Abstract

This paper contributes to the analytical research on the profit implications of delegating production decisions to managers in the context of cost-asymmetric competing firms. We generalize previous studies by relaxing the assumption of product homogeneity. We demonstrate that the interplay between strategic delegation and the degree of product differentiation may lead to the reversal of the classic profit-ranking of Cournot equilibria. We discuss the drivers beyond the pure marginal cost asymmetry, which lead to this reversal: specifically, how the abilities to delegate production decisions and to choose the extent of such delegation further expand the parameter space where the high-cost firm is earning higher equilibrium profits compared to its more efficient rival.

Similar content being viewed by others

Notes

And it stems from the asymmetry in parameters \(b_i\) of the quadratic utility function: \(U\mathit(q\mathit)\mathit\;=\mathit\;a_{\mathit1}q_{\mathit1}\mathit\;+\mathit\;a_{\mathit2}q_{\mathit2}\mathit-\mathit\;(b_{\mathit1}q_{\mathit1}^{\mathit2}+\mathit2\mathit\;\phi\;q_{\mathit1}q_{\mathit2}\mathit\;+\mathit\;b_{\mathit2}q_{\mathit2}^{\mathit2})/2\) which supports this inverse demand function.

The equivalence of price (Bertrand) and quantity (Cournot) competition with delegation has been demonstrated by [9].

Where \(f_L=\frac{c_B\left(4+\gamma_A\left(2-\gamma_B\right)\right)-2(\gamma_A-\gamma_B)}{4+(2-\gamma_A)\gamma_B}\;\mathrm{and}\;f_U=\frac{c_B\left(2+\gamma_A\right)-{(\gamma}_A-\gamma_B)}{2+\gamma_B}\)) are defined in the proof of Proposition 1 in the Appendix.

Indeed, substituting \({\gamma }_{B}={\gamma }_{A}=1\) into the optimal degree of delegation in equilibrium, \({\alpha }_{i}^{D/D}\) (listed in Table 1), and straightforward comparison of these \({\alpha }_{A}^{D/D}\) and \({\alpha }_{B}^{D/D}\) shows that \({\alpha }_{A}^{D/D}<{\alpha }_{B}^{D/D}\)\({c}_{A}<{c}_{B}\) when \({\gamma }_{B}={\gamma }_{A}=1\).

References

Bimpikis K, Ehsani S, İlkılıçc R (2019) Cournot competition in networked markets. Manage Sci 65:2467–2481

Blattberg RC, Wisniewski K (1989) Price-induced patterns of competition. Mark Sci 8:291–309

Chone P, Linnermer L (2020) Linear demand systems for differentiated goods: overview and user’s guide. International Journal of Industrial Organization 73.

Colombo S (2019) Strategic delegation under cost asymmetry revised. Oper Res Lett 47:527–529

Delbono F, Lambertini L, Marattin L (2016) Strategic delegation under cost asymmetry. Oper Res Lett 44:443–445

Farahat A, Perakis G (2011) Comparison of Bertrand and Cournot profits in oligopolies with differentiated products. Oper Res 59:507–513

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. American Economic Review 77:927–940

Häckner J (2000) A note on price and quantity competition in differentiated oligopolies. Journal of Economic Theory 93:233–239

Miller N, Pazgal A (2001) The equivalence of price and quality competition with delegation. RAND Journal of Economics 32:284–301

Pal R (2014) Price and quantity competition in network goods duopoly: a reversal result. Econ Bull 34:1019–1027

Pu X, Jin D, Han G (2017) Effect of overconfidence on Cournot competition in the presence of yield uncertainty. Man and Dec Econ 38:382–393

Sen D, Stamatopoulos G (2015) When an inefficient competitor makes higher profits than its efficient rival. Oper Res Lett 43:148–150

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. The RAND J of Econ 15:546–554

Sklivas S (1987) The strategic choice of managerial incentives. The Rand J of Econ 18:452–458

Symeonidis G (2003) Comparing Cournot and Bertrand equilibria in a differentiated duopoly with product R&D. Int J Ind Organ 21:39–55

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147

Wang Y, Niu B, Guo P (2012) On the advantage of quantity leadership when outsourcing production to a competitive contract manufacturer. Prod and Oper Man 22:104–119

