Abstract

Risk aversion has an unambiguous meaning in the univariate context: But, what does it mean to be risk averse in the multivariate case? Concave Risk Aversion (CRA) and Multivariate Risk Aversion (MRA) are relevant extensions of the risk aversion concept used in the univariate case to the multivariate case, corresponding to concave and ultramodular utility classes, respectively. Although CRA and MRA can coexist, they are dramatically different in some ways, leading to opposite preferences under some circumstances, as in the face of irreversible risks. We introduce the notions of purely concave and purely multivariate risk aversion, related to disjoint utility classes. We apply the purely risk aversion notions to the field of sustainability, where catastrophic and irreversible outcomes can be faced, in order to highlight and compare the consequences of the two approaches on sustainability policies. In this respect, we provide three main results. First, the kind of risk aversion determines the pursued goal. Second, the principle of “rejecting any fair bet” is not always preserved. Third, sustainability policies induced by different risk aversions, if repeated, produce final states in which mean-variance criterion holds.

Similar content being viewed by others

1 Introduction

The construction of a representative multiattribute utility function is a fundamental step in decision making under uncertainty when the selection is among uncertain prospects with multiple attributes.

The analytic properties usually required for the multiattribute utility function u are due to the non-satiation property and risk aversion. The non-satiation property states that more is preferred to less (Ingersoll 1987) and implies the strict monotonicity of u. While the non-satiation property has the same meaning in both univariate and multivariate contexts, there is not a unique definition of risk aversion in the multivariate context. A first extension of risk aversion from the univariate case to the multivariate case is that of Russell and Seo (1978, p. 607): “A risk averse agent is one who rejects every fair bet. In the multivariate case, as in the univariate, this condition is met if and only if the utility function is concave” . In this case, we have Concave Risk Aversion (for brevity, embodied in the CRA acronym) and we use the term to refer to both the utility function and DMs with this attitude towards risk.

Almost contemporaneously, Richard (1975) introduced a “new type of risk aversion unique to multivariate utility functions and called multivariate risk aversion ... in that the decision maker prefers getting some of the ‘best’ and some of the ‘worst’ to taking a chance on all of the ‘best’ or all the ‘worst”’. It corresponds to correlation aversion (Eeckhoudt et al. 2007; Lichtendahl and Bodely 2010; Epstain and Tanny 1980). Richard (1975) remarks that the concavity of u does not imply multivariate risk aversion and shows that, provided that \(u\in {\mathcal {C}}^{2}\), a necessary and sufficient condition for this kind of risk aversion is that the second-order mixed partial derivatives are all non-positive. This sign condition is equivalent to the submodularity of the utility function, as shown in Ortega and Escudero (2010). Tsetlin and Winkler (2009) define the preference for combining good with bad, which is a stronger condition than that introduced in Richard (1975), requiring that all second-order partial derivatives be non-positive. In this case, we have Multivariate Risk Aversion (for brevity, embodied in the MRA acronym) and, as before, we use the term to denote both the utility function and DMs. Although CRA and MRA are both notions of risk aversion, they result in dramatically different behaviours in some circumstances. One of the most relevant case is when irreversible risks are faced: for this, we study CRA and MRA in the field of sustainability where this kind of risks is widespread.

Sustainability is concerned with whether the current patterns of economic activity can be continued over long periods without catastrophic consequences for the environment and living beings. Sustainable development is referred to as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (Brundtland Report, 1987). As a consequence, sustainability needs to adopt policies to face “new” risks, such as global warming, species extintion, desertification, and lethal viral diseases. Most of them “are poorly understood, endogenous, collective and irreversible” (Chichilnisky and Heal 1998a).

Managing these risks requires to recognize the central role of uncertainty.

In the following, we always refer to risky situations involving catastrophic outcomes and in which the probabilities of relevant events are assessed.

Chichilnisky and Heal (1998a) distinguish different levels of uncertainty and possible sustainability actions. There are two levels of uncertainty. The first level is collective and generally concerns the incidence of the critical event in the population as a whole. The second level is individual and concerns whether an individual is harmed or not by the event (conditional upon its occurrence).

Chichilnisky and Heal (1998b) propose models to find financial solutions to mitigate the effects of both collective and individual risk, finding efficient allocations where the economy is described by statistical states instead of social states. A social state is a complete description of the state of the economy, that is, a list of the states of all the agents, while a statistical state lists the fractions of the population in each state. Given n states, any statistical state can be summarized in a non-negative vector \( x\in \left[ 0,1\right] ^{n}\) such that \(\sum _{i=1}^{n}x_{i}=1\).

Since irreversibility is the main reason for the distinctiveness of uncertainty in sustainability, there is a good reason to recommend caution, as validate by the Precautionary Principle,Footnote 1 that is a foundational principle to sustainability policies. The Precautionary Principle issues a word of caution, aiming to anticipate (or minimize) serious or irreversible risks for the environment under conditions of uncertanty. In this sense, it seems to advise high levels of risk aversion.

The aim of this paper is to study the diversity of the notions of CRA and MRA, which, in our opinion, are not fully addressed in the literature. Furthermore, we investigate the impacts on the preferences of the DM generated by this diversity.

Since CRA and MRA can coexist, we need to isolate the “pure” effect of each of them on the preferences of the DM. We thus define as purely CRA (p-CRA) and purely MRA (p-MRA) a CRA (but not MRA) DM and an MRA (but not CRA) DM, respectively. We use these terms to refer to the utility functions as well. We study the effects of p-CRA and p-MRA on the choice of sustainability policies in the face of catastrophic outcomes. We focus on the collective level of uncertainty, when a DM faces the problem of reducing the incidence of a harmful event and the economy is described by statistical states.

We show that, in the multivariate case, the choice of sustainability policies leading to prefixed results is related to the type of the DM’s risk aversion. A direct connection between the type of risk aversion and the goal is investigated. When the avoidance of irreversibly harmful events is the main concern driving the choice of sustainability policies, the aim is to minimize the occurrence of irreversible events. We show how this follows from p-MRA but not from p-CRA. On the contrary, a p-CRA DM can choose policies with a higher probability of irreversible events.

We test the principle of “rejecting any fair bet” for both p-MRA and p-CRA DMs. We compare sustainability policies that provide a sure outcome with ones leading to risky outcomes and an expected value equal to that of the certain outcome, ensuring that they both involve the same fraction of the population harmed by the irreversible event. We show how a p-MRA DM can exhibit risk-seeking behavior: For example, the DM can prefer a stochastic sustainability policy P to a deterministic policy Q, where P produces a result with an expected value equal to that of the result produced by Q. This does not happen in the case of a p-CRA DM, who always prefers Q to P, by definition.

Finally, we determine the state of the economy when the patterns of sustainability policies induced by p-MRA and p-CRA are repeated numerous times. We call this the final state and show how p-MRA induces a better final state than p-CRA does, according to mean-variance criterion (Ingersoll 1987).

The paper is organized as follows. Section 2 recalls the basic notions of multivariate risk aversion in the literature and introduces the definitions of p-MRA and p-CRA, with the related classes of utility functions. Section 3 presents our main results in the case of twice-differentiable utility functions, accompanied by an example that illustrates the impact of p-MRA and p-CRA on the choice of sustainability policies. We show that a p-MRA DM may be risk seeking in some of the choices whereas a p-CRA DM would never be. The case of quadratic utility functions, where the results are stronger, is also presented. Section 4 highlights the connection between the type of the risk aversion of the DM and the goal that he pursues. Section 5 studies the final state derived by the repetition for n times of the policy induced by p-CRA or, alternatively, by p-MRA. Section 6 draws some conclusions. All the proofs are relegated to the Appendix.

