Abstract

The empirical evidence on the relationship between the real exchange rate and export performance in emerging economies is inconclusive. In this paper, we present evidence that one reason for this inconclusiveness is the use of real exchange rate (RER) measures that do not consider the heterogeneity between economic sectors. To this end, we calculate a unique sectoral bilateral RER index (SBRER) for 12 Latin American economies, which considers the variation of producer price differentials and bilateral nominal exchange rates across 21 manufacturing sectors and 38 trade partners between 2001–2018, and to estimate the effect of SBRER movements on manufacturing exports. The regression results show that the SBRER is a significant determinant of aggregate manufacturing exports, whereas the bilateral RER is not significant. Moreover, sectoral export elasticities indicate that mainly sectors with low levels of product complexity and, to a lesser extent, those of medium complexity are affected by RER movements. These findings show that it is important to consider sectoral heterogeneity when estimating RER export elasticities from a macroeconomic perspective.

Similar content being viewed by others

1 Introduction

Economic theory considers the real exchange rate (RER) as a key macroeconomic indicator that reflects the average price competitiveness of firms. Accordingly, an appreciation (depreciation) of the RER is expected to affect a country’s exports negatively (positively), which has important implications for the current account balance, sectorial composition, and long-term growth prospects of countries (Rodrik, 2008). However, cross-country studies provide mixed empirical evidence concerning the effect of RER on exports.

For example, Thorbecke and Smith (2010) and Sekkat and Varoudakis (2000) find that exchange rate movements affect the export performance of China and Sub-Saharan countries, respectively, while Fang et al.'s (2006) results indicate that bilateral exports from Indonesia, Japan, Korea, Philippines, Singapore, and Taiwan to the USA are not affected by RER changes. Moreover, Ahmed et al. (2017) and Kang and Dagli (2018) show for a panel of developed and developing countries that the increasing integration of countries in global value chains has led to a decrease in the RER elasticity of exports. In contrast, the IMF (2015) provides evidence to the contrary (i.e., the results indicate that the relationship between RER movements and exports has remained relatively stable over time).

One limitation of cross-country studies is that they consider either a one-dimensional real effective RER index (REER) or a two-dimensional bilateral RER index (BRER). The REER considers inflation-adjusted averages that change over time but are constant with regard to trade partners, while the BRER value is different for each trade partner and year. Although the BRER is preferable over the REER (Mayer & Steingress, 2020),Footnote 1 both indices share the limitation that they assume that all industries within a country have the same RER, although industries can have heterogeneous RER movements when they have different trade partners (Goldberg, 2004), distinct cost changes, and/or diverging degrees of price stickiness (Carvalho & Nechio, 2011). This limitation might explain why single-country studies that use firm-level data present less mixed findings than cross-country studies and typically provide support for the theoretically predicted link between the RER and exports (e.g., Greenaway et al., 2010; Berman et al., 2012; Dai et al., 2021; Tang & Zhang, 2012; Cheung & Sengupta, 2013; Amiti et al., 2014; Li et al., 2015; Fornero et al., 2019).

However, especially for developing countries, rich firm-level datasets are often unavailable. To get around this problem and to reexamine the relationship between RER movements and export performance in emerging economies, this paper presents a novel approach that utilizes macrodata to account for the variation in trade partners and cost differences between sectors. To be more specific, we calculate a unique sectoral bilateral RER index (SBRER) for 12 Latin American countries, which considers the variation of producer price differentials and bilateral nominal exchange rates across 21 manufacturing sectors and 38 trade partners between 2001–2018. In a second step, panel data regressions are used to verify the impact of these 172,368 distinct SBRER observations on Latin American manufacturing exports, and the results are compared with those obtained when using a BRER measure.

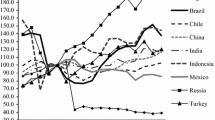

Latin America is an interesting case to study because, during the commodity boom of 2003–2014, the debate about the potential adverse effects of RER appreciation was revived in many countries of the region. More specifically, it has often been argued that the commodity boom led to a Dutch disease phenomenon that harmed the manufacturing sector of many countries in the region (Ocampo, 2017). Yet, despite this debate’s importance, we are unaware of a recent empirical paper that studies the relationship between RER movements and Latin American manufacturing exports.

The main findings of our empirical exercise provide robust support for the expected negative and significant relationship between SBRER and Latin American manufacturing exports (i.e., an appreciation has a negative impact on sectoral exports). In contrast, the baseline regression coefficient of the BRER measure is insignificant. Moreover, our findings reveal sectoral variations in response to RER movements, indicating that sectors with low levels of product complexity and, to a lesser extent, those of medium complexity are affected by these movements. Overall, these findings show that it is important to consider sectoral heterogeneity regarding trade partners and production costs when estimating RER export elasticities from a macroeconomic perspective, and they provide new evidence on the effect of RER movements on Latin American exports.

While we are unaware of another study with the same scope as ours, it is worthwhile to note that some related research exists. Goldberg (2004) is one of the first to calculate sectoral RER. She shows that industry-specific and aggregate RER differ substantially and that the former better predict US corporate profits. Some other studies show that the PPP puzzle can be partly solved when sectoral RER heterogeneity is accounted for (Imbs et al., 2005; Mayoral & Gadea, 2011; Robertson et al., 2009), while Berka et al. (2018) consider heterogeneous consumer price changes to verify the presence of the Balassa-Samuelson effect in the euro area. Moreover, existing literature establishes sectoral differences when estimating the exchange rate pass-through to import and export prices (Bhattacharya et al., 2008; Campa & Goldberg, 2005; Casas, 2020; Saygili & Saygili, 2019). A limitation of these studies is that they use aggregate producer prices that do not vary across sectors.

