Abstract

We adopt a simple model of endogenous growth with polluting capital and a fixed budget for aggregate emissions. Pollution abatement efficiency is growing over time due to technical progress. We find that long-run capital and consumption are inversely related to the initial capital stock. Capital taxation does not harm the economy but actually raises long-run consumption and production, which we call the “capital tax paradox.” The reason for this surprising result is that in an economy with a binding carbon policy, early abundance of polluting capital is not a blessing but a curse. It is preferable to have a large capital stock when abatement efficiency has grown sufficiently large. The paper also provides novel results on the impact of pollution intensity and the rate of technical progress on the greening of the economy and the pollution permit prices. In the quantitative part, we calibrate model and study economic growth under different assumptions on the basic model parameters.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is a rich literature on the optimal taxation of capital. The topic has fascinated many economic theorists, while it has tended to confound economic policymakers. The conundrum is that in reality all major economies tax capital, while a major strand of economic theory concludes that capital should not actually be taxed at all (Judd 1985; Chamley 1986; Chari et al. 2020). The basic intuition for the zero-tax result is that, to maximize efficiency, i.e., to minimize distortions by taxation in an economy, goods ought to be taxed according to their price elasticities. In a framework with intertemporal optimization over an infinite time horizon and with growth being based on capital accumulation, capital supply is very elastic and even infinitely elastic in the long run; a capital income tax would thus induce the “strongest” possible tax distortion. However, this class of models abstracts from various important issues. First, human life is finite and inheritance is a significant source of lifetime inequality. Piketty and Saez (2013) show that under these conditions, there is an optimal tax on inheritance. Second, these authors also argue that in reality agents cannot transfer resources across periods at a fixed and riskless interest rate. With such uninsurable risk, a lifetime capital tax is a useful addition to the inheritance tax. Third, the zero-tax results crucially depends on the assumption of a utilitarian social welfare function and the behavior of the social planner (or the assumed political process). Acemoglu et al. (2011) show that with an independent political process, the best equilibrium for the citizens involves long-run capital taxation provided that the politicians are less patient than the citizens. Kalsbach (2022) derives an optimal capital tax in an economy with the two distinct classes of workers and savers having different preferences with respect to intertemporal optimization.

Optimal capital taxation is also a central topic in environmental and resource economics, especially in a dynamic setup. Groth and Schou (2007) analyze the effects of taxing non-renewable resources with those of taxing capital; they find that capital taxes do not affect the long-run growth rate, whereas resource taxes are decisive for growth. Relating capital taxes to pollution becomes obvious when the use of capital is polluting. In the Pigouvian tradition of environmental economics, it is well known that a negative externality has to be internalized either by setting appropriate taxes or by implementing a permit market. This is where we start our analysis and where the paper makes a contribution to the literature.

We adopt a simple model of endogenous growth of the AK-type with polluting capital introduced earlier in Borissov and Bretschger (2021). We impose a fixed budget for aggregate emissions, which can be thought of as the remaining carbon in current climate policy. Pollution quantity is governed by pollution intensity and by abatement efficiency, which is improving over time due to technical progress. We state the optimization problem for both the social optimum and the decentralized economy. The paper provides analytical solutions and numerical applications of the base model.

For our endogenously growing economy subject to stringent climate policy, we derive a novel and surprising result on capital taxation, which we call a “paradox”. The paradox is that in our setup, long-run capital and consumption are inversely related to the initial capital stock. From this, it follows that positive capital taxation does not harm the economy but actually raises long-run consumption and production. Behind this “capital tax paradox” lies a simple but deep intuition. With a binding emission budget and abatement efficiency growing over time, early abundance of capital is not a blessing but a curse. In an initially wealthy economy, the emission budget is used up too early and too quickly. For welfare optimization, it is preferable to have a large capital stock at a later stage, when abatement efficiency has become sufficiently large. These findings contradict the cited earlier results of literature on capital taxation which can be explained by that fact that earlier models have abstracted from environmental problems which is a serious omission in times of climate change and associated policies.