2 Risk attitude in the multivariate case

In the multivariate as in the univariate case, several stochastic orderings are defined by means of a class of utility functions. A wide literature deals with this topic and stochastic orderings among vectors have a huge field of applications in probability and statistics (Denuit et al. 2013; Denuit and Mesfioui 2010). Two are the main consequences of this literature: On one hand, a different concept of risk aversion is derived and, on the other hand, an extension of the rules of first and second stochastic dominance for multivariate utility functions is investigated. In this work, we confine our attention to two classes of utility functions and to the corresponding stochastic orderings: concave utility functions related with multivariate second-order stochastic dominance, as shown in Russell and Seo (1978), and neg-ultramodular utility functions connected with second-degree concave stochastic dominance (Beccacece and Borgonovo 2011; Denuit et al. 2013; Marinacci and Montrucchio 2005). We stay within the expected utility framework. Alternatives to expected utility, developed in the last decades provide a richer definition of risk aversion in the univariate case (for a review see Starmer (2000)). The extension of these concepts to the multivariate case, surely of interest, is beyond the scope of our work.

We first introduce some notation. For two n-dimensional (row) vectors x, y we write \(x\geqq y\) to indicate that \(x_{i}\geqq y_{i}\) for all i and we write \(x\ge y\) when \(x_{i}\geqq y_{i}\) for all i but \(x\ne y \). Random variables and random vectors are denote by capital letters. Let X and Y be two n-dimensional random vectors whose ranges are contained in the n-dimensional simplex \(\Delta _{n}\), that is the set of n-vectors with non-negative values that add up no more than 1.

The vector Y is said to be smaller than X in the \(\succsim _{\star }\) ordering associated with the class \(U_{\star }\) of real-valued functions defined on \(\Delta _{n}\) when

Let \(U_{C}\) denote the class of all the utility functions that are increasing and concave on \(\Delta _{n}\). If (1) holds with \(U_{\star }=U_{C}\), then we say that Y is dominated by X in the concave multivariate ordering \(\succsim _{C}\). An agent with utility function \(u\in U_{C}\) is CRA, that is, the agent assesses that the certainty equivalent of any X is smaller than \({\textrm{E}}[X]\). Thus, the decision rule leads to preferring a sure outcome to any lottery that offers an equal expected value. Russell and Seo (1978) prove that the concave multivariate ordering \(\succsim _{C}\) is equivalent to a generalized second-order stochastic dominance.

The m-degree concave stochastic dominance is defined by means of a subset of utility functions \(u\in {\mathcal {C}}\) \(^{m}\) (Denuit et al. 2013). Let \(U_{m}\) denote the class of utility functions having all partial derivatives of a given order up to order m with the same sign and this sign is positive for odd orders and negative for even orders. If (1) holds with \(U_{\star }=U_{m}\), then we say that Y is dominated by X in the sense of mth degree concave stochastic dominance.Footnote 2

Concave stochastic dominance has a strict connection with the preference of combining good lotteries with bad lotteries, as defined in Tsetlin and Winkler (2009). Let (\(a_{j},b_{j}\)) be a sequence of m pairs of vectors of \(\mathbb {R} ^{n} \), with \(a_{j}\geqq b_{j}\), \(j=1,\cdots , m\); we say that, in each pair, \(a_{j}\) is good and \(b_{j}\) is bad. Recursive pairs of good and bad lotteries (\(X_{j},Y_{j}\)), \(j=1,\cdots ,m\), with equal chances of obtaining \(X_{j}\) or \(Y_{j}\), respectively, are created by combining the vectors \(a_{j}\) and \(b_{j}\) and assuming a preference for combining good with bad. Let \( X_{1}=a_{1}\) and \(Y_{1}=b_{1}\); in the pair (\(X_{1},Y_{1}\)) \(X_{1}\) is good and \(Y_{1}\) is bad (at the first level) and we write \(X_{1}\succsim _{L1}Y_{1}\). A second pair of lotteries is defined by combining (\(X_{1},Y_{1} \)) and (\(a_{2},b_{2}\)): \(X_{2}=[X_{1}+b_{2},Y_{1}+a_{2}]\) and \( Y_{2}=[X_{1}+a_{2},Y_{1}+b_{2}]\), where \(X_{2}\) combines good with bad and \( Y_{2}\) combines good with good and bad with bad. For the preference of combining good with bad, we find that \(X_{2}\) is good and \(Y_{2}\) is bad (at the second level). Thus we write \(X_{2}\succsim _{L2}Y_{2}\). Recursively, for each pair (\(X_{j},Y_{j}\)), \(j=1,2,\cdots ,m\), \(X_{j}\) combines good with bad and \(Y_{j}\) combines good with good and bad with bad; we thus write \(X_{m}\succsim _{Lm}Y_{m}\). A necessary and sufficient condition for the preference of combining good with bad up to level m is that the DM has a utility function \(u\in U_{m}\) (see Theorem 1 in Tsetlin and Winkler (2009), p. 1945). In particular, for \(m=2\), the DM has a preference for combining good with bad up to level 2 if and only if \(u \in U_2\), given all non-negative first-order partial derivatives and all non-positive second-order partial derivatives. This corresponds to second-degree concave stochastic dominance. A DM with \(u\in U_{2}\) is MRA and prefers combining good with bad up to level 2. We note that the preference of combining good with bad up to level 2 is a stronger condition than that introduced in Richard (1975), because it also requires single-attribute risk aversion. Since this additional condition implies that \(\dfrac{\partial ^{2}u}{\partial x_{i}^{2}}\leqq 0\) for \(i=1,2,\cdots ,n\), the condition on the second-order partial derivatives of u becomes that all of them are non-positive. Such a condition corresponds to the neg-ultramodularity of u (see Beccacece and Borgonovo (2011), Marinacci and Montrucchio (2005)).

The differences and similarities between CRA and MRA are not evident at first glance. On one hand, they do not conflict with each other, that is, \(U_{C}\cap U_{2}\ne \emptyset \). On the other hand, neither of the two implies the other, that is, \(U_{C} \nsubseteq U_{2}\) and \(U_{2} \nsubseteq U_{C}\). We conduct a more in-depth analysis of the two concepts. Fondamentally, the rationale behind both MRA and CRA is to ensure compliance with a founding principle regardless any other: combining good with bad and rejecting any fair bet, respectively. We focus on DMs (and utility fuctions) who are MRA and not CRA and, conversely, CRA and not MRA. Our approach, resulting in a restriction of the concept of MRA and CRA, offers, in our opinion, a new perspective to capture the essential meaning of the two kinds of risk aversion. As a consequence, from a mathematical viewpoint, we exclude the elements of the intersection \( U_{C}\cap U_{2}\ne \emptyset \) from our analysis, as the multiattribute utility introduced in Prékopa and Mádi-Nagi (2008), Definition 1.1, p. 594 and the mixex utility studied in Tsetlin and Winkler (2009), because compliant with both CRA and MRA.

Let us consider the set \(U=U_C \cup U_2\) and the partition of U:

Definition 1 introduces the concept of pure CRA and pure MRA, referring to both the DM and the utility function.

Definition 1

Let U be the set of utility functions given by (2).

