Abstract

The network of suppliers and, in particular, the allocation of a buyer’s procurement volumes is one of the key issues in supply chain management when following a multiple-sourcing strategy. This paper proposes a buyer–supplier model which considers a supplier quantity–quality trade-off reflecting the responsiveness of quality to changes in volume. The trade-off is based on the assumption that suppliers are not able to maintain the same level of quality, if quantity increases and vice versa. In order to model the relation between quantity and quality, a generalized logistic function is used. Considering heterogeneous suppliers in terms of the quantity–quality trade-off, we analyze, how different procurement volumes for a product affect the supplier structure of a buyer in a multiple-sourcing buyer–supplier network. An agent-based simulation is applied which is an appropriate approach to study systems of heterogeneous and interacting agents (e.g., buyer and suppliers, interactions between suppliers, mutual effects of parameters). The results show that in such a network not only the procurement volume remarkably shapes the supplier structure and, eventually, may lead to instability. Moreover, the results suggest that less advanced quality management systems on the buyer’s side may increase the stability of the supplier structure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Procurement activities are often seen as key business drivers (Gadde et al. 2010; Hesping and Schiele 2013; Van Weele 2010) and it appears that procurement is one of the most important parts of the value chain since it can not only significantly contribute to the company’s bottom line (net profits) but also to its top line (revenues) (Hartmann et al. 2012). In this respect, an efficient and smooth relationship between a buyer and its suppliers is a key to the buyer’s short-term financial success and its long-term competitive power (Van Weele 2010) since the buyer and its suppliers create value together (Kähkönen and Lintukangas 2012).

In a multiple-sourcing environment, an important strategic question is, how the buyer should allocate the procurement volume among the suppliers. Hence, a major task in multi-sourcing is to determine the volume allocated to each supplier considering possible constraints (e.g., capacity and quality) to satisfy the buyer’s demand (Songhori et al. 2011). Besides the intention to improve the quality of the product and the service level, splitting the procurement volume among several suppliers enhances the competition between the suppliers. An ongoing competition between the suppliers not only reduces the dependency on one single supplier but also limits the cost of goods and services. Since suppliers compete with each other for order volumes, this results in a lower price for goods and services and a higher quality (Linthorst and Telgen 2007; Tomlin 2006).

While the objective of many studies of the present literature on volume allocation is to reduce the total costs or to determine the optimal reorder level, this paper’s objective is to analyze the change of a buyer’s supplier structure when the product quality is paramount to the buyer’s demands, while the product price is negligible.

Until now, relatively little attention was given to the topic of a quantity–quality trade-off in the context of volume allocation among multiple suppliers. A trade-off can exist between a supplier’s quality and quantity and indicates the responsiveness of quality to changes in volume. This is based on the assumption that a supplier cannot maintain its level of quality with an increased volume and subsequently the supplier’s quality drops. This trade-off might stem from technological reasons (e.g., increasing the operating speed to produce more pieces may result in a lower quality) or the use of less-skilled workers required to increase the volume. In particular, this paper investigates the effects of the quantity–quality trade-off on the supplier structure of a buyer, when the buyer pursues a multiple-sourcing strategyFootnote 1 and when different procurement volumes are allocated among the suppliers which are heterogeneous with respect to the quantity–quality trade-off. In addition, we would like to mention that we didn’t find an analytical solution for the volume allocation problem because things look a lot more complicated when two or more suppliers with different quantity–quality trade-offs are involved.

1.1 Related literature

This paper builds on some previous work that has been done to study the quantity–quality trade-off.

Olmos and Martínez (2011) use the principal–agent theory to investigate a processor’s (principal) optimal incentive-based compensation contract, the principal should offer to a grower (agent) performing efforts in quantity and quality. Hence, the authors study the effects of a quantity–quality trade-off in a principal–agent framework for the agri-food industry and conclude, that under an appropriate incentive-based grower’s compensation, the processor may encourage the grower’s effort in quality without affecting its effort in quantity. Olmos and Martínez (2011) mention some limitations to their study. They note that the uncertainty in quality measurement led them to use a compensation scheme based on the principal’s revenue. Further, the authors point out that their study is not a dynamic analysis and that they do not consider a possible relationship between the principal and agent over time.

