Abstract

In this article, we analyse optimal statistical arbitrage strategies from stochastic control and optimisation problems for multiple co-integrated stocks with eigenportfolios being factors. Optimal portfolio weights are found by solving a Hamilton–Jacobi–Bellman (HJB) partial differential equation, which we solve for both an unconstrained portfolio and a portfolio constrained to be market neutral. Our analyses demonstrate sufficient conditions on the model parameters to ensure long-term stability of the HJB solutions and stable growth rates for the optimal portfolios. To gauge how these optimal portfolios behave in practice, we perform backtests on historical stock prices of the S&P 500 constituents from year 2000 through year 2021. These backtests suggest three key conclusions: that the proposed co-integrated model with eigenportfolios being factors can generate a large number of co-integrated stocks over a long time horizon, that the optimal portfolios are sensitive to parameter estimation, and that the statistical arbitrage strategies are more profitable in periods when overall market volatilities are high.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Statistical arbitrage strategies involve trading among pairs of assets having co-integration. The essential idea is that a pair of co-integrated asset prices have a difference that is mean reverting. This mean-reverting difference is referred to as a spread. For a trader with the ability to sell short and utilise leverage, a possible strategy is to long the cheaper asset, short the expensive asset, and then wait for the spread to converge, at which time point the positions can be closed for a profit. This is an example of statistical arbitrage because, while it may seem like a sure profit, there is not any finite time by when a spread will have almost surely converged. Instead, there is only a high probability of the spread converging before reaching a fixed and finite investment horizon.

The model we consider in this article is proposed in Avellaneda and Lee [1] and is implemented in Yeo and Papanicolaou [2]. The model considers stocks whose total returns have co-integration with the total returns of a set of factors. The factors can be any selection of variables, traded or untraded, which have explanatory power in the cross sections of stock returns. The spreads are defined as the residuals that are obtained after regressing the total returns of a stock onto the total returns of factors. A stock has co-integration with the factors if their spread forms a stationary stochastic process. We determine whether or not spreads have stationarity by checking that the time series of spreads rejects a unit-root hypothesis, that is, we run the co-integration test proposed in Engle and Granger [3].

The factors that we utilise are eigenportfolios, which are the orthogonal portfolios constructed from the correlation matrix of stock returns. Eigenportfolios are an effective factor construction because they are orthogonal, and so the addition of each factor adds another orthogonal variable to the regression. An alternative factor choice is to regress onto exchange traded funds (ETFs), but ETFs were not as prevalent in the early 2000s, which means that long-term backtesting requires synthesising of ETFs. In Avellaneda and Lee [1], they find better performance utilising eigenportfolios instead of historical sector ETFs data or synthetic sector ETFs. Trading of eigenportfolios can incur heavy transaction costs because they contain hundreds of stocks but only a few dozen that have co-integration. Therefore, trading signals with lower transaction costs should treat the eigenportfolios as untradeable factors and only take trading positions in the co-integrated stocks. This is a feature of the model in this article that adds generality, as there are other factors, such as the illiquidity returns of Pástor and Stambaugh [4], that lack tradeability.

Untradeable factors cause the markets to be incomplete, which is in contrast to the complete markets considered in Chiu and Wong [5] and Ma and Zhu [6]. An advantage to utilising the factor model of Avellaneda and Lee [1] is the simplification of parameter estimation, as the factor model allows for drift parameters to be estimated individually for each stock. In comparison, it can be more challenging to estimate the vector auto-regression matrices involved in general multi-asset co-integration models.

The contribution of this article is the analyses and implementation of solutions to the Hamilton–Jacobi–Bellman equations arising from the model of Avellaneda and Lee [1] with non-tradeability of factors. We formulate stochastic control and optimisation problems where the optimal portfolios depend on the spreads

where \(S_{t}^{i}\) is the price of the ith stock for \(i=1,\,2,\,\ldots ,\,d\in \mathbb {N}\), \(F_{t}^{j}\) is the jth eigenportfolio for \(j=1, 2, ..., m\in \mathbb {N}\), and the parameters \(\left( \alpha ^{i},\,\beta ^{ij}\right) \) are the regression coefficients returned by the statistical test for making \(Z_{t}^{i}\) stationary. As is the case in Mudchanatongsuk et al. [7] and Li and Tourin [8], these spreads form a stationary vector Ornstein-Uhlenbeck (O) process.

The optimal portfolio is obtained from the solution to an HJB equation, which in the case of power utility function we are able to reduce to a system of ordinary differential equations (ODEs) that includes a matrix Riccati equation and a pair of linear equations. We perform long-term stability analyses for these ODEs, which gives us an indication of the soundness of the model. In particular, finiteness of the ODEs for any finite-time investment horizon indicates that the model has an absence of arbitrage; if there was an arbitrage, then the ODEs would have singularities. In addition, if the solution of the HJB equation converges to a steady state as the investment horizon tends toward infinity, then there is a long-term statistical arbitrage portfolio that earns positive profits with probability close to one.

We analyse HJB equations for an unconstrained portfolio and for another portfolio constrained for market neutrality. Market neutrality is important when doing statistical arbitrage with a factor model, as it immunises the portfolio against market fluctuations. Basic pairs trading strategies where the spreads are directly tradeable have this immunisation built in, see Angoshtari [9]. However in our case, because the factors are not tradeable, the optimisation should be constrained in order to have a market-neutral portfolio.

We implement various optimal portfolios in backtests on historical stock prices data. These studies give us a practical sense for profitability of the optimal strategies that are given by the proposed models. We take the S&P 500 constituents from year 2000 through year 2021, and then look at the profits, expected returns, volatilities, Sharpe ratios, and maximum drawdowns for out-of-sample portfolios computed with varying estimation windows, both with and without a market-neutrality constraint. From these studies, we arrive at three main conclusions about statistical arbitrage strategies: first, the proposed co-integrated model with eigenportfolios being factors can generate a large number of co-integrated stocks over a long time horizon, second, these strategies are sensitive to parameter estimation, and third, these strategies have greater potential to out-perform the benchmark during periods of higher overall market volatilities. Sensitivity to parameter estimation is in line with the backtesting studies in Yeo and Papanicolaou [2], where they demonstrate the variation in Sharpe ratios relative to estimation windows and stock selections.

1.1 Literature of Related Research

A formal definition for statistical arbitrage is given in Hogan et al. [10]. A test for co-integration of financial time series is constructed in Engle and Granger [3], namely, the Engle-Granger co-integration test. An application of Engle and Granger [3] for co-integration-based trading strategies are shown in Vidyamurthy [11], trading of co-integrated pairs with implementation of methods for filtering and parameter estimation to handle latency is studied in Elliott et al. [12], and an in-depth statistical analysis of the performance of pairs trading strategies is done in Gatev et al. [13]. Principal component analysis of large number of stocks co-integrated through common factors is the topic in Avellaneda and Lee [1], and is the basis for the model in this article. Empirical testing of pairs trading, including out-of-sample experiments with changing parameters, is completed in Galenko et al. [14] and in Yeo and Papanicolaou [2]. In Liu and Timmermann [15], there is an analysis of pairs data from the Hong Kong China and Mainland China stock exchanges. Analysis showing significance of short-term reversal and momentum factors on returns of pairs trading is presented in Chen et al. [16].

Stochastic control and optimisation for pairs trading with OU spreads is studied in Mudchanatongsuk et al. [7]. A stochastic control approach for optimal trading of co-integrated pairs is proposed and solved in Tourin and Yan [17] and Angoshtari [9], and stochastic control for pairs trading with a local-volatility model is analysed by Li and Tourin [8]. A multi-variate version of the stochastic control problem with power utility is the topic in Chiu and Wong [5] and Ma and Zhu [6], with analyses of the matrix Riccati equation being presented. Additionally, there is the long-term stability analysis for matrix Riccati equations of multiple-asset models completed in Davis and Lleo [18], and the matrix Riccati equations analysis for a single co-integrated pair with partial information is studied in Lee and Papanicolaou [19]. An HJB equation for an optimal portfolio constrained to be 100% long is presented in Al-Aradi and Jaimungal [20] with a comparison of active and passive fund management, and has an HJB equation similar to the market-neutral constrained HJB equation that we present in this article. Related work also includes the optimal trading of spreads with transaction costs and stop-loss criterion, which are analysed in Lei and Xu [21] and Leung and Li [22]. There are also machine learning approaches to statistical arbitrage, such as reinforcement learning and boosting applied to co-integrated constituents in the S&P 500, which is completed by Fallahpour et al. [23].

1.2 Structure of This Article

In this article, we propose and solve stochastic control and optimisation problems for optimal statistical arbitrage portfolios, and then analyse the solutions for the unconstrained portfolio and the market-neutral constrained case. We explore the implementation of these portfolios by performing some empirical studies on historical stock data. The organisation of the article is as follows: Sect. 2 contains the mathematical models along with analyses of the HJB equations, with Sect. 2.1 defining the co-integration model with factors and the value function for the stochastic control problems, with Sect. 2.2 presenting the solution of the HJB equation for the unconstrained portfolio through an exponential ansatz, with Sect. 2.3 presenting the stability analysis, and then with Sect. 2.4 presenting the HJB equation and stability analysis for the optimisation with market-neutral constraint; the empirical analyses of historical stock data come in Sect. 3 with construction of factors through eigenportfolios presented in Section 3.1, preliminary data analyses and parameter estimation presented in Sect. 3.2, and analyses of portfolio performance, for example Sharpe ratio and maximum drawdown, presented in Sect. 3.3; Sect. 4 is the conclusion.

2 Model Constructions and Optimisations

This section introduces the models and the stochastic control and optimisation problems for multiple co-integrated stocks with factors. We first build the stochastic system for stock prices, factors, and spreads in Sect. 2.1. Then in Sect. 2.2, we propose a stochastic control problem for the unconstrained portfolio, and analyse the stability for its solution in Sect. 2.3. In Sect. 2.4, we formulate a constrained portfolio with respect to market-factor neutrality and complete the stability analysis for its solution.

