}}\rightarrow [0,1/2]\) be the truncation function defined by \(L(y)=(y\vee 0)\wedge \frac{1}{2}\), \(y\in {\mathbb {R}}\). Let \({\overline{f}}:\Omega \times [0,T]\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) be the function defined by

We first consider BSDE (7) with its driver replaced by \({\overline{f}}\) and on the filtered probability space \((\Omega , {\mathcal {F}}^\perp _T, ({\mathcal {F}}^\perp _t)_{t \in [0,T]}, P|_{{\mathcal {F}}_T^\perp })\), where \(P|_{{\mathcal {F}}_T^\perp }\) denotes the probability measure P restricted to the sigma algebra \({\mathcal {F}}_T^\perp \). Note that the expressions “P-a.s.” and “\(P|_{{\mathcal {F}}_T^\perp }\)-a.s.” have the same meaning. In the calculations below we assume without loss of generality that \(\rho \), \(\mu \), and \(\sigma \) satisfy (1) and (2) for all \((\omega ,t)\), as we can otherwise replace them in \(\overline{f}\) with \(({\mathcal {F}}^\perp _t)\)-progressively measurable processes \(\overline{\rho }\), \(\overline{\mu }\), and \(\overline{\sigma }\) that satisfy (1) and (2) for all \((\omega ,t)\) and such that \(\overline{\rho }=\rho \) \(P\times \mu _L\)-a.e., \(\overline{\mu }=\mu \) \(P\times \mu _L\)-a.e., and \(\overline{\sigma }=\sigma \) \(P\times \mu _L\)-a.e. Observe that for all \(t\in [0,T]\) the function \({\mathbb {R}}\ni y \mapsto {\overline{f}}(t,y)\) is continuous. Moreover, it is concave on [0, 1/2] and constant on the complement \({\mathbb {R}}\setminus [0,1/2]\). This implies for all \(t\in [0,T]\) and \(y'<y\) that

It follows that for all \(t\in [0,T]\) and all \(y,y' \in {\mathbb {R}}\) it holds

Moreover, it holds for all \(t \in [0,T]\) that

This implies in particular that \(\sup _{y\in {\mathbb {R}}}|{\overline{f}}(\cdot ,y) - {\overline{f}}(\cdot ,0)|\in L^2(\Omega \times [0,T])\). By (Proposition 5.1 Klimsiak and Rzymowski (2021)) (see also (Theorem 1 Kruse and Popier (2016))) there exists a pair \((Y,M^\perp )\) such that BSDE (7) on \((\Omega , {\mathcal {F}}^\perp _T, ({\mathcal {F}}^\perp _t)_{t \in [0,T]}, P|_{{\mathcal {F}}_T^\perp })\) with its driver replaced by \({\overline{f}}\) is satisfied a.s., Y is a càdlàg \(({\mathcal {F}}_t^\perp )_{t\in [0,T]}\)-adapted process with \(E[\sup _{t \in [0,T]} Y_t^2]<\infty \), and \(M^\perp \) is a càdlàg \(({\mathcal {F}}_t^\perp )_{t\in [0,T]}\)-martingale with \(M_0^\perp =0\) and \(E[[M^\perp ]_T]<\infty \).

Next, note that (0, 0) is a solution of the BSDE with driver \({\overline{f}}\) and terminal condition 0. Then a comparison principle for BSDEs e.g., (Proposition 4 Kruse and Popier (2016)) proves that \(Y_t\ge 0\) for all \(t\in [0,T]\) a.s. Furthermore, it holds a.s. that for all \(t\in [0,T]\)

Again the comparison principle ensures that \(Y_t\le \frac{1}{2}\) for all \(t\in [0,T]\) a.s. In particular, the truncation function in (8) is inactive. Therefore, \((Y,M^\perp )\) also a.s. satisfies BSDE (7) and Y is [0, 1/2]-valued.

Since \({\mathcal {F}}_T^W\) and \({\mathcal {F}}_T^\perp \) are independent and \({\mathcal {F}}_t=\bigcap _{\varepsilon >0}({\mathcal {F}}_{t+\varepsilon }^W\vee {\mathcal {F}}_{t+\varepsilon }^\perp )\) for all \(t\in [0,T)\), we have that \(M^\perp \) is not only an \(({\mathcal {F}}_t^\perp )_{t\in [0,T]}\)-martingale, but also an \(({\mathcal {F}}_t)_{t\in [0,T]}\)-martingale. Furthermore, we can show that \(M^\perp W\) is an \(({\mathcal {F}}_t)_{t\in [0,T]}\)-martingale. It follows that \(\langle M^\perp , W \rangle =0\). Since W is continuous, it holds that \([M^\perp ,W]\) is continuous, and hence \([M^\perp ,W]=0\). This completes the proof. \(\square \)

3.2 Representation of the optimal strategy

For a solution \((Y,M^\perp )\) of (7), we recall from ((3.5) Ackermann et al. (2021a)) the process \(\widetilde{\beta }=(\widetilde{\beta }_t)_{t \in [0,T]}\) defined by, in the present set-up,

By (1), (2), and the fact that Y is [0, 1/2]-valued, we have that \(\widetilde{\beta }\) is \(P\times \mu _L\)-a.e. bounded. It thus follows from (Proposition 3.8 Ackermann et al. (2021a)) that the solution of (7) is unique up to indistinguishability. Furthermore, by boundedness of \(\widetilde{\beta }\), under the condition that

we obtain from (Theorem 3.4 Ackermann et al. (2021a)) for any initial values \(x,d\in {\mathbb {R}}\) (see also (Lemma 3.3 Ackermann et al. (2021a)) for the case \(x=\frac{d}{\gamma _0}\)) the existence of an optimal strategy, which is unique up to \(P\times \mu _L\)-null sets. Notice that, in our present context, this is equivalent to uniqueness up to indistinguishability. Indeed, if \(X^{(1)}\) and \(X^{(2)}\) are optimal strategies, then they are indistinguishable, as \(X^{(1)}\) and \(X^{(2)}\) are càdlàg and \(X^{(1)}=X^{(2)}\) \(P\times \mu _L\)-a.e. Note that condition (10) is in particular guaranteed if \(\rho ,\mu ,\sigma \) are deterministic and of finite variation, as in the examples in Sect. 5 below.

