Abstract

In various sectors, such as retail, firms encounter customers with multiunit demand and often implement nonlinear pricing to accommodate this demand structure. While effective, this pricing strategy lacks the adaptability offered by dynamic pricing, a trend gaining significance in the retail landscape due to technological advancements. Neglecting multiunit demand in dynamic pricing, however, can result in suboptimal prices and revenue losses. In response, this paper introduces multiunit dynamic pricing which integrates the strengths of both nonlinear and dynamic pricing strategies. We formulate a stage-wise optimization problem, considering customer preferences for batches of a product through a model based on random willingness-to-pay. The willingness-to-pay is influenced by a combination of the customer’s attraction to and consumption of the product—both private information. The firm, functioning as a monopoly, has the ability to price-discriminate between various order sizes by quoting nonlinear batch prices. Our investigation explores three cases of observable information: attraction to the product, consumption of the product, or both. Optimality conditions are derived for all cases, establishing a closed-form expressions for two of them. Additionally, we demonstrate the preservation of desirable monotonicity in time and capacity. Leveraging this monotonicity, we showcase the dynamics of the optimal pricing policy. A simulation study underscores the potential of our approach, highlighting the value of information in supporting strategic decisions, particularly regarding investments in customer profiling and segmentation. Furthermore, we illustrate how our solutions enable firms to make informed stocking and restocking decisions, providing practical insights for firms in multiunit dynamic pricing environments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nonlinear pricing has been a widespread practice in many industries, particularly in retail, for quite some time. The objective of this pricing strategy is to increase overall demand by tempting customers to buy more. Examples of nonlinear pricing include special offers such as “buy 3, pay 2” or “take an additional item, get 25% off,” as well as volume discounts where customers pay lower unit prices for purchasing more units.

Dynamic pricing, on the other hand, is a relatively new field but its significance has been growing in recent years, particularly with the emergence of e-commerce and digital price tags in physical stores. With the capability of quickly adjusting prices, dynamic pricing has had a significant impact on various industries such as travel, hospitality, entertainment, electricity, and retail. Through e-commerce platforms and loyalty cards, sellers have access to more information about a customer’s purchasing behavior which, combined with the ability to adjust prices, can significantly influence a seller’s earnings.

Standard dynamic pricing assumes that customers will buy only one unit at a time. While this assumption may be reasonable in some cases (such as car rental or hotel rooms), it is not applicable in many other situations, such as for most grocery and fashion products. Neglecting the possibility to influence customers’ purchase quantity can lead to suboptimal prices and lost revenue in these cases. To fully leverage the revenue potential in such fields, a combination of nonlinear and dynamic pricing is highly desirable.

This paper addresses precisely such a scenario by introducing nonlinear prices in a multiunit dynamic pricing setting. Here, customers are assumed to have multiunit demand and the product is available for purchase in all batch sizes, ranging from a single unit to the entirety of the remaining stock. The purchase quantity is influenced by a nonlinear pricing scheme, deviating from the traditional approach of quoting a single unit price with batch prices derived from multiplying batch size by unit price. The objective is to dynamically quote batch prices for a single product to maximize expected revenue. The selling horizon and product inventory are limited, and after prices are quoted for each batch size, customers purchase one of these batches or nothing at all.

Our model assumes customers hold an undisclosed willingness-to-pay for each batch size, optimizing their utility by choosing the batch size with the greatest surplus over the quoted price. To capture this, we use a two-parameter approach—integrating a base willingness-to-pay reflecting interest and a consumption indicator signaling diminishing marginal appreciation. Both parameters are modeled as random variables. Additionally, we explore scenarios where the firm gains insight into the next customer’s choice parameters, observing their base willingness-to-pay, consumption indicator, or both before quoting batch prices. This mirrors practices in personalized online pricing, profiling logged-in customers based on purchase history. For non-logged-in customers, technologies like applets and cookies facilitate customer profiling [see e.g., Raghu et al. (2001)].

We contribute to the multiunit dynamic pricing literature through a stochastic dynamic optimization model. This model quotes batch prices, influencing random customer demand to maximize expected revenue. We consider various types of observable information about customer choice parameters, adapting the model for each type and solving it analytically. Our study reveals key properties of the value function and optimal batch prices. Notably, we prove the monotonicity of expected revenues with respect to capacity and time, in the context of multiunit purchases. This property aligns with an intuitive understanding of pricing dynamics relative to product scarcity. Importantly, the monotonicity in capacity ensures a unique optimal solution in our stage-wise optimization.

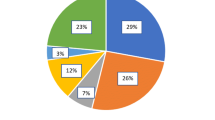

In our simulation study, we examine the value of information by comparing the three types of observation. Additionally, we consider a scenario where the firm lacks the ability to observe customers’ choice parameters. For this situation, Schur (2023) proposed a heuristic solution mechanism, which we briefly explain and apply. Furthermore, we assess the impact of distribution on expected revenues, assuming both uniform and normal distributions. In another study, we relax the assumption of precise customer information observation. Instead, we allow the firm to accurately assign customers to predefined segments, narrowing down the distribution of corresponding random variables. Lastly, we introduce an additional layer of decision-making: stocking and restocking.

The implications of our work can be summarized as follows:

-

When the firm accurately observes one or both of customers’ choice parameters, our models offer optimal batch prices for every state in the selling horizon. Moreover, knowing the optimal expected revenue for every stocking level enables the firm to make optimal stocking and restocking decision.

-

Understanding the value of information allows firms to evaluate the profitability of potential investments in customer profiling or segmenting, contributing to strategic decision-making in the ever-evolving landscape of dynamic pricing.

-

Our value function serves as an upper bound in restricted pricing scenarios, aiding firms in assessing potential revenue losses from pricing structure limitations (e.g., linear price with volume discounts like “3 for 2”).

-

In settings where customer parameters are unobservable, our findings offer valuable structural insights. These insights can serve as the foundation for effective heuristics, ranging from simple business rules (e.g., “additional units at a 10% discount”) to more sophisticated strategies (refer to Schur 2023).

This paper is organized as follows: In Sect. 2, we give a short overview of existing literature connected to multiunit dynamic pricing. We then present the setting, the customer choice as well as a general optimization model in Sect. 3. In Sect. 4, we present three adjustments to the general model to deal with three types of observations regarding customer choice parameters. In Sect. 5, we conduct our simulation study.

2 Literature review

In this paper, we extend dynamic pricing with nonlinear pricing. Accordingly, we start by shortly reviewing literature from both streams, nonlinear pricing and dynamic pricing. Thereafter, we focus on research belonging to multiunit or multiproduct dynamic pricing. The first category also covers the (scarce) literature on nonlinear dynamic pricing (as nonlinear pricing requires multiunit demand). The second category is primarily related to our setting because of the applied customer choice models where customer choose one of several options.

Nonlinear pricing is an often-applied pricing scheme that can be found in many industries including e.g. telecommunications, transportation, energy, supply chains, and retail. This broadness results in a diverse body of literature and is addressed by Wilson (1993) by giving an overview of application, substantial economics and marketing. Most nonlinear pricing research from the economics literature considers only static pricing. This can be observed in the review articles of Stole (2007) and Armstrong (2016) where only a small portion of covered literature assumes a dynamic environment. This literature commonly assumes these dynamics stem from competing firms and lock-in effects of recurring customers. More relevant to our setting is literature that focus on a dynamic environment stemming from dynamic demand [e.g., Dhebar and Oren (1986), and Braden and Oren (1994)]. However, different to our setting, this research does not consider a product with limited stock which is one of the core assumptions in most of dynamic pricing literature [cf., e.g., Talluri and van Ryzin (2004, Chapter 5) and Phillips (2005, Chapter 10)].

In the following, we turn our attention on dynamic pricing of a product with limited stock, finite selling horizon, and customer choice behavior. One of the first to consider such a setting were Gallego and van Ryzin (1994) who showed that the optimal price increases with remaining time and decreases with remaining stock. Their work laid the foundation for dynamic pricing as an emerging discipline in revenue management, which, during that period, was predominantly influenced by capacity control. Afterwards, dynamic pricing gained a lot of attention by researchers. They often focused on finding optimality conditions and showing monotonic behavior in time and capacity. This research was summarized by several review articles [e.g., Bitran and Caldentey (2003), Chiang et al. (2007), and, with a special focus, Gönsch et al. (2013) and den Boer (2015)] as well as textbooks [e.g. Talluri and van Ryzin (2004, Chapter 5) and Phillips (2005, Chapter 10)].

By dropping the common assumption that customers purchase at most one unit of a product, a new stream in the dynamic pricing community was born. Multiunit dynamic pricing considers multiunit demand, which, in turn, is the basis for combining nonlinear and dynamic pricing. An early publication in this stream is Elmaghraby et al. (2008) where the optimal design of a markdown pricing mechanism in the presence of multiunit demand was analyzed. They assume a full information setting meaning that the firm knows at the beginning of the selling horizon every customer and the respective willingness-to-pay values. This setting aligns to one of the three scenarios in our study (refer to Sect. 4.3). In this scenario, we assume full information availability regarding the current customer. In contrast, the other two scenarios (outlined in Sects. 4.1 and 4.2) involve customer decisions based on private information, rendering them unpredictable in advance. Furthermore, future revenues remain uncertain across all scenarios. Thereby, we acknowledge that firms typically cannot accurately predict specific customer streams or their purchasing behavior with absolute certainty. Levin et al. (2014) introduce a dynamic pricing model with stochastic batch demand. They assume customers have a certain batch size they want to purchase and request exactly and only this batch size from the firm. The firm then quotes a price and customers either buy the batch or leave the shop without purchasing anything. The authors show optimality conditions and prove monotonic properties of optimal policy and value function. However, their setting does not accommodate nonlinear pricing as customers exhibit inflexibility in their purchase quantities (such as a family buying flight tickets for their vacation), rendering firms unable to influence these quantities through the application of appropriate nonlinear batch prices. In our study, we presume customers to be flexible concerning batch sizes, as is common in retail scenarios. Instead of specifying a particular batch size, customers observe quoted nonlinear prices for various batch sizes and select the one that maximizes their utility. This flexibility introduces complexity to the optimization model, as firms must decide on several prices simultaneously while anticipating a broader range of potential customer reactions.