-

(i)

A DM who is CRA but not MRA is said to be p-CRA. The class of p-CRA multiattribute utility functions is

$$\begin{aligned} U_{\text {p-CRA}}=U_{C}\setminus U_{2}=\{u\in U_{C}:u\notin U_{2}\} \end{aligned}$$(3) -

(ii)

A DM who is MRA but not CRA is said to be p-MRA. The class of p-MRA multiattribute utility functions is

$$\begin{aligned} U_{p-MRA}=U_{2}\setminus U_{C}=\{v\in U_{2}:v\notin U_{C}\} \end{aligned}$$(4)

3 Preferences with p-CRA and p-MRA utility functions

There is a population at risk for serious, possibly lethal disease. We can consider a community of people or animals or a forest under risk. Olive Quick Decline Syndrome (OQDS), which is a current very relevant sustainability issue, can be taken as an example of our setting.Footnote 3 Several treatments - most of them with unknown results and performed on repeated courses - are adopted to contain the disease. Since treatments are alternative and expensive, the decision of the most efficient treatment, i.e. the best sustainability policy, is crucial. The effectiveness of those treatments may be measured through the percentages of healthy/sick/dead plants after therapy. As such, we list the possible social states that are relevant to the consequences, from best to worst. For simplicity, we assume only three possible states: healthy (H), sick (S), and dead (D). The extension to the case of n possible state with several levels of sickness of increasing severity is immediate. Let p and q be the fractions of H and S, respectively. Then \(p+q\leqq 1\) , \(p,q\in \left[ 0,1\right] \), while the fraction of D is univocally given by \( 1-p-q\geqq 0\). Any statistical state \(\sigma =(p;q)\) is represented by a vector in \(\left[ 0,1\right] ^{2}\): For example, \(\sigma =(0;1)\) means that all the members are S and \(\sigma =(0.1;0.5)\) means that 10% are H, 50% are S, and therefore 40% are D. The set of all possible statistical states is the 2-dimensional simplex \(\Delta _2=\left\{ (p \; q)\in \left[ 0,1\right] ^{2}, \mathbf {\ }p+q\leqq 1\right\} \).

Some sustainability policies do reduce the incidence of the disease, but most produce unknown results. To be simple, assume that a stochastic policy leads to a lottery with equal chances of reaching the statistical states \(\sigma _{1}\) and \(\sigma _{2}\). Let I denote the policy consisting in the lottery yielding \(\sigma _{1}\) or \(\sigma _{2}\) with the same probability; we then write \(I=\left[ \sigma _{1}^{I},\sigma _{2}^{I} \right] \). A deterministic policy produces a certain result corresponding to a unique statistical state that we denote with \(C=\sigma ^{C}\).

A DM must decide the best policy to apply. Let u be the DM’s multiattribute utility function defined on \(\Delta _2\). Henceforth, we assume that \(u\in {\mathcal {C}}\) \(^{2}\) and u is increasing in p and q on \(\Delta _2\) and therefore \( \dfrac{\partial u}{\partial p}\geqq 0\) and \(\dfrac{ \partial u}{\partial q}\geqq 0\) at any interior point of \(\Delta _2\), where \(p+q <1\) and the fraction of D is \(1-p-q >0\). Monotonicity of u with respect to p is intuitive: If p increases, the utility increases since there are more healthy living beings. It is worth noting that with q constant, the increase of p results in a decrease of the fraction of D given by \(1-p-q\). Similarly, so far as monotonicity of u with respect to q is concerned, the increase of q, with p constant, results in a decrease of the fraction of D as well as before, and thus the (overall) utility increases.Footnote 4

Concerning the DM’s risk attitude, we consider two different cases: (i) The DM, is p-CRA and, hence, the multiattribute utility function is concave but not neg-ultramodular on \(\Delta _2\); and (ii) the DM is p-MRA and, hence, the multiattribute utility function is neg-ultramodular but not concave on \(\Delta _2\). In both cases, the DM’s risk attitude can be analyzed by means of the sign of the second-order derivatives of the utility function.

First, to present the conclusion plainly, we address some comments and take advantage of a numerical example in which we assume quadratic multiattribute utility functions defined on \(\Delta _2\), so that the Hessian matrix is constant. In case (i), the Hessian matrix of u is negative semidefinite and the second-order mixed derivatives are non-negative, while, in case (ii), this is not so, and thus the Hessian matrix is indefinite.

As a simple running example, consider that the available sustainability policies are \(I=\left[ (0.5;0),(0;0.5)\right] \) and \(II=\left[ (0.5;0.5),(0;0)\right] \). Both provide uncertain results: Policy I leads (with equal chances) to the state with 50% H and 50% D (nobody is S) or to the state with 50% S and 50% D (nobody is H), while policy II leads to the state with 50% H and 50% S (nobody is D) or to the state where nobody is H or S (all are D).

The p-CRA DM has the multiattribute utility function

Such a u is strictly increasing on \(\Delta _2\). The Hessian matrix \(\nabla ^{2}u\) is negative definite and the second-order mixed derivatives are positive. Thus u is concave but not neg-ultramodular. This corresponds to case (i).

Since \(\textrm{E}[u(II)]=-15.25>-15.375=\textrm{E}[u(I)]\), the p-CRA DM prefers II to I.

The same I and II are faced by the p-MRA DM, with the multiattribute utility function

As before, v is strictly increasing on \(\Delta _2\). The Hessian matrix \(\nabla ^{2}v\) is indefinite and all the second-order derivatives are negative. Hence v is neg-ultramodular but not concave. This corresponds to case (ii). We remark that the function v reveals the preference for combining good with bad up to level 2 (see Richard (1975), Tsetlin and Winkler (2009)), meaning that

Since \(\textrm{E}[v(I)]=-67.875>-68.625=\textrm{E}[v(II)]\), the p-MRA DM prefers I to II. Such a preference is confirmed by combining good with bad, since (7) applies to the example, setting \(p=q=0\) and \( c=d=0.5\).

Let us now investigate what happens when, in addition to stochastic policies, a deterministic policy is offered to the DM. Let the policy \(III=\sigma ^{III}=(0.25;0.25)\) be added to I and II for the choices of the DM. Policy III provides for sure the expected valueFootnote 5 of I. For instance, we can imagine that a tested medicine provides the statistical state given by III and the DM must decide whether to change the previously selected policy to improve the outcomes of the policy, taking on the risk of uncertainty. In particular, we answer the following question: Are the two DMs risk averse, preferring III to I?

Since \(u(III)=-15.125>-15.375=\textrm{E} [u(I)]\), the p-CRA DM prefers III to I and hence is risk averse, according to the definition of p-CRA. Since u is concave on \(\Delta _2\), that is, any one-dimensional restriction of u is concave, every stochastic policy is dispreferred to the certain one offering the same expected value. We can conclude that III is preferred to I for any concave u and, a fortiori, for any concave u that is not neg-ultramodular.