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Appendix

Appendix

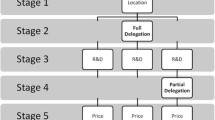

To prove proposition 1 and 2, we need to calculate the results in Table 1. By using backward induction, we solve the manager’s profit maximization problem first. The manager’s profit is \({M}_{i}=\left({p}_{i}-{\alpha }_{i}{c}_{i}\right){q}_{i}=\left(1-{{q}_{i}-\gamma }_{i}{q}_{-i}-{\alpha }_{i}{c}_{i}\right){q}_{i}\). If \({\alpha }_{i}=1,\) then the manager is not allowed to delegate otherwise s/he can delegate. To maximize the manager’s profits we take the derivative of their profit function \({M}_{i}({q}_{i},{q}_{i})\) with respect to \({q}_{i}\), simultaneously solve two FOCs, and obtain the optimal order quantities: \({q}_{i}^{*}({\alpha }_{A},{\alpha }_{B})=\frac{2-2{\alpha }_{i}{c}_{i}-{\gamma }_{i}+{\alpha }_{-i}{c}_{-i}{\gamma }_{i}}{4-{\gamma }_{A}{\gamma }_{B}}\). Next, we substitute \({q}_{i}^{*}({\alpha }_{A},{\alpha }_{B})\) into the firms’ profit functions \({\Pi }_{i}=\left({p}_{i}-{c}_{i}\right){q}_{i}\), which results in the following expression:

Subgame \(({\varvec{D}},{\varvec{D}})\)

If both firms delegate, then the firm’s profit maximization problem is \(\underset{{\mathrm{\alpha }}_{\mathrm{i}}\in (\mathrm{0,1})}{\mathrm{max}}{\Pi }_{i}^{*}\), and the profit maximizing degree of delegation \({\alpha }_{i}^{D/D}\) is listed in Table 1. By substituting \({\alpha }_{i}^{D/D}\) into \({q}_{i}^{*}({\alpha }_{A},{\alpha }_{B})\) and \({\Pi }_{i}^{*}\left({\alpha }_{A},{\alpha }_{B}\right),\) we obtain the corresponding optimal quantities \({q}_{i}^{D/D}\) and profits \({\Pi }_{i}^{D/D}\), also listed in Table 1.

Note that parameters \({c}_{i}\) and \({\gamma }_{i}\) must belong to a certain subset of parameter space, denoted the feasibility region\({F}^{D/D}\), to ensure that optimal prices and quantities are positive in this subgame (\({q}_{i}^{D/D}>0 ,{p}_{i}^{D/D}>0)\). The inequalities defining \({F}^{D/D}\) are lengthy but are available from the authors upon request.

Subgame \(\left({\varvec{N}}{\varvec{D}},{\varvec{D}}\right)\) or \(({\varvec{D}},{\varvec{N}}{\varvec{D}})\)

If one firm delegates and the other does not then \({\alpha }_{i}\in (\mathrm{0,1})\) and \({\alpha }_{-i}=1\). Let us focus on \((ND,D)\) with \({\alpha }_{A}=1,{\alpha }_{B}\in (\mathrm{0,1})\) (the derivations for subgame \((ND,D)\) are similar). The optimal degree of delegation, \({\alpha }_{B}^{ND/D}\), which solves \(\underset{{\alpha }_{B}\in (\mathrm{0,1})}{\mathrm{max}}{\Pi }_{B}\), is listed in Table 1 along with corresponding optimal quantities \({q}_{i}^{ND/D}\) and profits \({\Pi }_{i}^{ND/D}\). The feasibility region for parameters \({c}_{i}\) and \({\gamma }_{i}\) (resulting in positive prices and quantities in this subgame) denoted \({F}^{ND/D}({F}^{D/ND})\) (available upon request).

Subgame \(\left({\varvec{N}}{\varvec{D}},{\varvec{N}}{\varvec{D}}\right)\)

If neither firm delegates, then \({\alpha }_{A}={\alpha }_{B}=1,\) and the corresponding optimal production quantities \({q}_{i}^{ND/ND}\) and profits \({\Pi }_{i}^{ND/ND}\) are listed in Table 1. The set of feasible parameter values in this subgame is denoted \({F}^{ND/ND}\).

Subgame Perfect Nash Equilibrium

It is straightforward to see that (1) \({\Pi }_{A}^{ND/ND}<{\Pi }_{A}^{D/ND}\), and therefore subgame (ND,ND) is never an equilibrium; (2) \({\Pi }_{A}^{D/D}>{\Pi }_{A}^{ND/D}\) and \({\Pi }_{B}^{D/D}>{\Pi }_{B}^{D/ND}\), and therefore the subgame (D,D) is the unique SPNE. Throughout the paper, we focus on the feasible set of cost parameters: \({c}_{i}\in F={\cap }_{j\in \{D/D,ND/ND,D/ND,ND/D\}}{F}^{j}\).