We extract the following representation for the optimal strategy and its associated deviation from (Theorem 3.4 Ackermann et al. (2021a)) provided that (10) holds true. Define

and denote by \({\mathcal {E}}(Q)\) the stochastic exponential of Q, i.e.,

Let \(x,d \in {\mathbb {R}}\). Then the optimal strategy \(\left( X^*_t \right) _{t \in [0-,T]} \in {\mathcal {A}}_0(x,d)\) is given by the formulas

The associated deviation process \((D^*_t)_{t\in [0-,T]}\) is given by

We summarize the statements above in the following theorem.

Theorem 3.2

Assume that (1) and (2) hold true. Then the solution of the BSDE (7) is unique up to indistinguishability. If, in addition, (10) is satisfied, then for all \(x,d \in {\mathbb {R}}\) the unique (up to indistinguishability) optimal strategy \(X^*\) for (6) is given by (11) and the associated deviation process \(D^*\) satisfies (12).

4 Overjumping zero and premature closure

In this section we study qualitative effects of negative resilience on the optimal strategy. In particular, we examine effects that we call overjumping zero and premature closure. Roughly speaking, we are interested in market situations where it is optimal to change a buy program into a sell program (or vice versa), or where it is optimal to close the position strictly before the end of the execution period. More precisely, we intend to identify market conditions under which paths of optimal trade execution strategies with positive probability jump over the target level 0 or already take the value 0 prior to T. To this end recall that under (1), (2), and (10), given an initial position \(x\in {\mathbb {R}}\) and an initial deviation \(d\in {\mathbb {R}}\), the optimal strategy \(X^*\) satisfies for all \(t\in [0,T)\) that

This representation allows to disentangle the contributions to the optimal strategy’s sign of the initial conditions x and d on the one side and the input processes \(\rho \), \(\mu \), and \(\sigma \) defining the market dynamics on the other side. Indeed, since the stochastic exponential \({\mathcal {E}}(Q)\) is positive, the sign of \(X^*_t\) for \(t\in [0,T)\) is determined by the signs of the two factors \((x-\frac{d}{\gamma _0})\) and \((1-\beta _t)\). The first factor \((x-\frac{d}{\gamma _0})\) is determined by the initial conditions, does not depend on time, and thus can only contribute to a change of sign of \(X^*\) at time 0. Note that \((x-\frac{d}{\gamma _0})\) has a different sign than the initial condition \(X^*_{0-}=x\) if and only if \(\gamma _0|x|<{\text {sgn}}(x)d\). A nonzero initial deviation \(d\ne 0\) can thus have the effect that \(X^*\) changes its sign directly at time 0. In practice, one would typically assume that \(d=0\), in which case this factor does not contribute to a change of sign.

In the sequel we focus on the contribution of the second factor \((1-\beta )\) and provide definitions of the effects overjumping zero and premature closure which are only built upon \((1-\beta )\). This factor and hence also these effects are determined by the input processes \(\rho \), \(\mu \), and \(\sigma \) driving the market dynamics and are independent of the initial conditions x and d.

For ease of notation, we extend the domain of \(\beta \) to the point \(0-\) by setting \(\beta _{0-}=0\). In what follows, we denote by \(\pi _\Omega \) the projection operator from \(\Omega \times [0,T]\) onto \(\Omega \).

Definition 4.1

Assume that (1), (2), and (10) hold true. Define

-

(i)

We say that overjumping zero is optimal in the limit order book model driven by \(\rho \), \(\mu \), and \(\sigma \), if \(P(\pi _\Omega (A_{oj}))>0\).

-

(ii)

We say that premature closure is optimal, if \(P(\pi _\Omega (A_{pc}))>0\).

In relation with Definition 4.1 we need to make the following comments.

-

(a)

\(\pi _\Omega (A_{oj}),\pi _\Omega (A_{pc})\in {\mathcal {F}}_T\) by the measurable projection theorem (Theorem I.4.14 Revuz and Yor (1999)) (recall that \({\mathcal {F}}_T\) is complete and notice that \(A_{oj},A_{pc}\in {\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\) and, moreover, are optional sets, as \(\beta \) is adapted and càdlàg).

-

(b)

The terms overjumping zero and premature closure are well-defined, as \(\beta \) satisfying (10) is unique up to indistinguishability.

It is worth noting that the terms overjumping zero and premature closure could be equivalently defined with the help of stopping times:

Lemma 4.2

Assume that (1), (2), and (10) hold true. Then, overjumping zero (resp., premature closure) is optimal if and only if there exists a stopping time \(\tau :\Omega \rightarrow [0,T]\) such that \(P(\tau <T)>0\) and

Lemma 4.2 easily follows from the optional section theorem (Theorem IV.5.5 Revuz and Yor (1999)), which applies because \(A_{oj}\) and \(A_{pc}\) are optional sets. We also remark that a simple attempt to define \(\tau \) as, say, \(T\wedge \inf \{t\in [0,T):(1-\beta _{t-})(1-\beta _t)<0\}\) does not always work, as, for \(\omega \) such that \(\tau <T\) but the infimum is not attained, the expression \((1-\beta _{\tau -})(1-\beta _\tau )\) will be zero.

We now turn to the question about new qualitative effects we can get if we allow for negative resilience. Informally, with positive resilience one will not be able to observe overjumping zero or premature closure in the optimal strategy. On the contrary, if we allow the resilience to take negative values, then overjumping zero and premature closure in the optimal strategy become possible. Propositions 4.3 and 4.4 contain precise mathematical formulations of these statements. After these propositions we also provide a more detailed informal Discussion 4.5.

Proposition 4.3

-

(i)

We have

$$\begin{aligned} \widetilde{\beta }_.\le \left( 1-\frac{\rho _.}{2\rho _.+\mu _.}\right) {\mathbf {1}}_{\{\rho _.+\mu _.>0\}}\le 1\;\; P\times \mu _L\text {-a.e.}\; \text {on}\; \{(\omega ,t)\in \Omega \times [0,T]:\rho _t(\omega )\ge 0\}. \end{aligned}$$ -

(ii)

Assume (10) and that \(\rho \ge 0\) \(P\times \mu _L\)-a.e. Then overjumping zero is not optimal.

