Abstract

In recent years, political rhetoric implying international trade hinder employment has gained momentum. We argue that the dynamics between the unemployment rate and the current account balance have both economic and political relevance. The presence of cointegration between the unemployment rate and the current account balance to GDP ratio and the nature of their short-run fluctuations will help us analyze the dynamics between the two objectively to evaluate the political rhetoric. We use quarterly data from 1948: Q1 to 2020: Q1 on the unemployment rate and current account balance to GDP ratio in the United States. Traditional cointegration tests fail to detect any cointegration. However, threshold cointegration tests confirm statistical evidence of threshold cointegration between the two. The estimated threshold vector error-correction model shows statistically significant evidence of falling unemployment rate coupled with deteriorating current account balance. This finding indicates that as unemployment rates go down, the current account balance deteriorates to maintain the long-run co-movement. Arguably, as the unemployment rate decline, concurrently imports rise faster than exports causing the current account balance to deteriorate. This finding thereby refutes the political rhetoric.

Similar content being viewed by others

1 Introduction

Does international trade impact the unemployment rate in the United States?- A question that has political as well as economic relevance. From a firm-level perspective, a rise in the imports of manufacturing goods may subsequently create unemployment in the import competing sector. Trade expansion, on the other hand, create new investment opportunities leading towards potential new employments (Jansen and Lee 2007). The net effect of international trade on unemployment, job destruction against job creation, is likely to be challenging to measure, and could potentially show results contrary to political rhetoric. From a macroeconomic perspective, the magnitude of such net effects could be very small, and the business cycle has a larger impact on the labor market. From the aggregate expenditure perspective, a rise in the unemployment rate is likely to impact the aggregate current account balances through a decline in consumption spending. When the unemployment is higher, consumer spending on imported consumer goods is likely to be lower, leading to a decline in imports. A decline in imports, given exports, will improve the current account balance. Hence, the current account balance is likely to improve in favor of the home country during the spells of high unemployment rate. Although there is a dearth of theoretical explanation of this argument, Eaton et al. (2013) find evidence of higher unemployment and declining real wage playing a pivotal role towards a lower external deficit for some European nations.

Trade openness is inflicting the United States labor market- this political rhetoric has gained popularity in the United States political sphere in recent years. We can find a similar sentiment gaining momentum in the European political sphere as well. Arguably, this rhetoric may have played a role in the recent elections in the United States and Europe. Figure 1 below plots the unemployment rate and the current account balance to GDP ratio in the United States from 1948: Q1 to 2020: Q1 with the shaded area representing the National Bureau of Economic Research recession dates. The data plots indicate that there are several episodes of decreasing unemployment rate coincide with deteriorating current account balance to GDP ratio in the United States. Similarly, we can find episodes of improving current account balance coincide with the spells of rising unemployment rate. Especially since the mid-1980s, the current account balance has been deteriorating except for a brief period in the early 1990s, when the balance became positive during a recession. This spell also coincides with a recession when the unemployment rate rose fast with an improving current account balance. We can again observe the current account balance to improve during the ’Great Recession’ when the unemployment rate was rising. Does the rhetoric on trade and unemployment have empirical evidence? The labor market in the United States responds to changes in the supply and demand in the labor market, demographic factors, as well as macroeconomic stabilization policy. The current account balance, measured as exports minus imports, also responds to exchange rate, trade policy, and the international business cycle. This research acknowledges these aspects and addresses the nexus between the unemployment rate and the current account balance from a different interpretation. Both the unemployment rate and the current account balance are macroeconomic aggregates. These aggregates vary with the state of the economy as a whole. The presence of a long-run equilibrium relationship between the two will shed new insights into their dynamics. In addition, deviations from the long-run equilibrium relationship will help us understand their short-run dynamics as well. A formal statistical analysis of these long-run and short-run dynamics will allow us to evaluate the political rhetoric in an objective manner. The unemployment rate is a macroeconomic aggregate reflecting the state of the labor market. With the business cycle, the unemployment rate remains high during recessions and remains low during economic expansions. Hence, the unemployment rate behaves in an asymmetric manner with respect to the business cycle. Alessandria and Choi (2016) argue that asymmetries of the business cycle influence fluctuations in the trade balance in the United States. Hence, in this paper, we explore the presence of a long-run equilibrium relationship between the unemployment rate and the current account balance, and their short-run dynamics of any deviation from the long-run equilibrium using a nonlinear econometric framework to capture the asymmetric adjustment(s). We argue that the nature and type of the asymmetric adjustment in the short-run will allow us to evaluate the political rhetoric with robust empirical evidence.