The paper also provides novel results on the impact of pollution intensity and the rate of technical progress on the greening of the economy and the pollution permit prices. In the quantitative part, we calibrate model and study growth and carbon prices under different assumptions on the basic model parameters. We perform these calculations because there is widespread concern that stringent decarbonization will severely harm long-term economic development and disproportionately affect less developed countries. On a positive note, there is growing hope that new technological solutions can support a rapid transition of the global economy to a sustainable state. The present paper aims to address these issues in a second part using the framework from the theory part. In the present context, we will consider three topics. First, we study the impact of the stringency of climate policy on economic development. Second, we assess the different effects of climate policies for developed and less developed countries. Third, the setup is used to show the importance of the technology parameters, i.e., capital productivity and abatement efficiency. The purpose of the second paper part is to show the robustness of the present approach and to contribute to the general understanding of the derived paradoxes.

The remainder of the paper is organized as follows. Section 2 develops the underlying theory in a concise manner. Section 3 presents our theoretical results on capital taxation and pollution permit prices. In Section 4, we calibrate the model and derive numerical results for the growth issues at hand. Section 5 concludes with a discussion of the main results.

2 Model

2.1 General setup

We build on the analysis of the endogenous growth model introduced by Borissov and Bretschger (2021). The model may be thought of as representing either a single country or the world economy. First we briefly restate the basic model setup and then proceed with our main analysis.

Period t output \(Ak_t\) is produced by using capital \(k_t\) with a linear technology represented by factor productivity \(A > 0.\) Capital depreciates within one period. Output can be used for consumption or for building future capital stock. The initial stock of capital is given at some level \(\hat{k}_0 > 0\).

Capital use is polluting; for instance, one can think of \(CO_2\) emissions. Its impact on emissions is given by pollution intensity \(\nu > 0\) and abatement efficiency, which grows due to exogenous technical progress in abatement at a rate \(1/\gamma\), where \(0<\gamma < 1\). At time t, the level of emissions is equal to \(\gamma ^t \nu k_t\). As in Borissov and Bretschger (2021), we assume that

The social planner maximizes lifetime logarithmic utility with discount factor \(\beta\) which is assumed to be greater than 1/A.

2.2 Social optimum

At the end of time period \(t=0\), the social planner sets pollution budget (i.e., emissions aggregated over all future time periods) to some level \(E_0 > 0\) so that the capital stock path \(k_t\), \(t = 0, 1, \dots ,\) satisfies the inequality \(\sum \limits _{t=1}^{\infty }\gamma ^t\nu k_t \le E_0\). Thus, the social planner solves the following social optimum problem:

with \(k_0>0\) and \(E_0>0\) being given.

Let \(p_t\) and q denote Lagrange multipliers associated with constraints Eqs. 1b and 1c correspondingly. As usual, \(p_t\) can be interpreted as the shadow price of the aggregate good produced in period t, while q stands for the shadow price of emissions.

The Lagrangian for problem Eqs. 1a-–1d is

It is clear that on an optimal path, the capital stock and consumption are positive at every time (\(k_t>0, \ c_t>0, \ t=0,1,...\)). Therefore, the first-order conditions for problem Eqs. 1a–1d are:

and the transversality condition is

In Borissov and Bretschger (2021), it is proven that problem Eqs. 1a–1d have a unique solution and that conditions Eqs. 3–8 are necessary and sufficient conditions of optimality for this problem.

In what follows, we assume that the constraint on emissions is binding, i.e., \(q>0\).

2.3 Decentralized equilibrium

The optimal solution of the central planner problem Eqs. 1a–1d is naturally decentralized to a competitive equilibrium with a representative producer and a representative consumer. We take the single good as the numeraire, so that its market price is unity, and denote the price of emissions at the end of period t by \(\pi _{t}\).

At each time t, the representative producer solves the following profit maximization problem:

where \(1+r_{t}\) is the gross interest rate in period t and \(\pi _{t-1}\) is the current value price of emissions at the end of period \(t-1\). In equilibrium, the profit is equal to zero.

We assume that the government allocates a pollution quota in the form of permits to households equal to the amount of \(E_{0}\). The permits are freely tradable on the permit market.

The initial total wealth of the representative consumer is equal to the total output \(Ak_{0}\) plus the stock of permits valued at their initial price \(\pi _{0}\), \(\pi _{0}E_{0}\). The consumer maximizes her intertemporal utility \(\sum _{t=0}^{\infty }\beta ^{t}\ln c_{t}\) under a sequence of budget constraints, complemented by the no-Ponzi-game condition. The problem the representative consumer solves at time 0 is

Here, \(s_{t}\) are the savings in period t.

