Abstract

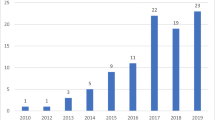

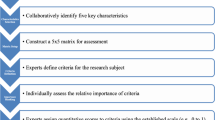

Although in the era of third generation (3G) mobile networks technical hurdles are minor, the continuing failure of mobile payments (m-payments) withstands the endorsement by customers and service providers. A major reason is the uncommonly high interdependency of technical, human and market factors which have to be regarded and orchestrated cohesively to solve the problem. In this paper, we apply Business Model Ontology in order to develop an m-payment business model framework based on the results of a precedent multi case study analysis of 27 m-payment procedures. The framework is depicted with a system of morphological boxes and the interrelations between the associated characteristics. Representing any m-payment business model along with its market setting and influencing decisions as instantiations, the resulting framework enables researchers and practitioners for comprehensive analysis of existing and future models and provides a helpful tool for m-payment business model engineering.

Similar content being viewed by others

Notes

We analyzed 27 case studies: billBOXtime (http://www.billbox.ch); Contopronto AS (http://www.luup.com); EasyPark (http://www.easypark.de); eCash (http://www.ecashdirect.net); Electronic Mobile Payment Services (http://www.nokia.com); FairCash (http://www.faircash.org); Geldhandy (http://www.geldhandy.info); Genion m-Payment (http://www.o2.com); i-mode (http://www. nttdocomo.com); Iti Achat (http://www.francetelecom.com); MicroMoney (http://www.t-pay.de); MIDRAY (http://www.midray. com); Mobileview (http://www.mobileview-ag.com); MoreCon (http://www.morecon.de/en); NCS mobile payment Bank (http://www.crandy.com); Obopay (http://www.obopay.com); ONE (http://www.one.at); Paybox Austria (http://www.paybox.at); Paybox Germany (http://www.paybox.de); PayPal (http://www.paypal.com); Paysafecard (http://www.paysafecard.com); SEMOPS (http://www.semops.com); Sonera Mobile Pay (http://www.sonera.fi/en); Street Cash (http://www.streetcash.de); Vodafone m-pay (http://www.vodafone.com); Whatever Mobile (http://www.whatevermobile.com); Mobipay (http://www.mobipay.com). Case studies are described in detail in Heinkele (2003) and Pousttchi et al. (2006). The case studies were chosen according to the m-payment standard types and theoretical categories proposed in Kreyer et al. (2003).

References

Alder H (1994) The technology of creativity. Manage Decis 32(4):23–30

Au YA, Kauffman RJ (2008) The economics of mobile payments: understanding stakeholder issues for an emerging financial technology application. Electron Commer Res Appl 7(2):141–164

Bagchi S, Tulskie B (2000) e-Business models: integrating learning from strategy development experiences and empirical research. In: 20th Annual international conference of the strategic management society. Vancouver

Baghdadi Y (2005) A business model for deploying Web services: a data-centric approach based on factual dependencies. Inf Syst e-Business Manage 3(2):151–173

Berentsen A (1999) Monetary policy implications of digital money. Kyklos 52(2):263–264

Bondi AB (2000) Characteristics of scalability and their impact on performance. In: Proceedings of the 2nd international workshop on software and performance, Ontario, pp 195–203

Bradley M, Jarrell G, Kim EH (1984) On the existence of an optimal capital structure: theory and evidence. J Finance 39(3):857–880

Chau PYK (1996) An empirical assessment of a modified technology acceptance model. J Manage Inf Syst 13(2):185–204

Choon SL, Hyung SS, Dae SK (2004) A classification of mobile business models and its applications. Ind Manage Data Syst 104(1):78–87

Coursaris C, Hassanein K (2002) Understanding m-commerce—a consumer centric model. Q J Electron Commer 3(2):247–271

Dahlberg T, Mallat N, Öörni A (2003) Consumer acceptance of m-payment solutions—ease of use, usefulness and trust. The second international conference on mobile business 2003. Vienna

Dahlberg T, Mallat N, Ondrus J, Zmijewska A (2006) M-payment market and research—past, present and future. Helsinki mobility roundtable, Helsinki

Dass SC, Jain AK (2007) Fingerprint-based recognition. Technometrics 49(3):262–276

Dowd K (1990) The state and the monetary system. Philip Allen, London

Eisenhardt K (1989) Building theories from case study research. Acad Manage Rev 14(4):532–550

EU Commission (2004) Application of the e-money directive to mobile operators—guidance note from the commission services. http://ec.europa.eu/internal_market/bank/docs/e-money/guidance_en.pdf. Accessed 17 July 2008

Fong S, Lai E (2005) Mobile mini-payment scheme using sms-credit. In: Proceedings of the international conference on computational science and its applications. Singapore, pp 1106–1114

Gilson SC (1998) Transactions costs and capital structure choice: evidence from financially distressed firms. J Finance 52(1):161–202