There are currently only two other research articles that consider stochastic flexible multiunit demand that can be influenced by nonlinear dynamic pricing: Gallego et al. (2020) and Schur (2023). Gallego et al. (2020) consider three dynamic pricing models: nonlinear, linear, and block pricing. They consider utility maximization choice models where customers are characterized by one single parameter. This parameter cannot be observed by the firm and is modeled as random variable. The authors give optimality conditions for their nonlinear dynamic pricing model and show structural properties like the monotonicity in time and inventory. Their work is related to this paper in the following way: Our scenarios where a firm can observe one of two choice parameters is an extension to a special case of their nonlinear pricing model. The key distinction in our approach lies in our customer choice model, where customers are characterized by two parameters: one reflecting the product’s attractiveness and another indicating the inclination to purchase multiple units. This allows for nuanced variations among customers. For instance, a parent may value diapers more than a childless individual, and a family might be more prone to buying several packs of toilet paper compared to someone living alone. Schur (2023) considers the same customer choice model as we do, but without the possibility to (partially) observe customers’ private information. In the absence of such information, the optimization model becomes analytically intractable, leading Schur (2023) to develop three heuristics. These heuristics, utilizing fluid approximation, are designed to be asymptotically optimal. In our setting, where we assume partial observation of current customer information, we encounter distinct yet related optimization problems that can be solved to optimality (numerically). Additionally, we demonstrate that the well-known monotonicity in time and inventory persists in our scenario. Lastly, our simulation study explores the value of knowing customers’ private information, contributing to the understanding of the situational and contextual value of different types of information.

Multiproduct dynamic pricing is another field in the domain of dynamic pricing that emerged more and more in recent years [see for a review, e.g., Chen and Chen (2015)]. By defining batches of a single product as several different products, we can draw a parallel between multiproduct and multiunit dynamic pricing. In multiproduct dynamic pricing the products often are substitutes and an upcoming customer can pick at most one of these products. Customers’ demand is stochastic and the firm is facing a finite selling horizon with scarce product-dependent inventory [see, e.g., Zhang and Cooper (2009), Dong et al. (2009), and Akçay et al. (2010)]. The main difference between multiunit (i.e., our work) and these multiproduct dynamic pricing models is the inventory structure. Whereas every product has its own inventory in multiproduct dynamic pricing, every batch (“product”) exploits the same inventory (but in another quantity) in multiunit dynamic pricing. One exception to the product-specific inventory setting is Maglaras and Meissner (2006). They analyze a setting where every product consumes one unit of the same resource. This assumption leads to different pricing dynamics when compared to our setting, where each product has varying resource consumption based on batch size. Consequently, in our context, each batch price reacts differently to changes in dynamic scarcity, unlike their setting where all products equally respond to the dynamic scarcity of the common resource. Maglaras and Meissner (2006) show that dynamic pricing and capacity control can be reduced to a common formulation. Instead of concentrating on dynamic pricing or capacity control, the firm finds optimal decisions by controlling the consumption rate of every product regarding resource capacity.

In our literature review, it becomes evident that research on nonlinear dynamic pricing is exceptionally limited, with only two notable exceptions: Gallego et al. (2020) and Schur (2023). However, these works have distinctive characteristics that set them apart. Gallego et al. (2020) focuses on a model where customer behavior is characterized by a single (random) parameter, whereas our approach involves two (random) parameters. This enables us to capture a more individualized customer choice behavior and introduces additional uncertainty into the optimization problem. On the contrary, Schur (2023) employ the same customer choice model as we do. However, different from our setting, they cannot observe customers’ private information. With these observations, we (numerically) solve the optimization model to optimality and determine the value of information in a simulation study. Notably, other works in the field diverge significantly in at least one critical assumption, leading them to analyze distinct settings. In many cases, these works do not consider customers with flexible multiunit demand, and consequently, do not explore the application of nonlinear pricing schemes to influence stochastic purchase quantities.

3 Problem definition

After introducing general setting and notation in Sect. 3.1, we present the customer choice model in Sect. 3.2. Building on this, we finally introduce the optimization model in Sect. 3.3.

3.1 General setting and notation

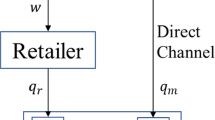

We introduce the following framework to combine nonlinear and dynamic pricing: A monopolistic firm sells a single product with fixed stock \(C\) over a finite selling horizon with \(T\) periods. The selling horizon is indexed backwards in time, i.e., periods \(T\) and \(0\) mark the beginning and the end, respectively. We assume that exactly one customer arrives in each period \(t = T, T-1, \dots , 1\) and is interested in buying one or more units of the product depending on the batch prices the firm is quoting. The capacity of the product is nonreplenishable and any capacity left at the end of the selling horizon (\(t=0\)) is worthless to the firm. At any point in time \(t\), the firm decides on batch prices \({\varvec{r}}={\left({r}_{1}, {r}_{2}, \dots , {r}_{c}\right)}^{T}\) based on remaining capacity \(c\le C\) and expectations of future demand. Thereby, the remaining capacity \(c\) defines the maximal possible batch size \(j\) that could be offered. Each \({r}_{j}\) represents the price a customer must pay for a batch of \(j\) units. The firm’s goal is to set the prices that maximize overall revenue, taking into account future demand and customer behavior. Arriving customers react on quoted batch prices and decide on the batch size to purchase, with \({p}_{j}\left({\varvec{r}}\right)\) denoting the probability that an arriving customer chooses to buy \(j\) units. In this case, the firm immediately earns \({r}_{j}\) in revenue and product’s capacity is lowered by \(j\). Throughout the remainder of this paper, to simplify our notation, we adopt the convention that \({r}_{0}=0\).

3.2 Customer choice model

In our setting, customers face several options (i.e., batch sizes, including also a batch of zero) and pick exactly one of these. We assume that customers have a personal (unknown to the firm) evaluation for each option and this evaluation can be expressed monetarily via customers’ willingness-to-pay. The utility, representing the difference between customers’ willingness-to-pay and the price, determines the choice, with customers opting for the option that yields the highest utility. This model is commonly employed in economic and pricing literature as it captures customers heterogeneity regarding their preferences (via personal willingness-to-pay) and firm’s influence on customers’ decision (via price). Moreover, it relies on a sound theoretical groundwork, as it aligns with economic principles and the rationale that individuals make decisions based on perceived value and cost considerations. Specifically, if customers face multiple options rather than a binary decision (such as purchasing or not), this model is often applied [see, e.g., Braden and Oren (1994) with their nonlinear (static) pricing setting, and Akçay et al. (2010) with their multiproduct dynamic pricing setting].

Customers’ willingness-to-pay \({X}_{j}\) for a batch of size \(j\) is private information and unknown to the firm. This makes \({X}_{j}\) a random variable and a proper model is needed to reflect customers’ preferences. In literature, a common assumption is that marginal willingness-to-pay, i.e., \({X}_{j+1}-{X}_{j}\), is non-negative and decreasing [see, e.g., Baucells and Sarin (2007), Goldman et al. (1984), Iyengar and Jedidi (2012), and Gallego et al. (2020)]. This assumption translates to: “An additional unit is never bad, but it is less appreciated than the previous one.” There are several methods to model random willingness-to-pay in settings where customers buy in batches. The model we apply is based on a formulation of Iyengar and Jedidi (2012) and was also applied by Schur (2023). Iyengar and Jedidi (2012) introduce a willingness-to-pay function that depends on known parameters. Uncertainty regarding customers’ behavior is then added with the help of an error term. Schur (2023) adapt this willingness-to-pay function. However, instead of using known parameters and adding randomness via an error term, the parameters itself are assumed to be private information, and thus, depicted by random variables. We follow the latter approach and define the willingness-to-pay \(X_{j}\) for a batch size of \(j\) by:

with independent continuous random variables \(\omega\) and \(\lambda\). We denote the corresponding density functions by \({f}_{\omega }\) and \({f}_{\lambda }\). Likewise, the cumulative distribution functions are given by \({F}_{\omega }\) and \({F}_{\lambda }\). We assume the support of both density functions is \(\left[0, 1\right]\). Furthermore, we make an assumption regarding the continuous failure rates of both random variables, \(\omega\) and \(\lambda\), defined over the interval \(\left(0, 1\right]\) by \({h}_{\omega }\left(x\right)=\frac{{f}_{\omega }\left(x\right)}{1-{F}_{\omega }\left(x\right)}\) and \({h}_{\lambda }\left(x\right)=\frac{{f}_{\lambda }\left(x\right)}{1-{F}_{\lambda }\left(x\right)}\), respectively. We assume that these failure rates are increasing in \(x\). This assumption ensures the existence of a unique solution to our optimization problem, as evidenced by the proof of Propositions 1 and 5. This is consistent with common practices in the standard literature, as random variables with increasing failure rates have an increasing generalized failure rate [see Lariviere (2006)]. It aligns with one of the three standard assumptions mentioned in Ziya et al. (2004). Furthermore, it is compatible with numerous probability distributions, including but not limited to the uniform, triangular, normal, exponential, Weibull, Gumbel, gamma distributions, and their truncated variants (some of them with restrictions regarding parameter choice) [see Banciu and Mirchandani (2013)].

