Abstract

Conventional emission permit markets are inefficient for non-uniformly mixed pollutants that create geographic ‘hot spots’ of different ambient emission concentrations and environmental damage. Economically efficient ambient concentration contribution markets involve difficult interactions among multiple markets that makes them practically infeasible. Extending economic theory by Muller and Mendelsohn (Am Econ Rev 99(5):1714–1739, 2009. doi:10.1257/aer.99.5.1714) and others about ‘getting the prices right’ through bilateral trading ratios, this paper introduces theoretical simplifications and a novel type of single permit market with a hybrid price-quantity instrument that addresses the dual heterogeneity of firm-specific abatement costs and regional variation in damage. This paper shows how to ‘get the market right’ robustly through simplicity, liquidity, and gradualism. Analytic solutions and simulation results demonstrate the feasibility of the novel market concept. Also discussed is the potential applicability of the market design to interstate trading in the United States in the wake of the recently implemented Cross-State Air Pollution Rule.

Similar content being viewed by others

Notes

Trading costs, combined with market and regulatory uncertainty, may reduce the efficiency of permit trading systems. Montero (1997) shows that these frictions can have a non-negligible impact on abatement outcomes: trade volume decreases, and total compliance cost increases. In the context of the RECLAIM market in the Los Angeles basin, Gangadharan (2000) finds that a variety of transaction costs reduce the probability of trading in the RECLAIM market in 1995 by 32 %. Transaction costs for permit trading systems consist of a variety of specific costs, which in turn are driven by particular economic factors (Egenhofer 2003). Search costs, the cost of matching buyer and seller, are greatly reduced through organized exchanges, but crucially depend on the liquidity and transparency of the market. Negotiation costs arise from contracting and standardization of contracts through permit exchanges. These depend on the clarity of the property rights assigned by the contracts. Monitoring costs arise through verification of compliance, but are typically borne by the regulator. Similarly, enforcement costs arise in the case of non-compliance when the regulator needs to enforce compliance or fine violators. For individual firms there are also information costs for monitoring permit markets. Firms may also incur insurance costs to allow for the technical risk of accidental non-compliance.

The term ‘hazard factor’ could be understood as a damage premium or damage discount and is the same as the ‘trading ratios’ in Muller and Mendelsohn (2009). With n firms, arbitrage (consistency) conditions enforce that the \(n(n-1)\) bilateral trading ratios are in fact just \(n-1\) relative prices.

I prefer using the term ‘hazard’ instead of ‘damage.’ Damage, by definition, describes harm or injury that has occurred already. Hazard, by contrast, describes the chance of being injured or harmed; the damage need not have occurred yet. Thus, hazard describes the exposure or vulnerability to harm or injury (i.e., the damage potential) and is perhaps a more inclusive term than ‘damage.’

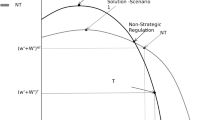

The underlying structure of the model is quadratic in emission concentrations, that is \(\sum _j A_j^2\). In a linear model inter-regional trade-offs between regions i and j would be \(\partial A_j/\partial A_i=-1\), suggesting that reducing emission concentrations in a ‘benign’ region i while letting them increase in a ‘hot spot’ j by the same amount would leave total hazard unchanged. By comparison, with a quadratic function the inter-regional trade-off is \(\partial A_j/\partial A_i=-A_i/A_j\). This means that to keep total hazard unchanged, an increase in ambient concentrations in ‘benign’ region i would only offset a smaller ambient concentration increase in ‘hot spot’ j to leave total hazard unchanged. As j is a ‘hot spot’ and thus \(A_i<A_j\), the ratio \(A_i/A_j<1\). Earlier work on emission hot spots often posits a constrained optimization problem so that \(\forall j{:} A_j\le \bar{A}\). This set-up rules out any inter-regional trade-offs and implies \(\partial A_j/\partial A_i=\infty \), a very strong Rawlsian view of the world. Contrastingly, the weighted quadratic loss function used here reflects a utilitarian approach.