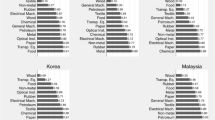

Regarding export intensity, Byrne et al. (2008) find that an increase in relative sectoral price differences affects bilateral US exports negatively. Lee and Yi (2005), Dai and Xu (2013), Sato et al. (2013), and Neumann and Tabrizy (2021) go a step further and use industry-level producer price indices to calculate sectoral REER and their impact on exports. They show that in China, Japan, Korea, Malaysia, and Indonesia, the impact of RER movements on competitiveness and trade flows differs between sectors. However, these studies do not account for bilateral effects and only consider Asian countries. The closest paper to ours is a case study about Colombia by Torres García et al. (2018). They calculate SBRER for 19 manufacturing sectors and find that this measure is better suited than other measures to derive RER export elasticities. However, prior to our results, it was unclear if this study’s findings were generalizable across countries.

The remainder of this paper is structured as follows. In the next Sect. (2), we briefly present the theoretical model guiding the empirical analysis and discuss the data and methodology used to econometrically test the impact of RER movements on Latin American manufacturing exports. Section 3 analyses the obtained regression results. Section 4 concludes.

2 Research design

2.1 Theoretical approach

To guide the empirical analysis of the RER's impact on Latin American countries’ bilateral sectoral manufacturing exports, we use the insights from Reinhart’s (1995) developing country trade model to rationalize the theoretical relationship between these two variables. According to this model, the demand for exports depends positively on the income of the trade partner and negatively on the relative price of the export good (i.e. on the bilateral RER):

where t is time, \(X\) is the amount of goods exported, and \({w}^{*}\) is the income of the foreign country.

To account for heterogeneity between industrial sectors arising from distinct cost changes and varying degrees of price stickiness, we maintain the same basic model structure. However, a crucial modification involves incorporating a variety of export goods, denoted as \({x}_{j}, j=\mathrm{1,2},\dots J\), where \(j\) represents the existing varieties demanded by foreign country households. Within this framework, it becomes evident that the optimal export demand is not contingent on the bilateral RER but on the sectorial RER:

According to this model, the sectoral bilateral exports of a developing country \({(X}_{t\widehat{j}})\), depend positively on the disposable income of its trade partner (\({w}_{t\widehat{j}}^{*})\) and negatively on the sectoral bilateral RER (\({RER}_{t\widehat{j}})\). Please see the Appendix for the formal derivation of this sectoral trade model.

2.2 Sample and exchange rate data used

To verify empirically if RER movements affect manufacturing exports of Latin American countries, we examine 12 countries (Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Nicaragua, Paraguay, Peru, and Uruguay) in the period 2001–2018. This sample is chosen due to data availability and represents approximately 85% of the region’s production and trade, and 83% of its population (World Bank, 2020).

We consider two distinct RER measures that have different levels of disaggregation. In line with the theoretical model from above, the most disaggregate measure is a sectoral bilateral RER index (SBRER). The SBRER is three-dimensional, with different values for each manufacturing sector (s), trading partner (b), and year (t). It is expressed as follows:

where \(\frac{{NER}_{bt}^{*}}{{NER}_{t}}\) is a nominal exchange rate index, measured as trade partner currency per USD divided by local currency per USD; and \(\frac{{P}_{st}}{ {P}_{sbt}^{*}}\) is the sectoral domestic manufacturing producer price index (PPI) with respect to the trade partner’s PPI of the same sector. An increase (decrease) of the SBRER represents a real appreciation (depreciation) in a specific sector in comparison to the same sector in a specific export destination.

The second measure is a two-dimensional bilateral RER index (BRER), which is commonly used by empirical studies to analyze the relationship between the RER and exports. The BRER value is different for each trading partner (b) and year (t) but, in contrast to the SBRER, assumes that each sector in a country has the same inflation rate (i.e., in a given t, each s has the same RER value with respect to a specific b). The BRER is calculated as shown in (16):

Both measures are self-calculated, considering 38 trade partners (b)Footnote 2 and 21 manufacturing sectors (s)Footnote 3 at the two-digit level from the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 3. This classification is chosen to be able to account for a relatively long time span, while the two-digit level is the highest disaggregation level for producer price data for most countries. The selection criterion for the 38 trade partners is that, on average, more than 0.5% of the exports of each of our sample countries are destined for these partners. The sum of exports to these destinations represents at least 80% of the exports of each sample country.

To create this unique dataset, we use annual averages of bilateral USD exchange rates readily available from BIS (2020). With regard to relative prices, aggregate manufacturing PPI data is used to calculate the BRER and PPI values at the two-digit level for the SBRER. Data is retrieved from National Statistics Bureaus, Central Banks, the IMF’s International Financial Statistics, or the World Bank. Sometimes, the data is only available in different product classifications than ISIC Rev. 3 and are homogenized using standard product nomenclature concordance tables (see Table 6 in the Appendix for details).