McCannon (2008) extends the standard vertical-product-differentiation-model to analyze the quantity–quality trade-off. The author presents a model of quality selection in an imperfectly competitive market considering a quantity–quality trade-off and studies its implications. In this regard, the author refers to the production of cigars which is very expensive to increase and, if at all, only at the expense of lower quality, since the enhancement of production requires the use of more low-quality tobacco leaves and more less-skilled laborers. Thus, an unambiguous link between the quantity and quality of the cigars produced results. In his findings, the author shows that the stronger the relationship between these two factors is, the more sales are shifted from the high to the low quality supplier (McCannon 2008).

Although both works consider a trade-off between quantity and quality, to our knowledge the effect of this trade-off in a buyer–supplier network has not yet been discussed in regard to the volume allocation problem which is the focus of our study. Since there is an apparent gap in the literature on studying the quantity–quality trade-off in buyer–supplier networks, we take the assumption of McCannon’s work and extend the literature on volume allocation to study the effects of such trade-off on the supplier structure of a buyer in an agent-based buyer–supplier model. Based on the identified research gap in the literature, our research question is:

-

How do different procurement volumes for a product affect the supplier structure of a buyer when facing heterogeneous (quality) suppliers in a multiple-sourcing environment?

At this point, the term quality is to be specified more precisely, since the focus in this paper is on the quantity the buyer requests from its suppliers and the quality the suppliers are able to offer for a certain quantity. Traditional quality management systems define quality mostly in a neutral, non-judgmental form. Hence, it is about objectively determinable properties or more specifically, the achievement of clearly defined requirements. The work of Sternad and Mödritscher (2018) considers a judgmental form of quality. For example, beside the product quality, which describes the character of physical products sold by a company, customers additionally demand a range of services accompanying a physical product (e.g., maintenance and repair of vehicles). In our model, we adopt a non-judgemental form of quality, since we assume that the buyer is only interested in the fact that the suppliers are able to deliver high quality products.

Finally, to get a relation between quantity and quality, we apply a generalized logistic function which has an S-shaped form. This function type corresponds to our before-mentioned assumption that with an increase of the quantity, the supplier is not able to maintain its level of quality which will subsequently drop to a lower quality level. S-shaped functions are very flexible and have essential properties so that they are often used, e.g., in neutral network learning methods as an activation function (Mitchell 1997) or in biological growth models for animal sciences and forestry (Koya and Goshu 2013).

1.2 Research method

To answer our research question, an agent-based simulation approach is applied. Agent-based modeling is a promising approach since it allows the representation of dynamic and complex systems such as supply chains (Hilletofth and Lättilä 2012). An agent-based simulation has the potential to show the effects on both, the buyer and the supplier side, in particular, when suppliers are heterogeneous with respect to the quantity–quality trade-off. Applying an agent-based simulation to the research problem allows the representation of processes in time, especially, the change of the supplier structure over time and this aspect would be particularly difficult to capture in empirical research. In particular, an agent-based model is constructed which allows to observe the behavior of the agents as well as the evolving properties of the supplier structure in time (Davis et al. 2007; Harrison et al. 2007; Wall 2016).

In a structure with multiple suppliers not only the interactions between the buyer and each single supplier is important to consider, but also the influence of different exogenous and endogenous variables that may have an impact on the structure of suppliers. In this sense, the other suppliers with their particular quantity–quality trade-offs shape the environment of each supplier. The agent-based model consists of several heterogeneous supplier agents and a buyer agent which interact in a virtual environment where the buyer agent tries to satisfy its demand of a product. Further, the buyer takes decisions during each time step regarding quantity and quality. The market, in which the buyer and the suppliers are situated, is characterized by quality variability (different supplier qualities for the same product). Hence, due to the heterogeneity of the suppliers, analytical solutions are very difficult or nearly impossible to obtain (Gilbert 2008).Footnote 2

The remainder of the paper is organized as follows. In Sect. 2, we introduce our simulation model, explain the model specifications, and declare the parameter settings for our simulation experiments. In Sect. 3, we present and discuss our results. Section 4 contains concluding remarks and suggests possible directions for future research.

2 The model

2.1 Overview

In this section, the agent-based model is introduced which is employed to study, how different procurement volumes affect the supplier structure of a buyer when suppliers are heterogeneous with respect to the quantity–quality trade-off. In a multiple-sourcing environment, the challenge for the buyer is to allocate the planned procurement volume in the required quality to the selected suppliers.

