Abstract

We analyse an optimal trade execution problem in a financial market with stochastic liquidity. To this end, we set up a limit order book model in continuous time. Both order book depth and resilience are allowed to evolve randomly in time. We allow trading in both directions and for càdlàg semimartingales as execution strategies. We derive a quadratic BSDE that under appropriate assumptions characterises minimal execution costs, and we identify conditions under which an optimal execution strategy exists. We also investigate qualitative aspects of optimal strategies such as e.g. appearance of strategies with infinite variation or existence of block trades, and we discuss connections with the discrete-time formulation of the problem. Our findings are illustrated in several examples.

Similar content being viewed by others

References

Ackermann, J., Kruse, T., Urusov, M.: Optimal trade execution in an order book model with stochastic liquidity parameters. SIAM J. Financ. Math. 12, 788–822 (2021)

Alfonsi, A., Acevedo, J.I.: Optimal execution and price manipulations in time-varying limit order books. Appl. Math. Finance 21, 201–237 (2014)

Alfonsi, A., Fruth, A., Schied, A.: Constrained portfolio liquidation in a limit order book model. In: Stettner, Ł. (ed.) Advances in Mathematics of Finance, Banach Center Publ., vol. 83, pp. 9–25. Polish Acad. Sci. Inst. Math, Warsaw, Poland (2008)

Alfonsi, A., Fruth, A., Schied, A.: Optimal execution strategies in limit order books with general shape functions. Quant. Finance 10, 143–157 (2010)

Almgren, R.: Optimal trading with stochastic liquidity and volatility. SIAM J. Financ. Math. 3, 163–181 (2012)

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–40 (2001)

Ankirchner, S., Fromm, A., Kruse, T., Popier, A.: Optimal position targeting via decoupling fields. Ann. Appl. Probab. 30, 644–672 (2020)

Ankirchner, S., Jeanblanc, M., Kruse, T.: BSDEs with singular terminal condition and a control problem with constraints. SIAM J. Control Optim. 52, 893–913 (2014)

Ankirchner, S., Kruse, T.: Optimal position targeting with stochastic linear-quadratic costs. In: Palczewski, A., Stettner, Ł. (eds.) Advances in Mathematics of Finance, Banach Center Publ., vol. 104, pp. 9–24. Polish Acad. Sci. Inst. Math, Warsaw, Poland (2015)

Bank, P., Fruth, A.: Optimal order scheduling for deterministic liquidity patterns. SIAM J. Financ. Math. 5, 137–152 (2014)

Bank, P., Voß, M.: Linear quadratic stochastic control problems with stochastic terminal constraint. SIAM J. Control Optim. 56, 672–699 (2018)

Becherer, D., Bilarev, T., Frentrup, P.: Stability for gains from large investors’ strategies in \(M_{1}\)/\(J_{1}\) topologies. Bernoulli 25, 1105–1140 (2019)

Bertsimas, D., Lo, A.W.: Optimal control of execution costs. J. Financ. Mark. 1, 1–50 (1998)

Carmona, R., Webster, K.: The self-financing equation in limit order book markets. Finance Stoch. 23, 729–759 (2019)

Cheridito, P., Sepin, T.: Optimal trade execution under stochastic volatility and liquidity. Appl. Math. Finance 21, 342–362 (2014)

Fruth, A., Schöneborn, T., Urusov, M.: Optimal trade execution and price manipulation in order books with time-varying liquidity. Math. Finance 24, 651–695 (2014)

Fruth, A., Schöneborn, T., Urusov, M.: Optimal trade execution in order books with stochastic liquidity. Math. Finance 29, 507–541 (2019)

Gârleanu, N., Pedersen, L.H.: Dynamic portfolio choice with frictions. J. Econ. Theory 165, 487–516 (2016)

Graewe, P., Horst, U.: Optimal trade execution with instantaneous price impact and stochastic resilience. SIAM J. Control Optim. 55, 3707–3725 (2017)

Graewe, P., Horst, U., Qiu, J.: A non-Markovian liquidation problem and backward SPDEs with singular terminal conditions. SIAM J. Control Optim. 53, 690–711 (2015)

Graewe, P., Horst, U., Séré, E.: Smooth solutions to portfolio liquidation problems under price-sensitive market impact. Stoch. Process. Appl. 128, 979–1006 (2018)

Horst, U., Kivman, E.: Small impact analysis in stochastically illiquid markets (2021). Preprint. arXiv:2103.05957

