Abstract

This paper investigates a green supply chain (GSC) consisting of one manufacturer and one retailer who possesses private demand forecast information. To promote green consumption, the government may provide subsidies to consumers. Within a dynamic game where the manufacturer serves as the leader and the retailer acts as the follower, three cases are examined: centralized decision, decentralized decision with and without demand forecast information sharing between the retailer and the manufacturer. We mainly examine the value of information sharing on the decisions of a GSC in the context of government subsidies for consumers. We find that: (i) demand forecast information sharing benefits the manufacturer but damages the retailer; (ii) if the predicted value is higher than the determinate part of the demand, the manufacturer is willing to choose a higher green degree of products in the case with information sharing compared with that without information sharing; otherwise, the manufacturer is willing to choose a lower green degree of products; (iii) a two-part tariff contract is appropriate to coordinate the GSC and it is effective in increasing the green degree of products; (iv) information sharing benefits the GSC if the green production efficiency is high enough; (v) the ex-ante social welfare always increases with information accuracy. Finally, numerical analyses are conducted to verify the above findings.

Similar content being viewed by others

Change history

18 October 2021

A Correction to this paper has been published: https://doi.org/10.1007/s10479-021-04268-w

References

Cachon, G., & Fisher, M. (2000). Supply chain inventory management and the value of shared information. Management Science, 46(8), 1032–1048.

Chen, C. (2001). Design for the environment: A quality-based model for green product development. Management Science, 47(2), 250–263.

Chernonog, T. (2021). Strategic information sharing in online retailing under a consignment contract with revenue sharing. Annals of Operations Research, 300, 621–641.

Gao, J., Xiao, Z., & Wei, H. (2018). Active or passive? Sustainable manufacturing in the direct-channel GSC: A perspective of two types of green product designs. Transportation Research Part D: Transport and Environment, 65, 332–354.

Gilbert, S., Xia, Y., & Yu, G. (2006). Strategic outsourcing for competing OEMs that face cost reduction opportunities. IIE Transactions, 38(11), 903–915.

Ha, A. Y., Tian, Q., & Tong, S. (2017). Information sharing in competing supply chains with production cost reduction. Manufacturing & Service Operations Management, 19(2), 246–262.

He, P., He, Y., & Xu, H. (2019). Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidies. International Journal of Production Economics, 213, 108–123.

Hong, Z., Wang, H., & Gong, Y. (2019). Green product design considering functional-product reference. International Journal of Production Economics, 210, 155–168.

Huang, Y., & Wang, Z. (2017). Values of information sharing: A comparison of supplier-remanufacturing and manufacturer-remanufacturing scenarios. Transportation Research Part E: Logistics and Transportation Review, 106, 20–44.

Jaiswal, D., & Kant, R. (2018). Green purchasing behavior: A conceptual framework and empirical investigation of Indian consumers. Journal of Retailing and Consumer Services, 41, 60–69.

Jiang, L., & Hao, Z. (2016). Incentive-driven information dissemination in two-tier supply chains. Manufacturing & Service Operations Management, 18(3), 393–413.

Jin, J., McKelvey, M., & Dong, Y. (2020). Role of local governments in fostering the development of an emerging industry: A market-oriented policy perspective. Frontiers of Engineering Management, 7(3), 447–458.

Jung, S. H., & Feng, T. (2020). Government subsidies for green technology development under uncertainty. European Journal of Operational Research, 286(2), 726–739.

Keifer, S. (2010). Beyond point of sale data: Looking forward, not backwards for demand forecasting. White Paper. GXS, Middlesex, UK.

Khan, M., Hussain, M., & Saber, H. (2016). Information sharing in a sustainable supply chain. International Journal of Production Economics, 181(part A), 208–214.

Koplin, J., Seuring, S., & Mesterharm, M. (2007). Incorporating sustainability into supply management in the automotive industry-the case of the Volkswagen AG. Journal of Cleaner Production, 15(11), 1053–1062.