A competitive equilibrium is defined by the following three conditions: (i) the equilibrium in the financial market requires that savings are distributed between physical capital and the pollution quotas according to \(s_{t}=k_{t+1}+\pi _{t}E_{t},\ t=0,1,2,...,\) where \(E_{t}\) is the pollution budget at the end of period t determined by \(E_{t} = E_{t-1} - \gamma ^{t}\nu k_{t}, \ t=1,2,...;\) (ii) the equilibrium in the goods markets requires that \(c_{t}+k_{t+1}=Ak_{t},\ t=0,1,...;\) (iii) finally, the equilibrium in the permit market requires that \(\lim _{t\rightarrow \infty } E_t \ge 0.\)

It is not difficult to show (see details in Borissov and Bretschger 2021) that a competitive equilibrium with free pollution permit trade and the social optimum are essentially the same thing and that the equilibrium interest rate and the current-value permits prices being associated with the Lagrange multipliers of problem Eqs. 1a–1c are given by

and

Note that, in equilibrium, the Hotelling rule holds:

3 Paradoxes

In this section, we proceed with a detailed analysis of the trajectories that arise in our model. We will discover a few paradoxical dynamic properties affecting capital taxation and will derive further theoretical results of the model.

We obtain from Eq. 4 that

and, taking account of Eq. 3, that

Therefore,

It is not difficult to check that \(\frac{k_{t+1}}{c_{t}}\xrightarrow [t \rightarrow \infty ]{}\frac{\beta }{\gamma A-\beta }\) and hence

and

To facilitate further analysis, the model needs to be detrended into a stationary form. We label the detrended variables using tildes so that

where \(g=\beta /\gamma\) denotes the growth rate.

From Eqs. 17 and 18, we see that the long-run growth rate of the economy under a climate budget constraint is fully determined by the discount factor \(\beta\) and the rate of technical progress in abatement, \(1/\gamma\). This basic finding has central implications which are further characterized by means of numerical simulation in the second part of the paper, where we will also check the robustness of the results in terms of their sensitivity to main model parameters. It is straightforward to show that \(\gamma A > 1\) is a key assumption both in this paper and Borissov and Bretschger (2021). Given that the factor productivity A is greater than the rate of technical progress in abatement, \(1/\gamma\), the model dynamics is different from the vanilla AK-model, where the economy’s growth rate is governed by total factor productivity A.

While the rate of growth of the economy is fully determined by the discount factor and the rate of technical progress in abatement, we can see from Eqs. 16 and 19 that the long-run detrended levels of the capital stock and consumption, \(\tilde{k}_{t}\) and \(\tilde{c}_{t}\), also depend on factor productivity A, pollution intensity \(\nu\), and the shadow price of emissions, q. These levels are increasing in A and decreasing in \(\nu\) and q.

In its turn, q depends on the initial stock of capital, \(k_0\), and the initial pollution budget \(E_0\). Therefore, long-run detrended levels of the capital stock and consumption depend on \(k_0\) and \(E_0\). What is this dependence? The answer is given by the following proposition.

Proposition 1

(Green growth paradox) The long-run detrended levels of the capital stock and consumption, \(\tilde{k}_{t}\) and \(\tilde{c}_{t}\), are increasing in \(E_0\) and decreasing in \(k_0\).

Proof

It follows from Eqs. 16 and 19 and the following lemma proved in the Appendix 1:

Lemma 1

The value of q is decreasing in \(E_0\) and increasing in \(k_0\).

That the long-run detrended levels of the capital stock and consumption increase when the pollution budget becomes less stringent, i.e., when \(E_0\) goes up, is natural. By contrast, that these levels are decreasing in the initial stock of capital seems surprising and even paradoxical. Indeed, this means that if we consider two countries with the same initial pollution budget and different initial capital stock, then the country that starts with lower stock of capital will eventually overtake the initially richer country. Thus, leapfrogging naturally arises in our model.