Gordijn J (2002) Value-based requirements engineering—exploring innovative e-commerce ideas. Doctoral Dissertation. Vrije, Amsterdam

Gordijn J, Osterwalder A, Pigneur Y (2005) Comparing two Business Model Ontologies for designing ebusiness models and value constellations. In: 18th BLED conference (eIntegration in action), CDrom

Grant RM (1991) The resource-based theory of competitive advantage: implications for strategy formulation. California Manage Rev 33(3):114–135

Green P, Rosemann M (2004) Applying ontologies to business and systems modelling techniques and perspectives: lessons learned. J Database Manage 15(2):105–117

Grigg I (1996) The effect of Internet value transfer systems on monetary policy. Working paper 001, London Business School, London

Hanemann WM (1991) Willingness to pay and willingness to accept: how much can they differ? Am Econ Rev 81(3):635–647

Heinkele C (2003) Überblick und Einordnung ausgewählter M-Payment-Verfahren. Report, Chair of Business Informatics and Systems Engineering, University of Augsburg, Augsburg

Henkel J (2002) M-payment. In: Silberer G, Wohlfahrt J,Wilhelm T (eds) Mobile commerce—basics, business models and success factors. Gabler, Wiesbaden

Herzberg A (2003) Payments and banking with mobile personal devices. Commun ACM 46(5):53–58

Hevner AR, March ST, Park J, Ram S (2004) Design science in information systems research. MIS Q 28(1):75–100

Jain AK, Bolle R, Pankanti S (1999) Biometrics: personal identification in networked society. Kluwer, Boston

Kalish S, Nelson P (1991) A comparison of ranking, rating and reservation price measurement in conjoint analysis. Mark Lett 2(4):327–335

Karnouskos S, Vilmos A, Hoepner P, Ramfos A, Venetakis N (2003) Secure m-payment—architecture and business model of SEMOPS. In: Proceedings of the EURESCOM summit. Heidelberg

Khodawandi D, Pousttchi K, Wiedemann DG (2003) Akzeptanz mobiler Bezahlverfahren in Deutschland. In: Proceedings of the 3rd workshop on mobile commerce. Augsburg, pp 42–57

Kotler P (2003) Marketing management, Pearson Education. Upper Saddle River, New York

Kreyer N, Pousttchi K, Turowski K (2003) Mobile payment procedures: scope and characteristics. eService J 2(3):7–22

Krueger M (2001) The future of m-payments—business options and policy issues. Background paper no. 2; Electronic Payment Systems Observatory (ePSO), Sevilla. http://epso.intrasoft.lu/papers/Backgrnd-2.pdf. Accessed 10 August 2007

Krueger M (2002) M-payments: a challenge for banks and regulators. IPTS report 63:5–11

Leary MT, Roberts MR (2005) Do firms rebalance their capital structures? J Finance 60(6):2575–2619

Leland HE (1998) Agency costs, risk management, and capital structure. J Finance 53(4):1213–1243

Linck K, Pousttchi K, Wiedemann DG (2006) Security Issues in M-payment from the customer viewpoint. In: Proceedings of the 14th European conference on information systems. Gothenburg, Sweden

Mallat N (2007) Exploring consumer adoption of mobile payments—a qualitative study. J Strateg Inf Syst 16(4):413–432

McFadzean E (2000) Techniques to enhance creative thinking. Team Perform Manage 6(3/4):62

Miao J (2005) Optimal capital structure and industry dynamics. J Finance 60(6):2621–2659

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297

Müller-Merbach H (1976) The use of morphological techniques for or-approaches to problems. Operations research ‘75. North-Holland, Amsterdam, pp 127–139

NFC Forum (2007) Near Field Communication and the NFC Forum: The Keys to Truly Interoperable Communications. http://www.nfc-forum.org/resources/white_papers/nfc_forum_marketing_white_paper.pdf. Accessed 25 August 2007

Ondrus J, Pigneur Y (2004) Coupling mobile payments and CRM in the retail industry. Accepted IADIS international e-Commerce 2004 conference

Ondrus J, Pigneur Y (2005) A disruption analysis in the mobile payment market. In: Proceedings of the IADIS 38th Hawaii international conference on system sciences, Hawaii, January 3–6

Ortiz E (2004) A survey of J2ME today. Available via http://developers.sun.com/mobility/getstart/articles/survey. Accessed 5 August 2007

Osterwalder A (2004) The business model ontology—a proposition in a design science approach. Dissertation, University of Lausanne, Switzerland

Osterwalder A, Pigneur Y, Tucci CL (2005) Clarifying business models: origins, present, and future of the concept. Commun AIS 15:751–755

Owen AL, Fogelstrom C (2005) Monetary policy implications of electronic currency: an empirical analysis. Appl Econ Lett 12(7):419–423

Pousttchi K (2003) Conditions for acceptance and usage of m-payment procedures. In: Proceedings of the 2nd international conference on mobile business. Vienna, pp 201–210