Li, B., Chen, W., Xu, C., & Hou, P. (2018). Impacts of government subsidies for environmental-friendly products in a dual-channel supply chain. Journal of Cleaner Production, 171, 1558–1576.

Li, L. (2002). Information sharing in a supply chain with horizontal competition. Management Science, 48(9), 1196–1212.

Ma, P., Zhang, C., Hong, X., & Xu, H. (2018). Pricing decisions for substitutable products with green manufacturing in a competitive supply chain. Journal of Cleaner Production, 183, 618–640.

Ma, W., Zhao, Z., & Ke, H. (2013). Dual-channel closed-loop supply chain with government consumption-subsidies. European Journal of Operational Research, 226(2), 221–227.

Shang, W., Ha, A. Y., & Tong, S. (2016). Information sharing in a supply chain with a common retailer. Management Science, 62(1), 245–263.

Sheu, J. B., & Chen, Y. J. (2012). Impact of government financial intervention on competition among green supply chains. International Journal of Production Economics, 138(1), 201–213.

Tong, W., Mu, D., Zhao, F., Mendis, G. P., & Sutherland, J. W. (2019). The impact of cap-and-trade mechanism and consumers’ environmental preferences on a retailer-led supply chain. Resources, Conservation and Recycling, 142, 88–100.

Vachon, S., & Klassen, R. D. (2008). Environmental management and manufacturing performance: The role of collaboration in the supply chain. International Journal of Production Economics, 111(2), 299–315.

Wan, N., & Hong, D. (2019). The impacts of subsidies policies and transfer pricing policies on the closed-loop supply chain with dual collection channels. Journal of Cleaner Production, 224, 881–891.

Wang, Z., Huo, J., & Duan, Y. (2019). Impact of government subsidy on pricing strategies in reverse supply chains of waste electrical and electronic equipment. Waste Management (elmsford), 95, 440–449.

Wei, J., Wang, Y., & Lu, J. (2021). Information sharing and sales patterns choice in a supply chain with product’s greening improvement. Journal of Cleaner Production, 123704.

Wei, L., Zhang, J., & Zhu, G. (2020). Incentive of retailer information sharing on manufacturer volume flexibility choice. Omega. https://doi.org/10.1016/j.omega.2020.102210

Wu, J., Wang, H., & Shang, J. (2019). Multi-sourcing and information sharing under competition and supply uncertainty. European Journal of Operational Research, 278(2), 658–671.

Yu, Y., Han, X., & Hu, G. (2016). Optimal production for manufacturers considering consumer environmental awareness and green subsidies. International Journal of Production Economics, 182, 397–408.

Yu, Y., & He, Y. (2021). Information disclosure decisions in an organic food supply chain under competition. Journal of Cleaner Production, 292, 125976.

Yue, X., & Liu, J. (2006). Demand forecast sharing in a dual-channel supply chain. European Journal of Operational Research, 174(1), 646–667.

Zhang, L., Zhou, H., Liu, Y., & Lu, R. (2019). Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. Journal of Cleaner Production, 213, 1063–1079.

Zhang, Y., & Li, J. (2020). Overview of research on carbon information disclosure. Frontiers of Engineering Management, 7(1), 47–62.

Zhang, Q., Chen, J., & Zaccour, G. (2020a). Market targeting and information sharing with social influences in a luxury supply chain. Transportation Research Part E: Logistics and Transportation Review, 133, 101822.

Zhang, Q., Zhao, Q., Zhao, X., & Tang, L. (2020b). On the introduction of green product to a market with environmentally conscious consumers. Computers & Industrial Engineering, 139, 106190.

Zhao, S., Zhu, Q., & Cui, L. (2018). A decision-making model for remanufacturers: Considering both consumers’ environmental preference and the government subsidies policy. Resources, Conservation and Recycling, 128, 176–186.

Zhu, Q., Sarkis, J., & Geng, Y. (2005). Green supply chain management in China: Pressures, practices and performance. International Journal of Operations & Production Management, 25(5), 449–468.

Zhu, W., & He, Y. (2015). Green product design in supply chains under competition. European Journal of Operational Research, 258(1), 165–180.