2.1 Co-integration Model with Factors

Suppose \(S_{t}^{i}\), \(i=1,\,2,\,\ldots ,\,d\in \mathbb {N}\), is the stock price of the \(\mathrm{i}{\mathrm {th}}\) individual firm in the financial market. Let \(F_{t}^{j}\) denote the value of the \(\mathrm{j}{\mathrm {th}}\) factor for \(j=1,\,2,\,\ldots ,\,m\in \mathbb {N}\). One of the stocks is co-integrated with these factors if there is a stationary stochastic process \(Z_{t}^{i}\) such that

where \(\alpha ^{i}\) is a component of the systemic return coefficient vector \(\varvec{\alpha }=\Big [\alpha ^{1},\,\alpha ^{2},\,\ldots ,\,\alpha ^{d}\Big ]^{\top }\in {\mathbb {R}}^d\) after controlling for the factor returns, and \(\beta ^{ij}\) is the loading of the ith stock on the jth factor and is recorded in matrix \(\varvec{\beta }\in \mathbb {R}^{d\times m}\). The total returns of stocks \(\int _0^t\frac{dS_u^i}{S_u^i}\) and the total returns of factors \(\int _0^t\frac{dF_u^j}{F_u^j}\) are non-stationary, but there will be statistical arbitrage strategies if the stock \(S_{t}^{i}\) is co-integrated with the factors \(F_{t}^{j}\). A stock \(S_{t}^{i}\) is determined to be co-integrated with a set of factors \(F_{t}^{j}\) if the stochastic process \(Z_{t}^{i}\) rejects a unit-root hypothesis. If we know that a stock is co-integrated with these factors, then we can further specify \(Z_{t}^{i}\) to be a stationary Ornstein-Uhlenbeck process if we model the dynamics of \(S_{t}^{i}\) in the same way as Liu and Timmermann [15] and as Tourin and Yan [17].

Let \(\varvec{B}_{t}=\left[ B_{t}^{1},\,B_{t}^{2},\,\ldots ,\,B_{t}^{d+m}\right] ^{\top }\in \mathbb {R}^{d+m}\) denote a vector of independentstandard Brownian motions (SBMs). The stochastic differential equation (SDE) for the dynamics of a factor is

where \(B_{t}^{k}\) is a component of the SBM vector \(\varvec{B}_{t}\), \(\eta ^{j}\) is a component of the factor drift coefficient vector \(\varvec{\eta }=\left[ \eta ^{1},\,\eta ^{2},\,\ldots ,\,\eta ^{m}\right] ^{\top }\in \mathbb {R}^{m}\), and \(\psi _{0}^{jk}\) is a component of matrix \(\varvec{\Psi }_{0}\in \mathbb {R}^{m\times \left( d+m\right) }\), which forms a symmetric positive definite (SPD) diffusion matrix \(\varvec{\Sigma }_{0}=\varvec{\Psi }_{0}\varvec{\Psi }_{0}^{\top }\). The SDE for the dynamics of an individual stock is

where \(\mu ^{i}\) is a component of the drift coefficient vector \(\mathbf {\varvec{\mu }}=\left[ \mu ^{1},\,\mu ^{2},\,\ldots ,\,\mu ^{d}\right] ^{\top }\in \mathbb {R}^{d}\) of stock prices, \(\delta ^{i}\) is a component of the mean reversion speed coefficient vector \(\mathbf {\varvec{\delta }}=\left[ \delta ^{1},\,\delta ^{2},\,\ldots ,\,\delta ^{d}\right] ^{\top }\in \mathbb {R}^{d}\) of the processes \(Z_{t}^{i}\), and \(\psi _{1}^{ik}\) is a component of matrix \(\varvec{\Psi }_{1}\in \mathbb {R}^{d\times \left( d+m\right) }\), which forms a SPD diffusion matrix \(\varvec{\Sigma }_{1}=\varvec{\Psi }_{1}\varvec{\Psi }_{1}^{\top }\). Utilising Eqs. (2.1), (2.2), and (2.3), the co-integrated process \(Z_{t}^{i}\) has the following stochastic differential equation:

where \(\theta ^{i}=\frac{1}{\delta ^{i}}\left( -\alpha ^{i}-\sum _{j=1}^{m}\beta ^{ij}\eta ^{j}+\mu ^{i}\right) \) is the stationary mean, \(\left( \varvec{\Psi }_{0}d\varvec{B}_{t}\right) ^{j}\) is the jth element of vector \(\varvec{\Psi }_{0}d\varvec{B}_{t}\), and \(\left( \varvec{\Psi }_{1}d\varvec{B}_{t}\right) ^{i}\) is the ith element of vector \(\varvec{\Psi }_{1}d\varvec{B}_{t}\). Each \(Z_{t}^{i}\) is a stationary OU process if \(\delta ^{i}>0\). The factor loadings in Eq. (2.1) are

which can be confirmed by looking at the quadratic cross variation between \(\frac{dS_{t}^{i}}{S_{t}^{i}}\) and \(\frac{dF_{t}^{j}}{F_{t}^{j}}\) for all \(i\le d\) and \(j\le m\).

Remark 2.1

Please note that from Eq. (2.5), it follows that the cross variation \(\frac{dF_{t}^{j}}{F_{t}^{j}}dZ_{t}^{i}\) equals zero for any i and j. This will be relevant in Sect. 2.4 when we equate market neutrality, or factor neutrality, to portfolios being adapted to the filtration generated by the co-integrated processes \(Z_{t}^{i}\).

We consider a self-financing portfolio process \(W_{t}\) with portfolio weight in the ith risky asset at time t denoted by \(\pi _{t}^{i}\) for \(i=1,\,2,\,\ldots ,\,d\), and \(\left( 1-\sum _{i=1}^{d}\pi _{t}^{i}\right) \) being the proportion of wealth invested in the risk-free asset with interest rate \(r\ge 0\). The SDE for the dynamics of the portfolio \(W_t\) is given by the following equation:

Please note that none of the factors \(F_{t}^{j}\), \(j=1,\,2,\,\ldots ,\,m\), are contained in the portfolio \(W_t\), as you can observe from Eq. (2.6).

A control process \(\left( \varvec{\pi }_t\right) _{t\le T}\) is at each time t the portfolio allocation \(\varvec{\pi }_{t}=\left[ \pi _{t}^{1},\,\pi _{t}^{2},\,\ldots ,\,\pi _{t}^{d}\right] ^{\top }\in \mathbb {R}^{d}\), which is sought to maximise the expectation of a utility function \(U\left( \cdot \right) \) with respect to the wealth \(W_T\) at terminal time \(t=T\). The value function for this stochastic control and optimisation problem is

where \(t\in \left[ 0,\,T\right] \), \(\varvec{Z}_{t}=\left[ Z_{t}^{1},\,Z_{t}^{2},\,\ldots ,\,Z_{t}^{d}\right] ^{\top }\in \mathbb {R}^{d}\), \(w\in {\mathbb {R}}^+\) and \(\varvec{z}=\left[ z^{1},\,z^{2},\,\ldots ,\,z^{d}\right] ^{\top }\in \mathbb {R}^{d}\) are the state variables, and \(\left( \varvec{\pi }_t\right) _{t\le T}\) is selected from a set of admissible controls \({\mathcal {A}}\) that is defined as

see chapter four of Fleming and Soner [24] for comprehensive mathematical details. In this article we assume a concave utility function \(U\left( w\right) \) of power type:

where \(\gamma <1\) \(\left( \gamma \ne 0\right) \) is the risk aversion coefficient. Risk aversion measures the risk preferences of traders. If \(\gamma \) approaches to one, it indicates that the trader is more risk loving, and if \(\gamma \) approaches to \(-\infty \), it represents that the trader is more risk averse; \(\gamma \) tending toward zero is the case of logarithmic utility.

2.2 Hamilton–Jacobi–Bellman Equation

In addition to \(\varvec{\beta }\), \(\varvec{\Sigma }_1\), and \(\varvec{\Sigma }_2\) that are defined in Sect. 2.1, we denote the following vectors and matrices for mathematical convenience for the upcoming parts of this article:

Please note that we assume that \(\varvec{\Sigma }_{1}\) is positive definite and invertible in this article. We can also observe that \(\varvec{\Sigma }_{1}\) and \(\varvec{\Sigma }_{3}\) are symmetric matrices, however \(\varvec{\Sigma }_{2}\) is not. Subsequently, we apply the standard stochastic control and optimisation techniques and expect the value function \(u\left( t,\,w,\,\varvec{z}\right) \) defined in Eq. (2.7) to satisfy the following HJB partial differential equation (PDE):

In the HJB Eq. (2.11), the control variable \(\varvec{\pi }\) is not subject to any constraint, so we call it the unconstrained stochastic control and optimisation problem, and the optimal portfolio \(W_{t}\) that is given by its solution is called the unconstrained portfolio. The wealth variable w can be factored out of the solution by utilising the following:

and the derivatives with respect to this ansatz are

Therefore, the HJB Eq. (2.11) can be transformed into

We then can compute the optimal control \(\varvec{\pi }^{*}\) by solving the unconstrained control problem described by Eq. (2.13) in terms of function \(g\left( t,\,\varvec{z}\right) \) and its partial derivatives:

Inserting the optimal \(\varvec{\pi }^{*}\) that is given by Eq. (2.14) back into Eq. (2.13) results in the following nonlinear PDE:

We utilise the following exponential ansatz for \(g\left( t,\,\varvec{z}\right) \) to solve PDE (2.15):

where \(a\left( t\right) \in \mathbb {R}\) is a scalar, \(\varvec{b}\left( t\right) =\left[ b_{i}\left( t\right) \right] \in \mathbb {R}^{d}\) is a column vector, and \(\varvec{C}\left( t\right) =\left[ c_{ij}\left( t\right) \right] \in \mathbb {R}^{d\times d}\) is a symmetric matrix, for \(i,\,j=1,\,2,\,\ldots ,\,d\). By utilising the exponential ansatz (2.16), PDE (2.15) can be transformed into a system of ODEs.

