Abstract

This paper studies contests with complementary prizes where each agent simultaneously distributes a fixed budget over multiple battlefields. Each battlefield has a single prize which is divided among the competitors in proportion to an arbitrary power function of their investment levels. A unique pure strategy Nash equilibrium is shown to exist under arbitrarily sensitive battlefield success functions if objective functions exhibit constant subunitary elasticity of substitution between prize shares. In contrast, Blotto contests with linear objectives have only mixed strategy Nash equilibria if battlefield success functions are sufficiently sensitive to investment levels. Sufficient complementarity between prize shares allows pure strategy Nash equilibria to exist under arbitrarily sensitive battlefield success functions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

An agent’s value for one resource often depends on their other resources. Military factions compete for both air supremacy and ground supremacy. The marginal increase in control over a contested region from additional air supremacy may depend in part on a faction’s level of ground supremacy.Footnote 1 Ride hailing firms compete for both riders and drivers.Footnote 2 The marginal revenue from an additional driver depends in part on the firm’s success marketing their platform to riders. Social media platforms compete for both users and advertisers. The marginal revenue from an additional user depends in part on the number of advertisers.Footnote 3 Pharmaceutical firms compete to convince both doctors and patients of their product’s effectiveness.Footnote 4 The marginal revenue from persuading an additional patient may depend in part on the firm’s success in convincing doctors.

This paper studies multi-battle contests where each agent simultaneously distributes a fixed budget between a finite number of battlefields. As in the Blotto contest of Borel (1921), contesting costs are sunk before agents allocate resources between battlefields. Each battlefield has a single prize which is divided among the competitors in proportion to a power function of the corresponding investment levels. Each agent seeks to maximize an objective function with constant subunitary elasticity of substitution between prize shares. A unique pure strategy Nash equilibrium is shown to exist under which resource allocations are proportional to prize values.

The unique Nash equilibrium is shown to be Pareto efficient over the set of feasible outcomes. Nonequilibrium outcomes often give every agent a lower payoff than they earn in equilibrium. No strategy profile gives every agent a higher payoff than they earn in equilibrium. Both the “size of the pie” and the “division of the pie” may vary, so these contests are not zero-sum games. In the two-agent case, equilibrium payoffs are shown to be minimax payoffs, so any deviation from equilibrium by one agent can be exploited by the other to obtain an above-equilibrium payoff.

If battlefield success functions are sufficiently sensitive to investment levels, conventional Blotto contests with linear objectives have only mixed strategy Nash equilibria (Roberson 2006; Jin and Zhou 2018). In contrast, the present paper shows that Blotto contests with arbitrarily sensitive battlefield success functions have pure strategy Nash equilibria if objective functions exhibit constant subunitary elasticity of substitution between prize shares.

The remainder of this paper is organized as follows. Section 2 discusses the related literature. Section 3 describes the contest. Section 4 considers the best response correspondence. Section 5 characterizes the Nash equilibrium. Section 6 discusses the efficiency of equilibrium and Sect. 7 concludes. Proofs are provided in the appendix.

2 Related literature

Borel (1921) describes the standard BlottoFootnote 5 contest where battlefield success functions take the auctionFootnote 6 form and payoffs are proportional to the number of battles won. Roberson (2006) notes that such contests have no pure strategy Nash equilibria. Subsequent work has investigated Blotto contests with lotteryFootnote 7 success functions. Friedman (1958) identifies pure strategy Nash equilibria in Blotto contests where battlefield success is proportional to investment levels. Jin and Zhou (2018) show that Blotto contests where objective functions are linear in battlefield success probabilities have no pure strategy Nash equilibria if battlefield success probabilities are sufficiently sensitive to investment levels.

Duffy and Matros (2015), Klumpp et al. (2019), and Anbarcı et al. (2020) consider Blotto contests with majoritarianFootnote 8 objectives and lottery success functions. Duffy and Matros (2015) consider simultaneous battles while Klumpp et al. (2019) and Anbarcı et al. (2020) consider sequential battles. Sela and Erez (2013) consider sequential Blotto contests with linear objectives and lottery success functions. Clark and Konrad (2007) and Kovenock and Roberson (2018) investigate two-player multi-battle contests with best-shotFootnote 9 and weakest-linkFootnote 10 objectives. Clark and Konrad (2007) consider settings where the attacker has a best-shot objective and the defender has a weakest-link objective. Kovenock and Roberson (2018) consider networks of battlefields with best-shot and weakest-link objectives both within and across networks. Clark and Konrad (2007) consider lottery success functions while Kovenock and Roberson (2018) consider auction success functions.