-

(iii)

Assume (10) and that there exists an \({\mathcal {F}}_T\)-measurable random variable \(\delta \) such that

$$\begin{aligned} \delta >0\;\;P\text {-a.s.\ and }\rho _.\ge \delta \;\;P\times \mu _L\text {-a.e.} \end{aligned}$$(14)Then neither overjumping zero nor premature closure is optimal.

In relation with Proposition 4.3 we make the following comments.

-

(a)

A rather widespread situation in today’s literature on resilient price impact is to assume a constant resilience. This falls into part (iii) of Proposition 4.3. To discuss the assumption in (iii) in more detail, we remark that, if

$$\begin{aligned} \inf _{t\in [0,T]}\rho _t>0\;\;P\text {-a.s.,} \end{aligned}$$(15)then (14) is satisfied. Indeed, in this case we can take \(\delta =\inf _{t\in [0,T]}\rho _t\) because, by the measurable projection theorem, for all \(z\in {\mathbb {R}}\) we have

$$\begin{aligned} \{\omega \in \Omega :\inf _{t\in [0,T]}\rho _t<z\}= \pi _\Omega (\{(\omega ,t)\in \Omega \times [0,T]:\rho _t(\omega )<z\})\in {\mathcal {F}}_T, \end{aligned}$$i.e., \(\delta :=\inf _{t\in [0,T]}\rho _t\) is \({\mathcal {F}}_T\)-measurable. More precisely, (14) is slightly weaker than (15) and can be, in fact, equivalently expressed as follows: there exists an \({\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\)-measurable \(\widetilde{\rho }\) such that \(\widetilde{\rho }=\rho \) \(P\times \mu _L\)-a.e. and \(\inf _{t\in [0,T]}\widetilde{\rho }_t>0\) P-a.s.

-

(b)

The observation in part (iii) of Proposition 4.3 is in line with Horst and Kivman (2021), where in a different but related setting (with a positive stochastically varying resilience) it is observed that the optimal strategy never changes its sign (see (Theorem 2.2 Horst and Kivman (2021))), which means in our terminology that neither overjumping zero nor premature closure is optimal.

-

(c)

Comparison of (ii) and (iii) poses the question if premature closure can be optimal with nonnegative resilience. The answer is affirmative: e.g., if \(\rho \equiv 0\), then \(\beta _t =1\) for all \(t \in [0,T]\), and the optimal strategy is to close the position immediately (cf. Proposition 3.7 Ackermann et al. (2021a)). This is, however, a rather degenerate example. A much more interesting one, for which we, however, allow the resilience to be negative, is presented in Sect. 5.3.

Proof of Proposition 4.3

-

(i)

Define

$$\begin{aligned} B=\{(\omega ,t)\in \Omega \times [0,T]:\quad&Y_t(\omega )\in [0,1/2],\\&2\rho _t(\omega )+\mu _t(\omega )-\sigma _t^2(\omega )>0,\\&\rho _t(\omega )\ge 0\} \end{aligned}$$and observe that \(B\in {\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\). It is enough to show the claim for every \((\omega ,t)\in B\). To this end, we fix an arbitrary \((\omega ,t)\in B\). By (9) we have to show that

$$\begin{aligned} \frac{(\rho _t(\omega ) + \mu _t(\omega ))Y_t(\omega )}{\sigma _t^2(\omega ) Y_t(\omega ) + \frac{1}{2} (2\rho _t(\omega ) + \mu _t(\omega ) - \sigma _t^2(\omega ) )}\le \left( \frac{\rho _t(\omega )+\mu _t(\omega )}{2\rho _t(\omega )+\mu _t(\omega )}\right) {\mathbf {1}}_{\{\rho _t(\omega )+\mu _t(\omega )>0\}}.\nonumber \\ \end{aligned}$$(16)If \(\rho _t(\omega )+\mu _t(\omega )\le 0\), this inequality is evident. Therefore we assume \(\rho _t(\omega )+\mu _t(\omega )>0\) in the sequel. Note that the fact that \(Y_t(\omega )\le \frac{1}{2}\) implies

$$\begin{aligned} \begin{aligned} Y_t(\omega )-\frac{1}{2}\frac{2\rho _t(\omega ) + \mu _t(\omega ) - \sigma _t^2(\omega ) }{2\rho _t(\omega )+\mu _t(\omega )}&\le Y_t(\omega )\left( 1-\frac{2\rho _t(\omega ) + \mu _t(\omega ) - \sigma _t^2(\omega ) }{2\rho _t(\omega )+\mu _t(\omega )}\right) \\&= \frac{\sigma _t^2(\omega )Y_t(\omega )}{2\rho _t(\omega )+\mu _t(\omega )}. \end{aligned} \end{aligned}$$This shows that

$$\begin{aligned} \begin{aligned} (\rho _t(\omega )+\mu _t(\omega ))Y_t(\omega )\le \frac{\rho _t(\omega )+\mu _t(\omega )}{2\rho _t(\omega )+\mu _t(\omega )} \left( \sigma _t^2(\omega )Y_t(\omega )+\frac{1}{2}(2\rho _t(\omega ) + \mu _t(\omega ) - \sigma _t^2(\omega )) \right) \end{aligned} \end{aligned}$$and hence establishes (16).

-

(ii)

We first notice that (i) and (10) ensure that \(\beta _.\le 1\) \(P\times \mu _L\)-a.e. As \(\beta \) has càdlàg paths, by the standard Fubini argument, we infer that P-a.s. it holds: for all \(t\in [0,T]\), we have \(\beta _t\le 1\). This shows that overjumping zero is not optimal.