Proposition 2.1

PDE (2.15) for the unconstrained stochastic control and optimisation problem (2.11) is solved by utilising the exponential ansatz (2.16), where for any \(t\le T\), functions \(a\left( t\right) \in \mathbb {R}\), \(\varvec{b}\left( t\right) \in \mathbb {R}^{d}\), and \(\varvec{C}\left( t\right) \in \mathbb {R}^{d\times d}\) of the ansatz satisfy the following system of ODEs:

Proof

By inserting the exponential ansatz (2.16) into PDE (2.15), and grouping terms as either quadratic in \(\varvec{z}\) and \(\varvec{z}^{\top }\), linear in \(\varvec{z}\), or constant in \(\varvec{z}\), then ODE (2.17), ODE (2.18), and ODE (2.19) are respectively obtained. \(\square \)

Because the gradient of the exponential ansatz (2.16) is \(\nabla _{\varvec{z}}\left( \ln g\right) = 2\varvec{C}\left( t\right) \varvec{z} + \varvec{b}\left( t\right) \), hence, the optimal \(\varvec{\pi ^{*}}\) from Eq. (2.14) can be expressed as

From Eq. (2.20), we can observe that the optimal control \(\varvec{\pi }^{*}\) contains two parts: a time-constant part and a dynamic part that contains the solution of the HJB Eq. (2.13). We call the time-constant part of Eq. (2.20) the myopic control of the unconstrained portfolio:

Remark 2.2

(Verification) Verification of optimality for strategy \(\varvec{\pi }^{*}\) that is given by Eq. (2.14) is shown by utilising the argument of Davis and Lleo [18]. Utilising the solution of the HJB Eq. (2.13) that is obtained from the exponential ansatz (2.16), the optimal control \(\left( \varvec{\pi }^{*}\right) _{t\le T}\) that is given by formula (2.20) belongs to the set of admissible controls \(\mathcal {A}\) defined in Eq. (2.8), and maximises the expected utility function defined in Eq. (2.7). The form of the model for this unconstrained control problem fits into the framework set forth in Davis and Lleo [25] and Davis and Lleo [18], and hence, the same argument for verification of these references applies here. The essential step in verification is to confirm that neither of the solutions a(t), \(\varvec{b}(t)\), or \(\varvec{C}(t)\) to Eqs. (2.17), (2.18), and (2.19), respectively, have finite-time blow up; Sect. 2.3 in the sequel confirms the absence of blow up.

2.3 Stability Analysis

Stability analyses of the ODE (2.17), the linear ODE (2.18), and the matrix Riccati equation (2.19) for the unconstrained stochastic control and optimisation problem inform us whether our solution to PDE (2.15) blows up or not. We extend the time domain for the ODEs (2.17), (2.18), and (2.19) to \(\left( -\infty ,T\right] \) for any finite T, and if the solution remains finite for all time, then we have a stable system from which we can draw intuition about long-term portfolio performance.

Our analysis for the matrix Riccati Eq. (2.19) with respect to \(\varvec{C}\left( t\right) \) utilises Theorem 2.1 from Wonham [26], which proves that the solution of the equation exists, is bounded, and is unique for all \(t\le T\). Let us rewrite the matrix Riccati ODE (2.19) as

where

Proposition 2.2

For \(\gamma <0\), the coefficient matrices of the quadratic term and the constant term of the matrix Riccati equation with respect to \(\varvec{C}\left( t\right) \), namely \(\mathbf {Q}_{u}\) and \(\mathbf {P}_{u}\) in Eq. (2.22), are symmetric positive definite and symmetric negative definite, respectively.

Proof

From formula (2.10), the coefficient matrix \(\mathbf {Q}_{u}\) of the quadratic term of the matrix Riccati Eq. (2.22) for the unconstrained stochastic control and optimisation problem has the following decomposition:

which is symmetric positive definite for \(\gamma <0\) if we can show that \(\mathbf {I}-\varvec{\Psi }_1^\top \varvec{\Sigma }_1^{-1}\varvec{\Psi }_1\) is symmetric positive semi-definite, where \(I \in R^{(d+m)\times (d+m)}\) is the identity matrix. Indeed, for any vector \(\varvec{x}\in {\mathbb {R}}^{d+m}\), we have \(\varvec{x} = \varvec{\Psi }_1^\top \varvec{y} + \tilde{\varvec{y}}\), where \(\varvec{\Psi }_1\tilde{\varvec{y}} = 0\). Then, \(\varvec{x}^\top \left( \mathbf {I}-\varvec{\Psi }_1^\top \varvec{\Sigma }_1^{-1}\varvec{\Psi }_1\right) \varvec{x}=\tilde{\varvec{y}}^\top \varvec{y} \ge 0 \), thereby confirming its positive semi-definiteness.

Proving that matrix \(\mathbf {P}_{u}\) is symmetric negative definite is uncomplicated. We can observe that matrix \(\varvec{\delta }\varvec{\Sigma }_{1}^{-1}\varvec{\delta }\) is symmetric positive definite. Consequently, for \(\gamma <0\), \(-\mathbf {P}_{u}\) is symmetric positive definite, in other words, matrix \(\mathbf {P}_{u}\) is symmetric negative definite. \(\square \)

Given Proposition 2.2, the stability analysis from Wonham [26] applies directly. In order to do so, it is useful to define the following properties.

Definition 2.1

(Controllability) Let \(\mathbf {A}\in \mathbb {R}^{n\times n}\) and \(\mathbf {B}\in \mathbb {R}^{n\times m}\) be constant matrices. The controllability matrix of \(\left( \mathbf {A},\,\mathbf {B}\right) \) is the \(n\times mn\) matrix \(\varvec{\Gamma }\left( \mathbf {A},\,\mathbf {B}\right) =\left[ \mathbf {B},\,\mathbf {A}\mathbf {B},\,\cdots ,\,\mathbf {A}^{n-1}\mathbf {B}\right] \). The pair \(\left( \mathbf {A},\,\mathbf {B}\right) \) is controllable if the rank of \(\varvec{\Gamma }\) is n. If \(\left( \mathbf {A},\,\mathbf {B}\right) \) is controllable, so is \(\left( \mathbf {A}-\mathbf {B}\mathbf {M},\,\mathbf {B}\right) \) for every matrix \(\mathbf {M}\in \mathbb {R}^{m\times n}\).

Definition 2.2

(Observability) Let \(\mathbf {A}\in \mathbb {R}^{n\times n}\) and \(\mathbf {E}\in \mathbb {R}^{p\times n}\) be constant matrices. The pair \(\left( \mathbf {E},\,\mathbf {A}\right) \) is observable if the pair \(\left( \mathbf {A}^{\top },\,\mathbf {E}^{\top }\right) \) is controllable.

Definition 2.3

(Stabilisability) Let \(\mathbf {A}\in \mathbb {R}^{n\times n}\) and \(\mathbf {B}\in \mathbb {R}^{n\times m}\) be constant matrices. The pair \(\left( \mathbf {A},\,\mathbf {B}\right) \) is stabilisable if there exists a constant matrix \(\mathbf {M}\) such that all the eigenvalues of \(\mathbf {A}-\mathbf {B}\mathbf {M}\) have negative real parts.

With these definitions that are given above, we have the following proposition for the matrix Riccati equation (2.19).

Proposition 2.3

For \(\gamma <0\), the coefficient matrix \(\mathbf {Q}_{u}\) of the quadratic term in the matrix Riccati Eq. (2.22) is symmetric positive definite. Consequently, there are matrices \(\mathbf {B}_{u}\), \(\mathbf {E}_{u}\), and \(\mathbf {N}_{u}\) such that \(\mathbf {Q}_{u}=\mathbf {B}_{u}\mathbf {N}_{u}^{-1}\mathbf {B}_{u}^{\top }\) and \(-\mathbf {P}_{u}=\mathbf {E}_{u}^{\top }\mathbf {E}_{u}\), with the pair \(\left( \mathbf {A}_{u},\,\mathbf {B}_{u}\right) \) being stabilisable, and the pair \(\left( \mathbf {E}_{u},\,\mathbf {A}_{u}\right) \) being observable. Hence, there is an unique solution \(\varvec{C}\left( t\right) \) to the matrix Riccati ODE (2.22) which is negative semi-definite and bounded on \(\left( -\infty ,\,T\right] \), and there exists a unique limit \(\bar{\mathbf {C}}=\underset{t\rightarrow -\infty }{\lim }\varvec{C}\left( t\right) \).

Proof

We first perform a change of variable. Define \(\tilde{\varvec{C}}\left( t\right) =-\varvec{C}\left( t\right) \), so the matrix Riccati Eq. (2.22) becomes

Proposition 2.2 has shown that matrix \(-\mathbf {P}_{u}\in \mathbb {R}^{d\times d}\) is symmetric positive definite. Therefore, all eigenvalues \(\varvec{\lambda }_{P_{u}}\) of matrix \(-\mathbf {P}_{u}\) are positive, and there exists an orthonormal basis for \(\mathbb {R}^{d}\) of their associated eigenvectors, in other words, there is an orthonormal matrix \(\mathbf {O}_{u}\) such that \(-\mathbf {P}_{u}=\mathbf {O}_{u}\mathbf {D}_{u}\mathbf {O}_{u}^{\top }\), where \(\mathbf {D}_{u}=\text {diag}\left( \varvec{\lambda }_{P_{u}}\right) \in \mathbb {R}^{d\times d}\) is a diagonal matrix with positive entries on the diagonal. Hence, we can write \(-\mathbf {P}_{u}=\mathbf {E}_{u}^{\top }\mathbf {E}_{u}\), where \(\mathbf {E}_{u}=\left( \mathbf {O}_{u}\sqrt{\mathbf {D}_{u}}\right) ^{\top }\) is a real square matrix. We can observe that matrix \(\mathbf {E}_u\) is invertible, and so the controllability matrix \(\varvec{\Gamma }\left( \mathbf {A}_{u}^{\top },\,\mathbf {E}_{u}^{\top }\right) \in \mathbb {R}^{d\times d^{2}}\), as defined by Definition 2.1, has rank d. Consequently, the pair \(\left( \mathbf {A}_{u}^{\top },\,\mathbf {E}_{u}^{\top }\right) \) is controllable, and the pair \(\left( \mathbf {E}_{u},\,\mathbf {A}_{u}\right) \) is observable as per Definition 2.2.

