Abstract

This study addresses the assessment of capital requirements in life insurance for idiosyncratic demographic risks arising from mortality and longevity in compliance with the Solvency II framework. A closed-formula methodology, using a cohort-based risk theoretical approach, is introduced to properly capture the volatility associated with policyholder deaths or survivals. This approach not only accounts for portfolio size effects but it also considers the impact of variability in sums insured within cohorts and coverage types with an additional specific address to distribution tails. The proposed methodology offers a viable alternative within the Solvency II context, addressing limitations identified in previous studies for the Standard Formula nowadays in force. Focusing only on the diversifiable part of demographic risk, the approach considers company’s specific parameters through a risk-based formula, as opposed to a simple scenario approach with demographic stress on the Best Estimate of underlying contracts valid for the whole business. Numerical results show its accuracy in approximating capital requirements for a large range of life insurance contracts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since 2016 a new regulatory framework, namely Solvency II, has been introduced to set out the requirements for insurance and reinsurance undertakings in the European Union (European Parliament and Council 2021). It has been designed to ensure that insurers have sufficient capital to face their risks and protect policyholders. Solvency II aims to increase transparency and accountability in the insurance sector, promote market discipline, and protect policyholders. It also requires insurers to have sound risk management and governance systems in place.

In particular, the regulation provides a risk-based approach that enables insurers to assess their overall solvency capital requirement (SCR) using either a standard formula approach or an internal model (European Parliament and Council 2014). The standard formula is a standardized method of calculating the SCR based on a set of scenarios and parameters calibrated at market-wide level, while the internal model allows to take into account in a more detailed way the specific risk profile of the insurer using its own exposures and characteristics.

However, the regulation provides also the possibility of using undertaking specific parameters (USPs) for the assessment of the capital requirement for specific risks, as premium & reserve risk in non-life underwriting. USPs in Solvency II play a critical role in the SCR calculations, as they allow insurers to tailor the capital requirement to their specific risk profile by applying fixed methodologies provided by the regulation (European Parliament and Council 2014). Differently from the market-wide approach, the calibration process involves collecting data on the relevant risks, determining the appropriate factors and calculating the corresponding capital requirement following anyhow, unlike in Internal Model, a driven formula.

Moreover, the possibility of extending USP to the computation of capital requirement for life underwriting risk is currently a topic under discussion in the Solvency II framework. The European Insurance and Occupational Pensions Authority (EIOPA) has published, under the Solvency II Review 2018, a discussion paper on the review of specific items in Solvency II (see EIOPA 2016) and one of the topics discussed is the possibility of allowing insurers to use their own data to calibrate USPs for life underwriting risks. EIOPA acknowledges that there are challenges in calculating capital requirements for life underwriting risks and the use of USPs could provide insurers with a more accurate assessment of their capital requirements.

Clearly, the implementation of USPs for life underwriting risks would require further analyses and discussions among industry experts and regulators before it may be adopted in the Solvency II framework. Therefore, at the moment, this topic is postponed to a later stage of the Solvency II review process (see EIOPA 2017a, b). Indeed, although some simplified methods have been provided in the Delegated Regulation (European Parliament and Council 2014) as easy-to-use approaches for smaller insurers to calculate their SCR for life underwriting risk, USP methodologies are needed for all insurers to accurately assess their risk exposure.

In this framework, a very limited literature focused on USPs’ proposals. In particular, Cerchiara and Demarco (2016) deal with the data requirements and methodologies according the so-called standardized methods proposed in the Solvency II regulation for the calibration of USPs and propose a comparison with the market-wide standard formula in non-life companies.

According to the evaluation of the capital requirement for life underwriting risk, there are several contributions in the literature, but no-one focused on the USPs. Indeed, the longevity risk of a portfolio of annuities is measured in Olivieri and Pitacco (2008) and Ngugnie Diffouo and Devolder (2020). A partial internal model for the longevity risk component, which incorporates an unsystematic element due to the size of the portfolio, is provided in Jarner and Møller (2015). A stochastic model for idyosincratic and trend risk in a market consistent framework is given in Clemente et al. (2022).

A mortality model is proposed for forecasting trends in Plat (2011). In Börger (2010), Solvency II scenarios are compared with the results of the forward models proposed by Bauer et al. (see Bauer et al. 2010a, 2008). An ad-hoc mortality model that considers demographic risk and the dependency structure between the different cohorts is given in Börger et al. (2014). Run-off and one-year approaches are compared in Gylys and Šiaulys (2019). Richards et al. (see Richards et al. 2014) focus on the share of longevity trend risk to be considered in a one-year value-at-risk framework.

Hari et al. (see Hari et al. 2008) assess the relevance of longevity risk for the solvency position of annuity portfolios distinguishing between micro and macro-longevity risks. The longevity risk capital requirement is obtained by applying the classical Lee-Carter model in Stevens et al. (2010), by least-squares regression and Monte Carlo simulations in Bauer and Ha (2015) and by modelling mortality intensity as a stochastic process in Dahl (2004).

As shown in the literature (for example, see Clemente et al. 2022) and as acknowledged by the Solvency II regulation (refer to Committee of European Insurance and Occupational Pensions Supervisors 2006; European Parliament and Council 2021), demographic risk comprises both idiosyncratic (or diversifiable) and trend risks. The former pertains to the volatility of the random variables, while the latter involves risks associated with structural changes of the second-order assumptions. Within this framework, we provide a methodology for assessing the capital requirement for idiosyncratic demographic risk due to mortality and longevity in an accounting framework aligned with the market consistent valuation prescribed by Solvency II. We provide indeed a closed formula based on a cohort approach aimed at catching the volatility linked to the random variable “policyholder deaths”(or survivals). It allows to highlight not only the pooling effects due to the portfolio size, but also the effects of the volatility of the sums insured within the cohort and of the type of coverage with relevant effects also on the distribution tail. Our proposal represents indeed a possible undertaking approach in the Solvency II context for measuring only the diversifiable source of demographic risk. Additionally, it overcomes some drawbacks of the proposal provided in Quantitative Impact Study n.2 in 2006 (see Committee of European Insurance and Occupational Pensions Supervisors 2006) where skewness and sum insured volatility were completely ignored.

