Abstract

The global warming problem has attracted worldwide attention. Cap-and-trade has been increasingly used in many countries to reduce carbon emissions. However, some firms are concerned about the additional costs required for carbon reduction, and another important concern comes from grandfathering in permit allocation. This paper incorporates these costs and cap-and-trade concerns into a multi-period carbon reduction problem in a Stackelberg game. The findings show that neither cap-and-trade nor the firm’s carbon reduction choice will always benefit the environment. From the government’s perspective, we identify the optimal grandfathering scheme to maximize social welfare that incorporates economic and environmental concerns. We demonstrate that the socially optimal emissions level depends on the level of low-carbon technology and the environmental recovery cost.

Similar content being viewed by others

References

Absi, N., Dauzère-Pérès, S., Kedad-Sidhoum, S., Penz, B., & Rapine, C. (2013). Lot sizing with carbon emission constraints. European Journal of Operational Research, 227(1), 55–61.

Atasu, A., Sarvary, M., & Van Wassenhove, L. N. (2008). Remanufacturing as a marketing strategy. Management Science, 54(10), 1731–1746.

Benjaafar, S., Li, Y., & Daskin, M. (2013). Carbon footprint and the management of supply chains: Insights from simple models. IEEE Transactions on Automation Science and Engineering, 10(1), 99–116.

Böhringer, C., & Lange, A. (2005). On the design of optimal grandfathering schemes for emission allowances. European Economic Review, 49(8), 2041–2055.

Cachon, G. P. (2014). Retail store density and the cost of greenhouse gas emissions. Management Science, 60(8), 1907–1925.

Chang, X., Xia, H., Zhu, H., Fan, T., & Zhao, H. (2015). Production decisions in a hybrid manufacturing–remanufacturing system with carbon cap and trade mechanism. International Journal of Production Economics, 162, 160–173.

Chen, C. (2001). Design for the environment: A quality-based model for green product development. Management Science, 47(2), 250–263.

Chen, X., Benjaafar, S., & Elomri, A. (2013). The carbon-constrained eoq. Operations Research Letters, 41(2), 172–179.

Drake, D. F., & Spinler, S. (2013). Om forumsustainable operations management: An enduring stream or a passing fancy? Manufacturing & Service Operations Management, 15(4), 689–700.

Du, S., Hu, L., & Wang, L. (2015a). Low-carbon supply policies and supply chain performance with carbon concerned demand. Annals of Operations Research. doi:10.1007/s10479-015-1988-0.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015b). Game-theoretic analysis for an emission-dependent supply chain in a cap-and-trade system. Annals of Operations Research, 228(1), 135–149.

Elhedhli, S., & Merrick, R. (2012). Green supply chain network design to reduce carbon emissions. Transportation Research Part D: Transport and Environment, 17(5), 370–379.

Ellerman, A. D. (2010). Pricing carbon: The European Union emissions trading scheme. Cambridge: Cambridge University Press.

Ellerman, A. D., Buchner, B. K., & Carraro, C. (2007). Allocation in the European emissions trading scheme: Rights, rents and fairness. Cambridge: Cambridge University Press.

Ferguson, M. E., & Toktay, L. B. (2006). The effect of competition on recovery strategies. Production and Operations Management, 15(3), 351–368.

Gallego, G., & Van Ryzin, G. (1994). Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Management Science, 40(8), 999–1020.

Hoen, K. M., Tan, T., Fransoo, J. C., & van Houtum, G.-J. (2013). Switching transport modes to meet voluntary carbon emission targets. Transportation Science, 48(4), 592–608.

IPCC. (2005). IPCC special report on carbon dioxide capture and storage. http://www.ipcc.ch. Accessed April 15 2015.

Jaber, M. Y., Glock, C. H., & El Saadany, A. M. (2013). Supply chain coordination with emissions reduction incentives. International Journal of Production Research, 51(1), 69–82.

Jeuland, A. P., & Shugan, S. M. (1988). Channel of distribution profits when channel members from conjectures. Marketing Science, 7(2), 202–210.

Kaur, H., & Singh, S. P. (2016). Sustainable procurement and logistics for disaster resilient supply chain. Annals of Operations Research. doi:10.1007/s10479-016-2374-2.