An interesting implication of Proposition 1 is that a short-term tax on capital will lead in the long run to a higher stock of capital. Indeed, suppose that at time 0 the government imposes a one-time tax on capital at rate \(\tau >0\) and, for simplicity, throws away the tax revenue. Then, the time-0 budget constraint of the representative consumer becomes

This is equivalent to a decrease of the initial stock of capital. Thus, we can formulate the following proposition.

Proposition 2

(Capital tax paradox) A one-time tax on capital will result in an increase in the long-run levels of the capital stock and of consumption.

Proof

Follows directly from Eq. 21.

Let us now turn to the dynamics of permit prices. From Eq. 15, we have that

and hence

We can see that the gross interest rate \(1 + r_t\), equal to the rate of growth of permit prices, \(\pi _{t}/\pi _{t-1}\), converges to the rate of technical progress in abatement, \(1/\gamma\), and that the detrended permit prices, \(\gamma ^t\pi _t\equiv \tilde{\pi }_t\), converge to a level, \(\frac{\gamma A - 1}{\gamma \nu }\), which is increasing in the factor productivity A. These are not surprising results.

What is surprising and even paradoxical is that the level to which the detrended permit prices converge is decreasing in pollution intensity \(\nu\). If we compare two countries with the same factor productivity and the same rate of technical progress in abatement, but different pollution intensity, we will see that the country in which the pollution intensity is higher has, in the long run, lower permit prices. Formally, we can formulate the following proposition:

Proposition 3

(Permit prices paradox) A higher pollution intensity leads in the long run to a lower level of permit prices.

Proof

Follows directly from Eq. 22.

An increase in \(\nu\) has two effects. On the one hand, it makes the pollution constraint more stringent, which pushes q upward. On the other hand, it decreases the long-run level of consumption (see Eq. 16), which pushes \(p_t\) downward. This proposition shows that the second effect overweight the first one.

4 Quantitative analysis

In this section, we present a quantitative investigation of the theoretical findings from the previous section. Our main purpose is to provide a further graphical intuition for the green growth paradox and its corollaries, but not to undertake detailed calibration.

Proposition 4

Assume pollution constraint is binding. Then, detrended variables converge:

where \(\tilde{c}_{\infty } = \frac{\gamma A - 1}{\nu \gamma q}, \tilde{k}_{\infty } = \frac{\gamma A - 1}{\nu q (\gamma A - \beta )}, \tilde{p}_{\infty } = \frac{\nu \gamma q}{\gamma A - 1}\) and \(\tilde{\pi }_{\infty } = \frac{\Gamma -1}{ \gamma \nu }\) .

Proof

See the previous section.

Below we investigate transition dynamics and give simple insights about the structure of the limiting values.

We solve the model in detrended variables using the forward iteration algorithm. Then, we can reconstruct the original variables using Eq. 20. For the baseline scenario, we adopt the current world rate of technical progress of around 3% and a low discount rate of roughly 1% implying \(\gamma =0.97\) and \(\beta =0.99.\) Furthermore, given our assumption of full capital depreciation within a period, for capital productivity, we need \(A>1\) and assume \(A=1.04.\) For the pollution intensity, we relate the values of capital stock and emissions budget (see below) to get \(\nu =0.0004.\) The remaining world budget of CO\(_{2}\) emissions is taken from the 1.5 \({}^{\circ }\) C report of IPCC (2018) which indicates an amount of 420 Gigatons CO\(_{2}\) left for reaching the 1.5\({}^){\circ }\)C temperature target, so that we set \(E_{0}=\hat{E}_{0}=420\cdot P_0\) below, where \(P_0\) is the initial period \(CO_2\) market price per GigatoneFootnote 1. We take the price equal to \(\$40\) per one tone of \(CO_2\). Since capital k represents all kinds of capital (including physical, human, and social), which makes it rather difficult to calibrate at a global level, we start with consumption instead and use data on the worldwide-consumption flow which was $64 trillion in 2019 (World Bank 2021). From there, we calculate the capital stock that is consistent with the model. We perturbate these values sequentially below to show the sensitivity of the model results with respect to the basic assumptions and to illustrate the green growth paradox and its implications.

First we consider the sensitivity of the results to the initial conditions. The economy growth rate is identically equal to \(g=\beta /\gamma\) in all such scenarios, while levels of economic variables are different.