A case study was conducted to evaluate the proposed approach using various life insurance contracts. The numerical results show how the proposal aligns consistently with the context, offering a reliable approximation of the capital requirement obtained through a simulated approach. For testing the goodness of fit, we compared the results with the capital requirement obtained by considering the simulated distribution of the demographic profit and loss derived by a Partial Internal Model (see Clemente et al. 2022) with consistent assumptions with the proposed USP approach. The Partial Internal Model has been employed using a traditional Monte Carlo approach although in the literature extensions have been proposed for specific purposes (see, e.g., Bauer et al. 2010b for nested simulations and Bauer and Ha 2015; Costabile and Viviano 2020; Floryszczak et al. 2016 for least-squares Monte Carlo)

The paper is organized as follows. Section 2 introduces some preliminary aspects and notation. Section 3 defines the idiosyncratic risk and the characteristics of the main random variables involved. Section 4 provides two alternative USPs for mortality and longevity risk. A numerical application is developed in Sect. 5, followed by the main Conclusions.

2 Preliminaries

2.1 The cohort approach model

Let us consider a measurable space \((\Omega , {\mathcal {F}})\), where \(\Omega \) is a set and \({\mathcal {F}}\) is a \(\sigma \)-algebra of subsets of \(\Omega \). This mathematical framework allows us to model a wide range of phenomena where uncertainty or randomness are present. In particular, we can define a probability measure \(P \) on \((\Omega , {\mathcal {F}})\) that assigns probabilities to events in \({\mathcal {F}}\), which represent the possible outcomes of our experiment.

To capture the evolution of such phenomena over time, we introduce a filtration \({\mathbb {F}}=({\mathcal {F}}_t)\) with \(t=0,1,..,n\), where n is the duration of the contracts. Each \({\mathcal {F}}_t\) is a \(\sigma \)-algebra representing the information available up to time t. This filtration allows us to study the evolution of uncertainty over time and to make expectations about future events based on the available information.

Contracts play a fundamental role in the actuarial practice, where they are used to model and manage various types of risks, such as insurance and financial risks. For several purposes, such as calculating reserves, assessing the performance of a portfolio, or determining regulatory compliance, contracts are often grouped together into cohorts based on certain characteristics they share, such as their issue date, policyholder’s age, technical bases or the type of coverage they provide.

Given the importance of this concept in actuarial science, we propose to adopt a precise definition of cohort for the purpose of our analysis. For instance, when studying the mortality risk of a life insurance portfolio, a cohort may be defined as a group of policies issued in a certain year to individuals of a specific age range and gender. By focusing on such cohorts, we can obtain a more granular and accurate understanding of the underlying risk profile and design effective risk management strategies.

In the context of this study, we define a cohort as a group of insurance policies that share certain relevant characteristics for the purpose of our analysis. Specifically, we consider policies with the same duration, the same insurance contract, issued within a specific time frame, and subscribed by insureds within the same age. The only difference between policies within the same cohort is the amount of the sum insured, which can vary across policyholders. This choice allows us to analyze the risk in a more detailed way, focusing on the factors that contribute most to the variability of the risk profile within a given population of policyholders, e.g., Sum-at-Risk (SaR) and sums insured variability.

We consider a cohort given by \(l_{0}\) policyholders (with \(k=1,...,l_{0}\)) at time 0 and we denote with \(S_{k,t}\) the random variable (r.v.)Footnote 1 “sum insured of the k-th policyholder at time t”. This generic r.v., independently of the type of contract, can be defined as the sum insured whereas the contract is in force at time t, zero otherwise. Considering a constant sum insured, \(S_{k,t}\) is equal to the product between the initial value \(s_{k,0}\) and t random variables that assume the value 1 if the policyholder survives in the given year and 0 in case of death:

where \({\mathbb {I}}_{k,\tau }^L\) is a Bernoulli r.v. that assumes value equal to one if the policyholder survives between \(\tau \) and \(\tau +1\). Therefore, the random variable \(S_{k,t}\) represents the amount that the insurance company will have to pay to the k-th policyholder if he/she is entitled to the benefit in that year.

Since the cohort is composed by policyholders with the same characteristics (except for the sums insured), we assume that the unexpected events (and deaths) of the policyholders can be described by conditionally independent and identically distributed random variables. Indeed, we assume that policyholders are conditionally independent from each other and that all those who belong to the same cohort have the same survival probability. In other words, conditional on the fact that the survival probabilities are the same, the survivals of policyholders are independent of each other (see Hanbali et al. 2019; Milevsky et al. 2006).Footnote 2 Furthermore, we define the sums insured of the whole portfolio as:

2.2 Premiums and reserves

We focus now on the valuation of technical liabilities in accordance to the rules set by the Solvency II directive.

The starting point is the definition of the vector \({{\textbf {X}}}_t\) whose components are the cashflows from t to n. At time \(t=0\), we have

where \(L ^2_{n+1}(P ,{\mathbb {F}})\) is a Hilbert space. Hence, the vector of cash-flows can be split as \({{\textbf {X}}}_t={{\textbf {X}}}_t^{out}-{{\textbf {X}}}_t^{in}\) whereas \({{\textbf {X}}}_t^{out}\) is the vector of the outflows and \({{\textbf {X}}}_t^{in}\) is the vector of the inflows, i.e., the premiums. Moreover, we assume that the premiums are paid in advance at the beginning of the year, while the benefits are paid at the end of year when the assured event occurs. For the sake of simplicity, we do not consider expenses in the outflows. Consequently, for consistency, expenses loadings are also excluded from the inflows, with premiums income being related only to pure premiums in our framework, then including only implicit safety loading. Similarly, the impact of lapses, affecting demographic risk only in terms of minor exposure, is neglected.

Therefore, we define the cash-out of the year as follows:

where \({\mathbb {I}}_{k,t-1}^B\) is a dichotomic r.v. which assumes value 1 whereas the k-th policyholders becomes eligible to obtain the benefit in the time span \((t-1,t]\).Footnote 3 Notice that the distribution of \({\mathbb {I}}_{k,\tau }^B\) depends on the type of the insurance contract of the cohort.Footnote 4

Similarly, for cash-in we have:

where \(p_t\) is the pure premium rateFootnote 5 per unitary sum insured. Notice that \(X_t^{in}\) is \({\mathcal {F}}_t\)-measurable, as the premium rate is a quantity known when the policies are underwritten.