The symmetric positive definiteness of matrix \(\mathbf {Q}_{u}\in \mathbb {R}^{d\times d}\) is proven in Proposition 2.2 as well. Thus, matrix \(\mathbf {Q}_{u}\) also has a diagonal decomposition, \(\mathbf {Q}_{u}=\mathbf {B}_{u}\mathbf {N}_{u}^{-1}\mathbf {B}_{u}^{\top }\), where \(\mathbf {B}_{u}\) is an orthogonal matrix, and \(\mathbf {N}_{u}^{-1}=\text {diag}\left( \varvec{\lambda }_{Q_{u}}\right) \in \mathbb {R}^{d\times d}\), where \(\varvec{\lambda }_{Q_{u}}\) are the positive eigenvalues of \(\mathbf {Q}_{u}\). Because matrix \(\mathbf {B}_{u}\) is invertible, hence we can find a constant matrix \(\mathbf {M}_{u}\in \mathbb {R}^{d\times d}\) such that all eigenvalues of \(\mathbf {A}_{u}-\mathbf {B}_{u}\mathbf {M}_{u}\) have negative real parts, therefore the pair \(\left( \mathbf {A}_{u},\,\mathbf {B}_{u}\right) \) is stabilisable.

The above analyses of matrix \(\mathbf {Q}_{u}\) and matrix \(-\mathbf {P}_{u}\) confirm that we can apply Theorem 2.1 from Wonham [26] to conclude that solution \(\tilde{\varvec{C}}\left( t\right) \) to the matrix Riccati Eq. (2.23) is unique, positive semi-definite, bounded on \(\left( -\infty ,\,T\right] \), and has unique limit as the time variable t tends toward \(-\infty \). \(\square \)

Remark 2.3

The stability analysis of Proposition 2.3 is sufficient for there to be no arbitrage in the model proposed by Eqs. (2.2) and (2.3). If there were an arbitrage, then it would always be optimal to take additional positions in the arbitrage portfolio, hence causing the value function to have a singularity in finite time, thus reaching a Nirvana, see Lee and Papanicolaou [19]. Stability of the matrix Riccati Eq. (2.19) with respect to \(\varvec{C}\left( t\right) \) ensures no such singularity for \(\gamma <0\).

After analysing the stability of the matrix Riccati Eq. (2.19), we then study the stability of the solution to the linear ODE (2.18) with respect to \(\varvec{b}\left( t\right) \). We start the analysis by introducing the following lemma, which is a theorem from Wielandt [27] in regard to the eigenvalues of matrices. Comprehensive mathematical knowledge for this lemma can be found in chapter one of Horn and Johnson [28].

Lemma 2.1

Let \(\mathbf {M}\) be a \(d\times d\) matrix and define the field of values \(\varvec{S}\left( \mathbf {M}\right) :=\big \{ \varvec{v}^{\top }\mathbf {M}\varvec{v}\mid \varvec{v}\) is a vector such that \(\varvec{v}^{\top }\varvec{v}=1\big \}\), which contains the eigenvalues of \(\mathbf {M}\).

-

(a)

Suppose \(\mathbf {M}_{1}\) and \(\mathbf {M}_{2}\) are two \(d\times d\) matrices. If \(\lambda \) is an eigenvalue of \(\mathbf {M}_{1}+\mathbf {M}_{2}\), then \(\lambda \in \varvec{S}\left( \mathbf {M}_{1}\right) +\varvec{S}\left( \mathbf {M}_{2}\right) =\left\{ \lambda _{1}+\lambda _{2}\mid \lambda _{1}\in \varvec{S}\left( \mathbf {M}_{1}\right) ,\;\lambda _{2}\in \varvec{S}\left( \mathbf {M}_{2}\right) \right\} \);

-

(b)

Suppose \(\mathbf {M}_{1}\) and \(\mathbf {M}_{2}\) are two \(d\times d\) matrices, \(0\notin \varvec{S}\left( \mathbf {M}_{2}\right) \) and \(\mathbf {M}_{2}^{-1}\) exits. If \(\lambda \) is an eigenvalue of \(\mathbf {M}_{2}^{-1}\mathbf {M}_{1}\), then

;

; -

(c)

Suppose \(\mathbf {M}_{1}\) is an arbitrary \(d\times d\) matrix, \(\mathbf {M}_{2}\) is symmetric positive semi-definite matrix. If \(\lambda \) is an eigenvalue of \(\mathbf {M}_{1}\mathbf {M}_{2}\), then \(\lambda \in \varvec{S}\left( \mathbf {M}_{1}\right) \varvec{S}\left( \mathbf {M}_{2}\right) =\left\{ \lambda _{1}\lambda _{2}\mid \lambda _{1}\in \varvec{S}\left( \mathbf {M}_{1}\right) ,\;\lambda _{2}\in \varvec{S}\left( \mathbf {M}_{2}\right) \right\} \).

Proof

The detailed and comprehensive proofs are given by the theorems of Wielandt [27] \(\square \)

Proposition 2.4

Let \(\varvec{R}_{u}\left( t\right) \) be the coefficient matrix of the homogeneous part of Eq. (2.18) for the unconstrained stochastic control and optimisation problem. For \(\gamma <0\), there exists a \(t^{*}>-\infty \) such that \(\varvec{R}_{u}\left( t\right) \) has all positive eigenvalues for \(t<t^{*}\), therefore, the solution of ODE (2.18) has a finite steady state.

Proof

By observing ODE (2.18) and utilising the formulae given by Eq. (2.10), the coefficient matrix \(\varvec{R}_{u}\left( t\right) \) of the homogeneous part for the ODE can be written as

Utilising Eq. (2.5), this expression can be simplified to

Let \(\bar{\mathbf {C}}=\underset{t\rightarrow -\infty }{\lim }\varvec{C}\left( t\right) \), then the limit of Eq. (2.24) is

where matrix \(\varvec{\delta }\) is assumed to be symmetric positive semi-definite.

Proposition 2.2 proves that matrix \(\mathbf {Q}_{u}\) is symmetric positive semi-definite, and Proposition 2.3 implies that matrix \(-\bar{\mathbf {C}}\) is symmetric positive semi-definite. Matrix \(\varvec{\Psi }_1 \varvec{\Psi }_0^\top \varvec{\Sigma }_0^{-1}\varvec{\Psi }_0\varvec{\Psi }_1^\top \) is also symmetric positive semi-definite. Therefore, if \(\gamma <0\), then it follows from Lemma 2.1 that matrix \(\mathbf {R}_{u}\) given by Eq. (2.25) has all positive eigenvalues. This allows us to say that there exists a \(t^{*}>-\infty \) such that \(\varvec{R}_{u}\left( t\right) \) has positive eigenvalues for all \(t<t^{*}\), and the solution \(\varvec{b}\left( t\right) \) of Eq. (2.18) has a finite steady state. \(\square \)

After analysing the stability of the matrix Riccati Eq. (2.19), and the stability of the solution to the linear ODE (2.18) with respect to \(\varvec{b}\left( t\right) \), we also need to study the stability of the solution to the linear ODE (2.17) with respect to \(a\left( t\right) \).

Proposition 2.5

For \(\gamma <0\), the solution of Eq. (2.17) for the unconstrained stochastic control and optimisation problem has a finite steady state as the time variable \(t\rightarrow -\infty \). Consequently, the long term certainty equivalent rate of the unconstrained control problem that is described by Eq. (2.13) is asymptotically proportional to the solution of ODE (2.17).

Proof

Denote by \(L\left( t\right) \) the right hand side of Eq. (2.17). From the analyses of Propositions 2.3 and 2.4, both of the solution \(\varvec{C}\left( t\right) \) and the solution \(\varvec{b}\left( t\right) \) to ODE (2.19) and ODE (2.18) have finite limits as the time variable t tends toward \(-\infty \), therefore when t approaches to \(-\infty \), we have

where \(\bar{\varvec{b}}=\underset{t\rightarrow -\infty }{\lim }\varvec{b}\left( t\right) \) and \(\bar{\mathbf {C}}=\underset{t\rightarrow -\infty }{\lim }\varvec{C}\left( t\right) \). Hence, as t tends toward negative infinity, Eq. (2.17) relaxes and we have

which shows that the solution of ODE (2.17) has a finite steady state:

Furthermore, given the utility function (2.9), the value function (2.12), and the exponential ansatz for \(g\left( t,\,\varvec{z}\right) \) that is defined by formula (2.16), the certainty equivalent is defined by

Hence, under the optimal control \(\varvec{\pi }^{*}\), the long-term growth rate is

In the previous paragraphs, utilising the conclusions of Propositions 2.3 and 2.4, we have already shown by Eq. (2.27) that \(a\left( t\right) \) is asymptotically linear as the time variable t tends toward negative infinity, therefore,

Consequently, utilising the result that is demonstrated by Eq. (2.26), the limit in Eq. (2.28) is

which demonstrates that the long-term growth rate is a constant. \(\square \)

2.4 Market-Neutral Constraint

It is common to seek statistical arbitrage strategies that are market neutrality. Market neutrality generally means that the returns of a portfolio are impacted only by the idiosyncratic returns of the stocks contained in the portfolio, and are uncorrelated with the returns of a benchmark or market factors, see Angoshtari [9] and Avellaneda and Lee [1]. Hence, under the condition of market neutrality, if we can diversify with a large number of co-integrated stocks, then there is a very high probability that the portfolio can maintain steady growth and low volatility. We consider a portfolio that is market neutral if the wealth process \(W_t\) of the portfolio is adapted to the filtration generated by the the co-integrated processes \(\varvec{Z}_{t}\). This is the case if \(\varvec{\pi }^{\top }\varvec{\beta }=0\), because

where \({\mathbf {1}}\in {\mathbb {R}}^d\) is a vector of ones. Therefore, in matrix/vector notation, the condition for market neutrality is \(\varvec{\pi }^{\top }\varvec{\beta }=0\).