Comparing III and I by means of the p-MRA utility function, we obtain \(v(III)=-68.0625<-67.875=\textrm{E}[v(I)]\) and hence the p-MRA DM prefers the stochastic policy I to the certain policy III. Then she is risk seeking in this case. The result should not be a surprise. The one-dimensional restriction of v in the direction \(h=(-0.5\; 0.5)\), starting from \(x^{*}=(p^{*}\; q^{*})=(0.5\; 0)\), is convex. Since \(\sigma _{1}^{I}\) corresponds to the vector \(x^{*}=(0.5\; 0)\), \(\sigma _{2}^{I}\) to \(x^{*}+h=(0.5\; 0)+(-0.5\; 0.5)=(0\; 0.5)\), and \(\sigma ^{III}\) to \(x^{*}+0.5h=(0.5\; 0)+0.5(-0.5\; 0.5)=(0.25\; 0.25)\), the outcome of III lies between the outcomes of I in the direction h. Due to the convexity of the one-dimensional restriction of v at \(x^{*}\) in the direction h,the p-MRA DM is risk seeking when comparing I with its expected value given by III.

The risk-seeking attitude shown in the example, with a p-MRA quadratic utility function, is not occasional: this result is worth considering because it suggests that risk-seeking behavior is embedded in p-MRA. The following analysis of p-MRA utility functions confirms such an intuition.

The goals pursued by the two DMs are due to their different risk aversions and not to the specifications of the utility functions.

Consider the classes \(U_{p-CRA}\) and \(U_{p-MRA}\) as defined in Sect. 3, which correspond to p-CRA and p-MRA and are consistent with the cases (i) and (ii), respectively. All the utility functions in \(U_{p-CRA}\) are concave with a negative semidefinite Hessian matrix and non-negative second-order mixed derivatives. The utility functions in \(U_{p-MRA}\) are neg-ultramodular, with a Hessian matrix that is not negative semidefinite everywhere and non-positive second-order derivatives. Since any \(v\in U_{p-MRA}\) is not concave, \(\nabla ^{2}v\) cannot be negative semidefinite at all the interior points of the domain. Moreover, thanks to the non-positivity of all the second-order derivatives, it cannot be positive semidefinite (or, in particular, positive definite) at any interior point as well. Therefore \( \nabla ^{2}v\) needs to be indefinite at some interior point \(x^{*}\).

Let \(\succsim _u\) and \(\succsim _v\) denote the preferences induced by u and by v, respectively (\(\succ _u\) and \(\succ _v\) indicate the strict preferences).

We now address two issues. First, we investigate the preference of a p-CRA DM and of a p-MRA DM when the DM faces the policies \(I=[(p+c;q),(p;q+d)]\) and \(II=[(p+c;q+d),(p;q)]\), where \(c,d>0\) and \((p+c;q+d)\in \Delta _2\). Second, we investigate whether the p-MRA DM can reveal risk-seeking behavior by preferring a stochastic policy to a deterministic policy with the same expected value.

Proposition 1 states the results concerning the preferences of the two DMs. Sufficient conditions for \( \succ _{u}\) and \(\succsim _{v}\) are provided, in addition to a necessary condition for \(\succsim _{u}\).

Proposition 1

Let \(u,v \in {\mathcal {C}}\) \(^2\) be multiattribute utility functions.

-

(i)

Suppose \(u\in U_{p-CRA}\).

-

(a)

If \(\dfrac{ \partial ^{2}u}{\partial p\partial q}>0\), then \( II\succ _{u}I\).

-

(b)

If \(\dfrac{\partial ^{2}u}{\partial p\partial q}\geqq 0\) and \( \dfrac{\partial ^{2}u}{\partial q^{2}}\) is strictly increasing in the first argument (or \(\dfrac{\partial ^{2}u}{\partial p^{2}}\) is strictly increasing in the second argument), then \(II\succ _{u}I\).

-

(c)

If \(II\succsim _{u}I\), then \(\dfrac{\partial ^{2}u}{\partial p\partial q}\geqq 0\) and \(\dfrac{\partial ^{2}u}{\partial q^{2}}\) is increasing in the first argument (or \(\dfrac{\partial ^{2}u}{\partial p^{2}}\) is strictly increasing in the second argument).

-

(a)

-

(ii)

Suppose \(v\in U_{p-MRA}\). Then \(I\succsim _{v}II\).

Sufficient and necessary conditions in case of quadratic utility functions are provided by Proposition 2.

Proposition 2

Let u, v be quadratic utility functions.

(i) If \(u \in U_{p-CRA}\), then \(II\succsim _{u}I\);

(ii) if \(v\in U_{p-MRA}\), then \(I\succsim _{v}II\);

In the following special case of (i), the conclusion can be strengthened:

(i’) If \(u\in U_{p-CRA}\) and \(\dfrac{ \partial ^{2}u}{\partial q\partial p}>0\), then \( II\succ _{u}I\).

The analogy of Propositions 1 and 2 is simple. In case (i), if u is not quadratic, a zero mixed second-order partial derivative does not allow one to be conclusive about the preference between II and I. For this, the sufficient condition is more structured and, precisely, two sufficient conditions are identified. Condition (a) states that, if the mixed second-order partial derivative is strictly positive, then the strict preference \(II\succ _{u}I\) holds. This condition corresponds to the sufficient condition (i’) of Proposition 2. Condition (b) provides a sufficient condition for \(\succ _{u}\) under the assumption of non-negative mixed second-order derivatives. It requires that the second-order derivatives \(\dfrac{\partial ^{2}u}{\partial q^{2}}\) or \(\dfrac{\partial ^{2}u}{\partial p^{2}}\) be strictly increasing in the second and first arguments, respectively. We note that such a condition corresponds to the concept of prudence introduced by Kimball (1990) to capture the idea of precautionary saving. Condition (c) states a necessary condition that follows directly from the above considerations. For case (ii), the statement is the same for quadratic and non-quadratic utility functions.

The previous example provides us with a p-MRA quadratic utility function consistent with risk-seeking behavior. This is true also for non-quadratic utility functions. Proposition 3 formalizes that a p-MRA DM can reject a deterministic policy with respect to a stochastic one offering an expected value equal to that of the sure outcome.

Proposition 3

Let \(v\in U_{p-MRA}\). Then there always exists an entire bidimensional region \(S\subset \Delta _2\) of lotteries such that

For utility functions that are p-MRA, the principle of rejecting any fair bet is thus contradicted in infinitely many cases. On one hand, any policy with both outcomes along one of the directions where v is convex, is preferred to the sure policy offering the same expected value. On the other hand, given a sure policy \( C=\sigma ^{c}\) in \(\Delta _2\), there exist infinitely many stochastic policies that are preferred to C, precisely all those with both outcomes lying on a (surely existing) direction along which the restriction of v is convex.

The intrinsic meaning of p-MRA does not include the concept of rejecting any fair bet but, on the contrary, is in accordance with risk-seeking behavior in the evaluation of lotteries belonging to a specific set. We therefore say that the risk-seeking behavior is systematic.

4 p-MRA and p-CRA goals in sustainability policies

A direct connection between the type of risk aversion and the pursued goal can be investigated. On the basis of the results illustrated in the previous sections, we highlight the main differences between the two approaches and their relevant consequences for the choice of sustainability policies. Since any stochastic policy leads to a lottery with equal chances of reaching the statistical state \( \sigma _{1}\) or \(\sigma _{2}\), the choice of the DM depends only on the results given by these statistical states and is not affected by probabilities.

The p-MRA DM has a preference for combining good with bad. This means that she likes to temper the possible result of the sustainability policy. In the example, she forgoes the chance of obtaining the best result offered by policy II consisting in 0% D, to avoid the risk of the policy’s total default, that is, the occurrence of the irreversible event of 100% D. With the aim of avoiding the irreversibly harmful event, the p-MRA DM compares the lowest fraction of survivals (i.e. the sum of the fractions of H and S) provided by all the policies and prefers the policy with the highest one, since the probability associated with each statistical state is always equal to 50%. Given such behavior, she clearly reveals the preference deriving from p-MRA: The main concern of avoiding irreversibly harmful events drives her choice.