As known, according to Art. 77 of Solvency II “the value of technical provisions shall be equal to the sum of a best estimate and a risk margin [...]. The best estimate shall correspond to the probability weighted average of future cash-flows, taking account of the time value of money (expected present value of future cash-flows), using the relevant risk-free interest rate term structure”.

Moreover, we specify that Directive 2009/138/EC and the Delegated Acts impose that the variations of the Risk Margin must not influence the Solvency Capital Requirement; because of this reason our attention is focused only on the best estimate component.

Therefore, we define the best estimate value of the liability \(R_t\) at a generic time t as follows:

in case of single premium or as follows

in case of an annual premium and where \(i_t(t,\tau )\) is the spot rate taken from the risk-free rate curve provided monthly by EIOPA. It can be noted that, in our framework, the best estimate value does not include technical provision regarding future expenses, such as acquisition and management expenses. We point out that this is generally not a major concern in practical scenarios with annual or regular premiums.Footnote 6

In relation to the expected value of formula (7), it is evident that the expectation of cash flows entails a dual source of uncertainty. This includes uncertainty regarding the value of sums insured at a given future time \(\tau \), as well as uncertainty concerning the occurrence of the event triggering the insurer’s payment.

Exploiting the assumption that the survivals (and deaths) of the policyholders of the cohort are conditionally i.i.d. r.v., it is possible to define

Notice that formula (8) (and more generally the whole of this paper) also works in the case of contracts with a single premium or in which \(p_t\) is not constant: in both cases the best estimate rate \({\mathcal {R}}_t\) considers the expected present value of future premiums, regardless of whether they are 0 or constant or different from each other.

Considering that \(S_{k,t}\) is \({\mathcal {F}}_t\)-measurable and exploiting formula (2), it is possible to write

or, more compactly,

where \({\mathcal {R}}_t\) is the best estimate rate (per unitary sum insured).

In conclusion, as per Olivieri and Pitacco (2015), we specify that the pure premium rate for each contract can be computed as a solution of the equation

where \({\mathcal {R}}^*_0\) is the mathematical reserve rate calculated at time zero with:

-

\(i_0(0,\tau )=i^*\;\forall \tau \in [1,n]\), \(i^*\) is usually called technical rate or financial first order basis,

-

The expectation is not under the real-word measure P, but under a probability-distorted measure \(P^*\), i.e. the so-called first order demographic basis.

Hence, according to formula (11), the expected present value of the benefits is equal to the expected present value of the premiums whereas the calculation involves the distorted probability \(P^*\) and the technical rate \(i^*\).

3 The SCR for demographic idiosyncratic risk

3.1 The claims development results (CDRs)

This subsection presents a financial statement model suitable for valuing the profits and losses of the insurance company over an annual time horizon, which is therefore consistent for the quantification of the Solvency Capital Requirement of Solvency II. Considering a generic time span \([t,t+1]\), the insurance company:

-

1.

Has at disposal the best estimates of the reserves \(R_t\), calculated with the most up-to-date information,

-

2.

Collect the deterministic premiums at the beginning of the period, i.e., \(x_t^{in}\) in t,

-

3.

Pay claims at the end of the period, i.e., \(X_t^{out}\) in \(t+1\),

-

4.

Assess new reserves at the end of the period, only for the policyholders remaining in the portfolio, on the basis of the new demographic and financial information available, i.e., \(R_{t+1}\) in \(t+1\).

The initial amount, given by the sum of the two components \(R_t\) and \(x_t^{in}\), is needed to cover potential claims in the event of an assured occurrence, as well as the updated best estimates for policyholders who survive in \(t+1\). As is customary, the premiums collected are typically invested to yield a return sufficient to fulfill obligations owed to the policyholders. To focus solely on evaluating demographic risk, we assume that the insurance company invests at the risk-free rate available in the market, and for the present discussion, we disregard the impact of financial volatilityFootnote 7 which instead is relevant for investment analysis. Therefore, we consider the quantity

Consistently with the existing literature (see Wüthrich and Merz 2013), we define the Claims Development Result (CDR) between time t and time \(t+1\) as

where, following formula (10), we have \(R_{t+1}=S_{t+1}\cdot {\mathcal {R}}_{t+1}\) with \({\mathcal {R}}_{t+1}\) best estimate rate at time \(t+1\).

According to formula (13), when capitalized premiums and reserves prove adequate to cover the claims for the year and future liabilities computed in the new reserve, a positive CDR arises. Conversely, if a loss is incurred, the CDR takes on a negative value. It is worth noting that the CDR incorporates the following sources of randomness:

-

Accidental (or idiosyncratic) mortality relative to the number of deaths in the cohort over the time span \((t,t+1]\),

-

The volatility linked to mortality estimates. The information used by the company for the provision of the best estimates in \(t+1\), \({\mathcal {F}}_{t+1}\), could be different from \({\mathcal {F}}_{t}\),

-

Volatility in the risk-free rate curves between time t and time \(t+1\). Since in this work we are only interested in quantifying the demographic risk, we assume that the spot rate curve in \(t+1\) coincides with the forward rate curve obtainable in t. As proved in Clemente et al. (2021), this assumption effectively eliminates the impact of financial volatility from the model.

Now, we introduce the quantity

where \(i_t(t+1,\tau )\) is the forward rate between \(t+1\) and \(\tau \) available from the spot curve at time t. From a qualitative point of view, \({\hat{R}}_{t+1}\) is equal to the best estimate of the policyholders in \(t+1\) calculated with demographic basis equal to those used in t, i.e., \({\mathcal {F}}_t\). Formula (14) can be rewritten as:

where \(\hat{{\mathcal {R}}}_{t+1}\) is the best estimate rate at time \(t+1\) computed using demographic basis defined at time t.

We define the following quantities,

and

We have thus divided the overall CDR into two components: \(CDR_{t+1}^{Idios}\) depends solely on the volatility of the year, whereas \(CDR_{t+1}^{Trend}\) is influenced by both the volatility of the year and, more notably, by potential revisions in demographic expectations resulting from this volatility.

3.2 The CDR for idiosyncratic risk and its characteristics

We focus now on the CDR for idiosyncratic risk defined in formula (16). Notice that considering the definition of the reserve given in (14), the assumptions reported in Wüthrich et al. (2010) and Clemente et al. (2022) are satisfied.