Unfortunately, PPI data at the two-digit level is not available for all sectors within each country and all trade partners. In such cases, aggregate manufacturing PPI data is used instead (22.1% of the data); if this data is also unavailable, wholesale or consumer price inflation data is used (4.9%). Moreover, for various countries manufacturing PPI data is not available at the two-digit level for all sample years; to impute data for the missing years, the growth rate of aggregate manufacturing PPI, wholesale, or consumer price inflation is used (16.2%). Table 7 in the Appendix gives an overview of the sources and data used for each country to create the sectoral price database.

2.3 Empirical approach

In line with the theoretical model from above, the following multiple fixed effects panel data model is used to estimate the impact that RER movements have on aggregate manufacturing exports:

where i stands for country, b for the 38 trade partners, s for the 21 manufacturing sectors, and t for the 18 years under consideration, \(lnX\) is the natural logarithm of manufacturing exports (in constant USD), \(lnRER\) is the natural logarithm of either (3) or (4), \(ln{Y}^{*}\) is the natural logarithm of the GDP of the trade partners (in constant USD), \(\theta\) are time fixed effects, \(\omega\) is the interaction of a time dummy and a country dummy, \(\mu\) are individual fixed effects, and \(\varepsilon\) is an error term.

The use of multiple fixed effects models is common in papers that study the impact of RER movements on exports (e.g., Ahmed et al., 2017; Chen & Juvenal, 2016; Li et al., 2015; Neumann & Tabrizy, 2021). The advantage of this methodology is that it allows controlling for time-invariant heterogeneity across bilateral trade partnerships in each sector (\(\mu\)) and time-variant effects (\(\theta ,\omega\)). To be more specific, \(\mu\) controls for constant bilateral export determinants that have been identified by the gravity literature –such as physical distance, contiguity, common language, common currency, colonial ties, one partner being a landlocked or remote county– as well as for unobservable sector specific components. Meanwhile, \(\theta\) controls for time-specific effects that affect all panel units in the same way, and \(\omega\) controls for time-specific effects that affect each country differently.

Including the RER as an explanatory variable of exports means that some econometric concerns need to be mitigated. According to theory, trade is a determinant of the nominal exchange rate, which creates the possibility of simultaneous causality between \(lnRER\) and \(lnX\). Moreover, contemporaneous collinearity between \(ln{Y}^{*}\) and \(lnRER\) might be present. To address both issues, both \(lnRER\) variables are included with a one-year lag, while \(ln{Y}^{*}\) is included with its contemporaneous value.Footnote 4 To include \(lnRER\) with a time lag is in line with the J-curve theory, which states that firms and consumers take some time to adjust to price changes. Another potential econometric strategy to address these concerns would be using generalized method-of-moments (GMM) estimators. However, given that the sample has a relatively large T, GMM estimators will likely produce inconsistent estimates.Footnote 5 Other alternative solutions, like the fully modified ordinary least squares (FMOLS), mean-group (MG), and pooled mean-group (PMG) estimators, are not viable because panel data unit root tests indicate that the export and RER data is stationary (see Table 8 in the Appendix).

Regarding the data for bilateral exports and GDP, nominal bilateral export data at the ISIC Rev. 3 two-digit level is readily available in WITS (2020b), while real GDP data is readily available from the World Bank (2020). The nominal export data is deflated with the US GDP deflator (World Bank, 2020) to obtain real bilateral exports. To calculate the weighted average GDP of each trade partner, the real GDP data is adjusted with bilateral trade weights of manufacturing exports. The application of the natural logarithm of variables in levels means that the obtained coefficients can be interpreted as RER (\({\beta }_{0})\) and income (\({\beta }_{1}\)) elasticities, respectively.

The maximum number of observations is 172,368 (12i * 21 s * 38b * 18t). However, only for the \(SBRER\) and \(X\), each of them has a distinct value. In the case of the BRER, on the contrary, only 8,208 of the 172,368 observations have a different value (while 164,160 values are repeated) because each s has the same value in a given i and t. Similarly, only 684 observations have a specific value of \({Y}^{*}\), since the trade partners’ GDP is the same for each i and s. Concerning the descriptive statistics, Table 1 shows that the mean and median values of the BRER and SBRER are nearly identical but that a higher level of disaggregation increases the standard deviation and the range of their min and max values. The latter indicates that the more precise measurement of the SBRER might help reveal important distinctions between sectors masked by more aggregate measures. The regression results of the following section will reveal if the differences between the two measures are sufficiently important to influence the main results obtained from the regressions.

3 The impact of the RER on Latin American manufacturing exports

3.1 Baseline regressions

Table 2 summarizes the results of the regression described in (5). The BRER measure in regression (i) has the theoretically expected negative sign, but the coefficient is not statistically significant. This finding suggests that Latin American manufacturing exports do not react to RER movements, which is at odds with theory and the empirical findings from firm-level single-country studies. However, regression (ii) shows that when instead the SBRER is used as the exchange rate measure, this result changes in the sense that its coefficient is significant at the 1% level. The SBRER coefficient value of 0.24 indicates that a 10% appreciation (depreciation) leads to a 2.4% decrease (increase) in manufacturing exports. This RER elasticity is lower than those reported in Torres García et al. (2018) for Colombia (value 0.77) and in Fornero et al. (2019) for Chile (range 0.4; 0.6), for example, but its value seems reasonable – especially considering the above-mentioned weak reaction of the region’s manufacturing exports after the depreciation of the mid-2010s.