This subsection deals with variations in the available carbon budget, the next with different endowments of initial capital. Figure 1 shows the development of detrended consumption and capital stock under the standard carbon budget \(\hat{E}_{0}\) as a benchmark, depicted by the solid line. Here and everywhere below we use dashed lines to depict the limiting values \(\tilde{c}_{\infty }\) and \(\tilde{k}_{\infty }\) of detrended consumption and capital. We then vary the pollution budget \(E_{0}\) by +/− 15% to obtain a likely range for both variables. We can see that reducing carbon budget by 15% results in lower detrended capital stock depicted by the dash-dotted line. In the short run, lower investment automatically results in higher consumption level.

Next we are interested in the effects of climate policy at different levels of economic development, represented by different levels of initial capital stock. With this, we can discuss the impact of decarbonization on rich and less developed economies, which is a big issue for international burden sharing of climate policy and international climate negotiations.

To this end, we vary the initial capital stock \(k_{0}\) in the initial period 0 and set the baseline \(k_{0}=\hat{k}_{0}\) equal to the implied value obtained above. The results for the development of detrended consumption and capital are depicted in Fig. 2, where we reproduce the benchmark as the solid line and reduce initial capital \(k_{0}\) by \(- 10\)% and \(- 20\)% to obtain results for both variables. As initial capital is known, we interpret the outcome as a result for more and less developed countries (with high and low \(k_{0}\)).Footnote 2

It is seen from the figures that a less developed economy is predicted to catch up to the wealthier countries, even when environmental policy is applied in an equal manner.

On the one hand, it is readily seen from the figure that the ratio of consumption and the ratio of capital stocks in two countries converge to a constant value, a result that can be confirmed in the theoretical model by Borissov and Bretschger (2021). On the other hand, the consumption ratio between the poor and the reach countries is increasing and converges to the value greater than one. In the long run, consumption of the initially poor country is higher than consumption of the wealthier country. This is exactly the statement of the green growth paradox.

To analyze the robustness of our model results, we now show the effects of a variation of central technology parameters. First, we perturb A, the capital productivity (which is equivalent to total factor productivity in this model), and second, we will vary \(\gamma\), the abatement efficiency rate.

Figure 3 shows that a higher capital productivity has a significant boost for consumption growth, even when the carbon budget is tight and fixed. Lower (compared to the baseline) value of capital productivity, apparently, results lower short-term consumption and capital, as well as lower amount of the pollution permits used. Consumption also remains lower in the long run. However, higher amount of the remaining pollution permits provides higher long-run capital stock.

Finally, we vary abatement efficiency rate parameter \(\gamma\). To make different scenarios comparable, we have to use nominal variables now. Assume that adoption of clean technology becomes more effective. Then, it is optimal to decrease short-run consumption and increase investment. Figure 4 shows that in case of decrease in \(\gamma\) by \(0.3\%\), it takes about 60 periods for consumption to become higher than in the baseline scenario.

5 Conclusions

In this paper, we have used a standard AK growth model with polluting capital to determine optimal policy and optimal growth. To limit pollution, we have introduced a fixed budget for aggregate emissions as often assumed for global climate policy. Abatement efficiency is growing over time due to technical progress. The theoretical part of the paper has revealed a number of interesting and surprising results. First we have established that a higher initial capital stock causes lower capital and consumption in the long run. It is then straightforward to conclude that in our economy with stringent climate policy, the taxation of capital does not reduce but actually raise long-run consumption and production. We have called this novel result the “capital tax paradox.” This novel effect of climate policy on optimal capital taxation adds to our understanding of an optimal policy design in an economy subject to climate change. The paper provides additional results on the pollution permit prices which may improve the accuracy of our predictions of future carbon prices.

In the quantitative part, we have shown that the macroeconomic effects of stringent climate policies are less significant than generally expected. Even with strict decarbonization, the global economy continues to grow. Of course, our assumption on technical progress in abatement technology supports this conclusion decisively. We believe, however, that given the recent experience in renewable energy development, the chosen setup is not overly optimistic. If we added endogenous innovation activities to the model, the growth effects shown in the paper could even be reinforced, because higher carbon prices induce energy-saving technical progress (Bretschger 2015). Our sensitivity analysis of the technology parameters reveals that even minor accelerations of technology improvements can add to a brighter picture.