-

(iii)

It suffices to show that premature closure is not optimal. Define

$$\begin{aligned} C=\{(\omega ,t)\in \Omega \times [0,T]:\quad&Y_t(\omega )\in [0,1/2],\\&2\rho _t(\omega )+\mu _t(\omega )-\sigma _t^2(\omega )>0,\\&\max \{|\rho _t(\omega )|,|\mu _t(\omega )|\}\le \overline{c},\\&\delta (\omega )>0\text { and }\rho _t(\omega )\ge \delta (\omega )\}, \end{aligned}$$where \(\overline{c}\) is from (2), and notice that \(C\in {\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\). It follows from (i) that

$$\begin{aligned} \widetilde{\beta }_t(\omega )\le \max \left\{ 1-\frac{\delta (\omega )}{3\overline{c}},0\right\} <1\quad \text {for all }(\omega ,t)\in C. \end{aligned}$$As \(P\times \mu _L((\Omega \times [0,T])\setminus C)=0\) and \(\beta \) is càdlàg, we conclude that P-a.s. it holds

$$\begin{aligned} \sup _{t\in [0,T]} \beta _t\le \max \left\{ 1-\frac{\delta }{3\overline{c}},0\right\} <1 \end{aligned}$$(again by the Fubini argument), and hence premature closure is not optimal.

\(\square \)

In the sequel, for a set \(K\subseteq \Omega \times [0,T]\) and \(\omega \in \Omega \), we use the notation

for the section of K. We will permanently use the well-known statements that, if \(K\in {\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\), then

-

for any \(\omega \in \Omega \), \(K_\omega \in {\mathcal {B}}([0,T])\),

-

and the mapping \(\omega \mapsto \mu _L(K_\omega )\) is \({\mathcal {F}}_T\)-measurable.

Proposition 4.4

Assume (1), (2), and (10). In addition, assume that there exists an \({\mathcal {F}}_T\)-measurable random variable \(\delta \) such that

where

Then overjumping zero or premature closure is optimal.

Discussion 4.5

-

(a)

The meaning of (17) is that, with positive probability, resilience \(\rho \) is assumed to be negative with positive Lebesgue measure in any neighbourhood of the terminal time T.

-

(b)

It is instructive to compare Proposition 4.4 with part (iii) of Proposition 4.3. The assumptions are “almost” complementary: compare (14) with (17)–(18). In both cases, we step a little away from 0 (this is the role of \(\delta \) in (14) and (18)) but in a “soft” sense (the bound \(\delta \) can depend on \(\omega \)).

-

(c)

In view of (a) and (b) we informally summarize part (iii) of Proposition 4.3 and Proposition 4.4 as follows. Positive resilience implies that neither overjumping zero nor premature closure is optimal; negative resilience “close to T ” implies optimality of overjumping zero or premature closure. There arises the question of whether negative resilience “far from T ” also implies overjumping zero or premature closure. The answer is negative: see Example 5.2 below.

Proof of Proposition 4.4

1. In the first step of the proof we establish that (1), (2), and (17) imply \(P\times \mu _L(C)>0\), where

To this end, we first recall from (Lemma 8.1 Ackermann et al. (2021a)) that \(\lim _{s\uparrow T}Y_s=Y_T\) (\(=\frac{1}{2}\)) P-a.s., i.e., for the solution \((Y,M^\perp )\) of (7), the orthogonal to W martingale \(M^\perp \) does not jump at terminal time T. We define

where \(\overline{c}\) is from (2), and notice that \(M\in {\mathcal {F}}_T\otimes {\mathcal {B}}([0,T])\), \(P\times \mu _L((\Omega \times [0,T])\setminus M)=0\). Now we set

where B is from (18), and observe that (17) holds with B replaced by K. As \(P\times \mu _L(C)=\int _\Omega \mu _L(C_\omega )\,P(d\omega )\), we get \(P\times \mu _L(C)>0\), once we prove

To establish (19), we fix an arbitrary \(\omega _0\in F\) and make the following simple observation

This yields that, for \(t\in K_{\omega _0}\), it holds

hence

Now we compute from (9) that, for \(t\in K_{\omega _0}\), we have the equivalence

Moreover, (20) and (21) reveal that, for \(t\in K_{\omega _0}\),

Recalling that \(\omega _0\in F\), the definition of the event F in (19), and that \(\lim _{s\uparrow T}Y_s(\omega _0)=\frac{1}{2}\) (as \(\omega _0\in F\) implies that there exists \(t\in [0,T]\) with \((\omega _0,t)\in K\subseteq M\)), we conclude from (22) that there exists \(n_0\in {\mathbb {N}}\) (which depends on \(\omega _0\)) such that

hence \(\mu _L(C_{\omega _0})\ge \mu _L(K_{\omega _0}\cap [T-1/{n_0},T])>0\). We thus proved (19) and completed the first step of the proof.

2. The first step together with (10) yields \(P\times \mu _L(\beta _.>1)>0\). Define the stopping time \(\tau =T\wedge \inf \{t\in [0,T]:\beta _t>1\}\) (as usual, \(\inf \emptyset :=\infty \)). As \(P\times \mu _L(\beta _.>1)>0\), we get, by the Fubini argument, that \(P(\tau <T)>0\). Since \(\beta _{0-}=0\) and \(\beta \) is càdlàg, P-a.s. on \(\{\tau <T\}\) it holds \(\beta _{\tau -}\le 1\) and \(\beta _\tau \ge 1\), which yields the result. \(\square \)

5 Case studies on the effects of negative resilience

In this section we analyze the effects of negative resilience and discuss the results of Proposition 4.3 and Proposition 4.4 in several subsettings of Sect. 2.

5.1 A case study with piecewise constant resilience and deterministic optimal strategies

In this subsection we assume that there are N different regimes of resilience. That is to say that \(\rho \) is piecewise constant. Moreover, we assume that \(\rho \) is deterministic, \(\mu >0\) is constant and \(\sigma \equiv 0\). These assumptions lead to deterministic optimal strategies. We summarize the results in the following proposition.