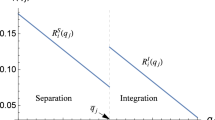

-

Proof of Proposition 1: Using the profit expressions presented in Table 1, we find that\(({\Pi }_{A}^{ND/ND}\ge {\Pi }_{B}^{ND/ND}\) and \({\Pi }_{A}^{D/D}\le {\Pi }_{B}^{D/D})\) \(\mathrm{\acute{o} } (\frac{{c}_{B}\left(4+{\gamma }_{A}\left(2-{\gamma }_{B}\right)\right)-2\left({\gamma }_{A}-{\gamma }_{B}\right)}{4+\left(2-{\gamma }_{A}\right){\gamma }_{B}}\le {c}_{A}\le \frac{{c}_{B}\left(2+{\gamma }_{A}\right)+{\gamma }_{B}-{\gamma }_{A}}{2+{\gamma }_{B}})\). Denote \({f}_{L}\left({c}_{B}\right)=\frac{{c}_{B}\left(4+{\gamma }_{A}\left(2-{\gamma }_{B}\right)\right)-2\left({\gamma }_{A}-{\gamma }_{B}\right)}{4+\left(2-{\gamma }_{A}\right){\gamma }_{B}}\mathrm{ and }{f}_{U}\left({c}_{B}\right)=\frac{{c}_{B}\left(2+{\gamma }_{A}\right)+{\gamma }_{B}-{\gamma }_{A}}{2+{\gamma }_{B}}\) ∎

-

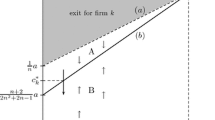

Proof of Proposition 2: Using the profit expressions presented in Table 1, we find that \({(\Pi }_{A}^{ND/ND}\le {\Pi }_{B}^{ND/ND})\)\(\left({c}_{B}-{c}_{A}\le {\frac{\left(1-{\mathrm{c}}_{\mathrm{A}}\right)\left({\upgamma }_{\mathrm{A}}-{\upgamma }_{\mathrm{B}}\right)}{2+{\upgamma }_{\mathrm{A}}}=G}^{ND/ND}\left({\gamma }_{A},{\gamma }_{B},{c}_{A}\right)\right);\)

-

(\({\Pi }_{A}^{D/D}\le {\Pi }_{B}^{D/D}\))\(\left({c}_{B}-{c}_{A}\le \frac{2\left(1-{\mathrm{c}}_{\mathrm{A}}\right)\left({\upgamma }_{\mathrm{A}}-{\upgamma }_{\mathrm{B}}\right)}{4+{\upgamma }_{\mathrm{A}}\left(2-{\upgamma }_{\mathrm{B}}\right)}{=G}^{D/D}\left({\gamma }_{A},{\gamma }_{B},{c}_{A}\right)\right).\)

-

A straightforward comparison demonstrates that \({G}^{D/D}\left({\gamma }_{A},{\gamma }_{B},{c}_{A}\right)\ge {G}^{ND/ND}({\gamma }_{A},{\gamma }_{B},{c}_{A})\). ∎

-

Proof of Proposition 3: Using the degree of delegation expressions presented in Table 1, it is straightforward to demonstrate that

-

(a) \({\alpha }_{B}^{D/D}<{\alpha }_{A}^{D/D}\)\(\gamma_{B} < \frac{{2c_{B} \left( {2 - \left( {1 - c_{B} } \right)\gamma_{A} } \right) - 4c_{A} }}{{2c_{A}^{2} + c_{B} \gamma_{A} - c_{A} \left( {2 + \gamma_{A} } \right)}}\), and.

-

(b)\({c}_{B}{\alpha }_{B}^{D/D}<{c}_{A}{\alpha }_{A}^{D/D }\)\(c_{B} < c_{A} + \frac{{\left( {1 - c_{A} } \right)\left( {\gamma_{A} - \gamma_{B} } \right)\gamma_{A} \gamma_{B} }}{{8 - 4\gamma_{A} \gamma_{B} + \gamma_{A}^{2} \gamma_{B} }}\).∎

-

-

Proof of Lemma 1: Using the profit expressions presented in Table 1, we find that.

-

(1)

\({\Pi }_{B}^{D/D}\le {\Pi }_{B}^\frac{ND}{ND}\) always holds; and

-

(2)

\(\begin{array}{l}{(\Pi}_A^{D/D}\geq\Pi_A^{ND/ND})\;\Leftrightarrow c_B-c_A>\left(1-c_A\right)\left[{(\gamma}_A-2\right)\left(\left(4-\gamma_A\gamma_B\right)^2-4\gamma_A\gamma_B\right)+\\\sqrt{4-2\gamma_A\gamma_B}(\left(4-\gamma_A\gamma_B\right)^2-2\gamma_A(4-\gamma_A\gamma_B)\rbrack/\lbrack\gamma_A(\left(4-\gamma_A\gamma_B\right)^2-\\4\gamma_A\gamma_B-2\sqrt{4-2\gamma_A\gamma_B}({4-\gamma}_A\gamma_B))\rbrack\end{array}\) ∎

-

(1)

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cohen-Vernik, D.A., Yang, L. & Pazgal, A. Strategic Delegation with Differentiated Products. Cust. Need. and Solut. 9, 66–73 (2022). https://doi.org/10.1007/s40547-022-00130-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40547-022-00130-7