It is therefore possible to rewrite \(CDR_{t+1}^{Idios}\) as

where

in case the cohort is composed by positive SaR policies (as term insurances, endowments) or

in case of policies with a negative SaR (pure endowments, annuities in the deferral periodFootnote 8). Note that the formulation of \(\eta _{t+1}\), the SaR rate, depends on the type of insurance contract considered. It is defined as the difference between the unitary sum insured payable in case of death (equal to zero for policies that only provide a benefit in case of survival) and the mathematical reserve rate. The SaR amount, if positive, signifies exposure to mortality risk; if negative it indicates the dismantling of the mathematical reserve if the death occurs.

The examination of the r.v. \(CDR_{t+1}^{Idios}\) at the cohort level is then connected to the analysis of the following r.v.: \(\sum _{k=1}^{l_0}{} E \left( S_{k,t}\cdot \left( 1-{\mathbb {I}}_{k,t}^L\right) \big |{\mathcal {F}}_{t+1}\right) \eta _{t+1}\).

The expected value of the \(CDR_{t+1}^{Idios}\) is equal to zero:

Previous result is due to the tower property. Therefore, from an actuarial point of view, if the company does not review its demographic expectations at the end of the period, the best estimate of the incoming reserves added to the annual premiums allow, on average, to meet the claims for the year and to set up new best estimates. It is also noteworthy that the use of prudential first-order bases in the pricing phase implies a negative best estimate to be obtained at the time of subscription, i.e. at the issue, the expected present value of the benefits is strictly lower than the expected present value of the premiums under second order bases.

For the cumulants of order greater than one, we focus on the moments generating function (mgf) of the r.v. sum insured of occurred death \(Z_{k,t+1}^B\) of the generic k-th policyholder.Footnote 9 We define the mgf as follows:

where \(q_{x+t}=E ^P \left[ {\mathbb {I}}_{k,t}^L\Big |{\mathcal {F}}_t\right] \) is the best estimate of the annual death probability for age \(x+t\) at time t.

The mgf of the sums insured of occurred deaths of the whole cohort is

Therefore, the cumulant generating function is defined as:

Variance and skewness of \(CDR_{t+1}^{Idios}\) are then obtained as follows (for detailed proof see Clemente et al. 2022):

and

where \(\bar{{{\textbf {S}}}}_{j,t}\) is the j-raw moment of the sums insured at time t.

In terms of variance, we observe its dependency on the age of the policyholders (and therefore on the realistic probability of death, denoted as \(q_{x+t}\)), as well as on the variability of the sums insured and the sum-at-risk rate \(\eta _{t+1}\). Regarding skewness, the sign of the index is opposite to that of the sum-at-risk. For contracts with a positive sum-at-risk (such as endowments and term insurances), we observe negative skewness unless extreme ages with \(q_{x+t}>50\%\). Conversely, the opposite situation is observed for pure endowments and annuities. In conclusion, adopting a cohort approach framework, which is commonly used in the literature as a model point for quantifying demographic risk, we have showed that the distribution of \(CDR_{t+1}^{Idios}\) is asymmetric and exhibits a volatility dependent on both the cohort’s characteristics (sums insured and age) and the type of contract.

The impact of diversification is also evident, influenced by the size of the portfolio as indicated by the number of policyholders \(l_{t}\) in formulas (25) and (26). Specifically, for larger portfolios, we observe a less-than-proportional increase in the standard deviation and a more symmetric distribution. Consequently, in such scenarios, we have that the capital requirement will escalate in a non-proportional manner with the expansion of the portfolio.

3.3 Solvency capital requirement framework

Solvency II Directive requires insurance companies to hold a Solvency Capital Requirement, calculated on an annual time horizon, using the Value-at-Risk risk measure, with a \(99.5\%\) confidence level.

The calculation of the SCR can be performed through either the use of an Internal Model or a Standard Formula. For a subset of risks, an approach based on the calibraton of specific parameters of the company (USP) is also allowed. Although this possibility has been under evaluation for the longevity and mortality risk sub-modules, at moment only a market-wide approach is allowed. In particular, the SCR for mortality and longevity risk is calculated as the reduction of the Basic Own Funds under the scenario of an increase in mortality rates by \(15\%\) and a decrease in mortality rates by \(20\%\), respectively, namely a stress on Best Estimate of liabilities.

Therefore, within the Standard Formula, the idiosyncratic-demographic risk is therefore not explicitly quantified, but is calculated within the Life Underwriting Risk with the methodologies described above. However, in several phases, the Solvency II process focused on the separate assessment of idiosyncratic and trend risk. For instance, an interesting aspect concerns one of the Solvency II preparatory studies conducted in 2006 by CEIOPS, the so-called Quantitative Impact Study number 2 (QIS2) (see Committee of European Insurance and Occupational Pensions Supervisors 2006).

In this context, the capital requirement for mortality risk was calculated as a function of idiosyncratic risk, defined as:

whereas for longevity risk (e.g., as in pure endowments),

where “Potential Release” indicated the amount of the technical reserves relevant to subjects exposed to longevity risk. In both cases, q represented the average mortality rate of the selected Homogeneous Risk Group. Focusing on QIS2 proposal, it could be noticed that the approach provided neglects both the skewness of the distribution and the variability of the sum insured. In particular, both formulas (27) and (28) are based on a multiplier equal to 2.58 that entails the assumption of normal distribution. Additionally, with respect to the variance given by formula (25), the volatility of the sums insured is not considered at all.

Starting from this proposal and previous studies (see Savelli 1993; Savelli and Clemente 2013), our aim is to provide a method that could represent a suitable USP approach for assessing capital requirement for longevity and mortality risk and that, at the same time, allows to overcome the pitfalls of the QIS2 approach.

We define the generic risk measure (see Artzner et al. 1999) as a function \(\varsigma \)

Our goal now is to propose an undertaking approach for the Solvency Capital Requirement of mortality and longevity idiosyncratic risk under cohort assumption and using a VaR risk measure. Notice that we follow the VaR approach in order to be consistent with Solvency II standard formula but the results can be extended also for alternative risk measures such as TVaR.