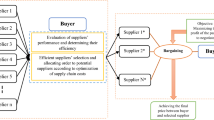

The buyer–supplier network is characterized by a buyer who is ordering a constant procurement volume of a certain product in every time period and by several suppliers who are offering this product under certain conditions. We suppose that the buyer operates in a highly quality sensitive market which means that the product price is negligible, since the buyer passes on the price directly to its customers. We assume that the buyer initially allocates an equal share of the procurement volume to the suppliers—without placing an order—and hence requests each supplier to state the quality for the demanded quantity. After receiving the information of the quality, the buyer allocates the procurement volume which is based on the buyer’s preferences regarding quality and quantity.

In addition, it is assumed that the buyer imperfectly observes the quality of the delivered procurement volume of each supplier. Based on this observation, the buyer updates the procurement volume allocated to each of the suppliers according to its volume allocation rule. An overview of the sequence of events, that occurs between the buyer and each supplier, is presented in Fig. 1.

2.2 Model specifications

Consider a buyer (abbreviated to B in formulas) whose procurement manager has identified \(m \in {\mathbb {N}}\) suppliers for a custom-made product and let \(i \in \{1,\ldots ,m\}\) denote the set of candidate suppliers (abbreviated to S in formulas). From the buyer’s perspective, a constant procurement volume X is ordered in each period \(t \in \{1,\ldots ,T\} \subset {\mathbb {N}}\) of the entire observation time T where the sum of the individual supplier volumes \(x_{i,t}^S\) of m suppliers equals the procurement volume:

2.2.1 Supplier quantity–quality trade-off and buyer’s quality measurement

In our model, we distinguish three different supplier types which differ from each other in terms of the quantity–quality trade-off. In order to model our supplier types, a generalized logistic function, also known as Richards’ curve (Richards 1959), is used because the function is similar to an S-shaped curve and this curve characteristic matches with our assumption that a supplier is not able to maintain the same level of quality, if quantity increases and vice versa. Hence, a supplier’s quantity–quality function is determined by

Let \(q_{i,t}^S \in (0,1)\) denote the individual quality of the i’th supplier at time t provided for a quantity \(x_{i,t}^S\). At the beginning of a simulation run, the quality parameters (\(H_i,G_i,C_i,k_i) \in {\mathbb {R}}^4\) are set exogenously for each supplier. Parameter \(H_i\) (\(G_i\)) reflects the upper (lower) asymptote of the quality curve, \(C_i\) is related to the quality in point \(x_{i,t}^S = 0\), and \(k_i\) represents the logistic shrinkage factor (or, in a positive sense, the logistic growth rate). \(H_i\), \(G_i\), \(C_i\), and \(k_i\) are set in such a way that the three supplier types represent our ‘typology’ of suppliers. For the sake of simplicity, we assume that all four parameters do not change over time.

Equation 2 indicates that with an increase in supplier quantity \(x_{i,t}^S\) the quality \(q_{i,t}^S\) provided by supplier i decreases and vice versa.Footnote 3 This is based on the aforementioned assumption that suppliers are not able to maintain the same level of quality \(q_{i,t}^S\) for an increased quantity \(x_{i,t}^S\) and vice versa, and is in the very center of our research question.

Upon receipt of the deliveries at time t, the buyer observes the quality \(q_{i,t}^B\) for each supplier. In every period t, the observed quality may not match the actual quality \(q_{i,t}^S\), since we assume that the observed quality \(q_{i,t}^B\) is afflicted with noise by adding a normally distributed random variable \(Q_{i,t}\) with mean 0 and standard deviation \(\sigma \) which can be comprehended as the buyer’s quality measurement:

The difference between the actual and observed quality might result from an imperfect buyer quality perception. Since the buyer is only interested in the supplier’s quality, the observed qualities \(q_{i,t}^B\) serve as a basis for the volume allocation for the next period.

2.2.2 Offer submission

Only at the beginning of a simulation run (abbreviated to \(t_0\) in formulas), the buyer makes a request by dividing the procurement volume X in equal shares to the selected suppliers:

Next, the buyer requests each supplier to submit an offer, stating the quality \(q_{i,t_0}^S\) for the allocated procurement volume \(x_{i,t_0}^S\). Hence, the supplier qualities, stated in the supplier offers, affect the volume ordered in the initial period from each supplier:

2.2.3 Volume allocation

Since the buyer is interested in a high quality, a bigger share of the procurement volume is allocated to the suppliers with a high quality and less to the suppliers with a low quality and, hence, the observed quality \(q_{i,t}^B\) in period t affects the volume \(x_{i,t+1}^S\) ordered in the next period from each supplier. In particular, the simulation distinguishes between two types of buyer’s formation of expectations (Hommes and Wagener 2009).