This research contributes to the existing literature from a unique perspective. We analyze the aforementioned political rhetoric objectively by examining the dynamics between two macroeconomic aggregates using a nonlinear econometric specification. This research is unique in its approach, as the research question of linkage between the current account balance and the unemployment rate is seldom analyzed from a macroeconomic perspective. The paper uses the nonlinear time series econometric approach to investigate the presence of a long-run equilibrium relationship or co-movement between seasonally adjusted unemployment rate and the current account balance to GDP ratio in the United States using quarterly data from 1948:Q1 to 2020:Q1. In addition, we analyze the short-run dynamics of any deviations in the long-run relationship by estimating a threshold vector error-correction model. Statistical tests reveal that the variables are non-stationary at the level, and their first difference is stationary. The Johansen and Juselius (1990) and the Phillips and Ouliaris (1990) tests do not detect any evidence of cointegration. But the Enders and Siklos (2001) and Hansen and Seo (2002) tests find formal statistical evidence of threshold cointegration between the two variables. We estimate the threshold vector error-correction model to analyze the short-run dynamics. The estimates from the threshold vector error-correction model indicate that both the unemployment rate and the current account balance to GDP ratio deteriorate to maintain the long-run equilibrium relationship in the short-run when the error-correction term is above the threshold. We argue that the decreasing unemployment in the economy increases aggregate spending, which deteriorates the current account balance in the United States conforming to the findings in Eaton et al. (2013) for Europe. These empirical findings from the threshold vector error-correction model contradict the political rhetoric that trade increases unemployment rate in the United States. Rather, a decline in the unemployment rate is associated with a deteriorating current account balance.

The rest of the paper is organized as follows: Sect. 2 discusses the relevant literature, in Sect. 3 we discuss the data and methodology, Sect. 4 presents the results and analysis, and Sect. 5 discusses the conclusion.

2 Literature review

The linkage between the unemployment rate and international trade is investigated from different perspectives using different methodologies. The empirical as well the theoretical evidence provide differential conclusions, often lacking a consensus. In this section, we will discuss some of the relevant literature.

We can find a plethora of research that investigates the impact of trade liberalization on employment and/or unemployment. These papers investigate the channels through which trade liberalization impact the labor market, for example, minimum wage, efficiency wage theorem, search and friction etc. From a theoretical standpoint, the results are ambiguous. Egger et al. (2012) argue that binding minimum wages lead to increased unemployment with trade liberalization and Amiti and Davis (2011) argue that labor market frictions arise due to the fair wages or efficiency wages in the model with trade liberalization. On the other hand, Felbermayr et al. (2013) and Dutt et al. (2009) using a reduced-form framework provide evidence that relatively more open economies experience lower unemployment rates on average. Wang et al. (2018) use a supply chain perspective in their empirical setup to examine the effects of trading with China on the labor market in the United States. Authors find robust evidence that total impact of trading with China is a positive boost to local employment and real wages, as the manufacturing sector in the United States use imported intermediate inputs from China.

The connection between trade balance and labor market outcome is another important aspect of economic research. Rose (2018) opine that the current account balance and unemployment rates in the United States are not related and argue that the current account deficit cannot explain the decline of manufacturing jobs. Borjas and Ramey (1994) investigate time-series evidence of an association between wage inequality and trade balance. They use the Engel (1987) procedure investigating the association between wage inequality in the labor market, merchandise imports and exports. The authors show that only variable that consistently shares the same long-run trend with wage-inequality series is the durable goods trade deficit as a percentage of the GDP. This paper provides formal statistical evidence linking the labor market with the current account deficit. Heid and Larch (2014) use a quantitative framework that allows for search and matching in the labor market to investigate trade and unemployment. The authors’ apply their structural framework to 28 O.E.C.D. countries and find that the trade improves welfare and labor market outcome in the presence of labor market friction. They also argue that workers spend part of their income on foreign varieties, and the increased income leads to higher import demand for all trading partners. Eaton et al. (2013) find evidence of higher unemployment and declining real wage playing a pivotal role towards a lower external deficit for some European nations. Batdelger and Kandil (2012) study the role of public and private imbalances, measured by budget deficit and gap between aggregate savings and investment respectively, influence on the current account balance in the context of an inter-temporal model. Authors argue that overall the budget deficit or public imbalance influence trade imbalance, and fluctuations in public imbalance are moderated by an increase in public savings and a reduction in private investment, moderating fluctuations in the current account balance. This paper uses a conceptual framework linking aggregate expenditures to the current account balance. We argue that these papers put emphasis on employment and spending, in a trade framework, influencing the current account balance through increased import spending.

The unemployment rate is counter-cyclical. Does the current account balance change to business cycle? Duncan (2016) using non-parametric regressions find a robust U-shaped relationship between the current account balance and the GDP cycle in the United States. Alessandria and Choi (2016) also argue that business cycle asymmetries account for the variation of the net trade flows, although the effect is not too large. Elliott and Fatás (1996) investigate how the transmission of productivity shocks vary across countries and how the response of investment and current account differ by estimating a structural model for Japan, United States and Europe. Authors find that the propagation of the productivity shock is proportional to trade, and United States shocks propagate quickly to Japan and Europe. The productivity shocks lead increased investment and current account deficit. Arguably, increased investment lower unemployment subsequently raising the demand for imports.