The emission permit market with hazard factors \(\phi _i\) entails two limiting cases. First, setting \(\phi _i=1\) replicates a conventional cap-and-trade market. This is a useful benchmark against which one can compare the benefits of introducing plant-specific hazard factors. This limiting case is also approached when the number of regions drops to \(m=1\), which implies that the world is a single ‘hot spot.’

This simplification rules out quantity adjustment in response to environmental price signals. This is a useful and plausible approximation when abatement costs play only a small part in the overall cost structure of a firm.

The practice of equivalency factors is well established for greenhouse gases, where emissions are expressed in carbon dioxide equivalency units.

There are two additional contributing factors for the drop in prices. On the market side, demand for coal being was replaced increasingly by demand for inexpensive natural gas. Furthermore, induced by the high emission prices, more and more power plants have installed flue gas desulfurization and selective catalytic reduction equipment to reduce \(\hbox {SO}_{2}\) and \(\hbox {NO}_{\rm x}\).

The US Clean Air Act contains a “good neighbour” provision under which each State Implementation Plan (SIP) must prohibit emissions that will significantly contribute to non-attainment of National Ambient Air Quality Standards (NAAQS) in a downwind state.

Technically, the Environmental Protection Agency (EPA) sets a pollution cap in each states covered by CSAPR. Power plants are bound by the state-wide cap, allowing for unlimited intra-state trading. Inter-state permit trading is permitted but cannot be used to meet state-level emission caps. See Federal Register 77(113), pp. 34830–34846, June 12, 2012 (http://www.gpo.gov/fdsys/pkg/FR-2012-06-12/pdf/2012-14251).

Group 1 sources can only trade with group 1 sources; group 2 sources can only trade with group 2 sources. Group 1 contains 16 northeastern and central states, and group 2 contains 6 mostly southeastern states.

In July 2015 the US Court of Appeals for the District Court of Columbia Circuit ruled that the EPA must reconsider the 2014 Budgets for \(\hbox {SO}_{2}\) and Ozone \(\hbox {NO}_{x}\) in several states because they required the states to reduce emissions beyond the points necessary to achieve air quality improvements in downwind areas.

References

Akao K, Managi S (2013) A tradable permit system in an intertemporal economy: a general equilibrium approach. Environ Resour Econ 55(3):309–336. doi:10.1007/s10640-012-9628-5

Antweiler W (2003) How effective is green regulatory threat? Am Econ Rev 93(2):436–441. doi:10.1257/000282803321947489

Atkinson SE, Tietenberg TH (1982) The empirical properties of two classes of designs for transferable discharge permits. J Environ Econ Manag 9(2):101–121. doi:10.1016/0095-0696(82)90016-X

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, Cambridge

Bennear LS, Stavins RN (2007) Second-best theory and the use of multiple policy instruments. Environ Resour Econ 37(1):111–129. doi:10.1007/s10640-007-9110-y

Bonacich P (1972) Factoring and weighting approaches to status scores and clique identification. J Math Sociol 3:113–120. doi:10.1080/0022250X.1972.9989806

Burtraw D (2013) The institutional blind spot in environmental economics. Dædalus 142(1):110–118. doi:10.1162/DAED_a_00188

Cronshaw MB, Kruse JB (1996) Regulated firms in pollution permit markets with banking. J Regul Econ 9(2):179–189

Egenhofer C (2003) The compatibility of the kyoto mechanisms with traditional environmental instruments. In: Carraro C, Egenhofer C (eds) Firms, governments and climate policy: incentive-based policies for long-term climate change. Edward Elgar, Cheltenham, pp 17–82 chap 1

Farrow RS, Schultz MT, Celikkol P, Van Houtven GL (2005) Pollution trading in water quality limited areas: use of benefits assessment and cost-effective trading ratios. Land Econ 81(2):191–205. doi:10.3368/le.81.2.191

Fowlie M, Muller N (2013) Market-based emissions regulation when damages vary across sources: what are the gains from differentiation?, NBER Working Paper 18801

Fowlie M, Reguant M, Ryan SP (2010) Pollution permits and the evolution of market structure, working Paper, Massachusetts Institute of Technology

Fowlie M, Reguant M, Ryan SP (2015) Market-based emissions regulation and industry dynamics. J Polit Econ 123 (forthcoming)