By restricting \(\lambda\) on \(\left[0, 1\right]\), we assure that marginal willingness-to-pay, i.e., \({X}_{j+1}-{X}_{j}=\omega \cdot {\lambda }^{j}\), is non-negative and decreases in quantity \(j\) (given \(\omega \ge 0\)). Thereby, this model covers the common assumption regarding customers’ preferences that was stated earlier in this section. Restricting \(\omega\) on \(\left[0, 1\right]\) is only a matter of scaling and normalizes marginal willingness-to-pay. The interpretation of the random variables, \(\omega\) and \(\lambda\), is the following: As \(\omega\) equals \({X}_{1}=\omega \cdot \sum_{k=0}^{0}{\left(\lambda \right)}^{k}=\omega\) and influences \({X}_{j}=\omega \cdot \left(\sum_{k=0}^{j-1}{\left(\lambda \right)}^{k}\right)\), \(j\ge 2\), in a linear manner, we can interpret it as attractiveness of the product to the customer. We call this parameter base willingness-to-pay. In contrast, the consumption indicator \(\lambda\) has no influence on \({X}_{1}=\omega\), but depicts the rate at which marginal willingness-to-pay is diminishing in \(j\). This can be observed by \({X}_{j+1}-{X}_{j}=\omega \cdot {\lambda }^{j}=\lambda \cdot \left(\omega \cdot {\lambda }^{j-1}\right)=\lambda \cdot \left({X}_{j}-{X}_{j-1}\right)\). We can interpret \(\lambda\) as customers’ willingness to stockpile or consume.

The following figure provides an illustrative representation of willingness-to-pay curves for three specific customers, each characterized by unique realizations of random variables \(\omega\) and \(\lambda\), denoted as \(w\) and \(l\), respectively.

In this example, customer 1 (dashed line) shares the same base willingness-to-pay (\(w=0.8\)) with customer 2 (dotted line), and the same consumption indicator (\(l=0.8\)) with customer 3 (solid line). Consequently, customers 1 and 2 exhibit identical willingness-to-pay values for a batch size of 1, implying they have a similar valuation of the product. However, a notable distinction arises when we examine the curves further. While the solid curve steadily increases until \(j=10\), the dotted curve reaches a relatively constant level at \(j=4\). This divergence stems from the fact that customer 1, with a consumption indicator twice as high, is significantly more interested in purchasing larger batches compared to customer 2.

Comparing customer 1 and 3, we observe that the solid line consistently falls exactly between the dashed line and zero. This is a direct consequence of both customers having the same consumption indicator, but with customer 3 having only half the base willingness-to-pay of customer 1. As a result, customer 1 is willing to pay twice as much as customer 3, indicating a substantially higher appreciation for the product.

From a theoretical perspective, if the firm were given the choice among the three customers, it would naturally prefer to serve customer 1, as it can charge the highest prices for each batch size. However, when deciding between customer 2 and 3, the choice is less clear-cut. When facing a stock shortage, serving customer 2 might be preferable, while in situations with ample stock availability, customer 3 could be the better option.

Briefly leaving the example behind us allows for the definition of customers’ utility. The utility \({u}_{j}\left({\varvec{r}}\right)\) for purchasing \(j\) units is the difference between their willingness-to-pay \(X_{j}\) and price \(r_{j}\):

Customers act rational and choose the option that yields the highest utility. Thus, they purchase \(j\) units if and only if \({u}_{j}\left({\varvec{r}}\right)=\underset{j=0, \dots ,c}{{\text{max}}}\left\{{u}_{j}\left({\varvec{r}}\right)\right\}\) with \({u}_{0}\left({\varvec{r}}\right)=0\) denoting the no-purchase option.

Resuming the previous example (Fig. 1), we introduce an arbitrary price vector (as shown by the red line in Fig. 2, left side). It’s important to highlight that while we use a linear pricing scheme in this particular illustration, our model is not restricted to linear pricing and explicitly accommodates non-linear pricing structures. The application of Eq. (2) results in the generation of three distinct utility curves (depicted in Fig. 2, right side), one for each customer.

Example of Fig. 1 with added price curve (left) and resulting utilities (right)

Upon close examination, we can observe that customer 1 (dashed line) has maximal utility at \(j=3\), customer 2 (dotted line) at \(j=1\), and customer 3 (solid line) at \(j=0\). In a scenario where these three customers collectively constitute the entire market and each customer’s arrival is equally likely, the firm would have the following probabilities of selling units with this price vector: \(0\) units, \(1\) unit, or \(3\) units, each with a probability of \(\frac{1}{3}\).

Given our assumption that \(\omega\) and \(\lambda\) are continuous random variables, we find ourselves in a realm with an infinite number of willingness-to-pay curves, each representing a specific customer. In this expansive landscape, it is impractical to individually assess every customer to pinpoint where their maximum utility lies, as we did in the example. Instead, when presented with a specific price vector \({\varvec{r}}\), we want to determine which utility curves, described as combinations of \(w\) and \(l\), have their maximum at batch size \(j\). In essence, for any given \(j\), we seek all \(\left(w, l\right)\) pairs for which \({u}_{j}\left({\varvec{r}}\right)=\underset{j=0, \dots ,c}{{\text{max}}}\left\{{u}_{j}\left({\varvec{r}}\right)\right\}\). According to Eq. (2), this condition holds for all \(\left( {w, l} \right)\) that satisfy:

To compute the probability that the next utility curve we encounter attains its maximum at \(j\), we must calculate the probability that \(\left(w, l\right)\) meets these conditions. This can be achieved using the density functions \({f}_{\omega }\) and \({f}_{\lambda }\) in combination with an indicator function \({1}_{\left\{{u}_{j}\left({\varvec{r}}\right)=\underset{j=0, \dots ,c}{{\text{max}}}\left\{{u}_{j}\left({\varvec{r}}\right)\right\}\right\}}\left(w,l\right)\). This indicator function equals \(1\) when the condition is met and \(0\) otherwise. Notably, this probability is technically equivalent to the probability \(p_{j} \left( {\varvec{r}} \right)\) of selling \(j\) units for a given price \({\varvec{r}}\) and we can express it as:

3.3 Dynamic programming formulation

A firm maximizes expected revenue over the whole selling horizon by solving a dynamic optimization problem. Thereby, it searches for the optimal batch prices \({r}_{j}\), \(1\le j\le c\), to offer at every time \(t\) with remaining capacity \(c\). The maximal number of purchasable units equals the remaining capacity in every state \(\left(t, c\right)\). To take the varying character of remaining capacity into account, we define a state-dependent action space \({\mathcal{R}}_{c}=\left\{{\varvec{r}}\in {\mathbb{R}}^{c}: {r}_{j}\ge 0, j=1, \dots ,c\right\}\) with \({\mathcal{R}}_{0}=\varnothing\). Action space \({\mathcal{R}}_{c}\) defines the set of feasible solutions to our maximization problem. By taking the remaining capacity \(c\) into account, it makes sure that only available batch sizes \(j\le c\) are offered. The dynamic problem is given by:

where \({V}_{t}\left(c\right)\) denotes the optimal expected revenue-to-go from period \(t\) onwards with remaining capacity \(c\). The boundary conditions are \({V}_{0}\left(c\right)=0\) for \(c\ge 0\) and \({V}_{t}\left(0\right)=0\) for \(t\ge 0\).

In every state, one out of \(c+1\) random events occurs: A customer purchases \(0\le j\le c\) units at a price of \({r}_{j}\) with probability \({p}_{j}\left({\varvec{r}}\right)\). Additionally, the firm can expect future revenues from remaining capacity \(c-j\) and time \(t-1\). We denote the optimal batch prices selected in a state \(\left(t,c\right)\) by \({{\varvec{r}}}_{t}\left(c\right)\in {\mathcal{R}}_{c}\).

An alternative formulation of (5) focuses on opportunity costs regarding selling \(j\) units, i.e.

and is given by

Thus, the goal to maximize expected revenues can be achieved by maximizing additional revenue gains that are realized by selling up to \(c\) units in period \(t\) instead of retaining the capacity for later customers. This formulation offers several advantages over (5). The first and most apparent advantage is the immediate insight that optimal prices should surpass opportunity costs. Failing to do so would result in no gain in expected revenue by selling, or worse, it could even lead to a net loss in overall expected revenue. Another advantage becomes evident in later sections as we establish key properties based on formulation (7). These properties are crucial in our pursuit to find the optimal solution of our optimization problem. Lastly, it underscores the significance of opportunity costs, which constitute the sole state-dependent component and are the primary driver behind the dynamic changes in optimal prices over time.

4 Different types of observable information

In this section, we consider different degrees of observability regarding next customer’s private information, i.e. base willingness-to-pay \(\omega\) and consumption indicator \(\lambda\). In three subsections, we assume that the firm knows at customer’s arrival the exact value of base willingness-to-pay, consumption indicator, or both parameters, respectively. Each of these subsections shows the adapted problem formulation, structural properties, and optimal solution (or at least a sufficient condition for optimality).

4.1 Observable base willingness-to-pay

We now consider the case where a firm can observe the base willingness-to-pay of the next customer in line, i.e. the realization \(w\) of random variable \(\omega\) becomes known at the moment the firm decides upon the next batch prices. Consumption indicator \(\lambda\) remains stochastic. Thereby, we eliminate some but not all of uncertainty regarding customers’ behavior.

