Abstract

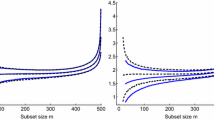

The paper examines the sensitivity for the solution of linear programming problems using Bayesian techniques, when samples for the coefficients of the objective function are uncertain. When data is available, we estimate the solution of the linear program and provide statistical measures of uncertainty through the posterior distributions of the solution in the light of the data. When data is not available, these techniques examine the sensitivity of the solution to random variation in the coefficients of the linear problem. The new techniques are based on two posteriors emerging from the inequalities of Karush–Kuhn–Tucker conditions. The first posterior is asymptotic and does not require data. The second posterior is finite-sample-based and is used whenever data is available or if random samples can be drawn from the joint distribution of coefficients. A by-product of our framework is a robust solution. We illustrate the new techniques in two empirical applications to the case of uncertain Data Envelopment Analysis efficiency, involving two large samples, of US commercial banks and a sample of European commercial banks regulated by the Single Supervisory Mechanism. We analyse whether some pre-determined criteria, associated with size and new supervisory framework, can adequately affect the solution of linear program. The results provide evidence of substantial improvements in statistical structure with respect to sensitivities and robustification. Our methodology can serve as a consistency check of the statistical inference for the solution of linear programming problems in efficiency under uncertainty in data.

Similar content being viewed by others

Notes

Troutt et al. (2006) proposed maximum likelihood techniques to solve the problem, although they did not use a Bayesian approach.

The Jacobian of transformation is: \(J(\rho ,\eta )={\rho }^{d-1}(1-{\eta }^{\prime}\eta {)}^{-1/2}\).

DEA is a nonparametric method to conduct relative performance measurements among a set of decision-making units. As Ehrgott et al. (2018) concluded (p. 241): “… questions for future research are whether and how a stochastic interpretation of uDEA opens a route to approaching the problem via simulation. The relationship between uDEA and parametric analysis will also lead to further questions”.

According to ECB, the criteria for significance for a credit institution include: (i) total assets more than €30 billion, (ii) total assets more than €30 billion but with more than 20% ratio of cross-border assets to liabilities in more than one EU countries, (iii) it has requested or received funding, or it is of economic importance to the country that it is based in or for the whole EU economy (Tziogkidis et al. 2020).

Tziogkidis et al. (2020) found that average net customer loans and customer deposits move in a declining trend, but after 2013 were increased, while average other earning assets have substantially declined after 2014.

References

Acharya, V. V., Engle, R., & Pierret, D. (2014). Testing macroprudential stress tests: The risk of regulatory risk weights. Journal of Monetary Economics, 65, 36–53.

Asmild, M., & Matthews, K. (2012). Multi-directional efficiency analysis of efficiency patterns in Chinese banks 1997–2008. European Journal of Operational Research, 219(2), 434–441.

Bauwens, L., Bos, C. S., van Dijk, H. K., & van Oest, R. D. (2004). Adaptive radial-based direction sampling: Some flexible and robust Monte Carlo integration methods. Journal of Econometrics, 123(2), 201–225.

Ben-Tal, A., & Nemirovski, A. (1999). Robust solutions of uncertain linear programs. Operations Research Letters, 25(1), 1–13.

Borgonovo, E., Buzzard, G. T., & Wendell, R. E. (2018). A global tolerance approach to sensitivity analysis in linear programming. European Journal of Operational Research, 267(1), 321–337. https://doi.org/10.1016/j.ejor.2017.11.034.

Chiong, K. X., Galichon, A., & Shum, M. (2016). Duality in dynamic discrete choice models. Quantitative Economics, 7(1), 83–115.

Ehrgott, M., Holder, A., & Nohadani, O. (2018). Uncertain data envelopment analysis. European Journal of Operational Research, 268(1), 231–242.

El-Ghaoui, L., & Lebret, H. (1997). Robust solutions to least-square problems with uncertain data matrices. SIAM Journal of Matrix Analysis and its Applications, 18(4), 1035–1064.

Fukuyama, H., & Matousek, R. (2017). Modelling bank performance: A network DEA approach. European Journal of Operational Research, 259(2), 721–732.

Gallant, A. R., Giacomini, R., & Ragusa, G. (2017). Bayesian estimation of state space models using moment conditions. Journal of Econometrics, 201(2), 198–211.

Kim, J. Y. (2002). Limited information likelihood and Bayesian analysis. Journal of Econometrics, 107(1–2), 175–193.

Kuhn, H. W., & Tucker, A. W. (1951). Nonlinear programming. In Proceedings of 2nd Berkeley symposium Berkeley: University of California Press (pp. 481–492).

Malikov, E., Kumbhakar, S. C., & Tsionas, M. G. (2015). A cost system approach to the stochastic directional technology distance function with undesirable outputs: The case of U.S. banks in 2001–2010. Journal of Applied Econometrics, 31(7), 1407–1429.

Ravi, N., & Wendell, R. E. (1985). The tolerance approach to sensitivity analysis of matrix coefficients in linear programming: General perturbations. Journal of the Operational Research Society, 36(10), 943–950.

Ravi, N., & Wendell, R. E. (1989). The tolerance approach to sensitivity analysis of matrix coefficients in linear programming. Management Science, 35(9), 1106–1119.

Sealey, A. C. W., & Lindley, J. T. (1977). Inputs, outputs, and a theory of production and cost at depository financial institutions. Journal of Finance, 32(4), 1251–1266.

Shahin, A., Hanafizadeh, P., & Hladk, M. (2016). Sensitivity analysis of linear programming in the presence of correlation among right-hand side parameters or objective function coefficients. Central European Journal of Operational Research, 24(3), 563–593.

Shi, X., & Shum, M. (2015). Simple two-stage inference for a class of partially identified models. Econometric Theory, 31(3), 493–520.

Troutt, M. D., Pang, W. K., & Hou, S. H. (2006). Behavioral estimation of mathematical programming objective function coefficients. Management Science, 52(3), 422–434.

Tziogkidis, P., Philippas, D., & Tsionas, M. G. (2020). Multidirectional conditional convergence in European banking. Journal of Economic Behavior & Organization, 173(5), 88–106.

Wagner, H. M. (1995). Global sensitivity analysis. Operations Research, 43(6), 948–969.

Wendell, R. (1984). Using bounds on the data in linear programming: The tolerance approach to sensitivity analysis. Mathematical Programming, 29(3), 304–322.

Wendell, R. E. (1985). The tolerance approach to sensitivity analysis in linear programming. Management Science, 31(5), 564–578.

Wolak, F. A. (1989). Testing inequality constraints in linear econometric models. Journal of Econometrics, 41(2), 205–235.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Tsionas, M.G., Philippas, D. Measures of global sensitivity in linear programming: applications in banking sector. Ann Oper Res 330, 585–607 (2023). https://doi.org/10.1007/s10479-021-03980-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-03980-x