Kumar Mittal, V., & Singh Sangwan, K. (2014). Modeling drivers for successful adoption of environmentally conscious manufacturing. Journal of Modelling in Management, 9(2), 127–140.

Ruiz-Hernández, D., Elizalde, J., & Delgado-Gómez, D. (2016). Cournot-stackelberg games in competitive delocation. Annals of Operations Research. doi:10.1007/s10479-016-2288-z.

Song, J., & Leng, M. (2012). Analysis of the single-period problem under carbon emission policies. International series in operations research & management science, 176(2), 297–312.

Song, M., Peng, J., Wang, J., & Dong, L. (2016). Better resource management: An improved resource and environmental efficiency evaluation approach that considers undesirable outputs. Resources, Conservation and Recycling. doi:10.1016/j.resconrec.2016.08.015.

Song, M., Wang, S., & Cen, L. (2015). Comprehensive efficiency evaluation of coal enterprises from production and pollution treatment process. Journal of Cleaner Production, 104, 374–379.

Song, M., Wang, S., Yu, H., Yang, L., & Wu, J. (2011). To reduce energy consumption and to maintain rapid economic growth: Analysis of the condition in China based on expended ipat model. Renewable and Sustainable Energy Reviews, 15(9), 5129–5134.

Soni, V., Singh, S., & Banwet, D. (2016). Sustainable coal consumption and energy production in India using life cycle costing and real options analysis. Sustainable Production and Consumption, 6, 26–37.

Stavins, R. N. (2008). Addressing climate change with a comprehensive us cap-and-trade system. Oxford Review of Economic Policy, 24(2), 298–321.

Tang, B., Gong, P., Xiao, Y., & Wang, H. (2017). Energy consumption flow and regional economic development: Evidence from 25 economies. Journal of Modelling in Management, 12(1), 96–118.

Tayal, A., Gunasekaran, A., Singh, S. P., Dubey, R., & Papadopoulos, T. (2017). Formulating and solving sustainable stochastic dynamic facility layout problem: A key to sustainable operations. Annals of Operations Research, 253(1), 621–655.

Toptal, A., Özlü, H., & Konur, D. (2014). Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. International Journal of Production Research, 52(1), 243–269.

Validi, S., Bhattacharya, A., & Byrne, P. (2014). A case analysis of a sustainable food supply chain distribution systema multi-objective approach. International Journal of Production Economics, 152, 71–87.

Von Stackelberg, H. (1952). The theory of the market economy. Oxford: Oxford University Press.

Wang, K., Xian, Y., Zhang, J., Li, Y., & Che, L. (2016). Potential carbon emission abatement cost recovery from carbon emission trading in China: An estimation of industry sector. Journal of Modelling in Management, 11(3), 842–854.

Yenipazarli, A., & Vakharia, A. J. (2017). Green, greener or brown: Choosing the right color of the product. Annals of Operations Research, 250(2), 537–567.

Yu, S., Weikard, H.-P., Zhu, X., & van Ierland, E. (2016). International carbon trade with constrained allowance choices: Results from the STACO model. Annals of Operations Research. doi:10.1007/s10479-016-2126-3.

Zhang, B., & Xu, L. (2013). Multi-item production planning with carbon cap and trade mechanism. International Journal of Production Economics, 144(1), 118–127.

Zhang, F., & Zhang, P. R. (2015). Trade-in remanufacturing, strategic customer behavior, and government subsidies. Available at SSRN. doi:10.2139/ssrn.2571560.

Acknowledgements

We are grateful for the editor’s and reviewers’ time and feedback. Their constructive comments have enabled us to greatly improve the quality of the paper. This research was supported by the National Natural Science Foundation of China (Grant Nos. 71571171, 71631006, 71603069), and the Youth Innovation Promotion Association, CAS (Grant No. 2015364). We thank American Journal Experts (AJE) for English language editing.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proof of firm’s optimal solutions

Proof

We first give the optimal solutions if the firm chooses to reduce product carbon emissions at the carbon reduction rate \({\varphi _t}\), where the profit function is:

Then, the first-order conditions can be derived as:

Accordingly, we have the second-order derivatives as follows.