Proposition 5.1

Assume that \(\gamma _0>0\) is deterministic and thatFootnote 6\(x-\frac{d}{\gamma _0}>0\). Suppose furthermore that \(\sigma \equiv 0\), that \(\mu >0\) is a deterministic constant, and that \(\rho :[0,T]\rightarrow (-\mu /2,\infty )\) is piecewise constant in the sense that there exist \(N\in {\mathbb {N}}\), \(\rho ^{(1)},\ldots , \rho ^{(N)} \in (-\mu /2,\infty )\), and \(0=T_0<T_1<\ldots <T_N=T\) such that for all \(t\in [0,T)\) it holds \( \rho _t=\sum _{i=1}^N\rho ^{(i)}{\mathbf {1}}_{[T_{i-1},T_i)}(t). \) Then, (1) and (2) are satisfied. The unique solution of (7) is given by

where \(n(t)=\max \{i\in \{0,\ldots , N\}:T_i\le t\}\). Moreover, (10) is satisfied with \( \beta _t = \widetilde{\beta }_t = \frac{\rho _t + \mu }{\rho _t + \frac{1}{2}\mu } Y_t\), \(t \in [0,T]. \) The optimal strategy \(X^*\) and the associated deviation \(D^*\) are deterministic, for every \(i\in \{1,\ldots , N\}\) they are continuous on \((T_{i-1},T_i)\), and for every \(i\in \{1,\ldots , N-1\}\) they have a jump at \(T_i\) if and only if \(\rho \) has a jump at \(T_i\). Furthermore, for every \(i\in \{1,\ldots , N\}\) the deviation \(D^*\) is constant on \((T_{i-1},T_i)\) and takes negative values, and the optimal strategy \(X^*\) is monotone on \((T_{i-1},T_i)\): more precisely, if \(\rho ^{(i)}>0\) (resp., \(\rho ^{(i)}<0\); resp., \(\rho ^{(i)}=0\)), then \(X^*\) is strictly decreasing (resp., strictly increasing; resp., constant) on \((T_{i-1},T_i)\).

Proof

Clearly, (1) and (2) are satisfied. Next note that Y from (23) satisfies for all \(t\in [0,T]\) that

From this it follows that Y is continuous and satisfies the Bernoulli ODE

Consequently, (Y, 0) is the unique solution of (7). Moreover, \(\widetilde{\beta }\) defined by (9) is càdlàg and of finite variation and thus we have (10) with \(\beta =\widetilde{\beta }\). In particular, \(\beta \) is deterministic, and since \(\sigma \equiv 0\) and \(\rho ,\mu \) are deterministic, we have that the optimal strategy \(X^*\) and its deviation \(D^*\) are deterministic as well.

For every \(i\in \{1,\ldots , N-1\}\) observe also that \(\beta \) has a jump at \(T_i\) if and only if \(\rho \) has a jump at \(T_i\). This directly translates into jumps of the optimal strategy \(X^*\) and jumps of the associated deviation \(D^*\) via (11) and (12). To show that the deviation \(D^*\) is constant on each \((T_{i-1},T_i)\), \(i \in \{1,\ldots , N\}\), observe that for all \(i \in \{1,\ldots ,N\}\) and \(t \in (T_{i-1},T_i)\) it holds that

and hence

It thus follows from (12) that \(D^*\) is constant on \((T_{i-1},T_i)\) for \(i \in \{1,\ldots ,N\}\). Moreover, since \(\rho >-\frac{1}{2}\mu \), \(\mu >0\), and \(Y>0\), it holds that \(\beta > 0\), and therefore \(D^* < 0\) (recall that we assume \(x-\frac{d}{\gamma _0}>0\)). Next note that we have for all \(i \in \{1,\ldots , N\}\) and \(t \in (T_{i-1},T_i)\) that, using (24),

Since \(\beta > 0\) and \(x-\frac{d}{\gamma _0}>0\), we conclude that if \(\rho ^{(i)}\) is positive, then \(X^*\) in (11) is decreasing on \((T_{i-1},T_i)\), and if \(\rho ^{(i)}\) is negative, then \(X^*\) is increasing on \((T_{i-1},T_i)\), \(i \in \{1,\ldots , N\}\). \(\square \)

In Examples 5.2, 5.3, and 5.4 below we consider the setting of Proposition 5.1 with \(N=3\) different regimes of resilience. More precisely, we assume in the sequel of this subsection the setting of Proposition 5.1 with \(N=3\), \(x=1\), \(d=0\), \(\gamma _0=1\), \(\mu =0.5\), and \(T_i=i\) for \(i\in \{1,2,3\}\).

We already know from Proposition 4.4 that overjumping zero or premature closure is optimal if we have negative resilience in the last regime (i.e., \(\rho ^{(3)}<0\)). In the three examples below we want to analyze under which conditions these effects occur in the case where the resilience is positive in the last (and also the first) regime. We choose \(\rho ^{(1)}=0.1\) and \(\rho ^{(3)}=1\). Proposition 4.3 entails that we necessarily need \(\rho ^{(2)}<0\) to see these effects. Therefore we choose a different negative value for \(\rho ^{(2)}\) in each example.

For these choices of \(\rho ^{(i)}\), \(i\in \{1,2,3\}\), Proposition 5.1 shows that it is optimal to first sell during (0, 1), change this to a buy program on (1, 2) to profit from the negative resilience during that time interval, and then sell again during (2, 3). Moreover, since \(\rho ^{(1)}\) and \(\rho ^{(3)}\) are positive, we can already derive (e.g., by Proposition 4.3) that \(\beta <1\) on [0, 1) and on [2, 3), and hence that \(X^*\) is strictly positive on [0, 1) and on [2, 3) due to \(x-\frac{d}{\gamma _0}=1\). Between Examples 5.2, 5.3, and 5.4 we vary the size of \(\rho ^{(2)}<0\). This then determines if we get overjumping zero or premature closure for the optimal strategy. Recall that \(\beta \) in all examples has jumps at \(t=1\) and \(t=2\) and is continuous on (0, 1), (1, 2), and (2, 3), with values strictly smaller than 1 on [0, 1) and [2, 3). The facts that \(\rho ^{(1)}=0.1\), \(\mu =0.5\), and \(Y_1\in (0,1/2]\) yield that also \(\beta _{1-}<1\). We moreover have that \((1-\beta _{t-})(1-\beta _t)>0\) for all \(t \in [0,1)\cup (2,3)\). This, continuity of \(\beta \) on (1, 2), \(\beta _{1-}<1\), and \(\beta _2<1\) imply that overjumping zero is optimal if and only if at least one of

and

is satisfied. Premature closure is optimal if and only if

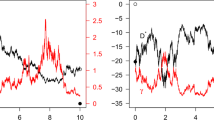

The resilience \(\rho \), the function \(\beta \), and the optimal strategy \(X^*\) for each of the examples below are shown in Fig. 1.