First, the buyer may form its expectations in a rather naïve way in expecting that the volume allocation of the procurement volume for the next period is only based on the actual quality \(q_{i,t}^B\). Consequently, the buyer has no memory because its volume allocation only depends on its quality measurement at time t. Apart from the initial period \(t_0\), the buyer allocates the procurement volume X according to the allocation rule

where \(q_{i,t}^B\) is observed according to Eq. 3.

Second, the buyer could form its expectations according to a more sophisticated method by allowing adaptive expectations (Hommes and Wagener 2009) which is ‘technically’ based on exponential smoothing, originated in Robert Brown’s work (1959). Here again, the volume allocation of the procurement volume is proportionately to the suppliers’ qualities, however, the buyer has a memory with a delay of one time step. Thus, the buyer’s expectation of the quality is a simple weighted average of the actual quality \(q_{i,t}^B \) and the last forecast of quality \(q_{i,t-1}^*\) as given by

where \(w \in [0,1]\) denotes the smoothing parameter.Footnote 4 With this, the allocation rule (Eq. 6) is modified to

2.3 Parameter settings

In the simulation experiments, the buyer allocates a procurement volume in a network of suppliers. Each supplier is characterized by a quality function which denotes the supplier’s quality capability for a certain procurement volume. This relationship captures the before mentioned trade-off between the quantity the supplier produces and the respective quality.

In our simulation model, we distinguish three different supplier types (hereafter type 1, type 2, and type 3) which differ from each other in terms of the type of production system employed (see Fig. 2). The first supplier type captures a company providing the highest level of quality for small volumes, since for instance it carries out a very large amount of manual work and individualized service [e.g., unit or job shop production system (Miltenburg 2005; Singh 2014)]. The quality of this supplier type reacts sensitively to a rise of the procurement volume demanded by the buyer, since the supplier is overstrained. This leads to a significant deterioration of the supplier’s quality which drops below the qualities of supplier types 2 and 3. Compared to supplier type 1, supplier type 2 is not able to offer the same high quality for smaller volumes, but can maintain its level of quality with an increased procurement volume. However, with a higher procurement volume also this supplier type’s quality deteriorates [e.g., batch flow production system (Miltenburg 2005; Singh 2014)]. The third supplier type is large and uses standardised tools, materials, and methods in the production process. Supplier type 3 is able to offer a medium quality, even for a high procurement volume, before its quality slowly starts dropping to a slightly lower quality level [e.g., mass or flow production system (Miltenburg 2005; Singh 2014)].

The simulation experiments are conducted in three steps: First, we investigate four baseline scenarios for parameter settings, before a sensitivity analysis is carried out in regard to the standard deviation of the precision of quality measured and the procurement volume. In these first two steps of the analysis, the buyer sticks to the ‘naïve’ formulation of expectations (according to Eq. 6). In the third part of the simulation study, we present results for a buyer with adaptive formation of expectations (according to Eq. 8). The simulation experiments are carried out for parameter settings as summarized in Table 1.

We decided to focus on theses parameter settings since it allows to concentrate more on the changing supplier structure during the observation period without having the results being mixed with a change in the number of suppliers. Although a lot of possible combinations can be build with the parameters shown in Table 1, we only concentrate on a few scenarios which we find particularly appropriate for the question under investigation. In our simulation experiments, we perform 1000 simulation runs with 100 periods for each scenario.Footnote 5 For a better understanding, we will subsequently explain the parameter settings in more detail.

We start by explaining the suppliers’ quality parameters. The quality parameter \(H_i\) corresponds to the quality that can be guaranteed with small volumes, while \(G_i\) is associated with the worst quality that can occur. To represent our ‘typology’ of our suppliers, we set these quality parameters as in Table 1. In order to obtain the parameters \(C_i\) and \(k_i\), we define the following two constraints: The parameter \(C_i\) refers to the quality, if nothing is produced, i.e., \(C_i = -\,(q_{i,t}^S(0) - G_i)/(q_{i,t}^S(0) - H_i)\). For simplicity, we assume \(q_{i,t}^S(0) = H_i - 0.01\). The parameter \(k_i\) is obtained by solving \(\tau _i=q_{i,t}^S{^\prime }(10)\) which reflects the quantity–quality trade-off in point \(x_{i,t}^S=10\). Due to the fact, that the derivative of the S-shaped function is a nonlinear function, we use the R package ‘nleqslv’ (Hasselman 2018) to solve this nonlinear equation for the parameter \(k_i\) given the parameters \(H_i\), \(G_i\), and \(C_i\). For simplicity, we assume the following quantity–quality trade-offs in point \(x_{i,t}^S=10\): \(\tau _1=-\,0.2\), \(\tau _2=-\,0.002\), and \(\tau _3=-\,0.001\). This leads to the following logistic shrinkage factors: \(k_1=0.499\), \(k_2=0.088\), and \(k_3=0.061\).

