Abstract

A production process involves a principal and two privately informed agents. Production requires coordinated decision making. It might be carried in a centralized organization or through delegated contracting in a hierarchical structure. We compare the performance of different organizational structures when renegotiation of initial contracts is possible. We show that delegated contracting always dominates centralization if the downstream contract between the agents is observable. Contracting (resp. control) should be delegated to the agent with the least (resp. most) important information. If downstream contracts are not observable, we obtain a tradeoff between centralization and delegation.

Similar content being viewed by others

Notes

When the decision is decentralized, any attempt by the agent to communicate and renegotiate is equivalent to cheap talk since such communication is not included in the contract. There are then beliefs by the principal that preclude any profitable renegotiation. In a centralized mechanism, communication is verifiable and governed by the contract. Beliefs play no role when communication is on the equilibrium path of the mechanism. Hence, gains to renegotiation are common knowledge, and hence, exploited.

Under our functional form assumptions, these standard assumptions ensure that a solution that satisfies “local” incentive-compatibility constraints is also globally incentive compatible.

If \(\theta _i\) is public, it is easy to show that organizational form is irrelevant.

All proofs are relegated to the “Appendix”.

We explain above why any attempt at communicating or renegotiating this non-linear schedule fails. The endogenous choice of an indirect mechanism (a non-linear schedule) is a means of alleviating costly renegotiation. It is an intrinsic feature of the mechanism rather than an assumption on the possibility of renegotiation.

We formally characterize below conditional second-best efficient outputs.

For example, see Mookherjee and Reichelstein (1992).

Implicitly, we do assume here that the principal can “choose” the highest payoff equilibrium if there were multiple equilibria. Also, a similar argument can be made for partial pooling.

References

Alonso R, Dessein W, Matouschek N (2008) When does coordination require centralization? Am Econ Rev 98:145–179

Beaudry P, Poitevin M (1995) Contract renegotiation: a simple framework and implications for organization theory. Can J Econ 28:302–335

Crémer J (1995) Arm’s length relationships. Q J Econ CX:275–295

Dessein W (2002) Authority and communication in organizations. Rev Econ Stud 69:811–838

Fudenberg D, Tirole J (1991) Game theory. MIT Press, Cambridge

Gibbard A (1973) Manipulation of voting schemes. Econometrica 41:587–601

Green J, Laffont JJ (1977) Characterization of satisfactory mechanisms for the revelation of preferences for public goods. Econometrica 45:427–438

Groves T, Radner R (1972) Allocation of resources in a team. J Econ Theory 4:415–441

Marschak T (1959) Centralization and decentralization in economic organizations. Econometrica 27:399–430

Mas-Colell A, Whinston MD, Green JR (1995) Microeconomic theory. Oxford University Press, Oxford

Melumad ND, Mookherjee D, Reichelstein S (1995) Hierarchical decentralization of incentives contracts. RAND J Econ 26:654–672

Mirrlees JA (1971) An exploration in the theory of optimal income taxation. Rev Econ Stud 38:175–208

Mookherjee D (2006) Decentralization, hierarchies, and incentives: a mechanism design perspective. J Econ Lit XLIV:367–390

Mookherjee D, Reichelstein S (1992) Dominant strategy implementation of bayesian incentive compatible allocation rules. J Econ Theory 56(378–399):36

Mookherjee D, Tsumagari M (2014) Mechanism design with communication constraints. J Polit Econ 122:1094–1129

Myerson RB (1981) Optimal auction design. Math Oper Res 6:58–73

Myerson RB (1982) Optimal coordination mechanisms in generalized principal agent problems. J Math Econ 10:67–81

Poitevin M (2000) Can the theory of incentives explain decentralization? Can J Econ 33:878–906

Radner R (1983) The organization of decentralized information processing. Econometrica 62:1109–1146

Watson J (2007) Contract, mechanism design, and technological detail. Econometrica 75:55–81

Author information

Authors and Affiliations

Corresponding author

Additional information

Michel Poitevin acknowledges financing from SSHRC. We would like to thank a referee and the Editor-in-Chief for valuable and insightful comments.