4.1.1 Customer choice and model formulation

Selling at least one unit of the product is now a deterministic occurrence. Notably, for \({r}_{1}<w\), we know for certain that a customer has a higher utility for purchasing one unit than for purchasing nothing at all (\({u}_{1}\left({\varvec{r}}\right)=w-{r}_{1}\) is deterministic and positive). However, we still face uncertainty regarding the precise number of units purchased, as we do not know if there are \({u}_{j}\left({\varvec{r}}\right)\) values exceeding \({u}_{1}\left({\varvec{r}}\right)\).

A customer is indifferent between purchasing zero and one unit of the product when \({r}_{1}=w\). As a tiebreaker, a firm could quote a price that is slightly above or below \(w\) (\({w}^{+}\) and \({w}^{-}\), respectively), depending on which outcome would be more suitable. Taking these two strategies explicitly into account would result in increased complexity of notation without adding to understandability. In most instances, a firm prefers customers to purchase at price \(w\). Consequently, we will assume \(w\) to act as \({w}^{-}\) without further mention. However, there are situations where the firm may not want to sell at \(w\) (e.g., if \(w\) is too low). In such cases, we will explicitly indicate that the firm employs \({w}^{+}\). Moreover, we ignore the case where a customer might have \(w=0\). This case almost surely does not occur (recall that \(\omega\) is continuously distributed), and even if it were to occur, it would have no impact. For a customer with a willingness-to-pay of zero for every batch size (as per Eq. (1)), there would be no price at which the customer desires to buy while the firm wishes to sell simultaneously. Consequently, the optimal solution in this case would be not to sell anything to that customer.

Observing realization \(w\) has the advantage that we can formulate necessary conditions for a customer to purchase \(j\) units:

-

(a)

\(\sum_{k=0}^{j-1}{\lambda }^{k}\ge \frac{{r}_{j}}{w}\),

-

(b)

\(\sum_{k=i}^{j-1}{\lambda }^{k}\ge \frac{{r}_{j}-{r}_{i}}{w}\) for all \(i\in \left\{1, 2, \dots , j-1\right\}\), and

-

(c)

\(\sum_{k=j}^{i-1}{\lambda }^{k}\le \frac{{r}_{i}-{r}_{j}}{w}\) for all \(i\in \left\{j+1, j+2, \dots , c\right\}\).

Conditions (a)–(c) arise from (3) with \(\lambda\) instead of \(l\) and by separating all known variables, i.e., decision variable \({\varvec{r}}\) and realization \(w\), from random variable \(\lambda\). These conditions ensure that purchasing \(j\) units yields at least the same utility for customers as purchasing nothing (condition (a)), purchasing less than \(j\) units (condition (b)), and purchasing more than \(j\) units (condition (c)).

Based on these conditions, there are several ways to eliminate demand for \(j\) units:

-

Picking batch price \({r}_{j}>j\cdot w\) makes it impossible to fulfill condition (a) for any \(\lambda \in \left[\mathrm{0,1}\right]\).

-

If \({r}_{j}>{r}_{i}\) for any \(i>j\), then there is no \(\lambda \in \left[\mathrm{0,1}\right]\) that satisfies condition (c).

-

Picking \({r}_{j}\) such that \({\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}>1\) makes it impossible to fulfill condition (b) for any \(\lambda \in \left[\mathrm{0,1}\right]\).

-

With batch prices \({r}_{j-1}\), \({r}_{j}\), and \({r}_{j+1}\) such that \({\left(\frac{{r}_{j+1}-{r}_{j}}{w}\right)}^\frac{1}{j}<{\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\), there is no \(\lambda \in \left[\mathrm{0,1}\right]\) such that \({\lambda }^{j-1}\ge \frac{{r}_{j}-{r}_{j-1}}{w}\) and \({\lambda }^{j}\le \frac{{r}_{j+1}-{r}_{j}}{w}\) simultaneously (conditions (b) and (c) with \(i=j-1\) and \(i=j+1\), respectively).

In a scenario characterized by limited capacity, it becomes crucial to possess the capability to eliminate demand for any batch size \(j\). There are two primary reasons why we seek this capability: firstly, we might encounter a situation where our capacity \(c\) is insufficient to fulfill an order of \(j\) units (i.e., \(c<j\)), and secondly, it may be more financially advantageous to reserve capacity for potential future customers. The latter circumstance arises when we are currently serving a customer with an exceptionally low willingness-to-pay, which is indicated by an exceedingly low value of \(w\). We can establish a formal criterion for \(w\) being too low by referring to Eq. (7). This equation reveals that \({r}_{j}\) should exceed \({\Delta }_{j}{V}_{t-1}\left(c\right)\) to increase overall expected revenue. The maximum possible willingness-to-pay for \(j\) units by a customer is given by \(j\cdot w\) (as per Eq. (1) with \(\lambda =1\)). When dealing with a customer whose \(w\) falls below \(\frac{{\Delta }_{j}{V}_{t-1}\left(c\right)}{j}\), there is no viable way to sell \(j\) units without incurring a loss in overall expected revenue. In such cases, the firm’s preference is not to sell \(j\) units to this customer, and we must ensure that at least one \({\varvec{r}}\) is feasible such that \({p}_{j}\left({\varvec{r}}\right)=0\).

Referring back to the previous points, we have ascertained that there exist numerous potential choices of \({r}_{j}\) to eliminate demand for \(j\) units. Given that the primary goal of these \({r}_{j}\) is to abstain from selling, it becomes immaterial which specific \({r}_{j}\) is employed for this purpose. These observations prompt us to exclude the majority, though not all, of these alternatives from the action space \({\mathcal{R}}_{c}\). In the ensuing lemma, we define a refined action space that assumes a crucial role in this section. This set is denoted as \({\mathcal{R}}_{c}\left(w\right)\) and its elements are referred to as relevant prices, as we have removed only those prices deemed irrelevant.

Lemma 1

Relevant prices \({\varvec{r}}\) are given by

Proof

Firstly, it is essential to recognize that the definition of \({\mathcal{R}}_{c}\left(w\right)\) is derived exclusively by excluding any price vector that satisfies one of the conditions outlined in the bullet points above. Specifically, the first and third bullet points correspond to \({r}_{1}\le {w}^{+}\) and \({\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\le 1\), the second to \(0\le {r}_{1}\) and \(0\le {\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\), and the fourth to \({\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\le {\left(\frac{{r}_{j+1}-{r}_{j}}{w}\right)}^\frac{1}{j}\).

The fundamental concept behind this proof is straightforward: We show that for any excluded price vector, there exists a price vector \({\varvec{r}}\in {\mathcal{R}}_{c}\left(w\right)\) that results in the same customer decisions and earned revenues. W.l.o.g., let us assume that an excluded price vector satisfies any of the bullet points for some \(j\) (if there are multiple instances, we iteratively apply the following steps). The implication is that demand for \(j\) units is eliminated. By substituting a certain value for \({r}_{j}\), we can ensure that demand for \(j\) units is still eliminated, while the resulting price vector belongs to \({\mathcal{R}}_{c}\left(w\right)\). Considering the bullet points mentioned earlier, we want to shortly discuss what happens if we replace the inequality of these conditions with equality: Thereby, there is at most one \(\lambda \in \left[\mathrm{0,1}\right]\) such that conditions (a) to (c) are fulfilled. As we assume \(\lambda\) to be a continuously distributed random variable, the probability of \(\lambda\) being exactly this value is zero. Thus, we can eliminate demand almost surely by choosing \({r}_{j}\) such that \({r}_{j}=j\cdot w\) (first bullet point with “\(=\)”), \({r}_{j}={r}_{i}\) (second bullet point with “\(=\)”), \({\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}=1\) (third bullet point with “\(=\)”), or \({\left(\frac{{r}_{j+1}-{r}_{j}}{w}\right)}^\frac{1}{j}={\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\) (fourth bullet point with “\(=\)”). Please note that the definition of \({\mathcal{R}}_{c}\left(w\right)\) always covers at least one of these four alternatives. This is sufficient for the purpose of maximizing expected revenue, and we can exclude all the cases mentioned in the bullet points without limiting possibilities for our optimization problem. □

In Eq. (1), we can observe that \({\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\) represents the lowest realization \(l\in \left[\mathrm{0,1}\right]\), for which a customer has nonnegative marginal utility when purchasing the \(j\)th unit (\(j\ge 2\)): \({u}_{j}\left({\varvec{r}}\right)-{u}_{j-1}\left({\varvec{r}}\right)=\left({X}_{j}-{r}_{j}\right)-\left({X}_{j-1}-{r}_{j-1}\right)=\left({X}_{j}-{X}_{j-1}\right)-\left({r}_{j}-{r}_{j-1}\right)=w\cdot {\lambda }^{j-1}-\left({r}_{j}-{r}_{j-1}\right)\ge 0\iff \lambda \ge {\left(\frac{{r}_{j}-{r}_{j-1}}{w}\right)}^{\frac{1}{j-1}}\). This threshold is crucial, and we define

Let us discuss the implication of this threshold in a short example: Assume we are dealing with a customer with a specific observable base willingness-to-pay (e.g., \(w=0.8\)) and an unobservable consumption indicator \(\lambda\) with realizations \(l\in \left[0, 1\right]\). The firm quotes an arbitrary price vector \({\varvec{r}}\) with \({\varvec{r}}\in {\mathcal{R}}_{c}\left(w\right)\) (e.g., the same price vector as depicted in Fig. 2). Now, we can calculate for every batch size \(j\) the marginal utility \({u}_{j}\left({\varvec{r}}\right)-{u}_{j-1}\left({\varvec{r}}\right)\). As the marginal utility depends on random variable \(\lambda\), we portray it as function of every possible realization \(l\in \left[0, 1\right]\), i.e., \(l \mapsto w \cdot l^{j - 1} - \left( {r_{j} - r_{j - 1} } \right)\). To provide a clear illustration in Fig. 3, we only show the marginal utilities for \(j\le 3\).