The model can be extended in various ways. Consumption could be assumed to be polluting as well, which would qualify but not fundamentally change our main results. Another option would be to make technical progress in general or in abatement endogenous in the model; the same could be done for pollution intensity. It would be interesting to study capital taxation also in an international perspective, which is especially challenging with high international capital mobility. These and more issues are left for future research.

Change history

01 September 2022

A Correction to this paper has been published: https://doi.org/10.1007/s10368-022-00548-3

Notes

All the variables must be measured using the same numeraire.

Which is equivalent to introduction of initial capital tax in our simple one-shot tax scheme.

References

Acemoglu D, Golosov M, Tsyvinski A (2011) Political economy of ramsey taxation. Journal of Public Economics 95(7):467–475

Borissov K, Bretschger L (2021) Optimal carbon policies in a dynamic heterogenous world. CER-ETH-Center of Economic Research at ETH Zurich, Working Paper

Bretschger L (2015) Energy prices, growth, and the channels in between: theory and evidence. Resource and Energy Economics 39:29–52

Chamley C (1986) Optimal taxation of capital income in general equilibrium with infinite lives. Econometrica 54(3):607–22

Chari V, Nicolini JP, Pedro T (2020) Optimal capital taxation revisited. Journal of Monetary Economics 116:147–165

Groth C, Schou P (2007) Growth and non-renewable resources: the different roles of capital and resource taxes. Journal of Environmental Economics and Management 53(1):80–98

IPCC (2018) Special report on global warming of of 1.5\({}^{\circ }\)C

Judd KL (1985) Redistributive taxation in a simple perfect foresight model. Journal of Public Economics 28(1):59–83

Kalsbach O (2022) Redistributive income taxes in light of social equity concerns. ETH Zurich, mimeo

Piketty T, Saez E (2013) A theory of optimal inheritance taxation. Econometrica 81(5):1851–1886

World Bank (2021) Global consumption database https://datatopics.worldbank.org/consumption

Acknowledgements

We thank Jürgen Jerger for valuable comments and Paul Welfens for his generous support.

Funding

Open access funding provided by Swiss Federal Institute of Technology Zurich

Author information

Authors and Affiliations

Corresponding author

Additional information

The original online version of this article was revised: In this article, Figs. 5 and 6 images must be swapped. Although the captions and figure numbers are correct, the pictures themselves are not: the graph in Fig. 6 should go to Fig. 5, and what is now in Fig. 5 should go to Fig. 6.

Appendix 1

Appendix 1

1.1 A Proof of Lemma 1

First we prove the following claim:

Claim 1

The product \(q E_0\) is decreasing in \(E_0\).

Proof

It is easy to note that for the solution of problem Eqs. 9–12 we have \(c_0 = (1-\beta )(Ak_0+\pi _0 E_0).\) By Eq. 3, we also have \(p_0=1/c_0\). Hence, \(p_0 = \frac{1}{(1-\beta )(Ak_0+\pi _0 E_0)}\). It follows from Eq. 13 that \(q=p_0 \pi _0\). Therefore, \(q E_0 = \frac{\pi _0 E_0}{Ak_0+\pi _0 E_0}\). Proposition 3 in Borissov and Bretschger (2021) states that \(\pi _0 E_0\) is decreasing in \(E_0\). It follows that \(q E_0\) is decreasing in \(E_0\).

For some initial capital stock \(k_0\) and some initial pollution budget \(E_0\), consider the solution of problem Eqs. 1a–1d, \((c_t,k_{t+1})_{t=0}^{\infty }\) and the associated Lagrange multipliers \((p_t)_{t=0}^{\infty }\) and q.

We need to prove that if we take as the initial capital stock some \(k^{\prime }_0 > k_0\), then the new shadow price of emissions, \(q'\) will be higher than the initial one, q.

