Abstract

We examine simultaneously the effects of real-exchange-rate movements and tariff reductions on plant death in Canadian manufacturing industries between 1979 and 1996. Consistent with the implications of recent international trade models with heterogeneous firms, we find that the impact of exchange-rate movements and tariff cuts on exit is heterogeneous—particularly pronounced among least efficient plants. Our results further reveal multi-dimensional heterogeneity that current models featuring one-dimensional heterogeneity (efficiency differences among plants) cannot fully explain: exporters and foreign-owned plants have much lower failure rates; however, their survival rates are more sensitive to changes in tariffs and real exchange rates.

Similar content being viewed by others

Notes

See also Caves (1998) for a discussion of this process in other countries.

A number of studies (Head and Ries 1999; Fung 2008) have looked at how the scale of production is impacted by changes in exchange rates. Using a panel of 230 Canadian manufacturing industries between 1988 and 1994 Head and Ries (1999), find that the overall growth in average output per plant is due to undercounting of small establishments, changes in the industry composition, exchange-rate depreciation, and US tariff reductions. Fung (2008), however, finds that real currency appreciations lead to scale expansion of surviving firms in Taiwanese manufacturing plants Baggs et al. (2009). Examines the issue of exchange-rate and firm survival, but differs from this paper in terms of data, sample period, methodology and findings.

The main channel for the productivity gain is through the declining relative price of imported intermediates, generating substitution of intermediates for labour and therefore productivity gain among surviving plants. Reallocation is also important: the gain from exiting of less productive domestic producers partially offset by the loss due to reallocation of production away from the most productive firms (who lose export markets).

Previous work has found that at the industry level, correlations in tariff changes across the two countries are sufficiently high as to make it difficult to discern separate effects of reductions in tariffs in each country on structural changes in Canada (Baldwin et al. 2005).

Tariff data for 1980 are used for 1979.

We are grateful to Alla Lileeva for providing us with the tariff data. For details on the sources and construction of the tariff data, see the Appendix in Trefler (2004).

Over the study period, the ‘survey’ was essentially a census with data on smaller firms being filled with administrative records.

The survey data are derived from long-form questionnaires (often given to larger plants) and short-form questionnaires (often given to smaller plants). The long-form questionnaires contain much more detailed information than the short-form questionnaires. Implicit in our analysis is the assumption that small plants (who filled in the short-form questionnaires) are non-exporters. The assumption is reasonable. According to a 1974 survey that collected export data for all plants, only 0.4% of plants that filled in the short-form questionnaires reported exports (Baldwin and Gu 2003).

Plants that temporarily stop reporting data but shortly thereafter start doing so are not classified as plant deaths here.

We experimented with these two approaches. They produce exactly the same results if there were no interaction terms. With interactions, the two are almost the same but not quite. This is because most statistical programs such as STATA would not know, for example, that the independent variable \( \Updelta v_{it} z_{{pt_{0} }} \) is an interaction term between \( \Updelta v_{it} \) and \( z_{{pt_{0} }} \). Including a set of period and industry dummies in the case of Eq. (3) is equivalent to subtracting the mean of \( \left( {\Updelta v_{it} z_{{pt_{0} }} } \right) \) from the product of \( \Updelta v_{it} \) and \( z_{{pt_{0} }} \) \( \left( {\Updelta v_{it} z_{{pt_{0} }} } \right) \). This is not the same as the product of the demeaned \( \Updelta v_{it} \) and \( z_{{pt_{0} }} \), as it should be.

To be consistent with fixed-effects model, variables \( X_{it} \) is demeaned as follows: \( x_{it} = X_{it} - \overline{X}_{i} - \overline{X}_{t} + \overline{\overline{X}} \), where \( x_{it} \) is the demeaned \( X_{it} ,\;\overline{X}_{i} \), is the average for each two-digit industry i, \( \overline{X}_{t} \) is the average for each time period t, and \( \overline{\overline{X}} \) is the average of \( \overline{X}_{i} \) over all two-digit industries or the average of \( \overline{X}_{t} \) over all time periods.

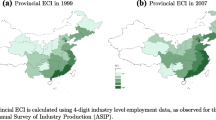

Due to the skewed distribution of plants in terms of productivity and employment (many small and less productive plants and a few larger and very productive plants), the plots only include plants whose relative productivity and relative employment is within two standard deviations from their industry mean. This covers more than 98% of plants for Figs. 1, 2 and 3.

All variables are measured as deviations from industry means. For example, relative productivity has a mean value of one; for a plant whose productivity is twice as much as the industry average, its relative productivity is two and its deviation from the mean of relative productivity is one.

Marginal effects are calculated based on probit coefficients in Table 5, and evaluated at the two-digit industry mean values of all variables.

Predicted exit rates are evaluated at the common industry mean values of tariff cuts and real-exchange-rate changes, and at group-specific industry mean values of productivity, employment and age.

To compare how a given shock in tariffs cost and the exchange rate impacts differently upon exporters and non-exporters, we evaluate the marginal effects by holding changes in tariff cost and exchange rate constant across the two groups (evaluated at the common industry mean values).

An alternative is to obtain the average predicted exit rates over all observations. The two methods yield very similar results.

References

Ai, C., & Norton, E. C. (2003). Interaction terms in logit and probit models. Economics Letters, 80(1), 123–129.