From a theoretical point of view, the choice of the p-MRA DM is the solution of an optimization problem. Let \({\mathcal {P}}\) \(_{i}\), \( i=\,1,2,\cdots ,z\), denote a family of possible sustainability policies, each leading to the statistical states \(\sigma _{j}^{i}=(p_{j}^{i},q_{j}^{i})\), \(j=1,2\). Combining good with bad, expressed by (7) means solving the problem

that is a maxmin strategy. According to the maximin principle, the p-MRA DM compares alternatives by the worst possible percentage of survivors given by (\(min_j (p_{j}^{i}+q_{j}^{i})\)) under each alternative, and she chooses one which maximizes the worst outcome. This principle tends to support the same operational measures as the Precautionary Principle, particularly in the case of high probability associated to the worst case.

What drives the p-CRA DM to prefer II to I? Do some intuitive reasons for the DM’s behavior stand out? The p-CRA DM prefers the policy providing the statistical state with the best result, that is, the lowest fraction of D, even if this choice could result in the total loss of the community, since the other statistical state associated to the policy yields 100% D. In this case, he does not seem to share with the p-MRA DM the concern of avoiding irreversibly harmful events: Choosing II, the DM has the same chance of facing 100% D and the total survival of the community. In addition, the outcomes deriving from policy II are much more unstable than those due to policy I. For all these reasons, the p-CRA DM does not seem to be risk averse in this context. This should not be a surprise. The preference relation stated by p-CRA concerns the choice when comparing a risky lottery and its expected value. This is not the case faced by the p-CRA DM, where both policies in question are stochastic. Then, only apparently, there are no reasons justifying his preference; on the contrary, the choice is based on a kind of risk aversion that drives the decision making in the case of uncertainty versus certainty.

5 The final state

In this section, we investigate the results of a sustainability policy under the assumption that it can be repeated more than once. To illustrate the problem we aim to address, we can consider the previously introduced example of a treatment for OQDS that is repeated for multiple cycles on a population of olive trees. The initial state of the plant population has a fraction \(q_0\) of S on which the therapy is applied. At the end of the first treatment cycle, the fraction of S has certainly decreased - some plants die, others recover - becoming \(q_1=q_0 \cdot q<q_0\). The second cycle of therapy is applied to the fraction \(q_1\), causing a further decrease in sick plants, resulting in a fraction \(q_2=q_1 \cdot q<q_1\), and so on, envisioning the completion of n cycles.

How can the DM measure the efficiency of a sustainability policy repeated n times? And how can the DM choose the best policy among several? Since the fraction of S decreases over time - becoming D or H - after a high number of repetitions, the population is approximately divided into dead and healthy living beings: we refer to this as the “final state”. The distribution of H (or D) after n repetitions of the policy serves as a tool for assessing efficiency: the higher H (or the lower D), the better the policy.

We now compute the distribution of H after n repetitions of the favorite strategy for the p-MRA and p-CRA DM, respectively.

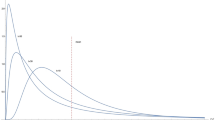

Let \(I=[(p;0),(0;q)]\) be the favorite policy for p-MRA DM. We denote by \(X_s\) the fraction of H after s repetitions for \(s=1,2, \cdots , n-1,n\). The evolution of \(X_s\) is sketchedFootnote 6 in Fig. 1.

The final state is described by the random variable

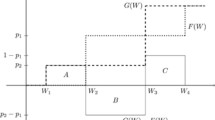

Let’s now move on to \(II=[(p;q),(0;0)]\), the favorite policy of the p-CRA DM. We denote by \(Y_s\) the fraction of H after s repetitions. The evolution of \(Y_s\) is sketched in Fig. 2.

The random variable describing the final state is

The comparison of the expected value and the variance of \(X_n\) and \(Y_n\) would be suitable for the DM’s purpose of finding the best policy. Mean-variance criterion is a consolidated normative principle that governs optimal decision making (Ingersoll, 1975).

First, it is easy to verify that \(X_1 \equiv Y_1\). The percentage of H is p or 0, both occurring with a probability of \(\dfrac{1}{2}\). Hence the expected values and the variances of \(X_1\) and \(Y_1\) are equal: \(\textrm{E}[X_1] = \textrm{E}[Y_1]\) and \(\textrm{Var}[X_1] = \textrm{Var}[Y_1]\). Despite their identity, the two random variables are subject to a crucial difference: while the p-MRA strategy provides p in an oucome and q in the other outcome, the p-CRA strategy provides p and q in the same outcome, and only D in the other one. This leads to a radical diversity of outcomes when the policy is repeated. In the case of p-MRA, the percentage of H takes intermediate values between 0 and p, with certain probabilities—thanks to the recovery of H from the percentage of S of previous stages—simultaneously decreasing the probability of it taking the value 0. Furthermore, the percentage of H never exceeds p, which always occurs with a probability of \(\dfrac{1}{2}\). In the case of p-CRA, on the other hand, the percentage of H takes values greater than p with a certain probabilities—thanks to the recovery of H from the percentage of S of previous stages—but does not take any value between 0 and p. In any case, the probability that it is equal to 0 is \(\dfrac{1}{2}\). This turns out in differentiating the set of values taken by \(X_n\) and \(Y_n\) respectively.Footnote 7\(X_n\) takes a finite number of values in the interval [0, p], with a probability mass of \(\dfrac{1}{2}\) at p. \(Y_n\) takes a finite number of values in the set \({\mathcal {A}}=\left\{ 0\right\} \cup [p, p \bar{q}_n]\), where \(\bar{q}_n=\sum _{t=1}^{n}q^{t-1}\), with a probability mass of \(\dfrac{1}{2}\) at 0.

The larger the number n the greater the effect: \(X_n\) takes more and more values in the interval [0, p] and the range of \(Y_n\) extends further and further to the right. Intuitively, the variance of X decreases, and the variance of Y increases as n grows. At first glance, nothing can be said about the expected values.

Proposition 4 provides a remarkable result stating the preference of \(X_n\) on \(Y_n\) according to the mean-variance criterion.

Proposition 4

Let \(X_n\) and \(Y_n\) be defined as in (10)

and (11), respectively.

It holds:

-

(i)

\(\textrm{E}[X_n] = \textrm{E}[Y_n]\) for \(n \ge 1\)

-

(ii)

VAR\([X_n]\) \(\le \) VAR\([Y_n]\) for \(n \ge 1\)

and \(X_n\) dominates \(Y_n\) for \(n \ge 1\) according to the mean-variance criterion.

6 Conclusions

Both CRA and MRA are used to model risk attitude in multidimensional decision problems. They can coexist but, indeed, differ greatly from each other, leading to distinct behaviors and choices in decision problems, especially when irreversible events are faced. To reveal their differences, we separate CRA and MRA and investigate the goal pursued by a DM driven MRA but not CRA and viceversa. To this end, we define p-CRA and p-MRA and study the preferences of a DM who faces a decision problem on sustainability policies, often involving irreversible and catastrophic risks.