As discussed in the previous section, we rely on fixed effects to control for bilateral trade determinants distinct from the real exchange rate and foreign income because most of them are time-invariant. A notable exception in this regard are free trade agreements (FTAs). To ensure the robustness of our results and to prevent bias resulting from omitting this trade determinant, regressions (ii) and (iv) include a dummy variable for bilateral free trade agreements (FTAs) that has the same value for all sectors. This variable was obtained from CEPII (2023). Nonetheless, the inclusion of this variable does not affect the RER elasticities in a meaningful way (see Table 2). A likely explanation is that in most groups the dummy value is time-invariant,Footnote 6 and within these groups the effect of the FTA is captured by the group fixed effects.

In all regressions the predicted income elasticity is significant with the expected positive sign and similar values, suggesting that a 10% increase in external income leads to an approximately 22% increase in manufacturing export. Considering that the income elasticity is higher than the SBRER elasticity, the results indicate that Latin American manufacturing exports are more sensitive to changes in external income changes than to movements of the RER. This finding is in line with Fornero et al.’s (2019) results for Chilean manufacturing exports. Most importantly for our purpose, Table 2 indicates that the use of aggregated BRER measures can lead to misleading results and that it is important to account for sectoral heterogeneity when estimating export elasticities.

3.2 Sectoral RER export elasticities

The pooled data from above might mask important differences across sectors. According to theoretical models (Chen & Juvenal, 2016) and previous empirical findings (Neumann & Tabrizy, 2021; Thorbecke & Smith, 2010; Torres García et al., 2018), the responsiveness of exports to RER movements can differ substantially between sectors. One important reason for this sectoral heterogeneity is that exports of products that have a low complexity tend to respond more to RER movements on the grounds that they can be substituted more easily than more complex products and that they tend to have a lower cost share that is paid in the currency of the destination country (because they rely more on local labor and less on imported inputs and have lower distribution costs). Following Hidalgo and Hausmann (2009), with complexity we are referring to the required sophistication and diversity of productive know-how necessary for manufacturing products within a specific sector.

We thus make use of the disaggregated data at hand to explore the specific RER export elasticity from each sector (\({\gamma }_{0}\)) by interacting the respective BRER and SBRER variable with 21 sector dummies (\({D}_{s15}{\dots D}_{s36}\)):

The first observation from the results of this exercise, shown in Table 3, is that more sectors react significantly to RER movements when the SBRER is used instead of the BRER (12 vs. 7 sectors). The second observation is that, in line with the baseline regressions in Table 2, the SBRER values are higher than those of the BRER. The third observation is that the elasticities of the different sectors are distinct, but their differences are not overly large: The SBRER export elasticity ranges from 0.41 to 0.86 in the sectors with significant coefficients. Unexpectedly, two of the twelve sectors with significant RER elasticities exhibit a positive sign: basic metals (27) and medical, precision and optical instruments (33). Similar findings are reported by Sierra and Manrique (2014) for Colombia, indicating that an RER appreciation leads to an increase in the value added of the medical, precision and optical instruments sector. In line with these authors, the reason for the sectors’ positive response to an RER appreciation is unclear to us. One potential explanation could be divergent demand patterns in the two sectors that may not be adequately captured by the overall demand proxy (i.e., foreign GDP). Unfortunately, the absence of sector-specific demand data prevents us from validating this potential explanation.

Moreover, it is important to note that, as in the other regressions, the value of the income elasticity is substantially higher than the individual RER elasticities, which suggests that the exports from all sectors are more sensitive to external income changes than to RER movements. Most importantly, as expected, the results suggest that sectors primarily affected by SBRER movements exhibit relatively low levels of product complexity (i.e., tobacco, textiles, wearing apparel, leather dressing and footwear, and wood and paper products). To verify econometrically if the RER elasticity of sectoral exports in Latin America differs according to the complexity of each sector, we use the following regression:

where \({D}_{L}{\dots D}_{H}\) are dummy variables that account for low-, medium- and high-complexity sector groups.

The complexity of each sector is approximated by the median Product Complexity Index (PCI) value from the year 2018. The PCI “ranks the diversity and sophistication of the productive know-how required to produce a product. Products with a high PCI value (the most complex products that only a few countries can produce) include electronics and chemicals. Products with a low PCI value (the least complex product that nearly all countries can produce) include raw materials and simple agricultural products” (Atlas of Economic Complexity, 2020). PCI values are available from the Atlas of Economic Complexity (2020) at a three-digit HS4 level.Footnote 7 Using the HS Combined to ISIC Rev 3 concordance table from WITS (2020a), we construct a PCI value for each sector by taking the median of the PCI values of all products that comprise the respective sector.