The World Trade Organization and the International Labour Organization jointly published a report titled “Trade and Unemployment Challenges and Policy Research”. The focus of this report is broad, which provides an extensive review of the literature related to unemployment and trade. The report argues that trade liberalization can lead to both job destruction as well as job creation. The report extensively investigates as to how trade impact employment and wages in an intra-industry setup, small country perspective, income inequality, etc. This work extensively discusses related policy as well. However, one missing aspect of this report is the linkage between the unemployment rate and the current account balance from an aggregate expenditure perspective.

The discussion above indicates a potential gap in the literature. The interrelation between the current account balance and the unemployment rate needs to be addressed from an aggregate expenditure perspective while considering the business cycle in the framework. Figure 1 does indicate that the unemployment rate and the current account balance in the United States appears to have a common trend during recessions and the expansions. In this paper, we envisage addressing this gap in the literature. We will analyze the dynamics between the unemployment rate and the current account balance, which are likely to portray some relationship in a nonlinear manner.

3 Data and methodology

The empirical approach used in this research follows Ahmed (2020) and Holmes (2011). We use quarterly time-series data on the unemployment rate, the current account balance, and nominal GDP in the United States from 1948: Q1 to 2020: Q1. We exclude the Covid-19 pandemic period from our analysis due to the unusual nature of this period. The current account balance is defined as total exports minus imports for each quarter. The data are collected from the Federal Reserve Bank of St. Louis website, and all three series are seasonally adjusted. We construct the current account balance to GDP ratio dividing the current account balance with the nominal GDP. We use \(Un_{t}\) to denote the unemployment rate and use \(CA_{t}\) to denote the current account balance to GDP ratio. Figure 1 plots the two variables used in this paper. We observe that the unemployment rate and the current account balance to GDP ratio depict asymmetry to business cycle. Unemployment rates rise and the current account depicts improvement during recessions, and vice versa. We hypothesize an asymmetric long-run co-movement and short-run adjustment between the two. In this research, we intend to empirically investigate the presence of a long-run equilibrium relationship or co-movement between the unemployment rate and the current account balance to GDP ratio using time series data. We envisage analyzing the short-run asymmetric adjustment in this long-run relationship. In this context, we begin our analysis with tests for stationarity, followed by cointegration tests. We use two separate cointegration as well as two separate threshold cointegration tests to ensure the robustness of our findings. We estimate a threshold vector error-correction model in the final step to analyze the short-run variations in the long-run relationship. The following paragraphs describe these tests and the procedures.

According to Hamilton (1994), an \((n \times 1)\) vector time series (say \(y_t\)) is said to be cointegrated when each time series is taken non-stationary at level, while some linear combination of the time series is stationary. Cointegration is also described as a long-run common trend or equilibrium relationship. The presence of a long-run equilibrium relationship or cointegration may depict nonlinearity due to the business cycle. We begin by investigating the stationarity property of the data. As per the definition of cointegration, we need to investigate the stationarity property of the data as a precondition. We employ the augmented Dickey and Fuller (1979) (henceforth ADF) and Phillips and Perron (1988) (henceforth PP) tests. According to Granger (1996), macroeconomic time series models must address structural breaks in the data in the econometric specification. Enders (2008) argues that in the presence of a structural break in the data, various ADF test statistics are biased towards the non-rejection of a unit root leading to erroneous conclusions. The PP test considers the presence of structural breaks in the data but at known dates. We argue that the data may have several structural break(s) at an unknown date(s). To address this we employ the Zivot and Andrews (2002) and Lumsdaine and Papell (1997) tests. For brevity, we will not discuss these empirical test procedures in detail in this researchFootnote 1.

Upon testing for stationarity, we proceed to the cointegration tests. We consider two separate possibilities: first, the presence of cointegration without any nonlinear adjustment, and second, the presence of cointegration with nonlinear adjustment. The unemployment rate varies with the business cycle, with spells of high unemployment rates during the recessions and low unemployment rates during the economic expansions. The current account balance to GDP ratio may also vary with the business cycles. As aggregate expenditures are low during the recessions, we may observe the current account balance to improve during recessions and deteriorate otherwise. The second scenario is more akin to our research hypothesis. Following Engle and Granger (1987), we can describe the cointegration between the unemployment rate and the current account balance to GDP ratio as follows:

We estimate the model described in equation one and retrieve the residuals, \(\hat{\epsilon _{t}}\). According to Engle and Granger (1987), if these residuals are stationary then the unemployment rate and the current account balance to GDP ratio are cointegrated or have a long-run equilibrium relationship. We employ the ADF test on the residuals to check for unit roots. Enders (2008) critique the Engle and Granger (1987) procedure by arguing that alternating the dependent and independent variables may also alter the resulting cointegration. The Johansen and Juselius (1990) and the Phillips and Ouliaris (1990) tests for cointegration are considered superior in the literature. For brevity, we will not discuss these procedures in detail in this paper. We employ these two separate testing procedures to evaluate the first case described earlier to ensure the robustness of our findings. For the case with nonlinear adjustment, we employ the Enders and Granger (1998) test on the residuals, \(\hat{\epsilon _{t}}\), to check for unit root under asymmetric adjustment. According to Hansen (2001) and Perron (2006), it is judicious to consider regimes in econometric analysis using time series data. As argued earlier, the unemployment rate and the current account to GDP depict asymmetric movement over time. To address the case of the regime(s) in the long-run equilibrium or cointegrating relationship, we will apply the threshold cointegration tests developed by Enders and Siklos (2001) and Hansen and Seo (2002). Again, we employ two separate tests to evaluate the second case and to ensure the robustness of our findings.