The main result is that p-CRA and p-MRA confirm different principles, both widely shared in decision theory. On one hand, p-CRA confirms the principle of rejecting any fair bet, that is, the most widely shared answer by risk averters when a risky alternative is compared with a sure outcome of equal expected value. On the other hand, p-MRA confirms the preference of combining good with bad, on a set of risky alternatives, which means the willingness of the DM to avoid the occurrence of irreversible outcomes. We conclude that p-MRA and p-CRA are effective and can be easily interpreted, in specific decision contexts.

In the general case, when the set of lotteries is composed of some risky lotteries and some certain ones, p-CRA and p-MRA lead to different choices and are not without some drawbacks. Basically, p-MRA has two consequences: The DM minimizes the occurrence of default but can also be risk seeking under some circumstances. This second fact cannot be easily justified in the framework of risk aversion. In the same context, p-CRA also has two consequences: It preserves the principle of rejecting any fair bet and leads the DM to compare the best cases offered by all the lotteries with equal probability, choosing the policy that offers the best outcome among all the best policies. Consequently, the other outcome of the lottery could be the absolutely worst case. This fact cannot be easily accepted when that case is irreversible.

Notes

The definition provided in the Report of the United Nations Conference (1992) is: “In order to protect the environment, the precautionary approach shall be widely applied by States according to their capabilities. Where there are threats of serious or irreversible damage, lack of full scientific certainty shall not be used as a reason for postponing cost-effective measures to prevent environmental degradation.”

An analogous multivariate ordering called m-degree convex stochastic dominance is defined by means of the class of utility functions for which all partial derivatives of a given order up to order m with the same sign and this sign is negative for odd orders and positive for even orders.

OQSD is a disease affecting olive plants, due to the bacterium Xylella fastidiosa and it is estimated to have caused the death of around 20 million olive plants in the last 10 years.

Comparing the statistical states \(\sigma ^1 =(0.1;0.5)\) and \(\sigma ^2 =(0.1;0.6)\), we have that \(u (\sigma ^1) \ge u (\sigma ^2)\), being 0.4 and 0.3 the fraction of D, respectively.

The policies I and II have the same expected value: For our purposes, we need only investigate the comparison between I and III. Obviously, a symmetric example can be built by comparing II with III.

For simplicity, we set \(q_0=1\) and q constant. We also indicate the portion of S (in parentheses).

References

Beccacece, F., Borgonovo, E.: Functional ANOVA, ultramodularity and monotonicity: applications in multiattribute utility theory. Eur. J. Oper. Res. 210(2), 326–335 (2011)

Chichilnisky, G., Heal, G.: Financial Markets for unknown Risks. In Sustainability, Dynamics and Uncertainty, pp. 277–294. Kluwer Academic Publishers, Dordrecht (1998)

Chichilnisky, G., Heal, G.: Global enviromental risks, In Sustainability, Dynamics and Uncertainty. pp. 23–46, Kluwer Academic Publishers, Dordrecht (1998)

Denuit, M., Mesfioui, M.: Generalized increasing convex and directionally convex orders. J. Appl. Probab. 47(1), 264–276 (2010)

Denuit, M., Eeckhoudt, L., Tsetlin, I., Winkler, R.L.: Multivariate concave and convex stochastic. Risk Measures and Attitudes dominance, Springer-Verlag, London (2013)

Dietz, S., Neumayer, E.: Weak and strong sustainability in SEEA: concepts and measurament. Ecol. Econ. 61(4), 617–626 (2007)

Eeckhoudt, L., Rey, B., Schlesinger, H.: A good sign for multivariate risk taking. Manage. Sci. 53(1), 117–124 (2007)

Epstein, L.G., Tanny, S.M.: Increasing general correlation: a definition and some economic consequences. Can. J. Econ. 13(1), 16–34 (1980)

Ingersoll, J.E., Jr.: Theory of Financial Decision Making. Cambridge University Press, Cambridge (1987)

Kimball, M.S.: Precautionary saving in the small and in the large. Econometrica 58(1), 53–73 (1990)

Lichtendahl, K., Bodely, S.: Preferences for consumption streams: scale invariance, correlation aversion, and delay aversion under mortality. Oper. Res. 58(4), 985–997 (2010)

Marinacci, M., Montrucchio, L.: Ultramodular Functions. Math. Oper. Res. 30(2), 311–332 (2005)

Ortega, E., Escudero, L.F.: On expected utility for financial insurance portfolios with stochastic dependencies. Eur. J. Oper. Res. 200, 181–186 (2010)

Prékopa, A., Mádi-Nagi, G.: A class of multi attribute utility for financial insurance portfolios with stochastic dependencies. Oper. Res. 34, 591–602 (2008)

Report of the United Nations Conference, http://www.un.org/documents/ga/conf151/aconf15126-1annex1.htm (1992)

Richard, S.F.: Multivariate risk aversion, utility independence and separable utility functions. Manage. Sci. 22(1), 12–21 (1975)

Russell, W.R., Seo, T.K.: Ordering uncertain prospects: the multivariate utility functions case. Rev. Econ. Stud. 45, 605–611 (1978)

Som, C., Hilty, L.M., Kohler, A.R.: The precautionary principle as a framework for a sustainable information society. J. Bus. Ethics 85, 493–505 (2009)

Starmer, C.: Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. J. Econ. Lit. 38, 332–382 (2000)

Tsetlin, I., Winkler, L.R.: Multiattribute utility satisfying a preference for combining good with bad. Manage. Sci. 55(12), 1942–1952 (2009)

World Commission on Environment and Development: Our Common Future, (The Brundtland Report). Oxford University Press, Oxford (1987)

Acknowledgements

I asked Erio Castagnoli to read the first version of this paper: the result was a long and close epistolary exchange, generous of him with comments, critics and ideas. Due to his untimely passing, he was unable to see this project through to completion. The article is dedicated to his memory.

Funding

Open access funding provided by Università Commerciale Luigi Bocconi within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author did not receive support from any organization for the submitted work. He has no financial or proprietary interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

-

(i)

Consider the difference

$$\begin{aligned} D =[u(p+c,q+d)-u(p+c,q)]-[u(p,q+d)-u(p,q)] \end{aligned}$$(12)The preference \( II\succsim _{u}I\) (\(II\succ _{u}I\)) means that \(D \geqq 0\) (\(D >0\)). The second-degree Taylor expansion of u guarantees that

$$\begin{aligned} u(x+h)=u(x)+\nabla u(x)h+hB(x)h^{\textrm{T}}+o(\Vert h\Vert ^{2}) \end{aligned}$$(13)where \(x\in \Delta _2\), h is such that \(x+h\in \Delta _2 \), and \(B(x)=\dfrac{1}{2}\nabla ^{2}u(x)\). Given (13), we have

$$\begin{aligned} D&=[\nabla u(p+c,q) -\nabla u(p,q)] \begin{pmatrix}0&d \end{pmatrix}^{\textrm{T}}+\begin{pmatrix}0&d \end{pmatrix}[B(p+c,q)-B(p,q)] \begin{pmatrix}0&d \end{pmatrix}^{\textrm{T}}+o(d^{2}) \nonumber \\&=\left[ \frac{\partial u(p+c,q)}{\partial q}-\frac{\partial u(p,q)}{ \partial q}\right] d +\left[ \frac{\partial ^{2}u(p+c,q)}{\partial q^{2}} -\frac{\partial ^{2}u(p,q)}{\partial q^{2}}\right] d^{2}+o(d^{2}) \end{aligned}$$(14)To investigate the sign of D, we distinguish the following cases.