When \(\lambda > \frac{8}{{{{(a - c - k)}^2}}}\), the determinant of Hessian is:

Thus, the solution to the first order conditions gives the unique solution. From the first order conditions, we get the stationary point as:

\(\square \)

Appendix B: Proof of Proposition 1

Proof

Note that \(\lambda > \frac{8}{{{{(a - c - k)}^2}}}\) is required to guarantee the quantity under the square root sign is positive. We assume it is always satisfied for all the analyse. To guarantee the positivity of demands, the market size should satisfy the condition: \(a>c+k\). We now compare the profits with and without carbon reduction to determine firm’s optimal selection. We get the carbon price threshold \({{\bar{x}}_t}\) by solving \(\pi _t^ *={{\tilde{\pi }} }_t^ *\). The form of \({{\bar{x}}_t}\) is given as:

It is easy to estimate that \(\frac{1}{2}\left( {a - c + k} \right) > \frac{1}{2}\sqrt{{{(a - c - k)}^2} - 8/\lambda } \). Thus, the value of \({{\bar{x}}_t}\) above is positive. When \(x_t>{{\bar{x}}_t}\), the firm choose to reduce product carbon emissions because \(\pi _t^ *>{{\tilde{\pi }} }_t^ *\). Otherwise, \(\pi _t^ *\le {{\tilde{\pi }} }_t^ *\) that the firm chooses not change the product carbon attribute but reduce the production quantity as the reaction to cap-and-trade regulation.

Within the constraint \(a>c+k\) (which we is assumed to be satisfied to guarantee the positivity of the demand, i.e., \(q_t^ *>0\)), and \(x_t>{{\bar{x}}_t}\), the inequity \(0\le \varphi _t^ *<1\) holds. Note that the have assumed that condition \(\lambda > \frac{8}{{{{(a - c - k)}^2}}}\) holds for all this paper. \(\square \)

Appendix C: Proof of Corollary 1

Proof

When \(x_t>{{\bar{x}}_t}\), we give the deviations of the optimal carbon reduction rate with respect to the carbon policy relating parameters.

It is trivial to show that the optimal price \(p_t^*\) is unaffected by the carbon policy because \(\frac{{\partial p_t^ * }}{{\partial {x_t}}} = \frac{{\partial p_t^ * }}{{\partial {x_{t + 1}}}} = \frac{{\partial p_t^ * }}{{\partial {\varepsilon _{t + 1}}}} = 0\).

When \(x_t \le {{\bar{x}}_t}\), the optimal price is \({\tilde{p}}_t^ * = \frac{{a + c + \left( {{x_t} - \delta {\varepsilon _{t + 1}}{x_{t + 1}}} \right) }}{2}\), and \(\frac{{\partial {\tilde{p}}_t^ * }}{{\partial {x_t}}} > 0\), \(\frac{{\partial {\tilde{p}}_t^ * }}{{\partial {x_{t + 1}}}} < 0\) and \(\frac{{\partial {\tilde{p}}_t^ * }}{{\partial {\varepsilon _{t + 1}}}} < 0\). \(\square \)

Appendix D: Proof of Corollary 2

Proof

We give the deviations of the optimal profits with respect to the carbon policy relating parameters. In the product carbon reduction scenario, From the condition \(x_t>{{\bar{x}}_t}\), we have \(k<{x_t}- \delta \varepsilon _{t + 1} {x_{t+1}} \) as the necessary condition. In another word, the inequity \(x_t>{{\bar{x}}_t}\) never holds if \(k>{x_t}- \delta \varepsilon _{t + 1} {x_{t+1}} \).

In the no product carbon reduction scenario:

\(\square \)

Appendix E: Proof of Corollary 3

Proof

Note that the current profits can increase in the next period’s carbon price but it does not implies that the overall profits in the carbon regulated periods can increase in the carbon price. Adding up the profits in period t and \(t+1\) which is affected by \({x_{t+1}}\), note that all the derivations are zero except \(\frac{{\partial \pi _{t - 1}^ * }}{{\partial {x_t}}}\) and \(\frac{{\partial \pi _t^ * }}{{\partial {x_t}}}\). Then in the product carbon reduction scenario we have:

From the first order condition we have:

Or the condition can be equivalently written as:

or

In the no product carbon reduction scenario we have:

From the first order condition we have

Or the condition can be equivalently written as:

\(\square \)

Appendix F: Proof of Proposition 2

Proof

We compare the single period’s carbon emissions in different scenarios to give the conclusions in Proposition 2.