The following paragraphs briefly discusses the threshold cointegration tests proposed by Enders and Siklos (2001). The following equations uses the residuals \((\hat{\epsilon }_{t})\) from Eq. (1).

where \(I_{t}\) is the Heaviside indicator function such that

where \(\tau\) is the value of the threshold and \(\nu _{t}\) is a sequence of zero-mean, constant variance independently and identically distributed random variable, such that \(\nu _{t} \perp \hat{\epsilon }_{t}\). As per Petruccelli and Woolford (1984), the necessary and sufficient conditions for the stationarity of the obtained residual (\(\hat{\epsilon }_{t}\)) are: \(\phi _{1}<0\),\(\phi _{2}<0\), and \((1+\phi _{1})(1+\phi _{2})<1\) for any value of the threshold (\(\tau\)). If the obtained residuals \((\hat{\epsilon }_{t})\) satisfy these conditions, it is considered to define a long-run equilibrium relationship between the variables in equation one with a threshold effect. The values of the threshold (\(\tau\)) along with the values of \(\phi _{1}\) and \(\phi _{2}\) are unknown and need to be estimated. Following Chan (1993), the estimation arranges the endogenously chosen threshold variable in ascending order, and we snip 15% at the top and the bottom to avoid over-fitting. The model is estimated for each value of the threshold, and we save the sum of squared residuals. Afterward, the model with the lowest sum of squared residuals is chosen as the efficient model with the corresponding value of the endogenous threshold variable as our threshold for the process. The Bayesian Information Criteria (BIC) is used to select the appropriate lag lengths in Eq. (2). Enders and Siklos (2001) test is similar to the Engel and Granger (1987) procedure for testing cointegration with potential asymmetric adjustment in the cointegrating vector. The authors describe two possible test statistics: \(H_{o}:\phi _{1}=\phi _{2}=0\) and \(H_{o}:\phi _{i}=0,i=1,2\). These authors refer to the first one as \(\Phi ^*\) statistics and the second one as the t-max statistics, and also emphasize that the \(\Phi ^*\) statistics has more power than the t-max statistics. The null hypothesis \(H_{o}:\phi _{1}=\phi _{2}=0\) implies no cointegration between the variables, and the alternative implies the presence of threshold cointegration. In this research, we use the critical values from Enders and Siklos (2001), as this test does not have a standard distribution.

We now describe the Hansen and Seo (2002) procedure, and the subsequent discussion extracts from Ahmed (2020) and Hansen and Seo (2002). Let \(y_{t}\) denote a p-dimensional I(1) time series which is cointegrated with one \(p \times 1\) cointegrating vector denoted by \(\beta\). Let \(z_{i}(\beta ) = \beta ^{'}y_{t}\) denote the I(0) error-correction term. A liner vector error-correction model can be compactly written as:

where

The dependent variable \(Y_{t-1}(\beta )\) is a \(K \times 1\) vector, A is \(k\times p\) matrix where \(k=pl+2\). We can extend Eq. 4 into a two-regime cointegration model of the following form:

where \(\tau\) is the threshold parameter with the two regimes defined by the value of the error-correction term, \(w_{t-1}(\beta )\). The coefficients in the matrices \(A_{1}\) and \(A_{2}\) dictate the dynamics within these two regimes defined by the error-correction term, \(w_{t-1}(\beta )\). In the Hansen and Seo (2002) test the null hypothesis, \(H_{0}\), is linear cointegration and the alternative, \(H_{1}\), is threshold cointegration. Hansen and Seo (2002) use the Lagrange Multiplier (henceforth LM) test statistic that allows us to bootstrap the critical values. When the true cointegrating vector, \(\beta\), and the threshold, \(\tau\), are unknown the LM test statistic is as follows:

where \(\tilde{\beta }\) is the null hypothesis estimate for the \(\beta\) coefficient. In this LM test, \([\tau ^U. \tau ^L]\) are the upper and lower limits defining the search region for the threshold parameter. In this respect, \(\tau ^U\) is the \(\pi _{0}\) percentile and \(\tau ^L\) is the \((1-\pi _{0})\) percentile of the threshold defined by the error-correction term. This research adopts \(\pi _{0}=0.15\) in our empirical estimation following Andrews (1994). The Hansen and Seo (2002) test is a one-step estimation, where as in the Enders and Siklos (2001) test is a two-step estimation process.