4 A proposal of USP approaches for idiosyncratic mortality and longevity risks

In this section, we present a proposal for USP approaches that could be employed to assess the capital requirement for mortality and longevity risk. In the case of longevity, we handle annuity contracts during the benefits payment period separately.

4.1 USP approach for idiosyncratic mortality risk

We consider here contracts with a positive sum-at-risk (as Term Insurance and Endowment) and we focus on a USP approach for idiosyncratic mortality risk. To this end, we define the random variable \(Y_{t+1}\) as a linear transformation of \(CDR_{t+1}^{Idios}\):

where \(d=max(CDR_{t+1}^{Idios})\). Since in a contract that pays in case of death, we obtain the maximum CDR when all policyholders survive at the end of the year (best case scenario), we can define:

where:

Hence, formula (30) can be rewritten as:

Since \(CDR_{t+1}^{Idios}\) has a negative skewness, through formula (33) we are focusing on the r.v. \(Y_{t+1}\) that represents next-year liabilities and has a positive skewness and non-negative values.

We assume

and we define the SCR with the USP approach for mortality as follows:

where the risk measure \(\varsigma \) is the Value-at-Risk with a confidence level of \(99.5\%\) on a 1 year time horizon basis, in line with the requirements of Solvency II.

Considering the well-known relation between Normal and LogNormal,

where \(N_{99.5\%}\) is the \(99.5\%\) percentile of a Standard Normal random variable.

We consider the usual relations related to the LogNormal parameters

and

where \(CV_{Y_{t+1}}\) is the volatility coefficient of \(Y_{t+1}\) defined as the ratio between standard deviation and expected value.

We also highlight that \(E \left[ Y_{t+1}\right] =d\) and \(\sigma _{Y_{t+1}}=\sigma _{CDR_{t+1}^{Idios}}\).

Exploiting formulas (37) and (38), formula (36) may be rewritten as:

from which, using the well known properties of exponentials

and considering the linearity of the expected value,

from formula (21), we finally obtain the proxy for mortality risk capital requirement:

where \(CV_{Y_{t+1}}\) is calculated as

4.2 Idiosyncratic longevity risk

4.2.1 Pure endowment and annuity during the deferral period

We focus now on contracts with a negative sum-at-risk (as pure endowment and annuities in the deferral period).

We recall that due to a negative sum at risk rate, the distribution of \(CDR_{t+1}^{Idios}\) in the Pure Endowment case, has a positive skewness. We define the r.v. \(W_{t+1}\) as

where \(g=min\left\{ CDR_{t+1}^{Idios}\right\} \) defined as

since the minimum CDR for these contracts is observed in case all policyholders survive (worst case scenario). It is worth noting that while formula (45) is equivalent to formula (31), it yields a negative value for pure endowments. We have indeed that the survival of the entire cohort represents an unfavourable scenario for the company, leading to a demographic loss.

We have that \(E \left[ W_{t+1}\right] =-g\) and \(\sigma _{W_{t+1}}=\sigma _{CDR_{t+1}^{Idios}}\).

Therefore, formula (44) can be rewritten as:

We are focusing on the r.v. \(W_{t+1}\) that represents next-year liabilities and has a positive skewness and non-negative values and, as before, we assume

and we define the SCR with the USP approach for longevity as follows:

Therefore,

Exploting the relationships presented in formulas (37) and (38), we obtain

With simple algebra,

considering that \(E \left[ W_{t+1}\right] =-g\),

where

4.2.2 Annuity during the payment phase

The scenario of the annuity during the benefit payment phase will be addressed separately. The necessity to treat this case independently arises from the fact that certain quantities undergo slight changes.

Given that in an annuity, the payout of the insured amount occurs only if the policyholder is alive on the policy anniversary, formula (9) is adjusted as follows:

Specifically, it is important to note that the component pertaining to the expected present value of the premiums is entirely disregarded, as it exclusively regards the accumulation phase. On the other hand, the random variable \({\mathbb {I}}_{k,\tau }^B\), which is associated with the eligibility of the insured to receive the benefit, equals one in the case of survival. Consequently, we denote it as \({\mathbb {I}}_{k,\tau }^L.\)

Exploiting formula (16), with simple algebra it is possible to prove

with

Also in this context we are dealing with a distribution with positive skewness; therefore we define the Claims Development Result as per formula (44) with \(g=V_{t+1}-S_t-{\dot{R}}_{t+1}\).

In conclusion, the SCR proxy can be calculated similarly to the pure endowment case as

where

5 Numerical results

In this Section, the purpose is to present the results of the model presented, highlighting how the formulas proposed to quantify the Solvency Capital Requirement are a good proxy of the results obtained from the Partial Internal Model based on the simulated distribution of the demographic profit and loss.

To this end, we summarize in Table 1 the main characteristics of the cohort. In particular, we consider a cohort of 15,000 policyholders aged 40 years at the inception, with an average sum insured of 100,000 euros and a coefficient of variation of the sums insured equal to 2.

Furthermore, it should be noted that, from the perspective of the insurance company, the policy yields a positive expected profit. This is due to the application of prudential technical bases during the pricing phase. Specifically, the demographic base used involves a 20% variation in the mortality rates respect to the second order basis (a decrease in the case of Pure Endowment and an increase in the case of both Endowment and Term Insurance). Additionally, the technical rate is set at 1%, representing the lowest value among all risk-free rates on the EIOPA curve.

In conclusion, we would like to specify that in this section, we will focus on Endowment and Pure Endowment policies. Regarding the latter, our decision is influenced by the fact that, within an annual time frame, it comprehensively encapsulates any annuity due to the principle of contract composition. The preference for Endowment over Term Insurance is simply to streamline this paper, as both are positive Sum-at-Risk policies and the interpretative results are nearly identical.

5.1 Pure endowment results

The Pure Endowment is a policy that assures the policyholder of receiving the sum insured if he/she survives until maturity. Its significance lies in the principle of contract composition, where an annuity is composed of a series of Pure Endowments sharing the same technical bases but with varying maturities.