Førsund FR, Nævdal E (1998) Efficiency gains under exchange-rate emission trading. Environ Resour Econ 12(4):403–423. doi:10.1023/A:1008247511950

Gangadharan L (2000) Transaction costs in pollution markets: an empirical study. Land Econ 76(4):601–614. doi:10.2307/3146955

Goodkind A, Coggins JS, Marshal JD (2014) A spatial model of air pollution: the impact of the concentration-response function. J Assoc Environ Resour Econ 1:451–479. doi:10.1086/678985

Hoel DG, Portier CJ (1994) Nonlinearity of dose–response functions for carcinogenicity. Environ Health Perspect 102(Suppl 1):109–113

Holland SP, Yates AJ (2015) Optimal trading ratios for pollution permit markets. J Public Econ 125:16–27. doi:10.1016/j.jpubeco.2015.03.005

Hung MF, Shaw D (2005) A trading-ratio system for trading water pollution discharge permits. J Environ Econ Manag 49(1):83–102. doi:10.1016/j.jeem.2004.03.005

Jackson MO (2008) Social and economic networks. Princeton University Press, Princeton, NJ

Konishi Y, Coggins JS, Wang B (2015) Water quality trading: can we get the prices of pollution right? Water Resour Res 51(5):3126–3144. doi:10.1002/2014WR015560

Krysiak FC, Schweitzer P (2010) The optimal size of a permit market. J Environ Econ Manag 60(2):133–143. doi:10.1016/j.jeem.2010.05.001

Lee TC, Chen HC, Liu SM (2013) Optimal strategic regulations in international emissions trading under imperfect competition. Environ Econ Policy Stud 15(1):39–57. doi:10.1007/s10018-012-0033-7

Montero JP (1997) Marketable pollution permits with uncertainty and transaction costs. Resour Energy Econ 20(1):27–50. doi:10.1016/S0928-7655(97)00010-9

Montgomery DW (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5(3):395–418. doi:10.1016/0022-0531(72)90049-X

Muller NZ, Mendelsohn R (2009) Efficient pollution regulation: getting the prices right. Am Econ Rev 99(5):1714–1739. doi:10.1257/aer.99.5.1714

Newell R, Pizer W, Zhang J (2005) Managing permit markets to stabilize prices. Environ Resour Econ 31(2):133–157. doi:10.1007/s10640-005-1761-y

Rindi B (2008) Informed traders as liquidity providers: anonymity, liquidity, and price formation. Rev Finance 12(3):497–532. doi:10.1093/rof/rfm023

Roberts MJ, Spence M (1976) Effluent charges and licenses under uncertainty. J Public Econ 5(3–4):193–208

Rubin JD (1996) A model of intertemporal emission trading, banking, and borrowing. J Environ Econ Manag 31(3):269–286. doi:10.1006/jeem.1996.0044

Schennach SM (2000) The economics of pollution permit banking in the contect of title IV of the 1990 Clean Air Act Amendments. J Environ Econ Manag 40(3):189–210. doi:10.1016/0022-0531(72)90049-X

Schmalensee R, Stavins RN (2012) The \(\text{ SO }_{2}\) allowance trading system: The ironic history of a grand policy experiment. Tech. rep., MIT Center for Energy and Environmental Policy Research, CEEPR WP 2012-012

Schmalensee R, Stavins RN (2013) The SO\(_2\) allowance trading system: the ironic history of a grand policy experiment. J Econ Perspect 27(1):103–122. doi:10.1257/jep.27.1.103

Siikamäki J, Burtraw D, Maher J, Munninge C (2012) The U.S. Environmental Protection Agency’s Acid Rain Program. Tech. rep., Resources for the Future

Theissen E (2003) Trader anonymity, price formation, and liquidity. Rev Finance 7(1):1–26. doi:10.1023/A:1022579423978

Tietenberg TH (2006) Emissions trading: principles and practice, 2nd edn. RFF Press, Washington, DC

Tietenberg TH, Grubb M, Michaelowa A, Swift B, Zhang Z (1999) International rules for greenhouse gas emissions trading: defining the principles, modalities, rules and guidelines for verification, reporting and accountability. UNCTAD, Geneva