For example, the trade-off \(\tau _1\) of \({-}\,0.2\) means that the quality decreases by approximately 0.2 as the volume increases by 1 (only approximate because the slope is not constant), while the logistic shrinkage factor \(k_1\) of 0.499 indicates that the value of the exponential function \(e^{-k_1 \cdot x_{1,t}^S}\) decreases by approximately 49.9% as the volume increases by 1. Figure 2 depicts the supplier quality functions for our three supplier types.

For our basline scenarios, we consider four different procurement volumes X ordered by the buyer since we want to analyze, how the supplier structure changes with a low, medium, and high procurement volume. In Table 1, we state the different procurement volumes which are ordered by the buyer in our simulation experiments.

Further, our baseline scenarios are modified with respect to the procurement volume and the precision of the buyer’s quality measurement in our first sensitivity analysis (see Table 1). In doing so, we want to analyze, how the supplier structure of the buyer changes when effects of imprecise buyer’s quality measurements are considered.

In our second sensitivity analysis, the effects of the mode of forming expectations of the suppliers’ qualities are studied for a smoothing parameter \(w=0.5\) which indicates that the buyer sets as much weight on new information as on old ones.

3 Results and discussion

3.1 Effects of the procurement volume (baseline scenarios)

We analyze, how the four different procurement volumes, which are allocated among the suppliers, affect the supplier structure of the buyer. The results displayed in Table 2 are analyzed in two steps: First, we present the results for each procurement volume and, afterwards, we discuss the findings in more detail.

Avg_Vol reports the average relative volume calculated over the last ten periods averaged over the 1000 simulation runs.Footnote 6 Compared against the initial equal volume split among the suppliers, it indicates how the supplier volume is changed over the observation period for each procurement volume. Next, Avg_VolShift denotes the average volume which is shifted in an average simulation run over the last ten periods of each of the 1000 simulation runs among the suppliers. In order to compare the scenarios with each other, Avg_Vol and Avg_VolShift are given in relative numbers. Figure 3 gives an overview of the volume allocation over the observation period for our baseline scenarios. The different line types represent the average relative supplier volumes over the observation period of 100 periods for 1000 simulation runs.

With respect to our research question, the most interesting aspect is, how the supplier structure of a buyer changes over the observation period when different supplier types with respect to different quantity–quality trade-offs, and different procurement volumes are considered.

The results in Table 2 show that, depending on the scenario, a different amount of the procurement volume is shifted among the suppliers during the observation period. For the first two baseline scenarios, we find that the supplier structure converges only after a few periods (see Fig. 3a, b). Considering a high procurement volume (see Fig. 3d), we notice that the supplier structure does not converge to a limit point and that more volume is shifted among the suppliers over the observation period.

In particular, the baseline scenario with \(X=30\) shows a cyclical behavior where the volumes allocated to the different supplier types fluctuate over the observation period between a low and a high limit point. The cyclical behavior with a higher procurement volume is reasonable and can be explained by the quality functions of the supplier types which imply a quantity–quality trade-off. This further explains the volume shifting, since an increased volume causes a drop of the supplier’s quality and vice versa. According to our ‘typology’ of suppliers, the qualities of the supplier types 1 and 2 react rather sensitive to an increased procurement volume, while the quality of supplier type 3 is fairly insensitive to increases in volume. Further, we notice that the smaller the procurement volume, the higher the chance that supplier type 1 will be allocated more volume and vice versa.

Hence, putting it more in the tradition of Porter’s prominent five forces model, results suggest that—in a situation with such a typology of suppliers—with increasing procurement volumes those suppliers gain shares and, hence, bargaining power whose quality is less sensitive towards the quantity delivered. Hence, if for example in a certain sector the quantity–quality trade-off should decrease with higher levels of automation involving less individualized elements of service (Lin et al. 2014), according to our results, this would result in a shift of bargaining power towards the more automated suppliers.