The marginal utility for the first unit is positive for all \(l\in \left[0, 1\right]\). Therefore, in this example, every customer with \(w=0.8\) prefers purchasing one unit over purchasing nothing at all. The marginal utility for the second and third unit becomes positive at \({\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\) and \({\underline{l}}_{3}\left({r}_{3}-{r}_{2}\right)\), respectively. Customers with \(l\ge {\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\) and \(l\ge {\underline{l}}_{3}\left({r}_{3}-{r}_{2}\right)\) can increase their utility by purchasing the second and third unit, respectively. We can now partition the interval \(\left[0, 1\right]\) into \(\left[0, {\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\right]\), \(\left[{\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right), {\underline{l}}_{3}\left({r}_{3}-{r}_{2}\right)\right]\), and \(\left[{\underline{l}}_{3}\left({r}_{3}-{r}_{2}\right), 1\right]\). Customers with \(l={\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right)\) almost surely do not arrive (remember, \(\lambda\) is continuously distributed). Thus, it is irrelevant which of the adjacent intervals contains them. For presentation purposes, we decided to include them in both and work with closed intervals. Customers belonging to the first interval (based on their personal \(l\)) have positive marginal utility for purchasing one unit. They also have negative marginal utility for purchasing the second and third unit. Consequently, these customers attain their maximal utility by purchasing one unit. Analogously, customers belonging to the second and third interval decide to purchase two and three units, respectively.

We can generalize these considerations and partition \(\left[0, 1\right]\) into \(\left[0, {\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\right]\), \(\left[{\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right), {\underline{l}}_{j+1}\left({r}_{j+1}-{r}_{j}\right)\right]\) for \(j=2, 3, \dots , c-1\), and \(\left[{\underline{l}}_{c}\left({r}_{c}-{r}_{c-1}\right), 1\right]\). For \({\varvec{r}}\in {\mathcal{R}}_{c}\left(w\right)\), by definition, \({\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right)\) is increasing in \(j\). Hence, these intervals are well-defined, cover the entire interval \(\left[0, 1\right]\), and are ordered such that \(\left[{\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right), {\underline{l}}_{j+1}\left({r}_{j+1}-{r}_{j}\right)\right]\) contains lower values than \(\left[{\underline{l}}_{i}\left({r}_{i}-{r}_{i-1}\right), {\underline{l}}_{i+1}\left({r}_{i+1}-{r}_{i}\right)\right]\) if \(j<i\). Moreover, we can conclude that customers belonging to \(\left[{\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right), {\underline{l}}_{j+1}\left({r}_{j+1}-{r}_{j}\right)\right]\) decide to purchase \(j\) units (as they have positive marginal utilities for \(i\le j\) and negative marginal utilities for \(i>j\)). Building on this, we can easily calculate the probability a customer purchase \(j\) units (\(1<j<c\)) by calculating the probability a customer belongs to \(\left[{\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right), {\underline{l}}_{j+1}\left({r}_{j+1}-{r}_{j}\right)\right]\):

This remains true for \(j=c\) by replacing \({\underline{l}}_{c+1}\left({r}_{c+1}-{r}_{c}\right)\) with \(1\). However, the \(j=1\) case is somewhat distinct: As utility for purchasing the first unit is independent of \(l\), the marginal utility is constant. With \({r}_{1}\le {w}^{+}\) (one of the conditions that defines \({\mathcal{R}}_{c}\left(w\right)\)), it is either positive (\({r}_{1}<w\)) or zero (\({r}_{1}=w\) and \({r}_{1}={w}^{+}\)). In the latter case, customers are indifferent between purchasing and not purchasing. We emphasize with \({r}_{1}=w\) and \({r}_{1}={w}^{+}\) which of these equally viable options customers choose. As \(w\) and \({w}^{+}\) are the same value, the resulting intervals, i.e., \(\left[0, {\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\right]\), are identical in the sense that they cover the same area. And yet, they differ in meaning. One represents all customers that purchase exactly one unit (resulting from \({r}_{1}=w\)), the other represents all customers that purchase nothing at all (resulting from \({r}_{1}={w}^{+}\)). Please note that this ambiguity has no impact on customers that belong to \(\left[{\underline{l}}_{j}\left({r}_{j}-{r}_{j-1}\right), {\underline{l}}_{j+1}\left({r}_{j+1}-{r}_{j}\right)\right]\) with \(j\ge 2\). These customers have a zero valued marginal utility for the first unit, a positive marginal utility for each \(i\)th unit with \(i\le j\), and negative marginal utilities for every other unit. Thus, they still attain their maximal utility by purchasing \(j\) units.

These considerations were enabled by restricting the action space to \({\mathcal{R}}_{c}\left(w\right)\). Only with this restriction, the intervals are guaranteed to be correctly ordered which, in turn, allows us to simplify the formulation of the selling probability \(p_{j} \left( {{\varvec{r}}|w} \right)\) for a batch of size \(j\):

with \({\underline{l}}_{1}\left({r}_{1}-{r}_{0}\right)={\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\cdot {1}_{\left\{{r}_{1}={w}^{+}\right\}}\) to properly reflect the ambiguous behavior of customers belonging to \(\left[0, {\underline{l}}_{2}\left({r}_{2}-{r}_{1}\right)\right]\).

The optimization problem with observable base willingness-to-pay is given by

with boundary conditions \({V}_{0}^{\omega }\left(c\right)=0\) for \(c\ge 0\) and \({V}_{t}^{\omega }\left(0\right)=0\) for \(t\ge 0\). By definition of \({p}_{j}\left({\varvec{r}}|w\right)\), \({r}_{j}\) influences the probability of three possible outcomes: selling \(j-1\), \(j\), and \(j+1\) units. This interconnection thwarts maximizing \(\sum_{j=1}^{c}{p}_{j}\left({\varvec{r}}|w\right)\cdot \left({r}_{j}-{\Delta }_{j}{V}_{t-1}^{\omega }\left(c\right)\right)\) separately. We can circumvent this obstacle by defining \(\Delta {r}_{j}={r}_{j}-{r}_{j-1}\) for \(j\le c\) (\({r}_{0}=0\)) and reformulating \(\sum_{j=1}^{c}{p}_{j}\left({\varvec{r}}|w\right)\cdot \left({r}_{j}-{\Delta }_{j}{V}_{t-1}^{\omega }\left(c\right)\right)=\sum_{j=1}^{c}{p}_{j}\left({\varvec{r}}|w\right)\cdot \left(\sum_{i=1}^{j}\Delta {r}_{i}-{\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-i\right)\right)=\sum_{j=1}^{c}\left(1-{F}_{\lambda }\left({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\right)\right)\cdot \left(\Delta {r}_{j}-{\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\right)\) for \({\varvec{r}}\in {\mathcal{R}}_{c}\left(w\right)\). Moreover, with (8), we write \({\mathcal{R}}_{c}\left(w\right)=\left\{{\varvec{r}}\in {\mathbb{R}}^{c}:0\le\Delta {r}_{1}\le {w}^{+}, \text{and }0\le {\underline{l}}_{j}\left(\Delta {r}_{j}\right)\le {\underline{l}}_{j+1}\left(\Delta {r}_{j+1}\right)\le 1 {\text{for}} \, 2\le j\le c-1\right\}\). The only remaining connection between marginal unit prices \(\Delta {r}_{j}\) is given by the imposed order \({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\le {\underline{l}}_{j+1}\left(\Delta {r}_{j+1}\right)\) for \(2\le j\le c-1\). When defining \({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\) in (8), we showed that this is the threshold between negative (\(l<{\underline{l}}_{j}\left(\Delta {r}_{j}\right)\)) and positive (\(l>{\underline{l}}_{j}\left(\Delta {r}_{j}\right)\)) marginal utility for purchasing the \(j\)th unit. So, in conclusion, this order ensures a pricing scheme where customers only consider buying the \(j+1\)th unit if they also buy the \(j\)th.

Currently, this order, imposed by conditions \({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\le {\underline{l}}_{j+1}\left(\Delta {r}_{j+1}\right)\), \(2\le j\le c-1\), is preventing us from optimizing every decision variable independently. By removing these conditions, we formulate an optimization problem that is entirely separable in each decision variable and serves as an upper bound to (10):

The roadmap for the remaining section is as follows: We first determine the solution of upper bound problem (11), show that under certain conditions this solution is also the solution of (10) resulting in the same expected revenue, and finally show by induction that these conditions are indeed met.

4.1.2 Solution and structural properties

For every \(j\), we check if we can economically sell the \(j\)th unit. We use the term “economic selling” to refer to selling an additional unit at a price that covers at least the lost expected revenue of the additionally sold capacity (opportunity cost), i.e. \(\Delta {r}_{j}\ge {\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j+1\right)\). Whenever \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\) is exceeding \(w\), we cannot economically sell the \(j\)th unit and choose to eliminate demand for it, i.e. we pick \(\Delta {r}_{j}=w\).