US-EPA (2004) EPA’s risk-screening environmental indicators (RSEI) chronic human health methodology, version 2.1.2, Appendix A. Tech. rep., United States Environmental Protection Agency. URL http://www.epa.gov/opptintr/rsei/pubs/

Welker M (1995) Disclosure policy, information asymmetry, and liquidity in equity markets. Contemp Account Res 11(2):801–827. doi:10.1111/j.1911-3846.1995.tb00467.x

Yap D, Reid N, de Brou G, Bloxam R (2005) Transboundary air pollution in Ontario. Tech. rep., Ontario Ministry of the Environment

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has benefited greatly from presentations at the University of British Columbia, the University of Kiel, the University of Cologne, York University, the University of Maryland, as well as presentations at the Canadian Economics Association conference, and the Canadian Resource and Environmental Economics study group meeting in 2012. I am grateful to all the audiences and individuals who have provided feedback and comments.

Appendices

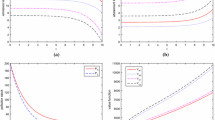

Appendix 1: Quasi-linear optimization

This paper makes use of a novel approach to solve the problem of optimizing a non-linear policy objective function. There is a class of policy problems that are characterized by (a) a policy objective function that is non-linear (e.g., a dose–response function); (b) a macro-economic policy instrument (e.g., a country-wide emission cap) and a set of corresponding micro-economic policy instruments (e.g., firm-level price factors); (c) additive separability of the micro-economic instruments; (d) monotonicity of the effect of the macro-economic variable with respect to the objective function; and (e) the ability to use the macro-economic policy instrument to drive a gradual adjustment process over time. The “quasi-linear optimization” approach introduced in this paper replaces a complex non-linear optimization problem (which yields an optimal solution in a single step) with an equivalent quasi-linear optimization problem that is much easier to solve, but only through gradual convergence to the optimum over time. Specifically, consider the problem of minimizing the single-valued quadratic objective function

where \({{\mathbf {x}}}=(x_1,\ldots ,x_n)\) is a vector of n micro-economic policy instruments that satisfy \(\partial ^2 F/\partial x_i\partial x_j=0\), z is a macro-economic policy instrument that satisfies \(\partial F/\partial z<0\) for any \(z>z^*\), and \(\alpha \) is a scaling parameter. Many non-linear policy problems can be approximated reasonably well as quadratic functions, at least near the optimal solution. Solving the system of first-order conditions

and

yields the optimal policy \(({{\mathbf {x}}}^*,z^*)\). However, this system of \(n+1\) equations in \(n+1\) unknowns can be very difficult to solve. Even though the partial derivatives may only depend on \(x_i\) separately, the appearance of \(f({{\mathbf {x}}},z)\) interacts the \(x_i\) in each equation with all other \(x_{j\ne i}\).

Quasi-linear optimization involves minimizing the objective function

gradually over time t. Objective function \(\tilde{F}\) approximates F when \(|z_t-z_{t-1}|\) is small. In each period t, the n first-order conditions \(\partial f_i/\partial x_{t,i}=0\) deliver a set of micro-economic policies \({{\mathbf {x}}}^*_t\) that are optimal in that time period conditional on the choice of macro-economic policy \(z_t\) that is governed exogenously. Because of the independence of the micro-economic policy instruments, these n first-order equations can be solved individually for the optimal policy \(x^*_{i,t}\) at time t. Note that \(f({{\mathbf {x}}}_{t-1},z_{t-1})\) is simply a scalar evaluated in the previous time period. The policy maker gradually reduces \(z_t\) over time, starting from the initial policy-less state \(z_0\). Decreasing \(z_t\) in small steps, the optimization procedure stops when decreasing \(z_t\) yields no further reduction in \(\tilde{F}({{\mathbf {x}}}^*_t,z_t)\), i.e., when \(\partial \tilde{F}({{\mathbf {x}}}^*,z)/\partial z=0\).