We now reformulate the optimal portfolio that is studied in Sects. 2.1 and 2.2 for market neutrality. We include an equality constraint \(\varvec{\pi }^{\top }\varvec{\beta }=0\) with respect to the market neutrality for the control variable \(\varvec{\pi }\). Consequently, we now have a constrained stochastic control and optimisation problem, the portfolio \(W_{t}\) that is given by its solution is called the market-neutral constrained portfolio, and the corresponding HJB equation is

Utilising the ansatz that is given by Eq. (2.12), the transformed HJB equation for the market-neutral constrained problem is

Letting \(\varvec{\lambda }\in {\mathbb {R}}^{m}\) denote the Lagrange multiplier, we define the Lagrangian function for the market-neutral constrained control problem:

By utilising the first-order condition \(\nabla _{\varvec{\pi }}L=\varvec{0}\), we can get the following optimal control \(\varvec{\pi }^{*}\) for the constrained stochastic control problem:

We then solve for the Lagrange multiplier \(\varvec{\lambda }\) to get its optimal value \(\varvec{\lambda }^{*}\) with respect to the condition of market-neutral constraint \(\varvec{\beta }^\top \varvec{\pi }^{*}=0\):

Inserting the optimal \(\varvec{\lambda }^{*}\) that is given by formula (2.33) back into Eq. (2.32), we can get the optimal control variables \(\varvec{\pi }^{*}\) with respect to the market-neutral constraint:

where \(\varvec{\Sigma }_{c}=\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\left( \varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\right) ^{-1}\varvec{\beta }^\top \varvec{\Sigma }_1^{-1}\in \mathbb {R}^{d\times d}\) is a symmetric matrix. We then insert the optimal control variable \(\varvec{\pi }^{*}\) that is given by formula (2.34) back into the HJB Eq. (2.31) and get the following nonlinear PDE for the market-neutral constrained problem:

Corresponding to the unconstrained stochastic control and optimisation problem of Sect. 2.2, we utilise the exponential ansatz (2.16) to solve PDE (2.35), from which the optimal control for the market-neutral constrained control problem can be expressed as

where \(a\left( t\right) \in \mathbb {R}\) is a scalar, \(\varvec{b}\left( t\right) =\left[ b_{i}\left( t\right) \right] \in \mathbb {R}^{d}\) is a column vector, and \(\varvec{C}\left( t\right) =\left[ c_{ij}\left( t\right) \right] \in \mathbb {R}^{d\times d}\) is a symmetric matrix, for \(i,\,j=1,\,2,\,\cdots ,\,d\), are the solutions of the system of ODEs that are given by the following Proposition 2.6. Correspondingly, the myopic control for the market-neutral constrained stochastic control problem is

Remark 2.4

The myopic control in Eq. (2.37) satisfies the market neutrality condition that is given by Eq. (2.29), which is \(\varvec{\beta }^\top \varvec{\pi }_m^*=0\). This will be shown in the proof of Proposition 2.7 as a consequence of proving \(\varvec{\beta }^\top \left( \varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{c}\right) =0\).

Proposition 2.6

PDE (2.35) for the constrained stochastic control and optimisation problem (2.30) is solved by utilising the exponential ansatz (2.16), where for any \(t\le T\), the functions \(a\left( t\right) \in \mathbb {R}\), \(\varvec{b}\left( t\right) \in \mathbb {R}^{d}\), and \(\varvec{C}\left( t\right) \in \mathbb {R}^{d\times d}\) of the ansatz satisfy the following system of ODEs:

Proof

The proof is similar to that for Proposition 2.1. \(\square \)

Remark 2.5

(Verification) Utilising the solution of the HJB Eq. (2.31) that is obtained from the exponential ansatz (2.16), the optimal control \(\left( \varvec{\pi }_t^{*}\right) _{t\le T}\) given by formula (2.32) belongs to the set of admissible controls \(\mathcal {A}\) defined by equation (2.8), and maximises the expected utility function defined by Eq. (2.7) subject to the market-neutral constraint \(\varvec{\pi }^{\top }\varvec{\beta }=0\). The form of the model for this constrained stochastic control and optimisation problem fits into the framework set forth in Davis and Lleo [25] and Davis and Lleo [18], and hence, the same argument for verification of these references applies here with the essential step being confirmation of no finite-time blow up in a(t), \(\varvec{b}(t)\), or \(\varvec{C}(t)\) given by Eqs. (2.38), (2.39), and (2.40), respectively; confirmation that there is no blow up is shown by Propositions 2.7, 2.8 and 2.9.

Analogous to the unconstrained control problem of Sects. 2.2 and Sect. 2.3, we perform the stability analyses for the solutions of the system of ODEs given by Eqs. (2.38), (2.39), and (2.40). We first study the behaviour of the solution to the matrix Riccati equation for \(\varvec{C}\left( t\right) \) of the constrained control problem, which is expressed by Eq. (2.40). We rewrite this matrix Riccati equation in the following way

where

Similar to the unconstrained problem, we prove that the coefficient matrix \(\mathbf {Q}_{c}\) for the quadratic term of the matrix Riccati Eq. (2.41) for the constrained problem is symmetric positive definite, and its coefficient matrix \(\mathbf {P}_{c}\) for the constant term is symmetric negative semi-definite.

Proposition 2.7

For \(\gamma <0\), in the matrix Riccati Eq. (2.41) for the constrained stochastic control and optimisation problem, the coefficient matrix \(\mathbf {Q}_{c}\) of its quadratic term is symmetric positive definite, and the coefficient matrix \(\mathbf {P}_{c}\) of its constant term is symmetric negative semi-definite.

Proof

Proposition 2.2 has proven that matrix \(\mathbf {Q}_{u}\) of Eq. (2.22) for the unconstrained stochastic control and optimisation problem is symmetric positive definite. By utilising the formulae of Eq. (2.10), matrix \(\mathbf {Q}_{c}\) has the following decomposition:

Because matrix \(\varvec{\Sigma }_{1}\) is symmetric positive definite, so its inverse \(\varvec{\Sigma }_{1}^{-1}\) is symmetric positive definite as well. Hence \(\left( \varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\right) ^{-1}>0\). Therefore, for \(\gamma <0\), matrix \(\mathbf {Q}_{c}\) is symmetric positive definite.

In order to prove matrix \(\mathbf {P}_{c}\) is symmetric negative semi-definite, we need to examine the symmetric matrix \(\varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{c}\). We observe that for any \(\varvec{x}\in {\mathbb {R}}^d\), we can decompose it as \(\varvec{x} = \varvec{\beta }\varvec{v} + \tilde{\varvec{v}}\), where \(\tilde{\varvec{v}}^\top \varvec{\Sigma }_1^{-1}\varvec{\beta } =0\), and then

where the equality holds if and only if \(\tilde{\varvec{v}} = 0\). Hence, \(\varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{c}\) is symmetric positive semi-definite. Consequently, \(\varvec{\delta }\left( \varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{c}\right) \varvec{\delta }\) is a symmetric positive semi-definite matrix with the columns of \(\varvec{\delta }^{^{-1}}\varvec{\beta }\) spanning its null space. Therefore, matrix \(-\mathbf {P}_{c}\) is symmetric positive semi-definite also with null-space spanned by \(\varvec{\delta }^{^{-1}}\varvec{\beta }\). \(\square \)

Corresponding to Proposition 2.3, because matrix \(\mathbf {Q}_{c}\) is symmetric positive definite, matrix \(-\mathbf {P}_{c}\) is symmetric positive semi-definite, therefore, Theorem 2.1 in Wonham [26] applies directly, consequently, the solution to matrix Riccati Eq. (2.40) exists, is bounded, and is unique.

Proposition 2.8

For \(\gamma <0\), if both matrices \(\varvec{\delta }-\varvec{\beta }\left( \varvec{\beta }^\top \varvec{\beta }\right) ^{-1}\varvec{\beta }^\top \varvec{\delta }\) and \(\varvec{\beta }^\top \varvec{\beta }\) are full rank:

then the coefficient matrix \(\mathbf {Q}_{c}\) of the quadratic term in the matrix Riccati Eq. (2.41) for the constrained stochastic control and optimisation problem is symmetric positive definite, and matrix \(-\varvec{P}_{c}\) is symmetric positive semi-definite. Hence, there are matrices \(\mathbf {B}_{c}\), \(\mathbf {E}_{c}\), and \(\mathbf {N}_{c}\) such that \(\mathbf {Q}_{c}=\mathbf {B}_{c}\mathbf {N}_{c}^{-1}\mathbf {B}_{c}^{\top }\) and \(-\mathbf {P}_{c}=\mathbf {E}_{c}^{\top }\mathbf {E}_{c}\), with the pair \(\left( \mathbf {A}_{c},\,\mathbf {B}_{c}\right) \) being stabilisable, and the pair \(\left( \mathbf {E}_{c},\,\mathbf {A}_{c}\right) \) being observable. Consequently, there is an unique solution \(\varvec{C}\left( t\right) \) to the matrix Riccati equation (2.41) which is negative semi-definite and bounded on \(\left( -\infty ,\,T\right] \), and there exists a unique limit \(\bar{\mathbf {C}}=\underset{t\rightarrow -\infty }{\lim }\varvec{C}\left( t\right) \).

Proof

The symmetric positive semi-definiteness of matrix \(-\mathbf {P}_{c}\) comes from Proposition 2.7, for which the proof shows that \(\varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\left( \varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\right) ^{-1}\varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}\) is symmetric positive semi-definite. This matrix is diagonalizable, \(\varvec{\Sigma }_{1}^{-1}-\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\left( \varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}\varvec{\beta }\right) ^{-1}\varvec{\beta }^{\top }\varvec{\Sigma }_{1}^{-1}=\mathbf {O}_{c}\mathbf {D}_{c}\mathbf {O}_{c}^{\top }\), where matrix \(\mathbf {O}_{c}\in \mathbb {R}^{d\times d}\) is orthonormal and \(\mathbf {D}_{c}\) is a diagonal matrix with non-negative eigenvalues along its diagonal. Thus, \(-\mathbf {P}_{c}=\mathbf {E}_{c}^{\top }\mathbf {E}_{c}\), where \(\mathbf {E}_{c}=\sqrt{\frac{-\gamma }{2\left( 1-\gamma \right) }}\sqrt{\mathbf {D}_{c}}\mathbf {O}_{c}^{\top }\varvec{\delta }\). As shown in the proof of Proposition 2.7, there is a null space of matrix \(-\mathbf {P}_{c}\) that is spanned by the columns of matrix \(\varvec{\delta }^{-1}\varvec{\beta }\), hence, the rank of matrix \(\mathbf {E}_{c}\) is strictly less than d with null space spanned by \(\varvec{\delta }^{-1}\varvec{\beta }\). However, the rank of the controllability matrix \(\varvec{\Gamma }\left( \mathbf {A}_{c}^{\top },\,\mathbf {E}_{c}^{\top }\right) \in \mathbb {R}^{d\times d^{2}}\) given by Definition 2.1 is d if the equations of formula (2.42) hold.