Appendix

Appendix

Proof of Proposition 1

Beaudry and Poitevin’s (1995) Proposition 5 shows that the renegotiation-proof equilibrium outputs are efficient when there is one agent and the outcome is separating (for the case of private values). It is easy to generalize their proof for two agents when the private information of each agent does not directly enter the payoffs of the other agent and the principal.

We now show that any renegotiation-proof allocation must be separating. Suppose that a mechanism involving some pooling is offered initially to the agents. Consider the subset \({\varvec{\widehat{\Theta }}}\) of types that pool, and suppose that the implemented output for this subset is \(\hat{q}\). Define by \(\theta _i^{\mathrm{min}}\) the lowest type of agent i in \({\varvec{\widehat{\Theta }}}\), and by \(\theta _i^{\mathrm{max}}\) the highest type of agent i.

Suppose first that \(\hat{q}< q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}})\). The principal can then renegotiate to a new pooling mechanism with the implemented output \(q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}})\). Since \(\pi (q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}}),\varvec{\theta })>\pi (\hat{q},\varvec{\theta })\) for all \(\varvec{\theta }\) in \({\varvec{\widehat{\Theta }}}\), she can set transfers w and t such that all types of all agents accept the renegotiation and such that she increases her expected payoffs. A symmetrical argument can be made if \(\hat{q}>q^*(\theta _M^{\mathrm{max}},\theta _R^{\mathrm{min}})\).

Consider now the case where \(q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}})\le \hat{q}< q^*(\theta _M^{\mathrm{max}},\theta _R^{\mathrm{min}})\). The principal can offer a contract with \(q^*(\theta _M^{\mathrm{max}},\theta _R^{\mathrm{min}})\) and transfers w and t such that the contract is only (strictly) profitable to agents \((\theta _M^{\mathrm{max}}\) and \(\theta _R^{\mathrm{min}})\). This can easily be achieved since agent \(\theta _M^{\mathrm{max}}\) is the most profitable agent M and agent \(\theta _R^{\mathrm{min}}\) is the most efficient agent R. All other pooling types would prefer the initial contract with \(\hat{q}\).

Finally, a similar argument can be made if \(q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}})< \hat{q}\le q^*(\theta _M^{\mathrm{max}},\theta _R^{\mathrm{min}})\) with the renegotiation offer now at \(q^*(\theta _M^{\mathrm{min}},\theta _R^{\mathrm{max}})\).

This implies that only separating allocations can be renegotiation-proof. As argued above, the vector of outputs \(\{q^*(\varvec{\theta })\}\) is the implemented renegotiation-proof allocation. \(\square \)

Proof of Lemma 1

On the equilibrium path, agent M reports his true information \(\theta _M\) to the principal, that is, \(\hat{\theta }_M=\theta _M\). Suppose agent M has information \(\tilde{\theta }_M\ne \bar{\theta }_M\) (that is reported truthfully to the principal). Conditional on this true type \(\tilde{\theta }_M\), the implemented allocation must be second-best efficient. If it was not, there would be an opportunity to renegotiate to an allocation that is second-best efficient conditional on \(\tilde{\theta }_M\). Such renegotiation would give the same payoff to agent M but it would eliminate distortions (conditional on \(\tilde{\theta }_M\)). This renegotiation would increase the payoff to the principal conditional on the realization \(\tilde{\theta }_M\). \(\square \)

Proof of Proposition 2

Consider first the downstream contract between the two agents. The downstream contract when contracting is delegated to M is given by:

where \(\tau \) is a function mapping \({\mathbb {R}}_+ \times \Theta _M\) to \(\Theta _R\) such that \(\tau (q^{DM}(\theta _M,\theta _R),\theta _M)=\theta _R\) for every \(\varvec{\theta } \in \varvec{\Theta }\). The transfer w corresponds to a non-linear schedule for remunerating agent R as a function of the output it produces.