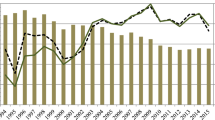

Considering that no established complexity threshold values exist, we employ three different approaches to classify sectors. In the first approach, we divide the 21 sectors equally into groups. The seven sectors with the highest PCI values are categorized into the high-complexity sector group (Group H; values > 0.55), the seven sectors with the lowest PCI values form the low-complexity sector group (Group L; < 0.10), and the remaining seven sectors are classified as medium-complex (Group M). In the second approach, the used thresholds are guided using a boxplot of the PCI median values (see Fig. 1 in the Appendix for the boxplot). In the third approach, we assume a light-tail distribution and divide the sectors that we classify as medium-complex into medium–high and medium–low categories.Footnote 8Table 4 provides an overview of the sector’s median PCI values and summarizes how the sectors are grouped in the three distinct classifications.

The results in Table 5 indicate that RER movements primarily affect exports from low-complexity sectors. The interactions of BRER and SBRER with the low-complexity group are significant in all regressions, regardless of the complexity threshold used. Notably, the results from the two RER measures differ; the coefficient size of SBRER is substantially larger than that of BRER. Specifically, the SBRER coefficients indicate that Latin America’s low-complexity sectors have an RER export elasticity slightly above 0.52 (i.e., a 10% depreciation approximately leads to a 5.2% increase in exports), whereas the BRER elasticity is below 0.38. Furthermore, the size and significance of the SBRER coefficient are more stable across the distinct specifications than those of the BRER.

Regarding medium-complexity exports, all BRER regression results suggest that this sector group is not significantly affected by RER movements. The same holds when using SBRER as a measure, and the sectors are divided equally across the three complexity groups (regression viii). However, when grouping the sectors according to the boxplot thresholds, the medium-complexity group interaction becomes borderline significant at the 10%-level of significance (with a p-value of 0.092). The RER elasticity of this group is much lower than that of the low-complexity sector group though (0.14 vs. 0.54). When using the light-tailed classification, both the medium–low and medium–high complexity groups are significant, with the medium–low complexity group having a higher elasticity than the medium–high complexity group (0.27 vs. 0.18) but a substantially lower one than the low-complexity group (0.27 vs. 0.52).

Consistent with the sectoral elasticities that are reported in Table 3, high-complexity exports seem to be the least affected by RER movements. The interaction of BRER and the SBRER with the high-complexity group dummy is not significant in five out of the six regressions, and in the only regression where it is, the coefficient is only borderline significant at the 10%-level (with a p-value of 0.096) and has a low elasticity value (0.16). As discussed above, this finding aligns with previous literature.

To summarize, all regression results show that the SBRER measure tends to reveal higher elasticities than the BRER measure and that more sectors react significantly to RER movements when the SBRER is used. This finding is in accordance with the diverging RER elasticities reported by studies that use aggregate data versus those that use disaggregate data (i.e., firm-level studies tend to report higher RER elasticities than aggregate data studies). Furthermore, the results indicate that RER movements affect low-complexity sectors more strongly than medium-complexity sectors, and that exports from most high-complexity sectors do no react significantly to exchange rate changes. Moreover, the results show that only the SBRER measure is significant in the baseline regression. Overall, these results indicate that it is important to consider cross-sectoral distinctions regarding trade partners and production costs when estimating RER export elasticities at an aggregate level.

4 Conclusions

In this paper, we have exploited trade partner and cost variations across manufacturing sectors to determine the importance of RER movements for Latin American manufacturing exports during 2001–2018. To this end, we have constructed a comprehensive dataset of 172,368 unique SBRER observations. The results from the baseline regressions suggest that the manufacturing exports of the region do not react to bilateral RER movements. When instead the SBRER measure is used, which accounts for sectoral differences in terms of relative production costs, RER movements become a significant determinant of Latin American manufacturing exports. Moreover, the results indicate that the RER elasticities of exports from individual sectors and sector groups are distinct and that the more refined SBRER is better suited than the BRER to reveal these distinctions. Overall, the contribution of this paper is to provide a more sophisticated and nuanced analysis of the relationship between RER movements and exports in Latin America, which can help inform policy decisions aimed at promoting economic growth and development in the region.

More specifically, in the Latin American case, RER movements mainly seem to affect manufacturing exports with a low level of product complexity and, to a lesser extent, those of medium complexity. This finding only provides partial support to the view that a competitive RER can act as an effective industrial policy tool that fosters economic growth (see, e.g., Eichengreen, 2007; Gala, 2008; Rodrik, 2008; Bresser Pereira, 2020) because it implies that exchange rate management policies yield limited benefits for high-complexity sectors. Besides, Latin American countries should be aware that such policies will have varying effects on individual sectors. This insight can help policymakers to identify better whether the potential gains of establishing competitive RER outweigh the associated costs (such as increasing import prices and declining real wages). Considering the existing trade-offs, recent research recommends implementing a system of multiple real exchange rates to target specific sectors (Guzman et al., 2018). While implementing multiple real exchange rates seems challenging in practice, our findings might be helpful for countries that aim to adopt such a policy.

Finally, it is important to note that the regression results indicate that Latin American manufacturing exports are more sensitive to external income changes than to RER movements. Hence, the region’s policymakers should increase their efforts to develop strategies that enable firms to export to countries with large market potential. However, to define specific policy proposals, it would be important that future research corroborates our findings on a country level, given that our cross-country analysis may mask important differences between countries. Moreover, future research might want to study in how far the reliance on imported inputs differs between sectors with varying degrees of complexity and whether such a difference is an additional explanatory factor for the observed heterogeneity across sectors. It was beyond the scope of this paper to consider this potential distinction between sectors because, to our best knowledge, bilateral sectoral input data is not publicly available for our sample.