Corollary 1

If \({V}_{t-1}^{\omega }\left(\cdot \right)\) is increasing and concave, \({N}_{t,c}\left(w\right)=\underset{j=1, \dots ,c}{max} \left\{j: {\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j+1\right)<w\right\}\) denotes the highest additional unit that can be sold economically. It holds that \(\left\{j: {\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j+1\right)<w\right\}=\left\{1, 2, \dots , {N}_{t,c}\left(w\right)\right\}\).

Proof

As \({V}_{t-1}^{\omega }\left(\cdot \right)\) is concave, \({\Delta }_{1}{V}_{t-1}^{\upomega }\left(c-j+1\right)\) is increasing in \(j\). Thus, there is \(\widehat{j}\in \left\{\mathrm{1,2},\dots ,c\right\}\) with \({\Delta }_{1}{V}_{t-1}^{\upomega }\left(c-j+1\right)<w\iff j\le \widehat{j}\). □

By definition, it holds that \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c-{N}_{t,c}\left(w\right)+1\right)<w\) and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c-\left({N}_{t,c}\left(w\right)+1\right)+1\right)\ge w\). Consequently, it also holds that \({\Delta }_{1}{V}_{t-1}^{\omega }\left(\left(c-1\right)-\left({N}_{t,c}\left(w\right)-1\right)-1\right)<w\) and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(\left(c-1\right)-{N}_{t,c}\left(w\right)+1\right)\ge w\) as well as \({\Delta }_{1}{V}_{t-1}^{\omega }\left(\left(c+1\right)-\left({N}_{t,c}\left(w\right)+1\right)-1\right)<w\) and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(\left(c+1\right)-\left({N}_{t,c}\left(w\right)+2\right)+1\right)\ge w\). This observation leads to the following remark.

Remark 1

It holds that \({N}_{t,c-1}\left(w\right)+1={N}_{t,c}\left(w\right)={N}_{t,c+1}\left(w\right)-1\).

The solution to \(\underset{\Delta {r}_{1}\in \left[0,w\right]}{{\text{max}}}\left\{\left(1-{F}_{\lambda }\left({\underline{l}}_{1}\left(\Delta {r}_{1}\right)\right)\right)\cdot \left(\Delta {r}_{1}-{\Delta }_{1}{V}_{t-1}^{\omega }\left(c\right)\right)\right\}\) is \(\Delta {r}_{1}=w\) (\({w}^{+}\) if \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c\right)\ge w\)). However, for every other \(j\), the solution is less apparent.

In the proof of Proposition 1, we show that there exists exactly one solution \(\Delta {r}_{j}\) to (11). We determine this solution with the help of the optimal customer threshold \({\underline{l}}_{j}\), which is (implicitly) defined in Proposition 1. There, we observe that the optimal solution depends on realization \(w\) and opportunity costs \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\).

Proposition 1

In every state \(\left(t,c\right)\) and for every \(w\in \left[\mathrm{0,1}\right]\), there is a unique optimal solution \(\Delta {r}_{t,j}\left(c|w\right)\), \(j\le c\), for (11):

-

If \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\ge w\), \(\Delta {r}_{t,j}\left(c|w\right)={w}^{+}\) with \({\underline{l}}_{j}\left(w\right)=1\).

-

If \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\in \left[0,w\right)\), \(\Delta {r}_{t,1}\left(c|w\right)=w\) with \({\underline{l}}_{1}\left(w\right)=0\) for \(j=1\) and \(\Delta {r}_{t,j}\left(c|w\right)=w\cdot {\left({\underline{l}}_{j}\left(w\right)\right)}^{j-1}\) with \({\underline{l}}_{j}\left(w\right)\) implicitly defined by \(w\cdot {\underline{l}}_{j}^{j-2}\left(w\right)\cdot \left({\underline{l}}_{j}\left(w\right)-\frac{j-1}{{h}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}\right)={\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\) for \(j\ge 2\).

Proof

We have already established that \(\Delta {r}_{{\text{t}},1}\left(c|w\right)=w\) when \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\in \left(0,w\right)\). Hence, our focus will be on \(j\ge 2\) in the subsequent discussion. In this proof, we aim to achieve two objectives. First, we intend to derive the implicit definition and argue that there is at least one solution meeting this criterion. Second, we aim to prove that there could only be one solution meeting this criterion. To accomplish the first goal, we will formulate the first-order condition and examine the values of the first derivative at the interval boundaries. The second goal will be secured by establishing the second derivative and demonstrating its negativity for every solution that satisfies the first-order condition. With the continuity of the first derivative, this is sufficient to conclude that there is exactly one point where the first derivative equals zero. Hence, there is exactly one solution meeting the first-order condition and maximizing the optimization problem.

We commence with a reformulation of the optimization problem, a convenient step to simplify the second derivative.

There are different approaches to tackle this optimization problem: we can try to find the optimal marginal price \(\Delta {r}_{j}\), the optimal customer threshold \({\underline{l}}_{j}\), or the optimal probability \(\theta =1-{F}_{\lambda }\left({\underline{l}}_{j}\right)\). As \({\underline{l}}_{j}\left(\Delta {r}_{j}\right)={\left(\frac{\Delta {r}_{j}}{w}\right)}^{\frac{1}{j-1}}\) is bijective on \(\left[0, w\right]\), and the distribution function is bijective on its support \(\left[0, 1\right]\), there is a unique mapping between \(\Delta {r}_{j}\), \({\underline{l}}_{j}\), and \(\theta\). This enables us to treat each of these variables as a decision variable and use the mapping to calculate the other two.

In this proof, it is more convenient to focus on \(\theta\) as our decision variable. Thereby, we do not have to deal with (varying) opportunity costs in the second derivative. We reformulate our optimization problem with \(\Delta {r}_{j}=w\cdot {\left({\underline{l}}_{j}\right)}^{j-1}\), \(\theta =1-{F}_{\lambda }\left({\underline{l}}_{j}\right)\), and \({F}_{\lambda }^{-1}\) being the inverse to \({F}_{\lambda }\):

We can now approach our first goal. The optimal solution has to meet the first-order condition:

This condition is well-defined as \({f}_{\lambda }>0\) on the distribution’s support \(\left[0, 1\right]\). The existence of a solution is ensured by the continuity of the first derivative as well as the fact that \({\text{it}}\) is non-negative for \(\theta =1\), and positive for \(\theta =0\) (remember that \(w>{\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\)).

With \({\underline{l}}_{j}={F}_{\lambda }^{-1}\left(1-\theta \right)\) and the definition of the failure rate, we can reformulate the first-order condition to

To achieve our second objective, we derive the second derivative on this formulation and write \({\underline{l}}_{j}\left(\theta \right)\) to emphasize that \({\underline{l}}_{j}\) depends on \(\theta\) (our decision variable in this proof). Subsequently, we demonstrate that the second derivative is negative for every \(\theta\) that satisfies the first-order condition. With the continuity of the first derivative, this is sufficient to establish the uniqueness of such a \(\theta\):

for \(j\ge 3\), and

for \(j=2\). With \(\frac{d}{d\theta }{\underline{l}}_{j}\left(\theta \right)<0\) and \({h}_{\lambda }^{\prime}\left({\underline{l}}_{j}\left(\theta \right)\right)\ge 0\), the latter case is trivial. Thus, we will focus on \(j\ge 3\) for the remaining part of the proof. Again with \(\frac{d}{d\theta }{\underline{l}}_{j}\left(\theta \right)<0\), we only need to show that \({\underline{l}}_{j}\left(\theta \right)-\frac{\left(j-2\right)\cdot {h}_{\lambda }\left({\underline{l}}_{j}\left(\theta \right)\right)-{\underline{l}}_{j}\left(\theta \right)\cdot {h}_{\lambda }^{\prime}\left({\underline{l}}_{j}\left(\theta \right)\right)}{{\left({h}_{\lambda }\left({\underline{l}}_{j}\left(\theta \right)\right)\right)}^{2}}>0\) for every \(\theta\) that meets the first-order condition. It holds that

The equality follows by the first-order condition. Also note that \({h}_{\lambda }\) is positive on the distribution’s support and increasing by assumption.□

Remark 2

For \(\lambda \sim U\left[0, 1\right]\) and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)=0\), the optimality condition leads to a closed-form solution: \(\Delta {r}_{t,j}\left(c|w\right)={w\cdot \left(\frac{j-1}{j}\right)}^{j-1}\), \(j\ge 2\).

For now, we have (implicitly) given the solution of upper bound (11). If we can show that this solution is a feasible solution to (10), i.e. \(\Delta {r}_{t,j}\left(c|w\right)\in {\mathcal{R}}_{c}\left(w\right)\), we can immediately conclude that \(\Delta {r}_{t,j}\left(c|w\right)\) results in the same expected revenue in (10) and is the unique optimal solution. It holds that \(\Delta {r}_{t,j}\left(c|w\right)\in {\mathcal{R}}_{c}\left(w\right)\iff \left(\Delta {r}_{t,1}\left(c|w\right)\in \left[0, {w}^{+}\right] {\text{and}} \, {\underline{l}}_{j}\left(w\right)\le {\underline{l}}_{j+1}\left(w\right) {\text{for}} \, 2\le j\le c-1\right)\).

In proof of Proposition 1, we have seen that \({\underline{l}}_{j}\left(w\right)<1\) (resulting from \(\theta >0\)) if \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)<w\) and \({\underline{l}}_{j}\left(w\right)=1\) if \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\ge w\). This could lead to contradicting condition \({\underline{l}}_{j}\left(w\right)\le {\underline{l}}_{j+1}\left(w\right)\) if there is \(j\) such that \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\ge w\) and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j\right)<w\). Therefore, a necessary condition for \(\Delta {r}_{t,j}\left(c|w\right)\in {\mathcal{R}}_{c}\left(w\right)\) is \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-\widehat{j}\right)\ge w\Rightarrow \left({\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\ge w\ \forall j\ge \widehat{j}\right)\). This is ensured when \({V}_{t-1}^{\omega }\left(\cdot \right)\) is concave, so we will stick with this condition.