The present paper considers blotto contests with divisible prizes. Instead of describing the probability that a given prize is awarded to a given agent, battlefield success functions in the present paper describe the share of a given prize awarded to a given agent. A unique pure strategy Nash equilibrium is shown to exist under arbitrarily sensitive battlefield success functions if objective functions exhibit constant subunitary elasticity of substitution between prize shares.

3 The contest

Consider a multi-battle contest where \(n\ge 2\) agents simultaneously distribute a fixed budget over m battlefields. The set of agents is indexed by \(N=\left\{ 1,2,\ldots ,n\right\} \). The set of battlefields is indexed by \(B=\left\{ 1,2,\ldots ,m\right\} \). Each battlefield contains a single divisible prize, so the set of prizes is also indexed by the set B. Let \(v_{b}\in \mathbb {R}_{++}\) denote the value of the prize in battlefield b.

Let \(x_{ib}\in \mathbb {R}_{+}\) denote the quantity of competitive resources invested by agent i in battlefield b. As in the Blotto contest of Borel (1921) and Roberson (2006), agent i’s total investment \(w_{i}\) is sunk before they distribute their resources between battlefields. Agent i’s allocation vector \(x_{i}=\left( x_{i1},\ldots ,x_{im}\right) \in \mathbb {R}_{+}^{m}\) satisfies the budget constraint

Let \(X_{i}=\left\{ x_{i}\in \mathbb {R}_{+}^{m}:\sum _{k=1}^{m}x_{ib}=w_{i}\right\} \) denote agent i’s strategy set and let \(X=\prod _{i\in N}X_{i}\) denote the set of all possible strategy profiles. Let \(y_{ib}\left( x\right) \) denote agent i’s share of the prize in battlefield b under the strategy profile x. Let \(\gamma _{b}:X\rightarrow \triangle _{n-1}\) denote the battlefield success function such that \(\gamma _{bi}\left( x\right) =y_{ib}\left( x\right) \). The battlefield success function \(\gamma _{bi}\) is assumed to be increasing in \(x_{ib}\) and decreasing \(x_{jb}\) for \(j\ne i\). It is assumed to be continuous, homogeneous of degree zero, and independent from irrelevant alternatives such that

Clark and Riis (1998) show that all such battlefield success functions must be proportional to a power function of the corresponding investment levels. Let \(\mu _{i}\in \mathbb {R}_{++}\) denote the strength of agent i’s competitive resources. Let \(a\in \mathbb {R}_{++}\) denote the sensitivity of the battlefield success function to investment levels such that agent i’s share of the prize in battlefield b is

If zero competitive resources are allocated to battlefield b, then \(y_{ib}\left( x\right) =\gamma _{bi}\left( x\right) =\mu _{i}/\sum _{j=1}^{n}\mu _{j}\). If a is very small then prize shares are relatively insensitive to resource allocations. Conversely, if a is very large then nearly the entirety of the prize in battlefield b is awarded to the agent who allocates the most resources to battlefield b. Agent i’s battlefield success vector is \(y_{i}\left( x\right) =\left( y_{i1}\left( x\right) ,\ldots ,y_{im}\left( x\right) \right) \in \mathbb {R}_{+}^{m}\).

Each agent aims to maximize an objective function with constant elasticity of substitution between prize shares. If \(y_{i}\left( x\right) \notin \mathbb {R}_{++}^{m}\) then agent i’s payoff is \(\pi _{i}\left( x\right) =0\). As shown in the appendix, continuity implies that \(\pi _{i}\left( x\right) =0\) if \(y_{i}\left( x\right) \notin \mathbb {R}_{++}^{m}\). Let \(c_{i}\in \mathbb {R}_{+}\) denote the degree of complementary between prizes for agent i. If \(y_{i}\left( x\right) \in \mathbb {R}_{++}^{m}\) then agent i’s objective function is

Uzawa (1962) shows that constant elasticity of substitution between prize shares implies the functional form of Eq. (4). For notational simplicity, dependence on the strategy profile x is sometimes suppressed. The sum of the prize values is normalized to unity. This is without loss of generality since linearly scaling the prize values by an arbitrary constant \(\lambda \in \mathbb {R}_{++}\) linearly scales the objective function by a corresponding constant.

Agent i’s elasticity of substitution between prizes is \(\eta _{i}=\left( 1+c_{i}\right) ^{-1}\) (Uzawa 1962). Since the level of complementary \(c_{i}\in \mathbb {R}_{+}\) is non-negative, the elasticity of substitution is less than one. Acemoglu (2002) and León-Ledesma et al. (2010) note that factors of production are complementary precisely when their elasticity of substitution is less than one. In the limit as \(c_{i}\rightarrow \infty \), prizes are perfect complements and agent i’s objective function converges to \(\pi _{i}\left( x\right) =\min \left\{ y_{i1}\left( x\right) ,\ldots ,y_{im}\left( x\right) \right\} \). In this limiting case, there are multiple pure strategy Nash equilibria as illustrated by example 1.