Availability of data and material

The data underlying this article are available in Mendeley and can be accessed at https://data.mendeley.com/datasets/4spjbtsm5p.

Code availability

The Stata code underlying this article is available in Mendeley and can be accessed at https://data.mendeley.com/datasets/4spjbtsm5p.

Notes

Mayer & Steingress (2020) show that a limitation of REER indices is that they are aggregated by using functional form assumptions and trade flow weighting schemes that are not consistent with structural gravity equations. The resulting bias in aggregate exchange rate elasticities is minor but statistically significant.

The 38 partner countries are: Argentina, Belgium, Bolivia, Brazil, Canada, Chile, China, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, France, Germany, Guatemala, Honduras, Hong Kong, India, Indonesia, Italy, Japan, Korea, Malaysia, Mexico, Netherlands, Nicaragua, Panama, Paraguay, Peru, Russian Federation, Singapore, Spain, Sweden, Switzerland, Thailand, United Kingdom, United States, Uruguay and Vietnam. Venezuela is not included in the trade partner sample due to data availability and questionable inflation data reliability.

The 21 sectors are: Manufacture of food products and beverages (division 15); Manufacture of tobacco products (16); Manufacture of textiles (17); Manufacture of wearing apparel; dressing and dyeing of fur (18); Tanning and dressing of leather; manufacture of luggage, handbags, saddlery, harness and footwear (19); Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials (20); Manufacture of paper and paper products (21); Publishing, printing and reproduction of recorded media (22); Manufacture of chemicals and chemical products (24); Manufacture of rubber and plastics products (25); Manufacture of other non-metallic mineral products (26); Manufacture of basic metals (27); Manufacture of fabricated metal products, except machinery and equipment (28); Manufacture of machinery and equipment n.e.c. (29); Manufacture of office, accounting and computing machinery (30); Manufacture of electrical machinery and apparatus n.e.c. (31); Manufacture of radio, television and communication equipment and apparatus (32); Manufacture of medical, precision and optical instruments, watches and clocks (33); Manufacture of motor vehicles, trailers and semi-trailers (34); Manufacture of other transport equipment (35); and Manufacture of furniture; manufacturing n.e.c. (36). In accordance with previous research (Torres García et al. (2018); Casas, 2020; Gopinath et al., 2020), the sector “Manufacture of coke, refined petroleum products, and nuclear fuel” (23) is not included in the sample. This decision is based on the strong association of this sector with commodity-based sectors. It can be assumed that the dynamics of commodity-related sectors differ from those of other manufacturing sectors (Casas et al., 2017).

The results are robust when \(ln{Y}^{*}\) is considered with a one-year lag instead its contemporaneous value.

The main findings are robust when a system GMM estimation approach is used. However, the regressions suffer from over-identification issues. Hence, we abstain reporting these results.

62% of the trade relationships had no bilateral Free Trade Agreement (FTA), and in 16% an FTA existed throughout the entire sample period.

The PCI “ranks the diversity and sophistication of the productive know-how required to produce a product. Products with a high PCI value (the most complex products that only a few countries can produce) include electronics and chemicals. Products with a low PCI value (the least complex product that nearly all countries can produce) include raw materials and simple agricultural products” (Atlas of Economic Complexity, 2020).

Please note that the grouping of the sectors remains consistent when mean values are used for classification instead of median values. The only exceptions are Tobacco products (16) and Leather dressing, footwear, etc. (19), which exhibit a reversed order when mean values are used instead of medians.

To simplify the model, it is assumed that the return on the assets is expressed in terms of a single import price.

References

Ahmed, S., Appendino, M., & Ruta, M. (2017). Global value chains and the exchange rate elasticity of exports. The B.e. Journal of Macroeconomics, 17(1), 1–24.

Amiti, M., Itskhoki, O., & Konings, J. (2014). Importers, exporters, and exchange rate disconnect. American Economic Review, 104(7), 1942–1978.

Atlas of Economic Complexity (2020). Country & product complexity rankings. Retrieved from https://atlas.cid.harvard.edu/rankings/product.

Berka, M., Devereux, M. B., & Engel, C. (2018). Real exchange rates and sectoral productivity in the Eurozone. American Economic Review, 108(6), 1543–1581.

Berman, N., Martin, P., & Mayer, T. (2012). How do different exporters react to exchange rate changes? Quarterly Journal of Economics, 127(1), 437–492.

Bhattacharya, P. S., Karayalcin, C. A., & Thomakos, D. D. (2008). Exchange rate pass-through and relative prices: An industry-level empirical investigation. Journal of International Money and Finance, 27(7), 1135–1160.

BIS (2020). Statistics – foreign exchange. Retrieved from https://www.bis.org/statistics/index.htm.

Bresser-Pereira, L. C. (2020). Neutralizing the Dutch disease. Journal of Post Keynesian Economics, 43(2), 298–316.

Byrne, J. P., Darby, J., & MacDonald, R. (2008). US trade and exchange rate volatility: A real sectoral bilateral analysis. Journal of Macroeconomics, 30, 238–259.

Campa, J. M., & Goldberg, L. S. (2005). Exchange rate pass-through into import prices. Review of Economics and Statistics, 87, 679–690.