Let \(\lambda = k^{\prime }_0/k_0\). Clearly, \(\lambda >1\). Let further \((c^{\prime \prime }_t,k^{\prime \prime }_{t+1})_{t=0}^{\infty }\) be the solution of problem Eqs. 1a–1d for the initial capital stock being equal to \(k^{\prime \prime }_0 = k^{\prime }_0 = \lambda k_0\) and the initial pollution budget being equal to \(E^{\prime \prime }_0 = \lambda E_0\) and \((p^{\prime \prime }_t)_{t=0}^{\infty }\) and \(q^{\prime \prime }\) be the associated Lagrange multipliers. It is easy to note that \(c^{\prime \prime }_t = \lambda c_t, \ t=0,1,...,\) and \(k^{\prime \prime }_{t} = \lambda k_t, \ t=1,2,....\) Taking into account the first-order conditions, we obtain that \(p^{\prime \prime }_t = p_t/\lambda , \ t=0,1,...,\) and hence \(q^{\prime \prime }=q/\lambda\).

It follows that \(q^{\prime \prime }E_0^{\prime \prime }=qE_0\). At the same time, by Claim 1, since \(k^{\prime \prime }_0 = k^{\prime }_0\) and \(E_0^{\prime \prime }>E_0\), we have \(q^{\prime \prime }E_0^{\prime \prime }<q^{\prime }E_0\). Therefore, \(q^{\prime }>q\). Thus, we have proved Lemma 1.

1.2 B Balanced growth path

We show below that for any given \(E_0\) there exists a (unique) balanced growth path, i.e., one can find \(k_0=k_{ss}(E_0)\) such that \(c_t = g^t c_0\) and \(k_t = g^t k_0\). However, the model cannot be solved analytically; we use numerical methods to get additional graphical illustrations.

A (detrended) path \((\tilde{c}_t, \tilde{k}_t, \tilde{p}_t)\) which does not change in time, is called stationary (or steady-state). In what follows, we subscribe \((\cdot )_{ss}\) to denote such path(s). Each steady state of the path defines a balanced growth path of the model Eqs. 1a–1c by expressions \(c_t = g^t\tilde{c}_{ss}, k_t = g^t \tilde{k}_{ss}, p_t =\tilde{p}_t/\gamma ^t, t\ge 0 .\)

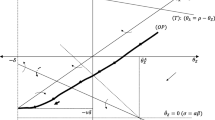

As above, we assume that carbon budget constraint is operating. Then for any optimal path, see Fig. 5

and, in particular, in the steady state, we must have

Setting \(k_0 = \tilde{k}_{ss} = \tilde{k}_{\infty } \equiv \frac{\Gamma -1}{\gamma q\nu (A-g)}\), the latter can be rewritten as

which results \(q_{ss} = \frac{\beta }{1-\beta }\frac{\Gamma -1}{\Gamma -\beta }\frac{1}{E_0}\).

After a little more algebra, we can obtain analytical expressions for the steady-state values of the remaining variables.

Proposition 5

Assume that the value of \(E_0\) is sufficiently low (such that the pollution constraint is binding and hence q and \(\pi _0\) are positive). Then for each given \(E_0\) problem, Eqs. (1a)–(1c) has a unique balanced growth path given by \(c_t = g^t\tilde{c}_{ss}, k_t = g^t \tilde{k}_{ss}, p_t =\tilde{p}_t/\gamma ^t, t\ge 0 .\) Here \(\tilde{c}_{ss}= \frac{(\Gamma -\beta )(1-\beta )}{\nu \beta \gamma }E_0,\) \(\tilde{k}_{ss} = \frac{1-\beta }{\nu \beta }E_0, \tilde{p}_{ss} =\frac{1}{\tilde{c}_{ss}},\) with \(q_{ss} = \frac{\beta }{1-\beta }\frac{\Gamma -1}{\Gamma -\beta }\frac{1}{E_0}\) and \(\tilde{\pi }_{ss} =\frac{{q}_{ss}}{\tilde{p}_{ss}} = \frac{A(\Gamma -1)}{\nu \Gamma }.\)

Remark

It is worth to note that detrended variables do not converge to the steady state, but instead they converge to their limiting values, see Proposition 4.

Figure 6 depicts (detrended) optimal and steady-state values of capital stock. Note that, although \(\hat{k}_0>\tilde{k}_{ss}\), in the long-run, \(\hat{k}_t>\tilde{k}_{ss},\) which also illustrates the green growth paradox.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Borissov, K., Bretschger, L. & Minabutdinov, A. The capital tax paradox in a greening economy. Int Econ Econ Policy 19, 315–329 (2022). https://doi.org/10.1007/s10368-022-00536-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-022-00536-7