Example 1

Consider a contest with two agents and two prizes where \(n=m=2\), \(w_{1}=w_{2}\), and \(\mu _{1}=\mu _{2}\). If \(x_{1}=x_{2}=\left( \theta ,w_{i}-\theta \right) \) with \(\theta \in \left( 0,w_{i}\right) \) then \(y_{ib}=\frac{1}{2}\). In the limit as \(c_{i}\rightarrow \infty \), prizes are perfect complements, so any unilateral deviation would be unprofitable as it would give the deviator less of at least one prize.

4 Best responses

If any agent allocates a non-zero quantity of resources to battlefield b, then agent i’s prize share \(y_{ib}\) is continuous in their allocation \(x_{ib}\) by Eq. (3). The objective function (4) is therefore continuous over the interior of the strategy set since it is continuous in prize shares. As illustrated by example 2, if all n agents allocate zero resources to battlefield b then agent i could obtain the entirety of prize b by reallocating an arbitrarily small quantity of resources to it.

Example 2

Consider a contest with two agents and two battlefields where \(a=1\), \(v=\left( \frac{1}{2},\frac{1}{2}\right) \), \(w=\mu =c=\left( 1,1\right) \). Suppose both players allocate all of their resources to battlefield 1, so \(x_{1}=x_{2}=\left( 1,0\right) \). Then agent 1’s battlefield success vector is \(y_{1}=\left( \frac{1}{2},\frac{1}{2}\right) \) and the payoff to agent 1 is \(\pi _{1}=\frac{1}{2}\). If agent 1 reallocates a small portion \(\varepsilon \) of their resources from battlefield 1 to battlefield 2 then their battlefield success vector would equal \(y_{1}'=\left( \frac{1-\varepsilon }{2-\varepsilon },1\right) \) and their payoff would equal \(\pi _{1}'=\left( \frac{1}{2}\left( \frac{2-\varepsilon }{1-\varepsilon }\right) +\frac{1}{2}\right) ^{-1}\). Taking the limit as \(\varepsilon \) converges to zero obtains \(\underset{\varepsilon \rightarrow 0}{\lim }\;\pi _{1}'=\frac{2}{3}>\frac{1}{2}=\pi _{1}\).

Proposition 1 states that agent i’s objective function is strictly quasiconcave over the interior of the strategy set. Since the objective function is differentiable over this region, first order conditions are sufficient for maximization over the interior of the strategy set.

Proposition 1

\(\pi _{i}\) is strictly quasiconcave over \(x_{i}\in \mathbb {R}_{++}^{n}\).

Proof

See Appendix A. \(\square \)

Strict quasiconcavity holds for \(c_{i}>0\) because agent i’s payoff is then a strictly increasing function of the strictly concave function

Strict quasiconcavity also holds for the limiting case \(c_{i}=0\) because agent i’s payoff is then a strictly increasing function of the strictly concave function

Proposition 2 states that every resource allocation on the boundary of agent i’s strategy set yields a strictly lower payoff than some other allocation in the interior of their strategy set. Hence the boundary of the strategy set never contains a best response. Since agent i’s payoff is strictly quasiconcave over the interior of their strategy set, they cannot have multiple best responses. Taking a convex combination between any two distinct best responses would yield a larger payoff.

Proposition 2

For every strategy profile \(x\in X\) such that \(x_{ib}=0\) for some \(b\in B\) there exists \(x_{i}'\in X_{i}\) such that \(\pi _{i}\left( x_{i}',x_{-i}\right) >\pi _{i}\left( x\right) \).

Proof

See Appendix A. \(\square \)

Proposition 2 implies that every best response lies in the interior of the strategy set. Agent i would obtain zero share of prize b if they allocate zero resources to the battlefield b and some other agent allocates a strictly positive amount. Conversely, if no other agent allocates resources to battlefield b, then agent i could obtain the entirety of prize b by allocating an arbitrarily small amount of resources to it. Proposition 3 characterizes the best response. Agent i maximizes their payoff by equalizing the marginal benefit of investment in each battlefield.