Figure 3a–d suggest that the procurement volume shapes whether a stable allocation or—in other words—a stable supplier structure emerges. Apparently, with a high procurement volume, the volume shift between the suppliers remains at a high level of about one third of the entire volume per period (Table 2). Differentiating for the suppliers (Fig. 3d), it becomes apparent that the supplier type 3 (low quantity–quality trade-off) faces the lowest volume shifts. Hence, this supplier has to manage the lowest level of volume oscillations in its operations management, while the supplier type 1 is confronted with remarkable oscillations.

It is well-known that dealing with high levels of oscillations could cause considerable costs (which are not captured in this simple model) (e.g., Villegas and Smith 2006). Moreover, should type 1 suppliers have, in turn, suppliers too, such oscillations may cause bullwhip-like effects (e.g., Lee et al. 1997; Lin et al. 2014). Hence, an obvious option for type 1 suppliers would be trying to conclude a framework contract with the buyer.

3.2 Effects of (imprecise) quality measurements (sensitivity analysis)

In the baseline scenarios presented in Sect. 3.1, we assumed that the quality measurement works perfectly, i.e., measures actual quality without noise. Hence, it is interesting how the model reacts when imperfect quality is imperfectly measured. In order to gain some insights on this, we ran further simulation experiments where the value for the standard deviation was varied between 0.01 and 0.10 in steps of 0.01 and the value for the procurement volume X between 1 and 100 in steps of 1.

The results are presented in Figs. 4, 5, and 6: Fig. 4 shows the relative average volume shift Avg_VolShift obtained over the last ten periods of 1000 simulation runs (see Sect. 3.1) for different levels of precisions of quality measurement and procurement volumes. For the range of \(X \in \{ 15,16,\ldots ,40 \}\), Fig. 5 presents these relative volume shifts to show the effects in detail. Figure 6 displays the average relative volume shifts per period at selected levels of measurement precision and volumes. For a low procurement volume (\(X \le 25\)), we note that the less precise the quality measurement (i.e., the higher the standard deviation \(\sigma \)) the more volume is shifted among the suppliers during the observation period. Consequently, the average final volumes of the suppliers oscillate more strongly than in the above presented baseline scenario with \(X=25\). Interestingly, we identify a tipping point in our sensitivity analysis (\(X=26\)) where this pattern no longer applies.Footnote 7 At this point, more precise measurement leads to more relative volume shifted among the suppliers, while with less precise measurements less volume ratios are shifted among the suppliers.

In the following, we discuss Fig. 6 which exemplary shows the results for scenario \(X=25\) and \(X=26\), i.e., at that particular volume increase which apparently causes the tipping point behavior, where we compare the average volume shift per period using a value of 0 for the standard deviation of quality measurement with results using a medium (0.05) and high value (0.10). While plots (a, b) of Fig. 6 show the results for perfect quality measurements, plots (c–f) depict the results for the sensitivity analysis with imperfect measurements. We note that imperfect quality measurements lead to more upward outliers and a higher variance of the relative volume shifted among the suppliers.

Hence, the results of this second step of our simulation study could be summarized as follows: (1) the volume shares of suppliers—and, hence, the supplier structure—may show some tipping point behavior with respect to the procurement volume; a slight increase in the procurement volume may result in oscillating supplier shares. (2) Less precise quality measurements on the buyer’s site do not universally have detrimental effects in terms of increasing oscillations. Rather, it appears that—depending on the procurement volume—imprecise quality information may stabilize or even reduce volume shifts. Obviously, the latter result is somewhat counterintuitive; commonly, one would assume that less precise information is detrimental. However, the result obtained here relates to studies suggesting on the potential beneficial effects of imperfect information by inducing false positive decisions (Wall 2010).

In our context, high buyer’s quality measurement errors (high \(\sigma \)) lead to the effect that poor quality suppliers achieve quality levels like a supplier with excellent quality, which makes the buyer’s volume allocation more evenly and vice versa, and, therefore, the volume shift stabilizes and decreases slightly. This may, to some extent, relativize calls for a perfect quality measurement system.

3.3 Effects of mode for formation of expectations

The higher the procurement volume X, the more a naïve buyer shifts the volumes between the suppliers, and this causes strong oscillations. Hence, an interesting question is, how a buyer employing a more sophisticated formation of expectations on the suppliers’ quality allocates the procurement volume. In particular, as described in Sect. 2.2, we study a buyer who adaptively forms its expectations (Hommes and Wagener 2009) technically based on exponential smoothing. Similar to the preceding section, we analyze the average relative volume shifts of the last ten periods. Figures 7 and 8 display the respective results similar to the figures in the preceding section.Footnote 8

Comparing the results from this Sect. 3.3 with the results from Sect. 3.2, we note, that, again, a tipping point occurs, though now with a higher procurement volume, namely, \(X=55\). Moreover, the results suggest that with adaptive expectations the relative volume shift for higher procurement volumes is lowest for medium levels of quality measurement errors—and not for perfect measurements. This, again, may put calls for a quality measurement as perfect as possible into perspective. However, in general, the relative volume shifts are at a remarkably lower level than obtained for naïve forecasting buyers.