We show that this contract is incentive-compatible and ex post individual rational.

R’s ex post payoff is

Maximizing with respect to q yields the following first-order conditions:

This condition is satisfied if \(q=q^{DM}(\theta _M,\theta _R)\). Furthermore, it is always possible to choose the function \(\tau \) such that this solution is a global maximum. Therefore, R has incentive to implement \(q^{DM}(\theta _M,\theta _R)\) when \(\theta _R\) is realized and when its wage is \(w(\theta _M,q)\). It is easy to check that agent R’s participation constraint is satisfied for all \(\theta _M\).

Given this downstream contract, agent M’s interim payoff when revealing truthfully \(\theta _M\) is

This is the incremental gain for M of reporting his true information in expectation over \(\theta _R\). It guarantees that his interim incentive-compatibility constraints hold. With the implemented allocation, agent M’s ex post payoff in any state \(\varvec{\theta }\) is \(E_{\theta _R} \left[ \int _{\underline{\theta }_M}^{\theta _M} \frac{\displaystyle \partial }{\displaystyle \partial \theta _M} B(q^{DM}(x,\theta _R),x)dx \right] \), which is obviously non-negative.

We now argue that these contracts cannot be renegotiated. First, it is easy to show that the downstream contract is not renegotiated. Conditional on the information of the middle agent M, it is interim efficient. Furthermore, it does not require any communication between the two agents because it takes the form of a non-linear schedule. This implies that the contract cannot be successfully renegotiated. A similar argument is made in Beaudry and Poitevin (1995) and Watson (2007).

Second, consider the contract between the middle agent and the principal. Given the downstream contract that is expected to be signed and implemented, the upstream contract is efficient for each type of the middle agent. Because of this, any renegotiation acceptable to one party would not be acceptable to the other party. It therefore cannot be renegotiated.

We now show that any other contract is either dominated or renegotiated. Suppose first that the upstream contract between the middle agent and the principal is pooling on the information of the middle agent. No communication is then required between these two players.

Because the single-crossing property holds, it can be shown that the downstream contract is separating, that is, different types of the middle agent offer different contracts. Furthermore this downstream contract can be implemented without renegotiation using a non-linear schedule. The final allocation is then separating with respect to the downstream agent’s information but pooling along the middle agent’s type.

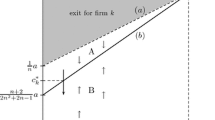

The maximal payoff that the principal can get from a pooling allocation when M is the middle agent and R the downstream one is given by

This payoff is clearly dominated by \(S_F^{DM}\). The principal would therefore offer the contract implementing \({q}^{DM} \).Footnote 12

Consider now any separating contract that implements a production schedule different from \(q^{DM}\). We argue that such contract would be renegotiated or is dominated by the equilibrium contract. Conditional on the truthful revelation of \(\theta _M\), the highest expected surplus that M can achieve by providing R with incentive to truthfully reveal his cost \(\theta _R\) is the solution to \(\left( {\mathcal {P}}_{\tilde{\theta }_M}\right) \):

Any other implemented separating contract either leaves room for renegotiation between agent M and F, or is dominated by the contract implementing \({q}^{DM}\).

This completes the argument that \({q}^{DM}\) is implemented when the downstream contract is observable. \(\square \)

Proof of Proposition 3

Symmetrically, the contracts implemented when contracting is delegated to R are:

where \(\tau '\) is a function mapping \({\mathbb {R}}_+ \times \Theta _R\) to \(\Theta _M\) such that \(\tau '(q^{DR}(\theta _M,\theta _R),\theta _R)=\theta _M\) for every \(\varvec{\theta } \in \varvec{\Theta }\). A similar proof as that above can be used to show that these contracts satisfy incentive compatibility and individual rationality while implementing \(q^{DR}\).