Proposition 2

If \({V}_{t-1}^{\omega }\left(\cdot \right)\) is increasing and concave, \(\Delta {r}_{t,j}\left(c|w\right)\) defined by Proposition 1 is the optimal solution for (10).

Proof

We formulated optimization problem (11) by removing conditions \({\underline{l}}_{j}\left(w\right)\le {\underline{l}}_{j+1}\left(w\right) {\text{ for }} \, 2\le j\le c-1\). Therefore, demonstrating that \(\Delta {r}_{t,j}\left(c|w\right)\) satisfies these conditions is sufficient to show Proposition 2. According to Corollary 1, \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j+1\right)<w\) holds for \(j\le {N}_{t,c}\left(w\right)\), and \({\Delta }_{1}{V}_{t-1}^{\omega }\left(c-j+1\right)\ge w\) holds for \(j>{N}_{t,c}\left(w\right)\). Combined with Proposition 1, this implies that \({\underline{l}}_{j}\left(w\right)=1\) for \(j>{N}_{t,c}\left(w\right)\), which evidently aligns with \({\underline{l}}_{j}\left(w\right)\le {\underline{l}}_{j+1}\left(w\right)\). Therefore, in the subsequent discussion, we exclusively focus on the case where \(j\le {N}_{t,c}\left(w\right)\).

We know from Proposition 1 (and its proof) that \(0={\underline{l}}_{1}\left(w\right)\le {\underline{l}}_{2}\left(w\right)\), and \({\underline{l}}_{j}\left(w\right)\) such that \(w\cdot {\underline{l}}_{j}^{j-2}\left(w\right)\cdot \left({\underline{l}}_{j}\left(w\right)-\frac{j-1}{{h}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}\right)={\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\), \(j\ge 2\).

Focusing on \(w\cdot {\underline{l}}^{j-2}\cdot \left(\underline{l}-\frac{j-1}{{h}_{\lambda }\left(\underline{l}\right)}\right)\), we can observe that this formulation is decreasing in \(j\) if \(\underline{l}-\frac{j-1}{{h}_{\lambda }\left(\underline{l}\right)}\ge 0\). As \({\underline{l}}_{j}\left(w\right)-\frac{j-1}{{h}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}\ge 0\), it holds that

\(j\ge 2\), where the equation follows by Proposition 1, the first inequality by increasing \(j\) to \(j+1\), and the last inequality by concavity of \({V}_{t-1}^{\omega }\left(\cdot \right)\). The negativity of the last term proves that the optimal solution \({\underline{l}}_{j}\left(w\right)\) for selling the \(j\)th unit does not satisfy the optimality condition for selling the \(j+1\)th unit. More precisely, it proves that the point where this optimality condition is fulfilled, denoted as \({\underline{l}}_{j+1}\left(w\right)\), must be positioned above \({\underline{l}}_{j}\left(w\right)\). In simpler terms, \({\underline{l}}_{j}\left(w\right)<{\underline{l}}_{j+1}\left(w\right)\). □

So far, we have shown \(\Delta {r}_{t,j}\left(c|w\right)\) (implicitly) defined by Proposition 1 is the optimal solution to (10) for every \(t\) if \({V}_{t-1}^{\omega }\left(\cdot \right)\) is increasing and concave. We will show that this condition indeed holds for the whole horizon. In the upcoming proof, the optimal expected margin \({m}_{j}\) for selling the \(j\)th unit, and its sensitivity to changes in opportunity costs, will play a crucial role. Hence, we introduce \({m}_{j}\left(\delta \right)=\underset{\Delta {r}_{j}\in \left[0,w\right]}{{\text{max}}}\left\{\left(1-{F}_{\lambda }\left({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\right)\right)\cdot \left(\Delta {r}_{j}-\delta \right)\right\}\) as a function of variable \(\delta\) which represents any opportunity costs. This allows us to analyze the impact of varying opportunity costs on the optimal expected margin. Lemma 2 outlines certain properties of \({m}_{j}\left(\delta \right)\) that will prove useful in establishing concavity of \({V}_{t-1}^{\omega }\left(\cdot \right)\) later in this section.

Lemma 2

If \(\delta \in \left[0,w\right)\), it holds that:

-

(a)

\({m}_{j+1}\left(\delta \right)-{m}_{j}\left(\delta \right)\le 0\)

-

(b)

\({m}_{j+1}\left(\delta \right)-{m}_{j}\left(\delta \right)\) is increasing in \(\delta\)

-

(c)

\({m}_{j}\left(\delta \right)\) is decreasing in \(\delta\)

Proof

We will address (a), (b), and (c) separately, though not in this order. To streamline the proof of (b), we will employ a formulation derived in (c), so we will modify the order accordingly.

(a): The assertion that the optimal expected margin declines with \(j\), i.e., \({m}_{j}\left(\delta \right)\ge {m}_{j+1}\left(\delta \right)\), is rooted in two observations: the suboptimality of the solution of \({m}_{j+1}\left(\delta \right)\) for \({m}_{j}\left(\delta \right)\), and the fact that expected margin decreases with \(j\) for any \(l\in \left[0, 1\right]\).

\({m}_{j}\left(\delta \right)\) is the optimal value of \(\underset{\Delta {r}_{j}\in \left[0,w\right]}{{\text{max}}}\left\{\left(1-{F}_{\lambda }\left({\underline{l}}_{j}\left(\Delta {r}_{j}\right)\right)\right)\cdot \left(\Delta {r}_{j}-\delta \right)\right\}=\underset{{\underline{l}}_{j}\in \left[\mathrm{0,1}\right]}{{\text{max}}}\left\{\left(1-{F}_{\lambda }\left({\underline{l}}_{j}\right)\right)\cdot \left(w\cdot {\left({\underline{l}}_{j}\right)}^{j-1}-\delta \right)\right\}=\left(1-{F}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)\right)\cdot \left(w\cdot {\left({\underline{l}}_{j}\left(w\right)\right)}^{j-1}-\delta \right)\) with \({\underline{l}}_{j}\left(w\right)\) representing the optimal solution. As \({\underline{l}}_{j+1}\left(w\right)\) (the optimal solution of \({m}_{j+1}\left(\delta \right)\)) is suboptimal for \({m}_{j}\left(\delta \right)\) and \(1-{F}_{\lambda }\left({\underline{l}}_{j+1}\left(w\right)\right)\ge 0\) as well as \({\underline{l}}_{j+1}\left(w\right)\le 1\), it holds that

(c): To prove (c), we will derive the first derivative of \({m}_{j}\left(\delta \right)\) with respect to \(\delta\) and demonstrate its nonpositivity.

Based on its implicit definition \(w\cdot {\underline{l}}_{j}^{j-2}\left(w\right)\cdot \left({\underline{l}}_{j}\left(w\right)-\frac{j-1}{{h}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}\right)=\delta\) (refer to Proposition 1), the optimal solution \({\underline{l}}_{j}\left(w\right)\) of \({m}_{j}\left(\delta \right)\) depends also on \(\delta\). As we are about to vary \(\delta\), we highlight this fact by writing \({\underline{l}}_{j}\left(\delta \right)\) instead of \({\underline{l}}_{j}\left(w\right)\) (\(w\) acts as a parameter in this proof). The same applies for \({\underline{l}}_{j+1}\left(\delta \right)\) and \({m}_{j+1}\left(\delta \right)\). Building the first derivative, we get

The last equation holds because of the implicit definition of \({\underline{l}}_{j}\left(\delta \right)\).

(b): Similarly to (c), we aim to calculate the first derivative \(\frac{d}{d\delta }\left({m}_{j+1}\left(\delta \right)-{m}_{j}\left(\delta \right)\right)\). Fortunately, we can leverage the first derivative of \({m}_{j}\left(\delta \right)\) with respect to \(\delta\). It is important to note that substituting \(j\) by \(j+1\) does not alter the reasoning in (c). Consequently, we find that \(\frac{d}{d\delta }{m}_{j+1}\left(\delta \right)=-\left(1-{F}_{\lambda }\left({\underline{l}}_{j+1}\left(\delta \right)\right)\right)\). Combining the first derivative of \({m}_{j}\left(\delta \right)\) and \({m}_{j+1}\left(\delta \right)\) leads to

Recalling the argumentation while developing Proposition 2, we know that \({\underline{l}}_{j+1}\left(\delta \right)\ge {\underline{l}}_{j}\left(\delta \right)\). Hence, we can conclude that \(\frac{d}{d\delta }\left({m}_{j+1}\left(\delta \right)-{m}_{j}\left(\delta \right)\right)\ge 0\). □

Even though we developed Lemma 2 mainly to show the desired concavity of \({V}_{t}^{\omega }\left(\cdot \right)\), it also brings interesting implications with it: The optimal expected margin for selling the \(j\)th unit is greater than the optimal expected margin for selling the \(j+1\)th unit given both cases result in the same additional opportunity costs. With a concave value function \({V}_{t}^{\omega }\left(\cdot \right)\), we can conclude that selling the \(j+1\)th unit results in higher additional opportunity costs and, thus, selling the \(j+1\)th unit definitely leads to a lower optimal expected margin than selling the \(j\)th unit does.