We also use the segmented cointegration tests proposed by Kejriwal and Perron (2010a) to develop more insight into the relationship between the unemployment rate and the current account balance to GDP ratio. This added test is intended to explore if the dynamics between the two variables depict any other type of long-run dynamics.

Upon confirming the evidence of threshold cointegration, we proceed to investigate the short-run dynamics using a threshold vector error-correction model (henceforth TVEC). The TVEC model can be estimated either by considering the threshold effect applied only to the error-correction term or with a threshold effect applied to all the independent variables. Following Krishnakumar et al. (2009), we extend the threshold structure to all the lagged dependent variables including the error-correction term. We estimate the following TVEC model:

with two regimes, \(ECT_{t-1}=(w_{t-1}(\beta ))\), lags denoted by \(i=2,3,..l\), and \(j=i+l,...k\). We use the Bayesian Information Criterion (BIC) to select the appropriate lag lengths in the model described by Eq. 9 above. The two regimes are defined by the lagged error-correction term as per the Enders and Siklos (2001) as follows:

The sign of the coefficients of the error-correction term \(ECT_{t-1}=(w_{t-1}(\beta ))\) can help us understand how the short-run adjustment is taking place when there is disequilibrium. For example, if the sign for the coefficients \(\kappa _{12}\) and \(\lambda _{22}\) are negative, this implies that both the unemployment rate decrease and the current account balance deteriorate to maintain the equilibrium relationship. Thus implying a deteriorating current account balance does not necessarily increase unemployment in the economy. Rather, a declining unemployment rate coexists with a deteriorating current account balance. We argue as the unemployment rate goes down, consumer spending on imports increase. Increased private spending on imported goods deteriorates the current account balance. These two aspects coexist to maintain the long-run equilibrium relationship.

4 Results and analysis

In this section, we present and elaborate on the results of the statistical analysis outlined in section three. We present the results in the following order: we start with the stationarity test results, then the cointegration and the threshold cointegration tests, and finally discuss the estimation output of the threshold vector error-correction model (or the TVEC model).

4.1 Test of stationarity

Tables 1 and 2 below present the augmented Dickey and Fuller (1981), the Phillips and Perron (1988), and the Zivot and Andrews (2002) (henceforth ZA) tests. As per the Dickey and Fuller (1981) test, the unemployment rate is stationary at the level. However, the Phillips and Perron (1988) test indicates the unemployment rate is non-stationary at the level. These tests provide contradictory results for the unemployment rate. The current account balance to GDP ratio is non-stationary at the level as per both the tests. Lee and Strazicich (2003) argue that the presence of structural break may lead to erroneous conclusions while conducting unit root tests. Test results, presented in Table 1, do not fully address the issue of a structural break in the data at unknown dates. The ZA test explores three specific scenarios of the structural break in the data: (a) break in the intercept, (b) break in the trend, and (c) break in the trend and intercept. The ZA test finds consistent results for both the variables: the unemployment rate and current account balance to GDP ratio are non-stationary at the level.

The ZA test considers only one structural break in the data. However, these two variables are likely to have more than one structural break. A visual inspection of the plot of the variables in Fig. 1 provides the rationale for considering multiple structural breaks in the data. As such, we use the Lumsdaine and Papell (1997) test which allows checking for at least two breaks. We explore three specific scenarios: (a) breaks in the intercept, (b) breaks in the trend, and (c) breaks in the intercept and trend. This will ensure the robustness of our findings of the stationarity properties of the data. The test results presented in Table 3 show that we cannot reject the null of a unit root. Thus, we conclude that both of these variables are non-stationary at the level. The Lumsdaine and Papell (1997) test provides us with the break dates for each series for the three cases mentioned above. We find that at least one of the break dates in the unemployment rate roughly coincides with the National Bureau of Economic Research recession dates in the United States. Similarly, for the current account balance to GDP ratio, we find at least one of the break dates corresponds to a recession.

The unit root test results suggest that the variables are non-stationary at the level. We take the first difference of the data and conduct the aforementioned unit root tests. When we plot the first difference of the two variables, we do not observe any presence of a trend or intercept. Table 4 presents the test results on the first-differenced data. Each of these tests rejects the null of a unit root implying that the first-differenced data are stationary. As per these tests, the data are non-stationary at their levels and stationary at their first difference, we conclude that they are integrated of order one, i.e. I(1). Thus, we can proceed to cointegration tests.

4.2 Cointegration test

Presence of cointegration implies the presence of long-run equilibrium relationship between two variables. In Tables 5 and 6, we present the Johansen and Juselius (1990) and Phillips and Ouliaris (1990) test results. These tests do not find any evidence of a long-run equilibrium relationship or cointegration between the two. In this research, we hypothesize that the long-run co-movement or cointegration may be asymmetric (or nonlinear) in nature. The unemployment rate in the United States is counter-cyclical and some papers argue that the current account balance is also subject to asymmetry in fluctuation owing to the business cycle. To address this nonlinearity, we now proceed to the threshold cointegration tests described in section three.