Horst, U., Qiu, J., Zhang, Q.: A constrained control problem with degenerate coefficients and degenerate backward SPDEs with singular terminal condition. SIAM J. Control Optim. 54, 946–963 (2016)

Horst, U., Xia, X.: Multi-dimensional optimal trade execution under stochastic resilience. Finance Stoch. 23, 889–923 (2019)

Jacod, J., Shiryaev, A.N.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, Berlin (2003)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1991)

Kruse, T., Popier, A.: Minimal supersolutions for BSDEs with singular terminal condition and application to optimal position targeting. Stoch. Process. Appl. 126, 2554–2592 (2016)

Lorenz, C., Schied, A.: Drift dependence of optimal trade execution strategies under transient price impact. Finance Stoch. 17, 743–770 (2013)

Morlais, M.A.: Quadratic BSDEs driven by a continuous martingale and applications to the utility maximization problem. Finance Stoch. 13, 121–150 (2009)

Obizhaeva, A.A., Wang, J.: Optimal trading strategy and supply/demand dynamics. J. Financ. Mark. 16, 1–32 (2013)

Papapantoleon, A., Possamaï, D., Saplaouras, A.: Existence and uniqueness results for BSDE with jumps: the whole nine yards. Electron. J. Probab. 23, 1–68 (2018)

Popier, A., Zhou, C.: Second-order BSDE under monotonicity condition and liquidation problem under uncertainty. Ann. Appl. Probab. 29, 1685–1739 (2019)

Predoiu, S., Shaikhet, G., Shreve, S.: Optimal execution in a general one-sided limit-order book. SIAM J. Financ. Math. 2, 183–212 (2011)

Schied, A.: A control problem with fuel constraint and Dawson–Watanabe superprocesses. Ann. Appl. Probab. 23, 2472–2499 (2013)

Acknowledgements

We are grateful to the Mathematical Finance session participants in the Bernoulli–IMS One World Symposium and to seminar participants in Gießen, Berlin, Moscow, and Leeds for insightful discussions. We thank Alexander Schied and two anonymous referees for their constructive comments and suggestions, which helped us improve the manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Once again on the cost functional and the dynamics of the deviation process

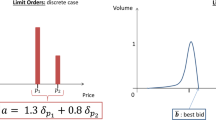

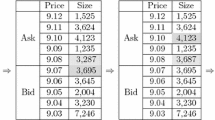

Here, we motivate the dynamics (1.2) of the deviation process and the cost functional (1.3) via a limiting procedure from a discrete-time setting.

Without loss of generality, we consider the starting time \(t=0\). We fix an initial position \(x\in \mathbb{R}\) and an initial deviation \(d\in \mathbb{R}\) and consider a continuous-time execution strategy \(X \in \mathcal{A}_{0}(x,d)\). For any (large) \(N\in \mathbb{N}\), we set \(h=\frac{T}{N}\) and consider trading in discrete time at points of the grid \(\{kh\colon k=0,\ldots ,N\}\). More precisely, the continuous-time strategy \(X\) is approximated by the discrete-time strategy that consists of trades \(\xi _{kh}\), \(k\in \{0,\ldots ,N\}\), at the grid points, where

Notice that \(\xi _{kh}\) is \(\mathcal{F}_{kh}\)-measurable, \(k=0,\ldots ,N\). Further, for \(k\in \{1,\ldots ,N\}\), we introduce \(\beta _{kh} = \exp ( -\int _{(k-1)h}^{kh} \rho _{s} d[M]_{s} )\) and the notations \(\eta _{r} = \exp ( - \int _{0}^{r} \rho _{s} d[M]_{s} )\) and \(\nu _{r}=\gamma _{r}\exp ( \int _{0}^{r} \rho _{s} d[M]_{s} )\), \(r \in [0,T]\).

In the discrete-time setting of Ackermann et al. [1], the deviation process (now denoted by \(\widetilde{D}^{(h)}\)) is defined by

The minus in the subscript of \(\widetilde{D}^{(h)}_{(kh)-}\) is purely notational (this is a discrete-time process); the meaning of \(\widetilde{D}^{(h)}_{(kh)-}\) is that this is the deviation at time \(kh\) directly prior to the trade \(\xi _{kh}\) at time \(kh\), and we preserve the minus sign in order to make the notation consistent with [1]. A straightforward calculation shows that