The proof of Proposition 2 can be easily adapted to the case when R is the middle agent. \(\square \)

Proof of Proposition 4

Since the downstream contract is non-observable, it cannot be affected by the contract between the principal and the middle agent. Agent i then offers to agent j a non-linear schedule implementing \({q}^{Di}\). This contract is interim efficient conditional on agent i’s type and cannot be renegotiated.

The contract between agent i and the principal cannot depend on output or the downstream contract. It must therefore be a constant payment. This payment is such that all participation constraints for all non excluded types of agent i are satisfied. It must be equal to the profits in the marginal non excluded state: \(\pi (q^{DM}(\tilde{\theta }_M,\bar{\theta }_R),(\tilde{\theta }_M,\bar{\theta }_R))\) or \(\pi (q^{DR}(\underline{\theta }_M,\tilde{\theta }_R),(\underline{\theta }_M,\tilde{\theta }_R))\). The marginal type \(\tilde{\theta }_i\) maximizes the expected profit for the principal as detailed in the text.

It is clear that these contracts are the unique contracts that can be implemented when the downstream contract is non-observable. \(\square \)

Proof of Proposition 5

First, consider the case where agent M is the middle agent.

Notice that, by definition, for every \(\varvec{\theta } \in \varvec{\Theta }\) and for every \(\theta _M \in \Theta _M\),

Since \(\pi (\cdot ,\varvec{\theta })\) is strictly concave for every \(\varvec{\theta }\), the later inequalities imply \(q^{DM}(\varvec{\theta }) \le q^*(\varvec{\theta })\) for all \(\varvec{\theta } \in \varvec{\Theta }\). Therefore, since \(r_M(.,\theta _M)\) is increasing, we have:

Second, by definition, \({q}^{DM}\) maximizes \(\text{ E }_{\varvec{\theta }}\left[ \pi (q(\varvec{\theta }),\varvec{\theta })-r_R(q(\varvec{\theta }),\theta _R) \right] \). Therefore, since \({q}^{DM}(\varvec{\theta }) \not = \{q^{*}(\varvec{\theta })\}\) and \({q}^{DM}\) is unique, we obtain:

The above inequality combined with (8) leads to \(S^{DM}_F > S^{C}_F\).

The proof for the case where agent R is the middle agent is similar. It is therefore omitted. \(\square \)

Proof of Proposition 7

The inequality in the statement of the proposition follows directly from comparing \(S^{DM}_F\) and \(S^{DR}_F\), and simplifying terms. \(\square \)

Proof of Proposition 8

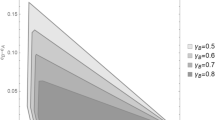

We present here the proof for the case where no types are excluded in both decentralization structures. For the other cases, the expressions are quite complicated and manipulations were performed with Mathematica. They are available from the authors upon request. The basic steps involved showing that both structures yield the same payoff when \(\Delta \theta _M=\Delta \theta _R\); then showing that delegation to M (to R) is preferred if \(\Delta \theta _M> (<)\ \Delta \theta _R\).

Suppose no types are excluded in both decentralization structures. Under Assumption 1,

Therefore,

and,

Straightforward computation shows that \(\bar{S}_F^{DM} \ge \bar{S}_F^{DR}\) leads to \(f_R(\bar{\theta }_R) \ge f_M(\underline{\theta }_M)\). This last condition is equivalent to \(\Delta \theta _M\ge \Delta \theta _R\). \(\square \)

Proof of Proposition 9

See the derivations in the main text. \(\square \)

Rights and permissions

About this article

Cite this article

Ambec, S., Poitevin, M. Decision-making in organizations: when to delegate and whom to delegate. Rev Econ Design 20, 115–143 (2016). https://doi.org/10.1007/s10058-015-0185-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-015-0185-6