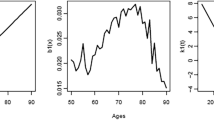

Figure 1 displays the simulated distribution of \(CDR_{10}^{Idios}\) obtained through 5 million simulations, while Table 2 presents the corresponding numerical results.Footnote 10

The first noteworthy aspect is that such a large number of simulations enables us to obtain estimates of the \(CDR_{10}^{Idios}\) distribution characteristics that are nearly robust and precise, notwithstanding the well-known weak convergence of skewness and kurtosis. The theoretical expected value is 0, as indicated by formula (12), demonstrating that, on average, the sum of best estimates and premiums capitalized at the risk-free rate \(i_t\left( t,t+1\right) \) (i.e., \(V_{t+1}\)) allows the insurer to cover both the claims of the year and the creation of new best estimate liabilities calculated with the same technical bases. Regarding the standard deviation, the primary factors are the mortality rate (depending on the youth of the cohortFootnote 11), the volatility of the sums insured, and the Sum-at-Risk rate \(\eta _{10}\), strongly depending from both policy type and cohort’s seniority. In particular, the absolute value of the SaR rate is 0.36, underscoring that the policy’s maturity is still far in the future. As the SaR rate, calculated as the opposite of the best estimate rate in the case of a pure endowment, is negative, then distribution skewness of \(CDR_{10}^{Idios}\) is positive.

We provide also a comparison with the QIS2 capital requirement (\(SCR^{Id,QIS2}\) in Table 2). In this context, the relevance of formula (28) proposed within the QIS2, highlighted a risk-theory approach notwithstanding certain limitations. Indeed, the percentile of order \(0.5\%\) of the distribution implies a standard deviation multiplier significantly lower than 2.58, which is suitable only in case of a nearly normal distribution. On the other hand, the QIS2 formula underestimates the capital obtained by Partal Internal Model and USP approaches because the volatility of sums insured is neglected.

Figure 2 compares the simulated distribution of \(W_{10}\) with a LogNormal distribution whose \(\mu \) and \(\sigma \) parameters are calibrated using formulas (37) and (38).

Furthermore, apart from the excellent fit of the LogNormal distribution, we would like to emphasize that the Solvency Capital Requirement (SCR) simulated through the Monte Carlo approach closely resembles \(SCR^{USP,l}\). Of particular interest is that, by employing formula (52), we obtain a capital requirement very close to the simulated value, aligning with a standard deviation multiplier of 1.48, notably below 2.58. In conclusion, we specify that \(SCR^{USP,l}\) provides a capital requirement that is lower of roughly 2% with respect to the partial internal model mainly due to slight differences in skewness and kurtosis.Footnote 12 This report highlights that the LogNormal is an excellent approximation of the \(W_{10}\) distribution, with a negligible underestimation error on the tails.

5.2 Endowment results

The Endowment policy, as it ensures the policyholder/beneficiary the sum insured in the event of both death and survival, is the most prevalent policy on the market for savings purposes.

Also in this context we run 5 millions simulations and we observe simulated results very close to the theoretical ones. Results are displayed in Table 3.

The slightly negative simulated expected value (instead of 0) is due to negligible convergence errors in simulations. According to formula (25), the primary factor affecting the standard deviation is the SaR rate. For the Endowment policy, this rate is 0.63, being the best estimate rate roughly 0.37. The SaR rate is almost twice the absolute value obtained for the Pure Endowment (being the best estimate rate equal to 0.35). This substantial difference explains the almost twofold increase in standard deviation.

An intriguing aspect associated with the potential payout of sums insured in the event of death is that, given the positive Sum-at-Risk rate (as shown in formula (19)), the skewness of \(CDR_{10}^{Idios}\) is negative. Consequently, in this scenario, the quest for the quantile at the 0.5% level shifts towards the heavy tail (refer to Fig. 3). Using the well-known relationship of the skewness for LogNormal distribution, it becomes evident that the skewness associated with the LogNormal employed to depict \(Y_{10}\) is 1.66, that is lower than the skewness is the simulated distribution (see Fig. 4 for a comparison between the LogNormal and the simulated distribution). Therefore, we observe a lower capital requirement of roughly 2.1% in case of the USP approach.

To complete the analysis, we present in Table 4 the results considering a Term Insurance contract. These results were obtained under the assumption, for simplicity, of pricing the contract and considering a cohort with the same characteristics as those used for the Endowment (as shown in Table 1). Notably, there is greater variability and, consequently, a higher SCR compared to the Endowment. This outcome is attributed to the high SaR and, consequently, a significant mortality risk associated with this contract. Furthermore, it is observed that, even in this case, the proposed USP offers a highly accurate approximation of the simulated results.

Focusing on mortality risk, we observe that the capital requirement calculated using the QIS2 formula (refer to formula (27)) underestimates both the USP and Partial Internal Model approaches. This underestimation arises from neglecting the variability of sums insured and the negative skewness associated with profit/loss distributions. Regarding the latter, we note that \(SCR^{Id,QIS2}\) provides a greater underestimation when mortality risk is evaluated. Specifically, in cases of longevity risk, the profit and loss distribution is positively skewed, with percentiles positioned in the non-fat tail.

Finally, to conclude our analysis, Fig. 5 illustrates the results of the comparison between \(SCR^{USP}\) and the simulated SCR for different values of sum insured variability across Endowment, Term, and Pure Endowment cohorts. It is evident that the proposed USP approach consistently provides highly reliable estimates for the value of sums insured coefficient of variation (CV) within a range around 2. Specifically, for Endowment and Term Insurance, a CV range between 1.25 and 2.75 results in an under/overestimation not exceeding 5%, with substantial overlap between Term and Endowment cases. For Pure Endowments, the CV range extends to 1.75–3.00 due to the fact that the SCR depends on the short tail of the \(CDR_{10}^{Idios}\) distribution, which exhibits positive skewness.

Furthermore, in the case of Endowment and Term, the ratio shows values that are hardly acceptable when sum insured CV exceeds 3. This is attributed to the right long tail of the transformed random variable \(Y_{10}\), and thus on the left long tail of the random variable \(CDR_{10}^{Idios}\). Consequently, despite LogNormal’s tendency to underestimate skewness as sums insured CV increases, the LogNormal itself has an infinite tail, while the Internal Model simulated results practically have a natural maximum limit, given by the worst-case scenario of all policyholders dying at year-end. This distribution behaviour leads to unreliable values when using the USP approach in these specific cases.

It is worth noting that this phenomenon does not occur, at least not to the same extent, for Pure Endowment contracts when sums insured CV exceeds 3. This is because we now have the opposite skewness compared to Endowment cases, hardly mitigating this undesirable effect on the USP proxy.