Proposition 3

A strategy \(x_{i}\in X_{i}\) maximizes agent i’s payoff \(\pi _{i}\) if and only if for all battlefields \(b,k\in B\)

Proof

See Appendix A. \(\square \)

These conditions are both necessary and sufficient for payoff maximization because best responses are always unique and they always lie in the interior of the strategy set. If agent i’s marginal payoff from investment in battlefield k was higher than their marginal payoff from investment in battlefield b then agent i could achieve a higher payoff by reallocating resources from battlefield b to battlefield k. Rearranging (8) to isolate the allocation ratio yields

Since \(c_{i}\) is non-negative, the right hand side of Eq. (9) is decreasing in \(y_{ib}\) and increasing in \(y_{ik}\). If agent i is best responding and their share \(y_{ib}\) of prize b is larger than their share \(y_{ik}\) of prize k, then their allocation ratio \(x_{ib}/x_{ik}\) must be less than the corresponding value ratio \(v_{b}/v_{k}\). Conversely, if \(y_{ib}\) was smaller than \(y_{ik}\) then \(x_{ib}/x_{ik}\) must be greater than \(v_{b}/v_{k}\). Example 3 illustrates why a best response may fail to exist if an agent allocates all their resources to a single battlefield.

Example 3

Consider a contest with two agents and two battlefields where \(a=1\), \(c_{1}=c_{2}=1\), \(\mu _{1}=\mu _{2}\), and \(v_{1}=v_{2}\). Suppose agent 1 allocates all of their resources to battlefield 1 such that \(x_{1}=\left( 0,1\right) \). Then agent 2 can obtain the entirety of prize 2 by allocating an arbitrarily small quantity resources to battlefield 2. Hence \(\pi _{2}\left( x_{1},x_{2}\right) <\pi _{2}\left( x_{1},x_{2}'\right) \) where \(x_{2}=\left( 1-\varepsilon ,\varepsilon \right) \) and \(x_{2}'=\left( 1-\frac{\varepsilon }{2},\frac{\varepsilon }{2}\right) \) for all \(\varepsilon \in \left( 0,1\right) \). Hence no interior strategy can be a best response for agent 2. Yet proposition 2 states that any best response must lie in the interior of the strategy space, so agent 2 has no best response to \(x_{1}=\left( 0,1\right) \).

If \(c_{i}\) was less than zero, the objective function could fail to be quasiconcave. In such settings, best responses might lie on the boundary of the strategy set and agents might have multiple best responses. Example 4 considers a setting where \(c_{i}=-2\) and one agent has multiple best responses on the boundary of their strategy set.

Example 4

Consider a contest with two agents and two battlefields where \(c_{1}=c_{2}=-2\), \(n=m=2\), \(a=2\), \(\mu _{1}=\mu _{2}=1\), and \(v_{1}=v_{2}\). The resulting payoff function is \(\pi _{i}\left( x\right) =v_{1}^{1/2}\left( y_{i1}\left( x\right) ^{2}+y_{i2}\left( x\right) ^{2}\right) ^{1/2}\). In this case, receiving the entirety of one prize and none of the other is better than receiving half of each prize. If \(x_{1}=\left( 0.5,0.5\right) \), then agent 2 can maximize their objective function by either allocating all of their resources to battlefield 1 or by allocating all of their resources to battlefield 2.

5 Nash equilibrium

The marginal value of an increase in agent i’s share of one prize depends on their share of other prizes. Complementarity between prizes incentivizes agent i to invest more in battlefields where they are relatively less successful. Proposition 4 states that agent i must receive the same share of each prize in equilibrium.

Proposition 4

In every pure strategy Nash equilibrium, \(y_{ib}=y_{ik}\) for every agent i and all battlefields b and k.

Proof

See Appendix A. \(\square \)

If agent i’s share of prize b was larger than their share of prize k then some other agent j must have a larger share of prize k than prize b. Then agent i’s allocation ratio \(x_{ib}/x_{ik}\) would be greater than agent j’s allocation ratio \(x_{jb}/x_{jk}\) by Eq. (3). If both agents are best responding, Eq. (9) would then imply that agent i’s allocation ratio must be lower than agent j’s allocation ratio. Hence agent i must obtain the same share of each prize in equilibrium and Eq. (9) implies that the equilibrium allocation ratio must equal the corresponding value ratio. Theorem 1 characterizes the Nash equilibrium.

Theorem 1

The unique pure strategy Nash equilibrium is \(x_{ib}^{*}=w_{i}v_{b}\).

Proof

See Appendix A. \(\square \)

The Nash equilibrium strategy profile depends on neither the level of complementarity \(c_{i}\) nor on the sensitivity a of the battlefield success function. Yet proposition 3 implies that agent i’s best response generally depends on both of these parameters. In equilibrium, \(y_{ib}=y_{ik}\) by proposition 4 and Eq. (9) reduces to

In this case, all of the terms involving a and \(c_{i}\) cancel out, so neither parameter affects the equilibrium investment ratio. The elasticity of substitution between prizes is given by \(\eta _{i}=\left( 1+c_{i}\right) ^{-1}\) (Uzawa 1962). Hence \(c_{i}\) is positive precisely when the elasticity of substitution \(\eta _{i}\) is less than one. As discussed in Sect. 3, theorem 1 always holds when \(c_{i}\ge 0\). Example 5 shows that the proportional strategy profile described by theorem 1 is still a Nash equilibrium in some contests with super-unitary elasticity of substitution.