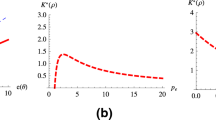

Comparing the total carbon emissions with and without product carbon reduction with all other parameters fixed, the inequity \( E_t^* <{{\tilde{E}}}_t^*\) holds when \({{\bar{x}}_t}<{x_t} < \frac{1}{2}\sqrt{{{(a - c - k)}^2} - 8/\lambda } + \frac{1}{2}\left( {a - c + k + 2\delta {\varepsilon _{t + 1}}{x_{t + 1}}} \right) \). where \( {{\bar{x}}_t}\) is given in Eq. 5 as the carbon price threshold for firm’s product carbon reduction. For simplicity, we denote \({{{\bar{x}}'}_t}\mathrm{{ = }}\frac{1}{2}\sqrt{{{(a - c - k)}^2} - 8/\lambda } + \frac{1}{2}\left( {a - c + k + 2\delta {\varepsilon _{t + 1}}{x_{t + 1}}} \right) \). So, the inequity \( E_t^* <{{\tilde{E}}}_t^*\) holds when \({{\bar{x}}_t}<{x_t}< {{{\bar{x}}'}_t}\). If the carbon price exceeds \({{{\bar{x}}'}_t}\), we have \( E_t^* >{{\tilde{E}}}_t^*\) where the firm emits more emissions in the product carbon reduction choice. The emissions increase comes from the production quantities increment. By comparing the production quantities, we have showed that \({q_t}^ * > {{\tilde{q}}}_t^ * \) always holds. \(\square \)

Appendix G: Proof of Corollary 4

Proof

We analyse the multi-periods’ carbon emissions in two product carbon reduction choices to give the conclusions in Corollary 4.

We can analysis the impacts of carbon price \(x_t\) all over the carbon regulated periods in the sequential two periods t and \(t-1\). If \(x_t \le {{\bar{x}}_t}\), the total emission is \({{\tilde{E}}}_t^*\mathrm{{ = }}\frac{{a - c - \left( {{x_t} - \delta {\varepsilon _{t + 1}}{x_{1 + t}}} \right) }}{2}\) and \(\frac{{\partial \sum _t {{{\tilde{E}}}_t^ * } }}{{\partial {x_t}}} = \frac{{\partial {{\tilde{E}}}_{t - 1}^ * }}{{\partial {x_t}}} + \frac{{\partial {{\tilde{E}}}_t^ * }}{{\partial {x_t}}} = \frac{1}{2}(\delta {\varepsilon _t} - 1)<0\). The carbon price in period t curb the current carbon emissions and promote the former period’s emission, while it has a overall negative impact on carbon emissions. If \(x_t >{{\bar{x}}_t}\),

From the second order condition we know that the overall carbon emissions in the product carbon reduction scenario are convex in period t’s carbon price. In particular, from the first order condition we have:

The grandfathering proportion affects the overall carbon emissions by affecting only his previous period’s emissions and we have:

\(\square \)

Appendix H: Proof of Proposition 3

Proof

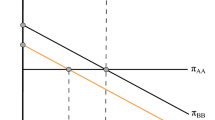

The optimal \(\varepsilon _1, \varepsilon _2,\ldots \varepsilon _T\) is determined by maximizing the social welfare overall periods of all the firms. In period t, \(\varepsilon _{t+1}\) effects the welfare independently, we can maximize the overall periods’ welfare by maximizing period t’s welfare through determining \(\varepsilon _{t+1}\). Here, we find that \(\varepsilon _{1}\) can not be determined. In period 1, the permits allocation works as subsidy and we do not discuss it in the later analyze. The government’s problem is then given as: \(\mathop {\max }\limits _{{\varepsilon _{t + 1}}} {SW}^\prime ({\varepsilon _{t + 1}}) = \)