Appendix 2: Pollution-plant centrality

The regulator’s main function in overseeing the permit market is to announce new \(\phi _{i,t}=Q_{i,t}/\bar{Q}_{i,t}\) at the beginning of each trading period t, based on measurements from the previous period. As ambient concentrations \(A_j\) depend on contributions from all plants, the hazard summation factor \(Q_{i,t}\) can be written as

Emissions from other plants affect plant i through the network of dispersion coefficients \(d_{ij}\). Firms are interconnected participants in the permit market where actions by one firm such as increasing or decreasing emissions may influence neighbouring plants by raising or lowering their particular hazard factor \(\phi _i\).

It is possible to capture the degree of interconnectedness through empirical measures of centrality. Such measures are widely used in the theory of social and economic networks (Jackson 2008), and they are also used in applications such as Google’s web page ranking. In matrix notation, \({{\mathbf {Q}}}=\omega ^2 {{\mathbf {D}}} {{\mathbf {P}}} {{{\mathbf {D}}}}^{{{\mathsf {T}}}} {{\mathbf {E}}}\), where \({{\mathbf {Q}}}\) and \({{\mathbf {E}}}\) are \(n\times 1\) vectors of each plant’s (non-normalized) hazard factor and emission level, \({{\mathbf {D}}}\) is an \(n\times m\) matrix of dispersion coefficients, \({{\mathbf {P}}}\) is an \(m\times m\) diagonal matrix with region factors \(P_j\), and the \({}^{{{\mathsf {T}}}}\) superscript indicates the matrix transpose. \({{\mathbf {S}}}\equiv {{\mathbf {D}}} {{\mathbf {P}}} {{{\mathbf {D}}}}^{{{\mathsf {T}}}}\) is a symmetric \(n \times n\) matrix that captures the inter-firm influences weighted by \({{\mathbf {P}}}\). Matrix \({{\mathbf {S}}}\) can be normalized through the transformation \({{\mathbf {U}}}\equiv {{\mathbf {R}}}{{\mathbf {S}}}{{\mathbf {R}}}-{{\mathbf {I}}}\) where \({{\mathbf {R}}}=[{{\rm diag}}({{\mathbf {S}}})]^{-1/2}\) and \({{\mathbf {I}}}\) is the identity matrix; this transformation is the same procedure that is used to compute a Pearson correlation matrix from a variance-covariance matrix. Thus, all elements in matrix \({{\mathbf {U}}}\) identify the relative impact of one plant on another, scaled to the range [0, 1[. Subtracting \({{\mathbf {I}}}\) ensures that the diagonal elements in \({{\mathbf {U}}}\) are all zero, as is required for adjacency matrices that are used to analyze networks.

The influence of an individual plant in the emission market network can be captured by eigenvector centrality, originally proposed by Bonacich (1972). The largest eigenvalue \(\bar{\lambda }\) that solves the eigenvector equation \({{\mathbf {U}}}{{\mathbf {v}}}=\lambda {{\mathbf {v}}}\) is associated with the principal eigenvector \(\bar{{{\mathbf {v}}}}\), which can be obtained numerically through power iteration even for very large matrices. The centrality measure can be suitably disaggregated into plants with zero or postive centrality. For the \(n^{+}\le n\) firms with positive centrality, rescaling makes the measures easier to interpret. Let \(\chi _i\equiv (\bar{v}_i/\sum _k \bar{v}_k)/(1/n^{+})\) denote plant centrality with an average of 1. Values larger than 1 indicate above-average centrality, and values below 1 indicae below-average centrality.

The plant-specific hazard factors \(\phi _i\) will be strongly rank-correlated with the centrality measures \(\chi _i\). The firm centrality measure is useful in the context of spatially interacting plants because it readily identifies which plants affect their neighbours more, and which less. For example, a centrality measure of \(\chi _i=1.5\) suggests that plant i has 50 % stronger influence on neighbouring plants than the average plant. By comparison, a plant with \(\chi _i=0.5\) is much less spatially connected, influencing other firms 50 % less than average. Plants that are far from any other plants have a \(\chi _i\) equal or close to zero.

About this article

Cite this article

Antweiler, W. Emission trading for air pollution hot spots: getting the permit market right. Environ Econ Policy Stud 19, 35–58 (2017). https://doi.org/10.1007/s10018-015-0138-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-015-0138-x