Example 5

If \(w_{1}=w_{2}=\mu _{1}=\mu _{2}=1\), \(v_{1}=v_{2}=\frac{1}{2}\), and \(\eta _{1}=\eta _{2}=2\) then \(c_{1}=c_{2}=-\frac{1}{2}\) and

If \(a=1\) then \(y_{ib}\left( x\right) \) is strictly concave in \(x_{ib}\) so \(g_{i}\left( x\right) \) is strictly concave in \(x_{i}\) and \(\pi _{i}\) is strictly quasiconcave in \(x_{i}\). Hence the first order condition is sufficient for maximization and the proportional strategy profile \(x_{ib}=\frac{1}{2}\) is a Nash equilibrium.

Example 6 illustrates why subunitary elasticity of substitution between prizes is important for theorem 1. For every super-unitary elasticity of substitution \(\eta _{i}>1\) there exists a contest where the proportional strategy profile is not a Nash equilibrium.

Example 6

If \(w_{1}=w_{2}=\mu _{1}=\mu _{2}=1\) and \(c_{1}<0\) then

If \(v_{1}=\left( \frac{2}{3}\right) ^{-c_{1}}\), \(v_{2}=1-v_{1}\), and \(x_{1}=x_{2}=\left( v_{1},v_{2}\right) \) then \(\pi _{1}\left( x_{1},x_{2}\right) =\frac{1}{2}\). If \(x_{1}'=\left( 1,0\right) \) then

Hence \(x_{1}\) is not a best response to \(x_{2}\) if battlefield success functions are sufficiently sensitive.

6 Efficiency

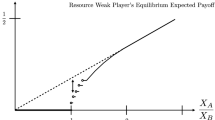

Proposition 5 states that agent i’s equilibrium payoff is a function of their endowment \(w_{i}\). Equilibrium payoffs exhibit greater sensitivity to initial endowments when battlefield success functions exhibit greater sensitivity to investment levels. Less sensitive battlefield success functions make equilibrium payoffs less sensitive to initial endowments without distorting equilibrium allocations.

Proposition 5

The unique Nash equilibrium payoff to agent i is

Proof

See Appendix A. \(\square \)

Proposition 6 states that Nash equilibrium maximizes the total payoff to all n agents. Consequently, the equilibrium strategy profile is Pareto efficient over the set of feasible outcomes. Hence any non-equilibrium strategy profile that gives one agent a greater payoff than they earn in equilibrium must give some other agent a lower payoff than they earn in equilibrium.

Proposition 6

The maximum total payoff to all n agents over all feasible strategy profiles \(x\in X\) is

Proof

See Appendix A. \(\square \)

The Pareto efficiency of the unique Nash equilibrium immediately rules out the possibility of strategy profiles that give every agent a higher payoff than they earn in equilibrium. Proposition 7 states that, in the two agent case, either agent can obtain an above-equilibrium payoff if their opponent employs a non-equilibrium strategy. Consequently, Nash equilibrium payoffs are minimax payoffs in the two agent case.

Proposition 7

If agent j employs a non-equilibrium strategy and \(n=2\) then agent i can obtain an above-equilibrium payoff.

Proof

See Appendix A. \(\square \)

Many non-equilibrium outcomes are Pareto dominated by the equilibrium outcome. Example 7 illustrates how non-equilibrium strategy profiles can give every player a lower payoff than they earn in equilibrium. Both the “size of the pie” and the “division of the pie” can vary, so these contests are not zero-sum games.

Example 7

Consider a contest with two players and two battlefields where \(a=1\), \(v=\left( \frac{1}{2},\frac{1}{2}\right) \), and \(w=\mu =c=\left( 1,1\right) \). If \(x_{1}=x_{2}=\left( \frac{1}{2},\frac{1}{2}\right) \) then \(y_{1}\left( x\right) =y_{2}\left( x\right) =\left( \frac{1}{2},\frac{1}{2}\right) \). If \(x_{1}'=\left( \frac{1}{3},\frac{2}{3}\right) \) and \(x_{2}'=\left( \frac{2}{3},\frac{1}{3}\right) \) then \(y_{1}\left( x'\right) =\left( \frac{1}{3},\frac{2}{3}\right) \) and \(y_{2}\left( x'\right) =\left( \frac{2}{3},\frac{1}{3}\right) \) so