Before delving into the proof of the preservation of concavity across periods, let us examine a small example. Assume that \(\omega\) and \(\lambda\) follow a uniform distribution. We address the optimization problem for all states \(\left(t, c\right)\) with \(t=1, 2\) and \(c=1, \dots , 5\). We start with \(t=1\), as \({V}_{2}^{\omega }\left(\cdot \right)\) depends on \({V}_{1}^{\omega }\left(\cdot \right)\) which in turn depends on \({V}_{0}^{\omega }\left(\cdot \right)\). After the selling horizon, no revenue can be earned, leading to the boundary condition \({V}_{0}^{\omega }\left(c\right)=0\) for \(c\ge 0\).

In \(t=1\), observe that \({V}_{0}^{\omega }\left(c\right)\) is (as a constant, not strictly) increasing and concave. Propositions 1 and 2 allow us to calculate \({V}_{1}^{\omega }\left(c\right)\). In addition, with no opportunity costs (\({\Delta }_{1}{V}_{0}^{\omega }\left(c\right)=0\)), we can use the closed-form expression of the optimal solution from Remark 2, i.e., \(\Delta {r}_{1}\left(c|w\right)=w\) and \(\Delta {r}_{j}\left(c|w\right)={w\cdot \left(\frac{j-1}{j}\right)}^{j-1}\), for every possible realization \(w\) of \(\omega\). This yields a closed-form expression for \({V}_{1}^{\omega }\left(c|w\right)={V}_{0}^{\omega }\left(c\right)+\sum_{j=1}^{c}{m}_{j}\left(0\right)={V}_{0}^{\omega }\left(c\right)+w\cdot {1}_{\left\{w>{\Delta }_{1}{V}_{0}^{\omega }\left(c\right)\right\}}+\sum_{j=2}^{c}\left(1-{F}_{\lambda }\left(\frac{j-1}{j}\right)\right)\cdot {w\cdot \left(\frac{j-1}{j}\right)}^{j-1}\) and we calculate \({V}_{1}^{\omega }\left(c\right)={\int }_{0}^{1}{V}_{1}^{\omega }\left(c|w\right)\cdot {f}_{\omega }\left(w\right) dw\). The results of these calculations are presented in Table 1, revealing that \({V}_{1}^{\omega }\left(c\right)\) is increasing in \(c\). As \({\Delta }_{1}{V}_{1}^{\omega }\left(c\right)={V}_{1}^{\omega }\left(c\right)-{V}_{1}^{\omega }\left(c-1\right)\) is decreasing in \(c\), \({V}_{1}^{\omega }\left(c\right)\) is also concave.

Moving to \(t=2\), Propositions 1 and 2 remain applicable (we just observed that \({V}_{1}^{\omega }\left(c\right)\) is increasing and concave). However, Remark 2 is no longer relevant (\({\Delta }_{1}{V}_{1}^{\omega }\left(c\right)\ne 0\)). Consequently, we can no longer rely on the closed-form expression of the optimal solution. Without the closed-form solution, solving the optimization problem for every realization \(w\) becomes more challenging. As an example, we focus on the specific realization \(w=0.1\) and \(c=5\) in detail.

The maximal number of units that can be sold economically is given by \({N}_{\mathrm{2,5}}\left(0.1\right)=\underset{j=1, \dots ,5}{max} \left\{j: {\Delta }_{1}{V}_{t-1}^{\omega }\left(6-j\right)<0.1\right\}=3\). Consequently, the optimization problem becomes \({V}_{2}^{\omega }\left(5|0.1\right)={V}_{1}^{\omega }\left(5\right)+\sum_{j=1}^{3}{m}_{j}\left({\Delta }_{1}{V}_{1}^{\omega }\left(6-j\right)\right)={V}_{1}^{\omega }\left(5\right)+\left(0.1-{\Delta }_{1}{V}_{1}^{\omega }\left(5\right)\right)+{m}_{2}\left({\Delta }_{1}{V}_{1}^{\omega }\left(4\right)\right)+{m}_{3}\left({\Delta }_{1}{V}_{1}^{\omega }\left(3\right)\right)\). To apply the optimality condition, we note that \(\frac{1}{{h}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}=\frac{1-{F}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}{{f}_{\lambda }\left({\underline{l}}_{j}\left(w\right)\right)}=1-{\underline{l}}_{j}\left(w\right)\) for \(\lambda \sim U\left[0, 1\right]\). The optimality condition becomes \(w\cdot {\underline{l}}_{j}^{j-2}\left(w\right)\cdot \left(j\cdot {\underline{l}}_{j}\left(w\right)-\left(j-1\right)\right)={\Delta }_{1}{V}_{t-1}^{\omega }\left(c+1-j\right)\).

Optimal \(\Delta {r}_{2}\) is given by \(\Delta {r}_{2}=0.1\cdot {\underline{l}}_{2}\left(0.1\right)\) with \({\underline{l}}_{2}\left(0.1\right)\) such that \(0.1\cdot \left(2\cdot {\underline{l}}_{2}\left(0.1\right)-1\right)={\Delta }_{1}{V}_{1}^{\omega }\left(4\right)\). Thus, \({\underline{l}}_{2}\left(0.1\right)=\frac{\left(10\cdot {\Delta }_{1}{V}_{1}^{\omega }\left(4\right)+1\right)}{2}\approx 0.7635\) and \(\Delta {r}_{2}=\left(\frac{{\Delta }_{1}{V}_{1}^{\omega }\left(4\right)+0.1}{2}\right)\approx 0.0764\). Optimal \(\Delta {r}_{3}\) is given by \(\Delta {r}_{3}=0.1\cdot {\left({\underline{l}}_{3}\left(0.1\right)\right)}^{2}\) with \({\underline{l}}_{3}\left(0.1\right)\) such that \(0.1\cdot {\underline{l}}_{3}\left(0.1\right)\cdot \left(3\cdot {\underline{l}}_{3}\left(0.1\right)-2\right)={\Delta }_{1}{V}_{1}^{\omega }\left(3\right)\). Thus, \({\underline{l}}_{3}\left(0.1\right)=\frac{2+\sqrt{4+120\cdot {\Delta }_{1}{V}_{1}^{\omega }\left(3\right)}}{6}\approx 0.9318\) and \(\Delta {r}_{3}\approx 0.0868\). Consequently, \({V}_{2}^{\omega }\left(5|0.1\right)\approx 0.7928+0.059+0.0056+0.0009\approx 0.8583\).

Similarly, we can calculate \({N}_{\mathrm{2,4}}\left(0.1\right)=2\), \({N}_{\mathrm{2,3}}\left(0.1\right)=1\), and \({N}_{\mathrm{2,2}}\left(0.1\right)={N}_{\mathrm{2,1}}\left(0.1\right)=0\) as well as \({V}_{2}^{\omega }\left(c|0.1\right)\), \(c\le 4\) (cf, Table 1). Once again, we observe that \({V}_{2}^{\omega }\left(c|0.1\right)\) increases, and \({V}_{2}^{\omega }\left(c|0.1\right)-{V}_{2}^{\omega }\left(c-1|0.1\right)\) decreases in \(c\).

Finally, we numerically derive \({V}_{2}^{\omega }\left(c\right)\), \(c\le 5\), and, again, observe that these properties are still intact.

In our example, we have seen that these conditions stayed intact. Now, we want to prove that these conditions indeed hold for every \(t\le T\) and any distribution that meets the assumption formulated in Sect. 3.2.

Proposition 3

For every \(t\), \({V}_{t}^{\omega }\left(\cdot \right)\) is increasing and concave.

Proof

See Supplement S.1.

Proposition 3 confirms the optimality of prices defined by Proposition 1 in a scenario where base willingness-to-pay is observable. The optimality condition is influenced by two factors: the specific customer type indicated by the observed base willingness-to-pay and opportunity costs. While the former is stochastic and, hence, ex ante unpredictable, the latter is state-dependent and can be determined beforehand. Consequently, understanding the dynamics of opportunity costs is crucial for comprehending the optimal pricing policy. The subsequent proposition illustrates how opportunity costs and the value function evolve over time. Notably, the increase in opportunity costs over time is intriguing, suggesting that optimal marginal prices may also experience an upward trend.

Proposition 4

For every \(c\), it holds:

-

(a)

\({\Delta }_{1}{V}_{t}^{\omega }\left(c\right)\) is increasing in \(t\)

-

(b)

\({V}_{t}^{\omega }\left(c\right)\) is increasing and concave in \(t\)

Proof

See Supplement S.2.

For a first impression regarding dynamics of optimal prices, we start with a generic look at the optimality condition given by Proposition 1. We will use \(\delta\) as variable for opportunity costs, and replace \({\underline{l}}_{j}\left(w\right)\) with \(\left( {\frac{{{\Delta }r_{j} }}{w}} \right)^{{\frac{1}{j - 1}}}\). With some algebra, we can reformulate the (sufficient) first-order condition to

We will momentarily set aside the fact that \(\Delta {r}_{j}\) is our decision variable and consider \(\delta\), \(w\), and \(\Delta {r}_{j}\) as arbitrary variables whose sole purpose is to satisfy the equality in (12). The left side of this equation increases with \(\delta\) and \(w\), while it decreases with \(\Delta {r}_{j}\). To maintain equality, a change in one of these variables must result in a change in at least one of the other two variables. There are several possible combinations of such variations, but we will emphasize three particularly important ones:

-

(a)

An increase (decrease) of \(\delta\) can be compensated by a decrease (increase) of \(w\) while keeping \(\Delta {r}_{j}\) constant

-

(b)

An increase (decrease) of \(\delta\) can be compensated by an increase (decrease) of \(\Delta {r}_{j}\) while keeping \(w\) constant

-

(c)