Substituting the definition of \(\beta _{kh}\), we obtain that for all \(k\in \{1,\ldots ,N\}\),

where for \(k\in \{0,\ldots ,N\}\), we set

The last expression shows that the continuous-time limit, for \(N\to \infty \) (and hence \(h=\frac{T}{N}\to 0\)) of the processes \((L^{(h)}_{kh})_{k\in \{0,\ldots ,N\}}\), is the process \((L_{s})_{s\in [0,T]}\) given by

(apply Jacod and Shiryaev [25, Proposition I.4.44 and Theorem I.4.47]). Combining this with (A.1) and the definition of \(\nu _{r}\), \(r \in [0,T]\), recovers that the continuous-time limit of the processes \((\widetilde{D}^{(h)}_{(kh)-})_{k\in \{0,\ldots ,N\}}\) is the process \((D_{s})_{s\in [0,T]}\) given by

(and \(D_{0-}=d\)), which is nothing else but (2.2) or, equivalently, (1.2).

We now turn to the cost functional. In the discrete-time setting, the cost is given by \(\sum _{j=0}^{N} ( \widetilde{D}^{(h)}_{(jh)-} + \frac{\gamma _{jh}}{2} \xi _{jh} ) \xi _{jh}\). Set \(X_{-h}=X_{0-}\;(=x)\). Then it holds that

For the first term on the right-hand side of (A.2), we have

which has the continuous-time limit

as \(\eta \) is a continuous process of finite variation. Further, the second term on the right-hand side of (A.2) tends to \(\int _{[0,T]}\frac{\gamma _{s}}{2}\,d[X]_{s}\), and the third term to \(\frac{1}{2}[\gamma ,[X]]_{T}=0\) because \(\gamma \) is continuous. As the continuous-time limit of the discrete-time cost, we thus obtain

which motivates our form of the cost functional in continuous time.

Appendix B: Heuristic derivation of the BSDE (3.2)

We have seen that the BSDE (3.2) plays a central role both in our results and in the proofs. But where does it come from? In this appendix, we motivate the BSDE (3.2) via a heuristic limiting procedure from discrete time.

To this end, we consider a discrete-time version of the stochastic control problem (1.4). For \(h>0\) such that \(h=\frac{T}{N}\) for some \(N\in \mathbb{N}\), \(t\in [0,T]\) and \(x, d \in \mathbb{R}\), let \(\mathcal{A}_{t}^{h}(x,d)\) be the subset of all processes \(X = (X_{s})_{s\in [t,T]} \in \mathcal{A}_{t}(x,d)\) of the form \(X_{s}= \sum _{k=0}^{N} X_{(kh) \vee t} 1_{[kh,(k+1)h)}(s)\) for all \(s \in [t,T]\). Moreover, let

for all \(x,d \in \mathbb{R}\), \(t\in [0,T]\), \(h>0\) with \(h=\frac{T}{N}\) for some \(N\in \mathbb{N}\). Then it follows from Ackermann et al. [1] that for each \(h>0\) with \(h=\frac{T}{N}\) for some \(N\in \mathbb{N}\), there exists a process \(Y^{h}=(Y_{t}^{h})_{t\in \{0,h,\ldots ,T\}}\) such that \(V_{t}^{h}(x,d) = \frac{Y_{t}^{h}}{\gamma _{t}} ( d-\gamma _{t} x)^{2} - \frac{d^{2}}{2\gamma _{t}}\), \(x,d \in \mathbb{R}\), \(t\in \{0,h,\ldots ,T\}\). The discrete-time process \(Y^{h}\) is given by the backward recursion \(Y_{T}^{h}=\frac{1}{2}\) and, for \(t \in \{0,h,\ldots ,T-h\}\),

We aim at deriving — at least heuristically — the dynamics of the continuous-time limit \(Y=(Y_{t})_{t\in [0,T]}\) of \(Y^{h}\). To this end, we suppose that \(Y\) can be decomposed as

where \((a_{t})_{t\in [0,T]}\), \((Z_{t})_{t\in [0,T]}\) are progressively measurable processes (\((a_{t})_{t\in [0,T]}\) is still to be determined) and \(M^{\perp }= (M^{\perp }_{t})_{t\in [0,T]}\) is a local martingale orthogonal to \(M\). From (B.2), we deduce that \((a_{t})_{t\in [0,T]}\) should be identified as the limit

Assume that replacing \(Y^{h}\) with \(Y\) in (B.1) introduces an error only of the magnitude \(o(E_{t}[ [M]_{t+h} ] - [M]_{t})\). Then for all \(t\in [0,T]\), we can get the expression for \(a_{t}\) by evaluating the limit, for \(h \to 0\), of