7 Conclusion

This paper considers multi-battle conflicts where agents allocate fixed budgets to compete over divisible prizes. The share of a given prize awarded to a given agent is given by an arbitrarily sensitive battlefield success function. Prize shares are proportional to a power function of investments and payoffs exhibit constant elasticity in prize shares. Blotto contests with linear objective functions have no pure strategy Nash equilibrium if success functions are sufficiently sensitive to investment levels. Conversely, if prizes exhibit subunitary elasticity of substitution, the proportional strategy profile is shown to be the unique Nash equilibrium under arbitrarily sensitive success functions.

The unique Nash equilibrium is shown to be Pareto efficient over the set of feasible outcomes. No strategy profile gives every player a higher payoff than they earn in equilibrium and nonequilibrium strategy profiles often give every player a lower payoff than they earn in equilibrium. Both the “size of the pie” and the “division of the pie” can vary, so these contests are not zero-sum games. In the two agent case, equilibrium payoffs are shown to be minimax payoffs. Any deviation from equilibrium by one agent can be exploited by the other to obtain an above-equilibrium payoff.

Many settings involve competition over complementary prizes. Ride hailing firms compete for both riders and drivers. Pharmaceutical firms compete to persuade both doctors and patients. Military factions compete for both air supremacy and ground supremacy. The existence of pure strategy Nash equilibria in such settings may depend on the level of complementarity between prizes. If prizes are sufficiently complementary, pure strategy Nash equilibria can exist under arbitrarily sensitive success functions. In contrast, Blotto contests where payoffs are linear in battlefield success have only mixed strategy Nash equilibria if success functions are sufficiently sensitive to investment levels. If policy makers are risk averse, they may prefer pure strategy equilibria over mixed strategy equilibria. Complementarity between prizes can allow pure strategy Nash equilibria to persist in the presence of highly sensitive success functions.

Generalizations of the present model should be considered by future research. The present paper considers objective functions that exhibit constant subunitary elasticity of substitution between prize shares. Example 6 shows that there are prize valuations under which the proportional strategy profile is not a Nash equilibrium if the elasticity of substitution between prize shares is greater than one. Future research should provide a more complete characterization of Nash equilibria in settings where the elasticity of substitution between prizes is greater than one. The present paper allows different prizes to have different values but assumes that a given prize has the same value to every agent. Future research should consider settings where different agents have different values for the same prize. The present paper assumes that prize shares are equally sensitive to investment levels in each battlefield. Future research should consider settings where different battlefield success functions exhibit different levels of sensitivity.

Notes

Pirnie Bruce et al. (2005) discusses complementarity between air and ground supremacy.

Farris et al. (2014) discusses competition for drivers between ride sharing firms.

Fulgoni and Lipsman (2014) describes complementary users and advertisers.

See Hurwitz and Caves (1988) for more on rent seeking by pharmaceutical firms.

In a Blotto contest, each agent allocates a fixed budget over multiple battlefields.

Under the auction success function, the agent who allocates the most resources to a given battle wins it with certainty.

Under lottery success functions, an agent’s probability of success in a given battle depends on the amount of resources they allocate to it.

An agent with a majoritarian objective aims to maximize the probability that they win a weighted majority of battles.

An agent with a best-shot objective aims to maximize the probability that they win at least one battle.

An agent with a weakest-link objective aims to maximize the probability that they win all battles.

References

Acemoglu D (2002) Directed technical change. Rev Econ Stud 69(4):781–809

Anbarcı N, Cingiz K, Ismail MS (2020) Proportional resource allocation in dynamic n-player blotto games. arXiv preprint arXiv:2010.05087

Borel E (1921) La théorie du jeu et les équations intégralesa noyau symétrique. C R Acad Sci 173(1304–1308):58

Clark DJ, Konrad KA (2007) Asymmetric conflict: weakest link against best shot. J Confl Resolut 51(3):457–469

Clark DJ, Riis C (1998) Contest success functions: an extension. Econ Theory 11(1):201–204

Duffy J, Matros A (2015) Stochastic asymmetric blotto games: some new results. Econ Lett 134:4–8

Farris P, Yemen G, Weiler, V, Ailawadi KL (2014) Uber pricing strategies and marketing communications. Darden case no. UVA-M-0871

Friedman L (1958) Game-theory models in the allocation of advertising expenditures. Oper Res 6(5):699–709

Fulgoni G, Lipsman A (2014) Digital game changers: how social media will help usher in the era of mobile and multi-platform campaign-effectiveness measurement. J Advert Res 54(1):11–16

