Abstract

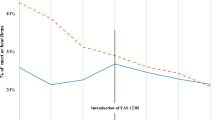

The riskiness developed by Aumann and Serrano (J Polit Econ 116:810–836, 2008) is a measure based on mean, standard deviation and higher order moments. Instead of relying on corporate policies as indirect measures of firm risk, we theoretically show a positive relation between the value of compensation contracts with convex payoff and the firm’s option implied riskiness through second-order stochastic dominance and provide supportive empirical evidence of this risk taking incentive. To address the endogeneity concern, we perform a difference-in-difference analysis using the implementation of FAS 123R in 2006, an accounting standard under which firms are required to recognize the fair value-based expense of stock option grants. Firms thereby are discouraged from granting executive stock options (ESO) because of the higher cost resulted from the strict expense recognition required by FAS 123R. Hence, the implementation of FAS 123R results in an exogenous negative shock to the use of ESO. Using this approach, we find a significant decrease in the option implied riskiness subsequent to FAS 123R, supportive of the risk-taking incentive associated with executive stock options.

Similar content being viewed by others

Notes

Following the theoretical relation indicated by the Black–Scholes option pricing formula whereby the value of equity compensation increases in the risk of firm value, many have hypothesized that the convexity of compensation payoff (often referred to in the literature as vega) induces risk-averse managers to increase firm risks (e.g., Haugen and Senbet 1981; Smith and Watts 1982; Smith and Stulz 1985). However, this hypothesis also is challenged on theoretical grounds in several studies (e.g. Lambert et al. 1991; Carpenter 2000; Ross 2004; Lewellen 2006). Via sophisticated analyses, these studies find that a manager’s equity compensation holdings do not unambiguously increase risk-taking incentives, as the actual incentive effect depends on an array of manager-level characteristics such as personal wealth and risk-aversion degrees.

Ferri and Li (2020) find that managers with more options-based compensation favor repurchases over cash payouts following FAS 123R.

Some work in asset pricing suggests that investors favor right skewness (e.g., Rubinstein 1973; Kraus and Litzenberger 1976; Jean 1971; Kane 1982; Harvey and Siddique 2000), but are averse to tail-risk and rare disasters (e.g., Barro 2006, 2009; Gabaix 2008, 2012; Gourio 2012; Chen et al. 2012; Wachter 2013).

Foster and Hart (2009) consider the possibility that an agent’s risk tolerance depends on the agent’s wealth, and define riskiness as the minimal wealth level at which they are willing to accept the risky asset.

See p. 9 of Aumann and Serrano (2008).

In addition, Dong et al. (2010) find that CEOs with higher convexity of compensation payoff are more likely to raise debts than to raise equity when they have financing needs. However, although R&D investment and firm focus can be regarded as risky corporate strategies, these policies can also be endogenously determined optimal corporate strategies. That is, whether managerial compensation indeed induces “excessive” risk-taking behavior is also an important research question. For example, Shen and Zhang (2013) find that R&D investments made by CEOs holding excessively high convexity of compensation payoff display low efficiencies.

Please see Appendix for the derivation of (2).

Under risk neutral measure, the expected value of (ST- S0)/S0 (\({\mu }_{y,f}\)) is equal to \({e}^{(r-q)T}-1\) under F and G. In addition, if m = 0, the convexity of the payoff structure disappears and (5) will be reduced to \({e}^{-qT}\).

As noted for example by Iqbal and Vähämaa (2019), vega provides an explicit measure of the risk-sensitivity of executive compensation.

The proof is available on request.

A comparison between using implied volatility and our riskiness measures is in order. Implied volatility is intuitive and simple to calculate. Nevertheless, the riskiness index is advantageous for the following reasons. While the increase in implied volatility will lead to the increase in call prices, the implied volatility may vary with the strike prices if the distribution of the stock price is not lognormal. Given the exact strike prices of ESOs for a certain CEO is hard to ascertain in reality, it is empirically difficult for researchers to decide which exact strike price we should use to investigate the risk-taking incentives of CEOs. Therefore, by using the riskiness index, we avoid such problem and theoretically link the convexity of the compensation payoff structure to the ESO values and the firm riskiness through the SSD.

As suggested by Buss and Vilkov (2012), we select out-of-the-money options (put options with deltas strictly larger than − 0.5 and call options with deltas smaller than 0.5).

Specifically, we interpolate the Black–Scholes implied volatilities inside the available moneyness range and extrapolate using the boundaries to fill in 1000 grid points in the moneyness range from 1/3 to 3.