We employ the Hansen and Seo (2002) and the Enders and Siklos (2001) tests for threshold cointegration detailed earlier in section three. We employ two separate tests to ensure robustness of our findings. The null hypothesis for the Hansen and Seo (2002) test is linear cointegration, whereas the null hypothesis for the Enders and Siklos (2001) test is no-cointegration. The alternative is threshold cointegration for both these tests. Table 7 display the threshold cointegration test results. These test results confirm that we can reject the null hypothesis against the alternative at 5% and 10% significance levels confirming our hypothesis. These test results provide formal statistical evidence of threshold cointegration or a threshold long-run equilibrium relationship between the unemployment rate and the current account balance to GDP ratio in the United States. It is interesting to note that the threshold values, 5.27 for the Hansen and Seo test (2002) and 5.47 for the Enders and Siklos test (2001), are very close to each other. We argue that the presence of a long-run equilibrium relationship stems from the aggregate expenditure perspective. The lower unemployment rate in the economy implies fewer people without a job. Such an economic state also coincide with increased aggregate expenditure on imports. The increased import spending deteriorates the current account balance simultaneously. During economic recessions, a higher unemployment rate implies lower spending leading to improving current account balance.

4.3 Threshold vector error-correction model

Given the formal evidence of threshold cointegration between the unemployment rate and current account to GDP ratio, we now proceed to estimate the threshold vector error-correction model. The TVEC model will allow us to empirically estimate how a deviation from the long-run equilibrium relationship is adjusted in the short-run. Table 8 below presents the estimation output from the TVEC model detailed in equation eight in the methodology section.

We define two regimes based on the threshold at 5.46 from the Enders and Siklos (2001) test. The lag length of one (1) is selected as per the Bayesian Information Criterion or the Schwarz Information Criterion (S.B.C). Regime one is defined by \(Un_{t} + 1.50 * CA_{t} > 5.47\), when the error-correction term is greater than the threshold of 5.47. Approximately \(34\%\) observations fall under regime one. In this regime, the unemployment rate is rising faster than the current account balance to GDP ratio. In this regime, the movement away from the equilibrium or the error-correction is dominated by the unemployment rate. Regime two is defined by \(Un_{t} + 1.50 * CA_{t} \le 5.47\), when the error-correction term is less than the threshold of 5.47. Approximately, 66 % of the observations fall in regime two. In this scenario, the current account to GDP ratio is rising faster than the unemployment rate. In this regime, the movement away from the equilibrium or the error-correction is dominated by the current account to GDP ratio.

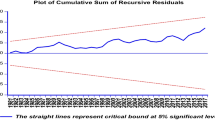

Figure 2 plots the threshold and the error-correction term used in the estimation with shaded areas representing the National Bureau of Economic Research (NBER) recession dates. It is interesting to observe that the prevalence of regime one coincides with the NBER recession dates. As we know the unemployment rate responds in a lagged fashion after a recession, hence known as a lagged indicator. As such, the error-correction term or the deviations away from the equilibrium also shows a lagged feature in this regime. The graph also shows that regime one occurred more frequently until the mid-1980s. Regime two, on the other hand, coincides with the periods of economic expansion periods. In this regime, we argue that a low unemployment rate implies fewer people without jobs. This state of the economy also coincides with increased aggregate expenditure on imports. The increased spending on imports deteriorates the current account balance simultaneously. The deteriorating current account balance to GDP ratio dominates the disequilibrium or movement away from the long-run equilibrium in regime two. Another interesting aspect we observe from Fig. 2 is that the disequilibrium becomes negative around 1999-2000, which becomes positive around the NBER recession of 2001. We observe the disequilibrium to turn negative again during the post-2001 recession, which improves and becomes positive during the Great Recession. Beyond the Great Recession, we observe the disequilibrium starts to deteriorate further. Regime two had a prolonged presence since the mid-1990s during which we observe the disequilibrium dominates or we observe movement away from the equilibrium. We also observe the disequilibrium shows a correcting behavior by becoming positive during the recession in 2001 and the Great Recession periods. A plausible explanation of such movement away from the equilibrium in regime two is arguably the increased spending on imports, which deteriorates the current account balance. During recessions, a higher unemployment rate coincides with reduced spending on imports improving the current account balance. The adjustment of the error-correction term during a recession is counter-cyclical, as we observe the error-correction tends to rise over time during the recessions and vice-versa. The unemployment rates rise, and the current account balance to GDP ratio indicates an improvement in the external balance. We know that a decline in aggregate spending is a key feature during the recessions in the U.S. economy. As such, the rising unemployment rate leads to a decline in aggregate spending. This leads to an improving current account balance. On the other hand, during economic expansions, the unemployment rate falls, and the trade balance deteriorates as a result of increased aggregate spending.