Acknowledgements

The work was supported by the National Natural Science Foundation of China (71971210, 71701200, 71972171, and 71572184).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A1. Centralized decision (Case 1)

1.1 Proof of Proposition 1

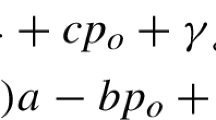

The expected profit of the GSC is expressed as follows.

The Hessian matrix of Eq. (A1-1) related to \(p\) and \(g\) is \(H = \left[ {\begin{array}{*{20}c} { - 2} & b \\ b & { - k} \\ \end{array} } \right]\). Given \(k > b^{2}\), the Hessian matrix is negative, and Eq. (A1-1) is a joint concave function of the retail price and green degree of products. Then, we obtain

Hence, the equilibrium \(p\) and \(g\) can be obtained as follows.

Then, we can obtain the ex-ante profit of the GSC in the following.

1.2 Proof of Corollary 1

According to (A1-3), the first order derivative of \(p^{c*}\) and \(g^{c*}\) with respect to \(t\) is

If \(\gamma \ge a_{0}\), then \(\frac{{\partial p^{c*} }}{\partial t} \ge 0\) and \(\frac{{\partial g^{c*} }}{\partial t} \ge 0\); if \(\gamma < a_{0}\), then \(\frac{{\partial p^{c*} }}{\partial t} < 0\) and \(\frac{{\partial g^{c*} }}{\partial t} < 0\).

The first order derivative of \(E\left( {\pi_{t}^{c*} } \right)\) with respect to \(t\) is

The first order derivative of \(E\left( {WF^{c*} } \right)\) with respect to \(t\) is

Because \(t = \frac{v}{v + \mu }\), and \(0 < t < 1\), it is easy to obtain \(\frac{{\partial E\left( {\pi_{t}^{c*} } \right)}}{\partial t} > 0\) and \(\frac{{\partial E\left( {WF^{c*} } \right)}}{\partial t} > 0\).

Appendix A2. The retailer does not share demand forecast information (Case 2)

2.1 Proof of Proposition 2

The expected profits of the manufacturer, the retailer and the GSC are written as

According to backward induction, the retailer first decides the retail price \(p\) as follows.

Because the retailer does not share forecast information, the manufacturer’s expected retail price is expressed as

By substituting Eq. (A2-5) into Eq. (A2-1), the expected profit of the manufacturer is obtained.

We can obtain the wholesale price and green degree of products in Eq. (A2-6)

Then, the equilibrium wholesale price and green degree of products are as follows.

By substituting Eq. (A2-9) and (A2-10) into Eq. (A2-4), the equilibrium retail price is obtained as follows.

Based on the above equilibrium solutions, the ex-ante profits of the manufacturer, the retailer and the GSC can be obtained as follows.

Then, the ex-ante consumer surplus is

Hence, the ex-ante social welfare can be expressed as

Appendix A3. The retailer shares demand forecast information (Case 3)

3.1 Proof of Proposition 3

The proof of proposition 3 is similar to that of proposition 1, thus we omit the details here.

Appendix A4. Comparative analysis

4.1 Proof of Proposition 4

We get the following equilibrium solutions.

\(w^{i*} = \frac{{2k\left( {E\left( {a\left| \gamma \right.} \right) + s} \right) + \left( {2k - b^{2} } \right)c}}{{4k - b^{2} }}\), \(w^{ni*} = \frac{{2k\left( {a_{0} + s} \right) + \left( {2k - b^{2} } \right)c}}{{4k - b^{2} }}\), \(g^{i*} = \frac{{b\left( {E\left( {a\left| \gamma \right.} \right) - c + s} \right)}}{{4k - b^{2} }}\), \(g^{ni*} = \frac{{b\left( {a_{0} - c + s} \right)}}{{4k - b^{2} }}\), \(p^{i*} = \frac{{3k\left( {E\left( {a\left| \gamma \right.} \right) + s} \right) + \left( {k - b^{2} } \right)c}}{{4k - b^{2} }}\), and \(p^{ni*} = \frac{{3k\left( {a_{0} + s} \right) + \left( {k - b^{2} } \right)c}}{{4k - b^{2} }} + \frac{{t\left( {\gamma - a_{0} } \right)}}{2}\).