If the distribution F dominates G by SSD under risk neutral measure, the risk neutral volatility should be larger under distribution G. However, we cannot compare the volatility of distribution F and distribution G under the real world measure.

References

Aumann RJ, Serrano R (2008) An economic index of riskiness. J Polit Econ 116:810–836

Baber WR, Janakiraman SN, Kang SH (1996) Investment opportunities and the structure of executive compensation. J Account Econ 21:297–318

Bakshi G, Madan D (2000) Spanning and derivative-security valuation. J Financ Econ 55:205–238

Bakshi G, Kapadia N, Madan D (2003) Stock return characteristics, skew laws, and the differential pricing of individual equity options. Rev Financ Stud 16:101–143

Bali TG, Cakici N, Chabi-Yo F (2011) A generalized measure of riskiness. Manage Sci 57:1406–1423

Bali TG, Cakici N, Chabi-Yo F (2015) A new approach to measuring riskiness in the equity market: Implications for the risk premium. J Bank Finance 57:101–117

Barro R (2006) Rare disasters and asset markets in the twentieth century. Quart J Econ 121:823–866

Barro R (2009) Rare disasters, asset prices, and welfare costs. Am Econ Rev 99:243–264

Berger PG, Ofek E, Yermack DL (1997) Managerial entrenchment and capital structure decisions. J Finance 52:1411–1438

Billings BK, Moon JR Jr, Morton RM, Wallace DM (2020) Can employee stock options contribute to less risk-taking? Contemp Account Res 37(3):1658–1686

Buss A, Vilkov G (2012) Measuring equity risk with option implied correlations. Rev Financ Stud 25:3113–3140

Carpenter JN (2000) Does option compensation increase managerial risk appetite? J Finance 55:2311–2331

Carr P, Wu L (2009) Stock options and credit default swaps: a joint framework for valuation and estimation. J Financ Econom 8:409–449

Chen H, Joslin S, Tran N (2012) Rare disasters and risk sharing with heterogeneous beliefs. Rev Financ Stud 25:2189–2224

Chen TF, Chung SL, Tsai WC (2016) Option implied equity risk and the cross section of stock returns. Financ Anal J 72:42–55

Coles JL, Daniel ND, Naveen L (2006) Managerial incentives and risk-taking. J Financ Econ 79:431–468

Core J, Guay W (1999) The use of equity grants to manage optimal equity incentive levels. J Account Econ 28(2):151–184

Core J, Guay W (2002) Estimating the value of employee stock option portfolios and their sensitivities to price and volatility. J Account Res 40:613–630

DiPrete TA, Eirich GM, Pittinsky M (2010) Compensation benchmarking, leapfrogs, and the surge in executive pay. Am J Sociol 115:1671–1712

Dong ZY, Wang C, Xie F (2010) Do executive stock options induce excessive risk taking? J Bank Finance 34:2518–2529

Faulkender M, Yang J (2010) Inside the black box: the role and composition of compensation peer groups. J Financ Econ 96:257–270

Ferri F, Li N (2020) Does option-based compensation affect payout policy? Evidence from FAS 123R. J Financ Quant Anal 55(1):291–329

Foster DP, Hart S (2009) An operational measure of riskiness. J Polit Econ 117:785–814

Gabaix X (2008) Variable rare disasters: a tractable theory of ten puzzles in macro-finance. Am Econ Rev 98:64–67

Gabaix X (2012) Variable rare disasters: an exactly solved framework for ten puzzles in macro-finance. Quart J Econ 127:645–700

Goolsbee A (2000) Taxes, high-income executives, and the perils of revenue estimation in the new economy. Am Econ Rev 90:271–275

Gourio F (2012) Disaster risk and business cycles. Am Econ Rev 102:2734–2766

Harvey C, Siddique A (2000) Conditional skewness in asset pricing tests. J Finance 55:1263–1295

Haugen RA, Senbet LW (1981) Resolving the agency problems of external cpital through options. J Finance 36:629–647

Hayes RM, Lemmon M, Qiu MM (2012) Stock options and managerial incentives for risk taking: evidence from FAS 123R. J Financ Econ 105:174–190

Iqbal J, Vähämaa S (2019) Managerial risk-taking incentives and the systemic risk of financial institutions. Rev Quant Finance Acc 53(4):1229–1258

Jean W (1971) The extension of portfolio analysis to three or more parameters. J Financ Quant Anal 6:505–515