This figure shows the ratios between capital requirements and best estimates, using both the proposed approach (\(SCR^{USP}\)) and the partial internal model. The x-axis shows various portfolio sizes (\(l_{0}\)), offering insights into the ratio patterns for endowment contracts with a CV of sums insured equal to 2

In conclusion, in Fig. 6, we illustrate the trend of the ratio \(SCR^{USP,m}\) on Best Estimate Liabilities for the Endowment, varying with the initial cohort size. In particular, we observe that as \(l_0\) increases, both \(SCR^{USP,m}\) and BEL grow, but the latter increases more rapidly than the capital requirement. As the portfolio size (\(l_0\)) tends towards infinity, the coefficient of variation (\(CV_{Y_t}\)) approaches zero. Consequently, the growth of \(SCR^{USP,m}\) is less than proportional, underscoring the diversification of idiosyncratic risk, which proves to be diversifiable. For this reason, if an insurance company were able to insure a very large number of policyholders from the same cohort, the ratio of capital requirement to BEL would be positive, but very close to zero, as the only effective source of risk for the insurance company would be that linked to systemic variations in mortality, such as pandemics or sudden improvements in longevity (i.e. trend risk, here neglected). Moreover, it is worth noting that the USP approach yields promising results across a range of portfolio dimensions, serving as a reliable proxy of the Partial Internal Model.

6 Conclusions

In conclusion, this paper presents a methodology for assessing idiosyncratic demographic risk arising from mortality and longevity within the framework of Solvency II. The proposed closed formula, rooted in a cohort approach, effectively captures either volatility and tail of profit and losses distributions associated with policyholder deaths or survivals, accounting for portfolio size, sums insured variability, duration and type of insurance contract (with the latter two influencing the relevant role of SaR rate). Moreover, recalling that Solvency II standard formula is calibrated on a 99.5% VaR approach, the ability to capture not only volatility but also the tail (both short and long) of the profit and loss distribution assumes a quite relevant role in identifying the capital requirement. Our approach offers a viable alternative within the Solvency II context providing a suitable USP approach for diversifiable risk, addressing limitations of prior proposals. Obviously, this approach requires specific statistical tests regarding the distributional hypotheses.

Through a case study, we have showed that our methodology aligns consistently with the regulatory framework, providing a reliable estimate of the capital requirement estimated by a partial internal model based on a simulated approach. This holds especially true for practical and frequent cases with limited sums insured volatility. Additionally, this approach mainly provides a slight overestimation of the requirement. However, this overestimation is not necessarily undesirable for supervisory authorities aiming to maintain conservative SCRs. In our aim this research may contribute to the ongoing discussion on the evaluation of specific risks under Solvency II, potentially enhancing future regulatory considerations and insurance industry practices. Further analyses could be conducted to assess the robustness of our USP approach across various combinations of durations, distributions of sums insured, and types of premium payments. Additionally, while our results have been derived at the cohort level, exploring the impact of aggregation between cohorts as well as across different insurance contracts, warrants deeper investigation. Particularly relevant is the consideration of natural hedging between contracts, where the inherent diversification benefits of a portfolio can mitigate risk exposure. By leveraging our proposed approach, there is an opportunity to develop effective natural hedging strategies for constructing life insurance portfolios aimed at minimizing demographic risk. This involves identifying complementary risk profiles across various insurance contracts within the portfolio, allowing for the offsetting of adverse demographic trends in one segment with favourable trends in another. The investigation of such strategies could enhance the stability of the portfolio but also contribute to optimize the overall risk-return profiles.

Further researches in this field might be also to appropriately model the trend risk and to compare the total demographic risk estimated in such a way with the Solvency II Standard Formula for mortality and longevity.

Notes

Random variables are indicated with capital letters, while deterministic values are indicated with small letters.

It is noteworthy that the conditionally independence assumption can be violated when relatives are considered in the same cohort (see Luciano et al. 2016)

Obviously, in the case of policies with benefits paid in the event of death, reference is made to the beneficiary.

For instance, considering a Term Insurance, we have \({\mathbb {I}}_{k,\tau }^B=1-{\mathbb {I}}_{k,\tau }^L\). Hence, \({\mathbb {I}}_{k,\tau }^B\) is a r.v. whose parameter is the annual, real death probability of the policyholder. Instead, for a Pure Endowment, \({\mathbb {I}}_{k,\tau }^B={\mathbb {I}}_{k,\tau }^L\) with parameter equal to annual, real survival probability of the policyholder.

Notice that we are neglecting expenses and formula (5) is valid for both annual and single premiums. In the latter case we have \(p_t=0\) for \(t>0\)

Indeed, acquisition expenses are anticipated by the insurer and thus only slightly reduce the best estimate, while future management expenses are often at a great level, but are largely offset by future loadings for management expenses (embedded in the gross premiums). Although this simplification might be less negligible in the case of single premium, it does not significantly affect our results.

An extended model considering a rate of return on premiums and reserves would incorporate an additional component in the model, equal to \((R_t+x_t^{in})\cdot (i_t(t,t+1)-j_t)\) with \(j_t\) stochastic return gained in year t.

It is noteworthy that, in case of an annuity evaluated in the payment period, the sum-at-risk rate defined in formula (20) can be easily obtained considering also the unitary amount paid in case of survival.

Notice that \(Z_{k,t+1}^B=\left( 1-{\mathbb {I}}_{k,t}^L\right) \cdot S_{k,t}\) for policies with a positive SaR rate and \(Z_{k,t+1}^B=0\) otherwise. For instance, considering a term insurance \(X_{k, t}^{out}=Z_{k,t}^B\), considering a pure endowment \(X_{k, t}^{out}=0\) when \(t<n\), \(X_{k, t}^{out}={\mathbb {I}}_{k,t-1}^L\cdot S_{k,t-1}\) otherwise.

BEL stands for Best Estimate Liabilities.

The term \(q_{49}\) is approximately \(0.13\%\).

Skewness is equal to 1.66 and 2.49 in case of, respectively, LogNormal and simulated distributions; in addition the kurtosis index is equal to 5.27 and 18.45 in case of LogNormal and simulated distributions.