The estimation output of the TVEC model described by equation eight are furnished in Table 8. We find the coefficients of the error-correction term are statistically significant in regime one in both the equations but are not statistically significant in regime two. The statistically significant coefficient of the error-correction term in the growth in the unemployment rate equation has a negative sign, which indicates that the unemployment rate declines to maintain the long-run equilibrium relationship in regime one. We know governments undertake stabilization policy during recessions to prevent the rise in the unemployment rate. Perhaps, the unemployment rate responds to macroeconomic policy interventions. We also find the coefficient for the error-correction term is statistically significant in the growth in the current account balance to GDP ratio equation and has a negative sign. This is indicating that the current account balance improves to maintain the long-run equilibrium relationship in regime one. We argue that when the unemployment rate is rising in the economy, the current account balance improves simultaneously. The rising unemployment also coincides with a state of decline in aggregate spending. We may observe the aggregate spending on imports to decline to cause the current account balance to improve. Arguably, the rising unemployment rate decreases aggregate spending in the United States, which decreases consumer spending on imported commodities in the economy. This subsequently improves the current account balance to GDP ratio. This empirical results make the political rhetoric unfounded. We argue that policies that address structural unemployment may help the electorates, and subsequently reduce the support for such rhetoric.

4.4 Robustness analysis: Segmented cointegration

In an attempt to find robustness of our earlier findings, we employ the segmented cointegration proposed by Kejriwal and Perron (2010a) and Kejriwal and Perron (2010b). Martins and Rodrigues (2021) use this approach to detect segmented cointegration in the United States government budgetFootnote 2. Kejriwal and Perron (2010b) argue that when variables are cointegrated, the long-run relationship may depict some parameter shifts. Martins and Rodrigues (2021) argue that this parameter shift is expected for macroeconomic variables, especially with variables that are subject to policy regimes.

Table 9 presents the segmented cointegration results that shows that we do not find any evidence of segmented cointegration between the unemployment rate and current account balance to GDP ratio in the United States. However, the test indicates that we have 1 break in the cointegrating relationship. We argue that this finding is not unusual given the asymmetric adjustment between the two variables. The unemployment rate rises faster during a recession and declines during an expansion. The current account balance in the United States also depict similar variation. As such we argue that an asymmetric adjustment is more prevalent in comparison to segmented adjustment. Martins and Rodrigues (2021) find evidence of segmented cointegration for fiscal balance, as the fiscal policy and budget may depict a common segment of long-run relationship owing to policy priorities of the United States President.

5 Conclusion

International trade is inflicting domestic labor market in the United States is a political rhetoric that gained momentum in the United States. We can find a similar notion in the European political sphere as well. Do we have empirical evidences to support this rhetoric? The unemployment rate rise and the aggregate spending slow down during a recession. The current account may show signs of improvement during a recession, as imports may slow down as well. During economic expansions, lower unemployment implies increased aggregate expenditure on imported goods, which in turn leads to deterioration of the current account balance, as imports rise. This paper empirically investigates the presence of a long-run equilibrium relationship between the unemployment rate and the current account balance to GDP ratio in the United States. We use quarterly data from 1948: Q1 to 2020: Q1 of the unemployment rate and the current account balance to GDP ratio for this research. We employ a nonlinear time series econometric approach to address our research question.

The variables are non-stationary at the level in the presence of structural break and we find their first difference to be stationary. We find no evidence of cointegration or long-run equilibrium relationship using the Johansen and Juselius (1990) and the Phillips and Ouliaris (1990) cointegration tests. Macroeconomic time-series depict cyclicality, for this purpose we employ the Hansen (2001) and Enders and Siklos (2001) threshold cointegration tests. Contrary to the regular cointegration tests, these two procedures provide us formal statistical evidence of threshold cointegration or threshold long-run equilibrium relationship between the unemployment rate and the current account balance to GDP ratio. We argue that during economic expansions the decline in the unemployment rate leads to an increase in aggregate spending on imports, which subsequently deteriorates the current account balance. During recessions, we observe higher unemployment rate coincide with improving current account balance. We also investigate the short-run dynamics of the threshold long-run equilibrium relationship using a threshold vector error-correction model. The short-run dynamics indicate that when the unemployment rate is decreasing we also observe the current account balance to improve as well in regime one. The error-correction term adjusts to maintain the long-run relationship with the signs confirming that unemployment rates declines and the current account balance improves simultaneously. The nature of the error-correction term, which shows the deviations from the long-run equilibrium relationship, is also counter-cyclical conforming to our argument. These empirical findings therefore refute the political rhetoric. We argue that policies that address structural unemployment may help the electorates, and subsequently reduce the support for such rhetoric.

In this paper, we do not argue of a causal interpretation between trade and unemployment. Rather, we posit to establish the presence of a common empirical trend, which contradicts with the political rhetoric. Linking the unemployment rate with the current account balance from the aggregate spending perspective is perhaps a least traversed path in this area.

Notes

There are other papers that discuss these procedures in detail.

We would like to thank the anonymous referee for this suggestion and Prof. Louis Filipe Martins, Ph.D. for helping us with the computation code used for segmented cointegration testing.