It is indeed correct for the model that is proposed here in Sect. 2.4. Recall the matrix \(\mathbf {A}_{c}\) defined for the matrix Riccati ODE (2.41), it can be written as

which when multiplied on the left-hand side by \(\varvec{\delta }^{-1}\varvec{\beta }\) and on the right by \(\varvec{E}_c^\top \), we have

We can observe that, for any vector \(\varvec{x}\), we know that \(\mathbf {E}_{c}\varvec{\beta }\varvec{x}=0\) if and only if \(\varvec{x}^\top \varvec{\beta }^\top \mathbf {P}_c\varvec{\beta }\varvec{x}=0\), which occurs if and only if \(\exists \,\varvec{v}\) such that \(\varvec{\beta }\varvec{x} =\varvec{\delta }^{-1}\varvec{\beta }\varvec{v}\). The nearest such \(\varvec{v}\) is \(\widehat{\varvec{v}}= \left( \varvec{\beta }^\top \varvec{\beta }\right) ^{-1}\varvec{\beta }^\top \varvec{\delta }\varvec{\beta }\varvec{x}\). Therefore, \(\mathbf {E}_{c}\varvec{\beta }\varvec{x}=0\) if we can find \(\varvec{x}\) such that \(\varvec{\delta }\varvec{\beta }\varvec{x} =\varvec{\beta }\widehat{\varvec{v}}\). This is the case if \(\left( \mathbf {I}-\varvec{\beta }\left( \varvec{\beta }^\top \varvec{\beta }\right) ^{-1}\varvec{\beta }^\top \right) \varvec{\delta }\varvec{\beta }\varvec{x}=0\), where \(\mathbf {I}\in \mathbb {R}^{d\times d}\) is the identity matrix, which occurs only for \(\varvec{x} =0\) if equations in formula (2.42) hold, because \(\varvec{\beta }^\top \varvec{\beta }\) is invertible implying that matrix \(\varvec{\beta }\) has no right-hand null vector. Therefore, \(\varvec{\Gamma }\left( \mathbf {A}_{c}^{\top },\,\mathbf {E}_{c}^{\top }\right) \in \mathbb {R}^{d\times d^{2}}\) has full rank if formula (2.42) holds. Thus, the pair \(\left( \mathbf {A}_{u}^{\top },\,\mathbf {E}_{u}^{\top }\right) \) is controllable, and the pair \(\left( \mathbf {E}_{u},\,\mathbf {A}_{u}\right) \) is observable as per Definition 2.2.

The symmetric positive definiteness of matrix \(\mathbf {Q}_{c}\) is proven in Proposition 2.7 as well. Corresponding to Proposition 2.3, matrix \(\mathbf {Q}_{c}=\mathbf {B}_{c}\mathbf {N}_{c}^{-1}\mathbf {B}_{c}^{\top }\), where \(\mathbf {B}_{c}\) is an orthogonal matrix, \(\varvec{\lambda }_{Q_{c}}\) are the eigenvalues of \(\mathbf {Q}_{c}\), and \(\mathbf {N}_{c}^{-1}=\text {diag}\left( \varvec{\lambda }_{Q_{c}}\right) \in \mathbb {R}^{d\times d}\). The matrix \(\mathbf {B}_{c}\) is invertible, hence we can find a constant matrix \(\mathbf {M}_{c}\in \mathbb {R}^{d\times d}\) such that all eigenvalues of matrix \(\mathbf {A}_{c}-\mathbf {B}_{c}\mathbf {M}_{c}\) have negative real parts, therefore, the pair \(\left( \mathbf {A}_{c},\,\mathbf {B}_{c}\right) \) is stabilisable.

Finally, we let \(\tilde{\varvec{C}}\left( t\right) =-\varvec{C}\left( t\right) \), so that the matrix Riccati Eq. (2.41) becomes

and the above analyses of matrices \(\mathbf {Q}_{c}\) and \(-\mathbf {P}_{c}\) confirm that we can apply Theorem 2.1 from Wonham [26] again, to conclude that solution \(\tilde{\varvec{C}}\left( t\right) \) to Eq. (2.43) is unique, positive semi-definite, bounded on \(\left( -\infty ,\,T\right] \), and has unique limit as the time variable t tends toward \(-\infty \). \(\square \)

Remark 2.6

In Proposition 2.8, the implication of needing \(\varvec{\beta }^\top \varvec{\beta }\) having full rank is that there needs to be at least as many co-integrated stocks as there are factors, as \(\varvec{\beta }\in {\mathbb {R}}^{d\times m}\).

Remark 2.7

In Proposition 2.8, a necessary condition for the first equation of formula (2.42) to hold is for \(\varvec{\beta }\left( \varvec{\beta }^\top \varvec{\beta }\right) ^{-1}\varvec{\beta }^\top \) to not commute with \(\varvec{\delta }\), which implies that \(\varvec{\delta }\not \propto \mathbf {I}\).

Next we analyse the behaviour of the solution for the ODE with respect to \(\varvec{b}\left( t\right) \) of the constrained control problem that is described by Eq. (2.39).

Proposition 2.9

Let \(\varvec{R}_{c}\left( t\right) \) be the coefficient matrix for the homogeneous part of Eq. (2.39) for the constrained stochastic control and optimisation problem. For \(\gamma <0\), there exists a \(t^{*}>-\infty \) such that \(\varvec{R}_{c}\left( t\right) \) has all positive eigenvalues for \(t<t^{*}\). Therefore, the solution \(\varvec{b}\left( t\right) \) with respect to ODE (2.39) has a finite steady state.

Proof

By observing Eq. (2.39), and following the notations that are denoted by formula (2.10), also utilising the expressions for matrix \(\varvec{\beta }\) and for matrix \(\varvec{\Sigma }_2\) in Eqs. (2.5) and (2.10), respectively, the coefficient matrix \(\varvec{R}_{c}\left( t\right) \) for the homogeneous part of ODE (2.39) can be written as,

From Proposition 2.7, we know that matrix \(\mathbf {Q}_{c}\) is symmetric positive definite, from Proposition 2.8, we have that matrix \(-\varvec{C}\left( t\right) \) is positive semi-definite for \(t<t^{*}\) with \(t^{*}>-\infty \), and by the assumptions of the model, we have that matrices \(\varvec{\Sigma }_1\), \(\varvec{\Sigma }_c\), and \(\varvec{\delta }\) are positive definite. Also note that matrix \(\varvec{\Sigma }_1^{-1}-\varvec{\Sigma }_c\) is symmetric positive semi-definite, matrix \(\varvec{\Psi }_1 \varvec{\Psi }_0^\top \varvec{\Sigma }_0^{-1}\varvec{\Psi }_0\varvec{\Psi }_1^\top \) is symmetric positive semi-definite as well. Therefore, the above expression for \(\varvec{R}_{c}\left( t\right) \) is the summations and products of positive semi-definite matrices, it has all positive eigenvalues, and the solution of ODE (2.39) is stable. \(\square \)

Remark 2.8

For \(\gamma <0\), the solution \(a\left( t\right) \) with respect to Eq. (2.38) for the constrained stochastic control and optimisation problem has a finite steady state as the time variable \(t\rightarrow -\infty \). The long-term growth rate of the certainty equivalent of the constrained control problem is proportional to the solution \(a\left( t\right) \) of ODE (2.38). The proof of such a proposition is similar to the proof of Proposition 2.5.

3 Numerical Experiments and Empirical Analyses

This section presents numerical experiments and empirical analyses utilising a sliding window backtesting approach on historical stock data. These experiments and analyses demonstrate the performances of the optimal portfolios proposed in Sect. 2. In Sect. 3.1, we first describe the method that is utilised for constructing eigenportfolios, which we then utilise as the factors \(F_{t}^{j}\) seen in equation (2.2). We also explain how we adjust the data for survivorship bias. The methods for parameter estimations and the approach for statistical testing of co-integration are described in Sect. 3.2. Lastly, the sliding window backtests and empirical analyses are discussed in Sect. 3.3.

We utilise Yahoo FinanceFootnote 1 as our data source. The data are the daily adjusted close stock prices of the S&P 500 constituents from January 3rd, 2000 to May 6th, 2021, which include 5370 observations for each stock, and the data set also includes the SPDR S&P 500 Trust ETF, whose ticker symbol is SPY, among these traded stocks. However, the SPY is not utilised in the calculation of eigenportfolios. Hence, there are 506 ticker symbols in total, and after removing the ticker symbols that do not have full length data, we are left with 375 stocks. We assume that the interest rate r is 0.01, and in every calendar year there are (around) 252 trading days.

3.1 Eigenportfolios for Constructing Factors

In order to implement the optimal portfolios that are proposed in Sect. 2, selecting the factors \(F_{t}^{j}\) in Eq. (2.2) is the initial step. The principal eigenportfolio is a factor because it tracks the capitalisation-weighted market portfolio, see Avellaneda et al. [29], which is closely tracked by the SPY. Our additional factors are the higher-order eigenportfolios, as are studied in Avellaneda and Lee [1] and Yeo and Papanicolaou [2].

Suppose \(\varvec{\rho }\in \mathbb {R}^{d\times d}\) is the correlation matrix of the stock returns:

Then, its eigenvalue decomposition is

where matrix \(\mathbf {V}=\left[ \mathbf {v}_{1},\,\mathbf {v}_{2},\,,\ldots \,\mathbf {v}_{d}\right] \in \mathbb {R}^{d\times d}\) is composed by the eigenvectors \(\mathbf {v}_{i}\in \mathbb {R}^{d}\) of \(\varvec{\rho }\) with orthonormal property \(\mathbf {V}^{\top }\mathbf {V}=\mathbf {V}\mathbf {V}^{\top }=\mathbf {I}\), and \(\varvec{\Lambda }\in \mathbb {R}^{d\times d}\) is a diagonal matrix whose diagonal elements \(\lambda _{ii}\) are the corresponding eigenvalues with \(\lambda _{11}\ge \lambda _{22}\ge \cdots \ge \lambda _{ii}\ge \cdots \ge \lambda _{dd}>0\). The weight vectors for the eigenportfolios are

where \(c_{j}=\mathbf {1}^{\top }\varvec{\sigma }^{-1}\mathbf {v}_{j}\), \(\varvec{\sigma }=\mathrm {diag}\left( \left[ \sigma _{1},\,\sigma _{2},\,\ldots ,\,\sigma _{d}\right] \right) \in \mathbb {R}^{d\times d}\) is a diagonal matrix whose diagonal elements are the standard deviations \(\sigma _{i}\) of the stock returns. The jth factor \(F^{j}\) has returns equal to those of the jth eigenportfolio,

where \(\omega _{ij}\) is the \(\mathrm{i}{\mathrm {th}}\) component of vector \(\varvec{\omega }_{j}\). Among all the factors \(\big (F_{t}^{j}\big )_{j=1,\,\ldots ,\,m}\) that are constructed utilising the eigenportfolios returns, factor \(F_{t}^{1}\) is called the principal eigenportfolio.