References

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Math. Financ. 9(3), 203–228 (1999)

Bauer, D., Börger, M., Ruß, J., Zwiesler, H.-J.: The volatility of mortality. Asia-Pac. J. Risk Insur. 3(1) (2008)

Bauer, D., Ha, H.: A least-squares Monte Carlo approach to the calculation of capital requirements, 2–6 (2015)

Bauer, D., Börger, M., Ruß, J.: On the pricing of longevity-linked securities. Insur.: Math. Econ. 46(1), 139–149 (2010)

Bauer, D., Bergmann, D., Reuss, A.: On the calculation of the solvency capital requirement based on nested simulations. ASTIN Bull. 42(2), 453–499 (2010)

Börger, M.: Deterministic shock vs. stochastic value-at-risk-an analysis of the Solvency II standard model approach to longevity risk. Blätter der DGVFM 31(2), 225–259 (2010)

Börger, M., Fleischer, D., Kuksin, N.: Modeling the mortality trend under modern solvency regimes. ASTIN Bull.: The J. IAA 44(1), 1–38 (2014)

Cerchiara, R.R., Demarco, V.: Undertaking specific parameters under solvency II: reduction of capital requirement or not? Eur. Actuar. J. 6, 351–376 (2016)

Clemente, G.P., Della Corte, F., Savelli, N.: A bridge between Local GAAP and Solvency II frameworks to quantify Capital Requirement for demographic risk. Risks 9(10), 175 (2021)

Clemente, G.P., Della Corte, F., Savelli, N.: A stochastic model for capital requirement assessment for mortality and longevity risk, focusing on idiosyncratic and trend components. Ann. Actuar. Sci. 16(3), 527–546 (2022)

Committee of European Insurance and Occupational Pensions Supervisors: Quantitative impact study 2 - technical specification (2006)

Costabile, M., Viviano, F.: Testing the Least-Squares Monte Carlo Method for the Evaluation of Capital Requirements in Life Insurance. Risks 8(2), 48 (2020)

Dahl, M.: Stochastic mortality in life insurance: market reserves and mortality-linked insurance contracts. Insur.: Math. Econ. 35(1), 113–136 (2004)

EIOPA: Consultation Paper on EIOPA’s first set of advice to the European Commission on specific items in the Solvency II Delegated Regulation (2017)

EIOPA: Consultation Paper on EIOPA’s second set of advice to the European Commission on specific items in the Solvency II Delegated Regulation (2017)

EIOPA: Discussion Paper on the review of specific items in the Solvency II Delegated Regulation (2016)

European Parliament and Council: Commission Delegated Regulation (EU) 2015/35 (2014)

European Parliament and Council: Directive 2009/138/EC (2021)

Floryszczak, A., Le Courtois, O., Majri, M.: Inside the Solvency 2 Black Box: Net Asset Values and Solvency Capital Requirements with a least-squares Monte-Carlo approach. Insur.: Math. Econ. 71, 15–26 (2016)

Gylys, R., Šiaulys, J.: Revisiting Calibration of the Solvency II Standard Formula for Mortality Risk: Does the Standard Stress Scenario Provide an Adequate Approximation of Value-at-Risk? Risks 7(2), 58 (2019)

Hanbali, H., Denuit, M., Dhaene, J., Trufin, J.: A dynamic equivalence principle for systematic longevity risk management. Insur.: Math. Econ. 86, 158–167 (2019)

Hari, N., De Waegenaere, A., Melenberg, B., Nijman, T.E.: Longevity risk in portfolios of pension annuities. Insur.: Math. Econ. 42(2), 505–519 (2008)

Jarner, S.F., Møller, T.: A partial internal model for longevity risk. Scand. Actuar. J. 2015(4), 352–382 (2015)

Luciano, E., Spreeuw, J., Vigna, E.: Spouses’ dependence across generations and pricing impact on reversionary annuities. Risks 4(2), 16 (2016)

Milevsky, M.A., Promislow, S.D., Young, V.R.: Killing the law of large numbers: Mortality risk premiums and the sharpe ratio. J. Risk Insur. 73(4), 673–686 (2006)

Ngugnie Diffouo, P.M., Devolder, P.: Longevity risk measurement of life annuity products. Risks 8(1), 31 (2020)

Olivieri, A., Pitacco, E.: Assessing the cost of capital for longevity risk. Insur.: Math. Econ. 42(3), 1013–1021 (2008)

Olivieri, A., Pitacco, E.: Introduction to insurance mathematics: technical and financial features of risk transfers, pp. 1–475. Springer, Berlin (2015)

Plat, R.: One-year value-at-risk for longevity and mortality. Insur.: Math. Econ. 49(3), 462–470 (2011)

Richards, S.J., Currie, I.D., Ritchie, G.P.: A value-at-risk framework for longevity trend risk. Br. Actuar. J. 19(1), 116–139 (2014)

Savelli, N.: Un modello di teoria del rischio per la valutazione della solvibilità di una Compagnia di assicurazioni sulla vita (1993)

Savelli, N., Clemente, G.P.: A Risk-Theory Model to Assess the Capital Requirement for Mortality and Longevity Risk. J. Interdiscip. Math. 16(6), 397–429 (2013)

Stevens, R., De Waegenaere, A., Melenberg, B.: Calculating capital requirements for longevity risk in life insurance products: Using an internal model in line with Solvency II (2010)

Wüthrich, M.V., Merz, M.: Financial modeling, actuarial valuation and solvency in insurance. Springer, Technical report (2013)

Wüthrich, M.V., Bühlmann, H., Furrer, H., et al.: Market-consistent actuarial valuation. Springer, Berlin (2010)

Acknowledgements

The authors deeply thank the anonymous referees whose precise and insightful comments have allowed us to enhance the work. The Authors acknowledge funding by the European Union - Next Generation EU. Project PRIN 2022 “Building resilience to emerging risks in financial and insurance markets”. Project code: 2022FWZ2CR - CUP J53D23004560008. The views and opinions expressed are only those of the authors and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the European Commission can be held responsible for them.

Funding

Open access funding provided by Università Cattolica del Sacro Cuore within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors have no conflict of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Clemente, G.P., Corte, F.D. & Savelli, N. An undertaking specific approach to address diversifiable demographic risk within Solvency II framework. Decisions Econ Finan (2024). https://doi.org/10.1007/s10203-024-00457-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10203-024-00457-x