Example 5.2

We choose \(\rho ^{(2)}=-0.05\). The first row in Fig. 1 shows that \(\beta \) stays strictly smaller than one also on [1, 2), and hence the optimal strategy \(X^*\) is strictly positive on the time interval [0, 3). We conclude that, in general, a period of negative resilience does not necessarily lead to overjumping zero or premature closure.

Example 5.3

We next provide an example where negative resilience indeed leads to overjumping zero and premature closure. To this end we choose \(\rho ^{(2)}=-0.09\) in the above set-up. From the second row of Fig. 1 we observe that \(\beta \) jumps above 1 at time \(t=1\), but then decays continuously below 1 already before its next jump at \(t=2\). It therefore holds that (25) and (27) are satisfied. We thus have overjumping zero as well as premature closure for the optimal strategy. This implies (recall \(x-\frac{d}{\gamma _0}=1\)) that the optimal strategy jumps to a negative value at time \(t=1\) and crosses 0 within the time interval (1, 2) to become positive again. Note that the set of points in time \(t \in [0,T)\) for which we have \(\beta _t>1\) is strictly included in the set where \(\rho _t<0\) (which is [1, 2)).

Example 5.4

We finally provide an example where the set of points in time \(t \in [0,T)\) for which we have \(\beta _t>1\) is equal to the set where \(\rho _t<0\). This means that the time periods with negative resilience exactly coincide with the time periods where the optimal strategy is negative. We achieve this for example for \(\rho ^{(2)}=-0.15\) in the above set-up (see the third row of Fig. 1). In particular, (25) is satisfied, i.e., overjumping zero is optimal. Furthermore, one can compute that (26) holds true as well. It follows that condition (27) is not met, and therefore, premature closure is not optimal. Note that the optimal strategy changes its sign twice, but does not continuously cross 0.

Top row: \(\beta \), a path of \(X^*\), and the corresponding path of \(D^*\) for \(\sigma =\sqrt{0.1}\) and \(\rho ^{(2)}=-0.05\). Middle row: \(\beta \), a path of \(X^*\), and the corresponding path of \(D^*\) for \(\sigma =\sqrt{0.1}\) and \(\rho ^{(2)}=-0.07\). Bottom row: \(\beta \), a path of \(X^*\), and the corresponding path of \(D^*\) for \(\sigma =\sqrt{0.1}\) and \(\rho ^{(2)}=-0.15\)

5.2 A case study with piecewise constant resilience and stochastic optimal strategies

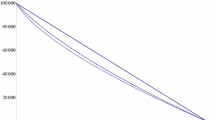

We here consider a similar setting as in Sect. 5.1, but now \(\sigma \) can be a deterministic constant different from 0. Although the solution of BSDE (7) and the process \(\beta =\widetilde{\beta }\) are still deterministic, the optimal strategy \(X^*\) and its associated deviation \(D^*\) in general become stochastic. The properties derived in Proposition 5.1 that \(D^*\) is constant between jumps and that \(X^*\) is monotone between jumps then no longer hold. However, we can produce the main effects discussed in Examples 5.2, 5.3, and 5.4 also in the case with nonzero \(\sigma \). Let \(\sigma = \sqrt{0.1}\), \(\mu =0.5\), \(x=1\), \(d=0\), \(\gamma _0=1\), \(T=3\). Assume \(\rho \) as in Proposition 5.1 with \(N=3\), \(T_0=0\), \(T_1=1\), \(T_2=2\), \(T_3=T\), \(\rho ^{(1)}=0.1\), \(\rho ^{(3)}=1\), and a \(\rho ^{(2)}<0\) chosen appropriately for each example. Then, for \(\rho ^{(2)}=-0.05\), we see that \(\beta <1\) everywhere, which implies that neither overjumping zero nor premature closure is optimal (cf. the first row of Figure 2). This is just as in Example 5.2. In order to obtain the same effect as in Example 5.3, we consider \(\rho ^{(2)}=-0.07\). Then, \(\{t\in [0,T):\beta _t>1\}\subsetneq \{t\in [0,T):\rho _t<0\}\), and \(\beta \) jumps above 1 in \(t=1\) and goes through 1 on (1, 2) (cf. the second row of Figure 2). Consequently, both overjumping zero and premature closure are optimal in this case. If we set \(\rho ^{(2)}=-0.15\), we observe that \(\{t\in [0,T):\rho _t<0\}=[1,2)=\{t\in [0,T):\beta _t>1\}\) (cf. the third row of Figure 2), and that overjumping zero is optimal, but premature closure is not. This is the analogon of Example 5.4.

5.3 A case study with premature closure over a time interval

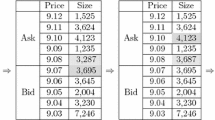

In Example 5.3 the optimal strategy entails to close the position at a certain point in time and reopen it immediately. On the other hand, in the case \(\rho \equiv 0\), it is optimal to close the position immediately and not to reenter trading (cf. Proposition 3.7 Ackermann et al. (2021a)). In the same way we can show that if, say, \(\rho =0\) on \((T_1,T)\), for some \(T_1\in (0,T)\), then the optimal strategy \(X^*\) satisfies \(X^*_.=0\) on \([T_1,T]\) (and it can involve non-trivial trading on \([0,T_1]\) depending on behaviour of the model parameters on \((0,T_1)\)). Keeping the position closed during a time interval and reopening again is more tricky, but also possible, as we show next. For an illustration, we refer to Fig. 3.