Hurwitz MA, Caves RE (1988) Persuasion or information? Promotion and the shares of brand name and generic pharmaceuticals. J Law Econ 31(2):299–320

Jin X, Zhou J (2018) Discriminatory power and pure strategy Nash equilibrium in the lottery blotto game. Oper Res Lett 46(4):424–429

Klumpp T, Konrad KA, Solomon A (2019) The dynamics of majoritarian blotto games. Games Econ Behav 117:402–419

Kovenock D, Roberson B (2018) The optimal defense of networks of targets. Econ Inq 56(4):2195–2211

León-Ledesma MA, McAdam P, Willman A (2010) Identifying the elasticity of substitution with biased technical change. Am Econ Rev 100(4):1330–57

Pirnie BR, Vick A, Grissom A, Mueller KP, Orletsky DT (2005) Beyond close air support forging a new air-ground partnership. Rand Corporation, Santa Monica, CA

Roberson B (2006) The colonel blotto game. Econ Theory 29(1):1–24

Sela A, Erez E (2013) Dynamic contests with resource constraints. Soc Choice Welf 41(4):863–882

Uzawa H (1962) Production functions with constant elasticities of substitution. Rev Econ Stud 29(4):291–299

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Proofs

Appendix A: Proofs

Proof of payoff continuity

If \(y_{i}\in \mathbb {R}_{++}^{m}\)then the payoff to agent i is

Since \(c_{i}>0\), \(y_{ib}^{-c_{i}}\) increases without bound as \(y_{ib}\) converges to zero, so the sum \(\sum _{b=1}^{m}v_{b}y_{ib}^{-c_{i}}\) increases without bound as as \(y_{ib}\) converges to zero. Hence \(\pi _{i}\) converges to zero as \(y_{ib}\) converges to zero. \(\square \)

Proof of Proposition 1

Let \(g_{i}\) denote an increasing function of \(\pi _{i}\) given by

Differentiating \(y_{ib}\) with respect to \(x_{ib}\) yields

So differentiating \(g_{i}\) with respect to \(x_{i}\) yields

Since the numerator of (20) is decreasing in \(x_{ib}\) and the denominator is increasing in \(x_{ib}\) we have \(\frac{\partial ^{2}g_{i}}{\partial x_{ib}^{2}}<0\). Since (20) is constant in \(x_{ih}\) for \(h\ne b\), the mixed second order partial derivatives are given by \(\frac{\partial ^{2}g_{i}}{\partial x_{ib}\partial x_{ih}}=0\). Thus the matrix of second order partial derivatives is negative definite, so \(g_{i}\) is strictly concave in \(x_{i}\). Hence \(\pi _{i}\) is strictly quasiconcave in \(x_{i}\) for \(c_{i}>0\) since \(g_{i}\) is a strictly increasing function of \(\pi _{i}\). If \(c_{i}=0\) then the payoff to agent i is given by

Taking the logarithm of both sides obtains

Differentiating with respect to \(x_{ib}\) yields

Thus \(\frac{\partial ^{2}\log \pi _{i}}{\partial x_{ib}^{2}}<0\) and \(\frac{\partial ^{2}\log \pi _{i}}{\partial x_{ib}\partial x_{ih}}=0\) for \(b\ne h\). Hence \(\pi _{i}\) is strictly quasiconcave in \(x_{i}\) for \(c_{i}=0\). \(\square \)

Proof of Proposition 2

Let \(x\in X\) such that \(x_{ib}=0\). Now consider the alternative strategy \(\hat{x}_{i}\in X_{i}\) such that

If \(x_{jb}>0\) for some \(j\ne i\) then \(\pi _{i}\left( x\right) =0<\pi _{i}\left( \hat{x}_{i},x_{-i}\right) \). Alternatively, if \(x_{jb}=0\) for all j then \(\gamma _{bi}\left( x\right) =\mu _{i}/\sum _{j=1}^{n}\mu _{j}<1=y_{ib}\left( \hat{x}_{i},x_{-i}\right) \) for all \(\varepsilon >0\). Since \(x_{jb}=0\) for all \(j\in N\) there exists at least one battlefield \(h\in B\) such that \(x_{jh}>0\) for some \(j\ne i\). Hence the limiting value of \(\gamma _{hi}\left( \hat{x}_{i},x_{-i}\right) \) as \(\varepsilon \) approaches zero from above is given by

Hence \(\pi _{i}\left( \hat{x}_{i},x_{-i}\right) >\pi _{i}\left( x\right) \) for some \(\varepsilon >0\) since \(\pi _{i}\) is continuous over \(y_{i}\in \mathbb {R}_{++}^{m}\). \(\square \)