4 Conclusion

In this paper, we study a simple buyer–supplier network considering a buyer employing multiple suppliers for a product. In our model, we investigate three different supplier types which are characterized by an S-shaped function of quality depending on the quantity. In particular, we consider a trade-off between the quantity and quality which is mentioned in the previous literature but to our knowledge until now was not considered in the context of a buyer–supplier network and the volume allocation problem. Based on an agent-based simulation, we analyze, how different procurement volumes for a product affect the supplier structure of a buyer when facing heterogeneous suppliers with regard to the quantity–quality trade-off.

In our simulation experiments, we first analyze the effect of different procurement volumes allocated by the buyer among the suppliers. For small procurement volumes, the supplier structure converges to a stable setting only after a few periods. However, if the buyer allocates a larger procurement volume among the suppliers, we notice that a large amount of volume is shifted over the whole observation period and the supplier structure leads to two limit points. Further, with a larger procurement volume allocated to the suppliers, the results show stronger oscillations of the supplier volumes. This is reasonable and can be explained by the quality functions of the supplier types. These results may contribute to the field in that they reveal a further source for oscillations—eventually causing a bullwhip-like effects in the entire supply chain. Moreover, the results indicate that for higher procurement volumes, the supplier structure shifts in favor of those suppliers which show lower sensitivity of the quality towards quantity.

The second part of our study shows that up to a certain volume, more noise in the quality measurements results in more volume shifted among the suppliers; however, we identify a tipping point in the procurement volume allocated by the buyer among the suppliers, where this pattern no longer applies. After reaching this tipping point, we note that more precise quality measurements result in more volume shifted among the suppliers. This finding obviously puts calls for a perfect as possible quality measurement into perspective.

While the aforementioned results were obtained for buyers employing a rather naïve mode of formation expectations on suppliers’ quality, in a third part of our simulation study, we analyze the effects of an adaptive formation of expectations. In general, this leads to a smoothing of oscillations in the volume allocation and, thus, stabilizes the supplier structure. However, in principle, we identify similar patterns including a tipping point behavior.

The research effort introduced in this paper is subject to several limitations and awaits various extensions. In particular, the model presented here does not take into account any constraints like the capacity of production and logistics of the suppliers which makes it easier to understand and to reproduce. Moreover, it is supposed that the supplier prices are not relevant to the buyer, since the focus lies on the product quality each supplier is able to offer. For the sake of simplicity, we concentrated on a simple configuration, since our main objective was the analysis of the changing supplier structure over time. However, it is planned to extend the model in several directions where the most important extension will be the price as an endogenous variable.

Notes

In this paper, it is assumed that the buyer employs multiple suppliers to protect itself against possible supply disruptions and to reduce the dependence on one single supplier.

Often, it is regarded the best way to derive the behavior of a model analytically because it will provide all the information needed to understand how the model will behave and react given a range of inputs. However, when an analytical solution is not feasible, a simulation approach allows to study the system of interest.

In our model, the quantity–quality trade-off is derived from the slope of the quality function.

The initial smoothing quality \(q_{i,t_0}^*\) corresponds to the initial observed quality \(q_{i,t_0}^B\) and both volume allocation rules are the same, if the smoothing parameter w is set to one.

Because of the coefficient of variance (ratio of standard deviation to the mean), 1000 simulation runs are sufficient to express the precision and repeatability of this experiment and 100 periods per simulation run are enough to stabilize the behavior of the buyer’s volume allocation.

We choose the last ten periods because we focus on the long-term behavior of the volume allocation.

A closer analysis reveals that beyond the intersection point of supplier type 1 and 3 (see Fig. 2) at about \(x = 8.51\) oscillations between supplier type 1 and 3 start. In particular, at this point, the quality provided by the supplier type 1 falls below the level provided by supplier type 3. In consequence, in the next period, the buyer orders a higher volume from supplier type 3 and supplier type 1’s quantity decreases below the intersection point’s volume, and, hence, quality increases. In the next period, the buyer increases supplier type 1’s quantity even more beyond the intersection point’s volume. These oscillations continue.