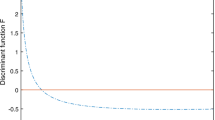

The principal eigenportfolio \(F_{t}^{1}\) should track the SPY. However, there exists a survivorship bias if data are collected with future knowledge of the S&P 500 constituents. In other words, because S&P Global Incorporated adjusts the constituents of S&P 500 Index periodically, the latest constituents have already passed a selection process based on market capitalisation. For instance, the list of S&P 500 constituents that we utilise for numerical experiments was downloadedFootnote 2 on May 6th, 2021, but on April 20th, 2021, PTC Incorporated, whose ticker symbol was PTC, replacedFootnote 3 Varian Medical Systems Incorporated, whose ticker symbol was VAR, in the S&P 500 list of constituents. By observing Fig. 1, we can see clearly that in a long-time horizon the survivorship bias is significant. Consequently, to improve the interpretability of our numerical experiments, we should adjust for this survivorship bias in the data for the stock returns utilising the following regression:

where \(S_{t}^{\mathrm {SPY}}\) is the daily adjusted close price of the SPY, and \(\epsilon _t\) is the regression residual between the return of the principal eigenportfolio and the SPY return. The survivorship-adjusted stock returns are

where \(i=1,\,2,\,\ldots ,\,d\). In the above formulae, \(\alpha _{b}\) is the survivorship bias, because the trackability with respect to the SPY of the principal eigenportfolio \(F_{t}^{1}\) implies that the null hypothesis is \(\alpha _{b}=0\). Therefore, any non-zero value of \(\alpha _{b}\) from the regression should be subtracted from the stock returns.

3.2 Parameter Estimation

For the numerical experiments that we perform, we select the factors to be the top six eigenportfolios, in other words, \(m=6\) in Eq. (2.2). These six factors correspond to the largest six eigenvalues of the correlation matrix \(\varvec{\rho }\) of Eq. (3.1). The factor drift coefficient vector \(\varvec{\eta }\) of the factors seen in Eq. (2.2) have \(\eta ^{j} = r\) for \(j>1\), \(\eta ^{1}\) of the principal eigenportfolio is estimated utilising the returns of the SPY, see Boyle [30], and the diffusion matrix \(\varvec{\Sigma }_{0}\) is estimated utilising the method proposed in Ledoit and Wolf [31].

The next step is to identify co-integrated stocks and estimate the parameters in Eqs. (2.1), (2.3), and (2.4). We first run a linear regression on the factor model of Eq. (2.1) to get the residual processes \(\varvec{Z}_{t}\), then we utilise the augmented Dickey-Fuller test to detect stationarity. Accordingly, the systematic return vector \(\varvec{\alpha }\) and the co-integration coefficient matrix \(\varvec{\beta }\) are estimated by the least squares approach of the linear regression of stock returns onto factor returns. In Eq. (2.4), the long-term mean parameter vector \(\varvec{\theta }\) is estimated by the time-series averages of the co-integrated processes \(\varvec{Z}_{t}\). The drift coefficient vector \(\mathbf {\varvec{\mu }}\) of stock prices is calculated utilising the relationship between \(\theta ^{i}\) and \(\mu ^{i}\) given by Eq. (2.4).

Estimating the speed of mean-reversion vector \(\mathbf {\varvec{\delta }}\) is important because each reciprocal \(1/\delta ^{i}\) represents the characteristic time scale for mean reversion. Consequently, it affects portfolio profit significantly because it changes the duration of the trade and the inventory-risk exposure. The co-integrated process \(Z_{t}^{i}\) is assumed to follow a stationary OU process that is described by Eq. (2.4). Therefore, by applying the ergodic theory, the mean-reversion speed parameter \(\delta ^{i}\) can be estimated by the order-one auto-correlation of the process \(Z_{t}^{i}\):

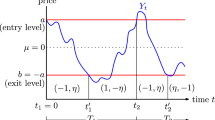

where \(\hat{\theta ^{i}}=\frac{1}{T}\sum _{t=1}^{T}Z_{t}^{i}\) is the estimation of the mean-reversion parameter \(\theta ^{i}\). Both of the estimators \(\hat{\theta ^{i}}\) and \(\hat{\delta ^{i}}\) converge to their true values in probability as \(T\rightarrow +\infty \). The error for estimator \(\hat{\delta ^{i}}\) is asymptotically Gaussian distributed with expectation zero and variance approximately \(2\delta ^{i}\), see Kutoyants [32]. Figure 2 illustrates the fifteen co-integrated processes \(Z_{t}^{i}\) that have largest mean-reversion speeds \(\hat{\delta ^{i}}\) among those whose augmented Dickey-Fuller tests reject the unit-root hypothesis with p-value \(\le 0.01\), and with \(\hat{\delta ^{i}}\) estimated from daily data between January \(3^{\text {rd}}\), 2000 and April \(15^{\text {th}}\), 2021.

Co-integrated processes \(\varvec{Z}_{t}\) of the in-sample training period from January 3rd, 2000 to April 15th, 2021. Their mean-reversion speeds \(\mathbf {\varvec{\delta }}\) are the fifteen largest among all the OU processes \(\varvec{Z}_{t}\) whose augmented Dickey-Fuller tests reject the unit-root hypothesis with p-value \(\le 0.01\)

We implement parameter estimation with a sliding window approach over the entire data set. Parameters are estimated utilising data from the in-sample training windows, and are then utilised to compute portfolios in the out-of-sample testing windows, see Fig. 3. In each in-sample training window, the number of co-integrated stocks varies approximately in the range of ten to one hundred. We set \(d\le 15\) of Eq. (2.3), which means that for each in-sample training window, we first sort all the co-integrated stocks in descending order with respect to the values of the mean reversion speeds \(\mathbf {\varvec{\delta }}\), and then select only the fifteen stocks whose values of \(\mathbf {\varvec{\delta }}\) are the largest. If the total number of co-integrated stocks for this window is less than fifteen, we then proceed with all of them. For each out-of-sample testing window following its respective in-sample training window, we utilise those stocks that are selected without knowing which will remain co-integrated in the testing window. In other words, there exists model risk in the out-of-sample testing window. By setting up the backtests in this way, we allow both of the number of co-integrated stocks and the ticker symbols to change with each in-sample training and out-of-sample testing window pair. Table 1 lists the fifteen ticker symbols with fastest mean-reversion times \(252/\mathbf {\varvec{\delta }}\) among all the selected co-integrated stocks for three different in-sample training windows. Figure 4 displays the total number of co-integrated stocks in each and every in-sample training window from January 3rd, 2000 to April 8th, 2021. Each training window has 220 trading days, which we slide forward every fifteen trading days, for a total of 343 in-sample training windows and 343 out-of-sample testing windows. The total number of co-integrated stocks is the number of significant augmented Dickey–Fuller test statistics at the 1% rejection level for each of these training windows. By observing the figure we can see that, in each in-sample training window, the number of co-integrated stocks is greater than fifteen, which is the threshold for d that we set for backtesting. Figure 4 is an indication that the proposed co-integration model described by Eq. (2.1) can generate a large number of co-integrated stocks over a long time horizon, which suggests that the model has advantages in practical application. For multi-variate time series, the Johansen test proposed by Johansen [33] can be also utilised to detect the number co-integrated stocks. However, the Johansen test is based on a vector auto-regressive model, whereas we consider the factor model shown in Eq. (2.1), that is, the co-integration property for the proposed model of this article is between a stock and factors. Therefore, rather than utilising Johansen test, we instead count the number of co-integrations utilising separate augmented Dickey-Fuller tests as described above.

The number of co-integrated stocks in each in-sample training window from January 3rd, 2000 to May 6th, 2021. The labels of the horizontal axis are the terminal dates of the in-sample training windows. Each training window has 220 trading days, which we slide forward every fifteen trading days, for a total of 343 in-sample training windows. The vertical axis is the number of significant augmented Dickey-Fuller test statistics, at the 1% level, in each window

3.3 Portfolio Performance

The final step before evaluating the performances of optimal portfolios is to solve the system of ODEs for the unconstrained portfolio and market-neutral constrained portfolio. Because we work in the setting of very large terminal time T, we can utilise the steady-state portfolios to demonstrate the results. In other words, we work with the limiting optimal control vector \(\bar{\varvec{\pi }}^{*}\) that is calculated utilising \(\bar{\mathbf {C}}=\underset{t\rightarrow -\infty }{\lim }\varvec{C}\left( t\right) \) and \(\bar{\mathbf {b}}=\underset{t\rightarrow -\infty }{\lim }\varvec{b}\left( t\right) \). In this situation, for the unconstrained problem with HJB Eq. (2.11), the matrix Riccati Eq. (2.19) has a steady state \(\bar{\mathbf {C}}\) that solves a continuous-time algebraic Riccati equation, which can be solved numerically, see Dooren [34] and Arnold and Laub [35]. The linear ODE (2.18) has a steady state \(\bar{\mathbf {b}}\) that solves a linear system. The optimal control (2.20) for the unconstrained portfolio under the steady state is

Correspondingly, the optimal control (2.36) for the market-neutral constrained portfolio under the steady state is

The wealth of optimal portfolio that is calculated utilising the steady-state optimal control \(\bar{\varvec{\pi }}^{*}\) is denoted by \(W_{t}\left( \bar{\varvec{\pi }}^{*}\right) \).