The resilience \(\rho \), \(\beta \), a path of the optimal strategy \(X^*\), and the corresponding path of the deviation \(D^*\) in the setting where \(\sigma \) and \(\mu =\sigma ^2 +2\) are deterministic constants and \(\rho \) is defined as in (28). The specific parameter values are \(x=1\), \(d=0\), \(\gamma _0=1\), \(\sigma =1\), \(T=3\), \(T_1=1\), \(T_2=2\), \(\rho ^{(1)}=0.01\), \(\rho ^{(3)}=1\), and \(\kappa =2.416\). Observe that \(\beta =1\) and \(X^*=0\) between \(t=1\) and \(t=2\)

Let \(T_1,T_2 \in (0,T)\) such that \(T_1<T_2\). Suppose that \(\sigma ^2>0\) is a deterministic constant and that \(\mu =\sigma ^2 + 2\). For deterministic \(\rho ^{(1)}>-1\), \(\rho ^{(3)}>0\), and \(\kappa >0\) let

Note that (1) and (2) are satisfied. Let Y be the unique solution of the ODE (cf. (7) in the current setting)

We have (10) with

This implies that

In the sequel we establish that if \(\kappa \) is chosen such that \(\lim _{t\uparrow T_2} \frac{\rho _t+1}{\rho _t+2}=Y_{T_2}\), then \(\frac{\rho +1}{\rho +2}=Y\) on \((T_1,T_2)\). To this end, supposeFootnote 7 that \(\lim _{t\uparrow T_2} \frac{\rho _t+1}{\rho _t+2}=Y_{T_2}\) and define \(\widetilde{Y}=\frac{\rho +1}{\rho +2}\) on \((T_1,T_2)\). We show that \(\widetilde{Y}\) is a solution of (29) on \((T_1,T_2)\). It holds for all \(t\in (T_1,T_2)\) that

On the other hand, we obtain for all \(t \in (T_1,T_2)\) that

In order to show that

note first that this is equivalent to

Denoting \(a_t=\kappa e^{2(t-T)}\), \(t \in (T_1,T_2)\), and using \(\rho _t+1=(a_t+1)^{-\frac{1}{2}}\), \(t\in (T_1,T_2)\), we can rewrite this as

The right hand side equals \((a_t+1)^{-1}-1\), \(t \in (T_1,T_2)\). We thus obtain the equivalent equation

which clearly holds true. This proves (30). Thus, by uniqueness of the solution of (29) and \(\lim _{t\uparrow T_2} \frac{\rho _t+1}{\rho _t+2}=Y_{T_2}\), we have \(Y=\frac{\rho +1}{\rho +2}\) on \((T_1,T_2)\). This implies that \(\beta =1\) on \((T_1,T_2)\). It follows that for all \(x,d \in {\mathbb {R}}\), almost all paths of the optimal strategy \(X^*\) (cf. (11)) equal 0 on \([T_1,T_2)\). Finally, observe that if \(x,d \in {\mathbb {R}}\) with \(x\ne \frac{d}{\gamma _0}\), then almost all paths of \(X^*\) are nonzero everywhere on \([T_2,T)\) because, on \([T_2,T)\), we have \(Y\le \frac{1}{2}<\frac{\rho ^{(3)}+1}{\rho ^{(3)}+2}\), as \(\rho ^{(3)}>0\), i.e., \(Y=\frac{\rho +1}{\rho +2}\) holds nowhere on \([T_2,T)\).

Notes

This, instantaneous, impact is alternatively called temporary impact. There can also be a permanent component in the price impact, but it has no effect on determining optimal execution strategies. In the literature, such models are often called the Almgren-Chriss type models; see, e.g., (Almgren, 2012; Almgren & Chriss, 2001; Ankirchner et al., 2014) and references therein.

From this perspective, the models within the first group are essentially models with infinite resilience, whereas the models in the second group are models with finite resilience.

The exceptions are Graewe and Horst (2017) and Horst and Xia (2019), where optimal strategies are absolutely continuous, although the models belong to the second group according to our classification. The reason is that jumps are strongly penalized by the form of the functionals that are optimized in Graewe and Horst (2017) and Horst and Xia (2019).

In SSRN an earlier version of Obizhaeva and Wang (2013) appeared already in 2005.

Uniqueness of the solution will follow as a byproduct of our analysis; see Theorem 3.2 below.

This assumption is only for ease of exposition. All statements hold also in the case \(x-\frac{d}{\gamma _0}<0\) with the suitable adjustments.

Observe that to determine \(Y_{T_2}\) it suffices to consider \(\rho \) only on \([T_2,T]\). In particular, \(Y_{T_2}\) does not depend on the choice of \(\kappa \). Moreover, as \(\rho ^{(3)}\ne 0\), we have \(Y_{T_2}\in (0,1/2)\) (via a straightforward comparison argument for (29)). Therefore, we can set \(\kappa =e^{2(T-T_2)}(1-2Y_{T_2}) Y_{T_2}^{-2}>0\). It follows for this \(\kappa \) that \(\lim _{t\uparrow T_2} \frac{\rho _t+1}{\rho _t+2}=Y_{T_2}\).

References

Ackermann, J., Kruse, T., & Urusov, M. (2021). Càdlàg semimartingale strategies for optimal trade execution in stochastic order book models. Finance and Stochastics, 25(4), 757–810.

Ackermann, J., Kruse, T., & Urusov, M. (2021). Optimal trade execution in an order book model with stochastic liquidity parameters. SIAM Journal on Financial Mathematics, 12(2), 788–822.

Alfonsi, A., & Acevedo, J. I. (2014). Optimal execution and price manipulations in time-varying limit order books. Applied Mathematical Finance, 21(3), 201–237.

Alfonsi, A., & Blanc, P. (2016). Dynamic optimal execution in a mixed-market-impact Hawkes price model. Finance and Stochastics, 20(1), 183–218.

Alfonsi, A., Fruth, A., & Schied, A. (2008). Constrained portfolio liquidation in a limit order book model. Banach Center Publ, 83, 9–25.

Alfonsi, A., Fruth, A., & Schied, A. (2010). Optimal execution strategies in limit order books with general shape functions. Quantitative Finance, 10(2), 143–157.

Alfonsi, A., & Schied, A. (2010). Optimal trade execution and absence of price manipulations in limit order book models. SIAM Journal on Financial Mathematics, 1(1), 490–522.

Alfonsi, A., Schied, A., & Slynko, A. (2012). Order book resilience, price manipulation, and the positive portfolio problem. SIAM Journal on Financial Mathematics, 3(1), 511–533.