-

(a)

\(\dfrac{\partial u(p+c,q)}{\partial q}- \dfrac{\partial u(p,q)}{ \partial q}\ne 0\) for all (p, q) . Applying the first-degree Taylor expansion to the function \(\dfrac{\partial u}{\partial q}\), we obtain

$$\begin{aligned} D \sim \left[ \frac{\partial u(p+c,q)}{\partial q}-\frac{\partial u(p,q)}{\partial q}\right] d\sim \frac{\partial ^{2}u(p,q)}{\partial p\partial q}cd \end{aligned}$$If \(\dfrac{\partial ^{2}u(p,q)}{\partial p\partial q}0\), then \(D >0\).

-

(b)

\(\dfrac{\partial u(p+c,q)}{\partial q}-\dfrac{\partial u(p,q)}{ \partial q}=0\) for some (p, q). Then, around these points,

$$\begin{aligned} D \sim \left[ \frac{\partial ^{2}u(p+c,q)}{\partial q^{2}}-\frac{ \partial ^{2}u(p,q)}{\partial q^{2}}\right] d^{2} \end{aligned}$$Hence, if \(\dfrac{\partial ^{2}u(p,q)}{\partial p\partial q} =0 \) and \(\dfrac{\partial ^{2}u(p,q)}{\partial q^{2}}\) is strictly increasing in the first argument p, then \(D >0\). Summing up, we conclude that, if \(\dfrac{\partial ^{2}u(p,q)}{\partial p\partial q}\geqq 0\) and \(\dfrac{\partial ^{2}u(p,q)}{\partial q^{2}}\) is strictly increasing in the first argument p, then \(D >0\).

-

(c)

Conversely, if \(D \geqq 0\), then \(\dfrac{\partial ^{2}u(p,q) }{\partial p\partial q}\geqq 0\) and, if \(\dfrac{\partial ^{2}u(p,q)}{ \partial p\partial q}=0\), \(\dfrac{\partial ^{2}u(p,q)}{\partial q^{2}}\) is increasing in p.

Since (14) can be alternatively written as

$$\begin{aligned} D= & {} \left[ \nabla u\left( p,q+d\right) -\nabla u\left( p,q\right) \right] (c\; 0)^{\textrm{T}}+(c\; 0)\left[ B\left( p,q+d\right) \right. \\{} & {} \left. -B\left( p,q\right) \right] (c\; 0)^{\textrm{T}}+o(c^{2}) \\= & {} \left[ \frac{\partial u(p,q+d)}{\partial p}-\frac{\partial u(p,q)}{ \partial p}\right] c+\left[ \frac{\partial ^{2}u(p,q+d)}{\partial p^{2}}- \frac{\partial ^{2}u(p,q)}{\partial p^{2}}\right] c^{2}+o(c^{2}) \end{aligned}$$the condition of monotonicity (with respect to the second argument) is valid for the second-order partial derivative \(\dfrac{\partial ^{2}u(p,q)}{\partial p^{2}}\) as well.

-

(a)

-

(ii)

It follows directly from Tsetlin and Winkler (2009, Theorem 1, p. 1945) and from Beccacece and Borgonovo (2011, Proposition 2, p. 328). \(\square \)

Proof of Proposition 2

-

(i)

Condition \(II\succsim _{u}I\) requires that

$$\begin{aligned} \frac{1}{2} u(p+c,q+d)+\frac{1}{2} u(p,q)\geqq \frac{1}{2}u(p+c,q)+\frac{1}{2} u(p,q+d) \end{aligned}$$or, equivalently,

$$\begin{aligned} u(p+c,q+d)-u(p+c,q)\geqq u(p,q+d)-u(p,q) \end{aligned}$$(15)The quadratic utility function u is of the form \(u\left( x\right) =xBx^{ \textrm{T}}\), where \(x\in \Delta _2\) and \(B= \left( \begin{array}{cc} b_{11} &{} b_{12} \\ b_{21} &{} b_{22} \end{array}\right) \) is a constant symmetric \(2\times 2\) matrix (and, moreover, \(\nabla ^{2}u=2B\)). Both sides of (15) can be written as

$$\begin{aligned} u\left( x+h\right) -u\left( x\right) =\left( x+h\right) B\left( x+h\right) ^{ \textrm{T}} -xBx^{ \textrm{T}} \end{aligned}$$where h is such that \(x+h\in \Delta _2\mathbf {.}\) Given the symmetry of B, we obtain

$$\begin{aligned} \left( x+h\right) B\left( x+h\right) ^{ \textrm{T}}= & {} \left( x+h\right) Bx^{ \textrm{T}}+\left( x+h\right) Bh^{ \textrm{T}}= \\= & {} xBx^{ \textrm{T}}+hBx^{ \textrm{T}}+xBh^{ \textrm{T}}+hBh^{ \textrm{T}}= \\ {}= & {} xBx^{ \textrm{T}}+2xBh^{ \textrm{T}}+hBh^{ \textrm{T}} \end{aligned}$$and hence

$$\begin{aligned} \mathbf {\ }u\left( x+h\right) -u\left( x\right) =\left( x+h\right) B\left( x+h\right) ^{ \textrm{T}} -xBx^{ \textrm{T}}=2xBh^{ \textrm{T}}+hBh^{ \textrm{T}} \end{aligned}$$(16)We apply (16) to both sides of (15). Setting \(x=\begin{pmatrix} p+c&q \end{pmatrix}\) and \(h=\begin{pmatrix} 0&d \end{pmatrix}\), the left-hand side results in

$$\begin{aligned} \begin{aligned} u(p+c,q+d)-u(p+c,q)&= 2 \begin{pmatrix} p+c&q \end{pmatrix}B \begin{pmatrix} 0&d \end{pmatrix} ^{\textrm{T}}+ \begin{pmatrix} 0&d \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}} = \\&=2 \begin{pmatrix} p+c&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+d^{2}b_{22}= \\&=2\ \begin{pmatrix} p&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix} ^{\textrm{T}}+2 \begin{pmatrix} c&0 \end{pmatrix}B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+d^{2}b_{22} \end{aligned} \end{aligned}$$Setting \(x= \begin{pmatrix} p&q \end{pmatrix} \) and \(h= \begin{pmatrix} 0&d \end{pmatrix}\), the right-hand side results in

$$\begin{aligned} \begin{aligned} u(p,q+d)-u(p,q)&= 2 \begin{pmatrix} p&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+ \begin{pmatrix} 0&d \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}= \\&=2 \begin{pmatrix} p&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+d^{2}b_{22} \end{aligned} \end{aligned}$$Hence (15) becomes

$$\begin{aligned} 2 \begin{pmatrix} p&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+2 \begin{pmatrix} c&0 \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+d^{2}b_{22}\ge 2 \begin{pmatrix} p&q \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}+d^{2}b_{22} \end{aligned}$$and finally

$$\begin{aligned} 2 \begin{pmatrix} c&0 \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}=2cdb_{12}=cd\frac{\partial ^{2}u}{\partial p\partial q} \ge 0 \end{aligned}$$which is always satisfied thanks to the non-negativity of the second-order mixed derivatives of u.

-

(i’)

The special case of condition \(II\succ _{u}I\) corresponds to

$$\begin{aligned} u(p+c,q+d)-u(p+c,q) > u(p,q+d)-u(p,q) \end{aligned}$$(17)and, almost as before, we obtain

$$\begin{aligned} 2 \begin{pmatrix} c&0 \end{pmatrix} B \begin{pmatrix} 0&d \end{pmatrix}^{\textrm{T}}=2cdb_{12}=cd\frac{\partial ^{2}u}{\partial p\partial q} > 0 \end{aligned}$$Thanks to the positivity of the second-order mixed derivatives of u, (17) is always satisfied.