If there are m firms make the product carbon reduction decision, and the number of the firms do not make this choice is \(n-m\), the first order condition is given as \(\frac{{dS{W^\prime }({\varepsilon _{t + 1}})}}{{d{\varepsilon _{t + 1}}}} = \frac{{dS{W^\prime }(\left. {{\varepsilon _{t + 1}}} \right| \varphi _t^i > 0)}}{{d{\varepsilon _{t + 1}}}} + \frac{{dS{W^\prime }(\left. {{\varepsilon _{t + 1}}} \right| \varphi _t^i = 0)}}{{d{\varepsilon _{t + 1}}}}=0\)

For the product carbon reduction firms \(i=1,2,\ldots m\), the social welfare’s first and second derivatives with respect to \({\varepsilon _{t + 1}}\) is:

For the other firms \(i=m+1, \ldots n\) choose \({\varphi _t^i({\varepsilon _{t + 1}})}=0\), the social welfare’s first derivative with respect to \({\varepsilon _{t + 1}}\) is:

Therefore, we have the first order condition as \(\frac{{dS{W^\prime }({\varepsilon _{t + 1}})}}{{d{\varepsilon _{t + 1}}}} =\)

It gives the solution \(\varepsilon _{t + 1} = \frac{{{x_t} - {w_t}}}{{\delta {x_{t + 1}}}}\), at this point, the second derivative of social welfare is

So we get the optimal grandfathering proportion \(\varepsilon _{t + 1}^ * = \frac{{{x_t} - {w_t}}}{{\delta {x_{t + 1}}}}\) to maximize social welfare.

At \(\varepsilon _{t + 1}^ * = \frac{{{x_t} - {w_t}}}{{\delta {x_{t + 1}}}}\), the optimal social welfare is

The social optimal welfare is decreasing in the social weight on environment because we have the first order conditions that \(\sum _{i =1}^m {\frac{1}{{{\lambda ^i}({k^i} - {w_t})}}} - \sum _{i = m+1}^n {\frac{{{a^i} - {c^i} - {w_t}}}{2}} < 0\). In the second expression, \(a^i> c^i+ {w_t}\) because the inequity \(a> c + {x_t} - \delta {\varepsilon _{t + 1}}{x_{t + 1}}=c+ {w_t}\) holds to guarantee a positive demand in the no product carbon reduction scenario. \(\square \)

Appendix I: Proof of Corollary 5

Proof

Replacing \(\varepsilon _t\) with the social optimal grandfathering proportion \(\varepsilon _t^ *\) into the optimal solutions in the product carbon reduction scenario we have firm i’s optimal solutions at \(\varepsilon _t =\varepsilon _t^ *\):

In the above functions, \(k^i<w_t\) is always satisfied in firm’s product carbon reduction scenario. Because in Proposition 1 the condition for this choice is \(x_t>{\bar{x}}_t\), the inequity \(k^i<{x_t}- \delta \varepsilon _{t + 1} {x_{t+1}}=w_t \) always holds as a necessary condition. Thus at social optimal, \({\varphi _t^ *}^i\) and \({E_t^\mathrm{{*}}}^i\) are positive. From the first derivation of profits \(\frac{{\partial {\pi _t^ * }^i}}{{\partial {w_t}}}\mathrm{{ = }}\frac{1}{{\lambda ^i (k^i - {w_t})}} < 0\), we prove the firm’s profit in period t decreases in the social weight on environment. And the other derivations are: \(\frac{{\partial {\varphi _t^ * }^i}}{{\partial {w_t}}} > 0\), \(\frac{{\partial {p_t^ *}^i }}{{\partial {w_t}}} = 0\) and \(\frac{{\partial {E_t^ * }^i}}{{\partial {w_t}}} < 0\). It implies that at social optimal the more the weight social puts on the environment, the higher the product carbon reduction rate the firms choose. \(\square \)

Rights and permissions

About this article

Cite this article

Du, S., Zhu, Y., Zhu, Y. et al. Allocation policy considering firm’s time-varying emission reduction in a cap-and-trade system. Ann Oper Res 290, 543–565 (2020). https://doi.org/10.1007/s10479-017-2606-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2606-0