For the remainder of this section, we fix \(t\in [0,T]\) and assume that all stochastic integrals with respect to \(dM\) and \(dM^{\perp }\) that appear are true martingales. We define the process \(\Gamma =(\Gamma _{s})_{s\in [t,T]}\) by \(\Gamma _{s}=\frac{\gamma _{s}}{\gamma _{t}}\). Since for all \(s\in [t,T]\),

it holds for all \(h\in (0,T-t) \) that

Together with

we obtain heuristically that

Furthermore, it holds for all \(h\in (0,T-t)\) that

From (B.4) and (B.6), we derive heuristically that

Recall that \(\Gamma _{s}^{-1} = \frac{\alpha _{s}}{\alpha _{t}}\), \(s\in [t,T]\), with

Therefore, it holds that

Moreover, we have for all \(h\in (0,T-t)\) that

It follows from (B.8) and (B.9) that

and hence

Therefore, we obtain heuristically that

From

we derive heuristically that

We conclude from (B.5), (B.7), (B.10), and (B.11) that the limit for \(h \to 0\) of (B.3) equals

with \(f\) given in (3.3). Finally, the fact (which is proved in [1]) that the discrete-time processes \(Y^{h}\), \(h \in (0,T-t)\), are \((0,1/2]\)-valued explains the requirement in (3.4) that \(Y\) is \([0,1/2]\)-valued.

Appendix C: Comparison argument for Sect. 7.1

Here we justify via a comparison argument that in Proposition 7.1, we get that \(Y\) is \([0,1/2]\)-valued.

In the following result, we are interested in a BSDE with driver \(f\) and terminal value \(\xi \) of the form

and denote such a BSDE by BSDE\((f,\xi )\). Recall that in Proposition 7.1, the driver does not depend on \(Z\). Therefore, we do not consider a dependence on \(Z\) in (C.1).

Proposition C.1

Assume (3.8). Let \(f\) and \(\widetilde{f}\) be progressively measurable and \(f\) Lipschitz-continuous, i.e., there exists some \(L \in (0,\infty )\) such that for all \(y,y'\in \mathbb{R}\), it holds that \(\lvert f(s,y) - f(s,y') \rvert \leq L \lvert y-y'\rvert \) \(\mathcal{D}_{M}\)-a.e. Moreover, let \(\xi \) and \(\widetilde{\xi }\) be \(\mathcal{F}_{T}\)-measurable random variables. Let \((Y,Z,M^{\perp })\) be a solution of the BSDE\((f,\xi )\) and \((\widetilde{Y},\widetilde{Z},\widetilde{M}^{\perp })\) a solution of the BSDE\((\widetilde{f},\widetilde{\xi })\) such that \(E[ \int _{0}^{T} Z_{s}^{2} d[M]_{s} ] < \infty \), \(E[ [M^{\perp }]_{T} ] < \infty \), \(E[ \int _{0}^{T} \widetilde{Z}_{s}^{2} d[M]_{s} ] < \infty \) and \(E[ [\widetilde{M}^{\perp }]_{T} ] < \infty \). Set \(\delta Y_{t} = Y_{t}-\widetilde{Y}_{t}\) and \(\delta f_{t} = f(t, \widetilde{Y}_{t}) - \widetilde{f}(t,\widetilde{Y}_{t})\) for \(t\in [0,T]\). Furthermore, define

and introduce the process \(\Gamma =(\Gamma _{t})_{t\in [0,T]}\) given by \(\Gamma _{t} = \exp ( \int _{0}^{t} b_{s} d[M]_{s} )\), \(t\in [0,T]\). Then \(\delta Y\) admits the representation

In particular:

(i) If \(\xi \geq \widetilde{\xi }\) a.s. and \(f(s,\widetilde{Y}_{s})\geq \widetilde{f}(s,\widetilde{Y}_{s})\) \(\mathcal{D}_{M}\)-a.e., then \(Y_{t}\geq \widetilde{Y}_{t}\) a.s. for all \(t \in [0,T]\).

(ii) If \(\xi \leq \widetilde{\xi }\) a.s. and \(f(s,\widetilde{Y}_{s})\leq \widetilde{f}(s,\widetilde{Y}_{s})\) \(\mathcal{D}_{M}\)-a.e., then \(Y_{t}\leq \widetilde{Y}_{t}\) a.s. for all \(t\in [0,T]\).