Jiang GJ, Tian YS (2005) The model-free implied volatility and its information content. Rev Financ Stud 18:1305–1342

Kadan O, Liu F (2014) Performance evaluation with high moments and disaster risk. J Financ Econ 113:131–155

Kane A (1982) Skewness preference and portfolio choice. J Financ Quant Anal 17:15–25

Kraus A, Litzenberger R (1976) Skewness preference and the valuation of risk assets. J Finance 31:1085–1100

Lambert RA, Larcker DF, Verrecchia RE (1991) Portfolio considerations in valuing executive-compensation. J Account Res 29:129–149

Lee CF, Hu C, Foley M (2021) Differential risk effect of inside debt, CEO compensation diversification, and firm investment. Rev Quant Finance Acc 56(2):505–543

Leiss M, Nax HH (2018) Option-implied objective measures of market risk. J Bank Finance 88:241–249

Levy H (1992) Stochastic dominance and expected utility: survey and analysis. Manage Sci 38:555–593

Lewellen K (2006) Financing decisions when managers are risk averse. J Financ Econ 82:551–589

Machina M, Rothschild M (2008) The new palgrave dictionary of economics. Macmillan, London

Murphy K (1999) Executive compensation. Handb Lab Econ 3:2485–2563

Murphy K (2013) Handbook of the economics of finance. In: Constantinides G, Harris M, Stulz R (eds) executive compensation: where we are, and how we got there. Elsevier

Peng L, Röell A (2008) Manipulation and equity-based compensation. Am Econ Rev 98:285–290

Peng L, Röell A (2014) Managerial incentives and stock price manipulation. J Finance 69:487–526

Perry T, Zenner M (2000) CEO compensation in the 1990s: shareholder alignment or shareholder expropriation? Wake Law Rev 35:123–152

Rasmusen E (2007) When does extra risk strictly increase an option’s value? Rev Financ Stud 20:1647–1667

Ross SA (2004) Compensation, incentives, and the duality of risk aversion and riskiness. J Finance 59:207–225

Rubinstein M (1973) The fundamental theorem of parameter-preference security valuation. J Financ Quant Anal 8:61–69

Safdar I, Neel M, Odusami B (2022) Accounting information and left-tail risk. Rev Quant Finance Acc 58(4):1709–1740

Schroth J (2018) Managerial compensation and stock price manipulation. J Account Res 56:1335–1381

Shen CHH, Zhang H (2013) CEO risk incentives and firm performance following R&D increases. J Bank Finance 37:1176–1194

Smith CW, Stulz RM (1985) The determinants of firm’s hedging policies. J Financ Quant Anal 20:391–405

Smith CW, Watts R (1982) Incentive and tax effects of U.S. executive compensation plans. Aust J Manag 7:139–157

Taboga M (2014) The riskiness of corporate bonds. J Money Credit Bank 46:693–713

Wachter J (2013) Can time-varying risk of rare disasters explain aggregate stock market volatility? J Finance 68:987–1035

Funding

The funding was provided by Ministry of Science and Technology, Taiwan, (Grand No. 102-2410-H-008-020-).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

According to the spanning formula of Bakshi and Madan (2000) and Bakshi et al. (2003), any function of the form \(H\left(S\right)\) with \(E\left[H\left(S\right)\right]< \infty\) can spanned by a collection of call and put options:

where \({H}_{S}\left(\bullet \right)\) and \({H}_{SS}\left(\bullet \right)\) represent the first and second derivative of H with respect to S and \(\overline{S }\) is the initial stock price. We denote

In addition, S denotes \({S}_{j,T}\), \(\overline{S }\) denotes \({S}_{j,0}\) and \(H\left[{S}_{j,T}\right]={e}^{-\frac{{g}_{j,T}}{{{\varvec{R}}}_{j}}}\). Since \(E\left({e}^{-\frac{{g}_{j,T}}{{{\varvec{R}}}_{j}}}\right)=1\) and by the spanning formula of Bakshi and Madan (2000) and Bakshi et al. (2003), we have

where \({r}_{T}\) is the return on the risk-free security over a period T, \({P}_{j}\left(K,T\right)\) and \({C}_{j}\left(K,T\right)\) are put price and call price of stock j with strike price equal to K and time to maturity equal to T at the present time 0 respectively, and

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lu, CC., Shen, C.Hh., Shih, PT. et al. Option implied riskiness and risk-taking incentives of executive compensation. Rev Quant Finan Acc 60, 1143–1160 (2023). https://doi.org/10.1007/s11156-022-01123-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-022-01123-2