In order to perform comprehensive comparisons, we also consider the myopic wealth process \(W_{t}\left( \varvec{\pi }_{m}^{*}\right) \). Utilising the myopic control \(\varvec{\pi }_{m}^{*}\) given by Eq. (2.21) for the unconstrained portfolio and Eq. (2.37) for the market-neutral constrained portfolio, a myopic wealth process is computed utilising Eq. (2.6) with the optimal control \(\varvec{\pi }^{*}\) substituted by the myopic control \(\varvec{\pi }_{m}^{*}\). Correspondingly, the wealth of the portfolio that is calculated utilising the steady-state myopic control \(\bar{\varvec{\pi }}_{m}^{*}\) is denoted by \(W_{t}\left( \bar{\varvec{\pi }}^{*}_{m}\right) \).

We implement the optimal portfolio in the sliding window backtest format that is shown in Fig. 3, for both of the unconstrained portfolio and the market-neutral constrained portfolio. In each in-sample training window we identify co-integrated stocks, estimate parameters, select those stocks that are the fastest mean reverters, and then solve the equations for steady-state values \(\bar{\mathbf {C}}\) and \(\bar{\mathbf {b}}\). Afterwards, in each out-of-sample testing window, we utilise the estimated parameters, \(\bar{\mathbf {C}}\) and \(\bar{\mathbf {b}}\) to calculate the steady-state myopic control \(\bar{\varvec{\pi }}_{m}^{*}\) and the steady-state optimal control \(\bar{\varvec{\pi }}^{*}\). Over time, we compute and record the myopic wealth \(W_{t}\left( \bar{\varvec{\pi }}_{m}^{*}\right) \) and the optimal wealth \(W_{t}\left( \bar{\varvec{\pi }}^{*}\right) \).

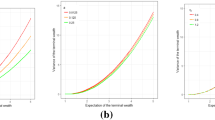

Figures 5 and 6 illustrate the time series of the myopic wealth and the optimal wealth for the unconstrained portfolio and the market-neutral constrained portfolio over the entire time interval from January 3rd, 2000 to May 6th, 2021, respectively, for a fixed in-sample training window length 220 days and a fixed out-of-sample training window length fifteen days. Tables 2 and 3 display the annualised statistics of expected returns, volatilities, profit percentages, Sharpe ratios, and maximum drawdowns of the myopic wealth and the optimal wealth for the unconstrained portfolio and the market-neutral constrained portfolio with differing sliding window lengths over the entire time interval. For the optimal wealth trajectories of unconstrained portfolio and market-neutral constrained portfolio for varying sliding window lengths over the entire time interval, see the figures in the Supplementary MaterialsFootnote 4 of this article. For the annualised statistics of the myopic wealth and the optimal wealth for the unconstrained portfolio and the market-neutral constrained portfolio among four different sub-intervals over the entire time interval from January 3rd, 2000 to May 6th, 2021, see the tables in the Supplementary Materials.

Sliding window out-of-sample tests for the optimal unconstrained portfolio from November 14th, 2000 to May 6th, 2021. The in-sample training window is 220 days, the out-of-sample testing window is fifteen days, risk aversion coefficient is \(\gamma = -100\), factor number is \(m=6\), and interest rate is \(r=1\%\). The annualised statistics for myopic wealth are profit of \(1703.167\%\), expected return of \(15.458\%\), volatility of 0.163, Sharpe ratio of 0.888, and maximum drawdown of 0.231. The statistics for optimal wealth are profit of \(17735.254\%\), expected return of \(30.011\%\), volatility of 0.306, Sharpe ratio of 0.947, and maximum drawdown of 0.445. The statistics for the S&P 500 ETF are profit of \(340.999\%\), expected return of \(9.196\%\), volatility of 0.196, Sharpe ratio of 0.417, and maximum drawdown of 0.552

Sliding window out-of-sample tests for the optimal market-neutral constrained portfolio from November 14th, 2000 to May 6th, 2021. The in-sample training window is 220 days, the out-of-sample testing window is fifteen days, risk aversion coefficient is \(\gamma = -100\), factor number is \(m=6\), and interest rate is \(r=1\%\). The annualised statistics for myopic wealth are profit of \(753.696\%\), expected return of \(11.195\%\), volatility of 0.119, Sharpe ratio of 0.857, and maximum drawdown of 0.221. The statistics for optimal wealth are profit of \(4922.455\%\), expected return of \(21.679\%\), volatility of 0.226, Sharpe ratio of 0.917, and maximum drawdown of 0.303. The statistics for the S&P 500 ETF are profit of \(340.999\%\), expected return of \(9.196\%\), volatility of 0.196, Sharpe ratio of 0.417, and maximum drawdown of 0.552

As we can observe from the figures and tables, the optimal portfolios usually have greater profits, higher expected returns, and larger volatilities in out-of-sample tests. However, their Sharpe ratiosFootnote 5 are slightly worse than those of myopic portfolios, which can be attributed to their higher volatilities. Also, their maximum drawdowns are bigger than those of myopic portfolios, which are caused by their higher volatilities as well. These empirical results demonstrate that the non-myopic component of the optimal \(\varvec{\pi }^{*}\) provides improvement to the profits and expected returns. It is also clear that the optimal market-neutral constrained portfolios, when compared to the optimal unconstrained portfolios, have smaller profits, less expected returns, lower volatilities, weaker Sharpe ratios, and milder maximum drawdowns. The results also show that trading in multiple co-integrated stocks can generate significant profits during the time periods of high volatilities, for example the post Internet bubble period among years 2000–2003, the financial crisis during years 2007–2008, the European sovereign debt crisis between years 2010–2012, and the coronavirus pandemic of years 2020–2021. The slowdown in statistical arbitrage performance in the post Internet bubble period running up to year 2007 is analysed in Khandani and Lo [36]. Furthermore, from the tables and figures, we can also observe that although the optimal portfolios constructed utilising the proposed models of this article have high risk aversion \(\gamma =-70\), they still out-perform the SPY during those time periods of high volatilities mentioned above. These results are a general indication that statistical arbitrage strategies have their greatest potential for generating profits when the overall level of market volatility is higher than normal.

Implementation of these optimal portfolios involves the selection of five hyper-parameters: risk aversion coefficient \(\gamma \), number of co-integrated stocks d, number of factors m, in-sample training window length, and out-of-sample testing window length in each training window and testing window. Tables 2 and 3 exhibit considerable variations in portfolio performances as the sliding window lengths change. In our studies, we prearrange five sets for these hyper-parameters, which contain different values for each of them, and then evaluate the performances of all hyper-parameter combinations. The indication is that selection of these hyper-parameters, prior to real-time trading, is a considerable challenge for practical implementation of these portfolios. In order to achieve better portfolio performance, for every in-sample training window and out-of-sample testing window, these hyper-parameters should be selected dynamically, for example utilising the \(R^2\) screening method of Yeo and Papanicolaou [2].

Finally, we should mention the effects of transaction costs and liquidity, which we have not included in these sliding window backtests. However, these backtests can be rerun with a five or ten basis points penalty on trading and the results will still be reasonable from the points of view of practitioners. Liquidity is a deeper issue because brokers put considerable restraints on leverage and short sales during times of crises, which means that potential returns from statistical arbitrage strategies in year 2008 and in year 2020 require a broker who allows trading while most other brokers freeze the trades of their clients. To summarise, backtestings of statistical arbitrage based on historical data, such as we present in this article, are an informative feasibility study, but considerations given to transaction costs and liquidity are essential for practical implementation.

4 Conclusion

In this article, we present an analysis of optimal statistical arbitrage strategies under a multiple co-integrated stocks model with eigenportfolios being factors. We compute optimal portfolios for both an unconstrained stochastic control and optimisation problem and a market-neutral constrained stochastic control and optimisation problem. The optimal solution is found by solving a Hamilton-Jacobi-Bellman partial differential equation, which for power utility function can be solved with an exponential ansatz that leads to a system of ordinary differential equations. This system consists of a matrix Riccati equation and two first-order linear ordinary differential equations. We present the stability analyses for the solutions to these ordinary differential equations, for both of the unconstrained case and the market-neutral constrained case. We then apply the optimal formulae to historical stock data and estimate the model parameters, and then perform sliding window backtests. The results of these backtests indicate that statistical arbitrage portfolios have profit-generating potential during periods of higher overall market volatilities, but are sensitive to parameter estimation. In particular, we demonstrate that profits and Sharpe ratios can be quite good but vary as we change the lengths of the sliding windows for in-sample training and out-of-sample testing. The conclusions drawn from these backtests are that the proposed co-integrated model can generate a large number of co-integrated stocks over a long time horizon, that the greatest potential for profits occur during periods of higher overall volatility, and that a priori selection of window-length parameters is a significant challenge for profitable implementation of statistical arbitrage in practice.

Notes

Data source for stock prices: https://finance.yahoo.com.

S&P 500 constituents list: https://en.wikipedia.org/wiki/List_of_S%26P_500_companies.

S&P Dow Jones Indices announcement for the changes to the S&P 500: https://www.spglobal.com/spdji/en/documents/indexnews/announcements/20210415-1358567/1358567_5var-6egov-pr.pdf.

The Supplementary Materials can be accessed through the webpage of the author: https://apapani.wordpress.ncsu.edu/publications.

In this article, the annual return that is utilised for calculating Sharpe ratio is the annualised expected return: \(\mathbb {E}\left( \Delta W_{t}/W_{t}\right) / \Delta t\).

References

Avellaneda, M., Lee, J.-H.: Statistical arbitrage in the US equities market. Quant. Financ. 10(7), 761–782 (2010)

Yeo, J., Papanicolaou, G.: Risk control of mean-reversion time in statistical arbitrage. Risk Decis. Anal. 6(4), 263–290 (2017)

Engle, R.F., Granger, C.W.J.: Co-integration and error correction representation estimation and testing. Econometrica 55(02), 251–276 (1987)

Pástor, L., Stambaugh, Robert F.: Liquidity risk and expected stock returns. J. Polit. Econ. 111(3), 642–685 (2003)

Chiu, M.C., Wong, H.Y.: Optimal investment for an insurer with cointegrated assets: CRRA utility. Insur. Math. Econ. 52(1), 52–64 (2013)

Ma, G., Zhu, S.-P.: Optimal investment and consumption under a continuous-time cointegration model with exponential utility. Quant. Financ. 19(7), 1135–1149 (2019)