Carvalho, C., & Nechio, F. (2011). Aggregation and the PPP puzzle in a sticky-price model. American Economic Review, 101(6), 2391–2424.

Casas, C., Díez, F., Gopinath, G. & Gourinchas, P.-O. (2017). Dollar pricing redux (BIS Working Papers, No. 653).

Casas, C. (2020). Industry heterogeneity and exchange rate pass-through. Journal of International Money and Finance, 106, 1–20.

Chen, N., & Juvenal, L. (2016). Quality, trade, and exchange rate pass-through. Journal of International Economics, 100, 61–80.

Cheung, Y.-W., & Sengupta, R. (2013). Impact of exchange rate movements on exports: An analysis of Indian non-financial sector firms. Journal of International Money and Finance, 39, 231–245.

Dai, M., Nucci, F., Pozzolo, A. F., & Xu, J. (2021). Access to finance and the exchange rate elasticity of exports. Journal of International Money and Finance, 115, 1–23.

Dai, M., & Xu, J. (2013). Industry-specific real effective exchange rate for China: 2000–2009. China & World Economy, 21(5), 100–120.

Eichengreen, B. (2007). The real exchange rate and economic growth. Social and Economic Studies, 56(4), 7–20.

Fang, W. S., Lai, Y. H., & Miller, S. M. (2006). Export promotion through exchange rate depreciation or stabilization? Southern Economic Journal, 72(3), 611–626.

Fornero, J. A., Fuentes, M. A., & Sangama, A. G. (2019). How do manufacturing exports react to the real exchange rate and foreign demand? The Chilean Case. World Economy, 43(1), 274–300.

Gala, P. (2008). Real exchange rate levels and economic development: Theoretical analysis and econometric evidence. Cambridge Journal of Economics, 32(2), 273–288.

Goldberg, L. S. (2004). Industry-specific exchange rates for the United States. FRBNY Economic Policy Review, 10(1), 1–16.

Gopinath, G., Boz, E., Casas, C., Diez, F. J., Gourinchas, P.-O., & Plagborg-Møller, M. (2020). Dominant currency paradigm. American Economic Review, 110(3), 677–719.

Greenaway, D., Kneller, R., & Zhang, X. (2010). The effect of exchange rates on firm exports: The role of imported intermediate input. World Economy, 33(8), 961–986.

Guzman, M., Ocampo, J. A., & Stiglitz, J. E. (2018). Real exchange rate policies for economic development. World Development, 110, 51–62.

Hidalgo, C. A., & Hausmann, R. (2009). The building blocks of economic complexity. PNAS, 106(26), 10570–10575.

Imbs, J., Mumtaz, H., Ravn, M. O., & Rey, H. (2005). PPP strikes back: Aggregation and the real exchange rate. Quarterly Journal of Economics, 120(1), 1–43.

IMF (2015). Exchange rates and trade flows: Disconnected?. In IMF (eds.): World economic outlook, October 2015. Washington, D.C.: International Monetary Fund, Chapter 3.

Kang, J. W., & Dagli, S. (2018). International trade and exchange rates. Journal of Applied Economics, 21(1), 84–105.

Lee, J. & Yi, B. (2005). Industry level real effective exchange rates for Korea. Institute for Monetary and Economic Research. The Bank of Korea.

Li, H., Ma, H., & Xu, Y. (2015). How do exchange rate movements affect Chinese exports? – A firm-level investigation. Journal of International Economics, 97, 148–161.

Mayer, T., & Steingress, W. (2020). Estimating the effect of exchange rate changes on total exports. Journal of International Money and Finance, 106, 1–22.

Mayoral, L., & Gadea, M. D. (2011). Aggregate real exchange rate persistence through the lens of sectoral data. Journal of Monetary Economics, 58, 290–304.

Neumann, R., & Tabrizy, S. S. (2021). Exchange rates and trade balances: Effects of intra-industry trade and vertical specialization. Open Economics Review. https://doi.org/10.1007/s11079-020-09612-4

Ocampo, J. A. (2017). Commodity-led development in Latin America. International Development Policy, 9, 51–76.

Reinhart, C. (1995). Devaluation, relative prices and international trade. IMF Staff Papers, 42(2), 290–312.

Robertson, R., Kumar, A., & Dutkowsky, D. H. (2009). Purchasing Power Parity and aggregation bias for a developing country: The case of Mexico. Journal of Development Studies, 90(2), 237–243.

Rodrik, D. (2008). The real exchange rate and economic growth: Theory and evidence. Brookings Papers on Economic Activity, 39(2), 365–412.

Sato, K., Junko, S., Shrestha, N., & Zhang, S. (2013). Industry-specific real effective exchange rates and export price competitiveness: The cases of Japan, China, and Korea. Asian Economic Policy Review, 8, 298–321.

Saygili, H., & Saygili, M. (2019). Exchange rate pass-through into industry specific prices: An analysis with industry-specific exchange rates. Macroeconomic Dynamics, 25(2), 304–336.

Sekkat, K., & Varoudakis, A. (2000). Exchange rate management and manufactured exports in Sub-Saharan Africa. Journal of Development Economics, 61, 237–253.

Sierra, L. P., & Manrique, K. (2014). Impacto del tipo de cambio real en los sectores industriales de Colombia: Una primera aproximación. Revista CEPAL, 114, 127–143.