-

(ii)

Condition \(I\succsim _{v}II\) follows directly from Tsetlin and Winkler (2009, Theorem 1, p. 1945) and from Beccacece and Borgonovo (2011, Proposition 2, p. 328). \(\square \)

Proof of Proposition 3

Consider the one-dimensional restrictions \(\varphi _{h}\left( t\right) =v\left( x^{*}+th\right) \) of v in the direction h (and starting from \(x^{*}\)). Their second derivatives turn out to be \(\varphi _{h}^{\prime \prime }\left( t\right) =v^{\prime \prime }\left( x^{*}+th\right) =h \cdot \nabla ^{2}v\left( x^{*}+th\right) \cdot h^{\textrm{T}}\). Since \(\nabla ^{2}v\) is necessarily indefinite at some interior point \( x^{*}\), then \(\varphi _{h}^{\prime \prime }\left( 0\right) =h\cdot \nabla ^{2}v\left( x^{*}\right) \cdot h^{\textrm{T}}\) changes sign with h and, thus, there exists some direction h (starting from \(x^{*}\)) in which it takes on strictly positive values and (thanks to the continuity of all the second-order derivatives) these remain strictly positive, at least in an open interval of t containing the origin. There exists, thus, at least one point \(x^{*}\) and one direction h such that the restriction \( \varphi _{h}\) of v is convex in an interval \(\left( a,b\right) \) of value t, with \( a<0<b\). Thanks to the continuity of the second-order derivatives of v, for each point \(x^{*}\) there exist infinitely many directions h that satisfy that condition; then an entire bidimensional region exists on which v is convex. \(\square \)

Proof of Proposition 4

\(X_n\) dominates \(Y_n\) according to the mean-variance criterion if (i) and (ii) hold.

-

(i)

We compute the expected values of \(X_n\) and \(Y_n\).

$$\begin{aligned} \begin{aligned} \textrm{E}[X_n]=\sum _{s=0}^{n-1}pq^{n-s-1}\left( \frac{1}{2}\right) ^{n-s} \end{aligned} \end{aligned}$$$$\begin{aligned} \begin{aligned}\textrm{E}[Y_n]=p\left[ \sum _{s=1}^{n-1}\left( \frac{1}{2}\right) ^{s+1} \cdot \sum _{t=1}^{s}q^{t-1}+\left( \frac{1}{2}\right) ^{n}\sum _{t=1}^{s}q^{t-1}\right] \end{aligned} \end{aligned}$$Setting \(B_n=\displaystyle {\sum _{s=1}^{n-1}\left( \frac{1}{2}\right) ^{s+1}\cdot \sum _{t=1}^{s}q^{t-1}}\) and \(C_n=\displaystyle {\left( \frac{1}{2}\right) ^{n}\sum _{t=1}^{s}q^{t-1}}\), we expand the terms of \(B_n\) and \(C_n\) as follows \( \begin{array}{llll} s=1 &{} \quad &{} \left( \frac{1}{2}\right) ^{2}q^0 &{} +\\ s=2 &{} \quad &{} \left( \frac{1}{2}\right) ^{3} (q^0+q^1) &{} + \\ s=3 &{} \quad &{} \left( \frac{1}{2}\right) ^{4}(q^0+q^1+q^2) &{} + \\ \cdots &{} &{} \cdots \\ s=n-1 &{} \quad &{} \left( \frac{1}{2}\right) ^{n}(q^0+q^1+ \cdots +q^{n-2}) &{} + \\ \quad &{} \quad &{} \quad \\ C_n &{} \quad &{}\left( \frac{1}{2}\right) ^{n}(q^0+q^1+ \cdots +q^{n-2}+q^{n-1}) &{} = \end{array} \) Rearranging the terms according to the increasing powers of q, we get

$$\begin{aligned} \begin{aligned} B_n+C_n=q^0 \left( \frac{1}{2}\right) ^{2} \sum _{s=0}^{n-2}\left( \frac{1}{2}\right) ^{s}+ q^1\left( \frac{1}{2}\right) ^3\sum _{s=0}^{n-3}\left( \frac{1}{2}\right) ^{s} + \cdots +q^{n-2}\left( \frac{1}{2}\right) ^{n} + \\ + \left( \frac{1}{2}\right) ^{n}(q^0+q^1+ \cdots +q^{n-2}+q^{n-1})= q^0\left[ \left( \frac{1}{2}\right) ^{2} \frac{1- \left( \frac{1}{2}\right) ^{n}}{\frac{1}{2}}+ \left( \frac{1}{2}\right) ^{n-1}\right] + \\ +q^1\left[ \left( \frac{1}{2}\right) ^{3} \frac{1- \left( \frac{1}{2}\right) ^{n-2}}{\frac{1}{2}}+ \left( \frac{1}{2}\right) ^{n}\right] + ... +q^{n-2}\left[ \left( \frac{1}{2}\right) ^{n}+\left( \frac{1}{2}\right) ^{n} \right] +q^{n-1}\left( \frac{1}{2}\right) ^{n}= \\ +q^0\left( \frac{1}{2}\right) +q^1\left( \frac{1}{2}\right) ^{2}+ \cdots +q^{n-2}\left( \frac{1}{2}\right) ^{n-1}+q^{n-1}\left( \frac{1}{2}\right) ^{n}= \sum _{s=0}^{n-1}q^{n-s-1}\left( \frac{1}{2}\right) ^{n-s} \end{aligned} \end{aligned}$$Finally we have

$$\begin{aligned} \textrm{E}[Y_n]=p(B_n+C_n)=\sum _{s=0}^{n-1}pq^{n-s-1}\left( \frac{1}{2}\right) ^{n-s}=\textrm{E}[X_n] \end{aligned}$$ -

(ii)

Let Z be the random variable \( Z=\left\{ \begin{array}{cc} 0 &{} \dfrac{1}{2} \\ \quad &{} \quad \\ p &{} \dfrac{1}{2} \end{array}\right. \qquad \) whose variance is \(Var[Z]=\dfrac{p^2}{4}\). We now compare the variance of Z with that of \(X_n\) and \(Y_n\), respectively. \(X_n\) takes a finite number of values in the interval [0, p], with a probability mass of \(\dfrac{1}{2}\) at p. Since the dispersion of the values of \(X_n\) is not higher than that of Z, it follows that the variance of \(X_n\) is not greater than the variance of Z. \(Y_n\) takes a finite number of values in \(\left\{ 0\right\} \cup [p, p \bar{q}_n]\), with a probability mass of \(\dfrac{1}{2}\) at 0. The dispersion of the values of \(Y_n\) is not lower than that of Z, therefore the variance of \(Y_n\) is not lower than the variance of Z. As a result, the following relationship holds

$$\begin{aligned} Var[X_n] \le \dfrac{p^2}{4} \le Var[Y_n] \end{aligned}$$In particular, the equality holds for \(n=1\), since \(X_1 \equiv Y_1 \equiv Z\). \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Beccacece, F. Multivariate risk attitude: a comparison of alternative approaches in sustainability policies. Decisions Econ Finan (2024). https://doi.org/10.1007/s10203-024-00441-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10203-024-00441-5