Proof of Proposition 3

Suppose \(x_{i}\) is a best response for agent i. By proposition 2, \(x_{i}\) must lie in the interior of the strategy set. Since agent i’s payoff is differentiable over the interior of the strategy set we have

By proposition 2 every best response must lie in the interior of the strategy set. By proposition 1 agent i’s payoff \(\pi _{i}\) is strictly quasiconcave over this region. Since the objective function is differentiable in \(x_{i}\) over this region, the first order conditions on \(x_{i}\) are sufficient for maximization. \(\square \)

Proof of Proposition 4

If \(y_{ib}<y_{ik}\) then we have

Hence there exists \(j\ne i\) such that \(y_{jk}<y_{jb}\) and

By proposition 3 the first order conditions on \(x_{i}\) can be written as

If x is a Nash equilibrium then by Eq. (32) we have

But this contradicts Eq. (31). \(\square \)

Proof of Theorem 1

By proposition 4 if x is a Nash equilibrium strategy profile then for every agent i there exists \(\bar{y}_{i}\in \left[ 0,1\right] \) such that for every battlefield b agent i’s share of prize b is \(y_{ib}=\bar{y}_{i}\). Hence by proposition 3 the necessary and sufficient first order conditions on \(x_{i}\) for the maximization of \(\pi _{i}\) are given by

Hence \(x_{ib}v_{k}=x_{ik}v_{b}\) and summing over k obtains \(x_{ib}=w_{i}v_{b}\). \(\square \)

Proof of Proposition 5

By proposition 4 if x is a Nash equilibrium strategy profile then for every agent i there exists \(\bar{y}_{i}\in \left[ 0,1\right] \) such that for every battlefield b agent i’s share of prize b is given by \(y_{ib}=\bar{y}_{i}\). Hence the payoff to agent i can be written as

Now since \(\sum _{b=1}^{m}v_{b}=1\) we have

\(\square \)

Proof of Proposition 6

Let Y denote the set of all \(y\in \mathbb {R}_{+}^{n\times m}\) such that for all battlefields \(b\in B\) the sum of all prize shares is given by \(\sum _{i=1}^{n}y_{ib}=1\). Hence Y includes all feasible outcomes. Let \(g_{i}\) denote a strictly increasing function of \(\pi _{i}\) given by

For \(\theta \in \triangle ^{n-1}\) let \(G_{\theta }\) denote a weighted sum of all \(g_{i}\) given by

Hence \(G_{\theta }\) is increasing in \(\pi _{i}\) for each agent i. Now differentiating \(G_{\theta }\) with respect to \(y_{ib}\) yields \(\frac{\partial G_{\theta }}{\partial y_{ib}}=\frac{\theta _{i}v_{b}}{y_{ib}^{c_{i}+1}}>0\) and twice differentiating \(G_{\theta }\) with respect to \(y_{ib}\) yields \(\frac{\partial ^{2}G_{\theta }}{\partial y_{ib}^{2}}=-\left( c_{i}+1\right) \frac{\theta _{i}v_{b}}{y_{ib}^{c_{i}+2}}<0\). The cross partial derivatives are given by \(\frac{\partial G}{\partial y_{ib}\partial y_{jb}}=0\). Hence \(G_{\theta }\) is strictly concave over \(y_{Nb}=\left( y_{1b},\ldots ,y_{nb}\right) \in \mathbb {R}_{++}^{m}\). The first order conditions on \(y_{Nb}\) for the maximization of \(G_{\theta }\) are given by

Thus if y maximizes \(G_{\theta }\) over Y then the payoff to agent i satisfies \(\pi _{i}=\bar{y}_{i}\). Now if \(y\in Y\) maximizes the total payoff \(\sum _{i=1}^{n}\pi _{ib}\) over Y then it is Pareto efficient over Y, so there exists some \(\theta \in \triangle ^{n-1}\) such that y maximizes \(G_{\theta }\) over Y and the total payoff is given by

\(\square \)

Proof of Proposition 7

Let \(x_{j}\) denote an allocation employed by agent j and suppose that agent i employs the allocation

Then the share of prize b awarded to agent i is given by

Hence the payoff to agent i is given by

Thus by proposition 5 agent i can always obtain at least their unique Nash equilibrium payoff. Now if \(x_{jb}\ne w_{j}v_{b}\) then the strategy given by Eq. (41) does not satisfy the first order conditions for the maximization of agent i’s payoff. Hence it is not a best response by proposition 3, so there exists some alternative strategy that does better. \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Stephenson, D. Multi-battle contests over complementary battlefields. Rev Econ Design (2024). https://doi.org/10.1007/s10058-024-00351-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10058-024-00351-3