Pousttchi K (2004) An analysis of the m-payment problem in Europe. In: Proceedings of the Multikonferenz Wirtschaftsinformatik Essen, pp 260–268

Pousttchi K (2008) A modeling approach and reference models for the analysis of mobile payment use cases. Electron Commer Res Appl 7(2):182–201

Pousttchi K, Selk B, Turowski K (2002) Akzeptanzkriterien für mobile Bezahlverfahren. Mobile and Collaborative Business 2002. In: Proceedings zur Teilkonferenz der Multikonferenz Wirtschaftsinformatik. Lecture notes in informatics (LNI), pp 51–68

Pousttchi K, Wiedemann DG, Schaub J (2006) Aktueller Vergleich mobiler Bezahlverfahren im deutschsprachigen Raum. Studienpapiere der Arbeitsgruppe Mobile Commerce. Augsburg, pp 50–96

Pousttchi K, Schiessler M, Wiedemann DG (2007) Analyzing the elements of the business model for mobile payment service provision. In: Proceedings of the 6th international conference on mobile business (ICMB 2007). IEEE Computer Society Press, Toronto

Salvi AB, Sahai S (2002) Dial M for money. In: Proceedings of the 2nd ACM international workshop on mobile commerce, Atlanta, USA, pp 95–99

Schwiderski-Grosche S, Knospe H (2002) Secure mobile commerce. In: Mitchell C (ed) Spec issue IEEE Electron Commun Eng J Secur Mobil 14(5):228–238

See-To EWK, Jaisingh J, Tam KY (2007) Analysis of electronic micro-payment market. J Electron Commer Res 8(1):63–83

Seppanen M, Makinen S (2005) Business model concepts: a review with case illustration. In: Proceedings of the Engineering Management Conference. IEEE International, pp 376–380

Shapiro C, Varian HR (1999) Information rules: a strategic guide to the network economy. Harvard Business School Press, Boston

Spinellis D, Kokolakis S, Gritzalis S (1999) Security requirements, risks and recommendations for small enterprise and home-office environments. Inf Manage Comput Secur 7(3):121–128

Timmers P (1998) Business models for electronic markets. Electron Mark 8:3–8

Toshimitsu T (2007) A note on quality choice, monopoly, and network externality. J Ind Compet Trade 7(2):131–142

Turowski K, Pousttchi K (2004) Mobile Commerce. Grundlagen und Techniken, Springer, Heidelberg

van Baal S, Krueger M (2005) Internet-Zahlungssysteme aus Sicht der Händler (IZH3), IWW, Universität Karlsruhe

Varshney U, Vetter R (2002) Mobile commerce: framework, applications and networking support. Mobile Netw Appl 7(3):185–198

Voelckner F (2006) An empirical comparison of methods for measuring consumers’ willingness to pay. Mark Lett 17(2):137–149

Waris FS, Mubarik FM, Pau LF (2006) Mobile payments in the Netherlands: adoption bottlenecks and opportunities, or throw out your wallets. In: ERIM report series reference no. ERS-2006-012-LIS. Available at SSRN: http://ssrn.com/abstract=898921

Wiedemann DG, Goeke L, Pousttchi K (2008) Ausgestaltung mobiler Bezahlverfahren—Ergebnisse der Studie MP3. In: Breitner MH, Breunig M, Fleisch E, Pousttchi K, Turowski K (eds) Mobile und Ubiquitäre Informationssysteme—Technologien, Prozesse, Marktfähigkeit. In: Proceedings of the 3rd conference on mobile and ubiquitous information systems (MMS 2008). Lecture notes in informatics (LNI), Bd. P–123, Gesellschaft für Informatik, Bonn, pp 94–107

Yin RK (2002) Case study research—design and methods. Sage, Thousand Oaks

Zmijewska A (2005) Evaluating wireless technologies in mobile payments: a customer centric approach. In: Proceedings of the international conference on mobile business (ICMB'05), pp 354–362

Zmijewska A, Lawrence E (2005) Reshaping the framework for analysing success of mobile payment solutions. Paper presented at the IADIS international conference on e-Commerce, Porto

Zmijewska A, Lawrence E (2006) Implementation models in m-payments. In: Proceedings of the IASTED international conference advances in computer science and technology, Puerto Vallarta, Mexico, pp 19–25

Zmijewska A, Lawrence E, Steele R (2004) Classifying m-payments—a user-centric model. In: Proceedings of the third international conference on mobile business (ICMB'04). New York

Zwicky F (1966) Entdecken, Erfinden. Forschen im Morphologischen Weltbild. Knaur-Droemer Verlag, Munich

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pousttchi, K., Schiessler, M. & Wiedemann, D.G. Proposing a comprehensive framework for analysis and engineering of mobile payment business models. Inf Syst E-Bus Manage 7, 363–393 (2009). https://doi.org/10.1007/s10257-008-0098-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10257-008-0098-9