Almgren, R. (2012). Optimal trading with stochastic liquidity and volatility. SIAM Journal on Financial Mathematics, 3(1), 163–181.

Almgren, R., & Chriss, N. (2001). Optimal execution of portfolio transactions. Journal of Risk, 3, 5–40.

Ankirchner, S., Jeanblanc, M., & Kruse, T. (2014). BSDEs with singular terminal condition and a control problem with constraints. SIAM Journal on Control and Optimization, 52(2), 893–913.

Bank, P., & Dolinsky, Y. (2019). Continuous-time duality for superreplication with transient price impact. The Annals of Applied Probability, 29(6), 3893–3917.

Bank, P., & Dolinsky, Y. (2020). Scaling limits for super-replication with transient price impact. Bernoulli, 26(3), 2176–2201.

Bank, P., & Fruth, A. (2014). Optimal order scheduling for deterministic liquidity patterns. SIAM Journal on Financial Mathematics, 5(1), 137–152.

Bank, P., & Voß, M. (2019). Optimal investment with transient price impact. SIAM Journal on Financial Mathematics, 10(3), 723–768.

Becherer, D., Bilarev, T., & Frentrup, P. (2018). Optimal asset liquidation with multiplicative transient price impact. Applied Mathematics & Optimization, 78(3), 643–676.

Becherer, D., Bilarev, T., & Frentrup, P. (2018). Optimal liquidation under stochastic liquidity. Finance and Stochastics, 22(1), 39–68.

Becherer, D., Bilarev, T., & Frentrup, P. (2019). Stability for gains from large investors’ strategies in \(M_1\)/\(J_1\) topologies. Bernoulli, 25(2), 1105–1140.

Carmona, R., & Webster, K. (2019). The self-financing equation in limit order book markets. Finance and Stochastics, 23(3), 729–759.

Cartea, A., Jaimungal, S., & Ricci, J. (2018). Algorithmic trading, stochastic control, and mutually exciting processes. SIAM Review, 60(3), 673–703. Revised reprint of “Buy low, sell high: a high frequency trading perspective” [ MR3233098].

Cayé, T., & Muhle-Karbe, J. (2016). Liquidation with self-exciting price impact. Mathematics and Financial Economics, 10(1), 15–28.

Fruth, A., Schöneborn, T., & Urusov, M. (2014). Optimal trade execution and price manipulation in order books with time-varying liquidity. Mathematical Finance, 24(4), 651–695.

Fruth, A., Schöneborn, T., & Urusov, M. (2019). Optimal trade execution in order books with stochastic liquidity. Mathematical Finance, 29(2), 507–541.

Fu, G., Horst, U., & Xia, X. (2022a). Portfolio liquidation games with selfexciting order flow. Mathematical Finance, 32(4), 1020–1065.

Fu, G., Horst, U., & Xia, X. (2022b). A mean-field control problem of optimal portfolio liquidation with semimartingale strategies. Preprint, arXiv:2207.00446.

Gatheral, J., Schied, A., & Slynko, A. (2012). Transient linear price impact and Fredholm integral equations. Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics, 22(3), 445–474.

Graewe, P., & Horst, U. (2017). Optimal trade execution with instantaneous price impact and stochastic resilience. SIAM Journal on Control and Optimization, 55(6), 3707–3725.

Horst, U., & Kivman, E. (2021). Optimal trade execution under small market impact and portfolio liquidation with semimartingale strategies. Preprint, arXiv:2103.05957.

Horst, U., & Xia, X. (2019). Multi-dimensional optimal trade execution under stochastic resilience. Finance and Stochastics, 23(4), 889–923.

Klimsiak, T., and Rzymowski, M. (2021). Nonlinear BSDEs in general filtration with drivers depending on the martingale part of a solution. Preprint, arXiv:2103.07536.

Kruse, T., & Popier, A. (2016). BSDEs with monotone generator driven by Brownian and Poisson noises in a general filtration. Stochastics, 88(4), 491–539.

Lorenz, C., & Schied, A. (2013). Drift dependence of optimal trade execution strategies under transient price impact. Finance and Stochastics, 17(4), 743–770.

Luo, X., & Schied, A. (2019). Nash equilibrium for risk-averse investors in a market impact game with transient price impact. Market Microstructure and Liquidity, 5(01n04), 2050001.

Obizhaeva, A. A., & Wang, J. (2013). Optimal trading strategy and supply/demand dynamics. Journal of Financial Markets, 16, 1–32.

Predoiu, S., Shaikhet, G., & Shreve, S. (2011). Optimal execution in a general one-sided limit-order book. SIAM Journal on Financial Mathematics, 2(1), 183–212.

Revuz, D., & Yor, M. (1999). Continuous martingales and Brownian motion, volume 293 of Grundlehren der Mathematischen Wissenschaften. Springer, Berlin, third edition.

Roch, A.F. (2022). Optimal liquidation through a limit order book: A neural network and simulation approach. Preprint, SSRN 4057478.

Schied, A., Strehle, E., & Zhang, T. (2017). High-frequency limit of Nash equilibria in a market impact game with transient price impact. SIAM Journal on Financial Mathematics, 8(1), 589–634.

Schied, A., & Zhang, T. (2019). A market impact game under transient price impact. Mathematics of Operations Research, 44(1), 102–121.

Strehle, E. (2017). Optimal execution in a multiplayer model of transient price impact. Market Microstructure and Liquidity, 3(03n04), 1850007.

Acknowledgements

We thank two anonymous referees for suggestions that helped improve the manuscript. The article was prepared while T.K. was a member of the Institute of Mathematics at the University of Gießen.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ackermann, J., Kruse, T. & Urusov, M. Self-exciting price impact via negative resilience in stochastic order books. Ann Oper Res 336, 637–659 (2024). https://doi.org/10.1007/s10479-022-04973-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04973-0

Keywords

- Optimal trade execution

- Limit order book

- Stochastic market depth

- Stochastic resilience

- Negative resilience

- Quadratic BSDE

- Infinite-variation execution strategy

- Semimartingale execution strategy