Comparing the solutions in different cases, we get.

\(w^{i*} - w^{ni*} = \frac{{2kt\left( {\gamma - a_{0} } \right)}}{{4k - b^{2} }}\), \(g^{i*} - g^{ni*} = \frac{{bt\left( {\gamma - a_{0} } \right)}}{{4k - b^{2} }}\), and \(p^{i*} - p^{ni*} = \frac{{t\left( {\gamma - a_{0} } \right)\left( {2k + b^{2} } \right)}}{{2\left( {4k - b^{2} } \right)}}\).

Thus, if \(\gamma \ge a_{0}\), then \(w^{i*} \ge w^{ni*}\), \(g^{i*} \ge g^{ni*}\), and \(p^{i*} \ge p^{ni*}\); otherwise, we have \(w^{i*} \textless w^{ni*}\), \(g^{i*} \textless g^{ni*}\), and \(p^{i*} \textless p^{ni*}\).

4.2 Proof of Proposition 5

(1) When information is shared, the ex-ante profits of the manufacturer and the retailer are

When no information is shared, the ex-ante profits of the manufacturer and the retailer are

Comparing the ex-ante profits in different cases, we can get

(2) When no information is shared, the ex-ante profit of the GSC is

When information is shared, the ex-ante profit of the GSC is

Comparing the ex-ante profits in different cases, we can get

From Eq. (A4-6), we find that if \(b^{2} < k < \frac{{\left( {3 + \sqrt 5 } \right)b^{2} }}{4}\), then \(E\left( {\pi_{t}^{di*} } \right) > E\left( {\pi_{t}^{dni*} } \right)\); if \(k \ge \frac{{\left( {3 + \sqrt 5 } \right)b^{2} }}{4}\), then \(E\left( {\pi_{t}^{di*} } \right) \le E\left( {\pi_{t}^{dni*} } \right)\).

(3) When no information is shared, the ex-ante social welfare is

When information is shared, the ex-ante social welfare is

Comparing the ex-ante social welfares in different cases, we find that if \(k \le \frac{{\left( {5 + \sqrt {10} } \right)b^{2} }}{10}\), then \(E\left( {WF^{{di{*}}} } \right) \ge E\left( {WF^{{dni{*}}} } \right)\); if \(k > \frac{{\left( {5 + \sqrt {10} } \right)b^{2} }}{10}\), then \(E\left( {WF^{{di{*}}} } \right) < E\left( {WF^{{dni{*}}} } \right)\).

4.3 Proof of Proposition 6

In the case with the contract, the expected profits of the manufacturer and the retailer are expressed as follows.

According to the coordination conditions, we substitute \(g^{tp*} = g^{c*}\) and \(p^{tp*} = p^{c*}\) into Eqs. (A4-9) and (A4-10), the equilibrium wholesale price and green degree under the two-part tariff contract are

Since the ex-ante profits of the manufacturer and the retailer are subject to \(E\left( {\pi_{m}^{tp*} } \right) \ge E\left( {\pi_{m}^{dni*} } \right)\), \(E\left( {\pi_{r}^{tp*} } \right) \ge E\left( {\pi_{r}^{dni*} } \right)\), then we obtain \(F \in \left[ {E\left( {\pi_{m}^{dni*} + \frac{1}{2}k(g^{c*} )^{2} + \left( {w^{tp} - c} \right)q^{c*} } \right),E\left( {\left( {p - w^{tp} } \right)q^{c*} - \pi_{r}^{dni*} } \right)} \right]\).

Rights and permissions

About this article

Cite this article

Wang, W., Lin, W., Cai, J. et al. Impact of demand forecast information sharing on the decision of a green supply chain with government subsidy. Ann Oper Res 329, 953–978 (2023). https://doi.org/10.1007/s10479-021-04233-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04233-7