Baggs, J., Beaulieu, E., & Fung, L. (2009). Firm survival, performance, and the exchange rate. Canadian Journal of Economics, 42(2), 393–421.

Baldwin, J. R. (1995). The dynamics of industrial competition: A north American perspective. Cambridge: Cambridge University Press.

Baldwin, J. R., Caves, R. E., & Gu, W. (2005). Responses to trade liberalization: changes in product diversification in foreign and domestic controlled plants. In L. Eden & W. Dobson (Eds.), Governance, multinationals and growth. Cheltenham: Elgar.

Baldwin, J. R. Gellatly, G., & Gaudreault, V. (2002). Financing innovation in new small firms: New evidence from Canada. 11F0019MIE. No. 190. Analytical studies series. Ottawa: Statistics Canada.

Baldwin, J. R., & Gu, W. (2003). Export-market participation and productivity performance in Canadian manufacturing. Canadian Journal of Economics, 36(3), 634–657.

Baldwin, J. R., & Gu, W. (2006). Plant turnover and productivity growth in Canadian manufacturing. Industrial and Corporate Change, 15(3), 417–465.

Baldwin, J. R., & Gu, W. (2009). The impact of trade on plant scale, production-run length and diversification. In T. Dunne, J. B. Jensen, & M. J. Roberts (Eds.), Producer dynamics: New evidence from micro data. Chicago: University of Chicago Press.

Bandick, R. (2010). Multinationals and plant survival. Review of World Economics/Weltwirtschaftliches Archiv, 146(4), 609–635.

Bernard, A. B., Eaton, J., Jensen, J. B., & Kortum, S. (2003). Plants and productivity in international trade. American Economic Review, 93(4), 1268–1290.

Bernard, A. B., & Jensen, J. B. (2002). The deaths of manufacturing plants. (NBER Working Paper Series, No. 9026).

Brainard, L., & Riker, D. (1997a). Are US multinationals exporting US jobs? (NBER Working Paper Series, No. 5958).

Brainard, L., & Riker, D. (1997b). US multinationals and competition from low wage countries. (NBER Working Paper Series, No. 5959).

Caves, R. E. (1998). Industrial organization and new findings on the turnover and mobility of firms. Journal of Economic Literature, 36(4), 1947–1982.

Caves, R. E. (2007). Multinational enterprise and economic analysis. Cambridge: Cambridge University Press.

Dunne, T., Roberts, M. J., & Samuelson, L. (1989). Patterns of firm entry and exit in U.S. manufacturing industries. Rand Journal of Economics, 19(4), 495–515.

Fung, L. (2008). Large real exchange rate movements, firm dynamics and productivity growth. Canadian Journal of Economics, 41(2), 391–424.

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13, 421–440.

Görg, H., & Strobl, E. (2003). Footloose multinationals? Manchester School, 71(1), 1–19.

Gu, W., Sawchuk, G., & Rennison, L. W. (2003). The effect of tariff reductions on firm size and firm turnover in Canadian manufacturing. Review of World Economics/Weltwirtschaftliches Archiv, 139(3), 440–459.

Harris, R. I. D., & Li, Q. (2007). Firm level empirical study of the contribution of exporting to UK productivity growth. Report to UK trade and investment. https://www.uktradeinvest.gov.uk/UKTI/fileDownload/FAMEFinalReport2007v2.pdf?cid=401169.

Head, K., & Ries, J. (1999). Rationalization effects of tariff reductions. Journal of International Economics, 47(2), 295–320.

Johnson, J., Baldwin, J. R., & Hinchley, C. (1997). Successful Entrants: creating the capacity for growth and survival. Catalogue (pp. 61–524). Ottawa: Statistics Canada.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50(3), 649–670.

Li, J., & Guisinger, S. (1991). Comparative business failures of foreign-controlled firms in the United States. Journal of International Business Studies, 22(2), 209–224.

Lileeva, A. (2008). Trade liberalization and productivity dynamics: Evidence from Canada. Canadian Journal of Economics, 41(2), 360–390.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Melitz, M., & Ottaviano, G. (2008). Market size, trade and productivity. Review of Economic Studies, 75(1), 295–316.

Norton, E. C., Wang, H., & Ai, C. (2004). Computing interaction effects and standard errors in logit and probit models. The Stata Journal, 4(2), 154–167.

Pakes, A., & Ericson, R. (1995). Markov-perfect industry dynamics: A framework for empirical work. Review of Economics Studies, 62(1), 53–82.

Pakes, A., & Ericson, R. (1998). Empirical implications of alternative models of firm dynamics. Journal of Economic Theory, 79(1), 1–45.

Pérez, S. E., Llopis, A. S., & Llopis, J. A. S. (2004). The determinants of survival of Spanish manufacturing firms. Review of Industrial Organization, 25, 251–273.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. March (Ed.), Handbook of organizations. Chicago: Rand McNally.

Trefler, D. (2004). The long and short of the Canada-U.S. Free trade agreement. American Economic Review, 94(4), 870–895.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180.

Yeaple, S. R. (2002). A simple model of firm heterogeneity, international trade and wages. University of Pennsylvania mimeo.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Baldwin, J., Yan, B. The death of Canadian manufacturing plants: heterogeneous responses to changes in tariffs and real exchange rates. Rev World Econ 147, 131–167 (2011). https://doi.org/10.1007/s10290-010-0079-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-010-0079-1