Tang, H., & Zhang, Y. (2012). Exchange rates and the margins of trade: Evidence from Chinese exporters. Cesifo Economic Studies, 58(4), 671–702.

Thorbecke, W., & Smith, G. (2010). How would an appreciation of the renminbi and other East Asian currencies affect China’s exports? Review of International Economics, 18(1), 95–108.

Torres García, A., Goda, T., & Sánchez González, S. (2018). Efectos diferenciales de la tasa de cambio real sobre el comercio manufacturero en Colombia. Ensayos Sobre Política Económica, 36(86), 193–206.

WITS (2020b). Trade Data – UN Comtrade. Retrieved from https://wits.worldbank.org.

WITS (2020a). Product Concordance. Retrieved from https://wits.worldbank.org/product_concordance.html.

World Bank (2020). World Development Indicators. Retrieved from https://databank.worldbank.org/source/world-development-indicators.

Acknowledgements

We thank the participants of the 27th Annual Latin American and Caribbean Economic Association (LACEA) Meeting, the 25th Conference of the Forum for Macroeconomics and Macroeconomic Policies (FMM), the Institute for Latin American Studies (LAI) Colloquium on Economics & Latin America, and an anonymous referee for their comments that helped us to improve earlier versions of this manuscript.

Funding

Open Access funding provided by Colombia Consortium.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

See Fig. 1 and Tables 6, 7, and 8.

Boxplot of the median PCI values. Note: This figure shows the boxplot of the sector’s median PCI values (see Table 4 for details)

Formal derivation of the sectoral trade model

To modify Reinhart’s (1995) country trade model, we assume that bilateral export demand for the manufacturing goods of a developing country is determined considering a maximization problem of foreign country households, which consume a non-tradable domestic good (\({h}_{t}^{*}\)), and a variety of imported goods (\({x}_{j}, j=\mathrm{1,2},\dots J\)), where \(j\) represents the existing varieties. Assuming \(\beta\) is the subjective discount rate, the utility function of the representative foreign consumer is as follows:

Supposing furthermore that the domestic good and the imported varieties are imperfect substitutes, the functional form of the utility function can be expressed as

where α and ρ are the parameters of the utility function.

Taking the natural logarithm of both sides, the utility function for a given period is given by (3.a):

Concerning the flow budget constraint, it is assumed that the foreign consumer possesses a certain quantity of the non-tradable domestic good (\({q}_{t}^{*}\)), that has a price of \({p}^{*}\), and a certain quantity of a variety (\(l\)) of tradable goods (\({m}_{l}, l=\mathrm{1,2},\dots L\)) that are not consumed domestically but instead exported to the developing country and have a price of \({p}_{l}^{m}\). The total income of the foreign country, normalized by the available quantities of the non-tradable domestic good, is thus:

Assuming that the foreign country is a net lender to the rest of the world that can accumulate assets, it also receives interest (\({r}_{t}^{*}\)) for its total foreign assets (\(A\)). Henceforth, the inter-temporal budget restriction of the foreign country is expressed as in (5.a):

where \({p}_{j}^{x}\) is the price of the j-th imported good.Footnote 9 The Hamiltonian of the problem is expressed as follows:

The first order condition in respect to the j-th imported good of the foreign country \(\left({x}_{\widehat{j}t}\right)\) is

Combining (7.a) and (8.a) reveals the relationship between the consumption of the non-tradable domestic good and imported goods in the foreign country:

The long-run determinants of the exports of a developing country can be obtained by guaranteeing (9.a) and that \({q}_{t}^{*}={h}_{t}^{*}\). With this condition, and using (10.a), the following expression is derived:

Taking the natural logarithm of (12.a) and isolating imports from the \(\widehat{j}\) good gives (13.a):

Now, defining \({X}_{t\widehat{j}}={\text{ln}}\left({x}_{t\widehat{j}}\right)\): imports (exports) from the foreign country (developing country); \({w}_{t\widehat{j}}^{*}={\text{ln}}\left[\left(\frac{1}{{p}^{*}}\right)\sum_{l=1}^{L}{p}_{lt}^{m}{m}_{lt}+{r}_{t}^{*}A{\left(\frac{{p}_{j}^{x}}{{p}^{*}}\right)}_{t}-\frac{1}{{p}^{*}}\sum_{\begin{array}{c}j=1\\ j\ne \widehat{j}\end{array}}^{J}{p}_{jt}^{x}{x}_{jt}\right]\): disposable income from the foreign country to buy the imported good \({X}_{t\widehat{j}}\); and \({P}_{t\widehat{j}}={{\text{ln}}\left(\frac{{p}_{\widehat{j}}^{x}}{{p}^{*}}\right)}_{t}\): relative price of the good \(\widehat{j}\) with respect to the price of the non-tradable domestic good, which is equivalent to the bilateral real exchange rate of the good \(\widehat{j}\) (\({RER}_{t\widehat{j}}\)). The equation that summarizes the determinants of the exports of the sector \(\widehat{j}\) to the foreign country is defined as follows:

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Goda, T., Torres García, A. & Larrahondo, C. Real exchange rates and manufacturing exports in emerging economies: the role of sectoral heterogeneity and product complexity. Rev World Econ (2024). https://doi.org/10.1007/s10290-023-00523-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10290-023-00523-3