Proof

It holds for all \(t\in [0,T]\) that

Since we have for all \(s\in [0,T]\) that

it follows that

Together with \(d\Gamma _{s} = \Gamma _{s} b_{s} d[M]_{s}\), \(s\in [0,T]\), we obtain by integration by parts that

If the local martingales \(S=\int _{0}^{\cdot } \Gamma _{s} Z_{s} dM_{s}\), \(\widetilde{S}=\int _{0}^{\cdot } \Gamma _{s} \widetilde{Z}_{s} dM_{s}\), \(U=\int _{(0,\cdot ]} \Gamma _{s} dM^{\perp }_{s}\) and \(\widetilde{U}=\int _{(0,\cdot ]} \Gamma _{s} d\widetilde{M}^{\perp }_{s}\) are true martingales, then it follows that

which yields the representation (C.2) of \(\delta Y\).

To show that \(S\) is a martingale, note first that due to the Lipschitz-continuity of \(f\), the process \(b\) is bounded \(\mathcal{D}_{M}\)-a.e. by the corresponding Lipschitz constant. By the Cauchy–Schwarz inequality, it holds that

Since \(b\) is bounded and (3.8) holds, we have \(E[ \sup _{t\in [0,T]} \Gamma _{t}^{2} ]<\infty \). We also have by assumption that \(E[ \int _{0}^{T} Z_{s}^{2} d[M]_{s} ]<\infty \). Therefore, it follows from (C.3) and the Burkholder–Davis–Gundy inequality that \(E[ \sup _{t\in [0,T]} \lvert S_{t}\rvert ] < \infty \). Thus \(S\) is a martingale. A similar reasoning applies also to \(\widetilde{S}\), \(U\) and \(\widetilde{U}\).

Finally, the claims (i) and (ii) are straightforward consequences of (C.2). □

We now apply Proposition C.1 to obtain \(0\leq Y\leq \frac{1}{2}\) in the proof of Proposition 7.1. Observe that \((\widetilde{Y},\widetilde{Z},\widetilde{M}^{\perp })=( \frac{1}{2},0,0 )\) is a solution of the BSDE\((0,\frac{1}{2})\), which obviously satisfies \(E[ [\widetilde{M}^{\perp }]_{T}]<\infty \) and \(E[ \int _{0}^{T} \widetilde{Z}_{s}^{2} d[M]_{s} ] <\infty \). Moreover, with \(\overline{f}\) as defined in the proof of Proposition 7.1, it holds that

and both BSDEs have the same terminal value \(\frac{1}{2}\). Therefore Proposition C.1 applies and yields \(Y\leq \widetilde{Y} = \frac{1}{2}\).

For the other bound, note that \((\widetilde{Y},\widetilde{Z},\widetilde{M}^{\perp })=( 0,0,0 )\) is a solution of the BSDE \((0,0)\) with \(E[ [\widetilde{M}^{\perp }]_{T} ]<\infty \) and \(E[ \int _{0}^{T} \widetilde{Z}_{s}^{2} d[M]_{s} ] <\infty \). Since \(\overline{f}(s,0)=0\) for all \(s\in [0,T]\) and \(Y_{T} = \frac{1}{2} \geq 0 = \widetilde{Y}_{T}\), it follows from Proposition C.1 that \(Y\geq \widetilde{Y}=0\).

Remark C.2

Notice that in the proof of Proposition C.1, we need (3.8) and the Lipschitz-continuity of \(f\) only to show that \(E[ \sup _{t\in [0,T]} \Gamma _{t}^{2} ]\) is finite. Replace these two conditions by the assumption that there exists a predictable process \(R\) such that for all \(y,y'\in \mathbb{R}\), \(\lvert f(\omega ,s,y) - f(\omega ,s,y')\rvert \leq R_{s}(\omega ) \lvert y-y'\rvert \) \(\mathcal{D}_{M}\)-a.e. and for all \(c\in (0,\infty )\), \(E[ \exp ( c\int _{0}^{T} R_{s} d[M]_{s} ) ] <\infty \). Then we still have that

Hence the claim of Proposition C.1 also applies to the setting mentioned in Remark 7.2.

Rights and permissions

About this article

Cite this article

Ackermann, J., Kruse, T. & Urusov, M. Càdlàg semimartingale strategies for optimal trade execution in stochastic order book models. Finance Stoch 25, 757–810 (2021). https://doi.org/10.1007/s00780-021-00464-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-021-00464-5

Keywords

- Optimal trade execution

- Continuous-time stochastic optimal control

- Limit order book

- Stochastic order book depth

- Stochastic resilience

- Quadratic BSDE

- Infinite-variation execution strategy

- Semimartingale execution strategy