Abstract

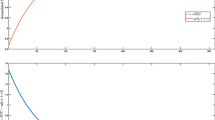

We show that value-maximizing CEOs compensated with stock options prefer debt to equity. Our pecking order result does not depend on managerial risk aversion, managerial firm-specific human capital, or asymmetric information. Moreover, our result holds at least weakly regardless of the distribution of firm cash flows and strictly as long as the support of the cash flow distribution is big enough to bring all features of the stock option contract into play with positive probability

Similar content being viewed by others

References

Bizjak J.M., Brickley J.A., Coles J.L. (1993). Stock-based incentive compensation and investment behavior. Journal of Accounting and Economics 16:349–372

Brennan M., Kraus A. (1987). Efficient financing under asymmetric information. Journal of Finance XLII:1225–1243

Brumelle S.L., Vickson R.G. (1975). A unified approach to stochastic dominance. In: Ziemba W.T., Vickson R.G (eds). Stochastic optimization models in finance. Academic Press, New York

Cohen, R. B., Hall, B. J., Viceira, L. M.: Do executive stock options encourage risk-taking? Working paper, Graduate School of Business Administration, Harvard University (2000)

Coles, J. L., Daniel, N. D., Naveen, L.: Managerial incentives and risk-taking. Working paper, Department of Finance, Arizona State University (2004)

Constantinides G., Grundy B. (1987). Optimal investment with stock repurchase and financing as signals. Review of Financial Studies 2:445–465

Defusco R.A., Johnson R.R., Zorn T.S. (1990). The effect of executive stock option plans on stockholders and bondholders. Journal of Finance 45:617–627

Fisher I. (1930). The theory of interest. Macmillan, London

Garvey, G. T., Mawani, A.: Executive stock option plans and incentives to take risk in levered firms: equity value or firm value maximization. Working paper, Department of Finance, University of British Columbia (1998)

Guay, W.: Compensation, convexity and the incentives to manage risk: an empirical analysis. Working Paper, The Wharton School, University of Pennsylvania (1998)

Hanoch G., Levy H. (1969). The efficiency analysis of choices involving risk. Review of Economic Studies 36:335–346

Harikumar T. (1996). Leverage, risk-shifting incentives, and stock based compensation. Journal of Financial Research 19:417–428

Harris M., Raviv A. (1991). The theory of capital structure. Journal of Finance 46:297–355

Hirshleifer J. (1970). Investment, interest, and capital. Prentice-Hall, London

Lambert R.A., Lanen W.N., Larker D.F. (1989). Executive stock option plans and corporate dividend policy. Journal of Financial and Quantitative Analysis 24:409–424

Myers S., Majluf N. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13:187–221

Noe T. (1988). Capital structure and signaling game equilibria. Review of Financial Studies 1:331–356

Ross S., Westerfield R., Jaffe J. (2005). Corporate finance. McGraw-Hill Irwin, Boston

Rothschild M., Stiglitz J.E. (1970). Increasing risk I: A definition. Journal of Economic Theory 2:225–243

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification Numbers: G0, G3

An earlier version of this paper was completed while Page was visiting CERMSEM at Paris 1 and the University of Warwick. Page gratefully acknowledges the support and hospitality of CERMSEM, Paris 1 and Warwick. Page also gratefully acknowledges financial support from the Department of Economics, Finance, and Legal Studies and the Culverhouse College of Business at the University of Alabama. Both authors are grateful to seminar participants in the Financial Markets Group Workshop at LSE for many helpful comments and both authors are especially grateful to an anonymous referee whose detailed and insightful comments led to substantial improvements in the paper

Rights and permissions

About this article

Cite this article

MacMinn, R.D., Page, F.H. Stock options and capital structure. Annals of Finance 2, 39–50 (2006). https://doi.org/10.1007/s10436-005-0029-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-005-0029-4