References

Brown RG (1959) Statistical forecasting for inventory control. McGraw/Hill, London

Davis JP, Eisenhardt KM, Bingham CB (2007) Developing theory through simulation methods. Acad Manag Rev 32(2):480–499

Gadde LE, Håkansson H, Persson G (2010) Supply network strategies. Wiley, Berlin

Gilbert GN (2008) Agent-based models (Quantitative applications in the social sciences). Sage, Los Angeles

Harrison JR, Lin Z, Carroll GR, Carley KM (2007) Simulation modeling in organizational and management research. Acad Manag Rev 32(4):1229–1245

Hartmann E, Kerkfeld D, Henke M (2012) Top and bottom line relevance of purchasing and supply management. J Purch Supply Manag 18(1):22–34

Hasselman B (2018) Package ‘nleqslv’ - Systems of nonlinear equations. R package version 3.3.2. http://www.vps.fmvz.usp.br/CRAN/web/packages/nleqslv/nleqslv.pdf. Accessed 29 May 2020

Hesping F, Schiele H (2013) Towards a framework for strategy in purchasing: German and English language literature. In: Bogaschwesky R, Eßig M, Lasch R, Stoelzle W (eds) Supply management research. Springer, Berlin, pp 57–86

Hilletofth P, Lättilä L (2012) Agent based decision support in the supply chain context. Ind Manag Data Syst 112(8):1217–1235

Hommes CH, Wagener F (2009) Bounded rationality and learning in complex markets. In: Rosser JB, Cheltenham J (eds) Handbook of economic complexity. Edward Elgar, London, pp 87–123 (Chap 5)

Kähkönen AK, Lintukangas K (2012) The underlying potential of supply management in value creation. J Purch Supply Manag 18(2):68–75

Koya PR, Goshu AT (2013) Generalized mathematical model for biological growths. Open J Model Simul 1:42–53

Lee HL, Padmanabhan V, Whang S (1997) Information distortion in a supply chain: the bullwhip effect. Manag Sci 43(4):546–558

Lin WJ, Jiang ZB, Liu R, Wang L (2014) The bullwhip effect in hybrid supply chain. Int J Prod Res 52(7):2062–2084

Linthorst MM, Telgen J (2007) Public purchasing future: buying from multiple sources. In: Piga P, Thai KV (eds) Advancing public procurement: practices, innovation and knowledge-sharing. Pr Academics Press, Boca Raton, pp 471–482

McCannon BC (2008) The quality–quantity trade-off. East Econ J 34(1):95–100

Miltenburg J (2005) Manufacturing strategy: how to formulate and implement a winning plan. Productivity Press, London

Mitchell TM (1997) Machine learning. McGraw-Hill International Edition

Olmos MF, Martínez JR (2011) The quality–quantity trade-off in the principal–agent framework. Agric Econ Rev 11(1):57–68

Richards F (1959) A flexible growth function for empirical use. J Exp Bot 10(2):290–301

Singh SP (2014) Production and operations management. Vikas Publishing House, New Delhi

Songhori MJ, Tavana M, Azadeh A, Khakbaz MH (2011) A supplier selection and order allocation model with multiple transportation alternatives. Int J Adv Manuf Technol 52(1–4):365–376

Sternad D, Mödritscher G (2018) Qualitatives Wachstum. Der Weg zu nachhaltigem Unternehmenserfolg. Springer, Belin

Tomlin B (2006) On the value of mitigation and contingency strategies for managing supply chain disruption risks. Manag Sci 52(5):639–657

Van Weele AJ (2010) Purchasing and supply chain management: analysis, strategy, planning and practice. Cengage Learning EMEA, London

Villegas F, Smith N (2006) Supply chain dynamics: analysis of inventory vs. order oscillations trade-off. Int J Prod Res 44(6):1037–1054

Wall F (2010) The (beneficial) role of informational imperfections in enhancing organisational performance. In: Li Calzi M, Milone L, Pellizzari P (eds) Progress in artificial economics. Springer, Berlin, pp 115–126

Wall F (2016) Agent-based modeling in managerial science: an illustrative survey and study. Rev Manag Sci 10(1):135–193

Acknowledgements

Open access funding provided by University of Klagenfurt.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Strmenik, K., Wall, F., Mitsch, C. et al. Volume allocation in multi-sourcing: effects of the quantity–quality trade-off. Cent Eur J Oper Res 29, 753–771 (2021). https://doi.org/10.1007/s10100-020-00685-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-020-00685-7