References

Ahmed HA (2020) Monetary base and federal government debt in the long-run: A non-linear analysis. Bull Econ Res 72(2):167–184

Alessandria G, Choi H (2016) The dynamics of the us trade balance and the real exchange rate: The j curve and trade costs? Tech. rep., mimeo

Amiti M, Davis DR (2011) Trade, firms, and wages: Theory and evidence. Rev Econ Stud 79(1):1–36

Andrews DW (1994) Empirical process methods in econometrics. Handb Econ 4:2247–2294

Batdelger T, Kandil M (2012) Determinants of the current account balance in the united states. Appl Econ 44(5):653–669

Borjas GJ, Ramey VA (1994) Time-series evidence on the sources of trends in wage inequality. Am Econ Rev 84(2):10–16

Chan KS (1993) Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. The Annals of Statistics pp 520–533

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society pp 1057–1072

Duncan R (2016) Does the us current account show a symmetric behavior over the business cycle? Int Rev Econ Financ 41:202–219

Dutt P, Mitra D, Ranjan P (2009) International trade and unemployment: Theory and cross-national evidence. J Int Econ 78(1):32–44

Eaton J, Kortum S, Neiman B (2013) On deficits and unemployment. Revue économique 64(3):405–420

Egger H, Egger P, Markusen JR (2012) International welfare and employment linkages arising from minimum wages. Int Econ Rev 53(3):771–790

Elliott G, Fatás A (1996) International business cycles and the dynamics of the current account. Eur Econ Rev 40(2):361–387

Enders W (2008) Applied Econometric Time Series. John Wiley & Sons

Enders W, Granger CWJ (1998) Unit-root tests and asymmetric adjustment with an example using the term structure of interest rates. J Bus Econ Stat 16(3):304–311

Enders W, Siklos PL (2001) Cointegration and threshold adjustment. J Bus Econ Stat 19(2):166–176

Engel R (1987) F, granger cw j. Cointegration and error correction: Representation Estimation, and Testing 35

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society pp 251–276

Felbermayr GJ, Larch M, Lechthaler W (2013) Unemployment in an interdependent world. Am Econ J Econ Pol 5(1):262–301

Granger CW (1996) Can we improve the perceived quality of economic forecasts? J Appl Economet 11(5):455–473

Hamilton JD (1994) Time Series Analysis. Princeton University Press, NJ

Hansen BE (2001) The new econometrics of structural change: dating breaks in us labour productivity. J Econ Perspect 15(4):117–128

Hansen BE, Seo B (2002) Testing for two-regime threshold cointegration in vector error-correction models. J Econ 110(2):293–318

Heid B, Larch M (2014) International trade and unemployment: a quantitative framework

Holmes MJ (2011) Threshold cointegration and the short-run dynamics of twin deficit behaviour. Res Econ 65(3):271–277

Jansen M, Lee E (2007) Trade and employment: challenges for policy research: a joint study of the International Labour Office and the Secretariat of the World Trade Organization. International Labour Organization

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Oxford Bull Econ Stat 52(2):169–210

Kejriwal M, Perron P (2010) A sequential procedure to determine the number of breaks in trend with an integrated or stationary noise component. J Time Ser Anal 31(5):305–328

Kejriwal M, Perron P (2010) Testing for multiple structural changes in cointegrated regression models. J Bus Econ Stat 28(4):503–522

Krishnakumar J, Neto D et al (2009) Estimation and testing for the cointegration rank in a threshold cointegrated system. Cahiers du département d’économétrie, Faculté des siences économiques et socliales, Université de Genève

Lee J, Strazicich MC (2003) Minimum lagrange multiplier unit root test with two structural breaks. Rev Econ Stat 85(4):1082–1089

Lumsdaine RL, Papell DH (1997) Multiple trend breaks and the unit-root hypothesis. Rev Econ Stat 79(2):212–218

Martins LF, Rodrigues PM (2021) Tests for segmented cointegration: an application to us governments budgets. Empir Econ pp 1–34

Perron P (2006) Dealing with structural breaks. Palgrave Handbook of Econometrics 1(2):278–352

Petruccelli JD, Woolford SW (1984) A threshold ar (1) model. J Appl Probab 21(2):270–286

Phillips PC, Ouliaris S (1990) Asymptotic properties of residual based tests for cointegration. Econometrica: Journal of the Econometric Society pp 165–193

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Rose SJ (2018) Is foreign trade the cause of manufacturing job losses? Urban Institute, Washington, DC

Wang Z, Wei SJ, Yu X, Zhu K (2018) Re-examining the effects of trading with china on local labor markets: A supply chain perspective. Tech. rep, National Bureau of Economic Research

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20(1):25–44

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Ahmed, H.A., Nasser, T. Long-run relationship between the unemployment rate and the current account balance in the United States: An empirical analysis. Port Econ J 22, 397–416 (2023). https://doi.org/10.1007/s10258-022-00220-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-022-00220-3